Notícias do Mercado

-

16:34

Foreign exchange market. American session: the Canadian dollar traded lower against the U.S. dollar after the weak Canadian gross domestic product

The U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data. The final Reuters/Michigan Consumer Sentiment Index jumped to 86.9 in October from 86.4 in September, exceeding expectations for a rise to 86.4.

The Chicago purchasing managers' index increased to 66.2 in October from 60.5 in September, beating expectations for a decline to 59.5.

Personal income in the U.S. rose 0.2% in September, missing expectations for a 0.3% increase, after a 0.3% gain in August.

Personal spending in the U.S. declined 0.2% in September, missing expectations for a 0.1% rise, after a 0.5% gain in August.

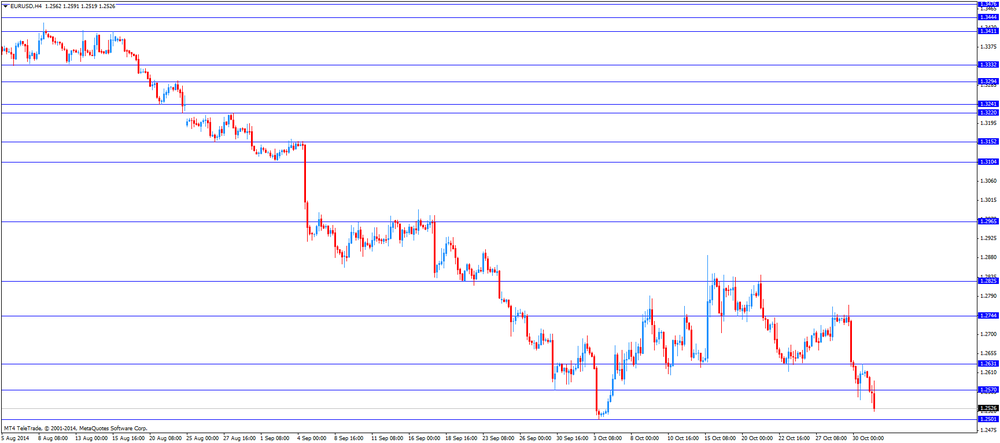

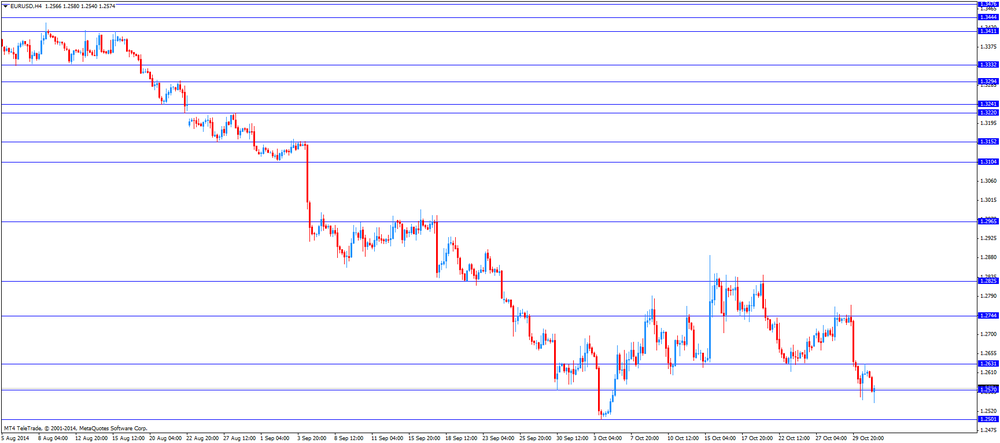

The euro traded slightly higher against the U.S. dollar. Eurozone's consumer price index climbed at an annual rate of 0.4% in October, in line with expectations, up from a 0.3% rise in September.

Eurozone's unemployment rate remained unchanged at 11.5% in September, in line with expectations.

German adjusted retail sales fell 3.2% in September, missing expectations for a 1.0% decline, after a 1.5% gain in August. August's figure was revised down from a 2.5% increase.

Consumer spending in France dropped 0.8% in September, missing forecasts of a 0.5% decrease, after a 0.9% decline in August. August's figure was revised down from a 0.7% rise.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the weak Canadian gross domestic product. The Canadian gross domestic product fell 0.1% in August, after the flat reading in July.

3.5% in the third quarter, beating expectations for a 3.1% gain, after a 4.6% rise in the second quarter.

The New Zealand dollar fell against the U.S. dollar. In the overnight trading session, the kiwi traded mixed against the greenback after the weak building permits data from New Zealand. The number of building permits in New Zealand dropped a seasonally adjusted 12.2% in September, after the flat reading in August.

The kiwi was supported by news that the Chinese government is lifting the temporary suspension for export of Fonterra powder products.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie declined against the greenback after the release of Australian producer price index and private sector credit. Australia's producer price index (PPI) rose 0.2% in the third quarter, after a 0.1% decline in the second quarter.

On a yearly basis, Australia's PPI increased 1.2% in the third quarter, missing expectations for a 2.6% rise, after a 2.3% gain in the second quarter.

Private sector credit in Australia climbed 0.5% in September, beating expectations for a 0.4% rise, after a 0.4% increase in August.

On a yearly basis, private sector credit in Australia rose 5.4% in September, after a 5.1% gain in August.

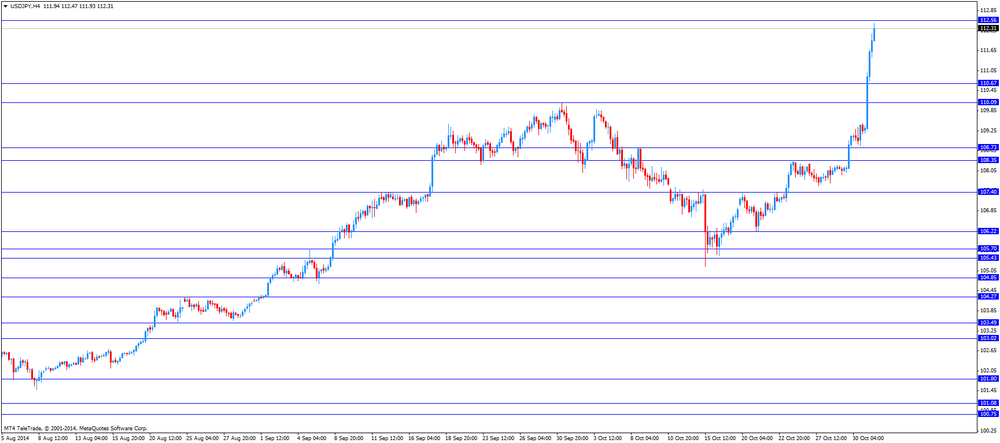

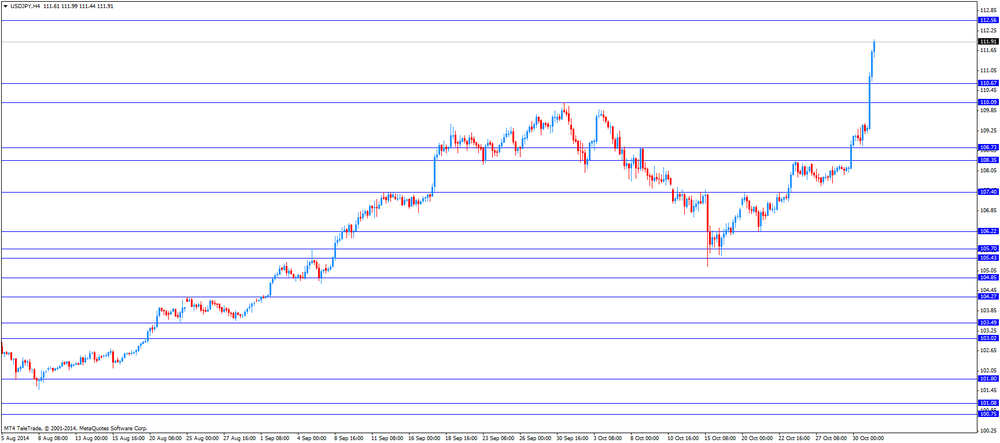

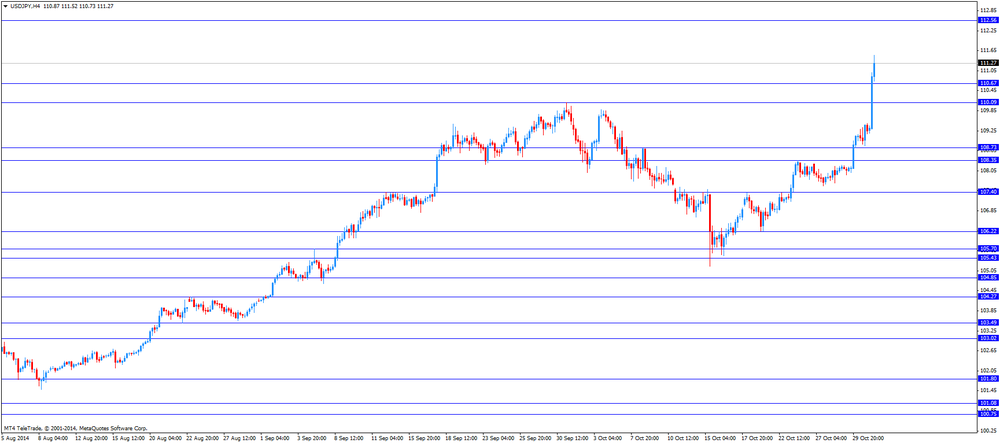

The Japanese yen dropped against the U.S. dollar after the Bank of Japan's interest rate decision. The Bank (BoJ) decided to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion. This decision was not expected by analysts.

News that the Japanese government approved plans by the Government Pension Investment Fund to raise the holding of foreign stocks to 25% from 12% also weighed on the yen.

Japan's national consumer price index (CPI) rose 3.2% in September, exceeding expectations for a 3.0% gain, after a 3.3 increase in August.

Japan's national CPI excluding fresh food increased 3.0% in September, in line with expectations, after a 3.1% rise in August.

Tokyo's CPI climbed 2.5% in October, after a 2.9% rise in September.

Tokyo's CPI excluding fresh food gained 2.5% in October, in line with expectations, after a 2.6% increase in September.

Household spending in Japan dropped at annual rate of 5.6% in September, missing forecasts of a 4.0% decrease, after a 4.7% fall in August.

Japan's unemployment rate rose to 3.6% in September from 3.5% in August, in line with expectations.

-

15:15

Bank of Japan Governor Haruhiko Kuroda: further stimulus measures are necessary “to ensure the early achievement of our price target”

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a press conference on Friday that the central bank expanded its quantitative and qualitative easing "to ensure the early achievement of our price target". He added that "now is a critical moment for Japan to emerge from deflation".

Kuroda said that Japan's economy continues to recover, but falling oil prices, slowing global growth and weak household spending after the tax hike had a negative impact on price growth.

-

15:01

-

13:55

U.S.: Reuters/Michigan Consumer Sentiment Index, October 86.9 (forecast 86.4)

-

13:45

U.S.: Chicago Purchasing Managers' Index , October 66.2 (forecast 59.5)

-

13:40

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600-05(E2.3bn), $1.2615(E1.1bn), $1.2700(E2.5bn), $1.2800(E1.5bn)

USD/JPY: Y107.65($2.8bn), Y108.50($1.2bn), Y109.50($550mn)

EUR/JPY: Y138.50(E615mn), Y138.85(E230mn)

GBP/USD: $1.6000(stg713mn), $1.6100(stg700mn)

EUR/GBP: stg0.7940-50(E1.0bn)

USD/CHF: Chf0.9445-60($440mn), Chf0.9560-65($500mn)

AUD/USD: $0.8745(A$2.5bn), $0.8775, $0.8850(A$649mn), $0.8900(A$300mn)

AUD/JPY: Y95.25(A$602mn), Y96.00(A$510mn)

NZD/USD: $0.7750(NZ$550mn), $0.7900(NZ$1.2bn)..(AUD/NZD Friday NZ$1.1300 A$1bn)

USD/CAD: C$1.1015($2.2bn)

-

13:11

Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies ahead of the Chicago purchasing managers' index and final Reuters/Michigan Consumer Sentiment Index

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 United Kingdom Gfk Consumer Confidence October -1 -2

00:30 Australia Producer price index, q / q Quarter III -0.1% +0.2%

00:30 Australia Producer price index, y/y Quarter III +2.3% +2.6% +1.2%

00:30 Australia Private Sector Credit, m/m September +0.4% +0.4% +0.5%

00:30 Australia Private Sector Credit, y/y September +5.1% +5.4%

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Housing Starts, y/y September -12.5% -17.1% -14.3%

06:00 Japan BOJ Outlook Report

06:30 Japan BOJ Press Conference

07:00 Germany Retail sales, real adjusted September +1.5% Revised From +2.5% -1.0% -3.2%

07:00 Germany Retail sales, real unadjusted, y/y September -0.7% Revised From +0.1% +1.2% +2.3%

07:45 France Consumer spending September -0.9% Revised From +0.7% -0.5% -0.8%

07:45 France Consumer spending, y/y September +1.4% +0.2%

10:00 Eurozone Unemployment Rate September 11.5% 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) October +0.3% +0.4% 0.4%

12:30 Canada GDP (m/m) August 0.0% -0.1%

12:30 U.S. Employment Cost Index Quarter III +0.7% +0.5% +0.7%

12:30 U.S. Personal Income, m/m September +0.3% +0.3% +0.2%

12:30 U.S. Personal spending September +0.5% +0.1% -0.2%

12:30 U.S. PCE price index ex food, energy, m/m September +0.1% +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y September +1.5% +1.5%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the Chicago purchasing managers' index and final Reuters/Michigan Consumer Sentiment Index. The Chicago purchasing managers' index is expected to decline to 59.5 in October from 60.5 in September.

The final Reuters/Michigan Consumer Sentiment Index is expected to rise to 86.4 in October.

Personal income in the U.S. rose 0.2% in September, missing expectations for a 0.3% increase, after a 0.3% gain in August.

Personal spending in the U.S. declined 0.2% in September, missing expectations for a 0.1% rise, after a 0.5% gain in August.

The greenback remained supported by yesterday's U.S. gross domestic product. The U.S. preliminary gross domestic product increased at an annual rate of 3.5% in the third quarter, beating expectations for a 3.1% gain, after a 4.6% rise in the second quarter.

The euro traded lower against the U.S. dollar. Eurozone's consumer price index climbed at an annual rate of 0.4% in October, in line with expectations, up from a 0.3% rise in September.

Eurozone's unemployment rate remained unchanged at 11.5% in September, in line with expectations.

German adjusted retail sales fell 3.2% in September, missing expectations for a 1.0% decline, after a 1.5% gain in August. August's figure was revised down from a 2.5% increase.

Consumer spending in France dropped 0.8% in September, missing forecasts of a 0.5% decrease, after a 0.9% decline in August. August's figure was revised down from a 0.7% rise.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar dropped against the U.S. dollar after the weak Canadian gross domestic product. The Canadian gross domestic product fell 0.1% in August, after the flat reading in July.

EUR/USD: the currency pair dropped to $1.2519

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y111.99

The most important news that are expected (GMT0):

13:45 U.S. Chicago Purchasing Managers' Index October 60.5 59.5

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 84.6 86.4

-

12:45

Orders

EUR/USD

Offers $1.2770, $1.2720, $1.2700, $1.2665

Bids $1.2540, $1.2500

GBP/USD

Offers $1.6185, $1.6100, $1.6085, $1.6035

Bids $1.5940, $1.5900, $1.5875

AUD/USD

Offers $0.8925, $0.8910, $0.8860

Bids $0.8755, $0.8720, $0.8700, $0.8685, $0.8650

EUR/JPY

Offers Y141.25, Y141.00, Y140.00

Bids Y139.05, Y138.00, Y136.90

USD/JPY

Offers Y113.00, Y112.00

Bids Y110.00, Y109.00, Y108.80

EUR/GBP

Offers $0.7910, $0.7900, $0.7880

Bids stg0.7835, stg0.7800,

-

12:32

Bank of Japan boosted its stimulus measures

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its interest unchanged, but decided to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion. This decision was not expected by analysts.

Five BoJ board members voted in favour to boost stimulus measures, while four voted against the further stimulus measures.

The central bank said that "Japan's economy continues to recover moderately as a trend and its expected to keep growing above its potential". The BoJ added that "weak domestic demand after the sales tax hike and sharp falls in oil prices are weighing on prices".

-

12:30

Canada: GDP (m/m) , August -0.1%

-

12:30

U.S.: Employment Cost Index, Quarter III +0.7% (forecast +0.5%)

-

12:30

U.S.: Personal spending , September -0.2% (forecast +0.1%)

-

12:30

U.S.: Personal Income, m/m, September +0.2% (forecast +0.3%)

-

12:30

U.S.: PCE price index ex food, energy, m/m, September +0.1% (forecast +0.1%)

-

12:30

U.S.: PCE price index ex food, energy, Y/Y, September +1.5%

-

10:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2600-05(E2.3bn), $1.2615(E1.1bn), $1.2700(E2.5bn), $1.2800(E1.5bn)

USD/JPY: Y107.65($2.8bn), Y108.50($1.2bn), Y109.50($550mn)

EUR/JPY: Y138.50(E615mn), Y138.85(E230mn)

GBP/USD: $1.6000(stg713mn), $1.6100(stg700mn)

EUR/GBP: stg0.7940-50(E1.0bn)

USD/CHF: Chf0.9445-60($440mn), Chf0.9560-65($500mn)

AUD/USD: $0.8745(A$2.5bn), $0.8775, $0.8850(A$649mn), $0.8900(A$300mn)

AUD/JPY: Y95.25(A$602mn), Y96.00(A$510mn)

NZD/USD: $0.7750(NZ$550mn), $0.7900(NZ$1.2bn)..(AUD/NZD Friday NZ$1.1300 A$1bn)

USD/CAD: C$1.1015($2.2bn)

-

10:12

Foreign exchange market. Asian session: the Japanese yen dropped against the U.S. dollar after the Bank of Japan’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 United Kingdom Gfk Consumer Confidence October -1 -2

00:30 Australia Producer price index, q / q Quarter III -0.1% +0.2%

00:30 Australia Producer price index, y/y Quarter III +2.3% +2.6% +1.2%

00:30 Australia Private Sector Credit, m/m September +0.4% +0.4% +0.5%

00:30 Australia Private Sector Credit, y/y September +5.1% +5.4%

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Housing Starts, y/y September -12.5% -17.1% -14.3%

06:00 Japan BOJ Outlook Report

06:30 Japan BOJ Press Conference

07:00 Germany Retail sales, real adjusted September +1.5% Revised From +2.5% -1.0% -3.2%

07:00 Germany Retail sales, real unadjusted, y/y September -0.7% Revised From +0.1% +1.2% +2.3%

07:45 France Consumer spending September -0.9% Revised From +0.7% -0.5% -0.8%

07:45 France Consumer spending, y/y September +1.4% +0.2%

10:00 Eurozone Unemployment Rate September 11.5% 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) October +0.3% +0.4% 0.4%

The U.S. dollar traded mixed to higher against the most major currencies. The greenback was supported by yesterday's U.S. gross domestic product. The U.S. preliminary gross domestic product increased at an annual rate of 3.5% in the third quarter, beating expectations for a 3.1% gain, after a 4.6% rise in the second quarter.

The New Zealand dollar traded mixed against the U.S. dollar after the weak building permits data from New Zealand. The number of building permits in New Zealand dropped a seasonally adjusted 12.2% in September, after the flat reading in August.

The kiwi was supported by news that the Chinese government is lifting the temporary suspension for export of Fonterra powder products.

The Australian dollar declined against the U.S. dollar after the release of Australian producer price index and private sector credit. Australia's producer price index (PPI) rose 0.2% in the third quarter, after a 0.1% decline in the second quarter.

On a yearly basis, Australia's PPI increased 1.2% in the third quarter, missing expectations for a 2.6% rise, after a 2.3% gain in the second quarter.

Private sector credit in Australia climbed 0.5% in September, beating expectations for a 0.4% rise, after a 0.4% increase in August.

On a yearly basis, private sector credit in Australia rose 5.4% in September, after a 5.1% gain in August.

The Japanese yen dropped against the U.S. dollar after the Bank of Japan's interest rate decision. The Bank (BoJ) decided to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion. This decision was not expected by analysts.

News that the Japanese government approved plans by the Government Pension Investment Fund to raise the holding of foreign stocks to 25% from 12% also weighed on the yen.

Japan's national consumer price index (CPI) rose 3.2% in September, exceeding expectations for a 3.0% gain, after a 3.3 increase in August.

Japan's national CPI excluding fresh food increased 3.0% in September, in line with expectations, after a 3.1% rise in August.

Tokyo's CPI climbed 2.5% in October, after a 2.9% rise in September.

Tokyo's CPI excluding fresh food gained 2.5% in October, in line with expectations, after a 2.6% increase in September.

Household spending in Japan dropped at annual rate of 5.6% in September, missing forecasts of a 4.0% decrease, after a 4.7% fall in August.

Japan's unemployment rate rose to 3.6% in September from 3.5% in August, in line with expectations.

EUR/USD: the currency pair declined to $1.2558

GBP/USD: the currency pair fell to $1.5961

USD/JPY: the currency pair rose to Y111.21

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) August 0.0%

12:30 U.S. Employment Cost Index Quarter III +0.7% +0.5%

12:30 U.S. Personal Income, m/m September +0.3% +0.3%

12:30 U.S. Personal spending September +0.5% +0.1%

12:30 U.S. PCE price index ex food, energy, m/m September +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y September +1.5%

13:45 U.S. Chicago Purchasing Managers' Index October 60.5 59.5

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 84.6 86.4

-

10:00

Eurozone: Harmonized CPI, Y/Y, October +0.4% (forecast +0.4%)

-

10:00

Eurozone: Unemployment Rate , September 11.5% (forecast 11.5%)

-

07:45

France: Consumer spending , September -0.8% (forecast -0.5%)

-

07:00

Germany: Retail sales, real adjusted , September -3.2% (forecast -1.0%)

-

07:00

Germany: Retail sales, real unadjusted, y/y, September +2.3% (forecast +1.2%)

-

06:27

Options levels on friday, October 31, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2698 (1733)

$1.2654 (1643)

$1.2625 (359)

Price at time of writing this review: $ 1.2570

Support levels (open interest**, contracts):

$1.2543 (6024)

$1.2512 (5452)

$1.2476 (5759)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 58809 contracts, with the maximum number of contracts with strike pric $1,2900 (6950);

- Overall open interest on the PUT options with the expiration date November, 7 is 60288 contracts, with the maximum number of contracts with strike price $1,2600 (6024);

- The ratio of PUT/CALL was 1.03 versus 1.04 from the previous trading day according to data from October, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.6201 (2837)

$1.6103 (1693)

$1.6006 (441)

Price at time of writing this review: $1.5972

Support levels (open interest**, contracts):

$1.5897 (2388)

$1.5799 (1492)

$1.5700 (1013)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 28237 contracts, with the maximum number of contracts with strike price $1,6200 (2837);

- Overall open interest on the PUT options with the expiration date November, 7 is 33776 contracts, with the maximum number of contracts with strike price $1,6000 (2956);

- The ratio of PUT/CALL was 1.20 versus 1.15 from the previous trading day according to data from October, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:02

Japan: Housing Starts, y/y, September -14.3% (forecast -17.1%)

-

04:52

Japan: Bank of Japan Monetary Base Target, 275 (forecast 270)

-

04:47

Japan: BoJ Interest Rate Decision, 0.10% (forecast 0.10%)

-

00:33

Australia: Private Sector Credit, y/y, September +5.4%

-

00:31

Australia: Private Sector Credit, m/m, September +0.5% (forecast +0.4%)

-

00:30

Australia: Producer price index, y/y, Quarter III +1.2% (forecast +2.6%)

-

00:30

Australia: Producer price index, q / q, Quarter III +0.2%

-

00:05

United Kingdom: Gfk Consumer Confidence, October -2

-

00:00

Currencies. Daily history for Oct 30'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2612 -0,19%

GBP/USD $1,6001 -0,06%

USD/CHF Chf0,9557 +0,14%

USD/JPY Y109,25 +0,38%

EUR/JPY Y137,80 +0,21%

GBP/JPY Y174,81 +0,33%

AUD/USD $0,8838 +0,54%

NZD/USD $0,7844 +0,45%

USD/CAD C$1,1185 +0,02%

-