Notícias do Mercado

-

23:34

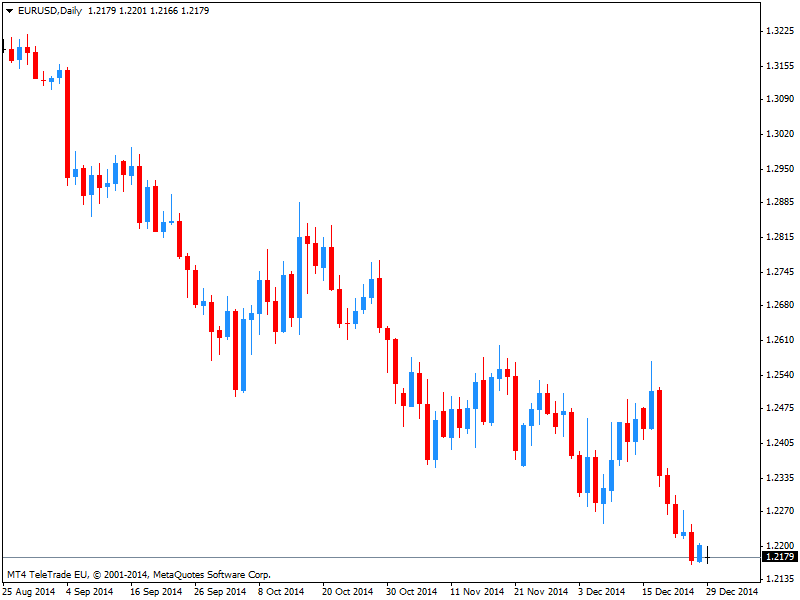

Currencies. Daily history for Dec 29’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2152 -0,41%

GBP/USD $1,5515 -0,20%

USD/CHF Chf0,9897 +0,46%

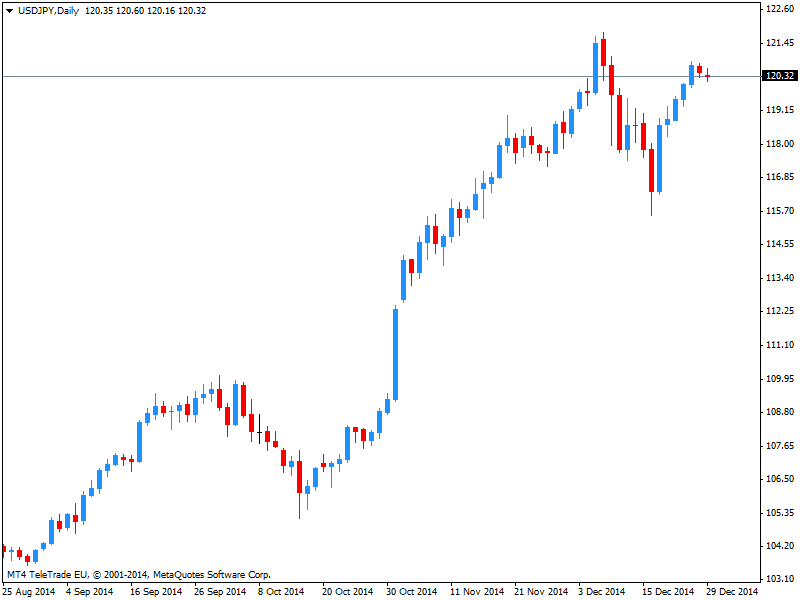

USD/JPY Y120,66 +0,18%

EUR/JPY Y146,63 -0,23%

GBP/JPY Y187,21 -0,02%

AUD/USD $0,8130 +0,26%

NZD/USD $0,7785 +0,72%

USD/CAD C$1,1635 +0,22%

-

23:00

Schedule for today, Tuesday, Dec 30’2014:

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Nationwide house price index December +0.3% +0.3%

07:00 United Kingdom Nationwide house price index, y/y December +8.5% +7.7%

09:00 Eurozone M3 money supply, adjusted y/y November +2.5% +2.6%

09:00 Eurozone Private Loans, Y/Y November -1.1% -0.9%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y October +4.9% +4.4%

15:00 U.S. Consumer confidence December 88.7 94.6

21:30 U.S. API Crude Oil Inventories December +5.4

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2150(E248mn), $1.2300(E616mn), $1.2380(E371mn), $1.2420(E434mn)

USD/JPY: Y119.09($1.5bn), Y120.00($1.3bn), Y120.50($750mn)

EUR/GBP: Stg0.7825(E200mn), stg0.7835(E250mn)

USD/CAD: C$1.1625($490mn)

-

12:51

Orders

EUR/USD

Offers $1.2320, $1.2300-05, $1.2270-73

Bids $1.2150, $1.2100

GBP/USD

Offers $1.5786, $1.5750-53, $1.5600/10

Bids $1.5536/40, $1.5510/00, $1.5480, $1.5465/50

AUD/USD

Offers $0.8250, $0.8195/00

Bids $0.8060-50, $0.8000, $0.7950

EUR/JPY

Offers Y148.50, Y148.00, Y147.50

Bids Y146.00

USD/JPY

Offers Y122.00, Y121.50, Y121.20, Y121.00

Bids Y120.00, Y119.80, Y119.50

EUR/GBP

Offers stg0.7975/80, stg0.7950/55, stg0.7900, stg0.7880/85, stg0.7860-70

Bids stg0.7800

-

09:20

Press Review: Oil prices climb on Libya supply worries

REUTERS

Oil prices climb on Libya supply worries(Reuters) - Oil prices rose on Monday, after dropping for the past two sessions, as escalating clashes in Libya stoked worries about supply from the OPEC member.

A fire caused by fighting at one of Libya's main export terminals has destroyed 800,000 barrels of crude - more than two days of the country's output, officials said, amid clashes between factions battling for control of the nation..

"Libya, and all the other problems, warrants some kind of risk premium," said Jonathan Barratt, chief investment officer at Sydney's Ayers Alliance. "Oil is at a level where people are happy to build in a risk premium," he said.

Source: http://www.reuters.com/article/2014/12/29/us-markets-oil-idUSKBN0K701D20141229

BLOOMBERG

China Money Rate Drops a Fifth Day as Deposit Rules Ease Concern

China's benchmark money-market rate fell for a fifth day in the longest run of declines since October on speculation changes to deposit rules will reduce lenders' precautionary funding needs.

A new People's Bank of China regulation, reported yesterday by the official Xinhua News Agency, relaxes rules on the calculation of banks' deposits and waives reserves requirements for savings of non-deposit-taking financial institutions held at lenders. The changes make a broader cut in reserves requirements unlikely in the near term, Shenyin Wanguo Securities Co. analysts led by Shanghai-based Chen Kang wrote in a research note today.

"Investors who were concerned about the impact of reserve charges due to deposit adjustments will now expect liquidity to be smooth," said Deng Haiqing, a Beijing-based analyst at Citic Securities Co. "The new rule itself delivered a message that the PBOC wants liquidity to remain stable, and will maintain a relatively loose monetary policy overall."

BLOOMBERG

The 94% Plunge That Shows Abenomics Losing Global Investors

Foreign investors have had just about enough of Abenomics.

After pumping record amounts of cash into Japanese shares last year, they've hardly added to holdings in 2014. Inflows are down 94 percent this year to 898 billion yen ($7.5 billion), on pace for the smallest annual amount since the 2008 global financial crisis. The month of April 2013 alone registered almost three times as much foreign investment in the stock market as all of 2014.

-

07:30

Foreign exchange market. Asian session: U.S. dollar trades weaker against major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

07:00 SwitzerlandUBS Consumption Indicator November 1.32 (Revised From 1.29) 1.29

The greenback traded weaker against its major peers. The euro could recover from its two-year lows hit on December 23rd amid the third and final attempt of Greece's Prime Minister Antonio Samaras attempt to get his candidate approved by the parliament. If this third attempt is not successful general elections will be held in late January or early February where the anti-austerity party Syriza could become more powerful.

The Australian dollar further recovered from new lows at USD0.8086 hit on December 23rd currently trading at USD8134 amid signs that China is going to spur lending to strengthen economic growth. China is Australia's most important trading partner.

New Zealand's dollar rose against the greenback.

The Japanese yen traded slightly stronger during the Asian. This weekend the Japanese Government approved a 3.5 Trillion Yen fiscal stimulus to strengthen its economy and restore the country's public finances. Since the end of 2011 the Japanese currency slid more than 36%

EUR/USD: the euro added small gains against the greenback

USD/JPY: the U.S. dollar traded slightly weaker against the yen

GPB/USD: The British pound gained against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

no news scheduled for today

-

07:00

Switzerland: UBS Consumption Indicator, November 1.29

-

06:24

Options levels on monday, December 29, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2339 (3737)

$1.2306 (1036)

$1.2255 (422)

Price at time of writing this review: $ 1.2189

Support levels (open interest**, contracts):

$1.2159 (3505)

$1.2129 (2872)

$1.2107 (6003)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 56234 contracts, with the maximum number of contracts with strike price $1,2500 (6310);

- Overall open interest on the PUT options with the expiration date January, 9 is 61410 contracts, with the maximum number of contracts with strike price $1,2000 (7003);

- The ratio of PUT/CALL was 1.09 versus 1.11 from the previous trading day according to data from December, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.5801 (2064)

$1.5702 (2437)

$1.5606 (1013)

Price at time of writing this review: $1.5572

Support levels (open interest**, contracts):

$1.5494 (1765)

$1.5397 (1157)

$1.5298 (1169)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 24398 contracts, with the maximum number of contracts with strike price $1,5850 (4020);

- Overall open interest on the PUT options with the expiration date January, 9 is 19932 contracts, with the maximum number of contracts with strike price $1,5450 (1960);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from December, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-