Notícias do Mercado

-

23:47

Fed’s Mester: Fed will need to hike rates above 5% and hold them there for a while

“Federal Reserve will need to hike rates above 5% and hold them there for a while,” said Federal Reserve Bank of Cleveland leader Loretta Mester late Tuesday.

The policymaker also stated that the recent bank tighter credit may result from turmoil.

Additional comments

Tightening monetary policy needed to cool too hot inflation.

How much more the fed hikes depends on economy and how it reacts.

Tighter financial conditions should create restraint on economy.

Banking sector resilient, stresses appear to have eased since last month.

Fed balance sheet cuts aiding rate-hike cycle.

Fed closely watching banking system for signs of stress.

Expects inflation to ease to 3.75% by end of year, 2% by 2025.

Expects growth to moderate this year.

Expects jobless rate to rise to between 4.5% and 4.75% this year.

Market implications

The news might have allowed the US Dollar bears to take a breather at the lowest levels in two months, making rounds to 101.50 by the press time.

Also read: Forex Today: Dollar under pressure, Gold jumps and US yields tumble

-

23:43

USD/CHF juggles near fresh 19-month low below 0.9060 as US labor market cools down

- USD/CHF is hovering near a fresh 19-month low below 0.9060 ahead of US economic data.

- The cooling US labor market has infused confidence among investors that the Fed would call for an early pause.

- After weak US Manufacturing PMI, Services PMI are also expected to contract ahead.

The USD/CHF pair is displaying a back-and-forth action above 0.9050 in the early Tokyo session. The Swiss Franc asset is expected to continue its downside momentum amid an absence of recovery signs after a plunge. The downside bias for the US Dollar has strengthened as the cooling United States labor market has propelled an unchanged policy stance from the Federal Reserve (Fed) for its May policy meeting.

The US Dollar Index (DXY) witnessed an intense sell-off on Tuesday after US Job Openings data dropped below 10 million for the first time since 2021. Market pundits considered it as a sign of cooling US labor market, which would allow Fed chair Jerome Powell to remain light on interest rates in May’s monetary policy meeting.

S&P500 futures are showing nominal gains in the early Asian session after ending Tuesday’s session on a bearish note, portraying an attempt of recovery in the risk appetite of the market participants. The demand for US government bonds soared as odds for a steady Fed policy zoomed led by declining labor demand and contracting manufacturing activities. The 10-year US Treasury yields have dropped below 3.34%.

For further action, US Automatic Data Processing (ADP) Employment and ISM Services PMI data will be keenly watched. According to the estimates, the US economy has hired additional 200K talent in March, lower than the former release of 242K.

After weaker-than-anticipated US Manufacturing PMI, Services PMI is also set to contract further. The Services PMI is seen declining to 54.5 from the former release of 55.1. And, New Orders Index is expected to soften firmly to 57.6 vs. February’s figure of 62.6.

On the Swiss franc front, the monthly Consumer Price Index escalated by 0.2% but remained below expectations of 0.4% and the former release of 0.7%. Also, annual CPI has softened to 2.9% from the consensus and the former release of 3.2% and 3.4% respectively. Softening inflationary pressures are going to delight Swiss National Bank (SNB) policymakers.

-

23:37

Silver Price Forecast: Options market signals discomfort with XAG/USD rally to $25.00

Silver price (XAG/USD) seesaws around one-year high, making rounds to $25.00 during Wednesday’s initial Asian session after rising the most in three weeks the previous day.

In doing so, the bright metal portrays the market’s cautious mood ahead of the key US ISM Services PMI and ADP Employment Change for March. Also challenging the XAG/USD bulls are the signals from the options market suggesting the buyer’s doubt about the latest run-up in the bright metal’s prices.

That said, a one-month risk reversal (RR) of the Silver price, a gauge of the spread between the call and put options, prints the first daily loss mark in five while marking the -0.390 figure by the end of Tuesday’s North American session. It’s worth noting, however, that the weekly RR up for the fourth consecutive time, to 0.2000 by the press time, whereas the monthly options market signals are also firmer so far in April after posting the biggest gains in a year in March.

Hence, the short-term traders of the XAG/USD seem to have a lesser liking for the latest run-up in the Silver price, which in turn may trigger the quote’s pullback in a case where the scheduled US data print firmer outcomes and allow the US Dollar to rebound.

Also read: Silver Price Analysis: XAG/USD buyers eye $25.00 after breaking resistance around $24.25

-

23:29

GBP/USD Price Analysis: Bulls have limited room towards the north, 1.2550 in focus

- GBP/USD bulls take a breather at 10-month high, seesaws after rising the most in three weeks.

- Clear upside break of 1.2445-50 horizontal hurdle, bullish MACD signals favor Cable pair buyers.

- Rising wedge, overbought RSI teases sellers to take a risk and aim for 50-DMA, 100-DMA convergence.

GBP/USD buyers sit tightly in the driver’s seat while riding along the lines of the highest levels since June 2022, sidelined near 1.2500 during early Wednesday.

The Cable pair marked the biggest daily gains in three weeks the previous day after crossing an important horizontal resistance comprising multiple tops marked since mid-December 2022, now immediate support around 1.2450-45. Adding strength to the upside momentum were the bullish MACD signals.

It’s worth noting, however, that the RSI (14) line is near the overbought territory and suggests a pullback in the GBP/USD prices before mark the next leg towards the north. Also teasing the Cable pair sellers is the existence of a one-month-old rising wedge bearish chart pattern, currently between 1.2550 and 1.2390.

Should the quote drops below 1.2390, it confirms the bearish formation and can refresh the 2023 bottom, around 1.1800 by the press time. However, a convergence of the 50-DMA and the 100-DMA, close to 1.2155-50 acts as an important support to watch during the anticipated fall.

On the flip side, a clear upside break of the 1.2550 hurdle, comprising the stated wedge’s top line, defies the bearish chart pattern and can propel the GBP/USD prices toward the May 2022 high of around 1.2665.

That said, the 1.2600 round figure and September 2020 low near 1.2675 act as extra upside filters for the Cable pair buyers to watch during the quote’s further upside.

GBP/USD: Daily chart

Trend: Limited upside expected

-

23:09

EUR/USD turns sideways around 1.0950 as investors await US Employment for fresh impetus

- EUR/USD is oscillating around 1.0950 ahead of US Employment and ISM Services PMI data.

- A significant decline in US Job Opening indicates that the US labor market is cooling now.

- The ECB would continue hiking rates as a recent jump in the oil price could spark Eurozone inflation.

The EUR/USD pair is displaying a sideways action after an upside move above 1.0970 in the early Asian session. The shared currency pair is expected to continue its lackluster move as investors are awaiting the release of the United States Automatic Data Processing (ADP) Employment and ISM Services PMI data.

S&P500 ended Tuesday’s gains with decent losses as investors turned cautious ahead of US economic reports, portraying a drop in the risk appetite of the market participants. The US Dollar Index (DXY) has refreshed its monthly low near 101.46 as investors are anticipating the maintenance of status-quo by the Federal Reserve (Fed) for its May monetary policy meeting.

As per the CME Fedwatch tool, chances for an unchanged interest rate decision stand near 60%. The Fed is required to shift its focus towards contracting manufacturing activities to safeguard the United States economy from falling into recession. The release of the US economic data on Wednesday would provide more clarity.

According to the consensus, the US economy has added fresh 200K jobs in March than the former additions of 242K. Hopes for one more rate hike from the Fed could be propelled if the US labor market continues to remain tight. However, the release of weak Job Openings data on Tuesday indicates that the labor market is cooling now. Data released on Tuesday indicates lower talent acquisition requests at 9.9 million, compared to 10.5 million in January and 10.4 million as expected by the market participants.

In addition to US Employment data, US ISM Services PMI will also keep investors busy. The US ISM Services PMI (Mar) is expected to contract to 54.5 from the former release of 55.1. Also, New Orders Index that reflects forward-demand would drop to 57.6 from the prior release of 62.6.

On the Eurozone front, European Central Bank (ECB) policymakers would get delighted as consumer inflation expectations for the next 12 months fall to 4.6% in February vs. 4.9% in January. However, it seems that the data has yet not incorporate the recent rise in the oil price, which could have spoiled the mood. Therefore, ECB President Christine Lagarde would continue hiking rates ahead.

-

23:07

NZD/USD traders await the RBNZ

- NZD/USD is in the hands of the bulls in the 0.63s.

- RBNZ is going to be the main scheduled event for the day ahead.

The New Zealand Dollar rallied to the highest levels in over six weeks, amid a weakening US Dollar and poor US data. At the time of writing, NZD/USD is sitting in the 0.63 area, although as analysts at ANZ Bank said, ´´it is struggling to capitalize on the freefall in the USD DXY (which is approaching February’s low) in the wake of soft JOLTS jobs data there, and fresh financial instability fears.´´

The greenback was pressured after a plunge in US factory activity raised concerns over slowing economic growth. The US manufacturing PMI fell in March to the lowest since May of 2020. US factory orders declined for a second straight month, down 0.7% in February after falling 2.1% in January from the 1.7% jump in December. This data comes on the heels of the Institute for Supply Management (ISM) that yesterday reported that its Manufacturing PMI fell to 46.3 last month. This was the worst since May 2020, from 47.7 in February. Last week’s PCE data, the Federal Reserve´s preferred inflation measure, was also mixed and weighed on the greenback. However, while headline and core both came in a tick lower than expected, super core accelerated for a second straight month to 4.63% YoY which is the highest since October. ´´This is not the direction that the Fed desires and so we look for the hawkish tilt in Fed comments to continue,´´ analysts at Brown Brothers Harriman explained.

RBNZ in focus

´´While the Kiwi is at the upper end of recent trading ranges, it is well off its February high, and it has underperformed on major crosses,´´ analysts at ANZ Bank said. ´´A bullish take on that is that there is plenty of room for that gap to be closed without significant technical barriers. A hawkish RBNZ today might help with that today, especially if the focus is on rebuilding and resilience, rather than engineering a recession. But what happens in the US matters an awful lot too!´´

´´We continue to forecast the OCR to peak at 5.25% with one further hike in May. Yesterday’s release of the Quarterly Survey of Business Opinion provided little to suggest any change to how the RBNZ behaves today. Business sentiment has improved, lifting off a record low. However, 61% of respondents expect conditions to deteriorate, versus 74% in Q4 and a historical average of -7%,´´ the analysts said.

It is wirth noting that the RBNZ has lifted its policy rate by a total of 450 basis points, bringing the cash rate to a 41-year record of 4.75%, well above the RBNZ's medium-term target of 1%-3%.

-

23:04

AUD/USD prods pullback from five-week high near 0.6750, RBA’s Lowe, US data eyed

- AUD/USD licks its wounds after posting RBA-induces losses near five-week high.

- RBA paused rate hike trajectory and called the Aussie bears, RBA Statement defends hawks.

- Softer US data, positive sentiment and challenges to US Dollar’s reserve currency status drown US Dollar.

- RBA’s Lowe need to defend hawkish Statement to recall Aussie pair buyers, US data important too.

AUD/USD bears take a breather around mid-0.6700s during early Wednesday as traders await Reserve Bank of Australia (RBA) Governor Philip Lowe’s speech after the Aussie central bank paused the rate hike trajectory and pleased sellers the previous day.

After 10 consecutive rate increases, the RBA announced the status quo of its current monetary policy with the benchmark rate being 3.60% at the latest. In doing so, the Australian central bank justifies the recent downside of Australian inflation and Retail Sales data while also saying, “Board expects that some further tightening of monetary policy may well be needed.”

Risk-on mood joins news suggesting recent challenges to the US Dollar’s reserve currency status appear to weigh on the greenback.

Bloomberg released a news report suggesting the US Dolllar’s less acceptance as a reserve currency in Russia while highlighting the greenback’s latest weakness. “Chinese Yuan has surpassed the US Dollar as the most traded currency, in monthly trading volume, for the first time in Russia in February,” said the news while also adding that the gap has continued to widen in March.

In the last week, Brazil and China agreed to pause the US Dollar’s usage as an intermediary in trade transactions.

Alternatively, Russian Foreign Minister Sergei Lavrov raised fears of escalating Moscow-Brussels tussle by saying, “The European Union (EU) has "lost" Russia.” The policymaker also added that Moscow will deal with Europe in a tough fashion if need be. The US-China tension is also on the spoke as Beijing keeps reiterating its dislike for the US-Taiwan ties but Washington seems to ignore it. China’s Consulate General in Los Angeles spokesperson criticized a meeting between Taiwan President Tsai Ing-wen and US House Speaker Kevin McCarthy on early Tuesday.

Talking about the data, US Factory Orders for February came in -0.7% MoM versus -0.5% expected and downwardly revised -2.1% prior. Further, the US JOLTS Job Openings dropped to the lowest levels since May 2021 while flashing 9.931M figure for February versus 10.4M expected and 10.563M revised prior.

Amid these plays, Wall Street closed in the red while the yields are down amid softer US data.

Moving on, RBA Governor Lowe’s speech will be crucial for the AUD/USD pair traders to watch as traders will look for clues of how the policymakers may renew the rate hike trajectory, which in turn can propel the Aussie price.

On the other hand, US ISM Services PMI for March and ADP Employment Change for the said month will be important for any sign of recovery of the US Dollar.

Also read: US ADP Jobs/ISM Service PMI Preview: Slowing but still positive

Technical analysis

Despite the latest pullback, the AUD/USD prices remain beyond the 200-DMA support of 0.6745, which in turn suggests the recovery towards a convergence of the 100-DMA and 50-DMA surrounding 0.6805.

-

22:59

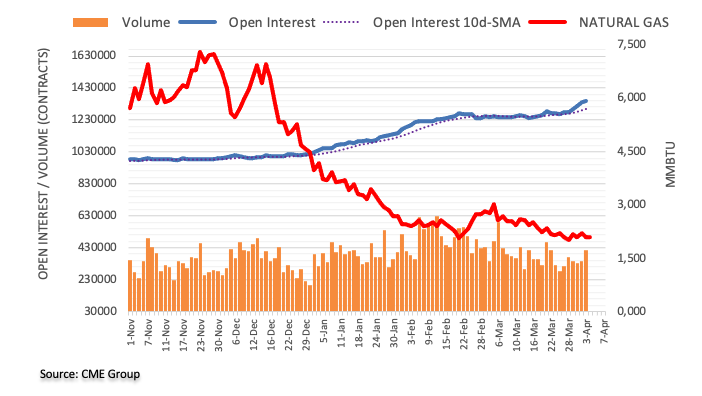

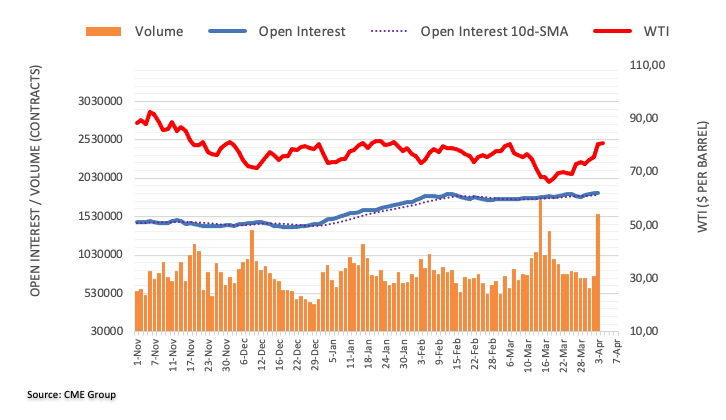

WTI holds above $80.00 per barrel as traders digest OPEC+ cuts, weak global PMIs

- On Tuesday, soft US economic data increased worries about a curtailed oil demand.

- US crude oil inventories withdrew more than 4 million barrels last week.

- WTI Price Analysis: The breaks of a 7-month-old downslope resistance trendline can pave the way for further gains.

Western Texas Intermediate (WTI) holds to its previous day’s gains, clings above the $80.00 per barrel psychological level as traders diggest over-the-weekend news of the OPEC planned cuts. WTI is trading at $80.96 PB, gains 0.71%.

Wall Street finished Tuesday’s session with losses after US jobs data revealed a deceleration in the labor market. The US JOLTs report showed a decrease in job openings of 632,000 from January’s 10.6 million to 9.9 million in February. Factory Orders plunged 0.7% MoM in February, slightly improving after January’s 2.1% plunge.

Given the backdrop and the recent release of global manufacturing PMIs weakening, it raised concerns about oil demand.

The commodities complex rose, led by Gold prices (XAU/USD) reaching new YTD highs at $2,025.17, while Silver (XAG/USD) broke the $25.00 mark.

Latest data revealed by the Organization of Petroleum Exporting Countries (OPEC), brought the total volume of cuts to 3.66 million BPD, including a 2 million barrel cut in October 2022, equal to about 3.7% of global demand.

In the meantime, US crude oil inventories withdrew more than 4 million barrels last week, according to sources citing American Petroleum Institute figures.

Furthermore, money market futures expect the US Federal Reserve to keep rates unchanged at 5.00%.

WTI Technical analysis

Following the OPEC+ crude oil output headline, WTI gapped over $6.00, breaking a 7-month-old downslope resistance trendline. That lifted WTIs towards $80.00 PB. Nevertheless, for a bullish continuation, buyers need to crack the YTD high at $81.75, which would clear the path to test the November 7 high at $93.73. On the flip side, any falls below $80.00 could send WTI’s diving towards $75.00.

-

22:00

South Korea FX Reserves above expectations (424.64B) in March: Actual (426.07B)

-

21:53

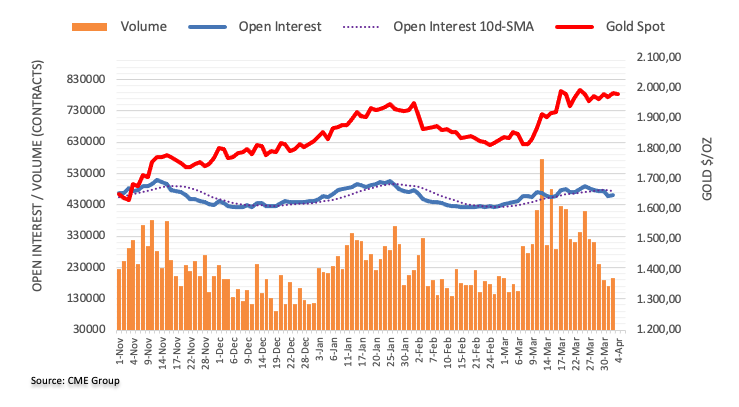

Gold Price Forecast: XAU/USD bulls jump on US Dollar weakness, busting out of the coil

- Gold price busts out of the coil.

- Gold price bulls eye higher still but a pull back could be warranted.

Gold price climbed to the highest in more than a year on Tuesday, finally busting through and holding above the $2,000 mark as the US Dollar and bond yields fell. Yet more US data weighed on the greenback and consequently helped the yellow metal rally out of a coiled formation. At the time of writing, the Gold price is trading at $2,020 and is 1.8% higher.

US job openings in February fell to the lowest level in nearly two years and there was a continued decline in factory orders. Job openings, a measure of labor demand, decreased from 632,000 to 9.9 million on the last day of February, the lowest since May 2021, according to the monthly Job Openings and Labor Turnover Survey, or JOLTS report. ´´he largest drop in openings was in professional and business services, followed by healthcare. Accommodation and food services, saw openings fall back to the middle of 2022 levels. Construction job openings picked up despite the sector’s interest rate sensitivity,´´ analysts at ANZ Bank said.

US factory orders declined for a second straight month, down 0.7% in February after falling 2.1% in January from the 1.7% jump in December. This data comes on the heels of the Institute for Supply Management (ISM) that yesterday reported that its Manufacturing PMI fell to 46.3 last month. This was the worst since May 2020, from 47.7 in February.

The data echoed, in part, last week’s PCE data, the Federal Reserve´s preferred inflation measure, which was mixed. However, while headline and core both came in a tick lower than expected, super core accelerated for a second straight month to 4.63% YoY which is the highest since October. ´´This is not the direction that the Fed desires and so we look for the hawkish tilt in Fed comments to continue,´´ analysts at Brown Brothers Harriman explained.

Meanwhile, the rate futures market priced in a roughly even chance of a 25 basis-point rate hike in May, with rest of the odds tilted towards a pause from the Fed. On Monday, the probability of a 25-bp hike was more than 65%. The money markets have also factored in Fed cuts by end-December. In late morning trading, the US Dollar index dropped to a two-month low of 101.45 DXY and was last down 0.39% at 101.64.

Gold technical analysis

As per the pre-market open weekly Gold price analysis, Gold, Chart of the Week: XAU/USD bulls remain in control, the Gold price indeed rallied:

Prior Gold price analysis

We had a bullish pennant on the daily and 4-hour charts:

Gold price updates

The Gold price bulls were back in the market after an anticipated drive from around the supporting area. The Gold price bulls needed to commit at this juncture to get and stay above $2,010.

Gold price update, live chart

The bullish pennant thesis played out as illustrated in the live chart above.

On the following daily chart, the price has rallied through resistance, and if there is not just a continuation right off the bat into $2,050s, then the Fibonacci scale comes into play. We have the 38.2% Fibonacci retracement aligned with the $2,000 area that could come back under pressure for a retest, if not lower, prior to the next bullish impulse and an eventual upside continuation:

-

21:47

Forex Today: Dollar under pressure, Gold jumps and US yields tumble

Data from the US weighed on the US Dollar, which remains under pressure ahead of more employment figures, including NFP on Friday. The ADP Employment report is due on Wednesday. The key event on Asian hours will be the Reserve Bank of New Zealand’s decision. RBA Lowe will speak after the central bank's pause. The Greenback looks set to extend losses but could receive help from the new economic reports.

Here is what you need to know on Wednesday, April 5:

The US Dollar Index posted the lowest close in two months on Tuesday after falling for the second day in a row. Economic data did not help the Dollar on Tuesday. The JOLTs report showed job openings fell to 9.93 million, the lowest level since May 2021, while Factory Orders fell by 0.7%.

The US economic figures pushed US yields further to the downside and were not cheered by Wall Street. The Dow Jones lost 200 points or 0.59%, the Nasdaq declined by 0.52%, and the S&P 500 by 0.58%.

The Japanese Yen outperformed during the American session, favored by lower yields and the deterioration in market sentiment. As a result, USD/JPY lost ground for the second day in a row, breaking below 132.00.

EUR/USD continued to move higher and approached 1.1000. The Pound also outperformed as GBP/USD jumped to 1.2500, breaking decisively above December and January highs.

The Australian Dollar weakened following the pause from the Reserve Bank of Australia (RBA); however, the AUD/USD still looks bullish, holding above 0.6720. RBA Governor Lowe will speak on Wednesday.

On Wednesday, the Reserve Bank of New Zealand will announce its decision. A 25 basis points rate hike to 5% is expected. NZD/USD is trading above 0.6300, at the highest since mid-February.

RBNZ Preview: Forecasts from eight major banks, decelerating hikes as recession is looming over New Zealand

Crude oil prices finished flat on Tuesday, holding on to Monday’s rally following the OPEC+ output cut. If prices resume the upside, it would be another problem for central bankers around the world.

Gold bulls welcomed lower US yields. XAU/USD finally rose above $2,000, and it holds near the recent highs at the $2,020 area, with a strong momentum. Silver joined the rally, and soared to $25.00, the highest level in a year.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:39

United States API Weekly Crude Oil Stock climbed from previous -6.076M to -4.346M in March 31

-

20:34

USD/MXN rises above 18.1000 despite a soft USD

- The US JOLTs report showed a decrease of 632,000 job vacancies in February.

- Factory Orders in the US fell in February, caused by higher borrowing costs.

- Money market futures estimate a 57% chance of a pause in the Fed’s tightening cycle.

Despite the greenback’s weakness, the Mexican Peso (MXN) losses ground vs. the US Dollar (USD). Deterioration in market sentiment and worse-than-expected economic data from the United States (US) spurred capital outflows from emerging market economies. At the time of writing, the USD/MXN is trading at 18.1170, above its opening price by 0.34%.

USD/MXN climbs on risk-off mood

US equities remain to trade in negative territory, while US Treasury bond yields plunge. Data released by the US Department of Labor showed that job vacancies dropped by 632,000 to 9.9 million, as shown by February’s JOLTs report. At the same time, Factory Orders fell in February, dropping 0.7% MoM, slightly recovering from January’s 2.1% plunge.

Following the latest reports, investors increased their bets that the US Federal Reserve (Fed) will pause its tightening cycle. Money market futures estimate a 57% chance of a pause, compared to Monday’s 43% odds. The forecast for 25 bps lies at a 43% chance.

The US Dollar Index (DXY), a gauge that measures the performance of six currencies vs. the American Dollar (USD), drops 0.44% and sits at 101.591, sponsored by falling US Treasury bond yields. The US bond yields plunge was spurred by traders repricing a less aggressive Federal Reserve.

An absent Mexican economic docket left USD/MXN traders adrift to sentiment and US Dollar dynamics. Bad news for the US economy is beginning to weigh on the greenback, with investors shifting towards growth as inflation cools.

USD/MXN Technical analysis

The USD/MXN appears to have bottomed at around the weekly low of 17.9644, reached on Monday. A double bottom emerged though the USD/MXN needs to reclaim the 20, 50, and 100-day EMAs in the near term, so the chart pattern could remain in play. Therefore, if the USD/MXN cracks the 100-day EMA at 18.8477, that could open the door for further upside. That said, the USD/MXN next resistance would be the 19.0000 figure, followed by the March 20 high at 19.2327 and the February 6 high at 19.2905, before aiming towards the YTD high at 19.5345.

-

20:32

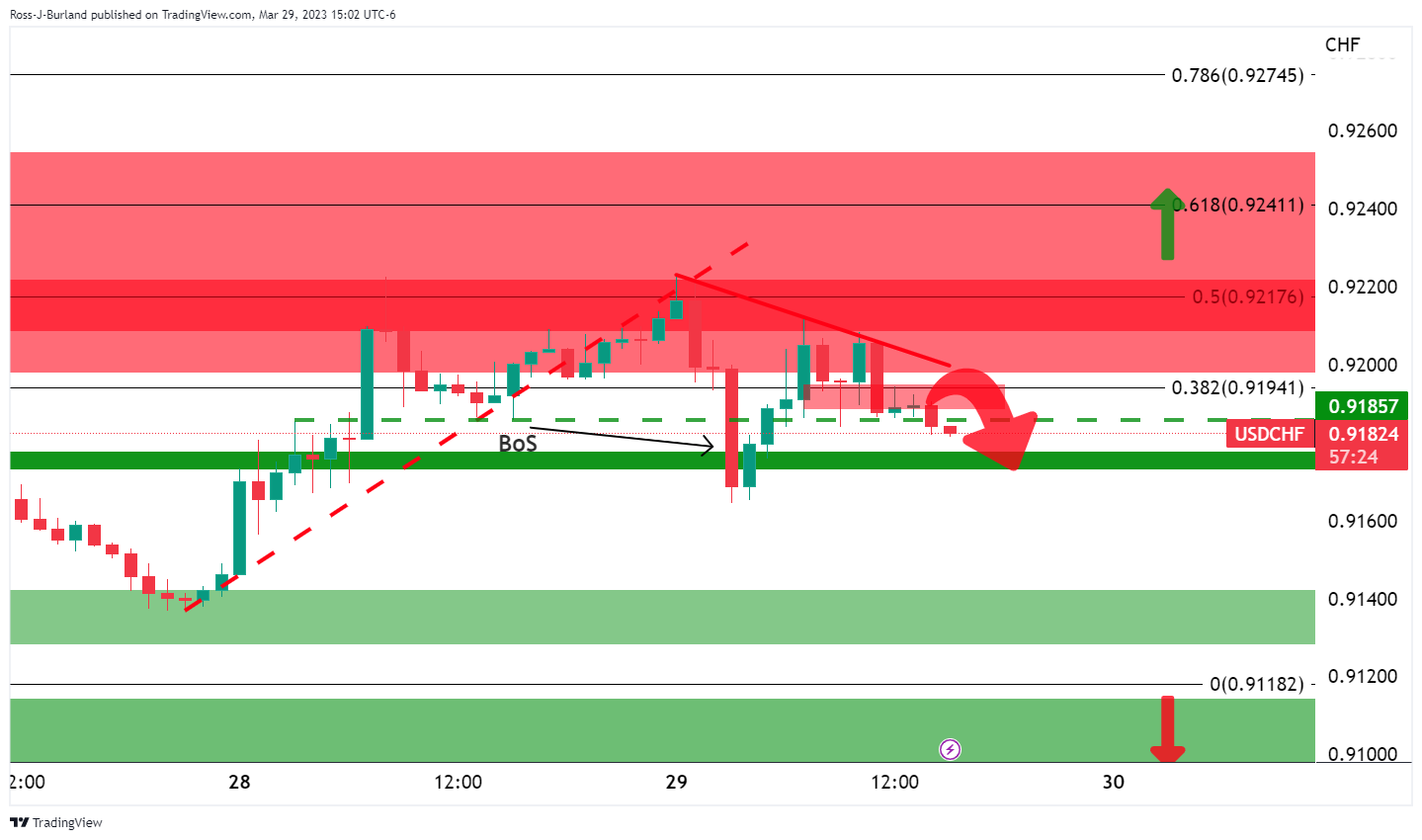

USD/CHF Price Analysis: Bullish correction eyed, but bears to commit below 0.9150

- USD/CHF bears could be headed for a test of the 0.8920s.

- The bears will need to commit below 0.9150 on a correction.

As per the prior analysis, USD/CHF Price Analysis: Bears are in the market and eye a break of 0.9120, the bears stayed with the course and busted to lower levels as the following will illustrate.

USD/CHF prior analysis

USD/CHF daily chart

It was noted that the M-formation was bearish with the price struggling at the neckline resistance...

Update

USD/CHF H1, prior analysis chart

The resistance on the hourly chart was showing that the price was being resisted after the break of structure, BoS, from the prior day.

Update

At this juncture, it would appear that the momentum is with the bears that are headed for a test of the 0.8920s as per the following weekly chart:

Meanwhile, the daily chart shows that the bears have broken structure as follows:

The bears are meeting prior support of 0.9060 and have pierced the level to 0.9055. There could be a correction here but if the bears commit below 0.9150, the likelihood will be for a downside continuation as per the weekly support area.

-

19:13

AUD/USD bears in the market but China could be its savior

- AUD/USD pressured by RBA rate decision.

- RBA held the policy rate at 3.60%.

- RBA Statement says inflation has peaked, labour market remains very tight, some further tightening may well be needed.

AUD/USD remains offered in the mid-US session morning with the Reserve Bank of Australia leaving interest rates unchanged Tuesday. The RBA's softer guidance over the need for further rate increases has reinforced expectations that it's close to or has ended its rate-rise cycle. At the time of writing, AUD/USD is trading at 0.6740 and down from 0.6793 highs. The pair fell to as low as 0.6720 after the rate decision.

However, the Aussie decline was slowed due to another drop in the US Dollar that tumbled to a two-month low on Tuesday in choppy trading. The US data is disappointing the bulls of late which are reinforcing investor bets that the Federal Reserve is nearly done with its own tightening cycle.

Data today showed that US job openings in February dropped to the lowest level in nearly two years. at the same time, there was a continued decline in factory orders. Job openings, a measure of labor demand, decreased 632,000 to 9.9 million on the last day of February, the lowest since May 2021, according to the monthly Job Openings and Labor Turnover Survey, or JOLTS report. U.S. factory orders declined for a second straight month, down 0.7% in February after falling 2.1% in January from the 1.7% jump in December. This data comes on the heels of the Institute for Supply Management (ISM) that yesterday reported that its Manufacturing PMI fell to 46.3 last month. This was the worst since May 2020, from 47.7 in February.

Meanwhile, last week’s PCE data, the Federal Reserve´s preferred inflation measure, were mixed. However, while headline and core both came in a tick lower than expected, super core accelerated for a second straight month to 4.63% YoY and is the highest since October. ´´This is not the direction that the Fed desires and so we look for the hawkish tilt in Fed comments to continue,´´ analysts at Brown Brothers Harriman explained.

Nevertheless, on Tuesday, the rate futures market priced in a roughly even chance of a 25 basis-point rate hike in May, with rest of the odds tilted towards a pause from the Fed. On Monday, the probability of a 25-bp hike was more than 65%. The money markets have also factored in Fed cuts by end-December. In late morning trading, the dollar index dropped to a two-month low of 101.45 DXY and was last down 0.39% at 101.64.

Not all bad for AUD

For the Aussie, MUFG currency analyst Lee Hardman said in a note that while the expectations are that the RBA is close to or has ended its rate-rise cycle, negative for AUD, ´´it's partially offset by bets other G10 central banks are at similar points.´´ He argues that ´´the AUD also remains driven more by the outlook for global growth, particularly for China's economy. Stronger growth in China as its economy continues to fully reopen this year supports our forecast for the Australian dollar to strengthen."

-

18:51

Silver Price Analysis: XAG/USD buyers eye $25.00 after breaking resistance around $24.25

- XAG/USD’s breakout of technical resistance opened the door to testing $25.00.

- XAG/USD’s pullback would expose a prior’s resistance trendline turned support around $24.25.

Silver price is eyeing to extend its gains past the $25.00 a troy ounce after hitting a new YTD high at $24.98. Since then, the XAG/USD retreaded some of those gains and hovers around the $24.80-$24.95 area, gaining 4.03%.

XAG/USD Price action

From a daily chart perspective, the XAG/USD is upward biased. The break of a four-month-old downslope resistance trendline opened XAG’s door to test the $25.00 mark, which, once cleared, could pave the way for further upside, with risks at April 18 daily high at $26.21, followed by 2022 high at $26.94.

Oscillators like the Relative Strength Index (RSI) entered overbought conditions, but remained below 80, seen as the overbought peak, after a strong uptrend. The Rate of Change (RoC) continues to push higher, though it remains shy of hitting its peak after the RoC soared after Silver’s bottom was around $19.92.

In the event of a pullback, XAG/USD’s first support would be the four-month-old resistance trendline turned support at $24.20-35, followed by the $24.00 psychological level. Once broken, that would exacerbate a dip towards the hanging man low at $23.57.

XAG/USD Daily chart

XAG/USD Technical levels

-

18:01

EUR/USD rises above 1.0900 on growing speculation for a Fed pause

- US JOLTs reports revealing a drop of 32,000 job openings, increasing assumptions that the labor market is cooling.

- The US Department of Commerce reported a 0.7% MoM drop in orders.

- ECB’s Makhlouf: The impact of rate hikes is “well underway,” as it emphasizes that the ECB must be ready to tackle inflation.

The EUR/USD edges above the 1.0900 figure for the second consecutive day after data from the United States (US) shifted expectations that the US Federal Reserve (Fed) would pause its tightening cycle. At the time of writing, the EUR/USD is trading at 1.0947 after hitting a low of 1.0882.

EUR/USD rises above 1.0900 as bad US economic data turns negative for the US Dollar

Sentiment shifted sour as of late after a round of labor market data in the US has shown signs of cooling down. Job openings in February, reported in the JOLTs reports, dropped from 10.4 million to 9.931 million, a drop of 32,000. This could be a prelude that the labor market is cooling. Further data will be revealed during the week, with ADP Employment figures shown on Wednesday, followed by Initial Jobless Claims and the US Nonfarm Payrolls report.

At the same time, Factory Orders in the US dropped for the second straight month. Orders plummeted 0.7% MoM, worst than the estimated 0.5% decrease, as the US Department of Commerce reported.

The EUR/USD rose from 1.0886 towards 1.0973, its daily high, before stabilizing at around 1.0947, sponsored by broad US Dollar weakness. The US Dollar Index, which tracks the value of a basket of six currencies vs. the American Dollar (USD), falls 0.41%, at 101.628, blamed on falling US T-bond yields.

On the European front, the Producer Price Index (PPI) for February continued its downward trend, while the German Balance of Trader for the same period remained flat at €16B. In the meantime, the European Central Bank (ECB) Governing Council member, Gabriel Makhlouf, said that the impact of higher borrowing costs is “well underway.” He added that the ECB must remain steadfast and ready to act as required” to ensure inflation returns to target over the medium-term.

EUR/USD Technical analysis

From a daily chart perspective, the EUR/USD triplet bottom remains in play, targeting 1.1000. On Monday, the EUR/USD dipped and tested the 20-day EMA at 1.0788 before skyrocketing above 1.0900. That exacerbated a continuation of the uptrend and has opened the door for further upside. The EUR/USD first resistance would be 1.0973, followed by 1.1000, and then the YTD high at 1.1033. On the other hand, the EUR/USD first support would be 1.0900, followed by the 20-day EMA At 1.0788.

-

17:31

USD/CAD rises above 1.3450 despite broad USD weakness

- USD/CAD gained traction and climbed above 1.3450 in the American session.

- The US Dollar Index stays deep in negative territory below 102.00 after weak US data.

- WTI declined to $80 area following earlier advance.

Following Monday's sharp decline, USD/CAD stayed relatively quiet during the European trading hours on Tuesday. After retreating toward 1.3400 in the early American session, however, the pair regained its traction and turned positive on the day above 1.3450.

The data from the US revealed on Tuesday that Factory Orders declined at a faster pace than expected in February. More importantly, the US Bureau of Labor Statistics reported that job openings on the last day of February dropped to 9.9 million from 10.5 million in January, pointing to softening in labor market conditions. In turn, the US Dollar (USD) came under heavy selling pressure and the US Dollar Index fell to its lowest level since early February below 101.50.

Despite the persistent USD weakness, USD/CAD managed to reverse its direction with the commodity-sensitive loonie struggling to find demand amid retreating crude oil prices.

The barrel of West Texas Intermediate (WTI), which touched its highest level in over two months near $82, was last seen trading in negative territory at around $80.00. Later in the session, the American Petroleum Institute's Weekly Crude Oil Stock report will be watched closely by market participants.

Meanwhile, Wall Street's main indexes stretch lower after a mixed opening, helping the USD stay resilient against the CAD.

Technical levels to consider

-

17:00

USD/JPY drops to six-day lows near 131.50 as US yields tumble

- US economic data triggered a rally in US Treasury bonds.

- DXY boke below 102.00 to the lowest since early February.

- USD/JPY drops for the second day in a row, down more than 200 pips from the weekly high.

The USD/JPY fell sharply after the release of US economic data pointed to a slowdown. The pair tumbled from 132.80 to 131.53, reaching the lowest since March 29.

The pair remains under pressure under 131.80, with the US Dollar weaker across the board. The DXY is falling 0.48%, trading at 101.57, on its way to the second-lowest daily close since May 2022.The JOLTs report showed a decline to 9.9 million job openings, the lowest reading in two years. In a different report, Factory Orders dropped for the second month in a row, by 0.7% below the slide expected of 0.5%. The ADP Employment report and the ISM Service Sector PMI are due on Wednesday.

After the reports, US yields sank. The US 10-year yield dropped to 3.35% and the 2-year to 3.84%. The moves in the bond market boosted the Japanese currency which rose across the board.

Technical indicators in USD/JPY 4-hour chart point to another test of the daily lows around 131.50. A break lower would expose the next support that is seen at the 131.10 area. The Dollar needs to regain levels above 132.50 to alleviate the bearish pressure.

Technical levels

-

16:50

GBP/USD hits a new YTD high above 1.2500 on upbeat sentiment, weak US jobs data

- GBP/USD remains trading nearby the YTD highs hit at 1.2525.

- US JOLTs reports drop to the lowest level in two years; could this be a prelude to a jump in the Unemployment Rate?

- BoE Pill focused on incoming data to decide his stance at the May meeting.

The Pound Sterling (GBP) climbs above 1.2500 and hits a new YTD high at 1.2525, on risk on impulse in the FX space and overall US Dollar (USD) weakness. Economic data released in the United States (US) flashes the economy is slowing down, a headwind for the greenback. At the time of writing, the GBP/USD is trading at 1.2499, above its opening price by 0.72%.

GBP/USD stays positive, despite sentiment shifting sour

Wall Street reversed its course and turned red. The US JOLTs reports, sought by the US Federal Reserve (Fed) as they monitor labor market data, dropped to their lowest level in two years. Figures showed a decrease of 32K to 9.9 million job openings on the last day of February, its lowest since May 2021. Meanwhile, Factory Orders in the US fell for two consecutive months, printing a 0.7% MoM plunge, worst than an estimated contraction of 0.5%, according to the US Commerce Department.

On the data release, the GBP/USD increased from around 1.2465 to its new YTD high at 1.2525. The Fed has constantly reiterated the tightness of the labor market, and a decrease in job vacancies, could help inflation to continue its downward trajectory. Despite OPEC’s latest crude oil production cut, that could make Fed’s job easier.

On Wednesday, the ADP Employment Change report, followed by jobless claims on Thursday, and the US Nonfarm Payrolls data, would update the effect of higher rates on the labor market.

On the UK front, Bank of England (BoE) speakers had been crossing the wires. Of late, the BoE Chief Economist Huw Pill commented that his May rate decision would be focused on “data flow and its interpretation in the forecast.” Earlier, Sylvana Tenreyro, a BoE Monetary Policy Committee (MPC) member, said that a “looser stance is needed to meet the inflation target.”

GBP/USD Technical analysis

From a daily chart perspective, the GBP/USD turned bullish after cracking the February 14 daily high of 1.2270. Additionally, oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) justified the case for higher prices. RSI is still in bullish territory, with space before turning overbought. For a bullish continuation, the GBP/USD must achieve a daily close above 1.2500 to test the newly hit YTD high at 1.2525. A breach of the latter will expose the June 7 high at 1.2599, with upside risks at May 27 daily high at 1.2667. Otherwise, a daily close below 1.2500 could pave the way for a pullback. The first demand area would be 1.2400, followed by the 20-day EMA at 1.2274.

-

16:07

BoE's Pill: There is a lot of policy-in-the-pipeline still to come through

Bank of England Chief Economist Huw Pill said on Tuesday that caution is still needed in assessing inflation prospects on account of the potential persistence of domestically generated inflation, as reported by Reuters.

Key takeaways

"The onus remains on ensuring enough monetary tightening is delivered to see the job through."

"There is a lot of policy-in-the-pipeline still to come through."

"Caution is still needed in assessing inflation prospects on account of the potential persistence of domestically generated inflation."

"MPC need to remain vigilant to signs of tightening financial conditions."

"I will base my may rate decision on data flow and its interpretation in the forecast."

"Recent developments in indicators of inflation persistence have been mixed."

"Wage developments, particularly higher frequency indicators of current momentum, appear to be easing."

"MPC should be cautious viewing better prospects for activity as something inherently inflationary."

"Relative to where we were a few months ago, the difficult trade-off facing monetary policy has eased."

Market reaction

GBP/USD preserves its bullish momentum on Tuesday and was last seen rising 0.75% on the day at 1.2505.

-

16:00

New Zealand GDT Price Index dipped from previous -2.6% to -4.7%

-

16:00

Gold Price Forecast: XAU/USD to shed some gains if the higher Oil price sparks inflation fears – Commerzbank

Gold price jumped above $2,010, reaching the highest level since March of last year. However, economists at Commerzbank believe that the yellow metal could correct lower if higher Oil price sparks inflation fears.

Gold price benefiting from economic concerns

“Gold's strength was by no means intuitive: after all, the significant rise in the Oil price brought about by the decision taken by the OPEC+ members pushes up inflation, whereas the fall in the Purchasing Manager’s Index points to faltering economic momentum, which should ease price pressures. The reaction should therefore come as a surprise in the former case in particular.”

“Doesn’t higher inflation point to higher interest rates, which should weigh on the Gold price? This was probably not the market’s first thought, however. Instead, its first reflex was presumably to switch to ‘crisis’ mode and focus on possible economic risks.”

“It cannot be ruled out that the Gold price will shed at least some of the gains it chalked up yesterday if the higher Oil price sparks inflation fears and thus rate hike speculation.”

-

16:00

Denmark Currency Reserves down to 599.2B in March from previous 600B

-

15:30

EUR/USD open to a push towards 1.1250 as ECB sticks to its guns – Credit Suisse

Economists at Credit Suisse look for EUR/USD to push towards 1.1250.

EUR still being carried by the ECB

“At the start of Q1 we wrote ‘a hawkish ECB framework, lower energy prices in Europe and a market fixation with US disinflation potential all leave room for EUR/USD to push again towards 1.0950 near-term.’ With that framework intact/strengthened post US bank failures in March and a stubborn ECB, we expect an extension now to 1.1250.”

“The key view risk is that banking stress spills over into Europe or that political tensions exacerbate, though the 1.0500 level should be strong support.”

-

15:15

US: JOLTS Job Openings decline to 9.9 million in February vs. 10.4 million expected

- Job openings in the US declined sharply in February.

- US Dollar Index stays under bearish pressure below 102.00.

The data published by the US Bureau of Labor Statistics (BLS) revealed on Tuesday that the number of job openings on the last business day of February stood at 9.9 million, compared to 10.5 million in January. This reading came in below the market expectation of 10.4 million.

"Over the month, the number of hires and total separations changed little at 6.2 million and 5.8 million, respectively," the BLS noted in its press release. "Within separations, quits (4.0 million) edged up, while layoffs and discharges (1.5 million) decreased."

Market reaction

The US Dollar Index turned south after this data and was last seen losing 0.35% on the day at 101.67.

-

15:15

Breaking: Gold rises above $2,010/oz to highest level in a year

- XAU/USD is up by more than 1%, rises $35 in an hour.

- Price was already higher and received another boost after US data.

- US yields and the US Dollar are falling sharply.

Gold price jumped above $2,010 following the release of US economic data reaching the highest level since March of last year. XAU/USD is rising 1% so far on Tuesday, boosted by a weaker US Dollar and lower US Treasury bond yields.

XAU/USD peaked at $2,024/oz, the strongest level since March 9, 2022. As of writing, it trades at $2,020

Dollar and yield tumble

XAU/USD accelerated to the upside after the beginning of the American session and following the release of US employment data. Job openings fell to 9.93 million from 10.5 million in February, below the 10.4 million expected. A different report showed that Factory Orders fell 0.3% in February, against expectations of a 0.5% decline, and January’s figures were revised lower from -1.6% to -2.1%.

Those number sent US yields sharply lower. The US 10-year stands at 3.38%, the lowest since March 27 while the 2-year dropped from above 4.00% to 3.83%. The DXY broke decisively below 102.00 falling to 101.60, the lowest in two months.

Technical levels

-

15:06

United States IBD/TIPP Economic Optimism (MoM) up to 47.4 in April from previous 46.9

-

15:04

US: Factory Orders decline by 0.7% in February vs. -0.5% expected

- Factory Orders in the US declined more than expected in February.

- US Dollar Index stays in negative territory below 102.00.

The data published by the US Census Bureau revealed on Tuesday that new orders for manufactured goods, Factory Orders, decreased $3.9 billion, or by 0.7%, in February to $536.4 billion. This print followed January's decline of 2.1% and came in worse than the market expectation for a decrease of 0.5%.

"New orders for manufactured durable goods in February, down three of the last four months, decreased $2.7 billion or 1.0 percent to $268.4 billion, unchanged from the previously published decrease," the publication further read.

Market reaction

The US Dollar stays under selling pressure after this data and the US Dollar Index was last seen losing 0.2% on the day at 101.82.

-

15:04

USD/CAD: Downtrend might continue for a little bit longer – Commerzbank

The Canadian Dollar was able to benefit from the USD weakness yesterday. Economists at Commerzbank expect the USD/CAD pair to extend its decline.

USD is having a tough time at present

“In our view, imminent rate cuts are not a fait accompli yet, the BoC will probably want to see further hard facts first. As a result, the market may be forced to delay its rate cut expectations which could support CAD.”

“Moreover, USD is having a tough time at present so that the downtrend in USD/CAD might continue for a little bit longer. On the other hand, the BoC’s rate decision next week is approaching and the market is likely to act increasingly carefully in the run-up.”

-

15:01

United States JOLTS Job Openings below forecasts (10.4M) in February: Actual (9.931M)

-

15:00

United States Factory Orders (MoM) registered at -0.7%, below expectations (-0.5%) in February

-

14:45

USD/MXN: Seasonals do not tend to favour a stronger Peso in April – SocGen

The MXN rallied to below 18.00 against the USD after Oil prices took off following the production cut by OPEC. But economists at Société Générale note that seasonals do not favour the Peso in April.

Downside risk for MXN if US yields march higher after ISM and payrolls

“The question from here is whether the Peso can strengthen towards the levels close to 17.45 of 2017. Seasonals do not tend to favour a stronger MXN in April.”

“The MXN is up 8% in Q1 and leapfrogged the CLP as best performing currency this year. Speculative investors trimmed long positions though for a second straight week, but the long base remains elevated in historical terms at 21%. This poses downside risk if US yields march higher after ISM and payrolls.”

-

14:25

EUR/USD Price Analysis: Next up barrier of note comes at the 2023 high

- EUR/USD fades the earlier bull run to new tops near 1.0940.

- Bulls now shift their attention to the YTD peak near 1.1030.

EUR/USD climbs to new multi-week highs near 1.0940 and deflates afterwards following a late bounce in the dollar.

The likelihood of extra advances appears favoured for the time being. Against that, the pair needs to clear the April high at 1.0938 (April 4) prior to a potential test of the 2023 high at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0343.

EUR/USD daily chart

-

14:21

USD to remain under pressure, how to manage this decline? – UBS

The US currency has come under renewed pressure, falling 2% in March. Economists at UBS expect the US currency to remain under pressure and advise investors to consider various steps to manage this decline.

Investors can add Gold to portfolios

“We believe the main pillars of US Dollar strength last year-aggressive tightening by the Federal Reserve and a resilient US economy-are unlikely to support the currency going forward.”

“Non-USD investors should strengthen their home bias with a currency hedge or asset shift. This is a natural move for non-USD based investors who have accumulated large savings in the dollar and face the risk of depreciation.”

“Investors should also consider increasing exposure to select G10 currencies. We have the AUD as our most preferred currency, which we expect to benefit from China's recovery. We also see upside for the JPY and the CHF, as both countries benefit from low inflation. We also favor a select basket of emerging market currencies for carry.”

“Investors can add Gold to portfolios. The Gold price measured in USD tends to rise when the Dollar falls on a trade-weighted basis and when US interest rates are declining.”

-

14:03

NZD/USD to drift higher but at a more modest pace – MUFG

The New Zealand Dollar was close to unchanged in March. Economists at MUFG expect the Kiwi to lag as economy slows.

RBNZ may be close to done

“The greater the banking sector turmoil, the greater the risk to global growth which would see NZD underperform as a high-beta G10 currency. This would be reinforced if the New Zealand economy weakens further.”

“One further 25 bps hike on 5th April appears likely but we would expect that to be the last. The OIS market still has 50 bps of tightening so as the economy weakens further, short-term yields could come further lower. This could see NZD/USD underperform but through the remainder of the year we would expect NZD/USD to drift higher but at a more modest pace.”

“NZD/USD Q2 2023 0.6300 Q3 2023 0.6400 Q4 2023 0.6600 Q4 2024 0.6500.”

-

13:55

United States Redbook Index (YoY): 3.7% (March 31) vs 2.8%

-

13:30

Canada Building Permits (MoM) above expectations (2%) in February: Actual (8.6%)

-

13:22

USD Index Price Analysis: Extra weakness could revisit the 2023 low

- DXY remains offered and drops to new lows near 101.80.

- Further losses could revisit the YTD low near 100.80 seen in February.

DXY comes under pressure and struggles to regain some upside traction around the 102.00 region on Tuesday.

Against that, the persistence of the bearish mood could force the index to breach the so far April low at 101.79 (April 4). Once the latter is cleared, DXY could then head towards the 2023 low around 100.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.53, the outlook for the index is expected to remain negative.

DXY daily chart

-

13:07

USD/CAD: April is the best month of the calendar year for the Loonie over the past 20 years or so – Scotiabank

The Loonie rebound that really started to get going late in March is set to extend this month as April is good for the CAD from the seasonality point of view, economists at Scotiabank report.

Undertone remains bullish

“The CAD typically trades somewhat stronger in Q2/Q3 after a soft Q1. April is the best month of the calendar year for the CAD over the past 20 years or so (CAD strengthens 75% of the time for an average return of around 1% or a little more).”

“Trend momentum signals are leaning USD-bearish on the intraday and daily studies while the market is effectively chopping (or hesitating) around trend support at 1.3430, the odds of a deeper USD drop towards 1.3275/1.3325 are growing.”

“USD resistance is 1.3445/50 and (stronger) at 1.3490/00.”

-

12:35

EUR/USD should make progress toward a retest of the early 2023 peak at 1.1030 – Scotiabank

EUR/USD extends gains through the low 1.09 area. Economists at Scotiabank expect the pair to retest the early 2023 peak at 1.1030.

Sustained bull trend

“The technical set up here – sequential higher highs and higher lows on the short-term charts and solid bull trend momentum on the intraday, daily and weekly oscillators – points to a sustained bull trend which should make progress towards a retest of the early 2023 peak at 1.1030 – and perhaps more.”

“While ECB comments on rate prospects have become a bit more nuanced (aside from Holzmann’s comments yesterday that a 50 bps hike was still on the cards), there has been enough concern expressed by policymakers about rising core inflation to keep a half-point move as a risk for the May policy decision (even if markets are pricing more along the lines of +25 bps).”

-

12:31

Indonesia: Further improvement in base metal industry – UOB

Economist Enrico Tanuwidjaja and junior Economist Agus Santoso at UOB Group assess the recent developments in the base metal industry in Indonesia.

Key Takeaways

“Indonesia has a large natural resources advantage contributing to its total exports. However, most commodities are exported in the form of raw materials, thus lacking in value-added. To answer for higher global demand and reap higher exports revenue in the imminent future, Indonesia must embark on increasing its down streaming capacity and capability, starting with the base metals.”

“The base metal industry is important in itself and furthermore, has a spillover effect to various sectors. Increasing demand for manufactured base metal commodities has led the government to expand downstream to various base metal commodities such as nickel, copper, bauxite and tin.”

“The government has prepared 3 strategic steps to encourage the implementation of downstream in Indonesia such as strengthening infrastructure, regulatory deregulations, and developing industrial ecosystems.”

-

12:28

EUR/JPY Price Analysis: Next on the upside comes 146.70

- EUR/JPY adds to Monday’s positive price action beyond 145.00.

- The next resistance level emerges around the 146.70 zone.

EUR/JPY picks up further pace following the promising start of the week and advances north of the 145.00 barrier on Tuesday.

A daily close above the 2023 top at 145.67 (March 31) should motivate the cross to shift its focus to the December 2022 top around 146.70 (December 15) in the short-term horizon.

In the meantime, extra gains remain on the table while the cross trades above the 200-day SMA, today at 141.82.

EUR/JPY daily chart

-

12:27

GBP/USD: Sustained break above 1.2445 implies upside potential toward 1.30 – Scotiabank

GBP/USD gains accelerate through key resistance at 1.2445. This is a strong bullish signal for the GBP, economists at Scotiabank report.

A major bull move in the Pound is developing

“Gains in the GBP through the mid-1.24 area that has capped the Pound since last year are a bullish technical signal that augurs for more strength ahead.”

“Assuming there is no quick reversal of the breakout, the move implies upside potential in Cable towards 1.30 over the next 3-6 months.”

“Solid-looking bull trend signals on the short, medium and long-term DMI oscillators lend a lot of credence to the idea that a major bull move in the Pound is developing here.”

-

12:20

EUR/USD: Move beyond 1.0930 essential for further up move – SocGen

EUR/USD recovered from 1.0788 but ran into resistance in the familiar 1.09 area. The pair must surpass 1.0930 to enjoy further gains, economists at Société Générale report.

A deeper pullback is likely on a break under 50-DMA

“While we remain constructive on the euro outlook, it is worth asking how far and how fast the single currency can strengthen if the ECB shifts into slower tightening gear. At least three council members (Villeroy, Stournaras and Centeno) believe there is not far to go.”

“A move beyond 1.0930 can result in an extended up move.”

“If a break below 50-DMA at 1.0730/1.0710 materializes, a deeper pullback is likely.”

-

12:05

China: Recovery remained firm in March – UOB

UOB Group’s Economist Ho Woei Chen reviews the latest set of data releases in the Chinese economy.

Key Takeaways

“Better-than-expected manufacturing and non-manufacturing PMIs indicate that China’s economic recovery continued to gain traction in Mar, led by the services sector while the manufacturing sector may hold up stronger than initially thought.”

“Nonetheless, the components of the PMIs suggest that there remains weakness in the economic recovery. Employment in both the manufacturing and nonmanufacturing sectors contracted in Mar while the decline in output/ selling prices may indicate demand weakness and weak profitability. Furthermore, softening external demand and geopolitical tensions continue to pose risk to China’s manufacturing sector.”

“Given a relatively high base of comparison, we forecast GDP to expand by around 3.4% y/y in 1Q23 (4Q22: 2.9% y/y).”

-

11:46

AUD/USD set for a race higher through the rest of 2023, but risk aversion periods will slow the advance – MUFG

The Australian Dollar weakened modestly further in March. Economists at MUFG Bank see upside scope but tempered by bouts of risk aversion.

RBA unlikely to cut rates this year

“With China re-opening likely to provide support for growth this year, we do not expect the RBA to cut rates this year.”

“AUD/USD should be set for a move higher through the rest of the year although periods to risk aversion will see AUD suffer more, which will slow the move higher.”

“AUD/USD: Q2 2023 0.6800 Q3 2023 0.7000 Q4 2023 0.7200 Q1 2024 0.7100.”

-

11:36

US Dollar stays under pressure following Monday’s slide

- US Dollar continues to lose value against its major rivals on Tuesday.

- EUR/USD could target 1.1000 once it confirms 1.0900 as support.

- Bloomberg reported Chinese Yuan replaced US Dollar as the most traded foreign currency in Russia.

The US Dollar (USD) stays on the back foot on Tuesday after having registered losses against its major rivals on Monday. Although markets are pricing in a nearly 60% probability of the US Federal Reserve (Fed) raising its policy rate by 25 basis points (bps) in May, the currency is having a hard time finding demand. The risk-positive market atmosphere and news of the USD losing some of its appeal as reserve currency seems to be forcing the US Dollar Index (DXY) to stay on the back foot.

Daily digest market movers: US Dollar on the back foot for the second straight day

- Bloomberg reported on Tuesday that Chinese Yuan has surpassed the US Dollar as the most traded currency, in monthly trading volume, for the first time in Russia in February. According to the outlet, the gap has continued to widen in March.

- Last week, Brazil and China have reached an agreement to stop using the US Dollar as an intermediary in trade transactions.

- The CME Group FedWatch Tool shows that markets are pricing in a 58% probability of the Fed raising its policy rate by 25 basis points (bps) to the range of 5-5.25% in May.

- On Sunday, Saudi Arabia announced that several producers in OPEC+ will participate in voluntary output cuts from May to the end of the year. The group’s total output will be reduced by more than 1.5 million barrels per day in that period.

- The barrel of West Texas Intermediate (WTI) started the week with a large bullish gap and touched its highest level since late January above $82. Following a consolidation phase, WTI holds comfortably above $80.

- Federal Reserve Bank of St. Louis President James Bullard said on Monday that the unexpected decision by OPEC to lower output could make the Fed’s jobs of bringing inflation down back to 2% target more challenging.

- ISM’s Report on Business revealed on Monday that the headline Manufacturing PMI declined to 46.3 in March from 47.7 in February, revealing a contraction at an accelerating pace in the manufacturing sector’s economic activity.

- The Prices Paid Index of the PMI survey, the inflation component, dropped to 49.2 from 51.3. This reading suggests that input inflation in the sector softened in March.

- Fueled by the upbeat performance of energy shares, the S&P 500 closed in positive territory on Monday.

- US stock index futures trade modestly higher on Tuesday.

- February Factory Orders and JOLTS Job Openings will be featured in the US economic docket on Tuesday.

- Later in the week, the ISM Services PMI survey, ADP private sector employment data and the US Bureau of Labor Statistics’ March jobs report could influence the US Dollar valuation.

Technical analysis: US Dollar shows no signs of life against Euro

Despite the modest retreat seen at the beginning of the week, EUR/USD has managed to gather bullish momentum. The Relative Strength Index (RSI) indicator on the daily chart rose above 60 and the 20-day Simple Moving Average (SMA) made a bullish cross with the 50-day SMA. Both of these technical developments suggest that the pair’s bullish bias remains intact and there is more room on the upside before it turns technically overbought.

EUR/USD trades above 1.0900 (psychological level, static level) and it could target 1.1000 (end-point of the latest uptrend, psychological level) and 1.1035 (multi-month high set in early February) as long as that support holds.

On the downside, 1.0800 (psychological level, static level) aligns as first important support level before 1.0730/1.0750 area (20-day SMA, 50-day SMA) and 1.0660 (100-day SMA).

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.

-

11:18

PBOC Governor Yi: Will safeguard Yuan, financial stability to boost employment and economic growth

The People’s Bank of China (PBOC) Governor Yi Gang made some comments on the exchange rate value and financial stability in a statement on Tuesday.

“China will safeguard Yuan and financial stability to boost employment and economic growth,” Governor Yi said.

Market reaction

The Chinese proxy, the Australian Dollar, is unperturbed by the comments. The AUD/USD was last seen trading at 0.6750, down 0.45% on the day.

-

11:10

Sterling seasonals turn bullish in April – SocGen

The Pound wrapped up the first quarter of the year as the best currency in G10. Economists at Société Générale note that GBP seasonals turn bullish in April.

Sterling’s seasonal sweet spot

“Seasonal trends place the GBP/USD pair in the sweet spot in April with gains in eight of the last ten years.”

“GBP/USD has rebounded towards last December/January high of 1.2450. This hurdle must be overcome to affirm extension in the up move.”

“Last week's low of 1.2210/1.2190 is an important support zone.”

-

11:02

EUR/USD: Decisive break above 1.0930 could usher in greater momentum toward 1.1030 – OCBC

EUR/USD retreated slightly after having climbed above 1.0900 on Monday. A sustained break above 1.0930 would clear the way toward 1.1030, economists at OCBC Bank report.

Bias to buy dips

“EUR reversed its earlier losses overnight amid USD softness. But the rise above 1.09-handle was stalled in its tracks again. This is the fourth time in two weeks that EUR’s rally had stalled at again.”

“Bullish momentum on daily chart intact though there are tentative signs of it easing while RSI fell.”

“Support at 1.0780, 1.0730 levels (21, 50-DMAs) before 1.0650 (100-DMA).”

“Bias to buy dips.”

“Key resistance remains at 1.0930 (triple top). Decisive break above could usher in greater momentum towards 1.1030 (2023 high).”

-

10:46

RBNZ Preview: Forecasts from eight major banks, decelerating hikes as recession is looming over New Zealand

The Reserve Bank of New Zealand (RBNZ) will announce its monetary policy decision on Wednesday, April 5 at 02:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of eight major banks.

RBNZ is expected to hike the key Official Cash Rate (OCR) by 25 basis points (bps) from 4.75% to 5.00%. Eyes will be on the language in the statement amid no updated forecasts and Governor Orr’s presser.

ANZ

“We expect the RBNZ will raise the OCR 25 bps to 5.00%. If that’s not to be, we see a 50 bps hike as likelier than a pause. On balance, local data since the February MPS has not convincingly tilted things in either direction. But global financial sector wobbles suggest a degree of caution is appropriate, which the RBNZ can now afford given they are fairly confident the OCR is now in contractionary territory. We continue to forecast the OCR to peak at 5.25% with one more hike to come in May.”

Standard Chartered

“We believe the RBNZ is approaching the end of its hiking cycle. We maintain our forecast for a last 25 bps rate hike in April, taking the terminal policy rate to 5%, well short of the current RBNZ projection of 5.5%. We expect slowing inflation and a weak growth backdrop to allow the RBNZ to turn more dovish.”

TDS

“The February Monetary Policy Statement made clear the Bank thinks further hikes are needed and we expect the RBNZ to hike its OCR by 25 bps to 5.00%. The Bank is likely to acknowledge the recent turmoil in US and European financials, but conclude NZ banks are in good shape. A tightening in offshore lending standards and Fed Funds terminal rate forecasts shifting lower imply downside risk to our 5.50% RBNZ terminal rate forecast. Unless the RBNZ suggests that terminal may be lower, NZD should be contained on the crosses but NZD is more likely to be a function of broad USD/Fed pricing dynamics.”

Rabobank

“The RBNZ will deliver their latest OCR decision, where a hike of 25 bps is expected to take the OCR to 5.00%. We expect the same outcome. The 0.6% contraction in Q4 GDP might prompt some pause for thought, and the RBNZ does have a reputation for shooting from the hip. Still, the prospect of structurally higher energy prices should be enough to tip the RBNZ over the line.”

NAB

“We think the RBNZ/MPC will largely hold to its February MPS line, by delivering a 25 bps hike in the OCR and maintaining a hawkish tilt in its commentary and minutes.”

Citi

“The MPC is expected to step down its pace of rate hikes and we expect this would be last hike in the current cycle, implying a terminal policy rate of 5.00%. A 5% terminal rate would be lower than the Bank’s guidance of the OCR at 5.5%. However, we believe that the data in NZ has deteriorated a lot earlier than the RBNZ’s bullish forecast and should justify not only stepping down its pace of rate hikes from 50 bps to 25 bps but also should signal the end of the tightening cycle because the impact of previous rate hikes is still filtering through the economy. If correct, and this is the last hike the RBNZ delivers in the tightening cycle, then the Statement from the MPC will likely need to be open the possibility for less hawkish forward guidance. Similar to the BoC, the RBNZ could signal that further tightening could be necessary to help alleviate inflation concerns. Either way, the RBNZ is likely to push against any nascent expectations of interest rate cuts this year.”

Wells Fargo

“We expect the central bank to continue tightening monetary policy. With inflation still elevated, we expect the RBNZ to deliver a 25 bps rate hike at its April meeting to 5.00%, and then deliver one last 25 bps hike in May to a peak of 5.25%.”

ING

“We expect the RBNZ to hike by 25 bps to 5.0% and to maintain a hawkish tone, which can support NZD. The slower pace of tightening is warranted by external and domestic downside risks to the economy and a lower inflation outlook. These same factors make us doubt that the 5.50% peak rate (projected by the RBNZ) will be reached.”

-

10:43

Germany forecast to skirt recession – Reuters

Citing sources who have seen the so-called Joint Economic Forecasts, to be presented in Berlin on Wednesday, Reuters reported on Tuesday that the German economy is likely to narrowly skirt recession and post modest growth in the first quarter of the year.

Key takeaways

“Joint Economic Forecasts expect a 0.1% expansion in the gross domestic product in the first quarter. This follows a 0.4% contraction in the fourth quarter of 2022.”

“The five economic institutes which prepare the Joint Economic Forecasts predict GDP growth in Germany of 0.3% in 2023, up from a predicted contraction of 0.4% in the autumn.”

“For 2024, the institutes - four German and one Austrian - forecast GDP growth of 1.5%, down from 1.9% previously.”

“The economic institutes predict inflation of 6.0% in 2023, before slowing to 2.4% in 2024.”

Market reaction

The Euro is catching fresh bids on the above report, as EUR/USD is adding 0.33% on the day to trade at 1.0930.

-

10:40

AUD/USD: Decline could extend on failure to overcome 0.6850 – SocGen

AUD/USD formed a Head and Shoulders and has embarked on a phase of pullback. Failure to recapture 0.6850 could trigger fresh selling, analysts at Société Générale report.

Below 0.6550, next potential support aligns at 0.6400

“AUD/USD confirmed a Head and Shoulders and almost achieved the target at 0.6550 last month. It has staged a bounce and is attempting a break above the 200-DMA. Neckline of the pattern at 0.6850 is short-term resistance. If the pair fails to overcome this, the decline could extend.”

“First support is at 0.6680/0.6650, the 50% retracement of the rebound. Break below could mean extension in downtrend towards 0.6550 and 0.6400, the 76.4% retracement from last October.”

-

10:31

BoE’s Tenreyro: BoE might need to cut rates sooner than thought

Bank of England (BoE) interest rate-setter Silvana Tenreyro said on Tuesday, “I expect that the high current level of bank rate will require an earlier and faster reversal, to avoid a significant inflation undershoot.”

Additional quotes

“With bank rate moving further into restrictive territory, I think a looser stance is needed to meet the inflation target.”

“Looser stance can be achieved either through lower bank rate today or through lower bank rate in future.”

“In the absence of further counterbalancing cost-push shocks, I judge inflation is likely to fall well below target.”

“Cannot be complacent about the ability of QE to substitute for an interest-rate policy if, when inflation falls, we find ourselves still in a world of low equilibrium interest rates

“High-frequency private-sector regular pay growth has fallen back sharply in recent months.”

“Terms of trade shock to the UK has unwound faster than I expected.”

“I expect lower price inertia from second-round effects via wage growth, given a lower rate of headline inflation.”

“We will see less of a drag on demand and the output gap from further falls in real income.”

Market reaction

Despite the dovish remarks from the BoE policymaker, GBP/USD is holding its latest uptick near 1.2500, adding 0.73% on the day.

-

10:28

USD should continue to struggle amid economic concerns – Commerzbank

The FX market is increasingly concerned about the US economy. Hardly surprising therefore that USD is currently struggling. Economists at Commerzbank expect the greenback to remain under pressure.

Economic concerns affect USD

“If signs mount that the US economy is cooling significantly, the market might feel confirmed in its assumption that the US central bank might start cutting interest rates in the second half of the year, whereas the ECB for example continues to attract attention with reasonably hawkish comments so that rate cuts are not playing much of a role for now.”

“A data highlight is due on Friday in the shape of the labor market report. Even though the data is likely to point towards a relatively tight labor market, the report would probably have to be phenomenal to dispel the economic concerns on the market. Of course that cannot be excluded but we expect a further slowing in the number of new jobs. As a result USD should continue to struggle.”

-

10:15

New Zealand: RBNZ could hike again in April – UOB

Economist at UOB Group Lee Sue Ann sees the RBNZ raising the OCR by 25 bps at the April 5 event ahead of a potential pause in the next months.

Key Quotes

“We now think the RBNZ will have to dial back on further rate hikes, especially in light of the looming policy-induced recession and surging migration domestically.”

“We are pencilling in a 25bps hike in the OCR to 5.00%, after which we expect a pause in the current tightening cycle.”

-

10:15

USD/JPY retakes 133.00 ahead of US data

- USD/JPY is challenging 133.00 again amid rebounding US Treasury bond yields.

- European stocks advance while US S&P 500 futures turn positive.

- Bearish 50DMA support is in sight amid the pullback from multi-week highs.

USD/JPY is regaining the upside traction in the European session, as risk sentiment rebounds on firmer European equities while the US S&P 500 futures turn positive on the day.

The positive shift in the market mood has reduced the demand for safe havens such as the US government bonds and the US Dollar, lifting the US Treasury bond yields across the curve. The benchmark 10-year US Treasury bond yields are up 0.71% on the day at 3.456%.

Earlier in Asian trading, the major faced rejection just shy of the 133.00 mark and turned south to test the 135.50 psychological level. The pair was last seen trading at 132.91, adding 0.40% on the day.

The further upside in the USD/JPY pair could depend on Wall Street performance, as the US Dollar is resuming its downside below 102.00 against its major rivals. On the data docket, the United States will feature the JOLTS Job Openings and the Factory Orders data in the North American session.

From a short-term technical perspective, USD/JPY is running into a critical resistance of the horizontal 50-Daily Moving Average (DMA) at 133.00.

The 14-day Relative Strength Index (RSI) is edging lower but holds well above the midline, suggesting that the upside momentum is likely to remain intact.

However, a potential 21 DMA and 50 DMA bearish crossover could warrant caution for USD/JPY buyers.

Therefore, bulls need acceptance above the 50 DMA barrier on a daily closing basis to break from the recent trading range and target the 133.50 static resistance.

On the flip side, a sustained move below the 132.50 demand area will threaten intermittent support near 132.20. Further south, the 132.00 round figure will be the last line of defense for bulls.

USD/JPY: Daily chart

USD/JPY: Additional technical levels

-

10:01

A higher EUR/USD certainly looks the direction of travel for the rest of the year – ING

EUR/USD remains well supported and not far off recent highs at 1.0900/0930. Economists at ING expect the pair to extend its race higher throughout the rest of 2023.