Notícias do Mercado

-

23:51

AUD/JPY Price Analysis: Corrects upwards, but downside risks remain around 61.8 Fibonacci level

- AUD/JPY pair sees two straight days of losses as sellers remain in charge.

- A breach of 20-day EMA support at 88.81 opens the path for further decline.

AUD/JPY Price Action

With the AUD/JPY pair extending its losses to two-straight days and breaching the 20-day Exponential Moving Average (EMA) support at 88.81 has opened the path for sellers. After testing previous resistance at around 90.00, where a prior support trendline turned resistance, sellers gathered momentum, and since then, the AUD/JPY has dropped 2.86%.

Oscillators remain in bearish territory, with the Relative Strength Index (RSI) aiming lower, while the Rate of Change (RoC) portrays sellers remaining in charge.

In the short term, the AUD/JPY 1-hour chart portrays the pair correcting upwards, testing the 38.2% Fibonacci retracement around 88.24. Upside risks lie at the central pivot point at 88.33, which, once cleared, would expose the R1 daily pivot at 89.03. Nevertheless, the confluence of April’s 5 low and the 61.80% Fibonacci retracement at around 88.62 would cap any rallies. If AUD/JPY retreats at the latter, look for a slide toward the S2 daily pivot point at 86.77.

AUD/JPY 1-Hour Chart

AUD/JPY Technical Levels

-

23:38

US House Speaker McCarthy praises Taiwan talks, China Foreign Ministry alleges break of commitment

US House of Representatives Speaker Kevin McCarthy crossed wires, via Reuters, late Wednesday while praising talks with Taiwanese President Tsai Ing-Wen. The Diplomat, however, ruled out chatters of his visit to the Asian nation by saying, “I don't have any current plans to visit Taiwan but that doesn't mean I will not go.”

Additional comments

We must continue arms sales to Taiwan.

We must strengthen our economic cooperation, particularly with trade and technology.

Congressional meeting shows we take our support for the people of Taiwan seriously.

America's support for the people of Taiwan will remain resolute, unwavering and bipartisan.

US arms sales to Taiwan must be delivered on timely basis.

We look forward to more meetings like this in the future.

We support Taiwan and we're going to turn those words into action in this congress.

It is not our intention to escalate tensions with China.

There might be further ramifications for Chinese balloon flight over US.

There is no need for retaliation from China for meeting with Taiwan president.

China cannot tell me where I can go or who I can meet.

China should engage with US.

We talked about how We can speed up Weapons going to Taiwan.

Believes there is a bipartisan position on need to speed up arms deliveries to Taiwan.

Soon after the comments from US House Speaker McCarthy, China’s Foreign Ministry Spokesperson crossed wires and alleged the US of breaking its commitment on the Taiwan issue. The following are additional statements from Chinese Foreign Ministry Spokesperson:

China firmly opposes and strongly condemns the acts.

US colluded with Taiwan authorities, connived at attempts by separatists seeking "Taiwan independence" to carry out political activities on US soil.

Action of McCarthy has seriously broken the commitment made by the United States to China on the Taiwan question.

In response to 'seriously erroneous acts of collusion', China will take resolute and effective measures to safeguard national sovereignty, territorial integrity.

Market reaction

The news could weigh on the AUD/USD price which is picking up bids to pare recent losses around 0.6720 by the press time.

Also read: AUD/USD regains 0.6700 in a corrective bounce ahead of Australia trade numbers, China PMI

-

23:34

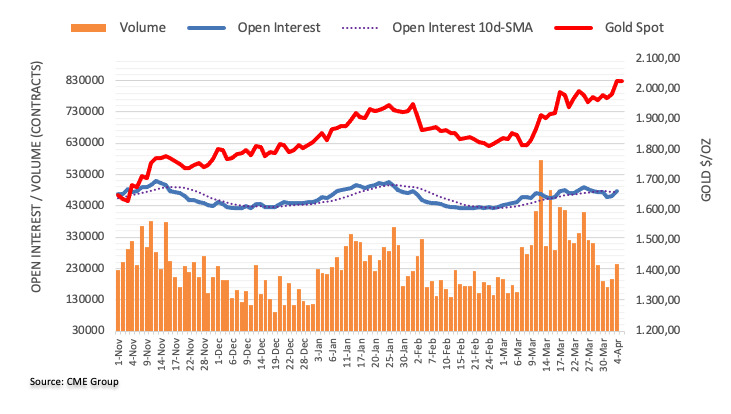

Gold Price Forecast: XAU/USD turns sideways after a wild gyration above $2,020 as investors eye key US NFP

- Gold price has turned sideways above $2,020.00 ahead of the US NFP data.

- US Services PMI defending dropping below 50.0 but recession fears get deepened.

- The Labor Cost Index data is expected to soften ahead, which might decelerate inflationary pressures further.

Gold price (XAU/USD) is showing a lackluster performance above $2,020.00 in the early Tokyo session. The precious metal witnessed a wild gyration after the release of weak United States Employment data on Wednesday. The Gold price has turned sideways as investors have shifted their focus toward the release of the US Nonfarm Payrolls (NFP) data.

S&P500 continued its downside move on Wednesday as weaker Services PMI stroked signs of recession in the US economy, indicating negative market sentiment. The US Dollar Index (DXY) rebounded firmly from its fresh monthly low of 101.40 but observed a restricted upside near 102.00. The USD Index attracted significant bids despite the release of downbeat US Services PMI and labor market data.

March’s US ISM Services PMI dropped to 51.2 vs. the consensus of 54.5 and the former release of 55.1. A slowdown in the Service sector shows deepening concerns due to higher rates by the Federal Reserve (Fed). Also, households are struggling in bearing the burden of high inflation. The New Orders Index that conveys forward-demand dropped dramatically to 52.2 from the estimates of 57.6 and the prior release of 62.6. It is quite satisfactory that the US Services PMI gamut didn’t fall below 50.0 as it would have been considered a contraction.

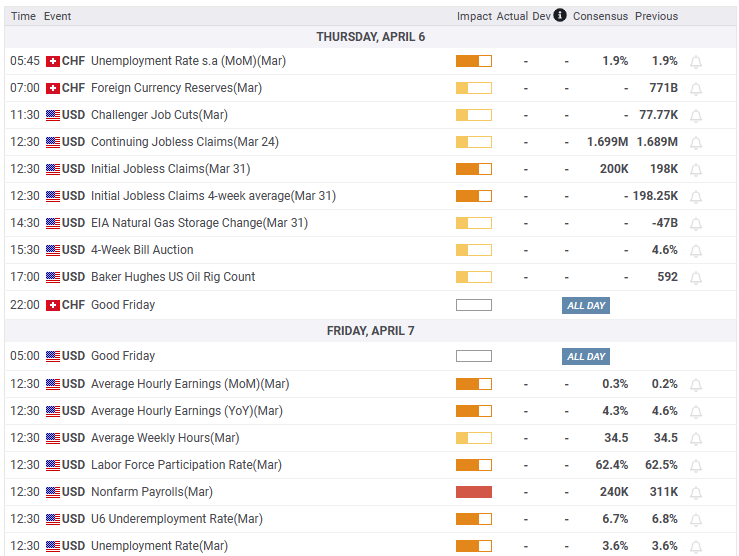

After the release of downbeat US Automatic Data Processing (ADP) Employment data, investors are keenly awaiting the release of US NFP, which will provide more clarity on labor market conditions. The Unemployment Rate is expected to remain steady at 3.6%. And Average Hourly Earnings would soften to 4.3% vs. the former release of 4.6%.

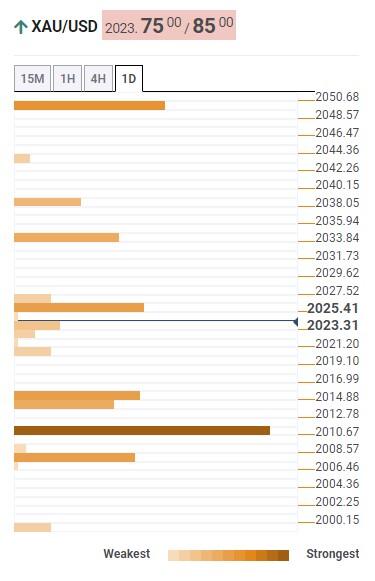

Gold technical analysis

Gold price is oscillating in a narrow range of $2,011-2,033 on an hourly sale. The precious metal found cushion after a wild move from March 20 high at $2,009.88. The Gold price is struggling to sustain above the 20-period Exponential Moving Average (EMA) at $2,021.20. While the 50-period EMA at $2,010.00 is still advancing.

Meanwhile, the Relative Strength Index (RSI) (14) has dropped into the 40.00-60.00 range after exhaustion in the upside momentum.

Gold hourly chart

-

23:24

AUD/USD regains 0.6700 in a corrective bounce ahead of Australia trade numbers, China PMI

- AUD/USD picks up bids to pare recent losses, snaps two-day downtrend.

- RBA’s Lowe fails to convince markets of the Aussie central bank’s hawkish capacity after pausing rates.

- US Dollar rebound, sour sentiment also weighs on the risk-barometer pair.

- Australia’s trade numbers, China Caixin Services PMI will be important to watch for clear directions.

AUD/USD picks up bids to pare recent losses around 0.6720 as it braces for the Aussie foreign trade numbers for February and China’s Caixin Services PMI for March on early Thursday. The Aussie pair dropped in the last two consecutive days despite softer US data as the Reserve Bank of Australia’s (RBA) pause to the rate hike trajectory pushed back the bulls even if Governor Philip Lowe tried to recall them.

On Wednesday, Reserve Bank of Australia (RBA) Governor Philip Lowe tried to appease hawks, following the RBA’s pause in rate hikes. The Policymaker ruled out rate cuts while also saying, “Balance of risks lean toward further rate rises.”

On the other hand, the US Dollar rebound amid recession woes and ignored the downbeat data. That said, the ADP Employment Change for March dropped to 145K from 200K expected and an upwardly revised prior of 261K. On the same line, the final readings of S&P Global Composite and Services PMIs for March also came in downbeat as the former one declined to 52.3 from 53.3 preliminary estimations while the Services PMI dropped to 52.6 from 53.8 anticipated earlier. More importantly, the US ISM Services PMI for the said month amplified pessimism as it dropped to 51.2 versus 54.5 expected and 55.1 prior.

Against this backdrop, the recession woes in the US grew stronger and weighed on the sentiment. The same marked downbeat Wall Street close and drowned the US Treasury bond yields. However, the sour sentiment allowed the US Dollar Index (DXY) to recover from a two-month low and snap a two-day downtrend.

Looking ahead, Australia’s monthly Trade Balance, Exports and Imports for February will precede China’s Caixin Services PMI for March to direct immediate AUD/USD moves. Given the dovish RBA, the Aussie pair is likely to remain pressured unless the data provides positive surprise.

Technical analysis

A daily closing below one-month-old support line near 0.6680 becomes necessary for the AUD/USD bears to retake control.

-

23:11

GBP/USD pullback fades around 1.2450 as US Dollar rebound lacks support from employment clues

- GBP/USD remains sidelined after refreshing 10-month high.

- Brexit optimism, softer US Dollar initially pleased Cable buyers before a corrective move amid recession chatters.

- UK employment numbers flash downbeat signals and weigh on yields, US Dollar.

- Monthly US jobs report will be crucial to watch, risk catalysts are also important for fresh impulse.

GBP/USD seesaws around 1.2460 during early Thursday in Asia, after a volatile day that initially refreshed the multi-month high before reversing the gains.

The Cable pair rose to the highest levels since June 2022 earlier on Wednesday amid broad US Dollar weakness and Brexit optimism. However, the following rebound in the greenback, due to the recession woes, triggered the much-awaited pullback in prices. It’s worth noting, though, that the USD’s latest rebound ignores downbeat employment clues. Additionally, mixed data at home might have also allowed the GBP/USD pair buyers to take a breather.

On Wednesday, the UK’s final readings of S&P Global/CIPS Composite and Services PMIs for March came in mixed as the former confirmed the initial estimations of 52.2 but the key Services gauge improved to 52.9 from 52.8 initial forecasts.

Talking about Brexit, “A new model will be announced later on Wednesday to ‘reduce the need for checks for many types of goods,’” said Sky News while citing an anonymous UK Cabinet Office source speaking on the post-Brexit checks on goods coming to the UK from the European Union (EU).

After a disappointing 19-month low of the US JOLTS Job Openings for February, the ADP Employment Change for March dropped to 145K from 200K expected and an upwardly revised prior of 261K.

On the same line, the final readings of S&P Global Composite and Services PMIs for March also came in downbeat as the former one declined to 52.3 from 53.3 preliminary estimations while the Services PMI dropped to 52.6 from 53.8 anticipated earlier. More importantly, the US ISM Services PMI for the said month amplified pessimism as it dropped to 51.2 versus 54.5 expected and 55.1 prior.

Amid these plays, the recession woes in the US grew stronger and weighed on the US Dollar despite the latest rebound. On the same line are the latest challenges to its reserve currency status. With this, Wall Street marked downbeat close and drowned the US Treasury bond yields. However, the sour sentiment allowed the US Dollar Index (DXY) to recover from a two-month low and snap a two-day downtrend.

Moving on, a light calendar with only second-tier US data may entertain GBP/USD traders but risk catalysts are more important for clear directions.

Technical analysis

Unless declining back below 1.2445-50 resistance-turned-support, GBP/USD remains on the bull’s radar even if the overbought RSI suggests a pullback in prices.

-

22:56

EUR/USD rebounds from 1.0900 as tight US labor market cools down further

- EUR/USD has shown recovery from 1.0900 amid signs of softening the US labor market.

- US firms have slowed down their hiring process amid rising interest rates by the Fed and a bleak economic outlook.

- The ECB would continue its policy-tightening process ahead.

The EUR/USD pair has sensed support after dropping to near the round-level support of 1.0900 in the early Asian session. The major currency pair has attempted a recovery after falling to near 1.0900 as the tight United States labor market has cooled down further after US Employment data released by Automatic Data Processing (ADP) missed estimates.

As per the released data, the US economy added 145K jobs in March, significantly lower than the estimates of 200K and the former release of 242K. Firms have slowed down their hiring process amid rising interest rates by the Federal Reserve (Fed) and a bleak economic outlook. A slowdown in the recruitment process after the release of weak Job Openings data indicates that the US labor market has started cooling off and chances are solid of an escalation in the Unemployment Rate ahead.

Meanwhile, S&P500 settled Wednesday’s session with some losses as the risk of recession has been fuelled further after the release of the downbeat US ISM Services PMI data, portraying a risk appetite theme. The US Dollar Index (DXY) rebounded to near 102.00 after defending the fresh monthly low above 102.40. The demand for US government bonds soared as weak Services PMI and a slowdown in payroll numbers have confirmed that the Fed will favor an unchanged interest rate decision ahead. The 10-year US Treasury yields have sipped sharply below 3.31%.

In Eurozone, the survey of consumer expectations for inflation, conducted by the European Central Bank (ECB) on a monthly basis showed that median inflation expectations for the next 12 months have fallen to 4.6% in February vs. 4.9% recorded in January. Constantly rising rates by European Central Bank President Christine Lagarde to tame sticky Eurozone inflation has trimmed consumer inflation expectations.

-

22:55

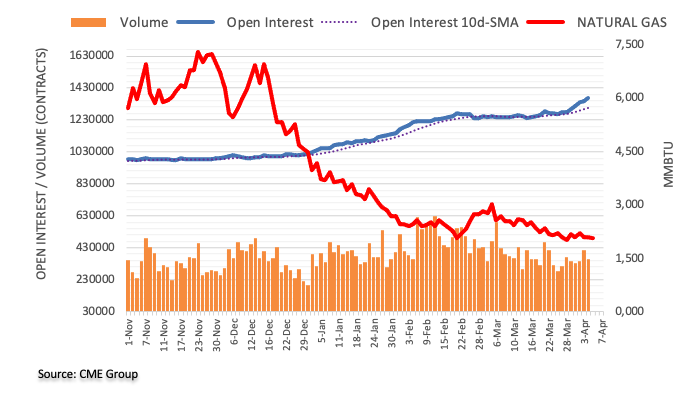

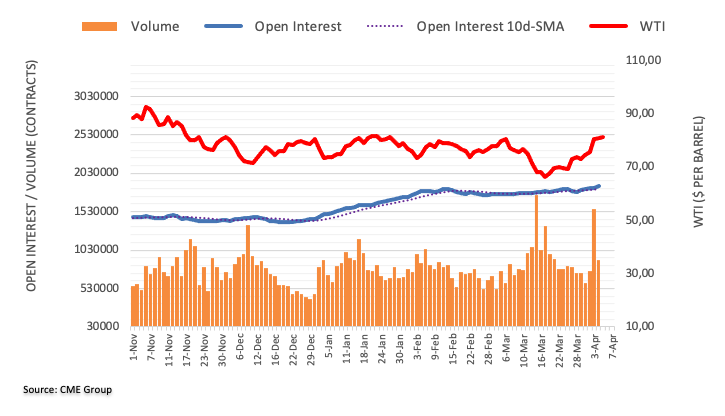

WTI retreats to $80.00 PB as the US Dollar advanced

- The US EIA reports a 3.7 million barrel drop in inventories, with gasoline and distillates falling even more than estimated.

- Global Manufacturing and Services PMIs suggest a potential economic slump, adding pressure to WTI prices.

Western Texas Intermediate (WTI), the US crude oil benchmark, retreats from weekly highs at $81.75 and drops on greater-than-expected reductions in US crude and fuel stockpiles. Investors’ speculations that a Fed pivot is likely to happen as recession fears grow turned flows towards the US Dollar. At the time of typing, WTI is trading at around $80.30.

US oil inventories decline, though failed to underpin WTI price

Data from the US Energy Information Administration (EIA) office showed that inventories fell by 3.7 million barrels. In comparison, gasoline and distillates dropped more than estimates by 4.1 million barrels and 3.6 million barrels, respectively.

US crude oil prices jumped over the weekend, highlighting the Organization of Petroleum Exporting Countries (OPEC) decision to cut output by 1 million barrels.

Also weighing on WTI price are the recent readings of Global Manufacturing and Services PMIs, indicating that the economy might slump worldwide.

The latest data in the United States (US) showed that business activity is slowing down while the labor market is catching up with the Fed’s cumulative tightening. Therefore, traders estimate a pause in the US central bank tightening campaign, with over a 50% chance of keeping rates unchanged.

Job openings in the US fell to their lowest in almost two years, according to the JOLTs report. The market participants focus on Thursday’s Initial Jobless Claims data, followed by Friday’s Nonfarm Payrolls.

WTI Technical Analysis

WTI remains braced to the $80.00 per barrel figure on sideways trading. Price action during the last week remains almost flat. The Relative Strength Index (RSI) persists in bullish territory and shifts flat. At the same time, the Rate of Change (RoC) portrays that buying pressure is waning. If WTI resumes upwards, the first resistance would be $81.00. A breach of the latter will expose the November 7 pivot high at $93.73. On the flip side, WTI’s would dip, towards $75.00, if sellers reclaim the $80.00 PB psychological level.

-

22:14

USD/CAD sits tight near 1.3450 ahead of key jobs reports

- USD/CAD bulls come up for air ahead of US NFP.

- The US Dollar is paring back shorts into the holidays.

USD/CAD is flat on Wednesday and had traveled between a low of 1.3423 and 1.3484 as the CAD consolidates this week´s gains as investors turned their attention to the release of US and Canadian employment data.

After touching its weakest intraday level since Feb. 16 at 1.3406, the pair rallied as investors pared back some of the short positions on profit-taking ahead of Friday´s showdown event. However, the US Dollar initially fell to mark a fresh bear cycle low on Wednesday but has since recovered the best part of the losses made on Tuesday´s sell-off and is now reaching back towards 102.00 DXY.

Meanwhile, a report today that showed US private sector employers added 145,000 jobs in March, well under expectations for a rise of 210,000 is casting a dark cloud over the Greenback. /The ADP National Employment report showed US private employers hired fewer workers than expected in March, suggesting a cooling labor market. Private employment increased by 145,000 jobs last month, while economists polled by Reuters had forecast private employment increasing by 200,000. In other data, the United States services industry was also shown to have slowed more than expected in March as the measure of prices paid by services businesses fell to the lowest in nearly three years. The ISM's Non-Manufacturing index dropped to 51.2 in March from 55.1 in February. The services sector's employment indicator sliding as well to 45.8 from 47.6 in February.

For Canada, data on Wednesday showed that Canada posted a smaller-than-expected trade surplus of C$422 million ($313 million) in February, as both exports and imports recorded widespread declines. Meanwhile, the price of oil , one of Canada's major exports, was under pressure with WTI down some 0.8% into the close but off the lowest point of the day down at $79.77bbls. Oil has been weighed by worsening economic prospects against expectations of US crude inventory declines and plans by OPEC+ producers to reduce output.

Looking ahead, Canada's employment report for March is due on Thursday. This is expected to show the economy added 12,000 jobs. This data falls ahead of Friday´s US Nonfarm Payrolls report whereby traders who are in on Good Friday will be looking for any confirmation that the labor market is cooling, a major requisite in the Federal Reserve's fight to curb inflation. Particular attention will be paid to the Unemployment Rate in this regard.

Analysts at Brown Brothers Harriman said the following with regard to the forthcoming jobs data:

´´The consensus for Nonfarm Payrolls this Friday stands at 240k vs. 311k in February, while the unemployment rate is seen steady at 3.6%. Average hourly earnings are expected to slow to 4.3% y/y vs. 4.6% in February. It's worth noting that the data will come on Good Friday. With markets likely to be very thin, we could get some outsize movements from the numbers, whether good or bad. ´´

-

21:35

Forex Today: Dollar rebounds despite US data, Yen gains amid lower yields

After the ADP and ISM Service PMI, attention turns to Nonfarm Payrolls. Data releases on Thursday include Australian trade, Reserve Bank of Australia Financial Stability Review, Chinese Caixin Service PMI, Canadian employment and US weekly Jobless Claims. Markets can be affected by Easter holidays.

Here is what you need to know on Thursday, April 6:

After two days of heavy losses, the US Dollar rose despite dismal US data. On Wednesday, stocks finished mixed on Wall Street and bonds rallied. The bond market continues to signal recession ahead, but economic figures and equities to a slowdown.

The US Dollar Index climbed from two-month lows toward 102.00. DXY's trends is still bearish. US and European bond yields fell on Wednesday, with the bond market suggesting a recession. The US 10-year ended at 3.30%, the lowest close since September.

Data from the US came in below expectations. The ADP Employment report showed an increase in private payrolls of 145K in March, against expectations of 200K. The ISM Service PMI dropped from 55.1 in February to 51.2 in March. On Friday, the US Jobs report is due.

Lower yields continue to boost the Japanese Yen that outperformed again. USD/JPY fell for the third day in a row, but managed to retake 131.00, amid Dollar's strength during the American session.

EUR/USD dropped from two-month highs to settle around 1.0900. The rally took a breather amid lower European yields and on the back of a deterioration in market sentiment.

GBP/USD lost ground after trading above 1.2500 for the first time since June 2022; it found support at 1.2430 and trimmed losses. EUR/GBP fell modestly, posting the lowest close since mid-March. The pound outperformed following comments from Bank of England (BoE) Chief Economist Pill about inflation persistence.

AUD/USD regained levels above 0.6700, after falling to 0.6676, slightly above the 20-day Simple Moving Average. The Aussie received some support from Reserve Bank Governor Philip Lowe. He said that despite the decision to pause the hike cycle, it does not mean tightening is over.

The New Zealand Dollar was among the best performers on Wednesday, boosted by the surprise of the Reserve Bank of New Zealand (RBNZ). The central bank raised rates by 50 basis points to 5.25%. NZD/USD jumped initially to 0.6379 and then dropped to as low as 0.6282 to rise later to the 0.6330 area. AUD/NZD spiked down to 1.0588, the lowest since December, and then rebounded to 1.0640.

USD/CAD corrected higher for the second consecutive day, rising above 1.3450. However, the bearish trend is intact. Canada will release job market numbers on Thursday. Analysts expected more modest gains in jobs, predicting on average a 12K increase in payroll in March and a small increase in the Unemployment Rate to 5.1%.

The Mexican Peso was the worst performer on Wednesday, with USD/MXN rising above 18.30. Mexico reported a slowdown in annual inflation from 7.62% to 6.85% in March. The Central Bank of India will announce its decision on Thursday.

Gold price lost some momentum and fell to $2,009/oz only to rise back to $2,020 showing that bulls are still in control. Silver continues to consolidate around $25.00.

Bitcoin ended flat, hovering around $28,250, while Ethereum rose 1.60% to $1,910.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:19

AUD/USD bulls come up for air but US Dollar shorts get pared-off

- AUD/USD stuck in the US dollar´s ebb and flow.

- all eyes turn to the US NFP.

AUD/USD is trading at 0.6720 and has been stuck in a range of between 0.6676 and 0.6779 so far. The US Dollar has been firmer on Wednesday, recovering from two-month lows as investors lightened their short positions ahead of Friday´s US Nonfarm Payrolls and the Easter holidays.

The Greenback was initially offered at 101.415, DXY, after a second-straight report showed slowing employment growth in the United States. The combination of this week´s data and a report today that showed US private sector employers added 145,000 jobs in March, well under expectations for a rise of 210,000 is casting a dark cloud over the US Dollar.

The ADP National Employment report showed US private employers hired fewer workers than expected in March, suggesting a cooling labor market. Private employment increased by 145,000 jobs last month, while economists polled by Reuters had forecast private employment increasing by 200,000.

The services industry was also shown to have slowed more than expected in March as the measure of prices paid by services businesses fell to the lowest in nearly three years. The ISM's Non-Manufacturing index dropped to 51.2 in March from 55.1 in February. The services sector's employment indicator sliding as well to 45.8 from 47.6 in February.

This data falls ahead of Friday´s US Nonfarm Payrolls report whereby traders who are in on Good Friday will be looking for any confirmation that the labor market is cooling, a major requisite in the Federal Reserve's fight to curb inflation. Particular attention will be paid to the Unemployment Rate in this regard.

Analysts at Brown Brothers Harriman said the following with regard to the forthcoming jobs data:

´´The consensus for Nonfarm Payrolls this Friday stands at 240k vs. 311k in February, while the unemployment rate is seen steady at 3.6%. Average hourly earnings are expected to slow to 4.3% y/y vs. 4.6% in February. It's worth noting that the data will come on Good Friday. With markets likely to be very thin, we could get some outsize movements from the numbers, whether good or bad. ´´

Meanwhile, the analysts at BBH noted that Cleveland Fed President Loretta Mester, a known hawk, said monetary policy needs to move “somewhat further into restrictive territory this year, with the fed funds rate moving above 5% and the real fed funds rate staying in positive territory for some time.” She added that she was “very comfortable” with the Fed’s decision to hike rates 25 bp last month and that “So far that seems to have stabilized at the moment.”

´´Yet Fed tightening expectations continue to fall,´´ the analysts said. ´´WIRP suggests around 55% odds of 25 bp hike at the May 2-3 meeting. After that, it’s all about the cuts; 2-3 cuts by year-end are priced in. In that regard, Powell said that Fed officials “just don’t see” any rate cuts this year. ´´

The analysts also pointed put that last week’s PCE data were mixed. ´´While headline and core both came in a tick lower than expected, super core accelerated for a second straight month to 4.63% y/y and is the highest since October. This is not the direction that the Fed desires and so we look for the hawkish tilt in Fed comments to continue,´´ the analysts argued.

AUD could have last laugh

For the Aussie, MUFG currency analyst Lee Hardman said in a note that while the expectations are that the RBA is close to or has ended its rate-rise cycle, negative for AUD, ´´it's partially offset by bets other G10 central banks are at similar points.´´He argues that ´´the AUD also remains driven more by the outlook for global growth, particularly for China's economy. Stronger growth in China as its economy continues to fully reopen this year supports our forecast for the Australian dollar to strengthen."

-

20:52

GBP/USD struggles at 1.2500, retraces amidst US recession fears, Fed pause

- GBP/USD is forming a bearish-harami candlestick pattern with bearish implications.

- Private hiring and business activity in the US missed estimates as economic growth decelerated.

- Business activity in the UK expands, though inflation remains at double digits.

GBP/USD faces strong resistance at around 1.2500 and retraces due to risk aversion as investors assess a possible recession in the United States (US). The latest US economic data paints a gloomy scenario, which is already foreseen by the US Federal Reserve (Fed) as the last piece of the puzzle, the larbor market, showed signs of slowing down. The GBPUSD trades at 1.2459, down by 0.33%.

US equities continue to tumble across the board. The ISM revealed its non-manufacturing index, which rose by 51.2, below estimates and the prior’s month data. Earlier, private hiring in the US, as reported by ADP in collaboration with Stanford Digital Economy Lab, jumped to 145K, below the 200K consensus.

After the release of the figures, the GBP/USD seesawed in an extensive 70-pip range, from 1.2505-1.2432, before stabilizing around 1.2450. As business activity slows down, recessionary fears are growing amongst investors.

Aside from this, money market futures continued to price in that the US central bank, the Federal Reserve (Fed) would keep rates unchanged at their May meeting.

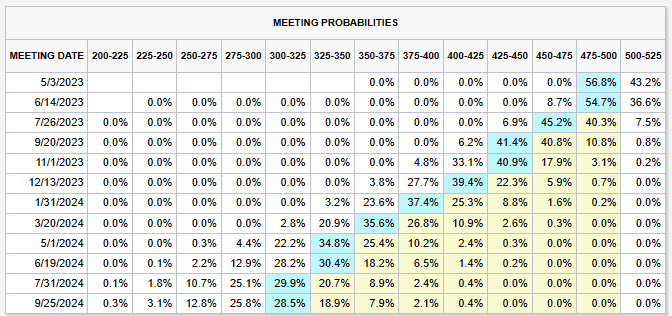

Source: CME FedWatch Tool

Aside from this, the UK economic docket featured the S$P Global/CIPS Services PMI, which came at 52.9, below estimates but at expansionary territory. However, fundamentally speaking, inflation in the UK remains at double-digit figures, though per the latest Bank of England (BoE) Monetary Policy Report (MPR), the central bank expected inflation to drop “significantly in Q2 2023.” That said, investors have begun to price in a less hawkish BoE, and for the next monetary policy meeting, odds for a no change sit at 54.5%.

GBP/USD Technical Analysis

From a technical perspective, the GBP/USD appears to have peaked at around 1.2500. A daily close at current exchange rates would confirm the formation of a bearish-harami two-candlesticks pattern, suggesting further downside is expected. If GBP/USD tumbles below Tuesday’s low of 1.2394, the pair’s next support would be the 20-day EMA at 1.2276, followed by the psychological 1.2200 mark. Downside risks lie at the 50-day EMA.

-

20:25

GBP/JPY Price Analysis: Bulls looking for a discount within the bull trend

- GBP/JPY is bearish while on the front side of the bear trend.

- Bulls will need to get on the backside of the bear trend and break 163.50 horizontal resistance thereafter.

GBP/JPY holds in bullish territories on the longterm outlook but is currently offered toward trendline support as the following will illustrate.

GBP/JPY daily charts

The price is in a bull trend and the M-formation might serve as a basis for bulls to get long on the front side of the trendline again. It is a reversion pattern that could see the price pulled into the neckline. However, that is not to say that there will not be more downsides to come in the coming days first of all.

GBP/JPY H4 chart

The bearish wick on the prior 4-hour candle could well be filled in the next session or so.

GBP/JPY M15 chart

The price is bearish on the front side of the bear trend and a filling of the 4-hour wick will mitigate a price imbalance on the 15-minute chart for a restest of 163 the figure. Bulls will need to get on the backside of the bear trend and break 163.50 horizontal resistance thereafter.

-

20:02

Argentina Industrial Output n.s.a (YoY) fell from previous 6.3% to -1.4% in February

-

19:12

USD/CHF rebounds after hitting YTD low amid risk-off impulse on US recession fears

- Private hiring in February rose by 145K, lower than anticipated.

- ISM Non-Manufacturing PMI drops to 51.2, below expectations and the previous month’s reading.

- USD/CHF Price Analysis: Bullish continuation requires reclaiming 0.9100 resistance; otherwise, further losses lie below 0.9000.

USD/CHF hits a new YTD low at 0.9005 but rebounds as a risk-off impulse, seeing a flight to safety, as shown by US equities trading in the red. Growing concerns in the United States (USD) arose after the last tranche of US economic data increased the likelihood of a recession. At the time of writing, the USD/CHF is trading at 0.9070.

Wall Street fluctuates between gains and losses. US Treasury bond yields continued to drop as the bond market rallied, on investors seeking safe-haven assets. The USD/CHF fell to a multi-month low, though it recovered some ground after US data revealed elevated recession fears.

The ISM Non-Manufacturing PMI headed to 51.2, less than the expected 54.4, and fell short of the previous month’s reading of 55.1. Business activity deterioration, and a decline in new orders growth, were the reasons for the dip. Earlier, the ADP Employment Change report showed that private hiring in February rose by 145K, below the anticipated 200K, trailing January’s upwardly revised figure of 261K.

Given the backdrop that labor market indicators suggesting a downturn in unemployment claims could pave the way for a weak US Nonfarm Payrolls report. The consensus estimates that the US economy in March created 240K jobs, lower than February’s 311K.

USD/CHF Technical Analysis

The daily chart shows that the USD/CHF remains downward biased. Wednesday’s fall toward a multi-month low at around 0.9005 and a late recovery is forming a hammer, which, preceded by a downtrend, can exacerbate an upward correction. For a bullish continuation, the USD/CHF needs to reclaim 0.9100. Above that resistance, a previous support trendline turned resistance around 0.9170-0.9180, which would be the next supply zone, ahead of testing the 20-day EMA. Otherwise, the USD/CHF could extend its losses below 0.9000.

What to watch?

-

19:08

Gold Price Forecast: XAU/USD bears are pushing back ahead of Nonfarm Payrolls

- Gold price is stalling on the bid and the focus is on a meanwhile correction.

- The US Dollar is firming up ahead of the US Nonfarm Payrolls report this Friday.

Gold price is tracking the ebbs and flows in the US Dollar on Wednesday but holding its own in the $2,020s in midday trade having traveled between a low of $2010.09 and $2032.11 so far on the day. The US Dollar initially fell to mark a fresh bear cycle low on Wednesday but has since recovered the best part of the losses made on Tuesday´s sell-off and is now reaching back towards 102.00 DXY, making the Gold price a touch less affordable for international buyers.

Nevertheless, the Gold price rose to a fresh 13-month high early on Wednesday as investors move to safe havens after a second-straight report showed slowing employment growth for the United States as interest rates rise. A combination of this week´s data and a report today that showed US private sector employers added 145,000 jobs in March, well under expectations for a rise of 210,000, sent the greenback to a low of 101.415 DXY. The data came in well below the 242,000 positions gained in February. The data follows the weak result for US new job openings released Tuesday and gives rise to sentiment that the Federal Reserve is about to pivot due to the evidence that the US economy is slowing.

US Treasury yields dropping

Consequently, investors are fearful of recession and are pricing in Federal Reserve rate cuts later in the year and the Gold price is finding support from a fall in US Treasury yields. The US two-year note was paying as little as 3.646% on the day while the yield on the 10-year note was down to a low of 3.268%. Both notes were poised to close at lows last seen in September as safe-haven buying pushed bond prices, which move opposite to their yields, higher.

Reuters reported that ´´futures priced in a 39.1% likelihood that the Fed raises its target rate by 25 basis points on May 3 when policymakers conclude a two-day meeting, down from 59.7% on Monday, CME's FedWatch Tool showed. Chances the Fed cuts rates by year's end also rose, with the outlook for the US central bank's target rate falling below 4.0% in December.´´

US Nonfarm Payrolls could see outsize movements

Looking ahead, the market now is waiting for the US Nonfarm Payrolls report on Friday and Gold price bulls will be keen to see if there will be any confirmation that the labor market is cooling, a major requisite in the Federal Reserve's fight to curb inflation. Particular attention will be paid to the Unemployment Rate in this regard.

Analysts at Brown Brothers Harriman said the following with regard to the forthcoming jobs data:

´´The consensus for Nonfarm Payrolls this Friday stands at 240k vs. 311k in February, while the unemployment rate is seen steady at 3.6%. Average hourly earnings are expected to slow to 4.3% y/y vs. 4.6% in February. It's worth noting that the data will come on Good Friday. With markets likely to be very thin, we could get some outsize movements from the numbers, whether good or bad. ´´

Gold technical analysis

As per the pre-market open weekly Gold price analysis, Gold, Chart of the Week: XAU/USD bulls remain in control, the Gold price indeed rallied:

Prior Gold price analysis

We had a bullish Gold price pennant on the daily and 4-hour charts:

Gold price updates

The Gold price bulls were back in the market after an anticipated drive from around the supporting area. The Gold price bulls needed to commit at this juncture to get and stay above $2,010.

The Gold price bullish pennant thesis played out as illustrated in Tuesday´s chart above.

It was shown that the Gold price Fibonacci scale comes into play.

We have the 38.2% Fibonacci retracement of the Gold price aligned with the $2,000 area that could come back under pressure for a retest, if not lower, prior to the next bullish impulse and an eventual upside continuation:

Gold price update, live chart

The Gold price doji is a stalling candle and it could be followed by a bearish engulfment on Thursday that could give way to the prospects of a move lower in the Gold price as the bias. However, so long as the Gold price bulls stay committed, this bullish cycle will have further to run for the Gold price.

-

18:28

US: Service sector resilience called into question – Wells Fargo

The March ISM Service PMI showed lower-than-expected numbers in its main indicators. Analysts at Wells Fargo point out it signalled cooler activity in March amid a pullback in new demand as higher rates and recent banking sector stress weigh on the outlook. However, they noted that business activity practically held firm and major components remained consistent with expansion.

Key quotes:

“The breadth of service sector activity clearly pulled back in March. We expected service activity to cool to some degree last month, but the near-four point drop was larger than anticipated. The ISM services index is now at 51.2, which still signals expansion, but the latest report takes some wind out of the sails of the services sector.”

“Service-providers continued to hire in March, but at a slower pace with the employment component dropping to 51.3. Recent labor market data suggest the jobs market is loosening. The number of job openings in February fell to its lowest level since May 2021 and the ISM manufacturing hiring component fell for the third straight month reaching its lowest reading since 2020.”

“This report is not great news for service resilience, but the sector is still expanding and the major components (business activity, new orders, employment) remain in expansion.”

-

17:38

USD/MXN exchange rate leaps on Mexico’s inflation cools down, weak US data

- USD/MXN sees strong gains on cooling inflation data from Mexico.

- Weaker PMI and ADP figures suggest potential challenges for the US labor market and economic growth.

- USD/MXN Price Analysis: A daily close above the 20-day EMA could lead to a rally towards the 100-day EMA at 18.8382.

The Mexican Peso (MXN) depreciated vs. the US Dollar (USD) as market sentiment shifted sour. A raft of economic data from the United States (US) and Mexico spurred a jump in the exchange rate. At the time of writing, the USD/MXN is trading at 18.3469

USD/MXN climbs as Mexico’s inflation cools down

Wall Street is trading mixed, with the S&P 500 and the Nasdaq posting losses while the Dow Jones climb. The USD/MXN is registering solid gains on data from Mexico, showing that inflation is cooling down. Data from INEGI showed that inflation rose by 6.85% YoY, below estimates of 6.90%, as revealed by a Reuters poll. Core inflation, which excludes volatile items, cooled from 8.09% to 8.09% annually.

Last week, Banxico (the Mexican central bank) raised rates by 25 bps moderating the pace of tightening. Analysts expect Banxico to keep rates unchanged at around 11.25%,

On the US front, the ISM Non-Manufacturing PMI dropped to 51.2, which is lower than the anticipated 54.4 and falls short of the previous month’s reading of 55.1. The decline is attributed to a decrease in new orders growth and less robust business activity. Meanwhile, February ADP figures showed private hiring increased by 145K, below the expected 200K, trailing January’s upwardly revised figure of 261K.

Given the latest round of labor market metrics pointing to deterioration, a jump in Initial Jobless Claims for the latest week could open the door for a weaker US Nonfarm Payrolls figure. Analysts predict that the number of payrolls for March will be around 240K, which is lower than February’s figure of 311K.

USD/MXN Technical analysis

The USD/MXN appears to have bottomed at around 18.0000. USD/MXN weekly gains above 2% spurred a rise from 17.9644 toward 18.4000, exposing the 20-day Exponential Moving Average (EMA) at 18.3329. A daily close above the latter could exacerbate a rally towards the 100-day EMA At 18.8382, but firstly, buyers need to clear the 50-day EMA At 18.5235. On the other hand, a dip below the 20-day EMA and the USD/MXN could re-test 18.0000.

-

16:43

NZD/USD fluctuates as sentiment deteriores, despite RBNZ's rate hike spurring an initial surge

- The Reserve Bank of New Zealand’s decision to raise rates by 50 bps lifted the NZD/USD pair to new 2-month highs.

- The US ADP Employment Change report for March was below estimates, as the labor market feels the Fed’s cumulative tightening.

- NZD/USD Price Analysis: Downside risks remain below 0.6400.

The New Zealand Dollar (NZD) reversed its course against the US Dollar (USD), after hitting a fresh two-month high at 0.6379, following an astonishing 50 bps hike by the Reserve Bank of New Zealand (RBNZ). However, sentiment shifting sour spurred flows toward safe-haven assets. Therefore, the NZD/USD is trading at 0.6331, clinging to minimal gains of 0.30%.

NZD/USD clings to decent gains as the US Dollar recovers

Economic data from the United States (US) continued to show deterioration. The ISM Non-Manufacturing PMI, also known as Services, fell to 51.2, below estimates of 54.4, and trailed February’s 55.1 reading. The index fell due to weaker new orders growth and softer business activity. Earlier data revealed that private hiring in February rose 145K below estimates of 200K and trailed January, which was upwards revised to 261K.

Given the latest round of labor market metrics pointing to deterioration, a jump in Initial Jobless Claims for the latest week could open the door for a weaker US Nonfarm Payrolls figure. Analyst estimates payrolls for March at 240K, below February’s 311K.

The greenback is recovering some ground after falling to fresh two-month lows at 101.42, as shown by the US Dollar Index. At the time of typing, the DXY sits at 101.780, up 0.41%.

On the New Zealand (NZ) front, the RBNZ surprised the markets and hiked the Overnight Cash Rate (OCR) by 50 bps to 5.25%. The RBNZ sees upside risks to inflation, according to February’s Monetary Policy Statement (MPS).

NZD/USD Technical analysis

The NZD/USD remains neutral to upward biased after the RBNZ’s decision. As the NZD/USD rallied towards 0.6379 and challenged 0.6389, the February 14 high, buyers did not have the strength to crack the latter and lift the pair towards 0.6400. Therefore, NZD/USD sellers stepped in, and dragged the exchange rate toward the 0.6320 area.

Upside risks lie at 0.6390, which would pave the way to 0.6400 before testing the August 12 high at 0.6468. On the other hand, a breach of 0.6300 and the NZD/USD would dive to the 200-day EMA at 0.6268.

-

16:32

EUR/USD retreats to 1.0900 despite weaker-than-expected US data

- US Dollar gains momentum during the American session.

- US data points to a slowdown in activity, hiring and also, inflation.

- EUR/USD down for the day, moves away from two-month highs.

The EUR/USD corrected to the 1.0900 zone after the beginning of the American session and despite weaker-than-expected US economic data. The US Dollar gained momentum, pushing the pair to the downside.

DXY holds to gains after US data

Automatic Data Processing (ADP) released its employment report showing that in March the private sector added 145K jobs, below expectations of 200K. The US Dollar dropped after the report but later, following the ISM Service, PMI turned decisively higher for the day.

The ISM Service PMI came in at 51.2 in March, a bigger-than-expected slowdown from the 55.1 of February, and below market expectations of 54.5. The Employment Index fell to 51.3 from 54 and the Price Paid fell from 65.6 to 59.5. The report shows activity expanding at a modest pace with inflation indicators retreating further.

Despite the fact that the economic figures offer arguments for the monetary policy doves the US Dollar gained momentum, even as US yields printed fresh lows.

The EUR/USD is hovering around 1.0920. The slide from the 1.0970 area is seen as a correction so far. Below 1.0900, the next support stands at 1.0870. On the upside, if the Euro retakes 1.0950, it could likely rise to test the 1.0970 zone again.

Technical levels

-

15:58

Gold Price Forecast: XAU/USD to eye $2,300 on a sustained break above $2,070/75 record highs – Credit Suisse

Gold has benefitted strongly from the fall in Yields and decline in the USD. Economists at Credit Suisse look for a test of major resistance at the $2,070/75 highs.

Break under 55-DMA at $1,898 would suggest another reversion lower

“We look for a retest of long-term resistance from the $2,070/75 record highs of 2020 and 2022. Whilst this should clearly be respected, a clear and sustained break higher would mark a major bullish long-term breakout to open the door to a move to $2,300 next.”

“Ideally, the 55-DMA, currently seen at $1,898, floors the market now. If this breaks, this would lessen the risk of a breakout above $2,070/75 and suggest another reversion lower within the broader range, with next support at $1,778.”

-

15:36

CHF still enjoys “safe haven” allure, but this factor will be less supportive in the coming weeks – HSBC

Economists at HSBC discuss the Swiss Franc outlook. Its “safe haven” is likely to be less supportive in the coming weeks.

CHF to move largely sideways against the USD in the weeks ahead

“The CHF can still enjoy occasional ‘safe haven’ allure, but we expect this factor will be less supportive in the coming weeks.”

“CHF weakness against the EUR may be tempered but not reversed by SNB FX interventions.”

“We expect the CHF to move largely sideways against the USD in the weeks ahead.”

-

15:30

United States EIA Crude Oil Stocks Change below expectations (-2.329M) in March 31: Actual (-3.739M)

-

15:14

Weaker than expected NFP report to result in a more substantial depreciation of the Dollar – MUFG

Each day brings more data that suggests the US economy could be weakening more abruptly than assumed only recently. In the view of economists at MUFG Bank, weakening US data is set to weaken the US Dollar further.

Weaker growth concerns increase

“With the ISM Manufacturing Employment Index down at 46.9, there is growing evidence that the positive demand in the US labour market is now beginning to fade. If that is confirmed on Friday by a weaker than expected Nonfarm Payrolls report it will likely result in a more substantial depreciation of the Dollar.”

“The potential tightening of credit conditions fuelled by banking sector turmoil is likely to see another hit to real economic activity. Indeed, it is worth noting that credit conditions were already tightening significantly prior to the March banking sector turmoil that may explain the weakness in the data we are seeing for February.”

“The area of the US economy that has held up best continues to be the labour market but we may be on the cusp of that changing.”

-

15:06

US: ISM Services PMI declines to 51.2 in March vs. 54.5 expected

- Service sector growth in the US lost momentum in March.

- US Dollar Index stays in daily range near 101.50.

Economic activity in the US services sector expanded at a softening pace in March with the ISM Services PMI declining to 51.2 from 55.1 in February. This reading came in weaker than the market expectation of 54.5.

The inflation component of the PMI survey, the Price Paid sub-index, edged lower to 69.5 from 65.6 in February, the New Orders sub-index declined sharply to 52.2 from 60.4 and the Employment sub-index fell to 51.3 from 54.

Commenting on the data, “there has been a pullback in the rate of growth for the services sector, attributed mainly to (1) a cooling off in the new orders growth rate, (2) an employment environment that varies by industry and (3) continued improvements in capacity and logistics, a positive impact on supplier performance," said Anthony Nieves, Chair of the ISM Services Business Survey Committee.

Market reaction

The US Dollar Index stays in its daily range at around 101.50 after this report.

-

15:00

United States ISM Services PMI below forecasts (54.5) in March: Actual (51.2)

-

15:00

United States ISM Services New Orders Index came in at 52.2, below expectations (57.6) in March

-

15:00

United States ISM Services Employment Index below forecasts (52) in March: Actual (51.3)

-

15:00

United States ISM Services Prices Paid below forecasts (65.2) in March: Actual (59.5)

-

14:56

USD/CAD will gradually fall to 1.29 by December this year – ANZ

The Canadian Dollar is expected to struggle in the near-term. Nonetheless, economists at ANZ Bank believe that the USD/CAD pair will turn back lower later in the year.

BoC’s pause will pay off

“If CPI continues to slip towards the BoC’s expectations of 2.6% YoY by year-end, the pause in the current monetary policy tightening cycle may bring about a rebound in broader economic data later in the year, leading to tailwinds for the CAD as the DXY declines and Oil prices rise as per our forecasts.”

“In the near term, CAD underperformance will continue, but we believe that USD/CAD will gradually fall to 1.29 by December this year.”

-

14:46

Gold Price Forecast: XAU/USD prints fresh one-year highs above $2,030 after US ADP

- Gold price rose to $2,031/oz, new one-year high.

- US March ADP report came in below expectations, attention turns to ISM Service PMI.

- US yields and DXY turn lower after data.

Gold price printed fresh one-year highs at $2,031 after the release of US employment data. The yellow metal then pulled back modestly, and ahead of more economic reports, it is hovering around $2,020.

US data weighs on yields, boosts Gold

Automatic Data Processing (ADP) released it employment report showing that in March the private sector added 145,000 jobs, below market consensus of 200,000. February’s figures were revised higher from 242,000 to 261,000.

After the report, US yields printed fresh weekly lows and the US Dollar weakened. The numbers still show a healthy labor market, but slowing down. More data from the US is due on Wednesday with March ISM Service PMI.

Indicators remain bullish for Gold. A break above $2,030 would favor a test of the all-time high around $2,075. On the downside, the immediate support stands at $2,015 followed by $2,000.

Technical levels

-

14:45

United States S&P Global Services PMI came in at 52.6, below expectations (53.8) in March

-

14:45

United States S&P Global Composite PMI below forecasts (53.3) in March: Actual (52.3)

-

14:44

Silver Price Analysis: XAG/USD bulls take a breather amid slightly overbought RSI

- Silver pulls back from a nearly one-year peak touched earlier this Wednesday.

- The technical setup still favours bulls and supports prospects for further gains.

- Any further slide is likely to support near the $24.40-30 resistance breakpoint.

Silver retreats from the $25.10-$25.15 area, or a nearly one-year high touched this Wednesday and erodes a part of the previous day's strong gains. The white metal remains depressed through the early North American session and is currently placed near the lower end of its daily range, around the $24.85-$24.80 region.

From a technical perspective, the overnight sustained move and acceptance above the $24.30-$24.40 strong horizontal barrier was seen as a fresh trigger for the XAG/USD bulls. A subsequent strength beyond the previous YTD peak, around the $24.65 zone, might have already set the stage for an extension of the recent strong upward trajectory witnessed over the past month or so.

The positive outlook is reinforced by the fact that the XAG/USD is holding comfortably above technically significant Simple Moving Averages (SMAs) - 50, 100 and 200-day SMAs. That said, Relative Strength Index (RSI) on the daily chart is flashing overbought conditions and makes it prudent to wait for some near-term consolidation or a modest pullback before placing fresh bullish bets.

In the meantime, any meaningful pullback is likely to attract fresh buyers and remain limited near the $24.40-$24.30 resistance breakpoint, now turned support. This should now act as a pivotal point, which if broken decisively might prompt some technical selling and make the XAG/USD vulnerable to weaken below the $24.00 mark, towards testing the weekly low, around the $23.60-$23.55 area.

Silver daily chart

Key levels to watch

-

14:40

EUR/USD remains cautious and retreats from recent peaks, back to 1.0950

- EUR/USD fades part of the initial move to 1.0970 on Wednesday.

- Final Services PMIs in Germany and the EMU remained firm in March.

- The US ADP report came in below expectations at 145K jobs.

EUR/USD alternates gains with losses around the 1.0950 region on Wednesday.

EUR/USD: Initial resistance appears in the 1.0970/80 band

EUR/USD keeps the cautious note and exchanges ups & downs in the 1.0950 region amidst the equally inconclusive price action around the greenback on Wednesday.

Earlier hawkish comments from ECB policy makers (Vasle, Vujcic) lend some support to the single currency along with healthy prints from Services PMIs in the euro area, although the generalized steady prudence ahead of the NFP figures on Friday appears to keep bulls contained for the time being.

In US data space, the ADP Employment Report showed the US private sector created 145K jobs in March vs. 200K expected and down from February’s 261K jobs. Additionally, the US trade deficit widened to $70.5B in February and the final Services PMI improved to 52.6 during last month. Finally, the ISM Non-Manufacturing is expected later in the session.

What to look for around EUR

EUR/USD keeps the weekly rally well and sound despite the ongoing knee-jerk, allowing for a potential test of the key 1.1000 mark sooner rather than later.

In the meantime, price action around the single currency should continue to closely follow dollar dynamics, as well as the incipient Fed-ECB divergence when it comes to the banks’ intentions regarding the potential next moves in interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany, EMU Final Services PMI (Wednesday) – Germany Construction PMI (Thursday).

Eminent issues on the back boiler: Continuation, or not, of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.05% at 1.0944 and faces the immediate contention at 1.0788 (monthly low April 3) followed by 1.0745 (55-day SMA) and finally 1.0712 (low March 24). On the flip side, a break above 1.0973 (monthly high April 4) would target 1.1032 (2023 high February 2) en route to 1.1100 (round level).

-

14:31

USD/MXN: Two major risk factors might contribute to some Peso weakening ahead – MUFG

In March, the Mexican Peso appreciated from 18.343 to 18.047 against the US Dollar. Economists at MUFG Bank keep their view that two major risk factors might contribute to some MXN weakening ahead.

High interest rates might keep some attractiveness of MXN

“The Mexican finance minister stated its confidence on the soundness of Mexican banking system, not being impacted by the recent events abroad. In such scenario, we keep our view of moderate rather than sharp MXN weakening in the coming quarters.”

“Additionally, Banxico keeps committed to make inflation to converge to the target in the next years, which means high policy rates for longer in the current scenario of resilient high core inflation, thus keeping the MXN attractive as a carry currency.”

“We keep our view that two major risk factors might contribute to some MXN weakening ahead. Firstly, the slowdown/recession in the US might hit USD inflows into Mexico. Secondly, Lopez Obrador’s nationalistic policies especially on the energy sector may deter private investments. However, the MXN might continue to be supported by investment and exports from companies reallocating global supply chains into Mexico.”

-

14:14

GBP/USD can rise towards 1.2650 over the quarter – Credit Suisse

GBP saw relative stability in Q1 after a torrid 2022. Economists at Credit Suisse believe that the GBP/USD could reach over the second quarter.

Relative ECB hawkishness should allow for an upward EUR/GBP drift

“Relative ECB hawkishness should allow for an upward EUR/GBP drift, but we suspect the BoE will not be shy to hike rates still more if the data support that, and so GBP/USD can rise towards 1.2650 over the quarter.”

“If we are wrong and the BoE decides to see through high inflation and shift in a materially dovish direction for reasons such as financial risk, EUR/GBP would quickly move above 0.9000.”

-

14:09

USD/CAD surrenders a major part of its intraday gains, retreats to mid-1.3400s

- USD/CAD struggles to capitalize on its modest gains amid the emergence of fresh USD selling.

- The weaker ADP report lifts bets for an imminent Fed rate-hike pause and weighs on the buck.

- The downside seems limited ahead of Canadian jobs data on Thursday and Friday’s NFP report.

The USD/CAD pair builds on the previous day's bounce from the 1.3400 mark, or its lowest level since February 16 and edges higher for the second successive day on Wednesday. The intraday positive move, however, runs out of steam ahead of the 100-hour Simple Moving Average (SMA), forcing spot prices to retreat below mid-1.3400s during the early North American session.

Crude Oil prices struggle to capitalize on this week's big bullish gap opening and the subsequent move up to the highest level since January 17 amid worries that looming recession risks will dent fuel demand. This, in turn, undermines the commodity-linked Loonie and lends some support to the USD/CAD pair. The US Dollar, on the other hand, struggles to capitalize on its modest intraday recovery from over a two-month low, which, in turn, caps the upside for the pair.

Growing acceptance that the Federal Reserve (Fed) is nearly done with its tightening cycle keeps a lid on any meaningful rally in the US bond yields and holds back the USD bulls from placing aggressive bets. In fact, the markets are now pricing in an even chance of a 25 bps lift-off at the May FOMC meeting and the possibility of rate cuts by end-December. The bets were reaffirmed by the incoming softer US macro releases, including the US ADP report on Wednesday.

According to the data published by Automatic Data Processing, the US private-sector employers added 145K jobs in March as compared to the 200K expected and the previous month's upwardly revised reading of 261 K. This comes on the back of the JOLTS report released on Tuesday, which indicated that job openings in February dropped to the lowest in nearly two years. This is seen as a sign that the Fed's efforts to slow the labor market may be having some impact.

Apart from this, looming recession risks reinforce speculations that the Fed might soon pause its inflation-fighting rate hikes, which suggests that the path of least resistance for the USD is to the downside. That said, a softer risk tone could lend some support to the safe-haven buck and help limit the downside for the USD/CAD pair. Traders might also refrain from placing aggressive bets ahead of Thursday's release of Canadian jobs data and the US NFP report on Friday.

Technical levels to watch

-

14:08

USD Index remains under pressure near 2-month lows ahead of data

- The index lacks conviction to spark a more serious rebound.

- US ADP report came in below expectations in March.

- Next of note will come the ISM Non-Manufacturing.

The greenback returns to the 101.50 region when gauged by the USD Index (DXY) following a failed attempt to advance north of the 101.75/80 band earlier on Wednesday’s session.

USD Index loses traction post-ADP

The index now adds to the weekly leg lower and puts the area of multi-week lows to the test once again following a bout of weakness after the release of the ADP report.

Indeed, speculation of a potential “on hold” stance at the Fed’s meeting in May was reinforced after the ADP report showed the US private sector added fewer jobs than initially expected during last month (145K).

Further data saw the trade deficit widened to $70.5B in February while the final Services PMI and the ISM Non-Manufacturing are due later in the NA session.

Back to the Fed, CME Group’s FedWatch Tool now sees the probability that the Fed could leave rates unchanged at nearly 55% at the May 3 gathering.

What to look for around USD

Price action around the index remains depressed well below the 102.00 mark against the backdrop of rising prudence among market participants ahead of the release of US Nonfarm Payrolls in the second half of the week.

Also weighing on the current bearish outlook for the dollar emerges the almost omnipresent view that the Federal Reserve could pause its ongoing tightening stance in May, which has been propped up by persevering disinflation, nascent weakness in some key fundamentals and fresh concerns surrounding the banking sector

In addition, dwindling hawkishness from Fed rate setters also seems to have removed some strength from the greenback, particularly since the latest FOMC gathering and events around SVB and other medium-size US lenders.

Key events in the US this week: MBA Mortgage Applications, ADP Employment Change, Balance of Trade, Final Services PMI, ISM Non-Manufacturing (Wednesday) – Initial Jobless Claims (Thursday) – Non-Farm Payrolls, Unemployment Rate, Consumer Credit Change (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is retreating 0.07% at 101.49 and the breach of 101.43 (monthly low April 5) would open the door to 100.82 (2023 low February 2) and finally 100.00 (psychological level). On the other hand, the next resistance level aligns at 103.33 (55-day SMA) followed by 103.91 (100-day SMA) and then 105.88 (2023 high March 8).

-

14:01

EUR/USD could very soon rise back toward the middle of the 1.1000-1.1500 range – MUFG

EUR/USD advanced to its strongest level since early February above 1.0970. Economists at MUFG Bank expect the pair to move back toward the middle of that 1.1000-1.1500 range.

Two-year swap spread will help EUR/USD higher

“We see the US Dollar suffering most against the core G10 currencies. The Swiss Franc, Yen and Euro remain three of the top four best performing G10 currencies (the Pound is the other) and if yields in the US decline further that’s where we would expect to see the bigger moves.”

“EUR/USD continues to lag where yields imply it should be trading – somewhere between 1.1000-1.1500.”

“The 2-year EZUS swap spread closed yesterday at -86 bps, close to recent highs not seen since October 2021. If that level can be sustained over the short-term, we could very soon see EUR/USD back toward the middle of that 1.1000-1.1500 range.”

-

13:57

Canada: International Merchandise Trade surplus narrows to C$0.42 billion in February

- Canada's international trade surplus narrowed unexpectedly in February.

- USD/CAD trades virtually unchanged on the day at around mid-1.3400s.

Canada's merchandise trade surplus with the world declined to C$0.42 billion in February from to C$1.2 billion in January, Statistics Canada reported on Wednesday. This reading came in worse than the market expectation for a surplus of C$1.8 billion.

"Exports were down 2.4%, while imports decreased 1.3%," Statistics Canada further noted in its publication. "The February surplus is close to the typical bounds for monthly revisions to imports and exports."

Market reaction

USD/CAD has erased its daily gains in the early American session and was last seen trading flat on the day at around 1.3450.

-

13:56

Poland NBP Base rate meets forecasts (6.75%)

-

13:51

US: Goods and services deficit expands to $70.5 billion in February vs. $69 billion expected

- US Goods and Services Trade Balance came in at -$70.5 billion in February.

- US Dollar Index stays in daily range near 101.50.

The United States international trade deficit in goods and services rose by $1.9 billion to $70.5 billion in February, the data published jointly by the US Census Bureau and the US Bureau of Economic Analysis revealed on Wednesday. This reading came in worse than the market expectation for a deficit of $69 billion.

"February exports were $251.2 billion, $6.9 billion less than January exports," the publication further read. "February imports were $321.7billion, $5.0 billion less than January imports."

Market reaction

Following the technical correction seen earlier in the day, the US Dollar Index is struggling to gather recovery momentum and was last seen unchanged on the day at 101.55.

-

13:41

USD/INR to trade in a 81.00-83.00 range in Q2 – Credit Suisse

Economists at Credit Suisse preview the upcoming monetary policy decision in India. Whether the RBI hikes should have a limited impact on their USD/INR forecast of 81.00-83.00 in Q2.

RBI will continue intervening at the 81.00-83.00 levels to limit volatility

“We think more balanced trade flows and a less hawkish Fed outlook will result in less Rupee depreciation pressure. However, we still think RBI intervention is the main driver for the USD/INR exchange rate.

“The RBI has intervened at 81.00 and 83.00 since October 2022. The decision to hike or hold on 6 April is unlikely to shift these RBI intervention levels. As such, we continue to expect USD/INR to trade in a 81.00-83.00 range in Q2.”

See – RBI Preview: Forecasts from five major banks, hiking 25 bps, will be the final?

-

13:33

USD/JPY hits fresh weekly lows under 131.00 after weaker-than-expected ADP report

- US ADP March Private Employment rises by 145K in March, below 200K expected.

- Japanese Yen rises as US yields tumble, USD/JPY at weekly lows testing 131.00.

- Data ahead: US March ISM Service PMI, expected at 54.5.

After moving sideways for hours, the USD/JPY broke to the downside, hitting fresh weekly lows following the release of the US ADP Employment report. The pair is testing the 131.00 area amid a weaker US dollar.

ADP below expectations

The report published by Automatic Data Processing (ADP) showed that in March the private sector added 145,000 jobs, below expectations of a 200,000 increase. February’s figures were revised higher from 242,000 to 261,000. On Friday, the Nonfarm Payrolls report is due. Later on Thursday, at 14:00 GMT, the March ISM Service PMI Index will be released.

US yields accelerated the decline after the ADP report, boosting the Japanese Yen across the board. The US 10-year yield fell to 3.30%, and is about to test March lows. The 2-year Treasury yield was at 3.89% and bottomed at 3.75%. The US Dollar Index erased daily gains and fell from 101.70 to 101.50. On Tuesday, the DXY posted the lowest daily close since early February.

The USD/JPY bottomed at 130.97, hitting the lowest level since March 29. As of writing, it is testing the 131.00 zone. A consolidation below would suggest more losses ahead, targeting the next strong support seen at 130.50/60. On the upside, the key resistance is 131.80.

Technical levels

-

13:30

Canada International Merchandise Trade came in at $0.42B below forecasts ($1.8B) in February

-

13:30

United States Goods and Services Trade Balance came in at $-70.5B, below expectations ($-69B) in February

-

13:30

Canada Exports down to $65.03B in February from previous $67.02B

-

13:30

Canada Imports dipped from previous $65.1B to $64.61B in February

-

13:30

United States Goods Trade Balance: $-93B (February) vs previous $-91.6B

-

13:29

AUD/USD pares intraday losses, holds steady around 0.6700 mark post-ADP report

- AUD/USD drifts lower for the second straight day and is pressured by a combination of factors.

- The RBA’s dovish outlook continues to weigh on the Aussie amid a modest intraday USD uptick.

- The disappointing ADP report reaffirmed bets for Fed rate-hike pause and caps the Greenback.

The AUD/USD pair comes under heavy selling pressure on Wednesday and extends the previous day's retracement slide from the vicinity of the 0.6800 mark, or its highest level since February 24. Spot prices, however, manage to recover a few pips from the daily low and trade around the 0.6700 round figure during the early North American session.

The Australian Dollar continues to be weighed down by the Reserve Bank of Australia's (RBA) dovish outlook, which, along with a modest US Dollar (USD) rebound from over a two-month low, drag the AUD/USD pair lower for the second straight day. It is worth recalling that the Australian central bank on Tuesday paused its rate-hiking cycle following 10 consecutive raises and signalled that inflation had likely peaked. In the accompanying policy statement, the RBA noted that it wanted additional time to assess the full effects of rate increases as the economy slows.

The USD, on the other hand, draws some support from an intraday uptick in the US Treasury bond yields, though lacks bullish conviction amid expectations that the Federal Reserve (Fed) is nearly done with its tightening cycle. In fact, the current market pricing indicates an even chance of a 25 bps lift-off at the May FOMC meeting and the possibility of rate cuts by end-December. The bets were reaffirmed by the disappointing release of the US ADP report, showing that private-sector employers added 145K jobs in March, down sharply from the 261K in the previous month.

This comes on the back of the monthly Job Openings and Labor Turnover Survey, or JOLTS report, which indicated that job openings in February dropped to the lowest in nearly two years. This is seen as a sign that the Fed's efforts to slow the labor market may be having some impact. Apart from this, looming recession risks reinforce speculations that the Fed might soon pause its inflation-fighting rate hikes, which caps the upside for the US bond yields. This, in turn, is holding back the USD bulls from placing aggressive bets and lending some support to the AUD/USD pair.

Moving ahead, traders now look to the release of the US ISM Services PMI for a fresh impetus. The focus, however, will remain on the closely-watched US monthly employment details, popularly known as the NFP report, on Friday. Nevertheless, the aforementioned mixed fundamental backdrop warrants some caution before positioning for any meaningful corrective downfall for the AUD/USD pair.

Technical levels to watch

-

13:15

Breaking: US private sector employment rises by 145K in March vs. 200K expected

The data published by Automatic Data Processing (ADP) showed on Wednesday that private sector employment in the US rose by 145,000 in March. This reading came in below than the market expectation of 200,000. On a positive note, February's print of 242,000 got revised higher to 261,000.

Commenting on the data, "our March payroll data is one of several signals that the economy is slowing,” said Nela Richardson, chief economist, ADP. "Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down."

Market reaction

With the initial reaction, the US Dollar lost its recovery momentum and the US Dollar Index was last seen trading flat on the day at 101.55.

-

13:15

United States ADP Employment Change below forecasts (200K) in March: Actual (145K)

-

13:14

EUR/USD Price Analysis: Scope for further upside near term

- EUR/USD comes under pressure following a move to 1.0970.

- Next on the upside appears the 2023 high at 1.1032.

EUR/USD faces some selling pressure after another test of the multi-week tops near 1.0970 on Wednesday.

The likelihood of extra advances appears favoured for the time being. Against that, the pair needs to clear the April high at 1.0973 (April 4) to challenge the YTD peak at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0346.

EUR/USD daily chart

-

13:13

USD/CAD: Minor gains from the low 1.34 area may have a little further to go – Scotiabank

The CAD’s failure to make more impression on the 1.34 area has prompted some drift off this week’s peaks on a generally soft USD. Economists at Scotiabank expect the USD/CAD to enjoy minor gains.

USD trend support holds

“Minor gains in the USD from the low 1.34 area may have a little further to go.”

“The USD’s positive reaction to the test of nearly year-long trend support in the low 1.34 area reflects the fact that trend dynamics are leaning USD-bearish but are not as well-established as some other currencies.”

“Resistance is 1.3490/00, with 1.3525 (100-Day Moving Average) firmer resistance above the figure.”

-

13:10

Mexico Consumer Confidence: 44.5 (March) vs previous 44.6

-

13:10

Mexico Consumer Confidence s.a came in at 47.4, above expectations (44.6) in March

-

13:02

Mexico Headline Inflation came in at 0.27% below forecasts (0.31%) in March

-

13:01

Mexico 12-Month Inflation came in at 6.85% below forecasts (6.9%) in March

-

13:01

Mexico Consumer Confidence s.a below expectations (44.6) in March: Actual (44.5)

-

13:01

Mexico Core Inflation came in at 0.52%, below expectations (0.76%) in March

-

12:58

USD/JPY could extend lower beyond 125 – Credit Suisse

Economists at Credit Suisse expect the USD/JPY to extend its decline toward the 125 level.

Yen strength can persist towards USD/JPY 125

“We were wrong in early Jan setting the 125 level as our end-Q1 target, as excessive positioning, a slothful BoJ and upside US / European inflation surprises delayed JPY appreciation. But any real hint that the BoJ could shift away from YCC would likely create another wave of interest in long JPY positioning, given now-greater concerns about global macro fragility. Even without that shift, arguably JPY assets are looking more attractive anyway to Japanese investors.”

“If US debt ceiling fears gather pace into the end of Q2, USD/JPY could extend lower beyond 125.”

-

12:45

USD/INR to start to benefit from a weaker US Dollar by end-2023 and decline to 79.50 – MUFG

The India Rupee strengthened slightly against the US Dollar in March. Economists at MUFG Bank expect the USD/INR pair to fal toward 79.50 by the end of the year.

RBI likely to continue capping INR volatility through FX intervention

“We are reasonably sanguine on INR’s prospects, and expect USD/INR to start to benefit from a weaker US Dollar by end-2023 and decline to 79.50.”

“From a fundamental perspective, there are certainly some things to like, but with some risks to watch for. First, the current account deficit is narrowing faster than expected. Second, the government has committed to fiscal consolidation in its latest budget. Third, real yields are still positive. Fourth, equity outflows have stabilised. Lastly, exchange rate valuations are not exorbitant, given the meaningful decline in trade weighted exchange rate index since 4Q2022 last year.”

“Moving forward, a key driver of the Indian Rupee will continue to be the RBI’s FX intervention strategy. The RBI seems to dislike excessive FX volatility, especially if it is driven by portfolio flows (in both directions).”

-

12:39

USD Index Price Analysis: Further retracement not ruled out

- DXY reverses two sessions with losses and bounces off 101.45/40.

- Extra decline could still retest the 2023 low near 100.80.

DXY manages to rebound from earlier 2-month lows near 101.40 on Wednesday.

The bearish sentiment around the dollar remains well and sound and this could force the index to breach the so far April low at 101.43 (April 5) and head towards the 2023 low around 100.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.51, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:26

EUR/USD: Gains should resume on a break above 1.0965/70 intraday – Scotiabank

EUR/USD holds in narrow range above low 1.09 zone. Economists at Scotiabank expect the pair to resume its race higher on a break above 1.0965/70.

Bull trend remains intact

“The EUR is little changed but the fact that spot is consolidating above the late Feb/early Mar high suggests firm underlying support for the currency.”

“The bull trend remains intact and will need little encouragement to reassert itself.”