Notícias do Mercado

-

23:54

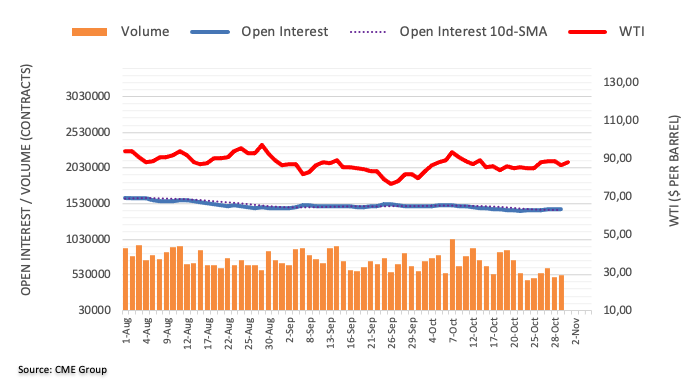

WTI Price Analysis: Bulls brace for a bumpy road around $88.00

- WTI grinds higher after an upbeat start to November.

- Monthly resistance line, five-week-old horizontal region challenge buyers.

- Convergence of 200-SMA, ascending trend line from late September appears a tough nut to crack for bears.

- Oscillators suggest further upside momentum towards the previous monthly top.

WTI crude oil price remains sidelined around $88.10 during Wednesday’s sluggish Asian session, mildly bid after posting the biggest daily gain in a week.

In doing so, the black gold buyers prepare to battle with the broad resistance region between $88.50 and $89.30, comprising a one-month-old descending trend line and a horizontal area comprising levels marked since October 06.

Following that, the quote’s run-up to the previous monthly peak of $92.63 appears imminent. However, the RSI (14) approaches the overbought territory and might challenge the oil buyers around then.

If the energy benchmark remains firmer past $92.65, the odds of witnessing a rally towards August month’s high near $97.30 and then to the $100.00 psychological magnet can’t be ruled out.

Alternatively, pullback moves remain elusive unless the quote stays beyond the $84.70 level representing a convergence of the 200-SMA and a five-week-old ascending trend line.

In a case where WTI successfully breaks the $84.70 support confluence, October’s low of around $81.30 and the $80.00 round figure will gain the market’s attention.

WTI: Four-hour chart

Trend: Limited upside expected

-

23:52

Japan Monetary Base (YoY) registered at -6.9%, below expectations (-4.9%) in October

-

23:40

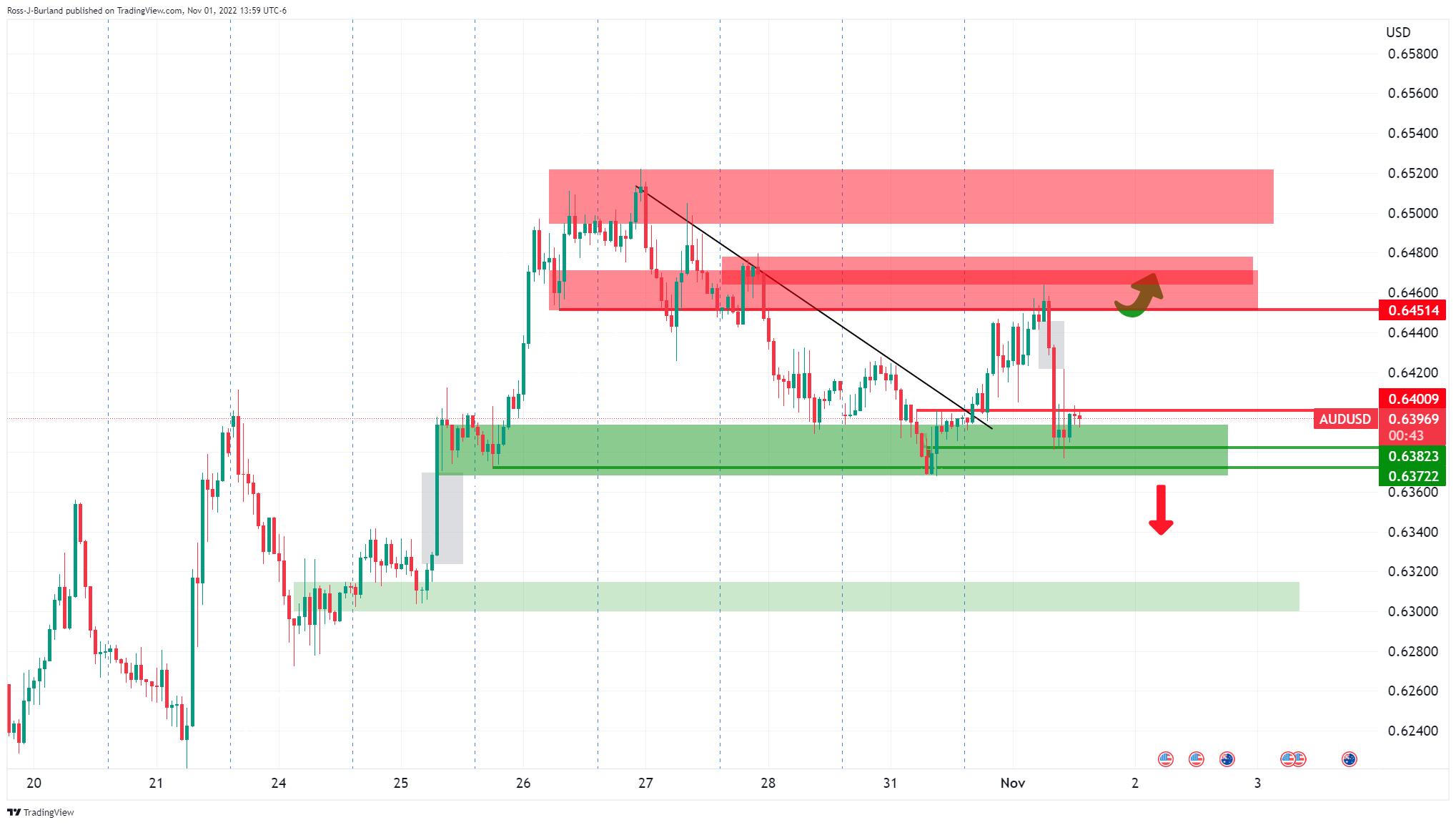

AUD/USD portrays pre-Fed anxiety around 0.6400 ahead of US ADP Employment Change

- AUD/USD remains sidelined around short-term key supports amid sluggish markets.

- Indecision over Fed’s move in December restricts the Aussie pair’s immediate moves.

- Hopes of easy covid restrictions in China and the already-priced 75 bps rate hike from Fed favor bulls.

- Australia Building Permits, US ADP Employment Change are extra catalysts to watch for clear directions.

AUD/USD treads water around 0.6400 as traders turn cautious ahead of the key Federal Open Market Committee (FOMC) meeting on early Wednesday. In addition to the pre-Fed anxiety, the mixed concerns surrounding China and the US also challenge the Aussie pair traders amid a sluggish Asian session.

That said, the recent positive US data increased hopes of a hawkish Fed move and challenged the market’s previous notion that the policymakers will signal slower rate lifts from December. However, the growing fears of recession and higher price pressure seem to challenge the Fed hawks and the AUD/USD bears too.

That said, the US JOLTS Job Openings increased to 10.717M in September versus 10.0M forecast and upwardly revised 10.28M previous readings. Further, US ISM Manufacturing PMI increased to 50.2 in October versus 50.0 market forecasts and 50.9 prior. On the same line, final readings of the US S&P Global Manufacturing PMI for October rose past 49.9 initial forecasts to 50.4 but stayed below 52.0 readings for the previous month.

On the other hand, the Reserve Bank of Australia’s (RBA) readiness to offer more rate hikes, despite announcing the second 25 basis points (bps) of a lift to the benchmark rate the previous day, favor the AUD/USD buyers. “Rates have been increased by a large amount in a very short period of time,” Reserve Bank of Australia (RBA) Governor Philip Lowe said in his scheduled appearance on Tuesday. The policymaker also added that the board has judged it appropriate to raise rates at a slower pace.

Elsewhere, hopes of easing covid restrictions in China and recently firmer China Caixin Manufacturing PMI for October, despite posting the third print below 50.00, might have previously helped the AUD/USD buyers.

While portraying the mood, the yields remain inactive around 4.05%, following an upbeat start to November, whereas the S&P 500 Futures print mild gains even as Wall Street closed in the red.

That said, the AUD/USD pair traders should watch the risk catalysts and Australia’s Building Permits for September for fresh impulse amid the lackluster markets. Also important will be the October month US ADP Employment Change, as it is an early signal to Friday’s US Nonfarm Payrolls. However, major attention should be given to how well the Fed policymakers could convey a brake to the aggressive rate hikes.

Technical analysis

Tuesday’s daily candle joins the AUD/USD pair’s refrain from declining below the 10-DMA support near .6390 to keep buyers hopeful. However, a downward-sloping resistance line from early August, close to 0.6480 by the press time, challenges the quote’s upside momentum.

-

23:20

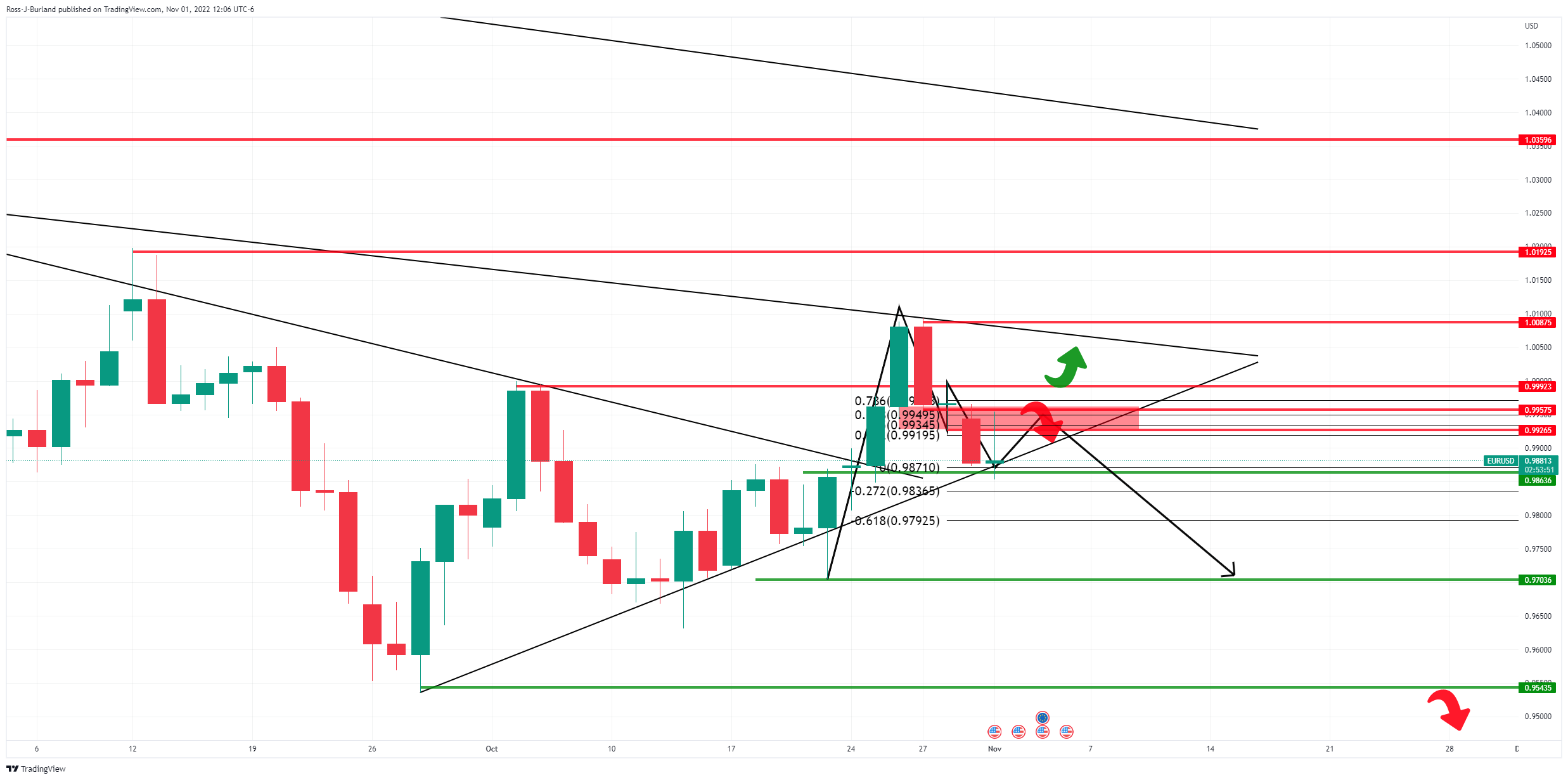

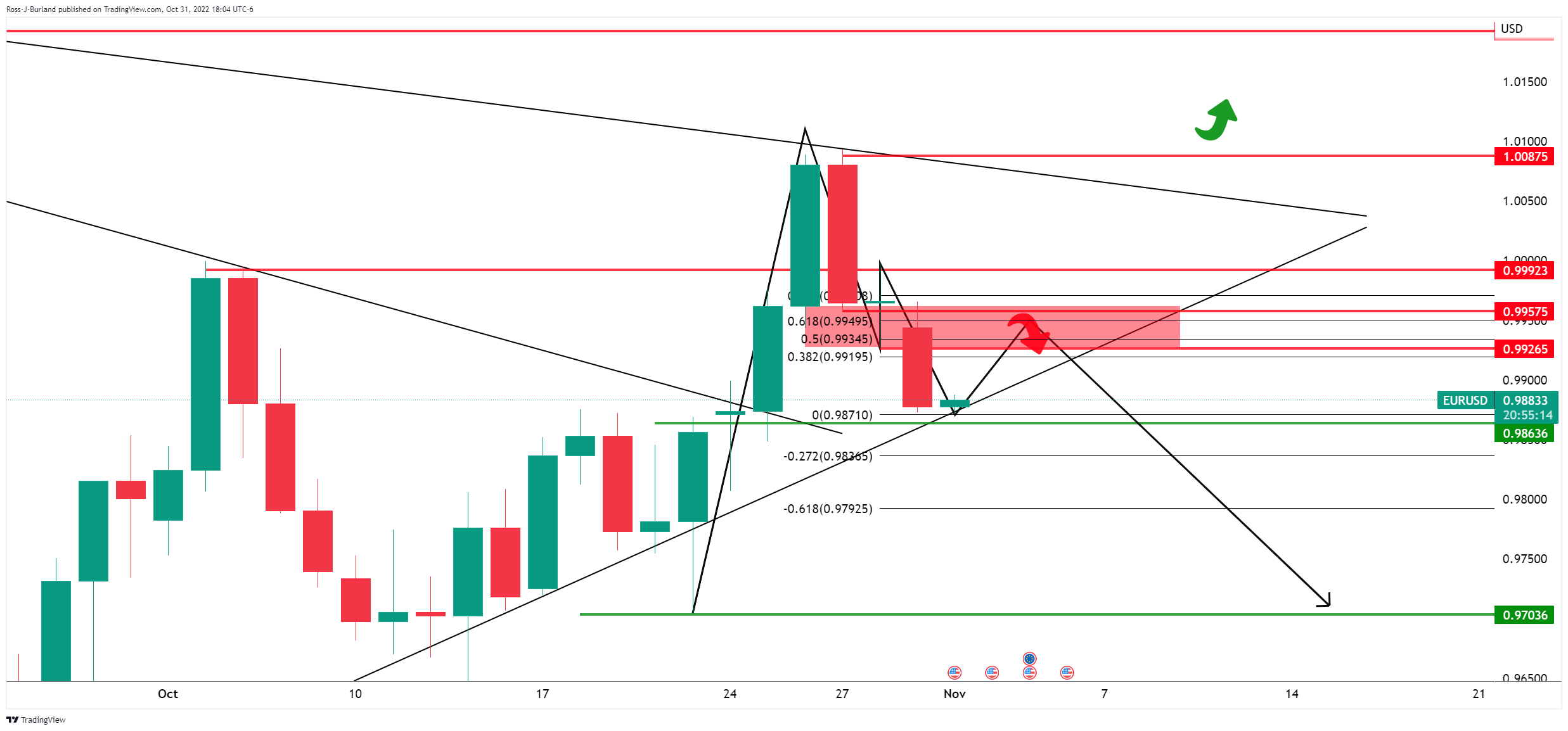

EURUSD: ECB members capped the EUR fall against the USD, despite upbeat US data

- The USD got bolstered by upbeat US economic data, erasing EURUSD's earlier gains.

- European Central Bank (ECB) officials expressed the need for higher rates, putting a lid on EUR losses.

- Short term, the EURUSD is downward biased, eyeing a break of 0.9800 to challenge 0.9700.

The Euro gave back some of its earlier gains vs. the US Dollar and finished the day almost flat, though registering a minimal loss of 0.04%. Goodish economic data out of the United States, and US Treasury yields recovering from the daily lows, below 4%, and the Federal Reserve November meeting, were some of several reasons that undermined the EUR. The EURUSD is trading at 0.9874, down by 0.02%.

Manufacturing activity in the United States expanded though at a slower level, underpinned the USD to the detriment of the EUR

On Tuesday, Wall Street finished with decent losses amidst data revealing that the United States economy remains at expansionary territory. The Institute for Supply Management (ISM) PMI for October showed that manufacturing activity remained resilient at 50.2, beating estimates of 50, but lower than the September report. Echoing some of the same results as the S&P Global Manufacturing PMI for the same period was a prelude for the ISM, rising to 50.4, exceeding estimates and the previous month's data.

The EURUSD tumbled on the S&P Global PMI headline, from around 0.9930s toward 0.9860s, and since the release of the ISM PMI, has hovered around the 0.9870s area.

In the meantime, the US labor market, widely mentioned by the Federal Reserve in its monetary policy statement, remains tight as the September JOLTS report, revealed by the US Labor Department, reported that job openings, augmented by 10.717 million, above the 10 million forecast, and smashed August’s 10.28 million.

European Central Bank (ECB) policymakers added that rates hikes would continue

Aside from this, European Central Bank (ECB) policymakers, led by its President Christine Lagarde, said that rates in the Euro area should peak at a level that “ensures” that inflation returns to the 2% target over the medium term. Lagarde’s added that “the destination is clear, and we haven’t reached it yet,” said in an interview.

Lagarde’s added that inflation remains too high throughout the Eurozone, following Monday’s report of inflation around 10.7%, and acknowledged that the likelihood of a recession has increased.

Late in the New York session, more ECB officials, led by Joachim Nagel and Pablo Hernandez de Cos, agreed that inflation is persistent and that the ECB still has “a long way to go.”

Traders get ready for the Federal Reserve (Fed)

Elsewhere, EURUSD traders prepared for the Fed’s November meeting. Analysts expect the US central bank to hike rates by 75 bps, which would be a fourth of a kind as the Federal funds rate (FFR) will hit the 3.75-4% range. Even though the decision is important, due to the financial narrative speculation for a Federal Reserve pivot, the highlight of the day will be Jerome Powell's press conference, which would shed some light regarding a deceleration for the pace of interest-rate hikes, or grab a page of the ECB’s President Lagarde’s book, and probably go to the “meeting-by-meeting” decisions.

EURUSD Price Analysis: Technical outlook

The EURUSD hourly chart confirms the pair as neutral-to-downward biased. Even though the EUR jumped toward the 20-hour Exponential Moving Average (EMA) at 0.9907, on a headline of the US President Biden endorsing a Fed pivot. However, later it was corrected as Biden endorsed the Fed tightening monetary policy in 2022, After the headline, the EURUSD reversed its uptrend and plunged toward its daily low at 0.9853.

The Relative Strength Index (RSI) at bearish territory portrays sellers remaining in charge. Hence, the EURUSD's first support would be 0.9853. Break below will expose the 0.9800 figure, followed by the October 21 daily low at 0.9704.

-

23:17

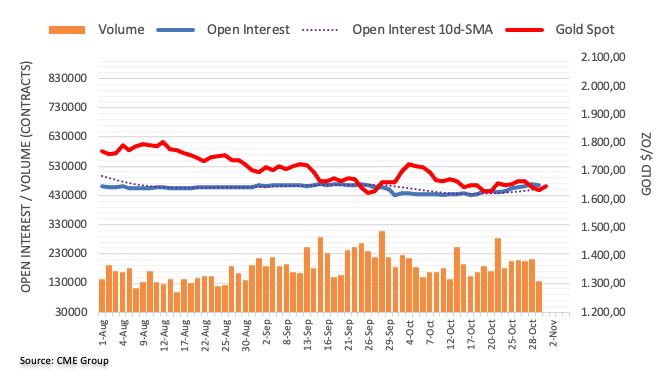

Gold Price Forecast: XAU/USD remains easy around $1,650, falling wedge, Fed in focus

- Gold price pares the biggest daily gains in eight days inside a bullish chart pattern.

- Pre-Fed anxiety and firmer yields weigh on the XAU/USD prices.

- Gold bears can cheer Fed’s 75 bps rate hike in absence of signals favoring a slower lift to rates in December.

Gold price (XAU/USD) remains sidelined around $1,648, mildly offered, after witnessing an upbeat start to the week, as traders await the all-important Federal Open Market Committee (FOMC) verdict on Wednesday.

While the US dollar’s struggle offered a good November start to gold, after a seven-month downtrend, the market’s anxiety ahead of the key Fed meeting and the US dollar’s recent pick-up appears to challenge the bulls of late.

That said, the US Dollar Index (DXY) grinds near 111.50, following an initial slump to 110.70, as firmer US data and a recovery in the Treasury yields recalled the greenback buyers.

The US JOLTS Job Openings increased to 10.717M in September versus the 10.0M forecast and upwardly revised 10.28M previous readings. Further, US ISM Manufacturing PMI increased to 50.2 in October versus 50.0 market forecasts and 50.9 prior. On the same line, final readings of the US S&P Global Manufacturing PMI for October rose past 49.9 initial forecasts to 50.4 but stayed below 52.0 readings for the previous month.

In addition to the firmer US data, the increasing hawkish Fed bets also weigh on the XAU/USD prices due to the metal’s inverse relationship with the US dollar. Recently, the CME’s FedWatch Tool printed an 85% chance of the Fed’s 75 bps rate hike in today’s monetary policy meeting.

Against this backdrop, Wall Street closed in the red despite a firmer opening while the US Treasury yields are firmer around 4.05%, suggesting the risk-off mood, which in turn probed the XAU/USD bulls.

It’s worth noting, however, that the indecision over the policymakers’ verdict on the rate increases from December appears the key catalyst to watch for the metal traders as the 75 bps rate lift is already priced-in and makes no major difference. As a result, Fed Chair Powell’s press conference and the US central bank’s ‘dot-plot’ will be crucial to watch for fresh impulse.

Also read: Fed November Preview: Is it time for a dovish signal?

Technical analysis

Gold price portrays a one-week-old falling wedge bullish formation on the four-hour chart. The hopes of an upside move also take clues from the recently bullish MACD signals and firmer RSI (14).

However, the 100-EMA and the 200-EMA, respectively around $1,655 and $1,668, act as additional upside filters to watch for the XAU/USD bulls before aiming the theoretical target of $1,700.

Meanwhile, the stated wedge’s lower line, around $1,630 by the press time, restricts the metal’s immediate downside.

Following that, the lows marked in October and September, close to $1,617 and $1,615 in that order, will challenge the gold bears ahead of the 61.8% Fibonacci Expansion (FE) of October 04-26 moves, near $1,605, quickly followed by the $1,600 threshold.

Gold: Four-hour chart

Trend: Limited upside expected

-

23:00

South Korea Consumer Price Index Growth (YoY) registered at 5.7% above expectations (5.6%) in October

-

23:00

South Korea Consumer Price Index Growth (MoM) came in at 0.3%, above forecasts (0.2%) in October

-

22:50

GBP/USD Price Analysis: Retreats towards 1.1450 inside weekly bearish channel

- GBP/USD remains depressed inside a one-week-old bearish chart pattern.

- Downbeat MACD signals also keep sellers hopeful even if 50-SMA tests intraday bears.

- Convergence of 100-SMA, five-week-long ascending trend line appears a tough nut to crack for sellers.

GBP/USD fades the month-start optimism as it slides to 1.1480 during Wednesday’s Asian session while staying inside a one-week-long descending trend channel.

That said, the Cable pair’s latest losses also take clues from the bearish MACD signals and keep the sellers hopeful.

However, the 50-SMA level surrounding 1.1460 restricts the quote’s immediate downside ahead of the stated channel’s lower line, close to 1.1430 at the latest.

Even if the GBP/USD bears manage to conquer the 1.1430 support level, the 1.1335-30 support confluence comprising the 100-SMA and an upward-sloping trend line from late September will be a tough nut to crack for them. Following that, the monthly support line near 1.1200 will be the last defense for the pair buyers.

Alternatively, recovery moves need to defy the bearish chart pattern to please the bulls. In doing so, the quote needs to cross the 1.1575 hurdle.

Even so, October’s peak around 1.1645 will hold the gate for the GBP/USD pair’s run-up towards the September monthly high of 1.1738.

Overall, GBP/USD is likely to decline further but the road to the south appears bumpy.

GBP/USD: Four-hour chart

Trend: Limited downside expected

-

22:34

BoC's Macklem: We expect our policy rate will need to rise further

Bank of Canada (BoC) Governor Tiff Macklem said, per Reuters, “We expect our policy rate will need to rise further.” It’s worth noting that the policymaker spoke before the standing senate committee on banking, trade and the economy amid early Wednesday in Asia.

Additional comments

How much further rates go up will depend on how monetary policy is working, how supply challenges are resolving and how inflation is responding to this tightening cycle.

We have yet to see a generalized decline in price pressures.

There are no easy outs to restoring price stability.

Reiterates that, ‘This tightening phase will draw to a close. We are getting closer, but we are not there yet.'

Reiterates that we are still far from goal of low, stable and predictable inflation.

It will take time to get back to solid growth with low inflation, but we will get there.

The measures for inflation the banks is watching have stopped their rapid rise, but have not yet declined.

USD/CAD grinds higher

USD/CAD holds onto the previous day’s recovery above 1.3600 following the comments.

Also read: USD/CAD Price Analysis: Bulls meet a firm daily resistance

-

22:22

NZD/USD struggles above 0.5800 on mixed New Zealand Q3 employment statistics, Fed eyed

- NZD/USD fails to reverse pullback from six-week high, mildly offered of late.

- New Zealand’s Employment Change increased, Unemployment Rate stayed static in Q3.

- Market sentiment sours ahead of Fed, firmer US data recall DXY buyers.

- DXY bulls need more than Fed’s 75 bps rate hike to keep the reins.

NZD/USD prints mild losses around 0.5830, failing to reverse the late Tuesday’s pullback from a six-week high after an initial uptick post-New Zealand’s (NZ) third quarter (Q3) employment data released on early Wednesday. In addition to the mixed job numbers, the market’s anxiety ahead of the all-important Federal Open Market Committee (FOMC) meeting also challenges the Kiwi pair.

New Zealand's Q3 Unemployment Rate remained unchanged at 3.3% and the Employment Change rose to 1.3% versus 3.2% and 0.5% respective market forecasts. Following the data, Reserve Bank of New Zealand Deputy Governor Christian Hawkesby said, “We have a very hot labor market, need to ensure that demand cools.” While speaking at the RBNZ's Financial Stability Report (FSR), the policymaker also stated that (RBNZ) will consider tightening policy faster or slower at MPS while seeing the balance of risks on global economy to the downside.

Also read: New Zealand jobs data puts a marginal bid into NZD

Earlier in the day, GDT Price Index slumped to -3.9% versus 0.6% expected and -4.6% prior.

On the other hand, the US data relating to the October month activities and job openings came in firmer. That said, the US JOLTS Job Openings increased to 10.717M in September versus 10.0M forecast and upwardly revised 10.28M previous readings. Further, US ISM Manufacturing PMI increased to 50.2 in October versus 50.0 market forecasts and 50.9 prior. On the same line, final readings of the US S&P Global Manufacturing PMI for October rose past 49.9 initial forecasts to 50.4 but stayed below 52.0 readings for the previous month.

It should be noted, however, that hopes of easing covid restrictions in China and recently firmer China Caixin Manufacturing PMI for October, despite posting the third print below 50.00, might have previously helped the NZD/USD buyers.

Amid these plays, Wall Street closed in the red despite a firmer opening while the US Treasury yields are firmer around 4.05%, suggesting the risk-off mood, which in turn probed the NZD/USD bulls near the multi-day high.

Looking forward, comments from RBNZ Governor Adrian Orr could entertain NZD/USD traders ahead of the key Fed verdict. In that, the US central bank’s readiness for a 0.75% rate hike is already priced-in and hence won’t please the US dollar much. However, the important part will be how well the Fed policymakers could convey a brake to the aggressive rate hikes.

Technical analysis

A daily closing beyond the 50-DMA hurdle surrounding 0.5845 appears necessary for the NZD/USD buyers to keep the reins.

-

21:51

New Zealand jobs data puts a marginal bid into NZD

The New Zealand Employment Change that is released by Statistics New Zealand as a measure of the change in the number of employed people in New Zealand has put a slight bid into the kiwi, with the headline data beating expectations:

New Zealand's Unemployment Rate remained unchanged at 3.3 % in the third quarter. Economists polled by Reuters had forecast an unemployment rate of 3.2 % and employment growth of 0.5 %.

- Unemployment rate 3.3 % (Reuters poll 3.2 %)

- Third quarter jobs growth +1.3 % QoQ (Reuters poll +0.5 %)

- Participation rate 71.7 % (Reuters poll 71.0 %)

NZD/USD has risen from a low of 0.5835 to a session high of 0.5846.

Why it matters to traders?

Statistics New Zealand releases employment data on a quarterly basis. The statistics shed a light on New Zealand’s labour market, including unemployment and employment rates, demand for labour and changes in wages and salaries. These employment indicators tend to have an impact on the country’s inflation and the Reserve Bank of New Zealand’s (RBNZ) interest rate decision, eventually affecting the NZD. A better-than-expected print could turn out to be NZD bullish.

-

21:48

New Zealand Labour Cost Index (YoY) in line with expectations (3.8%) in 3Q

-

21:47

New Zealand Participation Rate registered at 71.7% above expectations (71%) in 3Q

-

21:47

New Zealand Labour Cost Index (QoQ) in line with expectations (1.1%) in 3Q

-

21:46

New Zealand Employment Change registered at 1.3% above expectations (0.5%) in 3Q

-

21:46

New Zealand Unemployment Rate came in at 3.3%, above expectations (3.2%) in 3Q

-

21:34

EUR/JPY Price Analysis: A pullback on the cards, as negative divergence and a rising-wedge lurks

- The EUR/JPY remains intact, but the divergence between price action/RSI might open the door for a pullback.

- Also, the EUR/JPY daily chart shows price action meandering within a rising wedge, which suggests the Euro might weaken vs. the Japanes Yen.

The EUR/JPY extends to two-day of losses amidst a risk-off impulse as witnessed by Wall Street’s finishing with losses. Meanwhile, as the Asian Pacific session begins, the EUR/JPY is trading at 146.42, registering minuscule gains of 0.04%.

EUR/JPY Price Analysis: Technical outlook

While the EUR/JPY retreated from weekly highs around 147.75, as shown by the daily chart, the uptrend remains intact – for now. However, the emergence of a rising wedge, lays the ground for a pullback, at least to the 20-day Exponential Moving Average (EMA) at 145.21, ahead of critical support reached on October 24, following the Bank of Japan (BoJ) FX intervention at 143.72, shy of the 144.00 figure.

The Relative Strength Index (RSI) has reached a successive series of lower highs, contrarily to price action. So two technical indicators namely the rising wedge and divergence between the EUR/JPY price action and RSI, suggest that sellers are gathering momentum.

EUR/JPY Key Technical Levels

-

21:30

Australia AiG Performance of Mfg Index fell from previous 50.2 to 49.6 in October

-

21:23

NZD/USD Price analysis: Eyes on technicals ahead of the jobs data

NZD/USD is NZD/USD is under pressure mid-week after reaching a high through 0.59 the figure. The US dollar was in recovery despite yesterday’s JOLTS data that suggested the US labour market has a way to go before it’s no longer adding significant inflation pressure, as analysts at ANZ Bank explained.

The analysts argued that ''positioning ahead of the FOMC decision tomorrow is also at play, and suggests moves in the Kiwi following today’s NZ labour market data may be short-lived. But that’s not to say these data doesn’t have the potential to rattle a few cages when it comes to RBNZ expectations.''

''The hurdle for the labour market not to look inflationary is extremely high, but the hurdle to beat the RBNZ’s forecast (particularly for wage growth) isn’t what we’d call low. These data can be quite volatile though, so we’re not counting any chickens yet.''

NZD/USD technical analysis

As for the technical, the price is climbing a daily support line as follows:

The hourly picture shows the price balanced on a key hourly support structure:

A break here opens risk to the trendline while a break higher will leave the bulls in control ahead of the Fed with eyes on the 0.59 figure again.

-

20:54

United States API Weekly Crude Oil Stock dipped from previous 4.52M to -6.53M in October 28

-

20:43

Silver Price Forecast: XAG/USD rises sharply to fresh three-week highs but retreated to $19.60s

- Silver price rallies more than 2.50% courtesy of a flat US Dollar and unchanged US Treasury yields.

- A risk-off impulse acted as a tailwind for XAG, albeit goodish US economic data underpinned the USD.

- XAG/USD traders brace for the November Federal Reserve’s meeting, eyeing Jerome Powell’s press conference, looking for a Fed pivot.

Silver price snaps two days of losses and climbs above the 20 and the 100-day Exponential Moving Averages (EMAs) amidst a flat US Dollar while falling US Treasury yields, particularly the 10-year rate, is almost unchanged at 4.046%. Hence the XAG/USD is trading at $19.60, up by 2.63%.

XAG/USD climbs steadily and holds to gains, despite goodish US data

Wall Street trimmed some of its earlier losses, though it closed in the red. US economic data reinforced the need for further Federal Reserve tightening as manufacturing activity continues to expand at the brink of entering recessionary territory, which could pressure Jerome Powell and Co. to decelerate their pace of interest-rate hikes.

The US Institute for Supply Management (ISM) Manufacturing PMI for October was better than expected at 50.2 but lower than September’s reading, while the price index showed that costs fell to more than a two-year low. Earlier, the S&P Global Manufacturing PMI for the same period was a prelude for the ISM’s one, at 50.4, above estimates and the previous month’s number.

Meanwhile, the JOLTS report, revealed by the US Labor Department, reported that job openings jumped by 10.717 million, above the 10 million estimates, and smashed August’s 10.28 million.

Once the reports crossed newswires, the white metal retreated from three-week highs of $20.02 to just above the 100-day EMA at $19.50, which was difficult support to hurdle.

That said, XAG/USD traders brace for the Federal Reserve Open Market Committee (FOMC) meeting. Most of the street’s analysts expect a 75 bps rate hike, but they would scrutinize each word of the Fed Chairman Jerome Powell to assess whether there’s a Fed pivot or the December’s meeting would be “live,” meaning that there would not be any forward guidance.

Before the Fed’s decision, the US calendar will reveal the ADP Employment Change report.

XAG/USD Price Analysis: Technical outlook

From a daily chart perspective, XAG/USD is neutral-to-downward biased unless silver buyers reclaim October’s high of $21.23. Break above the latter will expose essential resistance levels, like the 200-day EMA at $21.54, which, once cleared, could send XAG/USD rallying to June high at $21.92. On the other hand, XAG/USD's first support would be the 100-day EMA at $19.50, followed by the 20-day EMA at $19.28, ahead of the 50-day EMA at $19.10.

-

20:38

ECB could start shrinking bond portfolio from start of 2023

Reuters reported that the European Central Bank has a long way to go before it is done with interest rate hikes and it should also start reducing its oversized holding of government debt at the start of next year, Bundesbank President Joachim Nagel told a German newspaper.

"We should start shrinking our bond portfolio at the beginning of next year, for example by allowing existing bonds to expire in a market friendly way," Frankfurter Allgemeine Zeitung quoted Nagel as saying on Tuesday in an interview.

Nagel, asked about future rate hikes, also said: "There's still a long way to go.

"I am convinced that this is not the end of the rate hikes."

Meanwhile, the US dollar index which measures the greenback against six rivals, including the euro, was slightly lower at 111.49 and the euro traded flat at 0.9870.

-

20:25

AUD/USD Price Analysis: Bears are in control ahead of the Fed, eyes on a break of key structure

- AUD/USD bears stay on top as the price meets key support,

- The bears eye a break to test critical structure on the downside.

AUD/USD is under pressure despite the expectation that the Federal Reserve will signal a slower pace of tightening at its upcoming meeting to assess the impact of its rate hikes on the economy. Nevertheless, investors widely expect the Fed this week to raise its benchmark overnight interest rate by 75 basis points (bps) to a range of 3.75% to 4.00%, the fourth such increase in a row. the following illustrates the technical picture in AUD/USD heading into the meeting.

AUD/USD H1 chart

The price is accumulated on the backside of the trend and is vulnerable to a move higher should the support structure hold up over the course of the next day. On a break of the said support area, the bears will be back in control and will be looking for a fast move-in to test the next layer of support on the way to 0.63 the figure.

AUD/USD daily chart

On the daily chart, the price has dropped heavily into the demand area and there are prospects of a downside continuation as we head into the Federal Reserve in the coming hours while on the backside of the daily trendline.

-

20:23

Gold Price Forecast: XAU/USD steady above $1,640 after pulling back from $1,657

- Gold finds support at $1,640 and remains positive on the day.

- Dollar's bullish reaction to US data has capped gold's recovery.

- Hopes of further Fed hawkishness have weighed on gold prices.

Gold futures reversal from session highs at $1,657 seen during the US morning trade has been contained at $1,640 before picking up to $1,650 area at the time of writing. On the daily chart, the precious metal remains 0.8% up, regaining lost ground after a three-day reversal.

US dollar’s rebound has capped gold’s recovery

The yellow metal went through a solid recovery during the Asian and European sessions, appreciating from $1,630 to session highs at $1,657, buoyed by the positive risk sentiment that sent the US dollar tumbling.

The market mood changed radically after the release of a series of bright US macroeconomic figures, that bolstered confidence in the US economic momentum, and cleared the path for further aggressive tightening by the Federal Reserve.

Manufacturing activity has been a positive surprise in October, with the US S&P and the ISM PMIs registering better than expected results. Beyond that, the JOLTS job openings have shown a solid increase in vacancies despite the Federal Reserve’s efforts to cool a historically tight labor market, which shows 1,9 jobs for every worker.

These figures have eased fears of an economic slowdown triggered by disappointing data released previously and refute the theory that the Federal Reserve might start to signal a slower monetary tightening in the months ahead.

Technical levels to watch

-

19:42

GBP/USD, supported above 1.1450 after rejection at 1.1565

- Pound's reversal from the 1.1565 high finds support at 1.1450.

- Better than expected US data has boosted the USD.

- GBP/USD maintains its positive bias while above 1.1440 – UOB.

Sterling’s reversal from session highs at 1.1565 witnessed on Tuesday’s morning US session has found buyers at 1.1450, allowing the pair to return to levels near 1.1500. On the daily chart, the cable remains moderately bid, picking up after a 0.9% reversal on Monday.

Hopes of a hawkish Fed have crushed the pound

The positive market sentiment witnessed during the Asian and European sessions, which pushed the GBP to the mid-1. 1500 range, vanished during the North American session. A series of upbeat US macroeconomic indicators challenged the theory of a softer Fed tightening in the months ahead and sent the US dollar surging.

Manufacturing activity beat expectations in October, with the US S&P and the ISM PMI’s posting better than expected results, while the JOLTS job openings confirmed the tight US labor market conditions. These figures have eased concerns about the possibility of a softer economic scenario that would force the US central bank to adopt a more accommodative stance.

GBP/USD maintains a positive outlook while above 1.1440 – UOB

FX analysts at UOB see the pair biased higher in the near term, while above 1.1440: “We turned positive on GBP early last week. In our latest narrative from last Thursday (27 Oct, spot at 1.1630), we indicated that GBP is still strong and we noted that the next level to monitor is at 1.1760 (…) However, we continue to hold a positive GBP view for now and only a break of 1.1440 (no change in ‘strong support’ level from last Friday) would indicate that GBP is not advancing further."

Technical levels to watch

-

19:37

Brazil Trade Balance came in at 3.92B below forecasts (4.25B) in October

-

19:31

Forex Today: Dollar bulls return as US Federal Reserve’s decision looms

What you need to take care of on Wednesday, November 2:

Easing US Treasury yields have helped high-yielding assets to advance early on Tuesday, with the American dollar edging lower throughout the first half of the day. The yield on the 10-year Treasury note pulled down to 3.92%, and the USD tends to slide when it breaks below the 4% threshold. The latter recovered following Wall Street’s opening, providing support to the greenback, which reached fresh intraday highs across the FX board.

Further helping the mood to improve at the beginning of the day, market talks made the round about China looking to relax its zero-covid policy. The rumour backed Asian markets, despite no official word on the matter.

The dollar benefited from upbeat US data. The October ISM Manufacturing PMI came in better than expected, printing at 50.2. The employment sub-component, however, slid to 50, while that measuring prices paid contracted to 46.6, as manufacturers noted “a decline in the prices for oil, metals and other commodities used for production.” Also, the JOLTS report showed that the number of job openings increased to 10.7 million on the last business day of September, beating expectations.

The greenback changed course, and Wall Street turned red, while US Treasury yields settled near their intraday highs.

Major pairs finished the day little changed. The EUR/USD pair settled for a second consecutive day a handful of pips below the 0.9900 mark, while GBP/USD trades around 1.1470 at the end of the American session. AUD/USD trades just ahead of 0.6400 while USD/CAD seesaws around 1.3620. Finally, the USD/CHF hovers around parity, while USD/JPY trades around 148.20.

Spot gold holds on to intraday gains, now trading at $1,649 a troy ounce, while crude oil prices also advanced. WTI trades at $88.50 a barrel.

Market players gear up for the US Federal Reserve, as the US central bank will announce its monetary policy in the American afternoon. The central bank is widely anticipated to hike rates by 75 bps, sending the main rate to 3.75%-4%. Policymakers are also expected to pave the way for a slower pace of quantitative tightening from now on, although the latest employment-related figures raised doubts on whether the Fed has room for a couple more aggressive rate hikes.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: The calm before the storm

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:20

USD/CAD Price Analysis: Bulls meet a firm daily resistance

- USD/CAD bears are looking to the daily trendline.

- Bulls attempt to break out of the channel.

USD/CAD was adding to its October gains while the price of oil climbed and hopes that central banks are nearing the end of their tightening cycles helped underpin investor sentiment. Additionally, the Bank of Canada has already downshifted the pace of its tightening at an interest rate decision last week while the Fed is expected to hike interest rates by 75 basis points when its meeting concludes. Technically, the following illustrates the price breaking a key channel resistance:

USD/CAD H1 charts

USD/CAD daily chart

Meanwhile, however, there are scopes of a downside move into the broader trendline as the above chart illustrates. We have seen significant pull back already and resistance is serving a purpose, so far.

-

19:08

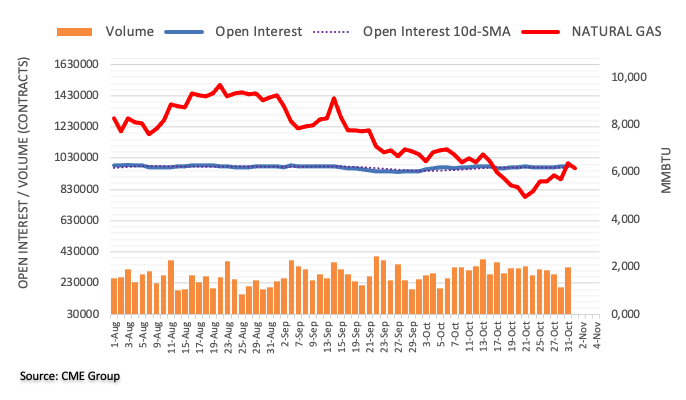

WTI’s recovery stalls below $89.00 with the US dollar surging

- WTI's rebound from $85.30 stalls below $89.00.

- Crude prices' recovery loses strength with the US dollar surging.

- Bright US data dampen hopes of a Fed pivot in December.

The solid recovery in oil prices witnessed during Tuesday’s Asian And European sessions, has lost traction during the US session, weighed by a sudden USD rally. WTI futures have been capped at $89.40 after having bounced up from $85.30 lows on Monday.

The US dollar jumps on bright US data

A set of better-than-expected US macroeconomic figures released earlier on Tuesday have boosted confidence in the strength of the US economy, leaving clearing the path for the Fed to continue with its aggressive tightening path. This has sent the US dollar higher, thus weighing on crude prices.

US manufacturing activity has posted a positive surprise. The ISM PMI slowed down to 50.2 in October, better than the 50 reading expected and the S&P PMI confirmed the good news. October's 50.4 reading reveals that sector activity expanded, against the expectations of a moderate contraction, at 49.9.

Beyond that, the JOLTS job openings have shown an increase to 10.7 million vacancies in September, up from 10.2 million in August, instead of the decline to 10 million anticipated by the experts. These figures demonstrate the tight conditions of the US labor market, despite the Fed’s efforts to cool it off in order to curb inflation.

Previously, Oil prices had rallied more than 3% in a risk-on session amid growing speculation pointing out to a Fed pivot in December. The federal funds futures market had priced in a 57% chance of a 0.50% rate hike in December, which sent the USD tumbling across the board during the Asian and European sessions.

Technical levels to watch

-

18:39

GBP/JPY Price Analysis: Rising wedge in the daily paves the way for a pullback

- The GBP/JPY plunges from YTD highs above 172.00 as traders brace for the Federal Reserve’s monetary policy decision.

- From a technical perspective, the GBP/JPY remains upward biased, but a downward correction looms.

- Short term, the GBP/JPY Is neutral-to-downward biased eyeing a break below the 200-EMA at 169.47

The GBP/JPY retraces from YTD highs at 172.13 and tumbles for the second-straight day due to a risk-off impulse, but also traders booking profits in the GBP/USD ahead of the Federal Reserve’s policy decision on Wednesday. Hence, the GBP/JPY is trading at 170.09, below its opening price by 0.19%.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY remains upward biased, even though a rising wedge is forming, nearby meaning that GBP/JPY risks are skewed to the downside. If the bearish rising wedge is confirmed, a test of the 200-day Exponential Moving Average (EMA) is on the cards at around 161.58. Otherwise, the GBP/JPY would consolidate in the 169.00-172.00 range, awaiting a fresh catalyst.

The Relative Strength Index (RSI) at bullish territory further confirms the latter. Nevertheless, market sentiment deterioration or if the Bank of England’s (BoE) monetary policy decision disappoints investors, the GBP/JPY might extend its losses below 170.00.

The GBP/JPY hourly chart depicts a neutral-to-bearish biased pair. The EMAs lie above the spot price, except for the 200-EMA at 169.47, the last piece of the domino keeping the GBP/JPY from sliding further. The RSI is at bearish territory, with a downward slope, warranting that sellers are in charge.

Hence, the GBP/JP First support would be the 200-EMA at 169.47, the S2 daily pivot at 169.15, and the 169.00 figure, the October 25 low at 167.83, and the October 24 daily low at 167.58.

GBP/JPY Key Technical Levels

-

18:25

EUR/GBP looking for direction, with upside attempts limited below 0.8625

- Euro's recovery attempt from 0.8570 stalls right above 0.8600

- The pair treads water ahead of the BoE's monetary policy decision.

- EUR/GBP is hovering above key support at 0.8570.

The euro has remained moving sideways against the British pound on Tuesday, as Monday’s rebound from 0.8570 lows remains limited below 0.8625. From a wider perspective, the pair remains trapped within a negative channel from late September highs above 0.9000.

Sideways consolidation ahead of the BoE’s meeting

The negative pressure on the euro witnessed last week seems to have eased, which allowed the pair to trim losses on Monday. The investors are more cautious, awaiting the outcome of the Bank of England’s monetary policy meeting, due on Thursday.

The Bank of England is widely expected to hike rates by 0.75%. The market, however, contemplates the possibility of some hints to less aggressive tightening in the months ahead, as the bleak economic prospects will force them to lift their feet off the pedal to avoid accelerating the economic downtrend.

On the political front, the market enthusiasm on the news of the appointment of Rishi Sunak as British Prime minister has ebbed. The pound has lost momentum, following a 5-day rally, with the focus shifting to the huge challenges ahead following a historical market turmoil amid a deteriorating economic outlook and with a divided Tory party.

EUR/GBP: Hovering above important support at 0.8570

From a technical point of view, the pair has found support at a key 0.8570 area (September 7 and October 17 and 28 lows). Below here next downside targets would be the downward trendline support, from mid-November lows, which meets the 200-day SMA at the 0.8500 area.

On the upside, the pair should extend past session highs at 0.8625 to target the 50-day SMA, at 0.8690 to aim for the October 21 high at 0.8780.

Technical levels to watch

-

18:03

EUR/USD steadies in bullish territory ahead of the Fed

- EUR/USD sits back into neutral territory as markets get set for the Fed.

- Traders are on look out for a pivot in the chair's tone.

EUR/USD is sitting tight in mas investors await the outcome of the Federal Reserve this week while investors fret over a potential slowdown in the pace of interest-rate hikes from December.

Analysts at TD Securities look for the FOMC to deliver another 75bp rate hike and say the decision will bring policy to a level at which the Committee might feel more comfortable in shifting to a steadier hiking pace. ''The exact timing, however, will highly depend on the CPI data before the Dec meeting. Powell might offer some hints in the post-meeting presser.'

Looking forward, for December, the fed funds futures market has priced in a 57% probability of a 50-bps increase amid suggestions from Fed officials of potentially slowing down the tightening pace. That was down, however, from roughly a 70% chance last Friday. ''Any dovish tone in Powell's testimony could bull steepen the curve. The tactical market is decently priced for a flexible Fed but can still extend. Absent any clues from Powell risks a pain trade. That could be limited given the USD's tighter correlation with easing priced into the curve vs terminal, however.''

The US dollar index has rallied more than 15% this year as the Fed has hiked rates hard, crushing other currencies and heaping pressure on the global economy. Investors have therefore taken cheer from speeches and interviews by some Fed officials that have suggested the central bank could do smaller hikes after Wednesday's meeting.

Meanwhile, the Institute for Supply Management (ISM) purchasing managers' index (PMI) shed 0.7 point to land at 50.2, remaining in expansion territory by the skin of its teeth. The dip in new orders was shallower and employment was unchanged. Markets were also reminded that global inflation remains stubbornly high on Monday when data showed euro zone prices surged by the most on record in the year through October.

EUR/USD technical analysis

The price has carved out an M-formation within the symmetrical triangle which leaves bias to the downside so long as the neckline of the M-formation holds over the coming sessions:

-

17:52

NZD/USD eyes a break above the 50-DMA, as the NZD registers gains despite upbeat US data

- The NZD clings to gains as one of the G8 currencies posting gains vs. the USD.

- Data from the United States underpinned the US Dollar, as manufacturing activity is a tough nut to crack.

- New Zealand’s Building Permits surprisingly rose after August’s fall.

The NZD/USD rises in the North American session but remains off the daily highs above 0.5900, as a report showed that manufacturing activity in the US, albeit slowing, the economy is at expansion, a headwind for the NZD. Nevertheless, a possible review of China’s Covid-19 restrictions and an RBA rate hike kept the safe-haven USD in check. The NZD/USD is trading at 0.5839, above its opening price by almost 0.50%.

Sentiment remains negative, as shown by US equities trading with losses. As traders brace for the US Federal Reserve November monetary policy decision, a tranche of US economic data keeps the greenback climbing.

Data-wise, the Institute for Supply Management reported that the manufacturing PMI for October grew by 50.2, above 50 estimates and lower than September’s 50.9. Earlier, S&P Global issued the PMI for the US, which also expanded at a 50.4 pace, above calculations of 49.9, meaning that the US economy is about to hit a recession.

At the same time as the release of ISM data, the Department of Labor reported that job openings increased. September JOLTS data showed vacancies increased by 10.717M above 10M estimates, smashing August’s 10.28M.

Given that US data crushed the forecasts, expectations for further Fed tightening augmented demand for the US Dollar, in part by US Treasury yields, namely the 10-year, jumping above the 4% threshold.

The NZD/USD pair dwindled from 0.5880 and reached a daily low at 0.5828 before retracing and hovering around the R1 daily pivot at 0.5840.

It should be noted that Reuters reported that the White House economic advisos Bernstein said that Biden endorsed the Fed pivot, which was perceived as a dovish signal, sending the NZD/USD towards t0.5870. But later, it was corrected, and the economic advisor to the White House meant that Biden endorsed the Fed pivot to tighten policy, so the NZD/USD erased those gains.

Elsewhere, New Zealand data reported during the Asian session helped the NZD to strengthen against the USD. Building Permits for September rose by 3.8% MoM vs. a 1.6% contraction in August, reported Statistics New Zealand. Furthermore, under review China’s Covid-19 restriction policy and the Reserve Bank of Australia’s (RBA) 0.25% rate hike gave an additional leg-up to the NZD/USD, rallying from 0.58010 to 0.5909.

What to watch

The New Zealand economic calendar would be busy, revealing the Reserve Bank of New Zealand (RBNZD) Financial Stability Report. Additionally, Employment data for Q3, namely Employment Chance, Labor Costs Index, participation Rate, and an RBNZ Press Conference, would be catalysts that can underpin the New Zealand Dollar.

On the US front, the calendar will feature the ADP Employment Change, a prelude for Friday’s Nonfarm Payrolls, alongside the Federal Reserve monetary policy decision and Jerome Powell press conference.

NZD/USD Key Technical Levels

-

17:26

GBP/USD plummets to 1.1450 area following upbeat US data

- The pound gives away gains and dives to session lows at 1.1450.

- Bright US data dampens hopes of a Fed pivot in December.

- GBP/USD: Breach of 1.1440 will negate the positive bias – UOB.

The pound has lost nearly 100 pips in a matter of minutes, following the release of a set of positive US macroeconomic indicators. The pair has dropped from levels near 1.1550, giving away all the ground taken during Tuesday’s Asian and European trading sessions, to hit lows at 1.1455.

US data gives leeway for more aggressive Fed tightening

A series of better-than-expected macroeconomic releases have boosted confidence in the momentum of US economy, easing concerns of a potential slowdown triggered by previous disappointing releases and clearing the path for the Federal Reserve to extend its aggressive tightening path beyond November. This has sent the greenback and US treasury bonds surging.

Business activity in the manufacturing sector has beaten expectations in October. The US S&P Global Manufacturing PMI improved to 50.4 in October, against market expectations of 49.9 and the ISM Manufacturing PMI confirmed the positive news, posting a 50.2 reading against the 50 anticipated by the market consensus.

Beyond that, the JOLTS job openings have displayed the strength of the US labor market, despite the Fed's efforts to cool it off. JOLTS job vacancies increased to 10.7 million in September, up from 10.2 million in August, and against market expectations of a decline to 10 M.

GBP/USD: A reversal below 1.1440 would negate the positive bias – UOB

FX analysts at UOB maintain a positive outlook on the pair as long as the 1.1440 level is not breached: “We continue to hold a positive GBP view for now and only a break of 1.1440 (no change in ‘strong support’ level from last Friday) would indicate that GBP is not advancing further. That said, as upward momentum has waned, the odds of GBP advancing to the major resistance at 1.1760 have diminished.”

Technical levels to watch

-

17:24

USD/CHF returns above parity with the US dollar surging

- The dollar bounces up from session lows near 0.9900, back above parity.

- Bright US macroeconomic data have boosted the greenback and US Treasury bonds.

- USD/CHF is nearing important resistance at the 1.0030 area.

The US dollar has retraced previous losses against the Swiss Franc on Tuesday’s US session, jumping from levels nearing 0.9900, back beyond 1.0000 on the back of a series of better-than-expected US macroeconomic figures.

Bright US data dampens hopes of a Fed pivot

US labor and manufacturing activity figures have beaten expectations earlier on Tuesday, improving investors’ confidence in the US economy’s health and giving leeway to the Federal Reserve to keep hiking rates aggressively for some time. This sentiment has triggered a knee-jerk reaction in the USD and US Treasury bonds, sending them surging from session lows.

US manufacturing activity data has posted a positive surprise, with a better-than-expected performance in October. The ISM PMI slowed down to 50.2, better than the 50 expected by the market, while the S&P PMI reported a 50.4 reading, which reveals that sector activity grew, when the market expected a moderate contraction, at 49.9 for the second consecutive month.

Beyond that, the JOLTS job openings have reported an increase to 10.7 million vacancies in September, up from 10.2 million in August, instead of the decline to 10 million anticipated by the expert. These figures are consistent with the image of a tight labor market, despite the Fed’s efforts to cool it off in order to curb inflation.

With all eyes on the Federal Reserve, which is widely expected to hike rates by 75 basis points on Wednesday. These figures have eroded the idea that the bank might be forced to slow down its monetary normalization path in December, as had been signaled in recent comments by some Fed officials.

USD/CHF: Approaching an important resistance at 1.0030

From a technical perspective, the pair has improved its near-term bias, returning above the 50 and 200-hour SMA at 0.9970/80 area, to attempt another assault to the 1.0030 level (October 24,25 highs). Above here, the next target would be the three-year high at 1.0145.

On the downside, the mentioned 200-hour SMA at the 0.0970 area is acting as support so far. Below here, the next potential targets are October 30 low at 0.9945 and October 27 high at 0.9920/25.

Technical levels to watch

-

17:00

AUD/USD falls from daily highs above 0.6460 despite RBA rate hike after upbeat US data

- The Australian Dollar is on the defensive at the mercy of heightened US T-bond yields, despite RBA’s rate hike.

- The Federal Reserve has a green light to continue its aggressive cycle after US PMIs remained at expansionary territory.

- The US labor market remains tight, as shown by the JOLTS report.

The AUD/USD slid for the fourtñ-consecutive day, courtesy of broad US Dollar strength, after manufacturing activity in the United States flashed the economy’s resilience, albeit that the Reserve Bank of Australia (RBA) lifted rates by 25 bps, which bolstered the AUD ahead of the US session. At the time of writing, the AUD/USD is trading a 0.6387,

The USD got bolstered by data, weighing on the AUD

The market sentiment remains downbeat, as shown by US equities trading with losses. The ISM Manufacturing report for October was better than forecasts at 50.2 vs. 50 estimated, while a subcomponent that measures prices fell to more than a two-year low. Meanwhile, an earlier report was a prelude for ISM data, with S&P Global PMI Manufacturing Index for the same period slowed. Still, it was above estimates of 49.9, at 50.4, but below the September figure.

Also, the US Labor Department revealed September’s JOLTS data, which unexpectedly rose above estimates of 10M to 10.717M, topping August’s 10.28M.

The AUD/USD reacted to the downside, weighed by a jump in US T-bond yields, particularly the 10-year, reclaiming the 4% threshold. The pair dived from around 0.6437 to 0.6380.

Aside from this, in the Asian session, the Reserve Bank of Australia (RBA) lifted rates by 25 bps, as expected, leaving the cash rate at 2.85%. The RBA Governor Philip Lowe commented that the central bank was seeking to return inflation to the 3% target, which according to the central bank forecasts, would be achieved by 2024.

Given that quarterly inflation rose by 7.3%, the RBAs acknowledged that monetary policy operates with a lag, so the path of slowing from 50 to 25 would allow the RBA to assess consumer spending amidst an uncertain global economic outlook.

What to watch

Ahead in the week, the Australian economic calendar will feature the AI Group Manufacturing Index for October, alongside housing data and the RBA Chart Pack. On the US front, the docket will reveal the Mortgage Rate update, the ADP Employment Change, and the Federal Reserve policy decision.

AUD/USD Key Technical Levels

-

16:40

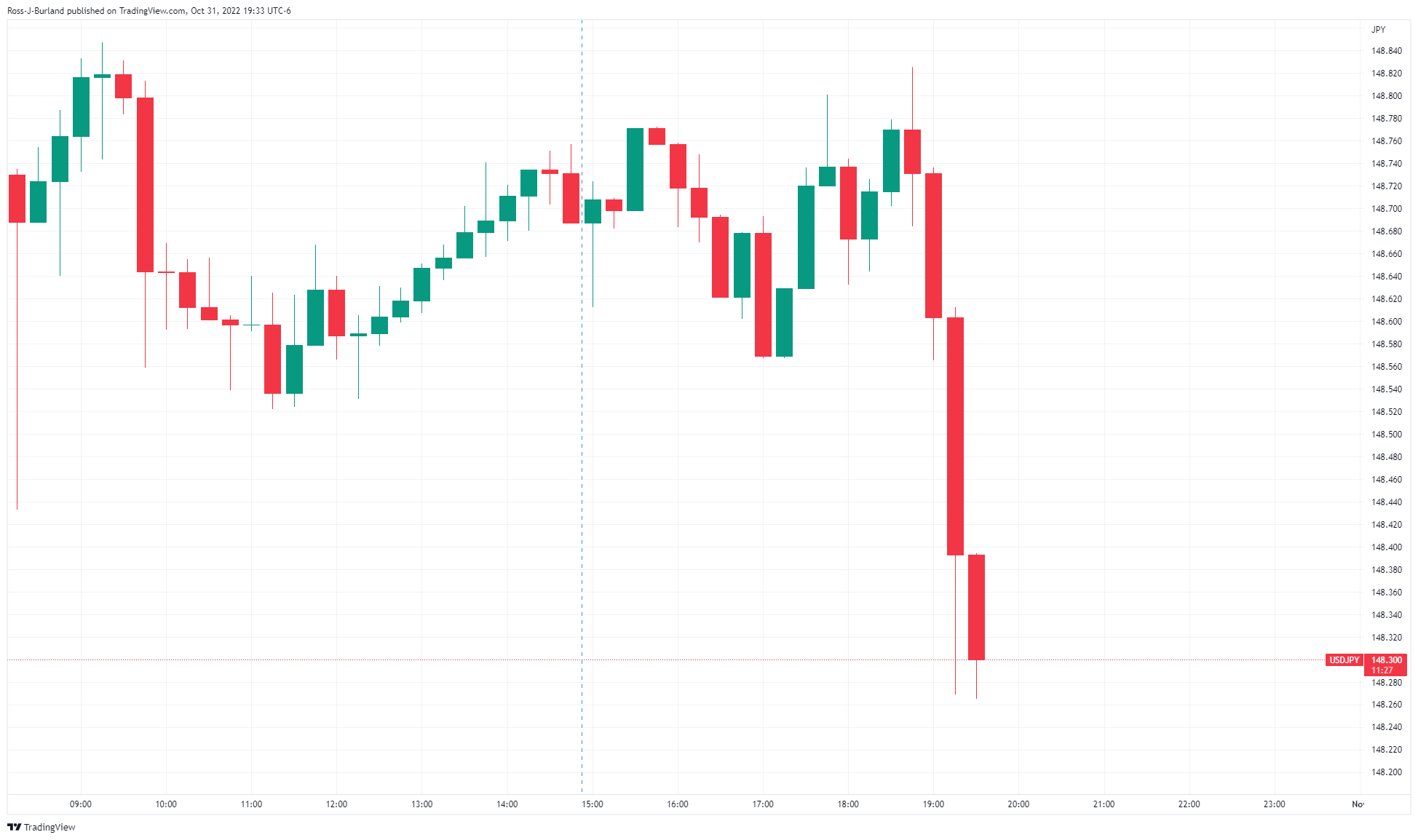

USD/JPY jumps back above 148.00 boosted by bright US data

- The dollar pares losses and returns above 148.00.

- A set of positive US data refutes the theory of Fed easing.

- USD/JPY: Consolidating between 145.50 and 146.90 – UOB.

The greenback surged from session lows at 147.00 to pare losses from the Asian and European sessions and return to levels above 148.00. The release of a set of better-than-expected US macroeconomic indicators has boosted a hitherto weak US dollar.

US data refutes the theory of Fed easing

Macroeconomic figures from the US rattled FX markets on Tuesday, improving the sentiment about the US economic momentum and undermining the idea that the Federal Reserve might be forced to consider slowing down its monetary tightening path in December. This new scenario has sent the dollar and US treasury bond yields surging.

US manufacturing activity has beaten expectations in October, easing concerns about the possibility of a certain economic softening triggered by previous disappointing figures. The US ISM Manufacturing PMI has posted a 50.2 reading, against the 50 expected by the market, while the S&P PMI confirmed the upbeat news with the October reading improving to 50.4 and returning to figures consistent with expansion, against market expectations of a flat performance at 49.9.

Furthermore, the JOLTS job openings have registered an increment to 10.7 million vacancies in September, up from 12.2 million in August, and against market expectations of a decline to 10 M. These figures show the tight conditions of theUS labor market, despite the Fed’s efforts to cool it off in order to curb inflation.

The US Federal Reserve’s monetary policy meeting, due on Wednesday remains the main attraction this week. The Fed is widely expected to hike rates by 75 basis points, but the market was increasingly confident that the bank would signal a softer hike in December, a theory that has come into question after today’s releases.

USD/JPY remains consolidating between 145.50 and 149.60 – UOB

From a wider perspective, FX analysts at UOB see the pair in a consolidative range between 145.50 and 149.60: “USD (…) dipped to 145.10 before rebounding strongly and the build-up in downward momentum faded quickly. USD appears to have moved into a consolidation phase and is likely to trade between 145.50 and 149.60 for the time being.”

Te3chnical levels to watch

-

16:06

EUR/GBP: Time for a breather? – Rabobank

Analysts from Rabobank see the risk of the EUR/GBP cross rising to the 0.90 area early in 2023. They point out that risks of a general election in the UK could rise if PM Sunak fails to gain support of most Tory MPs.

Key Quotes:

“In our view both the EUR and GBP will be battling demons in the months ahead. The EUR has had good news recently in the form of an easing in gas prices. Warm weather and mostly full gas storage stations have reduced the risk of blackouts in the Eurozone during the forthcoming winter.”

“A 75bp rate hike from the ECB in October has lent the EUR some protection, but by the central bank’s next meeting, Germany could be in recession. It is unclear whether hiking interest rates into a recession will be able to give the EUR much support.”

“The UK’s current account deficit has further exposed the GBP to the impact of the weak line up of fundamentals. Relief that the new PM and Chancellor understand both the necessity of working with the BoE to bring down inflation and the risk to the gilt market of unfunded tax cuts, has seen gilt yields and GBP settle back after recent volatility. However, the coming months will not be easy for PM Sunak.”

“If Sunak cannot muster the support of most Tory MPs, there is a risk that a general election may have to be called. Even if the party does unite, the government is set to announce tax hikes next month in the face of a recession and despite the cost of living crisis. Not only will this be difficult for the electorate to stomach but, in the absence of reforms aimed at encouraging investment and productivity growth, GBP’s recovery may already have run out of traction. We see risk of EUR/GBP climbing to the 0.90 area early next year.”

-

15:59

Fed: Clear signs of a possible smaller hike in December are still unlikely – BBVA

On Wednesday, the Federal Reserve will announce its decision on monetary policy. A 75 basis points rate hike is priced in. According to the Research Department at BBVA, all eyes on hints of a potential downshift in tightening pace.

Key Quotes:

“Given that a super-sized hike is a done deal, the focus will be on hints on what will drive a slowdown in the pace of hikes. We think that Chair Powell will not be able to provide clear guidance about the most likely size of the December hike, not only because it will depend on upcoming data -two more monthly job market data and two more inflation readings-, but also considering that a wide consensus within the FOMC on the next steps seems still unlikely at this moment in which some Fed officials have just begun to coincide on the importance of assessing the effects of “cumulative tightening” on the economy and inflation.”

“We think that a shift to a slower pace of hikes and then the decision to end the tightening cycle will depend (more) on labor market data. With inflation set to remain quite high in the short term, and underlying inflation pointing to stickiness ahead, what will drive the Fed to slow the hiking cycle will be signals that the labor market is on a pace of rebalancing. Thus, the most important signal in Chair Powell’s remarks will be hints on what the Fed is looking for in the labor market to slow down the pace of tightening and then to stop.”

-

15:54

GBP/USD plummets to 1.1450 area following upbeat US data

- The pound gives away gains and dives to session lows at 1.1450.

- Bright US data dampens hopes of a Fed pivot in December.

- GBP/USD: Breach of 1.1440 will negate the positive bias – UOB.

The pound has lost nearly 100 pips in a matter of minutes, following the release of a set of positive US macroeconomic indicators. The pair has dropped from levels near 1.1550, giving away all the ground taken during Tuesday’s Asian and European trading sessions, to hit lows at 1.1455.

US data gives leeway for more aggressive Fed tightening

A series of better-than-expected macroeconomic releases have boosted confidence in the momentum of US economy, easing concerns of a potential slowdown triggered by previous disappointing releases and clearing the path for the Federal Reserve to extend its aggressive tightening path beyond November. This has sent the greenback and US treasury bonds surging.

Business activity in the manufacturing sector has beaten expectations in October. The US S&P Global Manufacturing PMI improved to 50.4 in October, against market expectations of 49.9 and the ISM Manufacturing PMI confirmed the positive news, posting a 50.2 reading against the 50 anticipated by the market consensus.

Beyond that, the JOLTS job openings have displayed the strength of the US labor market, despite the Fed's efforts to cool it off. JOLTS job vacancies increased to 10.7 million in September, up from 12.2 million in August, and against market expectations of a decline to 10 M.

GBP/USD: A reversal below 1.1440 would negate the positive bias – UOB

FX analysts at UOB maintain a positive outlook on the pair as long as the 1.1440 level is not breached: “We continue to hold a positive GBP view for now and only a break of 1.1440 (no change in ‘strong support’ level from last Friday) would indicate that GBP is not advancing further. That said, as upward momentum has waned, the odds of GBP advancing to the major resistance at 1.1760 have diminished.”

Technical levels to watch

-

15:53

AUD/USD: Australian fundamentals are relatively strongly positioned – Rabobank

According to analysts from Rabobank, the AUD/USD pair could drop a little further in the near term, but they see Australian fundamentals strongly positioned, favoring a rebound later. They forecast AUD/USD at 0.64 in three months and at 0.65 in six months.

Key Quotes:

“In early October the RBA was the first major central bank to return to a more ‘normal’ 25bp rate hike. Although the Bank had signaled it was considering such a move, in view of the prevalence of high inflation levels, the decision was still a surprise to the market. The reason given by policy makers for reverting to a 25bp incremental move was “that the cash rate had been increased substantially in a short period of time and the full effect of that increase lay ahead.” It would appear very likely that policy makers were concerned about the impact on the affordability of mortgages from this year’s series of rate rises.”

“Given our expectation that USD strength is set to persist, we see risk of AUD/USD dipping back a little further in the near-term. However, in terms of relative growth prospects, terms of trade and current account position, Australian fundamentals are relatively strongly positioned.”

“We favour the AUD vs. both the EUR and the GBP and see scope for AUD/USD to move towards 0.65 early next year.”

-

15:45

USD/CAD jumps above 1.3650 as USD turns positive after a sharp reversal

- US Dollar gains momentum during the American session amid risk aversion.

- DXY reverses sharply, rises from 110.70 to 111.50.

- USD/CAD rebounds more than 120 pips from daily lows.

The USD/CAD rose sharply from the lowest level in two days around 1.3530 to 1.3658, reaching a fresh daily high. The bounce was triggered by a rally of the US Dollar across the board following the release of US economic data.

The greenback was falling but it reversed it course dramatically following the ISM Manufacturing PMI and the Jobs Opening reports. Both reports surpassed expectations. After the numbers, US stocks turned sharply to the downside, and US yields soared.

The Dow Jones is falling by 0.51% after a positive opening while the S&P 500 drops by 0.45%. The US 10-year yield rose from 3.92% to 4.07 while the 2-year climbed from 4.40% to 4.53%, hitting the highest since October 21.

The Canadian S&P Global Manufacturing dropped from 49.8 to 48.8, below the 49.2 of market consensus. Late on Tuesday, Bank of Canada Governor Tiff Macklem will deliver a speech.

Market participants are focused on the FOMC meeting that started on Tuesday. The Federal Reserve is expected to announce a 75 bps rate hike. “The decision will bring policy to a level at which the Committee might feel more comfortable in shifting to a steadier hiking pace. The exact timing, however, will highly depend on the CPI data before the Dec meeting. Powell might offer some hints in the post-meeting presser”, mentioned analysts at TD Securities.

Levels to watch

On the upside, above 1.3660, the next resistance stands at 1.3685 (Oct 31 high), followed by 1.3755. On the downside, support might be located at 1.3605/00 and then at 1.3580 and the 1.3500 zone. A daily close below 1.3500 would open the doors to more losses.

-

15:34

United States 52-Week Bill Auction: 4.505% vs 3.955%

-

15:22

Gold Price Forecast: XAU/USD trims earlier gains as US data justify further Fed rate hikes

- Gold price clings to gains after upbeat US economic data, though off the highs around $1640s.

- US ISM and S&P Manufacturing PMIs, remained at expansionary territory, an excuse for further Fed tightening.

- Short term, XAU/USD bias is neutral-to-downward biased, and if it clears $1640, a fall towards $1620 is on the cards.

Gold price advances in the North American session due to a fall in US Treasury yields weakening the US Dollar, following the release of solid US data, namely factory activity. Further, a risk-on in the equities market, spurred by speculations that China is adjusting to exit its zero-tolerance Covid-19 stance, was cheered by investors. At the time of writing, XAU/USD is trading at $1647, up by 0.89%.

XAU/USD trimmed earlier losses on upbeat US data and heightened US Treasury yields

In the United States, economic data revealed by the Institute for Supply Management (ISM), alongside S&P Global, showed the economy’s resilience. Firstly the ISM Manufacturing Index came better than estimated at 50.2 vs. 50 forecasts, while a subcomponent that measures prices fell to more than a two-year low. Timothy Fiore, Chairman of the ISM Manufacturing Business Survey Committee, commented that October’s report reflects companies are getting ready for an adjustment for lower demand.

Earlier, the S&P Global PMI Manufacturing Index also dropped but remained at expansionary territory at 50.4, above estimates of 49.9, though it trailed September’s 52.

At the same time, the US Department of Labor reported that job openings in September surprisingly rose, as the JOLTS report showed an increase of close to 500K, to 10.717M from August’s 10.28M, and exceeding estimates of 10M.

Given that US data was positive, a Fed pivot narrative could lose some weight, as it justifies additional tightening, as shown by the CME Fed WatchTool, increasing from an 86 to 88 percent chance of hiking 75 bps. Regarding December’s decision, the odds are 50% chances of lifting rates by 50 or 75 bps.

Market’s reaction

The XAU/USD tumbled from around $1650 towards $1643, a $7 loss, while US Treasury bond yields jumped from their daily lows at 3.924% towards 4.075%, a headwind for the yellow metal. Therefore, some downward pressure could be expected ahead of Wednesday’s Federal Reserve monetary policy meeting.

XAU/USD Price Forecast: Technical outlook

The XAU/USD is neutral-to-downward biased in the near term, as shown by the one-hour chart, with prices sliding throughout the session below the 100 and 200-EMAs, which would be difficult hurdles to surpass, around the $1648/51 area. However, if buyers have the strength to clear the latter, a retest of the daily highs around $1656 is on the cards, ahead of the last week’s $1674.94 high. On the flip side, if XAU/USD breaks below the R1 daily pivot, it will expose the central pivot at $1636, followed by the S1 daily pivot at $1628, ahead of the S2 pivot level at $1623.

-

14:45

EUR/USD trims gains and breaks below 0.9900 post-US ISM

- EUR/USD gives away some gains and breaches 0.9900.

- The dollar rebounds following positive results from the docket.

- ISM Manufacturing surprised to the upside in October at 50.2.

EUR/USD abandons the area of daily highs around 0.9950 and makes an abrupt U-turn to revisit the sub-0.9900 zone in the wake of US data results on Tuesday.

EUR/USD: Upside capped around 0.9950

EUR/USD rapidly drops and revisits the area below 0.9900 on the back of an equally sudden rebound in the dollar, all in response to the better-than-expected prints from the US ISM Manufacturing for the month of October (50.2).

Indeed, the results do nothing but reinforce the view of a resilient US economy at a time when some Fed’s rate-setters have hinted at the potential start of a debate over the probability of slowing the pace of the subsequent rate hikes as soon as at the December meeting.

Additional releases in the US calendar saw Construction Spending unexpectedly expand 0.2% MoM in September, the final S&P Global Manufacturing PMI at 50.4 (also surpassing estimates) and the JOLTs Job Openings increase to 10.717M also in September.

What to look for around EUR

The initial optimism in the risk complex lifted EUR/USD to the 0.9950/55 band on Tuesday, just to deflate soon afterwards following auspicious results from the US calendar.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The resurgence of speculation around a potential Fed’s pivot seems to have removed some strength from the latter, however.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Germany Balance of Trade, Unemployment Change, Unemployment Rate, Final Manufacturing PMI, EMU Final Manufacturing PMI (Wednesday) – EMU Unemployment Rate (Thursday) – EMU/Germany Final Services PMI, ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.05% at 0.9882 and faces the next up barrier at 1.0093 (monthly high October 27) followed by 1.0197 (monthly high September 12) and finally 1.0368 (monthly high August 10). On the downside, a breach of 0.9871 (weekly low November 1) would target 0.9704 (weekly low October 21) en route to 0.9631 (monthly low October 13).

-

14:34

New Zealand GDT Price Index came in at -3.9% below forecasts (0.6%)

-

14:21

US: JOLTS Job Openings rise to 10.7 million in September vs. 10 million expected

- US JOLTS Job Openings surpassed the market expectation in September.

- US Dollar Index edges higher toward 111.50 after the data.

The number of job openings increased to 10.7 million on the last business day of September, the US Bureau of Labor Statistics (BLS) reported in its Job Openings and Labor Turnover Summary (JOLTS) on Tuesday. This print came in higher than the market expectation of 10 million.

"The number of hires edged down to 6.1 million, while total separations decreased to 5.7 million," the publication further read. "Within separations, quits (4.1 million) changed little and layoffs and discharges (1.3 million) edged down."

Market reaction

The US Dollar Index, which touched a daily low of 110.79, gained traction after this report and was last seen losing 0.2% on the day at 111.35.

-

14:06

US: ISM Manufacturing PMI declines to 50.2 in October vs. 50 expected

- US ISM Manufacturing PMI came in slightly above 50 in October.

- US Dollar Index recovered above 111.00 ith the initial reaction to the PMI data.

The business activity continued to expand in the US manufacturing sector in October albeit at a softer pace than in September with the ISM Manufacturing PMI falling to 50.2 from 50.9. This reading came in slightly better than the market expectation of 50.

Further details of the publication revealed that the Employment Index improved to 50 from 48.7, the Prices Paid Index dropped to 46.6 from 51.7 and the New Orders Index edged higher to 49.2 from 47.1.

Commenting on the survey's findings, "panelists' companies continue to carefully manage hiring, month-over-month supplier delivery performance was the best since March 2009, and the Prices Index indicated decreasing prices for the first time since May 2020," said Timothy R. Fiore, Chair of the Institute for Supply Management Manufacturing Business Survey Committee.

"Like in September, mentions of large-scale layoffs were absent from panelists' comments, indicating companies are confident of near-term demand," Fiore further elaborated. "As a result, managing medium-term head counts and supply chain inventories remain primary goals."

Market reaction

With the initial reaction, the US Dollar Index managed to erase a small portion of its daily losses and was last seen losing 0.35% on the day at 111.18.

-

14:01

United States JOLTS Job Openings above expectations (10M) in September: Actual (10.717M)

-

14:00

United States ISM Manufacturing PMI above forecasts (50) in October: Actual (50.2)

-

14:00

United States ISM Manufacturing Prices Paid registered at 46.6, below expectations (53) in October

-

14:00

United States ISM Manufacturing New Orders Index above expectations (49.1) in October: Actual (49.2)

-

14:00

United States Construction Spending (MoM) came in at 0.2%, above expectations (-0.5%) in September

-

14:00

United States ISM Manufacturing Employment Index came in at 50 below forecasts (51.4) in October

-

13:57

Silver Price Analysis: XAG/USD eases from multi-week high, strong rally stalls near 61.8% Fibo.

- Silver rallies to over a three-week high on Tuesday and taps the $20.00 psychological mark.

- The momentum confirms a bullish break through the 100 DMA/50% Fibo. confluence hurdle.

- Sustained weakness below the $19.00 mark is needed to negate the near-term positive outlook.

Silver catches aggressive bids on Tuesday and rallies to over a three-week high during the early North American session. The white metal is currently trading just below the $20.00 psychological mark, with bulls now awaiting sustained strength beyond the 61.8% Fibonacci retracement level of the recent fall from the October monthly swing high.

Looking at the broader picture, the strong intraday move-up confirms a fresh bullish breakout through the $19.55-$19.65 confluence hurdle. The said area comprises 50% Fibo. level and the 100-day SMA, which should now act as a strong near-term base and a key pivotal point to determine the next leg of a directional move for the XAG/USD.

Given that technical indicators on the daily chart have just started gaining positive traction, some follow-through buying will reaffirm the constructive set-up and pave the way for additional gains. The XAG/USD might then accelerate the momentum towards an intermediate resistance near the $20.50 zone en route to the $21.00 round-figure mark.

On the flip side, the $19.65-$19.55 resistance breakpoint is likely to protect the immediate downside. Any further decline might continue to attract some buyers near the $19.00-$18.90 support, marking the 23.6% Fibo. level. A convincing break below the latter will shift the bias in favour of bearish traders and make the XAG/USD vulnerable.

The subsequent downfall could get extended and drag spot prices towards the next relevant support near the $18.30-$18.25 region. This is closely followed by the $18.00 round-figure mark, which if broken decisively will expose the YTD low, around the $17.55 zone touched in September.

Silver daily chart

Key levels to watch

-

13:50

US: S&P Global Manufacturing PMI falls to 50.4 in October (final) vs. 49.9 expected

- S&P Global Manufacturing PMI fell toward 50 in October.

- US Dollar Index stays deep in negative territory below 111.00.

The S&P Global Manufacturing PMI declined to 50.4 in October from 52 in September. This reading came in better than the initial estimate and the market expectation of 49.9.

Assessing the survey's findings, "October PMI data signalled a subdued start to the final quarter of 2022, as US manufacturers recorded a renewed and solid drop in new orders," said Siân Jones, Senior Economist at S&P Global Market Intelligence.

"Domestic and foreign demand weakened due to greater hesitancy among clients as prices rose further and amid dollar strength," Jones added. "As such, efforts to clear backlogs of work, rather than new order inflows, drove the latest upturn in production."

Market reaction

The greenback failed to help the dollar gather strength against its rivals. As of writing, the US Dollar Index was down 0.6% on the day at 110.88.

-

13:46

United States S&P Global Manufacturing PMI above forecasts (49.9) in October: Actual (50.4)

-

13:39

EUR/USD Price Analysis: Extra gains need to surpass the parity zone

- EUR/USD reverses the recent weakness and regains 0.9900 and above.

- Next on the upside comes the parity level ahead of 1.0093.

EUR/USD manages to rebound from the 0.9870 region and reclaims the area above the 0.9900 yardstick on Tuesday.

The continuation of the rebound should initially target the parity level. Once cleared, then the pair could dispute the October high at 1.0093 (October 27) ahead of the September peak at 1.0197 (September 12).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0488.

EUR/USD daily chart

-

13:34

Canada: S&P Global Manufacturing PMI declines to 48.8 in October vs. 49.2 expected

- S&P Global Manufacturing PMI continued to decline in October.

- USD/CAD trades deep in negative territory at around mid-1.3500s.