Notícias do Mercado

-

23:39

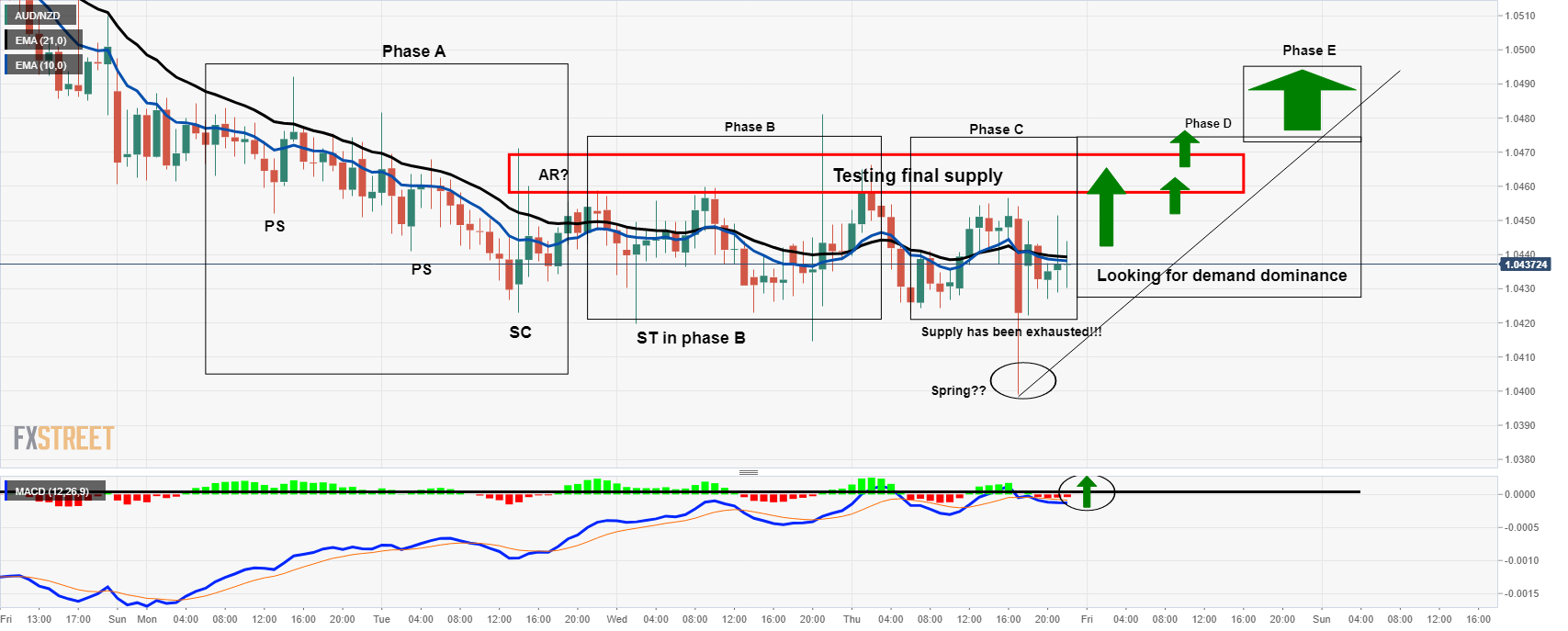

NZD/USD teases bullish flag confirmation below 0.7200, focus on US GDP

- NZD/USD grinds higher inside a bullish technical set-up.

- Record trade deficit, softer ANZ data probed bulls ahead of the key day.

- Market sentiment sours amid pre-US GDP cautions, central bank moves.

- No major data at home, risk catalysts are important for fresh impulse.

NZD/USD remains directionless, taking rounds to the weekly top during the initial Asia session on the key Thursday. That being said, the kiwi pair recently retreats to 0.7170 following the first daily negatives in four.

Although hopes of the heavy rate hike by the Reserve Bank of New Zealand (RBNZ) and carry trade keep NZD/USD afloat, recently soft data at home join cautious mood to weigh on the quote of late.

New Zealand (NZ) Trade Balance shrank more than $-2139M (revised) prior to $-2171M in September to mark the all-time low MoM figures. However, the Imports and Exports were better than their previous readouts as the former rose past $6.495 billion to $6.57 billion whereas the latter grew to $4.4 billion versus $4.351 billion.

On the same line were downbeat figures of October’s Business Confidence and Activity Outlook by the Australia and New Zealand Banking Group (ANZ).

Alternatively, a lower-than-expected US Good Trade Balance and improvement in Durable Goods Orders probed the US dollar bulls ahead of the key Q3 GDP.

It should, however, be noted that the increasing optimism over the monetary policy tightening by the front-line central banks also hints at a reduction in the carry trade and challenge the NZD/USD bulls. Recently, the Bank of Canada (BOC) announced the end of bond purchases and the UK also cuts bond issuance. Further, Australia’s strong prints of the RBA Trimmed Mean CPI also push the Reserve Bank of Australia (RBA) towards a rate hike.

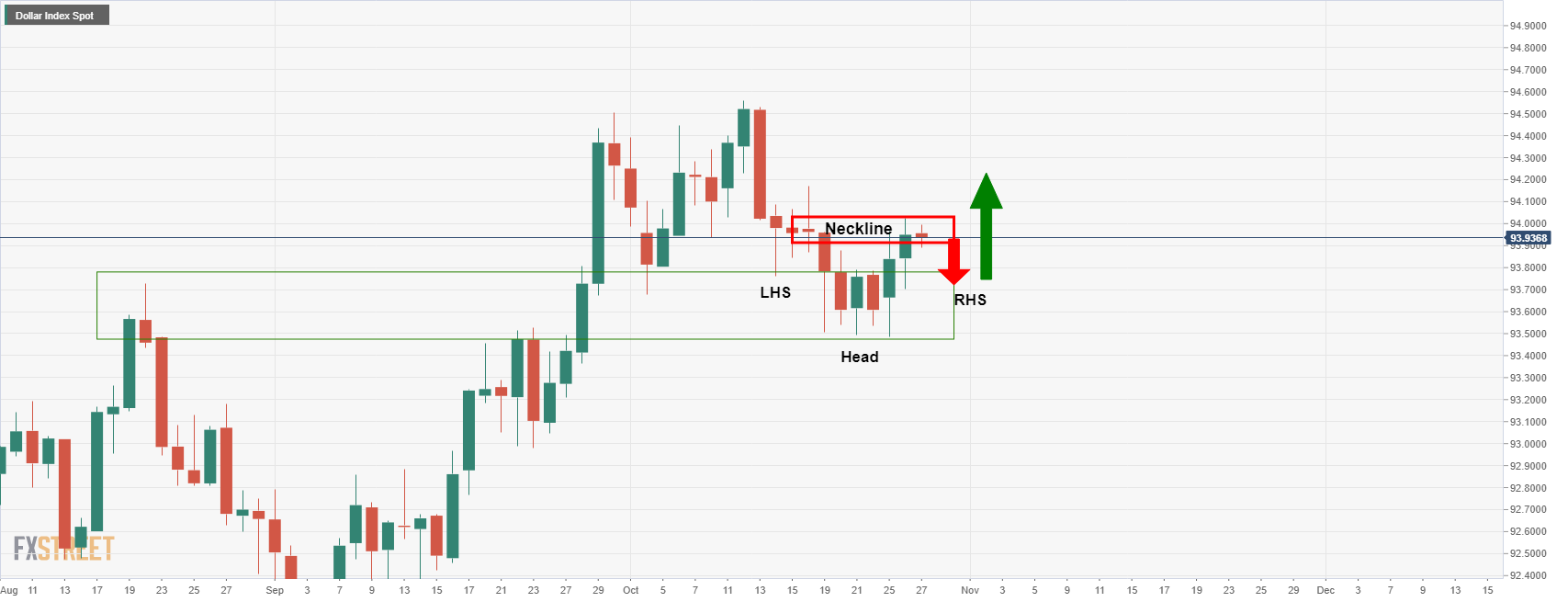

Amid these plays, the US 10-year Treasury yields dropped the most since mid-August and weighed on the US Dollar Index (DXY). However, the equities were mixed and the futures are mildly bid by the press time.

Looking forward, a light calendar at home keeps NZD/USD moves at the mercy of external factors. The same highlight today’s speech from RBA Deputy Governor Guy Debelle and Australia’s Import-Export Price Index for Q3. However, major attention will be given to the preliminary readings of the US Q3 GDP for clear direction.

Read: US Third Quarter GDP Preview: A most uncertain estimate

Technical analysis

NZD/USD prints a bullish flag chart pattern on the four-hour (4H) timeframe amid firmer RSI, suggesting a need for the breakout to portray a fresh upside.

The 0.7190 mark acts as a trigger for the north-run aiming a rally towards 0.7360 theoretical target, with May’s high near 0.7315-20 acting as an intermediate halt. Alternatively, 50-SMA restricts immediate declines around 0.7150 before the flag’s support line, close to 0.7120. In a case where the quote drops below 0.7120, the 100-SMA and 50% Fibonacci retracement of October 06-21 upside, around 0.7050, will be in focus.

NZD/USD: Four-hour chart

Trend: Bullish

-

23:38

USD/JPY consolidates below 114.00 ahead of BOJ decision, US critical data

- USD/JPY consolidates on Thursday in the initial Asian session.

- Lower US Treasury yields undermine the demand for the US dollar.

- BOJ interest rate decisions will be on the traders radar.

USD/JPY continue to move sideways following the previous session’s downside movement. The pair stayed in a narrow trading range. At the time of writing USD/JPY is trading at 113.81, down 0.01% so far.

The US benchmark 10-year T bond yields fell to 1.53%, the biggest decline since July, which underscores the demand for the greenback. Investors remained concerned about rising inflation, supply chain issues, and downbeat data.

The greenback remains steady near 93.80, following downbeat economic data. The US New Durable Goods orders fell less than estimated in September. The rise for August was revised down to 1.3% growth from 1.8%.

On the other hand, the Japanese yen struggles to find demand ahead of the Bank of Japan (BoJ) policy update. The BoJ is expected to maintain its massive stimulus program and cut this year’s inflation forecasts at its meeting on Thursday.

It is worth noting that, S&P 500 Futures are trading at 4,550.50,up 0.13% so far.

As for now, traders are waiting for Japan Retail Sales, BOJ Interest Rate Decision, and US GDP Growth Rate to gauge the market sentiment.

USD/JPY additional levels

-

23:12

White House pushes for budget talks, Democrats add extra meeting for US Pres. Biden

“President Joe Biden’s top budget official urged lawmakers to swiftly broker an agreement on spending levels for federal agencies for the current fiscal year,” said Bloomberg during early Thursday morning in Asia.

The news adds the reasons behind the move as to, “Avoid another stopgap bill when the current short-term measure runs out in a little over six weeks.”

Key quotes (from Bloomberg)

In a letter obtained by Bloomberg News, Acting Budget Director Shalanda Young wrote to the leaders of the House and Senate Appropriations Committees urging swift talks on top-line spending levels for the year that began October 1.

The 12 draft bills cover regular agency spending, distinct from the longer-term economic bills now before Congress. Democratic congressional leaders are hoping to pass Biden’s estimated $2 trillion tax and social safety net package and a $550 billion bipartisan infrastructure bills in the coming days.

Lawmakers will then need to pivot to avoiding a government shutdown after Dec. 3, when the current stopgap funding measure runs out, addressing the federal debt ceiling. The Treasury’s borrowing authority is set to run out around the same Dec. 3 deadline.

On a different page, the US House Democrats have added an extra meeting around 13:00 GMT Thursday for negotiations over US President Joe Biden’s stimulus plan. The reason could be the latest demands from the Republicans to remove the majority of Biden’s component from the stimulus proposal.

Late on Thursday, Reuters came out with the news saying, "White House spokeswoman Jen Psaki said on Wednesday that it is still realistic for congress to get a deal on U.S. President Joe Biden's signature spending agenda by Thursday." The hopes of a deal on Thursday were also backed by the Senator Joe Manchin.

FX implications

The news adds to the cautious sentiment in the market and weighs on the S&P 500 Futures by the press time.

Read: AUD/USD: Bulls take a breather below 0.7565 hurdle ahead of US GDP

-

23:06

GBP/JPY steady around 156.40 amid a mixed market sentiment

- GBP/JPY gave back its Tuesday’s gains, as investors flew towards safe-haven assets, the Yen is up.

- Market sentiment has dampened, as robust US Q3 corporate earnings fade, alongside month-end flows.

- UK’s economy expected to grow 6.5% in 2021 – UK’s Office for Budgetary Responsibility.

On Wednesday, the GBP/JPY seesawed at a wide range, dipping down from 157.27 to 155.70, ultimately stabilizing around 156.40 as the Asian session began.

The market sentiment Is mixed as the Asien session kicks in

As the New York session winds down, the market sentiment was mixed, as showed by US stock indices finishing in the red, except for the heavy-tech Nasdaq Composite, which printed gains of 0.25% on the back of Microsoft and Google Alphabet.

Uncertainties like the US fiscal policy, central bank tightening, and inflationary pressures kept investors uncomfortable, as some safe-haven currencies appreciated in tandem with precious metals. That, in part, boosted the prospects of the Japanese yen, which despite non-important information on its macroeconomic docket, relied on its safe-haven status versus the risk-sensitive British pound.

In the meantime, in the UK, Rishi Sunak, the Chancellor of the Exchequer, presented the Autumn 2021 British budget. Sunak appeared at the Parliament. He said that the British economy would expand by 6.5% in 2021, better than the 4% predicted during COVID-19 lockdowns. Putting this aside, the Office for Budgetary Responsibility (OBR) expects a deficit contraction, to 7.9% of the GDP, from previous forecasts of 10.3%.

GBP/JPY Price Forecast: Technical Outlook

Weekly chart

The weekly chart depicts the GBP/JPY pair is in a solid upward trend portrayed by rising slope weekly simple moving averages (WSMA’s) located beneath the spot price, alongside a test of the February 2, 2018, resistance level at 156.61. Since July, the cross-currency has appreciated 6.50%, and the 100-WSMA is just crossing over the 200-WSMA, adding another bullish sign to the previously mentioned hints.

Furthermore, an upward slope trendline that travels from March 2020 lows under September 2020 lows was unsuccessfully tested by the GBP/JPY pair, which bounced off at 150.00, rallying over 700 pips until finally settling at current levels.

Hence, the pair could be headed towards the upside. However, the lack of recent price action above the 156.00 threshold leaves June 24, 2016, swing highs around 159.20 as the next resistance level.

-

22:56

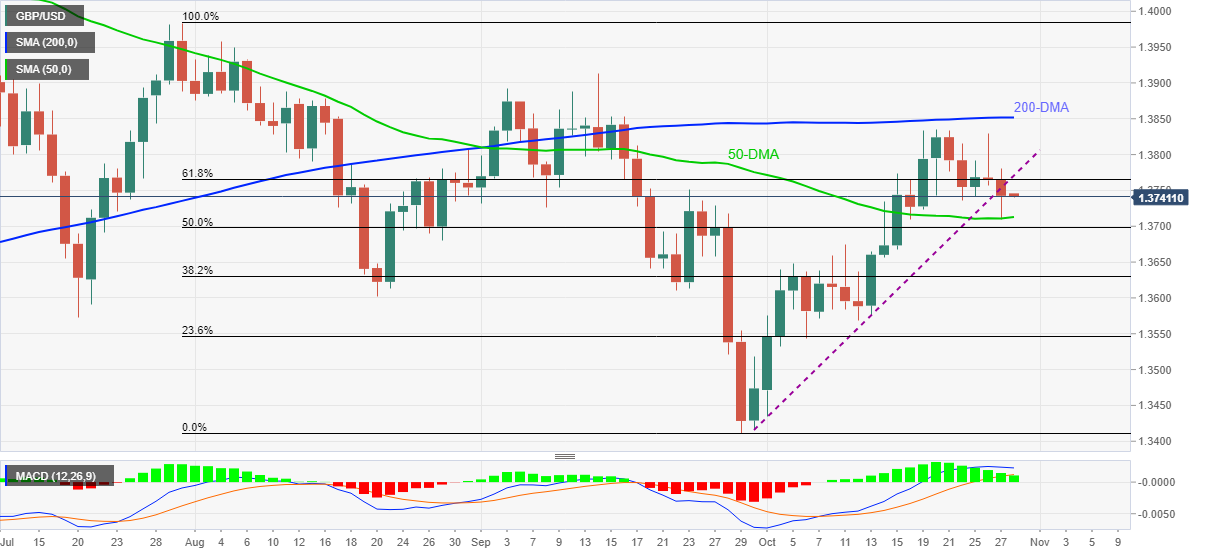

GBP/USD Price Analysis: Sellers attack 50-DMA on monthly support break

- GBP/USD fades bounce off weekly low, keeps monthly support line breakdown.

- Bullish MACD challenges downside past 50-DMA, recovery moves have a bumpy road below 200-DMA.

GBP/USD prints a three-day downtrend following the key support break, pressured around 1.3740 during the early Asian session on Thursday.

The cable pair broke an ascending support line, now resistance, from September 30 the previous day but refrained from closing below 50-DMA.

Given the bullish MACD signals and multiple supports around the 1.3710-3700 area, comprising 50-DMA and 50% Fibonacci retracement of late July-September fall, the GBP/USD pair’s heavy downside remain doubtful.

However, a daily closing below 1.3700 won’t hesitate to direct the pair bears towards August lows of 1.3600.

Meanwhile, a convergence of the previous support and 61.8% Fibonacci retracement level near 1.3770-75 guards the quote’s corrective pullback ahead of the 200-DMA level surrounding 1.3855.

In a case where GBP/USD bulls manage to conquer the 1.3855 hurdle, September’s high of 1.3913 and July peak close to 1.3985 may probe the run-up towards the 1.4000 psychological magnet.

GBP/USD: Daily chart

Trend: Further weakness expected

-

22:40

Brazil Interest Rate Decision came in at 7.75%, above forecasts (7.25%)

-

22:39

AUD/USD: Bulls take a breather below 0.7565 hurdle ahead of US GDP

- AUD/USD seesaws around monthly high, retreats of late.

- Strong RBA Trimmed Mean Inflation prints join global central bank actions to favor bulls.

- Softer yields, mixed US data weigh on USD to offer additional upside momentum.

- Australia’s Import-Export Price Index, RBA’s Debelle can entertain traders ahead of Q3 US GDP.

AUD/USD seesaws around monthly high, despite recently easing to 0.7520 during the four-day uptrend at the start of the key Thursday.

The risk barometer pair previously benefited from a jump in the Reserve Bank of Australia (RBA) preferred inflation gauge before the global central banks portrayed tapering moves. However, the bulls are recently cautious ahead of the speech from RBA Deputy Governor Guy Debelle and preliminary readings of the US Q3 GDP.

Australia’s headlines Consumer Price Index (CPI) matched 0.8% QoQ forecast for the third quarter (Q3) release while the YoY figures eased below 3.8% prior and 3.1% market consensus to 3.0%. However, it was the RBA Trimmed Mean CPI that lured the bulls with a six-year high yearly print of 2.1%, versus 1.8% expected and 1.6% prior. The central bank’s preferred gauge of inflation rose past 0.5% market forecast and previous readouts to 0.7% on QoQ.

With the inflation figures back to the RBA’s 2-3% target range for the first time since 2015, the Aussie central bank is likely rushing towards the rate hike and joining its Western pals. Such speculations propelled the Treasury bonds at home to a multi-year high, before retreating a bit and fueling the AUD/USD prices.

In addition to the increasing hopes of the RBA’s rate hike, the UK’s cut in bond issuance and the Bank of Canada’s (BOC) end of tapering were additional signals that the global central bank is more confident, which in turn fuelled AUD/USD due to its safe-haven allure.

Elsewhere, a lower-than-expected US Good Trade Balance and improvement in Durable Goods Orders probed the US dollar bulls ahead of the key Q3 GDP. The same joined the optimism at other central banks and weighed on the US Treasury yields, as well as the US Dollar Index (DXY). It should be noted, however, that the equities were mixed and the commodities dropped as risk-averse traders await the key US data amid Fed tapering tantrums.

Read: US Third Quarter GDP Preview: A most uncertain estimate

While the US Q3 GDP will be important for AUD/USD moves, RBA’s will be eyed more closely for immediate moves as the Aussie policymakers previously highlighted the need for firmer wages to accept the reflation fears. Hence, any hints of the firmer inflation pushing the RBA towards a rate hike will be welcomed with zeal by the AUD/USD buyers while an otherwise case may take clues from the pre-US GDP sentiment to probe the upside moves.

Technical analysis

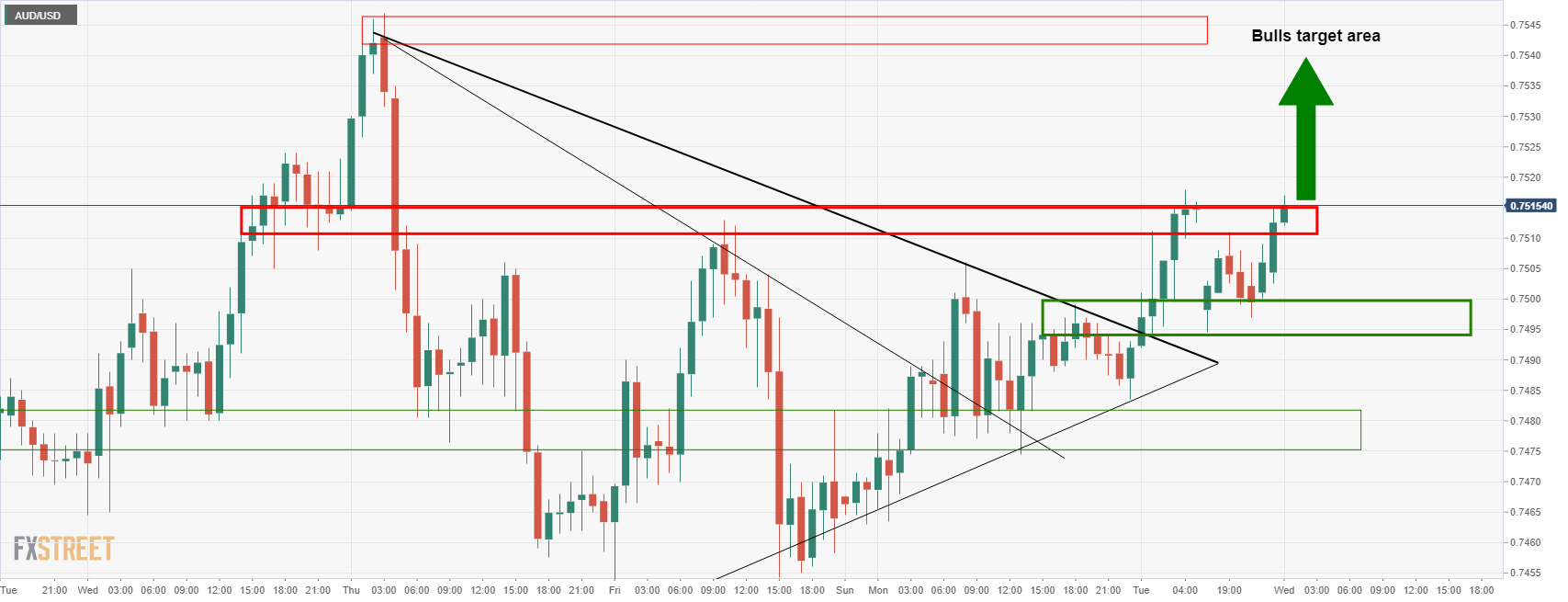

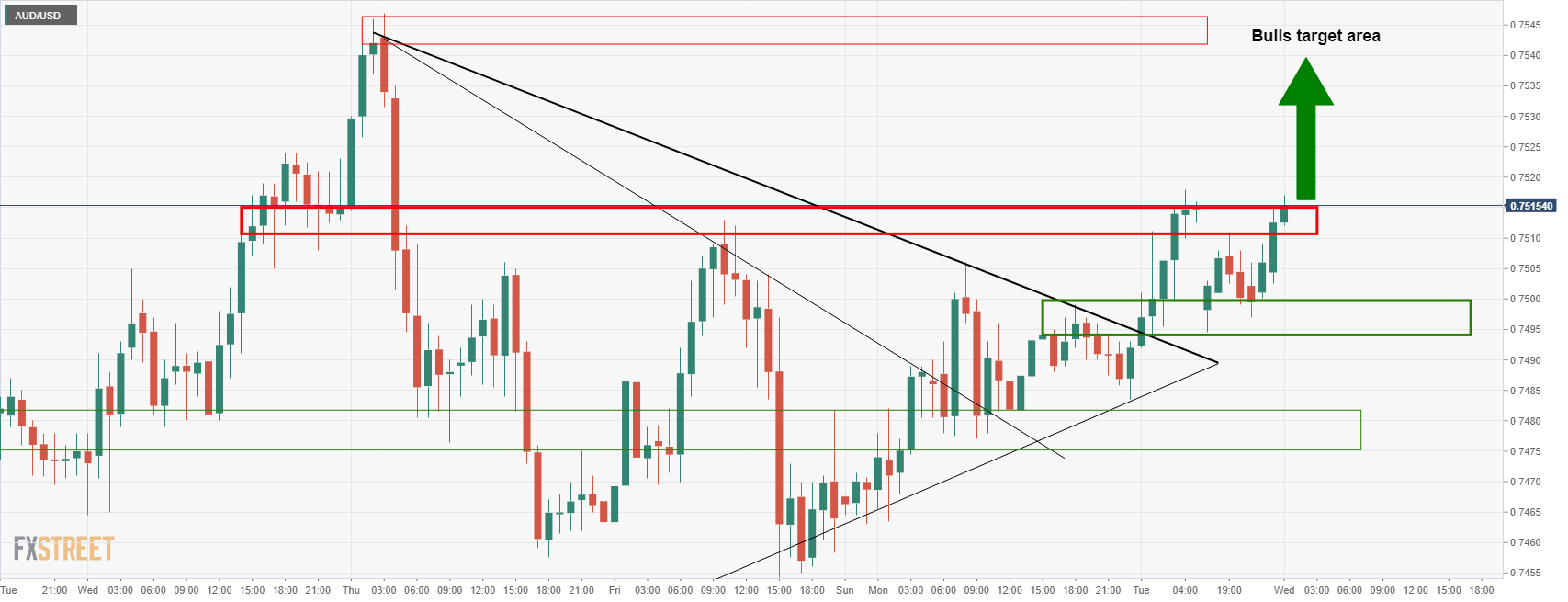

Although AUD/USD bulls seem to have tired below the 200-DMA near, the monthly support line and a hidden bullish divergence, a condition where prices make lower high but the RSI prints higher high, keeps the upside momentum intact. Hence, even a short-term pullback remains less convincing until the quote stays beyond the stated support line around 0.7495. However, the 200-DMA level close to 0.7565 acts as the key hurdle to watch during the fresh run-up.

-

22:20

US Stoks Forecast: Nasdaq supported by tech big caps

- The Dow Jones Industrial Average fell 266.19 points, or 0.74%,

- The S&P 500 lost 23.11 points, or 0.51%, and the Nasdaq Composite added 0.12 points.

US stocks were mixed on Wednesday as strong results from technology heavyweights kept the Nasdaq Composite in the green. However, declining government bond yields and a drop in commodity prices sent the Dow Jones Industrial Average and the S&P 500 lower.

The Nasdaq finished little changed on Wednesday, supported by gains in Microsoft and Google parent Alphabet following quarterly results. The Dow Jones Industrial Average lost 266.19 points, or 0.74%, to 35,490.69, the S&P 500 dropped 23.11 points, or 0.51%, to 4,551.68 and the Nasdaq Composite added 0.12 point, or unchanged, to 15,235.84.

As for performers, Microsoft Corp MSFT added 4.21% and ended making a record high after forecasting a strong end to the calendar year. Alphabet Inc rallied 4.96% after reporting a record quarterly profit on a surge in ad sales. The move combined added 90 points to the Nasdaq. Microsoft was the biggest boost to the Dow Industrials, S&P 500 and Nasdaq. Meanwhile, the drop in the far data US Treasury bond yields and a flattening of the yield curve lifted the growth stocks which were the only advancing S&P sectors on the day.

The benchmark 10-year US Treasury yield declined for a fourth straight day, dropping more than 6 basis points to put it on track for its biggest one-day decline since Aug 13. Thus taking it below the daily dynamic trendline support and opening bearish prospects:

-

21:21

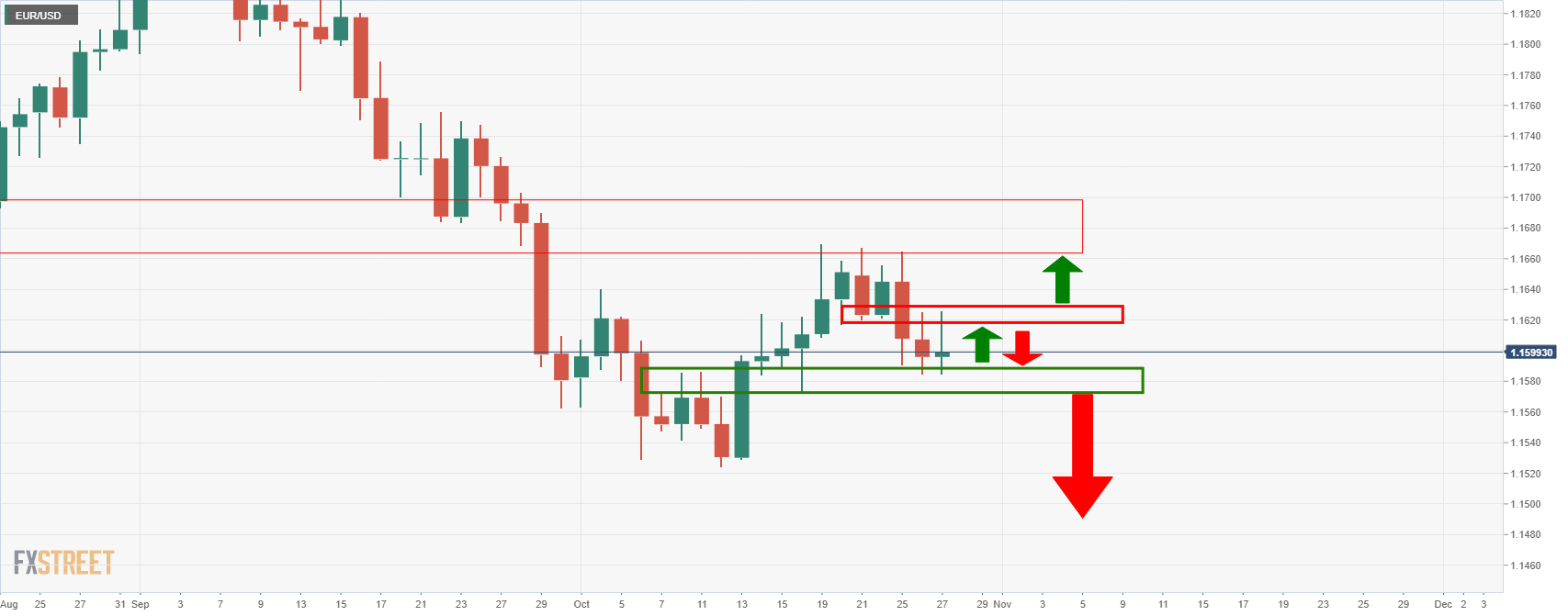

EUR/USD Price Analysis: Bears stepping in as US yields melt

- EUR/USD is currently trapped between critical support and resistance.

- The single unit is faring better following a fall in US yields.

EUR/USD is slightly firmer on the day trading around the 1.16 figure after rising from a low of 1.1548 to a score a high of 1.1626 following a drop in US yields as follows:

The 10-year yield is testing the horizontal support and has broken below the trendline. On a restest of what is now regarded as a counter trendline, should the bears step in, the US dollar would be expected to be pressured also. This gives rise to bullish prospects for the single currency as follows:

EUR/USD weekly chart

The weekly chart offers a bearish bias at this juncture, pressure below the resistance.

EUR/USD daily chart

As for the daily chart, the price is trapped between critical support and resistance following a test of the M-formation's neckline.

EUR/USD 4HR chart

The 4-hour chart illustrates the trapped scenario and the critical levels of support and resistance structure shown in the chart above.

-

20:58

USD/CAD downward move capped at 1.2300, steady around 1.2350

- USD/CAD trims some of its daily losses, despite BoC ending QE.

- USD/CAD plunged 130 pips once the central bank released its monetary policy decision.

- Bank of Canada will begin the "reinvesting phase," meaning a replacement of maturing bonds for new ones.

- Bank of Canada: If inflation is stickier than expected, the bank will act to bring it down.

The USD/CAD slumps for the first time in the week, down 0.25%, trading at 1.2358 during the New York session at the time of writing. Earlier 30-minutes into the New York stock market session, the Bank of Canada (BoC) released its monetary policy statement announcing the ending of its weekly pandemic bond-purchasing program.

Furthermore, the BoC decided to keep interest rates unchanged. However, investors' expectation towards the QE was a reduction in its weekly purchases from CAD 2 billion to CAD 1 billion. Instead, the central bank decided to halt its stimulus, as the threatening of stickier inflation clouds the economic growth.

The USD/CAD pair reaction to the BoC decision

Before the announcement, the pair was trading at 1.2430 but plummeted on the announcement 130 pips, touching the daily low at 1.2300.

BoC Governor Tiff Macklem: We will consider raising rates sooner than we had previously thought

One hour after the release of the Statement, BoC Governor Tiff Macklem held a press conference. He said that despite the bank's decision to finalize the QE program, significant stimulus to the economy would remain in the palace.

The end of QE comes as increasing vaccination rates are enabling continued progress in the economic recovery in Canada and around the world", said the BoC in the opening statement.

Additionally, the central bank announced that it would end the QE program, but it will begin the "reinvesting phase." The BoC will purchase bonds only to replace those maturing, meaning that the overall holdings remain stable over time.

Further, Macklem added that he believes there are good reasons for inflation to ease in 2022 but warned that if they see signs of prolonged inflation, they will take action to curb elevated price pressures.

-

20:43

Forex Today: The global tightening spree has just started

What you need to know on Thursday, October 28:

The greenback seesawed between gains and losses, ending the day weaker against most major rivals, although within familiar levels. Demand for the greenback eased as yields retreated further. The yield on the 10-year Treasury note currently stands at 1.54%, while that on the 2-year note ticked higher, now at 0.50%. The yield curve is flattening, usually a hint of a rate hike cycle.

Speculation of tighter monetary policies across the board was fueled by news that Australian inflation surged at its fastest annual pace since 2015 in the three months to September. According to the official report, the RBA Trimmed Mean CPI was up 2.1% YoY, well above the 1.8% expected and the previous 1.6%. The quarterly figure printed at 0.7% up from 0.5% in the second quarter. Investors were caught off guard and rushed to price in an earlier interest rate hike.

Additionally, the Bank of Canada announced it has decided to end its weekly purchases of government bonds, the first central bank to end pandemic-related facilities, surprising investors who were speculating on a gradual reduction of QE. The US Federal Reserve, the Bank of England and even the European Central Bank, are also in the tapering path, with movements there expected for the next quarter. The Bank of Japan and the ECB will announce their decisions this Thursday, while the Fed will meet next week.

Global indexes edged mostly lower. In Wall Street, only the Nasdaq Composite was able to post some gains.

Gold edged higher, ending the day around $1,796 a troy ounce, while crude oil prices plummeted. WTI settled at $82.10 a barrel after the EIA reported a larger than anticipated build in local stockpiles of 4.267 million.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:24

EUR/JPY Price Analysis: Bulls seek a monthly extension, but bears in control on the 4-hour

- EUR/JPY bears on top n the ower time frames.

- Bulls are taking charge longer-term as per the monthly chart.

EUR/JPY is under pressure as per the lower time frames and the following is a top-down analysis that arrives at a bullish bias longer term, but bearish for the near term.

EUR/JPY monthly chart

The monthly chart is showing signs of a fresh impulse to the upside, although there could still be some work to be done yet by the bulls according to the lower time frames.

EUR/JPY weekly chart

The weekly chart is offering a bearish bias as the price continues to slip following the big rejection wick of last week's business.

EUR/JPY daily chart

On the daily chart, we can see that the price is attempting to recover from a close touch of the 38.2% Fibonacci. retracement level. However, given the velocity of the correction, the momentum is still with the bears and a visit of 131.50 is probable.

EUR/JPY 4HR chart

The 4-hour chart is offering a bearish bias also with the price coming in close to the 61.8% Fibonacci retracement level and caped bt the 21-EMA.

-

20:13

NZD/USD stalls at 0.7200, steady around 0.7177 amid risk-off market sentiment

- The NZD/USD gains despite mixed market sentiment but struggles at 0.7200.

- The commodity currencies edge higher against the greenback.

- NZD/USD: The daily chart confirms the upward bias, but NZD bulls, to accelerate the trend, will need to reclaim 0.7200.

The NZD/USD advances for the fourth consecutive day, despite mild risk-off market sentiment is up 0.27%, trading at 0.7183 during the New York session at the time of writing.

Major US equity stocks are mixed as the New York session wanes. The S&P and the Nasdaq Composite rise 0.09% and 0.94%, respectively, while on the other hand, the Dow Jones losses 0.27%. Investors remain at bay due to month-end flows, US fiscal policy uncertainties, and central bank pandemic-stimulus ends.

That said, antipodean currencies and the Canadian dollar advance against the greenback. Meanwhile, the US Dollar Index, which tracks the buck’s performance against a basket of its peers, slumps 0.16%, sits at 93.79.

It is worth noting that on Wednesday, the Bank of Canada ended its weekly QE program, adding to the Reserve Bank of New Zealand as the only central banks, that are normalizing their monetary policy.

Turning to US fiscal policy, according to wires, US President Joe Biden reportedly agreed to push for a deal as soon as possible in a meeting with lawmakers. Also, the US Senate Finance Committee Chairman Ron Wyden unveiled a 23.8% tax proposal focused on unrealized gains of assets held by billionaires, affecting 700 people.

Macroeconomic data from New Zealand reported that the ANZ Business Confidence dropped from -8.6 in September to -13.4 in October. Furthermore, Statistics of New Zealand said that the Trade Balance deficit expanded in September.

Meanwhile, in the US economic docket, Durable Good Orders for September contracted by 0.4%, less than the 1.1% expected by analysts. On the other hand, the Nondefense orders, excluding aircraft, expanded by 0.8%, higher than the 0.5% estimated.

NZD/USD Price Forecast: Technical outlook

The NZD/USD daily chart depicts the pair has a bullish bias, portrayed by daily moving averages (DMA’s) beneath the spot price, with an upward slope.

Furthermore, the Relative Strength Index (RSI), a momentum indicator at 66, edges slightly up, confirming the abovementioned, but the trend seems to fade. NZD bulls to accelerate the upward trend speed will need a daily close above 0.7200. In that outcome, they will find immediate resistance at 0.7219. A clear break of the latter would expose crucial supply zones, the June 7 high at 0.7244, followed by the 0.7300 thresholds.

NZD/USD TECHNICAL LEVELS TO WATCH

-

20:09

USD/CHF unable to regain 0.9200, edges down to 0.9170

- The dollar fails to return above 0.9200, edges down to 0.9170 area.

- US dollar loses momentum on the back of softer US T-bond yields.

- USD/CHF remains weak while below 0.9200.

The US dollar is trading lower on Wednesday after having failed to return above 0.9200. The pair depreciates 0.3% on the daily chart, retreating towards the 0.9170 area amid moderate dollar weakness.

The USD loses ground amid lower US Treasury bonds

The pair has confirmed its reversal from Tuesday’s high at 0.9225 weighed by broad-based US dollar weakness. The decline in US T-Bond yields, which have fueled USD’s rally from late July lows is pulling the dollar lower across the board.

The yield on the benchmark 10-year note has dropped to 1.52% on Wednesday, down from the multi-month highs at 1.68% hit last week. The hawkish message from the Bank of Canada, which confirmed the end of its QE program earlier today, has rattled debt markets with the investors bracing for a similar decision by the Federal Reserve at next week’s meeting.

On the macroeconomic front, US data has been mixed today with orders for durable goods manufactured in the US contracting less than expected in September, due to a solid increase of non-defense capital goods. On the other hand, the US goods trade deficit widened to $96.3B in September from $89.4B in the previous month on the back of a sharp decline in exports which will have a negative impact on the third quarter’s growth.

USD/CHF: Near-term trend remains negative below 0.9200

Technical indicators show the near-term USD/CHF trend biased lower, after having broken the upward channel from early August lows, with next potential targets at 0.9150 (October 22 and 24 lows) and 0.9100 (August 18 and 30 lows), which might expose August 4 low at 0.9020.

On the upside, a bullish reaction past 0.9225 (October 26 high) would ease negative pressure and confirm the breach of trendline resistance, increasing positive traction towards October 18 high at 0.9275 and then 0.9310 (October 12 and 13 highs).

USD/CHF Daily Chart

Technical levels to watch

-

19:18

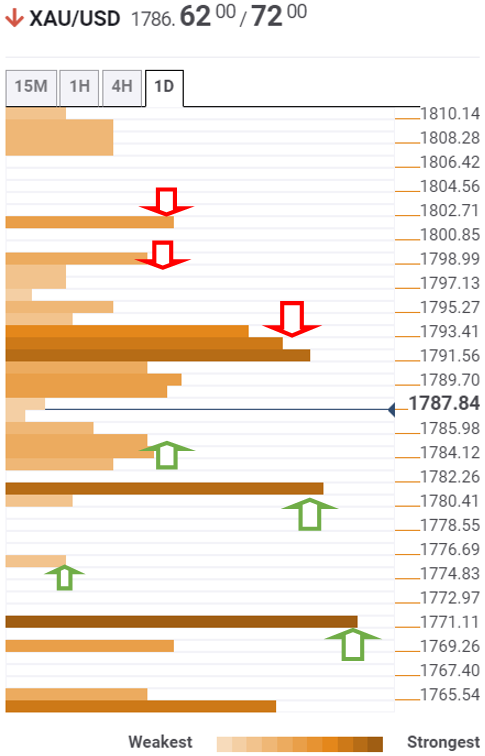

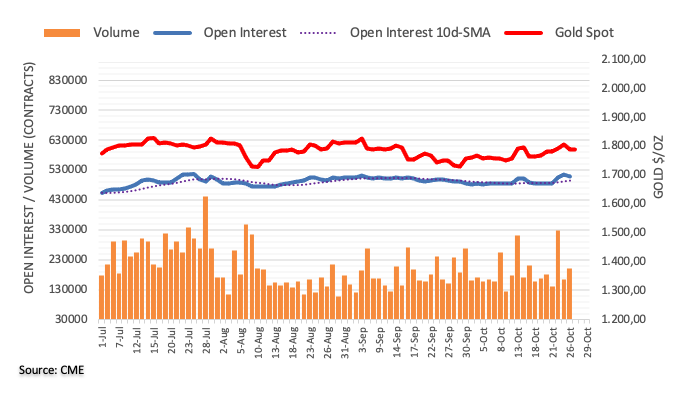

Gold Price Forecast: Bull’s eye $1,800 as US T-bond yields plummet as central banks cut stimulus

- The Bank of Canada adds to the RBNZ as the only central banks that finished its pandemic QE.

- US T-bond yields plunged once the BoC decision hit the wires.

- Gold aims higher, as nervousness grows on investors, of what the Federal Reserve might do next.

Gold (XAU/USD) climbs during the New York session, is up 0.20%, trading at $1,796.47 a troy ounce at the time of writing. The non-yielding metal recovered some of its brightness as the session progressed, boosted by safe-haven flows.

Risk-off market sentiment spurred my month-end flows and US fiscal policy concerns, kept investors at bay. Furthermore, the economic growth outlook and central bank tightening monetary policy conditions seem to weigh on lately, hurting the greenback thus favoring gold.

In the meantime, the US T-bond yields plummet in the session, with the 10-year note breaking decisively below the 1.60% threshold, sitting at 1.535% down eight basis points, weighing on the greenback, as noted by the US Dollar Index falling 0.16%, at 93.79.

It is worth noting that on Wednesday, the Bank of Canada ended its weekly bond-purchasing program, that in turn, weighed on investors as yields plunged severely in the session.

That said, expectations around gold lie heavily on the Federal Reserve November meeting. A $15 Billion bond taper is priced in. However, If the Federal Reserve aims for a quicker than expected bond-tapering, that might send gold tumbling below the $1,720 threshold and potentially towards a renewed test of 2021 lows.

XAU/USD Price Forecast: Technical outlook

Daily chart

Gold (XAU/USD) spot price is above the confluence of the 100 and 200-day moving average (DMA) and on Tuesday broke a downward slope trendline previously resistance-turned-support, which could be viewed as a bullish signal. The Relative Strength Index (RSI) is at 58, aims slightly low, but as it remains above the 50-midline, it is bullish for the yellow metal.

To resume the upward trend, gold buyers will need a daily close above $1,800. In that outcome, the September 3 high at $1,834 would be the first resistance level. A clear break above the latter would expose the June 4 low at $1,855, followed by the $1,900 threshold.

XAU/USD TECHNICAL LEVELS TO WATCH

-

19:15

GBP/JPY finds support at 155.90 and bounces up towards 156.45

- Pound reversal from 157.75, contained at 156.00 area.

- The sterling trims losses following an upbeat UK Budget Report.

- GBP/USD remains biased higher, aiming to 158.22 – DBS Bank.

The pound’s reversal from 157.75 witnessed on Tuesday has failed to confirm below the 155.90/00 support area, where the pair found support to bounce up on Wednesday’s US trading time and return to the 156.45 area.

The sterling appreciates on upbeat budget forecasts

The pound has shrugged off the previous weakness on Wednesday, trimming losses against its main rivals on the back of the positive economic forecasts released by the British finance minister, Rishi Sunak, at the Autumn 2021 budget statement.

Sunak assured that The British economy will expand at a 6.5% pace in 2021, beating previous forecasts of a 4.0% growth predicted at the time when COVID-19 lockdowns were still active. Beyond that, the Office for Budgetary Responsibility (OBR) expects the deficit for the financial year to shrink to 7.9% of the GDP, down from previous estimations of 10.3%.

GBP/JPY is expected to resume its uptrend, aiming to 158.22 – DBS Bank

On a broader view, according to Benjamin Wong, Strategist at DBS Bank, expects the pair to resume its uptrend from late-July lows: “A quick look at the daily Ichimoku charts shows bullish momentum remains in a feverish pitch, and there is no affirmation that the 158.22 highs are a verified absolute top. Hence, we remain open to the possibility of the cross assailing higher levels before it ends terminally the bull run that currently came off 148.47, the July 2021 lows.”

Technical levels to watch

-

18:56

US bond market is in a sate of flux post BoC and ahead of the Fed next week

- US yields plunge below daily trendline support and weighs on USD.

- BoC rocks the applecart with a hawkish tone.

Worries around rising inflation, supply chain issues and a slowdown in the economy, continue to weigh on investors’ minds. US yields have taken a knock in trade today with the 10-year yield sliding below critical trendline support while MSCI's global equity benchmark hovers close to Monday's seven-week high, on track for the best month in almost a year.

This has led to an offer in the US dollar that has lost value against major currencies on Wednesday as the Bank of Canada hit a hawkish tone. The moves in debt markets came after the BoC announced that it was ending its quantitative easing program, joining a growing number of central banks that are rolling back their pandemic era programs. The US Federal Reserve is set to meet again next week. The action broke a calm that had settled over the currency markets this week and took the US dollar index down 0.2% to 93.693

The BoC said it now expected slack in the economy to be absorbed in the "middle quarters" of 2022, signalling rates could rise months sooner than previously forecast. Before the announcement, the Canadian dollar traded as highs as 1.2341 vs the greenback, but is now down nearly 0.4% after touching a low of 1.2300, moving in on its lowest level in nearly two weeks. The comments from the Bank of Canada could trigger new assessments of how interest rates will change and impact currencies as central bankers try to support the pandemic recovery without unleashing sustained inflation.

US yields in focus

Meanwhile, the US Treasury's 5-year auction hit a high yield of 1.157% on Wednesday, up from the 0.99% high in the previous auction. The bid to cover ratio for the auction was 2.55, above the 2.37 ratio in the previous auction. Dealers represented 56.86% of the bids, with direct bidders at 10.65% and indirect bidders at 32.49%. For takedown, bidders took 17.85%, with direct bidders at 17.37% and indirects were awarded 64.78%.

The 10-year US Treasury yield plunged over 8 basis points to 1.527% which is a major upset for the forex space. This leaves a bearish prospect on the daily chart as follows:

The moves in yields come as investors prepare for the next move from the Federal Reserve. The Fed is widely expected to begin slowing its asset purchases later this year. Even though yields have retreated below the trend line, the 10-year is still trading well above its recent lows near 1.1% in early August. However, we could still see a continuation of the long-end creeping up as the short end is just basically going to trade based on what the market expects for next year as far as rate hikes go

-

18:43

United States 5-Year Note Auction climbed from previous 0.99% to 1.157%

-

18:28

Silver Price Analysis: XAG/USD remains capped below $24.20/25 resistance area

- Solver prices' recovery from 23.80 lows stalls below $24.25.

- Precious metals edge up on Wednesday, favoured by a softer US dollar.

- XAG/USD is expected to appreciate towards $25.20 – Commerzbank.

Silver futures are attempting to bounce up from intra-week lows at $23.80 on Wednesday. The precious metal has pared previous losses, turning positive on the day, although it remains unable to consolidate above $24.00, with sellers at the $24.20/25 area keeping upside attempts in check.

Precious metals edge up as the US dollar falters

Precious metals are trading in a slightly positive tone on Wednesday’s US session as the greenback loses ground. The US Dollar Index is trading 0.2% lower on the day, retreating from 94.00 to the mid-range of 93.00, weighed by the decline in US Treasury bond yields.

Markets, however, remain broadly calm, moving within narrow ranges, with the investors awaiting monetary policy decisions by the European Central Bank and the Bank of Japan on Thursday, which are expected to give a fresh impulse to the major currency crosses and, probably, set the near-term direction for precious metals.

XAG/USD remains positive, aiming to $25.53 – Commerzbank

From a technical point of view, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, remains bullish on silver, expecting the pair to reach levels past $25.00: “Silver has rallied towards and failed just ahead of the $24.95 recent high and looks to be easing back to the 55-DMA at $23.41, provided it stabilizes around here an upside bias will remain (…) Resistance extends up to tougher resistance offered by the 200-DMA at $25.53 and $26.07, the August high. The market will need to regain this area to regenerate bullish impetus. Please note that the 55-week ma also lies at $25.29. We favor the topside but it may take several attempts to clear this band.”Technical levels to watch

-

18:07

GBP/USD recovers from daily lows hover around 1.3750

- Market sentiment is downbeat as investors weigh the Q4 economic outlook and US fiscal policy woes.

- UK’s Treasury reveals a 75 Billion pound budget, slashed taxes to pubs and restaurants.

- UK’s economy to grow 6.5% by the end of the year.

- US Durable Good Orders were better than expected but contracted.

The GBP/USD edges lower during the New York session, down 0.12%, trading at 1.3748 at the time of writing. The London fix lifted the pair as traders suddenly increased the bets on cable, jumping from 1.3720 to current levels.

Factors like month-ending flows, portfolio reshuffling, economic growth concerns, and US fiscal policy woes kept investors’ mood negative, as witnessed by US equity indices falling. Safe-haven currencies like the Japanese yen, the Swiss franc, and the US Dollar benefit on a flight to safe-haven flows.

During the European session, Rishi Sunak, the Chancellor of the Exchequer, revealed a 75 Billion pound budget in which he slashed taxes for pubs and restaurants, cut duties on alcohol, and increased support for the nation’s poorest, he said in a statement on the Parliament.

Furthermore, UK’s economy contracted almost 10% in 2020, but it is set to grow 6.5% by the end of the year, according to the Office for Budget Responsibility (OBR). Also, the OBR expects inflation to average 4%, double of the Bank of England’s target, which the Bank of England has been aware of, as some policymakers had expressed concerns about elevated prices.

An absent UK economic docket leaves GBP/USD traders at the dynamics and developments around the greenback. Meanwhile, in the US economic docket, Durable Good Orders for September contracted by 0.4%, less than the 1.1% expected by analysts. On the other hand, the Nondefense orders, excluding aircraft, expanded by 0.8%, higher than the 0.5% estimated.

That said, GBP/USD trader’s focus turns to the US Gross Domestic Product for the Q3, expected at 2.5%, to be unveiled on Thursday. On Friday, the Fed’s favorite inflation measure, the PCE, will be revealed. Good numbers out of those readings would be positive for the greenback.

GBP/USD Price Forecast: Technical outlook

Daily chart

The GBP/USD pair is in a mild-bearish trend, depicted by the daily moving averages (DMA’s) above the spot price, except for the 50-day moving average at 1.3705 that was tested early in the day.

Furthermore, Tuesday’s price action depicted a grave-stone doji indicating selling pressure mounting on the pair but failed to break below the 50-DMA at the time being.

The Relative Strength Index (RSI) is at 52, aims lower, indicates the downward trend might accelerate but, a pierce of the 50-mid line is required to confirm the abovementioned.

A daily close below the 50-DMA could send GBP/USD tumbling below 1.3700. Key support levels lie ahead on the way south. The first support would be the April 12 low at 1.3669, followed by the October 12 low at 1.35.67, and then the 2021 low at 1.3411.

GBP/USD ADDITIONAL TECHNICAL LEVELS

-

17:41

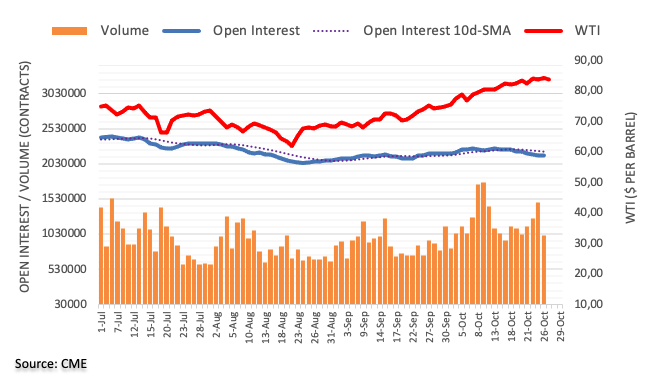

WTI dips below $83.00 on the back of higher US stocks

- WTI futures depreciate beyond 1% to hit session lows below $83.00.

- Higher than expected US stocks have increased negative pressure on oil prices.

- WTI: testing support at $82.50.

Front-month WTI prices have extended their reversal from multi-year highs at 85.35 on Monday. Crude prices have depreciated more than 1% so far today, reaching session lows at $82.50.

US crude oil stocks increase beyond expectations

Commercial inventories of crude oil increased in the US by 4.3 million barrels last week, according to data released by the US Energy Information Administration. These figures represent a much higher increment than the 1.91 million barrels anticipated by market analysts and have added negative pressure on crude prices.

Oil prices have surged about 35% over the last two months, boosted by concerns that the global increase in demand due to the post-pandemic recovery will cause an energy crunch. Beyond that, the Organization of Petroleum Exporting Countries remains reluctant to increase supply, which has prompted some analysts to forecast crude prices near $100 by the end of the year.

WTI testing support at test support at $82.50 area

WTI futures have accelerated their reversal on Wednesday, retreating below $83.00 to seek support at 82.50. Below here, the next potential targets might be at 81.75 (October 22 low) and $80.80 (October 20 and 21 lows).

Alternatively, a bullish reaction from current levels would send the pair to retest intra-day highs at $84.20 ahead of October 25 high at $85.35, which would open the path towards the 90.00 psychological area.Technical levels to watch

-

17:08

US Durable Goods Orders: Blame transportation for the 0.4% decline – Wells Fargo

Data released on Wednesday showed a lower-than-expected slide in Durable Goods Orders in September. Analysts at Wells Fargo point out weakness in transportation orders was largely behind the 0.4% decline in the main index. They point out numbers continue to demonstrate a manufacturing sector strapped by a lack of supply.

Key Quotes:

“Durable goods orders slipped 0.4% in September, but declines can largely be traced to the volatile transportation sector. Excluding transportation, orders advanced for the seventh consecutive month, rising 0.4%. While the trend in core orders has been rather resilient, the data for September continue to demonstrate a manufacturing sector strapped by a lack of supply.”

“The weakness in transportation orders was largely expected. The 27.9% decline in aircraft orders is consistent with orders data from Boeing, which revealed just 27 new orders during the month, around half of what is traditionally seen during September, and down from 53 new orders in August.”

“Outside transportation, the orders details were pretty mixed. Orders for machinery and metals increased, but computers and electrical equipment orders decreased. Overall, the continued gain in core capital goods orders in September is encouraging and points to ongoing strength in capital investment.”

“This morning's data present some upside risk to our call for equipment spending to decline by 7.6% in Q3.”

-

17:00

Russia Industrial Output registered at 6.8% above expectations (4.6%) in September

-

16:48

EUR/USD fails again at 1.1625 and pulls back to 1.1600 area

- The euro consolidates near 1.1600 with upside attempts limited below 1.1625.

- The common currency hesitates ahead of ECB's monetary policy decision.

- EUR/USD is expected to drop towards 1.1524 – Scotiabank.

Euro-dollar's rebound from 1.1585 lows witnessed during Wednesday’s European trading session has been unable to extend past 1.1625 and the pair retreated to the 1.1600 area.

The euro treads water awaiting the ECB

The pair remains practically flat for the second consecutive day in a rather calm market on Wednesday. The euro is looking for direction with all eyes on the ECB’s monetary policy decision with the USD in a soft tone, as the Dollar Index edges down 0.1% on the back of lower US T-Bond yields and mixed macroeconomic data.

Investors are positioning for a dovish message by the European Central Bank, which is expected to maintain its bond-purchasing plan unchanged and the benchmark interest rate near zero, in spite of the persistently high inflation, to avoid creating tensions in some peripheral markets.

On the macroeconomic front, in the absence of relevant Eurozone releases, orders for durable goods manufactured in the US have contracted less than expected in September, due to a solid increase of non-defense capital goods. These figures suggest that US businesses have continued spending in equipment, in spite of the disruptions caused by supply restrictions.

On the other hand, the US goods trade deficit widened to $96.3B in September from $89.4B in the previous month due to a sharp decline in exports.

EUR/USD: Expected to extend losses towards 1.1524 – Scotiabank

The FX Analysis team at Scotiabank observes the pair biased lower, targeting 1.1524 area: “The German and Eurozone economy more broadly are expected to decelerate significantly in the fourth quarter – pointing to moderate weakness ahead in the EUR (…) The EUR’s bearish reversal is likely to extend past the high-figure zone after support at 1.1572, setting the 1.1524 October low in its sights.”

Technical levels to watch

-

16:43

BoC's Macklem: We will considering raising rates sooner than we had previously thought

Bank of Canada (BoC) Governor Tiff Macklem said on Wednesday during the press conference he believes there are good reasons for inflation to ease in 2022 and warned that if they see signs of prolonged inflationary pressures, they will take action to bring it back down to target.

Earlier in the day, the BoC left its policy rate unchanged at 0.25% as expected. Additionally, the bank announced that it will end net purchases of government bonds, ending QE and going into the “reinvesting phase”. The central bank will purchase bonds only to replace those that are maturing so the overall holdings remain roughly stable over time.

“We move forward the timing of when we think we will be considering raising our policy interest rate”, said Macklem. He mentioned they are adjusting and they will continue to adjust to bring inflation back to the 2% target but it will take a bit longer. “This global supply issues, shipping bottlenecks, are proving to be more severe and persistent than expected but there are good reasons for those to ease off”.

-

16:31

AUD/USD falls from daily tops at 0.7535, hovers around 0.7510

- Risk-off market sentiment surrounds the financial markets, but the Australian dollar resilience holds.

- US President Joe Biden agreed to push for a deal in a meeting with lawmakers.

- Australian CPI figures rose more than expected, lifting the AUD/USD towards the daily tops at 0.7535.

- US Durable Good Orders shrank less than expected, minimizing the impact on the US dollar.

The AUD/USD edges higher during the New York session, up 0.17% is trading at 0.7513 at the time of writing. The market sentiment was downbeat during the European session, which benefited safe-haven currencies like the greenback. However, the risk-sensitive AUD held to its gains, sitting comfortably around 0.7510.

The market sentiment is downbeat, as US stock indices shed early week gains, except for the tech-heavy Nasdaq Composite rising 0.47%. The US spending bill is back on the radar, as it was one of the factors, while commodity prices ease a tad.

According to wires, US President Joe Biden reportedly agreed to push for a deal as soon as possible in a meeting with lawmakers. Also, the US Senate Finance Committee Chairman Ron Wyden unveiled a 23.8% tax proposal focused on unrealized gains of assets held by billionaires, affecting 700 people.

US mixed economic data sent the US Dollar Index seesawing between gains and losses

In the Asian session, the Australian economic docket unveiled inflationary numbers. The RBA Trimmed Mean Consumer Price Index for the Q3 expanded by 0.7%, higher than the 0.5% estimated, while the headline Consumer Price Index rose by 0.8%, in line with foreseen and Q2 figures. The AUD/USD reacted positively to the news, reaching a daily high at 0.7535, ahead of US figures.

On the US front, the macroeconomic docket featured Durable Good Orders for September. The headline Durable Good Orders came at -0.4% better than the -1.1% expected but lower than the 1.3% August figure. Contrarily the Nondefense Capital Goods Orders excluding Aircraft rose to 0.8%, higher than the 0.5% estimated and previously printed number.

The greenback reacted negatively to the news, but it has last seen at 93.82, losing 0.14% at press time underpinned by falling US T-bond yields, with the 10-year benchmark note down four basis points, sitting at 1.575%.

That said, the AUD/USD traders would lie on the back of the market sentiment, along with US dollar dynamics, as focus turns to the Federal Reserve meeting on November 2-3. Additionally, spending bills and fiscal policy developments would be watched for investors, as market sentiment triggers, as November kicks in, reducing maneuver time on the Democrats.

AUD/USD ADDITIONAL LEVELS TO WATCH

-

16:27

BoC's Macklem: Increasing vaccination rates are enabling continued progress in the economic recovery

Bank of Canada (BoC) Governor Tiff Macklem said on Wednesday that despite today’s decisions, significant stimulus injected through QE remains in place. “The end of QE comes as increasing vaccination rates are enabling continued progress in the economic recovery in Canada and around the world”, said the BoC in the opening statement.

Earlier in the day, the BoC left its policy rate unchanged at 0.25% as expected. Additionally, the bank announced that it will end net purchases of government bonds, ending QE and going into the “reinvesting phase”. The central bank will purchase bond only to replace those that are maturing so the overall holdings remain roughly stable over time.

Additional takeaways:

“With the economy once again growing robustly, Governing Council judged that QE is no longer needed. This means we will stop growing our holdings of Government of Canada bonds. It is important, however, to remind Canadians that the significant stimulus we have injected through QE remains in place. We just won’t be adding to it. We call this the reinvestment phase. In this phase, we will purchase bonds only to replace those that are maturing so that our overall holdings of Government of Canada bonds remain roughly stable over time.”

“The end of QE comes as increasing vaccination rates are enabling continued progress in the economic recovery in Canada and around the world.”

“We’ve seen strong job growth in recent months. Many sectors that were hardest hit by lockdowns earlier in the pandemic rebounded strongly as Canadians resumed more normal activities. Strong job growth has reduced the very uneven impacts of the pandemic, particularly for youth and women.”

“In view of the continued excess capacity in the economy, my fellow Governing Council members and I judged that the economy still needs considerable monetary policy support. While we ended QE, we kept our policy interest rate at its lowest level, and reaffirmed our commitment to keep it there until slack in the economy is absorbed so that the 2 percent inflation target is sustainably achieved. Based on our current projection, this happens sometime in the middle quarters of 2022.”

“How long the reinvestment phase lasts is a future monetary policy decision. It will depend on the strength of the recovery and the evolution of inflation. But as I indicated in September, it is reasonable to expect that we will be there for a period of time, at least until we raise our policy interest rate.”

-

16:05

USD strength could persist into 2022 – Wells Fargo

According to analysts at Wells Fargo, with global growth still trending softer and the Federal Reserve likely to taper asset purchases in the near future, the dollar can broadly strengthen through the end of this year. They believe the dollar’s strength could persist into early 2022.

Key Quotes:

“The external environment we highlighted above should, in our view, be conducive to U.S. dollar strength through at least the end of this year. We believe a decelerating global economy that is still facing serious and potentially longer-term risks, should attract safe-haven capital flows toward the U.S. dollar. As safe-haven flows hit the U.S. dollar, we expect most G10 currencies to weaken, with some of the more risk-sensitive currencies, such as the Australian dollar, to underperform.”

“Also supporting our view for short-term dollar strength is an elevated likelihood the Fed officially announces a decision to taper asset purchases in the near future. Given recent commentary from Fed Chair Powell and other FOMC members, we believe a taper announcement could take place as early as November and for the actual reduction in asset purchases to begin in December.”

“Tighter Fed monetary policy in 2022 and slower policy tightening from foreign central banks could result in a stronger greenback into early next year as well. For now, we believe the U.S. dollar will revert to a weaker trend over the longer term; however, given recent developments, that longer-term outlook is also evolving and the greenback's performance could be more mixed. We still expect U.S. dollar softness against many foreign currencies, but also see increasing potential for U.S. dollar resilience against several foreign currencies based on country-specific fundamentals.”

-

15:54

USD/JPY rebound from weekly lows but find resistance again around 113.80/85

- USD/JPY remains off lows, facing resistance at 113.85.

- Quick rebound in US yields did not last, USD weakens again.

The USD/JPY rose from weekly lows at 113.37 to 113.83, reaching the highest level since the beginning of the European session but then quickly pulled back to the 113.65 area.

After the release of the Durable Goods Orders report, the USD/JPY bottomed at 113.37, the lowest level since October. A few minutes later, the decision of the Bank of Canada to end its QE program, boosted US yields and triggered a spike in USD/JPY to 113.83.

During the last hour, US yield turned again to the downside. The US 10-year yield is back at 1.56% after a brief rebound to 1.59%, down more than 3% for the day. The recovery in Treasuries is keeping the USD/JPY under pressure.

On Thursday, the Bank of Japan will have its monetary policy meeting and US economic data to be released includes Q3 GDP.

The immediate support in USD/JPY is seen around 113.40 area. A consolidation below would add more pressure targeting 113.20 and then 113.00/05. The US dollar needs to recover levels above 113.85 to alleviate the bearish pressure. Above the next resistance is located at 114.25.

Technical levels

-

15:47

US Pres. Biden: Deeply concerned by China’s coercive actions across Taiwan strait

While speaking at the East Asia Summit on Wednesday, US President Joe Biden said that they are deeply concerned by China's coercive and proactive actions across the Taiwan strait and called it a threat to peace and stability, per Reuters.

Biden further noted that the US will start discussions with Indo-Pacific partners on the regional economic framework.

Market reaction

These comments don't seem to be having a noticeable impact on market sentiment. As of writing, the S&P 500 Index was virtually unchanged on the day at 4,572.

-

15:42

US: EIA Crude Oil Stocks rise by 4.3 million barrels, WTI trades below $84

Commercial crude oil inventories in the US increased by 4.3 million barrels in the week ending October 22, the weekly report published by the US Energy Information Administration (EIA) revealed on Wednesday. This reading came in much higher than the market expectation for an inventory build of 1.9 million barrels.

Market reaction

Crude oil prices remain on the back foot after this report. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $83.50, losing 1.1% on a daily basis.

Additional takeaways

"Total motor gasoline inventories decreased by 2.0 million barrels last week and are about 3% below the five year average for this time of year."

"US crude oil refinery inputs averaged 15.0 million barrels per day during the week ending October 22, 2021."

"US crude oil imports averaged 6.3 million barrels per day last week, up by 430,000 barrels per day from the previous week."

"Total products supplied over the last four-week period averaged 20.8 million barrels a day, up by 9.9% from the same period last year."

-

15:30

United States EIA Crude Oil Stocks Change came in at 4.267M, above forecasts (1.914M) in October 22

-

15:20

BoC lowers 2021 growth forecast to 5.1% from 6%

The Bank of Canada (BoC) said in its fall Monetary Policy Report (MPR) that it lowered the 2021 Gross Domestic Product (GDP) growth forecast to 5.1% from 6% in July's MPR.

Key takeaways from MPR as summarized by Reuters

"2021 Q2 annualized GDP was -1.1% (vs +2.0% in July MPR), Q3 annualized GDP seen +5.5% (vs +7.3%), Q4 annualized GDP seen +4.0%."

"Output gap was between -2.25% to -1.25% in Q3, smaller than revised estimate of -3.25% to -2.25% in Q2."

"Significant uncertainty surrounds outlook for GDP and potential output."

"Canada Q4 annual inflation rate likely to hit 4.8%; around one-third of this will come from higher energy prices."

"Overall Canada 2021 inflation seen at 3.4% vs 3.0% in July MPR, 2022 inflation seen at 3.4% (2.4%) dipping to around 2% by end 2022, in 2023 seen at 2.3% (vs 2.2%)."

"Realization of upside risks to inflation could lead to rise in inflation expectations along with more pervasive labor cost and inflationary pressures."

"Canadian economy is once again growing robustly; labor market recovery is well under way but incomplete."

"Potential output growth to average about 1.6% per year over 2021-23, down 0.2 percentage points from July MPR."

"US growth seen +5.6% in 2021 vs +6.6% in July MPR, +3.9% in 2022 (vs +5.1%) and +2.7% in 2023 (vs +1.8%)."

-

15:13

USD/CAD tumbles toward 1.2300 after BoC decision

- Bank of Canada decision to end QE boosts CAD across the board.

- USD/CAD drops toward 1.2300, falling more than a hundred pips from highs.

The USD/CAD dropped sharply following the announcement of the Bank of Canada (BoC) to end QE. The loonie soared across the board becoming the best performer. Versus the dollar is climbed to the highest in three days.

BoC’s decision to keep interest rates unchanged as expected. Market consensus was looking at a reduction in QE to around CAD1 billion per week from 2B, instead, the central bank decided to end purchases. In a few minutes, BoC Governor Macklem will host a press conference.

The larger than expected tightening from the BoC triggered also a rebound in US yields.

The USD/CAD dropped from 1.2410 to 1.2312 after the statement reached the lowest level since Thursday. The pair remains near the lows. A break under 1.2320 (Oct 22 low) will clear the way for a test of 1.2300. Earlier on Wednesday, USD/CAD traded at 1.2430, the highest level in two weeks.

Technical levels

-

15:02

Gold Price Forecast: XAU/USD to tackle support at $1721 as rally falters aheaf of $1813 – Commerzbank

Gold has rallied to and so far failed at the $1813 55-week moving average. Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, expects XAU/USD to drop to the $1721 September low.

Gold falters at the 55-week ma of $1813

“Gold has rallied towards the 55-week ma at $1813 and currently remains capped here. We suspect that the move back from here will be pretty shallow, but we are essentially neutral at this point.”

“XAU/USD has to clear the $1832/34, highs since July and the $1842 2020-2021 resistance line in order to regenerate upside interest for a recovery to $1856/57 4th June low. Above here lies the $1917 May 2021 peak.”

“We have minor support at $1760 ahead of the $1721 September low. Below $1721, support is found at $1679/77, and is reinforced by the $1670 June 2020 low.”

“Below $1670 would target the 2018-2021 uptrend at $1611.”

See – Gold Price Forecast: XAU/USD to tank towards $1565/60 on a break below $1691/77 – Credit Suisse

-

15:01

Breaking: BoC leaves policy rate unchanged, ends weekly asset purchases

The Bank of Canada (BoC) announced on Wednesday that it left its key rate unchanged at 0.25% following the October policy meeting as expected. More importantly, the BoC decided to end its weekly purchases of the government of Canada bonds, the quantitative easing program. The policy statement revealed that the BoC will continue to buy only enough bonds to replace those that are maturing.

Market reaction

With the initial market reaction, the USD/CAD pair fell sharply and was last seen losing 0.42% on the day at 1.2336.

Key takeaways from policy statement as summarized by Reuters

"Economic slack should be absorbed sometime in the middle quarters of 2022; had previously said this would happen in H2 2022."

"Maintaining extraordinary forward guidance on the path for the overnight rate."

"Moving from QE into the reinvestment phase, will now purchase Canada government bonds solely to replace maturing bonds."

"Will keep overall holdings of Canada government bonds roughly constant."

"Economy continues to require considerable monetary policy support."

-

15:00

Canada BoC Interest Rate Decision in line with expectations (0.25%)

-

14:38

S&P 500 Index opens flat above 4,550, energy shares slide

- Wall Street's main indexes trade mixed on Wednesday.

- Energy stocks push lower amid falling crude oil prices.

- Data from the US showed a contraction in Durable Goods Orders in September.

Major equity indexes in the US opened mixed on Wednesday as investors assess the latest earnings reports and data releases from the US.

As of writing, the S&P 500 was down 0.1% on the day at 4,570, the Dow Jones Industrial Average was losing 0.06% at 35,737 and the Nasdaq Composite was rising 0.3% at 15,283.

Earlier in the day, the data published by the US Census Bureau revealed that Durable Goods Orders declined by 0.4% on a monthly basis in September. Additionally, the international trade deficit expanded to $96.3 billion from $88.2 billion in August.

Among the 11 major S&P 500 sectors, the Energy Index is down 1.7% after the opening bell pressure by a more-than-1% drop witnessed in crude oil prices. On the other hand, the Consumer Discretionary Index is up 0.4% as the largest gainer in the early trade.

S&P 500 chart (daily)

-

14:38

USD/TRY stays on the defensive, extends the downside to 9.4600

- USD/TRY remains in corrective mode and tests sub-9.50 levels.

- Turkey’s Economic Confidence Index eased to 101.40 in October.

- The lira regains some ground following Monday’s all-time low.

The Turkish lira appreciates for the third session in a row and now drags USD/TRY to the 9.4600 region just to bounce soon afterwards.

USD/TRY retreats from all-time highs

USD/TRY extends the negative streak for the third day on Wednesday in response to fresh buying interest surrounding the lira and the persistent offered stance in the greenback.

Indeed, declining US yields hurt the dollar and prompt the US Dollar Index (DXY) to reverse two consecutive daily advances and refocus instead on the downside.

Spot, in the meantime, regains downside traction and puts further distance from Monday’s new all-time highs past the 9.8000 mark. It is worth recalling that the lira collapsed at the beginning of the week in response to President Erdogan’s threats over the weekend to expel 10 foreign ambassadors, a move that could have opened the door to a new crisis between Ankara and the West.

The outlook for the lira did nothing but worsen over the past sessions, starting with the unexpected decision by the Turkish central bank (CBRT) to reduce the One-Week Repo Rate by 200 bps to 16% at its meeting on October 21.

In the domestic data space, Turkey’s Economic Confidence Index ticked lower to 101.40 for the current month (from 102.40). In addition, the trade deficit nearly halved in September at $2.55B (from $4.26B).

USD/TRY key levels

So far, the pair is losing 0.23% at 9.5084 and a drop below 9.4128 (weekly low Oct.26) would aim for 9.1965 (weekly low Oct.21) and finally 9.1605 (20-day SMA). On the other hand, the next up barrier lines up at 9.8395 (all-time high Oct.25) followed by 10.0000.

-

14:33

BoJ Preview: Forecasts from seven major banks, holding fire, slashing price outlook

The Bank of Japan (BoJ) will announce its policy decision on Thursday, October 28 at 03:00 GMT, and as we get closer to the release time, here are the expectations forecast by the economists and researchers of seven major banks. The central bank is unlikely to alter its monetary policy but it is seen cutting growth and price outlook.

See BoJ’s Preview by FXStreet’s Dhwani Mehta to discover how this event can affect the USD/JPY pair.

ING

“The BoJ is likely to retain its accommodative stance, so we don’t expect any surprises here.”

MUFG

“We expect the BoJ to keep monetary policy unchanged, with the policy rate at -0.1% and the target level for the 10Yr JGB yield at around zero percent, with a range of 25bps.” We expect the Monetary Policy Board to split its time addressing: 1) the Outlook Report: corporate and household sector conditions amidst rising prices resulting from a weakening JPY and resource prices climb; and 2) a checkup of the financial system, especially restructuring of the regional banking sector.”

Standard Chartered

“We expect the BoJ to maintain the policy balance rate at -0.1% and the 10Y yield target at c.0%. We think the BoJ has less headroom to normalise liquidity given the slow economic recovery and low inflation. Moreover, we think it is hard to ease policy given global inflationary pressure.”

Danske Bank

“While the pandemic programme has increased loans, they have been unwinding government bonds for about a year now. The October reopening of the economy is convenient at a stage where exports are declining sharply amid lack of supplies. It will be interesting how the BoJ assesses the recent significant JPY weakening after the cabinet has been out warning for the need for a stable currency this week. We expect no changes to the bank’s QQE with yield curve control.”

BBH

“Updated macro forecasts will be released. Reports have emerged that the BoJ will lower its inflation forecast for FY21 to around 0% from 0.6% due to re-basing of the CPI. FY21 growth forecast will reportedly be cut too, but FY22 would be raised. Overall, we expect the updated forecasts to signal a dovish hold that suggests no liftoff before FY24 at the earliest. FY24 will be added with the April 2022 Outlook Report and is likely to show inflation remaining well below the 2% target, which would mean no liftoff until FY25 at the earliest.”

SocGen

“We expect that the BoJ will maintain its current main monetary policy (YCC and ETF purchases). The BoJ will judge that the delay in the economic recovery and the reduction of the price outlook will not be enough to take additional easing into consideration. Although the outlook remains uncertain, it will nevertheless maintain its forecast that the economy will improve as COVID-19 infections subside. In addition, according to the September Tankan survey, the financial positions of both large and small enterprises improved. Therefore, measures to support financing will also be maintained.”

Citibank

“We do not expect any surprises from the BoJ Monetary Policy Meeting, with the bank sticking to its current monetary policy.”

-

14:28

Gold Price Forecast: XAU/USD inches closer to $1,800 amid sliding bond yields/weaker USD

- Gold attracted some dip-buying for the second successive day on Wednesday.

- Retreating US bond yields, weaker USD acted as a tailwind for the commodity.

- Hawkish central bank expectations might continue to cap gains for the metal.

- Gold Price Forecast: 50-DMA to test bulls’ commitments again, as focus shifts to US data, central banks

Gold continued showing some resilience below the 100/200-day SMA confluence and attracted some dip-buying ahead of the $1,780 level for the second successive day. The intraday uptick pushed spot prices to the $1,796 region, or fresh daily highs during the early North American session, albeit lacked follow-through. The US dollar met with some fresh supply on Wednesday and reversed the previous day's upbeat US macro data-inspired gains to over one-week tops. This, in turn, was seen as a key factor that acted as a tailwind for dollar-denominated commodities, including gold.

Apart from this, a softer tone around the equity markets extended additional support to the safe-haven precious metal. Bulls further took cues from an extension of the recent pullback in the longer-dated US Treasury bond yields, which tends to benefit the non-yielding gold. In fact, the yield on the benchmark 10-year US government bond declined for the fourth straight session and slipped below the 1.60% threshold. Conversely, the yield on short-dated US government bonds rose to the highest level since March 2020 amid rising bets for an early policy tightening by the Fed.

Investors seem convinced that the US central bank would be forced to adopt a more aggressive policy response to contain stubbornly high inflation. Adding to this, the markets have been pricing in the possibility of a potential interest rate hike by the Bank of England sooner rather than later. The Bank of Japan and the European Central Bank are also scheduled to announce their policy decision on Thursday, though are not anticipated to announce a change in the policy stance. Nevertheless, the hawkish outlook might cap gains for gold heading into the key central bank meetings.

Technical outlook

From a technical perspective, the emergence of fresh buying at lower levels favours bullish traders. The positive outlook is reinforced by the fact that technical indicators on the daily chart are holding in the bullish territory. That said, the recent pullback from an intermediate hurdle near the $1,812-14 region warrants some caution. This makes it prudent to wait for a strong follow-through buying beyond the mentioned barrier before positioning for any further gains. Gold might then accelerate the momentum further towards challenging the $1,832-34 heavy supply zone.

On the flip side, the $1,783-82 region now seems to have emerged as immediate strong support. A convincing break below might prompt some technical selling and drag the XAU/USD towards the next relevant support near the $1,765-64 zone en-route monthly swing lows, around the $1,745 area. Failure to defend the mentioned support levels will shift the bias in favour of bearish traders and turn gold vulnerable to test $1,722-21 support before eventually dropping to the $1,700 round-figure mark.

Technical levels to watch

-

14:19

USD/CAD to climb towards 1.28 if BoC reaffirms the output gap will close by late-2022 – Scotiabank

USD/CAD trades past 1.24 ahead of steady-handed Bank of Canada policy announcement. Economists at Scotiabank expect the USD/CAD pair to potentially rise towards 1.26 if the BoC pushes back against market pricing for an earlier start to the rate tightening cycle.

USD/CAD to plunge towards 1.23 on a more hawkish BoC

“We are very dubious on whether the BoC will make any concession to the output gap closing earlier than the middle of next year – which would be shorthand for earlier interest rate hikes. In other words, we expect the statement to push back against market pricing for an earlier (April) start to the rate tightening cycle.”

“The CAD is liable to soften towards 1.25 and might extend towards 1.26 if the BoC sticks with the view that the output gap will not close until later in 2022.”

“In the unlikely event of the bank sounding more hawkish and effectively endorsing current market pricing for rates, the CAD will rally towards the low 1.23s at least.”

See – BoC Preview: Forecasts from seven major banks, asset purchases to be cut

-

14:10

EUR/USD set to decline towards the 1.1524 October low – Scotiabank

EUR/USD is steady around 1.16 but technically bearish. Economists at Scotiabank expect the world’s most popular currency pair to slide towards the 1.1524 October low.

Soggy eurozone economy to dampen the euro

“The German and Eurozone economy more broadly are expected to decelerate significantly in the fourth quarter – pointing to moderate weakness ahead in the EUR.”

“The EUR’s bearish reversal is likely to extend past the high-figure zone after support at 1.1572, setting the 1.1524 October low in its sights.”

“Resistance is 1.1615/25.”

-

13:43

US: International trade deficit expands to $96.3 billion in September

- US' international trade deficit increased by $8.1 billion in September.

- US Dollar Index remains on the back foot near 93.80.

The data published by the US Census Bureau revealed on Wednesday that the United States' international trade deficit expanded to $96.3 billion in September from $88.2 billion in August.

"Exports of goods for September were $142.2 billion, $7.0 billion less than August exports," the publication read. "Imports of goods for September were $238.4 billion, $1.1 billion more than August imports."

Market reaction

The US Dollar Index showed little to no reaction to this report and was last seen losing 0.2% on a daily basis at 93.78.

-

13:42

GBP/USD pares intraday losses, keeps the red below mid-1.3700s

- GBP/USD found some support ahead of the 1.3700 mark and stalled its intraday decline.

- BoE rate hike expectations, weaker USD helped attract some dip-buying at lower levels.

- Brexit jitters capped any further gains amid a break below ascending channel support.

The GBP/USD pair quickly recovered around 30-35 pips from daily lows and was last seen trading with modest losses, just below mid-1.3700s.

The pair extended the previous day's sharp retracement slide from the 1.3825-30 resistance zone and witnessed heavy selling during the first half of the trading action on Wednesday. The downward trajectory drag the GBP/USD pair to over one-week lows during the mid-European session, though lacked follow-through selling.

The intraday bounce followed the UK finance minister Rishi Sunak's upbeat economic assessment while presenting the annual government budget. Office for Budget Responsibility (OBR) sees UK GDP will return to the pre-crisis level at the turn of the year and expand 6.5% in 2021. OBR forecasts show GDP growth of 6% and CPI of 4% in 2022.

This reinforced market expectations about an imminent Bank of England rate hike move at the upcoming policy meeting next week and extended some support to the British pound. This, along with the emergence of fresh selling around the US dollar, assisted the GBP/USD pair to find decent support ahead of the 1.3700 mark.

The USD was pressured by an extension of the recent decline in the US Treasury bond yields, which fell for the fourth successive day. In fact, the yield on the benchmark 10-year US government bond slipped below the 1.60% threshold and undermined the greenback, which failed to gain any traction following the release of Durable Goods Orders.

Despite the supporting factors, the attempted recovery witnessed around the GBP/USD pair lacked bullish conviction amid fresh Brexit jitters. In the latest developments, the UK Prime Minister said on Wednesday that conditions had been met to invoke Article 16 unless they see rapid progress on the Northern Ireland protocol.

Even from a technical perspective, the GBP/USD pair has broken through support marked by the lower boundary of an upward sloping channel extending from September swing lows. The technical set-up supports prospects for further losses, suggesting that any further recovery might still be seen as a selling opportunity.

Technical levels to watch

-

13:35

US: Durable Goods Orders decline by 0.4% in September vs. 1.1% expected

- Durable Goods Orders in US fell less than expected in September.

- US Dollar Index stays in the negative territory below 94.00.

Durable Goods Orders in the United States declined 0.4%, or $1 billion, in September to $261.3 billion, the data published by the US Census Bureau showed on Wednesday. This reading followed August's increase of 1.3% and came in better than the market expectation for a contraction of 1.1%.

"Excluding transportation, new orders increased 0.4%," the publication further read. "Excluding defense, new orders decreased 2.0%. Transportation equipment, down two of the last three months, drove the decrease, $1.8 billion or 2.3% to $77.7 billion."

Market reaction

The dollar remains on the back foot after this report and the US Dollar Index was last seen losing 0.2% on the day at 93.79.

-

13:31

United States Wholesale Inventories down to 1.1% in September from previous 1.2%

-

13:31

United States Durable Goods Orders ex Transportation in line with expectations (0.4%) in September

-

13:30

United States Goods Trade Balance dipped from previous $-89.4B to $-96.3B in September

-

13:30

United States Durable Goods Orders came in at -0.4%, above expectations (-1.1%) in September

-

13:30

United States Durable Goods Orders ex Defense came in at -2% below forecasts (0.2%) in September

-

13:07

When is the BoC monetary policy decision and how could it affect USD/CAD?

BoC Monetary Policy Decision – Overview

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision this Wednesday at 14:00 GMT and is expected to reduce government bond purchases to C$1 billion a week from C$2 billion. The BoC is also anticipated to upgrade its inflation and growth forecasts in the accompanying policy statement, setting the stage for an interest rate hike during the first half of 2022. This will be followed by the post-meeting press conference, where comments from Governor Tiff Macklem will be looked upon for the central bank's outlook on interest rates.

How Could it Affect USD/CAD?