Notícias do Mercado

-

22:57

United Kingdom CFTC GBP NC Net Positions: £15K vs £1.6K

-

22:56

European Monetary Union CFTC EUR NC Net Positions: €-11.3K vs €-12.1K

-

22:56

Australia CFTC AUD NC Net Positions rose from previous $-76.1K to $-75.2K

-

22:56

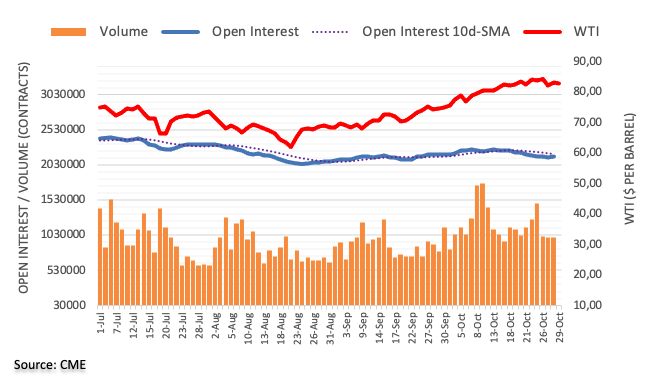

United States CFTC Oil NC Net Positions down to 423.7K from previous 429.6K

-

22:56

United States CFTC S&P 500 NC Net Positions: $96.5K vs $67.6K

-

22:56

Japan CFTC JPY NC Net Positions: ¥-107K vs previous ¥-102.7K

-

22:56

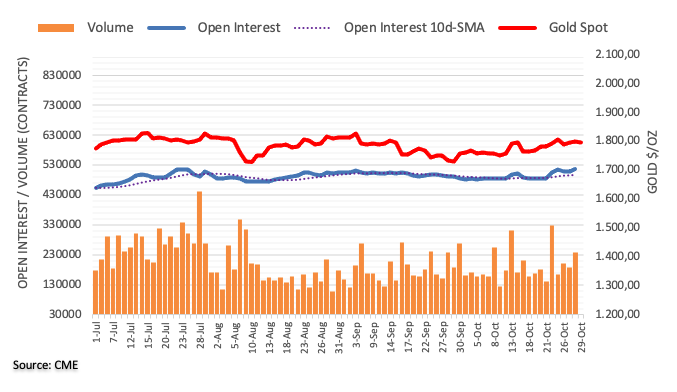

United States CFTC Gold NC Net Positions rose from previous $193.3K to $214.6K

-

22:39

AUD/USD clung to 0.7500 amid mixed-market sentiment ahead of the weekend

- AUD/USD fell on broad US dollar strength, as the greenback rose almost 1% in the US Dollar Index.

- European stock indices fell, while US equity indices rose, depicting a mixed-market sentiment, which benefited the US Dollar.

- US Core PCE rise overshadowed the Australian Retail Sales jump, weighed on the AUD/USD.

The Australian dollar slid for the first day of the week, down 0.37% as the New York session ends at 0.7516 at press time.

On Friday, the market sentiment was mixed as European equity indices fluctuated between winners and losers. Meanwhile, across the pond, US stock indices finished the day with gains between 0.19% and 0.46%.

Despite the risk-on market mood in the New York session, risk-sensitive currencies like the GBP, the NZD, and the AUD, were not able to extend their Thursday rally. Also, the US Dollar strengthened due to several factors like month-end flows, portfolio reshuffling, inflation concerns, and the upcoming Federal Reserve meeting, where market participants expect a bond taper announcement.

Worth noting that US T-bond yields were unchanged during the session, with the 10-year benchmark note ending the week-month at 1.561%.

Hence, AUD/USD sellers were benefited from the market sentiment and rising inflation figures in the US, which, despite remaining steady, spurred demand for the greenback as investors focus turns to the Federal Reserve.

US Core PCE rise overshadowed the Australian Retail Sales jump, weighed on the AUD/USD

On the macroeconomic docket, Australian retail sales bounced up sharply in September after plummeting in the previous three months, where lockdowns were to blame.

Across the pond, the Fed’s favorite gauge for inflation, the US Core PCE, rose by 3.6% for September on a yearly basis, which increased demand for the greenback, as market participants became aware that the Federal Reserve meeting was around the corner. Rising inflations increase the odds of hiking rates sooner than later.

-

22:00

Mexico Fiscal Balance, pesos declined to -99578.3B in September from previous -19.76B

-

21:36

DXY Price Analysis: Strong support at 93.50 spurred US Dollar demand, finishing the week at 94.10

- The US Dollar Index rose almost 1% during the day, printing a fresh weekly high at 94.30.

- The greenback strengthened across the board amid falling US T-bond yields.

- DXY: A break above 94.17 opens the door for a renewed test of 2021 high at 94.56.

The US Dollar Index, which tracks the greenback’s performance against a basket of six peers, rallies 0.86% during the New York session, is at 94.10, short of the 94.30 fresh weekly high at the time of writing. In the meantime, US T-bond yields are falling, with the 10-year benchmark note down two basis points, sitting at 1.545%.

The market sentiment is mixed, depicted by European stock indices, splitting between gainers and losers. Across the pond, the story is positive for US equities. On Thursday’s late New York session, Us equity futures pointed lower, headed by the Nasdaq Composite and the S&P 500, which were falling sharply due to missed earnings by Apple and Amazon. But as of press time, the indices rise between 0.05% and 0.19%, ultimately boosting the greenback prospects

DXY Price Forecast: Technical outlook

Daily chart

On Thursday, the index broke below the 93.50 substantial support area, unsuccessfully broken three times before. But on Wednesday, it finally yielded way for USD bears, printing a daily low at 93.27. At that level, the confluence of an upslope support trendline that travels from May 26 low towards the September 3 low and the 50-day moving average at 93.36 capped the downward move.

However, the story changed on Friday, as the index rose to print a fresh weekly high at 94.30, to settle at 94.10 finally. Friday’s price action printed a huge candlestick that completely covered Thursday’s one, forming a bullish engulfing candle with a solid upward conviction of USD bulls.

Furthermore, the daily moving averages (DMA’s) remain below the price, and a rising upslope trendline acted as solid support, adding two bullish signals to the US Dollar Index overall trend bias. The Relative Strength Index (RSI) at 56 is aiming higher, sums to the abovementioned, so the confluence of three bullish signals, confirm the bullish bias.

However, to resume the uptrend, USD bulls will need a daily close above the October 18 high at 94.17. In that outcome, the 2021 year high at 94.56 would be the only resistance level left before reaching fresh yearly highs.

On the flip side, failure at 94.17 might open the door for a newed re-test of the crucial 93.50 support area.

-

21:17

Colombia Interest rate registered at 2.5% above expectations (2.25%)

-

20:11

GBP/USD finds support at 1.3665 after plunging from 1.3800 area

- The pound finds buyers at 1.3665 after a 0.75% daily decline.

- The sterling suffers against a stronger USD.

- GBP/USD's reaction to the BoE is unpredictable – MUFG.

The British pound is attempting to find support at 1.3665 lows on Friday’s late US trading, after plummeting more than 0.7% on the day. End-of-month moves with November’s Federal Reserve meeting around the corner, have boosted the US dollar across the board.

The USD surges on expectations of a hawkish Fed statement

The GBP/USD has dropped sharply on Friday, weighed by broad-based US dollar strength in a combination of a moderate risk aversion, and higher expectations of a hawkish turn by the Federal Reserve next week.

US macroeconomic data might have encouraged investors to close US dollar shorts, especially after the Core Personal Consumption Expenditures, the Fed’s preferred inflation gauge, accelerated 3,6% year-on-year in September. These figures reaffirm the idea that the central bank will be forced to accelerate its monetary normalization plan, which has favored the US dollar.

Higher inflation expectations have also pushed the US Treasury bond yields higher, which has increased bullish traction on the USD.

All in all, the investors are bracing for an eventful next week, with the meetings of both, the Bank of England and the Federal Reserve scheduled. The Federal Reserve is expected to announce the end of its monetary stimulus, while, according to some market sources, the BoE might hike interest rates for the first time in three years in order to tackle inflation pressures.

GBP/USD’s reaction to BoE is unpredictable – MUFG

FX analysts at MUFG consider that the BoE could hike rates by 0.15% next week, although they warn about a negative GBP reaction: “Based on the recent FX response to central bank guidance we could well see GBP dismissing this guidance of slower tightening going forward. However, we would expect GBP to ultimately weaken on the back of a 15bp hike and guidance suggesting the need for less tightening than what is currently priced. That message may not be explicit but should be implied by the MPR forecasts.”

Technical levels to watch

-

19:48

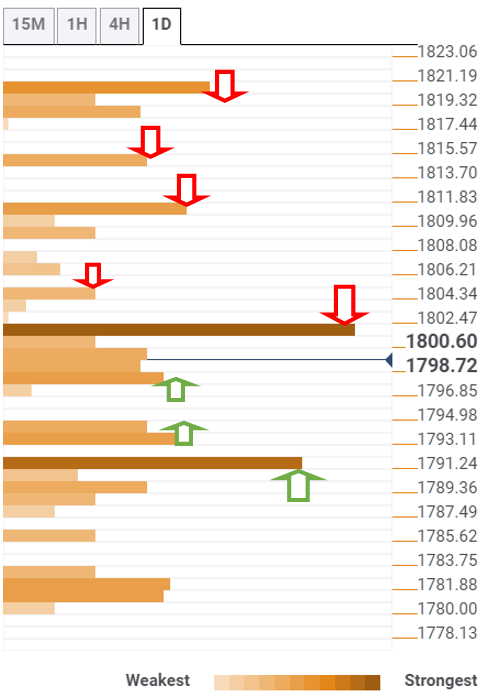

Gold Price Forecast: XAU/USD slid below $1,800 on broad greenback strength, despite lower US yields

- XAU/USD plummeted almost $25.00 on steady US Core PCE reading, at 3.6%.

- A risk-off market mood boosted the US dollar, spurred by month-end flows and firm US T-bond yields.

- XAU/USD: A daily close below $1,780 could send gold tumbling towards $1,721.

Gold (XAU/USD) slides during the New York session, down almost 1%, trading at $1,782 at the time of writing. Earlier in the session, gold reached a fresh weekly low at $1,771 but bounced off the lows to stabilize at current levels.

Risk-off market sentiment spurred a flight towards safe-haven assets, but it failed to uplift the non-yielding metal. Concerns about high inflation, central bank tightening, and some CEOs from US companies complaining about supply shortages and high production costs dented the market mood.

The US Dollar Index reached a fresh weekly high at 94.30

That, in turn, boosted the greenback. The US Dollar Index is reversing Thursday losses, up 0.85%, at 94.14. During some time of the day, it reached a fresh weekly high around 94.30.

Contrarily, the US 10-year Treasury yield is firmly at 1.564%, unchanged throughout the day.

On the macroeconomic front, the US Core Personal Consumption Expenditure for September, the Federal Reserve favorite gauge for inflation, rose by 3.6%, a tad lower than the 3.7% foreseen by analysts.

Moreover, in October, the University of Michigan Consumer Sentiment weakened modestly and slid to 71.7 from 72.8 in September’s reading. Despite the fall, it was better than the 71.4 estimated by market participants.

The market’s reaction for the Core PCE, gold collapsed from $1,793 to $1,775 and gained traction towards the weekly low of $1,771, as the US Dollar Index continued its rally during the day.

XAU/USD Price Forecast: Technical outlook

Daily chart

Gold (XAU/USD) daily chart depicts the yellow metal has been up-trending steadily, in ranges of $20.00 average. The 100 and the 200-day moving averages (DMA’s) are above the spot price. Meanwhile, gold is testing the 50-day moving average at $1,780, which, if broken to the downside, confirmed by a daily close underneath it, could propel USD bulls to open fresh bets, in the possibility of a trip towards the September 29 low at $1,721.

The Relative Strenght Index (RSI), a momentum indicator, is at 51, above the 50-midline, which could refrain XAU/USD sellers from opening new bets, unless it breaks below 50.

-

19:12

EUR/USD trying to bottom at 1.1535 after plunging from 1.1700 area

- The euro attempts to find support at 1.1535 after losing more than 1% on the day.

- The US dollar appreciates with the investors bracing for the Fed's meeting next week.

- Higher US bond yields and hawkish Fed expectations have crushed the euro.

The euro is attempting to hit a bottom at 1.1535 after plummeting more than 1% on the day. The pair has dropped like a stone on Friday, crushed by a combination of factors and a stronger US dollar.

The euro plummets with the US dollar firming up

The common currency has lost on Friday all the ground it gained on Wednesday and Thursday’s rally, weighed by the US dollar’s strength. End-of-the-month moves, as the market positions for the Federal Reserve’s monetary policy meeting next week and higher US Treasury bonds might have been the main reason for the sharp EUR/USD reversal.

The Bureau of Economic Analysis revealed today that US Core Personal Consumption Expenditures, the Fed’s favourite inflation gauge, accelerated 3,6% year-on-year in September. These figures come to reaffirm the theory that the US central bank will be forced to accelerate its monetary normalization plans, which, less than one week ahead of November’s meeting, has boosted demand for the USD,

Against this backdrop, US-T bond yields edged up again, with the 10-year note reaching levels near 1.6%, which has increased bullish pressure on the US dollar.

Technical levels to watch

-

18:46

United States Baker Hughes US Oil Rig Count increased to 444 from previous 443

-

18:36

USD/JPY extends past 114.00 buoyed by higher US yields

- The dollar bounces at 113.25 and reaches levels past 114.00.

- The greenback appreciates on higher inflation expectations.

- USD/JPY: expected to dive towards 112.00 in three months – Rabobank.

The dollar has regained bullish traction on Friday and is rallying nearly 0.5% so far today, erasing the previous two days’ losses. The USD/JPY is testing levels above 114.00 at the time of writing, after having bounced up from two-week lows at 113.25 on Thursday

Higher inflation expectations and stronger yields are buoying the USD

The greenback has been boosted by higher inflation expectations in the US, which have reinforced the idea that the Federal Reserve will be forced to accelerate its monetary policy normalization plan.

The US core personal consumption expenditures, the Fed’s preferred indicator for consumer inflation, has risen 3,6% year-on-year in September, which adds pressure on the bank to start increasing interest rates. As a consequence, US-T bond yields ticked up on the back of these figures, pushing the US dollar higher across the board.

Currency volatility surged in the second half of the week, after a very calm opening. Monetary policy decisions by the ECB, the BoC, and the BoJ plus the US GDP data have triggered significant fluctuations in FX markets. In that sense, the scenario can be fairly similar over the next week, with the investors awaiting decisions by the Federal Reserve, the Bank of England and the Reserve Bank of Australia.

USD/JPY: Forecast remains for a slide to 112.00 in three months – Rabobank

In spite of the current bullish reaction, FX Analysts at Rabobank remain dovish on the USD: “This may be a warning to the market that in view of the inflationary implications the BoJ is not entirely happy with the JPY’s position at the worst-performing G10 currency in the year to date. This signal may be sufficient to limit upside potential for USD/JPY near-term, particularly since the weakness of US Q3 GDP data has also undermined the greenback today. We retain a 3 month USD/JPY forecast of 112.”

Technical levels to watch

-

18:28

USD/CHF pares some weekly losses, hovers around 0.9150

- USD/CHF bounces off 0.9099 amid risk-off market sentiment.

- The US Dollar Index rises in the day, despite falling US T-bond yields.

- The USD/CHF 4-hour chart shows the pair is within a bullish flag, but a break below 0.9100 could invalidate the chart pattern.

The USD/CHF trims some weekly losses, advances sharply during the New York session, up 0.61%, trading at 0.9171 at the time of writing. Comments of some US CEOs about supply shortages, and higher costs amid companies missing earnings expectations, dampened the market sentiment. Additionally, inflationary pressures and central bank tightening monetary conditions kept investors at bay

Earlier in the day, the USD/CHF printed a weekly low of around 0.9099. But once American traders got to their desks, the pair jumped almost 70 pips, due in part to month-end flows and US dollar demand.

In the meantime, the US Dollar Index is rising almost 1%, sitting at 94.28 amid falling US T-bond yields. The US 10-year Treasury yield is flat, currently at 1.568%.

On the macroeconomic front, the US Personal Consumption expenditures, the Fed’s preferred inflation gauge, surged 3.6% year-on-year in September, a tad lower than expectations but in line with the August figure, signaling that inflation is stabilizing after a sudden jump to 6.1%.

USD/CHF Price Forecast: Technical outlook

4-hour chart

The USD/CHF pair is in a downtrend, shown by the simple moving averages (SMA’s) located above the spot price. Furthermore, a descending channel that seems to be a bullish flag capped the last downward move, bouncing off the bottom of the channel, towards the 50-simple moving average at 0.9181.

Nevertheless, the Relative Strength Index (RSI) at 48 is seesawing up and down, showing no clear confirmation of the actual trend.

If USD/CHF buyers fail to gain traction above 0.9200, investors could expect a renewed re-test of the daily lows around 0.9099.

-

18:04

EUR/USD: A more hawkish Fed and a overdone reaction to ECB – MUFG

Analysts at MUFG Bank are recommending a trade idea of shorting the EUR/USD pair with a target at 1.1300, an entry level of 1.1650 and a stop at 1.1850. They consider the EUR/USD could struggle to build on Thursday’s gains.

Key Quotes:

“The EUR bounced yesterday on a sense that ECB President Lagarde was less than enthusiastic in pushing back current market pricing for rate hikes next year. But senior central bankers rarely comment on specific market pricing and hence we did not view Lagarde as shifting the ECB stance in any way. We are in a market where investors are increasingly questioning the forward guidance of central banks – but we would argue that the ECB is on more credible ground than some of the other central banks and therefore a sustained divergence favouring a weaker EUR is likely to persist going forward.”

“The focus next week will shift of course to the FOMC and while we do not get any formal updated guidance on rates, we will get the QE tapering plan, the statement and the press conference and it is likely that Fed Chair will talk tougher on inflation given developments of late. We don’t expect any huge shift in tone or message but enough to prompt some reversal of the heavy USD selling in evidence in October.”

“Technically, EUR/USD is at an interesting point as well. The downtrend resistance on the daily intra-day chart from the highs in June and again in September comes in a little above the current spot rate (1.1706 today) and that could act to limit the upside over the short-term.”

-

17:58

GBP/JPY, rejected at 157.05, dives to levels sub-156.00

- The sterling retreats below 156.00 after failure at 157.05.

- Closing positions at the end of the month might have hit the pound.

- GBP/USD is testing support at 155.95 area.

The British pound has lost its bullish momentum after failing to confirm above 157.00 during Friday’s London trading, and the pair has posted a significant pullback during the US session, reaching day-lows right above 156.00.

The sterling gives away gains on end-of-month trading

The GBP/JPY is depreciating about 0.3% on the day, and on track to close the week practically flat, with the pair losing in less than two hours all the ground taken on Thursday and early Friday. In absence of relevant macroeconomic releases, closing positions at month-end might be one of the main reasons behind the sudden pound reversal.

Earlier this week, the sterling was buoyed by the dovish monetary statement by the Bank of Japan, which maintained its ultra-expansive policy and downgraded the country’s growth prospects for 2021.

On the other hand, the upbeat economic outlook forecasted by the UK finance minister Rishi Sunak at the Autumn Budget Report boosted hopes of a strong post-pandemic recovery in the UK and reinforced market expectations of a BoE rate hike in early 2022.

GBP/JPY is testing support at 155.95

On a broader view, the pair is hovering right above the bottom of the last weeks’ horizontal range, with immediate support at 155.95 (Oct. 22, 28 lows) ahead of 155.70 (Oct. 27 lows) If these levels are breached next potential target might be 154.80 (October 12 high).

On the upside, the pair should break above 157.10 where the October 28 high meets the 50-period SMA in the 4hr chart. Above here, the pair would regain bullish traction to extend towards 157.75 (Oct. 26 high) and then 158.20 (Oct. 20, 21 highs).

Technical levels to watch

-

17:56

BoE: Markets are overestimating the scale of future tightening – ING

Next Thursday, the Bank of England will have its monetary policy meeting. Analysts at ING expect a 15bp rate hike, following recent hawkish comments. They consider markets are overestimating the scale of future tightening, so they argue some modest pushback from policymakers in the form of lower medium-term inflation forecasts and a split rate hike vote, seems likely.

Key Quotes:

“Policymakers are likely to offer some modest pushback against the market's tightening expectations for 2022. That leads us neatly onto whether policymakers will attempt to lean more heavily against market pricing. We think they will, if only subtly.”

“For one thing, if the committee does indeed opt to increase rates on Thursday, then it's unlikely to be a unanimous decision. While a handful of committee members will likely take Governor Bailey’s lead and vote for a rise, we know at least one member is likely to dissent (Silvana Tenreyro). This should be a warning sign for markets: if the first – partial – rate rise can’t command a unanimous decision, then it’s harder to see a series of aggressive, future moves gaining similar levels of support.”

“When it comes to the forecasts, we may well see a downgrade to the inflation projections for two/three years' time. Don't forget that the Bank takes market interest rates and plugs them into its models. Back in August, a modest 40bp of tightening over its forecast horizon neatly kept inflation around 2% in the medium-term. All else equal, the much higher degree of tightening now priced into markets should result in that 2024 inflation forecast moving lower.

If that happens, then it would be an implicit sign that policymakers don’t see a need to act as aggressively as the markets.”“GBP has undoubtedly benefited from the dramatic re-pricing of the UK money market curve since early September. However, the BoE’s broad, trade-weighted measure of GBP is up only 1.1% over the same period, so it seems fair to describe GBP gains as ‘hard-won’.”

-

17:50

AUD/USD: Recent gains built on shaky foundations – MUFG

Market expectations for aggressive rate hikes next year from the Reserve Bank of Australia (RBA) are likely to be disappointed, according to analysts at MUFG Bank. They argue recent outsized gains of the Australian dollar are built on shaky foundations.

Key Quotes:

“At the same time the AUD has derived support from the aggressive repricing of RBA rate hike expectations.”

“Next week’s RBA policy meeting (Tues) will be closely watched to see if they make any policy adjustments and/or push back more strongly against early rate hike expectations. While we can anticipate the RBA bringing forward rate hike plans from the current guidance for no hikes before 2024, it is one hell of a long shot to expect the RBA to completely capitulate and start planning for hikes as soon as next year and joining the Norges Bank, RBNZ, BoE, BoC and Fed.”

“The RBA remains concerned that underlying inflation pressures have been uncomfortably low over the last six years averaging only around 1.6%Y/Y. Similar to the ECB, we do not expect the RBA to be in a rush to respond to the current period of higher inflation.”

“We doubt that recent AUD strength can be sustained beyond the near-term. Market expectations for RBA hikes next year will be disappointed while the Fed starts to raise rates, and the negative growth impact from real estate weakness in China will become bigger weight on the AUD going forward as well.”

-

17:46

BoC forecast of first rate hike pulled forward to April 2022 – NFB

Analysts at the National Bank of Canada, pulled forward the timing of the expected first rate hike from the Bank of Canada after the recent hawkish bias introduced by the central bank. They see some potential for a Fed rate hike by Q3 2022.

Key Quotes:

“In light of the Bank’s more hawkish tilt, we’ve pulled forward the expected timing of the first rate hike to April 2022. We could envision the Bank kick-starting a tightening cycle with back-to-back moves, as they’ve done in each of the past few cycles, settling into a quarter-move-per-quarter pattern in the second half of next year. The resulting year-end target rate of 1.25% implies four hikes next year, alongside prospective commencement of a gradual balance sheet run-off later in the year. The pace of tightening could moderate in 2023, with at least two hikes bringing overnight to the lower end of the BoC’s perceived neutral range (estimated at 1.75%-2.75%).”

“While the shifting BoC outlook has garnered plenty of airtime, attention will now rightly pivot to the Fed. A QE taper is set to commence in November. Given our long-standing and perhaps more pronounced inflation fears, alongside an ongoing evaporation of labour market slack, we see a compelling argument for hurrying the taper along. Prodded by an overheated economy, the Fed could take as little as six months to taper. A more condensed taper process would, in turn, set up an earlier lift off for the fed funds target. We now believe the Fed’s initial rate hike could come as early as 2022:Q3 (i.e., three months earlier than we had previously forecast).”

-

17:41

GBP/USD: Pound's response to BoE is unpredictable – MUFG

Analysts at MUFG Bank, point out that the Bank of England (BoE) is set to hike interest rates when it meets next week with clear rhetoric and pricing, pointing to action. They see an unpredictable response regarding the pound in the currency market.

Key Quotes:

“Following clear and explicit guidance from BoE Governor Bailey earlier this month we decided to move forward the timing of the first-rate hike by the BoE to next week – we maintain that view now and expect the MPC to vote in favour of a 15bps hike in Bank Rate taking it to 0.25%. It remains a close call with the strongest argument favouring a delay being to provide more time for assessing labour market conditions following the end of the Job Retention Scheme. But the possible confusion (market now expects a move) created by not hiking will likely sway a majority to act now.”

“We expect the BoE to remain on hold in December and hike by 25bps in February 2022.”

“Based on the recent FX response to central bank guidance we could well see GBP dismissing this guidance of slower tightening going forward. However, we would expect GBP to ultimately weaken on the back of a 15bp hike and guidance suggesting the need for less tightening than what is currently priced. That message may not be explicit but should be implied by the MPR forecasts.”

“The MPR should be the tool in which the BoE signals rate hikes are coming but not as much as priced which should ultimately weigh on GBP performance.”

-

17:33

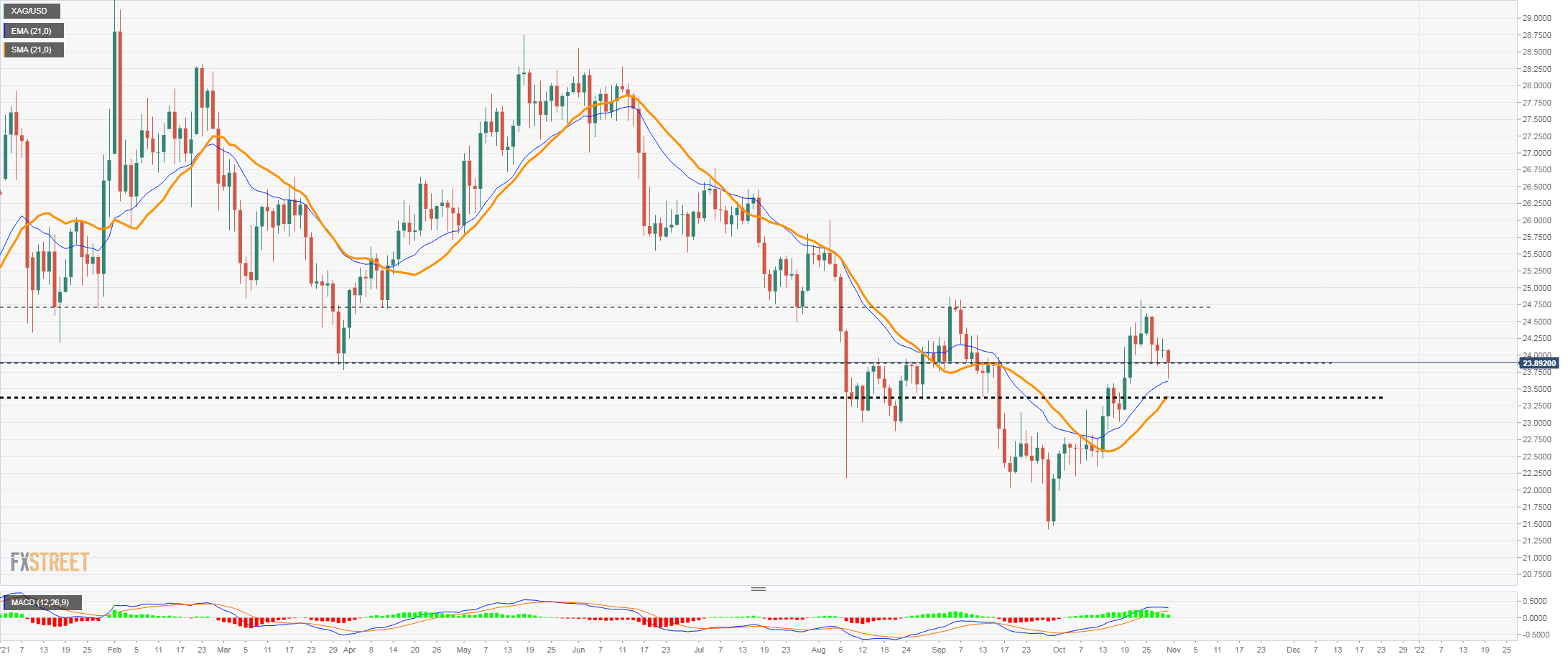

Silver Price Forecast: XAG/USD rebounds and trims losses, eyes 24.00

- Metals stabilized after sharp slide, DXY hits monthly highs above 94.00.

- The strong US dollar keeps metals under pressure ahead of next week’s FOMC meeting.

- XAG/USD falls for the fourth day, but moves off lows.

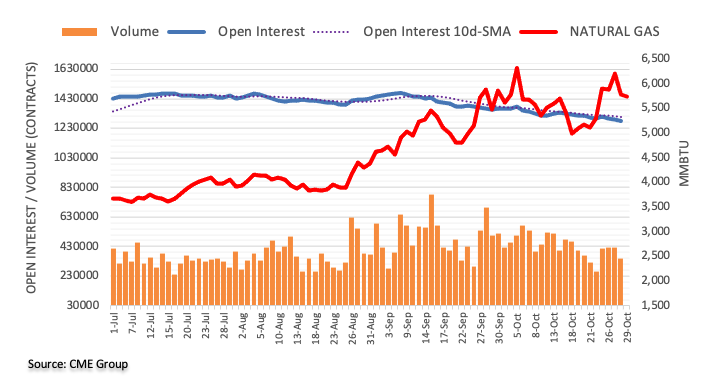

Silver and gold are falling sharply on Friday. A rally of the US dollar pushed XAG/USD to 23.68$, the lowest level in a week. During the last hours, silver recovered ground and rose to 23.90$ It is about to end the week lower, after finding resistance at the 20-week moving average around 24.40.

The DXY is up by 0.90% on Friday, trading at monthly highs at 94.20, boosted amid end-of-month flows and ahead of next week’s FOMC meeting. The Federal Reserve is expected to announce a tapering of its QE program. The latest round of economic data, including today’s Core CPE did not alter market expectations.

US stocks are modestly higher. Not even risk appetite is avoiding the rally of the greenback. For metals, a pullback in US yields favoured a consolidation.

The bias in the daily chart in XAG/USD still shows some bullish arguments, with price above key moving averages. The move off lows on Friday is another fact. Now silver needs initially to recover 24.25$ to gain momentum, and then break the key 24.75$ resistance to clear the way to more gains. A slide below 23.50$ on the contrary would increase the negative pressure.

Silver daily chart

-

17:24

USD/CAD advances firmly towards 1.2400 amid risk-off market sentiment

- USD/CAD briefly pierced 1.2400, reaching a daily high at 1.2408

- Concerns about inflation, central bank tightening, and US CEOs commenting on supply shortages and elevated prices dented market sentiment.

- US Core PCE remains steady at 3.6%, though lower than expected.

The USD/CAD climbs during the New York session, up 0.41%, trading at 1.2396 at the time of writing. Broad US dollar strength across the board keeps the Loonie under pressure. Also, weak Apple and Amazon Q3 corporate earnings and both companies CEO commenting about supply shortages and higher costs dented the market sentiment

Furthermore, concerns about inflation and central bank tightening conditions added to the abovementioned factors.

Earlier in the day, the Loonie appreciated against the greenback, maintaining the pair around 1.2329, near the lows of Thursday. However, month-end flows, and US Dollar demand, weakened the oil-linked Canadian dollar.

Also, crude oil prices, which boost or dents the CAD prospects, are falling, with the Western Texas Intermediate (WTI) down 0.23%, trading at $82.31 on Friday.

The US Dollar Index, which tracks the buck's performance against a basket of its peers, rallies almost 1%, sitting at 94.26, despite falling US bond yields, as the 10-year benchmark note drops one basis point, down to 1.566%, at press time.

US Core Personal Consumption Expenditure, Fed's favorite measure of inflation, steady at 3.6%

In the Canadian economic docket, Statistics of Canada released the Gross Domestic Product for August, which expanded by 0.4%, lower than the 0.7% estimated but better than July's -0.1% reading.

According to RBC Capital market in a note to clients, the disappointment of the GDP report should not derail the Bank of Canada hawkishness. Further noted, "The softer print on Q3 shouldn't derail the BoC's newfound hawkishness — the Bank's flexible treatment of the output gap still leaves April as the most likely point for lift-off. But nor do we want to give the impression that economic data is totally irrelevant here. If the economy fails to rebound in Q4 the Bank's shift in forward guidance may start to look ill-advised."

The Federal Reserve's favorite measure of inflation, the Core PCE for September, remained unchanged at 3.6% on a yearly basis, a tick lower than foreseen by economists and in line with the previous month. Moreover, in its final reading, the University of Michigan Consumer Sentiment Index drops to 71.7 in October, against 71.4 expected.

USD/CAD Price Forecast: Technical outlook

Daily chart

The USD/CAD pair is testing the top of a bearish flag, around 1.2400, which also confluences with a downslope trendline traveling from September 20 high towards September 29 high that the pair is testing at press time.

Nevertheless, to resume the downward trend, as confirmed by the daily moving averages (DMA's) above the spot price and the Relative Strength Index (RSI) at 41, it will need a daily close below the bottom of the bearish flag.

Therefore, due to US dollar strength at Friday's session, it seems the pair is under a mild correction before resuming the downward trend, as signaled by the moving averages and the RSI.

-

17:23

EUR/GBP dips further to hit fresh session lows below 0.8440

- Euro's reversal from 0.8475 extends to session lows below 0.8440.

- The pound remains stronger fuelled by BoE hike expectations.

- EUR/GBP: Biassed lower while below 0.8530 - Commerzbank.

The euro continues heading south against the British pound on Friday. The pair has depreciated about 0.4% so far today, reversing Thursday’s gains after its rejection from 0.8475, to reach session highs below 0.8440 and approaching

The pound remains firmer on BoE hike expectations

The sterling has regained the firm tone seen during the last weeks, buoyed by market expectations that the Bank of England might accelerate its monetary normalization plan to tackle inflation. This theory has been supported in the Autumn Budget Report when finance minister Rishi Sunak forecasted a strong post-pandemic recovery in the UK.

The European Central Bank, however, maintained its dovish stance in the face of the increasing inflationary pressures and pushed back any interest rate hike at least until late 2023, which has weighed on demand for the common currency.

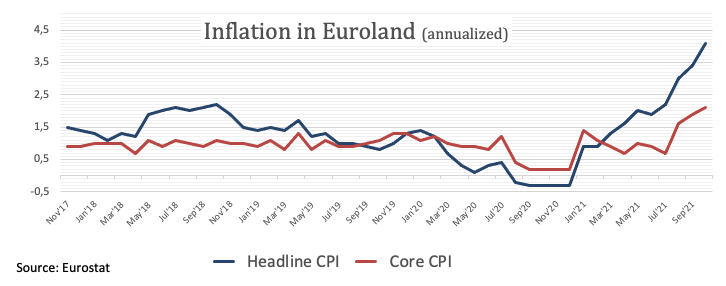

ECB’s assumption that the currently high inflation levels will be temporary has been disputed by Eurozone CPI data earlier on Friday. Consumer inflation accelerated to a 4.1% year-on-year pace in September, more than twice the bank’s target for price stability, putting the ECB in an awkward situation. As a matter of fact, German 10-year Treasury yields rose by 8 basis points following the release of inflation figures, a signal that the market does not accept the bank’s dovish rhetoric.

EUR/GBP should break above 0.8530 to ease negative pressure – Commerzbank

Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank sees the pair biased lower while below 0.8530: “We have initial resistance at 0.8500. Above here lies the 55-day ma at 0.8530 and will need to regain this in order to alleviate downside pressure and to challenge the 0.8659/73 highs since May (…) Below 0.8400 attention should revert to the 0.8239 2019 low and the 200-month ma lies at 0.8159.”

Technical levels to watch

-

17:08

Canada: GDP report shouldn't derail BoC’s hawkishness – RBC CM

Growth data from Canada was released on Friday. Industry-level GDP disappointed in August with the 0.4% print coming in well below the market consensus for 0.7%, explained analysts at RBC Capital Markets. They don’t expect the report to derail the Bank of Canada’s hawkishness.

Key Quotes:

“The economic recovery hit another snag in August with industry-level GDP rising by 0.4% m/m. In isolation, this would be considered a relatively robust print but markets had been expecting something considerably stronger (+0.7%), and flash estimates for September adding to the disappointment with Statistics Canada projecting a flat print.”

“With the flat flash estimate for September, Statistics Canada is projecting an unannualized gain of 0.5% for Q3 GDP (so call it roughly 2.0% annualized). We had been looking for Q3 growth in the mid-to-low 3s, while the BoC had forecast Q3 growth at 5.5% in its most recent MPR. Following today's report, we now look for 2021 GDP growth of about 4.7%, compared to the BoC's forecast of 5.1% growth.”

“The softer print on Q3 shouldn't derail the BoC's newfound hawkishness — the Bank's flexible treatment of the output gap still leaves April as the most likely point for lift-off. But nor do we want to give the impression that economic data is totally irrelevant here. If the economy fails to rebound in Q4 the Bank's shift in forward guidance may start to look ill-advised.”

-

17:01

Colombia National Jobless Rate declined to 12.1% in September from previous 12.3%

-

17:00

Russia Unemployment Rate down to 4.3% in September from previous 4.4%

-

16:45

AUD/USD retreats to 0.7500 area after failure at 0.7555

- The aussie retreats to 0.7500 after failure at 7545/50.

- The risk-sensitive AUD loses ground as market mood worsens.

- AUD/USD might extend losses if 0.7550 resistance caps.

The Australian dollar has been rejected again at the 0.7545/55 resistance area again, and the pair has given away Thursday’s gains, returning to the 0.7500 area. The aussie is heading lower on Friday, with the US dollar strengthening across the board.

The US dollar picks up as market sentiment sours

The AUD has been unable to maintain the bid tone shown during the previous four days and is pulling back against a firmer dollar. The USD is taking advantage of its safe-haven status amid a deteriorated market sentiment and firmer US Treasury yields.

Risk appetite was hammered on Thursday after the Commerce Department revealed that the US economy decelerated beyond expectations. These figures have curbed optimism about a strong post-pandemic recovery, which is taking a toll on equity markets and risk-sensitive currencies like the aussie.

On the macroeconomic calendar the US Personal Consumption expenditures, the Fed’s preferred inflation gauge surged 3.6% year-on-year in September, adding pressure to the central bank to accelerate its policy normalization plan. US T bond yields have ticked up on the back of these figures, thus increasing demand for the US dollar.

In Australia, retail sales bounced up strongly in September after having plunged over the previous three months as the easing COVID-19 restrictions have helped consumers to go to the shops.

AUD/USD: Headed lower if 0.7550 resistance caps – Citibank

The FX analysis team at Citibank, warns that failure to breach 0.7550 resistance could trigger a significant reversal: “The RBA decided not to defend its 3y yield target 0.1% which sent the April 2024 bond soaring. This has increased conviction that RBA may shift more hawkish in their forward guidance. However, as reflation bets move towards stagflation ones, the aussie struggles, particularly with the pullback in commodity prices that has kept it supported all month (…) Add to that the usual USD bid into month end, and risk/reward in AUD/USD appears more skewed to the downside, with 0.7550 providing firm resistance.”

Technical levels to watch

-

16:36

US: Overall consumer spending growth should remain solid – Wells Fargo

According to analysts at Wells Fargo, the 0.6% monthly pickup in personal spending is the latest sign that there is still some spring in the step of the US consumer heading into the final stretch of the year. They explained that the fact that last month's spending increase was revised higher by two-tenths of a percent actually makes today's report a slightly better than expected outcome.

Key Quotes:

“Despite a transition from transfer payments to wages that held back income growth in September, consumer spending still rose 0.6%, which was spot-on expectations. The fact that last month's spending increase was revised higher by two tenths of a percent actually makes today's report a slightly better than expected outcome.”

“Coming off of yesterday's GDP report, which showed only tepid consumer spending growth, the additional detail we get from today's personal income and spending report reveals that Q3 finished strong in August and September. As we describe in detail below, the long anticipated transition to services spending came at the cost of a sharp slowing in goods spending.”

“Looking ahead, we expect more payback may be in order for goods consumption, but with more and more services spending coming back online amid a decline in COVID cases, overall consumer spending growth should remain solid.”

-

16:25

GBP/USD plummets below 1.3700, on US dollar strength, ahead Fed and BoE week

- GBP/USD accumulates to its weekly losses, breaking below 1.3700.

- Due to month-end flows and the London fix, GBP/USD plummeted almost 80 pips in the last three hours.

- US Core PCE for September remains steady at 3.6%, as the Fed’s November meeting approaches.

The GBP/USD slides for the third time in the week, looking forward to ending the week in the red, down 0.67%, trading at 1.3696 during the New York session at the time of writing. Worse than expected, heavy-tech US Q3 corporate earnings on Thursday and concerns about inflation and tight monetary policy dampened market sentiment, weakening risk-sensitive currencies like the British pound.

In the last three hours, the GBP/USD pair has shed almost 80 pips, which also could lie on month-end flows, or profit-taking ahead of a critical Federal Reserve and Bank of England monetary policy week. Furthermore, US T-bond yields are flat at press time, with the 10-year benchmark note steady at 1.56%, while the US Dollar is reversing Thursday losses, as the US Dollar Index is rallying 0.62%, to sit at 93.93.

Meanwhile, scalations of the conflict between the UK and the Eurozone would open another chapter in their negotiations. The British PM Boris Johnson and France President Emmanuel Macron will meet this weekend after a conflict post-Brexit fishing rights. In the week, France seized a British boat, and London threatened to retaliate against French fishers.

Just breaking at press time, the European Commission has told member states that the role of the European Court of Justice in the North Ireland protocol is not up for discussion.

Fed’s favorite measure of inflation, the Core PCE unchanged at 3.6% versus August reading

On the macroeconomic front, the UK economic docket is absent.

Across the pond, the Federal Reserve’s favorite measure of inflation, the Core PCE for September, rose by 3.6% on a yearly basis, a tick lower of the estimations and in line with the previous month. Further, in its final reading, the University of Michigan Consumer Sentiment Index drops to 71.7 in October, against 71.4 expected.

That said, GBP/USD prepare for the next week, as the central banks of both countries will host their monetary policy meetings. Regarding the US, the Fed is expected to announce the QE reduction by $15 billion a week, to begin by mid-November. Concerning the UK, market participants expect a rate hike by the BoE.

GBP/USD Price Forecast: Technical outlook

Daily chart

On Wednesday, the GBP/USD pair broke below a daily bearish flag, but on Thursday, trimmed some of its losses but failed to get back above the bottom of the channel. Wednesday’s momentum carried today, as the GBP/USD collapsed below the bottom trendline. It is also testing the 50-day moving average (DMA), which could spur additional losses for the British pound if it breaks it lower.

Further, the Relative Strength Index (RSI) is at 49, aiming lower, indicating the British pound is under strong selling pressure, favoring USD buyers.

-

16:05

EUR/USD tumbles below 1.1600 to lowest in two weeks

- Euro under pressure around the London fix, drops across the board.

- US dollar strengthens even as US yields pull back.

- EUR/USD drops a hundred pips from weekly highs.

The EUR/USD pair is accelerating the decline on Friday amid a stronger US Dollar across the board. Around the last London fix of October, the pair dropped to 1.1563, reaching the lowest level in two weeks.

The pair remains near the lows, with a strong bearish tone. The euro is also falling versus the Swiss franc and the pound. EUR/CHF is having the worst day in months, trading under 1.0580, at the lowest since May 2020.

US yields look steady while US stocks are posting mixed results, not behind the rally of the greenback. End-of-month flow and some positioning ahead of next week’s FOMC meeting could be playing a key role. “With the Fed set to embark on taper and flexibility likely to be a key feature of policy going forward, risk/reward is shaping up more positively for the USD into and out of the Fed,” explained analysts at TD securities.

The reversal in EUR/USD pushed the price from the highest in four weeks to weekly lows. The euro is headed toward the lowest weekly close since May 2020. Currently stands at 1.1570, where the 200-week simple moving average stands.

Technical levels

-

15:10

US: UoM Consumer Sentiment Index edges lower to 71.7 (final) in October vs. 71.4 expected

- UoM Consumer Sentiment Index fell slightly in October.

- US Dollar Index continues to edge higher toward 94.00.

Consumer confidence in the US weakened modestly in October with the University of Michigan's Consumer Sentiment Index declining to 71.7 in October's final reading from 72.8 in September. This print came in slightly better than the flash estimate and the market expectation of 71.4.

Further details of the publication revealed that the Current Conditions Index edged lower to 77.7 from 80.1 and the Consumer Expectations Index fell to 67.9 from 68.1.

Commenting on the survey, "the positive impact of higher income expectations and the receding coronavirus has been offset by higher rates of inflation and falling confidence in government economic policies," Richard Curtin, Surveys of Consumers chief economist. "Consumers not only anticipated the highest year-ahead inflation rate since 2008 in the October survey, consumers also expressed greater uncertainty about the year-ahead inflation rate than anytime in nearly forty years."

Market reaction

The greenback continues to gather strength against its rivals after this report and the US Dollar Index was last seen rising 0.47% on the day at 93.80.

-

15:05

USD/ZAR to turn decisively bullish on a break above the 15.3950 August high – Credit Suisse

USD/ZAR is edging higher and economists at Credit Suisse expect the pair to challenge the 15.3950 August high. A break above here would signal a significant trend change to the upside.

USD/ZAR to tackle resistance starting at 15.3103 and stretching up to 15.3950

“USD/ZAR is pushing above its downtrend from August and we look for a break above the 15.2533 September high for a test of medium-term resistance, starting at 15.3103 and stretching up to the 15.3950 August high.”

“Above the 15.3950 level at any stage would establish a medium-term base to turn the core trend higher, with just initial resistance then seen at 15.6560/15.6645.”

-

15:01

United States Michigan Consumer Sentiment Index came in at 71.7, above expectations (71.4) in October

-

14:45

United States Chicago Purchasing Managers' Index registered at 68.4 above expectations (63.5) in October

-

14:41

S&P 500 Index opens lower on October's last trading day

- Wall Street's main indexes trade mixed on Friday.

- Financial shares post modest gains on rising US Treasury bond yields.

- S&P 500 Consumer Discretionary Index is down more than 1%.

Major equity indexes started the last trading day of the month on a mixed note. As of writing, the S&P 500 Index was down 0.35% on the day at 4,580, the Dow Jones Industrial Average was rising 0.15% at 35,776 and the Nasdaq Composite was falling 0.55% at 15,360.

Among the 11 major S&P 500 sectors, the Consumer Discretionary Index is losing more than 1% as the biggest decliner after the opening bell. On the other hand, the Financials Index is trading in the positive territory supported by a more-than-1% increase seen in the benchmark 10-year US Treasury bond yield.

Earlier in the day, the data from the US showed that the Core Personal Consumption Expenditures (PCE) Price Index, the Fed's preferred gauge of inflation, stayed unchanged at 3.6% on a yearly basis in September.

S&P 500 chart (daily)

-

14:41

EUR/USD set to fall below the 1.16 level – Scotiabank

The EUR/USD pair has retraced part of yesterday’s post-ECB gains in broadly dollar-positive price action. Economists at Scotiabank expect the world’s most popular currency pair to tick down and slide below the 1.16 level.

Break above 1.17 is key to see further EUR gains

“We maintain a bearish view on the currency after yesterday’s ECB announcement. Lagarde did not push back on market rate hike expectations as the outlook on inflation remains highly uncertain – and a strong rebuke of market pricing could ‘backfire’.

“Month-end trading and short-covering likely also conspired to the spike in the EUR and we expect pressure for a firm drop under 1.16 to continue.”

“1.17 remains a key level to breach (50-day MA at 1.1699) against downtrend resistance from late-May/early-June (the level is also the 23.6% Fibo retracement of the May-Oct move). Beyond 1.17, 1.1750 stands as resistance while support is 1.1620 and the 1.1600 zone; 1.1572 follows.”

-

14:41

US Dollar Index pushes higher to the 93.80 zone, daily highs

- DXY regains further ground and retests the 93.75/80 band.

- US Core PCE came at 3.6% YoY in October, 0.2% MoM.

- Final October U-Mich Index comes next.

The US Dollar Index (DXY), which tracks the greenback vs. a basket of its main rival currencies, accelerates the daily recovery and flirts with the 100-hour SMA near 93.80 o Friday.

US Dollar Index up on higher yields, sticky inflation

The index extends the bounce off the 93.30 region and manages to advance to the 93.75/80 band at the end of the week on the back of rising US yields and persistent elevated US inflation.

In fact, yields in the front end and the belly of the curve extend the leg higher to the 0.55% region and the vicinity of 1.62%, respectively, while the long end clings to the positive ground around 1.98%.

The index gathered steam after US inflation figures tracked by the PCE rose 4.4% in a year to September, while the Core PCE rose 3.6% and matched the August’s reading. Additional data saw Personal Spending up 0.6% MoM inter-month and Personal Income contracting 1.0% from a month earlier.

US Dollar Index relevant levels

Now, the index is gaining 0.33% at 93.67 and a break above 94.02 (weekly high Oct.26) would open the door to 94.17 (weekly high Oct.18) and then 94.56 (2021 high Oct.12). On the flip side, the next down barrier emerges at 93.27 (monthly low October 28) followed by 92.98 (weekly low Sep.23) and finally 92.86 (100-day SMA).

-

14:40

Gold Price Forecast: XAU/USD dives to over one-week lows, below $1,780 level

- A strong pickup in the USD demand prompted aggressive selling around gold on Friday.

- The USD drew some support from elevated US bond yields and hawkish Fed expectations.

- A softer risk tone could lend some support to the safe-haven metal and limit further losses.

- Gold Price Forecast: XAU/USD to maintain range play around $1800 ahead US PCE inflation

Gold witnessed aggressive selling during the early North American session and dived to one-and-half-week lows, around the $1,776 region in the last hour. The US dollar was back in demand on the last trading day of the week and has now reversed a major part of the previous day's dismal US GDP-led slide to one-month lows. This, in turn, was seen as a key factor that weighed heavily on dollar-denominated commodities, including gold.

The USD held on to its strong intraday gains following the release of the softer than expected Core PCE Price Index. The Fed's preferred inflation gauge held steady near 30-year highs in September and came in at 3.6% YoY as against consensus estimates for a modest uptick to 3.7%. The data indicated that consumer cost pressures are getting entrenched and validated expectations the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation.

This, in turn, allowed the yield on the benchmark 10-year US government bond to hold steady above the 1.60% threshold, which further contributed to drive flows away from the non-yielding gold. Apart from this, the latest leg of a sudden fall over the past hour or so could further be attributed to some technical selling below 200-hour SMA. However, a softer risk tone – as depicted by a cautious mood around the equity markets – could extend some support to the safe-haven XAU/USD.

The continuous rise in inflationary pressures comes amid signs of a global economic slowdown and fueled worries about the risk of stagflation. This, in turn, tempered investors appetite for perceived riskier assets, which might hold bearish traders from placing aggressive bets around gold. Nevertheless, the precious metal remains on track to end the week as the focus now shifts to next week's FOMC meeting, where the US central bank is expected to begin tapering its bond purchases.

Technical outlook

From a technical perspective, repeated failures near the $1,810-12 resistance zone and the subsequent fall suggests that the recent positive move has run out of steam. Hence, some follow-through weakness towards testing the next relevant support, near the $1,762 region, remains a distinct possibility. The corrective pullback from multi-week tops could further get extended towards October monthly swing lows, around the $1,745 area.

On the flip side, any meaningful recovery now seems to confront stiff resistance near the $1,790-92 region (100/200-day SMAs confluence) and remain capped near the $1,800 mark. A sustained strength beyond could allow bulls to make a fresh attempt to clear the $1,810-12 barrier and push gold prices towards the $1,832-34 heavy supply zone.

Levels to watch

-

14:29

GBP/USD: Resistance from the 200-DMA at 1.3852 to cap with support seen at 1.3709/02 – Credit Suisse

GBP/USD has rallied strongly from price support at 1.3709. Nonetheless, economists at Credit Suisse expect the resistance from the 200-day moving average (DMA) at 1.3852 to cap the cable for another leg lower.

GBP/USD to see a top below the 200-DMA at 1.3852

“Despite the strength seen yesterday our bias remains to look for a fresh cap at the 200-DMA of 1.3830/55 and for the risk to turn back lower again.”

“Support moves to 1.3775 initially then 1.3755, with a break below 1.3709/02 now needed to mark a near-term top for a fall to 1.3674/67. Beneath this latter area remains needed to suggest we are seeing a more concerted move lower, with support seen next at 1.3575/69, then 1.3544 and eventually the 1.3411 low.”

“A close above 1.3855 would reassert a broader sideways range, with resistance then seen next starting at the 1.3914 September high and stretching up to the 61.8% retracement of the fall from June at 1.3929, with a fresh cap expected here.”

-

14:06

USD/CAD spikes to 1.2400 neighbourhood amid stronger USD/sliding oil prices

- A combination of factors assisted USD/CAD to gain some positive traction on Friday.

- A softer risk tone, elevated US bond yields revived demand for the safe-haven USD.

- Weaker Canadian GDP print, a fresh leg down in oil prices undermined the loonie.

- The markets had a rather muted reaction to the mixed US PCE Price Index data.

The USD/CAD pair shot to fresh daily tops during the early North American session, with bulls making a fresh attempt to conquer the 1.2400 round-figure mark.

A strong follow-through uptick in the US Treasury bond yields allowed the US dollar to stage a solid rebound from one-month lows touched in reaction to dismal US GDP print on Thursday. This, in turn, was seen as a key factor that assisted the USD/CAD pair to attract some buying on the last day of the week and rally nearly 70 pips from the daily swing lows, around the 1.2330-25 region.

The intraday positive move picked up pace in the last hour following the release of the Canadian monthly GDP report, which showed that the economy expanded by 0.4% in August. This marked a notable recovery from a modest decline recorded in August but was well short of market expectations for a 0.7% growth and turned out to be a key factor that weighed on the Canadian dollar.

From the US, the Fed's preferred inflation gauge – the Core PCE Price Index – held steady near 30-year highs in September and came in at 3.6% YoY, slightly below 3.7% anticipated. Additional details showed that Personal Income declined significantly, by 1.0% MoM, while Personal Spending rose +0.6% MoM. Nevertheless, the data indicated that consumer cost pressures are getting entrenched.

This, in turn, validated market expectations that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation. This was evident from elevated US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond climbed back to 1.61%, which, along with a softer risk tone, continued benefitting the safe-haven greenback.

Apart from this, a fresh leg down in crude oil prices undermined the commodity-linked loonie, which was seen as another factor that provided a goodish lift to the USD/CAD pair. It will now be interesting to see if the pair is able to capitalize on the move and confirm a near-term bullish breakout through a downward sloping channel extending from September swing highs.

Technical levels to watch

-

14:04

EUR/USD drops further to new daily lows around 1.1620

- EUR/USD accelerates losses to the 1.1620 region.

- US Core PCE rose 3.6% YoY, headline PCE gained 4.4% YoY.

- US Consumer Sentiment comes next in the docket.

The selling pressure around the single currency now picks up extra pace and forces EUR/USD to recede to the 1.1620 zone, or new daily lows.

EUR/USD met resistance near 1.1690

EUR/USD sinks into the negative territory at the end of the week pari passu with the quick rebound in the greenback.

Indeed, the buck gathers extra steam and manages well to leave behind the recent area of multi-week lows around 93.30 (October 28) sustained by the profit taking sentiment in the risk complex and higher US yields.

In Germany, yields of the 10y benchmark Bund advanced to fresh multi-day highs around -0.08%.

In the docket, US inflation figures tracked by the headline PCE rose at an annualized 4.4% and 3.6% when it comes to the Core PCE (excluded food and energy costs). Further US data witnessed Personal Spending expanding 0.6% MoM in September and Personal Income contracting 1.0% inter-month. Later in the session, the final October Consumer Sentiment will close the weekly calendar.

EUR/USD levels to watch

So far, spot is losing 0.46% at 1.1623 and faces the next up barrier at 1.1692 (monthly high Oct.28) followed by 1.1698 (55-day SMA) and finally 1.1755 (weekly high Sep.22). On the other hand, a break below 1.1582 (weekly low Oct.28) would target 1.1571 (low Oct.18) en route to 1.1524 (2021 low Oct.12).

-

13:43

USD/JPY clings to gains post-US data, remains below 114.00 mark

- USD/JPY gained positive traction on Friday and snapped two days of the losing streak.

- A strong pickup in the US bond yields revived the USD demand and remained supportive.

- The US PCE Price Index did little to impress bulls or provide any impetus to the major.

The USD/JPY pair maintained its bid tone through the early North American session and was last seen hovering near daily tops, just below the 114.00 mark. The pair moved little following the release of the US PCE Price Index.

Following an early dip to the 113.40-35 region, the USD/JPY pair attracted some buying on the last day of the week and snapped two successive days of the losing streak. The move was sponsored by a strong follow-through uptick in the US Treasury bond yields, which assist the US dollar to rebound from one-month lows touched in reaction to dismal US GDP print on Thursday.

The USD stood tall and had a rather muted reaction to a slight disappointment from the US Core PCE Price Index, which held steady at a 3.6% YoY rate in September as against an uptick to 3.7% anticipated. Nevertheless, the data validated expectations for an early policy tightening by the Fed and allowed the yield on the benchmark 10-year US bond yield to hold steady above the 1.60% threshold. This, in turn, acted as a tailwind for the greenback and the USD/JPY pair.

Meanwhile, the Fed's inflation gauge indicated that consumer cost pressures are getting entrenched. This comes on the back of signs of an economic slowdown and further fueled concerns about the risk of stagflation, which might continue to weigh on investors' sentiment. This should keep a lid on any optimistic move in the markets and benefit the safe-haven Japanese yen, capping any meaningful upside for the USD/JPY pair, at least for the time being.

Hence, it will be prudent to wait for a strong follow-through buying beyond the 114.00 mark before confirming that the recent corrective pullback has run its course. This will set the stage for a move beyond multi-year tops, around the 114.70 region touched last week, and push the USD/JPY pair further towards reclaiming the key 115.00 psychological mark.

Technical levels to watch

-

13:38

Canada: Real GDP expands by 0.4% in August vs. 0.7% expected

- Canadian economy grew at a softer pace than expected in August.

- USD/CAD edges higher in the early American session.

Canada's Real Gross Domestic Product (GDP) expanded at a monthly rate of 0.4% in August, the data published by Statistics Canada showed on Friday. This reading came in weaker than the market expectation for a growth of 0.7%.

"Preliminary information indicates that real GDP was essentially unchanged in September," the publication further read. "This advance estimate points to an approximate 0.5% increase in real GDP in the third quarter of 2021."

Market reaction

The USD/CAD pair gained traction after this report and was last seen rising 0.15% on the day at 1.2360.

-

13:34

Brazil Nominal Budget Balance down to -42.018B in September from previous -29.739B

-

13:32

Brazil Primary Budget Surplus came in at 12.933B, above expectations (3B) in September

-

13:31

Breaking: US annual Core PCE inflation stays unchanged at 3.6% in September vs. 3.7% expected

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, stayed unchanged at 0.3% on a monthly basis in September, the US Bureau of Economic Analysis reported on Friday. On a yearly basis, the PCE Price Index edged higher to 4.4% from 4.2% but came in lower than the market expectation of 4.7%.

More importantly, the Core PCE Price Index, the Fed's preferred gauge of inflation, remained steady at 3.6% on a yearly basis, compared to market expectation of 3.7%.

Market reaction

This report doesn't seem to be having a noticeable impact on the greenback's performance against its rivals. As of writing, the US Dollar Index was up 0.25% on the day at 93.58.

-

13:31

United States Personal Spending above expectations (0.5%) in September: Actual (0.6%)

-

13:31

United States Core Personal Consumption Expenditures - Price Index (MoM) meets forecasts (0.2%) in September

-

13:31

Canada Industrial Product Price (MoM) came in at 1%, above expectations (0.5%) in September

-

13:31

United States Personal Consumption Expenditures - Price Index (YoY) came in at 4.4% below forecasts (4.7%) in September

-

13:31

United States Core Personal Consumption Expenditures - Price Index (YoY) came in at 3.6% below forecasts (3.7%) in September

-

13:31

Canada Raw Material Price Index above expectations (0.1%) in September: Actual (2.5%)

-

13:31

Canada Gross Domestic Product (MoM) below forecasts (0.7%) in August: Actual (0.4%)

-

13:31

United States Personal Consumption Expenditures - Price Index (MoM) in line with expectations (0.3%) in September

-

13:30

United States Employment Cost Index came in at 1.3%, above forecasts (0.9%) in 3Q

-

13:30

United States Personal Income (MoM) came in at -1%, below expectations (-0.2%) in September

-

13:11

EUR/USD Price Analysis: A move to 1.1750 in the offing?

- EUR/USD partially fades Thursday’s sharp move to 1.1690.

- Further north comes the 1.1750 region, late September tops.

EUR/USD gives away part of the recent advance and returns to the negative ground near 1.1650.

In the meantime, if the upside impulse pushes the pair above the 1.1700 neighbourhood – where the monthly top, the 55-day SMA and the short-term resistance line all coincide – it could attempt to re-visit the late-September peaks in the mid-1.1700s in the not-so-distant future.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1904.

EUR/USD daily chart

-

13:04

India FX Reserves, USD down to $640.1B in October 23 from previous $641.01B

-

13:04

South Africa Trade Balance (in Rands): 22.24B (September) vs previous 42.4B

-

13:00

AUD/USD remains on the defensive below mid-0.7500s, awaits key US data

- AUD/USD was seen consolidating its recent gains to the highest level since early July.

- Rallying US bond yields, the cautious market mood underpinned the safe-haven USD.

- Hawkish RBA expectations helped limit the downside ahead of the US inflation data.

The AUD/USD pair extended its sideways consolidative price action and remained on the defensive, below mid-0.7500s through the mid-European session.

The pair struggled to capitalize on the previous day's positive move to the highest level since early July and edged lower on the last trading day of the week. Investors turned cautious amid growing concerns about the risk of stagflation following the release of the dismal US Q3 GDP print on Thursday. This was evident from a softer tone around the equity markets, which drove some haven flows towards the US dollar and acted as a headwind for the perceived riskier aussie.

The greenback drew additional support from a strong follow-through uptick in the US Treasury bond yields, bolstered by the prospects for an early policy tightening by the Fed. In fact, the markets now seem convinced that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation. This, in turn, was seen as a key factor that pushed the yield on the benchmark 10-year US government bond back above the 1.60% threshold.

Hence, the market focus will remain on Friday's release of the Fed's preferred inflation gauge – the Core PCE Price Index. This will set the tone heading into next week's FOMC meeting and provide some meaningful impetus to the AUD/USD pair. In the meantime, speculations for an interest rate hike by the Reserve Bank of Australia (RBA) might continue to lend some support to the Australian dollar and help limit the downside for the major.

Technical levels to watch

-

13:00

India Infrastructure Output (YoY) below expectations (16.7%) in September: Actual (4.4%)

-

12:55

US Dollar Index Price Analysis: Further losses likely below 94.00

- DXY bounces off recent lows in the 93.30 region.

- While capped by 94.00 the index faces extra decline.

The index reverses the recent weakness and manages to regain the 93.60 zone on Friday.

If DXY cannot clear recent tops around 94.00 in the near term, it would likely expose a deeper pullback in the next sessions. That said, the immediate target now emerges at the monthly low at 92.32 (October 28)., which is also reinforced by the 55-day SMA.

Looking at the broader picture, the constructive stance on the index is seen unchanged above the 200-day SMA at 91.95.

DXY daily chart

-

12:29

ECB's Holzmann: Forward guidance requires credible inflation projections

European Central Bank (ECB) policymaker Robert Holzmann told Reuters on Friday that the ECB's forward guidance requires credible inflation projections for market participants.

"It is important to drive on sight in the course of next year, in particular given the high uncertainty about inflation developments in 2022 and beyond," he added.

Market reaction

These comments don't seem to be having a noticeable impact on the shared currency's performance against its major rivals. As of writing, the EUR/USD pair was down 0.22% on a daily basis at 1.1653.

-

12:25

When is US PCE Price Index and how could it affect EUR/USD?

US PCE Price Index Overview

Friday's US economic docket highlights the release of the September Personal Consumption Expenditure (PCE) Price Index, scheduled later during the early North American session at 12:30 GMT. The headline gauge is expected to ease from 0.4% to 0.3% during the reported month, while the yearly rate is seen rising to 4.7% from 4.3% in August. The core reading is forecast to rise 0.2% in September, down from 0.3% previous, and edge higher to 3.7% YoY from 3.6% in August.

According to Joseph Trevisani, Senior Analyst at FXStreet: “Inflationary pressures in the United States economy have not abated with the heat. Continuing supply-chain restrictions, labor shortages and commodity price increases are set to make the fall and winter as uncomfortable for consumers as the summer.”

How Could it Affect EUR/USD?

Against the backdrop of Thursday's dismal US GDP print, a stronger reading will further fuel worries about the risk of stagflation. This, however, will validate expectations for an early policy tightening by the Fed and result in higher US bond yields/a stronger US dollar. Conversely, a softer print is likely to be overshadowed by the prevalent cautious mood in the financial markets. This, in turn, should act as a tailwind for the safe-haven greenback, suggesting that the path of least resistance for the EUR/USD pair is to the downside.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook for the major: “With Thursday's upsurge, EUR/USD broke above 1.1670 resistance but lost its momentum before reaching 1.1700. The Relative Strength Index (RSI) indicator on the four-hour chart is edging lower after reaching 70, suggesting that the pair is now making a technical correction.”

Eren also outlined important technical levels to trade the EUR/USD pair: “Currently, the pair is trying to flip 1.1670 into support and buyers could try to test 1.1700 as long as this level holds. Above 1.1700 (psychological level), the next resistance aligns at 1.1720 (Fibonacci 50% retracement of September downtrend) before 1.1770 (Fibonacci 61.8% retracement). On the downside, 1.1670 (Fibonacci 38.2% retracement, former resistance) is the first support ahead of 1.1635 (50-period SMA) 1.1600 (psychological level, 100-period SMA).”

Key Notes

• Personal Consumption Expenditure Price Index September Preview: Transitory inflation becomes permanent

• EUR/USD Forecast: Can euro crack 1.1700 ahead of the weekend?

• EUR/USD Price Analysis: 50-DMA, monthly trend line check heaviest daily jump since May

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While the Personal spending stimulates inflationary pressures, it could lead to rise interest rates. A high reading is positive (or Bullish) for the USD.

-

12:23

EUR/JPY Price Analysis: Extra gains seen retesting the mid-133.00s

- EUR/JPY meets resistance near 133.00 on Friday.

- Immediate hurdle comes at the monthly peaks near 133.50.

Sellers returned to the market and dragged EUR/JPY back to the negative territory on Friday.

The earlier spike met initial hurdle near 133.00 at the end of the week after rebounding from weekly lows in the mid-131.00s. The continuation of the recovery could extend further in the very near term and retest the October high near 133.50 (October 20). This is considered as the last defence for a probable move to the 2021 high past 134.00 the figure (June 1).

In the broader scenario, while above the 200-day SMA at 130.20, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

-

12:01

India Federal Fiscal Deficit, INR: 5268.51B (September) vs 4680.09B

-

10:44

USD/CAD remains confined in a range around mid-1.2300s, US/Canadian data awaited

- USD/CAD extended its consolidative price action through the early European session.

- A combination of factors revived the USD demand and acted as a tailwind for the pair.

- A modest downtick in oil prices undermined the loonie and further extended support.

The USD/CAD pair quickly recovered around 20 pips from daily lows touched in the last hour and was last seen trading with modest intraday gains, around mid-1.2300s.

The pair continued with its struggle to gain any meaningful traction and continued with its two-way price move in a narrow trading band for the second successive day on Friday. A more hawkish Bank of Canada acted as a tailwind for the domestic currency and capped the upside for the USD/CAD pair. That said, a combination of factors extended some support to the major and helped limit losses, at least for the time being.

Crude oil prices failed to capitalize on the overnight goodish rebound from two-week lows, instead met with a fresh supply and undermined the commodity-linked loonie. The intraday downtick in the black gold followed reports that OPEC and its allies (OPEC+) cut 2022 oil demand growth outlook slightly to 5.7 million barrels per day. Apart from this, a solid US dollar rebound from one-month lows extended some support to the USD/CAD pair.

Worries about a faster-than-expected rise in inflation, along with signs of a global economic slowdown have raised fears about the risk of stagflation. The market concerns were further fueled by Thursday's dismal US GDP report, which showed that the growth in the world's largest economy decelerated sharply during the third quarter of 2021. This, in turn, weighed on investors' sentiment and revived demand for the safe-haven greenback.

The USD drew additional support from a strong follow-through rally in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond shot back above the 1.60% threshold amid expectations for an early policy tightening by the Fed. The markets have been pricing in the possibility of a potential interest rate hike in 2022 amid worries about a faster-than-expected rise in inflationary pressures.

Hence, the market focus will remain glued to the release of the US Core PCE Price Index, which will set the tone heading into next week's FOMC meeting. Friday's economic docket also features the release of monthly Canadian GDP print, which, along with oil price dynamics, should produce some trading opportunities around the USD/CAD pair.

Technical levels to watch

-

10:39

AUD/USD points to the downside as the 0.7550 mark caps – Citibank

AUD rates continue to be in focus after the Reserve Bank of Australia once again did not defend its yield target. Economists at Citibank expect the AUD/USD to turn back lower as the 0.7550 level proves to be a tough resistance.

Pullback in commodity prices dampens the AUD

“The RBA decided not to defend its 3y yield target 0.1% which sent the April 2024 bond soaring. This has increased conviction that RBA may shift more hawkish in their forward guidance. However, as reflation bets move towards stagflation ones, the aussie struggles, particularly with the pullback in commodity prices that has kept it supported all month.”

“Add to that the usual USD bid into month end, and risk/reward in AUD/USD appears more skewed to the downside, with 0.7550 providing firm resistance.”

-

10:21

EUR/GBP keeps the red post-Eurozone data, downside seems limited

- EUR/GBP edged lower on Friday and eroded a part of the overnight post-ECB gains.

- BoE rate hike expectations turned out to be a key factor that underpinned the GBP.

- Upbeat Eurozone GDP/hotter CPI extended support to the euro and limited losses.

The EUR/GBP cross remained depressed through the first half of the European session and was last seen hovering near daily lows, just above mid-0.8400s.

The cross struggled to capitalize on the previous day's post-ECB strong move up to two-week tops, instead met with some supply on the last trading day of the week. The British pound's relative outperformance comes amid firming market expectations for an imminent rate hike by the Bank of England at the upcoming meeting. The speculations were reinforced by the UK finance minister Rishi Sunak's upbeat economic assessment during the annual budget presentation on Wednesday.

On the other hand, the shared currency was pressured by dovish sounding remarks from ECB President Christine during the post-meeting press conference on Thursday. Lagarde acknowledged stronger-than-expected inflationary pressures but downplayed the need to hike interest rates. This, however, failed to convince investors that bets for an earlier policy tightening were misplaced amid the continuous rise in the Eurozone consumer prices for the fourth straight month in October.

According to the flash estimates released by Eurostat this Friday, the headline Eurozone CPI jumped to a 13-year high level of 4.1% for the current month. This marked a notable acceleration from 3.4% recorded in September and was also higher than the rise to 3.7% anticipated. Adding to this, the core reading exceeded the ECB's 2% target. This, along with a better-than-expected Eurozone GDP print for the third quarter, overshadowed a slight disappointment from German growth figures.

This, in turn, should act as a tailwind for the shared currency. Apart from this, Brexit jitters might hold the GBP bulls from placing aggressive bets and help limit any meaningful decline for the EUR/GBP cross. Investors remain worried about tensions between the UK and France over the post-Brexit fishing rights and a fresh row over the Northern Ireland protocol.

Even from a technical perspective, the overnight move beyond the top boundary of over one-week-old trading range suggests that the EUR/GBP cross might have bottomed out and favours bullish traders. Hence, any subsequent decline might still be seen as a buying opportunity and remain limited. Nevertheless, the stage seems set for a further near-term appreciating move, which should allow bulls to aim back to reclaim the key 0.8500 psychological mark.

Technical levels to watch

-

10:14

US Treasury Sec. Yellen: Inflationary pressures to normalize in second half of next year

In two different interviews with CNN and CNBC News on Friday, US Treasury Secretary Janet Yellen touched upon various topics, including rising inflation, supply chain crisis, economic recovery and the infrastructure spending bill.

Key quotes

Expect price increases to normalize in the second half of next year.

Hopeful and fully expects Congress to pass both infrastructure bill and larger spending bill.