Notícias do Mercado

-

23:47

Commodities. Daily history for Oct 29'2014:

(raw materials / closing price /% change)

Light Crude 81.98 -0.27%

Gold 1,211.80 -1.07%

-

23:32

Stocks. Daily history for Oct 29'2014:

(index / closing price / change items /% change)

Nikkei 225 15,553.91 +224.00 +1.46%

Hang Seng 23,819.87 +299.51 +1.27%

Shanghai Composite 2,373.03 +35.16 +1.50%

FTSE 100 6,453.87 +51.70 +0.81%

CAC 40 4,110.64 -2.03 -0.05%

Xetra DAX 9,082.81 +14.62 +0.16%

S&P 500 1,982.3 -2.75 -0.14%

NASDAQ Composite 4,549.23 -15.07 -0.33%

Dow Jones 16,974.31 -31.44 -0.18%

-

23:23

Currencies. Daily history for Oct 29'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2636 -0,76%

GBP/USD $1,6011 -0,74%

USD/CHF Chf0,9544 +0,78%

USD/JPY Y108,83 +0,64%

EUR/JPY Y137,51 -0,12%

GBP/JPY Y174,24 -0,09%

AUD/USD $0,8790 -0,68%

NZD/USD $0,7809 -1,42%

USD/CAD C$1,1183 +0,14%

-

23:00

Schedule for today, Thursday, Oct 30’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Import Price Index, q/q Quarter III -3.0% +0.3%

00:30 Australia Export Price Index, q/q Quarter III -7.9% -4.8%

01:00 Australia HIA New Home Sales, m/m September +3.3%

07:00 Switzerland UBS Consumption Indicator September 1.35

08:00 Switzerland KOF Leading Indicator October 99.1 99.2

08:55 Germany Unemployment Rate s.a. October 6.7% 6.7%

08:55 Germany Unemployment Change October 13 5

10:00 Eurozone Business climate indicator October 0.07 -0.01

10:00 Eurozone Economic sentiment index October 99.9 99.5

10:00 Eurozone Industrial confidence October -5.5 -5.8

12:30 U.S. Initial Jobless Claims October 283 277

12:30 U.S. PCE price index, q/q Quarter III +2.3% +1.7%

12:30 U.S. PCE price index ex food, energy, q/q Quarter III +2.0% +1.4%

12:30 U.S. GDP, q/q (Preliminary) Quarter III +4.6% +3.1%

13:00 Germany CPI, m/m (Preliminary) October 0.0% 0.0%

13:00 Germany CPI, y/y (Preliminary) October +0.8% +0.9%

13:00 U.S. Fed Chairman Janet Yellen Speaks

21:45 New Zealand Building Permits, m/m September 0.0%

23:30 Japan Unemployment Rate September 3.5% 3.6%

23:30 Japan Tokyo Consumer Price Index, y/y October +2.9%

23:30 Japan Household spending Y/Y September -4.7% -4.0%

23:30 Japan Tokyo CPI ex Fresh Food, y/y October +2.6% +2.5%

23:30 Japan National Consumer Price Index, y/y September +3.3% +3.0%

23:30 Japan National CPI Ex-Fresh Food, y/y September +3.1% +3.0%

-

20:00

New Zealand: RBNZ Interest Rate Decision, 3.50% (forecast 3.50%)

-

19:00

Dow 16,986.59 -19.16 -0.11%, Nasdaq 4,535.50 -28.79 -0.63%, S&P 500 1,975.60 -9.45 -0.48%

-

18:00

U.S.: FOMC QE Decision, 0

-

18:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

17:00

European stocks closed in different ways: FTSE 100 6,453.87 +51.70 +0.81%, CAC 40 4,110.64 -2.03 -0.05%, DAX 9,087.96 +19.77 +0.22%

-

17:00

European stocks close: most stocks closed higher as investors are awaiting the Fed' interest rate decision today

Most stock indices closed higher. Corporate earnings weighed on markets.

Investors are awaiting the Fed' interest rate decision today. They expect that the Fed will end its bond-buying program. Investors are awaiting new signs for further monetary policy in the U.S. The slowdown of the global growth and recent weaker-than-expected U.S. economic data could lead that the Fed will keep its low interest rate for a longer period.

Fiat Chrysler Automobiles NV shares surged 12% after the company said it spin off its Ferrari unit.

Sanofi shares dropped 5.51% after the company removed its chief executive.

STMicroelectronics NV shares dropped 10.0% after the company said fourth-quarter sales will decline around 3.5% because of weaker demand, and reported the weaker-than-expected third-quarter net revenue.

Schneider Electric SE shares rose 2.7% after reporting the better-than-expected third-quarter revenue.

Total SA shares climbed 2.0% after posting the better-than-estimated third-quarter net income.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,453.87 +51.70 +0.81%

DAX 9,082.81 +14.62 +0.16%

CAC 40 4,110.64 -2.03 -0.05%

-

16:40

Oil rose

Brent crude rose to a two-week high after OPEC's Secretary-General said the recent plunge in prices doesn't reflect the balance between supply and demand. West Texas Intermediate gained before government inventory data.

Both grades are rebounding after falling more than 20 percent from this year's high in June. Shale oil drillers will be hurt by the fall in crude prices before members of OPEC because their costs are higher, OPEC's Abdalla El-Badri said in London today. WTI gained on expectations that U.S. stockpiles of gasoline and diesel fell last week.

"OPEC is trying to talk the market up a little bit," said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. "A draw in refinery product stocks is going to be bullish. There is some short-covering going on."

Brent for December settlement gained 99 cents, or 1.2 percent, to $87.02 a barrel at 9:25 a.m. New York time on the London-based ICE Futures Europe exchange. The contract reached an intraday high of $87.74, the most since Oct. 14. The volume of all futures was 13 percent below the 100-day average.

WTI for December delivery rose 72 cents, or 0.9 percent, to $82.14 a barrel on the New York Mercantile Exchange. Volume was 8 percent below the 100-day average. Brent traded at a premium of $4.88 to WTI on the ICE.

-

16:30

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies ahead of the Fed's interest rate decision

The U.S. dollar traded mixed to lower against the most major currencies ahead of the Fed's interest rate decision. Investors expect that the Fed will end its bond-buying program. They are awaiting new signs for further monetary policy in the U.S. The slowdown of the global growth and recent weaker-than-expected U.S. economic data could lead that the Fed will keep its low interest rate for a longer period.

The euro rose against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound increased against the U.S. dollar. In the morning trading session, the pound fell against the greenback after the weaker-than-expected economic data from the U.K. The number of mortgages approvals in the U.K. fell to 61,267 in September from 64,054 in August. That was the lowest level since July 2013. Analysts had expected the number of mortgages approvals to decline to 63,000.

Total lending to individuals in the U.K. rose by GBP 2.7 billion in September, missing expectations for an increase by GBP 2.8 billion, after a GBP 3.2 billion gain in August.

The Canadian dollar traded slightly higher against the U.S. dollar despite the weaker-than-expected economic data from Canada. Canada's raw materials purchase price index fell 1.8% in September, missing expectations for a 1.5% rise, a 2.2% drop in August.

Canada's industrial product price index declined 0.4% in September, missing forecasts for a 0.3% rise, after a 0.3% gain in August. August's figure was revised up from a 0.2% increase.

The New Zealand dollar traded higher against the U.S. dollar after the solid the ANZ business confidence index for New Zealand. The ANZ business confidence index for New Zealand rose to 26.5 in October from 13.4 in September.

Market participants are awaiting the Reserve Bank of New Zealand's and Fed' interest rate decision on Wednesday. They expect that the Reserve Bank of New Zealand will keep its interest rate unchanged at 3.50%, and the Fed will end its bond-buying program.

Investors also expects new signs for further monetary policy.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

Market participants are awaiting the Fed' interest rate decision on Wednesday.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen increased against the U.S. dollar after the better-than-expected industrial production from Japan. Preliminary industrial production in Japan climbed 2.7% in September, exceeding expectations for a 2.3% gain, after a 1.9% decline in August.

On a yearly basis, preliminary industrial production rose 0.6% in September, beating forecasts for a 2.6% decrease, after 3.3% drop in August.

-

16:20

Gold fell

Gold prices fell to a three-week low in anticipation of the announcement of the decision of the US Central Bank.

Market participants are preparing for today's monetary policy meeting, the Fed, the results of which the bank is likely to announce the completion of its enabling asset purchases, known as quantitative easing.

Investors will closely examine the Fed statement to find in it further hints that interest rates will remain near zero for some time in the future.

Market analysts believe that those responsible for the monetary policy of the bank officials reiterated that rates will stay low for an "extended period" and that there was "considerable underutilized" labor market.

Meanwhile, Russia has increased its gold reserves sixth consecutive month in September, according to the International Monetary Fund.

The cost of December gold futures on the COMEX today dropped to 1220.80 dollars per ounce.

-

14:30

U.S.: Crude Oil Inventories, October +2.1

-

13:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2645(E1.2bn), $1.2680(E400mn), $1.2700-25(E3.0bn), $1.2750(E356mn)

USD/JPY: Y107.00($762mn), Y107.25($325mn), Y108.00($769mn)

EUR/JPY: Y136.45(E225mn)

GBP/USD: $1.6200(stg825mn)

USD/CHF: Chf0.9475($323mn)

EUR/GBP: Stg0.7800(E250mn)

AUD/USD: $0.8800(A$229mn)

NZD/USD: $0.7900(NZ$564mn).

-

13:44

Canada's raw materials purchase price index decreased 1.8% in September

Statistics Canada said the raw materials purchase price index and industrial product price index today. Canada's raw materials purchase price index fell 1.8% in September, missing expectations for a 1.5% rise, a 2.2% drop in August.

Canada's industrial product price index declined 0.4% in September, missing forecasts for a 0.3% rise, after a 0.3% gain in August. August's figure was revised up from a 0.2% increase.

The decline was driven by decreasing prices for energy products.

-

13:38

U.S. Stocks open: Dow 17,035.64 +29.89 +0.18%, Nasdaq 4,555.78 -8.51 -0.19%, S&P 1,986.68 +1.63 +0.08%

-

13:28

Before the bell: S&P futures -0.15%, Nasdaq futures -0.27%

U.S. stock futures were little changed as investors speculated the Federal Reserve will be in no hurry to raise interest rates even as it ends monthly bond purchases.

Global markets:

Nikkei 15,553.91 +224.00 +1.46%

Hang Seng 23,819.87 +299.51 +1.27%

Shanghai Composite 2,373.03 +35.16 +1.50%

FTSE 6,452.68 +50.51 +0.79%

CAC 4,122.3 +9.63 +0.23%

DAX 9,125.7 +57.51 +0.63%

Crude oil $82.46 (+1.24%)

Gold $1224.60 (+1.27%)

-

13:12

DOW components before the bell

(company / ticker / price / change, % / volume)

E. I. du Pont de Nemours and Co

DD

67.96

+0.01%

0.1K

Nike

NKE

92.46

+0.01%

0.1K

Cisco Systems Inc

CSCO

24.07

+0.02%

1.6K

JPMorgan Chase and Co

JPM

59.65

+0.03%

0.1K

Walt Disney Co

DIS

89.96

+0.03%

4.9K

McDonald's Corp

MCD

92.65

+0.05%

2.8K

Caterpillar Inc

CAT

101.22

+0.06%

0.5K

Verizon Communications Inc

VZ

49.99

+0.06%

26.0K

Intel Corp

INTC

33.77

+0.09%

5.0K

Merck & Co Inc

MRK

55.90

+0.09%

0.7K

Travelers Companies Inc

TRV

99.94

+0.21%

0.6K

International Business Machines Co...

IBM

163.98

+0.23%

1.3K

The Coca-Cola Co

KO

40.68

+0.30%

1.7K

Wal-Mart Stores Inc

WMT

76.60

+0.33%

0.6K

Exxon Mobil Corp

XOM

95.59

+0.52%

5.7K

Chevron Corp

CVX

117.89

+0.65%

5.9K

American Express Co

AXP

88.01

0.00%

0.1K

Pfizer Inc

PFE

29.09

0.00%

0.8K

Goldman Sachs

GS

186.29

-0.02%

0.4K

Procter & Gamble Co

PG

86.45

-0.02%

0.5K

Johnson & Johnson

JNJ

104.75

-0.04%

1.1K

General Electric Co

GE

25.85

-0.12%

0.3K

Microsoft Corp

MSFT

46.43

-0.13%

11.8K

3M Co

MMM

150.81

-0.17%

4.0K

AT&T Inc

T

34.25

-0.23%

8.8K

-

13:08

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected economic data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand ANZ Business Confidence October 13.4 26.5

09:30 United Kingdom Net Lending to Individuals, bln September 3.2 2.8 2.7

09:30 United Kingdom Mortgage Approvals September 64 63 61

12:30 Canada Industrial Product Prices, m/m September +0.3% Revised From +0.2% +0.3% -0.4%

12:30 Canada Raw Material Price Index September -2.2% +1.5% -1.8%

The U.S. dollar traded mixed against the most major currencies ahead of the Fed's interest rate decision. Investors expect that the Fed will end its bond-buying program. They are awaiting new signs for further monetary policy in the U.S. The slowdown of the global growth and recent weaker-than-expected U.S. economic data could lead that the Fed will keep its low interest rate for a longer period.

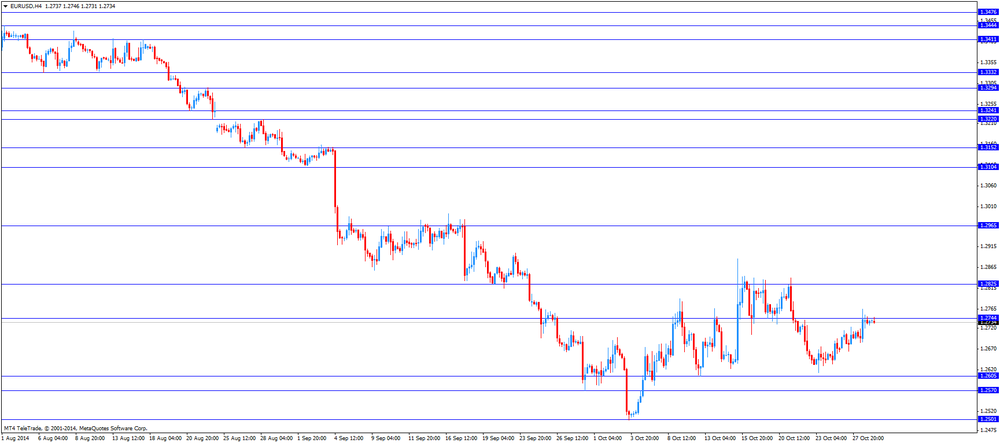

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone.

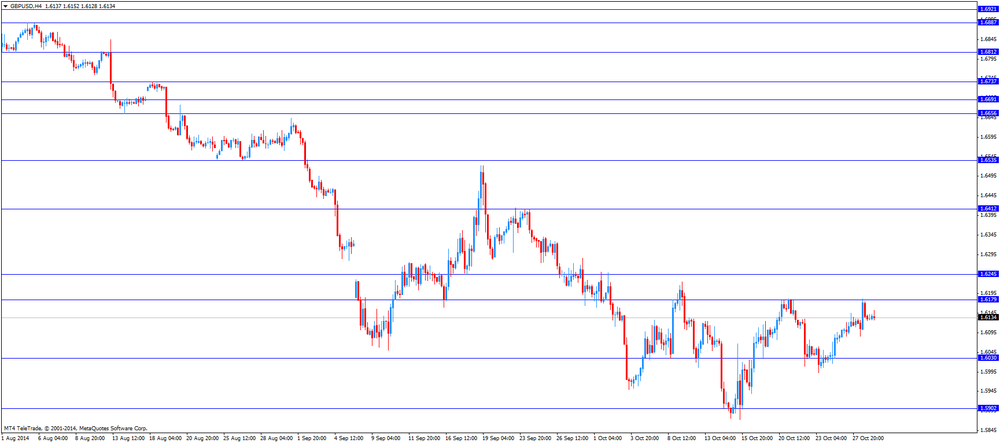

The British pound traded lower against the U.S. dollar after the weaker-than-expected economic data from the U.K. The number of mortgages approvals in the U.K. fell to 61,267 in September from 64,054 in August. That was the lowest level since July 2013. Analysts had expected the number of mortgages approvals to decline to 63,000.

Total lending to individuals in the U.K. rose by GBP 2.7 billion in September, missing expectations for an increase by GBP 2.8 billion, after a GBP 3.2 billion gain in August.

The Canadian dollar traded higher against the U.S. dollar despite the weaker-than-expected economic data from Canada. Canada's raw materials purchase price index fell 1.8% in September, missing expectations for a 1.5% rise, a 2.2% drop in August.

Canada's industrial product price index declined 0.4% in September, missing forecasts for a 0.3% rise, after a 0.3% gain in August. August's figure was revised up from a 0.2% increase.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6109

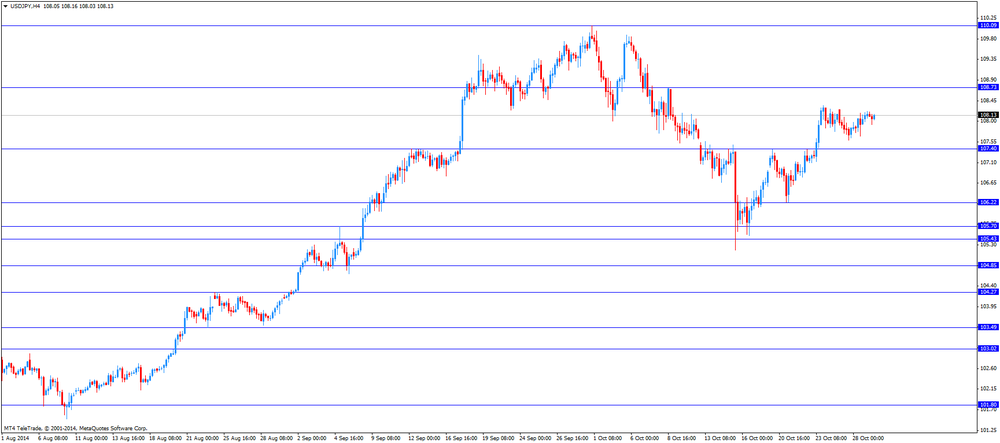

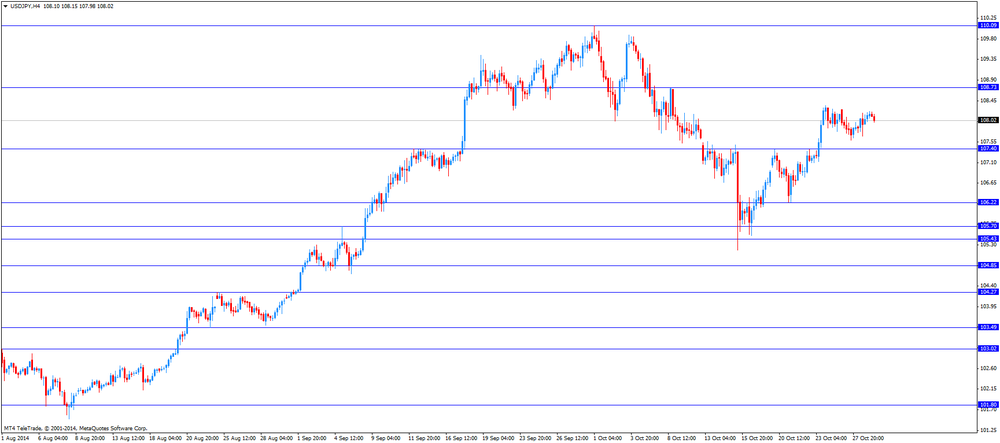

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 15 0

18:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

-

13:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Amazon.com (AMZN) initiated with a Overweight at Morgan Stanley, target $420

eBay (EBAY) initiated with a Underweight at Morgan Stanley, target $45

Yahoo! (YHOO) resumed with a Buy at Citigroup, target $63

-

13:00

Orders

EUR/USD

Offers $1.2885, $1.2845/40, $1.2800

Bids $1.2665, $1.2610, $1.2580

GBP/USD

Offers $1.6225, $1.6200, $1.6185

Bids $1.6060, $1.6000, $1.5940

AUD/USD

Offers $0.8950, $0.8900

Bids $0.8800, $0.8785/80, $0.8755/50, $0.8710/00

EUR/JPY

Offers Y138.80, Y138.00, Y137.90

Bids Y137.00, Y136.55/50, Y136.10/00, Y135.80, Y135.50

USD/JPY

Offers Y109.00, Y108.50

Bids Y107.55/50, Y107.20, Y107.00

EUR/GBP

Offers $0.8000, $0.7940

Bids stg0.7850, $0.6070

-

12:30

Canada: Raw Material Price Index, September -1.8% (forecast +1.5%)

-

12:30

Canada: Industrial Product Prices, m/m, September -0.4% (forecast +0.3%)

-

12:03

European stock markets mid session: stocks traded higher on the better-than-expected corporate earnings

Stock indices traded higher on the better-than-expected corporate earnings.

Investors are awaiting the Fed' interest rate decision today. They expect that the Fed will end its bond-buying program. Investors are awaiting new signs for further monetary policy in the U.S. The slowdown of the global growth and recent weaker-than-expected U.S. economic data could lead that the Fed will keep its low interest rate for a longer period.

Sanofi shares dropped 4% after the company removed its chief executive.

STMicroelectronics NV shares dropped 9.1% after the company said fourth-quarter sales will decline around 3.5% because of weaker demand, and reported the weaker-than-expected third-quarter net revenue.

Schneider Electric SE shares rose 2.8% after reporting the better-than-expected third-quarter revenue.

Total SA shares climbed 1.4% after posting the better-than-estimated third-quarter net income.

Current figures:

Name Price Change Change %

FTSE 100 6,444.91 +42.74 +0.67 %

DAX 9,125.05 +56.86 +0.63 %

CAC 40 4,117.83 +5.16 +0.13 %

-

10:32

Asian Stocks close: most stocks closed higher on solid corporate earnings reports

Asian stock indices closed higher on solid corporate earnings reports.

Investors are awaiting the Fed's interest rate decision today. They expect that the Fed will end its bond-buying program.

Investors also expects new signs for further monetary policy.

Japanese stocks rose as industrial production from Japan increased better than expected by analysts. Preliminary industrial production in Japan climbed 2.7% in September, exceeding expectations for a 2.3% gain, after a 1.9% decline in August.

On a yearly basis, preliminary industrial production rose 0.6% in September, beating forecasts for a 2.6% decrease, after 3.3% drop in August.

Indexes on the close:

Nikkei 225 15,553.91 +224.00 +1.46%

Hang Seng 23,819.87 +299.51 +1.27%

Shanghai Composite 2,373.03 +35.16 +1.50%

-

10:15

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2645(E1.2bn), $1.2680(E400mn), $1.2700-25(E3.0bn), $1.2750(E356mn)

USD/JPY: Y107.00($762mn), Y107.25($325mn), Y108.00($769mn)

EUR/JPY: Y136.45(E225mn)

GBP/USD: $1.6200(stg825mn)

USD/CHF: Chf0.9475($323mn)

EUR/GBP: Stg0.7800(E250mn)

AUD/USD: $0.8800(A$229mn)

NZD/USD: $0.7900(NZ$564mn).

-

09:50

Foreign exchange market. Asian session: the yen traded higher against the U.S. dollar after the better-than-expected industrial production from Japan

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand ANZ Business Confidence October 13.4 26.5

09:30 United Kingdom Net Lending to Individuals, bln September 3.2 2.8 2.7

09:30 United Kingdom Mortgage Approvals September 64 63 61

The U.S. dollar traded lower against the most major currencies. Yesterday's mixed U.S. economic data weighed on the greenback. The U.S. durable goods orders declined 1.3% in September, missing expectations for a 0.4% increase, after a 18.3% drop in August.

The U.S. consumer confidence index jumped to 94.5 in October from 89.0 in September; exceeding expectations for an increase to 87.4. That was the highest level since October 2007.

The New Zealand dollar traded higher against the U.S. dollar after the solid the ANZ business confidence index for New Zealand. The ANZ business confidence index for New Zealand rose to 26.5 in October from 13.4 in September.

Market participants are awaiting the Reserve Bank of New Zealand's and Fed' interest rate decision on Wednesday. They expect that the Reserve Bank of New Zealand will keep its interest rate unchanged at 3.50%, and the Fed will end its bond-buying program.

Investors also expects new signs for further monetary policy.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

Market participants are awaiting the Fed' interest rate decision on Wednesday.

The Japanese yen traded higher against the U.S. dollar after the better-than-expected industrial production from Japan. Preliminary industrial production in Japan climbed 2.7% in September, exceeding expectations for a 2.3% gain, after a 1.9% decline in August.

On a yearly basis, preliminary industrial production rose 0.6% in September, beating forecasts for a 2.6% decrease, after 3.3% drop in August.

EUR/USD: the currency pair rose to $1.2746

GBP/USD: the currency pair increased to $1.6146

USD/JPY: the currency pair fell to Y107.98

The most important news that are expected (GMT0):

12:30 Canada Industrial Product Prices, m/m September +0.2% +0.3%

12:30 Canada Raw Material Price Index September -2.2% +1.5%

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 15 0

18:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

-

06:26

Options levels on wednesday, October 29, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2841 (3263)

$1.2812 (3554)

$1.2773 (1678)

Price at time of writing this review: $ 1.2735

Support levels (open interest**, contracts):

$1.2698 (3123)

$1.2649 (3033)

$1.2578 (6312)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 57767 contracts, with the maximum number of contracts with strike pric $1,2900 (6908);

- Overall open interest on the PUT options with the expiration date November, 7 is 59707 contracts, with the maximum number of contracts with strike price $1,2600 (6312);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from October, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.6400 (1597)

$1.6301 (2074)

$1.6204 (2837)

Price at time of writing this review: $1.6143

Support levels (open interest**, contracts):

$1.6094 (1348)

$1.5997 (2319)

$1.5899 (1939)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 28632 contracts, with the maximum number of contracts with strike price $1,6200 (2837);

- Overall open interest on the PUT options with the expiration date November, 7 is 33045 contracts, with the maximum number of contracts with strike price $1,5400 (2350);

- The ratio of PUT/CALL was 1.15 versus 1.18 from the previous trading day according to data from October, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:00

Nikkei 225 15,539.51 +209.60 +1.37%, Hang Seng 23,738.82 +218.46 +0.93%, Shanghai Composite 2,346.1 +8.23 +0.35%

-

00:00

New Zealand: ANZ Business Confidence, October 26.5%

-