Notícias do Mercado

-

23:32

Japan: Tokyo CPI ex Fresh Food, y/y, October +2.5% (forecast +2.5%)

-

23:32

Japan: National CPI Ex-Fresh Food, y/y, September +3.0% (forecast +3.0%)

-

23:31

Japan: National Consumer Price Index, y/y, September +3.2% (forecast +3.0%)

-

23:31

Japan: Tokyo Consumer Price Index, y/y, October +2.5%

-

23:30

Japan: Unemployment Rate, September 3.6% (forecast 3.6%)

-

23:30

Japan: Household spending Y/Y, September -5.6% (forecast -4.0%)

-

23:00

Schedule for today, Friday, Oct 31’2014:

(time / country / index / period / previous value / forecast)

00:05 United Kingdom Gfk Consumer Confidence October -1

00:30 Australia Producer price index, q / q Quarter III -0.1%

00:30 Australia Producer price index, y/y Quarter III +2.3% +2.6%

00:30 Australia Private Sector Credit, m/m September +0.4% +0.4%

00:30 Australia Private Sector Credit, y/y September +5.1%

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Housing Starts, y/y September -12.5% -17.1%

06:00 Japan BOJ Outlook Report

07:00 Germany Retail sales, real adjusted September +2.5% -1.0%

07:00 Germany Retail sales, real unadjusted, y/y September +0.1% +1.2%

07:30 Japan BOJ Press Conference

07:45 France Consumer spending September +0.7% -0.5%

07:45 France Consumer spending, y/y September +1.4%

10:00 Eurozone Unemployment Rate September 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) October +0.3% +0.4%

12:30 Canada GDP (m/m) August 0.0%

12:30 U.S. Employment Cost Index Quarter III +0.7% +0.5%

12:30 U.S. Personal Income, m/m September +0.3% +0.3%

12:30 U.S. Personal spending September +0.5% +0.1%

12:30 U.S. PCE price index ex food, energy, m/m September +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y September +1.5%

13:45 U.S. Chicago Purchasing Managers' Index October 60.5 59.5

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 84.6 86.4

-

16:37

Foreign exchange market. American session: the euro rose against the U.S. dollar

The U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. economic data. The U.S. preliminary gross domestic product increased at an annual rate of 3.5% in the third quarter, beating expectations for a 3.1% gain, after a 4.6% rise in the second quarter.

The number of initial jobless claims in the week ending October 25 in the U.S. rose by 3,000 to 287,000. The previous week's figure was revised to 284,000 from 283.000. Analysts had expected a decline to 277.000.

The euro rose against the U.S. dollar. The number of unemployed people in Germany declined by 22,000 in October, beating expectations for a 5,000 increase, after a 9,000 gain in September. September's figure was revised down from a 13,000 rise.

Germany's adjusted unemployment rate remained unchanged at 6.7% in October, in line with expectations.

Germany's preliminary consumer price index declined 0.3% in October, after a flat reading in September. Analysts had expected the consumer price index to remain unchanged.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. The KOF leading indicator rose to 99.8 in October from 99.3 in September, exceeding expectations for an increase to 99.2. September's figure was revised up from 99.1.

The New Zealand dollar increased against the U.S. dollar. In the overnight trading session, the kiwi declined against the greenback after yesterday's Reserve Bank of New Zealand's and Fed' interest rate decision. The Reserve Bank of New Zealand (RBNZ) kept its interest rate unchanged at 3.50%.

The RBNZ Governor Graeme Wheeler reiterated the New Zealand dollar's strength is "unjustified and unsustainable". He also said that he expects a "further significant depreciation".

The Australian dollar climbed against the U.S. dollar. In the overnight trading session, the Aussie fell against the greenback after yesterday's Fed' interest rate decision.

The Housing Industry Association released new home sales data for Australia. New home sales in Australia were flat in September, after a 3.3% rise in August.

Australia's import price index declined 0.8% in the third quarter, missing expectations for a 0.3% rise, after a 3.0% drop in the second quarter.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback after yesterday's Fed' interest rate decision. No major economic reports were released in Japan.

-

15:15

Fed Chair Janet Yellen: more awareness of the need for diversity among economists

The Fed Chair Janet Yellen said at a conference in Washington on Thursday that she wants to raise awareness of the need for diversity among economists. She also said that relatively few women and minorities still decided to study economics in college.

Yellen said nothing about the Fed's monetary policy.

-

14:37

U.S. economy grew 3.5% in the third quarter

The U.S. Commerce Department released gross domestic product data on Thursday. The U.S. preliminary gross domestic product increased at an annual rate of 3.5% in the third quarter, beating expectations for a 3.1% gain, after a 4.6% rise in the second quarter.

Business investment, housing and consumer spending held up with job gains, which contributed to consumer confidence.

Consumer spending slowed to 1.8% in the third quarter from 2.5% in the second-quarter.

-

13:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600-05(E2.3bn), $1.2615(E1.1bn), $1.2700(E2.5bn), $1.2800(E1.5bn)

USD/JPY: Y107.65($2.8bn), Y108.50($1.2bn), Y109.50($550mn)

EUR/JPY: Y138.50(E615mn), Y138.85(E230mn)

GBP/USD: $1.6000(stg713mn), $1.6100(stg700mn)

EUR/GBP: stg0.7940-50(E1.0bn)

USD/CHF: Chf0.9445-60($440mn), Chf0.9560-65($500mn)

AUD/USD: $0.8745(A$2.5bn), $0.8775, $0.8850(A$649mn), $0.8900(A$300mn)

AUD/JPY: Y95.25(A$602mn), Y96.00(A$510mn)

-

13:12

Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies after the mixed U.S. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Import Price Index, q/q Quarter III -3.0% +0.3% -0.8%

00:30 Australia Export Price Index, q/q Quarter III -7.9% -4.8% -3.9%

01:00 Australia HIA New Home Sales, m/m September +3.3% 0.0%

07:00 Switzerland UBS Consumption Indicator September 1.28 Revised From 1.35 1.41

08:00 Switzerland KOF Leading Indicator October 99.3 99.2 99.8

08:55 Germany Unemployment Rate s.a. October 6.7% 6.7% 6.7%

08:55 Germany Unemployment Change October 9 Revised From 13 5 -22

10:00 Eurozone Business climate indicator October 0.02 Revised From 0.07 -0.01 0.05

10:00 Eurozone Economic sentiment index October 99.9 99.5 100.7

10:00 Eurozone Industrial confidence October -5.5 -5.8 -5.1

12:30 U.S. PCE price index, q/q Quarter III +2.3% +1.7% +1.2%

12:30 U.S. PCE price index ex food, energy, q/q Quarter III +2.1% Revised From +2.0% +1.4% +1.3%

12:30 U.S. GDP, q/q (Preliminary) Quarter III +4.6% +3.1% +3.5%

13:00 Germany CPI, m/m (Preliminary) October 0.0% 0.0% -0.3%

13:00 Germany CPI, y/y (Preliminary) October +0.8% +0.9% +0.8%

13:00 U.S. Fed Chairman Janet Yellen Speaks

The U.S. dollar traded lower against the most major currencies after the mixed U.S. economic data. The U.S. preliminary gross domestic product increased at an annual rate of 3.5% in the third quarter, beating expectations for a 3.1% gain, after a 4.6% rise in the second quarter.

The number of initial jobless claims in the week ending October 25 in the U.S. rose by 3,000 to 287,000. The previous week's figure was revised to 284,000 from 283.000. Analysts had expected a decline to 277.000.

The euro traded higher against the U.S. dollar. The number of unemployed people in Germany declined by 22,000 in October, beating expectations for a 5,000 increase, after a 9,000 gain in September. September's figure was revised down from a 13,000 rise.

Germany's adjusted unemployment rate remained unchanged at 6.7% in October, in line with expectations.

Germany's preliminary consumer price index declined 0.3% in October, after a flat reading in September. Analysts had expected the consumer price index to remain unchanged.

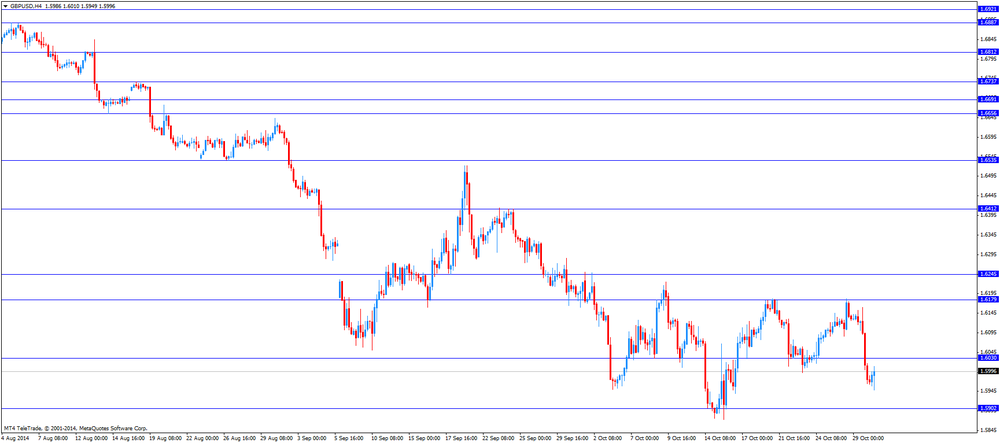

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. The KOF leading indicator rose to 99.8 in October from 99.3 in September, exceeding expectations for an increase to 99.2. September's figure was revised up from 99.1.

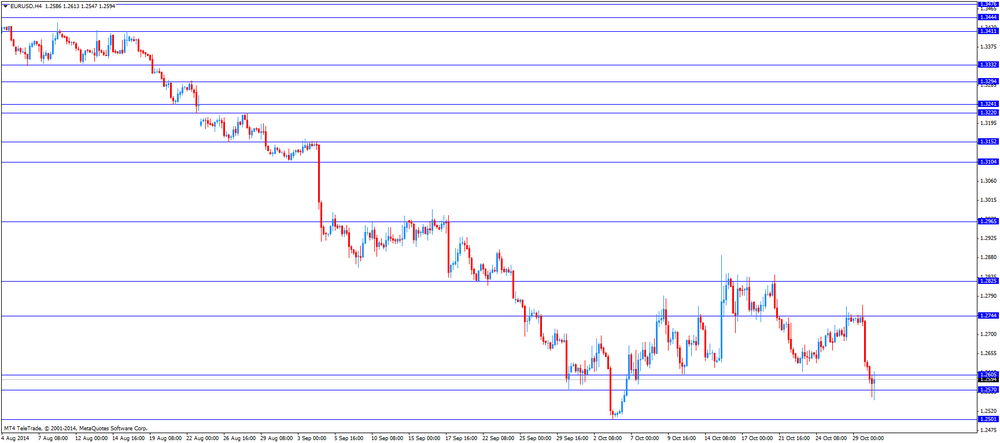

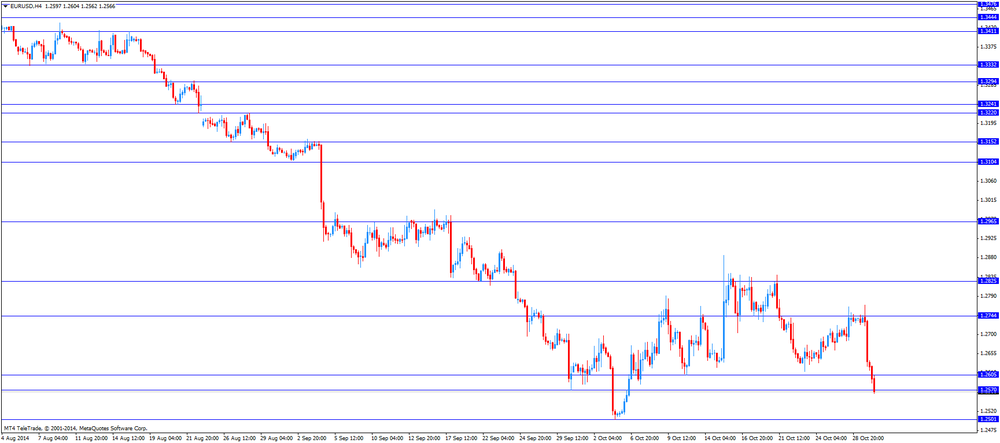

EUR/USD: the currency pair rose to $1.2613

GBP/USD: the currency pair increased to $1.6010

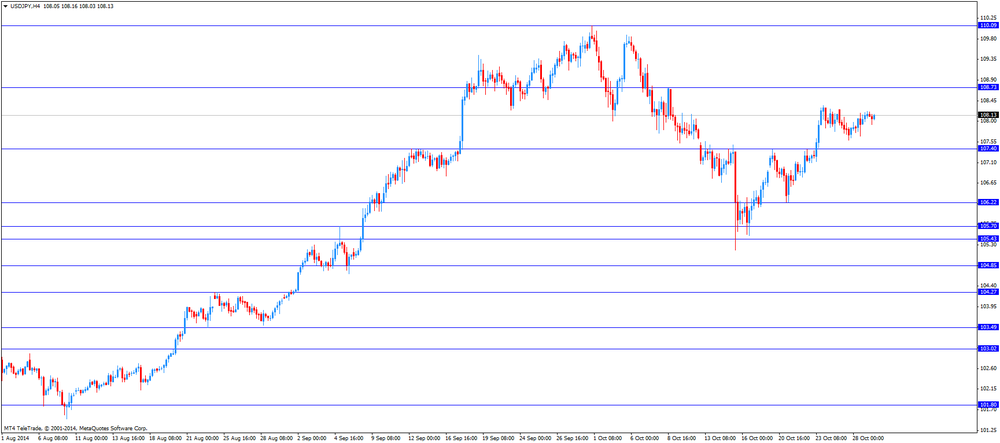

USD/JPY: the currency pair fell to Y108.84

The most important news that are expected (GMT0):

21:45 New Zealand Building Permits, m/m September 0.0%

23:30 Japan Unemployment Rate September 3.5% 3.6%

23:30 Japan Tokyo Consumer Price Index, y/y October +2.9%

23:30 Japan Household spending Y/Y September -4.7% -4.0%

23:30 Japan Tokyo CPI ex Fresh Food, y/y October +2.6% +2.5%

23:30 Japan National Consumer Price Index, y/y September +3.3% +3.0%

23:30 Japan National CPI Ex-Fresh Food, y/y September +3.1% +3.0%

-

13:00

Germany: CPI, m/m, October -0.3% (forecast 0.0%)

-

13:00

Germany: CPI, y/y , October +0.8% (forecast +0.9%)

-

12:51

Orders

EUR/USD

Offers $1.2770, $1.2720, $1.2700, $1.2665

Bids $1.2560, $1.2500

GBP/USD

Offers $1.6200, $1.6185, $1.6100, $1.6085

Bids $1.5940, $1.5900, $1.5875

AUD/USD

Offers $0.8910, $0.8860, $0.8830, $0.8800

Bids $0.8720, $0.8700, $0.8685, $0.8650

EUR/JPY

Offers Y138.80, Y138.00

Bids Y137.00, Y136.55/50, Y136.10/00, Y135.80, Y135.50

USD/JPY

Offers Y110.10, Y109.90

Bids Y108.35, Y107.60, Y107.00

EUR/GBP

Offers $0.8000, $0.7940

Bids stg0.7850, $0.6070

-

12:45

Federal Reserve ends its bond-buying program as widely expected

The Federal Reserve released its interest rate decision on Wednesday. The Fed has decided to end its bond-buying program as widely expected.

The Fed said that the labour market is improving further, with solid job gains and a lower unemployment rate. "The recovery in the housing sector remains slow", so the Fed.

Comments on the state of the labour market were more hawkish than in the past.

The Fed kept its interest unchanged and said that interest rates would remain unchanged for a "considerable time".

-

12:31

U.S.: PCE price index, q/q, Quarter III +1.2% (forecast +1.7%)

-

12:30

U.S.: Initial Jobless Claims, October 287 (forecast 277)

-

12:30

U.S.: GDP, q/q, Quarter III +3.5% (forecast +3.1%)

-

12:30

U.S.: PCE price index ex food, energy, q/q, Quarter III +1.3% (forecast +1.4%)

-

12:12

European Banking Authority Chairman Andrea Enria: even banks who passed the stress tests should not feel too secure

The chairman of the European Banking Authority (EBA), Andrea Enria, warned at a conference in Berlin on Thursday that even banks who passed the European Central Bank's (ECB) stress tests should not feel too secure, Reuters reported.

"The story is not over, even for the banks who passed it," said Enria.

The European Central Bank said on Sunday that 25 banks failed due to a capital shortfall and 13 banks have to raise an additional €10 billion in capital. Most banks have already taken steps to solve their problems.

-

11:30

Reserve Bank of New Zealand kept its monetary policy unchanged

The Reserve Bank of New Zealand released its interest rate decision on Wednesday. The Reserve Bank of New Zealand (RBNZ) kept its interest rate unchanged at 3.50%.

The central bank noted that New Zealand's economy has been grown faster than trend over 2014. The growth was driven by strong construction activity, high immigration and low interest rates.

The RBNZ pointed out that inflation remains low, but is expected to rise, while house price inflation has slowed significantly since late 2013.

The RBNZ Governor Graeme Wheeler reiterated the New Zealand dollar's strength is "unjustified and unsustainable". He also said that he expects a "further significant depreciation".

Wheeler added that "a period of assessment remains appropriate before considering further policy adjustment".

-

10:11

Foreign exchange market. Asian session: the U.S. dollar traded higher against the most major currencies yesterday’s Fed' interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Import Price Index, q/q Quarter III -3.0% +0.3% -0.8%

00:30 Australia Export Price Index, q/q Quarter III -7.9% -4.8% -3.9%

01:00 Australia HIA New Home Sales, m/m September +3.3% 0.0%

07:00 Switzerland UBS Consumption Indicator September 1.28 Revised From 1.35 1.41

08:00 Switzerland KOF Leading Indicator October 99.1 99.2 99.8

08:55 Germany Unemployment Rate s.a. October 6.7% 6.7% 6.7%

08:55 Germany Unemployment Change October 9 Revised From 13 5 -22

10:00 Eurozone Business climate indicator October 0.02 Revised From 0.07 -0.01 0.05

10:00 Eurozone Economic sentiment index October 99.9 99.5 100.7

10:00 Eurozone Industrial confidence October -5.5 -5.8 -5.1

The U.S. dollar traded higher against the most major currencies. The greenback was supported by yesterday's Fed' interest rate decision. The Fed has decided to end its bond-buying program as widely expected.

The Fed kept its interest unchanged and said that interest rates would remain unchanged for a "considerable time".

The New Zealand dollar declined against the U.S. dollar after yesterday's Reserve Bank of New Zealand's and Fed' interest rate decision. The Reserve Bank of New Zealand (RBNZ) kept its interest rate unchanged at 3.50%.

The RBNZ Governor Graeme Wheeler reiterated the New Zealand dollar's strength is "unjustified and unsustainable". He also said that he expects a "further significant depreciation".

The Australian dollar fell against the U.S. dollar after yesterday's Fed' interest rate decision.

The Housing Industry Association released new home sales data for Australia. New home sales in Australia were flat in September, after a 3.3% rise in August.

Australia's import price index declined 0.8% in the third quarter, missing expectations for a 0.3% rise, after a 3.0% drop in the second quarter.

The Japanese yen traded lower against the U.S. dollar after yesterday's Fed' interest rate decision. No major economic reports were released in Japan.

EUR/USD: the currency pair dropped to $1.2586

GBP/USD: the currency pair fell to $1.5963

USD/JPY: the currency pair rose to Y109.15

The most important news that are expected (GMT0):

2:30 U.S. Initial Jobless Claims October 283 277

12:30 U.S. PCE price index, q/q Quarter III +2.3% +1.7%

12:30 U.S. PCE price index ex food, energy, q/q Quarter III +2.0% +1.4%

12:30 U.S. GDP, q/q (Preliminary) Quarter III +4.6% +3.1%

13:00 Germany CPI, m/m (Preliminary) October 0.0% 0.0%

13:00 Germany CPI, y/y (Preliminary) October +0.8% +0.9%

13:00 U.S. Fed Chairman Janet Yellen Speaks

21:45 New Zealand Building Permits, m/m September 0.0%

23:30 Japan Unemployment Rate September 3.5% 3.6%

23:30 Japan Tokyo Consumer Price Index, y/y October +2.9%

23:30 Japan Household spending Y/Y September -4.7% -4.0%

23:30 Japan Tokyo CPI ex Fresh Food, y/y October +2.6% +2.5%

23:30 Japan National Consumer Price Index, y/y September +3.3% +3.0%

23:30 Japan National CPI Ex-Fresh Food, y/y September +3.1% +3.0%

-

10:10

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2600-05(E2.3bn), $1.2615(E1.1bn), $1.2700(E2.5bn), $1.2800(E1.5bn)

USD/JPY: Y107.65($2.8bn), Y108.50($1.2bn), Y109.50($550mn)

EUR/JPY: Y138.50(E615mn), Y138.85(E230mn)

GBP/USD: $1.6000(stg713mn), $1.6100(stg700mn)

EUR/GBP: stg0.7940-50(E1.0bn)

USD/CHF: Chf0.9445-60($440mn), Chf0.9560-65($500mn)

AUD/USD: $0.8745(A$2.5bn), $0.8775, $0.8850(A$649mn), $0.8900(A$300mn)

AUD/JPY: Y95.25(A$602mn), Y96.00(A$510mn)

-

10:01

Eurozone: Industrial confidence, October -5.1 (forecast -5.8)

-

10:01

Eurozone: Business climate indicator , October 0.05 (forecast -0.01)

-

10:00

Eurozone: Economic sentiment index , October 100.7 (forecast 99.5)

-

09:00

Germany: Unemployment Rate s.a. , October 6.7% (forecast 6.7%)

-

09:00

Germany: Unemployment Change, October -22 (forecast 5)

-

08:01

Switzerland: KOF Leading Indicator, October 99.8 (forecast 99.2)

-

07:01

Switzerland: UBS Consumption Indicator, September 1.41

-

06:28

Options levels on thursday, October 30, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2742 (3932)

$1.2693 (1949)

$1.2655 (379)

Price at time of writing this review: $ 1.2598

Support levels (open interest**, contracts):

$1.2556 (6089)

$1.2522 (5303)

$1.2483 (6357)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 58666 contracts, with the maximum number of contracts with strike pric $1,2900 (7005);

- Overall open interest on the PUT options with the expiration date November, 7 is 60999 contracts, with the maximum number of contracts with strike price $1,2500 (6357);

- The ratio of PUT/CALL was 1.04 versus 1.03 from the previous trading day according to data from October, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.6201 (2810)

$1.6103 (1472)

$1.6007 (440)

Price at time of writing this review: $1.5982

Support levels (open interest**, contracts):

$1.5897 (1946)

$1.5799 (1579)

$1.5700 (1147)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 28560 contracts, with the maximum number of contracts with strike price $1,6200 (2810);

- Overall open interest on the PUT options with the expiration date November, 7 is 32889 contracts, with the maximum number of contracts with strike price $1,5400 (2350);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from October, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Australia: Export Price Index, q/q, Quarter III -3.9% (forecast -4.8%)

-

00:30

Australia: Import Price Index, q/q, Quarter III -0.8% (forecast +0.3%)

-

00:02

Australia: HIA New Home Sales, m/m, September 0.0%

-