Notícias do Mercado

-

22:41

EUR/USD Price Analysis: Drops below 1.09 as double top forms, threatening to negate a triple bottom

- A triple bottom in the EUR/USD daily chart remains in play but at a brisk of being negated.

- EUR/USD’s price action during the last couple of weeks created a double top, which could shift the pair’s bias.

The Euro (EUR) drops from around weekly highs of 1.0925 on a buoyant US Dollar (USD) and on buyers’ failure to crack the YTD high at 1.0929. Nevertheless, a triple bottom in the daily chart is intact, at the brisk of being negated. At the time of writing, the EUR/USD is trading at 1.0842.

EUR/USD Price action

Failure to hold prices above the 1.0900 figure has exposed the EUR/USD to further selling pressure. A triple bottom in the daily chart remains in play. But, the upward movement was capped at around March’s 23 high of 1.0929, ahead of testing 1.1000.

For a bullish resumption, EUR/USD buyers must reclaim 1.0900, followed by 1.0929. Break above will expose the 1.1000 figure, followed by the YTD high at 1.1032.

Another scenario has developed in the last couple of weeks. Albeit a “triple bottom” is in place, the formation of a double top emerged. Hence, if the EUR/USD continues to dive further and achieves a daily close below the March 24 swing low of 1.0713, it would pave the way to test 1.0500.

Backing up the latter scenario are oscillators. The Relative Strength Index (RSI), although at bullish territory, its slope turned downwards, while the Rate of Change (RoC) shifted neutral.

EUR/USD Daily chart

EUR/USD Technical levels

-

21:56

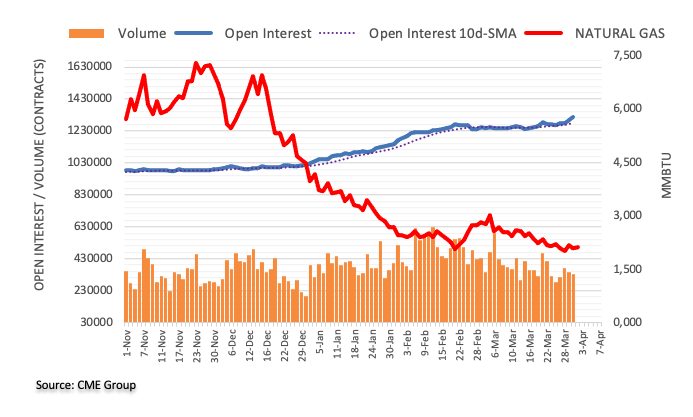

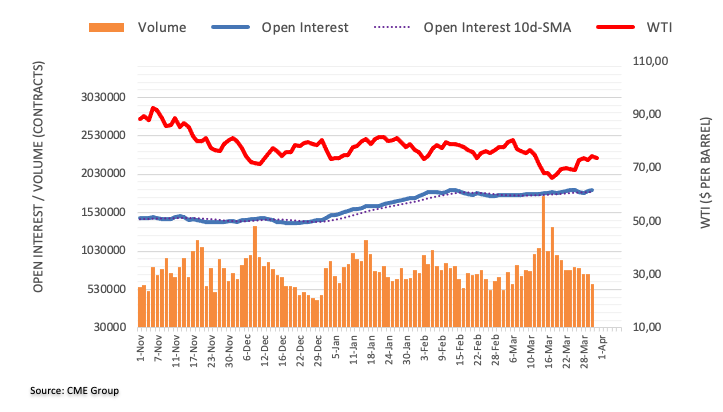

WTI surges from YTD lows and gains more than 9% in the week

- US Department of Commerce reported that PCE was below estimates, spurring speculations for a Fed shift.

- Oil prices rise after output reduction at several oilfields in northern Iraq’s Kurdistan region.

Western Texas Intermediate (WT), the US crude oil benchmark, is set to finish the week with more than 9% gains after touching a YTD low of $64.41. On Friday, WTI is trading at $75.60 PB, above its opening price by 1.74%.

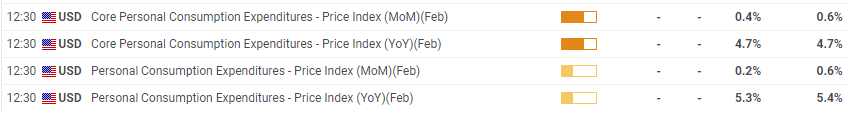

Wall Street finished the week with substantial gains. Inflation data in the United States (US) reported by the Department of Commerce showed that Personal Consumption Expenditure (PCE) Index rose below estimates. Headline inflation came at 5% YoY, below forecasts of 5.3%, and core PCE was 4.6% YoY, below estimates.

Hence, the odds that the US Federal Reserve (Fed) could pause tightening its policy increased. The CME FedWatch Tool shows that the odds for a pause lie at 49.6%. The latest round of inflation data pointing down improved investors’ mood, meaning that less aggressive rate hikes could keep the US Dollar in check.

Oil prices jumped since the halt of Kurdistan oil export through Turkey at the beginning of the week. The total amount of oil shortage was 450K BPD.

In the meantime, according to Reuters sources, the Organization of Petroleum Export Countries (OPEC) agreed to stick to its crude output production at a meeting on Monday.

According to a survey conducted by Reuters, OPEC’s crude oil production for the current month is estimated at 28.90 million barrels per day BPD, which is a decrease of 70K BPD compared to February. Moreover, the current output is more than 700K BPD lower than what was recorded in September.

WTI Technical levels

-

21:32

United States CFTC S&P 500 NC Net Positions: $-224.7K vs previous $-202.5K

-

21:31

Australia CFTC AUD NC Net Positions rose from previous $-38.5K to $-35.4K

-

21:31

European Monetary Union CFTC EUR NC Net Positions up to €145K from previous €144.8K

-

21:31

Japan CFTC JPY NC Net Positions climbed from previous ¥-66.3K to ¥-54K

-

21:31

United States CFTC Gold NC Net Positions climbed from previous $158.6K to $181.6K

-

21:30

United States CFTC Oil NC Net Positions: 181.1K vs 154.3K

-

21:30

United Kingdom CFTC GBP NC Net Positions: £-24.1K vs previous £-20.5K

-

21:23

US: PCE inflation is still hot enough to warrant another rate hike in May – Wells Fargo

After the release of the March Core Persona Consumption Expenditure Price Index, analysts at Wells Fargo still expect the Federal Reserve (Fed) to hike interest rates by 25 bps at its May monetary policy meeting.

Inflation moderates, but Fed's job not yet done

“Inflation is slowing, but only gradually. The core PCE deflator rose slightly less than expected, up just 0.3% in February, and inflation data for January were revised lower as well. This is a positive development, but a win can't yet be declared.”

“The Fed has further work to do to get inflation back to its 2% target. The core PCE deflator is still running well-above target at a 4.9% annualized rate the past three months. We'd summarize the inflation development as a step in the right direction, but we think the elevated readings keep the heat turned up on the Fed, and thus still expect the Fed to hike rates an additional 25 bps at its May monetary policy meeting.”

-

20:59

AUD/USD stumbles on expectations for a Fed pivot after softer US inflation data

- Buoyant US Dollar was the main reason for the AUD/USD’s fall.

- US inflation continues to cool down, while consumer sentiment deteriorated in March.

- TDS Analyst expects the RBA would keep rates on hold, on April’s meeting.

- AUD/USD Price Analysis: Subdued in the near term, awaiting for the RBA’s decision.

The Australian Dollar (AUD) retraces after hitting a weekly high of 0.6738, spurred on the American Dollar (USD) recovery as it got bolstered by weekly, monthly, and quarter-end flows. Wall Street is set to finish the week with gains, while US inflation data could cement the case for a pause in the Fed’s tightening cycle. The AUD/USD is trading at 0.6684, below its opening price by 0.43%.

AUD/USD dwindles below 0.6700 on a buoyant US Dollar

The Fed's preferred inflation gauge, the core PCE published by the US Department of Commerce, increased 4.6% YoY, lower than forecasts and beneath the previous month. Headline inflation was 5%, signaling that the Fed's tightening measures are still curbing inflation.

Susan Collins, President of the Federal Reserve Bank of Boston, expressed approval for the news but emphasized that the Fed still has work to accomplish.

The University of Michigan's (UoM) Consumer Sentiment on its final March reading was 62, worse than expected. At the same time, inflation expectations dropped. For the one-year horizon, American consumers forecast inflation at 3.6%, while for the 5-year horizon, inflation estimations dipped to 2.9%.

Of late, the New York Fed President John Williams said that an uncertain economic outlook and economic data would drive monetary policy. Williams expect inflation to drop to 3.5%, and the Gross Domestic Prodcut (GDP) to contract slightly before rebounding in 2024.

On inflation data, the AUD/USD reacted upwards to 0.6718 before reversing its course, fell sharply below the 0.6700 figure, and printed a daily low of 0.6670. Since then, the AUD/USD stabilized at around 0.6686.

On the Australian front, inflation data would give cues regarding the Reserve Bank of Australia’s (RBA) forward path. The TD Securities Inflation for February was 6.3% YoY, and any readings below the latter can discourage the RBA from continuing to tighten monetary conditions.

TDS expects an RBA’s pause on its tightening campaign

TD Securities Analysts in a note, “The Apr meeting is a close one, with analysts mixed about the RBA decision and markets pricing in no hike from the RBA. We now expect the Bank to pause at the April meeting given the lower Jan-Feb CPI prints and uncertainty over the outlook from the banking turmoil in the near-term.”

AUD/USD Technical analysis

The AUD/USD is trading sideways, as shown by its daily chart, though tilted to the downside. For a bearish continuation, sellers need to reclaim the March 24 swing low at 0.6625, exposing the YTD lows at 0.6564. Once cleared, and the path towards November 10 at 0.6386 is on the cards. On the flip side, if buyers crack 0.6700, that could keep them hopeful that the AUD/USD could test 0.6800 in the near term.

What to watch?

-

20:56

Canada Employment: More modest gains in the coming months – NFB

Next Thursday, the Canadian employment report will be released. Analysts at National Bank of Canada expect a gain of 10,000 in jobs in March.

Key quotes:

“In Canada, March’s Labour Force Survey will be watched closely. The job market has been extraordinarily strong recently, with headcounts expanding by 350,000 over the past 6 months. And while signs of an upcoming reversal remain few and far between, we think such a pace is unsustainable in the medium term.”

“We thus expect more modest gains in the coming months, starting with a +10K result in March. Despite this gain, and assuming that the participation rate remained unchanged at 65.7%, the unemployment rate could still increase by one tenth to 5.1%, the result of yet another sharp expansion of the labor force.”

-

20:24

Fed’s Williams: Expects inflation to decline to around 3.25% this year

Federal Reserve Bank of New York President John C. Williams said in prepared remarks at the Housatonic Community College in Connecticut that the economic outlook is uncertain and that their decision will be driven by the data. He expects real GDP to grow modestly in 2023 and to pick up next year.

Key quotes:

“One aspect of inflation that’s important for achieving and sustaining price stability is the anchoring of inflation expectations. Various measures of longer-run inflation expectations have remained well anchored at levels consistent with our 2 percent goal.”

“While the FOMC has taken decisive steps to bring inflation down, lags exist between policy actions and their effects. It will take time for all of our inflation gears to move at a pace that takes us to our 2 percent target. I expect inflation to decline to around 3-1/4 percent this year, before moving closer to our longer-run goal in the next two years.”

“I expect real GDP to grow modestly this year and for growth to pick up somewhat next year. Slower growth and tighter monetary policy will likely lead to some softening in the labor market. So, I anticipate unemployment gradually rising to about 4-1/2 percent over the next year.”

“The economic outlook is uncertain, and our policy decisions will be driven by the data and the achievement of our maximum employment and price stability mandates. I am confident that our actions will bring inflation down to our 2 percent longer-run goal.”

-

20:09

Fed’s Collins: Tight monetary policy is key to lowering inflation

Federal Reserve Bank of Boston President Susan Collins reached the headlines again on Friday, this time in an interview with Reuters. She said that surprises makes it hard to predict what will happen at the next FOMC meeting in May.

The banking system is in “good shape” despite some “pockets” of trouble said Collins. According to her, actions have restored confidence in the sector. She thanked that the stigma tied to drawing on lending facilities have eased.

Regarding inflation, Collins welcomed the latest Core PCE report but warned that not enough progress has been made. Maintaining tight monetary policy is the key to lowering inflation, explained the Boston Fed President.

Fed's Collins: Need to balance risk that we don't do enough on inflation vs doing too much

-

19:33

Forex Today: Focus shifts to US employment data

A not-so-short week is ahead. Despite the Easter holidays, the US Employment report on Friday warrants action till the last day. The Dollar lost ground again in the last week of March, ending with losses in the first quarter. The short-term trend favors Dollar’s bears, but key data ahead could trigger a correction before it resumes the downside.

Here is what you need to know for next week:

US stocks finished the week, the month and the quarter on a positive note, with solid gains, something that seemed unlikely just three weeks ago when the Silicon Valley Bank (SVB) was closed by financial regulators.

The improvement in market sentiment weighed on the US Dollar, which lost ground across the board, at a moderate pace. Government bond yields rose as volatility eased in the Treasury market.

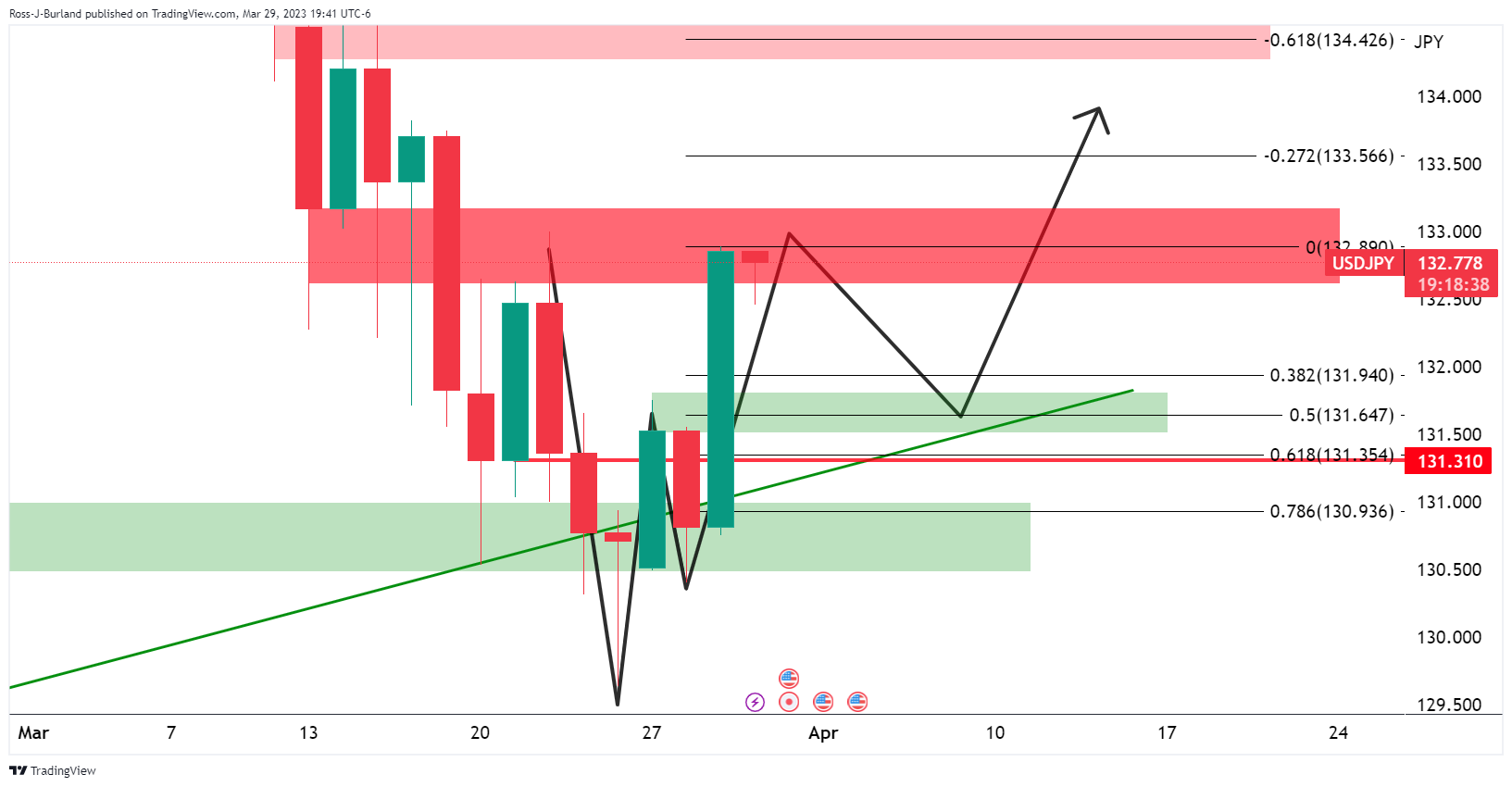

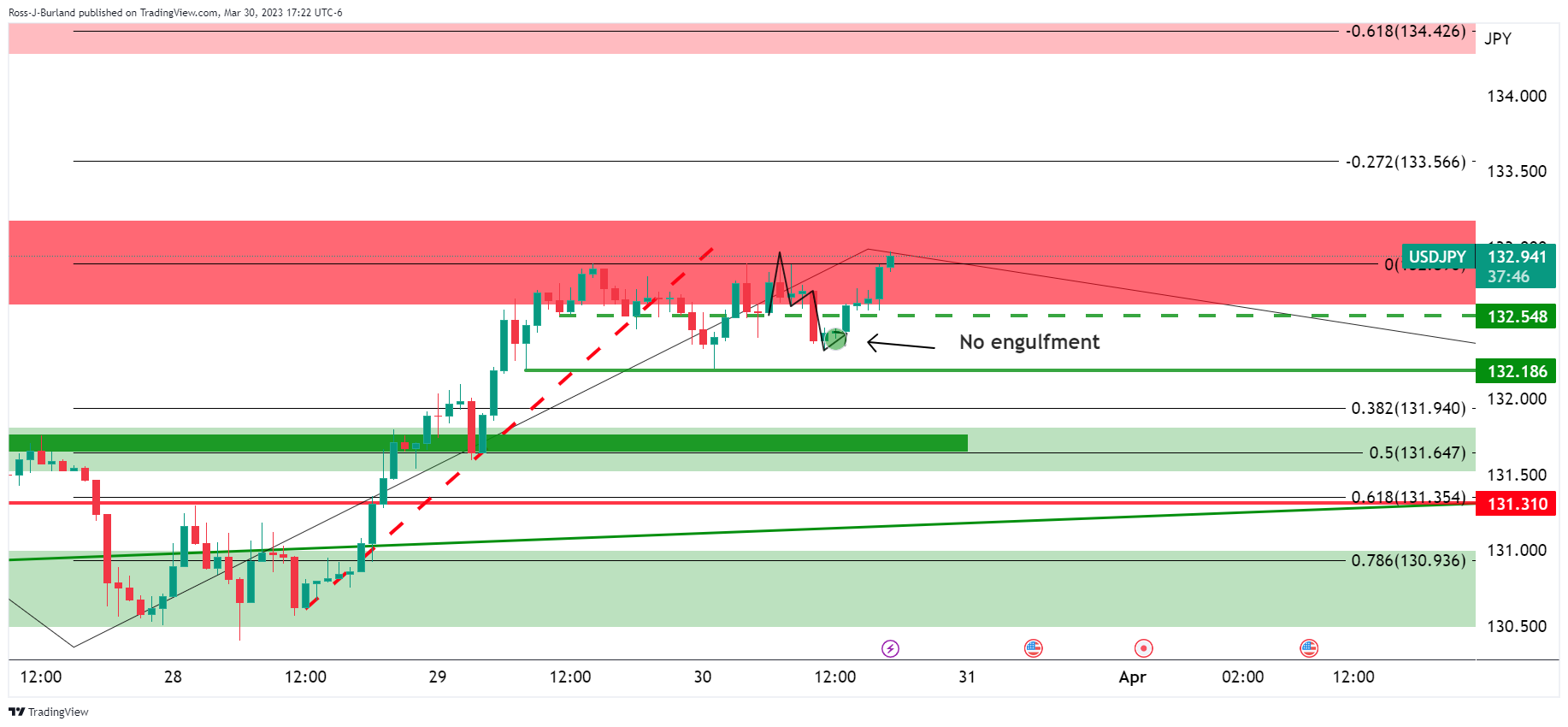

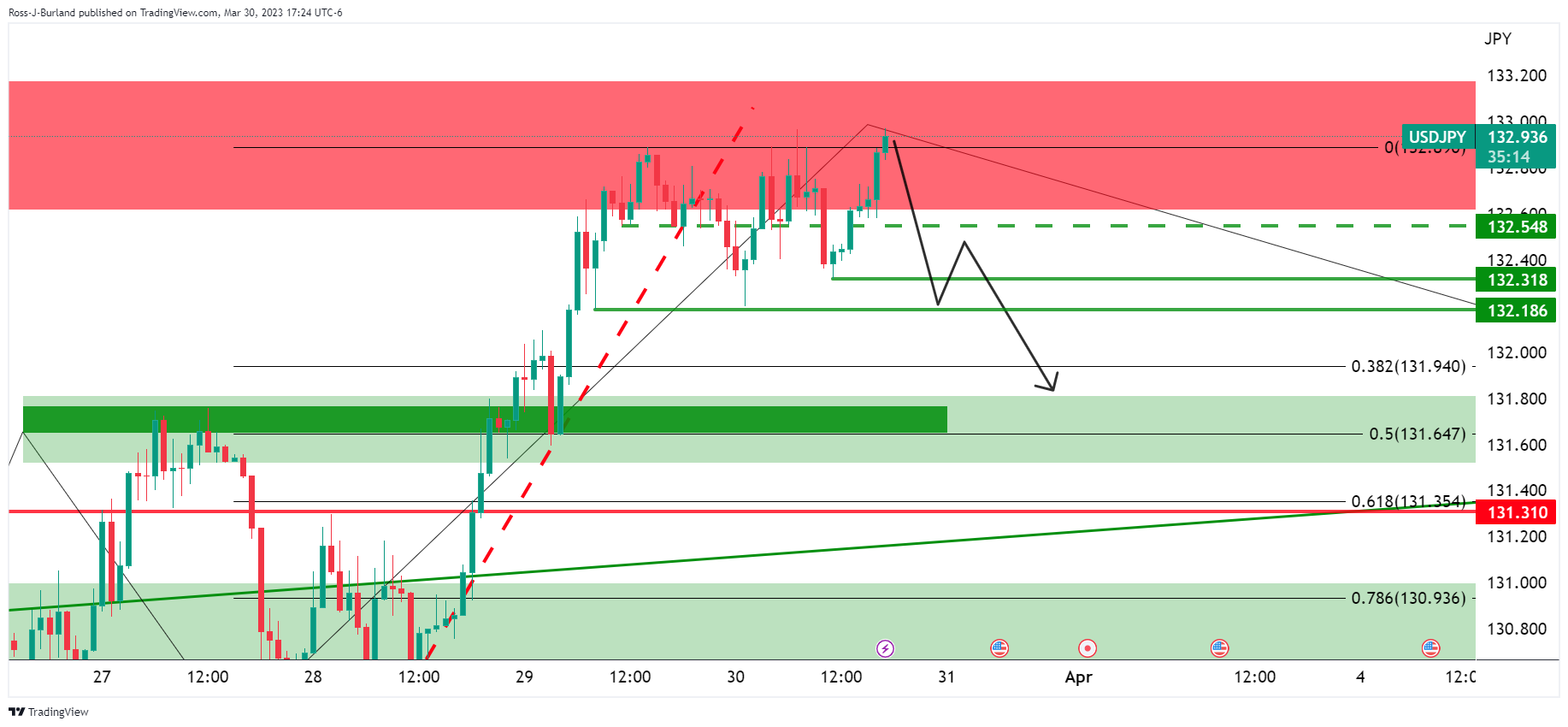

Higher yields and risk appetite sent the Japanese Yen sharply lower, which became the worst performer, falling even against the weak US Dollar. USD/JPY rose 250 pips, to the 20-week simple moving average at 133.50 that capped the upside.

The rally in USD/JPY limited the downside in the US Dollar Index. The DXY posted the third weekly decline in a row and the lowest close since January, around 102.50.

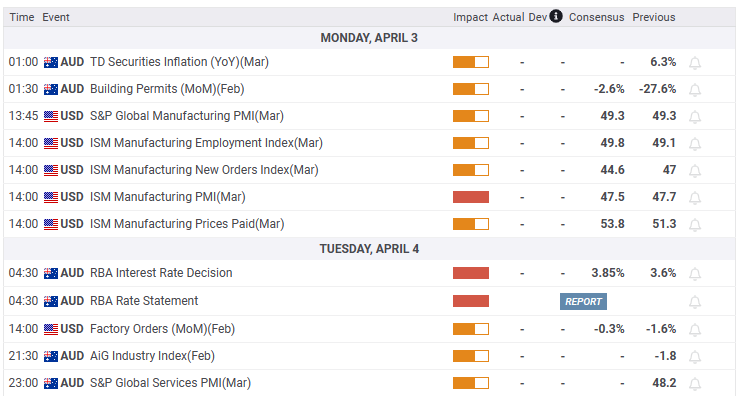

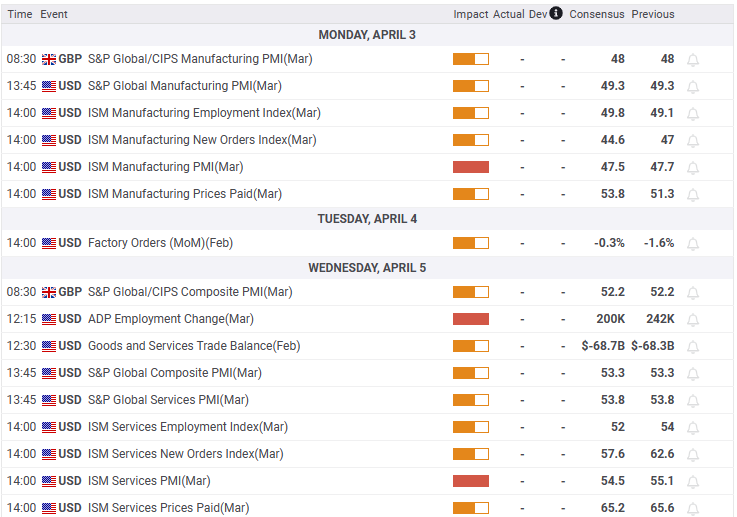

After an inflation-focused week, attention turns to activity and employment data. The March ISM report will help see how the US economy is performing, while the ADP private employment and Nonfarm Payrolls reports will show if the labor market remains tight. Market activity could be subdued because of Easter Holidays, particularly after Wednesday.

The Pound outperformed with GBP/USD rising for the third consecutive week and consolidating above 1.2300. Among the best trades of the week was going long GBP/JPY, which gained 2.50%.

It was a volatile week for the Swiss Franc. USD/CHF approached a key long-term support and then recovered some ground, rising to 0.9150. Next Monday, Switzerland will release inflation data.

AUD/USD posted a small weekly gain as it continued to move sideways. Australian inflation numbers boosted the odds that the Reserve Bank of Australia (RBA) will remain on hold next Tuesday.

NZD/USD rose during the week but once again found resistance around 0.6300. The Reserve Bank of New Zealand (RBNZ) will announce its monetary policy decision on Wednesday.

The Canadian Dollar caught up after lagging for weeks. USD/CAD lost 200 pips, to settle around 1.3540. CAD/JPY rose by 3.35%. Next Thursday, Canada will release its monthly jobs report.

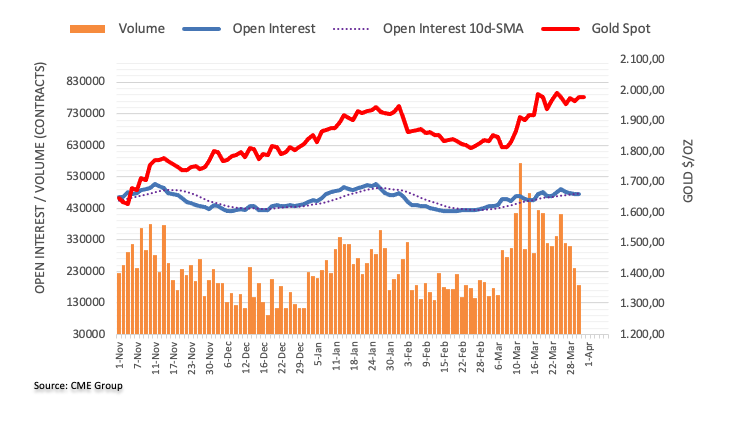

Gold posted another weekly decline as the yellow metal struggles to reclaim the $2,000 level. On the contrary, Silver rose for the third consecutive week, reaching $24.00.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:20

GBP/USD succumbs as market players buy US Dollars on weekly, quarter, and monthly-end flows

- Fed’s favorite inflation gauge signals that cumulative tightening continues to curb inflation.

- University of Michigan’s Consumer Sentiment was worse than expected, though inflation expectations cooled.

- GBP/USD Price Analysis: Above 1.2400 could challenge the YTD high; otherwise, it would remain sideways, at around 1.2300-1.2400.

The Pound Sterling (GBP) traded with decent losses in the mid-North American session, pressured by a resurgence of the US Dollar (USD), trimming its Thursday’s losses. Although inflation data could spur a pivot in the US Federal Reserve (Fed) policy stance, market participants buy the US Dollar as the weekly, monthly, and quarter-end looms. At the time of writing, the GBP/USD is trading at 1.2331.

US inflation edged lower, though Fed officials remain resilient in fighting inflation

US economic data from the Department of Commerce revealed that the Fed’s favorite inflation gauge, the core PCE rose 4.6% YoY, beneath forecasts and a prior’s month reading of 4.7%. Headline inflation was 5%, beneath January’s 5.3%, signaling that the cumulative tightening by the Fed continues to temper inflation.

The Fed Boston President Susan Collins welcomed the news but reiterated that the Fed has work to do. The New York Fed President, John Williams, will cross newswires later.

On other data, the University of Michigan (UoM) showed that Consumer Sentiment on its final March reading was 62, worse than expected. At the same time, inflation expectations dropped. For the one-year horizon, the estimated inflation rate is 3.6%, while for the 5-year horizon, consumers estimate inflation to be 2.9%.

After the US inflation data release, the GBP/USD hovered around 1.2400 before collapsing beneath the central pivot point at 1.2357 and extending its losses towards the 1.2340 area. However, an upward correction was capped at the former, and the GBP/USD resumed its downward trajectory, eyeing a test of the S1 pivot at 1.2320.

On the UK front, the economy expanded by 0.1% in Q4 2022, and by 0.6% YoY, according to data from the Office for National Statistics (ONS).

GBP/USD Technical analysis

From a daily chart perspective, the GBP/USD would remain trading sideways after diving below 1.2400. However, the GBP/USD could consolidate in the 1.2300-1.2400 area before extending its recovery past the 1.2423 YTD high. That would pave the way towards 1.2500, with upside risks at a May 27 high of 1.2666. Otherwise, if the GBP/USD prints a close at around 1.2300, that could form a bearish engulfing candle pattern, setting the major for a pullback toward the 20-day Moving Average (MA) at 1.2213.

What to watch?

-

18:02

United States Baker Hughes US Oil Rig Count declined to 592 from previous 593

-

17:58

Silver Price Forecast: XAG/USD hits new monthly highs above $24.00, driven by falling US bond yields

- XAG/USD surpasses monthly highs amid positive market sentiment, despite the rising US Dollar.

- US Core PCE was below estimates, opening the door for a less aggressive Fed.

- XAG/USD Price Analysis: Expected to continue its rally and test the YTD high of $24.63

Silver price trades at new monthly highs above $24.00 a troy ounce, sponsored by falling US Treasury bond yields. Sentiment continues to be the main driver in the session, with US equities set to finish the month with gains. At the time of writing, the XAG/USD is trading at $24.10, gaining 0.89%.

Fed's Collins welcomed inflation data, but reiterated the Fed's has work left to do

Wall Street continues to print gains across the board. The greenback is pressured by data from the United States (US), which showed inflation tempering; therefore, less aggression by the US Federal Reserve (Fed) is needed.

The Department of Commerce (DoC) featured the Fed’s preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) for February, which rose by 4.6% YoY, below estimates of 4.7%, while the headline inflation dropped from 5.3% to 5% YoY.

Consequently, US Treasury bond yields edged lower, a tailwind for the white metal, which pushed through the $24.00 threshold for the first time since February 2. The US 10-year Treasury bond yield dropped four basis points (bps) at 3.516%, while US Real Yields stood at 1.26% as of March 30.

In the meantime, the University of Michigan (UoM) Consumer Sentiment for March was lower than expected, at 62, as opposed to the foreseen 67. Moreover, the survey updated that American consumers revised their inflation expectations downward. For the one-year horizon, the estimated inflation rate is 3.6%, while for the 5-year horizon, consumers estimate inflation to be 2.9%.

On the central bank side, Boston Fed’s President Susan Collins said that PCE inflation data is positive news, yet there’s still more work to do to bring inflation towards the 2% target.

XAG/USD Technical analysis

Given the backdrop, the XAG/USD is set to extend its rally and test the YTD high at $24.63. The Relative Strength Index (RSI), albeit at overbought conditions, backed the uptrend, while the Rate of Change (RoC) portrays buyers piled around the $22.00 area. The XAG/USD might consolidate as the RSI exits from overbought conditions, as buyers prepare to assault $25.00. if the XAG/USD clears $24.63, the psychological $25.00 barrier would be exposed. Once cleared, on April 18, 2022, resistance at $26.21 is next.

-

16:32

USD/CHF hits weekly low below 0.9120 as US inflation data cools

- USD/CHF drops as US core PCE rose by 4.6% YoY, below the previous month.

- The University of Michigan’s Consumer Sentiment was below expected.

- USD/CHF Price Analysis: Presses toward 0.9100, but sellers struggle to break that support below.

USD/CHF falls to a new weekly low below 0.9126, sponsored by economic data from the United States (US) showing that inflation is cooling down. Hence, bets that the US Federal Reserve (Fed) might pause its tightening cycle, increasing, meaning the greenback would be under pressure. At the time of writing, the USD/CHF is trading at 0.9127, below its opening price.

US core PCE edges lower, cementing the case for a Fed’s pause

The Federal Reserve’s preferred gauge for inflation, the core Personal Consumption Expenditure (PCE), rose by 4.6% YoY, below the previous month’s 4.7%. On a monthly basis, inflation that excludes food and energy rose by 0.3%, below estimates of 0.4%.

Of late, the University of Michigan’s (UoM) Consumer Sentiment was below estimates of 67 and came at 62. According to Joanne Hsu, director of the survey, said, “Overall, our data revealed multiple signs that consumers increasingly expect a recession ahead.” The same study showed that inflation expectations for one year stood at 3.6%, down from 3.8%, while for a 5-year horizon, consumers estimate inflation at 2.9%.

The USD/CHF extended its losses amidst positive news on the US front. Although the Boston Fed President Susan Collins welcomed the data, she said it hadn’t changed her outlook, adding that the Fed has more work to do.

On the Switzerland front, the Swiss National Bank (SNB) continued to tighten monetary conditions when it raised rates by 50 bps on March 23 toward the 1.50% area. Furthermore, Retail Sales in February rose by 0.3% compared with the previous year, giving a leg-down to the USD/CHF pair.

USD/CHF Technical analysis

Even though the USD/CHF continued to press towards the 0.9100 figure, the sellers could not register a decisive break below the latter. Technical indicators like the Relative Strength Index (RSI) and the Rate of Change (RoC) are flat, suggesting that sellers are jumping from the boat. However, if the USD/CHF dives below 0.9100, that would open the door to challenge the YTD low at 0.9059. On the flip side, buyers reclaiming 0.9150 could pave the way for a recovery to 0.9200 and beyond.

-

16:05

Colombia National Jobless Rate meets expectations (12.7%) in February

-

15:59

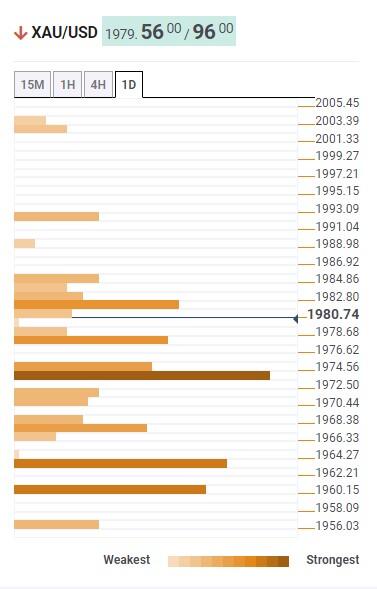

Gold Price Forecast: XAU/USD to hit $2,050 towards year-end – ANZ

Gold is supported by weaker USD and easing inflationary pressures. Economists at ANZ Bank forecast XAU/USD at $2,050 by the end of the year.

Silver to outperform Gold in a rising price environment

“We believe US recessionary fears, easing inflationary pressure and dovish monetary policy will drive Gold’s performance.”

“The macro backdrop will also remain supportive, so any price dips should be short lived, prompting opportunistic buying. We target gold at $2,050 towards year-end.”

“We expect Silver to outperform Gold in a rising price environment.”

-

15:33

EUR/GBP to revisit 0.90 as China reopening favor Euro relative to its European peers – TDS

Economists at TD Securities discuss GBP outlook and expect the EUR/BP pair to hit the 0.90 level.

Data trends favor EUR/GBP higher

“We upgraded our GBP view, underscoring the lift from a weaker USD profile. That said, we still think EUR/GBP revisits 0.90, as China reopening and relative Asian growth outperformance favor EUR relative to its European peers.”

“Domestic fragilities should keep GBP anchored relative to EUR and CHF at least.”

“GBP's growth and inflation mix is still poor relative to EUR, which gets a better terms of trade and China lift.”

-

15:31

US President Biden: We are making progress in the fight against inflation

US President Joe Biden delivered a statement following the February PCE report, highlighting the progress in the “fight against inflation”.

Quotes from the statement:

“We are making progress in the fight against inflation. Today’s report shows annual inflation down by nearly 30 percent from this summer, against a backdrop of low unemployment and steady growth. The fight against inflation isn’t over, and every day my Administration is working to give families more breathing room.”

“In February we saw the lowest food inflation in nearly two years.”

“We should continue to invest in America from the middle out and the bottom up. This is not the time to turn back to trickle-down economics by cutting American manufacturing and other critical programs American families count on, just to pay for tax cuts for the wealthy, Big Pharma, and Big Oil. The last thing our economy needs right now is the reckless threat of a chaotic default. Those threats must be taken off the table.”

-

15:23

US: UoM Consumer Confidence Index drops from 67.0 to 62.0 in March vs. 63.2 expected

- March UoM Consumer Confidence Index revised lower to 62.0 from 63.4 flash estimate.

- Limited impact from turmoil in the banking sector.

- DXY up 0.09% for the day, off highs.

Consumer sentiment in the US weakened in March more than what was previously reported, according to the University of Michigan's (UoM) Consumer Confidence report. The Consumer Sentiment Index was revised from the flash estimate of 63.4 to 62.0 in March, against the market expectation of 63.2. Current Economic Conditions fell from 70.7 in February to 66.3 and the Index of Consumer Expectations declined from 64.7 to 59.2.

“This month’s turmoil in the banking sector had limited impact on consumer sentiment, which was already exhibiting downward momentum prior to the collapse of Silicon Valley Bank. Overall, our data revealed multiple signs that consumers increasingly expect a recession ahead”, said Joanne Hsu, Surveys of Consumers Director.

Regarding inflation, year-ahead expectations “receded from 4.1% in February to 3.6%, the lowest reading since April 2021, but remained well above the 2.3-3.0% range seen in the two years prior to the pandemic.” Five-year expectations came in at 2.9% for the fourth consecutive month.

Market reaction

The US Dollar Index is rising modestly on Friday. It started to move off highs after the US Core PCE March report and it has been trending lower afterwards. As of writing trades at 102.25.

-

15:12

USD/JPY needs more BoJ action to justify a big move lower – SocGen

The Euro needs time, but the Yen still needs change, economists at Société Générale report.

EUR/USD: Waiting for things to calm down before rising

“If/when uncertainty about the global macro and geopolitical backdrop decreases, EUR/USD should move higher. USD/JPY on the other hand needs more BoJ action to justify a big move lower unless Fed easing becomes a realistic short-term prospect.”

“If the BoJ does nothing, and Treasury yields don’t fall, USD/JPY will probably rise. We expect the next policy move in June, which doesn’t really suggest that USD/JPY will break out of its 128-138 year-to-date range.”

“We haven’t changed our forecast of an eventual move to USD/JPY 125, but a more aggressive BoJ adjustment than we expect could see another sharp bout of Yen strength.”

-

15:00

United States Michigan Consumer Sentiment Index below expectations (63.2) in March: Actual (62)

-

15:00

United States UoM 5-year Consumer Inflation Expectation: 2.9% (March) vs 2.8%

-

14:56

USD/CAD: 1.35 support could face a serious test should US data print on the softer side in coming weeks – TDS

The Canadian economy saw a sharp rebound to begin the new year. CAD barely budged following the stronger data. 1.35 should offer key support but could face a serious test should US data falter in the coming weeks, economists at TD Securities report.

CAD GDP starts 2023 on an even stronger foot than expected

“The Canadian economy roared back to life in January with industry-level GDP exceeding the market consensus with a 0.5% gain. Details were even more upbeat, with broad-based growth and new projections for GDP to rise by 0.3% in February.”

“The CAD barely changed following the stronger GDP report. That may be muddled by quarter-end rebalancing flows. That said, USD/CAD has put in a decent reversal in rather short order from 1.38. So, insofar as this data has altered probabilities for BoC pricing, the pair may have already been priced in.”

“For now, we think 1.35 will be key support for USD/CAD but note that the pair still trades moderately rich. Should US data print on the softer side in the next couple of weeks, that support level could face a serious test.”

-

14:45

United States Chicago Purchasing Managers' Index registered at 43.8 above expectations (43.4) in March

-

14:43

GBP/USD recovers modest intraday losses post-US PCE Price Index, flat-lines below 1.2300

- GBP/USD attracts some dip-buying and remains closer to over a two-month high set on Friday.

- The USD pares intraday gains in reaction to softer inflation data and lends support to the pair.

- The fundamental backdrop favours bulls and supports prospects for a further appreciating move.

The GBP/USD pair reverses a dip to the 1.2355-1.2350 region and trades in the neutral territory during the early North American session on Friday. The pair, however, remains below over a two-month high touched this Friday and is currently placed around the 1.2380-1.2385 zone, nearly unchanged for the day.

The US Dollar (USD) trims a part of its intraday gains following the release of the Personal Consumption Expenditures (PCE) Price Index and turns out to be a key factor that assists the GBP/USD pair to attract fresh buyers at lower levels. In fact, the US Bureau of Economic Analysis reported that the headline PCE Price Index decelerated to a 5% YoY rate in February - the slowest pace of rise since September 2021. Adding to this, the Fed's favourite inflation indicator - Core PCE Deflator - edged down to 4.7% during the reported month against consensus estimates pointing to a steady reading of 4.7%.

The data fuels speculations that the Federal Reserve might soon pause the rate-hiking cycle in the wake of the turmoil in the banking sector, which is evident from a fresh leg down in the US Treasury bond yields. This, along with the prevalent risk-on mood, acts as a headwind for the safe-haven Greenback and lends support to the GBP/USD pair. The British Pound is further underpinned by the prospects for additional interest rate hikes by the Bank of England (BoE). The bets were reaffirmed by the UK GDP print, which showed that the economy expanded by 0.1% during the fourth quarter.

The fundamental backdrop favours bullish traders and suggests that the path of least resistance for the GBP/USD pair is to the upside. Hence, any meaningful pullback might still be seen as a buying opportunity and is more likely to remain limited, at least for the time being. Nevertheless, spot prices remain on track to register strong weekly gains and end in the green for the sixth successive week.

Technical levels to watch

-

14:38

Commodities prices to trend higher in 2023 and beyond – UBS

The global commodities sector has come under pressure in March. But strategists at UBS remain most preferred in this asset class.

Playing the long game in commodities

“We continue to see opportunities in longer-dated Brent Oil contracts with a price target of $100/bbl.”

“We also recommend a long Platinum trade, with a price target of $1,150 due to the metal’s close correlation to Gold.”

“We also see opportunities in selling the downside price risks in Crude oil, Copper, Nickel, Gold and Platinum.”

See – Gold Price Forecast: XAU/USD could reach end-March 2024 target of $2,100 earlier than expected – UBS

-

14:27

USD Index retreats from daily highs near 102.50 post-PCE

- The index loses momentum near the 102.50 region.

- US PCE showed further loss of traction in February.

- Final Consumer Sentiment comes next in the docket.

The greenback, in terms of the USD Index (DXY), gives away part of the earlier advance to daily highs in the 102.50/55 band.

USD Index trims gains post-PCE

Following the earlier move to daily peaks near 102.50, the index now comes under some selling pressure after the downtrend in US inflation figures was somewhat “confirmed” by the PCE results.

Indeed, prices tracked by the headline PCE rose 5.0% in the year to February and 4.6% when it comes to the Core PCE. Further data releases showed Personal Income rose 0.3% MoM and Personal Spending increased 0.2% vs. the previous month.

Later in the session, the final readings of the Michigan Consumer Sentiment for the month of March are due.

From the Fed’s backyard, Boston Fed S.Collins was again on the wires after suggesting that other sectors should respond to the tighter monetary conditions in the next quarters at the time when she noted that data indicating a slowing economy is welcomed by the Fed.

In the wake of the PCE release, the probability of a rate hike by the Fed at the May event is slightly favoured vs. a “no hike” according to CME Group’s FedWatch Tool.

What to look for around USD

The index rebounds markedly on the back of some hawkish comments from Fed rate setters as of late, although the persistent disinflation – this time via lower PCE figures – could lend support to a potential pivot in May and thus keep the buck under pressure.

So far, speculation of a potential impasse by the Fed in the short-term horizon should keep weighing on the dollar, although the resilience of the US economy and the hawkish narrative from Fed speakers are all seen playing against that view for the time being.

Key events in the US this week: PCE, Personal Income/Spending, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is advancing 0.21% at 102.38 and faces the next resistance level at 103.36 (55-day SMA) followed by 104.05 (100-day SMA) and then 105.88 (2023 high March 8). On the other hand, the breach of 101.93 (monthly low March 23) would open the door to 100.82 (2023 low February 2) and finally 100.00 (psychological level).

-

14:20

EUR/USD to be at 1.14 at year-end as the ECB’s hawkish stance will provide a tailwind for the Euro – ANZ

Economists at ANZ Bank expect the EUR/USD pair to race higher toward 1.14 by the end of the year.

Relative fundamentals are positive for the EUR vs the USD

“The Euro remains under-valued based on our fair value models and as interest rates between the ECB and Fed narrow, we expect the EUR to outperform.”

“We forecast the EUR/USD to be at 1.14 at year-end as the ECB’s hawkish stance will provide a tailwind for the Euro.”

“While the EUR/USD pair might experience volatility due to the vulnerabilities in the global banking sector, we believe relative fundamentals are positive for the EUR vs the USD.”

-

14:06

USD/MXN to head gradually higher toward 18.70 in Q2 – TDS

Banxico delivered a 25 bps hike, in line with the forward guidance it offered in February. The MXN reacted with a 0.4% depreciation towards 18.12 immediately after the announcement. The decision is in line with TD Securities’ expectation of a weaker MXN in the three-month horizon.

Banxico delivered what was promised

“Banxico hiked the policy rate in 25 bps, in line with our expectation and its forward guidance offered in early February. Despite lack of explicit acknowledgment by the central bank, we think the central bank has reached terminal at 11.25%.”

“Looking forward, the combination of Banxico stopping its hiking cycle and a repricing of idiosyncratic factors is behind our USD/MXN expectation of gradual weakening towards 18.70 in Q2.”

-

14:01

EUR/USD rises toward 1.0900 after US Core PCE

- US February Core PCE inflation comes in at 4.6%, below 4.7% expected.

- US yields hits fresh daily lows, US Dollar weakens.

- EUR/USD erases most of it day’s losses after numbers.

The EUR/USD rose from 1.0866 to 1.0895 following the release of US Core Consumer inflation that came in slightly below expectations. The figures weighed on the US Dollar that lost ground across the board.

The Core Personal Consumption Expenditures Price Index rose 0.3% in February, less than the 0.4% of market consensus to an annual rate of 4.6%, below the 4.7% of January. The PCE Price Index rose 0.3% in February and 5% YoY. The same report showed that Personal income grew by 0.3%, above the 0.2% expected while Personal Spending rose by 0.5%, surpassing consensus of 0.3%

The numbers showed consumer inflation in the US falling slowly. The February core CPE matched the lowest reading in 15 months. Those numbers could be welcome by the Fed, but still shows inflation remains elevated. The Chicago PMI and University of Michigan’s Consumer Confidence will be released later on Friday.

In the Eurozone, the Harmonised CPI came in softer at 6.9% YoY in March, down from 8.5%, below expectations of a drop to 7.1%. The Core CPI steadied at 5.7% YoY.

The US Dollar fell moderately across the board after the report as US yields sank. The 10-year Treasury yield fell from 3.54% to 3.51%, the lowest since Tuesday. The DXY is still up for the day, but it moved off highs.

The EUR/USD moved to the upside, approaching 1.0900. Still it remains below that relevant area. Earlier it peaked at 1.0925, before turning to the downside. It bottomed at 1.0863. On a weekly basis, the pair is heading toward the highest close in a year.

In the short term, the pair is moving with a bullish bias but is being unable to break the 1.0925/30 resistance and shows difficulties holding above 1.0900. Downward correction could find support at 1.0855/60 and 1.0820.

Technical levels

-

14:00

Fed's Collins: Need to balance risk that we don't do enough on inflation vs doing too much

In an interview with Bloomberg TV on Friday, Federal Reserve Bank of Boston President Susan Collins said that they are likely to see at least some impact of banking stress on credit conditions, via Reuters.

Additional takeaways

"We need to balance risk that we don't do enough on inflation vs doing too much."

"Banking stress is certainly a factor."

"There's a pathway to bringing inflation down without a significant downturn."

There were mistakes made on Silicon Valley Bank by the Fed."

"It will still be some time but over coming quarters we should see other sectors responding to tighter monetary policy."

Market reaction

These comments failed to trigger a reaction and the US Dollar Index was last seen gaining 0.15% on a daily basis at 102.32.

-

13:55

USD/CHF to end the year lower at 0.90 – ANZ

Economists at ANZ Bank expect the Swiss Franc to recover and forecast the USD/CHF pair at 0.90 by the end of the year.

Potential to recover after the dust settles

“While the Swiss Franc has struggled in recent weeks, sound domestic fundamentals and a hawkish, activist central bank affords the currency the potential to recover after the dust settles.”

“We see the USD/CHF pair moving to 0.90 by the end of 2023.”

See: Franc is a “safe haven,” but not a perfect one – Commerzbank

-

13:44

USD/JPY retreats further from two-week high, slides below 133.00 post-US PCE Price Index

- USD/JPY retreats from a two-week high, though lacks follow-through selling.

- The USD pares intraday gains on softer inflation data and acts as a headwind.

- The risk-on environment undermines the safe-haven JPY and to lends support.

The USD/JPY pair surrenders a major part of its intraday gains to a two-week high and retreats below the 133.00 round-figure mark during the early North American session on Friday.

The modest intraday US Dollar (USD) uptick loses steam after the US Bureau of Economic Analysis reported that the Personal Consumption Expenditures (PCE) Price Index decelerated to a 5% YoY rate in February from 5.3% previous. Adding to this, the Core PCE Price Index - the Fed's preferred inflation gauge - unexpectedly edged lower to a 4.6% YoY rate from 4.7% in January. The data adds to the uncertainty about the Fed's rate-hike path, which acts as a headwind for the Greenback and prompts some intraday selling around the USD/JPY pair.

Bearish traders further took cues from a modest pullback in the US Treasury bond yields, which results in the narrowing of the US-Japan rate differential and benefits the Japanese Yen (JPY). That said, the underlying bullish tone around the global equity markets - amid easing fears of a full-blown banking crisis - continues to undermine the safe-haven JPY and remains supportive of a mildly positive tone around the USD/JPY pair. This, in turn, warrants caution for bearish traders and before positioning for any meaningful corrective pullback.

Friday's US economic docket also features the release of the Chicago PMI and revised Michigan Consumer Sentiment Index, though might do little to provide any meaningful impetus. Nevertheless, the USD/JPY pair still seems poised to register weekly gains for the first time in the previous five and remains at the mercy of the USD price dynamics heading into the weekend.

Technical levels to watch

-

13:43

Canada: Real GDP expands by 0.5% in January vs. 0.3% expected

- Canadian economy grew at a stronger pace than expected in January.

- USD/CAD clings to small daily gains slightly below 1.3550.

The real Gross Domestic Product (GDP) of Canada grew by 0.5% on a monthly basis in January, Statistics Canada reported on Friday. This reading followed December's contraction of 0.1% and came in better than the market expectation for an expansion of 0.3%.

"Advance information indicates that real GDP increased 0.3% in February," Statistics Canada further noted in its press release. "Increases in the mining, quarrying, and oil and gas extraction, manufacturing, and finance and insurance sectors were slightly offset by decreases in construction, wholesale trade, and accommodation and food services."

Market reaction

USD/CAD retreated from daily highs after this data and was last seen rising 0.17% on the day at 1.3543.

-

13:32

Breaking: US annual Core PCE inflation declines to 4.6% in February vs. 4.7% expected

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, declined to 5% on a yearly basis in February from 5.3% in January, the US Bureau of Economic Analysis reported on Friday. This reading came in lower than the market expectation of 5.3%.

The annual Core PCE Price Index, the Federal Reserve's preferred gauge of inflation, edged lower to 4.6% from 4.7% in the same period, compared to analysts' forecast of 4.7%. On a monthly basis, Core PCE inflation and PCE inflation both rose 0.3%.

Further details of the publication revealed that Personal Income rose by 0.3% on a monthly basis in February and Personal Spending increased by 0.2%.

Market reaction

The US Dollar came under modest bearish pressure after these data and the US Dollar Index was last seen trading at 102.25, where it was still up 0.1% on a daily basis.

-

13:31

United States Personal Spending came in at 0.2%, below expectations (0.3%) in February

-

13:31

United States Core Personal Consumption Expenditures - Price Index (YoY) below forecasts (4.7%) in February: Actual (4.6%)

-

13:31

United States Personal Consumption Expenditures - Price Index (MoM) came in at 0.3%, above expectations (0.2%) in February

-

13:31

United States Core Personal Consumption Expenditures - Price Index (MoM) came in at 0.3% below forecasts (0.4%) in February

-

13:31

United States Personal Income (MoM) above expectations (0.2%) in February: Actual (0.3%)

-

13:31

United States Personal Consumption Expenditures - Price Index (YoY) registered at 5%, below expectations (5.3%) in February

-

13:30

Canada Gross Domestic Product (MoM) above forecasts (0.3%) in January: Actual (0.5%)

-

13:13

USD/CAD Price Analysis: Clings to recovery gains around 1.3550 ahead of US PCE Price Index

- USD/CAD stages a goodish rebound from a multi-week low amid a pickup in the USD demand.

- Bullish Crude Oil prices underpin the Loonie and act as a headwind amid a positive risk tone.

- Traders also seem reluctant to place bets ahead of the Canadian GDP and the US PCE inflation.

The USD/CAD pair shows resilience below the 100-day Simple Moving Average (SMA) and attracts some buying in the vicinity of the 1.3500 psychological mark, or a five-and-half-week low touched earlier Friday. The pair maintains its bid tone heading into the North American session and is currently placed around the 1.3550 area, just a few pips below the daily high.

The US Dollar (USD) regains some positive traction on the last day of the week and is seen as a key factor acting as a tailwind for the USD/CAD pair. That said, the prevalent risk-on mood keeps a lid on any meaningful upside for the safe-haven Greenback. Apart from this, the recent uptrend in Crude Oil prices, to a nearly three-week high, lends some support to the commodity-linked Loonie and contributes to capping gains for the major.

Traders also seem reluctant to place aggressive bets ahead of the release of the monthly Canadian GDP and the US Core PCE Price Index, the Fed's preferred inflation gauge. The USD/CAD pair, for now, seems to have stalled its intraday positive move near the 50% Fibonacci retracement level of the February-March rally. A sustained move beyond could lift spot prices beyond the 1.3600 mark, towards the 1.3640 region, or the 61.8% Fibo. level.

Some follow-through buying beyond mid-1.3600s will negate any near-term bearish bias and pave the way for a move towards the 1.3700 round figure en route to the 1.3720 zone, or the 23.6% Fibo. level.

On the flip side, the 1.3500 mark represents 61.8% Fibo. level and should now act as a pivotal point, which if broken will be seen as a fresh trigger for bearish traders. The USD/CAD pair might then turn vulnerable to accelerate the fall towards intermediate support near the 1.3455-1.3450 horizontal zone. Spot prices could eventually drop to the 1.3400 round figure en route to the next relevant support near the 1.3330-1.3325 region.

USD/CAD daily chart

Key levels to watch

-

13:07

Gold Price Forecast: XAU/USD to come under pressure as US NFP expected to be robust once again – Commerzbank

Gold price has defended most of the gains it accrued amid the market turmoil and is still trading at above $1,950. Market participants will presumably be focusing their attention on the US labour market next week, economists at Commerzbank report.

Market to correct its expectations of pronounced rate cuts later this year

“Gold market could see a more pronounced correction if the market saw itself forced by buoyant US labour market figures to scale back its expectations of rapid rate cuts before the year is out.”

“Since the beginning of March, the gold ETFs tracked by Bloomberg have registered inflows of 30 tons, meaning that they are likely to post monthly inflows again for the first time since April 2022.”

-

13:04

India Balance Payment $ increased to $0.9B in 4Q from previous $-30.4B

-

13:04

India Current Account Balance $ came in at $-18.2B, above forecasts ($-23B) in 4Q

-

13:04

India Trade Deficit – RBI: -72.7B (4Q) vs -83.5B

-

13:03

Chile Industrial Production (YoY) declined to -1.1% in February from previous 0.5%

-

13:01

South Africa Trade Balance (in Rands) above forecasts (-14.3B) in February: Actual (16.13B)

-

13:01

Mexico Jobless Rate below expectations (2.9%) in February: Actual (2.7%)

-

13:00

Mexico Jobless Rate s.a down to 2.8% in February from previous 2.9%

-

13:00

Brazil Unemployment Rate registered at 8.6%, below expectations (8.7%) in February

-

12:49

GBP/USD will likely simply track EUR/GBP and make its way slowly back to 1.30 – SocGen

Calmer times for Sterling. Economists at Société Générale expect GBP/USD to track EUR/GBP and move gradually higher toward 1.30.

EUR/GBP’s underlying trend remains upwards, slowly

“Since the start of November, Sterling has tracked five-year yield differentials, with a narrowing in the UK-German spread of nearly 110 bps in November-January taking EUR/GBP from 0.86 to almost 0.90.”

“Unless yield differentials narrow significantly from here, we may well find that EUR/GBP becomes dull for a while, trading at 0.87-0.92 over the coming months. Against that backdrop, GBP/USD will likely simply track EUR/GBP and make its way slowly back to 1.30.”

-

12:33

India Infrastructure Output (YoY) came in at 6%, above forecasts (4.6%) in February

-

12:32

India FX Reserves, USD: $578.78B (March 24) vs $572.8B

-

12:32

Brazil Primary Budget Surplus above forecasts (-30B) in February: Actual (-26.453B)

-

12:32

Brazil Nominal Budget Balance came in at -90.606B, below expectations (-36.559B) in February

-

12:25

USD/CAD: Losses through the low 1.35s target a test of long-term trend support at 1.3410/15 – Scotiabank

USD/CAD is trading higher for the first time this week. However, economists at Scotiabank expect the pair to continue moving lower as technicals suggest further downside pressure.

Gains on the day may already have peaked around 1.3565

“Steady losses in the USD since Monday, a break under the 40-Day Moving Average (1.3592 – now important resistance) and a bearish tilt in the intraday and daily trend intensity oscillators keep the focus on the downside for USD/CAD in the short run.”

“Modest USD gains on the day may already have peaked around 1.3565.”

“USD losses through the low 1.35s (100-DMA at 1.3519) target a test of long-term trend support at 1.3410/15.”

-

12:20

USD Index Price Analysis: No changes to the range bound theme

- DXY recoups part of the losses seen on Thursday.

- Decent support emerges at the 102.00/101.90 band.

DXY manages to regain some balance and bounces off the earlier retracement to the 102.00 neighbourhood.

So far, it seems the index could extend the consolidative range amidst the broader bearish stance. That said, a drop below the monthly low at 101.91 (March 23) should open the door to a potential visit to the 2023 low around 100.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.55, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:14

EUR/JPY Price Analysis: Next on the upside now comes 146.70

- EUR/JPY extends the move higher and prints new 2023 highs.

- The December 2022 peak near 146.70 now emerges on the horizon.

EUR/JPY advances past the 145.00 hurdle to record new YTD peaks in the 145.65/70 band on Friday.

A daily close above the 2023 peak should motivate the cross to shift its focus to the December 2022 top around 146.70 (December 15) in the short-term horizon.

In the meantime, extra gains remain on the table while the cross trades above the 200-day SMA, today at 141.81.

EUR/JPY daily chart

-

12:12

GBP/USD: Clear push through 1.2445/50 to drive gains towards 1.2750/00 in the next few months – Scotiabank

Sterling gains peaked in the low 1.24 zone earlier but losses are showing signs of reversing from the mid/upper 1.23s, economists at Scotiabank report.

Firm tone persists

“Cable gains stalled – again – in the low/ mid 1.24 area. Spot losses have, however, held short-term trend support at 1.2340 and spot gains over the past couple of hours suggest that a low may be in for the GBP in the short-run, at least.”

“Trend signals are bullish for the GBP across multiple timeframes which support the outlook for limited losses and ongoing gains.”

“A clear push through 1.2445/50 would drive gains towards 1.2750/00 in the next few months.”

-

12:09

When is the US February PCE Price Index and how could it affect EUR/USD?

US PCE Price Index Overview

Friday's US economic docket highlights the release of the Personal Consumption Expenditure (PCE) Price Index, scheduled later during the early North American session at 12:30 GMT. The gauge is anticipated to have risen by 0.2% in February as compared to the 0.6% increase in the previous month. The yearly rate possibly edged lower to 5.3% from 5.4% in January. Meanwhile, the Core PCE Price Index - the Fed's preferred inflation measure - likely held steady at the 4.7% YoY rate and rose 0.4% in February.

Analysts at TD Securities (TDS) offer a brief preview of the report and write: “We expect core PCE price inflation to slow down from a robust 0.6% MoM in Jan to a still-strong 0.4% in Feb (also below core CPI's 0.5% MoM gain). The YoY rate likely rose a tenth to 4.8%, suggesting the path to normalization in price gains will be bumpy. Conversely, personal spending likely fell, but that would follow an eye-popping 1.8% surge in the prior month.”

How Could it Affect EUR/USD?

Ahead of key macro data, the US Dollar (USD) regains positive traction amid hopes that the Federal Reserve might shift back to its inflation-fighting interest rate hikes. A surprisingly stronger report will reaffirm hawkish Fed expectations and prompt some near-term USD short-covering move. This, in turn, will set the stage for some meaningful corrective pullback for the EUR/USD pair, from a nearly two-month high touched on Thursday.

Conversely, weaker PCE data will fuel fresh speculations that the US central bank might soon pause the rate-hiking cycle. This, along with the prevalent risk-on environment and easing fears of a full-blown banking crisis, should weigh on the safe-haven buck and provide a fresh lift to the EUR/USD pair. Apart from this, the prospects for additional rate hikes by the Europen Central Bank (ECB) suggest that the path of least resistance for spot prices is to the upside.

Eren Sengezer, Editor at FXStreet, offers a brief technical outlook for the major and writes: “EUR/USD has met resistance in the 1.0900/1.0910 (psychological level, end-point of the latest uptrend) area late Thursday, confirming that level as a significant resistance. The Relative Strength Index (RSI) indicator on the four-hour chart declined toward 60, pointing to a loss of bullish momentum.”

Eren also outlines important technical levels to trade the EUR/USD pair: “In case the pair manages to hold above 1.0860 (ascending trend line, 20-period Simple Moving Average (SMA)), however, buyers could remain interested. In that scenario, EUR/USD needs to rise above 1.0900/1.0910 and use that level as support to be able to clear 1.0930 (static level, March 23 high) and target 1.1000 (psychological level).”

“On the downside, a four-hour close below 1.0860 could attract sellers and cause the pair to decline to 1.0820 (Fibonacci 23.6% retracement of the latest uptrend, 50-period SMA) and 1.0800 (psychological level),” Eren adds further.

Key Notes

• US February PCE Inflation Preview: Bad news for the Dollar, good news for the Fed?

• US Core PCE: Banks Preview, inflation still too hot

• EUR/USD Forecast: Euro bulls stay on sidelines ahead of US inflation data

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While Personal spending stimulates inflationary pressures, it could lead to raise interest rates. A high reading is positive (or Bullish) for the USD.

-

12:06

EUR/USD: Rebound back to and through 1.0930 needed to regain some positive traction – Scotiabank

EUR/USD edges back after another 1.0925 rejection but bull trend intact, economists at Scotiabank report.

Limited scope for EUR losses

“EUR gains peaked around 1.0925/30, setting up a minor double top reversal in price that was triggered by the EUR’s slip back under 1.0895 earlier. The pattern has more or less delivered on its bearish potential already, however.”

“While short-term patterns in the EUR look a little soft, spot is holding above key, short-term trend support at 1.0855 and trend strength oscillators are still aligned bullishly for the EUR, suggesting limited scope for EUR losses.”

“A rebound back to and through 1.0930 is needed for spot to regain some positive traction in the short run, however.”

-

11:59

Brent Oil: Failure to defend December trough of $75 to trigger next leg of downtrend – SocGen

Brent has staged an initial bounce after forming interim low near $70 earlier this month. But it could test this level again on failure to defend December trough of $75, strategists at Société Générale report.

Signals of a meaningful uptrend are not yet visible

“Daily MACD has started posting positive divergence however signals of a meaningful uptrend are not yet visible.”

“Trend line drawn since March 2022 at $83/84 which is also the 50-DMA is a short-term hurdle.”

“If Brent fails to defend December trough of $75, next leg of downtrend is likely to materialize towards $70 and $65/63, the 61.8% retracement of whole uptrend during 2020/2022.”

-

11:42

GBP/USD to reach 1.26 at year-end – ANZ

GBP/USD remained in a range of 1.19-1.24 in the first quarter of 2023. Economists at ANZ Bank expect the pair to edge higher toward 1.26 by the end of the year.

Higher interest rates are expected to be a feature of BoE meetings ahead

“While a recession may be avoided, UK inflation remains at multi-decade highs. Headline CPI in March was reported at 10.4%, with core CPI at 6.2%. Therefore, higher interest rates are expected to be a feature of BoE meetings ahead.”

“We think there is further upside and forecast GBP/USD to rise to 1.26 at end-2023.”

-

11:26

GBP/USD trades with modest losses, holds above mid-1.2300s ahead of US PCE Price Index

- GBP/USD pulls back from over a two-month high amid a modest pickup in the USD demand.

- The better-than-expected UK GDP reaffirms BoE rate hike bets and helps limit the downside.

- Traders also seem reluctant and prefer to wait for the release of the US Core PCE Price Index.

The GBP/USD pair comes under some selling pressure after touching over a two-month high, around the 1.2420-1.2425 area on Friday and maintains its offered tone through the first half of the European session. The pair is currently placed near the lower end of its daily trading range, around the 1.2370-1.2365 zone, down nearly 0.15% for the day.

A goodish pickup in the US Treasury bond yields helps revive the US Dollar (USD) demand on the last day of the week, which turns out to be a key factor dragging the GBP/USD pair lower. Hopes that a widespread banking crisis might have been averted fueled speculations that the US central bank might move back to its inflation-fighting interest rate hikes. Adding to this, three Fed officials on Thursday backed the case for more rate increases to lower high levels of inflation. This, in turn, acts as a tailwind for the US bond yields and lends some support to the Greenback.

Hence, the market focus will remain glued to the release of the US Core PCE Price Index, the Fed's preferred inflation gauge, due later during the early North American session. Heading into the key data risk, traders seem inclined to lighten their bullish bets around the GBP/USD pair, especially after this week's rally of over 200 pips. That said, the slightly better-than-expected UK GDP print reaffirms expectations for additional rate hikes by the Bank of England (BoE), which, in turn, holds back bearish traders from placing aggressive bets around the major, at least for now.

Apart from this, the prevalent risk-on mood - as depicted by an extension of the recent rally in the equity markets - keeps a lid on any meaningful gains for the safe-haven buck and contributes to limiting the downside for the GBP/USD pair. This makes it prudent to wait for strong follow-through selling before confirming that the upward trajectory witnessed since the first half of the current month has run out of steam and positioning for any meaningful depreciating move. Nevertheless, spot prices remain on track to end in positive territory for the sixth successive week.

Technical levels to watch

-

11:22

EUR/USD: Resilient US data next week could prompt a correction – MUFG

Economists at MUFG Bank analyze the two-year government bond spread between US and EU and discuss its implications for the EUR/USD pair.

Month-end FX flows today could spark some unpredictable moves

“We remain unconvinced that the ECB will have to tighten by a further 50 bps but expectations continue to grind higher with the 2yr government bond spread more indicative of EUR/USD trading up closer to 1.1500. But with the market still priced for about 50 bps of easing from the Fed by year-end, that spread looks set to continuing supporting EUR/USD for now. We remain wary over that spread dynamic remaining so compelling which could prompt a correction in EUR/USD – next week’s US data may be the catalyst for that if the data remains resilient.”

“Month-end (quarter-end and FY-end for Japan) FX flows today could also spark some unpredictable moves that could alter the complexion of the market ahead of the key data from the US next week.”

-

11:16

NOK to remain weak until the summer – Nordea

Economists at Nordea still see a weak Norwegian Krone (NOK) until the summer.

Lower rate differential against the Euro a key factor behind the weak NOK

“We expect the NOK to remain weak until the summer – with our view for EUR/NOK around 11.30 in 3M and 11.00 by year-end 2023.”

“Norges Bank’s NOK sales, low interest rate differentials and a high likelihood for risk-off all point to a NOK that will remain to be weak.”

“We expect that Norges Bank will gradually reduce their NOK sales going forward. That should support the NOK, in isolation. Yet, the NOK will likely remain weak because interest rate differentials will likely remain low for the time to come.”

“A lower rate differential against the Euro has been a key factor behind the weak NOK lately – and this is unlikely to change soon.”

-

10:55

The ECB is still under pressure to raise key rates further – Commerzbank

As expected, the inflation rate in the euro zone fell significantly from 8.5% to 6.9% in March. By contrast, underlying inflation increased further. In this respect, pressure on the ECB to raise key interest rates further remains high, economists at Commerzbank report.

Euro area inflation rate falls to 6.9%, but core rate continues to rise

“According to preliminary calculations by Eurostat, the inflation rate in the euro area fell by an impressive 1.6 percentage points to 6.9% in March. The core inflation rate – i.e. the year-on-year rate of change in the consumer price index excluding energy, food and beverages – rose by 0.1 percentage points to 5.7%.”

“The inflationary push from energy prices has run its course. In the coming months, energy prices are even likely to depress the inflation rate slightly. Food is also unlikely to boost inflation in the next few months. By contrast, underlying inflation is unlikely to ease much for the time being. The core inflation rate is not expected to reach its high point until July and will only decline slowly thereafter.”

“The ECB has repeatedly emphasized that it is currently focusing primarily on the core inflation rate. In this respect, the ECB is still under pressure to raise key rates further.”

-

10:48

USD/ZAR to head lower toward critical support zone at 17.40/30 – SocGen

USD/ZAR has returned below 18.00. The pair could challenge the critical support zone at 17.40/30, analysts at Société Générale report.

Neckline at 18.10 is first hurdle

“USD/ZAR failed to establish itself above the peak of last October near 18.58 and underwent a brief consolidation in the form of Head and Shoulders. It has breached the neckline (18.10) denoting possibility of short-term down move.”

“The pair is expected to head lower towards 17.64 and perhaps even towards the target of the pattern at 17.40/17.30 which is also the 200-DMA. This is a crucial support zone.”

“Neckline at 18.10 is first hurdle.”

-

10:41

EUR/USD to struggle around 1.05 in H1, rebounding toward 1.10 by year-end – BofA

Economists at the Bank of America Global Research expect the EUR/USD pair to remain under pressure in the first half of the year before recovering toward 1.10 by year-end.

Market has once again run ahead of itself

“We warn that the market has once again run ahead of itself, pricing early Fed cuts, with re-pricing likely to weigh on EUR/USD in the short term.”

“We continue to forecast EUR/USD at 1.05 in H1, appreciating to 1.10 by year-end and to 1.15 by end-2024, still below long-term equilibrium.”

“We assume that the worst of the recent bank turmoil is behind, but we remain concerned about two risks for the EUR in particular: the continued war in Ukraine and possible market pressure on Italy from the hawkish ECB.”

-

10:31

Malaysia: GDP expected to expand 4.0%-5.0% in 2023 – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest projections by the Bank Negara Malaysia (BNM).

Key Takeaways

“Bank Negara Malaysia (BNM) projects GDP growth to moderate to 4.0%-5.0% in 2023 (2022: 8.7%), driven by firm domestic demand amid slower global growth. The risks to growth are fairly balanced with downside risks primarily coming from external developments while there are upside risks from domestic factors including improved labor prospects, investments projects, and increasing tourism activity.”

“Headline and core inflation are expected to average above long-term averages at 2.8%-3.8% this year (2022: headline 3.3%, core 3.0%) after taking into account moderating global commodity prices, easing of supply constraints, and existing price controls and subsidies. Inflation is expected to stay elevated in 2023 owing to demand pressures and gradual subsidy rationalization.”

“On the path of interest rates, the current Overnight Policy Rate (OPR) of 2.75% remains supportive of growth and is just below our projected neutral level of ~3.00%. Given that growth is expected to be fairly robust while inflation risks are tilted higher, we expect one more 25bps hike at the next MPC meeting in May. On financial stability, Malaysia’s banking system remains resilient with strong capital ratios and liquidity buffers that are above the minimum requirements even under highly stressed scenarios.”

-

10:29

EUR/USD zeroing in on 1.10, GBP/USD should follow with a break above 1.25 – ING

The Pound is set to be the best-performing currency of the first quarter of 2023, having gained 2.5% against the Dollar. Economists at ING think EUR/USD may break 1.10 next week. If that is the case, Cable should follow with a break above 1.25.

No reasons to diverge from EUR

“We have been stressing how markets are rewarding currencies that can count on domestic tightening prospects despite financial turmoil, and the Pound is indeed one of those.”

“While our more dovish view for the BoE compared to the ECB keeps us bullish on EUR/GBP for the remainder of the year (we still target 0.90 in the second half of the year), there aren’t clear short-term drivers to buck the bullish GBP trend at the moment.”

“Cable is approaching some important levels. First of all, the 1.2426 December 2022 high, and then the key 1.2500 benchmark level. With no obvious catalyst driving divergence between EUR and GBP at the moment, a high chance of 1.1000 being tested next week in EUR/USD equals a high chance of 1.2500 being tested next week in Cable.”

-

10:20

Gold price uptrend limited ahead of crucial US PCE inflation

- Gold price uptrend continues despite shrinking volatility.

- US PCE inflation data on Friday has huge market implications.

- Federal Reserve future rate hike bets are shaping precious metal markets.

Gold price (XAU/USD) continues to trade within a solid uptrend, even in a calmer week in the financial markets. Things could get lively again on Friday as the market gets ready for the biggest data release of the week, the United States Personal Consumption Expenditures (PCE) inflation numbers, scheduled to be released at 12:30 GMT.

US PCE inflation numbers are crucial for Gold investors

US PCE data is the Federal Reserve’s preferred gauge of inflation, and the markets will scrutinize the numbers deeply to start figuring out the chances of another Fed interest rate hike in the next FOMC meeting on May 3. Market expectations for the March numbers are at 4.7% for the yearly core PCE measure, and 0.4% for the monthly change. Any relevant discrepancy from these figures will certainly have an impact on the financial market landscape.

US PCE inflation data consensus and previous numbers (source: FXStreet Economic Calendar)

Such development is crucial for Gold investors, as the bright metal moves the opposite direction to interest rates, which are highly correlated with US Treasury bond yields and the US Dollar. When yields and the Greenback are higher, that diminishes Gold value, as precious metals are yield-less and are priced in US Dollars.

Matías Salord, Senior Analyst at FXStreet, explains how a lower-than-expected PCE release could benefit Gold bulls, by damaging the US Dollar and US T-bond yields:

On the contrary, if the Core PCE eases, it would be great news for the Fed, but not for the Dollar. Signs that inflation continued to slowdown would alleviate the pressure for the Fed to do more. US bond yields could resume the slide and the US Dollar print fresh monthly lows.

Is Gold price capped despite recent rally?

Gold price uptrend has slowed down in the past days, but bulls still keep the edge, with the bright metal comfortably trading above $1,970 at the time of writing.

ANZ Bank strategists have analyzed the current Gold trend, and believe the bright metal is capped as they do expect the Federal Reserve to still hike interest rates one or two more times this year:

“Gold is well supported by US recession fears, easing inflationary pressure and more dovish monetary policy. Nevertheless, the upside looks limited in the near term amid easing banking risks and further Fed rate hikes.”

-

10:17

AUD/USD keeps the red below 0.6700 mark, focus remains on US PCE Price Index

- AUD/USD witnessed an intraday turnaround from over a one-week high touched on Friday.

- Rising US bond yields revive the USD demand and exert downward pressure on the major.

- The downside remains cushioned as traders keenly await the Fed’s preferred inflation data.

The AUD/USD pair retreats sharply from over a one-week high, around the 0.6735-0.6740 region touched earlier this Friday and continues losing ground through the first half of the European session. Spot prices reverse the previous day's positive move and drop to the 0.6670 area, or a fresh daily low in the last hour.

A goodish pickup in the US Treasury bond yields helps revive the US Dollar (USD) demand on the last day of the week, which, in turn, is seen as a key factor exerting downward pressure on the AUD/USD pair. That said, the prevalent risk-on mood - as depicted by a generally positive tone around the equity markets - could lend some support to the risk-sensitive Aussie. Against the backdrop of easing fears about a full-blown banking crisis, the better-than-expected Chinese PMI prints raise hopes for a strong recovery in the world's second-largest economy and boost investors' confidence.

Apart from this, the uncertainty over the Federal Reserve's (Fed) rate hike path could act as a headwind for the US bond yields, which might hold back the USD bulls from placing aggressive bets and contribute to limiting losses for the AUD/USD pair. It is worth recalling that the Fed had signalled recently that it might soon pause the rate-hiking cycle. That said, fading risk of bank contagion fueled speculations that the US central bank might shift back to its inflation-fighting rate hikes. Furthermore, three Fed officials on Thursday backed the case for more rate hikes to contain high inflation.

Hence, the market focus will remain glued to the release of the US Core PCE Price Index - the Fed's preferred inflation gauge - later during the early North American session. The data will play a key role in influencing market expectations about the next policy move. This, in turn, will drive the USD demand and help determine the next leg of a directional move for the AUD/USD pair. This, along with the emergence of some buying near the 0.6660 area over the past two trading sessions, warrants caution for aggressive bearish traders and before positioning for an extension of the intraday downfall.

Technical levels to watch

-

10:14

EUR/HUF's journey below 400 is not permanent and will reverse – TDS

In the view of economists at TD Securities, the Forint is too strong with EUR/HUF below 400. They, therefore, expect a sharp move higher in the pair.

May and June will likely be periods of increased EUR/HUF volatility

“We still think that EUR/HUF's journey below 400 is not permanent and will reverse.”

“May and June will likely be periods of increased EUR/HUF volatility as EU member states will need to extend the current sanctions on Russia related to the invasion of Ukraine. Hungary may use this opportunity to veto the extension unless it also receives part of frozen EU payouts from the Recovery Fund (RF).”

“The first batch of the RF payouts is due right around June 2023, so another open spat with the EU might be the card Hungary will choose to play.”

-

10:10

China's top envoy Wang: US-Sino relations are facing challenges and difficulties

China's top diplomat Wang Yi said on Friday that the US and China relations are facing challenges and difficulties.

“I urge the US to stop suppression, decoupling is wrong,” Wang added.

Market reaction

AUD/USD is under pressure below 0.6700, as the US Dollar stages a comeback ahead of the US PCE inflation data. Simmering US-Sino tensions are also weighing on the Aussie pair. At the time of writing, the major is trading 0.19% lower on the day at 0.6693.

-

10:02

Greece Retail Sales (YoY) climbed from previous -1.2% to 1.4% in January

-

10:02

USD/JPY to fall progressively toward 124 by year-end – ANZ

The concerns of financial instability saw an influx of safe haven buying for currencies such as the Japanese Yen. Economists at ANZ Bank expect the USD/JPY pair to move gradually lower toward 124 by the end of the year.

BoJ pivot still a key focus

“In the immediate term a policy shift looks unlikely. Incoming Governor Kazuo Ueda (whose term will start from 9 April), has publicly supported ultra-loose monetary policy even before his nomination.”

“ If a policy shift does materialise, which we anticipate being after Q2 this year, the JPY will rally on more favourable yield differentials.”

“We forecast USD/JPY to fall progressively to 124 by the end of the year.”

-

10:01

Breaking: Eurozone Preliminary HICP inflation declines to 6.9% YoY in March vs. 7.1% expected

The annualized Eurozone Harmonised Index of Consumer Prices (HICP) came in softer at 6.9% in March vs. February’s 8.5%, the latest data published by Eurostat showed on Friday. The market expected the inflation gauge to drop to 7.1% in the reported period.

The core HICP steadied at 5.7% YoY in March when compared to 5.7% expected and 5.6% recorded in the February clip.

On a monthly basis, the old continent’s HICP unexpectedly rose by 0.9% in March vs. 0.8% expectations and 0.8% previous. The core HICP arrived at 1.2% last month as against the 0.6% expected and 0.8% seen in February.

The Euro area inflation data is released a day after Germany’s annual HICP for March, which rose by 7.8%, beating 7.5% estimates while following a 9.3% advance seen in February.

Note that the European Central Bank’s (ECB) inflation target is 2%.

Investors closely scrutinize the bloc’s HICP figures to evaluate the ECB rate hike expectations. Markets are now pricing an 88% probability of a 25 basis points (bps) ECB rate increase in May.

Key details (via Eurostat)

“Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in March (15.4%, compared with 15.0% in February), followed by non-energy industrial goods (6.6%, compared with 6.8% in February), services (5.0%, compared with 4.8% in February) and energy (-0.9%, compared with 13.7% in February).”

EUR/USD reaction

The shared currency is unperturbed by the mixed Eurozone inflation data, as EUR/USD keeps its range near daily lows of 1.0872. The spot is down 0.22% on the day.

-

10:01

European Monetary Union Core Harmonized Index of Consumer Prices (MoM) came in at 1.2%, above expectations (0.6%) in March

-

10:01

European Monetary Union Core Harmonized Index of Consumer Prices (YoY) meets forecasts (5.7%) in March

-

10:01