Notícias do Mercado

-

19:21

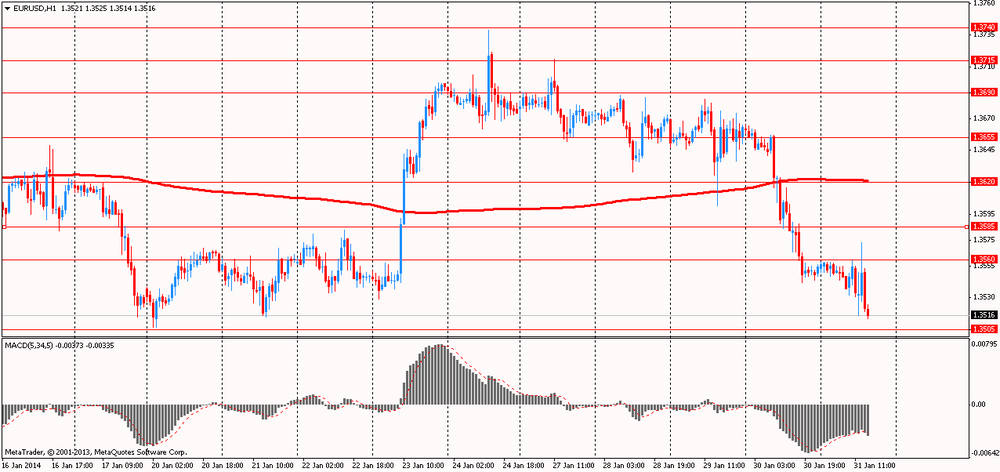

American focus : the euro fell sharply against the U.S. dollar

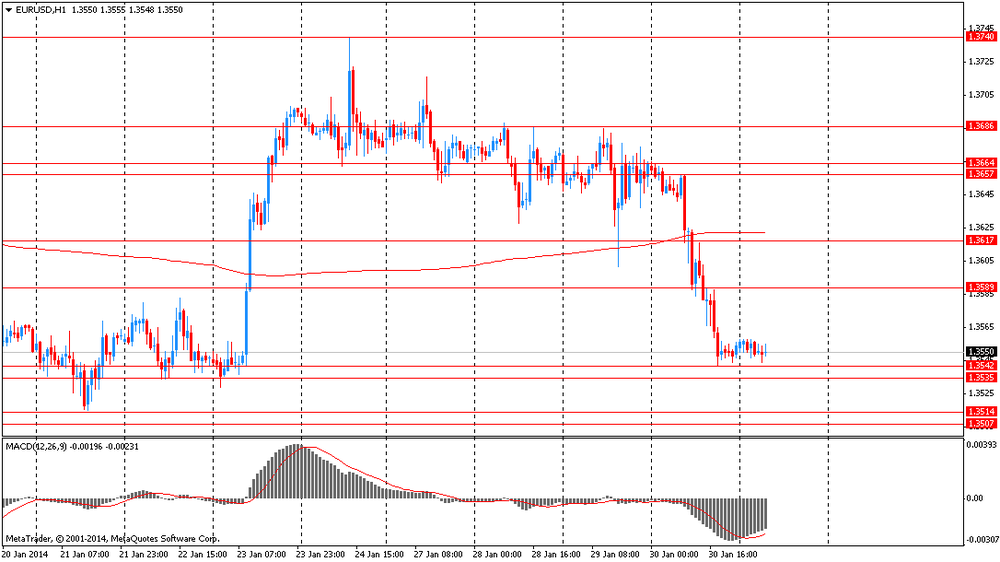

The dollar against the euro has grown significantly on the news about the intention of the Bundesbank complete sterilization of bond purchases the ECB to cash injections into the economy , similar to the Fed and QE. Besides support for the U.S. currency had submitted reports .

Ministry of Commerce said that personal spending in December rose to a seasonally adjusted 0.4 % compared with the previous month. Economists had forecast an increase of 0.2%. Spending growth in November was revised up to 0.6%. These gains were the strongest consecutive monthly increase since 2012 . Personal income remained virtually unchanged in December, weaker than the 0.2% growth that economists expected. When accounting for taxes and inflation annual growth was only 0.7 %.

Meanwhile , another report showed that PMI Managers Association in Chicago with correction for January rose to 59.6 from 59.1 in December. It is worth noting that, according to the average forecast of experts for this indicator was down to the level of 59.0 . Recall that the value above 50 is an indicator of accelerated growth in the economy. All components in January remained on the territory of expansion , except the Employment Cost Index . The growth compared with the previous month showed the index of purchase prices and new orders . Declines were observed in the indices of employment and deliveries.

Surprised with the final results of studies that were presented to Thomson-Reuters and the Michigan Institute . They showed that in January, American consumers feel less optimistic about the economy than was recorded in the last month. According to reports, in January the final index of consumer sentiment fell to 81.2 compared with the final reading for December at 82.5 , and the initial estimate for January at around 80.4 . It is worth noting that according to the average estimates of experts , the index was down compared with the December value to the level of 81.0 .

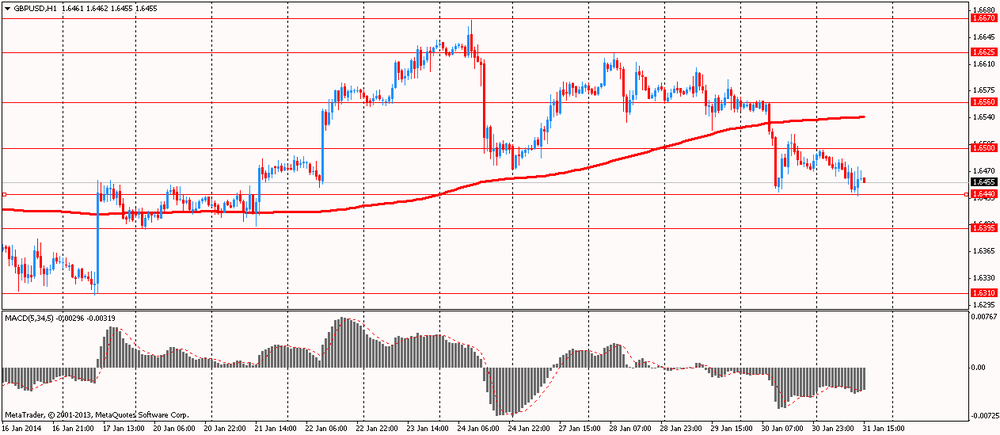

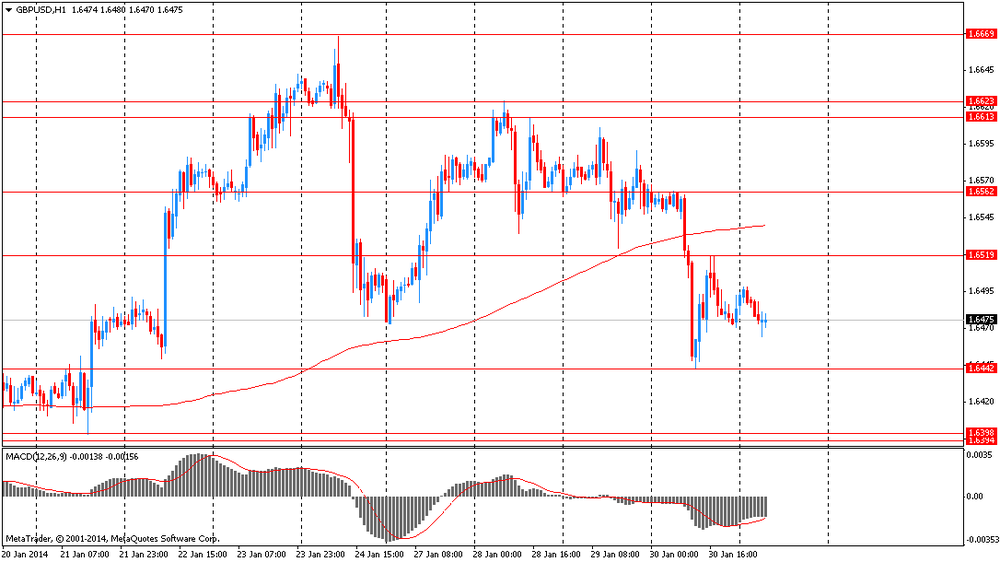

The British pound fell against the U.S. dollar amid risk aversion and the end of the month . In anticipation of the Bank of England next week, experts note that MPC, most likely will not approve further appreciation of the currency. It is also expected that the Bank of England will repeat his dovish tone by changing the statement of intent , as well as hints on future challenges that the economy still faced in the process of recovery.

Pressure on the pound also provided data for the U.S. , which showed that personal spending rose by 0.4 % vs. 0.2 %. Chicago PMI was 59.6 vs. 59.0 , and Michigan's consumer sentiment index was at the level of 81.2 against expectations of 81.0 .

The Canadian dollar rose sharply against the U.S. dollar , thus offsetting any previously lost ground. Improved sentiment against the U.S. dollar on the economic outlook , together with pigeon rhetoric Bank of Canada led the rally. The dynamics also influenced Canadian GDP data , which showed that the economy grew by a fifth consecutive month in November, against the backdrop of growth in the energy and mining, while the demands on electricity and natural gas caused the greatest increase in production in the communal areas since February 2007. Retail trade has also grown . But overall growth was restrained production, which declined for the first time in three months , as well as construction and wholesale trade. Gross domestic product , the total amount of goods and services produced in the country increased by 0.2 %, slightly slower than the 0.3% growth in each of the previous two months , Statistics Canada reported . In annualized growth slowed to 2.6% from 2.7%. The figures coincided with the consensus forecast of economists and Royal Bank of Canada . The pace of expansion put the economy on a path to an annual growth rate of about 2.5% in the fourth quarter , which would be in accordance with the new forecasts from the Bank of Canada, which he presented in its quarterly report on monetary policy last week.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, January 81.2 (forecast 81.0)

-

14:45

U.S.: Chicago Purchasing Managers' Index , January 59.6 (forecast 59.0)

-

13:48

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y101.60, Y102.00/25(VL), Y102.90, Y103.00(VL), Y103.40

EUR/USD $1.3475-85, $1.3530, $1.3550, $1.3570, $1.3575, $1.3650

GBP/USD $1.6500, $1.6600

EUR/GBP stg0.8280

EUR/CHF Chf1.2200, Chf1.2250

EUR/NOK Nok8.5000

AUD/USD $0.8650, $0.8800

AUD/JPY Y90.70, Y91.10

AUD/NZD NZ$1.0550

USD/CAD C$1.1000, C$1.1100, C$1.1175, C$1.1200

-

13:32

U.S.: Personal spending , December +0.4% (forecast +0.2%)

-

13:31

U.S.: Employment Cost Index, Quarter IV +0.5% (forecast +0.4%)

-

13:30

Canada: GDP (m/m) , November +0.2% (forecast +0.2%)

-

13:30

U.S.: PCE price index ex food, energy, m/m, December +0.1% (forecast +0.1%)

-

13:30

U.S.: PCE price index ex food, energy, Y/Y, December +1.2% (forecast +1.2%)

-

13:30

U.S.: Personal Income, m/m, December 0.0% (forecast +0.2%)

-

13:16

European session: the euro fell

07:00 Germany Retail sales, real adjusted December +1.5% +0.2% -2.5%

07:00 Germany Retail sales, real unadjusted, y/y December +1.6% +1.9% -2.4%

07:45 France Consumer spending December +1.4% -0.2% -0.1%

07:45 France Consumer spending, y/y December +1.5% -0.8% +0.2%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January +0.8% +0.9% +0.7%

10:00 Eurozone Unemployment Rate December 12.1% 12.1% 12.0%

The euro exchange rate shows mixed against the U.S. dollar with a predominance of negative component . Today we have published data on inflation and unemployment in the eurozone. Eurozone inflation slowed for the second month in a row in January , showed preliminary estimate by Eurostat. Another report showed that the unemployment rate in the currency bloc fell slightly in December.

Inflation unexpectedly fell to 0.7 percent in January from 0.8 percent in December . Economists had forecast that inflation will rise to 0.9 percent. Meanwhile, core inflation, which excludes prices of energy , food, alcohol and tobacco, rose to 0.8 percent from 0.7 percent in December . Result is consistent with economists' expectations . Inflation has remained below the target level of the European Central Bank " below but close to 2 percent," the twelfth consecutive month.

In a separate report , Eurostat said that the unemployment rate fell slightly to 12 percent in December compared with 12.1 percent in November. According to expectations , the unemployment rate was to remain unchanged. The number of unemployed fell by 129,000 from November to 19.01 million . In the 28 countries of the EU unemployment rate was 10.7 percent in December , compared with 10.8 percent in November .

In light of these results , Martin Van Vlient analyst ING, commented: "Given the uncertain recovery and high unemployment rate (12.0 %) , wage and price pressures in the euro area is likely to remain low for a longer time than currently expects the ECB ... However, at the moment, new signs of recovery suggest that during the meeting next week the central bank chooses to " keep their powder dry ."

At the same time , pressure on the single currency was weak retail sales data in Germany. German retail trade turnover decreased unexpectedly during the Christmas season , showed the preliminary results of the Federal Statistical Office .

Retail turnover fell by 2.5 percent in real terms compared with a month ago , offset by growth in November to 0.9 percent. Sales are expected to increase were 0.2 percent . Retail sales , on an annual basis , fell 2.4 percent in December , in contrast to 1.1 percent growth , placed in November and 1.9 percent growth expected by economists. Retail trade turnover during the year 2013 was 0.1 percent more than in the previous year , showing the same pace as in 2012 .

The British pound fell against the U.S. dollar despite the strong consumer confidence . UK consumer optimism in January reached its highest level in more than six years , helped by an improvement in both their personal finances because of the economic situation . This is evidenced by the results of the survey, presented Friday by research company GfK. Monthly consumer confidence index calculated by GfK, in January rose to -7 to -13 in December. This is the highest level since September 2007. The result was better than -10 expected by most economists .

"After three consecutive drops at one point in January, the index showed a dramatic return to the sharp increase , which was observed last summer ," - said Nick Moon , managing director of the Social Science Research in GfK. " All five of the individual elements that make up the index , showed a significant increase in this month ."

EUR / USD: during the European session, the pair rose to $ 1.3573 , and then fell to $ 1.3514

GBP / USD: during the European session, the pair fell to $ 1.6438

USD / JPY: during the European session, the pair fell to Y102.10

At 13:30 GMT , Canada will report on changes in the volume of GDP in November. In the U.S. at 13:30 GMT will main index for personal consumption expenditures , changes in spending, deflator for personal consumption expenditures in December , the index of the cost of labor for the 4th quarter , in 14:45 GMT - Chicago PMI index for January, in 14:55 GMT - an indicator of consumer confidence from the University of Michigan in January

-

10:30

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y101.60, Y102.00/25(VL), Y102.90, Y103.00(VL), Y103.40

EUR/USD $1.3475-85, $1.3530, $1.3550, $1.3570, $1.3575, $1.3650

GBP/USD $1.6500, $1.6600

EUR/GBP stg0.8280

EUR/CHF Chf1.2200, Chf1.2250

EUR/NOK Nok8.5000

AUD/USD $0.8650, $0.8800

AUD/JPY Y90.70, Y91.10

AUD/NZD NZ$1.0550

USD/CAD C$1.1000, C$1.1100, C$1.1175, C$1.1200

-

10:00

Eurozone: Harmonized CPI, Y/Y, January +0.8% (forecast +0.9%)

-

10:00

Eurozone: Unemployment Rate , December 12.0% (forecast 12.1%)

-

07:45

France: Consumer spending , December -0.1% (forecast -0.2%)

-

07:45

France: Consumer spending, y/y, December +0.2% (forecast -0.8%)

-

07:28

Asian session: The dollar headed

00:05 United Kingdom Gfk Consumer Confidence January -13 -10 -7

00:30 Australia Producer price index, q / q Quarter IV +1.3% +0.7% +0.2%

00:30 Australia Producer price index, y/y Quarter IV +1.9% +2.7% +1.9%

00:30 Australia Private Sector Credit, m/m December +0.3% +0.4% +0.5%

00:30 Australia Private Sector Credit, y/y December +3.8% +3.9%

The dollar headed for its best January since 2010 versus a basket of its peers ahead of data forecast to show Americans increased spending for an eighth month, adding to evidence the U.S. economy is growing. U.S. consumer spending probably rose 0.2 percent in December, following a 0.5 advance in November that was the biggest in five months, according to the median estimate of economists surveyed by Bloomberg before the Commerce Department report today.

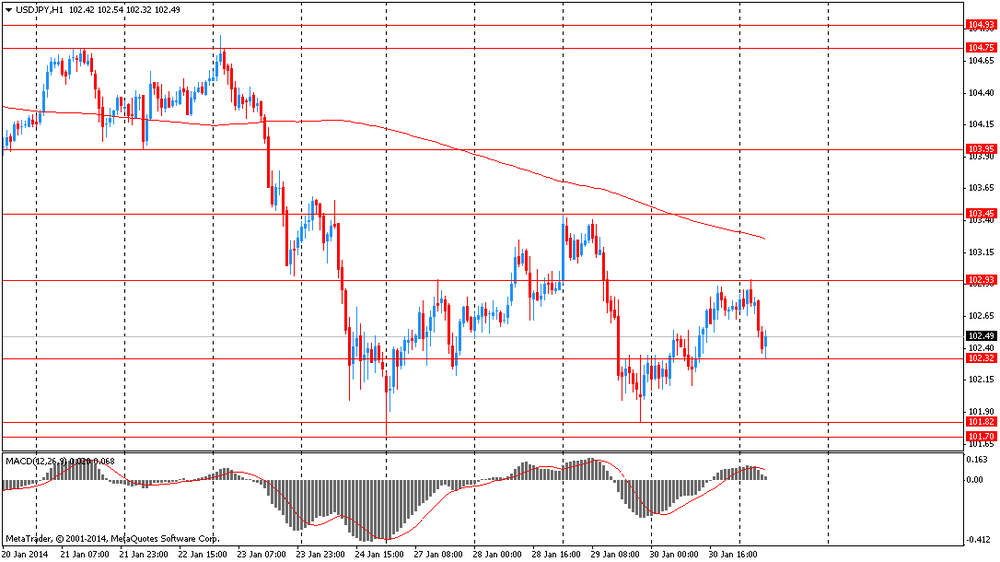

The yen extended monthly gains versus its 16 major peers as equities fell in Japan and data showing accelerating inflation reduced the case for monetary easing. A report today showed Japan’s December core consumer prices rose 1.3 percent from a year earlier, compared with the median estimate for a 1.2 percent gain in a Bloomberg News survey.

The euro was poised for its biggest monthly decline since March and the first loss since August against the greenback before a European Central Bank policy meeting Feb. 6.

The New Zealand dollar extended its worst start to a year since 2010 after Reserve Bank Governor Graeme Wheeler said today the exchange rate has “been stronger and initial indications are that house price inflation may be starting to moderate. The exchange rate remains a considerable headwind for the economy, and the bank does not believe its current level is sustainable in the long run,” he said.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3545-55

GBP / USD: during the Asian session the pair fell to $ 1.6465

USD / JPY: on Asian session the pair fell to Y102.30

Although the week's main events are behind us, there is still a full calendar ahead Friday. The European calendar gets underway at 0700GMT, with the release of the German December retail sales data. Sales are seen rising 0.2% on month, up 1.9% on year. At the same time, the German Finance Ministry releases its monthly report. French data set for release at 0745GMT includes the December construction spending data and the December PPI numbers. ECB Governing Council members Nowotny, Noyer and Rimsevics are to speak in Budapest, Hungary from 0800GMT. The EMU data set for release at 1000GMT is the December employment data and, perhaps more importantly, the January flash HICP data. HICP is seen by analysts at +0.9% on year, although there is a risk of a downside surprise. -

07:00

Germany: Retail sales, real unadjusted, y/y, December -2.4% (forecast +1.9%)

-

07:00

Germany: Retail sales, real adjusted , December -2.5% (forecast +0.2%)

-

06:25

Currencies. Daily history for Jan 30'2014:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3554 -0,80%

GBP/USD $1,6483 -0,49%

USD/CHF Chf0,9026 +0,90%

USD/JPY Y102,71 +0,42%

EUR/JPY Y139,22 -0,35%

GBP/JPY Y169,31 -0,06%

AUD/USD $0,8792 +0,63%

NZD/USD $0,8164 -0,59%

USD/CAD C$1,1155 -0,13%

-

06:07

Schedule for today, Friday, Jan 31’2014:

00:05 United Kingdom Gfk Consumer Confidence January -13 -10 -7

00:30 Australia Producer price index, q / q Quarter IV +1.3% +0.7% +0.2%

00:30 Australia Producer price index, y/y Quarter IV +1.9% +2.7% +1.9%

00:30 Australia Private Sector Credit, m/m December +0.3% +0.4% +0.5%

00:30 Australia Private Sector Credit, y/y December +3.8% +3.9%

05:00 Japan Housing Starts, y/y December +14.1% +13.9%

07:00 Germany Retail sales, real adjusted December +1.5% +0.2%

07:00 Germany Retail sales, real unadjusted, y/y December +1.6% +1.9%

07:45 France Consumer spending December +1.4% -0.2%

07:45 France Consumer spending, y/y December +1.5% -0.8%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January +0.8% +0.9%

10:00 Eurozone Unemployment Rate December 12.1% 12.1%

13:30 Canada GDP (m/m) November +0.3% +0.2%

13:30 U.S. Personal Income, m/m December +0.2% +0.2%

13:30 U.S. Personal spending December +0.5% +0.2%

13:30 U.S. PCE price index ex food, energy, m/m December +0.1% +0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y December +1.1% +1.2%

13:30 U.S. Employment Cost Index Quarter IV +0.4% +0.4%

14:45 U.S. Chicago Purchasing Managers' Index January 59.1 59.0

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) January 80.4 81.0

-