Notícias do Mercado

-

23:35

Commodities. Daily history for Dec 29’2014:

(raw materials / closing price /% change)

Light Crude 53.76 +0.28%

Gold 1,182.90 +0.08%

-

23:35

Stocks. Daily history for Dec 29’2014:

(index / closing price / change items /% change)

Nikkei 225 17,729.84 -89.12 -0.50 %

Hang Seng 23,773.18 +423.84 +1.82 %

Shanghai Composite 3,169.13 +11.53 +0.37 %

FTSE 100 6,633.51 +23.58 +0.36 %

CAC 40 4,317.93 +22.08 +0.51 %

Xetra DAX 9,927.13 +5.02 +0.05 %

S&P 500 2,090.57 +1.80 +0.09 %

NASDAQ Composite 4,806.91 +0.05 0.00%

Dow Jones 18,038.23 -15.48 -0.09 %

-

23:34

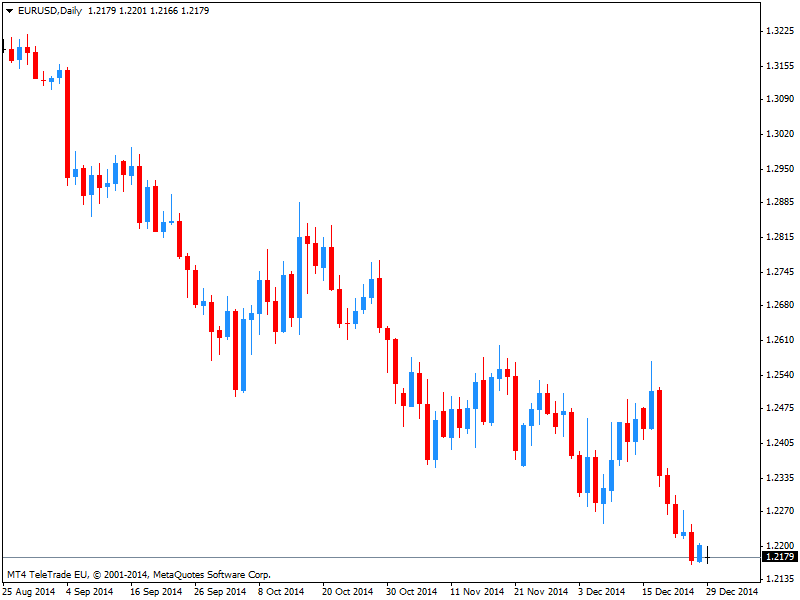

Currencies. Daily history for Dec 29’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2152 -0,41%

GBP/USD $1,5515 -0,20%

USD/CHF Chf0,9897 +0,46%

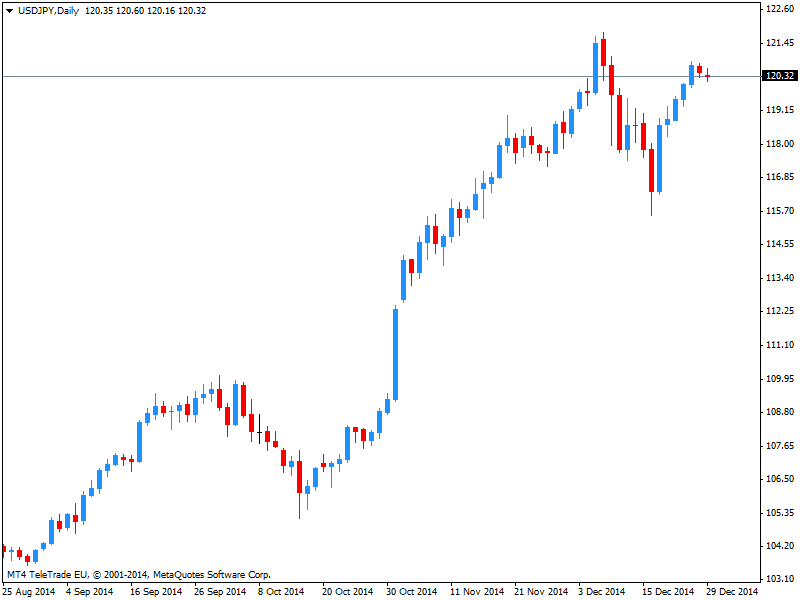

USD/JPY Y120,66 +0,18%

EUR/JPY Y146,63 -0,23%

GBP/JPY Y187,21 -0,02%

AUD/USD $0,8130 +0,26%

NZD/USD $0,7785 +0,72%

USD/CAD C$1,1635 +0,22%

-

23:00

Schedule for today, Tuesday, Dec 30’2014:

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Nationwide house price index December +0.3% +0.3%

07:00 United Kingdom Nationwide house price index, y/y December +8.5% +7.7%

09:00 Eurozone M3 money supply, adjusted y/y November +2.5% +2.6%

09:00 Eurozone Private Loans, Y/Y November -1.1% -0.9%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y October +4.9% +4.4%

15:00 U.S. Consumer confidence December 88.7 94.6

21:30 U.S. API Crude Oil Inventories December +5.4

-

20:00

Dow -4.48 18,049.23 -0.02% Nasdaq -0.15 4,806.71 -0.00% S&P +2.9 2,091.67 +0.14%

-

17:00

European stocks closed: FTSE 100 6,629.73 +19.80 +0.30% CAC 40 4,316.94 +21.09 +0.49% DAX 9,925.63 +3.52 +0.04%

-

16:40

Oil: A review of the market situation

Oil futures traded at a moderate decrease after rising more than 1.5% earlier today, which was caused by speculation that the escalation of the conflict in Libya may reduce the global supply of oil.

As it became known, December 25 largest oil port of Libya, Es Sider, which holds about 6.2 million barrels of oil, the fire started on five of the six oil tanks as a result of shelling by the Islamist armed groups. Since then, the fire was extinguished in two tanks, but the loss of oil are estimated at 850 thousand. Barrels. "The situation in Libya bit helps reduce supply on the market, - the expert said Mizuho Securities Bob Yeager. - However, the proposal is still very much greater than demand, and quotes are dangerously close to multi-year lows. The minimum pressure is enough to those lows again become a reality ".

It is worth emphasizing that oil prices have fallen 46 percent this year, which is the largest annual decline since 2008, as the Organization of Petroleum Exporting Countries opposed the reduction of production to protect market share in response to increased output in the United States over the past three decades .

Little impact continues to report from the Energy Information Administration, which showed that commercial oil stocks rose 7.3 million barrels to 387.2 million barrels, while the average forecast assumes a decrease of 1.8 million barrels. Gasoline inventories rose by 4.1 million barrels to 226.1 million barrels. Distillate stocks rose 2.3 million barrels to 123.8 million barrels, while analysts had expected a decline of 900,000 barrels. Utilization rate of refining capacity has remained at around 93.5%. Earlier, analysts expected a decrease in the index by 0.2 percentage points.

According to the analyst Phillip Futures Daniel Ang, this week will be traded Brent at around $ 60 per barrel and WTI in the range of $ 55-56. Support prices give cover short positions and plans for China and Japan to increase liquidity. As previously reported, the Japanese government approved a package of fiscal stimulus at 3.5 trillion. yen in order to accelerate the economy after the tax increase with sales in April led to a decline in consumer demand. The measures include vouchers for purchases, subsidized fuel for heating (for the poor), loans with low interest rates for small business (which was under the pressure of rising costs included). The government estimates that an additional GDP growth may be 0.7%. Economic Development Minister Amari said yesterday that the cost will be paid by revenues and unspent funds, and will not require a new bond issue.

The cost of the February futures on US light crude oil WTI (Light Sweet Crude Oil) dropped to 54.89 dollars per barrel on the New York Mercantile Exchange.

February futures price for North Sea Brent crude oil mix fell $ 0.52 to $ 59.33 a barrel on the London Stock Exchange ICE Futures Europe.

-

16:20

Gold: a review of the market situation

Gold prices fell markedly, having lost almost all positions earned at the end of last week, which is associated with a weak investment demand and a stronger dollar. Experts note that trading volumes are expected to remain lowered this week in connection with the celebration of the New Year.

The growth of the American currency to help the GDP data, which showed that US gross domestic product grew in the third quarter by 5.0% after rising 3.9% in the three months to June. This report further strengthened optimism about the strength of the US economic recovery and emphasized expectations that the Fed will raise interest rates next year. High interest rates to stimulate the US national currency and putting pressure on gold, has received support from the central bank liquidity and low interest rates after the 2008 financial crisis.

On the dynamics of trade is also affected by news of Greece. Today, the Greek Parliament for the third time in a row failed to elect a president. This will automatically lead to early parliamentary elections, the date of which the Prime Minister Samaras has already appointed on January 25. Recent polls show that the opposition party Syriza, which opposes austerity measures, still a little lead. However, the situation is very unstable, and there is talk that the New Democracy party may replace Samaras as prime minister, which can increase the chances of winning the ruling coalition. Political problems will become an obstacle to negotiations with the Troika, which can seriously affect the situation in the country by the end of March.

Meanwhile, data showed the world's largest reserves of the gold-traded exchange-traded fund SPDR Gold Trust on Friday fell by 0.08 per cent to six-year low 712.30 tons.

The cost of the February gold futures on the COMEX today fell $ 5.14 to 1180.20 dollars per ounce.

-

14:38

U.S. Stocks open: Dow 18,029.47 -24.24 -0.13%, Nasdaq 4,806.65 -0.21 -0.00%, S&P 2,087.81 -0.96 -0.05%

-

14:29

Before the bell: S&P futures -0.22%, Nasdaq futures -0.16%

U.S. stock-index futures fell amid the prospect of Greek snap elections.

Global markets:

Nikkei 17,729.84 -89.12 -0.50%

Hang Seng 23,773.18 +423.84 +1.82%

Shanghai Composite 3,169.13 +11.53 +0.37%

FTSE 6,593.7 -16.23 -0.25%

CAC 4,263.19 -32.66 -0.76%

DAX 9,838.01 -84.10 -0.85%

Crude oil $55.40 (+1.25%)

Gold $1193.40 (-0.16%)

-

14:09

DOW components before the bell

(company / ticker / price / change, % / volume)

Merck & Co Inc

MRK

57.79

+0.02%

0.2K

Chevron Corp

CVX

113.45

+0.18%

4.6K

Goldman Sachs

GS

195.45

0.00%

0.1K

Exxon Mobil Corp

XOM

93.21

0.00%

4.9K

Home Depot Inc

HD

103.75

0.00%

62.5K

Wal-Mart Stores Inc

WMT

86.89

-0.02%

0.9K

AT&T Inc

T

34.16

-0.03%

1.2K

Walt Disney Co

DIS

94.98

-0.05%

0.4K

Caterpillar Inc

CAT

94.14

-0.10%

0.2K

Johnson & Johnson

JNJ

104.96

-0.10%

0.1K

Nike

NKE

96.70

-0.13%

0.7K

The Coca-Cola Co

KO

42.90

-0.14%

0.4K

JPMorgan Chase and Co

JPM

62.45

-0.16%

0.1K

E. I. du Pont de Nemours and Co

DD

75.00

-0.17%

0.2K

McDonald's Corp

MCD

94.59

-0.20%

0.1K

International Business Machines Co...

IBM

162.00

-0.21%

2.1K

General Electric Co

GE

25.71

-0.27%

0.7K

Verizon Communications Inc

VZ

47.71

-0.31%

0.6K

Cisco Systems Inc

CSCO

28.26

-0.32%

0.1K

Pfizer Inc

PFE

31.55

-0.32%

0.1K

Boeing Co

BA

131.10

-0.40%

0.6K

UnitedHealth Group Inc

UNH

102.13

-0.41%

0.1K

Microsoft Corp

MSFT

47.62

-0.54%

2.9K

Intel Corp

INTC

37.34

-0.56%

6.3K

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2150(E248mn), $1.2300(E616mn), $1.2380(E371mn), $1.2420(E434mn)

USD/JPY: Y119.09($1.5bn), Y120.00($1.3bn), Y120.50($750mn)

EUR/GBP: Stg0.7825(E200mn), stg0.7835(E250mn)

USD/CAD: C$1.1625($490mn)

-

12:51

Orders

EUR/USD

Offers $1.2320, $1.2300-05, $1.2270-73

Bids $1.2150, $1.2100

GBP/USD

Offers $1.5786, $1.5750-53, $1.5600/10

Bids $1.5536/40, $1.5510/00, $1.5480, $1.5465/50

AUD/USD

Offers $0.8250, $0.8195/00

Bids $0.8060-50, $0.8000, $0.7950

EUR/JPY

Offers Y148.50, Y148.00, Y147.50

Bids Y146.00

USD/JPY

Offers Y122.00, Y121.50, Y121.20, Y121.00

Bids Y120.00, Y119.80, Y119.50

EUR/GBP

Offers stg0.7975/80, stg0.7950/55, stg0.7900, stg0.7880/85, stg0.7860-70

Bids stg0.7800

-

12:00

European stock markets mid-session: European indices decline after Greek ballot

European indices declined after the government's candidate, Savros Dimas, fell short of the 180 vote majority in the third of three votes. Now a general election has to be called and will be held in late January or early February. Elections could bring the anti-austerity party Syriza to power and threaten Greece's bailout and fuel concerns over the fate of the Eurozone and the timeline of ECB's plans for economic stimulus.

In today's session the FTSE 100 index shed early gains adding +0.05% quoted at 6,613.22 points, being the only of the three major European indices still positive supported by rising gold mining stocks. France's CAC 40 lost -0.52% trading at 4,273.43. Germany's DAX 30 is currently trading -0.86% at 9,836.76 points.

-

11:20

Oil: Prices recover on supply worries

Brent crude and West Texas Intermediate are trading higher today and halt a two-day decline as an attack on Libya's main export terminal Es-Sider caused a fire destroying up to 800,000 barrels of crude. The fires started on December 25th. Today the fires on three out of five oil-tanks were extinguished. Oil prices were further supported by China's and Japan's plans to boost their economies. The People's Bank of China plans to loosen loan-to-deposit ratios for banks from next year and the BoJ approved a USD29 billion stimulus.

Oil has slumped about 21 percent since OPEC decided against cutting its production target last month. Prices have tumbled by half since June amid surging production and slower-than-expected demand growth. Output in the U.S. is the highest in three decades.

Brent Crude added +0.76%, currently trading at USD59.90 a barrel, hitting the important level of USD60 earlier in trading today. West Texas Intermediate rose +0.93% currently quoted at USD55.24.

-

11:00

Gold back below USD1,200 threshold

Gold is trading just below the USD1,200 threshold again close to a one week high but the greenback's recent strength is weighing on the precious metal.

Trading volumes are expected to be low this week ahead of the new year's holiday which could lead to volatile and erratic markets. The precious metal is currently quoted at USD1,192.90, +1,54% a troy ounce.

GOLD currently trading at USD1,192.90

-

09:20

Press Review: Oil prices climb on Libya supply worries

REUTERS

Oil prices climb on Libya supply worries(Reuters) - Oil prices rose on Monday, after dropping for the past two sessions, as escalating clashes in Libya stoked worries about supply from the OPEC member.

A fire caused by fighting at one of Libya's main export terminals has destroyed 800,000 barrels of crude - more than two days of the country's output, officials said, amid clashes between factions battling for control of the nation..

"Libya, and all the other problems, warrants some kind of risk premium," said Jonathan Barratt, chief investment officer at Sydney's Ayers Alliance. "Oil is at a level where people are happy to build in a risk premium," he said.

Source: http://www.reuters.com/article/2014/12/29/us-markets-oil-idUSKBN0K701D20141229

BLOOMBERG

China Money Rate Drops a Fifth Day as Deposit Rules Ease Concern

China's benchmark money-market rate fell for a fifth day in the longest run of declines since October on speculation changes to deposit rules will reduce lenders' precautionary funding needs.

A new People's Bank of China regulation, reported yesterday by the official Xinhua News Agency, relaxes rules on the calculation of banks' deposits and waives reserves requirements for savings of non-deposit-taking financial institutions held at lenders. The changes make a broader cut in reserves requirements unlikely in the near term, Shenyin Wanguo Securities Co. analysts led by Shanghai-based Chen Kang wrote in a research note today.

"Investors who were concerned about the impact of reserve charges due to deposit adjustments will now expect liquidity to be smooth," said Deng Haiqing, a Beijing-based analyst at Citic Securities Co. "The new rule itself delivered a message that the PBOC wants liquidity to remain stable, and will maintain a relatively loose monetary policy overall."

BLOOMBERG

The 94% Plunge That Shows Abenomics Losing Global Investors

Foreign investors have had just about enough of Abenomics.

After pumping record amounts of cash into Japanese shares last year, they've hardly added to holdings in 2014. Inflows are down 94 percent this year to 898 billion yen ($7.5 billion), on pace for the smallest annual amount since the 2008 global financial crisis. The month of April 2013 alone registered almost three times as much foreign investment in the stock market as all of 2014.

-

09:00

European Stocks. First hour: Markets await Greek ballot

European indices opened mixed after a holiday-shortened week and amid concerns over political instability in Greece where the a third and final attempt of Greece's Prime Minister Antonio Samaras attempt to get his candidate approved by the parliament is taking place today. If this third attempt is not successful general elections will be held in late January or early February that could bring the anti-austerity party Syriza to power and threaten Greece's bailout. Trading volumes are expected to remain low.

The FTSE 100 index is currently trading +0.34% quoted at 6,632.35 points, Germany's DAX 30 lost -0.29% trading at 9,892.99. France's CAC 40 rose by +0.28%, currently trading at 4,307.79 points.

-

08:00

Global Stocks: S&P, DOW JONES and Shanghai Composite closed at new highs

U.S. markets closed higher on Friday after a broad rally and closed at record highs for their second weekly advance in light trading. The DOW JONES added +0.13% closing at 18,053.71 points. The S&P 500 added +0.33% with a final quote of 2,088.77 with eight of the ten sectors of the S&P adding gains.

Hong Kong's Hang Seng rose by +1.72% to 23,751.92 points. China's Shanghai Composite closed at 3,169.13 points, a plus of +0.37%, the highest since January 2010, as Chinese markets opened after the Christmas holiday break. Markets were supported by gains in U.S. indices and the new Chinese rules that will facilitate lending.

Japan's Nikkei declined by 1% shedding early gains after the health ministry announced a suspected case of the Ebola virus. The Nikkei closed at 17,729.84 points, a loss of -0.50%. This weekend the Japanese Government approved a 3.5 Trillion Yen fiscal stimulus to strengthen its economy and restore the country's public finances.

-

07:30

Foreign exchange market. Asian session: U.S. dollar trades weaker against major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

07:00 SwitzerlandUBS Consumption Indicator November 1.32 (Revised From 1.29) 1.29

The greenback traded weaker against its major peers. The euro could recover from its two-year lows hit on December 23rd amid the third and final attempt of Greece's Prime Minister Antonio Samaras attempt to get his candidate approved by the parliament. If this third attempt is not successful general elections will be held in late January or early February where the anti-austerity party Syriza could become more powerful.

The Australian dollar further recovered from new lows at USD0.8086 hit on December 23rd currently trading at USD8134 amid signs that China is going to spur lending to strengthen economic growth. China is Australia's most important trading partner.

New Zealand's dollar rose against the greenback.

The Japanese yen traded slightly stronger during the Asian. This weekend the Japanese Government approved a 3.5 Trillion Yen fiscal stimulus to strengthen its economy and restore the country's public finances. Since the end of 2011 the Japanese currency slid more than 36%

EUR/USD: the euro added small gains against the greenback

USD/JPY: the U.S. dollar traded slightly weaker against the yen

GPB/USD: The British pound gained against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

no news scheduled for today

-

07:00

Switzerland: UBS Consumption Indicator, November 1.29

-

06:24

Options levels on monday, December 29, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2339 (3737)

$1.2306 (1036)

$1.2255 (422)

Price at time of writing this review: $ 1.2189

Support levels (open interest**, contracts):

$1.2159 (3505)

$1.2129 (2872)

$1.2107 (6003)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 56234 contracts, with the maximum number of contracts with strike price $1,2500 (6310);

- Overall open interest on the PUT options with the expiration date January, 9 is 61410 contracts, with the maximum number of contracts with strike price $1,2000 (7003);

- The ratio of PUT/CALL was 1.09 versus 1.11 from the previous trading day according to data from December, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.5801 (2064)

$1.5702 (2437)

$1.5606 (1013)

Price at time of writing this review: $1.5572

Support levels (open interest**, contracts):

$1.5494 (1765)

$1.5397 (1157)

$1.5298 (1169)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 24398 contracts, with the maximum number of contracts with strike price $1,5850 (4020);

- Overall open interest on the PUT options with the expiration date January, 9 is 19932 contracts, with the maximum number of contracts with strike price $1,5450 (1960);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from December, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:04

Nikkei 225 17,892.68 +73.72 +0.41%, Hang Seng 23,786 +436.66 +1.87%, Shanghai Composite 3,203.25 +45.64 +1.45%

-