Notícias do Mercado

-

20:52

AUDJPY Price Analysis: Erases three days of losses, hovers shy of 95.00 on a risk-on impulse

- The AUDJPY is set to finish the week with gains of 0.40%.

- AUDJPY Price Analysis: Once it cleared 95.56, it could re-test the YTD highs at around 98.50.

The AUDJPY edges higher, snapping three days of consecutive losses amidst an upbeat market sentiment, as Wall Street pared its losses, while the US Dollar dropped almost 2%. At the time of writing, the AUDJPY is trading at 94.96, above its opening price by 1.89%.

AUDJPY Price Analysis: Technical outlook

The AUDJPY is neutral-to-upward biased and, on its recovery from weekly lows around 92.96, cleared the 50 and 100-day Exponential Moving Averages (EMAs), at 94.59 and 94.21, respectively. Of note, the AUDJPY needs to clear the weekly high at around 95.56, to pose a threat to the year-to-date highs at around 98.50.

On the flip side, the AUDJPY would remain range-bound, trapped in the 94.21-95.56 range.

Short term, the AUDJPY is neutral-to-upward biased, hoovering around the R3 daily pivot level, which, once cleared, could send the cross towards the R4 pivot point at 95.42. However, the RSI at overbought territory could open the door for a pullback before resuming the uptrend.

Otherwise, if the AUDJPY struggles at around 94.96, the first support would be the R2 pivot point at 94.52. Break below will expose crucial demand zones like the 100-EMA at 94.28, followed by the psychological 94.00 figure.

AUDJPY Key Technical Levels

-

20:08

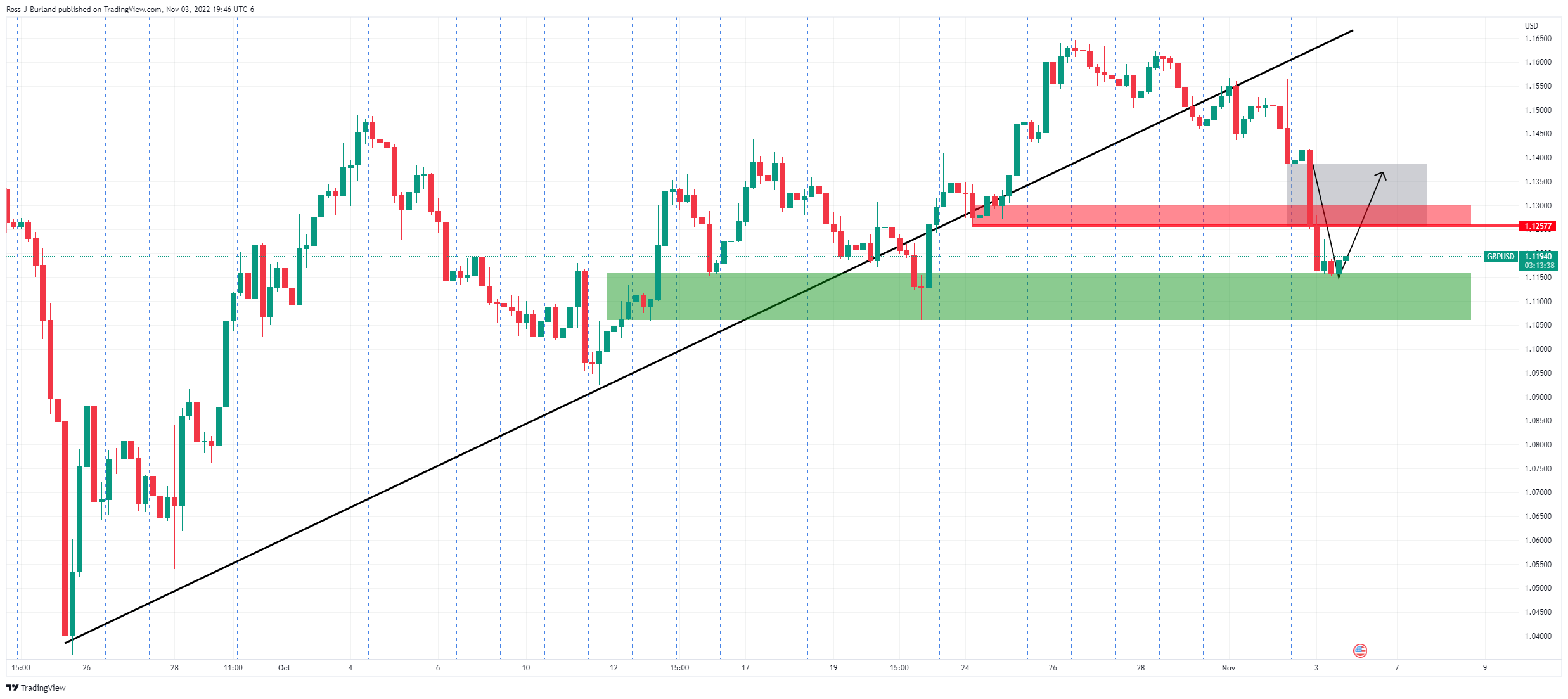

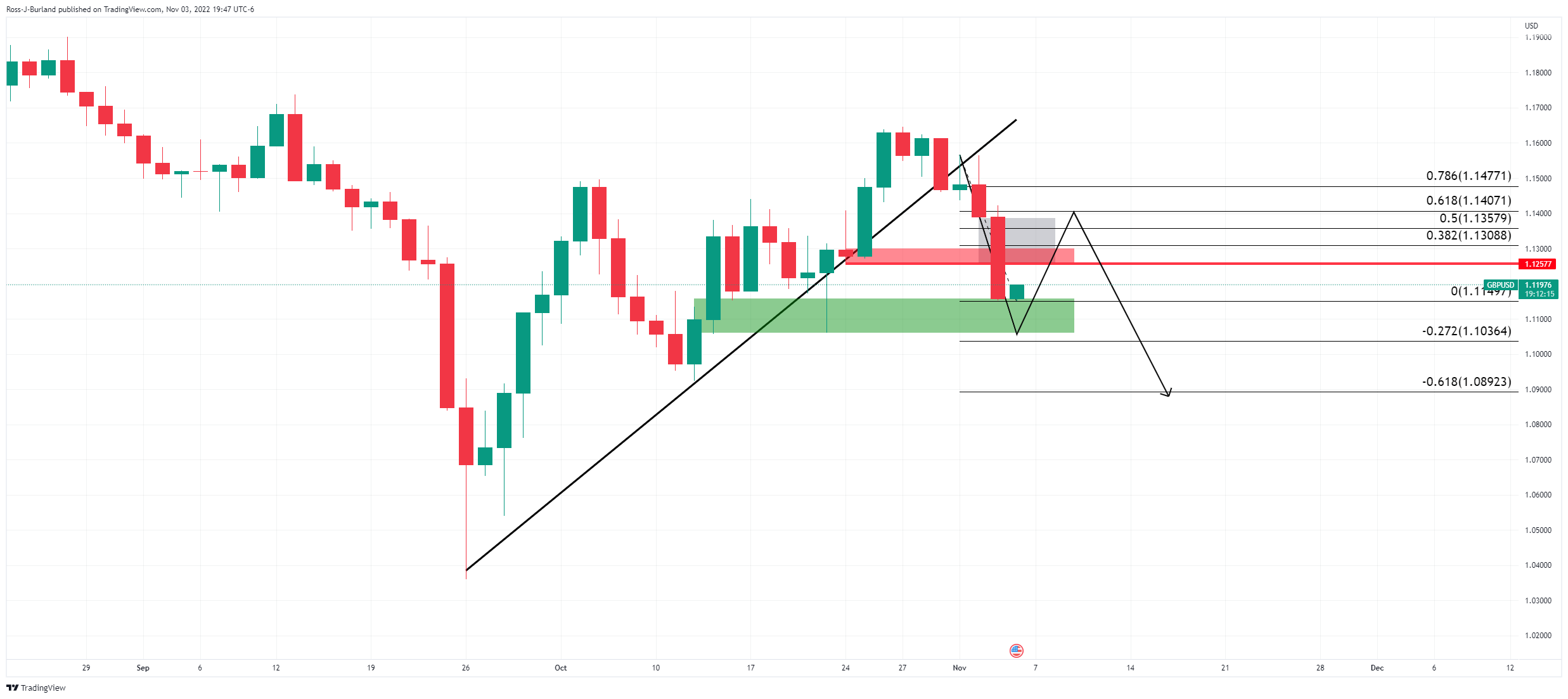

GBPUSD appreciates further and reaches session highs near 1.1400

- The pound rallies 1.9% on the day to close the week near 1.1400.

- US unemployment and wage inflation data hit the dollar.

- The pound has shrugged off post-BoE's bearish pressure.

The pound has continued appreciating during Friday’s US afternoon trading, buoyed by the broad-based USD weakness, to reach session highs at 1.1380.

The pair has shrugged off the previous day’s negative pressure on Friday, to perform a shocking 1.9% daily rally after bouncing from the lower range of the 1.1100s to close the week a few pips shy of 1.1400.

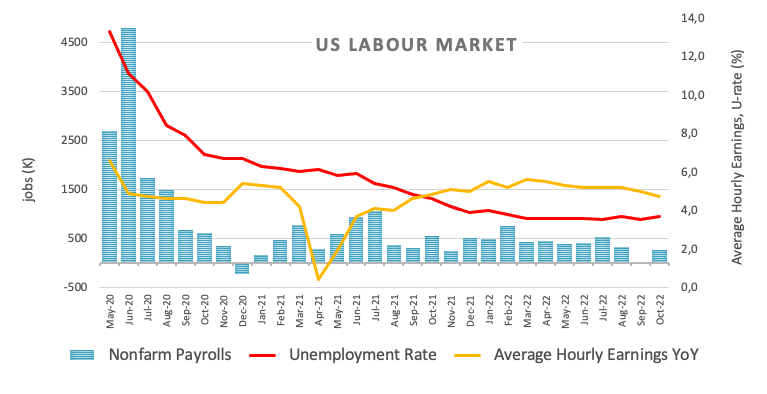

US unemployment grows with salaries slow down

Despite a brilliant Non-Farm Payrolls reading, the US unemployment rate and wage inflation data have shown the first signs of easing in the US labor market, which has tamed expectations of further aggressive tightening by the Federal Reserve and punished the US dollar.

Non-Farm employment has increased above expectations in October, showing a 261K reading, beating the 200K consensus, while September’s reading has been revised to a 315K increment from the 264K previously estimated. The unemployment rate, however, has increased to 3.7% from 3.5% in September, and the hourly wages have slowed down to 4.7% from 5%.

The pound has pared previous losses after having gone through one of its worst weekly performances in the last months. The dovish hike by the Bank of England on Thursday when BoE President Bailey signaled a softer tightening pace over the next months after delivering a 0.75% hike, triggered a broad-based pound sell-off.

Technical levels to watch

-

19:44

EUR/USD keeps appreciating and extends beyond 0.9950

- Euro recovery extends to 0.9960 and erases losses from the previous four days.

- US unemployment and wage growth data send the US dollar tumbling.

- EURUSD: Further decline to 0.9500 is still likely – Rabobank.

The euro has squeezed higher during Friday’s US afternoon trading, with the pair reaching session highs at 0.9960 so far. The common currency has erased the previous four days’ losses with a shocking 2.2% daily rally, turning positive on the weekly chart.

US unemployment and wage growth data have crushed the dollar

The greenback accelerated its downtrend earlier today, following the release of October’s employment report. Non-Farm Payrolls data have beaten expectations with a 261K reading, beyond the 200K consensus, and with September's record revised up to 315K from 264K.

On the other hand, the unemployment rate increased to 3.7%, from 3.5% in September, and wage inflation slowed down to 4.7% from 5%. These embryonic signs of a potential easing in the labor market conditions have brought back the theory of slower rate hikes in December, sending the US dollar tumbling across the board.

EUR/USD: A decline to 0.95 is still likely– Rabobank

Currency analysts at Rabobank remain bearish on the pair and maintain their view of further decline towards 0.9500: “It is our view that the EUR is not fully priced for the headwinds facing the Eurozone economy (…) We continue to see risk of a fall in EURUSD to 0.95 in the weeks ahead and see the potential for the EUR to stay weaker for longer vs. the USD.”

Technical levels to watch

-

19:35

Australia CFTC AUD NC Net Positions up to $-50.5K from previous $-51.4K

-

19:35

Japan CFTC JPY NC Net Positions increased to ¥-77.6K from previous ¥-102.6K

-

19:35

United States CFTC S&P 500 NC Net Positions climbed from previous $-219.1K to $-175.1K

-

19:35

United States CFTC Gold NC Net Positions: $64.6K vs previous $68K

-

19:35

United States CFTC Oil NC Net Positions up to 254.8K from previous 249.1K

-

19:35

European Monetary Union CFTC EUR NC Net Positions rose from previous €74.9K to €105.8K

-

19:35

United Kingdom CFTC GBP NC Net Positions climbed from previous £-47.8K to £-44.8K

-

19:07

Silver Price Analysis: XAG/USD thrashes resistance at $20.00 and approaches $21.00

- Silver prices surge 7% to hit three-week highs near $21.00.

- The US dollar falls as US labor markets show signs of easing.

- XAGUSD has reached an important resistance level at $20.90.

Silver prices skyrocketed on Friday, propelled by a weak US dollar, following a mixed US Non-Farm Payrolls report. The precious metal appreciated about 7% on the day, breaking beyond the top of the last two weeks' trading range, around $20, to hit three-week highs at $20.80 so far.

The US dollar dives as the labor market show signs of easing

The release of the US Non-Farm Payrolls report sent the US dollar tumbling earlier today. Non-Private payrolls increased to 261K in October, beating expectations of a 200K rise, and September’s figures have been revised up to 315K from the 264K initially estimated.

On the other hand, the unemployment rate has increased to 3.7% from 3.5% in September and wage inflation slowed down to 4.7% from 5% over the previous month. These figures suggest that labor market conditions might be easing, which brings the possibility of a dovish pivot in December back to the table.

XAGUSD approaching resistance at $20.95

From a technical point of view, silver is now right below an important resistance area at $20.90, where October 6 and 7 highs meet the 38,2% Fibonacci Retracement of the April – September decline.

With the pair now reaching overbought levels in hourly and daily charts, the possibility of a moderate pullback before further rally should be contemplated.

On the Upside, above $20.90, the next potential targets are October 4 high at $21.25 and. The 200-day SMA at 21.55.

On the downside, the intra-day level at $20.55 is holding bears for the time being, with the next potential targets at $20.00 previous resistance, and the 50-day SMA at $19.20.

XAGUSD daily chart

Technical levels to watch

-

18:26

United States Baker Hughes US Oil Rig Count rose from previous 610 to 613

-

18:22

USDJPY struggles at 147.00 after bouncing off one-month low 146.55

- The dollar dives 0.9% on the day and hits one-month lows at 146.55.

- US payrolls increase, but unemployment rises, and salaries slow down.

- USDJPY: More likely to peak at 155 than at 160 – MUFG.

The US dollar is trying to return above 147.00 in the US afternoon trading session, to trim losses after having lost nearly 0.9% on the day, reaching one-month lows at 146.55.

The US dollar dives on the back of the US Non-Farm Payrolls report

The greenback accelerated its downtrend on Friday, after the release of a mixed US NFP report. Employment creation remains robust, with non-farm private payrolls increasing by 261K in October, beating expectations of 200K and September’s figures revised up to 315K, from the previously estimated 4 K.

On the other hand, the unemployment rate has risen to 3.7% from 3.5% in September, above the consensus of 3.6%, while hourly earnings increased by 4,7% in October from 5% in September. These figures suggest that labor market conditions might be starting to ease and have revived the possibility of a shorter rate hike in December.

USDJPY: Ceiling at 155, with 160 a long way off – MUFG

From a wider perspective, Analysts at MUFG anticipate that the USDJPY peak might not be far off: “We forecast a near-term USDJPY ceiling of 155 given that it has already passed 150 once, is still hovering around 148, and considering the speed of its ascent over the last six-plus months (…) The 2 April 1990 high of 160.35 could come into view if the Fed steps up its communication with the market and a terminal rate of 5.5% to 6% comes into view, but we do not expect this at present.”

Technical levels to watch

-

17:48

USDCAD attempting to regain 1.3500 after hitting six-week lows at 1.3470

- The US dollar plunges 2.5% on Friday to hit six-week lows at 1.3470.

- A mixed NFP report sends the greenback tumbling.

- USDCAD is testing the neckline of a potential H&S formation.

The US dollar is about to close its worst daily performance in some months with a nearly 1.8% sell-off. The pair has extended its reversal from Thursday’s high at 1.3800 to levels below 1.3500 for the first time since late September.

A mixed employment report has hammered the US dollarThe US Non-Farm Payrolls report has shown a 261K increase in October, beating expectations of 200K, and September’s figures have been revised up to 315K, from the previously estimated 4 K.

The unemployment rate, however, has risen to 3.7% from 3.5% in September, above the consensus 3.6%, while hourly earnings increased 4,7% in October from 5% in September. These figures suggest that labor market conditions might be easing, which has tamed expectations of further aggressive rate hikes by the Fed.

The US dollar, which had been surging since Wednesday, after US Fed President, Jeremy Powell, reiterated the need for further monetary tightening, dropped like a stone on Friday on the first signs that the bank’s monetary policy could be starting to take effect.

USDCAD is testing support at 1.3500

The daily chart shows the pair reaching the area where the neckline of a Head And Shoulders formation meets the 50-day SMA, at 1.3500.

A clear breach of that area would activate the H&S pattern, and could push the pair towards 1.3200 (September 1 and 7 highs and the100-day SMA) and then probably the 1.3000 psychological level.

USDCAD daily chart

Technical levels to watch

-

17:14

AUDUSD hits resistance at 0.6475 and consolidates above 0.6425

- The aussie rallies 2.5% on the day to hit session highs at 0.6470.

- Risk appetite and a mixed US employment report have boosted the AUD.

- AUD/USD capped below an important resistance area at 0.6470/0.6525.

The aussie is going through an extraordinary recovery on Friday, rallying about 2.5% on the day amid a favorable market sentiment, to regain most of the previous six days’ losses. The pair bounced up at 0.6280 area earlier on Friday to reach highs at 0.6475 during the midday US trading session, before consolidating above 0.6425.

US dollar dives after a mixed Non-Farm Payrolls report

US employment figures have shown mixed readings in October, which has increased the weakness of an already vulnerable US dollar as risk appetite returned to the markets. European equity markets have closed with gains beyond 2%while the main US stock indexes are mixed in the afternoon trading after a strongly positive opening.

Non-Far private employment increased by 261K in October, beating expectations of 200K, while September’s figures were revised to 315K, up from the previously estimated 264K.

Investors’ enthusiasm about the strong employment data has been offset by the higher-than-expected unemployment rate, which rose to 3.7% from 3.5% in September, beating the consensus of a 3,6% reading, and the slowdown on hourly wages, 4,7% in October from 5% in September.

These latter figures suggest that labor market conditions might be finally easing, which has tamed expectations of more aggressive tightening by the Feral Reserve and increased bearish pressure on the USD.

AUDUSD has reached an important resistance hurdle at 0.6470

A look at the four-hour chart shows that Friday’s sharp rally has pushed the pair to an important resistance area between 0.6470 and 0.6520.

The bullish cross seen between the 50 and the 200-period SMA anticipates the possibility of further appreciation, although, with the pair reaching overbought levels in hourly charts, some hesitation seems likely before the pair resumes the upside path.

AUDUSD 4-hour chart

Technical levels to watch

-

17:06

EURJPY Price Analysis: A bullish-engulfing pattern to open the way toward 146.00 and beyond

- A bullish-engulfing candle pattern in the EURJPY daily chart could open the door for further gains.

- If the EURJPY struggles at 146.00, a fall towards 144.00 is on the cards, ahead of the 50-day EMA at 143.15.

The EURJPY rises during the North American session, forming a bullish-engulfing pattern in the daily chart, nearby the weekly lows at around 144.00, and set to finish the week with losses of 0.66%. At the time of writing, the EURJPY is trading at 145.89, above its opening price by almost 1%.

EURJPY Price Analysis: Technical outlook

As abovementioned, the EURJPY daily chart depicts a two-candle bullish formation that suggests upward pressure is mounting on the pair. The Relative Strength Index (RSI) offers further confirmation, as the oscillator dived towards the 50-midline, but as price action spiked towards the fresh two-day high shy of 146.00, the RSI slope turned bullish, in sync with the EURJPY price action.

If the EURJPY clears the 146.00 figure, it will pave the way for further gains. Firstly, the November 2 daily high at 146.48, followed by the 147.00 figure, ahead of the October 31 swing high at around 147.74.

On the other hand, failure to crack 146.00, the EURJPY could tumble towards the November 3 swing low at 144.03. A breach of the latter will expose crucial demand zones like the 50-day Exponential Moving Average (EMA) at 143.15, ahead of the psychological 143.00 figure and the 142.00 mark.

EURJPY Key Technical Levels

-

16:56

Mexico: Banxico to match the Fed with a 75bps rate hike next week – Wells Fargo

Next week the Bank of Mexico will have its monetary policy meeting. According to analysts at Wells Fargo, Banxico will follow the Federal Reserve with another 75 basis points rate hike, brining the key rate to 10%.

Key Quotes:

“With the Federal Reserve maintaining its hawkish stance on monetary policy and lifting interest rates 75 bps, we believe the Central Bank of Mexico will match that pace of tightening next week. Historically, Banxico has followed Fed interest rate decisions, and we do not think a decoupling will materialize next week. For what it's worth, Mexican policymakers have commented that a decoupling could be warranted if conditions change. However, with Mexico inflation still running above target and the economy relatively resilient, conditions have yet to change, and a 75 bps hike is likely to be delivered by Banxico members next week.”

“A 75 bps rate hike would leave Banxico as one of the last Latin American central banks that have not pivoted to a less aggressive stance on monetary policy. Peer central banks have started communicating a slowdown in their respective tightening cycles, although Mexico policymakers have yet to take their feet off the brakes. This hawkish posture has supported the Mexican peso over the course of this year and has resulted in the peso being one of the few currencies to strengthen against the dollar in 2022.”

-

16:40

Canada: Employment data supports the call for a 50bp hike at December – CIBC

The Canadian employment report surpassed expectations with a positive change in emlyment of 108K above the 10K of market consensus. Analysts at CIBC point out the surge could simply be a sign that some of the declines seen over the summer were simply statistical noise. According to them, the data support their call for a further 50bp interest rate hike at that time, but they warn there is still one more employment report to come before the next Bank of Canada (BoC) meeting.

Key Quotes:

“The big rebound in employment during October, accompanied by a rebound in the size of the labour force, is likely a sign that the declines seen over the summer were largely statistical noise, rather than a sign that the labour market truly surged ahead this month.”

“The breakdown of employment showed that all of the jobs created were full time positions, with part time actually down slightly relative to the prior month. Most of the jobs created were among private sector employees, although public sector employment and self-employment also rose.”

“Today's data support our call for a 50bp hike at the December meeting, rather than a more standard 25bp move, although there are plenty of economic data releases still between now and then, including one more labour force survey.”

-

16:30

US: Job growth to moderate further over the coming months – Wells Fargo

The US official employment report showed payrolls increased by 261K in October, above the market consensus of 200K. According to analysts at Wells Fargo job numbers won’t move the needle much toward a 75 basis points rate hike at the next FOMC meeting. They see job growth moderating further over the coming months.

Key Quotes:

“The somewhat perplexing resilience in sectors such as manufacturing and construction could be in part explained by technical factors. We noted in a recent report that the birth-death factors to the payroll survey have been unusually large over the past year, reflecting the extraordinary rate of new business creation since the pandemic. October's beat looks to be at least in part due a record boost for this time of year.”

“We look for job growth to moderate further over the coming months. Layoffs according to initial jobless claims and the JOLTS report remain low, but discharges are only half the net hiring equation. Demand for additional workers appears to be slipping.”

“Our sense is that the FOMC would prefer to hike by "only" 50 bps in December, but hot economic data could force the Committee's hand to once again go 75 bps. On net, we doubt today's data move the needle much toward a 75 bps hike. A 50 bps rate hike remains our base case, with next Thursday's CPI print the next pivotal piece of data.”

-

16:21

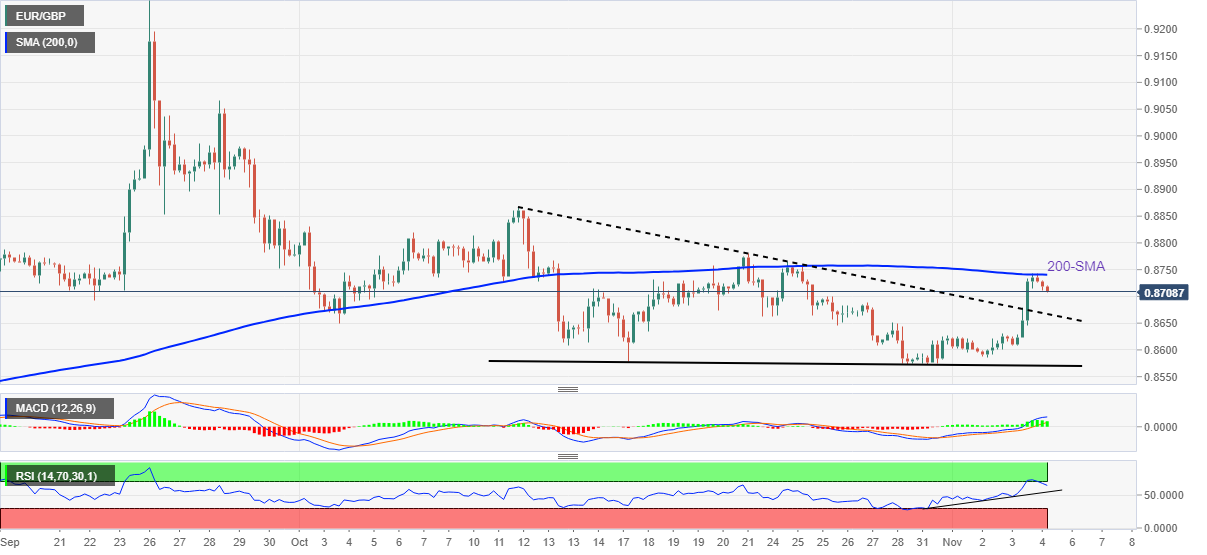

EURGBP extends recovery from 0.8590 to test three-week highs at 0.8780

- The euro appreciates for the third day in a row to test three-week highs at 0.8780.

- BoE's dovish rhetoric has increased downward pressure on the pound.

- EURGBP: Breach of 0.8780 resistance would cancel the downward trend from late-September highs.

The euro appreciated against the pound for the third consecutive day, extending its rebound from week lows at 0.8590 to test October 21 high at 0.8780 which, so far, remains firm.

A dovish BoE and grim economic prospects are hurting the GBP

The pound has been trading under strong bearish pressure this week, which has helped the EURGBP to rally nearly 2.4%, on the back of the dovish message by the Bank of England and the bleak economic perspectives ahead for the UK.

On Thursday, BoE President Andrew Bailey sent the pound tumbling at the press release held following the monetary policy decision, in spite of the 0.75% hike previously delivered by the bank. Bailey signaled to softer rates over the next months and warned that the country might have already entered a recession that could last two years and cause a 2.9% economic contraction.

EURGBP pushing against the 0.8780 resistance area

From a technical perspective, EURGBP bulls gained traction on Friday after confirmation above the 50-day SMA, at 0.8700, now acting as support to attempt an assault to the October 21 high at 0.8780.

Above here, the pair would have canceled the downward trend from late September highs, opening the path towards 0.8965 (Oct. 12 high) and 0.9000 psychological level.

On the downside, immediate support lies at the mentioned 50-day SMA, at 0.8700 with the next targets below there at 0.8650 (Oct 27 high) and 0.8570 (October 28 and 31 lows).

Technical levels to watch

-

16:02

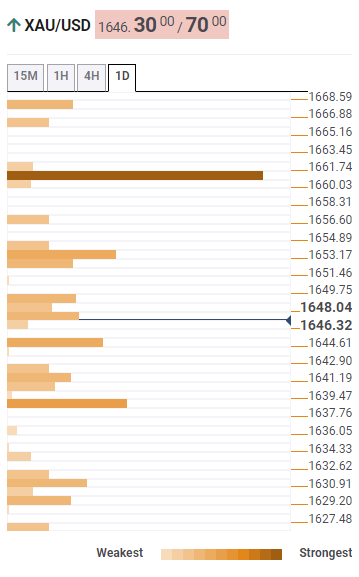

Gold Price Forecast: XAUUSD soars to resistance around $1670 after hitting a three-week high

- The American Dollar has difficulty finding its feet, down 1.39%, as shown by the US Dollar Index.

- Speculations that the Fed would tighten in smaller increases mounted as the labor market gave signs of easing.

- The US 2s-10s yield curve inversion, the deepest since the 1980s, and US recession fear increased.

Gold price continues to extend its rally in the October US Nonfarm Payrolls report aftermath, up by more than 2.50%, in growing speculations that an uptick in the rate of unemployment might deter the Federal Reserve from aggressive tightening. However, Federal Reserve Chairman Jerome Powell said the Federal Funds rate (FFR) peak would be higher than September’s projections. Therefore, the XAUUSD is trading at around $1672 amidst a volatile trading session.

The US Unemployment Rate is approaching to 4%, a headwind for the US Dollar

Following the release of the Nonfarm Payrolls, the US Dollar falls further. The US economy added 261K jobs, above estimates of 200K, but what probably rocked the boat was that the Unemployment Rate increased by 3.7% from 3.5% in the previous month, signaling that the labor market is easing amid the most aggressive Federal Reserve tightening cycle. Also, Jerome Powell’s words that the Fed might begin to slow its pace of increases “as soon as the next meeting” is a headwind for the greenback.

The US 2s-10s yield curve inverted the most in 40 years as recession drums got louder

In the meantime, US Treasury bond yields, particularly the 10-year benchmark note rate, almost parked at 4.156%, unchanged. However, what’s grabbing the attention is the inversion of the 2s-10s yield curve, which is used as a leading indicator of upcoming recessions. At the time of typing, the spread between the US 2s and 10s is -0.534%, and it’s the highest inversion of the curve since the 1980s, as the US 2-year bond yield sits at 4.694%.

Of late, some Fed speakers are crossing newswires, led by the Boston Fed President Susan Collins. She said that she supports 75 bps increases if needed, added that inflation is too high and that the Fed “must restore price stability. According to Collins, the Fed’s monetary policy “is now in restrictive territory.” Later, Richmond’s Fed President Thomas Barkin said that the jobs report was about as he expected, though he added that the labor market remains tight and that there’s some work left to do.

Gold Key Technical Levels

-

15:58

GBPUSD set to hold above the 1.10 level – BMO

GBPUSD fell after the BoE’s ‘dovish hike’. Nonetheless, economists at the Bank of Montreal expect the pair to hold above the 1.10 level.

Bank of England gave a divided policy decision

“The BoE actually moved boldly, raising its Bank rate 75 bps to 3.00%. Yes, the hawks are finally in the majority with seven (7) opting for 75 bps. The breakdown of the vote was surprising on two fronts: 1) We didn't expect four policymakers to join the three hawks, and 2) We didn't expect the dovish Silvana Tenreyo to shift from 50 bps to 25 (she felt that the economy was already in recession). Given this dissent, this is not a truly hawkish hike.”

“This is not the last we've seen from the BoE. We look for another 50 bps in December, then 25 bps in February, to 3.75%, with all moves being dependent on the data, and the fiscal update. Obviously.”

“We are cautiously optimistic that the 1.10 level in GBPUSD will hold, but a more aggressive-than-expected Fed is a downside risk to that call.”

-

15:58

EURUSD hits fresh highs near 0.9950 as dollar’s slide continues

- Dollar drops further on Friday despite NFP.

- After a busy week, now attention turns to US elections and CPI.

- EURUSD still down for the week, but reversal is euro positive.

The EURUSD rose further on Friday and hit a fresh two-day high at 0.9940, before pulling back to the 0.9900 area. The greenback is sharply lower across the board despite a better-than-expected NFP.

The employment numbers showed the US added 261K new jobs in October, above the 200K of market consensus. After an initial positive reaction, the Dollar then tumbled, and so far, it is having the worst day in weeks. An improvement in market sentiment contributes to weakening the Dollar amid job numbers and expectations that China will ease some of its Zero-Covid policies.

Next week, attention would be on US CPI numbers due on Thursday that should have a large impact on Fed policy expectations. The mid-term election will be on Tuesday.

Can the rebound continue?

“The EURUSD pair has spent the week below parity and posted a lower low and a lower high, a sign that bears are back. Profit-taking ahead of the weekend helped the pair to bounce on Friday, but the dominant bearish trend remains firmly in place”, explained Valeria Bednarik, Chief Analyst at FXStreet.

Bednarik warns the daily chart shows the bearish continuation is in doubt. “The EURUSD pair recovered above a directionless 20 SMA, which provides immediate support at around 0.9830, and seems poised to extend its recovery towards the next relevant dynamic resistance level, a bearish 100 SMA currently at around 1.0050.”

The pair is about to end the week with marginal losses and far from the weekly low, a positive sign for euro bulls. Still, it remains far from obtaining a weekly close the 20-week SMA at 1.0040.

Technical levels

-

15:47

GBPUSD appreciates further and tests levels beyond 1.1300

- The pound trims losses after a four-day sell-off; tests levels past 1.1300.

- A mixed US NFP report send the dollar tumbling.

- GBPUSD is expected to depreciate further in the near-term – UOB.

The pound is closing the week on a strong note, appreciating beyond 1% on the day, favored by a broad based US dollar weakness amid a positive market mood. The pair has extended its rebound from 1.1150 lows on Thursday, to hit session highs past 1.1300, trimming losses following a sharp sell-off over the previous four days.

US Non-Farm Payrolls paint a mixed picture

Non-Farm employment has increased above expectations in October with a 261K reading, beating the 200K consensus and showing that the US labor market remains in good health. Furthermore, September’s data have been revised to a 315K increment from the 264K previously estimated.

The unemployment rate, however, has increased to 3.7% from 3.5% in September, and the hourly wages have slowed down to 4.7% from 5%. These figures suggest that the tightness of the labor market might be starting to moderate, which has eased expectations of more aggressive tightening by the Federal Reserve, thus increasing downward pressure on the USD.

The greenback had rallied over the previous sessions following the hawkish comments by Fed President Powell, who reiterated the need for further monetary tightening after the bank’s monetary policy decision.

On the other end, the pound has been on the defensive over the previous days and particularly weak following the dovish hike by the Bank of England on Thursday. The bank hiked rates by 0.75% as expected, but BoE President Bailey signaled to a softer tightening pace over the next months, which accelerated the pound’s sell-off.

GBP/USD to face downward pressure over the near term – HSBC

FX analysts at HSBC are skeptical about the sustainability of the current pound rally and see the pair resuming the downtrend soon: “The BoE noted that, although further rate hikes would be required, this would ultimately mean going ‘to a peak lower than priced into financial market’. This is in direct contrast to the Fed which made the observation that guidance around the terminal rate would likely need to move higher (…) We see GBPUSD moving lower into year-end 2022, given this ongoing cyclical divergence between the US and UK economies and rate profiles.”

Technical levels to watch

-

15:44

USDCAD to lose altitude, seen at 1.28 by end-2023 – Westpac

USDCAD is snapping six-day uptrend. Economists at Westpac expect the pair to trend lower over the course of the next year and forecast USDCAD at 1.28 by end-2023.

CAD looks set for a run

“The Canadian Dollar has recently found itself in an interesting position, USDCAD remaining near its cycle highs despite the Bank of Canada delivering outsized rate hikes and signalling there is more to come; meanwhile, in our view, their economy has shown greater resilience than the US, Europe or the UK.”

“This status quo is unsustainable, so we continue to project USDCAD to lose altitude, targeting 1.28 and 1.26 as end-of-year levels for 2023 and 2024.”

-

15:20

EURUSD: At risk of falling to 0.95 in the weeks ahead – Rabobank

Economists at Rabobank have have revised down tehir EURUSD forecast. The pair is expected to slump towards the 0.95 mark.

It is not clear if the ECB can support the EUR with rates hikes

“It is our view that the EUR is not fully priced for the headwinds facing the Eurozone economy.”

“There are no guarantees that the ECB will be able to support the EUR vs. the USD with rate hikes if its guidance on the economic outlook is sour.”

“We continue to see risk of a fall in EURUSD to 0.95 in the weeks ahead and see the potential for the EUR to stay weaker for longer vs. the USD.”

-

15:17

WTI hits three-week highs above $92.00 PB, as the USD extends its losses

- Western Texas Intermediate (WTI) jumps more than 4%, courtesy of a weaker US Dollar.

- Changes in China’s Covid-19 zero-tolerance stance will support higher oil prices.

- WTI could rally on OPEC’s cut to crude oil output and the EU’s ban on Russia’s oil.

The US crude oil benchmark, also known as Western Texas Intermediate (WTI), climbed sharply following the release of US employment data, which exceeded estimates, while the Unemployment Rate shows easing signs in the labor market as the Federal Reserve expects. At the time of writing, WTI exchanges hands at $91.70 per barrel after hitting a three-week high at $92.55.

The US Dollar is on the defensive, despite a goodish US employment report

The US Dollar remains soft across the board, weighed by the October US Nonfarm Payrolls report, a tailwind for dollar-denominated assets. The US economy added 261K jobs to the economy crushing the 200K foreseen by analysts, but an uptick in the unemployment rate to 3.7% from 3.5% in the previous month, increased traders speculations that the Fed would tighten but at a slower pace.

Aside from this news that Chinese authorities are looking to relax the Covid-19 restrictions would benefit oil prices, as one of the top epidemiologists said at a local investment conference that he expects “substantial changes” to the Covid-19 zero-tolerance policy.

Elsewhere, the US Dollar Index, which tracks the greenback’s performance against most G8 currencies, tumbles more than 1.50%, at 111.102, after hitting fresh two-week highs at 113.148, in the Federal Reserve aftermath.

Another factor that would keep WTI’s prices heading north is the Organization of Petroleum Exporter Countries and its allies, known as OPEC, which cut crude-oil output by almost 2 million BPD. Worth noting, the US stockpiles slid, as reported earlier in the week by the US Energy Information Administration (EIA).

The above-mentioned factors lifted WTI prices as the US released oil from the Strategic Petroleum Reserve (SPR). Nevertheless, the Eurozone ban on Russia’s oil, to begin on December 5, would put further stress on the oil supply, meaning that it could be possible that WTIs hit $100 per barrel at the end of the year.

WTI Key Technical Levels

-

14:58

GBPUSD to face downward pressure over the near-term – HSBC

GBPUSD dropped after a somewhat more dovish than expected BoE announcement. Cable is likely to face further downward pressure, given the cyclical divergence between the UK and the US, in the view of economists at HSBC.

Underlying message is dovish

“Although the BoE matched the 75 bps hike delivered by the Fed, there was a clear point of difference about where rates could peak in the future. The BoE noted that, although further rate hikes would be required, this would ultimately mean going ‘to a peak lower than priced into financial market’. This is in direct contrast to the Fed which made the observation that guidance around the terminal rate would likely need to move higher, even if the pace of hikes was likely to slow. All in all, this is a very sobering message for the UK economy and for the GBP.”

“We see GBPUSD moving lower into year-end 2022, given this ongoing cyclical divergence between the US and UK economies and rate profiles.”

-

14:54

USDCHF tumbles below parity on USD worst day in weeks

- US Dollar extends losses during the American session.

- NFP surpasses expectations, but does not help dollar.

- USDCHF erases most weekly gains, back under parity.

The USDCHF is falling almost two hundred pips on Friday, on the worst performance in weeks, amid a broad-based Dollar slide. The better-than-expected US jobs numbers did not help the dollar, that is ending the week pointing to further weakness.

The pair recently hit a fresh two daily low at 0.9940 and it remains with a bearish bias. The next support stands around 0.9920. The reversal from the 1.0150 area, that again capped the upside, is firm.

Dollar down despite NFP

The US official employment report showed numbers above expectations, although the slowest monthly gain in jobs since December 2020. The labor market remains healthy.

The US Dollar initially rose following the NFP but then reversed sharply, resuming the decline. “The currency market looks to be more concerned about speculation of a relaxation of China's zero COVID policy than a firmer jobs report or higher Fed terminal rate, which may be more influential in triggering some positioning adjustments. The easy phase of the USD's bid is behind us, but the onus will be on regional prospects to undermine the USD. Near-term, we think there may be more noise-than-signal in the FX space”, commented analysts at TD Securities.

The US dollar is still marginally higher for the week but is far from the highs, on a busy week that included a 75 basis points rate hike from the Federal Reserve. Next week, on Tuesday are US mid-term elections and on Thursday CPI data is due. Inflation numbers will be the highlight of the week and will likely impact markets.

Technical levels

-

14:36

USDCAD: Loonie cheers upbeat jobs data and prospects of opening up China's economy – TDS

Canadian employment surged 108K in October, defying expectations for a slowdown. CAD strengthened following the number and is set to remain resilient in the short-term also thanks to speculation of China re-opening, economists at TD Securities report.

Canada's random number generator strikes again

“The Canadian economy added 108K jobs in October, smashing expectations for a 10K print, following the muted performance over the last six months. Details were even more hawkish with full-time employment driving job growth, alongside a 0.2pp increase to the participation rate as wages firmed by 0.4pp.”

“The CAD caught a solid bid following the surprise, which added to the positive momentum it gained overnight following growing speculation that China will relax its zero-COVID policy. Together, we think it is a positive story for CAD, at least in the short-term.”

-

14:25

Fed's Barkin: Not sure I know what we'll do in December

In an interview with CNBC on Friday, Richmond Fed President Thomas Barkin said that the US labor market was still tight and added that they were not getting much help on the labor supply side, as reported by Reuters.

Key takeaways

"It will be hard for people who have fought hard to raise prices to back off."

"Not sure I know what we'll do in December, many indicators still to come."

"Could be a potentially higher end-point for rates even if slower."

"If inflation were to persist, would need to respond appropriately."

"We need to get inflation down to target and do whatever we need to do to do that."

Market reaction

The US Dollar Index continues to push lower in the American session and was last seen losing 1.65% on the day at 111.12.

-

14:21

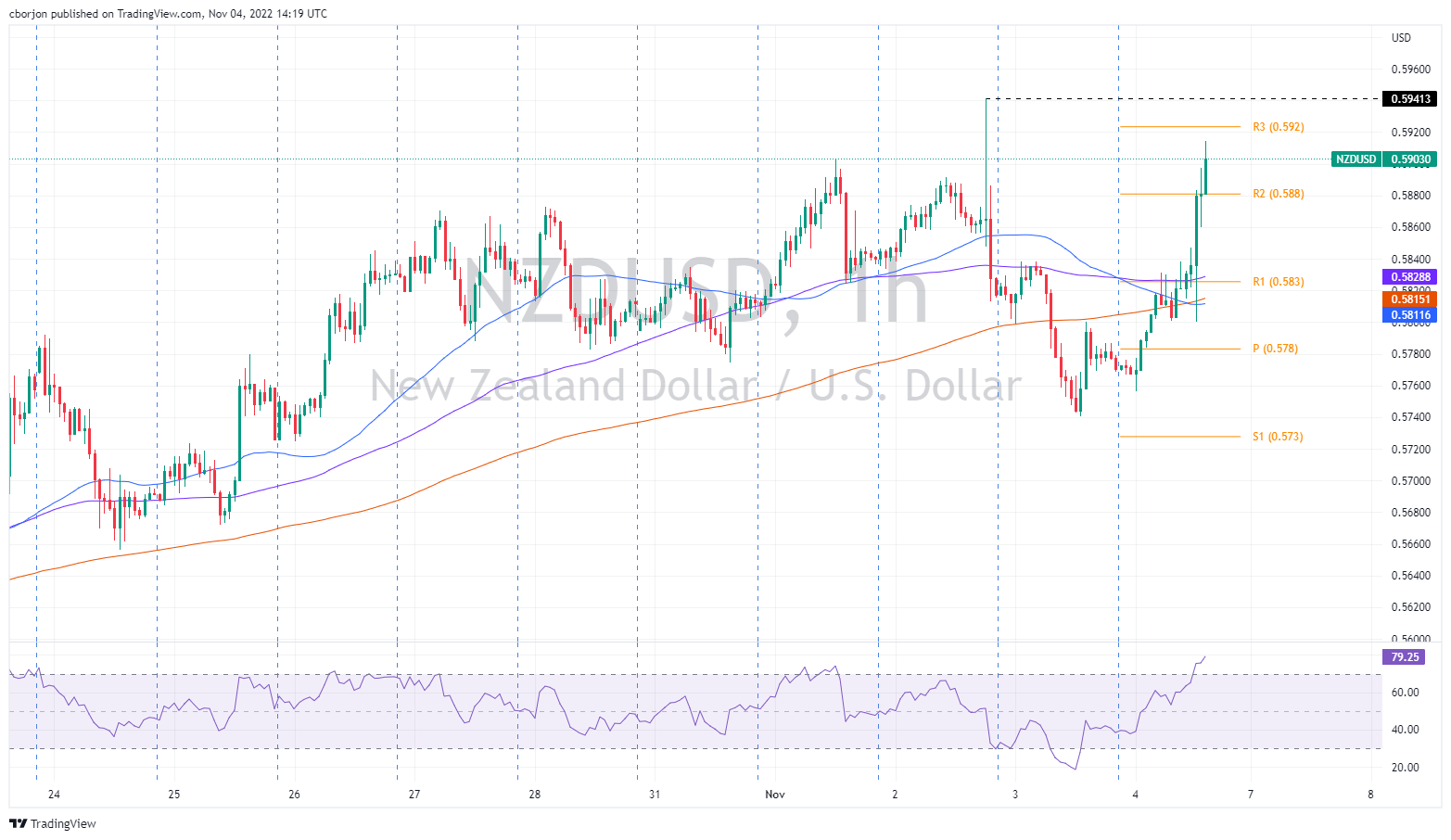

NZDUSD surges to two-day highs above 0.5900 amid a soft USD

- NZDUSD extends its daily gains above 0.5900 following an upbeat US NFP report.

- The United States economy added more than 260K jobs, beating estimates, but wages increased, adding to inflationary pressures.

- The US Dollar remains offered, despite printing a solid employment report, down 1.45% as shown by the US Dollar Index.

The NZDUSD advances and pierces the 50-day Exponential Moving Average (EMA) following the release of upbeat US employment data, while wages rose steadily, which would not deter the US Federal Reserve from tightening monetary policy conditions. At the time of writing, the NZDUSD is trading at 0.5902.

US Dollar remains heavy following October’s US employment situation

The US Dollar continues to weaken, even though the US jobs report was better than expected, with the Nonfarm Payrolls report for the last month exceeding estimates of 200K, increased by 261K. Even though the figures were solid, they came below September’s upward revision to 315K. Of note is that Average Hourly Earnings stood steadily at around 4.7%, as predicted, but lower than the previous month’s 5% jump.

Regarding the Unemployment Rate, it jumped as the Federal Reserve wanted, from 3.5% in September to 3.7% in October.

The Federal Reserve would continue to tighten conditions given October’s labor market figures. Albeit Jerome Powell and Co. revealed that they would slow the pace of interest-rate increases, they would look for the next week’s Consumer Price Index (CPI) for October, alongside the University of Michigan (UoM) Consumer sentiment and inflation expectations.

NZDUSD Market’s reaction

On the US Nonfarm Payrolls release, the NZDUSD edged towards the 0.5800 figure, beneath the confluence of the 50 and 100-hour Exponential Moving Averages (EMAs), before rallying towards fresh two-day highs at around 0.5900, hurdling on its way north, the R1 and R2 daily pivot levels, but shy of the weekly high at 0.5941.

The Relative Strength Index (RSI) is pushing higher towards overbought conditions, though it remains short of reaching the 80 level, used by most traders as the most-extreme overbought condition when an asset is in a strong uptrend. Nevertheless, caution is warranted as the major approaches the R3 daily pivot at 0.5920, opening the door for NZD buyers to book profits in the event of a pullback.

-

14:20

Fed's Collins: Still open to 75 bps hikes if needed

Boston Federal Reserve President Susan Collins said on Friday that it is time for the Fed to shift its focus from the size of rate hikes to the "ultimate "destination," as reported by Reuters.

Additional takeaways

"Fed entering a new phase for monetary policy tightening cycle."

"Inflation still too high, Fed must restore price stability."

"Signs inflation surge is starting to moderate."

"Smaller rate hikes may be likely to become more appropriate in future."

"Still open to 75-basis-point hikes if needed."

"Fed policy now in restrictive territory."

"Premature to say how far Fed will need to hike rates."

"I don't believe big slowdown is needed to achieve price stability."

"Fed will need to balance risks to outlook more as it moves forward."

"Optimistic for future path of the economy."

Market reaction

The US Dollar stays under heavy selling pressure and the US Dollar Index was last seen losing 1.5% on the day at 111.25.

-

14:14

More pressure on the Yuan if China open ups symmetrically – TDS

Is China about to open up? If China opens up symmetrically it would once again put pressure on the services balance of China's current account, leading to more and not less pressure on the Yuan, according to economists at TD Securities.

China’s opening is not going to be a panacea for the global economy and markets

“In terms of markets impact if China opens up symmetrically i.e. allows more Chinese to travel outside of China and not just allows more inward traffic, it would once again put pressure on the services balance of China's current account, leading to more and not less pressure on the CNY. As such, we maintain our view of CNY underperformance both vs. USD and on a trade-weighted basis. Conversely, it would be positive news for the likes of THB, and other tourism related currencies in the region including SGD.”

“For the rest of the world, clearly a full opening up and dismantling of zero-Covid, would bode well, especially if Chinese growth reaches 6-6.5% as noted above, but this is not our base case. Moreover, even if growth does ramp up, China's domestically-focussed stimulus, ongoing domestic structural constraints, and weaker trade means that China opening is not going to be a panacea for the global economy and markets.”

-

14:00

Canada Ivey Purchasing Managers Index s.a down to 50.1 in October from previous 59.5

-

14:00

Canada Ivey Purchasing Managers Index down to 51.4 in October from previous 55.9

-

13:58

GBPUSD looks firm and pokes with 1.1300

- GBPUSD challenges the key 1.1300 zone on Friday.

- The dollar remains offered and allows the bounce in Cable.

- US Nonfarm Payrolls surprised to the upside in October.

The Sterling regains the balance and sponsors the rebound in GBP/USD to the vicinity of the 1.1300 mark on Friday.

GBP/USD stronger on risk-on trade

GBPUSD leaves behind to sessions in a row with losses and manages to advance to the boundaries of 1.1300 the figure at the end of the week, where some initial resistance appears to have turned up.

The broad-based appetite for the risk-associated universe lent the Quid extra legs on Friday and helped the pair recoup part of the BoE-induced sell-off recorded on Thursday.

Indeed, the greenback remains well on the defensive despite the US economy created more jobs than expected in October (261K), while the Unemployment Rate edged higher to 3.7%.

In the UK docket, the Construction PMI improved to 53.2 in October (from 52.3), while BoE Chief Economist H.Pill suggested earlier in the session that markets should “re-anchor” their expectations around the policy rate following the recent political/financial effervescence.

GBP/USD levels to consider

As of writing, the pair is gaining 0.82% at 1.1248 and a breakout of 1.1375 (55-day SMA) would open the door to 1.1645 (monthly high October 27) and then 1.1690 (100-day SMA). On the other hand, the next support emerges at 1.1142 (weekly low November 4) followed by 1.0923 (monthly low October 12) and finally 1.0356 (2022 low September 26).

-

13:54

USDJPY bounces off daily low, keeps the red below mid-147.00s amid weaker USD

- USDJPY comes under some selling pressure amid broad-based USD weakness.

- The mixed US jobs data does little to impress the USD bulls or lend any support.

- The risk-on impulse and the Fed-BoJ policy divergence should limit the downside.

The USDJPY pair comes under some selling pressure during the early North American session and drops to a fresh daily low in the last hour. Spot prices, however, quickly recover a few pips from sub-147.00 levels, though remain in the negative territory amid the heavily offered tone surrounding the US Dollar.

In fact, the USD Index retreats further from a two-week high touched the previous day in reaction to the mixed US monthly employment details, which, in turn, is seen exerting pressure on the USDJPY pair. The closely-watched NFP report showed that the US economy added 261K new jobs in October against the 200K estimated. Furthermore, the previous month's reading was also revised higher to 315K from the 263K. That said, a slight disappointment from the unemployment rate, which rose to 3.7%, overshadows the upbeat headline prints and weighs on the greenback.

Furthermore, speculations that Japanese authorities might intervene again to soften any steep fall in the domestic currency contribute to offered tone surrounding the USDJPY pair. That said, the risk-on impulse - as depicted by a strong rally in the equity markets - should keep a lid on any further gains for the safe-haven JPY. Apart from this, a more hawkish stance adopted by the Federal Reserve should act as a tailwind for the greenback. This, in turn, should help limit the downside for the major and warrants some caution for aggressive bearish traders.

It is worth recalling that Fed Chair Jerome Powell smashed expectations for a dovish pivot and said on Wednesday that it was premature to discuss a pause in the rate-hiking cycle. Powell added that the terminal rate will still be higher than anticipated, which remains supportive of elevated US Treasury bond yields. In contrast, the Bank of Japan, so far, has shown no inclination to hike interest rates and reiterated that it will continue to guide the 10-year bond yield at 0%. This results in a further widening of the US-Japan rate differential and favours the USDJPY bulls.

Technical levels to watch

-

13:29

USD Index drops to 2-day lows near 111.50 post-NFP

- The index losses further ground and approaches 111.50.

- The selling pressure gathers traction after solid NFP figures.

- US yields lose momentum and retreat from peaks.

The USD Index (DXY), which tracks the greenback vs. a basket of its main currencies, retreats markedly and drops well south of the 112.00 at the end of the week.

USD Index weaker despite Payrolls

The index sets aside two consecutive daily pullbacks and breaks decisively below the key 112.00 support on the back of the renewed and intense appetite for the risk complex on Friday.

In fact, solid prints from US Nonfarm Payrolls failed to motivate the greenback to reverse course despite the labour market remains tight. This scenario is supportive of the continuation of the Fed’s normalization process via extra interest rate hikes in the upcoming months.

Back to the calendar, the US economy added 261K jobs during last month, although the jobless rate rose to 3.7% (from 3.5%) and Average Hourly Earnings came in above estimates after expanding 0.4% vs. the previous month.

What to look for around USD

The irruption of the selling bias in the dollar drags the index well south of the 112.00 level at the end of the week.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the buck.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot could emerge in … 2024? Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 1.20% at 111.62 and the breakdown of 109.53 (monthly low October 27) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13). On the other hand, there is an initial resistance at 113.88 (monthly high October 13) seconded by 114.76 (2022 high September 28) and then 115.32 (May 2002 high).

-

13:21

AUDUSD rallies towards 0.6450s following an upbeat US employment report

- The AUDUSD soars more than 2% on Friday and prepares to finish the week with gains of 0.50%.

- The US Nonfarm Payrolls report exceeded estimates, while the Unemployment Rate pushed upwards, weakening the USD and bolstering the AUD.

- AUDUSD Price Analysis: Gains 150-pips and consolidates around 0.6440-50 as the RSI enters the overbought territory.

The AUDUSD is surging toward 0.6420s following the release of US employment data, which underscores Fed worries about the narrow labor market, with the United States economy adding more jobs than expected, while the Average Hourly Earnings remained unchanged close to 5% YoY, adding to inflationary pressures. At the time of writing, the AUDUSD is trading at around 0.6440-55 after hitting a daily low of 0.6285.

The AUDUSD jumped on upbeat US Nonfarm Payrolls report

On Friday, the US Department of Labor reported that the US economy added 261K jobs in October, smashing estimates of 193K, justifying the need for further Federal Reserve (Fed) aggression, even though the Federal Funds rate (FFR) is already at the 3.75-4% range. Although Fed Chair Jerome Powell mentioned the bank’s intention to slow the pace of rate increases, he said that the peak of rates would be higher than September’s Summary of Economic Projections (SEP) report.

Digging a little deep into the report, the Unemployment Rate rose by 3.7%, shocked by a lower participation rate, while Average Hourly Earnings remained unchanged at 4.7% YoY.

Market’s reaction

The AUDUSD tanked on the headline release, as shown by the 5-minute chart, towards 0.6344 and shifted gears, rallying aggressively, clearing the psychological 0.6400 figure, and extending its gains towards the daily high at around 0.6452. Traders should be aware that the Relative Strength Index (RSI) sits at 83 at overbought conditions, suggesting that the AUDUSD might pull back before resuming its upward bias.

AUDUSD 5-minute chart

-

13:13

GBPUSD to grind higher towards 1.20 by end-2023 – Westpac

GBPUSD held near 1.15 the past week before dipping to 1.12 on a dovish 75 basis points hike by the BoE. Economists at Westpac see Cable trading at 1.20 and 1.27 by end-2023 and end-2024, respectively.

Market confidence and reduced energy and inflation risks expected to win out

“The road ahead is fraught with risk as Prime Minister Rishi Sunak’s Government hold off on further stimulus and likely tighten their stance while the economy is very weak.”

“Inevitably, market confidence and reduced energy and inflation risks are expected to win out, sending the GBPUSD higher – to 1.20 and 1.27 come end-2023 and end-2024.”

-

12:59

USDCAD hammered down to weekly low, below mid-1.3500s post-US/Canadian jobs data

- USDCAD plummets back closer to the weekly low and is pressured by a combination of factors.

- A rise in the US jobless rate overshadows the upbeat NFP print and weighs heavily on the USD.

- Stellar Canadian jobs data, rallying oil prices underpin the Loonie and add to the selling bias.

The USDCAD pair adds to its heavy intraday losses and sinks the weekly low, below mid-1.3500s in reaction to the US/Canadian employment details.

The US Dollar maintains its heavily offered tone after the closely-watched US NFP report showed that the added 261K jobs in October, much higher than the 200K anticipated. Adding to this, the previous month's reading was revised higher from 263K to 315K. This, however, was offset by a slight disappointment from the unemployment rate, which rose to 3.7% during the reported month against expectations for an uptick to 3.6% from 3.5% in September. The mixed data fails to impress the US Dollar bulls or lend any support to the USDCAD pair.

The Canadian Dollar, on the other hand, gets a strong boost from mostly upbeat Canadian jobs data. Statistics Canada reported that the economy added 108.3K jobs in October, smashing expectations for a 10K rise by a huge margin. Additional detail revealed that the jobless rate held steady at 5.2% against expectations for an uptick to 5.3%. This comes amid an intraday rally in crude oil prices, which is seen as another factor underpinning the commodity-linked Loonie and further contributes to the USDCAD pair's steep intraday decline.

Apart from the aforementioned fundamental factors, the latest leg down witnessed over the past hour or so could also be attributed to some technical selling below the 1.3600 mark. Hence, it remains to be seen if the downfall marks a fresh bearish breakdown or is seen as a buying opportunity amid a more hawkish stance adopted by the Federal Reserve. Nevertheless, the USDCAD pair remains on track to end in the red for the third successive week.

Technical levels to watch

-

12:55

Gold Price Forecast: XAUUSD climbs sharply toward $1655 post US NFP report

- US Nonfarm Payrolls for October exceeded forecasts of 193K.

- The US Unemployment Rate edged higher, at around 3.7%.

- Gold Price Analysis: Dived at the headline but resumed its early gains.

Gold price seesaws around $1648 after a measure of employment in the United States showed the economy added more jobs than expected, as the US Department of Labor reported, while the US Dollar weakened. US Treasury yields rose, though this did not deter Gold from clinging to earlier gains. At the time of writing, XAUUSD is trading at around $1640-$1660 in a volatile session

US Nonfarm Payrolls crushed expectations, and the Unemployment Rate rises

The Bureau of Labor Statistics (BLS) revealed that US Nonfarm Payrolls for October rose by 261K above estimates of 193K, suggesting that the US Federal Reserve will need to keep lifting rates due to the tightness of the labor market. Given that the US central bank hiked 0.75% for the fourth time in the year and acknowledged an overheated labor market, the December meeting could be live, where the Fed could weigh its options by half or three-quarters of a percent.

In the same report, the Unemployment Rate jumped by 3.7% due to lower participation, and Average Hourly Earnings were unchanged at 6.7%.

Markets’ reaction

XAUUSD price dived towards $1641.16, shy of the 200-EMA as shown by the 5-minute chart, before bouncing off and climbing towards the high $1650s, as the US Dollar weakener, breaking on its way up, the 50-EMA and the 20-EMA, each at $1649.88 and $1651.82, respectively. Even though, to further extend its gains, XAUUSD lacks the strength to re-test the weekly high of $1169.52, as the Relative Strength Index (RSI) at overbought conditions suggests a pullback towards the $1650 area is on the cards.

XAUUSD 5-minute chart

Gold Key Technical Levels

-

12:53

Canada: Unemployment Rate stays unchanged at 5.2% in October vs. 5.3% expected

- Employment in Canada grew at a much stronger pace than expected in October.

- USDCAD trades deep in negative territory below 1.3550.

The Unemployment Rate in Canada remained unchanged at 5.2% in October, the data published by Statistics Canada revealed on Friday.

Net Change in Employment arrived at +108.3K, surpassing the market expectation of 10K by a wide margin. Additionally, the Participation Rate improved to 64.9% from 64.7.

"Year-over-year growth in the average hourly wages of employees remained above 5% for a fifth consecutive month in October, rising 5.6% (+$1.68 to $31.94) compared with October 2021 (not seasonally adjusted)," Statistics Canada further noted in its press release.

Market reaction

USDCAD declined sharply with the initial reaction and was last seen trading at 1.3544, where it was down 1.5% on a daily basis.

-

12:45

EURUSD climbs to daily highs beyond the 0.9800 yardstick on NFP

- EURUSD keeps the bid tone above the 0.9800 mark on Friday.

- US Nonfarm Payrolls surprised to the upside in October.

- The Unemployment Rate climbed to 3.7% (from 3.5%).

EURUSD extends the daily upside to the 0.9810/15 band, or daily highs, in the wake of another solid report from US Nonfarm Payrolls on Friday.

EURUSD looks supported near 0.9750

EURUSD briefly revisited the mid-0.9700s soon after Nonfarm Payrolls showed the US economy added 261K jobs during October, surpassing initial estimates for a gain of 200K jobs. The September reading was revised up to 315K (from 263K).

Further data saw the Unemployment Rate ticked higher to 3.7% (from 3.5%) and the key Average Hourly Earnings – a proxy for inflation via wages – rose 0.4% MoM and 4.7% from a year earlier. Additionally, the Participation Rate receded a tad to 62.2% (from 62.3%).

Despite the strong Payrolls keep supporting the case for the continuation of the tightening cycle by the Federal Reserve, the greenback remains on the defensive, while US yields extend their march north.

What to look for around EUR

EURUSD manages to regain some poise – and the 0.9800 mark - despite the stronger-than-expected Payrolls for the month of October.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The recent decision by the Fed to hike rates and the likelihood of a tighter-for-longer stance now emerges as the main headwind for a sustainable recovery in the pair (if it was any at all).

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: EMU/Germany Final Services PMI, ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EURUSD levels to watch

So far, the pair is gaining 0.50% at 0.9794 and faces the next resistance at 0.9975 (weekly high November 2) seconded by 1.0093 (monthly high October 27) and finally 1.0197 (monthly high September 12). On the other hand, a breach of 0.9704 (weekly low October 21) would target 0.9631 (monthly low October 13) en route to 0.9535 (2022 low September 28).

-

12:42

GBPUSD will be back below 1.1000 soon enough – MUFG

UK will stand out from other key G10 economies and is set to underperform. Thus, economists at MUFG expect further GBP depreciation, with the GBPUSD trading below the 1.10 mark.

Pound remains very vulnerable to the downside for now

“The Pound remains very vulnerable to the downside for now. The US and even the eurozone look set to perform better than the UK and that economic underperformance relative to most of the rest of the G10 will likely be reflected most easily through GBP depreciation.”

“The grim GDP forecasts from the BoE don’t even incorporate the coming fiscal consolidation to be announced on 17th November.”

“We remain bullish on the US Dollar, a view we remain confident on after the FOMC meeting yesterday. Hence, the greater traction for GBP weakness will remain through GBPUSD. A period trading back below the 1.1000 level looks increasingly likely.”

-

12:39

GBPUSD refreshes two-week low on mostly upbeat US jobs report, lacks follow-through

- GBPUSD comes under renewed selling pressure on Friday and drops to a fresh two-week low.

- The USD gains some traction in reaction to the upbeat NFP report and exerts some pressure on Cable.

- The lack of follow-through selling warrants some caution before placing aggressive bearish bets.

The GBPUSD pair struggles to preserve its intraday gains and drops to a fresh daily low, below mid-1.1100s during the early North American session.

The US Dollar catches some bids and recovers a major part of its early lost ground in reaction to the upbeat US employment details, which, in turn, attracts fresh sellers around the GBPUSD pair. In fact, the headline NFP showed that the US economy added 261K new jobs in October, better than the 200K estimated.

Adding to this, the previous month's reading was revised higher to 315K from 263K. That said, the jobless rate rose more than anticipated, to 3.7% from 3.5%. Nevertheless, the data reaffirms the Fed's hawkish outlook, which remains supportive of elevated US Treasury bond yields and underpins the buck.

The British Pound, on the other hand, continues to be weighed down by the Bank of England's dovish rate hike on Thursday, which suggests that the path of least resistance for the GBPUSD pair is to the downside. Bears, however, might wait for acceptance below mid-1.1100s before placing fresh bets.

Technical levels to watch

-

12:35

USD Index to sink to 103 by end-2023 amid greater certainty and longevity of Dollar downtrend – Westpac

Having reached a new cycle (and multi-decade) high of 114.1 in late September, the US Dollar Index (DXY) has since been locked in a relatively tight trading range between 110 and 113. Economists at Westpac expect that the US Dollar peak is behind us.

The weight of reality is hitting the USD

“Expectations and risks related to inflation continue to dictate moves within the range; although, over the past month, participants have been showing greater concern over the consequences of tight policy for the economy, and consequently a growing belief that the peak in rates is nigh. Available activity data certainly argues for this being the case.”

“Although the direction of travel for the US economy, and by association consumer inflation, is clear, markets are still apprehensive to step out and take risk, particularly while the FOMC holds onto its hawkish stance, evinced again by Chair Powell this week. Into year-end, we expect this to remain the case. 2023 is likely to be very different, however.”

“From 113, we look for DXY to fall to 103 by end-2023 and 96 end-2024 – declines of 9% and 15% from spot – with Euro and Sterling key to the result.”

-

12:32

United States Average Hourly Earnings (YoY) meets forecasts (4.7%) in October

-

12:32

United States Unemployment Rate registered at 3.7% above expectations (3.6%) in October

-

12:31

United States Average Hourly Earnings (MoM) registered at 0.4% above expectations (0.3%) in October

-

12:31

Canada Participation Rate came in at 64.9%, above expectations (64.7%) in October

-

12:31

United States Average Weekly Hours in line with forecasts (34.5) in October

-

12:31

United States Labor Force Participation Rate down to 62.2% in October from previous 62.3%

-

12:30

United States Nonfarm Payrolls registered at 261K above expectations (200K) in October

-

12:30

Canada Net Change in Employment came in at 108.3K, above forecasts (10K) in October

-

12:30

Canada Unemployment Rate below expectations (5.3%) in October: Actual (5.2%)

-

12:30

United States U6 Underemployment Rate meets expectations (6.8%) in October

-

12:30

Breaking: US Nonfarm Payrolls rise by 261,000 in October vs. 200,000 expected

Nonfarm Payrolls in the US rose by 261,000 in October, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading came in much higher than the market expectation of 200,000. Additionally, September's reading got revised higher to 315,000 from 263,000.

Further details of the publication revealed that the Unemployment Rate edged higher to 3.7% from 3.5% and the annual wage inflation, as measured by the Average Hourly Earnings, declined to 4.7% from 5%. Finally, the Labor Force Participation Rate inched lower to 62.2% from 62.3%.

Follow our live coverage of market reaction to the US jobs report.

Market reaction

With the immediate reaction, the US Dollar Index erased a portion of its daily losses and was last seen trading at 112.55, where it was down 0.37% on a daily basis.

-

11:49

The US Dollar is at an advantage against the Euro thanks to the Fed – Commerzbank

Whose monetary policy is more attractive? A comparison of the Fed and ECB shows the US Dollar is more attractive than the Euro, economists at Commerzbank report.

Dollar holds advantage over the Euro

“Fed Chair Jay Powell has pointed out that the Fed is aiming for a key rate level above inflation medium-term. That means the Fed will only stop hiking interest rates or lower them again once it can be sufficiently certain that inflation is easing notably. The impression the ECB is giving to observers is completely different. One gets the impression that Europe’s central bankers have to be forced by high inflation data to get them to hike rates. From the FX market’s point of view that means the Dollar is at an advantage against the Euro.”

“If inflation were to not fall or ease much less than the central banks expect the ECB would always be chasing inflation developments, would stand little chance of anchoring it and would produce negative real interest rates medium-term as a result. The Fed on the other hand would hike its key rate more significantly than it is planning so far. In the end, US Dollar real interest rates would also be positive in that scenario.”

“What is decisive from the FX market’s point of view depends on the rule the central bank applies to set its rates. The Fed’s rule seems to be more suited for protection against negative inflation surprises. That too makes the Dollar attractive, not just the current rate advantage.”

-

11:31

India Bank Loan Growth meets forecasts (17.9%) in October 21

-

11:30

India FX Reserves, USD rose from previous $524.52B to $531.08B in October 28

-

11:19

USDCAD to breach sticky resistance at 1.38 on weak Canadian jobs pared with firm NFP

USDCAD will be a function of broad USD variation and US Nonfarm Payrolls. A mix of weaker CAD data plus stronger US NFP will leave sticky resistance around 1.38 vulnerable, economists at TD Securities report.

On-consensus CAD jobs unlikely to do much for the Loonie

“An on-consensus print for jobs is unlikely to do much for the CAD. Instead, we think the focus will be on US payrolls. That said, CAD has been rather resilient on the crosses so an on-consensus print for payrolls will likely see that extend.”

“Payrolls data will be rather important for USDCAD as the USD leg has been very dominant in driving variation in the pair. But we see a limit to USD dips with a resolutely hawkish Powell. Slippage in Canadian data is likely to become magnified in USDCAD rather than on CAD crosses, but we think over time, this will reverse course as the acute pressures Canada faces are consumer related.”

“1.38 will be sticky resistance, but we think it will be liable to break on stronger US and weaker CAD data.”

See:

- NFP Preview: Forecasts from 10 major banks, further significant job growth

-

Canadian Jobs Preview: Forecasts from five major banks, quite tepid jobs gain in October

-

11:16

When is the Canadian monthly jobs report and how could it affect USDCAD?

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly employment report for October later this Friday at 12:30 GMT. The Canadian economy is anticipated to have added 10K jobs during the reported month, down from the 21.1K rise reported in September. The unemployment rate is anticipated to edge higher from 5.2% to 5.3% in October.

According to analysts at NBF: “Recent economic indicators point to a slowdown in growth in Canada, a phenomenon that could be reflected in employment data. Layoffs may well have remained low during the month, but we believe this could have been offset by a slowdown in hiring amid declining small business confidence. Our call is for a 5K increase. Despite this gain, the unemployment rate may increase from 5.2% to 5.4%, assuming the participation rate rose one tick to 64.8% and the working-age population grew at a strong pace.”

How could the data affect USDCAD?

The data is more likely to be overshadowed by the simultaneous release of the closely-watched US jobs report - popularly known as NFP. That said, a significant divergence from the expected readings should influence the Canadian dollar and provide some meaningful impetus to the USDCAD pair. In the meantime, a sharp intraday rise in crude oil prices, to a nearly one-month high, underpins the commodity-linked Loonie. This, along with a modest US Dollar pullback from a two-week high touched on Thursday, is seen exerting heavy downward pressure on the major.

Strong domestic data should provide an additional lift to the Canadian dollar and pave the way for a further intraday depreciating move for the USDCAD pair. Spot prices might then turn vulnerable to weaken further below the 1.3600 mark and aim back to test the 1.3500 psychological mark, which now coincides with the 50-day SMA.

Conversely, any disappointment from the Canadian jobs data and (or) upbeat US NFP report should assist the USDCAD pair to attract fresh buying. Any attempted recovery, however, might confront some resistance near the 1.3675-1.3680 region. This is closely followed by the 1.3700 round figure and the next relevant hurdle near the 1.3735-1.3740 region. A sustained strength beyond the latter will negate any near-term negative bias and allow spot prices to aim back to conquer the 1.3800 mark.

Key Notes

• Canadian October Jobs Preview: Labor market upturn in the doldrums

• Canadian Jobs Preview: Forecasts from five major banks, quite tepid jobs gain in October

• USDCAD remains heavily offered below mid-1.3600s ahead of US/Canadian jobs data

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

-

11:05

Gold Price Forecast: XAUUSD unlikely to move much further from the lows – Commerzbank

Gold climbed toward $1,650 despite the hawkish Fed tone. However, the recovery is set to stall, strategists at Commerzbank report.

Gold under pressure following the hawkish remarks made by the Fed chair

“Fed Chair Jay Powell stressed that the speed of rate hikes was not so important anymore and that the key question was the level at which interest rates would finally peak. And this, Fed members now believe, looks set to be higher than they had assumed in September.”

“The Fed’s goal is to bring real interest rates into positive territory. This means that the key rate will remain at a high level until such time as the rate of inflation has fallen below it.”

“Generally speaking, the FOMC meeting turned out to be more hawkish than expected, which was then reflected in higher interest rate expectations and a firmer dollar and ultimately caused the Gold price to fall. Shortly before hitting its yearly low, Gold did a U-turn and began climbing again, though today’s US labour market report could put the brakes on its recovery again.”

See – NFP Preview: Forecasts from 10 major banks, further significant job growth

-

10:59

When is the US monthly jobs report (NFP) and how could it affect EURUSD?

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data for October. The popularly known NFP report is scheduled for release at 12:30 GMT and is expected to show that the economy added 200K jobs during the reported month, down from the 263K in September. The unemployment rate is anticipated to have edged higher from 3.5% to 3.6% in October. Apart from this, investors will take cues from Average Hourly Earnings, which could offer fresh insight into the possibility of a further rise in inflationary pressures.

Analysts at Societe Generale sound more optimistic and offer a brief preview of the important US macro data: “For October, we expect NFP to rise by 300K, faster than the 263K reported in September. Payrolls grew an average of 562K per month in 2021 and in the first half of 2022 they grew at a 444K pace. The unemployment rate is expected to hold steady at 3.5%, but we view a further decline to 3.4% as highly likely very soon. With employment gains above a 150-175K range per month, there is pressure for the unemployment rate to drop. We estimate the 150-175K pace as representing growth in the working-age population.”

How could the data affect EURUSD?

Ahead of the key release, the US Dollar retreats from a nearly two-week high touched the previous day and assist the EURUSD pair to regain some positive traction on Friday. Weaker US employment details might prolong the USD profit-taking slide and provide an additional lift to the major. That said, a more hawkish stance adopted by the Federal Reserve should limit deeper losses for the greenback.

Hence, any positive surprise should be enough to trigger a fresh leg up for the USD and attract fresh sellers around the EURUSD pair. This, in turn, suggests that any subsequent move up might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

Eren Sengezer, Editor at FXStreet, offers a brief technical overview and outlines important technical levels to trade the major: “EURUSD is facing interim resistance at 0.9800 (static level, psychological level) ahead of 0.9820 (200-period SMA on the four-hour chart, descending trend line). A four-hour close above the latter could be seen as a bullish sign and attract buyers. In case the Relative Strength Index (RSI) indicator rises above 50 on such development, the pair could extend its recovery toward 0.9860 (100-period SMA) and 0.9900 (psychological level).”

“On the downside, near-term support seems to have formed at 0.9740 (static level) before 0.9700 (psychological level, static level) and 0.9630 (Oct. 13 low),” Eren adds further.

Key Notes

• NFP Preview: Forecasts from 10 major banks, further significant job growth

• EURUSD Forecast: Euro needs to overcome 0.9820 to extend rebound

• EURUSD Price Analysis: Oversold oscillators in an uptrend structure triggers a bargain buy

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

-

10:31

GBPUSD to retest 1.10 over the next few days – ING

The Bank of England (BoE) hiked by 75 basis points but several details leaned in a dovish direction triggering a substantial fall in the Pound (-1.5% vs USD). Economists at ING expect GBPUSD to retest the 1.10 level.

A very dovish hike

“While the BoE hiked by 75 bps, it seemed to tweak the policy message to the dovish side as much as reasonably possible. The bottom line is that the BoE is essentially shutting the door to another 75 bps, and we expect a 50 bps hike in December.”

“The fiscal rigour brought by the new UK government may have already had a beneficial effect on the pound, and now the size of the current UK recession may become a primary currency driver. Indeed, the downside risks are still quite significant, and next week's GDP numbers will surely be watched quite closely: consensus is currently around a 0.4% quarter-on-quarter contraction.”

“Risks are skewed towards a re-test of 1.1000 in Cable over the next few days, with today's US payrolls possibly adding pressure on the pair.”

-

10:28

AUDUSD sits near daily high amid weaker USD, trades above mid-0.6300s ahead of US NFP

- AUDUSD regains positive traction on Friday amid broad-based USD weakness.

- A positive risk tone undermines the buck and benefits the risk-sensitive Aussie.