Notícias do Mercado

-

23:58

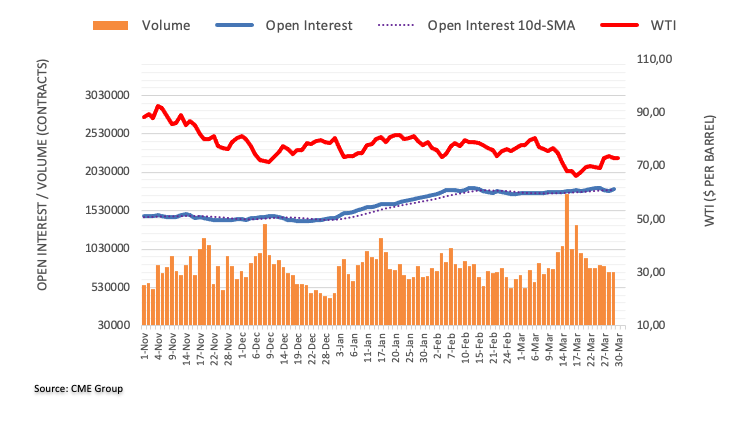

WTI bulls cheer risk-on mood, OPEC+ hopes at 13-day high around $74.50, China PMI, inflation eyed

- WTI crude oil grinds higher at two-week top as hopes of more energy demand joins supply crunch talks.

- OPEC+ is likely to continue with existing output cut policy in next week.

- Receding fears of banking crisis, softer US Dollar allow Oil buyers to keep the reins.

- China NBS Manufacturing PMI, inflation clues from Eurozone, US will be the key for clear directions.

WTI crude oil price remains firmer at the highest levels in more than two weeks as bulls flirt with the $74.50 level ahead of China’s official PMIs for March during early Friday. In doing so, the black gold cheers the market’s optimism and the broad US Dollar to brace for the biggest weekly gains since early February.

US Dollar Index (DXY) eyes three-week losing streak as hawkish Federal Reserve (Fed) comments fail to gain support from second-tier data and raise expectations of only limited rate hike options available to the policymakers. That said, Apart from Federal Reserve Chairman Jerome Powell, three Fed Officials backed further rate hikes on Thursday to tame the inflation woes.

Apart from the Fed concerns, hopes of sound banking system also favored the WTI bulls as Apart from Federal Reserve Chairman Jerome Powell, three Fed Officials backed further rate hikes on Thursday to tame the inflation woes.

US Treasury Secretary Janet Yellen said on Thursday, “Banking system is sound, even as it has come under pressure.”

Elsewhere, China’s hopes of upbeat march and talks of no change in the production policies of the Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, known collectively as OPEC+, seem to have favored the commodity bulls. “OPEC+ is likely to stick to its existing deal to cut oil output at a meeting on Monday, five delegates from the producer group told Reuters, after oil prices recovered following a drop to 15-month lows,” said Reuters.

Although the Oil bulls are in the driver’s seat, the price reaches the short-term key resistance and hence upbeat prints of China’s official PMIs for March becomes necessary for the quote to remain firmer. It should be noted that the higher inflation figures can back the latest hawkish rhetoric among the major central bank officials and could challenge the WTI buyers.

Technical analysis

A clear upside break of the previous support line from early December 2022, around $74.50 by the press time, becomes necessary for the WTI crude oil bulls to witness further upside. Otherwise, a pullback towards February’s low near $72.50 can be expected

-

23:42

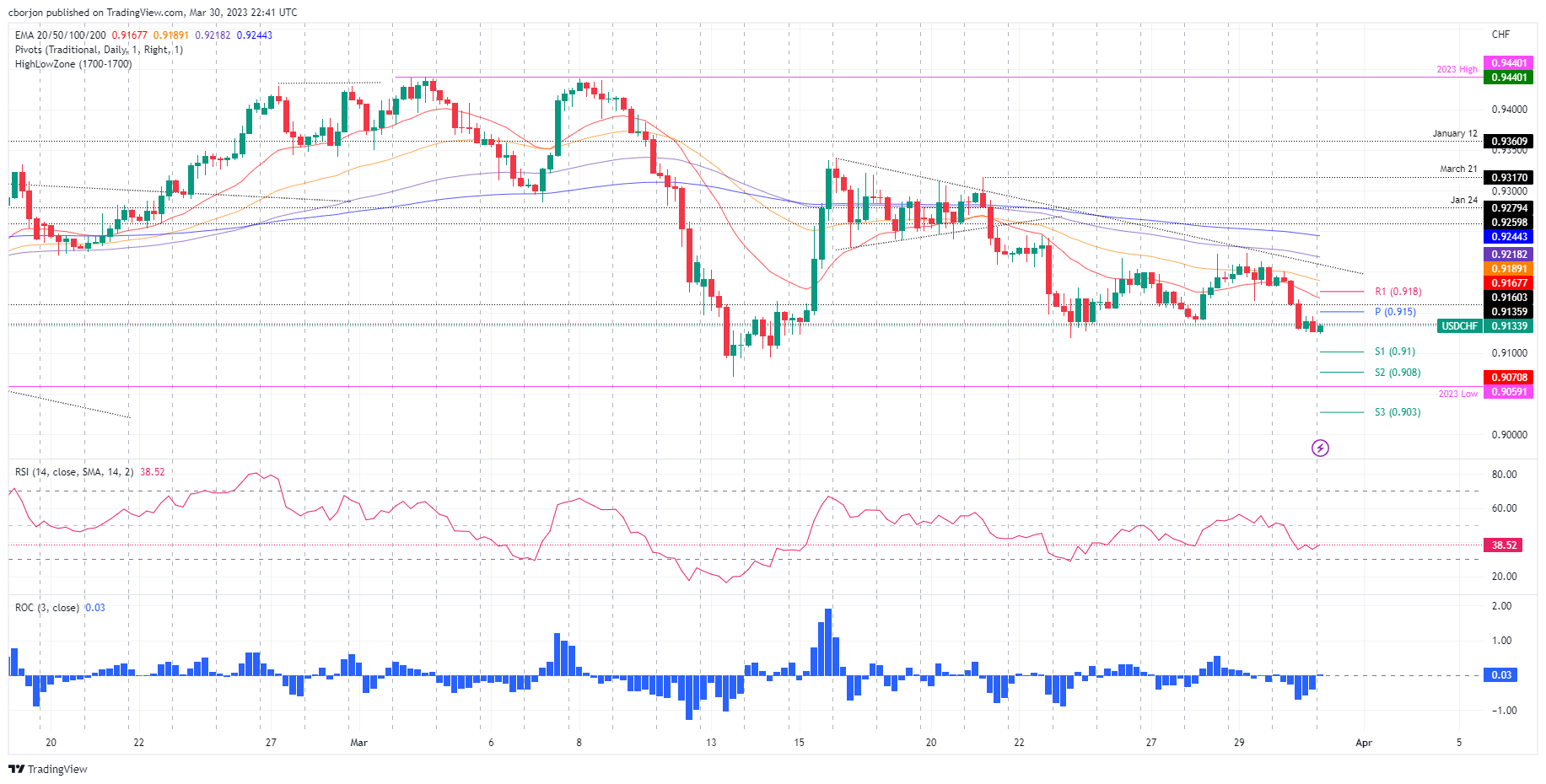

USD/CHF Price Analysis: Retreats beneath 0.9200 on the confluence of technical factors

- USD/CHF dropped after facing the 20-day EMA and a resistance trendline, extending its losses for two straight days

- USD/CHF Price Analysis: Short term, a triple bottom could cap the pair’s fall and open the door to test 0.9300.

After facing a resistance trendline, which intersects with the 20-day Exponential Moving Average (EMA), the USD/CHF dropped and extended its losses for two straight days. At the time of writing, the USD/CHF is trading at 0.9133, up 0.08%, as Friday’s Asian session begins.

USD/CHF Price action

The USD/CHF slid from the 0.9200 mark as the US Dollar (USD) weakened across the FX board. Furthermore, the USD/CHF pair is downward biased, though to further cement its bearish case, the major needs to break below the March 13 swing low at 0.9070. Once cleared, the USD/CHF pair would test the YTD lows at 0.9059, which, once cleared, could open the door towards 0.9000. On the flip side, buyers reclaim the 20-day EMA at 0.9215, and the major could test 0.9300.

Short term, the USD/CHF4-hour chart portrays a triple bottom forming, though it is at the brisk of being invalidated if the spot price tumbles and extends below 0.9118. If buyers keep the price above the latter, the chart pattern will remain in play. If the USD/CHF breaks above the daily pivot at 0.9150, the next resistance would be 0.9180, followed by March 30 high at 0.9200. Once cleared, the next reistace would be the 100-EMA at 0.9218, ahead of the 200-EMA at 0.9244.

In an alternate scenario, if the USD/CHF pair dwindles below 0.9118, that would pave the way to test the YTD low at 0.9059.

USD/CHF 4-Hour chart

USD/CHF Technical levels

-

23:41

USD/CAD declines towards 1.3500 on upbeat oil price, US PCE Price Index hogs limelight

- USD/CAD has registered a four-day losing streak amid a declining USD Index.

- S&P500 continued its upside momentum as investors are cheering ebbing fears of the potential banking crisis.

- Canada’s monthly GDP (Jan) is expected to expand by 0.3% vs. a contraction of 0.1%.

The USD/CAD pair has refreshed its five-week low below 1.3516 in the early Asian session amid weakness in the US Dollar Index (DXY) and rising oil prices. The Loonie asset has turned sideways after a four-day losing streak and is looking vulnerable above 1.3510. The USD Index witnessed an intense sell-off on Thursday after surrendering the critical support of 102.40. Less room for further upside in interest rates by the Federal Reserve (Fed) has built bearish bets for the USD Index.

S&P500 futures continued their upside momentum on Thursday as investors are cheering ebbing fears of a potential banking crisis, portraying a significant jump in the risk appetite of market participants.

The demand for US government bonds remained choppy as investors don’t see more casualties to the banking system. However, the 10-year US treasury yields surrendered their entire gains and settled Thursday’s session below 3.55%.

Going forward, the United States' core Personal Consumption Expenditure (PCE) Price Index data will remain in the spotlight. Analysts at CIBC expect “The Fed’s preferred gauge of inflation, core PCE prices, likely decelerated to a 0.4% monthly pace, slightly slower than its CPI counterpart given the lower weight of shelter in the index, but still too hot to reach on-target inflation, and justifying the Fed’s decision to raise rates further in March. We are roughly in line with the consensus, which should limit any market reaction.”

The Canadian Dollar will dance to the tunes of monthly Canada’s Gross Domestic Product (GDP) (Jan) data. As per the consensus, the economic data will expand by 0.3% vs. a contraction of 0.1%.

On the oil front, oil prices rose sharply above $74.00 in hopes that fewer rate hikes from western central banks collaboratively will strengthen the overall oil demand ahead. It is worth noting that Canada is the leading exporter of oil to the United States and higher oil prices will support the Canadian Dollar.

-

23:40

GBP/USD Price Analysis: Bulls flex muscles for another fight with 1.2450 hurdle

- GBP/USD stays firmer at the highest levels in two months.

- Successful trading above a fortnight-old ascending support line, 2.5-month-old horizontal area keeps Cable bulls hopeful.

- Multiple tops marked since early December 2022 highlights 1.2445-50 as the key upside resistance.

- Upbeat oscillators add strength to the bullish bias.

GBP/USD bulls keep the reins around a two-month high near 1.2390 as they approach a critical resistance area during early Friday. In doing so, the Cable pair braces for five-week uptrend.

That said, a sustained break of the 10-week-old horizontal resistance area, now support around 1.2285-65, joins the clear respect of a fortnight-long ascending trend line, close to 1.2320, to keep the GBP/USD pair buyers hopeful.

Adding strength to the upside bias are the bullish MACD signals and the firmer RSI (14) line, not overbought.

As a result, the Cable pair appears well-set to challenge an area comprising multiple tops marked since December 13, 2022, around mid-1.2400s.

Given the absence of the overbought RSI, in addition to the aforementioned price-positive catalysts, the GBP/USD is likely to cross the stated 1.2450 crucial resistance.

Following that, the 61.8% Fibonacci Expansion (FE) of its November 2022 to March 2023 moves, near 1.2610 will be in focus.

Meanwhile, the previously stated support line and the broad horizontal area, respectively near 1.2320 and 1.2285-65, restrict short-term GBP/USD downside.

In a case where GBP/USD drops below 1.2265, the mid-month top around the 1.2200 threshold could lure the bears.

It should be noted that the 23.6% Fibonacci retracement of the Cable pair’s November 2022 to January 2023 moves, near 1.2140, precedes the 1.2000 psychological magnet to challenge the bulls afterward.

GBP/USD: Daily chart

Trend: Further upside expected

-

23:12

EUR/USD defends 1.0900 ahead of Eurozone Inflation and German Retail Sales

- EUR/USD has defended the 1.0900 support as investors see more rate hikes from the ECB.

- Solid wage growth and labor shortage led to a jump in monthly German inflation.

- S&P500 futures continued their upside journey on Thursday as investors’ confidence has been restored.

The EUR/USD pair has shown decent buying interest after a gradual correction to near the round-level support of 1.0900 in the late New York session. The major currency pair has resumed its upside journey as investors are anticipating more rate hikes from the European Central Bank (ECB) as German inflation remained higher than expected.

In Germany, prices of goods and services in March have accelerated by 1.1%, higher than the consensus of 0.8% and the former release of 1.0%. Annual German Harmonized Index of Consumer Prices (HICP) landed at 7.8%, significantly lower than the prior release of 9.3% but higher than the estimates of 7.5%. Annual HICP figures have softened firmly led by lower energy prices, however, prices of core products look solid amid the shortage of labor.

The labor market has grabbed the bargaining power due to a shortage of job seekers and wage growth is now at between 5% and 6%, the highest in decades, as reported by Reuters. This has bolstered the case for more rate hikes from ECB President Christine Lagarde.

On Friday, the release of Eurozone HICP and German Retail Sales data will provide more clarity. Annual preliminary Eurozone HICP is expected to decelerate to 7.1% vs. the prior print of 8.5%. Along with them, monthly German Retail Sales are expected to expand by 0.5% against a contraction of 0.3%.

Meanwhile, the upside bias for the shared currency pair is also backed by the declining US Dollar Index (DXY). The USD Index is juggling after a fresh weekly low at 102.07. The USD Index failed to capitalize on the anticipation of one more rate hike this year by Federal Reserve (Fed) chair Jerome Powell in a private meeting with United States lawmakers.

S&P500 futures continued their upside journey on Thursday as investors’ confidence has been restored after easing US banking jitters, portraying a higher risk appetite of the market participants.

-

23:11

AUD/USD eyes weekly gains above 0.6700 ahead of China PMI, Fed’s favorite inflation

- AUD/USD reverses the previous weekly loss, grinds higher of late.

- Firmer sentiment, softer US Dollar allow Aussie bulls to keep the reins.

- Fed policymakers tease further rate hikes but don’t confirm the size of it and allow policy doves to remain hopeful.

- China-linked fears jostle with easing bank turmoil fears to tease buyers ahead of key data.

AUD/USD bulls occupy the driver’s seat while reversing the previous weekly losses around 0.6715 as traders await the key inflation clues from the US on Friday. Adding importance to the day’s Asian session are China’s official Purchasing Managers’ Indexes (PMIs) for March.

Receding fears of the banking crisis join the confusion about the future rate hikes among the key central banks to allow the AUD/USD pair to cheer the risk-on mood. Adding strength to the optimism, as well as the Aussie price are the comments from China suggesting higher growth figures in March that the first two months of the year.

That said, Fed Chair Jerome Powell teased one more rate hike in the current year and the other policymakers followed the suit while highlighting the task of taming inflation. However, the majority of them appeared cautious of not sounding too hawkish and hence raised doubts that the price pressure is easing. Additionally favoring the risk appetite, as well as the AUD/USD price, were comments suggesting the soundness of the banking sector. It should be noted that US Treasury Secretary Janet Yellen said on Thursday, “Banking system is sound, even as it has come under pressure.

Elsewhere, mixed US data, mostly softer, fails to justify the hawkish Fed concerns and allow the Aussie pair to grind higher. On Thursday, final readings of the US fourth quarter (Q4) Gross Domestic Product (GDP), also known as the Real GDP, marked an easy Annualized growth number of 2.6% versus 2.7% previous forecasts. It’s worth noting that the Q4 Personal Consumption Expenditure (PCE) Prices matched 3.7% QoQ forecasts and prior while the Core PCE figure grew to 4.4% QoQ versus 4.3% expected and prior. Moving on, the Weekly Initial Jobless Claims rose to 198K for the week ended on March 25 versus 191K prior and 196K market forecasts.

Alternatively, China's Taiwan Affairs Office threatened retaliation over Taiwan President Tsai Ing-wen's visit to the US on Wednesday. Additionally, China's Premier Li Qiang recently said that the economic situation in March is even better than in January and February. The policymaker, however, also raised geopolitical tension by opposing trade protectionism and decoupling, which indirectly targets the US.

Amid these plays, Wall Street closed positive but the yields grind higher and weigh on the US Dollar.

Moving on, China NBS PMIs for March will precede the Fed’s favorite inflation gauge to direct AUD/USD moves. Forecasts suggest that China’s headline NBS Manufacturing PMI is expected to ease to 51.5 versus 52.6 prior.

Also read: US February PCE Inflation Preview: Bad news for the Dollar, good news for the Fed?

Technical analysis

AUD/USD extends recovery from a three-week-old ascending support line, around 0.6660, towards 200-DMA hurdle surrounding 0.6755.

-

22:21

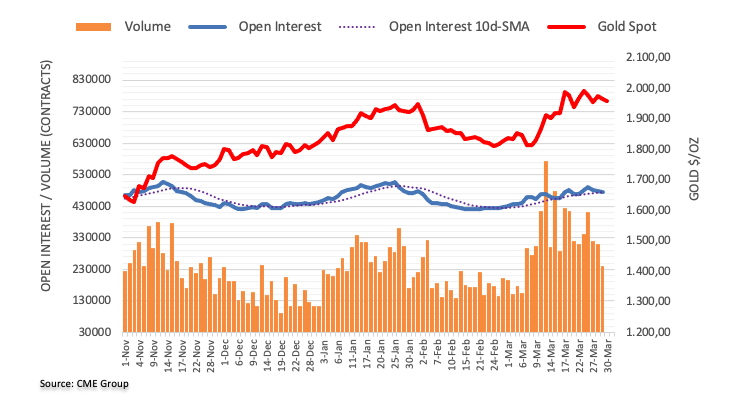

Gold Price Forecast: XAU/USD bulls run into key resistance

- Gold price bulls are in the market and eye the $2,000s.

- The Federal Reserve´s preferred inflation measure could be a catalyst on Friday.

Gold price has been buoyed in part by a weaker US Dollar and expectations for a fall in interest rates. The US Dollar index was down 0.4% at 102.20, raising the appeal of dollar-denominated gold prices. XAU/USD has traveled between a low of $1,955 and $1,984.36 on Thursday.

Analysts at TD Securities argued that investor participation has remained muted despite little evidence of a boon from safe-haven demand in gold markets. ´´In reality, underwhelming CTA flows have weighed on the white metal's performance, despite substantial buying activity in China,´´ the analysts explained.

´´Today, prices are surging overnight amid several large-scale CTA buying programs, as a drift lower in key trigger levels has finally kicked off significant algorithmic buying activity that should help the metal outperform, ´´ the analysts added further.

Federal Reserve sentiment, key for Gold price

Meanwhile, with the Federal Reserve in mind, the February reading of personal consumption expenditures (PCE) on Friday, the Fed's preferred inflation gauge, will be released and could be a catalyst for the Gold price. January figures showed a sharp acceleration in consumer spending so the data will be closely eyed.

´´Comments from Fed officials have been mixed with Jerome Powell indicating last week that the impact of the recent turmoil in the banking system could be the equivalent of 25bp of tightening,´´ analysts at ANZ Bank said. ´´However other Federal Reserve officials have pointed out that more tightening will be required if inflation risks persist.´´

Meanwhile, US data on Thursday showed that Jobless Claims last week rose more than expected from the week before indicating a cooling labor market, while fourth-quarter Gross Domestic Product growth was slightly lower at 2.6% compared with earlier estimates of 2.7%, both supporting the case for a softer Fed policy.

Gold price technical analysis

Gold price was testing the $1,980s resistance but the W-formation was a bearish pattern and this pulled on the Gold price. The gold price bulls have steppe din at neckline support and the price has rallied back into resistance. A pull back into the Fibonacci scale could be the next development before a move higher should the Gold price bulls stay committed with eyes on a restest in the $2,000s

-

22:19

GBP/JPY Price Analysis: Buyers prepare an assault for a resistance trendline ahead of 165.00

- The GBP/JPY daily chart tests a three-month-old resistance trendline at around 164.70-90.

- The Relative Strength Index (RSI) and the Rate of Change (RoC) shifted bullish, indicating an upward trend for GBP/JPY.

- GBP/JPY Price Analysis: Downside risks remain below 164.00.

The GBP/JPY pair is gaining 0.53% on Thursday and is trading at 164.29 after hitting a daily low of 162.96. The pair's uptrend is attributed to the market's current risk-on sentiment and expectations that central banks will pause hiking rates after the recent banking turmoil in the US and Switzerland.

GBP/JPY Price action

The GBP/JPY daily chart suggests the pair is testing a three-month-old resistance trendline that passes at around 164.70-90, trading at 4-week highs. The Relative Strength Index (RSI) shifted bullish, suggesting the GBP/JPY outlook is upwards. The Rate of Change (RoC) jumped from a neutral stance after the GBP/JPY snapped three days of consecutive losses, erased on Thursday.

If the GBP/JPY continues its uptrend, the next resistance would be the February 27 high at 166.00. A breach of the latter will expose the December 19 daily high at 167.01, followed by the December 12 high at 169.27.

On the other hand, the GBP/JPY first support would be the psychological level at 164.00. Downside risks lie at the next support area at the 20-day Exponential Moving Average (EMA) at 161.87, ahead of testing the 50-day EMA at 161.18.

GBP/JPY Daily chart

GBP/JPY Technical levels

-

22:10

Forex Today: DXY under pressure amid risk appetite; focus turns to US inflation data

The DXY is under pressure, particularly against its main European rivals, amid risk appetite and following German inflation data. On Friday, the focus will be on US and Eurozone inflation figures. Japan will also release the Tokyo CPI, alongside Industrial Production and Retail Sales. On Asian hours, China's official PMI for manufacturing and service sectors will be released.

Here is what you need to know on Friday, March 31:

Another positive day for Wall Street and a quiet one in the Treasury market. The Dow Jones rose 140 points or 0.43% to post the highest daily close in two weeks, while the Nasdaq reached seven-month highs. Banking jitters continue to fade, and economic data shows no signs of a “hard” or even “soft” landing. A pessimist uncertain outlook is being replaced by just an uncertain outlook.

“The challenge in assessing today’s economy is reconciling the strength of the recent data with the potential for weakness coming from the banking system,” Tom Barkin, Richmond Fed President.

The bond market does not look as optimistic as stocks. US yields drifted sideways on Thursday, not reflecting risk appetite. Bonds will probably take a more decisive direction after Friday’s US Core Personal Consumption Expenditure data.

German inflation figures showed a big decline in the annual rate but not as much as expected. On Friday, Eurozone Consumer Price Index (CPI) is due. So far, March preliminary figures show that inflation is slowing down but is still elevated, just like what European Central Bank (ECB) officials say publicly.

Volatility is set to rise on Friday, considering key inflation numbers due and also the fact that it is the last trading day of the week, month and quarter.

EUR/USD rose past 1.0900 to test the recent top. The pair remains bullish, consolidating important weekly gains, that could face some challenges on Friday with the critical economic reports due. GBP/USD posted the highest daily close in two months, near 1.2400, boosted by risk appetite and the weaker Dollar.

USD/JPY is moving sideways around 132.60. The US Dollar and the Japanese Yen are suffering from the rally in Wall Street. USD/CHF posted the lowest close in weeks and is approaching the key long-term support at 0.9050.

AUD/USD and NZD/USD rose above 0.6700 and 0.6250, respectively. USD/CAD fell for the fourth consecutive day, and it keeps trending lower, last seen trading around 1.3525.

It was a positive day for Emerging market currencies. The biggest gainer was the Rand (ZAR), after the South African central bank surprised with a bigger-thank-expected rate hike. The Bank of Mexico, as expected, raised rates by 25 basis points.

Gold broke above $1,970 and climbed above $1,980, while Silver surged 2.40% to $23.80, the highest level in two months.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

22:00

Mexico Fiscal Balance, pesos below expectations (-0.9B) in February: Actual (-74.37B)

-

21:17

GBP/USD pops towards the 1.24 psychological target

- GBP/USD bulls are in the market with eyes on the 1.24 area.

- Traders will be turning to Friday's key US inflation data.

GBP/USD was last up 0.65% at 1.2391 having traveled between a low of 1.2293 and 1.2392 putting the pair on track for its biggest monthly gain since November, as concerns among investors over the banking sector dwi9ndled and dented the safe haven US Dollar.

The Great British Pound has climbed around 3% vs. the US Dollar in March and is penetrating its way through resistance to eight-week highs. Domestically, at more than 10%, headline inflation in Britain is showing no signs of slowing down. In this respect, money markets show traders now think rates will top out at 4.5% by September meaning the Bank of England likely has one more quarter-point rise planned.

´´The BoE is hoping for a quick decline in inflation in the course of the year,´´ analysts at Commerzbank explained. ´´So far, however, the economic data rather harbor upside risks for inflation. If inflation does turn out to be more persistent than the BoE expects, its rather dovish stance is likely to weigh further on the pound.´´

Meanwhile, traders will look to the February reading of personal consumption expenditures (PCE) on Friday. The data is the Fed's preferred inflation gauge. January figures showed a sharp acceleration in consumer spending so the data will be closely eyed.

Today, US data showed that jobless claims last week rose more than expected from the week before indicating a cooling labor market, while fourth-quarter Gross Domestic Product growth was slightly lower at 2.6% compared with earlier estimates of 2.7%, both supporting the case for a softer Fed policy.

-

21:00

Colombia Interest rate meets forecasts (13%)

-

20:46

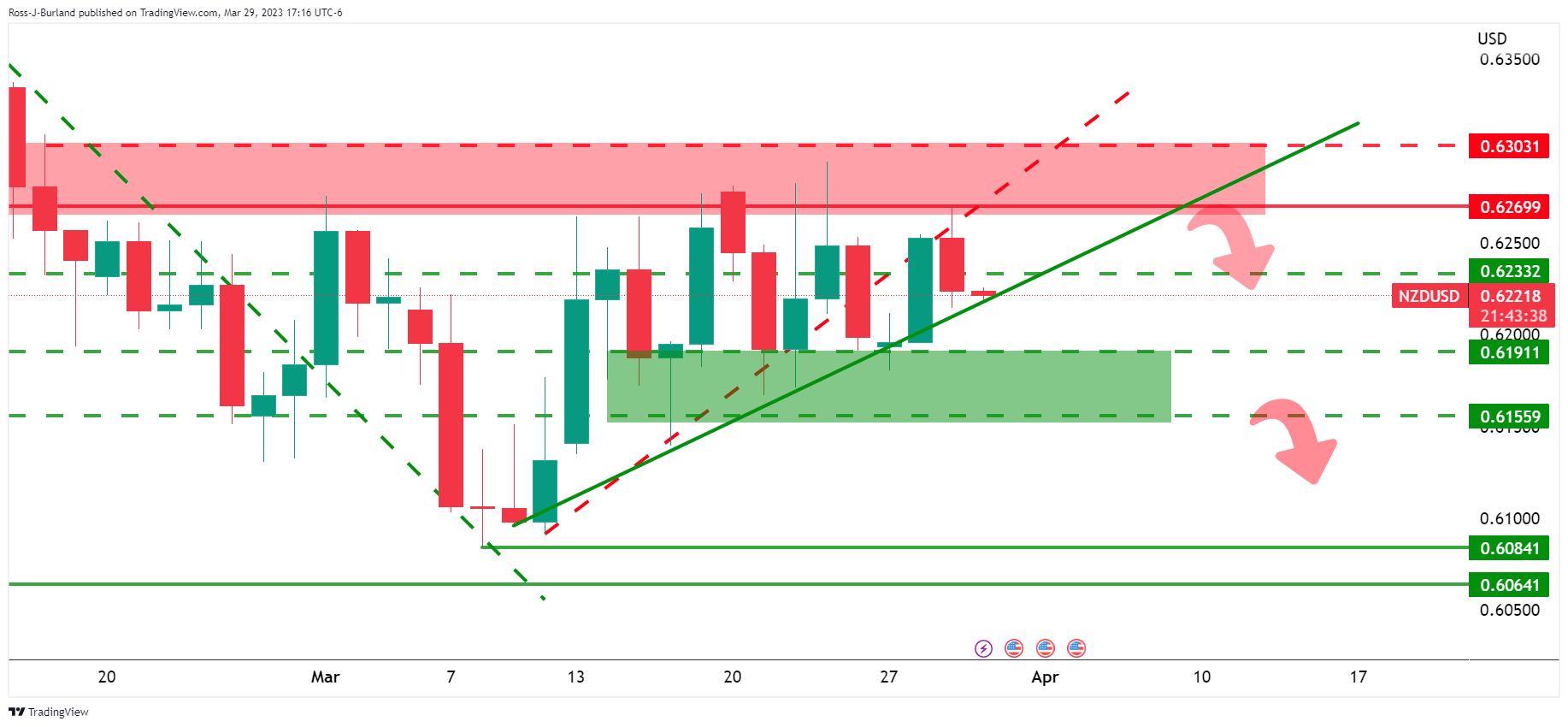

NZD/USD holds in familiar ranges, coiling up for a breakout

- NZD/USD is higher on the day and testing familiar resistance.

- Traders will turn to the Fed´s preferred inflation reading on Friday for a potential catalyst.

The New Zealand dollar fluctuated at around 0.6250 vs. the US Dollar and struggled for direction while investors awaited the Reserve Bank of New Zealand's monetary policy decision next week and US inflation data on Friday. At the time of writing, NZD/USD is trading between a low of 0.6203 and a high of 0.6264, capped at late February and March´s resistance.

It's been a light data week for New Zealand, but the latest came from New Zealand's business confidence which was almost unchanged at -43.4 in March, remaining at very subdued levels compared to historical averages as manufacturing and services firms remained pessimistic, amid rising cost pressures. In this regard, New Zealand’s annual inflation is currently running near three-decade highs of 7.2%, well above the central bank’s medium-term target of 1%-3%. However, inflation indicators continue to inch lower and going in the right direction, albeit painfully slowly. The RBNZ has lifted its policy rate by a total of 450 basis points, bringing the cash rate to a 41-year record of 4.75%.

´´We expect RBNZ’s tone next week to be hawkish, mindful of resource constraints facing an economy in post-cyclone rebuild mode, and local banks strong and not at risk of some of the issues that plagued bust US banks,´´ analysts at ANZ bank said. ´´That leans toward the RBNZ pressing ahead with hikes amid recovering global risk appetite.´´

Traders now await the major US economic reports in Friday´s inflation data in the February reading of personal consumption expenditures (PCE). This is the Fed's preferred inflation gauge. January figures showed a sharp acceleration in consumer spending so the data will be closely eyed.

Meanwhile, US data on Thursday showed that jobless claims last week rose more than expected from the week before indicating a cooling labor market, while fourth-quarter Gross Domestic Product growth was slightly lower at 2.6% compared with earlier estimates of 2.7%, both supporting the case for a softer Fed policy.

-

20:12

Mexico: Banxico raises rates by 25 basis points to 11.25% as expected

- Banxico raises key rate by 25 bps to 11.25% in unanimous decision.

- Statement mentions that the current monetary policy stance adjusts to what is necessary for inflation to converge to the target.

- Mexican Peso retreats after decision, USD/MXN climbs to 18.10.

The Bank of Mexico raised it key interest rate by 25 basis points as expected, to 11.25%. That represents the smallest rate hike since November 2021. Since then, it raised by 50 bps at six meetings, and by 75 bps in four. The decision was unanimous. In the statement, Banxico said that "the monetary policy stance adjusts to the trajectory required for inflation to converge to its 3% target within the forecast horizon", suggesting it's done raising rates.

Key quotes from the statement:

“Inflation expectations for 2023 and 2024 were revised upwards again, while those for longer terms remained relatively stable.”

“The balance of risks for the trajectory of inflation within the forecast horizon remains biased to the upside.”

“The Governing Board evaluated the magnitude and diversity of the inflationary shocks and its determinants, along with the evolution of medium- and long-term inflation expectations and the price formation process. It considered the challenges stemming from the ongoing tightening of global financial conditions, the environment of uncertainty, the persistence of accumulated inflationary pressures and the possibility of greater effects on inflation, as well as the monetary policy stance already attained in this hiking cycle.”

“The Board decided unanimously to raise the target for the overnight interbank interest rate by 25 basis points to 11.25%. With this action, it slows the pace of interest rate increases and the monetary policy stance adjusts to the trajectory required for inflation to converge to its 3% target within the forecast horizon.”

“The Board will thoroughly monitor inflationary pressures as well as all factors that have an incidence on the foreseen path for inflation and its expectations. The latter, in order to set a policy rate that is consistent at all times with both the orderly and sustained convergence of headline inflation to the 3% target within the time frame in which monetary policy operates as well as with an adequate adjustment of the economy and financial markets. For its upcoming decision, the Board will take into account the inflation outlook, considering the monetary policy stance already attained.”

Market reaction

Prior to the decision, the USD/MXN was trading at 18.05, at the lowest level in three weeks. Following the decision, it jumped toward 18.10, erasing daily losses.

-

20:05

AUD/USD rises above 0.6700 amidst a soft US Dollar, falling US bond yields

- AUD/USD climbs as market participants expect a US Federal Reserve pivot on its monetary policy stance.

- Boston Fed’s Susan Collins argues that the Fed will maintain steady rates after a future hike.

- Richmond Fed’s Thomas Barkin commented that turmoil at Credit Suisse removed 50 bps rate hikes off the table.

The Australian Dollar (AUD) edges higher against the US Dollar (USD), which continues to weaken across the board, as shown by a basket of six currencies, namely the US Dollar Index. In addition, US Treasury bond yields are falling, and US equities are climbing, painting a challenging outlook for the US currency. At the time of writing, the AUD/USD is trading at 0.6701.

US Dollar weakened on falling UST Bond yields after soft jobs data

Risk appetite continues to be the main driver after the banking crisis woes eased. The financial markets narrative shifted back to central banks, though not inflation but regulation. However, Federal Reserve officials like Boston Fed President Susan Collins and Richmond’s Thomas Barkin crossed news wires and spoke about monetary policy.

Boston Fed Susan Collins said that getting inflation low justifies no rate cuts. She added that the US Federal Reserve (Fed) would hold rates steady after another hike. Richmond Fed President Thomas Barkin commented that the inflation fight would take some time and that Credit Suisse’s turmoil took off the table of a 50 bps rate hike.

Even though both Fed officials looked mildly hawkish, investors had begun pricing in a no change to the Federal Funds Rate (FFR) at the upcoming meeting in May. Therefore, the AUD/USD has been underpinned by a probable shift in the US central bank monetary policy stance, though inflation data is waiting to be released on Friday.

Aside from this, jobs data from the United States (US) showed that the labor market is cooling off, with Initial Jobless Claims for the last week exceeding estimates. At the same time, the US Gross Domestic Product (GDP) for Q4 2022 was 2.6%, below forecasts of 2.7%.

On the Australian front, the latest inflation report surprised the market, as inflation was lower than expected. There are growing rumors amongst financial analysts that the Reserve Bank of Australia (RBA) could pause rate hikes in the next week.

AUD/USD Technical analysis

The AUD/USD is bracing for the 20-day Exponential Moving Average (EMA), at 0.6696, consolidating within a narrow 70 pip range during the last three trading days. Although oscillators remain in bearish territory, like the Relative Strength Index (RSI), the Rate of Change (RoC) is bullish. Hence, mixed signals warrant caution.

If the AUD/USD breaks upwards, it will face resistance at the 50-day EMA at 0.6753, followed by the 100 and the 200-day EMAs at 0.6771 and 0.6821, respectively. On the other hand, the AUD/USD first demand level would be the March 24 low at 0.6625, followed by the 0.6600 figure.

-

20:00

Mexico Central Bank Interest Rate increased to 11.25% from previous 11%

-

19:54

EUR/USD bulls climb to fresh highs within the bull cycle, tapping into the 1.09´s

- EUR/USD pops higher and extends the bull cycle in the 1.09´s.

- All eyes will turn top the US PCE data on Friday.

EUR/USD rallied on easing fears about banking sector troubles and Us stocks on Wall Street have moved higher on encouraging economic signs from the chip industry. In a risk-on setting, EUR/USD has traveled from a low of 1.0823 to a high of 1.0926 so far as investors grew more confident that recent stress in the banking sector would be contained.

The banking turmoil in the collapse of two regional US lenders had sparked concerns about contagion in the banking sector which led to a dramatic shift in monetary policy expectations from the Federal Reserve. Meanwhile, according to CME Group's Fedwatch tool, bets are now almost equally split between a pause and a 25-basis-point rate hike by the Fed in May,

For further insight, investors are awaiting the February reading of personal consumption expenditures (PCE) on Friday and this is the Fed's preferred inflation gauge. January figures showed a sharp acceleration in consumer spending so the data will be closely eyed.

Meanwhile, US data on Thursday showed that jobless claims last week rose more than expected from the week before indicating a cooling labor market, while fourth-quarter Gross Domestic Product growth was slightly lower at 2.6% compared with earlier estimates of 2.7%, both supporting the case for a softer Fed policy.

-

19:01

Silver Price Analysis: XAG/USD breaks two-month resistance trendline, pierced $23.90

- XAG/USD is upward biased from a daily chart perspective, and it might test the YTD high at $24.63.

- XAG/USD is in a solid uptrend, supported by oscillators at bullish territory.

- XAG/USD may experience a downside if it falls below $23.50, as it could drop toward the S1 pivot point.

Silver price broke a two-month resistance trendline, reaching a new 8-week high of $23.92 due to overall US Dollar (USD) weakness and falling US Treasury bond yields. Therefore, the XAG/USD is trading at $23.74, up more than 2%, after hitting a low of $23.24.

XAG/USD Price action

From a daily chart perspective, the XAG/USD is upward biased and might soon test the YTD high at $24.63 once it reclaimed the $23.50 figure. But firstly, Silver buyers need to reclaim the $24.00 figure, ahead of challenging YTD highs. The Relative Strength Index (RSI) at overbought conditions continues to aim higher, while the Rate of Change (RoC) portrays buyers in charge. If XAG/USD fails to break $24.00, that could pave the way for a pullback.

In the short term, the XAG/USD 4-hour chart portrays the white metal in a solid uptrend, testing the R3 daily pivot point at $23.83 after hitting a daily high of $23.92. If the XAG/USD conquers $24.00, that will expose the YTD high. The Relative Strength Index (RSI) justifies an upward continuation at bullish territory, while the Rate of Change (RoC) does it too.

On the flip side, if the XAG/USD stumbles beneath the R2’s daily pivot at $23.62, it would pave the way for further downside. Hence, the XAG/USD first support would be the R1 pivot point at $23.47, followed by the intersection of the 20-EMA and the daily pivot point at $23.30, before diving towards the S1 pivot point at $23.11.

XAG/USD 4-hour chart

XAG/USD Technical levels

-

18:57

Federal Reserve´s Kashkari: We have to bring down inflation

Minneapolis Federal Reserve President Neel Kashkari said the United States has very high inflation, but it's not being driven by wages.

Key comments

We have to bring down inflation.

Once we get inflation down, we can get back to pre-pandemic economy with low inflation, low unemployment, decent wage growth.

Our bank supervisors at minneapolis fed are focused on interest-rate risk exposure.

Banking stresses tend to take longer than you think to get through.

I'm prepared this could take longer than we expect.

Vast majority of banks have taken interest-rate risk seriously.

Banking system is sound.

What's unclear is how much of banking stresses of past few weeks is leading to a sustained credit crunch.

US debt ceiling needs to be raised.

Hopeful political parties will come together and make sure US can pay its bill.US Dollar update

The DXY, an index that measures the US Dollar vs. a basket of currencies, dropped on Thursday on easing fears about banking sector troubles, encouraging economic signs from the chip industry and rising oil prices. On the weekly DXY chart, the US Dollar is closing in on support and the M-formation, a reversion pattern, could hold up the price from moving much lower at this juncture.

-

18:36

Fed’s Barkin: If inflation persists, we can react by raising rates further

Richmond Federal Reserve President Thomas Barkin said on Thursday that he is content with the current trajectory set by the FOMC of evaluating whether a 25 bps interest rate hike is required at each meeting. According to Barkin, there is a lot of money available for spending among households.

Key quotes:

“The challenge in assessing today’s economy is reconciling the strength of the recent data with the potential for weakness coming from the banking system.”

“Policy will need to be nimble. If inflation persists, we can react by raising rates further. If I am wrong about the pricing dynamics at play, or about credit conditions, then we can respond appropriately.”

“It is possible that tightening credit conditions, along with the lagged effect of our rate moves, will bring inflation down relatively quickly. But I still think it could take time for inflation to return to target.”

“Let me now turn to our most recent meeting. I saw substantial inflationary pressure and a resilient banking system. So, I supported raising rates 25 basis points. I am heavily influenced by the experience of the 70s. If you back off on inflation too soon, inflation comes back stronger, requiring the Fed to do even more, with even more damage. With inflation high, broad-based and persistent, I didn’t want to take that risk.”

“If inflation persists, we can react by raising rates further. It was only a few weeks ago that some were calling for a 50-basis-point increase. And if I am wrong about the pricing dynamics at play, or about credit conditions, then we can respond appropriately.”

-

18:18

Fed´s Collins: More banking sector stress could affect policy outlook

Federal Reserve Bank of Boston leader Susan Collins has crossed the wires saying that the risks to the outlook have increased with the banking stress and said her economic views are close to the Federal Open Market Committee´s forecasts.

Key comments

Economic views close to FOMC forecasts.

Risks to outlook have increased with banking stress.

Inflation expectations data show confidence fed will control inflation.

Still seeing labor market strength, wage pressures key for inflation.

Job market data may be lagging indicator right now.

Paying greater attention to banking sector issues.

Banking stress will make some firms more conservative in activities.

Before banking stress, had expected Fed to raise rates more than prior projection.

More banking sector stress could affect policy outlook.US Dollar update

The US Dollar declined on Thursday on easing fears about banking sector troubles, encouraging economic signs from the chip industry and rising oil prices. On the weekly DXY chart, the US Dollar is closing in on support and the M-formation, a reversion pattern, could hold up the price from moving much lower at this juncture.

-

18:00

Egypt CBE Interest Rate Decision in line with forecasts (18.25%)

-

17:46

USD/MXN trades at around 18.1000 despite US Dollar weakness, ahead of Banxico’s decision

- USD/MXN remains depressed, falling 3.54% weekly due to the Mexican Peso’s strength.

- The rise in US unemployment claims cement the case for a Federal Reserve’s pause as the labor market cools.

- The Bank of Mexico is expected to raise rates by 25 bps, and then a pause is foreseen.

In the North American session, the USD/MXN is almost flat on Thursday after the Mexican Peso (MXN) failed to push through the 18.00 figure. However, the Mexican currency prints gains vs. the US Dollar (USD) of 3.54% amidst ongoing optimism amongst investors that the US Federal Reserve will end its tightening cycle. The USD/MXN is trading at 18.0860.

USD/MXN is almost flat, with traders awaiting Banxico’s move

Sentiment remains upbeat as Wall Street trades in the green. The greenback continues to weaken to fresh weekly lows, as shown by the US Dollar Index (DXY), but MXN bulls stay on the sidelines, awaiting Banxico’s decision.

Data from the United States (US), amongst other reasons, keep the US Dollar pressured. Initial Jobless Claims for the week ending March 25 jumped by 198,000, higher than the predicted 196,000, the Department of Labor (DoL) reported. Meanwhile, the US Commerce Department disclosed the final reading of the Gross Domestic Product (GDP) for Q4 2022, which fell slightly below the estimated 2.7% at 2.6%.

The rise in US unemployment claims is more than welcomed by the Federal Reserve as it scrambles to curb elevated inflation. If the labor market continues that trend, that will help to drop inflation. However, it’s premature to call victory, as the Fed’s preferred gauge for inflation will be revealed on Friday. The Core Personal Consumption Expenditure (PCE) is estimated at 4.7% YoY.

On the Mexican front, most analysts expect Banxico’s last interest rate hike of its tightening cycle of 25 bps, leaving the TIIE at 11.25%. TD Securities Senior Latam Strategist Joel Virgen Rojano wrote in a note, “We expect Banxico to hike in 25bps on March 30 and hit terminal at 11.25%. We think the bar is high for the central bank to contradict its own forward guidance once again.”

Regarding the future of the Mexican Peso after Banxico’s decision, Virgen Rojano added, “We do not expect a meaningful MXN reaction to Banxico’s decision as we think it has been mostly priced in. However, we expect a gradual weakening of MXN against the USD in the coming months

USD/MXN Technical levels

-

16:34

United States 4-Week Bill Auction increased to 4.6% from previous 4.15%

-

16:22

USD/CAD slips as risk appetite improves, US Dollar weakens on Fed’s pausing in May

- USD/CAD approaches the 100-day EMA at 1.3520, yet shy of testing it.

- US Bureau of Labor Statistics (BLS) reveals unemployment claims rise above estimates.

- US GDP for Q4 2022 slides a tick below expectations at 2.6%.

USD/CAD stumbles below the 50-day Exponential Moving Average (EMA) spurred by a risk-on impulse, as shown by Wall Street opening in the green. Market participants estimated that the US Federal Reserve (Fed) would not hike rates at the May meeting while the buck weakens. At the time of typing, the USD/CAD is trading at 1.3528, below its opening price by 0.22%.

USD/CAD falls on US unemployment claims rising, easing the Fed’s job

The Canadian Dollar (CAD) strengthened for the fourth straight day, with the USD/CAD tumbling below 1.3600 for the first time since March 7. The greenback’s fall continued after the US Bureau of Labor Statistics (BLS) revealed unemployment claims. Initial Jobless Claims for the week ending on March 25 rose 198K, above estimates of 196K.

At the same time, the US Commerce Department revealed the Gross Domestic Product (GDP) for Q4 2022 on its final reading, it came a tick below 2.7% estimates, at 2.6%

The US labor market data is a relief for the Federal Reserve, as the central bank is trying to curb stickier inflation levels above 6%. If the labor market continues to cool down, that will ease inflationary pressures. Nevertheless, the Fed’s preferred gauge for inflation will be revealed on Friday. The Core Personal Consumption Expenditure (PCE) is estimated at 4.7% YoY. Readings above the consensus could open the door for additional rate increases, meaning that the US Dollar (USD) could appreciate in the near term; hence further upside in the USD/CAD can be expected.

Nevertheless, the USD/CAD has held below 1.3600 on rising oil prices. WTI, the US crude oil benchmark, is increasing 1.88%, at $74.16 PB, a headwind for the USD/CAD. A good part of Canada’s economic growth is linked to oil and natural gas exports.

On the Canadian side, January’s Gross Domestic Product (GDP) is expected at 0.3% MoM. Analysts at TD Securities noted, “We look for industry-level GDP to rise by 0.4% m/m in January, in line with the market consensus and slightly above flash estimates for a 0.3% gain. Details should reveal broad-based strength across goods and services, and if realized, our forecast would leave Q1 GDP tracking further above BoC projections of 0.5%.”

USD/CAD Technical analysis

Despite the recent four-day pullback, the USD/CAD is still neutrally biased. Sellers need to drag prices below the 50-day EMA at 1.3520, which would open the door to testing 1.3500. Further downside below the figure will expose the 200-day EMA at 1.3369. But if USD/CAD buyers step in around 1.3500, the USD/CAD could test the 20-day EMA at 1.3648 in the short term.

-

16:15

USD/CHF hits weekly lows under 0.9150, approaches key long-term support

- Spain and German inflation declined YoY, but core prices still stubbornly high.

- US Dollar under pressure on risk appetite, Treasuries drift sideways.

- Further weakness in the Dollar could send USD/CHF to test the 0.9050 area.

The USD/CHF is losing over 50 pips on Thursday following Spain and Germany's preliminary Consumer Price Index (CPI) numbers and US Jobless Claims. The pair bottomed at 0.9124, the lowest level in a week.

After the beginning of the American session, USD/CHF staged a recovery to 0.9145 but it is back at 0.9130, showing that the bearish pressure persists.

Economic data on Thursday showed mixed numbers regarding inflation in the Eurozone. Spain's CPI figures came in below expectation, while the German annual CPI declined to 7.4% YoY, above the 7.5% of market consensus.

European markets are rising, with main indexes up by more than 2%. Wall Street is also rising, but off recent highs. The improvement in market sentiment weighs on the US Dollar. The DXY is falling 0.48%, approaching 102.00.

Crucial level back in the radar

The pair is headed toward the lowest daily close in two weeks and again looks at the long-term critical support area of 0.9050.

If Dollar's weakness persists, USD/CHF could drop to test the critical area. A break below, would expose 0.9000, and could open the door to significant losses ahead. At the same time, levels near 0.9050 have triggered sharp rebounds in 2023, and also during the fourth quarter of 2021.

Technical levels

-

15:59

Gold Price Forecast: XAU/USD year-end target raised to $2,000 – Commerzbank

Gold price has given back some of its gains of the past two weeks. However, economists at Commerzbank consider the further correction potential to be limited, which is why they have raised their forecast for XAU/USD.

XAU/USD unlikely to fall back toward $1,800 in the foreseeable future

“Markets seem to have calmed somewhat. As a result, the Gold price has given back some of its gains. However, we do not believe that it will fall back to its starting levels of around $1,800 in the foreseeable future.”

“We estimate that the corridor for the Fed Funds rate could be raised further by a total of 50 bps to 5.25-5.50% in the next months. However, the decisive factor is that the market is likely to realize that, contrary to its current expectations, the Fed will not lower its interest rates this year. Due to the need for a correction of market expectations, we expect the Gold price to fall to around $1,900 (previously $1,800) in the coming months.”

“However, rate cut speculations are likely to return and drive the Gold price upwards on a sustained basis as soon as US inflation has fallen more sharply and the significantly higher interest rates are felt more strongly in the real economy. This should be the case in the second half of the year, which is why we continue to expect XAU/USD to rise then. We have even raised our year-end forecast from $1,950 to $2,000.”

-

15:34

US Core PCE: Banks Preview, inflation still too hot

The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (Core PCE), will be released by the US Bureau of Economic Analysis on Friday, March 31 at 12:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of seven major banks.

Core PCE is expected to stay at 4.7% year-on-year while rising 0.4% in February (MoM). The headline is seen increasing by 0.2% in February, and a slowdown in the annual rate from 5.4% to 5.3%.

Deutsche Bank

“We see a +0.36% advance for the core PCE in February and MoM declines for both income (-0.1% vs +0.6% in January) and consumption (-0.6% vs +1.8%).”

CIBC

“The Fed’s preferred gauge of inflation, core PCE prices, likely decelerated to a 0.4% monthly pace, slightly slower than its CPI counterpart given the lower weight of shelter in the index, but still too hot to reach on-target inflation, and justifying the Fed’s decision to raise rates further in March. We are roughly in line with the consensus, which should limit any market reaction.”

Citi

“Core PCE inflation should rise 0.31% MoM in February based on details of CPI and PPI, a softer increase than in January but with core PCE YoY moderating only slightly to 4.6% and with risks of a print that remains at 4.7%. Some strong details of CPI will still be supportive of PCE inflation, including persistently strong shelter prices. Meanwhile, we continue to pencil in modestly stronger core PCE prints than CPI for much of this year due to the strength in key non-shelter services prices.”

TDS

“We expect core PCE price inflation to slow down from a robust 0.6% MoM in Jan to a still-strong 0.4% in Feb (also below core CPI's 0.5% MoM gain). The YoY rate likely rose a tenth to 4.8%, suggesting the path to normalization in price gains will be bumpy. Conversely, personal spending likely fell, but that would follow an eye-popping 1.8% surge in the prior month.”

NBF

“The annual core PCE deflator may have stayed unchanged at 4.7%.”

Wells Fargo

“We forecast the PCE deflator (+0.4%) to outpace nominal spending (+0.3%).”

Credit Suisse

“We expect the monthly reading to just round down to 0.3%, leaving YoY core inflation unchanged at 4.7%. Monthly headline inflation should be similar to core, but the YoY measure should drop to 5.1% owing to an easy base effect.”

-

15:30

United States EIA Natural Gas Storage Change above forecasts (-54B) in March 24: Actual (-47B)

-

15:18

Nasdaq 100 to remain capped at key price and retracement resistance at 12856/81 – Credit Suisse

Nasdaq 100 strength has extended. However, economists at Credit Suisse expect the index to move back lower from the 12856/81 resistance zone.

Weekly close above 12856/81 would suggest a more meaningful move higher can emerge

“We continue to look for the key resistance from the 38.2% retracement of the 2021/22 fall and YTD high at 12856/81 to cap to define the top of a broad range.”

“Near-term support moves to 12407, below which can add weight to our view for a fall back to the key 63 and 200-DMA cluster at 11963/05. Below 11695 is needed to warn of a falll back to the ‘neckline’ to the small base from the beginning of the year at 11093.”

“A weekly close above 12856/81 would instead suggest a more meaningful move higher can emerge for resistance next at the 50% retracement and summer 2022 high at 13603/721.”

-

15:00

USD/MXN could break below 18.00 as Banxico hikes and oil stays supported – ING

Economists at ING think the Mexican Peso’s bullish momentum may have further to run.

25 bps hike by Banxico, and maybe a break below 18.00

“Today, Banxico will announce monetary policy and we expect a 25 bps rate hike to 11.25%. “Market pricing suggests investors have already scaled back expectations for additional Banxico tightening beyond today’s hike. If anything, leaving the door open for more tightening if needed as the Bank reiterates its resolution to fight inflation might see some positive impact on the MXN.”

“We think MXN remains attractive in an environment where markets favour currencies with high carry and positive exposure to rebounding crude prices.”

“A break below 18.00 in USD/MXN may be on the cards soon, potentially today on a hawkish surprise by Banxico.”

-

14:35

USD Index to end the year lower at 98 – ANZ

Year-to-date, the US Dollar has been whipsawing from positive to negative on the back of multi-sigma moves in the rates markets. Economists at ANZ Bank expect the US Dollar Index (DXY) to plummet toward 98 by the end of the year.

US growth to slow

“We expect a slowdown in US growth on the back of recent events which reinforce our view of a weaker Dollar this year.”

“A steeper yield curve tends to correlate with a weaker Dollar, especially as interest rate cuts are now being priced in.”

“Our year-end forecast for the US Dollar Index is 98.”

-

14:32

US Treasury Sec. Yellen: Banking system is sound, even as it has come under pressure

US Treasury Secretary Janet Yellen will tell at National Business Economics Association on Thursday that recent development in the banking industry remains them the “urgent need” to complete unfinished post-crisis reforms. “The US banking system is sound”:

In prepared remarks, she called Congress to raise or suspend the debt limit and also spoke about stable-coin.

Key quotes from the speech:

"Financial stability is a public good. Government plays a fundamental role in the provision of financial stability, as the costs of systemic failure are externalized to the broader society."

“During the COVID pandemic and again this month, the proverbial fire department had to be called – in the form of interventions by the Fed, FDIC, and Treasury. These events remind us of the urgent need to complete unfinished business: to finalize post-crisis reforms, consider whether deregulation may have gone too far, and repair the cracks in the regulatory perimeter that the recent shocks have revealed.”

“Today, the U.S. banking system is sound, even as it has come under pressure. The new Fed facility and discount window lending are working as intended to help banks meet the needs of all of their depositors. The capital and liquidity positions of the overall system remain at strong levels.”

“Let me be clear: this month’s developments have been very different than those of the Global Financial Crisis. Back then, many financial institutions came under stress due to their holdings of subprime assets. We do not see that situation in the banking system today.”

“The strong actions we have taken ensure that Americans’ deposits are safe. And we would be prepared to take additional actions if warranted.”

“It's also important that we reexamine whether our current supervisory and regulatory regimes are adequate for the risks that banks face today. We must act to address these risks if necessary.”

“We’ve been focused on mitigating systemic risks from the use of leverage at hedge funds and similar funds. Hedge fund gross assets in 2021 reached almost $10 trillion, up more than 50 percent since 2016. Hedge funds playing bigger role in U.S. Treasury market.”

“Recommended that Congress enact legislation to establish a comprehensive prudential regulatory framework for stablecoin issuers. Such a framework would include consolidated federal supervision, requirements for how a coin could be backed, capital and liquidity requirements, and restrictions on affiliation with commercial companies.”

“We have existing consumer and investor protection standards in traditional financial markets. These same principles and protections should apply in markets for crypto-assets.”

“This catastrophe is preventable. Congress must raise or suspend the debt limit. It should do so without conditions – and without waiting until the last minute.”

-

14:20

GBP/USD climbs to new multi-week highs around 1.2380

- GBP/USD gathers fresh upside traction and approaches 1.2400.

- The greenback accelerates losses and trades closer to 102.00.

- US final Q4 GDP Growth Rate disappointed estimates.

Further losses in the greenback allow GBP/USD to pick up extra pace and reach the 1.2380 region, or multi-week highs, on Thursday.

GBP/USD stronger on USD-selling

GBP/USD sees its upside pressure intensify on the back of the persistent selling pressure in the greenback and the solid improvement in the risk complex on Thursday. The marked knee-jerk in the dollar came in response to higher-than-expected inflation figures in Germany, which could reinforce the case for further tightening by the ECB as soon as at the May gathering.

In the meantime, price action around the British pound appears underpinned by the better tone among its risk-linked peers, while the continuation of the hiking cycle by the BoE should offer some extra support to the quid despite the "Old Lady" could be approaching its peak on rates.

There were no data releases across the Channel on Thursday, while US GDP Growth Rate expanded below consensus 2.6% YoY in Q4 and Initial Jobless Claims rose by 198K in the week to March 25.

GBP/USD levels to consider

As of writing, the pair is gaining 0.40% at 1.2361 and the breakout of 1.2380 (monthly high March 30) would open the door to 1.2447 (2023 high January 23) and then 1.2666 (monthly high May 27 2022). On the other hand, the next support emerges at 1.2160 (55-day SMA) followed by 1.2010 (weekly low March 15 and finally 1.1892 (200-day SMA).

-

14:19

South Africa SARB Interest Rate Decision registered at 7.75% above expectations (7.5%)

-

14:10

USD/CAD: Clear push under 1.35 to solidify prospects for a substantial drop toward 1.33/1.34 – Scotiabank

CAD extends gains to a one-month high on the USD. Shaun Osborne, Chief FX Strategist at Scotiabank, expects the USD/CAD pair to plummet toward 1.33/34 on a sustained break under the 1.35 zone.

Backdrop looks CAD positive

“At month-end, there is a risk that CAD gains are related to short-term flows. However, if you combine (relatively extended CAD-bearish) positioning, valuation considerations, CAD-positive seasonals, some (developing) technical momentum and throw in the narrowest WCS/WTI spread in nearly a year and the idea of CAD gains having some sticking power is not so far-fetched. A positive risk backdrop adds to the bullish backdrop for the CAD too.”

“Technical damage has already been done to the USD by spot’s weakness under the 40-Day Moving Average (1.3584) I believe but a clear push under the 1.35 area would solidify prospects for additional CAD gains in the coming weeks towards 1.33/1.34. “

-

14:00

Russia Central Bank Reserves $ up to $594.6B from previous $585.8B

-

13:43

USD/MXN: Peso should quickly retrace its losses thanks to Banxico’s continued hawkish approach – Commerzbank

Esther Reichelt, FX Analyst at Commerzbank, analyzes the outlook for the Mexican Peso following the nervousness in the US banking sector.

Banxico has significant scope for rate cuts in case of a crisis

“If the uncertainties were to continue, contrary to our expectations, putting undue pressure on the US economy this is also likely to critically affect the Mexican economy due to the close ties between the two, which would be reflected in a weaker inflation outlook sooner or later.”

“As Banxico has significant scope for rate cuts in case of a crisis thanks to its aggressive rate hike cycle the peso was amongst the biggest losers as a result of the turbulence in the US banking sector. However, if these fade as our economists expect, MXN should quickly retrace its losses thanks to Banxico’s continued hawkish approach.”

-

13:39

US: Weekly Initial Jobless Claims rise to 198K vs. 196K expected

- Initial Jobless Claims in the US increased by 7,000 in the week ending March 25.

- US Dollar Index continues to push lower toward 102.00.

There were 198,000 initial jobless claims in the week ending March 25, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 191,000 and came in worse than the market expectation of 196,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 198,250, an increase of 2,000 from the previous week's unrevised average.

"The advance number for seasonally adjusted insured unemployment during the week ending March 18 was 1,689,000, an increase of 4,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar struggles to find demand after this report and the US Dollar Index was last seen losing 0.4% on the day at 102.20.

-

13:34

US: Real GDP grows at an annual rate of 2.6% in Q4 vs. 2.7% expected

- The US BEA revised Q4 GDP lower to 2.6% from 2.7%.

- US Dollar Index stays deep in negative territory below 102.50.

The real Gross Domestic Product (GDP) of the US expanded at an annualized rate of 2.6% in the fourth quarter, the US Bureau of Economic Analysis' (BEA) final estimate showed on Thursday. This reading came in below the previous estimate and the market expectation of 2.7%.

"The revision primarily reflected downward revisions to exports and consumer spending," the BEA explained in its press release. "Imports, which are a subtraction in the calculation of GDP, were revised down."

Market reaction

The US Dollar stays on the back foot after this data and the US Dollar Index was last seen losing 0.38% on the day at 102.25.

-

13:31

United States Personal Consumption Expenditures Prices (QoQ) in line with forecasts (3.7%) in 4Q

-

13:31

United States Core Personal Consumption Expenditures (QoQ) above forecasts (4.3%) in 4Q: Actual (4.4%)

-

13:30

United States Gross Domestic Product Price Index in line with forecasts (3.9%) in 4Q

-

13:30

United States Gross Domestic Product Annualized came in at 2.6% below forecasts (2.7%) in 4Q

-

13:30

United States Continuing Jobless Claims registered at 1.689M, below expectations (1.697M) in March 17

-

13:30

United States Initial Jobless Claims above forecasts (196K) in March 24: Actual (198K)

-

13:30

United States Initial Jobless Claims 4-week average: 198.25K (March 24) vs 196.25K

-

13:27

EUR/USD rises to weekly highs near 1.0900 after German inflation data

- Euro hits fresh highs following Eurozone inflation data.

- German preliminary March annual inflation at 7.4%, above 7.3% expected.

- EUR/USD approaches 1.0900, looking bullish while above 1.0820.

The EUR/USD rose further following the release of German inflation figures and climbed to 1.0891, reaching the highest level in a week. The pair remains near the highs, supported by a stronger Euro.

Data released on Thursday showed that inflation in Germany, the Consumer Price Index (CPI), declined to 7.4% YoY in March from 8.7% in February, above the 7.5% of market consensus. The CPI rose 0.8% in March according to the preliminary report, above the 0.7% estimated, matching February’s print.

The data shows a sharp slowdown in the annual rate in Germany, to the lowest since August 2022, but higher than expected. Earlier, Spain surprised with a softer-than-expected CPI. The German 10-year bund yield jumped after the data to 2.35%, the highest level in a week.

In a few minutes, the US will report Jobless Claims and the third estimate of Q4 GDP growth.

Looking at 1.0900

The EUR/USD is approaching the 1.0900 mark. If it holds firm above 1.0905, a test of last week’s high at 1.0929 seems likely. On the contrary, 1.0860 has become a support level, followed by 1.0825.

Technical levels

-

13:08

USD Index remains prone to a push back through last week’s low at 101.92 – Scotiabank

USD remains soft. Shaun Osborne, Chief FX Strategist at Scotiabank, expects the US Dollar Index (DXY) to challenge last week’s low at 101.92.

There is little or no sign that the soft USD tone overall is relenting

“The pro risk mood may be weighing on the USD somewhat and the backdrop of reduced Fed rate hike expectations (to the point of no additional hikes being reflected in OIS swaps from here now) remains.”

“There is a chance that month and quarter-end influences are adding to USD headwinds (but my take is that passive rebalancing at least might cancel themselves out).”

“Broadly, there is little or no sign that the soft USD tone overall is relenting. That implies little upside potential for the DXY from there (resistance for the index is about a point higher than spot at 103.50) while the market remains prone to a push back to – and through – last week’s low at 101.92.”

-

13:04

Germany: Annual HICP declines to 7.8% in March vs. 7.5% expected

- Inflation in Germany declined at a softer pace than expected in March.

- EUR/USD continues to push higher toward 1.0900 after the data.

Inflation in Germany, as measured by the Consumer Price Index (CPI), declined to 7.4% on a yearly basis in March from 8.7% in February. This reading came in higher than the market expectation of 7.3%. On a monthly basis, the CPI was up 0.8%, matching February's print.

The annual Harmonised Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred gauge of inflation, fell to 7.8% from 9.3% in the same period, compared to analysts' estimate of 7.5%.

Market reaction

EUR/USD continues to edge higher following these data. As of writing, the pair was up 0.4% on the day at 1.0886.

-

13:03

Brazil Industrial Output (MoM) meets expectations (-0.3%) in January

-

13:00

Brazil Industrial Output (YoY) below forecasts (1.3%) in January: Actual (0.3%)

-

13:00

Germany Consumer Price Index (MoM) registered at 0.8% above expectations (0.7%) in March

-

13:00

Germany Harmonized Index of Consumer Prices (YoY) above forecasts (7.5%) in March: Actual (7.8%)

-

13:00

Germany Consumer Price Index (YoY) registered at 7.4% above expectations (7.3%) in March

-

13:00

Germany Harmonized Index of Consumer Prices (MoM) came in at 1.1%, above forecasts (0.8%) in March

-

12:53

EUR/USD is within reach of last week’s 1.0930 high – Scotiabank

EUR/USD probes upper 1.08s. Economists at Scotiabank expect the pair to test last week’s high of 1.0930.

Intraday support looks pretty solid at 1.0830

“A firm, short-term bull trend is supporting a positive EUR technical tone on the short-term charts.”

“Intraday support looks pretty solid at 1.0830; bullish trend momentum signals across a range of time frames implies limited downside scope for the EUR and ongoing pressure for gains to extend.”

“The EUR is within reach of last week’s 1.0930 high; above here targets 1.10+.”

-

12:38

EUR/GBP sits near multi-day peak, above 0.8800 mark ahead of German CPI

- EUR/GBP rallies over 50 pips from the 100-day SMA support and jumps to a multi-day peak.

- The ECB’s hawkish outlook boosts the shared currency and remains supportive of the move.

- Bets for further rate hikes by the BoE underpin the British Pound and might cap the upside.

The EUR/GBP cross rebounds swiftly from the 100-day Simple Moving Average (SMA) support, around the 0.8780 area and turns positive for the second successive day on Thursday. Spot prices rally to a four-day peak, around the 0.8820 region during the first half of the European session and seem poised to appreciate further.

The shared currency strengthens across the board after the European Central Bank (ECB), in its Economic Bulletin, noted that inflation is projected to remain too high for too long. This comes on the back of the recent hawkish commentary by several ECB officials and reaffirms bets for additional interest rate hikes in coming months, which, in turn, prompts aggressive short-covering around the EUR/GBP cross.

It is worth recalling that the ECB chief economist Philip Lane reiterated that rates would need to rise several times to make sure inflation comes down to 2%. Adding to this, Slovak central bank chief Peter Kazimir noted the ECB should not change its stance on rates, though advocated the case for slower rises following three straight 50 bps hikes. This reinforces prospects for further policy tightening by the ECB.

The EUR/GBP bulls, meanwhile, seem rather unaffected by softer Eurozone inflation data, which showed that the Spanish Harmonized Index of Consumer Prices (HICP) fell to 1.1% in March from 0.9% recorded in the previous month. Next on tap is the flash German consumer inflation figures, which will play a key role in influencing the Euro and provide some meaningful trading impetus to the EUR/GBP cross.

In the meantime, rising bets for further rate hikes by the Bank of England (BoE) might continue to underpin the British Pound and cap gains for the cross. In fact, the UK central bank Governor Andrew Bailey said earlier this week that interest rates may have to move higher if there were signs of persistent inflationary pressure. This might hold back traders from placing aggressive bullish bets around the EUR/GBP cross.

Technical levels to watch

-

12:27

EUR/USD Price Analysis: Further gains favoured beyond 1.0930

- EUR/USD keeps the weekly bullish tone unchanged on Thursday.

- If the recovery picks up pace it could revisit the 1.0930 zone.

EUR/USD climbs to weekly highs in the 1.0880/85 band on Thursday, extending the bounce for the fourth session in a row.

The likelihood of extra advances appears favoured for the time being. Against that, the pair could now set sail to the March peak at 1.0929 (March 23) prior to a potential test of the 2023 high at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0338.

EUR/USD daily chart

-

12:23

GBP/USD: Key resistance at 1.2445/50 looks reachable in the near-term – Scotiabank

GBP/USD strengthens to mid 1.23s. Cable should retain a firm undertone, in the view of economists at Scotiabank.

Bulls are in control

“The broader outlook remains positive – solid trend momentum and a steady run of higher highs and higher lows on the short-term chart that shows the bulls are in control.”

“Key resistance remains the recent peaks for the pound at 1.2445/50 but that looks reachable in the near-term.”

“Minor resistance stands at 1.2400. Support is 1.2295/00.”

See – GBP/USD: On course to retest and eventually break above the 1.2447/49 highs – Credit Suisse

-

12:18

USD Index Price Analysis: Extra consolidation likely ahead of further losses

- DXY keeps the erratic mood and resumes the decline on Thursday.

- Next on the downside emerges the March low near 101.90.

DXY rapidly fades Wednesday’s uptick and refocuses on the downside amidst the continuation of the choppiness activity so far this week.

In the meantime, it seems the index could face some consolidative range amidst the prevailing bearish stance for the time being. That said, a drop below the monthly low at 101.91 (March 23) should open the door to a potential visit to the 2023 low around 100.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.56, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:15

USD/JPY to settle in the low 130.00’s for now – MUFG

USD/JPY bottom out as systemic banking fears ease. Economists at MUFG Bank expect the pair to stabilize around the 130.00 level.

JPY gives back some of recent gains as banking fears ease

“The reversal of recent Yen gains reflects that investors have become less concerned for now over the risk of a bigger negative systemic shock coming from the banking system although the loss of confidence is expected to result in tighter credit conditions and less lending into the economy than would otherwise have been the case that will put a dampener on the global growth outlook.”

“US rate market participants remain reluctant to price back in further rate hikes for the Fed. It sets a much higher bar for US rates to regain higher levels that were in place prior to the collapse of Silicon Valley Bank earlier this month.”

“We now believe it is more likely that USD/JPY will settle in the low 130.00’s for now rather than quickly retracing its steps back to the high from 7th March at 137.91.”

“JPY should derive more support in the month ahead as well from building speculation over a further shift in YCC policy settings in the run up to new Governor Ueda’s first policy meeting on 28th April. We still expect the BoJ to abandon YCC in Q2 but have recently delayed the timing from the April to June in response to recent banking disruption. However, we are becoming more confident that the BoJ will exit negative rates later this year.”

-

12:05

EUR/JPY Price Analysis: Next on the upside now comes the 2023 high

- EUR/JPY picks up extra pace and trespasses the 144.00 hurdle.

- Extra advance could put the YTD high near 145.60 to the test.

EUR/JPY adds to the weekly optimism and extends the strong rebound north of 144.00 the figure on Thursday, or 2-week peaks.

Following the breakout of the key 200-day SMA (141.80), the cross could now accelerate gains to the 2023 top at 145.56 (March 2). The surpass of this level could motivate the cross to embark on a potential visit to the December 2022 high around 146.70 (December 15).

In the meantime, extra gains remain on the table while the cross trades above the 200-day SMA.

EUR/JPY daily chart

-

12:00

Brazil Inflation Index/IGP-M came in at 0.05% below forecasts (0.15%) in March

-

12:00

USD/ZAR: A retracement toward 18.00 is not ruled out if the SARB comes across as hawkish – SocGen

Economists at Société Générale analyze Rand's outlook ahead of the South African Central Bank meeting.

Positive carry and dovish repricing of the Fed are a boon for the Rand

“We have pencilled in another 25 bps increase to 7.50% today after core inflation unexpectedly accelerated to a 5-year high of 5.2% in February.”

“Our house view is that today may not be the final hike. We have pencilled in a peak of 7.75% in 2Q.”

“The positive carry and dovish repricing of the Fed are a boon for the Rand.”

“A retracement in USD/ZAR towards 18.00 is not ruled out if the SARB comes across as hawkish.”

-

11:59

USD/CAD remains depressed around mid-1.3500s amid softer USD, rising Oil prices

- USD/CAD drifts lower for the fourth straight day and is pressured by a combination of factors.

- The risk-on mood weighs on the USD and acts as a headwind amid a fresh leg up in Oil prices.

- Spot prices find some support ahead of the 100-day SMA as traders look to the US macro data.

The USD/CAD pair remains under some selling pressure for the fourth successive day on Thursday and drops to over a one-month low during the first half of the European session. The pair, however, manages to rebound a few pips in the last hour and is currently placed around mid-1.3500s, down less than 0.10% for the day.

The prevalent risk-on environment - as depicted by an extension of the recent rally in the equity markets - exerts fresh downward pressure on the safe-haven US Dollar (USD) and turns out to be a key factor acting as a headwind for the USD/CAD pair. The takeover of Silicon Valley Bank by First Citizens Bank & Trust Company helped calmed market nerves about the contagion risk. Furthermore, no further cracks have emerged in the banking sector over the past two weeks, which suggests that a full-blown banking crisis might have been averted and drives flows away from traditional safe-haven assets, including the Greenback.

Apart from a modest USD weakness, a fresh leg up in Crude Oil prices underpins the commodity-linked Loonie and contributes to the offered tone surrounding the USD/CAD pair. A surprise drop in US Crude stockpiles to a two-year low and concerns about tightening global supplies assist the black liquid to regain positive traction following the overnight pullback from over a two-week high. In fact, the Energy Information Administration reported an unexpected fall in US inventories to a two-year low

during the week of March 24. Moreover, exports from Iraq's northern region remain halted and lend support to Oil prices.The USD/CAD pair, however, manages to find some support ahead of a technically significant 100-day Simple Moving Average (SMA) as traders keenly await the US inflation data due on Friday. The US Core PCE Price Index - the Fed's preferred inflation gauge - will play a key role in influencing market expectations about future rate hikes. This, in turn, will drive the USD demand and provide a fresh directional impetus to the major. In the meantime, traders on Thursday will take cues from Thursday's US economic docket, featuring the release of the final Q4 GDP print and the usual Weekly Initial Jobless Claims data.

Technical levels to watch

-

11:36

EUR/USD set retest the 1.1035 YTD high after consolidation phase – Credit Suisse

EUR/USD is expected to see an eventual break above its downtrend from May 2021 and 50% retracement at 1.0931/44, analysts at Credit Suisse report.

Break under 1.0750/14 would warn of a fall back toward 1.0590

“Whilst we see scope for further consolidation beneath key resistance from the 50% retracement of the 2021/2022 fall and downtrend from May 2021 at 1.0931/44, we continue to look for an eventual break for a retest of the 1.1035 YTD high. Whilst this should continue to be respected, we see no reason not to look for an eventual break for a test of 1.1185/1.1275 – the 61.8% retracement and March 2022 high.”

“Support at 1.0750/14 now ideally holds. A break would warn of a fall back to the uptrend from last September, currently at 1.0590.”

-

11:18