Notícias do Mercado

-

23:41

GBP/USD Price Analysis: Stays range-bound near 1.3750, closer to monthly support

- GBP/USD keeps pullback from weekly top, grinds lower of late.

- Downside break of 50-SMA, sluggish Momentum keep sellers hopeful.

- 200-DMA adds to the upside filters, 200-SMA restricts short-term downside.

GBP/USD remains on the back foot around 1.3765, keeping the weekly trading range during Wednesday’s Asian session. In doing so, the cable pair inches closer to an ascending support line from September 29.

Given the sluggish Momentum and the quote’s latest break below the 50-SMA, the sellers are sneaking in for entries. However, the weekly trading range and the stated support line, respectively around 1.3750 and 1.3740, restrict the short-term declines.

Should GBP/USD bears manage to conquer the aforementioned supports, 200-SMA near 1.3685 will challenge the further downside.

Alternatively, an upside break of 50-SMA, around 1.3770 by the press time, will redirect the GBP/USD buyers toward the recent range resistance, near 1.3835.

Though, the 200-DMA level surrounding 1.3855 on the daily chart becomes a tough nut to crack for the bulls afterward, a break of which will challenge the previous month’s top near 1.3915.

GBP/USD: Four-hour chart

Trend: Further downside expected

-

23:34

USD/JPY consolidates above 114.00 amid lower US Treasury yields

- USD/JPY consolidates in the middle of the week in the initial Asian session.

- Lower US Treasury yields undermine the demand for the US dollar.

- Major issues remain unresolved as Democrats seek a deal on spending.

USD/JPY continue to move higher following the previous two session’s upside movement. The pair stayed in a narrow trading range. At the time of writing USD/JPY is trading at 114.15, up 0.02% so far.

The US benchmark 10-year T bond yields trades lower at 1.61% which undemins the demand for the greenback. Investors digested the November Fed’s tapering with a less hawkish view on interest rate hikes.

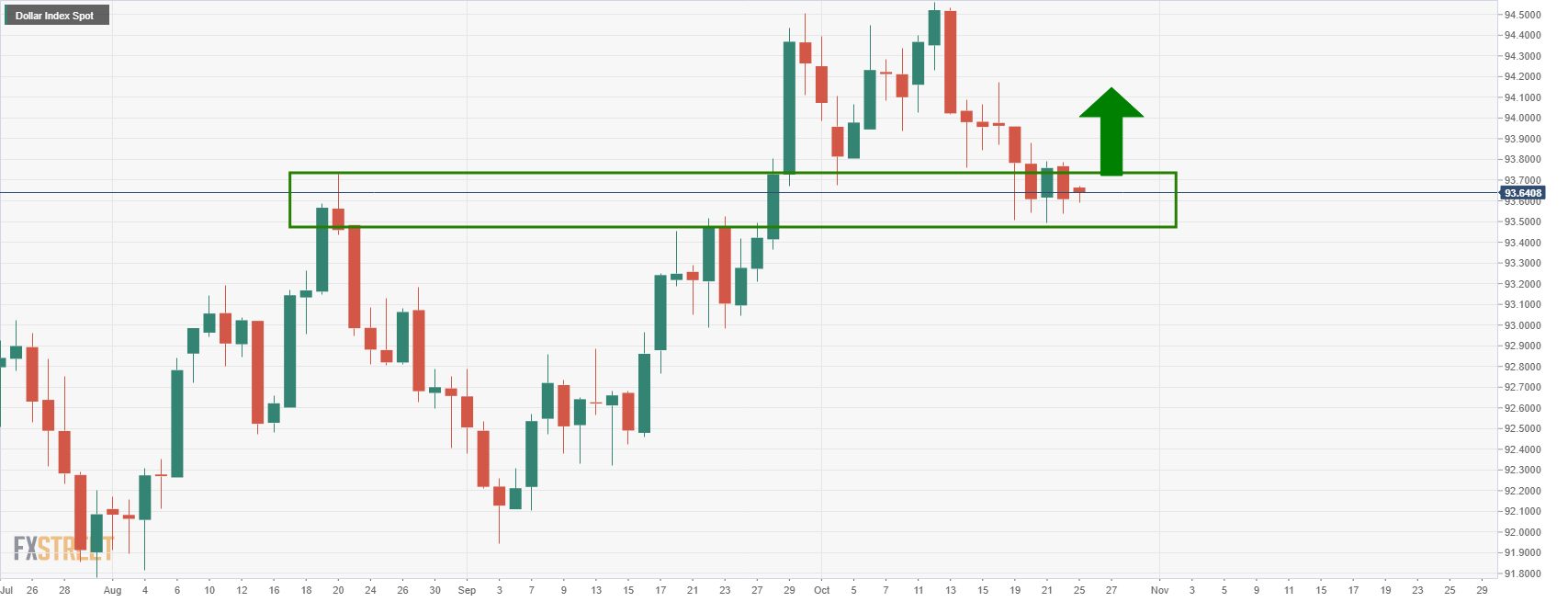

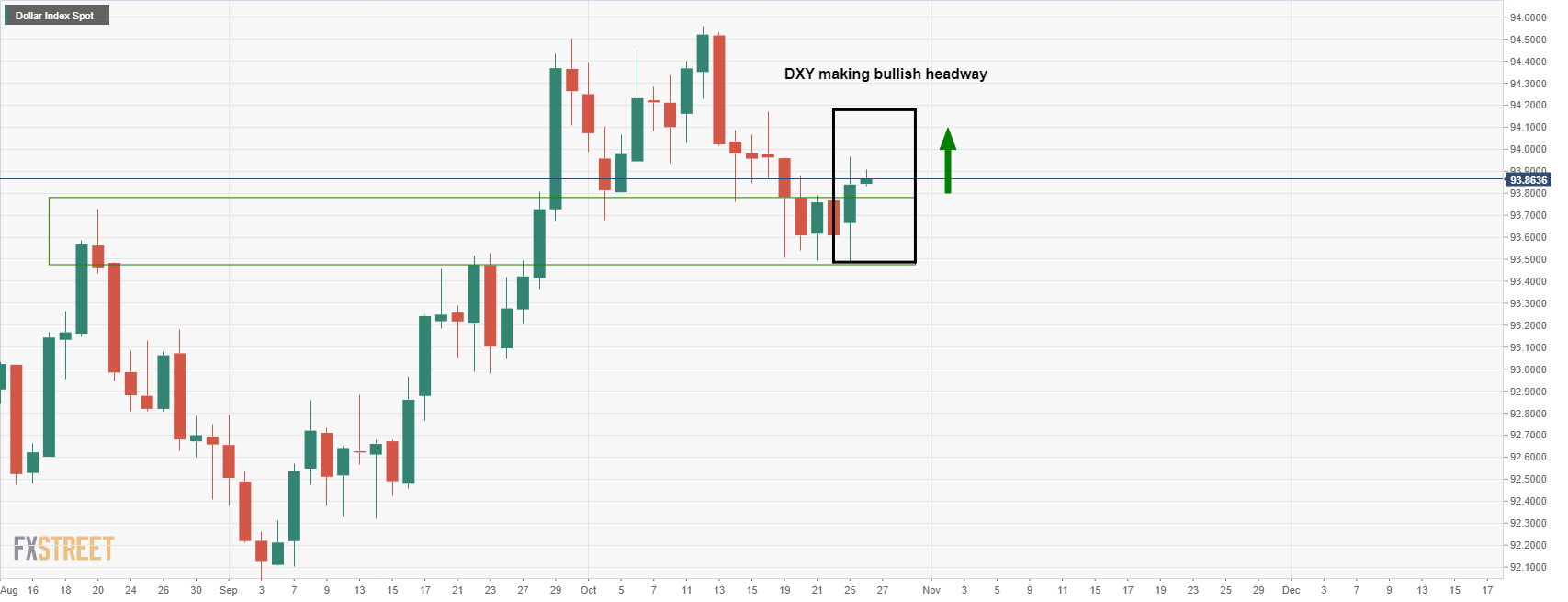

The greenback remains steady near 93.70 as the market awaits updates from upcoming central bank meetings.

On the other hand, the Japanese yen lost the ground, follwoing the Bank of Japan (BoJ) policy preview. The BoJ is expected to maintain its massive stimulus program and cut this year’s inflation forecasts at its meeting on Thursday.

It is worth noting that, S&P 500 Futures are trading at 4,566,up 0.03% so far.

As for now traders are waiting for the US Durable Goods Orders, and Goods Trade Balance to gauge the market sentiment.

USD/JPY additional levels

-

23:23

Goldman Sachs CEO: There is a risk of higher inflation and slower growth globally

“There will be consequences for having accommodative monetary policy for a long time,” said Goldman Sachs (GS) Chief Executive David Solomon at the Future Investment Initiative conference in Saudi Arabia's capital, Riyadh, per Reuters.

“There is a risk of higher inflation and slower growth globally,” adds the GS leader said Reuters.

FX implications

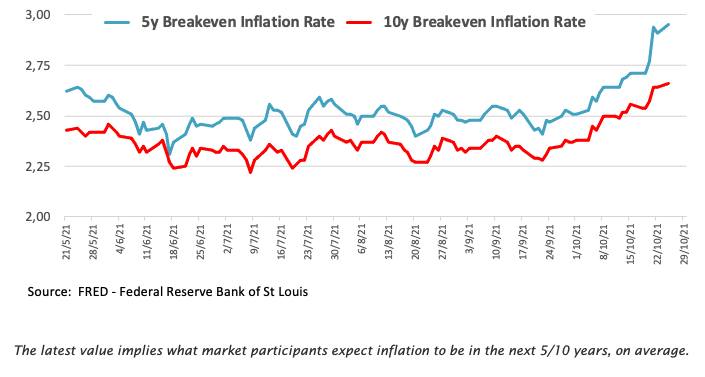

Given the multi-year high inflation expectations in the US and Eurozone, the monetary policy consolidation is back on the table, which in turn challenges the latest run-up in the equities.

Read: Uneven economic recovery vs inflation

-

23:08

New Zealand Exports rose from previous $4.351B to $4.4B in September

-

23:08

New Zealand Imports increased to $6.57B in September from previous $6.495B

-

23:08

New Zealand Trade Balance NZD (YoY) declined to $-4090B in September from previous $-2.944B

-

23:04

AUD/JPY Price Analysis: Retreats from Tuesday’s daily highs around 86.00, steady at 85.60

- AUD/JPY extends its two-day rally but faces strong resistance at 86.00.

- AUD/JPY price action is driven by market sentiment and Australian macroeconomic figures.

- AUD/JPY: The daily and hourly charts are tilted to the upside, but both time-frames RSI’s figures are closing to overbought levels.

The AUD/JPY slides as the New York session ends, barely down 0.01%, trading at 85.61 at the time of writing. On Tuesday, the Australian dollar extended its rally against the Japanese yen, for the second consecutive day, up in the week 1.53%.

Risk-on market sentiment keeps investors propelling the US stock market, as portrayed by the S&P 500 reaching an all-time high during the New York session, contrarily US T-bond yields fell across the board, with the 10-benchmark note falling two and a half basis points, sits at 1.61%.

That said, the AUD/JPY pair will lie for the remainder of the week on market sentiment, and in macroeconomic figures, like Australia CPI figures.

AUD/JPY Price Forecast: Technical outlook

Daily chart

The daily chart portrays the cross-currency has an upward bias, depicted by the daily moving averages (DMA’s) remaining below the spot price with an up slope confirming the actual trend.

The pair is testing the 61.8% Fibonacci retracement at press time, which coincided with the May 10 high around the 85.60-75 area. An upside break of the latter would expose the October 26 high at 85.92, immediately followed by the October 21 at 86.25.

On the flip side, failure at the 61.8% Fibonacci retracement could lead to an AUD/JPY slide towards 84.60, as the RSI exits overbought levels.

The Relative Strenght Index (RSI) at 72 flattish in overbought levels indicates the AUD/JPY might consolidate before determining which direction to take. However, the potential of an upside bias is supported by the DMA’s.

1-hour chart

The hourly chart shows that the AUD/JPY pair is in consolidation, just retreated from daily highs threatening to form a head-and-shoulders pattern. The hourly simple moving averages (HSMA) lie below the spot price, with the 50-HMA trapped within the 100 and the 200-HMA’s, confirming a sideways trend. A break below an upslope trendline around the 85.40 area confirms the pair’s head-and-shoulders pattern and exerts additional downward pressure on the AUD/JPY.

The first supply zone on the downside would be the 100-HSMA at 85.34, immediately followed by the 50-HSMA at 85.31, and then the 200-HSMA at 85.16.

The Relative Strength Index (RSI) is at 57 is edging slightly low, but as it remains above the 50-midline, it will refrain sellers from opening fresh downward bets on the AUD/JPY pair.

-

23:03

NZD/USD drops back to 0.7150 on New Zealand’s record trade deficit

- NZD/USD consolidates weekly gains after Tuesday’s sluggish performance.

- New Zealand trade deficit refresh record top, Imports and Exports grow in September.

- Market sentiment dwindles as DXY stays firm despite softer Treasury yields, mildly bid equities near record top.

- Aussie Inflation numbers, ANZ monthly sentiment data eyed ahead of US Durable Goods Orders.

NZD/USD remains pressured around 0.7155 after the dismal New Zealand trade deficit release, having reversed the upside momentum towards 0.7200 the previous day.

New Zealand (NZ) Trade Balance shrank more than $-2139M (revised) prior to $-2171M in September to mark the all-time low MoM figures. However, the Imports and Exports were better than their previous readouts as the former rose past $6.495 billion to $6.57 billion whereas the latter grew to $4.4 billion versus $4.351 billion.

In addition to the downbeat NZ data, mixed sentiment in the market and the US dollar strength also weigh on the NZD/USD prices.

Although hopes of the US stimulus and Sino-American talks join the receding coronavirus fears to keep the market’s mood positive, strong US data and caution ahead of the US advance estimation for Q3 GDP and Fed tapering woes challenge the optimists.

It should be noted that the firmer earnings and recently positive US data helped Wall Street benchmarks to cling to record tops, backed by softer US 10-year Treasury yields around 1.61%. However, the US Dollar Index (DXY) refreshed its weekly top during the second consecutive daily upside, recovering from the monthly low, while poking the 94.00 threshold by the end of Tuesday’s North American session.

Talking about data, US CB Consumer Confidence unexpectedly recovered in October while figures concerning New Home Sales for September and Richmond Fed Manufacturing Index for the last month also flashed better-than-forecast numbers.

Having witnessed the initial reaction to NZ trade numbers, NZD/USD traders will pay attention to the Australia and New Zealand Banking Group’s (ANZ) monthly sentiment data for October before the Q3 inflation figures for Australia. Following that, US Durable Goods Orders for September may entertain markets before the key US GDP figures, up for publishing tomorrow.

Regarding Aussie inflation and its impact on NZD/USD, ANZ said, “While not directly relevant to the NZD, any surprises will impact the AUD, and by correlated association, the NZD. Chief among the market’s fears: a big upside surprise like that seen here last week. If that were to happen, the AUD would likely spike sharply higher, taking NZD with it.”

Technical analysis

NZD/USD pair’s latest pullback is yet to negate the previous rebound from the 5-day EMA, which in turn directs the bulls toward a four-month-old resistance line near 0.7220 but nearly overbought RSI conditions may challenge further upside. On the contrary, a downside break of the immediate EMA support, around 0.7150 by the press time, should trigger a short-term pullback targeting late September highs near 0.7090. Though, the latest swing low of 0.7130 may act as an extra filter to the south.

-

22:45

New Zealand Trade Balance NZD (MoM) down to $-2171M in September from previous $-2144M

-

22:45

New Zealand: Trade Balance, mln, September -2171

-

22:30

USD/CAD Price Analysis: Grinds higher around 1.2400, BOC Interest Rate Decision eyed

- USD/CAD remains sidelined around weekly top as bulls brace for BOC.

- MACD, RSI joins sustained break of 10-DMA, 61.8% Fibonacci retracement to keep buyers hopeful.

- July’s low acts as immediate hurdle ahead of five-week-old resistance line.

- Bank of Canada Rate Decision Preview: Inflation prospects headline policy review

USD/CAD stays on the way to the second consecutive weekly run-up following its successful break of 10-DMA and 61.8% Fibonacci retracement (Fibo.) of June-August upside. That said, the quote edges higher around 1.2390 by the press time of early Wednesday morning in Asia.

With the MACD line teasing bulls and the RSI also gradually recovering, the pair buyers can extend the latest rebound towards July’s low surrounding 1.2425.

However, any further upside will be questioned by a descending resistance line from September 20, near 1.2460, 50% Fibo. level of 1.2478 and 200-SMA close to 1.2500.

Alternatively, a convergence of the 10-DMA and 61.8% Fibo. around 1.2368 offers immediate support to the Loonie pair ahead of the monthly bottom near 1.2290, also the lowest since late June.

In a case where the Bank of Canada (BOC) propels the CAD, dragging the quote back below 1.2290, June 23 low close to 1.2250 and the mid-May’s top near 1.2200 will be in focus ahead of the yearly bottom of 1.2007.

USD/CAD: Daily chart

Trend: Further recovery expected

-

22:24

United States API Weekly Crude Oil Stock registered at 2.318M above expectations (1.65M) in October 22

-

22:24

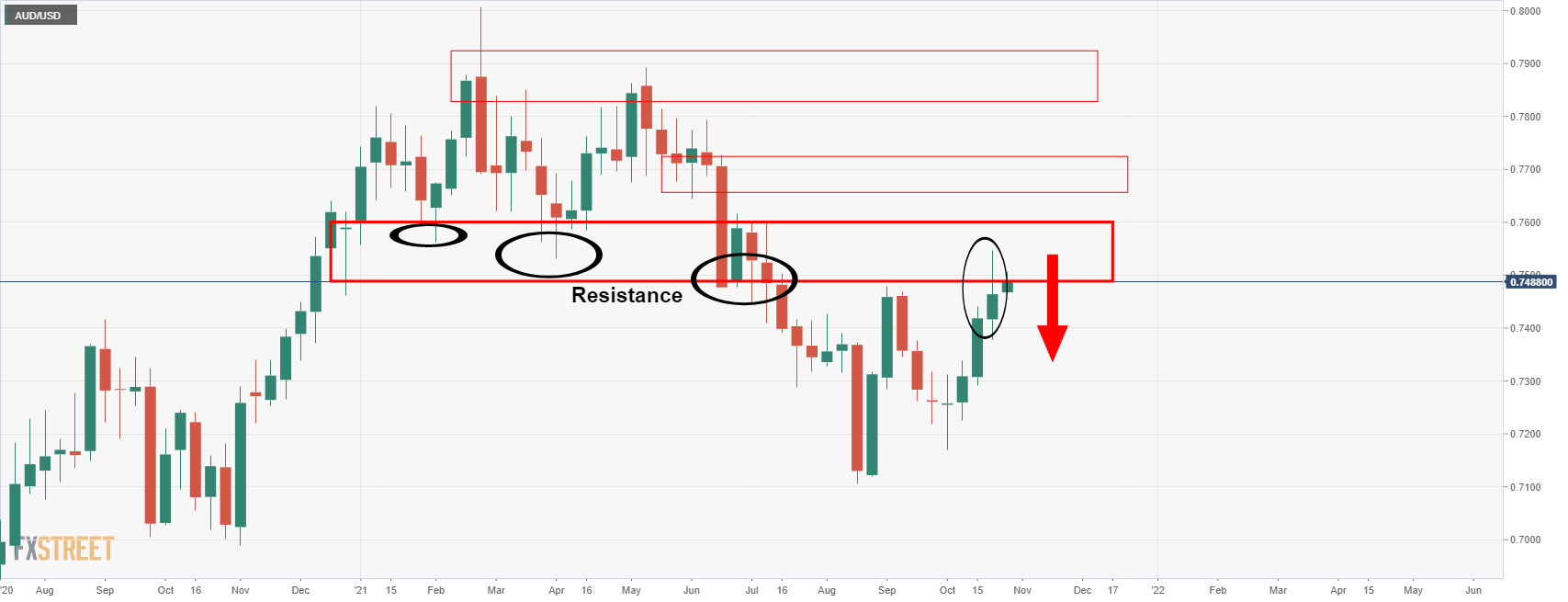

AUD/USD bulls engage and target a higher high on CPI day

- AUD/USD is building a bullish case ahead of CPI.

- Aussie CPI could be make or break time for the near term for AUD.

AUD/USD has been trading in firmer hands towards the North American close and has travelled from a low of 0.7484 to a high of 0.7525 on the day. The market's attention will now turn to the Asian sessions key data in the Australian third quarter Consumer Price Index. It will then it’s in the hands of the RBA next week.

Commodity prices were higher again on Tuesday with the CRB Index by 0.25% which has helped the Aussie keep its head above water. AUD/USD traded above $0.75 against the greenback for the first time since July. This happened despite the US dollar edging up on Tuesday. Traders are awaiting news from upcoming central bank meetings that might attract some forex volatility.

Meanwhile, a report showed that US consumers were more confident about the economy than expected. This gives rise to a higher US dollar when considering the effect consumer confidence at the highest of the covid 4th wave had on the greenback. For now, the US dollar is between its one-year high that was reached earlier this month and the one-month low touched early on Monday.

AUD's domestic risks

Domestically, the risks for AUD stay with the Evergrande story in China which appears to have taken a less concerning path, and this has clearly benefited the highly exposed AUD. However, it is unlikely that there can be any more - significant upside room for AUD on the back of improving sentiment in China. Instead, the Aussie currency with face today's 3Q CPI data out of Australia.

Traders are bracing for deceleration from the 3.8% 2Q figure as Covid restrictions generated some deflationary pressures in late summer. Consensus is reported at 3.1% for the headline rate, but given the massive surprise in New Zealand’s very strong (4.9%) read for the same quarter, there could be some follow-through here for Australia. If there is a disappointment, however, this will underpin the RBA’s dovish stance and likely weigh heavily on the Aussie, sending AUD/NZD back into its consolidation depths and AUD/USD back into a correction of the current bullish impulse on the daily chart.

AUD/USD technical analysis

As seen in the chart above, the 50% mean reversion has acted as support and the price is building a bullish case from here. However, a break of support will open risk back towards 0.7350 again.

-

22:00

South Korea Consumer Sentiment Index climbed from previous 103.8 to 106.8 in October

-

21:13

Google Earnings: GOOG beats Q3 estimates on top and bottom line

Alphabet (GOOG) scored solidly on its third quarter results released after the market close on Tuesday, October 26. The search leader reported earnings per share of $27.99 per share, well above estimates, on revenues of $65.1 billion. Analyst consensus expected EPS of $23.48 per share on revenue of $63.3 billion.

Google Cloud revenue came in just below $5 billion compared to estimates of $3.4 billion. YouTube revenue also came in above expectations at $7.2 billion vs. $5 billion. The stock rose 0.6% on the beat and is up 58.4% YTD.

-

21:08

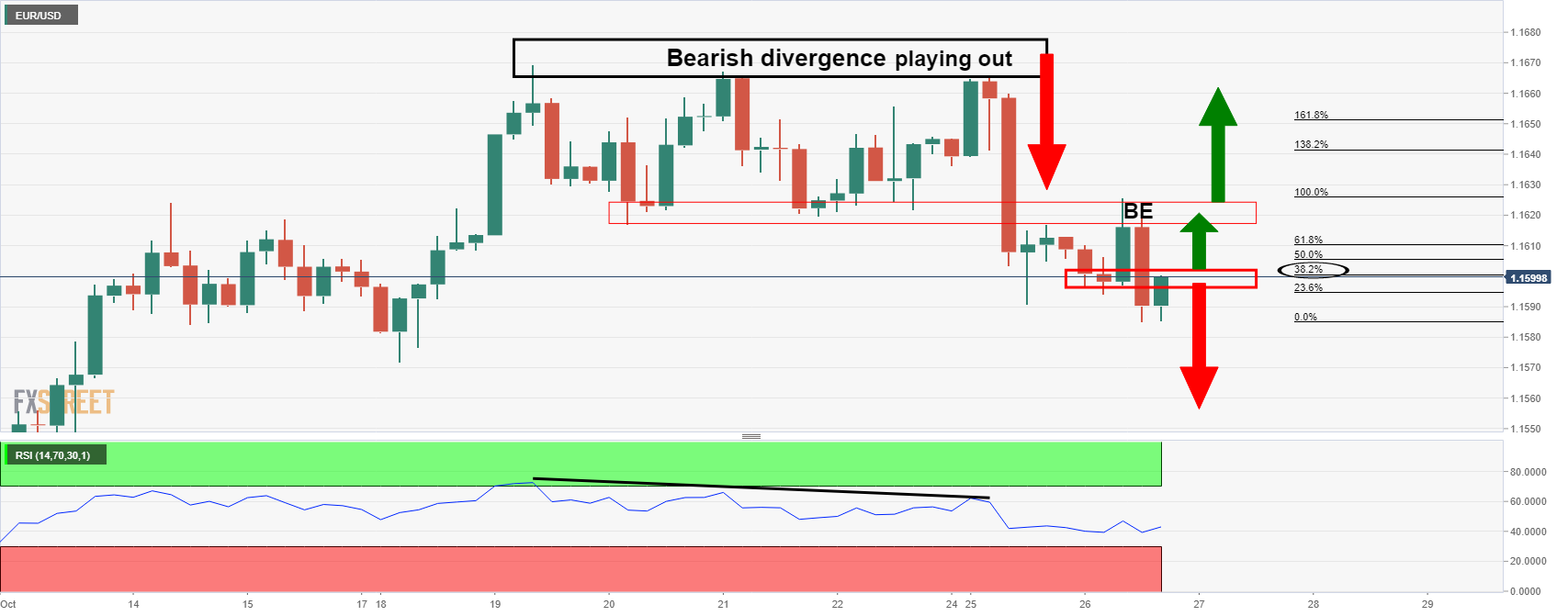

EUR/USD Price Analysis: A mixed technical picture leaning with slight bearish bias

- EUR/USD is leaning slightly bearish when taking into account a multi-time-frame analysis.

- EUR/USD 4-hour bearish structure includes the 21-EMA, resistance and tweezer tops.

- EUR/USD daily chart leans bullish above the dynamic support line.

EUR/USD is a mixed picture across the weekly, daily and 4-hour time frames. The following is a top-down analysis that arrives at both a bear and bullish conclusion depending on the time frames. Overall, the bias leans to the downside, however.

EUR/USD weekly chart

From a weekly perspective, the price is being pressured at resistance and by the 38.2% Fibonacci retracement level of the prior bearish impulse. This could equate to a downside continuation in the coming weeks and towards prior highs expected to act as a support zone near 1.1420.

EUR/USD daily chart

The daily chart, however, is on the verge of a test of support that could result in a move back to the upside to test the M-formation's neckline where it meets the 21-day EMA that would be expected to resist on first attempts. A break of the horizontal support, however, will pressure the dynamic and potentially lead to a downside continuation.

EUR/USD 4-hour chart

As illustrated above, the bearish divergence with the RSI has already played out. However, the confluence of the bearish engulfing candle is worth noting with the price below the bearish structure as per the 21-EMA, resistance and tweezer tops.

-

20:45

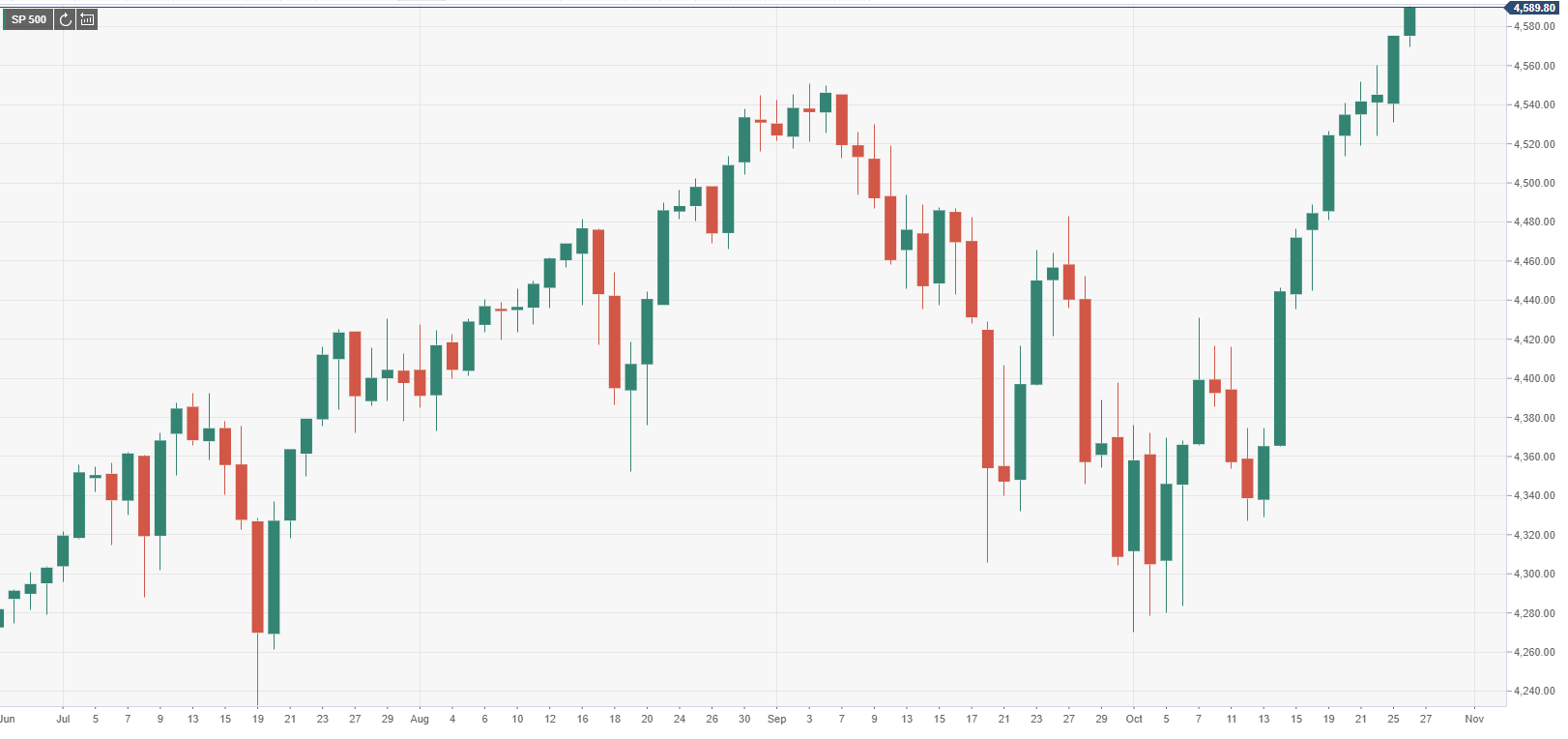

S&P 500 Price Forecast: Triple bottom around 4,300, puts 4,650 as the next target for bulls

- S&P 500: A weekly close above the mid-point of an ascending channel opens the doors for a further upside move.

- S&P 500: A triple bottom in the daily chart puts 4,651.86 as the next upside target for bulls.

The S6P advances during the New York session, is up 0.35%, sitting at 4580.93 at the time of writing. The market sentiment is upbeat, portrayed by major US stock indices, rising between 0.26% and 0.35%.

Factors like solid US corporate third-quarter earnings have kept investors positive, despite elevated prices and central bank pandemic-stimulus reduction, which in part tries to curb inflationary pressures around the globe.

S&P 500 Price Forecast: Technical outlook

Weekly chart

The S&P 500 has rallied almost 112%, from March 23, 2020, until October 26, 2021. At press time, it is trading briefly above the mid-point line of an ascending channel, leaving the door open for an upward move towards the top of the ascending channel, which lies around the 4,800-4,900 area. A weekly close above the mid-line would open the door towards the abovementioned, but it would find resistance areas at the round levels, such as 4,600, followed by 4,700.

The Relative Strength Index (RSI), a momentum indicator that approaches 68, aims higher, indicating that the index still has the potential of printing another leg-up before reaching overbought levels.

Daily chart

The S&P 500 is in an overextended upward trend which has found strong support around the 50-day moving average (DMA), which has successfully supported the index eight times before resuming the upward direction. Nevertheless, on September 20, it finally breached below the 50-DMA, finding consolidation around the 4,300-4,500 area, which printed a triple bottom.

The measure of the bottom of the triple bottom to the “neckline” (if it could be called like this) is 186.46 points, which added to the September 23 high at 4,465.40, puts the 4,651.86 figure as the next upside target for the S&P 500.

In the outcome of a downward correction, the first support would be the September 2 high at 4,545.85, followed by the September 23 high at 4,465.40.

The Relative Strenght Index (RSI) is at 69. Edces slightly up, indicates that the S&P 500 might consolidate, before printing another leg-up.

-

20:43

Forex Today: Tensions mount as central banks take center stage

What you need to know on Wednesday, October 27:

The American dollar ended the day mixed, particularly stronger against its European rivals. The EUR/USD pair is down to the lower end of its weekly range, trading in the 1.1590 price zone, while GBP/USD settled around 1.3760, getting additional pressure from European Commissioner for the Internal Market Thierry Breton, who said on Tuesday that Brexit has resulted in an "economic catastrophe" for the UK.

US CB Consumer Confidence unexpectedly bounced in October, printing at 113.8 from an upwardly revised 109.8. According to the official report, “the proportion of consumers planning to purchase homes, automobiles, and major appliances all increased in October—a sign that consumer spending will continue to support economic growth through the final months of 2021.”

Crude oil prices started the day on the back foot but managed to end the day with gains. WTI settled t $84.60 a barrel. On the other hand, gold edged lower and settled around $1,795 a troy ounce.

The DJIA and the S&P 500 reached all-time highs ahead of the opening, although US indexes retreated, to end the day mixed around their opening levels.

US Treasury yields remained subdued, with the benchmark on the 10-year note down to 1.61%.

Australia will publish Q3 inflation data on Wednesday, although expectations point to easing price pressures.

The Bank of Canada is having a monetary policy on Wednesday, with the Bank of Japan and the European Central Bank set to announce their decisions on Thursday. The BOC is expected to taper anticipating the Federal Reserve.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Small correction ahead of cryptos before next leg up

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:08

GBP/USD bulls have been sent onto the backfoot as greenback spikes

- GBP/USD spiked but fell back to the start again and sits steady into closing hours on wall Street.

- Brexit, covid and BoE risks are at the forefront of GBP/USD's trajectory.

- US dollar catches a bid as investors weigh the outlook of central banks.

At the time of writing, GBP/USD is flat on the day following a spike to the upside that was met with fierce resistance, sending it all the way back to the start again. GBP/USD is set at 1.3767 after travelling between a low of 1.3757 and a high of 1.3829. Meanwhile, the US dollar has rallied and tested the 94 figures as measured by the DXY index.

The domestic themes in play are positive headlines surrounding coronavirus cases lower in the UK and prospects of lighter restrictions, Brexit, central banks and the UK's budget risks. Across the pond, inflation and the Federal Reserve are propping up the US dollar as investors await the outcome of central bank meetings.

With regards to the Bank of England, money markets are pricing in a rate hike before the end of the year while expectations of further tightening grew as labour market data showed median full-time weekly pay in April was 4.3% above year-ago levels.

Brexit saga continues

On the Brexit front, Britain has threatened to take unilateral action if a solution cannot be found at the ongoing talks, which some reckon could emerge as a serious headwind for the pound. "Uncertainty around the UK's relationship with the EU may intensify in the coming days and possibly act as a check on BoE rate hike bets next week or at the December meeting, as well as set a short-term floor on euro-sterling," Scotiabank analysts said in a note mid-week.

UK budget coming up

However, there are also concerns around potential tax hikes that may be unveiled in Wednesday's budget announcement. Finance Minister Rishi Sunak's budget statement and his plans for higher corporate tax and national insurance contributions alongside more spending are already known in the market, but the fact is yet to be traded. The Chancellor has long been rumoured to be considering bringing capital gains tax rates more in line with income tax, possibly resulting in a switch to 20 per cent rates for people on the basic rate, 40 per cent for the higher bracket and 45 per cent for the additional rate bracket.

Covid Plan B could be avoided

Meanwhile, in recent trade, it has circulated that there could be good news on the coronavirus front. There has been a fall in England's infection rates which raises hopes of avoiding plan B. Expert advising on jabs had warned that the vaccination programme will not be enough to bring current infection rates under control.

However, the British prime minister Boris Johnson has to date resisted pleas from health leaders for tighter restrictions despite the rising number of Covid-19 cases. The PM has been of the mind that vaccines would get the country through the winter and out of the pandemic.

-

19:58

EUR/GBP ticks up from 20-month lows at 0.8400

- The euro edges up after hitting fresh lows at 0.8400.

- The pair remains weak, weighed by BoE tightening expectations.

- EUR/GBP: Attention to the 2019 low ar 0.8239 – Commerzbank.

The euro has trimmed losses during Tuesday’s afternoon US session, returning to the previous range, right above 0.8420, after having hit fresh multi-month lows at 0.8400. From a wider perspective, however, the pair remains on the defensive, after having depreciated about 2.5% in October.

Expectations of a hawkish BoE are underpinning Pound’s strength

The pound remains firmer against the European currency, supported by market expectations the Bank of England will have to accelerate its monetary normalization plan. With yearly inflation accelerating at levels nearly twice the Bank’s target for price stability, investors are starting to price an interest rate in the first half of next year and, probably, others to follow.

On the other hand, the euro remains weighed by the common view that the dovish stance will prevail at the next Thursday’s ECB monetary policy meeting. The Bank is widely expected to maintain its bond-purchasing plan unchanged and the benchmark interest rate near zero, in spite of the persistently high inflation, to avoid creating tensions in some peripheral markets.

EUR/GBP: Attention to the 2019 low at 0.8239 – Commerzbank

Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank expects the pair to resume its downward trend soon, heading towards 0.8239: “EUR/GBP has tested and failed at key nearby resistance at 0.8471, which represents April 2021 low and May 2019. This is negative price action, and while we hold below the 55-DMA at 0.8532 we stay negative for now (…) Attention is on the 0.8239 2019 low and the 200-month ma lies at 0.8159.”

Technical levels to watch

-

19:39

GBP/JPY upward move capped around 157.70 despite a risk-on market sentiment

- GBP/JPY rises for the second day in a row amid risk-on market sentiment.

- Bank of England hiking rate expectations for the November 4 meeting, shed by 50%, but fully priced in for December meeting,

- GBP/JYP: From a technical perspective, there is room for another leg-up as RSI is still short of overbought levels.

The GBP/JPY cross-currency pair advances during the New York session, up 0.38%, trading at 157.15 at the time of writing.

Investors’ mood is upbeat, portrayed by rising US equity indices, rising between 0.19% and 0.36%. Factors like Q3 solid US corporate earnings calm market participants, despite elevated inflation and central bank tightening monetary policy. Furthermore, the risk-on environment undermined the safe-haven Japanese yen status, as it remains the laggard of the session, losing 0.39% during the day against most G8 currencies.

Cable has remained well supported by Bank of England hawkish members, like Governor Andrew Bailey and Chief Economist Huw Pill. They expressed concerns about high inflation, supporting the thesis of tackling inflation before it gets out of control. Nevertheless, on Monday, Silvana Tenreyro, an external member of the Boe, said that inflation pressures from surging energy prices were likely to fade quickly.

According to Brown Brother Harriman (BBH analysts, on a note to clients, expectations of a Bank of England (BoE) rate hike by the November 4 meeting are getting trimmed.

“WIRP suggests only 50% odds of liftoff November 4, down from being fully priced in at the start of last week. However, a hike at the next meeting on December 16 remains fully priced in,” per BBH report.On Monday, on the Brexit front, David Frost said that EU proposals would not offer a more profound solution as the UK wants. Further added, “The problem with the EU proposals on Northern Ireland is that they don’t go far enough.”

That said, GBP/JPY traders will look for market mood sentiment and ongoing developments surrounding the UK. The Bank of England November 4 monetary policy seems priced in, as the cross-currency has rallied almost 6% in the MTD, from 150.00 to 158.00 tops.

GBP/JPY Price Forecast: Technical outlook

Daily chart

The GBP/JPY is trading near last Friday’s tops around 157.20’s, taking a breather after a steep upside move of 800 pips without consolidation. The daily moving averages (DMA’s) are below the spot price, supporting the upward bias, while the Relative Strength Index (RSI) at 67 aims higher, opening the door for another leg-up, potentially towards 158.00.

GBP/JPY ADDITIONAL LEVELS

-

19:21

NZD/USD testing support at 0.7150 on rejection from 0.7195

- The kiwi fails at 0.7195 and returns to the support area at 0.7150.

- The US dollar appreciates further on a risk-on session.

- NZD/USD's upside momentum loses vigour – UOB.

The New Zealand dollar has given away previous gains after pulling back from 0.7195 on Tuesday, to test support at 0.7150. The pair has been moving without a clear direction in a choppy trading session, ahead of key central bank meetings this week.

The US dollar picks up on a risk-on session

The kiwi has been unable to take advantage of moderately positive market sentiment. Stock markets have posted gains on Tuesday on the back of better than expected quarterly earnings reports by UPS and General Electric.

The US Dollar Index has pared losses on Tuesday after a soft opening, extending Monday’s rebound from 93.45, to session highs at 94.00.

Better than expected US new home sales, which surged 14% in September to reach six-month highs with 800,000 units sold, plus the unexpected improvement in US consumer sentiment and the solid increase on the Richmond Fed Manufacturing Index might have offered a fresh boost to the USD during the American trading time.

Major currencies, however, have remained within previous levels, with the investors awaiting key monetary policy decisions by the ECB, BoJ and BoC, due to be released later this week, which might set the near-term direction for FX markets.

NZD/USD’s upside momentum loses vigor – UOB

The FX analysis team at UOB warns that the NZD is losing upside traction: “As highlighted, upward momentum is beginning to wane and a break of 0.7125 (no change in ‘strong support’ level) would indicate that the NZD strength that started more than a week ago has run its course. In order to rejuvenate the flagging momentum, NZD has to move and stay above 0.7180 within these 1 to 2 days, or a break of 0.7125 would not be surprising.”

Technical levels to watch

-

19:17

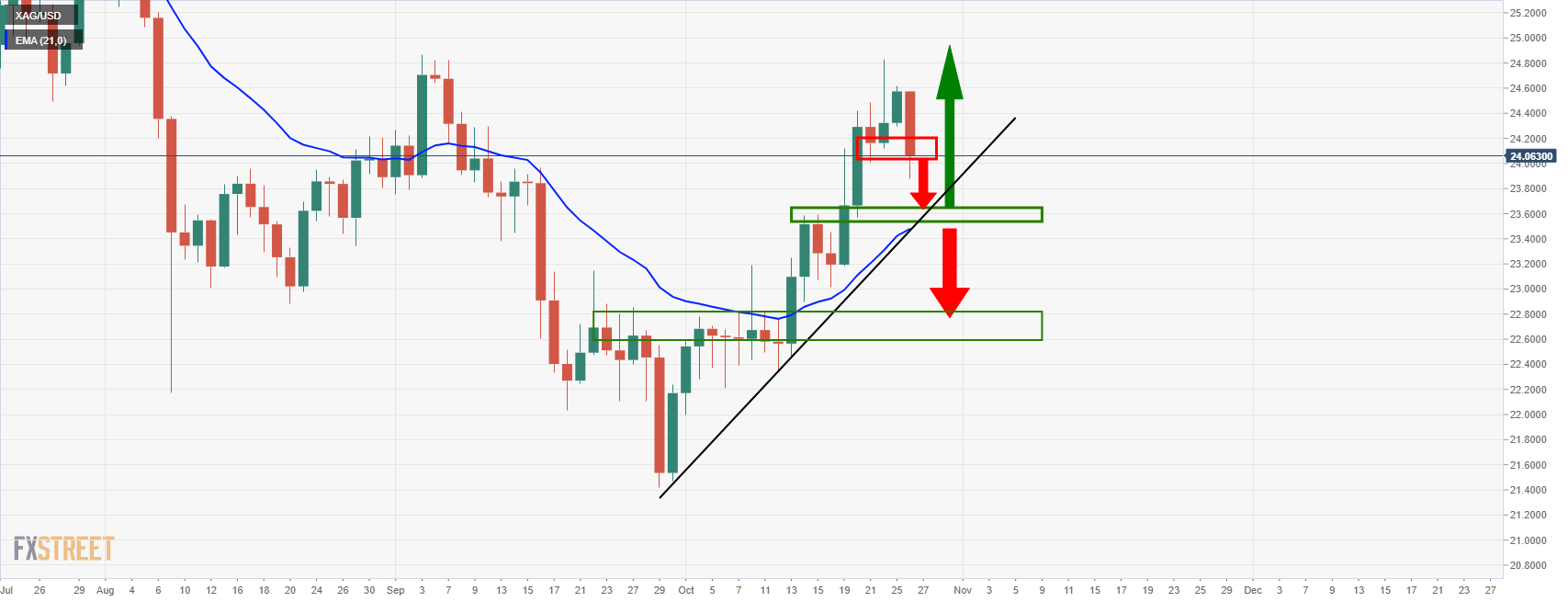

Silver is under pressure to a critical daily dynamic support

- Silver is under pressure as investors move into the greenback.

- Event risks are looming with critical central banks meetings slated this and next week.

- US yields are adding pressures with the 10-year yield now at critical dynamic support.

The price of silver is down heavily on the day following an aggressive 4-hour candle that extended the drift from Asian flows back into the US dollar. At the time of writing, XAG/USD is trading near $24.0430, down 2.13% after falling from a high of $24.58 to a low near $23.87.

The greenback has been stuck in a narrow range while markets await news from central bankers this and next week which include the European Central Bank on Thursday, the Bank of Canada tomorrow (Wed), and the Federal Reserve next week. The US dollar, as measured by the DXY index, was unchanged bid at 93/95 at the time of writing which is hurting precious metals today. There has been a strong rally in the greenback which has based at a triple bottom low on the 4-hour charts following a breakout from a downtrend that started on Oct 12.

US yields in focus

Investors could well be positing ahead of the slew of central bank meetings and economic critical data that could shift views on interest rates, inflation and growth rates. In this regard, the yields on 10-year U.S. note is testing critical trendline support which could equate to a fresh run to the upside, supportive of the US dollar and a headwind for precious metals:

At the time of writing, this is yielding 1.6263% in the mid-day of the New York session. Meanwhile, analysts at TD Securities argue that the hunt for inflation protection is intensifying.

''Ten-year breakeven yields continue to firm at their highest levels since 2012, as speculators brace for inflation. In this context, global markets remain intensely focused on pricing the Fed's exit, with the recent surge in market-based inflation expectations fueling bets for an earlier Fed hike.''

''Yet, we continue to argue that market pricing for Fed hikes remains far too hawkish as it fails to consider that a rise in inflation tied to a potential energy shock and lingering supply chain shortages would be unlikely to elicit a Fed response,'' the analysts argued.

''In fact,'' they said, ''the market is increasingly pricing in a policy mistake which is unlikely to take place, considering that central banks are likely to look past these disruptions as their reaction functions have been historically more correlated to growth than inflation.''

Silver & DXY technical analysis

The confluence of the daily dynamic and 21-day EMA is compelling. A break to there could see the price rally. Or, alternatively, there are likely risks below the support to the next layer down near the head and shoulders neckline.

Meanwhile, the US dollar is looking as though it is make or break time:

The rally has made a 38.2% Fibo retracement and that could be expected to resist leading to a downside test of the dynamic trendline support. If, on the other hand, it breaks the resistance, then the next layer is located in the highs near 94.50 which would likely cripple the precious metals for the near term.

-

18:48

USD/CHF hesitates around 0.9200 after failure at 0.9225

- The US dollar's recovery from 0.9150 meets resistance at 0.9225.

- The dollar, looking for direction ahead of central banks' meetings.

- USD/CHF biased lower, aiming to 0.9081 – Commerzbank.

The US dollar whipsawed around 0.9200 on Tuesday as the pair’s rebound from 7-week lows at 0.9150 found resistance at 0.9225 earlier today. On a broader view, the USD/CHF remains trapped within a clear downward channel from late September highs at 0.9365.

The US dollar, looking for direction ahead of Central Banks’ meetings

The greenback’s recovery has lost steam on Tuesday, with the pair unable to maintain the positive tone seen on Monday in spite of the upbeat market sentiment seen during the European and US market sessions and the positive US macroeconomic data.

The USD Index has reversed earlier losses, after bouncing at 93.68, returning to 94.00 area, buoyed by the positive market sentiment triggered by upbeat earnings reports. Beyond that, US new home sales surged 14% in September to a six-month high of 800,000 units sold, with the Richmond Fed manufacturing Index improving beyond expectations and consumer confidence improving unexpectedly in October.

In a bigger picture, however, the major currency crosses remain moving within previous ranges, with the market awaiting monetary policy decisions by the ECB, BoJ, and BoC, which might provide a fresh push to currency markets.

USD/CHF remains vulnerable, aiming towards 0.9081 – Commerzbank

From a technical perspective, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, maintains its negative outlook and sees the current decline reaching levels below 0.9100: “USD/CHF is vulnerable near-term, it is under pressure and we would allow for further losses (..) It is possible that this is only an ABC correction but intraday Elliott wave counts remain negative and we suspect that the market will see a deeper sell-off to the 0.9142 200-day ma and potentially the 2020-2021 uptrend at 0.9081.”

Technical levels to watch

-

18:39

United States 2-Year Note Auction rose from previous 0.31% to 0.481%

-

18:27

WTI surges above $84.00 for the second day in a row amid broad US dollar strength

- WTI extends its three-month rally, and prices have increased 37% since August 2021.

- The market sentiment is upbeat despite overall US dollar strength across the board.

- Saudi Aramco CEO said that if COVID-19 eases as expected and more people fly, it would be a crude oil supply deficit.

Western Texas Intermediate (WTI) US crude oil benchmark rises during the New York session, short of Monday's tops, trading at $84.30 at the time writing. The market sentiment has remained upbeat as US stock indices remain supported by US Q3 solid corporate earnings, which helped ease investors' nervousness around high inflation and central bank monetary policy tightening.

In the meantime, the US Dollar Index, whose price influences commodity prices, is rising 0.18%, sitting at 93.98 at press time

Crude oil prices lie in the hands of the OPEC+ and the increasing demand for it as the energy crisis worsens. On Tuesday, Amin Nasser, CEO of Saudi Aramco, said that capacity worldwide is dropping quickly, and companies need to invest more in production. His comments come as the US, among other countries, have called OPEC+ to increase the current output.

Nasser added that if the coronavirus pandemic eases as expected and more people fly, the supply deficit could worsen in 2022.

Despite the abovementioned, the Organization of Petroleum Exporting Countries and its partners (OPEC+) stick to the 400,000 daily output increase each month. The group led by Russia and Saudi Arabia will meet on November 4 to decide whether to keep or change the strategy.

WTI Price Forecast: Technical outlook

WTI's upward move is overextended, portrayed by the Relative Strength Index (RSI), which is at 74 and has remained in overbought levels since October 11, showing no signs to move lower. The daily moving averages remain well below the price, with an upward slope, supporting the upward bias.

A sustained upside break above $84.00 could open the way for a $91.00 challenge, but crude oil dynamics also lie in fundamental developments. So, in this case, cautions is warranted. The first resistance level would be $85.00, subsequently followed by $86.00.

In case of a correction lower, the first meaningful support level would be the July 6 high at $77.00.

WTI KEY ADDITIONAL LEVELS TO WATCH

-

17:57

USD/JPY consolidates above 114.00 with upside attempts capped at 114.30

- The US dollar returns above 114.00 to stall right below 114.00.

- Risk appetite, dovish BoJ weigh on the Japanese yen.

- USD/JPY expected to appreciate towards 117.00/10 – Credit Suisse.

The dollar maintains a moderate bid tone on Tuesday, extending its rebound from the 113.40 low hit last Friday. The pair has returned to levels past 114.00, with the safe-haven yen weighed on a risk-on market, before hitting resistance at 114.30 area.

The yen weakens on risk appetite, dovish BoJ

The Japanese yen has opened the week on a soft tone on the back of a moderate appetite for risk with quarterly earnings reports triggering advances in the world’s major equity markets.

Beyond that, the market is bracing for a dovish monetary policy statement by the Bank of Japan later this week, which is adding negative pressure on the yen. With the US Federal Reserve expected to start reducing its stimulus program over the coming months, the widening yield differential between the US and Japanese Treasury bonds has been one of the main reasons behind the nearly 5% rally performed by the USD/JPY since late September.

On the macroeconomic front, US new home sales have surged 14% in September, hitting a six-month high rate of 800,000 units, well above the 620,000 units anticipated by market experts. Furthermore, the Richmond Fed Manufacturing Index has improved to 12, from -3 in the previous month, with all components, shipments, new orders and employment showing improvements. On the negative side, The US Home Prices index and S&P Case-Schiller home prices have increased below expectations.

USD/JPY expected to rally towards 117.00/10 – Credit Suisse

From a wider angle, economists at Credit Suisse observe the pair in a consolidation phase, ahead of further appreciation: “With a major base in place above the 112.40 high of 2019 we look for an eventual break above 114.73/92 in due course for a move to 115.51 initially and then the long-term downtrend from April 1990 at 117.00/10. We look for a potentially lengthy consolidation phase to emerge here.”

Technical levels to watch

-

17:24

AUD/USD retreats from 0.7520 as US T-bond yields rise

- AUD/USD shed 30 pips in the last hour, as US T-bond yields rise amid risk-on market mood.

- Broad US Dollar strength across the board weighs on the AUD/USD pair.

- US Consumer Confidence rose more than expected by economists, the AUD/USD barely moved.

The AUD/USD barely advances during the New York session, is up 0.08%, trading at 0.7497 at the time of writing. Earlier in the day, the pair dipped to 0.7483, yet bounced off the daily lows to print a daily high at 0.7524, finally settling at current levels.

The market sentiment is upbeat due to robust US Q3 corporate earnings, with almost 81% of the S&P 500 companies reporting earnings, beating expectations. Additional factors like inflationary pressures and tightening monetary policy conditions remain in the backseat.

However, in the last hour, rising US T-bond yields seem to change the tone of risk-sensitive currencies, like the aussie dollar. The US 10-year Treasury yield is advancing 0.07%, sitting at 1.636%, putting a lid on the AUD/USD pair upbreak move above 0.7500. Also, the US Dollar Index reclaims the 94.00 level, up 0.18%, at press time.

US mixed macroeconomic, ignored by AUD/USD traders

The US economic docket unveiled the US Housing Price Index for August (MoM) reading which rose by 1%, lower than the 1.3% foreseen. Further, the S&P/Case-Shiller Home Price Indices (YoY) expanded by 19.7% less than the 20.1% expected.

Further, US New Home Sales for September increased by 0.8M, better than the 0.76M estimated by analysts. The US Consumer Confidence for October improved to 113.8 versus 108.3 expected.

The AUD/USD pair reaction was muted, but as US T-bond yields started to rise, the pair shed 30 pips, trading at current levels.

Next ahead on the Australian economic docket, the RBA Trimmed Mean CPI for the Q3 is expected at 0.5%, while the Consumer Price Index for the same period is estimated to increase by 0.8%.

KEY ADDITIONAL LEVELS TO WATCH

-

17:10

USD/CAD bounces up from 1.2350 and approaches 1.2400

- The US dollar, contained at 1.2350, returns to levels near one-week highs at 1.2400.

- The greenback bounces up after upbeat housing, manufacturing data.

- USD/CAD is expected to rally towards 1.25/26 after BoC – Scotiabank.

The US dollar has shrugged off previous weakness and bounced up from session lows at 1.2350 against its Canadian counterpart, returning to levels right below 1.2400 and turning positive on daily charts.

The dollar bounces up after US data

The greenback has bounced up, to regain lost ground following a soft performance during the Asian and European trading sessions. Better than expected US new home sales and the strong performance of the Richmond Fed Manufacturing Index seem to have reactivated confidence in the US dollar, pushing the pair back to levels near the one-week top, at 1.2400.

Sales of new homes have surged 14% in the US in September, hitting a six-month high rate of 800,000 units and beating market expectations of 620,000 units sold. Furthermore, the Richmond Fed Manufacturing Index improved to 12, from -3 in the previous month, with all components: shipments, new orders, and employment showing advances. On the negative side, home prices have increased below expectations.

The Canadian dollar had edged up earlier, buoyed by higher oil prices and improved market sentiment on the back of strong corporate earnings. The CAD, however, remains heavy, with the market positioning for a dovish BoC monetary policy statement later this week.

USD/CAD to appreciate towards 1.25/26 after BoC – Scotiabank

The FX Analysis team at Scotiabank expects the pair to advance further this week, with a dovish BoC increasing negative pressure on the CAD: “We look for narrow range trading for the CAD ahead of tomorrow’s policy decision and feel the risk of soft-pedaling nearer-term rate expectations might nudge the CAD somewhat lower in the short-run. USD gains to the 1.25/1.26 will very likely be met with renewed USD supply, however.”

Technical levels to watch

-

16:59

Brazil: Central bank to raise key rate by 150bps with some risk of an even more aggressive move – TD Securities

The central bank of Brazil (BCB) will meet this week. Market consensus point to an increase in the main policy rate to 7.75%, an 150bps hike. According to analysts from TD Securities there is some risk of an even more aggressive move.

Key Quotes:

“We expect the BCB to make a more aggressive policy rate adjustment by hiking rates by 150bps, aimed at containing inflation expectations and stabilizing BRL. There is some risk of an even more aggressive move in our view.”

“The risk to BRL is skewed to the downside. We believe that a 150bp rate hike, with a commitment of another equivalent hike at the December meeting, will be required to bolster BRL. Anything less risks a resumption of BRL selling.”

“The rates market has priced-in an assumption of an aggressive shift in the BCB's stance, leaving a terminal rate near 13.00% by late 2022.”

-

16:52

Fed: Taper announcement in November, no rate hikes until 2023 – Wells Fargo

Next week, the Federal Reserve will have its monetary policy meeting. Analysts at Wells Fargo, expect the FOMC to formally announce plans to taper asset purchases. They don’t expect higher rates until 2023.

Key Quotes:

“Our working assumption is that the FOMC announces a taper on November 3, with the actual tapering of purchases beginning at the start of December. From there, we assume that the Federal Reserve reduces its asset purchases each month by $10B for Treasury securities and $5 billion for MBS. At this pace, the Fed would complete its asset purchase program by the end of June 2022. The Fed's balance sheet, which is currently about $8.5T, would be slightly above $9T by mid-2022.”

“It is likely Chair Powell will pair the tapering announcement with another firm reminder that the bar for increasing short-term interest rates is much higher. At August's rate of job growth it would take a little more than two years to recoup 100% of the jobs lost during the pandemic, and even then the economy would still be several million jobs short of its pre-pandemic trend. Even with our faster projected pace of job growth, we still expect the labor market to face a meaningful employment gap for the entirety of 2022. In our view, this employment gap, paired with our projected slowdown in inflation, will keep the Fed from raising rates until 2023.”

-

16:49

BoC Preview: Progress has been made – TDS

On Wednesday, the Bank of Canada (BoC) will announce its decision on monetary policy. The base case scenario according to analysts at TD Securities is for the BoC to keep to broader narrative intact and guidance unchanged; and signal inflation is largely transitory. They see the BoC announcing a shift to QE reinvestment, starting in November.

Key Quotes:

“We expect the BoC to argue that inflation is largely transitory, and to maintain its current forward guidance for the overnight rate. We also look for the BoC to announce that its QE program will transition to the reinvestment phase in November.”

“We like USDCAD higher into the BoC. While the stagflation theme has oddly benefited CAD, it's likely moved too far, too fast. CAD is trading at a 1-sigma premium on our dashboard and is the most overbought currency in the G10. We look for better selling levels ahead of the 1.2850 pivot point.”

-

16:36

US: Easing in COVID cases boosted optimism – Wells Fargo

US economic data released on Tuesday came in above expectation, with a Consumer Confidence measure rising unexpectedly. According to analysts at Wells Fargo, favourable views of the labor market helped to fuel gains in both the present situation and expectation measures and lifted the Consumer Confidence headline index to 113.8 from 109.8.

Key Quotes:

“Consumer confidence rose for the first time in four months, jumping four points to 113.8 in October, as concerns that drove confidence to a seven-month low in September eased. COVID cases are again receding from their more-recent peak and the onslaught of negative news in September, which ranged from natural disasters to fiscal uncertainty and the wind-down of the war in Afghanistan, has subsided. There was an improvement in consumers views of both current conditions and expectations for the future.”

“Higher optimism around income may be boosting spending in the near-term. Retail sales surprised to the upside in September, and while some of that is likely due to higher prices, it is an indication demand has not fallen off a cliff headed into the holiday shopping season. Buying intentions suggest a similar conclusion, as plans to buy automobiles, major appliances and even homes over the next six months all improved from September.”

“On Friday, we'll get the personal income & spending report for September which will shed some light on the price versus spending dynamics. Even if spending intentions to not materialize, and we see lackluster sales to end the year, holiday sales are still set for a record year-over-year gain this year.”

-

16:34

EUR/USD, rejected at 1.1625, approaches one-week lows at 1.1590

- The euro pulls back from 1.1625, returns to 1.1600.

- Upbeat US figures trigger a dollar rebound.

- EUR/USD expected to dive below 1.1600 after ECB's meeting – Scotiabank.

The euro’s upside attempt seen during the European trading session has been short-lived. The pair failed at 1.1625 to give away gains following the release of US home sales and manufacturing data, returning to levels right below 1.160 and nearing the 1.1590 support area.

The US dollar appreciates on upbeat macroeconomic data

A slew of better than expected figures in the US has strengthened a hitherto softer dollar, dashing the tame euro recovery attempt supported by positive market sentiment and the pause on US T-Bonds rally.

US new home sales have surged 14% in September to a six-month high rate of 800,000 units, beating market expectations of 620,000 units. The median price, however, accelerated 18,7% year on year and remains at levels beyond $400,000, which is hampering the possibilities of first-time buyers.

Furthermore, the Richmond Fed Manufacturing Index improved to 12, from -3 in the previous month, well above the 3 reading forecasted by the analysts. All components of the index, shipments, new orders, and employment have improved this month, which has eased concerns about the impact of supply disruptions.

The US dollar has bounced up on the back of these releases, although the major currency crosses remain contained within previous ranges, with all eyes on the monetary policy decisions and US GDP figures, due later this week.

EUR/USD: Dovish ECB decision to push the pair returning 1.1600 – Scotiabank

The FX Analysis team at Scotiabank, sees the pair closing this week below 1.1600, weighed by a dovish ECB: “Even a moderately less dovish statement will stand starkly in contrast to next week’s Fed decision, so room for EUR gains is limited and selling the currency on a post-ECB gain is the most sensible strategy.”

Technical levels to watch

-

16:32

Gold Price Forecast: XAU/USD fails to hold above $1800, tumbles toward $1780

- Recovery of the US dollar triggers sell-off in metals.

- Gold tumbles losing more than $10 in a few minutes, later trims losses.

Gold dropped below $1800 and tumbled to $1782, reaching the lowest level since Thursday. It then trimmed losses and rose toward $1790. It still remains under pressure, as the US dollar strengthens across the board.

The greenback gained momentum during the American session following the release of better-than-expected US economic data. US bond yields bounced to the upside with the 10-year rising from the lowest in a week at 1.61 to 1.66%. The DXY turned positive and rose toward 94.00, to test the weekly top.

The decline in metals during the last hours was significant. Silver is down by more than 2%, trading under $24.00. XAG/USD reversed sharply, extending the retreat from monthly highs. XAU/USD is falling 1.05%.

The sharp decline in gold adds doubts to the current upside short-term bias. A recovery above $1790 would be a positive development, but in order to keep the doors open to more gains, XAU/USD needs to regain $1800.

A break under $1777 should sign to further losses and to a deterioration in the technical outlook; targeting $1770 initially and then $1760.

Technical levels

-

16:19

GBP/USD struggles for the fourth day out of six, at 1.3830, retreats below 1.3800

- The British pound advances for the second day in a row amid risk-on market sentiment.

- GBP/USD: Faces strong resistance at 1.3830, despite BoE hawkish comments.

- US Q3 corporate earnings, keep investors mood in risk-on mode, boosts the risk-sensitive GBP.

- Brown Brother Harriman (BBH): Expectations of a Bank of England November 4 hike, trimmed by 50%.

The British pound climbs during the New York session is trading at 1.3789 at the time of writing. Earlier in the Asian session, the GBP/USD dipped to 1.3756, but as European traders got to their desks, the pair jumped to 1.3829, faced strong resistance, and retreated towards current levels.

US Q3 corporate earnings, keep investors mood in risk-on mode

Sterling’s recovery during the European session lies on the back of the positive market sentiment. Factors like follow-through from last week’s US corporate third-quarter earnings, with Alphabet, Amazon, and Apple Microsoft, left to report earnings this week, keep the market on a positive tone. Investors are gauging from those reports if companies are passing higher production prices to customers, leaving macroeconomic developments on the side.

Additionally, earnings season remains in the driver seat, with elevated inflation and tightening monetary policy, staying in the backseat for the time being,

During the European session, UK Chancellor Sunak will reportedly unfreeze public sector salaries next April. Reports suggest that Sunak will also announce an increase in the national minimum wage to GBP 9.50 per hour. He is due to unveil his budget speech on Wednesday.

According to Brown Brother Harriman (BBH), on a note to clients, expectations of a Bank of England (BoE) rate hike by the November 4 meeting are getting trimmed.

“WIRP suggests only 50% odds of liftoff November 4, down from being fully priced in at the start of last week. However, a hike at the next meeting on December 16 remains fully priced in,” per BBH report.Additionally, on Monday, Silvana Tenreyro, an external member of the Bank of England, said that she needed more time to judge how the furlough scheme would affect the labor market, signaling that she was not in a rush to lift rates. Furthermore, she added that inflation pressures from surging energy prices were likely to fade quickly.

That said, it seems the GBP/USD pair will remain around the 1.3700-1.3850 levels until the November 4 BoE monetary policy meeting. A hawkish “surprise” could propel the British pound through the 1.3830 strong resistance area, but as investors trimmed their bets of a hike rate, it may well be priced in.

US mixed macroeconomic data, ignored by investors

An absent UK economic docket left the GBP/USD pair at the mercy of US dollar dynamics. In the meantime, the US economic docket featured the US Housing Price Index for August (MoM) reading which rose by 1%, lower than the 1.3% foreseen. Further, the S&P/Case-Shiller Home Price Indices (YoY) expanded by 19.7% less than the 20.1% expected.

Moreover, US New Home Sales for September increased by 0.8M, better than the 0.76M estimated by analysts. The US Consumer Confidence for October improved to 113.8 versus 108.3 expected.

-

15:40

US Sen. Maj. Leader Schumer: Confident deal on domestic investment bill is within reach

US Senate Democratic Leader Chuck Schumer said on Tuesday that Democrats are continuing to make progress on US President Joe Biden's economic plan, as reported by Reuters.

"I remain confident a deal is within reach on the large domestic investment bill," Schumer added.

Market reaction

Risk flows continue to dominate the financial markets following these comments. As of writing, the S&P 500 and the Dow Jones Industrial Average indexes were trading at new record highs, rising 0.6% and 0.4% on a daily basis, respectively.

-

15:14

US: New Home Sales surge by 14% in September vs. 1.5% expected

Following a contraction of 1.4% in August, New Home Sales in the US surged by 14% in September, the data published by the US Commerce Department showed on Tuesday. This reading surpassed the market expectation for an increase of 1.5% by a wide margin.

Further details of the publication revealed that the median sale price rose by 18.7% on a yearly basis to $408,000.

Market reaction

The dollar stays resilient against its major rivals after this report. As of writing, the US Dollar Index was up 0.05% on a daily basis at 93.87.

-

15:08

US: CB Consumer Confidence improves to 113.8 in October vs. 108.3 expected

- US CB Consumer Confidence Index rose more than expected in October.

- US Dollar Index stays in a consolidation phase below 94.00.

Consumer confidence in the US strengthened in October with the Conference Board's Consumer Confidence Index rising to 113.8 from 109.8 in September. This reading came in higher than Reuters' estimate of 108.3.

Further details of the publication revealed that the Present Situation Index edged higher to 147.4 from 144.3 and the Consumer Expectations Index improved to 91.3 from 86.7.

Market reaction

This report doesn't seem to be having a significant impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was up 0.03% on the day at 93.85.

-

15:00

United States Richmond Fed Manufacturing Index came in at 12, above forecasts (3) in October

-

15:00

United States New Home Sales Change (MoM) came in at 14%, above expectations (1.5%) in September

-

15:00

United States New Home Sales (MoM) came in at 0.8M, above expectations (0.76M) in September

-

14:42

EUR/GBP to drop substantially below 0.84 if BoE sets on a tightening path – Scotiabank

EUR/GBP nears 0.84. If the Bank of England (BoE) lays out a tightening path in its next week's meeting, the pair would slide below the mentioned 0.84 level.

EUR/GBP to suffer a major fall below 0.84

“Next week may see the EUR/GBP firmly fall under the 0.84 mark if the BoE sets on a tightening path.”

“EUR/GBP is nearing key support at 0.84 after it held through multiple sessions to the 0.8420 mark. Below 0.84, only big figure psychological and 0.8277/82 (2019/2020 lows) support stand.”

-

14:40

S&P 500 Index notches new record-high after the opening bell

- Wall Street's main indexes opened in the positive territory on Tuesday.

- All major sectors of the S&P 500 push higher.

After managing to post gains on the first day of the week, major equity indexes in the US opened in the positive territory as risk flows continue to dominate the financial markets. Reflecting the upbeat market mood, the CBOE Volatility Index (VIX) touched its lowest level since early July at 15.

As of writing, the S&P 500 and the Dow Jones Industrial Average indexes were trading at new record highs, rising 0.42% and 0.25%, respectively. The Nasdaq Composite is up 0.71% at 15,338.

After the opening bell, all major sectors of the S&P 500 push higher with the Technology Index leading the rally by rising more than 1%.

Later in the session, the Conference Board's Consumer Confidence Index for October and September New Home Sales data will be featured in the US economic docket.

S&P 500 chart (daily)

-

14:34

USD/CAD to climb to the 1.25/26 zone as BoC may dampen rate expectations – Scotiabank

The Canadian dollar unwinds yesterday’s loss but the Bank of Canada (BoC) risks linger. Economists at Scotiabank expect the loonie to weaken following the BoC meeting, rising USD/CAD to the 1.25/26 area.

BoC to cool down rate expectations

“The CAD is one currency that we fully expect to hold its own– and even improve somewhat – against a more robust USD going forward, given our forecast for a relatively rapid tightening in the BoC policy rate once that tightening cycle gets started (we assume H2 next year).”

“We fully expect a further reduction in asset purchases but policy makers might try to dampen rate expectations somewhat in order to avoid disappointing market participants and creating more volatility down the road.”

“We look for narrow range trading for the CAD ahead of tomorrow’s policy decision and feel the risk of soft-pedaling nearer-term rate expectations might nudge the CAD somewhat lower in the short-run. USD gains to the 1.25/1.26 will very likely be met with renewed USD supply, however.”

-

14:30

US Senator Manchin: $1.5 trillion for spending bill is more than fair

Democratic US Senator Joe Manchin said on Tuesday he thinks that a $1.5 trillion for spending bill is "more than fair," as reported by Reuters.

Manchin further added that he doesn't know if the domestic investment bill will rise above the $1.5 trillion he wants.

Commenting on the Senate filibuster rule, Manchin noted that the debt limit increase should be decided by the US President with Congress having the power to override it.

Market reaction

These comments don't seem to be having a noticeable impact on the dollar's market valuation. As of writing, the US Dollar Index was unchanged on the day at 93.81.

-

14:27

EUR/USD Price Analysis: Further losses likely below 1.1590

- EUR/USD regains some ground following Monday’s drop.

- The breakdown of 1.1590 should allow for a deeper pullback.

EUR/USD regains some composure and looks to extend the bounce above the 1.1600 mark on a more sustainable fashion.

In the meantime, the inability of spot to move higher in the short-term horizon could trigger some corrective move to, initially, the weekly low at 1.1590 (October 25). A drop beyond this level is seen exposing another weekly low near 1.1570 (October 18), all prior to the 2021 low at 1.1524 (October 12).

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1911.

EUR/USD daily chart

-

14:26

EUR/USD: Dovish ECB meeting to drag the pair below the 1.16 level – Scotiabank

EUR/USD is steady to marginally higher with the 1.16 zone acting as an anchor against broad losses in the dollar today. According to economists at Scotiabank, markets may be preparing for another dovish European Central Bank (ECB) meeting this week, which would leave the pair pointing to losses extending below the 1.16 mark.

Room for EUR gains is limited

“Even a moderately less dovish statement will stand starkly in contrast to next week’s Fed decision, so room for EUR gains is limited and selling the currency on a post-ECB gain is the most sensible strategy.”

“EUR/USD is currently trading against ~1.1620 resistance to be followed by the mid 1.16s zone that stands as a clear area to breach that would signal a firmer rejection of downward pressure – resistance at 1.17 (50-day MA at 1.1702) follows.”

“Support is 1.1572 after the 1.16 area.”

-

14:10

Gold Price Forecast: XAU/USD slides further below $1,800 mark, downside seems limited

- The risk-on mood prompted fresh selling around the safe-haven gold on Tuesday.

- Hawkish Fed expectations further exerted pressure on the non-yielding XAU/USD.

- Fresh COVID-19 jitters, worries about global economic growth helped limit losses.

- Gold Price Forecast: Acceptance above 100/200-day SMAs favours XAU/USD bulls

Gold added to its intraday losses and weakened further below the $1,800 mark during the early North American session. The XAU/USD has now reversed a major part of the previous day's positive move back closer to six-week tops and was last seen flirting with the 100/200-day SMA confluence resistance breakpoint. The dominant risk-on mood in the markets was seen as a key factor that dented demand for traditional safe-haven assets and exerted some pressure on the safe-haven precious metal.

Meanwhile, the latest leg of a sudden drop over the past hour or so could be attributed to a modest US dollar strength, which tends to undermine dollar-denominated commodities, including gold. The USD drew some support from elevated US Treasury bond yields, bolstered by the prospects for an early policy tightening by the Fed. The markets have been pricing in the possibility of a potential interest rate hike in 2022 amid worries about a faster than expected rise in inflationary pressures.

However, a combination of factors should hold traders from placing aggressive bearish bets around the XAU/USD and limit any deeper losses, at least for the time being. The latest COVID-19 outbreak in China has raised fears about the imposition of economically damaging lockdowns. Against the backdrop of the recent power shortages in China, this could lead to production stoppages/shortages of products down the supply chain and derail the global economic recovery. This, in turn, should continue to act as a tailwind for the gold prices ahead of this week's key event/data risks.

The Bank of Japan and the European Central Bank (ECB) are scheduled to announce their policy decision on Thursday. Neither of the central banks is anticipated to announce a change in the policy stance, though warn about a faster than expected rise in inflation. Beyond this, the market focus will be on the release of the Advance US Q3 GDP growth report, which will set the tone heading into the FOMC policy meetings next week and infuse some volatility around gold.

In the meantime, traders on Tuesday will take cues from the US economic docket – featuring the releases of the Conference Board’s Confidence Index, Richmond Manufacturing Index and New Home Sales. Apart from this, the US bond yields, the USD price dynamics and the broader market risk sentiment should assist traders to grab some short-term opportunities around gold.

Technical outlook

From a technical perspective, gold, so far, has managed to defend the 100/200-day SMAs confluence resistance breakpoint. The mentioned resistance-turned-support, currently around the $1,795-90 area, should act as a key pivotal point for short-term traders. A convincing breakthrough, leading to a subsequent slide below the $1,782 horizontal support, will shift the bias in favour of bearish traders. The XAU/USD might then accelerate the fall towards the next relevant support near the $1,760 region before eventually dropping to monthly swing lows, around the $1,746-45 zone.

On the flip side, the $1,810 region, closely followed by multi-week tops, around the $1,814 area now seems to act as immediate resistance. Some follow-through buying should set the stage for an extension of the recent appreciating move and push gold beyond the $1,825-26 intermediate hurdle. Bulls could eventually aim to challenge the $1.832-34 heavy supply zone, which has been acting as a strong barrier since mid-July.

Levels to watch

-

14:03

US: Housing Price Index rises by 1% in August vs. 1.3% expected

- US FHFA Housing Price Index rose less than expected in August.

- US Dollar Index continues to move sideways below 94.00.

The Housing Price Index released by the US Federal Housing Finance Agency (FHFA) arrived at +1% in August following July's increase of 1.4%. This reading fell short of the market expectation of 1.3%.

Meanwhile, the S&P/Case-Shiller Home Price Indices edged lower to +19.7% on a yearly basis in August from 20%, missing analysts' estimate of 20.1%.

Market reaction

These figures don't seem to be having a significant impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was virtually unchanged on the day at 93.80.

-

14:00

United States Housing Price Index (MoM) below forecasts (1.3%) in August: Actual (1%)

-

14:00

United States S&P/Case-Shiller Home Price Indices (YoY) below forecasts (20.1%) in August: Actual (19.7%)

-

13:55

United States Redbook Index (YoY) climbed from previous 15.4% to 15.6% in October 22

-

13:43

US Dollar Index Price Analysis: Extra range bound looks likely

- DXY fails once again to reclaim the 94.00 area on Tuesday.

- The mid-93.00s emerge as a strong support so far.

DXY extends the erratic performance recorded as of late and comes under some selling pressure following another unsuccessful attempt to re-visit the 94.00 yardstick.

In the meantime, the greenback looks poised for further consolidation as long as the 93.50 region holds. On the other hand, the surpass of 94.00 – ideally in the very near term – could motivate the index to initiate a more convincing recovery to initially, the weekly top at 94.17 (October 18) followed by the 2021 high at 94.56 (October 12).

Looking at the broader picture, the constructive stance on the index is seen unchanged above the 200-day SMA at 91.90.

DXY daily chart

-

13:12

USD/JPY sticks to modest gains near 114.00 mark ahead of US data

- USD/JPY edged higher for the second successive day, though lacked any follow-through.

- The risk-on mood undermined the safe-haven JPY and remained supportive of the move.

- Retreating US bond yields weighed on the USD and kept a lid on any meaningful gains.

The USD/JPY pair maintained its bid tone heading into the North American session, albeit struggled to find acceptance or build on the momentum beyond the 114.00 mark.

The pair built on the overnight rebound from the 113.40 area, marking ascending trend-line support extending from September swing lows, and gained some follow-through traction on Tuesday. This marked the second successive day of a positive move and was sponsored by the prevalent risk-on mood, which tends to undermine the safe-haven Japanese yen.

The uptick, however, lacked bullish conviction amid the emergence of fresh selling around the US dollar, weighed down by an extension of the recent decline in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond has now dropped closer to the 1.60% threshold, though hawkish Fed expectations should act as a tailwind.

The Fed chair Jerome Powell reaffirmed on Friday that the US central bank remains on track to begin tapering its bond purchases by the end of this year. The markets have also been pricing in the possibility of a potential interest rate hike in 2022 amid worries that the recent widespread rally in commodity prices will stoke inflation.

The fundamental backdrop seems tilted in favour of bullish trades and supports prospects for additional gains. That said, investors are likely to refrain from placing aggressive bets ahead of Thursday's Bank of Japan policy meeting and the Advance US Q3 GDP report. This, in turn, warrants some caution for aggressive bullish traders.

Market participants now look forward to the US economic docket, featuring the releases of the Conference Board’s Confidence Index, Richmond Manufacturing Index and New Home Sales. This, along with the US bond yields and the broader market risk sentiment, should assist traders to grab some short-term opportunities around the USD/JPY pair.

Technical levels to watch

-

13:12

More USD strength into year-end, another leg lower in early 2022 – TDS

The market remains on the tensions between stagflation and reflation, shifting a bit to the latter recently. Although the USD could remain on the back foot for the next few weeks, economists at TD Securities expect the greenback to end the year on a solid foot.

MSCI World is within striking distance of recent peak, S&P 500 marks fresh highs

“Global equities, proxied through the MSCI World, are within striking distance of the recent highs. US equities have already posted new highs, likely informed by a solid start to earnings season. A relatively upbeat Q3 earnings season would probably support the reflation environment, even if central bank rhetoric leaned on the hawkish side.”

“We're biased towards more USD strength into year-end for the low yielders, like CHF, JPY, and EUR, though things have moved pretty far in JPY.”

“Given the back-and-forth, flip-flopping state of markets now, we see a step back for the USD followed by a step forward in the final two months of the year. In other words, the USD should consolidate into year-end before starting another push lower in early 2022.”

See: The case for a stronger USD is compelling against the low yielding EUR, CHF and JPY – MUFG

-

13:00

Brazil Mid-month Inflation came in at 1.2%, above expectations (0.97%) in October

-

12:53

EUR/JPY Price Analysis: Recovery could attempt a move to 133.50

- The sharp move higher in EUR/JPY meets resistance near 133.50.

- Bets for a near-term test of 2021 high remain well in place.

EUR/JPY seems to have regained some upside traction and so far reverses three consecutive daily pullbacks on Tuesday.

The rebound from the sub-132.00 levels (October 25) now looks to revisit the next hurdle at the Fibo level at 132.79 ahead of the monthly peak around 133.50 (October 22). Further up, there are minor hurdles at 133.68 (June 15) and 133.76 (June 10) prior to the more relevant YTD high at 134.12 (June 1).

In the broader scenario, while above the 200-day SMA at 130.11, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

-

12:26

USD/CAD slides to fresh session lows, around mid-1.2300s

- A combination of factors prompted fresh selling around USD/CAD on Tuesday.

- The risk-on mood, retreating US bond yields weighed on the safe-haven buck.

- Bullish crude oil prices underpinned the loonie and contributed to the decline.

The intraday USD selling bias picked up pace in the last hour and dragged the USD/CAD pair back closer to mid-1.2300s during the first half of the European session.

Having faced rejection near the 1.2400 mark, the USD/CAD pair met with some fresh supply on Tuesday and for now, seems to have stalled its recent bounce from four-month lows touched last week. The downtick was sponsored by the emergence of fresh selling around the US dollar and a modest uptick in crude oil prices, which tend to underpin the commodity-linked loonie.

The dominant risk-on mood in the markets failed to assist the safe-haven USD to capitalize on the previous day's goodish rebound from one-month lows. Apart from this, a modest decline in the US Treasury bond yields undermined the greenback. That said, expectations for an early policy tightening by the Fed should limit the USD losses and lend support to the USD/CAD pair.

The Fed Chair Jerome Powell reaffirmed last Friday that the US central bank remains on track to begin tapering its bond purchases by the end of this year. Investors also seem convinced that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation. This supports prospects for the emergence of some dip-buying around the USD.

Market participants now look forward to the US economic docket, featuring the releases of the Conference Board’s Confidence Index, Richmond Manufacturing Index and New Home Sales. This, along with the US bond yields and the broader market risk sentiment, will influence the USD. Traders will further take cues from oil price dynamics for some impetus around the USD/CAD pair.

Technical levels to watch

-

12:23

USD/JPY set to surge as high as 117.00/10 – Credit Suisse

The setback in USD/JPY following its rejection from 114.73/92 has been contained at its rising 13-day exponential average at 113.46. Economists at Credit Suisse look for the core uptrend to resume from here towards the 117.00/10 area.

Support at 113.46/41 to hold for an eventual break above 114.73/92

“USD/JPY weakness has been contained at its rising short-term 13-day exponential average, now seen at 113.46 and we look for a resumption of the core uptrend. Above 114.21 should add weight to our view for a fresh look at 114.73/92 – the high of November 2017 and 78.6% retracement of the December 2016/March 2020 fall just.”

“With a major base in place above the 112.40 high of 2019 we look for an eventual break above 114.73/92 in due course for a move to 115.51 initially and then the long-term downtrend from April 1990 at 117.00/10. We look for a potentially lengthy consolidation phase to emerge here.”

“Below 113.46/41 would warn of a deeper corrective setback to 113.29/21, with the 38.2% retracement of the October rally at 113.08/00 ideally holding.”

-

12:19

EUR/USD: Rejection at 1.1671 reasserts the downtrend towards 1.1495 – Credit Suisse

EUR/USD has posted a bearish “reversal day” to mark a more decisive rejection of 38.2% retracement resistance at 1.1671. Economists at Credit Suisse look for a resumption of the downtrend to the 1.1495/93 mark.

Resistance at 1.1671 to cap for a resumption of the downtrend

“Support moves to 1.1590 initially, then 1.1571/66, below which should clear the way for a fall back to 1.1529/24, then our 1.1495/93 first objective – the key March 2020 high and 50% retracement of the 2020/2021 bull trend.”

Whilst we would look for the 1.1495/93 to hold at first for a fresh consolidation phase, below in due course should clear the way for a move to 1.1290.”