Notícias do Mercado

-

19:20

American focus: dollar fell slightly against the euro

The euro exchange rate rose slightly against the dollar in terms of investor activity restrained. Market participants gradually shift focus to important statistical reports on the U.S. economy - preliminary data on GDP for the second quarter of 2014, the July report on unemployment and the index of business activity in the manufacturing sector. According to experts, the number of jobs in the U.S. economy in July increased by 228 thousand after increasing by 262 million in June, unemployment remained unchanged at 6.1%. U.S. GDP, according to the consensus of experts in April-June 2014 increased by 3%, after declining by 2.9%.

Focus will also have a Fed meeting. It is expected that at the upcoming meeting of the Monetary Policy FOMC, is likely to announce another round of quantitative easing to minimize the program (QE) for another $ 10 billion, bringing the total amount of monthly purchases of bonds of $ 25 billion With regard to the Committee, tone it is likely not practically change. Given that the document will be released before the release of the employment report, the economic statements are unlikely to be significantly different from previous ones. It is expected that Yellen will continue to argue that the rate of b / p at 6.1% is still pointing to weak growth in the labor market, as also evidenced by the slow growth of wages.

As for today's data, the report had little impact on the housing market, which showed: The index of pending home sales (PHSI), predictive indicator based on signed contracts, dropped 1.1 percent to 102.7 in June from 103.8 in May and was 7.3 percent lower than in June 2013 (110.8). Despite the decline, the index exceeds the level of 100, which is considered a middle-contract activity, the second consecutive month.

The British pound retreated from session high against the U.S. dollar, but continues to trade on the rise. Today we have published data on the secondary housing market, according to which the confidence of British homebuyers worsened in the second quarter. These results showed a survey by mortgage lender Halifax on Monday. The number of people who believe that today - "good time to buy," fell to 5% from 34% in the previous quarter, which is the most serious decline since April 2011. Approximately 57% of simplification believe that the time is now for sale real estate, and 32 believe the opposite; indicators, thus, form the balance 25. Craig McKinley, director of mortgages at Halifax, said: "It seems that we have reached a tipping point when the balance between buyers and sellers is not synchronized in the near future."

-

15:00

U.S.: Pending Home Sales (MoM) , June -1.1% (forecast -0.2%)

-

14:45

U.S.: Services PMI, July 61.0 (forecast 62.3)

-

14:23

Option expiries for today's 1400GMT cut

EUR/USD $1.3475

USD/JPY Y102.00/10, Y102.45

AUD/USD $0.9350

GBP/USD $1.6975, $1.7035

EUR/GBP Stg0.7910/15, stg0.8000

-

13:20

European session: the euro rose

During the European session, the Forex market the euro rose slightly against the dollar in the conditions of low-key activity of investors. Danske Bank analysts say that today we are calm before the storm, because on the eve of the eventful week calendar Monday is almost empty.

Interest is the only U.S. report on pending real estate transactions, which is a good leading indicator of existing home sales.

Recently, the report featured a good performance, demonstrating that the last two months, this sector is recovering, confirmed that the housing market index and NAHB.

Meanwhile, other indicators were not as optimistic, in particular - building permits and new home sales.

J. Yellen noted priority market dynamics properties for CB, stressing that the sector remains weak, and although he showed little progress, the overall results of this year so far has been disappointing.

The British pound is trading sideways against the U.S. dollar. Published secondary data on the housing market, according to which the confidence of British homebuyers worsened in the second quarter. These results showed a survey by mortgage lender Halifax on Monday.

Balance of people who believe that now the "good time to buy" fell from 34 to 5 in the previous quarter. It was the biggest drop since April 2011.

Meanwhile, about 57 percent believe that now is a good time to sell, and 32 percent think it's a bad time to form the balance of 25.

Craig McKinley, director of mortgages at Halifax, said: "It seems that we have reached a tipping point when the balance between buyers and sellers is much far from the synchronization."

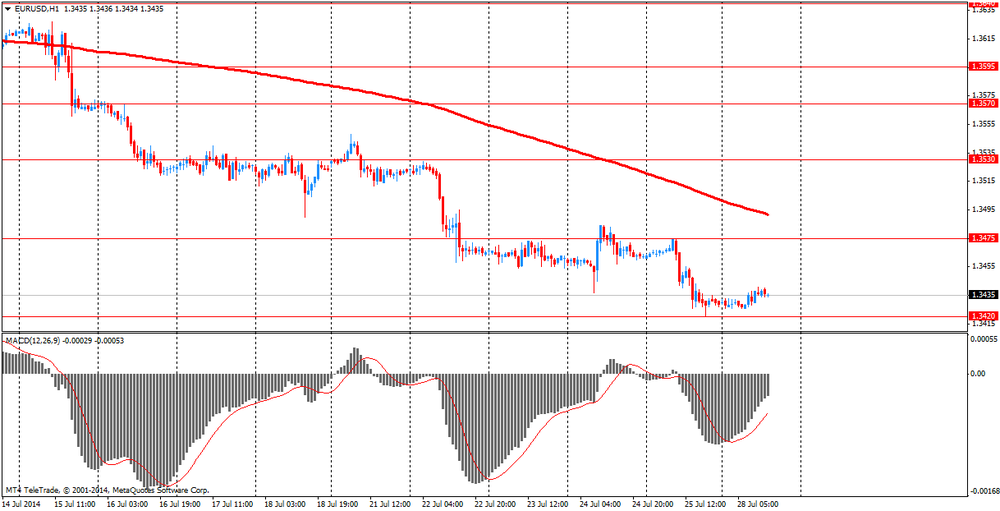

EUR / USD: during the European session, the pair rose to $ 1.3441

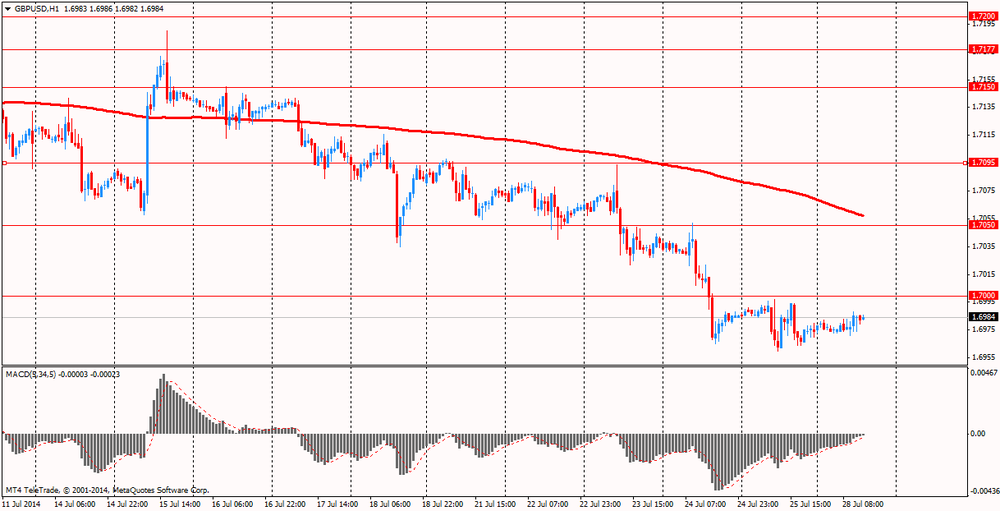

GBP / USD: during the European session, the pair traded in the range of $ 1.6971 - $ 1.6988

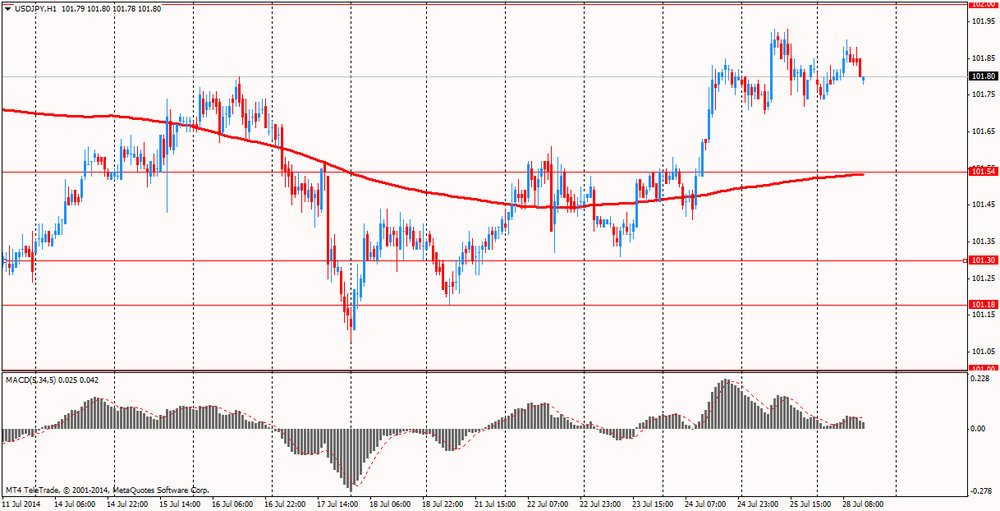

USD / JPY: during the European session, the pair rose to Y101.90 and stepped

At 14:00 GMT the United States will change in the volume of pending home sales for June. 23:30 GMT Japan will present the change in volume level of household expenditure in June in 23:50 GMT - the change in retail sales for June.

-

12:55

Orders

EUR/USD

Offers $1.3500-10, $1.3440-50

Bids $1.3420

GBP/USD

Offers $1.7080, $1.7065

Bids $1.6920, $1.6900, $1.6885/80

AUD/USD

Offers $0.9480, $0.9450, $0.9420/25

Bids $0.9385/80, $0.9370, $0.9350, $0.9320

EUR/JPY

Offers Y137.75/80, Y137.50, Y137.20/25, Y137.00

Bids Y136.50, Y136.00, Y135.75

USD/JPY

Offers Y102.20, Y102.00

Bids Y101.50, Y101.20, Y101.00

EUR/GBP

Offers stg0.7980/85, stg0.7950

Bids stg0.7850

-

10:22

Option expiries for today's 1400GMT cut

EUR/USD $1.3475

USD/JPY Y102.00/10, Y102.45

AUD/USD $0.9350

GBP/USD $1.6975, $1.7035

EUR/GBP Stg0.7910/15, stg0.8000

-

06:23

Asian session: The dollar traded near the strongest in eight months against the euro

The dollar traded near the strongest in eight months against the euro as investors raised bets it would climb versus the single currency to the most since November 2012.

The U.S. currency maintained its biggest weekly advance since March against major peers before reports forecast to show growth in services held near the fastest pace in at least three years, employers added more than 200,000 jobs for a sixth month, and economic growth rebounded last quarter. The preliminary reading of a Purchasing Managers' Index of U.S. services from Markit Economics was at 59.8 in July, according to the median estimate of economists in a Bloomberg survey. That would be the ninth-straight month above the 50 level that divides expansion from contraction.

Economists in a separate Bloomberg poll predict the U.S. Commerce Department will say on July 30 that gross domestic product rose at a 3 percent annualized rate in the second quarter. The 2.9 percent decline in the first quarter was the worst reading since the same three months in 2009. A Labor Department report on Aug. 1 will show nonfarm payrolls increased 231,000 in July, economists' forecasts show.

The Federal Reserve meets from tomorrow to debate the pace of interest-rate increases and whether to further reduce bond purchases.

The New Zealand dollar fell to a one-month low. Reserve Bank of New Zealand Governor Graeme Wheeler said on July 24 that the currency's level is "unjustified and unsustainable," after signaling a pause following four interest rate increases this year.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3425-35

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6975-85

USD / JPY: on Asian session the pair traded in the range of Y101.75-85

A generally light data calendar for Monday (US Svcs PMI at 1345GMT then pending home sales at 1400GMT the stand out interest) with moves to come from end month flows and any geopolitical developments.

-

06:11

Options levels on monday, July 28, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3522 (821)

$1.3491 (756)

$1.3469 (134)

Price at time of writing this review: $ 1.3426

Support levels (open interest**, contracts):

$1.3411 (7006)

$1.3392 (3652)

$1.3364 (3408)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 28738 contracts, with the maximum number of contracts with strike price $1,3650 (4142);

- Overall open interest on the PUT options with the expiration date August, 8 is 34720 contracts, with the maximum number of contracts with strike price $1,3500 (7006);

- The ratio of PUT/CALL was 1.21 versus 1.24 from the previous trading day according to data from July, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.7200 (1661)

$1.7101 (2053)

$1.7004 (919)

Price at time of writing this review: $1.6975

Support levels (open interest**, contracts):

$1.6897 (2091)

$1.6799 (2402)

$1.6700 (1157)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 16851 contracts, with the maximum number of contracts with strike price $1,7250 (2424);

- Overall open interest on the PUT options with the expiration date August, 8 is 25486 contracts, with the maximum number of contracts with strike price $1,7000 (2679);

- The ratio of PUT/CALL was 1.51 versus 1.53 from the previous trading day according to data from Jule, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:27

Currencies. Daily history for Jule 25'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3429 -0,25%

GBP/USD $1,6974 -0,06%

USD/CHF Chf0,9046 +0,24%

USD/JPY Y101,82 +0,02%

EUR/JPY Y136,75 -0,22%

GBP/JPY Y172,84 -0,04%

AUD/USD $0,9394 -0,21%

NZD/USD $0,8552 -0,14%

USD/CAD C$1,0812 +0,65%

-

01:00

Schedule for today, Monday, Jule 28’2014:

(time / country / index / period / previous value / forecast)

13:45 U.S. Services PMI (Preliminary) July 61.0 62.3

14:00 U.S. Pending Home Sales (MoM) June +6.1% -0.2%

23:30 Japan Unemployment Rate June 3.5% 3.5%

23:30 Japan Household spending Y/Y June -8.0% -3.7%

23:50 Japan Retail sales, y/y June -0.4% -0.4%

-