Notícias do Mercado

-

23:58

RBA to officially drop its YCC policy on November 2 – Goldman Sachs

Goldman Sachs (GS) came out with its analytics ahead of the key Reserve Bank of Australia (RBA) monetary policy meeting, citing the Aussie central bank’s earlier decision to not defend the yield target.

The US bank expects the RBA to officially drop its Yield Curve Control (YCC) policy on November 02. The same hints at, “The risks around the meeting appear skewed in a hawkish direction as the Bank has limited options to forcefully push back against market pricing," per the GS.

Goldman also cites the Aussie core inflation below the 2.5% target and wage growth more subdued than the RBA's 3-4% criteria for liftoff to expect that, “RBA to remain a laggard in the medium-run in terms of liftoff relative to other G10 central banks.”

The same joins the bank’s bullish view on oil and bearish expectations for iron to mention that the AUD/CAD downside could become an attractive opportunity once the tactical risk event has passed.

Also read: AUD/USD retreats towards 0.7500 ahead of RBA

-

23:52

Japan Monetary Base (YoY) below expectations (10.4%) in October: Actual (9.9%)

-

23:50

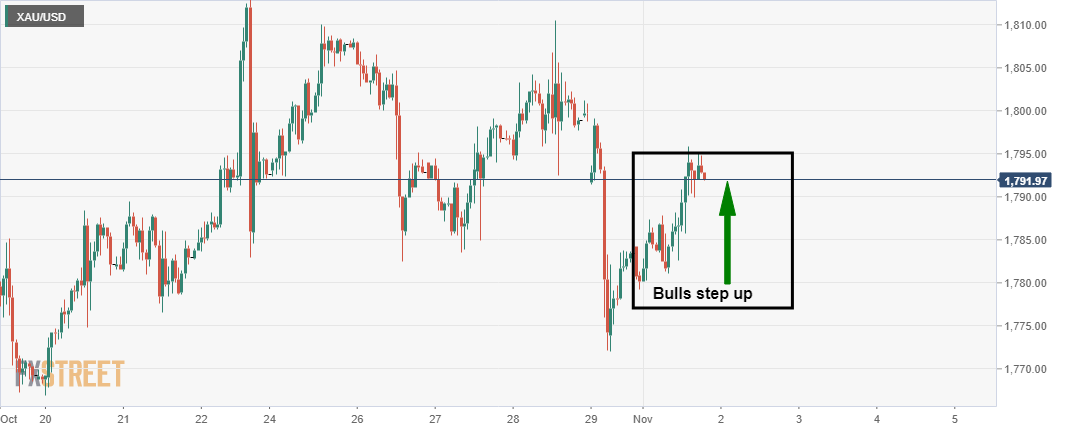

Gold Price Forecast: XAU/USD battles previous support near $1,800 amid sluggish markets

- Gold struggles to extend Monday’s rebound near short-term resistance line.

- Market sentiment dwindles ahead of the key central bank events.

- Inflation concerns remain elevated despite recently mixed clues, Sino-American trade deal, US stimulus favored buyers of late.

- Gold Price Forecast: Cautious optimism underpins the metal

Gold (XAU/USD) remains shy of $1,800 despite Monday’s rebound, hovering around $1,790 amid early Tuesday’s Asian session. The yellow metal cheered recovery in the market’s mood and softer US dollar to consolidate Friday’s losses the previous day. However, cautious sentiment during the run-up to the key central bank meetings seems to challenge the metal’s immediate moves.

US President Joe Biden’s commitment to getting the multi-billion dollars worth of economic stimulus through the Senate this week underpinned the traders’ optimism earlier in the week.

Following that, comments from US Treasury Secretary Janet Yellen added to the market’s mild risk-on mood. The ex-Fed Boss Yellen hinted that the US-China Phase One trade deal and reciprocal easing of tariffs may tame inflation. The same highlights optimism towards reaching the much-awaited trade agreement among the world’s top two economies. Also favoring the risk-on mood could be US Treasury Secretary Yellen’s statements like, “I don’t think US economy is overheating.”

Additionally, a fourth consecutive daily fall in the US inflation expectations, per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, also tamed tapering tantrums and helped gold buyers too. It's worth noting that the inflation gauge jumped to the highest since 2006 before portraying the latest pullback. On the same line was the US PMI data as the ISM Manufacturing PMI eased below the previous readings in June whereas the Markit PMIs also dropped past 59.2 market consensus and preliminary forecast for October.

However, the Fed Clevland’s version of the median PCE Inflation rate rockets higher of late, allowing the US Federal Reserve (Fed) hawks to remain hopeful.

That being said, firmer Wall Street benchmarks around the record tops and sluggish US Treasury yields printed positive mood on Monday but the recently downbeat S&P 500 Futures portray cautious sentiment and probe the gold buyers.

Moving on, inflation and central bankers remain hot topics for this week while headlines concerning the US-China trade deal and infrastructure spending package may offer additional filters to direct short-term gold moves.

Technical analysis

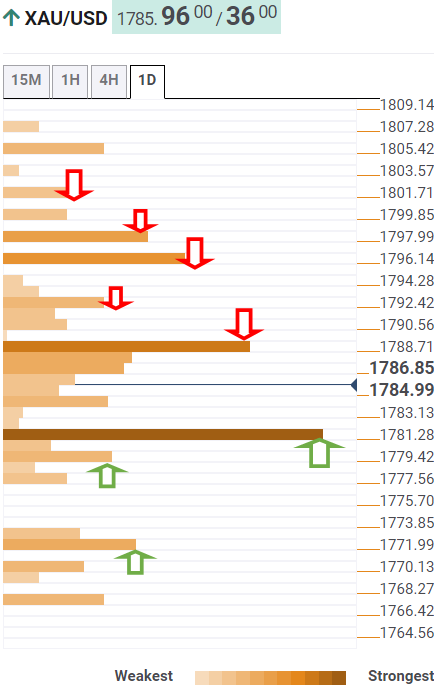

Having reversed Friday’s monthly support line break on Monday, gold pokes the support-turned-resistance, also keeping the bounce off 100-SMA, inside a weekly descending trend channel of late.

Given the firmer RSI conditions, not overbought, coupled with the MACD line teasing buyers, the upside momentum seems ready to overcome the bearish chart pattern with an upside break of $1,800 hurdle.

Following that, October’s peak near $1,813 will test the gold buyers ahead of fueling the run-up towards the key $1,834 resistance level, comprising tops marked during July and September.

Meanwhile, 100-SMA surrounding $1,781 restricts pullback moves before the channel’s support and 200-SMA offers a tough nut to crack for the gold sellers around $1,768.

During the quote’s weakness past $1,768, multiple supports near $1,745 will test the gold bears before directing them to the previous month’s bottom of $1,721.

Gold: Four-hour chart

Trend: Further recovery expected

-

23:32

AUD/NZD hovers around 1.0474 ahead of the RBA monetary policy statement

- AUD/NZD pair is subdued ahead of the RBA monetary policy statement.

- AUD/NZD: RBA to keep rates unchanged and abandon Yield Curve Control.

- RBA: Would the central bank drop the calendar reference, or stay put with it?

The AUD/NZD slides as the Asian session begins, down 0.10%, trading at 1.0476 at the time of writing. Later on Tuesday, the Reserve Bank of Australia will unveil its monetary policy statement. Market participants are expecting no change at the cash rate. Regarding forward guidance, most economists expect a drop of the calendar reference, as expressed in the last monetary policy meeting when the bank told conditions for a hike rate “will not be met until 2024.”

According to ANZ analysts, in a note to clients, said: “The problem with dropping the calendar reference is that it will likely encourage the market to solidify its expectation that rate hikes will happen in the early part of 2022.“ Concerning the Yield Curve Control, ANZ expects that the RBA would not use additional Yield Curve Control.

The base case scenario for the RBA is to hold rates, abandon the Yield Curve Control (YCC), and drop the calendar reference in the forward guidance. In the abovementioned outcome, the AUD/NZD pair would be under intense buying pressure, which would target 1.0500, followed by the 100-day moving average at 1.0520.

On the flip side, if the RBA holds rates, drop the Yield Curve Contro (YCC) but sticks to the calendar reference of 2024, the AUD/NZD could tumble towards 1.0400.

AUD/NZD Price Forecast: Technical outlook

Daily chart

The AUD/NZD has a downward bias, as shown by the daily moving averages (DMA’s) above the spot price, except for the 50-DMA lying at 1.0423. The Australian dollar recovered some ground against the kiwi, supported by a rising slope trendline that travels from the September 16 low towards the October 22 low, which Is support.

For NZD buyers to accelerate the downtrend, they will need a daily close below the 1.0400 level. In that outcome, the first support level would be the September 21 resistance now turned support, at 1.0361.

On the flip side, AUD buyers will need to reclaim the 100-DMA at 1.05200. A breach of the latter would exert upward pressure on the AUD/NZD, leaving the 200-DMA exposed as the first resistance level at 1.0640.

Nevertheless, the pair has not been trading solely on technicals. Recent developments between both central banks have kept both currencies fighting, within a 1.0400 – 1.0500 range, without any clear trend, but the NZD has the upper hand, as it lifted interest rates, leaving the AUD trailing.

-

23:27

USD/CAD consolidates losses below 1.2400 as oil retreats to $83.00

- USD/CAD picks up bids to recover Monday’s losses, stays around four-month low since October 15.

- WTI eases amid cautious market sentiment ahead of the key central bank events.

- Inflation expectations trouble Fed hawks, stimulus hopes, US/Canada data came out mixed for October.

- Canada Building Permits, API Weekly Crude Oil Stock will decorate calendar but pre-Fed mood restricts short-term moves.

USD/CAD licks the week-start wounds near 1.2375 amid a quiet Asian session on Tuesday. The Loonie pair benefited from the broad US dollar weakness the previous day before the latest shift in the risk appetite questioned the recovery move.

The US Dollar Index (DXY) pared the heaviest daily jump since June on Monday as market sentiment improved amid hopes of further stimulus and easy US PMI data, not to forget the US-China headlines. However, fears ahead of the key central bank events underpin the US dollar’s safe-haven demand and recall the USD/CAD buyers of late.

US President Joe Biden remains hopeful of passing the infrastructure spending plan this week and favored the market’s mood even as Republicans showed refrain from altering their demands. On the same line were comments from US Treasury Secretary Janet Yellen concerning the US-China Phase One trade deal.

The diplomat hinted reciprocal easing of tariffs may tame the inflation while also saying, “I don’t think US economy is overheating.” The US inflation expectations, as the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, justify Yellen’s comments by dropping for the fourth consecutive day from levels last seen during August 2006 by the end of Monday’s North American trading. However, the Fed Clevland’s version of the median PCE Inflation rate rockets higher and keeps the Fed tapering woes alive.

Elsewhere, US ISM Manufacturing PMI eased below the previous readings in June whereas the Markit PMIs also dropped past 59.2 market consensus and preliminary forecast for October. On the other hand, Canada’s Markit Manufacturing PMI crossed 57.0 previous reading and 57.2 expectations to 57.7 for October.

Against this backdrop, S&P 500 Futures struggle to extend Wall Street gains and the US 10-year Treasury yields also wobble around 1.56% after a sluggish start to the week.

Given the cautious mood in the market ahead of the RBA, Fed and the BOE meetings, USD/CAD traders may attention to Canada’s main export item WTI crude oil for fresh impulse. The black gold recently eased to $83.00 amid fears emanating from the monetary policy decisions and the OPEC+ verdict. For an immediate basis, weekly inventory data from the industry source, namely the American Petroleum Institute (API), prior 2.318M, will entertain the oil traders, as well as direct immediate USD/CAD moves.

Technical analysis

Multiple levels marked during July restrict immediate USD/CAD between 1.2300 and 1.2425-30. Also acting as an upside filter is September’s bottom near 1.2495 whereas a clear downside break of 1.2300 will direct the bears toward the mid-May peak near 1.2200.

-

23:11

GBP/JPY Price Analysis: Bears seeking break of 155.70

- GBP/JPY is on the verge of a downside continuation as per the hourly chart.

- The bears will be on the lookout for a break of 155.70.

GBP/JPY is correcting the latest bearish impulse on an hourly basis and the following illustrates the prospects of a downside continuation.

GBP/JPY H1 chart

The above chart illustrates the recent hourly breakout below the hourly structure and a retest of the old support that would now be expected to act as resistance. The structure has a confluence of the 21-EMA and a 38.2% Fibonacci retracement level that reinforces the prospects of firm resistance.

GBP/JPY 15m chart

Meanwhile, from a 15-min perspective, the price will need to break below 155.70 support structure if there is going to be a higher probability of a downside continuation below the dynamic trendline support.

-

23:00

South Korea Consumer Price Index Growth (YoY) came in at 3.2%, above forecasts (3.15%) in October

-

23:00

South Korea Consumer Price Index Growth (MoM) meets forecasts (0.1%) in October

-

22:56

EUR/USD Price Analysis: Rebound remains elusive below monthly resistance

- EUR/USD faded bounce off three-week low, sidelined of late.

- 100-SMA, 200 SMA guard immediate upside ahead of the key short-term resistance line.

- One-month-old horizontal area restricts nearby downside ahead of yearly low.

- Sluggish RSI, key resistances challenge recovery moves, bears need conviction.

EUR/USD fails to extend the week-start rebound past 1.1600 during the initial Asian session on Tuesday.

The major currency pair’s corrective pullback from a three-week low crossed a horizontal area comprising multiple levels marked since September-end. However, 100-SMA recently challenged the EUR/USD recovery.

Given the steady RSI and a lack of momentum strength to cross the immediate key SMA, the pair’s recovery moves are likely to be reversed. Though, sellers await a clear downside break of the stated horizontal support zone near 1.1580-85 for fresh entry.

Following that, the yearly low around 1.1525, also the lowest since July 2020, will question the quote’s further weakness ahead of directing the bears towards the March 2020 peak of 1.1496.

Meanwhile, EUR/USD run-up beyond the immediate hurdle of 100-SMA, around 1.1610 by the press time, needs to cross the 200-SMA level surrounding 1.1635 to aim for the ascending trend line from early October, close to 1.1695.

In a case where the pair rise past 1.1695, also successfully pierce the 1.1700 threshold, late September highs near 1.1755 will be in focus.

EUR/USD: Four-hour chart

Trend: Bearish

-

22:38

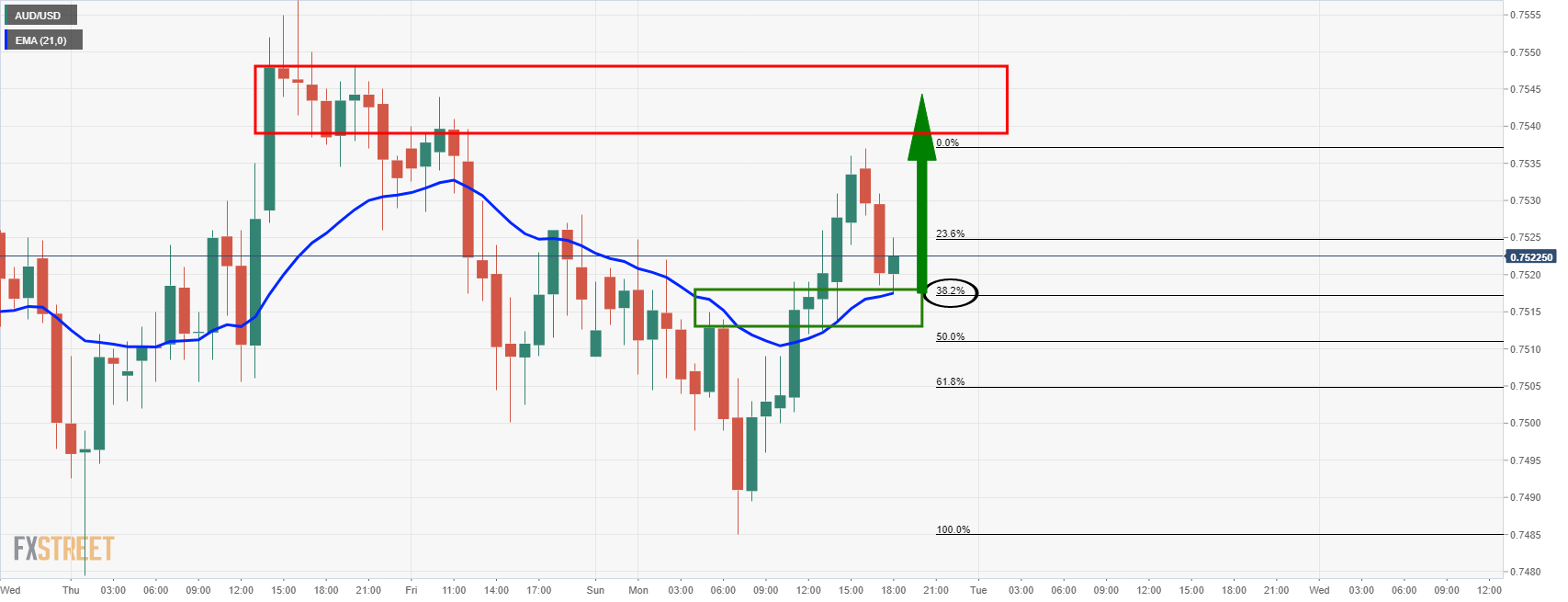

AUD/USD retreats towards 0.7500 ahead of RBA

- AUD/USD consolidates the week-start gains around the multi-month high.

- Mixed clues, cautious optimism ahead of the key central bank events favored Aussie buyers of late.

- RBA’s forward guidance eyed amid hopes of dumping yield curve control, no rate change expected.

AUD/USD struggles to extend the previous day’s rebound from a one-week low, easing to 0.7515 amid the initial Asian session on the key Tuesday. In doing so, the Aussie pair seems to bear the burden of the pre-RBA mood amid cautious optimism in the market.

Having initially dropped on China’s downbeat official PMIs, AUD/USD benefited from firmer Caixin Manufacturing PMI from Beijing and mixed data at home during early Monday. Following that, optimism over the Sino-American trade deal and softer-than-previous US ISM Manufacturing PMI helped the AUD/USD buyers to keep the bounce off a one-week low. However, the cautious mood ahead of the Reserve Bank of Australia (RBA) monetary policy meeting challenges the quote of late.

Although China’s official PMIs portrayed the contraction in October activities, Caixin Manufacturing PMI offered a positive surprise and favored the AUD/USD prices. On the same line could be the US ISM Manufacturing PMI for October that eased below 61.1 prior readouts to 60.8, beating 60.6 market forecasts. The softer US data and firmer China figures also join mixed housing market data at home and Australia’s strong Commonwealth Bank PMI for October to favor AUD/USD recovery moves.

Additionally, comments from US Treasury Secretary Janet Yellen added to the market’s mild risk-on mood, The diplomat hinted that the US-China Phase One trade deal and reciprocal easing of tariffs may tame the inflation. The same highlights optimism towards reaching the much-awaited trade agreement among the world’s top two economies. Also favoring the risk-on mood could be US Treasury Secretary Yellen’s statements like, “I don’t think US economy is overheating.” Her comments on Inflation could be justified by the US inflation expectations as the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, dropped for the fourth consecutive day from levels last seen during August 2006 by the end of Monday’s North American trading. The same hints at the Fed’s cautious action during Wednesday’s meeting and favors the AUD/USD buyers.

It’s worth noting that the recent challenges to the global economic growth hints at a bit slower dialing back of the easy money policies across the globe and hence keep the AUD/USD bulls ahead of the key central bank meetings, including the Fed and Bank of England (BOE) decisions, on Wednesday and Thursday respectively. Furthermore, Australia’s opening up of the international borders and positive chatters over the US stimulus are some extra positive catalysts for the pair.

Amid these plays, US stocks remain remained firm around the record top whereas the US 10-year Treasury yields portrayed a sluggish start to the week. Further, the US Dollar Index (DXY) pared Friday’s heavy gains on Monday and helped the Aussie buyers too.

Looking forward, the AUD/USD traders will pay close attention to the RBA moves as the Aussie central bank indirectly has stopped yield curve controls and may formally accept the same, backed by the recent jump in the Aussie inflation data. However, RBA Government Philip Lowe earlier highlighted the need for the wage prices to remain firmer to push the central bank towards faster rate hikes, which in turn makes RBA forward guidance the key.

Read: Reserve Bank of Australia Preview: Reality check for Australian policymakers

Technical analysis

Having defied a downside break to the ascending support line from September 29, AUD/USD bulls struggle around the stated trend line near 0.7515 by the press time. Given the bullish MACD and firmer RSI, not overbought, the quote is expected to stay firmer, inching closer to the 200-DMA hurdle surrounding 0.7560. However, a three-month-old trend line resistance near 0.7565 will challenge any further advances amid nearly overbought RSI conditions. Meanwhile, the buyers’ inability to carry the rebound from a short-term key support line, around 0.7515 by the press time, will seek validation of a bearish impulse from August month’s peak of 0.7478 and the latest swing low close to 0.7450.

-

22:22

France's Beaune: Received first signals from UK authorities to speed up Brexit talks

Amid the escalating EU-UK tussle over Brexit, the French Europe Minister Clement Beaune said, per Reuters, “France received first signals from UK authorities to speed up talks, an answer to latest french proposals is expected by Wednesday.”

Additional comments

Has invited UK counterpart David Frost to Paris on Thursday for deeper talks about implementing EU-UK agreements.

That sanctions announced by France will not be applied before that meeting and investigation of new UK responses to fishing licences.

In response, the UK government spokesperson said, “We welcome the French government's announcement.”

The official announcement from No.10 adds, “We have said we are ready to continue intensive discussions on fisheries.”

Furthermore, the news also mentions the UK government saying, “We welcome France saying that in-depth discussions are needed to resolve a range of difficulties in UK-EU relationship.”

“Brexit minister Frost accepted invitation and looks forward to discussions in France on Thursday,” hints the UK Government spokesperson.

FX implications

GBP/USD traders seem to have failed to respond to a welcome change on the Brexit issue as the quote seesaws around 1.3660, around a three-week low by the press time early Tuesday morning in Asia.

-

21:45

New Zealand Building Permits s.a. (MoM) down to -1.9% in September from previous 3.8%

-

21:45

New Zealand: Building Permits, m/m, September -1.9%

-

21:43

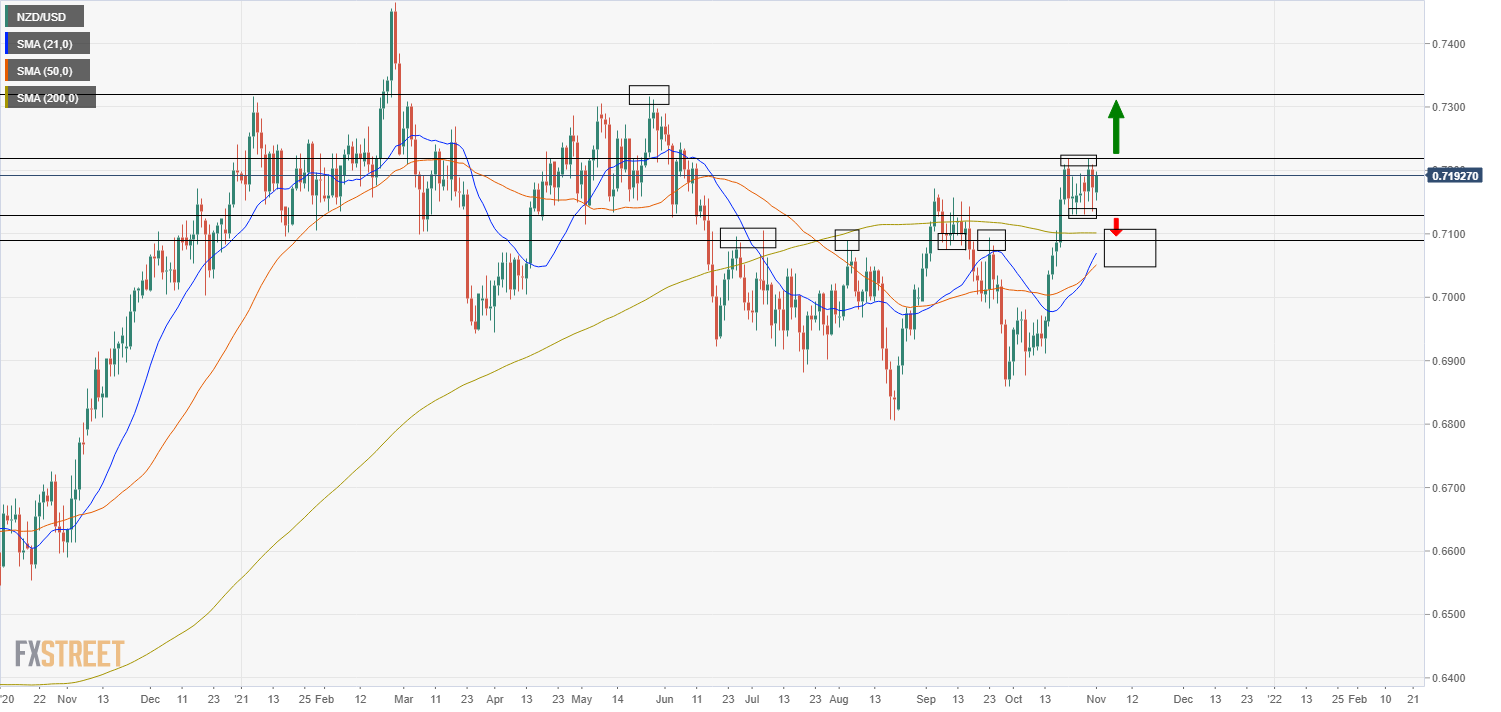

NZD/USD keeps nearby trading range around 0.7200 on RBNZ’s Orr, cautious optimism

- NZD/USD grinds higher inside a 70-pips trading range following a positive week-start.

- RBNZ’s Orr expects housing prices to ease over medium term.

- Market sentiment improves amid hopes of stimulus, softer US ISM PMI.

- No major data at home keep Kiwi at the mercy of overseas catalysts, RBA will be the key.

NZD/USD hovers around the upper end of the short-term range, teasing 0.7190 figures at the start of Tuesday’s Asian session. The Kiwi pair recently reacted to comments from Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr while hopes of US stimulus, a bit softer US ISM Manufacturing PMI and US-China headlines also favored the latest positive performance.

While accepting the fact that New Zealand’s (NZ) housing market challenges monetary and financial stability, RBNZ’s Orr also said, per Reuters, “Expect to see an easing in house prices over the medium term.”

Read: RBNZ’s Orr: Unsustainable level of house prices poses monetary, financial stability challenges

Given the RBNZ’s already-announced rate hike and the likely reduction in the US-NZ carry due to the Fed’s anticipated tighter monetary policy going forward, such comments from the RBNZ leader probe the NZD/USD bulls. The same fundamental logic could be applied to NZ’s neighbor and close trading partner Australia which inches closer to a rate hike amid firmer inflation, highlighting today’s Reserve Bank of Australia (RBA) monetary policy meeting. However, NZ is still the first major central bank to announce the rate lift and buyers remain hopeful of further advances ahead of any strong clues from either the RBA or the Fed concerning rate hikes, which is likely far from here.

Elsewhere, the US ISM Manufacturing PMI for October eased below 61.1 prior readouts to 60.8, beating 60.6 market forecasts. While the easing of the US private manufacturing gauge tests the Fed tapering woes, the activity figures are comfortably higher during the last four months and hence favor Fed hawks, also challenging the NZD/USD buyers.

Further, US Treasury Secretary Janet Yellen hints that the US-China Phase One trade deal and reciprocal easing of tariffs may tame the inflation. The same highlights optimism towards reaching the much-awaited trade agreement among the world’s top two economies. Also favoring the risk-on mood could be US Treasury Secretary Yellen’s comments stating, “I don’t think US economy is overheating.”

Additionally, an easing in the US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, dropped for the fourth consecutive day from levels last seen during August 2006 by the end of Monday’s North American trading. The same hints at the Fed’s cautious action during Wednesday’s meeting and favor the NZD/USD buyers.

Alternatively, the US and the European Union (EU) joined hands to overcome the steel and aluminum tariffs to battle China over its high productions, suggesting the Sino-American rift.

Above all, the market’s wait-and-watch approach ahead of the key central bank meetings allowed the US Dollar Index (DXY) to consolidate Friday’s heavy gains, the biggest since the mid-June and helped the NZD/USD to witness a positive start to the week.

Looking forward, there are no major data/events at home and hence the quote is likely to rely on the RBA verdict for fresh impulse. Given the firmer Aussie inflation and the RBA’s pause on yield curve control, forward guidance will be the key to watch.

Technical analysis

NZD/USD grinds higher inside a 70-pip trading range between 0.7150 and 0.7220, with a firmer RSI line keeping buyers hopeful before hitting the overbought region. Meanwhile, 100-SMA and an ascending trend line act as additional downside filters around 0.7095 and 0.7055 respectively. On the contrary, an upside clearance of 0.7220 will need validation from a four-month-old resistance line near 0.7230 before aiming May’s high near 0.7320.

-

21:04

USD/CHF Price Analysis: Positive divergence at a 4-hour chart could cap a move towards 0.9000

- USD/CHF slumps to fresh three-month lows, beneath 0.9100.

- Broad US Dollar weakness across the board weighed on the USD/CHF.

- USD/CHF: The pair trades within a bearish flag, but USD bulls need to reclaim 0.9150.

- USD/CHF: In the 4-hour chart, a positive divergence between price action and RSI indicates the pair could be headed to the upside.

The USD/CHF slides to fresh three-month lows, down 0.70%, trading at 0.9095 during the New York session at the time of writing. Mild risk-off market sentiment has kept the USD weaker across the board, except for risk-sensitive currencies, like the AUD and the GBP.

The US Dollar Index, which tracks the performance against a basket of six peers, declines 0.25%, down to 93.89, while the US 10-year Treasury yield remains flat at 1.558%. Furthermore, investors seem convinced that the Fed would hike rates by the beginning of the second half of 2022,

USD/CHF Price Forecast: Technical outlook

Daily chart

The USD/CHF is trading below the trend-setter 200-day moving average (DMA) which lies at 0.9147. Furthermore, the downward trend accelerated, pushing the pair towards the bottom trendline of a bullish flag channel, which would invalidate the pattern in case of being broken.

In the outcome of a downside break, the next support would be the August 4 low at 0.9018. A breach of the latter could send the pair tumbling towards the June 15 low at 0.8965.

Conversely, if USD bulls keep the price within the channel, they need a daily close above the 200-DMA around 0.9147. In that outcome, the immediate resistance would be the 100-DMA at 0.9186.

The Relative Strenght Index (RSI), a momentum indicator at 34, shows a slight positive divergence, which usually signals that the pair will reverse the recent downtrend to the upside.

4-hour chart

he USD/CHF 4-hour chart depicts the pair has a solid downward bias, represented by the simple moving averages (SMA’s) above the spot price and successive lower-highs and lower-lows development. However, the Relative Strength Index (RSI) at 32 shows a positive divergence, meaning that despite lower lows in price action, the RSI is printing higher lows,

indicating that the pair could move to the upside. Nevertheless, to confirm its validity, the USD/CHF needs to reclaim 0.9100.

-

20:42

RBNZ’s Orr: Unsustainable level of house prices poses monetary, financial stability challenges

The Reserve Bank of New Zealand's governor, Adrian Orr, has just stated that the unsustainable level of house prices poses monetary, financial stability challenges.

Key notes

House prices and housing affordability are affected by both supply and demand factors.

House prices have become more unsustainable over the past 12 months.

Well advanced in work to commence consulting on additional ‘debt servicing ratio’ tools.

Expect to see an easing in house prices over the medium term.

-

20:40

GBP/USD remains at two-week lows, unreactive as UK/France fishing tensions show signs of easing

- GBP was the worst performing G10 currency on Monday, with GBP/USD remains subdued around 1.3650-1.3700.

- News that France has postponed a deadline for an agreement with the UK over fishing rights hasn’t moved markets.

- While cross-channel tensions are one key theme this week, whether the BoE hikes rates or not is another.

GBP is the worst performing G10 currency on Monday, down about 0.2% versus the US dollar, but down about 0.6% versus the euro. That has meant that GBP/USD has traded subdued between 1.3650-1.3700 for the majority of the day, its lowest in about two and a half weeks. Tensions with France over fishing have escalated in recent days and are widely being attributed as behind Monday’s underperformance.

But the latest news on this front has been positive; according to Reuters, on Monday evening at the sidelines of the COP26 summit, French President Emmanuel Macron announced that his government would be postponed by one day the deadline for a resolution of the ongoing fishing row with the UK. Previously the French government had said that it would be implementing stricter checks on trucks coming into the EU from Britain and would be banning British trawlers from docking at French ports from 2300GMT on Monday. France claims that the UK has not fulfilled its pledges in the Brexit deal in terms of giving fair access to French fishing boats in UK waters. Talks between the UK and France were ongoing on Monday and Macron said that such talks must continue. “We'll see where we are tomorrow at the end of the day,” said Macron.

UK PM Boris Johnson’s rhetoric/tone to the press on the escalating spat over fishing access with France was fairly measured, with the PM merely pledging that the UK will take proportional action. The UK PM and French President will have spent a great deal of time in the presence of each other on Monday and over the last few days, given both of their presence at the G20 (which has now ended) and the start of COP26 (which ends in two weeks) and this finally appears to have resulted in an easing of tensions. But one day is not long for the two sides to reach an agreement, so the risk of the spat escalating in an actual trade/legal battle remains high and is a key story for GBP traders to watch this week. If France is to follow through with its threats against the UK, this arguably does pose an (albeit small) downside risk to the UK economy by further exacerbating the supply chain disruptions/bottlenecks currently hampering growth.

Another key theme to watch this week is Thursday’s Bank of England meeting; economists and money markets are split on whether or not the bank is going to go ahead with a 15bps rate hike. There are four hawkish Monetary Policy Committee (the committee of nine who vote on interest rates, sometimes referred to as the MPC) members who likely favour a hike, including Governor Andrew Bailey, Chief Economist Huw Pill, Deputy Governor Dave Ramsden, and External MPC member Michael Saunders. These members have expressed worries about inflation expectations becoming deanchored amid the recent surge in CPI to multi-year highs and amid expectations this surge is going to worsen next year. Meanwhile, there are three MPC members, including external members Catherine Mann, Jonathon Haskell and Silvana Tenreyro who would rather wait until at least December to observe how the labour market develops in wake of the end of the government’s furlough scheme in September (much of the labour market data for October won’t be out until December). Deputy Governors Jon Cunliffe and Ben Broadbent have not given indicated which camp they fall in yet, and their votes will ultimately swing whether or not there is a hike or not.

-

20:13

EUR/USD bulls step up and defend key territory

- EUR/USD finds its footing in preparation for the big events ahead this week.

- The US dollar has given back a significant portion of Friday's bid as markets get set for the Fed.

EUR/USD recovered the end of month drop on Monday, rising from a low of 1.1546 to a fresh high of 1.1608 on the day as the greenback gives back a significant portion of Friday's bid. At the time of writing, EUR/USD is higher by some 0.37% as the focus switched from US data to the mid-week US Federal Reserve interest rate meeting.

For the pair, it is now a battle of the central banks and data as strong EU data is now starting to test the European Central Bank's dovish resolve. In contrast today, the US ISM Manufacturing index eased 0.3pts in October to 60.8, however arguably, it is still indicating a strong expansion in the manufacturing economy for the 17th consecutive month. Analysts at ANZ Bank explained that optimism about future growth prospects is high and positive growth comments outweighed cautious ones by a ratio of 4:1.

Meanwhile, the US dollar has eased on Monday versus its main rivals on Monday, after posting its biggest daily rise in more than four months in the previous session, as traders position themselves ahead of this week's highly anticipated US Federal Reserve policy meeting.

US jobs in focus

Additionally, the US labour market will be in focus this week as well. On Friday, the Nonfarm payrolls will take centre stage no matter the outcome of the Fed. ''However, the labour market has lagged notably behind, with the labour force as well as employment still down sharply from the pre-COVID level,'' analysts at TD Securities explained, adding that the reasons behind the labour-force gap are numerous but mostly virus-related.

''We remain of the view that persistent labour-market scarring stemming from the pandemic remains a low-probability scenario, as the recovery has been swifter than that post-2008-9. In turn, we continue to expect the Fed to remain patient while achieving the maximum employment goal set under its new policy framework.''

-

19:48

Forex Today: Dollar bulls on pause ahead of critical central banks’ announcements

What you need to know on Tuesday, November 2:

The greenback edged lower against most major rivals on Monday, but its bullish potential remains intact. Market participants were cautiously optimistic pushing global equities higher and favoring a modest uptick in government bond yields. However, several central banks will unveil fresh decisions on monetary policy, including the RBA on Tuesday, US Federal Reserve on Wednesday and the Bank of England on Thursday. All of them are expected to introduce changes to their monetary policies, amid persistent inflationary pressures.

The EUR/USD pair trades around 1.1600, while GBP/USD remained under pressure in the 1.33660 price zone.

The positive tone of equities helped AUD/USD to recover above the 0.7500 threshold heading into the RBA’s monetary policy announcement. The USD/CAD pair trades around 1.2369.

Commodities are ending Monday with gains, with gold trading around $1,792 a troy ounce and WTI flirting with $84.00 a barrel.

Wall Street advanced, although gains were modest. Treasury yields ticked higher, although that on the 10-year Treasury note stood below 1.60%.

Shiba Inu prints bullish continuation pattern towards $0.00011

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:39

S&P 500 Index consolidates recent gains, remains above 4600

- The S&P 500 is consolidating at record levels above 4600.

- Dip-buyers and bargain-hunters will be eyeing retests of support at 4550 and around 4460-4480.

After closing above the 4600 level for the first time last Friday, meaning the index ended the month up nearly 7.0% (its best month since November 2020), the index has been consolidating. On an intra-day basis, the index has swung within a 4595-4620ish range and is right now trading close to 4610, putting it on course for another record close. Given the sheer pace of gains in recent weeks, it would seem reasonable to see a period of relative underperformance going forward or perhaps even a bit of a profit-taking driven technical retracement. One key level that any potential patient but dip-hungry equity bulls would be looking at would be the high from back in September at around 4550, which acted as a decent area of resistance and then support as it was broken through in October. If this level is a little too obvious and if stops are triggered, deepening the pullback, the next area to look at would be the 4460-4480 zone, where a late August high, the 21 and 50-day moving averages each resides. Again, this might be another place the dip-buyers want to get involved.

Of course, whether or not dip-buyers will actually show up or not will depend on whether any retracement lower is predominantly being driven by position adjustment or an actual deterioration in the fundamental backdrop. A negative economic shock (perhaps a new, highly dangerous Covid-19 variant, or a fresh spike in energy prices) could fulfill this criterion, as could a hawkish shift in Fed policy that is deemed by market participants as a “policy mistake” (i.e. that the Fed’s overly hawkish stance will hurt growth or even trigger a recession). Equity investors don’t seem overly worried about these risks right now and Q3 corporate earnings have, thus far, been (mostly) bumper. But if any such negative fundamental scenarios were to unfold, dip-buyers would be well to be a little more cautious.

-

19:38

EUR/GBP advances towards 0.8500 despite BoE hawkish tone in the last weeks

- EUR/GBP edges higher on the back of the EUR/USD, as the Sterling weakens against the greenback.

- Worse than expected, German Retail Sales, ignored by investors as the EUR/GBP kept trading north.

- EUR/GBP: From a technical perspective has a downward bias, as long as EUR/GBP remains below 0.8530.

The EUR/GBP climbs to two-week highs during the New York session, trading at 0.8495, up 0.53% at the time of writing. A mild risk-off market mood keeps risk-sensitive currencies like the British pound from appreciating, despite the hawkish rhetoric by important BoE members, as the BoE will unveil its monetary policy on Thursday of this week.

The European Central Bank (ECB) held its monetary policy meeting last week, where the bank kept unchanged interest rates. Also, despite rising inflationary pressures, with the Eurozone CPI expanding by 4.1%, it maintained its dovish stance, pushing backward investors’ intentions of a rate hike until late 2023.

Furthermore, the single currency is rising on the back of the EUR/USD, rising some 0.40%. Contrarily the British pound slides 0.20% against the greenback as both central banks head to their monetary policy meetings later in the week.

On the macroeconomic front, German Retail Sales for September on an annual basis collapsed, shrank 0.9% against a 1.8% increase foreseen by analysts. Despite the dismal report, the EUR/GBP continued its upward trend throughout the day.

EUR/GBP Price Forecast: Technical outlook

Daily chart

The EUR/GBP cross-currency pair has a downward bias, portrayed by the daily moving averages (DMA’s) located above the spot price. At press time, the pair is approaching the confluence of the 50 and the 100-DMA around 0.8520-30 area, which would oppose strong resistance for EUR buyers. However, the Relative Strength Index (RSI) at 53 aims higher, a bullish signal that diverges with price action.

To continue the downward trend, EUR/GBP sellers will need to hold the price below the September 16 low at 0.8500. In that outcome, EUR sellers could push the pair towards a renewed re-test of 0.8402, which is 2021 low.

For EUR/GBP buyers to confirm its upward bias, they will need a daily close above 0.8530. In that outcome, the following resistance would be the 200-DMA at 0.8588.

-

19:18

Gold Price Forecast: Bulls stepping off the gas in meeting daily resistance

- Gold move sin to test the bearish commitment at a daily counter trendline.

- All eyes are on the Fed this week while the US dollar gives back a significant portion of the recent surge to the upside.

- XAU/USD’s drop below $1,780 an ominous sign ahead of Fed

The price of gold is some 0.6% higher on the day following a solid climb into daily resistance in the highs of the day of $1,795.82. XAU/USD has travelled from a low of $1,779.23 while the US dollar eased versus its main rivals on Monday.

The greenback has corrected a significant portion of the biggest daily rise in more than four months which occurred in the previous session. Hedge funds are cutting back bearish bets ahead of this week's highly-anticipated US Federal Reserve policy meeting where the Fed is widely expected to announce its tapering plans.

Fed in focus

''Financial markets are priced aggressively for hikes in 2022, but the Fed is unlikely to endorse or push back on those expectations at this point as we await more inflation evidence,'' analysts at Societe Generale argued. We also have US Employment trends in focus and these are expected to regain momentum. The analysts at Societe general are anticipating a 520k job gain for Nonfarm Payrolls at the end of this week.

Staying with the Fed, traders across global markets have aggressively raised their outlook for policy tightening, as an energy crunch and snarled supply chains drive inflation higher, leading market participants to price the risk of a faster exit.

Analysts at TD Securities note that US Treasuries are pricing in the first hike by July 2022 and a 90% chance of a hike in June, despite the fact that tapering is on course to only end by June.

''We reiterate that pricing for Fed hikes remains far too hawkish, but insofar as the outlook for actual hikes becomes increasingly dependent on the Fed's jobs mandate, this week's nonfarm payrolls number could steal the show, the analysts added. Nonetheless, they say, ''as an ongoing CTA selling program winds down, recent pressure on gold could soon abate.''

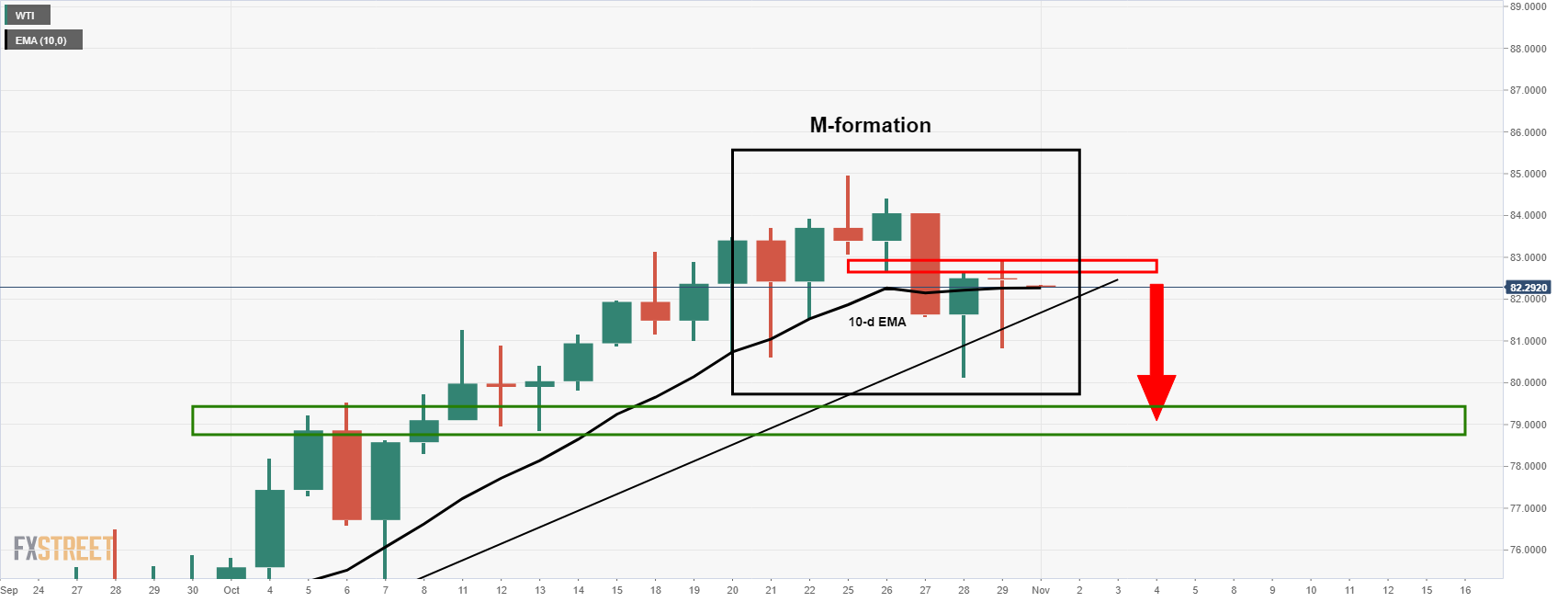

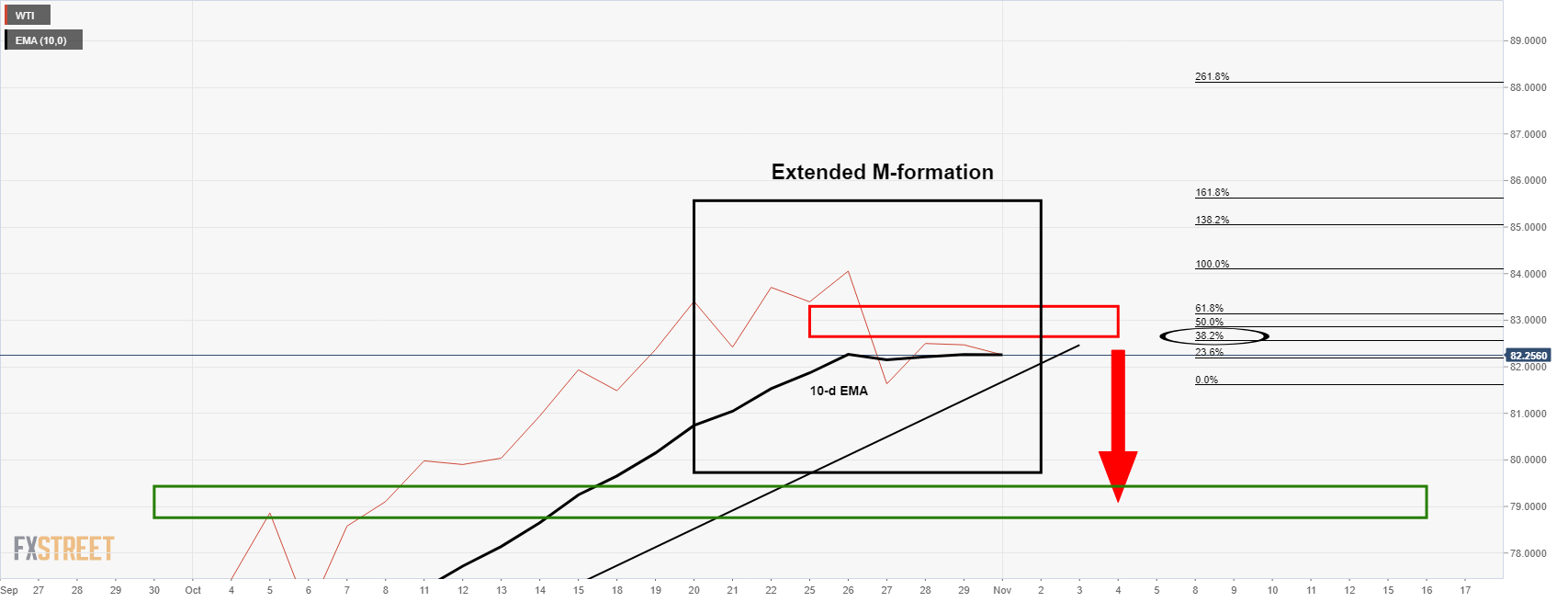

Gold technical analysis

The moves on Monday have undermined the opening bearish bias seen at the start of the week with the grind to the upside as follows:

As illustrated, the downside prospects were eliminated with a conservative bid as London opened up which has seen the price move in on daily resistance as follows:

The price is now at a crossroads whereby a break of the neckline of the M-formation will leave a bullish bias for the days ahead, while a rejection at the counter trendline will put the bears back in charge.

-

19:07

USD/JPY reverts to 114.00 as attention shifts from Japan election to state-side risk events

- USD/JPY has pulled back to the 114.00 level from Asia Pacific session highs around 114.50.

- The pair was initially boosted following Japan PM’s Kishida’ LDP party securing a surprise majority at the weekend general election.

- Focus now shifts to key global events, like the FOMC meeting, US jobs and ISM services data.

During Monday’s Asia Pacific session, USD/JPY hit its highest level in about one and a half weeks at just below 114.50, meaning it only came within about 20 pips of the annual high printed roughly two weeks ago around 114.70. During European and US trade, however, the pair has eased back and is currently flirting with the 114.00 level, meaning it currently trades, leaving it roughly at the midpoint of its 113.20s-114.70ish range over the last two/three weeks.

Surprise LDP majority

The big news out of Japan from the last few days has been the result of the general election held on Sunday; Prime Minister Kishida’s LDP party did better than feared and, against expectations, managed to hold onto a majority in the lower house of parliament, albeit with fewer seats than held in the term that just ended. The news has eased fears that Kishida was on course for a short stint as PM, as had been the case for his predecessor Yoshida Suga, and keeps the prospect of further fiscal stimulus before the end of the year on the table. Thus, Japanese stocks saw substantial gains on Monday, with the Nikkei 225 gaining north of 2.5% on the session – according to some traders, the risk on tone to the Japanese trading session, which also seemed to have a positive spillover effect on global risk appetite, was touted as weighing on the Japanese yen early on Monday.

Focus shifts to state-side events

With the election out of the way, focus in Japanese markets and for the Japanese yen returns to global dynamics. The most important calendar events this week will be the upcoming Fed and BoE meetings, as well as US jobs and ISM Services data. Monday saw the release of the October US ISM Manufacturing PMI survey did not have much impact on FX markets (including on USD/JPY). But the survey did add allude to current economic themes in the US, such as that economic growth, though slower, remains robust, as does demand, but that supply bottlenecks continue to hold back economic activity by slowing manufacturing output, while input costs remain sharply elevated.

Watch yield developments

As has been the case more often than not in recent months, USD/JPY is likely to follow developments in US bond markets, particularly any shifts in the US/Japan 10-year yield differentials. The US 10-year fell back below 1.60% last week and has since struggled to regain ground as inflation expectations pullback from recent highs; 10-year breakevens are back to just above 2.50% having been close to 2.70% at the start of last week. But US real yields have been picking up in recent days, which has mostly offset the drop in inflation expectations, with the US 10-year TIPS yield now at around -0.95% having been as low as -1.15% just four sessions ago. If hawkish FOMC vibes and strong US data this week can support further upside in the TIPS without resulting in too much downside for inflation expectations, then this should push nominal 10-year yields higher again, perhaps back towards recent highs around 1.70%, which would likely be enough to push USD/JPY back towards recent highs in the upper 114.00s.

-

19:05

RBA Preview: Forecasts from 10 major banks, an opportunity to mould the market mood

The Reserve Bank of Australia (RBA) will announce its decision on monetary policy on Tuesday, November 2, at 03:30 GMT. As we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming central bank's decision. Rates are expected to remain unchanged but the RBA is expected to change its guidance following stronger core inflation.

Westpac

“The RBA Board meeting for November is not expected to see any changes to policy settings. The focus will be on the wording and guidance around the likely timing of the initial rate rise in the upcoming cycle. Currently, RBA guidance is: ‘will not increase the cash rate until actual inflation is sustainably within the 2 to 3 percent target range. The central scenario for the economy is that this condition will not be met before 2024’. We anticipate an early timing, forecasting an initial rate hike in the March quarter 2023, likely at the February meeting. Core inflation, surprising to the high side, to now be inside the target band for the first time since 2015, lends weight to an earlier timing than envisaged by the RBA.”

Standard Chartered

“The upcoming RBA policy meeting will be an interesting one. We think the RBA may adjust some of its monetary settings at the upcoming meeting. While the central bank is unlikely to make changes to the QE purchase of AUD4 B a week, it may change its phrasing related to QE purchases to ‘until mid-February 2022’ (from ‘until at least mid-February 2022’). Second, the RBA may now note that the core scenario warranting a hike may materialise earlier than 2024, albeit with a wider range of plausible scenarios (versus ‘condition will not be met before 2024’). Third, it may remove the YCC measure as the RBA has not conducted any purchases to lower the target bond yield ahead of the policy meeting.”

ING

“The RBA meets to discuss policy although we believe the bank will remain in supportive mode as the economy recovers.”

TDS

“We expect the RBA to announce an end to its Yield Target Framework next week. This follows the RBA's decision to not defend the yield on the Apr'24s even after trading significantly above the 10bps target. As for QE we expect the Bank to leave its guidance unchanged, continuing to purchase bonds at a weekly AUD4 B rate through to Feb.”

BBH

“Rates are expected to remain steady at 0.10%. However, it appears that the markets may force the bank to formally abandon Yield Curve Control and adjust its forward guidance. The RBA did not intervene to maintain the 0.10% yield on the targeted April 2024 bond, instead of allowing it to close out the week near 0.72%. If YCC is abandoned, then the RBA will also have to acknowledge that liftoff is likely to come before the current guidance for 2024. In turn, AUD would likely strengthen and so the economy will face a double whammy of higher interest rates and a stronger currency. Of note, the swaps market is pricing 75-100 bp of tightening over the next twelve months. The bank will release its Statement on Monetary Policy Friday, which will contain new macro forecasts.”

Deutsche Bank

“Two-year yields last week rose from 0.15% on Wednesday morning to 0.775% at the close on Friday as the RBA were conspicuous by their absence in defending the 0.1% target on the April 24 bond. I’ve absolutely zero idea what they are going to do tomorrow which should help you all tremendously but their absence again this morning gives a decent indication. I was taught economics in an era where central banks liked to keep an element of mystery and surprise. As such I’ve always disliked the forward guidance era as it encourages markets to pile on to much riskier, one-way positions that a normally functioning market should naturally allow. But to go from forward guidance to silence (that rhymes) is a recipe for huge market turmoil if the facts change. It's unclear if the full implications of last week’s carnage at the global front end has yet been cleared out.”

SocGen

“The target for the cash rate and three-year government bond yields (for the April 2024 bonds) will be maintained at 0.10%. The government bond purchase programme will also continue at the rate of AUD4 B a week until at least mid-February 2022. Policymakers are expected to maintain their near-term growth outlook that a material decline in 3Q21 GDP will be followed by an instant bounce-back in 4Q21 based on the increase in vaccination rates and the easing of COVID-19 restrictions. The RBA will likely continue to say that wage and price pressures remain subdued, and that inflation is running at around 1.75% in underlying terms, though the near-term forecasts for trimmed mean inflation may be revised up to reflect the 3Q data. The RBA will also maintain its current ultra-accommodative forward guidance in terms of rate hikes to 2024 in the closing paragraph of the policy statement.”

Natixis

“The RBA is expected to signal its intention to move away from its unconventional policy measures aimed at stabilizing the economy from the pandemic. Specifically, the Reserve Bank is anticipated to terminate its YCC and to discontinue to purchase government bonds in February 2022. Our call on YCC termination and tapering is that the RBA will keep a lot of flexibility to avoid a too rapid steeping of the curve as the cash rate is not expected to be increased until 2023. Our main scenario is that the Reserve Bank will fully scrap the YCC next March after updating their economic outlook on the February State of Monetary Policy. The good news is that the protracted wage weakness gives some room to the RBA as the expectation of second-round effects on inflation from wages are much lower than in the US economy.”

MUFG

“While we can anticipate the RBA bringing forward rate hike plans from the current guidance for no hikes before 2024, it is one hell of a long shot to expect the RBA to completely capitulate and start planning for hikes as soon as next year and joining the Norges Bank, RBNZ, BoE, BoC and Fed. The RBA remains concerned that underlying inflation pressures have been uncomfortably low over the last six years averaging only around 1.6%Y/Y. Similar to the ECB, we do not expect the RBA to be in a rush to respond to the current period of higher inflation. As a result, we doubt that recent AUD strength can be sustained beyond the near-term.”

ANZ

“We think the RBA will expect inflation to be 2% or higher for the duration of its forecast horizon. This would make its view that inflation will not be ‘sustainably within the 2 to 3 per cent target range’ until 2024, untenable. We anticipate the RBA will shift its forward guidance to expecting a rate hike in the second half of 2023. A change in forward guidance removes the rationale for the yield target. The RBA has two options: drop it altogether or shift to a shorter bond such as the Apr-23 ACGB. We think shifting to a bond that has just 18 months until it matures is not worth the effort, so we expect the yield target policy to be dropped. It has served its purpose. The RBA’s failure to defend the yield target recently supports our expectation.”

See – Reserve Bank of Australia Preview: Reality check for Australian policymakers

-

18:30

AUD/USD meets a critical level of hourly support, central banks in focus

- AUD/USD is meeting support by the hourly 21 EMA and eyes are on the upside.

- The focus is on the RBA and Fed as the major risk events for the week ahead.

AUD/USD AUD/USD is edging back to flat during the New York day, travelling between a low of 0.7486 and a high of 0.7536 so far and within an almost two-week range.

The Australian dollar gained 4% in October, the most in 10 months, helped by high commodity prices amid energy shortages in Europe and Asia and amid speculation the bank will drop a commitment to keep yields on short term bonds at record lows.

RBA in focus

Meanwhile, traders braced for Australia's central bank meeting this week that could mark a retreat from its dovish rate policy. As for positioning, net AUD short positions have moved lower for a third straight week, but they still have not captured the recent sharp moves in money market rates. ''The RBA still has not intervened to maintain the 0.10% yield on the targeted April 2024 bond,'' analysts at Brown Brothers Harriman explained.

''Due to the lack of any action by the RBA, markets expect the bank to abandon Yield Curve Control tomorrow and tacitly acknowledge that liftoff is likely to come before the current guidance for 2024. If this were to happen, AUD would likely strengthen and so the economy would face a double whammy of higher interest rates and a stronger currency,'' the analysts added. Moreover, the swaps market is pricing in around 75 bp of tightening over the next twelve months.

DXY on the backfoot

Meanwhile, the US dollar is on the back foot versus its main rivals on Monday flowing its biggest daily rise in more than four months in the previous session. The Federal Reserve is eyed as a major risk event this week also, ahead of the all-important Nonfarm Payrolls on Friday.

The Fed is widely expected to announce a tapering of stimulus, a factor that has fueled the greenback's rise in recent weeks. The dollar index DXY, which measures the US currency against six rivals, was down 0.24% at 93.907 at the time of writing.

AUD/USD technical analysis

The price has corrected a significant portion of the recent bullish impulse to meet the hourly 21-EMA and there are now prospects of an upside continuation for the sessions ahead from this support zone.

-

18:24

Silver Price Forecast: XAG/USD climbs above $24.00 despite high US T-bond yields

- XAG/USD reclaims $24.00 on broad US dollar weakness across the board.

- The market sentiment is mild-negative, portrayed by US equities, with just the Dow Jones rising.

- XAG/USD: From a technical perspective, silver is tilted to the upside, but as risk events lie ahead, caution is warranted.

Silver (XAG/USD) edges higher during the New York session, gains 0.60%, trading at $24.00 at the time of writing. A weaker greenback despite higher US T-bond yields with the 10-year note rising two and a half basis points at 1.579% boosts the precious metal, in line with gold, which is also advancing 0.65% at press time.

The market sentiment is mixed as US stock indices fluctuate between gainers and losers amid absent European traders, as the Eurozone observes a holiday. Furthermore, inflation has been the trend in the last couple of weeks.

This week, three major central bank monetary policy meetings would give investors the general overview of policymakers, which could spur movement in silver. If policymakers view inflation as temporary, this could trigger safe-haven asset buying as a hedge for inflation, as that would indicate that central banks would extend the easy money cycle. On the other hand, a hawkish tone in the Reserve Bank of Australia, the Federal Reserve, and the Bank of England could send yields higher, which would weaken XAG/USD.

XAG/USD Price Forecast: Technical outlook

4-hour chart

Silver price broke beneath an upslope support trendline, which now turned resistance, that would spur a bearish signal, but at press time, XAG/USD is pressuring to regain above it. Furthermore, a bullish flag was broken to the upside, confirming the upward bias.

Nevertheless, the confluence of the upward slope trendline and the 50-simple moving average at $24.14 would oppose strong resistance for XAG/USD bulls, who would need a break above the latter to spur an upside move towards the October 22 high at $24.80.

On the flip side, failure at the abovementioned could send silver tumbling towards the 100-simple moving average (SMA) at $23.60.

The Relative Strength Index (RSI), although slightly flattish at 49, suggests a downward bias, but there is a slight positive divergence, which means the price is headed to the upside

-

17:43

GBP/USD stalls at hourly support in a weak US dollar environment

- GBP/USD is holding in a consolidation zone in New York trade, little changed as investors await the BoE.

- Traders await the next impetus and weigh Brexit risk and US fundamentals.

GBP/USD is down some 0.15% on the day so far after travelling from a high of 1.3693 to a low of 1.3641. Sterling has been pressured at the start of the week and fell to the lowest level vs the greenback in over two weeks as investors weigh the Bank of England's policy stance vs. the ongoing spat between the UK and EU that has morphed into a disagreement with France over fish.

The latest on this front comes with the British Foreign Secretary Liz Truss who has said that Paris had “behaved unfairly” and made “completely unreasonable threats”, with the two sides at loggerheads over the number of licences the UK has handed French vessels keen to fish in its territorial waters.

BoE in focus

Meanwhile, the Bank of England is expected to hike by 15bp, but also to push back against some of the tightening bets through their inflation forecasts. Nevertheless, there are prospects for GBP weakness. Traders, in this regard, will be on the lookout for dialled down hawkishness in an overpopulated long position in speculative positions. Net positioning on the pound rose by 8.6% of open interest, reaching +10%, in the week ending 26 October which likely allows scope for some short-squeezing.

''GBP net longs positions jumped higher as speculation increased that the BoE could bring forward rate hikes,'' analysts at Rabobank explained. ''GBP had been slow to react to speculation about a possible 2021 BoE rate rise given fears of a policy mistake. Focus on the November 4 BoE policy meeting.''

Fed taper eyed

Across the pond, the US dollar has eased versus its main rivals on Monday flowing its biggest daily rise in more than four months in the previous session. The Federal Reserve is widely expected to announce a tapering of stimulus, a factor that has fueled the greenback's rise in recent weeks. The dollar index DXY, which measures the US currency against six rivals, was down 0.18% at 93.95 at the time of writing.

-

17:23

EUR/CHF hits fresh 18-month lows under 1.0550, eyes post-pandemic lows at 1.0500

- EUR/CHF has picked up where it left things off in October and has continued to decline to fresh multi-month lows.

- Technicians will be eyeing a test of the post-pandemic lows around 1.0500.

- Recent CHF strength has perplexed some analysts and traders.

After falling 1.9% over the course of October from close to 1.0800 to under 1.0600, negative momentum in EUR/CHF has carried over into the first trading day of November. The pair printed fresh 18-month lows when it briefly slipped below the 1.0550 level in earlier trade. Bearish momentum has gathered pace since EUR/CHF saw a significant break below what had been a solid area of support at 1.0700 on 21 October and then failed to break back above this level on the retest. Technicians and bears will have multi-year lows at the 1.0500 level, set last May, in their sights.

CHF strength catches many off guard

Recent strength in the swiss franc has caught many an analyst and trader off guard, given that it seems not to reflect recent fundamental developments. These fundamental developments can pretty much be summed up as 1) a spike in global inflationary pressures (though not really in Switzerland) leading to a hawkish repricing of interest rate expectations for most major G10 central banks (again, though not really for Switzerland) and 2) a risk-on environment for stocks that has seen major US and European equity bourses surge back to record levels after September’s sell-off. The former suggests that CHF should have weakened as a result of a dwindling yield appeal and the latter suggests CHF weakness as a result of dwindling safe-haven demand.

The fact that the drop in EUR/CHF has accelerated in wake of what was largely viewed as a hawkish showing from the ECB and its President Lagarde last Thursday is doubly perplexing; markets have brought their ECB rate hike bets even further forward since last week’s ECB meeting, now seeing a 10bps hike in July and a 20bps hike in October, in anticipation (one would assume) that the ECB loses its nerve with regards to inflation, drops its “inflation is transitory stance” and starts hiking by the middle of the year. Perhaps the view of FX market participants buying CHF is that all of these pro-inflationary developments in Europe (driven primarily by the spike in energy costs), and the associated more hawkish ECB stance, will be a negative for long-term Eurozone growth prospects, capping the ECB’s terminal interest rate, thus actually, in the end, being a positive for EUR vs CHF yield/carry differentials.

What to watch this week

A modest MoM slowdown in Swiss Manufacturing output growth, as indicated by modest fall in October Manufacturing PMI to 65.4 from last month’s 68.1 reading, and a hefty jump in Swiss Sight Deposits (indicating that the SNB has been intervening to try to slow the CHF rally) weren’t enough to significantly slow the swiss franc’s ascent. EUR/CHF traders will now switch their focus to the release of Final October Eurozone Manufacturing PMI data, Swiss October CPI and Swiss September Retail Sales, all out on Tuesday in the European morning. Thereafter, focus is likely to switch to broader macro themes, like the Fed and BoE rate decisions and the US jobs report.

-

16:43

USD/CAD breaks below 1.2400 on good Canadian Manufacturing PMI ahead risk events

- USD/CAD stalls at 1.2400, retreated to 1.2350 on good Canadian macroeconomic data.

- Positive market mood, and rising crude oil prices, boost the CAD prospects.

- Canadian IHS Markit Manufacturing PMI reading was better than expected.

The USD/CAD slides during the New York session, down 0.27%, trading at 1.2356 at the time of writing. A risk-on market mood, alongside rising crude oil prices, boosts the Canadian dollar.

During the Asian session, the US Dollar was firmly bid, trading as high as 1.2400. However, once the Canadian IHS Markit PMI Manufacturing reading was released, the pair broke beneath the 1.2400 figure as renewed optimism surrounded the Loonie.

US Dollar Index below 94 again, despite rising US T-bond yields

In the meantime, the US Dollar Index, which measures the greenback's performance against a basket of six peers, slumps 0.18%, breaking below 94, sitting at 93.95. Contrarily, the US T-bond 10-year benchmark note, which dramatically influences the US dollar, rises three and a half basis points, up to 1.589%.

Canadian IHS Markit Manufacturing PMI reading was better than expected

On the macroeconomic front, the Canadian economic docket featured the IHS Markit Manufacturing PMI for October rose to 57.7, better than the 57.2 expected and higher than the September reading. That motivated CAD bulls, which promptly spurred a downward move towards the 1.2350 familiar level, but lacked the conviction to push the pair towards 1.2300, as the Federal Reserve November meeting, is around the corner.

Concerning the US economic docket, the Institute for Supply Management (ISM) revealed the Manufacturing PMI for October, which rose to 60.8 more than the 60.6 estimated. Although the reading was good, it fell short against the September reading. Moreover, the new orders slumped to a 16-month low as factories continued to experience raw materials shipment delays.

USD/CAD Price Forecast: Technical outlook

Daily chart

The USD/CAD pair unsuccessfully tested a downslope resistance trendline, which caused a retracement from 1.2400 towards 1.2360, in line with the downward bias depicted by daily moving averages (DMA's) located above the spot price. Furthermore, the price action of the last eight days has formed a bearish flag, which in case of a downward break, would open the door for 1.2278, immediately followed by the June 23 low at 1.2252.

The Relative Strength Index (RSI) is at 37, well below the 50-mid line edging slightly lower, indicating that bears are in control. However, fundamental and macroeconomic news suggests that market participants would remain on the sidelines, awaiting the Federal Reserve meeting.

-

16:37

BoE Preview: A close call – Danske Bank

On Thursday, the Banko of England (BoE) will announce its decision on monetary policy. According to analysts from Danske Bank, it is a close call whether the central bank hikes or not. On balance, they expect the BoE to keep monetary policy unchanged.

Key Quotes:

“The Bank of England (BoE) meeting on Thursday 4 November is going to be a key market mover this week. What was unthinkable in the beginning of the year, is now a real possibility. Will the BoE raise the Bank Rate or not? Investors have more or less fully priced in a 15bp rate hike while economists are evenly divided between unchanged and a 15bp rate hike. The sudden hawkish shift in September was a major driver of higher yields also in Europe, so BoE’s policy decision is also going to be interesting from a broader market perspective.”

“Bank of England has not pushed back on market pricing, but to some extent it probably also reflects that BoE policymakers have very different views on the economy. It is much more difficult for central banks to communicate to markets when policymakers disagree on the fundamental analysis of what is going on. If we are wrong, we expect a dovish hike, as we expect the BoE to say a hiking cycle will be “gradual and limited”.”

“A dovish rate hike is probably also what is needed for the hawks to get support from neutral and dovish BoE policymakers.”

“Markets are pricing in very aggressive rate hikes from the Bank of England until 2022 (a total of 125bp rate hikes from now until year-end 2022), which we believe is wrong – and at least very different from what the Bank of England communicated at the last meeting. We expect a total of 65bp rate hikes on the same horizon. It is also notably that markets are pricing lower rates starting from 2024.”

-

16:32

GBP/JPY Price Analysis: Bearish bias while below 156.50, key support around 155.50

- GBP/JPY moving sideways around 156.00 with a modest bearish bias.

- The negative momentum is easing; consolidation under 156.00 to trigger more losses.

The GBP/JPY continues to make lower highs but it failed to print fresh lows. It keeps getting rejection from under 156.00. A consolidation clearly under 156.00 should open the doors to more losses, targeting 155.65 first and then 155.35. The next support stands at 154.95.

On the upside, a firm recovery above 156.50, would put the price above the 21-SMA, improving the outlook for the pound. The next level to watch is the 157.00 zone followed by a downtrend line at 157.20. A break higher would negate the bearish bias, strengthening further the positive outlook.

Technical indicators are tilted to the downside but showing not much force. During the week, key economic reports in the US are due and also the Federal Reserve and Bank of England decisions, so volatility could rise sharply.

On a wider perspective, the correction in GBP/JPY from multi-year highs reached the 155.50/70 support area. A slide below should point to more losses. While if it holds above it could resume the upside move.

Technical levels

-

16:26

NZD/USD probing 0.7200, set to remain rangebound ahead of key risk events

- NZD/USD is probing the 0.7200 level and NZD is an outperformer on Monday, but the pair is within recent ranges.

- Catalysts for a break out of recent ranges include Wednesday’s NZ jobs data or FOMC meeting, or US NFP.

Despite a lack of any specific fundamental catalysts relating to New Zealand, the kiwi is one of the better performing G10 currencies on Monday, with NZD/USD nursing gains on the day of about 0.4%. Currently probing the 0.7200 level, the pair remains well within the well-established 0.7130-0.7220 range of the last week and a half. A stronger than expected number for the headline US ISM Manufacturing index for October (which came in at 60.8 versus forecasts for 60.5), as well as further increases in the employment subindex to 52 and prices paid index to an elevated 85.7, has thus far failed to result in broader USD strength, which is for now allowing NZD/USD to remain supported. The report contained further evidence that US (and hence global) manufacturing continues to suffer badly from supply chain disruptions, with auto production affected particularly badly, which should strengthen the Fed’s growing conviction that the supply side-driven inflation may take longer to fade.

Risk Events

Indeed, this week’s Fed meeting is a key event and will be a key driver of NZD/USD on Wednesday, as will the remainder of this week’s US data, such as the ISM Services PMI survey release (Wednesday) and October Labour Market Report (Friday). But FX market participants should also take note of key jobs data being released in New Zealand this week; the Q3 labour market report is set for release early on during Wednesday’s Asia Pacific session and the unemployment is seen dropping under 4.0% and potentially to its lowest since 2008. Westpac note that “employment indicators have all been notably strong over recent months, with job advertisements well above pre-Covid levels, unemployment benefit numbers falling, and filled jobs accelerating”, suggesting that the data should be strong and support the RBNZ’s stance that a gradual withdrawal of monetary policy stimulus is warranted.

If the range breaks

If NZD/USD breaks to the north of its recently established range, then technicians would likely target a test of the 26 May high at just above 0.7300 as the next stop for the pair. Strong NZ jobs data with hawkish implications for RBNZ policymaking could be a catalyst for a push in this direction. Conversely, if NZD/USD breaks its range to the south, the most immediate support to look at is around the 0.7100 level in the form of a bunch of recent lows and highs, as well as the 200-day moving average.

-

16:01

US ISM Manufacturing: Activity remains strong despite persistent supply issue – Wells Fargo

Data released on Monday showed the ISM Manufacturing Index dropped in October from 61.1 to 60.8; a reading above expectations. According to analysts at Wells Fargo, the report demonstrated that activity remains strong despite persistent supply issues. They point out purchasing managers across industries continue to cite strong demand.

Key Quotes:

“October's ISM manufacturing report demonstrates that activity remains strong despite persistent supply issues. The overall index slid to 60.8 last month, largely due to a 6.9 point drop in new orders. That said, purchasing managers across industries continue to cite strong demand. The largest gains came from two components that continue to be at the center of supply issues: prices paid and supplier deliveries.”

“The employment component of the ISM has diverged from other employment readings in recent months. But squaring the expansionary reading for October with the pickup in the other regional PMI employment indices bodes well for manufacturing hiring in October's nonfarm payroll report to be released Friday.”

“Our pressure gauge continues to demonstrate little, if any, improvement in supply issues. The number of ships on average awaiting port space off the West Coast rose to a record 67 in October and the price of shipping a container across the Pacific Ocean remains more than six times above pre-pandemic norms.”

-

15:37

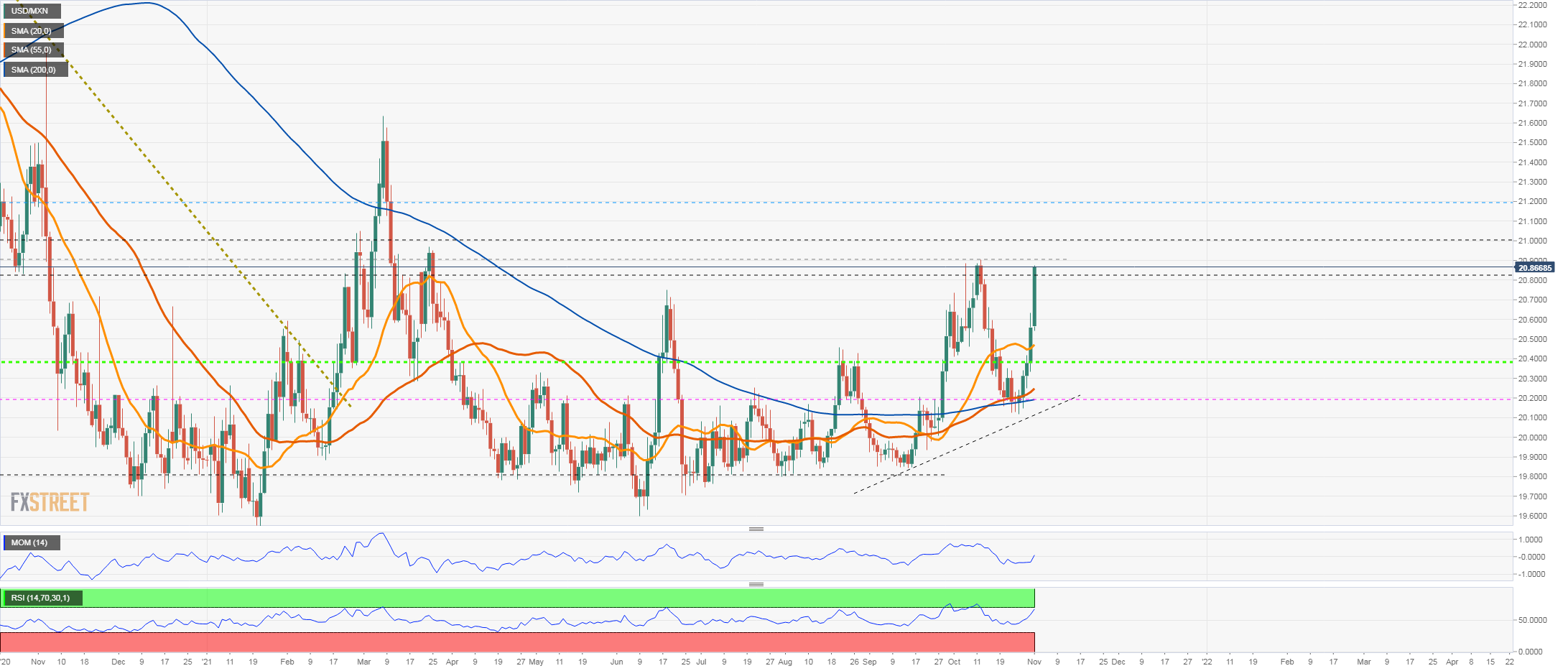

USD/MXN jumps to highest in almost three weeks near 21.00

- Mexican peso under pressure across the board amid concerns about the economy.

- USD/MXN eyes 21.00, up for the fifth consecutive day.

The USD/MXN is rising for the fifth consecutive day on Monday and it has accelerated the move reaching 20.85, the highest level since October 12. It remains near the highs with the bullish tone intact.

The MXN is being affected by increasing concerns about the health of the Mexican economy after it was reported last week a GDP contraction for the first time since the recovery from the COVID begun. At the same time, inflation remains elevated forcing the Bank of Mexico to raise rates.

The deterioration in the economic outlook weighs on the Mexican peso that continues among the worst performers. Not even an improvement in global risk appetite and in crude oil prices helped the currency.

Higher interest rates in the US are also affecting MXN. On Wednesday, the Federal Reserve will announce its decision on monetary policy that could impact on yields. Another relevant event will be the release of the US employment report on Friday.

The rally of the USD/MXN looks now at the 20.89 October highs. If it breaks higher, attention would turn to the 21.00 zone. The immediate short-term support has been moved to 20.70 and 20.50.

Technical levels

-

15:37

WTI buoyant above $84.00 with OPEC+ set to ignore international calls for faster output hikes

- WTI is currently trading above $84.00, up about 1.0% on the day and not far from annual highs at $85.50.

- Expectations that OPEC+ will not cave to international pressure and will continue to slowly increase oil production is supportive.

- Traders should also keep an eye on OPEC+ compliance to its deal, which is currently excessively strong.

Front-month futures of the American benchmark for sweet light crude, called West Texas Intermediary (commonly abbreviated to WTI) has slipped back from earlier session highs of just under $85.00 per barrel in recent trade, though continues to trade above the $84.00 per barrel level, for now, meaning the futures contract is still trading with gains on the day of about 1.0% and is less than $1.50 (or 1.5%) from the annual highs printed last week at close to $85.50.

Prices are higher at the start of the week despite an announcement by Chinese authorities during the Monday Asia Pacific session that they had released gasoline and diesel reserves in order to stabilise prices in some regions of the country, as traders instead focus on this Thursday’s OPEC+ meeting. Commodity strategists do not expect the cartel to deviate from its long-established policy of easing its output cuts at a gradual pace of 400K barrels per month, despite pressure from the international community (particularly from oil importers) to increase output at a faster rate. Over the weekend, US President Joe Biden insisted that oil-producing G20 countries boost output in order to ensure the strength and stability of the post-pandemic global economic recovery, though oil ministers from a number of OPEC+ nations have not taken notice and have, in recent days, thrown their support behind the cartel’s current output cut easing plans.

Analysts Bullish

The tone of analysts and market commentators on oil remains largely bullish; Goldman Sachs on Monday reaffirmed their $90.00 per barrel year-end target for Brent (currently trading just above $84.00), given their expectations for a supply deficit of 2.5M barrels per day. Analysts at oil brokerage PVM agree that the “fundamentals have not changed, and the oil market will remain tight in the near-term”, and a recent poll of 41 analysts and economists conducted by Reuters showed that Brent is expected to average around $80.00 per barrel for the rest of the year. One common theme underpinning the bullishness exhibited by many analysts is expectations that the shortage of natural gas in Europe will feed into higher oil demand as power companies switch strategically from using costlier natural gas to relatively less costly derivatives of crude oil.

Strong Compliance

Another OPEC+-related theme for oil traders to consider is the cartel’s excellent compliance to its current output cut deal; Reuters just published a survey that found that compliance with the pact rose to 118% in September, up from 114% in August. A number of OPEC+’s smaller producers have failed in recent months to keep up with the allowed increases in oil production under the cartel’s pact owing to a variety of idiosyncratic factors; the biggest drop was seen in Nigeria, where output fell by 70K barrels after a pipeline shutdown. Strong compliance is another factor underpinning bullish oil market conditions and a drop back to 100% or even below is one risk to watch, as it could encourage some profit-taking on profitable long-oil positions.

-

15:24

EUR/USD hovers around 1.1580 after mixed US PMI data

- The single currency begins November on the right foot after printing its third-consecutive month of losses.

- The market sentiment is mixed, thus mildly boosting the shared currency against the greenback.

- US ISM Manufacturing PMI figure was better than expected but trailed September’s reading.

The shared currency begins November on the right foot, advances 0.24%, trading at 1.1583 at the time of writing. The EUR/USD slid for the third consecutive month due to firm US dollar, higher US T-bond yields, and the expectations of a bond-tapering announcement, which increased on the Federal Reserve September 22 meeting. Also, reinforcing the abovementioned, Fed Chairman Jerome Powell, on a virtual event organized by the Bank of International Settlements, said, “I do think it is time to taper” but reiterated that it is not time to hike interest rates.