Notícias do Mercado

-

23:50

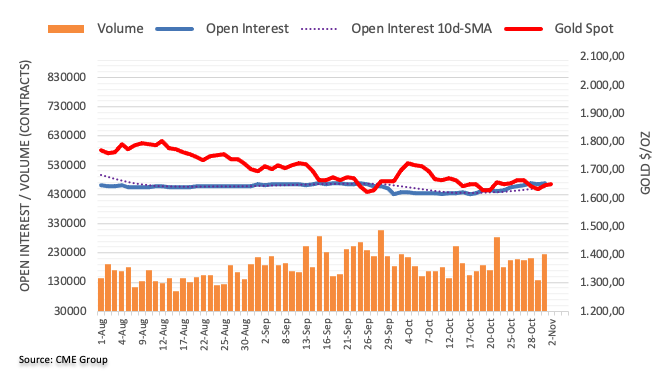

Gold Price Forecast: XAU/USD extends Fed-inspired losses below $1,650 amid looming death cross

- Gold price takes offers to refresh intraday low, stretches U-turn from one-week high.

- Hawkish comments from Fed Chair Powell propelled US dollar, geopolitical/covid woes also weigh on XAU/USD.

- US ISM Services PMI, NFP will be crucial for near-term directions.

Gold price (XAU/USD) renews its intraday low near $1,632 while extending the post-Fed slump during Thursday’s Asian session. In doing so, the quote takes clues from the recently deteriorating market sentiment amid a light calendar.

North Korea’s firing of missiles and Japan’s warning to residents appear the latest blow to the risk appetite, which in turn weighed on the gold price. On the same line could be the coronavirus fears from China as the lockdown surrounding the area involving the world’s largest iPhone factory defied hopes of easing the dragon nation’s zero-covid policy.

On Wednesday, Fed’s 75 bps increase in the benchmark rate initially triggered the US dollar’s slump as the rate statement highlighted the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. However, Powell’s speech propelled the greenback as it cited the need to bring down inflation “decisively” while also suggesting a bit longer play for the restrictive policy.

Elsewhere, fears of economic slowdown in the UK and Eurozone, as well as higher rates intensify ahead of Thursday’s Bank of England (BOE) meeting, which in turn keeps markets dicey and exerts downside pressure on the XAU/USD.

Amid these plays, the US Treasury Yields are back near the multi-month high above 4.0% while the Wall Street benchmarks closed in the red. Further, the S&P 500 Futures print mild losses at the latest.

Looking forward, China’s Caixin Services PMI for October, prior 49.3, will offer immediate directions along with the risk catalysts. However, major attention will be given to the US ISM Services PMI as it bears downbeat forecasts of 55.5 for October compared to 56.7 previous readings. Following that, Friday’s US Nonfarm Payrolls (NFP) will be the key, mainly due to the strong ADP data.

Technical analysis

A swift pullback from a weekly top joins bearish MACD signals to highlight the impending death cross as the 100-HMA pokes the 50-HMA from above. With this, the gold price drops towards the weekly bottom of $1,630 before targeting the previous monthly low near $1,617.

In a case where XAU/USD remains bearish past $1,617, the year’s low marked in September around $1,614 and the $1,600 threshold could lure the bears.

Alternatively, recovery remains elusive unless crossing the stated HMA confluence surrounding $1,647. Following that, $1,657 and $1,670 will be on the buyer’s radar.

Overall, gold is likely to decline further but the downside appears limited.

Gold: Hourly chart

Trend: Further downside expected

-

23:33

Australia S&P Global Services PMI came in at 49.3, above expectations (49) in October

-

23:33

Australia S&P Global Composite PMI: 49.8 (October) vs 49.6

-

23:24

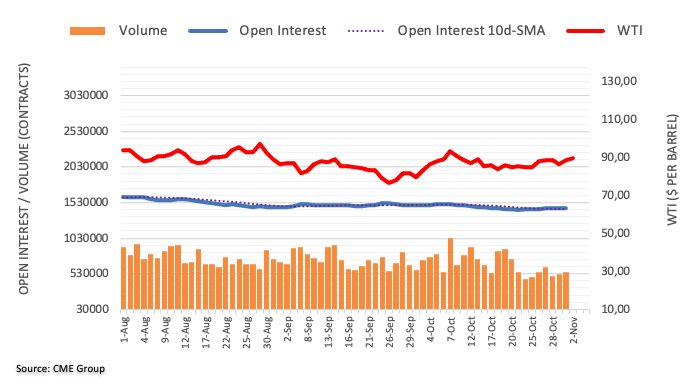

WTI Price Analysis: Retreats from four-month-old resistance to sub-$89.00 region

- WTI crude oil eases from three-week high, snaps two-day uptrend.

- Firmer RSI and successful trading above 50-DMA favor buyers.

- 100-DMA adds to the upside filters, bears need validation from $85.30 to retake control.

WTI crude oil pares recent losses around $88.50 while posting the first intraday loss in three during Thursday’s Asian session.

The black gold rose to the highest level since October 12 during the previous day before reversing from a four-month-old descending resistance line. The pullback move, however, remains beyond the 50-DMA and keeps the buyers hopeful. Also challenging the bearish bias is the steadily rising RSI (14), not overbought.

That said, the quote’s latest pullback remains elusive unless breaking the 50-DMA support of $85.80. Also acting as the short-term key support is an upward-sloping trend line from September 27, near $85.30.

In a case where the energy benchmark drops below $85.30, $81.30 and an early September low of $80.95 can please the WTI bears before directing them to the $80.00 and September’s monthly bottom of $76.08.

Meanwhile, the aforementioned resistance line from early July, close to $89.50 at the latest, guards the quote’s immediate run-up ahead of the 100-DMA hurdle surrounding $91.45.

Following that, the tops marked during October and late August, near $92.65 and $97.30 in that order, could lure the WTI crude oil buyers.

WTI: Daily chart

Trend: Limited downside expected

-

23:23

GBP/JPY holds itself above 168.00 ahead of BOE monetary policy

- GBP/JPY is displaying back-and-forth moves around 168.50 as the focus has shifted to BOE policy.

- A rate hike of 75 bps by the BOE could be followed by dovish guidance to scrap recession fears.

- The risk profile has been harmed as Japan-North Korea tensions have renewed.

The GBP/JPY pair is oscillating around the immediate hurdle of 168.50 in the early Tokyo session as investors are awaiting the announcement of the interest rate decision by the Bank of England (BOE). The cross is declining continuously since the Bank of Japan (BOJ) announced an unchanged interest rate policy to support its economic prospects.

Meanwhile, the risk aversion theme has been underpinned as the Federal Reserve (Fed) has hiked its interest rate for the fourth time. Also, Japan-North Korea tensions have renewed as North Korea has fired an unidentified ballistic missile over Japan, as broadcast by NHK. Also, Japan administration has warned residents to take shelter from missile threats. This could bring volatility for the Japanese yen.

Going forward, the interest rate decision by BOE Governor Andrew Bailey will be of utmost importance. Economists at Goldman Sachs have voted in favor of the biggest rate hike of 75 basis points (bps) by the UK central bank since 1989. What is surprising now is that the bigger rate hike will be followed by dovish guidance on interest rates as recession fears have accelerated in the UK economy.

Goldman Sachs’ Chief European Economist Sven Jari Stehn wrote in his latest research note that the UK economic recession is likely to be deeper than previously forecast. “The country is likely to have a four-quarter cumulative fall in the gross domestic product (GDP) of 1.6%.” The investment banking firm has also lowered UK’s growth projections to 1.4% from -1.0% for 2023 on an annual basis.

-

23:18

North Korea fired unidentified ballistic missile toward east sea

North Korea fired an unidentified ballistic missile toward east sea that has since been reported to have flown over Japan.

Nevertheless, Japan warns residents to take shelter in the threat of the North Korean missile.

Meanwhile, the BBC reported that the North launched its most missiles in a single day - at least 23 - including one that landed less than 60km (37 miles) off the South's city of Sokcho.

''Seoul responded with warplanes firing three air-to-ground missiles over the disputed maritime demarcation line.

Later Pyongyang fired six more missiles and a barrage of 100 artillery shells.

The North says the launches are in response to large-scale military exercises current being held by South Korea and the United States, which it calls "aggressive and provocative".

On Tuesday, Pyongyang warned they would pay "the most horrible price in history" if they continued their joint military drills, seen as a veiled threat to use nuclear weapons.

US secretary of state, Antony Blinken, and his South Korean counterpart, Park Jin, condemned North Korea's "escalatory launch of ballistic missiles".

The North has tested a record number of missiles this year as tensions have risen.''

The BBC has also warned that despite crippling sanctions, Pyongyang has conducted six nuclear tests between 2006 and 2017, and is rumoured to be planning a seventh. ''It has continued to advance its military capability - in breach of United Nations Security Council resolutions - to threaten its neighbours and potentially even bring the US mainland within striking range.''

-

23:02

EURUSD plunges 150 pips from weekly highs on Powell’s hawkish remarks after Fed rate hike

- The Euro is at the mercy of a hawkish Federal Reserve, as Eurozone PMIs show a recession is lurking.

- The Federal Reserve’s dovish statement and a hawkish Jerome Powell spurred turmoil in the market, benefitting the safe-haven American dollar.

- The EURUSD downtrend remains intact, and once sellers clear 0.9770, a test of the 2022 lows is on the cards.

The Euro tumbled against a buoyant US Dollar on Wednesday, following the release of a dovish perceived US Federal Reserve (Fed) 75 bps rate hike, on which the EURUSD rallied and hit a fresh weekly high at 0.9975. However, Jerome Powell, the Chairman of the Federal Reserve, turned hawkish, sending the markets into turmoil, while the safe-haven USD pared its earlier losses. At the time of writing, the EURUSD is trading at 0.9814, at fresh weekly lows, as the Asian session begins.

Jerome Powell lifted the USD to the detriment of the EUR

Sentiment shifted sour after the Federal Reserve decision, but volatility increased once Jerome Powell took the stand. In its Q&A, Powell said that interest rates in the United States would go higher than September’s projections, a powerful “hawkish” statement that sent the EURUSD diving from around 0.9975 to 0.9827, almost a 150 pip drop. It should be noted that the Federal Reserve Open Market Committee (FOMC) monetary policy statement was slightly dovish, as shown by the EURUSD bouncing from around 0.9860 toward its weekly highs, on a sentence that mentioned: “the Committee will take into account the cumulative tightening of monetary policy.”

High inflation and a tight labor market in the United States will deter a Fed pivot

Even though the Fed’s “cumulative tightening” of 375 bps In the year shocked some parts of the United States economy, like housing, inflation remains stubbornly high, the unemployment rate is low, and job vacancies are rising, which means the Fed has work to do.

Regarding that, in its monetary policy statement, the Federal Reserve Open Market Committee (FOMC) noted that ongoing increases will be needed to a restrictive level to bring inflation to the 2% goal. Meanwhile, for the Federal Reserve’s December meeting, money market futures expect a 50 basis points move to the Federal funds rate (FFR), peaking by the end of the year at 4.25-4.50%

Interest rate differentials and a Eurozone recession looming will keep the EURUSD on the defensive

Therefore, the Euro might be under pressure due to interest-rate differentials between the Fed and the European Central Bank (ECB). Albeit both institutions are laying the ground for a slower pace of interest rate increases, the United States will enjoy rates at 4.50% by the end of 2022, while the Eurozone will likely be at 2%. Also, Manufacturing PMIs from the Eurozone flashing a recession contrarily to the United States will undermine the appetite for the Euro. Therefore, the EURUSD will retain its downward bias.

EURUSD Price Analysis: Technical outlook

The EURUSD downtrend is intact, though it should be noted that sellers did not have the strength to clear the 0.9800 figure, which could have opened the door for a YTD challenge at 0.9535. Even though the Relative Strength Index (RSI) suggests that selling pressure is mounting, a one-month-old upslope trendline drawn from YTD lows that pass at around 0.9770 should be broken to pose a real threat for EURUSD buyers. Once cleared, the next demand zone would be 0.9700 and the October 13 low at 0.9631.

-

23:01

USD/CHF struggles to defend post-Fed rally above 1.0000 ahead of Swiss Inflation, US ISM PMI

- USD/CHF seesaws around the highest levels in two weeks.

- Fed Chair Powell pushed back doves by hesitating over softer rate increases.

- FOMC matched market forecasts of announcing 75 bps rate hike.

- Swiss CPI, US ISM Services PMI may entertain traders, risk catalysts are key too.

USD/CHF grinds higher past the 1.0000 psychological magnet during early Thursday as bulls take a breather after a volatile move around the Federal Open Market Committee (FOMC) announcements. That said, the Swiss currency (CHF) pair picks up bids to 1.0030 by the press time. In addition to the post-Fed calm, the anxiety ahead of the Swiss Consumer Price Index (CPI) data for October and the US ISM Services PMI for the said month also challenge the pair buyers of late.

That said, Fed’s 75 bps increase in the benchmark rate initially triggered the US dollar’s slump as the rate statement highlighted the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” However, Powell’s speech propelled the greenback as it cited the need to bring down inflation “decisively” while also suggesting a bit longer play for the restrictive policy.

Also helping the USD/CHF bulls were geopolitical fears surrounding Taiwan and Ukraine, as well as the covid woes emanating from China. Furthermore, the strong points of the US ADP Employment Change for October, to 239K versus 195K expected and a revised down prior figures of 192K, also propelled the quote.

Against this backdrop, the US Treasury Yields are back near the multi-month high while the Wall Street benchmarks closed in the red. Further, the S&P 500 Futures print mild losses at the latest.

Moving on, Swiss CPI is expected to ease on YoY to 3.2% during October versus 3.3% prior while the US ISM Services PMI also bears downbeat forecasts of 55.5 for the said month compared to 56.7 previous readings. Should the actual releases match the market consensus, the USD/CHF prices are likely to grind higher due to the aftershocks of the Fed. Also likely to keep the pair on the bull’s radar is the optimism ahead of Friday’s US Nonfarm Payrolls (NFP), mainly due to the strong ADP data.

Technical analysis

An impending bull cross on the MACD and sustained trading beyond the 21-DMA immediate support, around 0.9980 at the latest, keep the USD/CHF buyers hopeful.

-

22:50

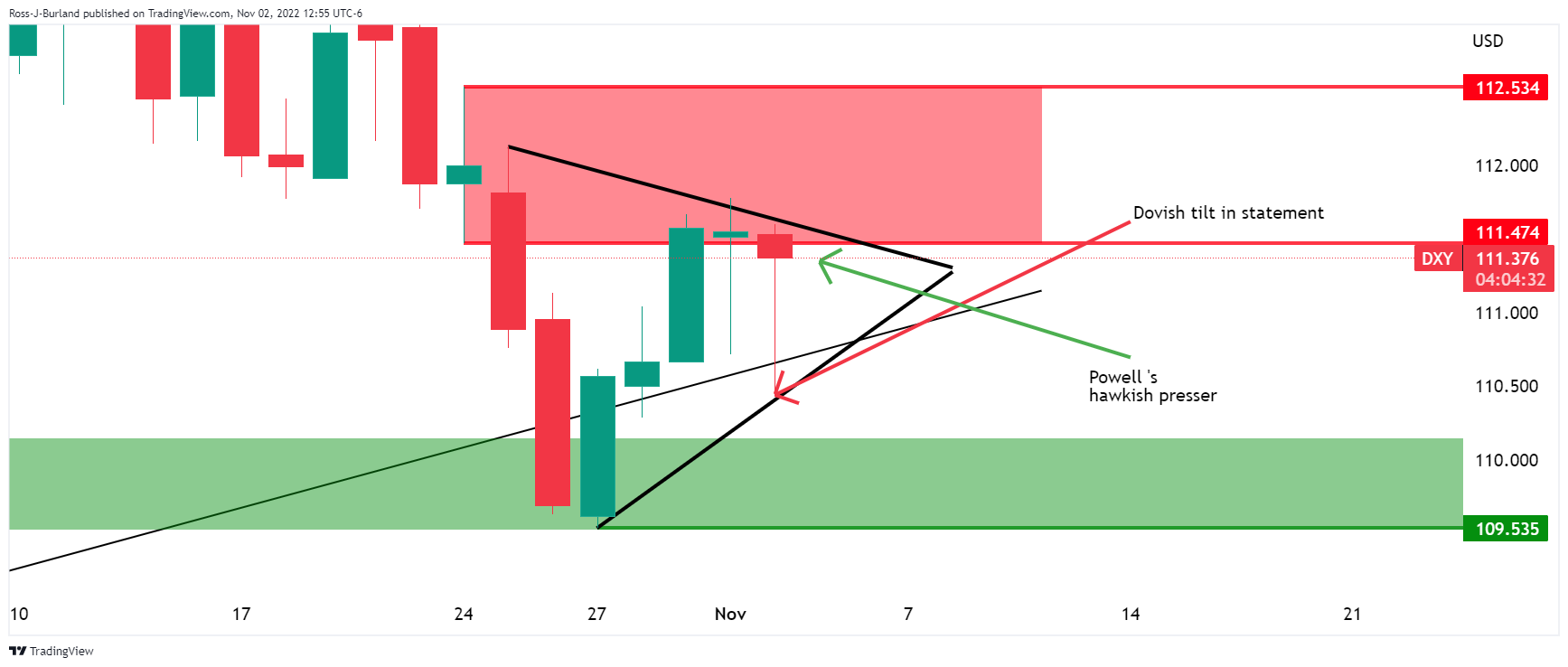

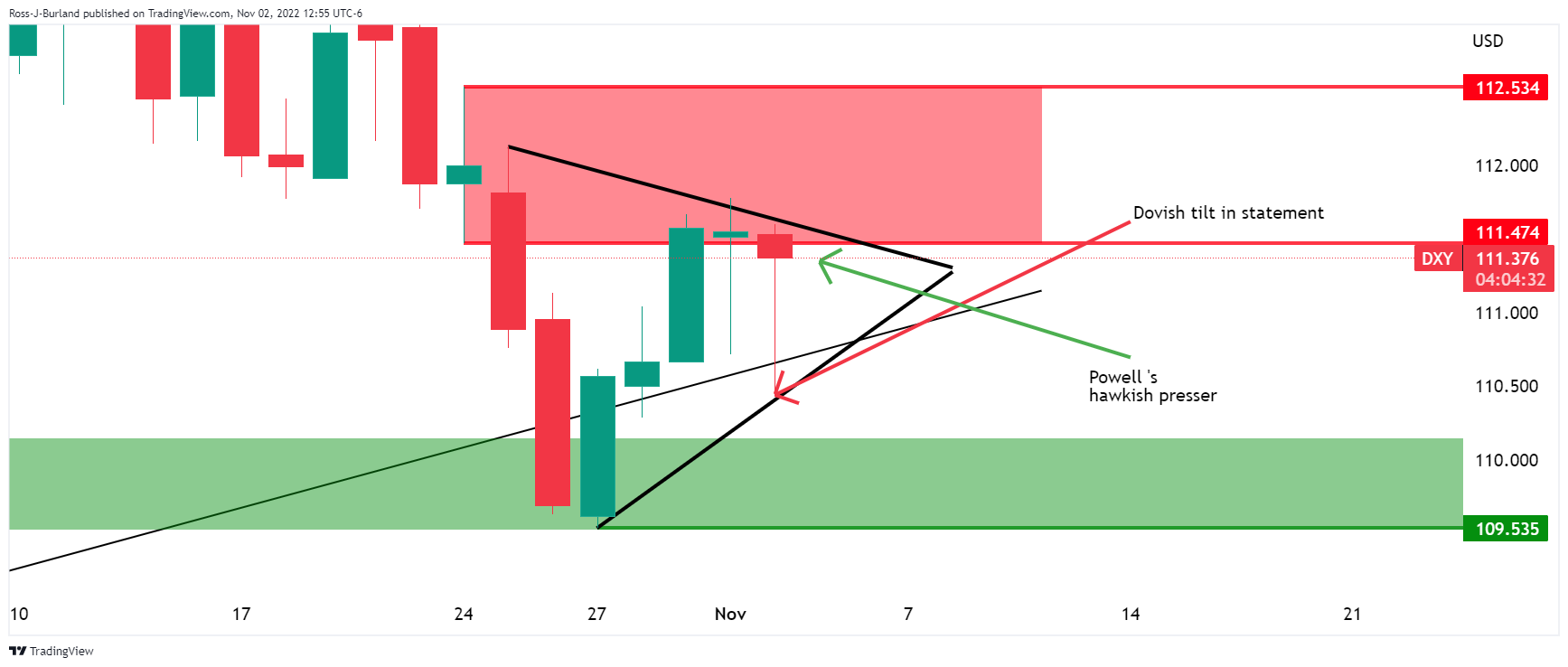

US dollar takes on critical 112.00 and US 10-year back to 4% after FOMC

- US dollar turns on a dime following hawkish Fed Powell.

- DXY bulls ere 114.00 with prospects of a higher terminal rate at the Fed.

It was one of the most eventful Federal Reserve meetings since the start of the year with respect to market volatility. The US 10-year Treasury note yield bounced back above 4% as investors continue to see interest rates extending substantially higher until inflation is under control. The Fed's chairman, Jerome Powell flipped the switch on the day when he signalled a higher terminal rate, combatant in the face of risk-on markets that took off following a dovish FOMC statement.

Fed Chair Powell said during the press conference that incoming data since the last meeting suggested the terminal level of interest rates will be higher than expected. He said this after the FOMC decided to raise interest rates by 75bps, signalling more hikes, though possibly in smaller increases.

"In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial deviations," the statement reads.

However, rates shot higher when Powell's hawkish comments at the presser started to sink in, sending the US dollar in a U-turn:

-

Powell speech: Very premature to be thinking about pausing

-

Powell speech: Will likely need restrictive stance of policy for some time

-

Powell speech: Longer-term inflation expectations are still well anchored

-

Powell speech: Will take time for full effects of monetary restraint to be realized

-

Powell speech: Time for slower hikes may come as soon as December or February

US dollar & 10-year yield technical analysis

The 10-year yield has carved out the M-formation with the yield moving gin on the neckline and hugging the counter trendline. However, the retracement has potentially run its course in a 50% mean reversion. The bulls will need to get above 4.20% for a convincing upside continuation bias.

As for the greenback, DXY has rallied sharply into test 112.00.

Looking forward, if the bulls can get above 112.00 and then 112.50, there will be prospects of a move to 114.00.

-

22:47

AUD/USD finds bids from 0.6350, downside looks likely on Fed-RBA policy divergence

- AUD/USD may continue its downside momentum conclusion of a less-confident pullback from 0.6350.

- Fed’s fourth consecutive 75 bps rate hike as widened Fed-RBA policy divergence.

- Australian Trade Balance is seen higher at 8,850M for the September month vs. the former release of 8,324M.

The AUD/USD pair has attempted a recovery after registering a fresh weekly low at 0.6350 in the early Asian session. The greenback bulls are extremely solid after the rate hike announcement by the Federal Reserve (Fed). As Fed chair Jerome Powell has pushed interest rates to 3.75-4%, negative market sentiment has sky-rocketed, which could terminate the less-confident pullback move by the aussie bulls.

The major won’t be able to sustain its rebound and will display more weakness on hawkish guidance by the Fed. A fourth consecutive rate hike of 75 basis points (bps) was highly expected as the odds for the event were at the rooftop. What has soured the market sentiment is the commentary from Fed policymakers that it is premature to consider a pause in the policy tightening spree. The reason behind the absence of consideration of a pause in restrictive measures is the accelerating inflationary pressures.

The inflation rate is extremely higher than Fed’s target and remained stronger than expected last month. Households are facing the headwinds of higher payouts due to de-anchored short-term inflation. Consumer spending has trimmed dramatically but still needs time to show its impact on price growth.

A bigger rate hike by the Fed has widened the divergence in the Reserve Bank of Australia (RBA)-Fed policy. The Australian central bank accelerated its interest rates too this week. RBA Governor Philip Lowe continued with a 25 bps rate hike structure, keeping in mind, economic prospects should remain firmer along with the agenda of bringing price stability.

On Thursday, Australian external activities data will remain in focus. The Aussie Trade Balance data for September month is seen higher at 8,850M vs. the prior release of 8,324M. A better-than-projected Trade Balance data may support aussie dollar against the greenback.

-

22:39

NZD/USD Price Analysis: Extends pullback from 50-DMA towards 0.5800, bullish channel is at risk

- NZD/USD remains depressed after reversing from six-week high.

- Bulls are safe above 0.5790 but oscillators and failure to cross 50-DMA tease sellers.

- Multiple hurdles stand ready to challenge buyers past 50-DMA, bears may aim for yearly low on breaking 0.5790.

NZD/USD readies the move to defy the three-week-old ascending trend channel by holding lower ground near 0.5825 amid Thursday’s Asian session.

That said, the Kiwi pair jumped to the highest since September 20 during the initial announcements from the US Federal Open Market Committee (FOMC) meeting.

However, the post-Fed slump portrays the quote’s inability to cross the 50-DMA hurdle. The same joins recently easing bullish signals from the MACD and a sluggish RSI (14) line to keep sellers hopeful of breaking the stated channel’s support, around 0.5790 by the press time.

Following that, a slump to the 23.6% Fibonacci retracement level of the NZD/USD pair’s August-October downturn, around 0.5740, will precede multiple supports around 0.5580-70 to challenge the bears on their way to the yearly low of 0.5511.

Alternatively, an upside break of the 50-DMA hurdle surrounding 0.5840 will find it difficult to cross the 38.2% Fibonacci retracement level and the aforementioned channel’s upper line, close to 0.5880 and 0.5945 in that order.

Even if the NZD/USD bulls manage to cross the 0.5945 hurdle, the 50% Fibonacci retracement near 0.5995 and the 0.6000 psychological magnet will be crucial for them to conquer before rising further.

NZD/USD: Daily chart

Trend: Further downside expected

-

22:37

Australia S&P Global Composite PMI dipped from previous 49.6 to 49.3 in October

-

22:21

GBP/USD bears attack 1.1400 support on FOMC showdown, BOE’s “Super Thursday” eyed

- GBP/USD holds lower ground near one-week low, pokes five-week-old support line.

- Fed’s 75 bps rate hike, Chairman Powell’s hawkish press conference propelled DXY of late.

- “Old Lady” is expected to announce 75 bps rate hikes, revise economic forecasts.

- Cable is up for a lose-lose situation unless BOE surprises markets.

GBP/USD holds onto post-Fed pessimism as it stays pressured around a seven-day low near 1.1400 during early Thursday morning in Asia. The Cable pair’s latest losses could be linked to the US Federal Reserve’s (Fed) rate action and Chairman Jerome Powell’s surprising press conference.

Fed’s 75 bps increase in the benchmark rate initially triggered the US dollar’s slump as the rate statement highlighted the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” However, Powell’s speech propelled the greenback as it cited the need to bring down inflation “decisively” while also suggesting a bit longer play for the restrictive policy.

It’s worth noting that the strong points of the US ADP Employment Change for October and fears emanating from China’s covid-led lockdown, as well as a US diplomat’s visit to Taiwan, added strength to the US Dollar Index (DXY). That said, the greenback’s gauge versus the six major currencies refreshed a one-week high following the Federal Open Market Committee (FOMC) meeting.

Amid these plays, Wall Street closed in the red and the yields are back up with the 10-year benchmark rising to 4.10% by the end of Wednesday’s North American session.

Moving on, GBP/USD traders will pay attention to the Bank of England’s (BOE) monetary policy announcements for clear directions. The “Old Lady”, as the central bank is informally known, is likely to unveil a 75 bps rate hike but is also divided over the 50 bps move. Also increasing the importance of the event is the quarterly monetary policy statement that makes it the “Super Thursday”.

Given the fears of the UK’s recession, or maybe London is already in one, the BOE is less likely to impress the GBP/USD buyers even by announcing the 75 bps rate hike.

Also read: BoE Interest Rate Decision Preview: A close call between 50 bps and 75 bps, GBP/USD set to suffer

On the other hand, the second-tier US data and risk catalysts might also offer extra directives to the Cable pair.

Technical analysis

An upward-sloping support line from September 26, around 1.1395, precedes the 50-DMA support near 1.1350 to restrict the short-term GBP/USD downside. That said, the RSI (14) and MACD suggest further downside of the Cable pair.

-

22:11

USD/CAD refreshes weekly high above 1.3700 as Fed announces bigger rate hike

- USD/CAD has registered a fresh weekly high at 1.3710 as Fed pushes interest rates to 3.75-4%.

- Market mood has turned extremely soured on Fed’s hawkish guidance.

- Canada’s employment change is seen lower at 10k vs. the prior release of 21.1k.

The USD/CAD pair witnessed a steep reversal after dropping below 1.3560 and registered a fresh weekly high at 1.3710 in no time in the early Tokyo session. The asset picked bids as the Federal Reserve (Fed) has announced the fourth consecutive 75 basis point (bps) rate hike to safeguard the economy from the headwinds of mounting inflationary pressures.

The risk profile has turned extremely negative as guidance from Fed chair Jerome Powell is hawkish as US central bank sees no pause in further policy tightening. This has sent S&P500 into a negative trajectory as earnings guidance has turned subdued. Meanwhile, the US dollar index (DXY) has scrolled above 112.00 after dropping to near 110.43 as rates have been pushed to a 4% trajectory. The 10-year US Treasury yields have jumped to 4.1%.

After a wild gyration, the asset is expected to display a volatility contraction and the focus of investors will shift to the US Nonfarm Payrolls (NFP) data. But before that, Wednesday’s release of US Automatic Data Processing (ADP) Employment Change has remained upbeat. The US economy has added 239k fresh jobs in the labor market, which will support the Fed to keep up the pace of the hiking rate further.

The US NFP is seen lower at 200k vs. the prior release of 263k. While the unemployment Rate will increase to 3.6%.

Meanwhile, loonie investors are also awaiting the release of the employment data. The Net Change in Employment is seen lower at 10k against the former figure of 21.1k. While the jobless rate is seen lower at 5.2%.

On the oil front, oil prices are looking to recapture the critical hurdle of $90.00 for the first time in the past three weeks. A decline in crude oil inventories reported by the Energy Information Administration (EIA) has infused fresh blood in the oil bulls. The oil stockpiles dropped by 3.115M barrels against the projection of an increment of 0.367M barrels.

-

21:25

Gold Price Analysis: XAU/USD plunges, eyeing a re-test of $1600 after Powell’s hawkish commentary

- Gold retraces from weekly highs, eyeing a test of the $1600 figure, following a hawkish Fed.

- XAU/USD hit a daily high at $1669 before erasing its gains.

- If XAU/USD clears the $1617.30 support, a re-test of $1600 is on the cards.

Gold price erased Tuesday’s gains following the release of the November monetary policy meeting of the Federal Reserve, which finished with the US central bank lifting rates by 75 bps to 3.75-4.00%, the highest level reached since 2008, at around the financial crisis. At the time of writing, XAU/USD is trading at $1635.16, down by 0.81%.

Gold Price Analysis: Technical outlook

After the Fed’s decision, the XAU/USD remains neutral-to-downward biased, aiming to break to fresh two-week lows below $1634. Of note, the 20-day Exponential Moving Average (EMA) was pierced as gold hit a fresh four-day high at $1669.52 before retreating to current price levels.

That said, a triple-bottom chart pattern is forming, which would be confirmed by the break of the last swing high, the October 4 daily high at $1729.48.

If that scenario is to play out., the XAU/USD needs to hurdle some key resistance levels in the daily chart. Firstly the 20-day EMA at $1656.26, followed by the 50-day EMA at $1678.25, and the 100-day EMA at $1723.82, ahead of the October monthly high.

On the other hand, if XAU/USD extends its losses, the first support will be the October 21 swing low at $1617.30. A breach of the latter will send XAU sliding towards March 2020 lows at around $1567.80, followed by the $1500 figure.

XAU/USD Key Technical Levels

-

21:00

South Korea FX Reserves above forecasts (413.47B) in October: Actual (414.01B)

-

20:45

USD/JPY Price Analysis: Bulls step in regardless of BoJ risks

- USD/JPY bulls are back in the game following FOMC.

- BoJ will be disappointed and threats of intervention may keep a lid on the pair.

USD/JPY has been taken back by the bulls in trade on Wednesday following an eventful FOMC meeting and outcome for financial markets. The price initially dropped to test a low of 145.66 before it rallied to wipe out all of the losses and leave gins for the New York session to a post-Fed high of 147.89 so far.

The Federal Reserve statement was written with dovish rhetoric while the Chair's presser turn risk appetite on a dime with hawkish comments from Jerome Powell.

DXY daily chart

USDJPY H1 chart

The price has left a 3-line strike on the hourly chart which is a change of direction candle, breaking through the structure to leave a bullish bias on the charts for the day ahead. However, the Bank of Japan will be disappointed with Jerome Powell's pushback against risk in today's meeting and investors will be wary of subsequent intervention hazards.

-

20:34

Forex Today: The dollar wins again

What you need to take care of on Thursday, November 3:

The dollar finished Wednesday higher across the FX board following a volatile American session. The US Federal Reserve was behind the wild moves, as the central bank delivered as expected, but Chair Jerome Powell surprised with a hawkish speech.

The central bank pulled the trigger by 75 basis points, and the accompanying statement suggested policymakers would soon slow the pace of QT. “In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” The greenback plummeted to fresh weekly lows against most major rivals as investors rushed to price in a 50 bps rate hike in December.

However, Chair Jerome Powell’s speech brought dollar buyers back to life. The head of the central bank noted that inflation needs to be taken down “decisively,” adding they are ready to change the monetary policy as needed. He mentioned that slowing the pace of rate hikes will become necessary at some point but also that it may take time for inflation to come down, and therefore, a restrictive policy stance should stay for some time. Finally, he added that the ultimate level of rates would be higher than previously expected. His words revived the odds of a fifth 75 bps in December. Stocks fell, yields surged, and the dollar soared.

Meanwhile, speculation that China could ease its zero-covid policy was erased after the country announced a new lockdown, this particular one, involving the area around the world's largest iPhone factory, spurred concerns at the beginning of the day.

The EUR/USD pair trades in the 0.9820 price zone after posting a fresh weekly high of 0.9975. GBP/USD plummeted below 1.1400, while AUD/USD trades around 0.6350. The USD/CAD pair is currently advancing above 1.3700.

The dollar also gained against safe-haven rivals. USD/CHF is above parity, while USD/JPY trades around 147.80.

Gold advanced at the beginning of the day but finished it at around $1,636 a troy ounce.

According to preliminary EIA data, US imports of Saudi crude oil increased 208k bpd to 533k bpd for the week ending Oct. 28, according to preliminary EIA data, unexpectedly boosting oil prices. WTI eased at the end of the day amid plummeting equities but still closed in the green at $89.20 a barrel.

The Bank of England is having a Super Thursday next.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:06

GBP/USD Price Analysis: Bears pounce on the bulls and drag them back to channel support

- GBP/USD falls on the back of hawkish comments from Powell.

- The US dollar is back in the driving seat and cable is meeting channel support.

Risk markets were whipsawed around the FOMC event on Wednesday when the Federal Reserve statement was written with dovish rhetoric while the Chair's presser started out and ended with a hawkish tilt.

His hawkish comments wiped out almost 100% of the FOMC dovish statement drop in the US dollar:

GBP/USD H1 chart

The price has dropped into the channel's support following Powell's pushback against rallying risk markets when pressed for commentary around the timings of a pivot. However, on a break of support, there is a void of liquidity according to the rally that took place on October 25.

Given the timings of the day, the most likely trajectory from here would be for a correction prior to the next impulse to the downside:

-

20:00

Argentina Tax Revenue (MoM): 1964.056B (October) vs previous 2127.181B

-

19:55

AUD/USD hits one-week lows at 0.6350 as Fed Powell boosts the USD

- The aussie U-turns from 0.9490 and dives to one-week lows at 0.9350.

- Fed Powell takes a hawkish stance and sends the USD higher.

- The dollar suffered following a dovish tilted FOMC statement.

The US dollar whipsawed following the outcome of the Federal Reserve’s meeting. The Aussie spiked up to session highs right above 0.6500 following a dovish monetary statement before plummeting to 0.6350 on the back of Powell’s press release.

Fed Powell takes the hawkish side and boosts the USD

The dollar made a dramatic U-turn following Fed President Jerome Powell’s comments at the bank’s press release. Powell struck a more hawkish tone in front of the journalists, offsetting the impact of the previously released statement, and sending the US dollar higher.

Jerome Powell refuted the idea that the bank might have overtightened and reaffirmed the need for ongoing rate hikes to get policy sufficiently restrictive.

Beyond that, he affirmed that economic data suggests that “we may eventually move to higher levels than we anticipated at the September meeting”, which has curbed expectations of a dovish pivot in December.

In regards to the next meeting, Powell assured that there will be a discussion, as no decision has been taken yet and that the time to slow the pace of rates could be as soon as December or at February’s meeting.

Previously, the FOMC statement affirmed that the pace of future rate hikes will be decided considering “cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

The bank met expectations and hiked rates by 75 basis points for the fourth consecutive time, leaving the Federal Funds Rate at the 3.75% - 4.00% range.

Technical levels to watch

-

19:23

EUR/USD reverses sharply on Powell's words, breaks below 0.9850 to weekly lows

- Fed hikes rates by 75 basis points as expected could slow down in December.

- Fed Chair Powell does not sound so dovish, triggers a recovery USD recovery.

- EUR/USD dropped from 0.9970 back to the 0.9860 area.

The EUR/USD reversed sharply from the highest level since Friday at 0.9975 and broke below 0.9850, reaching the lowest level in a week at 0.9830. The words from Fed Chair Powell strengthened the greenback.

Dovish FOMC, hawkish Powell

The Federal Reserve raised interest rates by 75 basis points on Wednesday, for the fourth time in a row. The vote was unanimous. The FOMC said it would take into account the cumulative effect of monetary tightening and the lag between the rate hikes and the impact on the economy. During the press conference, Powell said time for slower hikes may come as soon as December or February.

After the FOMC statement the US dollar, US yields tumbled while equity markets soared. During Powell’s press conference the dollar bottomed and then started recover. It is back at the levels it had before Fed’s decision. Stocks and Treasuries gave back all gains. The moment of the reversal was when Fed Chair said the ultimate level of interest rates will likely be higher than earlier estimates.

The EUR/USD is hovering around 0.9840, below the critical short-term support area of 0.9850, looking weak. Euro bulls need the pair to consolidate above 0.9920 in order to gain strength.

Technical levels

-

19:21

NZD/USD returns to 0.5860 area after spiking up to 0.5940 post-FOMC

- The kiwi loses steam at 0.5940 and returns to previous levels at 0.5860.

- The US dollar picks up supported by Fed Powell's hawkish comments.

- A dovish-tilted FOMC statement sent the USD tumbling.

The New Zealand dollar has given away all the ground taken immediately after the release of FOMC’s decision, with the US dollar picking up, supported by Fed President Powell’s comments at the press release.

Investors punished the US dollar after the release of the FOMC's statement, which sent the kiwi to five-week highs at 0.5940, before returning to previous levels in the mid-range of 0.5800 as Powell’s press release goes on.

The dollar picks up on the back of Fed Powell’s comments

The greenback has bounced up strongly with Fed President Jerome Powell taking a more hawkish stance to offset the negative impact of a dovish monetary policy statement.

Jerome Powell has denied the idea that the bank might have overtightened and assured that economic data suggests that “we may eventually move to higher levels than we anticipated at the September meeting”, which has eased expectations of a dovish pivot in December.

Regarding the next meeting, Powell assured that no decision has been taken yet and that the time to slow the pace of rates could be ass soon as December or at February’s meeting.

Previously, the US dollar dropped against its main rivals, after the FOMC statement affirmed that the pace of future rate hikes will be decided considering “cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Technical levels to watch

-

19:15

S&P 500 seesaws between 3830-3896 post-Fed decision, on Powell commentary

- The S&P 500 rallied once the Federal Reserve’s decision was known, as the statement was perceived as dovish.

- Powell “rocked the boat” when he said that the “ultimate level of rates will be higher than previously expected.”

- The S&P 500 erased its gains achieved in reaction to the Fed’s decision.

The S&P 500 is seesawing in a volatile session after the US Federal Reserve raised rates as expected by 75 bps, and by its statement, announced that “cumulative tightening” in place would be taken into account and acknowledged that monetary policy is still lagging in specific sectors of the economy, namely the labor market and price stability. Therefore, the S&P 500 retreats some of its early gains, hoovering around 3842.16-3866.28 at the time of typing.

Jerome Powell’s press conference remarks

During his press conference, Federal Reserve Chairman Jerome Powell said that the central bank is strongly committed to bringing inflation down, and he added that the ongoing rate increases are “appropriate” to get policy sufficiently restrictive. Even though those are some of his usual remarks, once he said that the “ultimate level of rates will be higher than previously expected,” the S&P 500 tanked from its daily highs at 3894.44 to 3801.50, as it was perceived as a hawkish statement.

Powell’s additional remarks:

No One Knows If There Will Be A Recession

A Soft Landing Is Possible But Window Has Narrowed

Have A Ways To Go, Ground To Cover With Hikes

Strong Economy In US, Says Strong Dollar Is A Challenge For Some Countries

Broader Picture Is Still An Overheated Labour Market

Have A Ways To Go On Rates

Very Premature To Be Thinking About Pausing

If We Overtighten, Can Use Our Tools To Respond

Short-Term Inflation Expectations Have Moved Up, Could Affect Wages

The Time For Slower Hikes May Come ‘As Soon As December’

Data Suggests We May Ultimately Move To Higher Levels Than Anticipated At September Meeting

Need To See Inflation Coming Down Decisively, But We Don't Need Inflation To Come Down To Slow Pace Of Hikes

We Think Ongoing Hikes Will Be Appropriate To Get Policy Sufficiently Restrictive

Summary of Fed’s monetary policy statement

Regarding the monetary policy statement, the Fed acknowledged that growth was slowing down in spending and production and commented that labor market conditions remain “robust” and the unemployment rate is slow. Policymakers added that inflation remains elevated, a reflection of the supply/demand imbalances blamed on the pandemic and higher food and energy prices.

Even though Fed policymakers mentioned that they are resolute in taming inflation and will continue to tighten monetary conditions, they laid the ground for a slower pace of interest-rate increases. Fed officials added to the statement, “the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Concerning the Fed’s balance sheet reduction, policymakers added that it would keep reducing as expected and added that the Federal Reserve Open Market Committee (FOMC) would be data-dependent, taking into account public health readings, labor market conditions, inflation pressures, and inflation expectations.

The market reacted negatively, sending the US Dollar down, and the S&P 500 rallied toward its daily highs as traders perceived the monetary policy statement. Nevertheless, the Federal Reserve Chair Jerome Powell press conference, shifted the initial markets reaction, as shown below by the S&P 500 5-minute chart.

S&P 500 5-minute chart

-

19:12

Powell speech: If we overtighten, we have tools to support economic activity

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3.75-4% following the November policy meeting.

Key quotes

"If we overtighten then we have the ability with our tools to support economic activity."

"On the other hand, if you undertighten, it is a year or two down the road you realize you haven't got inflation under control."

"A mistake in the direction of not tightening enough risks entrenched inflation, bigger employment costs."

"Employment costs of that go up with the passage of time."

"We are now focused on what's the level we need to get rates to."

"I don't know what we'll do when we get there by the way."

"I am trying to make sure our message is clear that we have a ways to go until we have got to a sufficient level on interest rates."

-

19:11

Gold Price Forecast: XAU/USD whipsawed on conflicting FOMC guidance

- The gold price has flipped over on the back of conflicting comments from the Fed's Chairman Powell.

- The bid that bulls enjoyed following a dovish statement was wiped out by Chair Powell's hawkish presser.

Gold has dropped back to the start again on the back of hawkish comments from the Federal Reserve's Chairman, Jerome Powell, that sent the 2-year Treasury yields higher when he said the ultimate rate level will be higher than previously expected. Markets had started to price in a slower pace of rate hikes based on the following from today's FOMS statement:

"In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial deviations."

However, rates shot higher when Powell's hawkish comments at the presser dropped, sinking gold prices:

-

Powell speech: Very premature to be thinking about pausing

-

Powell speech: Will likely need restrictive stance of policy for some time

-

Powell speech: Longer-term inflation expectations are still well anchored

-

Powell speech: Will take time for full effects of monetary restraint to be realized

-

Powell speech: Time for slower hikes may come as soon as December or February

Gold & US dollar technical analysis

The daily gold chart above shows the price being whipsawed on the day as the US dollar battles back for ground on Powell's hawkish comments:

The daily outlook shows the US dollar price sandwiched between support and resistance.

The presser started out with a hawkish delivery from Powell which wiped out almost 100% of the FOMC dovish statement drop.

-

19:02

Powell speech: Strong dollar is a challenge for some countries

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3.75-4% following the November policy meeting.

Key quotes

"We keep close tabs on economic developments abroad."

"We are in frequent contact with our foreign counterparts."

"I have a meeting this weekend with many central bankers."

"Clearly this is a difficult time in the global economy."

"We're seeing China having issues with zero covid policy."

"Strong dollar is a challenge for some countries."

"We take all that into account in our models."

"In the US, we have a strong economy."

"We know we need to use our tools to get inflation down, the world won't be better off if we don't do that."

"Price stability in the US is a good thing for the global economy."

-

18:59

Powell speech: Housing market needs to get back into balance

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3.75-4% following the November policy meeting.

Key quotes

"Housing significantly impacted by higher rates."

"Housing market needs to get back into balance."

"From a financial stability standpoint, we haven't seen poor credit underwriting on housing."

"We don't see financial stability issues from the housing sector."

"So it's a very different situation, with no apparent financial stability risks from housing."

"We had thought we would have better labor supply by now."

"Wages are a mixed picture."

"We keep looking for signs of gradual labor market signs, but it's not obvious to me."

"Wages are moving sideways right now not down."

"Vacancies have not come down as much as we thought."

"I don't see the case for real softening in labor market just yet."

"Wages have an effect on inflation, and vice versa."

"Wages are not the principal reason for inflation, not seeing a wage-price spiral."

-

18:58

US dollar bulls fight back hard on Fed Powell's hawkish comments

- FOMC dovish statement sent the US dollar lower but Fed's Powell's hawkish presser came to the rescue for the greenback.

- DXY is whipsawed and retraced close to 100% of the initial drop.

The US dollar has been whipsawed between a dovish FOMC statement followed by a hawkish delivery from Fed's Chair Jerome Powell who advocates for continued rate hikes with the potential to slow as soon as December, but without such a commitment to do so so soon.

At the time of writing, DXY, an index that measures the greenback vs. a basket of currencies, is trading at around 110.89 and has been traded between a post-FOMC statement high of 111.598 and 1110.426 the low.

Changes to FOMC statement

Firstly, DXY was offered heavily on the following in the statement: "In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial deviations."

Before the FOMC statement, the terminal top was priced at 5.03% in May, it's down to 4.95% now after the new sentence in the FOMC statement that signals more increases but hints at possibly smaller increments.

The US dollar fell critical trendline support as shown on the hourly and daily charts below:

However, as the event progressed and Jerome Powell spoke, the dollar bounced back.

-

Powell speech: Will likely need restrictive stance of policy for some time

-

Powell speech: Longer-term inflation expectations are still well anchored

-

Powell speech: Will take time for full effects of monetary restraint to be realized

-

Powell speech: Time for slower hikes may come as soon as December or February

US dollar technical analysis

The daily outlook shows the price sandwiched between support and resistance.

The presser started out with a hawkish delivery from Powell which wiped out alomost 100% of the FOMC dovish statement drop.

-

18:56

Powell speech: Very premature to be thinking about pausing

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3.75-4% following the November policy meeting.

Key quotes

"If we overtighten, can use our tools to respond."

"We want to be sure we don't make a mistake of not tightening enough or loosening too soon."

"If we don't tighten enough, inflation could get entrenched."

"As we move now into restrictive territory, it will be appropriate to think more about lags."

"It is very premature to be thinking about pausing, very premature to even talk about that."

"We will write down in December an updated sense of where rates will need to go."

-

18:54

Powell speech: Financial conditions have tightened quite a bit

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3.75-4% following the November policy meeting.

Key quotes

"Financial conditions have tightened quite a bit."

"Shorter-term inflation expectations moved up since last meeting, we don't think those are as indicative."

"Still it's very concerning."

"We don't have a clearly identified way of knowing when inflation becomes entrenched."

"We need to use our tools forcefully but thoughtfully."

"That's why we need to get inflation under control."

"Policy lags are thought to be long and variable, newer literature suggests lags are shorter."

"Financial conditions now react well before policy moves."

"Plenty of economists think that once financial conditions change, effects are faster than before."

-

18:46

Powell speech: Time for slower hikes may come as soon as December or February

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3.75-4% following the November policy meeting.

Key quotes

"Speed is becoming less important now."

"The time for slower rate hikes may come as soon as December of February."

"We will have discussion on that at next meeting, no decision made yet."

"Our principle focus is to keep rates restrictive."

"More important than pace of rate hikes will be how high rates need to go."

"Dont think we have overtightened."

"We had a discussion at this meeting about slowing rate hikes."

"There is still a need for ongoing rate increases, ground left to cover."

"We will want to get to real positive rates, we need real positive rates across the curve."

-

18:44

USD/CAD trims some of its earlier losses and hovers around 1.3580 as Powell’s presser begins

- The USD/CAD tumbled 80 pips on the release of the Fed’s decision.

- Fed officials will consider previous rate hikes increases, acknowledging that it would take some time to broaden the effects of monetary policy.

- Fed’s Powell: Officials project that the Federal funds rate (FFR) would peak at higher levels than estimated in September.

The USD/CAD plummets after the Federal Reserve hiked rates by 75 bps. However, it was dovish tilted, as officials said that they would take into account “the cumulative tightening of monetary policy” and acknowledge that the effects of policy affect economic activity and inflation. At the time of writing, the USD/CAD is trading at around 1.3550s, amid volatile conditions, after the FOMC’s decision.

Federal Reserve summary of the monetary policy statement

In its monetary policy statement, the Fed acknowledged that growth was slowing down in spending and production and commented that labor market conditions remain “robust” and the unemployment rate is slow. Policymakers added that inflation remains elevated, a reflection of the supply/demand imbalances blamed on the pandemic and higher food and energy prices.

Even though Fed policymakers mentioned that they are resolute in taming inflation and will continue to tighten monetary conditions, they laid the ground for a slower pace of interest-rate increases. Fed officials added to the statement, “the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” which initially is perceived as they acknowledge that monetary policy is not reacting as fast as expected, and would take into account that.

Concerning the Fed’s balance sheet reduction, policymakers added that it would keep reducing as expected and added that the Federal Reserve Open Market Committee (FOMC) would be data-dependent, taking into account public health readings, labor market conditions, inflation pressures, and inflation expectations.

USD/CAD Market’s reaction

The USD/CAD dived from around 1.3630 toward 1.3560, hitting a daily low of 1.3548. However, Federal Reserve Chair Jerome Powell said they would continue tightening monetary conditions; the USD/CAD erased some of its gains and is back at around 1.3600.

USD/CAD 5-minute chart

-

18:40

Powell speech: Will take time for full effects of monetary restraint to be realized

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3.75-4% following the November policy meeting.

Key quotes

"We think ongoing increases in rates will be appropriate to get policy sufficiently restrictive."

"Financial conditions have tightened significantly."

"Will take time for full effects of monetary restraint to be realized."

"At some point will become appropriate to slow pace of rate hikes."

"There is significant uncertainty around that level of interest rates."

"We still have some ways to go."

"Data suggest ultimate level of interest rates will be higher than previously expected."

"Taking forceful steps to moderate demand."

-

18:39

USD/CHF dives to 0.9925 after a dovish FOMC statement

- The dollar dives to session lows at 0.9925 after the FOMC statement.

- Investors see the bank's rhetoric tilted to the dovish side.

- The bank affirms that policy lags will be observed to decide further rate hikes.

The US dollar depreciated across the board on Wednesday, immediately after the release of the Federal Reserve’s Monetary policy decision. The pair retreated from the 1.000 area to hit session lows at 0.9925 so far.

US dollar suffers as the Fed strikes a dovish tone

The Federal Reserve has met expectations and hiked the Federal Funds rate by 75 basis points, for the fourth consecutive time, to the 3.75% - 4.00% range.

Investors, however, had been focused on the statement, and this has been tilted to the dovish side. The committee affirmed that the pace of future rate hikes will be decided considering “cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Furthermore, the bank has reaffirmed that interest rate increases will be necessary to return inflation to the 2% level, although warning about recent indicators pointing to modest growth in spending and production.

Technical levels to watch

-

18:36

Powell speech: Longer-term inflation expectations are still well anchored

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3.75-4% following the November policy meeting.

Key quotes

"Activity in housing has weakened."

"Slower output growth also weighing on business fixed investment."

"Job vacancies still very high."

"Labor market is extremely tight, still out of balance."

"Demand substantially exceeding supply there."

"Inflation is still well above our goal."

"Recent inflation data has come in stronger than expected."

"Longer-term inflation expectations are still well anchored."

"That is not grounds for complacency though, acutely aware high inflation imposes significant hardship."

-

18:34

Powell speech: Will likely need restrictive stance of policy for some time

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 75 basis points to the range of 3.75-4% following the November policy meeting.

Key quotes

"Strongly committed to bringing down inflation."

"Without price stability, will not achieve sustained strong labor market."

"We are moving policy stance purposefully."

"We will likely need restrictive stance of policy for some time."

"US economy has slowed significantly from last year."

"Growth in consumer spending has slowed, in part due to tighter financial conditions, lower real incomes."

-

18:32

USD/JPY hits multi-day lows near 146.00 as FOMC hints at a slower pace of rate hikes

- Fed raises interest rates by 75 basis points for the fourth time in a row, as expected.

- FOMC signals it could slow down rate hikes soon.

- US Dollar tumbles across the board as US yields drop sharply.

The USD/JPY broke below 146.80 and tumbled to 146.03, hitting the lowest level since last Friday following Fed’s monetary policy decision. A decline in US yields and a weaker dollar are keeping the pair under pressure, near daily lows.

Fed moves as expected, analysts look at clues

The US central bank raises interest rates by 75 basis points on Wednesday, for the fourth time in a row. The vote was unanimous. The FOMC said it would take into account the cumulative effect of monetary tightening and the lag between the rate hikes and the effects on the economy, probably suggesting it would consider a slowdown as soon as the next meeting.

The considerations from the FOMC pushed the US Dollar to the downside and sent equity markets to the upside. Fed Chair Powel’s post-meeting press conference is underway.

USD/JPY weaker

The DXY turned negative and hit the lowest level in two days under 111.00. At the same time, the Dow Jones turned positive and it was up by 0.85%.

Treasuries rose following the FOMC statement. The US 10-year yield fell from 4.05% to as low as 3.97%, before bouncing back to 4.00%. The US 2-year yield fell from above 4.55% to 4.44%.

The decline in yields with the possibility of a slowdown in Fed rate hikes sent USD/JPY to the downside. The pair remains under pressure but volatility is set to remain elevated during Powell’s press conference.

Below 146.00, important support emerges at 145.50 and then attention would turn to 145.00. A consolidation below should increase the bearish pressure, suggesting more losses ahead. On the upside, now 146.90 is the immediate resistance area followed by 147.45. If USD/JPY rises above 148.00, a test of the weekly high at 148.85 seems likely.

Technical levels

-

18:23

AUD/USD jumps to session highs at 0.6475 after the FOMC statement

- The aussie hits session highs at 0.6475 after Fed's decision.

- The market has seen the bank's statement tilted to the dovish side.

- The FOMC will take the cumulative tightening into account for future hikes.

The US dollar reacted negatively immediately after the release of the Federal Reserve’s monetary policy meeting. The Aussie, which had been trading within a tight range above 0.6400, has surged to session highs at 0.6470 so far.

Investors see a dovish tone in the Fed’s statement

As was widely expected, the bank has hiked the Federal Funds rate by 75 basis points, for the fourth consecutive time, to the 3.75% - 4.00% range.

The bank’s statement, however, has seen tilted to the dovish side. The committee observes that in determining the pace of future rate hikes, they will consider “cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Beyond that, the bank has warned about recent indicators pointing to modest growth in spending and production.

Technical levels to watch

-

18:22

GBP/USD rallies sharply towards 1.1530s on a volatile session after FOMC’s dovish hike

- The US Federal Reserve hiked rates by 75 bps and would take into account the “cumulative tightening of monetary policy.”

- Hence, the GBP/USD rallied as the rate hike was perceived as dovish.

- The GBP/USD rallied more than 100-pips in the first 5-minute candle, registering the high of the day at 1.1559.

The GBP/USD soars as the Federal Reserve decided to hike rates by 75 bps and also acknowledged that the tightening pace would depend on the cumulative tightening of monetary policy, inflation, and financial markets developments. At the time of writing, the GBP/USD is rallying, though in a volatile trading range within 1.1450-1.1550.

Summary of the Federal Reserve’s monetary policy statement

So the Fed pulled the trigger and hiked rates as expected. However, they added to the statement, “the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” which initially is perceived as they acknowledge that monetary policy is not reacting as fast as expected, and would take into account that. That said, the GBP/USD rallied sharply in a dovish-perceived rate hike.

Regarding the Fed’s balance sheet reduction, the policymakers said it would keep reducing as expected and added that the Federal Reserve Open Market Committee (FOMC) would be data-dependent, taking into account public health readings, labor market conditions, inflation pressures, and inflation expectations.

Market’s reaction

The GBP/USD initially dived towards 1.1458 and then skyrocketed toward 1.1559, breaking several resistance levels, like the 1.1500 figure and also 1.1550. Nevertheless, at the time of typing, the GBP/USD meanders around 1.1539 as traders brace for Fed Chairman Jerome Powell’s press conference.

GBP/USD 5-minute chart

GBP/USD Key Technical Levels

-

18:19

Gold Price Forecast: XAU/USD rallies through critical resistance after dovish tilt at FOMC

- Gold rallies hard on a dovish pivot at the FOMC.

- Markets now await clarity from Chair Powell's presser.

The gold price has shot higher on a hint of dovishness in today's interest rate decision by the Federal Open Market committee. The vote was unanimous in favour of the policy whereby the Fed hiked by 75bps, setting the target range at 3.75% - 4.00%.

Gold is up around 1% following the release of the statement trading at $1,663, rising from the day's low of $1,645.68, printing a post-Fed high of $1,665.53 so far.

Gold price is higher on the back of the swaps markets that are now downgrading the chances of another 75bps at its December meeting due to such changes in the statement as follows:

"In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial deviations."

Changes to FOMC statement

Before the FOMC statement, the terminal top was priced at 5.03% in May, it's down to 4.95% now after the new sentence in the FOMC statement that signals more increases but hints at possibly smaller increments.

The US dollar is testing critical trendline support as shown on the hourly and daily charts below:

Markets now await Chair Jerome Powell's presser for clarity on the dovish tilt.

Watch live Chiar Powell

Gold technical analysis

The weekly charts shows the price at the bottom of the sideways range.

The daily charts show the prospects of a move into channel resistance:

(Before Fed, above)

The price is digging into the M-formation's resistance that guards the channel resistance.

(After Fed, below):

The hourly chart shows the price reaching into

-

18:11

EUR/USD jumps to two-day highs above 0.9950 after FOMC statement

- Fed raises interest rate by 75 basis points as expected.

- US dollar weakens as FOMC says will take into account the cumulative tightening.

- EUR/USD gains momentum, above 0.9950 could test parity.

The EUR/USD rose following the Fed’s decision to raise interest rates by 75 basis points as expected as the US dollar tumbled across the board. The pair rose from 0.9970 to as high as 0.9945 in the minutes after the FOMC statement.

The FOMC said it “will take cumulative tightening of monetary policy, the lags with which monetary policy affects.” It also said it need to keep raising until rates are “sufficiently restrictive.” Now market participants await the post-meeting press conference (18:30 GMT).

The signals from the Fed pushed US yields to the downside and sent the greenback sliding. The US Dollar Index turned negative to test Monday lows while gold and silver jumped.

At the time of writing, the EUR/USD is moving higher trading at two-day highs above 0.9950. The next strong barrier is located around the parity area, followed by 1.0055 and then the last week's high at 1.0090 will come into attention. On the flip side, the immediate support now stands at 0.9915. A break under 0.9850 would likely trigger more losses.

Technical levels

-

18:01

United States Fed Interest Rate Decision meets forecasts (4%)

-

18:00

Breaking: Fed hikes policy rate by 75 bps to 3.75-4% as expected

The US Federal Reserve on Wednesday announced that it raised the policy rate, federal funds rate, by 75 bps to the range of 3.75-4% following the November monetary policy meeting. This decision came in line with the market expectation.

Follow our live coverage of the Fed's policy announcements and the market reaction.

Market reaction

The dollar came under renewed selling pressure and the US Dollar Index declined below 111.00 with the initial reaction.

Key takeaways from policy statement

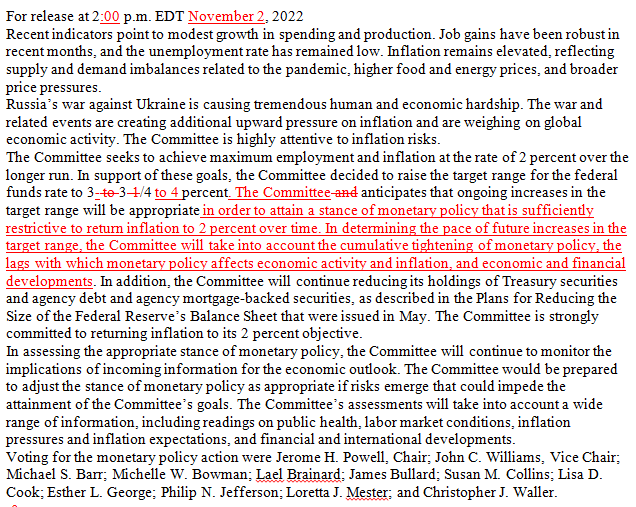

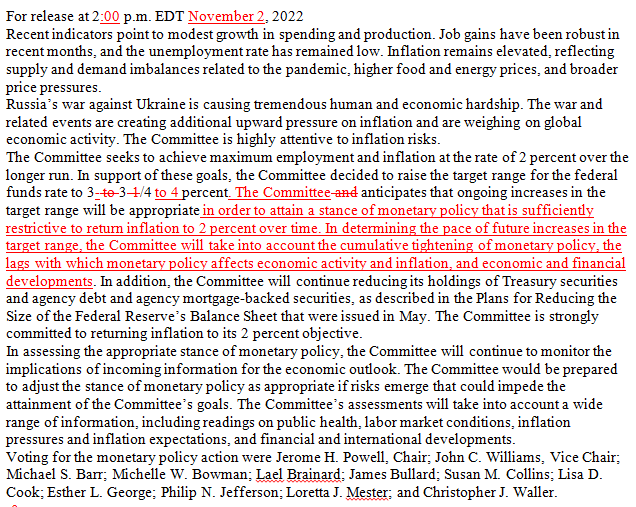

"Will take into account cumulative tightening, policy lags, and economic and financial developments in determining pace of rate hikes."

"Fed anticipates ongoing interest rate increases will be appropriate to attain a sufficiently restrictive policy stance to return inflation to 2% over time."

"Inflation remains elevated."

"Job gains have been robust, unemployment rate has remained low."

"Recent indicators point to modest growth in spending and production."

"War in Ukraine is creating additional upward pressure on inflation, weighing on global economic activity."

"Prepared to adjust policy as appropriate."

"FOMC is highly attentive to inflation risks."

"Vote in favor of policy was unanimous."

-

17:50

USD/JPY is right above the 146.85 session low with the FOMC looming

- The dollar is hovering near 146.85 session lows ahead of the FOMC.

- Investors, watching from the sidelines with all eyes on the Federal Reserve.

- USD/JPY expected to consolidate above 150.00 – Credit Suisse.

The US dollar is heading south for the second consecutive day on Wednesday, extending its reversal from last week’s highs near 152.00 to test prices below 147.00 with all eyes on the Federal Reserve.

Cautious session ahead of the FOMC

Major currency crosses are trading within previous ranges in a calm session on Wednesday, with all eyes on the outcome of the Federal Reserve’s meeting.

Investors have priced in a 0.75% rate hike, the fourth in a row, although market speculation about the bank signaling softer hikes in the future has boosted the interest on the event. In that sense, any hint that may suggest the direction of December’s move might trigger a significant increase in market volatility.

On the macroeconomic front, the bright US ADP employment report has anticipated an increment to 239,000 private-sector payrolls in October, well above the market consensus of 195,000. The impact on the dollar, however, has been muted, with the USD Index practically flat on the day.

USD/JPY seen trading sustainably above 150.00 – Credit Suisse

In the longer-term, Analysts at Credit Suisse expect the pair to consolidate above 150.00: “Japanese media suggests the main umbrella union Rengo will ask for wage hikes of 5% next year, up from the 4% level it wanted for this year (2% was actually achieved). With longer-term inflation expectations rising too, it seems Kuroda still sees this as a unique opportunity to reset Japan’s inflation mindset and is unwilling to let go. We suspect that over time this will cause USD/JPY to trade above 150.00 sustainably, and we think dips in USD/JPY to recent lows around 145.25 offer good entry points for longer-term players.”

Technical levels to watch

-

17:46

US dollar sitting tight at critical resistance ahead of FOMC dropping top of the hour

The US dollar came under pressure on Wednesday but has since picked up a bid again as the countdown to the FOMC moves into the final hour where another 75 bp hike is expected. The FOMC will release its policy statement at 1800 GMT. Markets will look to any hints that the Federal reserve is moderating in the response to inflation.

At the time of writing, DXY, an index that measures the greenback vs. a basket of major currencies was back to flat on the day having recovered from a low of 111.084 and recently marking a high of 111.598.

While the focus will be on the press conference where Chair Jerome Powell will be expected to maintain the hawkish tone that he has consistently held since Jackson Hole in late August, there are risks of a variant of a 100bps hike or a lesser 50bp which will come as a surprise. Additionally, the statement will be important in any outcomes and variants surrounding a 75bps hike. In a prior commentary, Powell suggested that hikes may not continue at their present pace, but if he were to switch that up and suggest that another 75bp rate hike in December is possible as inflation remains stubbornly high, the dollar could fly as investors start to price in a higher terminal rate. For the December meeting, the futures market is split on the odds of a 75- or 50-bps increase

However, analysts at Brown Brothers Harriman argued that he will give the markets what they are looking for, which is some hint of a pivot. In such a dovish outcome, Powell could suggest that another 75bp hike in December may not be necessary due to significant front-loading that has already taken place. This would suggest to markets that the central bank is nearing a policy peak and that inflation should begin to moderate relatively soon. The dollar would be presumed to come under pressure on such dovishness while risk markets, such as stocks and high better currencies would rally.

DXY technical analysis

The weekly chart is pointing to a higher US dollar, but 111.50 needs to be cleared:

From a daily perspective, the index has dipped below the trendline, but not for the first time:

We can paint the trendline with a broad brush, but what is significant is the horizontal resistance between 111.47 and 112.52. This Fed meeting could be make or break in this respect. If the price failed to get through here once the decision is digested over the rest of the week, then that would indicate we could be in for prolonged softness in the greenback and entirely data-dependent until the December meeting.

-

17:36

Fed Press Conference: Chairman Jerome Powell speech live stream – November 2

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

-

17:28

EUR/USD fluctuates around 0.9860 ahead of the FOMC's monetary policy decision

- EUR/USD is almost unchanged after hitting a daily high of 0.9915.

- The October US ADP Employment Change report gives another reason for the Fed to continue its “aggressive” approach to monetary policy.

- Eurozone’s S&P Global Manufacturing PMI Final for October confirms that the bloc might get a recession.

The EUR/USD is subdued ahead of the Federal Reserve Open Market Committee (FOMC) decision, which is utmost sure it will deliver the fourth 75 bps rate hike by the Fed, though what traders are looking for the pace of further increases if it would keep the pace, or slow it down, as sources linked to the Fed said in an article on October. At the time of writing, the EUR/USD is trading at 0.9867, almost unchanged.

The EUR/USD is range-bound ahead of the Fed’s decision

US equities continue to trade with minimal losses following the release of US jobs data, reflecting that the labor market is yet to ease. At the same time, the Fed pivot narrative would be confirmed or pushed back once Jerome Powell hit the stand.

ADP reported that the US companies hired more people than estimated in October. The ADP Employment Change report for October showed that private payrolls jumped by 239K above estimates of 185K and crushed the September upward revision of 192K.

According to Nela Richardson, ADP’s Chief Economist, the report is strong given the maturity of the economic normalization, though she noted that hiring was not broad-based. She added, “Goods producers, which are sensitive to interest rates, are pulling back, and job changers are commanding smaller pay gains.”

Given that the US economy is back in expansionary territory, the October Core Personal Consumption Expenditures (PCE), the Fed’s favorite gauge of inflation, increased, the ISM Manufacturing PMI remains in expansionary territory, and US jobs data flashing the tightness of the labor market, that could deter the Federal Reserve from slowing the pace of tightening.

Aside from this, the Eurozone calendar featured the Germany Balance of Trades which showed a surplus of €9 billion in September vs. €0.3 billion in August. Later, the S&P Global Manufacturing PMI on its final reading, plunged to 46.4, below estimates of 46.6, reinforcing the case that the Eurozone might get into a recession.

Ahead in the calendar, at 18:00 GMT, the Federal Reserve will reveal its monetary policy decision, followed by Jerome Powell’s press conference at 18:30 GMT.

EUR/USD Key Technical Levels

-

17:07

EUR/GBP in range below 0.8625 ahead of the FOMC

- The euro remains stalled below 0.8625 for the second consecutive day.

- The market is calm ahead of the FOMC.

- On Thursday, the BoE is expected to deliver a "dovish hike".

The euro has remained trading within a narrow range against the British pound for the second consecutive day. The pair has consolidated above 0.8600, yet with upside attempts lacking acceptance above 0.8625.

Consolidation ahead of the Fed and BoE decisions

Major FX crosses are trading rangebound on Wednesday, with the investors awaiting the outcome of the Federal Reserve’s monetary policy meeting, due later today.

The Fed is widely expected to hike rates by 0.75% for the fourth consecutive time, although growing speculation about the possibility of a signal towards softer rate hikes over the next months has boosted investors’ interest in November's meeting.

In this scenario, the traditional calm ahead of the FOMC, might lead to a significant deal of volatility, in case the bank discloses any hint about the direction of the next monetary policy moves.

Furthermore, the Bank of England is also expected to hike rates by 0.75% on Thursday. In this case, the bank is expected to adopt a dovish tone in the light of UK’s bleak economic prospects.

Technical levels to watch

-

16:55

WTI climbs above $90.00 per barrel as US oil inventories fall

- WTI is trading above $90.00 and has gained more than 2% weekly.

- The US government reported that oil-related products contracted, a tailwind for oil prices.

- WTI remains neutral, but a break above $93,62, could send oil rallying to the 200-day EMA.

Western Texas Intermediate (WTI), the US crude oil benchmark, rises close to 2% as the US Dollar weakens ahead of the Fed’s decision, while stockpiles in the US declined as refineries increased activity as the winter season looms. At the time of writing, WTI is trading at $90.13 per barrel after hitting a daily low of $87.76.