Notícias do Mercado

-

23:51

USDJPY is inside of last months highs and lows as NFP looms

- USDJPY is attempting to run higher but the Bank of Japan headwinds and Nonfarm Payrolls loom.

- The US dollar has remained in the driving seat following the Fed.

USDJPY has been creeping in on the US session and London highs, trading between 147.97 and 148.29 on Friday so far. The pair sticks to the front side of the micro trendline as illustrated below with no signs of a break in structure, so far, ahead of the key event of the day that will come in the US session.

There is always the threat of the Bank of Japan, BoJ, and Ministry of Finance, MoF, although, the Nonfarm Payrolls is a fixed schedule that traders are looking ahead to ahead of next week's inflation data. The recent volatility, stemming from the US Federal Reserve event on Wednesday has been a driver for forex over the recent sessions where the US dollar strengthened after the Fed's hawkish comments. Global equities fell while US Treasury yields rose on Thursday as a consequence while investors weighed the hawkish commentary with the prospects of further interest rate hikes targeted at reining in inflation. This would usually be bullish for the prior safe-haven yen, but the divergence between the Fed and BoJ has stripped the currency of such allure.

Powell said during a press conference that the "ultimate level" of interest rates is likely higher than previously estimated, and the central bank still has "some ways to go." This sent markets off a cliff, seeing the likes of the S&P 500 drop almost 100 points and the Dow by more than 500 points as rattled investors ran for cover while the two-year note climbed toward 5%. The yield on the benchmark 10-year note rose to 4.22%.

Meanwhile, the yen remains in demand vs the crosses and this could keep the threat of immediate intervention at bay. Japanese officials may decide to wait for the forthcoming data events as a guide to how strong the US dollar might get over the course of the weeks leading into the next Fed meeting in December.

USDJPY technical analysis

The price is headed into what would be expected to be a firm resistance area. The structure to the downside is located at 147.97, 147.61 and 147.28. While above these levels and on the front side of the micro trendline, the bias remains to the upside, however, with 149.71 eyed.

-

23:50

Japan Foreign Investment in Japan Stocks up to ¥337B in October 28 from previous ¥-356.6B

-

23:50

Japan Foreign Bond Investment: ¥-1172.5B (October 28) vs previous ¥164.5B

-

23:48

EURGBP sees fragile hurdles around 0.8740, upside looks likely amid UK recession

- EURGBP is looking to surpass the immediate hurdle of 0.8740 amid a recession in the UK.

- A severe slowdown in the UK economy has left less room for more rate hikes.

- The odds of a hawkish ECB have risen after ECB President cited that inflation is way too high.

The EURGBP pair is displaying signs of exhaustion in the upside momentum after a juggernaut rally to near 0.8740 in the early Asian session. The shared currency bulls had a ball on Thursday after the Bank of England (BOE) announced a rate hike by 75 basis points (bps).

It seems that the ‘Buy the Rumor Sell the News’ indicator was triggered on Thursday after BOE Governor Andrew Bailey announced a historic jump in interest rates. Pound bulls were severely punished after UK interest rates surged by 75 basis points (bps) for the first time since 1989 to 3.0%.

The extent of the rate hike was in line with the estimates. Also, UK Prime Minister Rishi Sunak and Chancellor Jeremy Hunt’s plan of squeezing liquidity from the market by tweaking fiscal policy are supportive of the BOE’s agenda of bringing price stability.

What is hurting the pound bulls is the least room for more hikes as economic prospects are extremely dark. The BOE has confirmed that the UK is already in recession and the situation will remain potentially two years longer than observed during the subprime crisis.

Goldman Sachs’ Chief European Economist Sven Jari Stehn wrote in his latest research note that the UK economic recession is likely to be deeper than previously forecast. “The country is likely to have a four-quarter cumulative fall in the gross domestic product (GDP) of 1.6%.” The investment banking firm has also lowered UK’s growth projections to 1.4% from -1.0% for 2023 on an annual basis.

On the Eurozone front, the hawkish commentary from European Central Bank (ECB) President Christine Lagarde has infused fresh blood into the shared currency bulls. On Thursday, ECB President cited that that inflation is way too high, ''we have to take action,'' She further added that the ECB will do whatever is needed and will use all instruments including balance sheet reduction.

-

23:37

US 10-year, 5-year inflation expectations refresh multi-day low

US inflation expectations portrayed a strong downside move on Thursday as traders reassessed updates from the US Federal Reserve (Fed). The same seemed to have probed the US Treasury yields’ upside momentum of late, which in turn challenges the US Dollar Index (DXY) bulls ahead of the key Nonfarm Payrolls (NFP) data for October.

That said, the inflation precursors, as per the 10-year and 5-year breakeven inflation rates per the St. Louis Federal Reserve (FRED) data, dropped to the lowest levels since October 19 and 13 in that order.

While noting the details, the longer-term inflation expectations dropped to the lowest level in three weeks whereas the 5-year benchmark slumped to the lowest levels in 12 days with the latest figures being 2.40% and 2.54% respectively.

The US Dollar Index (DXY) failed to justify the downbeat inflation expectations while refreshing the three-week high near 113.00, sidelined of late.

Moving on, the US employment report for October will be crucial for the market players to watch for fresh impulse. Forecasts suggest that the headline US NFP could ease to 200K in October from 263K prior while the US Unemployment Rate may increase to 3.6% from 3.5% prior.

Also read: US October Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

-

23:31

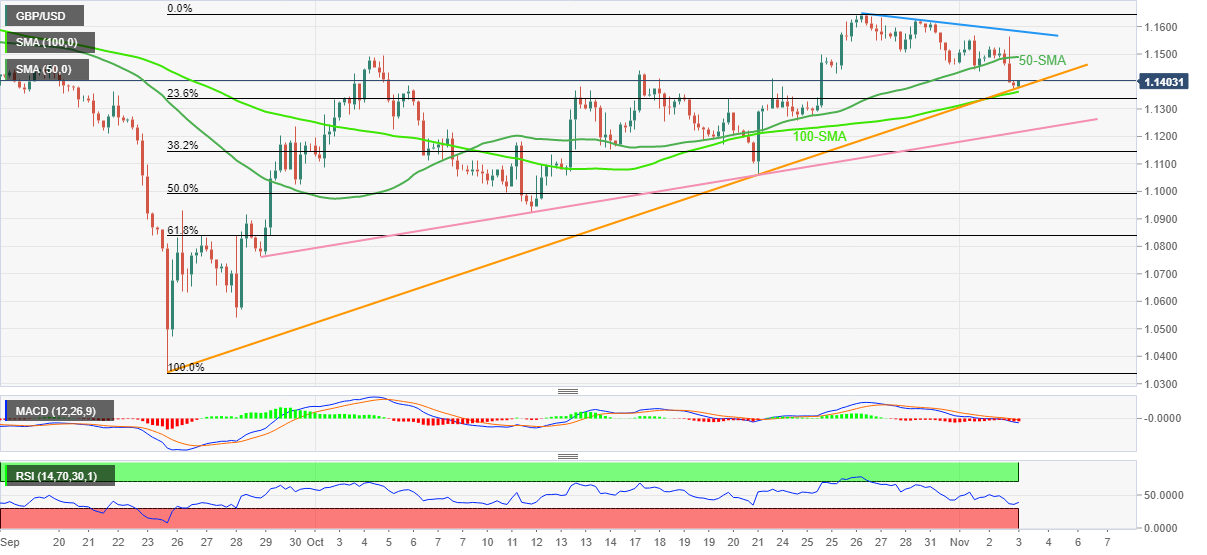

GBPUSD licks Fed/BOE-led wounds near 1.1150 ahead of US NFP

- GBPUSD bears take a breather at three-week low after falling the most in 1.5 months.

- BOE’s 75 bps rate hike couldn’t lure bulls amid recession woes.

- Hawkish Fed, geopolitical/covid concerns also underpinned US dollar strength.

- US employment data for October appears crucial for immediate directions, bears are likely to keep the reins.

GBPUSD steadies around a three-week low near 1.1160 following the biggest daily slump in 1.5 months as traders prepare for the US employment data for October during early Friday. Also keeping the Cable pair sidelined is the lack of major data/events.

Bank of England (BOE) hiked the monetary policy rate by 75 bps to 3.0% while matching the market forecasts. The “Old Lady”, as the BOE is informally known, also increased the inflation projections while cutting down the Gross Domestic Product (GDP) predictions from September forecasts. The central bank policymakers also signaled the longest and the shallowest economic recession ahead.

Following the rate announcements and the economic forecasts, BOE Governor Andrew Bailey said, “Bank rate may have to go up further.” The policymaker also stated that they maybe have the largest upside risk in inflation forecasts in MPC history.

The dovish rate hike from BOE drowned the GBPUSD prices and directed the bears toward the lowest levels since October 21. The quote’s bearish moves gained extra support from the market’s risk-off mood and strong US Treasury yields.

It should be noted that the mixed US data couldn’t stop the major currency pair from declining further. That said, US ISM Services PMI for October dropped to 54.4 from 56.7 prior and 55.5 market consensus. However, the Factory Orders matched 0.3% forecast versus 0.2% upwardly revised previous readings. It should be noted that the US S&P Global Composite PMI and Services PMI got an upward revision from their preliminary readings for the stated month whereas the Initial Jobless Claims eased to 217K for the week ended on October 28 versus 220K expected and 218K prior.

While portraying the mood, the Wall Street benchmarks closed in the red while the US 10-year Treasury yields refreshed a one-week high to 4.22% before retreating to 4.15%. Notably, the US 2-year bond coupons rose to the highest levels since 2007.

Moving on, GBPUSD may witness further grinding amid a lack of major data/events ahead of the US employment report for October. Forecasts suggest that the headline US NFP could ease to 200K in October from 263K prior while the US Unemployment Rate may increase to 3.6% from 3.5% prior. That said, the downbeat forecasts for the scheduled statistics signal a corrective bounce in case of a surprise. However, strong outcomes will allow bears to challenge the previous monthly low.

Also read: US October Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

Technical analysis

A clear downside break of a one-month-old ascending trend line and the 50-DMA confluence keeps GBPUSD bears hopeful.

-

23:16

AUDUSD: Recessionary fears in Australia and a hawkish Federal Reserve, to keep AUDUSD pressured

- The American Dollar remains in the driver’s seat, bolstered by the Federal Reserve Chair Jerome Powell.

- Positive US economic data underpinned the US Dollar, though justified the need for further tightening

- The Trade of Balance in Australia capped the AUD losses, though PMIs at recessionary territory weighed on the AUDUSD.

- AUDUSD Price Analysis: A fall below 0.6300 could exacerbate a fall towards 0.6209 ahead of testing the YTD low at 0.6169.

The Aussie Dollar is registering minimal gains as the Asian session kicks in, following a risk-off trading session as market participants assessed the Federal Reserve’s adjustments to its policy rate, saying that Jerome Powell and his colleagues would slow the size of rates increases but will revise up the Federal funds rate (FFR) projections for 2023. Additionally, the United States calendar revealed goodish economic data that weighed on the Australian Dollar. Hence the AUDUSD is trading at 0.6288 at the time of writing.

A dampened sentiment spurred by the Federal Reserve weighed on the AUD, bolstered the USD

Sentiment remains negative, as Wall Street’s ended with losses, while US equity futures prolong the ongoing week’s agony for the stock market. The Federal Reserve’s 75 bps rate hike and Fed Chair Jerome Powell’s hawkish press conference triggered risk aversion, a headwind for the AUD. Data from the US, like the ISM Non-Manufacturing PMI Index for October, confirmed a deceleration of the economy but persisted at expansionary territory at 54.4 vs. 55.5 estimates and 56.7, the previous month’s reading. At the same time, Factory Orders for September remained unchanged at 0.3% MoM, while the Jobless Claims for the week ending on October 28, rose by 217K, lower than the 220K estimated.

Given that economic data was positive for the United States economy, it’s not what the Federal Reserve is expecting, as it’s struggling to curb inflation at around 8% YoY levels, suggesting that the central bank would continue its tightening cycle until demand slows as expected.

The Balance of Trade in Australia registered a surplus, though weak PMIs and poor China data, headwinds for the AUD

Elsewhere, the economic calendar in Australia featured October’s S&P Global Services and Composite PMIs, which came lower than the previous reading, signaling that Australia´s economy is slowing faster than estimates. Also, the Balance of Trade printed a surplus of A$12.44 billion against A$8.85 billion foreseen, putting a lid on the AUDUSD fall on Thursday.

Additional factors, like China’s Caixin Services and Composite PMI, summed to a risk-off impulse, decreasing demand for the Aussie Dollar, as investors seeking safety turned to the US Dollar. The figures came at 48.4 and 48.3, respectively, illustrating that Covid-19 restrictions derailed the Chinese economy, weighing in its largest trading partner, Australia.

On Friday, the Australian economic calendar will feature Retail Sales and the RBA Statement of Monetary Policy (SoMP). On the US front, the US Nonfarm Payrolls report for October is awaited, alongside the Unemployment Rate.

AUDUSD Price Analysis: Technical outlook

After the Federal Reserve hiked rates on Wednesday, the AUDUSD remains downward biased, per the daily chart. The Fed day left a huge 140-pip candle, shy of testing the 50-day EMA, which pierced the 20-day EMA. But it retreated later in remarks by Federal Reserve Chair Jerome Powell, as the AUDUSD slid below the 20-day EMA as sellers gathered momentum.

That said, the AUDUSD is extending its losses and is eyeing the October 21 swing low at 0.6209, which, once cleared, could pave the way toward the YTD low at 0.6169. Nevertheless, if the AUDUSD reclaims 0.6300, it could climb towards the November 3 high at 0.6371, posing a real threat of challenging the psychological 0.6400.

-

23:14

USDCHF hovers around a three-year high at 1.0150, US NFP hogs limelight

- USDCHF is oscillating around a three-year high at 1.0148 amid a risk-off market mood.

- A better-than-projected US NFP could strengthen the DXY further.

- The DXY is looking to surpass the immediate hurdle of 113.00.

The USDCHF pair is displaying a lackluster performance from the late New York session after a juggernaut rally that pushed the asset to near three-year high at 1.0148. The asset has witnessed a stellar buying interest after overstepping the psychological hurdle of 1.0000.

The greenback bulls enjoyed bids from the market participants as the risk-off profile continued on Thursday. S&P500 faced sheer volatility and dropped more than 1% as hawkish Federal Reserve (Fed) guidance has forced economists to cut their corporate earnings guidance led by higher interest obligations.

Meanwhile, the US dollar index (DXY) is hovering around the 113.00 hurdle and may overstep the same amid a negative market mood. The 10-year US Treasury yields have climbed to 4.15 as the odds of continuation of a bigger rate hike are solid.

Going forward, the US employment data will be of utmost importance. As per the projections, the US Nonfarm Payrolls (NFP) data is seen at 200k, lower than the prior release of 263k. While the jobless rate could increase to 3.6%. It is worth noting that employment opportunities are rising in the US economy but at a declining rate for the past three months, which seems to be the result of accelerating interest rates by the US central bank.

Apart from the payroll additions, the Average Hourly Earnings data holds significant importance. The labor cost data is seen lower at 4.7% vs. the prior release of 5.0%. A decline in earnings could dent households’ sentiment as higher payouts won’t get offset by subdued earnings.

On the Swiss franc front, the headline Consumer Price Index (CPI) has dropped to 3.0% on an annual basis against the projections of 3.25 and the prior release of 3.3%. This may force the Swiss National Bank (SNB) not to turn extremely hawkish on monetary policy ahead.

-

23:08

AUDJPY grinds lower towards 93.00, yields, RBA Monetary Policy Statement eyed

- AUDJPY grinds lower towards 93.00, yields, RBA Monetary Policy Statement eyed

- AUDJPY seesaws around three-week low, eyes the first daily gain in four.

- Risk aversion and mixed Aussie data weigh on prices.

- Fears of Japan's intervention, dovish RBA statement keep sellers hopeful.

- Australia’s Q3 Retail Sales, the bond market’s performance eyed as well.

AUDJPY portrays the typical pre-event anxiety during early Friday morning in Asia. That said, bears take a breather the lowest levels since October 17, also probing the three-day downtrend, ahead of the key Reserve Bank of Australia (RBA) Monetary Policy Statement (MPS). Also important is the third quarter (Q3) detail of Australia’s Retail Sales, not to forget Japan’s return from holiday.

AUDJPY justified its risk-barometer status in the last few days amid the global central bankers’ rush towards higher rates, which in turn amplifies the recession fears. Recently, the US Federal Reserve (Fed) and the Bank of England (BOE) were among the same while comments from the European Central Bank (ECB) policymakers also raised such concerns.

Additionally, mixed data from Australia and China also exerted downside pressure on the AUDJPY prices of late. That said, China’s Caixin Services PMI for October dropped to the lowest level in five months while flashing 48.4 figure versus 49.3 prior. Further, Australia’s trade surplus increased to 12,444M in September versus 8,850M expected and 8,324M prior while the Exports rallied by 7.0%, compared to 2.6% prior. However, the growth of the Imports dropped to 0.4% versus 4.5% prior.

Earlier in the day, Australia’s AiG Performance of Construction Index for October eased to 43.3 versus 46.5 prior.

Elsewhere, the off in Japan, fears of Tokyo intervention and covid woes from China, not to forget the latest geopolitical tension emanating from North Korea, also weigh on the AUDJPY prices.

Against this backdrop, the Wall Street benchmarks closed in the red while the US 10-year Treasury yields refreshed a one-week high to 4.22% before retreating to 4.15%. Notably, the US 2-year bond coupons rose to the highest levels since 2007.

Looking forward, AUDJPY prices may witness further downside amid the market’s risk-off mood, as well as the likely dovish tone of the RBA’s MPS. However, Japan’s return from the holiday and any improvement in Aussie Q3 Retail Sales, expected at 0.4% QoQ versus 1.4% prior, might trigger the cross-currency pair’s corrective bounce.

Technical analysis

A daily closing below the 21-DMA, around 93.65 by the press time, directs AUDJPY towards the 200-DMA support level of 91.75.

-

23:04

Australia AiG Performance of Construction Index dipped from previous 46.5 to 43.3 in October

-

23:04

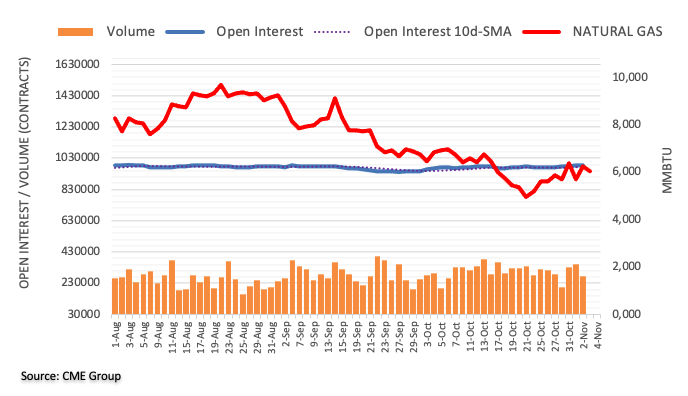

Oil market developments: Saudis to lower prices for Asia, US Biden expected to release more SPR

A series of news regarding the oil sector has come out in early Asia which may have an impact on the price of oil in the coming sessions.

Firstly, the US Department of Energy said it sold 15 million barrels of oil from the Strategic Petroleum Reserve which has completed the last batch of the largest-ever release from the stockpile. therefore, US President Joe Biden will be expected to release more. Additionally, the Saudis have said they will lower oil prices for Asian customers next month. This news dropped at the same time that the G7 agreed to fix a price cap on Russian oil.

Meanwhile, US oil declined on Thursday, with prices pressured by strength in the US dollar and concerns that aggressive rate hikes by Federal Reserve will lead to an economic recession. At the time of writing, WTI is trading at $87/95bbls.

-

22:46

EURUSD Price Analysis: Looks set to test 0.9680 support level

- EURUSD stays pressured around two-week low, braces for the first weekly loss in three.

- Clear break of five-week-old previous support line, bearish MACD signals favor sellers.

- A 1.5-month-long horizontal support can test bears before the yearly low.

- 21-DMA acts as an extra filter to the north, 61.8% FE can lure bears past 0.9535.

EURUSD remains on the back foot around the lowest levels in two weeks, pressured near 0.9745 during Friday’s Asian session.

In doing so, the major currency pair justifies the previous day’s upside break of an upward-sloping support line from late September, now resistance around 0.9775. Also increasing the strength of the bearish bias are the downbeat MACD signals and the RSI (14) conditions.

As a result, the EURUSD bears are all set to aim for the six-week-old horizontal support surrounding 0.9680 before targeting the yearly low near 0.9535.

If the pair bears keep the reins past 0.9535, the 61.8% Fibonacci Expansion (FE) of the quote’s moves between late June and October 26, around 0.9420, will gain the market’s attention.

Alternatively, an upside clearance of the support-turned-resistance line of 0.9775 is an open invitation to the EURUSD bulls as the 21-DMA level of 0.9828 guards the quote’s short-term recovery.

Even if the quote stays successfully beyond 0.9830, the EURUSD pair’s further upside remains doubtful as the 100-DMA and October’s peak, respectively around 1.0050 and 1.0095, could test the bulls before giving them control.

EURUSD: Daily chart

Trend: Bearish

-

22:35

NZDUSD Price Analysis: 200-EMA hammers antipodean, downside inevitable below 0.5740

- A declining highs structure has confirmed a bearish reversal in the asset.

- Negative risk traction has underpinned the greenback bulls.

- Stabilization below the 200-period EMA is supporting the downside bias.

The NZDUSD pair is displaying a rangebound structure in the early Tokyo session after facing barricades near the round-level resistance of 0.5800. The pullback move from Thursday’s low at 0.5741 could get concluded due to the risk-aversion theme.

The market profile is extremely negative post hawkish guidance from the Federal Reserve (Fed) and has forced economists to slash already weak economic projections and earnings guidance. Meanwhile, the US dollar index (DXY) is aiming to shift comfortably above the immediate hurdle of 113.00.

On an hourly scale, the commodity-linked currency has turned extremely weak as the asset has formed a lower-high lower-low structure, which indicates a bearish reversal. Stabilization below the 200-period Exponential Moving Average (EMA) at 0.5798 is supporting the downside bias.

The 20-period EMA at 0.5786 has slipped below the 200-EMA, which signals that the downside momentum has been triggered.

Also, the Relative Strength Index (RSI) (14) is struggling to break the 40.00 hurdle on the upside.

Going forward, a downside break of Thursday’s low at 0.5741 will drag the commodity-linked pair toward the round-level support at 0.5700, followed by October 24 low at 0.5657.

Alternatively, the kiwi bulls could regain strength if the asset oversteps October 31 high at 0.5836, which will drive the asset towards Tuesday’s high at 0.5903. A breach of the latter will expose the asset to recapture November’s high at 0.5944.

NZDUSD hourly chart

-638031116933952500.png)

-

22:18

USDCAD bulls flirt with 1.3750 ahead of US/Canada Employment data

- USDCAD steadies around two-week top, probes six-day uptrend.

- Firmer yields, risk aversion underpinned US dollar but mixed US data tests DXY bulls.

- Cautious mood ahead of the key statistics may restrict the pair’s immediate moves.

- Hawkish Fed, sour sentiment and firmer yields could favor bulls, NFP is the key.

USDCAD remains sidelined around 1.3745, after refreshing the fortnight high, as traders await crucial employment data from the US and Canada during early Friday. The Loonie pair rose for six consecutive days in the past before the latest inaction around the multi-day top. That said, the market’s rush for risk safety and softer prices of Canada’s key export, the Crude Oil, appeared to have favored the quote’s latest upside.

WTI crude oil prices dropped nearly 1.7% to $87.98 by the end of Thursday’s North American session, trading nearby by the press time, as fears of recession amplify as the major central banks keep fueling the benchmark rates. Also weighing on the black gold prices could be the covid woes from China and the latest headlines suggesting the Group of Seven (G7) has agreed to put a cap on Russian oil prices.

Elsewhere, the US Dollar Index (DXY) extended its post-Fed run-up towards refreshing the highest levels in two weeks. Increased risk aversion amid fears of higher rates and economic slowdown, as conveyed by policymakers from the Bank of England (BOE) and the European Central Bank (ECB), appears the key catalyst for the greenback’s latest run-up. On the same line could be the firmer yields. However, mixed US data seemed to have probed the DXY bulls ahead of the all-important US Nonfarm Payrolls (NFP).

US ISM Services PMI for October dropped to 54.4 from 56.7 prior and 55.5 market consensus. However, the Factory Orders matched 0.3% forecast versus 0.2% upwardly revised previous readings. It should be noted that the US S&P Global Composite PMI and Services PMI got an upward revision from their preliminary readings for the stated month whereas the Initial Jobless Claims eased to 217K for the week ended on October 28 versus 220K expected and 218K prior.

Amid these plays, the Wall Street benchmarks closed in the red while the US 10-year Treasury yields refreshed a one-week high to 4.22% before retreating to 4.15%. Notably, the US 2-year bond coupons rose to the highest levels since 2007.

Moving on, USDCAD traders may witness lackluster moves ahead of the key jobs report from the US and Canada. Forecasts suggest that the headline US NFP could ease to 200K in October from 263K prior while the US Unemployment Rate may increase to 3.6% from 3.5% prior. On the other hand, Canada’s Net Change in Employment may also ease to 10K versus 21.1K prior with the Unemployment Rate likely witnessing an uptick to 5.3% from 5.2% prior.

That said, the scheduled numbers may fail to impress USDCAD traders by matching the downbeat forecasts. However, the Fed’s hawkish performance versus the Bank of Canada’s (BOC) easy rate hike could keep the buyers hopeful, especially amid softer Oil prices.

Also read: Canadian October Jobs Preview: Labor market upturn in the doldrums

Technical analysis

A successful trading beyond the three-week-old resistance line, now support around 1.3650, keeps the USDCAD pair buyers hopeful of visiting the yearly high surrounding 1.3980.

-

21:59

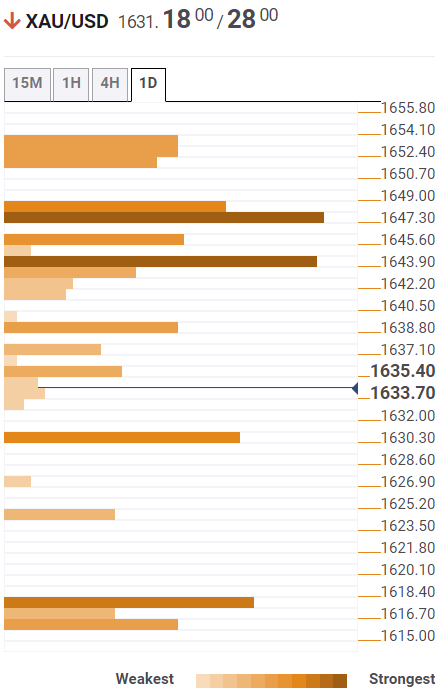

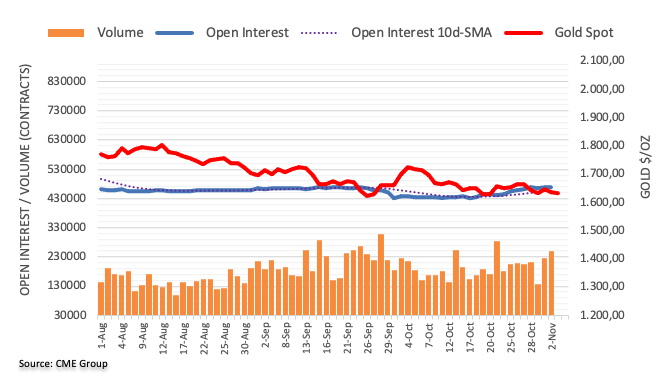

Gold Price Forecast: XAUUSD struggles around $1,630 ahead of US NFP data

- Gold price has faced hurdles while attempting to cross the immediate hurdle of $1,632.45.

- S&P500 continued facing sell-off as the risk aversion theme remained intact.

- The release of the US NFP data will provide some clarity for further Fed’s monetary policy action.

Gold price (XAUUSD) is facing barricades around the critical hurdle of $1,632.45 in the early Tokyo session. The precious metal has remained sideways around $1,630.00 after a rebound move post registering a fresh two-week low at $1,616.67 on Thursday. The gold prices are expected to continue auctioning into a rangebound structure as investors have shifted to focus on the US Nonfarm Payrolls (NFP) data.

Meanwhile, the risk profile has extended its sour performance as S&P500 witnessed a sell-off consecutively on Thursday. Also, the 10-year US Treasury yields accelerated to 4.15% after hawkish guidance from the Federal Reserve (Fed) enchanted risk aversion on market mood.

On Friday, the release of the US employment data will provide cues about Fed’s intentions toward December’s monetary policy. A higher-than-expected improvement in job additions data would delight Fed chair Jerome Powell to continue the current pace of hiking interest rates.

As per the projections, the US NFP is seen at 200k, lower than the prior release of 263k. While the jobless rate could increase to 3.6%.

Gold technical analysis

On an hourly scale, gold prices have resurfaced firmly after printing a fresh two-week low at $1616.67. The precious metal is auctioning above the 10-period Exponential Moving Average (EMA) at $1,626.50 and testing the upside break of the 20-EMA around $1,630.00.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range, which indicates that the gold bulls are not facing now downside momentum for now.

Gold hourly chart

-

21:58

EURJPY Price Analysis: Reverses at the 20-day EMA, eyeing 143.00

- EURJPY fails to crack the confluence of resistance and the 20-DMA around 145.40.

- JPY buyers are gathering momentum, as shown by the RSI at bearish territory, aiming downward.

The EURJPY slides a minuscule 0.05% as the Asian Pacific session begins, courtesy of a risk-off impulse that weighed on the EUR, which registered losses of 0.45% vs. the JPY on Thursday. At the time of writing, the EURJPY is trading at 144.50.

EURJPY Price Analysis: Technical outlook

The EURJPY daily chart displays that Japanese Yen buyers are gathering momentum due to some reasons. First, since hitting the 2022 year high at 148.40, the cross-currency pair hoovered within a range for five days before tumbling to fresh weekly lows at 144.03. Second, the Relative Strength Index (RSI) crossed beneath the 50-midline with a bearish slope, suggesting a test of the 50-day Exponential Moving Average (EMA) at 143.12 is on the cards.

For that scenario to play out, the EURJPY's first support would be the 144.00 mark. Key support levels lie at the October 24 daily low at 143.72, followed by the previously mentioned 50-day EMA at 143.12. The break below will expose the psychological 143.00.

Contrarily, if EUR bulls reclaim 145,00, the EURJPY could climb towards 146.00, which, once cleared, could lay the ground towards the psychological 147.00, ahead of the YTD high hat 148.40.

EURJPY Key Technical Levels

-

21:12

GBP/USD Price Analysis: Bears move in on a fresh layer of support

- GBP/USD bears are now taking on a new layer of support.

- Bulls eye a correciton for the end of the week.

As per the prior analysis that was made after the Federal Reserve event on Wednesday and during high volatility, GBP/USD Price Analysis: Bears pounce on the bulls and drag them back to channel support, the price has followed the trajectory as forcasted.

GBP/USD prior analysis

It was stated that the price had dropped into the channel's support following Powell's pushback against rallying risk markets when pressed for commentary around the timings of a pivot. However, it was argued that on a break of support, there was a void of liquidity according to the rally that took place on October 25:

It as argued that the most likely trajectory from here would be for a correction prior to the next impulse to the downside, and thats what we got, woth a follow through to the next layer of support:

The price might be expected to correct at this juncture but the Nonfarm Payrolls will be the clicher in the start of the North American day on Friday:

-

20:52

AUDUSD Price Analysis: Struggles at the 20-DMA and dives beneath 0.6300

- AUDUSD reached a new weekly low at around 0.6271 after hitting a weekly high at 0.6491.

- If the AUDUSD registers a daily close below 0.6300, it could exacerbate a fall towards 0.6209 ahead of testing the YTD low at 0.6169.

The AUDUSD plummets below the 0.6300 figure and beneath the 20-day Exponential Moving Average (EMA), extending its fall for six consecutive days after failing to crack the 50-day EMA at around 0.6548 since October 27. Hence, the AUDUSD tumbled and is trading at 0.6289, below its opening price by 0.86%, at the time of typing.

AUDUSD Price Analysis: Technical outlook

After the Federal Reserve hiked rates on Wednesday, the AUDUSD remains downward biased, per the daily chart. The Fed day left a huge 140-pip candle, shy of testing the 50-day EMA, which pierced the 20-day EMA. But it retreated later in remarks by Federal Reserve Chair Jerome Powell, as the AUDUSD slid below the 20-day EMA as sellers gathered momentum.

That said, the AUDUSD is extending its losses and is eyeing the October 21 swing low at 0.6209, which, once cleared, could pave the way toward the YTD low at 0.6169. Nevertheless, if the AUDUSD reclaims 0.6300, it could climb towards the November 3 high at 0.6371, posing a real threat of challenging the psychological 0.6400.

AUDUSD should be aware that the Relative Strength Index (RSI) is below the 50-midline with a bearish slope, suggesting the downtrend would likely continue in the near term.

AUDUSD Key Technical Levels

-

20:12

EURUSD is sinking into key support territory with a break of 0.9703 eyed

- EUR/USD bears are in control but the daily structure is intact still.

- The bulls could be about to move in from key support.

EUR/USD dropped on the day to test a key support area between 0.9750 and the low of the day at 0.9730. The price is pressured om a stronger US dollar following the prior day's Federal Open Maret Committee meeting that ended with a blow-off in risk assets due to the comments from Fed Chair Jerome Powell.

Treasury yields jumped on Thursday, with the two-year note climbing toward 5% due to Powell saying the "ultimate level" of the US central bank's policy rate would likely be higher than previously estimated. He said that after the Fed announced that they had raised that interest rates by 75 basis points, as expected, to push its target range to 3.75%-4.0%.

ECB/Fed divergence weighs

However, bond and equity markets have sold off on the hawkish stance, supporting the US dollar and remained under pressure on Thursday while traders are roughly evenly split between the odds of a 50 basis-point and 75 basis-point rate hike in December. The peak Fed funds rate is seen climbing to at least 5%, compared with a prior view of 4.50%-4.75% rise and that is fuelling a divergence between the Fed and the European Central Bank given the dovish rhetoric from the ECB's governor, Christine Lagarde.

Lagarde emphasised a data dependency and the meeting-by-meeting approach following the meeting that took place last week. There was no discussion about ending the QE reinvestment policy. Subsequently, Rates markets lowered the ECB's expectations for further rate hikes by around 25bp yesterday and are now pricing 57bp for the December meeting with a peak in the ECB deposit rate to around 2.6%.

EUR/USD technical analysis

The analysis above was posted after the FOMC on Wednesday and it stated that the daily chart was pointing to a lower level as its tried to break the trendline. ''The M-pattern's last leg is relatively short compared to the front side of the formation so it could be expected to extend lower in the coming sessions on Thursday. However, 0.9700 could be a tough nut to crack.''

The price has extended the last leg of the M-formation and a correction is to be expected at this juncture into the neckline, or at least into the 38.2% Fibonacci level near 0.9830. also to note, the price is now on the backside of the trendline, outside of the symmetrical triangle but is yet to break the daily structure of 0.9703.

-

20:05

GBPJPY Price Analysis: The pound dives to test support area at 65.00

- The pound has accelerated its reversal from week highs at 172.00.

- A breach of 165.00 would cancel the upside trend from late-September lows.

The Sterling depreciated across the board on Thursday, hammered by the dovish tone of BoE Bailey’s press release after November’s monetary policy decision. In this context, downward pressure on the GBPJPY has gathered pace, accelerating the reversal from 172.25 highs on Monday to test support at the 165.00 area.

A successful breach of the 165.00 level, (October 10 21, and 24 lows) would negate the upward trend from late=September lows and increase bearish pressure towards the 50 and 100 days SMAs, now at 164.00/15 area and, below there, probably 162.60 (October 11 high).

On the upside, the pair should break intra-day resistance at 166.00 and 167.15 to ease the near-term’s bearish pressure and aim toward session high at 168.20.

GBPJPY daily chart

Technical levels to watch

-

20:04

Forex Today: US Nonfarm Payrolls report to close a busy week

What you need to take care of on Friday, November 4:

The American Dollar extended its post-Fed rally and reached fresh weekly highs against most of its major rivals. Soaring government bond yields underpinned the greenback, as the yield on the 2-year Treasury note touched its highest level since 2007 at 2.74%.

The focus was on the Bank of England, which hiked its benchmark rate by 75 bps as anticipated. However, policymakers downwardly revised the growth forecast, anticipating the recession will continue well into the future. Policymakers now expect the UK economy to contract by 1% in 2024, compared to 0.25% in the previous meeting. Also,UK Prime Minister Rishi Sunak and Chancellor Jeremy Hunt are said to be planning tax hikes for roughly £40billion over the next 5 years. The GBPUSD pair ended the day with sharp losses at around 1.1160.

Dollar’s rally stalled after the release of mixed US data, with investors particularly eyeing a tepid ISM Services PMI, which fell to 54.4 in October, worse than anticipated. Wall Street trimmed most of its intraday losses, although the three major indexes closed in the red.

The EURUSD pair hovers around 0.9750 after falling to 0.9729. Commodity-linked currencies extended their slides against the American dollar, with AUDUSD now hovering around 0.6300 and USDCAD trading at around 1.3740.

Gold flirted with the year’s low before bouncing now at around $1,630 a troy ounce. Crude oil prices eased, with WTI changing hands at $88.20 a barrel.

On Friday, the US will release the October Nonfarm Payrolls report, with the country expected to have added 200K new jobs in the month. The Unemployment Rate is foreseen to tick higher from the current 3.5% to 3.6%.

Bitcoin Price Prediction: These on-chain metrics suggest bears are underwater

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:54

BoE's Mann: Need to do more if inflation keeps rising

Bank of England's Catherine Mann said there still is a lot of momentum in drivers of inflation and they will need to do more if inflation keeps rising.

Her comments come after the central bank today hiked interest rates by 75 bps in what was the biggest incremental hike since 1989.

However, the pound remains pressured on the day, falling to a low of 1.1153 and by some 2%.

''The trigger for the poor reaction for GBP was the guidance from the Bank that while 'further increases in Bank Rate may be required for a sustainable return of inflation to target,'' analysts at Rabobank explained.

''The upshot is that today’s move has been perceived as a dovish hike by markets and once again GBP is reacting to the gloomy projections from the Bank rather than to the fact that the Bank rate is now higher- albeit to a level that was already priced in.''

-

19:22

NZDUSD trims daily losses and returns to 0.5780

- New Zealand's dollar picks up from session lows at 0.5740, returns to the 0.5780 area.

- The kiwi has lost nearly 1% following US Fed's monetary policy decision.

- NZDUSD should break 0.5880 before further appreciation is likely – UOB.

The New Zealand dollar has trimmed losses on Thursday’s US session, bouncing up from one-week lows at 0.5740 and returning to 0.5780 so far. The par, however, is 0.6% lower on the day and has lost nearly 1% following the US Federal Reserve’s monetary policy decision.

The dollar reigns after Fed’s decision

The greenback outperformed the rest of the majors on Thursday, boosted by the hawkish comments of the Federal Reserve’s president, Jerome Powell, at the press release held after the monetary policy decision was released.

The bank met expectations with a 0.75% hike, but Powell signaled to further monetary tightening and suggested that rates might peak at levels above the market expectations. These comments surprised the markets, which had anticipated the possibility of a dovish pivot, and sent the US dollar rallying.

US macroeconomic data dented US strength earlier today, with the ISM Services PMI deteriorating to 54.4 in October from 56.7 in September, beyond the 55.5 expected.

Furthermore, preliminary data anticipated that US non-farm productivity increased by 0.3%, well below the consensus of 0.6% in the third quarter, with unit labor costs slowing down to 3.5% from 8.9% in the previous quarter.

NZD/USD should close above 0.5880 before further advance is likely – UOB

FX analysts at UOB see the pair in a consolidative mood while below 0.5880: NZD could rise, but it has to close above 0.5880 before further sustained advance is likely. NZD did not close above 0.5880 and yesterday (02 Nov), it dropped to a low of 0.5815 before extending its decline in early Asian trade. Upward pressure has subsided and we expect NZD to trade between 0.5740 and 0.5900 for the time being.”

Technical levels to watch

-

19:11

Silver Price Analysis: XAGUSD climbs above $19.50 amidst a buoyant US Dollar

- Silver price trims some of Wednesday's losses, despite high US Treasury yields.

- The XAGUSD daily chart depicts the precious metal as neutral-to-downward biased, with key resistance at $20.00.

- Short term, a break above $20.00 will open the door toward $21.00; otherwise, it would challenge $19.00.

Silver price recovered some ground on Thursday, even though the American Dollar is rising more than 0.70%, as shown by the US Dollar Index, underpinned by high US Treasury bond yields after the Federal Reserve raised rates by 75 bps. At the time of writing, the XAGUSD is trading at $19.50, above its opening price by 1.56%, after hitting a daily low of $18.84.

Silver Price Analysis (XAGUSD): Technical outlook

XAGUSD bias remains neutral-to-downward biased, even though it cleared the 50-day Exponential Moving Average (EMA) at $19.10 and is battling the 100-day EMA at $19.46. The Relative Strength Index (RSI) is in bullish territory suggesting the XAGUSD is headed upward, but a clear break above $20.00 is needed to shift the bias to neutral. On the flip side, if the XAGUSD closes below the 100-day EMA, a fall toward the 50-day EMA is on the cards, ahead of a $19.00 test.

The XAGUSD one-hour chart portrays a different picture, with the white metal bias as neutral-to-upwards. Nevertheless, it should be noted that XAGUSD price action shows a wide-trading range, spurred on a Fed day, turning the hourly EMAs almost flat, meaning that the XAGUSD is consolidating. Further confirmation was provided by the RSI being in bullish territory but nearly flat.

XAGUSD key resistance levels lie at $20.07, the November 2 high, followed by the October 7 daily high at $20.82, ahead of $21.00. On the flip side, the XAGUSD first support would be the 50-hour EMA at $19.45, followed by the confluence of the 100 and the 200-hour EMAs at $19.38, followed by the $19.00 figure.

Silver Key Technical Levels

-

18:46

ECB's Lagarde: Inflation way too high, we have to take action

The European Central Bank President Christine Lagarde said on Thursday that inflation is way too high, ''we have to take action,'' adding that the ECB will do whatever is needed and will use all instruments including balance sheet reduction.

Earlier, she was quoted saying, "we have to be attentive to potential spillovers'' and, "we are not alike and we cannot progress either at the same pace (or) under the same diagnosis of our economies."

"But we are also influenced by the consequences, particularly through the financial markets, and to a lesser extent, through trade as well, because clearly the exchange rate matters and has to be taken into account in our inflation projections," Lagarde said.

More to come...

-

18:44

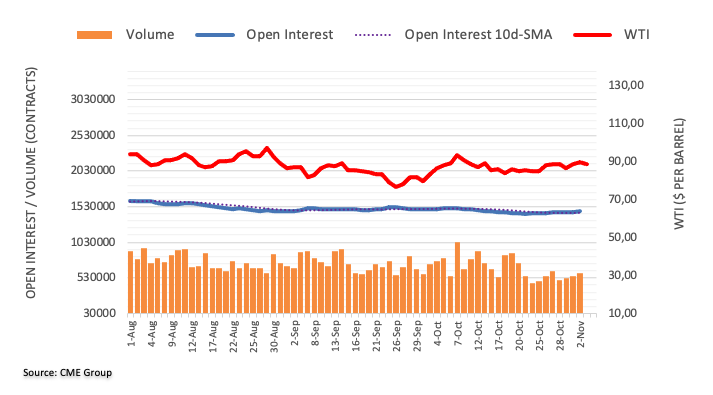

WTI approaching the $88.00 area with upside moves capped at $89.00

- Oil prices retreat from the $90.00 area to levels near $88.00.

- A strong US dollar, following Fed's decision is weighing on crude prices.

- WTI faces a key resistance area at $90.00.

WTI Oil might have peaked right above $90 this week, as crude prices pulled back on Thursday, to pare gains after a two-day recovery. The West Texas Intermediate has depreciated about 2% so far today, weighed by the US dollar's strength.

The US dollar surges after Fed’s decision

A soaring greenback has been pushing crude prices lower after Wednesday’s US Federal Reserve monetary policy decision. The bank hiked rates by 0.75% as expected and confirmed its commitment to continue tightening borrowing costs.

Fed president, Jerome Powell surprised the market with a hawkish rhetoric at the press conference, where he refused the idea that the bank might have overtightened and suggested that interest rates may peak at levels above the market expectations. These remarks curbed investors' expectations of a dovish pivot in December and sent the US dollar surging across the board.

US macroeconomic data, however, have not been particularly dollar-supportive on Thursday, especially the ISM services PMI, which has shown a weaker-than-expected increase on the sector’s activity in October, triggering a moderate pullback on the USD.

WTI capped below trendline resistance near $90.00

From a wider perspective, the WTI remains in its positive trend from late September lows, yet capped by the trendline resistance from early July highs, now at $90.00, which should give way to expose the 100-day SMA, at $91.50 before the October 10 high at 92.55.

On the downside, below session lows at $87.00, a successful move beyond the 50-day SMA and trendline support near $85.50 would negate the near-term bullish trend exposing the October 31 low at $84.70.

WTI daily chart

Technical levels to watch

-

18:27

USDJPY Price Analysis: At a crossroads, traders cautious on BoJ, will they or won't they?

- USDJPY rising into BoJ intervention territories.

- The pair is in no man's land between 148.70 and 146.20, risks are balanced.

USDJPY has been climbing on the day, rising 0.26% to a current 148.30 at the time of writing, travelling between 147.11 the low to 148.45 so far. Meanwhile, traders continue to watch for any further official intervention to shore up the battered Japanese currency. The overall picture for USDJPY is a mixed one from a daily perspective as the price trades between no man's land, 148.70 and 146.20:

USDJPY daily chart

As illustrated, the price is wedged into a coil between the said levels in the main with a current bias to the upside on a break of 148.70. However, as the following near-term charts will show, there is the threat of intervention from the Bank of Japan, BoJ.

USDJPY H1 charts

The price is climbing towards prior highs and this raises the prospects of intervention from the BoJ/Ministry of Finance, MoF. Therefore, given that the price is on the backside of the prior trend, there are prospects of a switch-up to the downside, as follows:

There has already been a break of structure, (BoS), so failures below the current resistance of 149.00 could see a significant drop below 147.00 to target 145.00.

-

18:26

GBPUSD plummets to two-week lows below 1.1170, courtesy of BoE’s dovish language, UK recession fears

- The British Pound tanks more than 200 pips weighed by BoE’s Governor Bailey, saying that rates would be lower than market expectations.

- The American Dollar continues to rise against most G8 currencies, bolstered by Fed commentary and US Services PMI.

- GBPUSD traders brace for the October US Nonfarm Payrolls report on Friday.

The GBPUSD continues to drop during Thursday’s North American session, following rate hikes by the Bank of England (BoE) and the Federal Reserve (Fed), lifting overnight rates by 75 bps. However, the interest rate differential favors the American Dollar to the detriment of the Pound Sterling. At the time of writing, the GBP/USD is trading at 1.1163, plunging to fresh two-week lows, down almost 2%.

The BoE Governor Bailey pushed back against peaking rates around 5%, and the GBPUSD sank

The BoE’s decision further than to help the British Pound weakened the currency, as the central bank pushed back against market expectations to hike the Bank Rate towards 5%. The BoE Governor Andrew Bailey said, “Further increases in Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets.” The central bank added that the UK economy entered a recession in the three months through September, with output falling an estimated 0.5%. The BoE expects a “long-lasting recession” will hit the UK, and the duration would depend on how high the BoE hike rates.

In addition, the lack of a fiscal plan, as the new Prime Minister (PM) Rishi Sunak delayed Chancellor’s James Hunt plan, as Sunak, a previous finance minister, wants to have some input regarding the UK’s new budget.

The US Dollar extends its gains propelled by upbeat US economic data

Elsewhere, the US Dollar remains underpinned by the Federal Reserve Chair Jerome Powell’s hawkish commentary, saying that rates would be higher than September’s forecast. Data-wise, the US economic calendar revealed that business activity in the services sector, as reported by the ISM, decelerated to 54.4 from 56.7 in September, suggesting the economy is cooling. Concerning the US labor market, the US Department of Labor reported Initial Jobless Claims for the week ending on October 28 were lower than expected and rose by 217K vs. 220K forecasts

GBPUSD Key Technical Levels

-

17:57

EURGBP’s rally from 0.8600 stalls right below 0.8740

- The euro consolidates above 0.8710 after rallying from the 0.8600 area.

- The pound sells off after BoE's dovish hike.

- EURGBP expected to move lower in the long-term – Danske Bank.

The euro is taking a breather right below 0.8740 following a nearly 1.3% rally against a vulnerable GBP on Thursday. The pair bounced up from session lows at 0.8600, to consolidate between 0.8710 and 0.8735 at the moment of writing.

BoE’s dovish hike sends the pound tumbling

The sterling has dropped across the board following the Bank of England’s dovish comments in the press conference that followed November’s monetary policy decision.

The Bank of England has hiked rates by 75 basis points, with two committee members voting for a softer hike. Beyond that, they signaled to a softer tightening pace over the next months, which has triggered a broad-based pound sell-off.

BoE President, Andrew Bailey has depicted a bleak economic outlook in the press release following the bank's decision, warning that the country might have already entered a recession that could last two years and cause a 2.9% economic contraction.

EURGBP expected to depreciate in the long-term – Danske Bank

FX analysts at Danske Bank see the pair picking up in the short term, to depreciating in the longer term: “We see a case for EURGBP to remain elevated in the near-term, but in the longer-term expect the cross to move lower as a global growth slowdown and the relative appeal of UK assets to investors are positive for GBP relative to EUR.

Technical levels to watch

-

17:47

S.Korean Defence Minister Lee: ‘Difficult to say’ when N.Korea will carry out nuclear test

In recent trade, the South Korean Defence Minister, Lee Jong-sup, has said it is ‘difficult to say’ when N.Korea will carry out a nuclear test. His comments follow 25 missiles of various kinds being fired on Wednesday by the North Koreans, including one that landed close to South Korea’s waters.

President Yoon Suk-yeol said it was effectively “a territorial invasion by a missile”. This was ''the first time since the 1945 division of the peninsula that North Korean weapons had landed so close to South Korea, 26km beyond the northern limit line'', The Guardian noted, warning of a world on the brink when referring to nuclear threats from Russia and an impasse in talks between the US and Iran.

''It now seems likely that North Korea will test a nuclear bomb for the first time since 2017, prompting some to argue that it is time for the US to recognise that North Korea is a nuclear weapons state,'' The Guardian wrote.

-

17:29

Trump considering launching fresh white house bid after midterm elections

Former President Donald Trump is considering launching a third bid for the White House this month. This could be a significant feature in financial markets considering, for one, Trump's stance on China and his general protectionist playbook that roiled markets during his previous term that ended on January 6, 2021. One source familiar with Trump’s plans said he intends to announce his re-election campaign shortly after Tuesday’s election.

A Trump run could mean a rematch of the 2020 Biden-Trump election. It is worth noting In a stark departure from a tradition whereby American presidents refrained from talking about the value of the American Dollar in order to avoid shaking up global markets, the 45th president of the United States regularly tweeted that he wanted the USD on the weaker side.

-

17:05

Gold Price Forecast: XAUUSD falls for two-straight days amidst a buoyant US Dollar

- Gold price is at the mercy of further Federal Reserve tightening as the US Dollar extended its gains.

- The US ISM Services index remained at expansionary territory, but it’s decelerating.

- Gold Price Analysis: Remains downward biased, though a triple bottom pattern is forming in the daily chart.

Gold price stumbles following hawkish commentary of the Federal Reserve Chairman Jerome Powell, who said that the “ultimate level of rates would be higher than previously expected,” spurring a jump in US Treasury bond yields, which underpinned the greenback, to the detriment of Gold. Also, data from the United States flashed that business activity continues to expand while the labor market remains tight. At the time of writing, the XAUUSD is trading at $1626, down by more than half a percent.

Hawkish commentary by the Fed lifts the USD and weighs on Gold prices

Sentiment remains downbeat, as shown by US equities falling. The Institute for Supply Management (ISM) reported its Services PMI, which decelerated to 54.4 from 56.7 in September, and below estimates of 55.5. Even though the index remained in expansion territory, it’s decelerating, a signal sought by Fed officials. Earlier, the US Department of Labor reported Initial Jobless Claims for the week ending on October 28 were lower than expected and rose by 217K vs. 220K forecasts, even though the US economy continues to weaken, according to specific economic indicators.

Aside from this, market participants bought the greenback on Federal Reserve’s Chair Jerome Powell’s words, who added that the pace of rate hikes would be slower, starting as soon as December, while acknowledging that the window for a soft landing is possible, but it’s getting narrower.

Powell added that September’s Federal Reserve Open Market Committee (FOMC) projections for the Federal funds rate (FFR) “would be higher than previously expected.” XAUUSD tanked on those remarks, after hitting a fresh four-day high at $1669.28, to $1633.23. It should be noted that the yellow metal is extending its losses on the hangover of the FOMC’s decision.

On Friday, the US economic calendar will reveal employment figures, with the Nonfarm Payrolls October’s report. Further data shown in the report is eyed, like the Unemployment Rate, and salaries, for signs that could flash signals of weakening in the labor market.

Gold Price Analysis: XAUUSD technical outlook

XAUUSD remains downward biased, as shown by the daily chart, though sellers were unable to crack the year-to-date low at $1614.67, opening the door for a formation of a triple bottom chart pattern. Nevertheless, to confirm the chart pattern, XAUUSD needs to clear $1729.35, which might open the door for a re-test of the 200-day Exponential Moving Average (EMA) at $1761.64.

-

17:02

AUDUSD, capped at 0.6325, approaches two-week lows at 0.6270

- The aussie remains close to two-week lows at 0.6270.

- A hawkish Fed has given a fresh boost to the USD.

- Weak services PMI data has dented greenback's strength.

The aussie is suffering on Thursday against a stronger greenback, following the Fed’s hawkish message after Wednesday’s monetary policy decision. The pair attempted to bounce up from 2-week lows at 0.9270 earlier today, although it was unable to find acceptance above 0.9300.

Fed’s hawkish rhetoric has boosted the greenback

The US dollar is rallying across the board after, buoyed by the Federal Reserve President Powell’s comments reiterating the bank’s commitment to continue tightening borrowing costs until inflation returns to the 2% target.

As was widely expected, the Fed raised its benchmark rate by 0.75%, the fourth such increase in a row. Beyond that, Fed’s Powell denied suggestions that the bank might have overtightened and signaled that interest rates may peak at levels beyond market expectations, which sent the dollar and US Treasury bonds surging.

The greenback has gone through a slight pullback on the US trading session, following weaker-than-expected US services’ activity data, although it has pared losses shortly afterwards.

According to data released by the Institute for Supply Management, October’s Services PMI slowed down to 54.4, from 56.7 in September, beyond the consensus of 55.5, with the employment and new orders gauges posting sharper than expected declines. These figures have dented the USD strength.

Earlier today, preliminary figures anticipated that non-farm productivity expanded well below expectations in the third quarter: 0.3% against the consensus 0.6%, with unit labor costs slowing down to 3.5% from 8.9% in the previous quarter.

On the positive side, initial jobless claims increased by 217K in the week of October 20 against expectations of a 220K rise.

Technical levels to watch

-

16:20

BoE to raise rates by 50 bps in December – Rabobank

On Thursday, the Bank of England raised interest rates by 75 basis points to 3%. Analysts at Rabobank expect a 50 bps rise in December and a 4.75% terminal rate.

Key Quotes:

“There has been a global debate about the current pace of interest rate hikes, the peak at which central banks decide that enough has been done, and the pivot that at some point will follow. Yesterday, the Fed signalled it is looking for a slower pace, to a higher peak, for a longer period of time. The Bank of England is instead signalling it is accelerating the pace, to a lower peak, for a shorter period of time. We don’t fully buy into this and expect the central bank to raise rates by 50 bps in December and eventually to 4.75% next year. This further amplifies the recession, but the UK’s inflation situation increasingly looks like a mix of the US’s and the eurozone’s.”

“A recession may be required to quell inflation. The market isn’t buying it either: investors are still pricing in a peak of 4.7%, but ‘inflation insouciance’ on the part of the central bank put pressure the backend of the gilt curve and accelerated the slump in sterling, to just below 1.12.”

-

16:16

NFP: Payrolls likely to have continued to lose steam in October – TDS

On Friday, the US official employment report will be release. Analysts at TD Securities expect an increase in payrolls of 220K, slightly above the market consensus of 200K. They see the dollar trading in the direction of the data.

Key Quotes:

“We expect payrolls to have continued to lose steam in October (TD: 220k), reflecting modest deceleration vs the 263K print registered in September. We look for October's deceleration in job creation to also be reflected in a jump in the unemployment rate to 3.7% following its new drop to 3.5% in September. We are also forecasting wage growth to accelerate to 0.4% m/m, but to slow to 4.7% on a y/y basis.”

“USD should trade in the direction of the data, though our above-consensus forecast is likely not enough to justify major upside pressure. Asymmetric reaction profile on weaker data, though we think there is some limit to the downside as CPI will be the main focus next week.”

-

16:14

USDCHF testing long-term highs at 1.0145 buoyed by Fed tightening expectations

- The dollar finds support at 1.0090 and approaches the 1.0145 high again.

- Renewed hopes of aggressive Fed tightening have boosted the US dollar.

- US services sector's activity data weighed on the USD earlier today.

The US dollar failed earlier today on its first attempt to breach multi-year highs at 1.0145 although the bearish reaction has been contained at 1.0090, with the pair returning above 1.0100 shortly afterward.

The Federal Reserve has given a fresh boost to the dollar

On Wednesday, the US Federal Reserve raised interest rates by 75 basis points, as expected, and reaffirmed their decision to keep tightening monetary policy until consumer inflation returns to the 2% target.

Fed President, Jerome Powell struck a hawkish tone on the press release and suggested that rates might peak at higher levels than markets had expected. These comments have dampened hopes of a slower hike in December sending the US dollar higher across the board.

On the macroeconomic front, US data have not been dollar-supportive on Thursday. The US ISM Services PMI expanded at a slower rate than expected in October, 54.4 against the consensus 55.5, which has triggered a moderate pullback on the USD.

In Switzerland, October’s Consumer Price Index has shown a sharper-than-expected deceleration. Yearly inflation slowed down to 3% from 3.3% in the previous month, against the 3.2% forecasted by the market. These figures have failed to offer any support to a vulnerable Swiss franc.

Technical levels to watch

-

16:05

Canada: Goods trade to make a healthy contribution to GDP growth during Q3 - CIBC

The trade surplus widened in September but less than expected in Canada. Analysts at CIBC point out that for the third quarter as a whole, inflation-adjusted exports were up 13.7% annualized while imports were down 3%, and as such goods trade will have made a healthy contribution to GDP growth during the quarter.

Key Quotes:

“The goods trade surplus surprisingly widened in September, albeit from a downwardly revised level in the prior month. As a result, the $1.14bn surplus (from a revised $0.55bn in the prior month) was actually very close to the $1.2bn expected by the consensus. When combined with trade in services, Canada remained in a deficit position for a second consecutive month, albeit a slimmer one than was seen in August.”

“Net trade will be a large positive contributor to GDP in Q3, and given the rise in agricultural exports towards the end of the quarter and prospect for more to come, export growth should remain solid in Q4 as well. While a slower global economy will weigh on trade in some areas, Canadian exports should fare better than in previous instances of weakening global demand.”

“The war in Ukraine and sanctions on Russia have increased demand for some Canadian exports (wheat, potash etc) while an easing in global supply chain disruptions could be a positive for export areas that failed to benefit fully from the initial, strong, post-Covid recovery (i.e. autos).”

-

15:59

Gold Price Forecast: Trend reversal threshold around $1,780 in XAUUSD appears attractive – TDS

Gold remains well below levels that would be consistent with a renewed uptrend over the coming quarter. In the view of strategists at TD Securities, trend reversal threshold around $1,780 in the yellow metal appears attractive.

Downtrend in precious metals will prevail over the coming months

“We remain confident that the downtrend in precious metals prices will prevail over the coming months, but a growing chorus of market participants seek to position for an eventual central bank pivot on the horizon to catalyze a sharp repricing higher in precious metals.”

“Our analysis argues that price action in Gold would only be consistent with an uptrend north of $1,830 by Mar2023, which appears unlikely as the Fed continues to tighten policy as it battles stubbornly elevated inflation over this timeframe. Notwithstanding, the critical thresholds for a sustained uptrend to form are largely unchanged by Sep2023. And, as we progress through the new year, the likelihood of a new easing cycle at the Fed is expected to rise.”

“Given we expect an easing cycle to begin in 2023Q4, trend reversal thresholds around $1,780 in Gold and $22 in Silver appear attractive for those looking to position for risks surrounding implications of a Fed pivot by Sep2023, particularly should family offices and proprietary traders capitulate on their bloated long positions.”

-

15:48

EURGBP to remain elevated in the near-term, but to move lower in the longer-term – Danske Bank

As expected, the Bank of England (BoE) raised Bank Rate by 75 basis points to 3%. EURGBP initially moved higher. Economists at Danske bank expect the pair to remain elevated for now, but a move back lower is likely in the longer-term.

A slowing pace of hikes going forward

“In line with our expectation, the BoE hiked the Bank Rate by 75 bps to 3.00% with 7 members voting for a 75 bps hike, one member voting for 50 bps and one member voting for 25 bps. As expected, there was no news in regards to QT-communication as outright selling of government bonds commenced on 1 November.”

“We expect fiscal tightening and recession to weigh on the economy, which in our view, supports a slower hiking pace going forward. We maintain our call for a 50 bps hike in December and 25 bps in February with risks to our call skewed towards additional hikes in 2023.”

“We see a case for EURGBP to remain elevated in the near-term, but in the longer-term expect the cross to move lower as a global growth slowdown and the relative appeal of UK assets to investors are a positive for GBP relative to EUR.”

-

15:37

EUR/USD ticks up to levels near 0.9800 as the US dollar eases

- The euro bounces up from the 0.9740 area to approach 0.9800.

- The greenback lost steam on the back of weak services activity data.

- EUR/USD seen at 0.93 in 12 months – Danske Bank.

The euro has trimmed losses on Thursday’s US trading session, bouncing up from the 0.9740 area to reach 0.9795. The pair, however, remains negative on the daily chart and trading nearly 3% down on the week.

The dollar pulls back on disappointing US data

Business activity in the US services sector expanded at a slower pace than expected in October, according to the ISM PMI, which has declined to 54.4 from 56.7 in September, beyond the 55.5 expected by the market.

Beyond that, the employment gauge has dropped to 49.1, entering levels consistent with a contraction, from 53.0 in the previous month while the new orders sub-index retreated to 56.5 from 60.6, revealing the uncertainty in the economic conditions.

These figures have weighed moderately on a hitherto strong dollar, which has been rallying across the board following Wednesday’s Federal Reserve’s monetary policy decision.

The Fed hiked rates by 0.75% for the fourth consecutive time, as widely expected, and suggested that interest rates might peak at higher levels than markets had expected. Fed President Powell’s hawkish comments dampened expectations of a dovish pivot in December and boosted the dollar and US Treasury bonds.

EUR/USD seen at 0.9300 in 12 months – Danske Bank

Currency analysts Danske Bank see the pair on the defensive amid the Fed’s hawkish stance, and point out to a 0.93 target: “Markets took the FOMC statement dovishly, but the move faded during the press conference and EUR/USD declined below pre-meeting levels while 2y UST yield rose around 6 bps. We maintain our forecast for EUR/USD at 0.93 in 12M.”

Technical levels to watch

-

15:35

USDJPY erases gains as dollar and yields retreat

- Japanese Yen among top performers on Thursday.

- US dollar trims gains during the American session after ISM.

- USDJPY unable to move away from the 148.00 mark.

The USDJPY erased gains during the American session and dropped from 148.44 to 147.60. The slide took place after the greenback lost momentum following the release of the ISM Service Index.

US data below expectations

Ahead of the Non-farm Payrolls report due on Friday, the ISM Service sector report showed numbers below expectations across all indicators. The headline fell from 56.7 to 54.4, against market consensus of 55.5. The employment index fell to 49.1, versus the 51.6 expected.

The greenback lost momentum after the report and following the first hour of trading on Wall Street, which saw equity prices trim losses. US yields pulled back and favored the retreat in USDJPY.

The range prevails

The slide from 148.45 extended to 147.59 where the pair found support and redounded toward 148.00. As of writing, it is hovering around 147.85, near the level it closed on Wednesday.

The USDJPY continues to trade sideways between 147.00 and 149.00. A break above 149.00 should point to more gains while a consolidation under 147.00, would expose last week’s low near 145.00.

Technical levels

-

15:33

GBPUSD set to return to the 1.10 mark – TDS

GBPUSD has dropped below 1.12. Economists at TD Securities expect the pair to challenge the 1.10 level.

Increasingly difficult to justify holding GBP

“The BoE is doing GBP no favours and clearly is less resolute to fight inflation than the Fed. With the change in government helping to reduce the risk premium around the UK, broader forces are becoming more important for GBP, much of which are US-centric. Those are likely to intensify in favour of the US unless data weakens.”

“We are left with the bias that a move back to 1.10 in Cable is in the offing in the very near-term.”

“For now, we think newfound USD strength will be an important force in restraining a surge higher in EURGBP. But, all bets are off if 0.8730 fails to hold, in which case 0.88+ is in the cards.”

-

15:32

United States 4-Week Bill Auction rose from previous 3.6% to 3.62%

-

15:23

USDCAD climbs toward 1.3720 on upbeat US data after Fed’s decision

- USDCAD extends its rally for six straight days.

- Initial Jobless Claims in the United States increased less than estimates, flashing the “overheated” labor market.

- The US ISM Services PMI remained at expansionary territory, showing business resilience.

- Canada’s Trade Balance September’s surplus almost doubled August’s downward revised figures.

The USDCAD advances sharply in the North American session following Wednesday’s Federal Reserve (Fed) 75 bps rate hike, which initially was perceived as a dovish hike. Still, later the Chairman of the Fed, Jerome Powell, pushed back against expectations for a Fed pivot, reiterating the need for “higher for longer.” Also, US jobs data revealed by the US Department of Labor bear out what Powell said regarding the tight labor market. At the time of writing, the USDCAD is trading at 1.3748, above its opening price by 0.27%.

Goodish US economic data and Fed’s hangover overshadowed Canada’s Trade surplus

Wall Street continues to extend its losses after the Fed’s decision. The US Initial Jobless Claims for the week ending on October 28 were lower than expected, rising by 217K vs. 220K estimates, even though the US economy continues to weaken, according to specific economic indicators. Albeit data shows the overheated labor market, Continuing claims rose by 1.49 million in the week ended on October 22, the highest since March. If the uptrend is sustained, it could be the first sign that the labor market is easing.

In the meantime, the Institute for Supply Management (ISM) revealed the Services PMI, which rose by 54.4, below forecasts of 55.3, while Factory Orders on an MoM reading grew by 0.3%, better than the previous month but aligned with estimates.

Aside from this, the Fed’s decision caused mixed reactions from market participants. The monetary policy statement was perceived as dovish due to the Fed considering the “cumulative tightening” under its belt. But, Federal Reserve Chair Jerome Powell acknowledged that the pace of rates would be slower. He added that the peak of rates compared with September projections should be revised upward, which sent US equities tumbling, US Treasury yield rising, and the US Dollar followed suit.

In the case of the USDCAD, after hitting a daily low of 1.3547, it rallied toward its daily high at 1.3712, a whole U-turn.

The Canadian economy record's a surplus though fails to underpin the CAD

On the Canadian front, the Trade Balance for September showed a surplus bolstered by crude oil and wheat exports. The surplus rose to C$1.1 billion, below estimates of C$1.2 billion, from a downwardly revised C$550 million in August.

Regarding housing data, Canadian Building Permits for the same period plunged by 17.5%, against a contraction of 6.1%, estimated a headwind for the already battered Loonie. According to Statistics Canada, it’s the first time all surveyed components registered monthly decreases since September 2019.

What to watch

For Friday, the Canadian and US economic calendar will feature employment figures.

USDCAD Key Technical Levels

-

15:16

GBPUSD to trade at 1.06 by the end of the first quarter next year – Wells Fargo

Economists at Wells Fargo now forecast slightly less tightening from the Bank of England than previously. Subsequently, the GBPUSD pair is set to plunge toward 1.06 by the end of the first quarter of 2023.

Policy rate to peak at 3.75%

“We expect a 50 bps rate increase in December, and a final 25 bps increase in February next year. That would see the policy rate peak at 3.75%, which is still well below the peak of around 4.65% forecast by market participants.”

“The combination of a protracted economic recession and a central bank that under delivers versus the market's rate hike expectations are key factors behind our view of renewed Sterling weakness into early 2023, with a targeted GBPUSD exchange rate of 1.0600 by the end of the first quarter next year.”

-

14:56

USDTRY rises to new all-time highs around 18.6500

- USDTRY prints new record highs around 18.6500 on Thursday.

- Inflation in Türkiye ran at a new 24-year top in October.

- The CBRT is expected to cut rates to single digits later in the month.

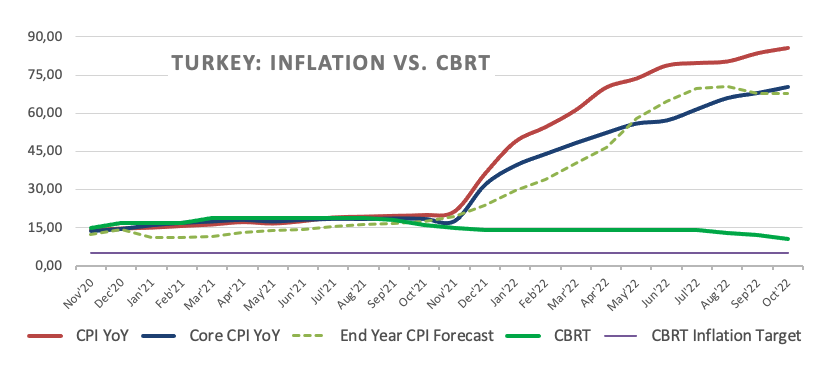

The Turkish lira remains on the defensive and lifts USDTRY to new all-time peaks around 18.6500 on Thursday.

USDTRY now shifts the attention to CBRT

USDTRY adds to Wednesday’s gains and rises to the 18.6500 region on the back of the unabated upside bias in the greenback, while another record high in the domestic inflation figures also put the lira under extra pressure.

On the latter, inflation in Türkiye rose to a new 24-year high at 85.51% in the year to October when gauged by the headline CPI and 3.54% from a month earlier. In addition, the Core CPI gained 70.45% YoY and Producer Prices advanced 157.69% vs. October 2021.

Investors’ attention is now expected to shift to the next interest rate decision by the Turkish central bank (CBRT) on November 24, where consensus appears tilted to another (the last one?) rate cut, taking the One-Week Repo Rate to single digits (currently at 10.50%) for the first time since August 2020 (8.25%).

What to look for around TRY

USD/TRY extends the upside to new all-time peaks around 18.6500 on Thursday.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in the last three months), real interest rates remain entrenched well in negative territory and the omnipresent political pressure to keep the CBRT biased towards a low-interest-rates policy.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth via transforming the current account deficit into surplus, always following a lower-interest-rate recipe.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.07% at 18.6141 and faces the next hurdle at 18.6503 (all-time high November 3) followed by 19.00 (round level). On the downside, a break below 18.4379 (weekly low November 1) would expose 18.3765 (55-day SMA) and finally 17.8590 (weekly low August 17).

-

14:51

The beginning of the end of the Dollar's rally – SocGen

The US Dollar is stronger across the board. Kit Juckes, Chief Global FX Strategist at Société Générale, believes that growth expectations will be a big driver for the greenback and less dollar-friendly.

Drivers of economic out-performance are fading

“The US growth outlook matters more for the dollar going forwards, than where US bond yields go next. So far, US rates have risen further and faster than elsewhere, on the back of economic out-performance. A fiscally fuelled reopening saw the US outperform and both geography (far from Kyiv) and being the world’s second-largest energy producer provided a cushion as others were hit by surging gas prices.”