Notícias do Mercado

-

23:43

GBP/USD sees a pullback to near 1.1500 as positive tone recovers, Fed/BOE policy in focus

- GBP/USD is expecting a pullback move after a perpendicular drop as the risk profile is turning positive.

- The BOE could announce the highest rate hike by 75 bps in the current rate hike cycle.

- The Fed may accelerate interest rates by 75 bps and the target range of rates may top around 5%.

The GBP/USD pair witnessed fresh demand around 1.1460 in the early Tokyo session. A pullback move in the cable looks favored as the risk-on impulse is getting traction. S&P500 futures have attempted a recovery after a bearish Monday while the 10-year US Treasury yields have also dropped to 4.05%.

The US dollar index (DXY) witnessed a vertical rise to near 111.50 after overstepping the critical hurdle of 111.00 as uncertainty ahead of monetary policies by the Federal Reserve (Fed) and the Bank of England (BOE) raised the credibility of safe-haven assets.

Analysts at Rabobank have come forward with a 75 basis point (bps) rate hike projection. Earlier, analysts were expecting a full percent rate hike after the disaster of the mini-budget under the leadership of former UK PM Liz Truss and Chancellor Kwasi Kwarteng.

However, novel leadership formation led by the appointment of Rishi Sunak as UK PM and Jeremy Hunt as Chancellor has infused optimism. They explain that it would still be the largest rate hike of this cycle. On policy guidance, analysts expect rates to peak at 4.75%.

The pound bulls could remain under pressure as UK’s business confidence has dropped to pandemic levels. The UK Consumer Confidence fell 1 point to 15% in the October survey, as reported by Bloomberg. However, the majority of employers are expecting that staff will increase for the first time in five months.

On the US front, the Fed is set to raise the target range for the federal funds rate by 75 bps to 3.75- 4.00% on Wednesday, in a note from analysts at Rabobank. They further added that “We expect a 50 bps hike in December, followed by two hikes of 25 bps in February and March, which would take the top of the target range to 5.00%.

-

23:41

Bond yields are currently likely in the process of topping out – JP Morgan

Analysts at JP Morgan highlight the recently sluggish Treasury bond performance while suggesting a pullback in the coupons as they said, “Bond yields are currently likely in the process of topping out.”

While citing the reasons, the investment bank stated that the disinflation phase has begun.

JP Morgan also mentioned that inflation will drop meaningfully lower in three to six months.

The US-based bank forecasts that core inflation will be at 5.3% YoY in the first quarter (Q1) of 2023, compared to the latest print of 6.6%.

It’s worth noting that the yields began the week on the positive side before marking a retreat as traders turn cautious ahead of the key US Wednesday’s all-important Federal Open Market Committee (FOMC) meeting and Friday’s Nonfarm Payrolls (NFP). That said, the US 10-year Treasury yields remain sidelined near 4.05% by the press time.

Also read: Forex Today: Dollar strengthens ahead of RBA, Fed and more

-

23:32

USD/CHF snaps three-day uptrend above parity level ahead of US ISM PMI

- USD/CHF seesaws around one-week high, prints mild losses.

- Mildly bid US stock futures, sluggish Treasury yields probe DXY bulls.

- Hawkish Fed bets, geopolitical/covid fears keep buyers hopeful.

USD/CHF bulls take a breather, following a three-day uptrend, as the quote makes rounds to 1.0010-15 during Tuesday’s Asian session. In doing so, the Swiss currency (CHF) pair seesaws around the highest level in a week while printing mild losses at the latest.

The pair’s recent weakness could be linked to a pause in the US Treasury yields’ run-up after a two-day winning streak. On the same line could be the mild gains of the S&P 500 Futures despite the Wall Street benchmark’s negative closing.

The downbeat US data and hopes of more easing in the oil prices, and inflation in turn, appeared to have exerted downside pressure on the US dollar. That said, the US Chicago Purchasing Managers’ Index and Dallas Fed Manufacturing Business Index for October came in at 45.2 and -19.4 versus 47.0 and -15.0 expected respectively.

“US President Joe Biden on Monday called on oil and gas companies to use their record profits to lower costs for Americans and increase production, or pay a higher tax rate, as he battles high pump prices with elections coming in a week,” said Reuters.

However, the market’s fears of hawkish Fed and cautious mood ahead of the key central bank announcements, as well as the employment data, underpinned the US dollar’s demand.

Looking forward, the USD/CHF traders may seek more clues to extend the latest pullback, which in turn highlights the Swiss SVME Purchasing Managers’ Index for October, expected 56 versus 57.1 prior. Following that, the US ISM Manufacturing PMI, likely to ease to 50.0 versus 50.9 prior, will direct immediate USD/CHF moves. Additionally, The US S&P Global Manufacturing PMI for the stated month, expected to confirm the initial forecast of 49.9 figure, will join the JOLTS Jobs Openings for September, forecast 10M versus 10.053M prior, to also entertain the pair traders.

Technical analysis

An upward-sloping trend line from late Thursday, around 0.9950 by the press time, restricts short-term USD/CHF declines.

-

23:23

GBP/JPY Price Analysis: Bears giving ground to the bulls at key support

- GBP/JPY has scope for a move higher so long as the bulls commit at 170.50.

- A break below 170.00 opens risks all the way to 169.00 for the day ahead.

GBP/JPY has been breaking higher this week with eyes on the 174.00s. However, for the near term, the bulls need to hold on as they take on the bears on the backside fo the trendline. The bears are looking to clean up the length that is vulnerable below 170.85 with 168.80 eyed. The following illustrates the market structures and bias on the weekly, daily and hourly charts.

GBP/JPY weekly chart

There is room for a move higher into weekly resistance while climbing the supporting trendline while the bullish W-formation and neckline remain intact.

GBP/JPY daily chart

The daily chart shows that the price is hugging the trend but the price is decelerating on the bid which could lead to a cascade of drops at key structure levels.

GBP/JPY hourly chart

This is where the near-term opportunity might evolve. The price is reaching higher, but should we have seen a break of structure to the downside but the bears have failed to stay on the front side of the trend. There is scope for a move higher so long as the bulls commit at 170.50. A break below 170.00 opens risks all the way to 169.00 for the day ahead.

-

23:03

AUD/JPY extends gains above 95.00 ahead of RBA policy

- AUD/JPY has refreshed its day’s high at 95.24 ahead of RBA’s monetary policy.

- It would be worth watching whether RBA will remain stick to 25 bps or return to a 50 bps structure.

- The Caixin Manufacturing PMI is seen higher despite a sheer drop in official manufacturing PMI.

The AUD/JPY pair has delivered an upside break of the immediate hurdle of 95.16 in the early Asian session. The asset is aiming higher ahead of the interest rate decision by the Reserve Bank of Australia (RBA).

The release of a significantly higher inflation rate for the second quarter in the Australian region has brought ambiguity in minds of investors regarding the extent of the rate hike by the RBA on Tuesday. In October monetary policy meeting, RBA Governor Philip Lowe slowed down the pace of hikes in the Official Cash Rate (OCR), citing that the economic prospects cannot be entirely sacrificed in achieving price stability.

The RBA announced a rate hike by 25 basis points (bps), terminating the 50 bps rate hike spell. Now, the inflation rate has delivered a historic surge after advancing to 7.3% vs. the expectation of 7.0%. This has accelerated chances that the RBA could return to a 50 bps rate hike structure to combat mounting price pressures.

Economists at ANZ Bank cited that “A 50 bps rise in November is possible, but we think the RBA will prefer to hike more frequently than shift back to 50 bps, given the reasoning behind the decision to go 25 bps in October.”

Apart from that, investors will also focus on the Caixin Manufacturing PMI data, being Australia a leading trading partner of China. The economic data is seen higher at 49.0 vs. the prior release of 48.1 despite a sheer drop in official manufacturing PMI data.

On the Tokyo front, investors are awaiting the release of the Bank of Japan (BOJ) monetary policy minutes on Wednesday. BOJ Governor Haruhiko Kuroda kept interest rates unchanged citing external demand shocks and the priority of achieving pre-pandemic growth levels.

-

23:03

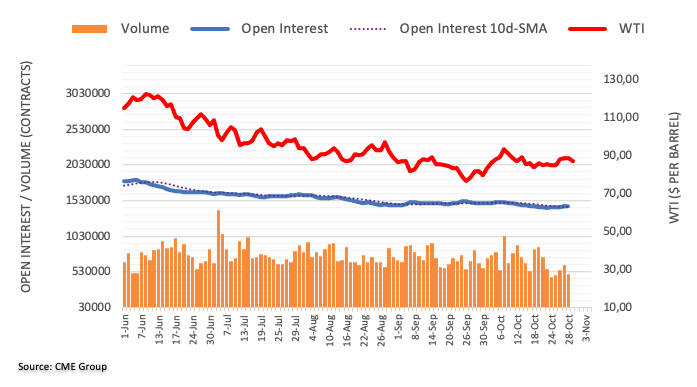

WTI Price Analysis: Bears approach monthly support near $84.40

- WTI holds lower ground after breaking 50-DMA support.

- Steady RSI keeps sellers hopeful to visit the short-term key support trend line.

- Buyers need validation from a three-month-old resistance line to retake control.

WTI crude oil prices print a three-day downtrend as it drops to 85.55 during Tuesday’s Asian session. In doing so, the black gold justifies the previous day’s downside break of the 50-DMA.

That said, the steady RSI (14) adds strength to the bearish bias suggesting the quote’s further downside towards an upward-sloping support line from September 26, around $84.40 at the latest.

In a case where the energy benchmark breaks the $84.40 key support, the odds of witnessing its slump towards the lows marked on October 18 and September 08, respectively around $81.30 and $80.95, can’t be ruled out.

However, the commodity’s downside past $80.95 appears difficult as the $79.30 level could challenge the sellers before directing them to September’s bottom around $78.00.

Alternatively, the 50-DMA hurdle surrounding $86.00 restricts the WTI crude oil’s immediate recovery before the previous week’s high of $89.30.

Following that, a downward-sloping resistance line from late July, around $89.90 and the $90.00 threshold could challenge the commodity buyers.

Should the quote manage to remain firmer past $90.00, it could rush toward the previous monthly peak of $92.63.

WTI: Daily chart

Trend: Further weakness expected

-

23:02

AUDUSD: The Aussie Dollar hovers around 0.6400 ahead of the RBA and the Fed decisions

- The AUD is at the mercy of central bank decisions by the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed).

- The AUDUSD tumbled on Monday as China’s PMI entered the recessionary territory, spurring a risk-off impulse.

- The USD was bolstered by Fed rate hike expectations and high US bond yields.

The AUDUSD is almost flat as the Asian session begins, following Monday’s trading session, with AUD losing ground against the USD due to a risk-off impulse. Hence, the safe-haven status of the US Dollar keeps the greenback underpinned. Factors like weaker-than-expected China data and Hong Kong Iron Ore prices tumbling below $80.00 were headwinds for the Aussie Dollar. At the time of writing, the AUDUSD is trading at 0.6396.

Broad US Dollar strength underpinned by Fed’s rate hike expectations weighed on the Aussie Dollar

Wall Street finished the session with hefty losses. A light US economic calendar keeps investors focused on the Federal Reserve’s November meeting as investors brace for a 75 bps rate hike based on the last week’s US data. Given that the Federal Reserve preferred gauge for inflation’s core Personal Consumption Expenditures (PCE) jumped by 5.1% YoY, below expectations but above August’s 4.9%, while the Employment Cost Index (ECI) for Q3 was 1.2% QoQ, lower than Q2 1.4%, is almost sure that Jerome Powell and Co., will continue to tighten monetary conditions. That said, US Treasury bond yields are higher, with most yields along the curve breaching the 4% threshold. Hence, the AUDUSD is on the brink of extending its losses if not by the Reserve Bank of Australia’s (RBA) monetary policy decision one day before the Fed.

US data wise, PMI figures released by the Regional Federal Reserve banks, like Chicago and Dallas, revealed Manufacturing Indices were ignored by AUDUSD traders. The Chicago Manufacturing Index missed expectations at 45.2, less than the previous reading. Later, the Dallas Manufacturing Index plunged to -19.2, lower than estimates, showing business conditions deteriorating for the sixth consecutive month.

AUDUSD buyers ignored Australia Retail Sales

Aside from the US, Australia revealed its Retail Sales for November, which rose by 0.6% MoM in September, aligned with estimates, and above the previous month’s reading. Even though the data was positive for the AUD, investors focused on the Fed and the RBA. Later, the Reserve Bank of Australia (RBA) is expected to hike a quarter percent (0.25%) of the Cash Rate, aligned with October’s monetary decision. The RBA’s decision to raise rates by 25 bps slowed the rate hikes and triggered a sell-off in the AUDUSD, which dived from around 0.6550, toward the YTD low at 0.6169, in just five days.

Factory activity in China weakens, weighing on the AUD

Elsewhere, China’s October official PMIs, stood at 48.7 from 50.6 reported in September, falling to contractionary territory, and weighing in commodity prices, particularly Iron Ore, which tumbled below $80 for the first time since 2019. Given the backdrop, investors’ moods shifted as they sold risk-perceived assets. In the Foreign Exchange (FX) market means selling the Aussie Dollar and buying US Dollars.

Ahead in the calendar, the Australian economic docket will feature the Reserve Bank of Australia (RBA) monetary policy decision at 02:30 GMT. Most commercial banks estimate a 25 bps rate increase, leaving the Cash Rate at 2.85%. If the RBA goes above estimates, it would be positive for the AUD; which could rally towards the 0.6500 figure; otherwise, it could be a less meaningful event, with the Federal Reserve decision looming.

On the US front, the US economic calendar will feature the S&P Global Manufacturing PMI for October, alongside the awaited ISM Manufacturing PMI and the JOLTs Job Openings.

AUD/USD Price Analysis: Technical outlook

The AUDUSD downward biased is intact, with most daily Exponential Moving Averages (EMAs) remaining above the exchange rate, except for the 20-day EMA at 0.6349. The Relative Strength Index is at 48.31, at bearish territory, though almost flat, meaning that choppy trading conditions remain. If the RBA surprises the market, the Aussie Dollar, could rally towards the October 31 daily high at 0.6428, followed by the October 28 high at 0.6479. On the flip side, a fall towards the 20-day EMA at 0.6349, followed by the 0.6300 figure.

-

22:44

USD/CAD retreats towards 1.3600 despite downbeat oil prices, US/Canada PMIs eyed

- USD/CAD snaps three-day uptrend, steps back from one-week high.

- Risk-aversion, softer oil prices helped buyers to keep the reins before the latest consolidation move.

- October’s PMIs for Canada, US will offer immediate directions ahead of Wednesday’s FOMC, Friday’s job numbers.

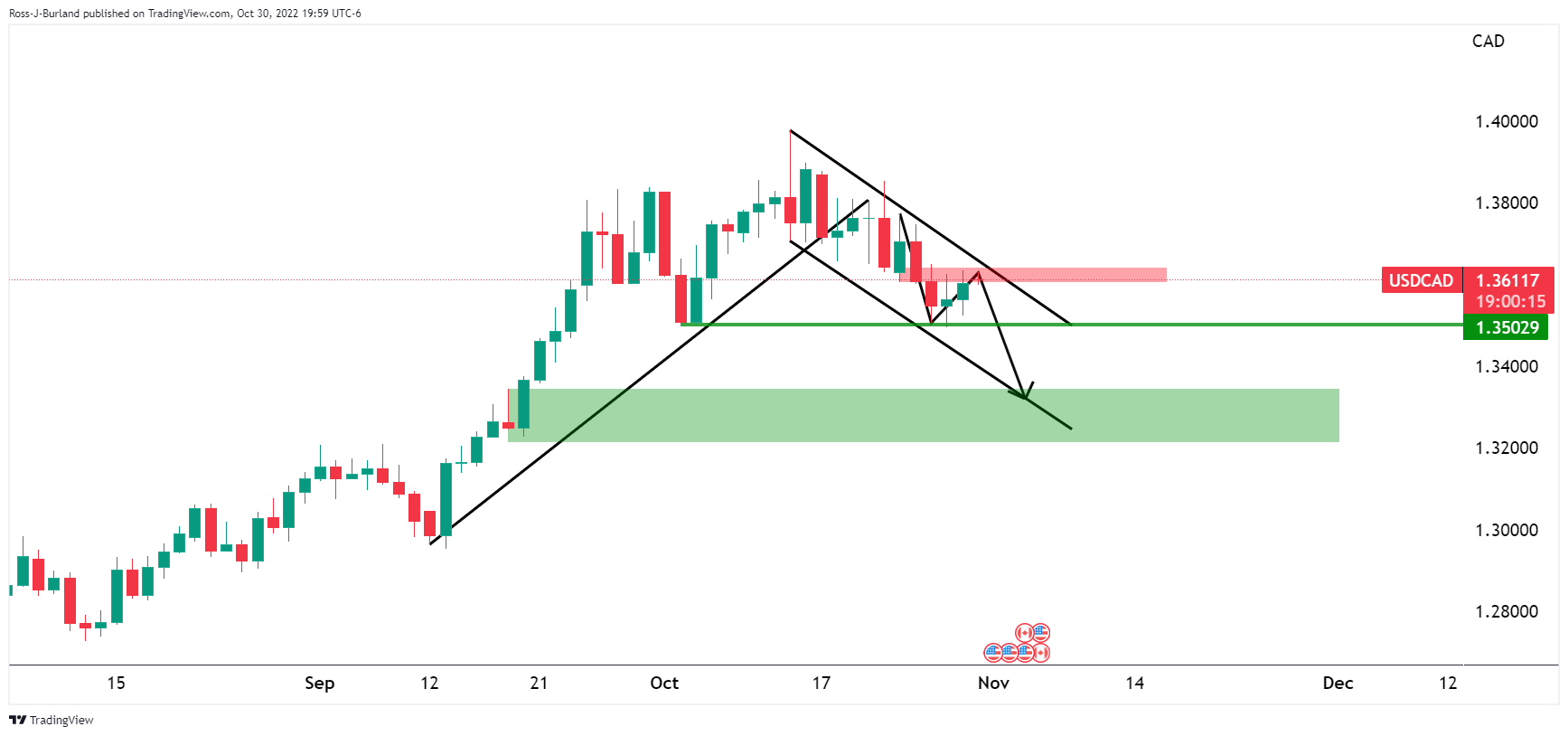

USD/CAD begins Tuesday’s trading on the negative side as it drops to 1.3610 following an upbeat start to the key week. The Loonie pair’s latest pullback fail to take clues from the downbeat prices of Canada’s key export item WTI crude oil, as well as the market’s rush towards the US dollar in search of risk safety. The reason could be linked to the anxiety ahead of important central bank announcements and the monthly employment data.

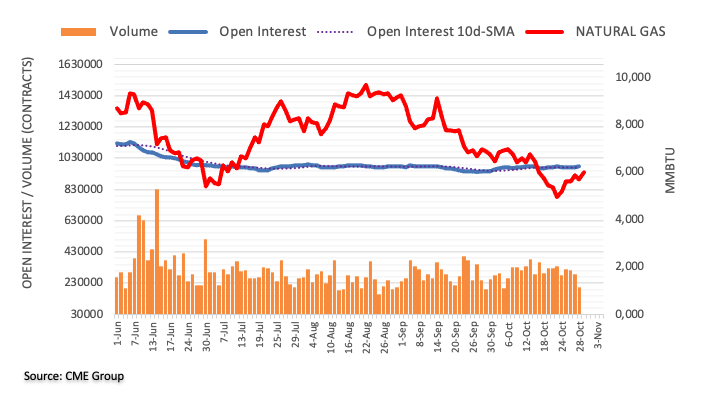

WTI crude oil remains pressured for the third consecutive day, down 0.22% intraday around $86.10 at the latest. The black gold’s recent weakness could be linked to the downbeat activity data from China, as well as the fresh covid-led lockdown and the fears emanating from it. Also, exerting downside pressure on the black gold prices could be US President Joe Biden’s push for lower energy prices. “US President Joe Biden on Monday called on oil and gas companies to use their record profits to lower costs for Americans and increase production, or pay a higher tax rate, as he battles high pump prices with elections coming in a week,” said Reuters.

Elsewhere, downbeat prints of the US activity data might have favored the USD/CAD sellers to take the risk. That said, the US Chicago Purchasing Managers’ Index and Dallas Fed Manufacturing Business Index for October came in at 45.2 and -19.4 versus 47.0 and -15.0 expected respectively.

Even so, the market’s fears of hawkish Fed and cautious mood ahead of the key central bank announcements, as well as the employment data, underpinned the US dollar’s demand. Also portraying the sour sentiment were firmer US Treasury yields and equities.

Looking forward, Canada’s S&P Global Manufacturing PMI for October, expected 49.2 versus 49.8 prior, will join the US ISM Manufacturing PMI, likely to ease to 50.0 versus 50.9 prior, will direct immediate USD/CAD moves. Additionally, The US S&P Global Manufacturing PMI for the stated month, expected to confirm the initial forecast of 49.9 figure, will join the JOLTS Jobs Openings for September, forecast 10M versus 10.053M prior, to also entertain the pair traders.

It should, however, be noted that Wednesday’s all-important Federal Open Market Committee (FOMC) meeting and Friday’s jobs report from the US and Canada are crucial catalysts for the Loonie pair traders to watch for clear directions.

Technical analysis

A pullback from the 21-DMA hurdle, around 1.3695 by the press time, directs the USD/CAD bears towards a four-day-old support line near 1.3590.

-

22:33

NZD/USD attempts a break of oscillation above 0.5800 ahead of Caixin PMI

- NZD/USD is aiming to deliver an upside break of the 17-pips consolidation ahead of Caixin PMI data.

- Chinese official manufacturing PMI remained downbeat amid zero Covid-19 policy.

- The antipodean is outperforming other risk-perceived currencies despite a pessimism in the market mood.

The NZD/USD pair has attempted a breakout after displaying back-and-forth moves in a 0.5803-0.5820 range in the early Tokyo session. The asset remained sideways from the late New York session as investors were awaiting the release of the Caixin Manufacturing PMI data for making an informed decision.

The commodity-linked currency refused to sustain below the critical support of 0.5800 on Monday and rebounded firmly unlike the other risk-sensitive currencies, which remained crippled against the greenback. Meanwhile, risk sentiment remained dampened as Federal Reserve (Fed)’s pre-anxiety period is compelling investors to hide behind safe-haven assets.

The US dollar index (DXY) advanced sharply on Monday after a breakout above the round-level hurdle of 110.00. Also, the 10-year US Treasury yields jumped to 4.05%.

As per the consensus, the Caixin Manufacturing PMI is seen higher at 49.0 vs. the prior release of 48.1. Official Manufacturing PMI which releases before the Caixin Manufacturing PMI remained downbeat on Monday. It is worth noting that New Zealand is a leading trading partner of China.

China’s official Manufacturing PMI landed lower at 49.2 vs. the projections of 50.0 and the prior release of 50.1, reported by the National Bureau of Statistics (NBS). Also, the Non-Manufacturing PMI had been recorded significantly lower at 48.7 against the expectations of 51.9 and the former release of 50.6. It seems that the continuation of the no-tolerance Covid-19 policy has weighed pressure on China’s economic activities.

Apart from that, kiwi’s labor market data will remain in focus. The Employment Change for the third quarter is seen at 0.5% against the former print of 0%. While the Unemployment Rate could trim to 3.2% vs. 3.3% released earlier. In addition to that, the labor cost index is also seen lower at 1% against the prior release of 1.3%.

-

22:23

EUR/USD bears take a breather below 0.9900 with eyes on US ISM PMI, Fed

- EUR/USD began the week on the negative side, holding lower ground near one-week bottom of late.

- Fears of Eurozone recession intensified after record high inflation data, unimpressive GDP figures.

- Hawkish hopes from ECB fail to defend pair buyers as USD benefits from rush to risk safety.

- US ISM PMI, JOLTS Job Openings will decorate calendar ahead of Wednesday’s FOMC.

EUR/USD steadies inside a 20-pip trading range below 0.9900 following a downbeat start to the central bank’s week. In doing so, the major currency pair seesaws around a one-week low.

Monday’s risk-aversion joined fears of more economic hardships for the old continent to exert downside pressure on the EUR/USD prices. The same stopped the quote to cheer hawkish expectations from the European Central Bank (ECB) and the multi-year high inflation data.

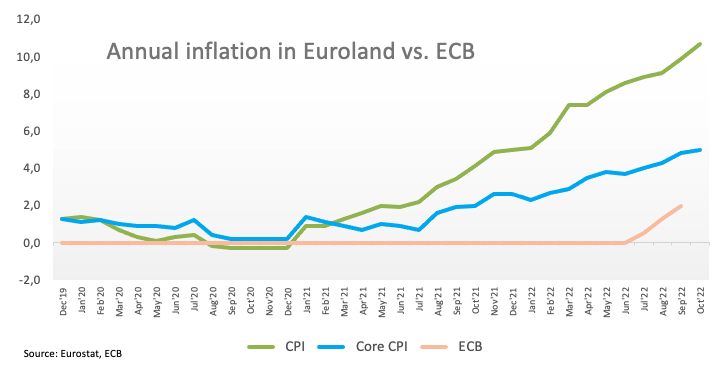

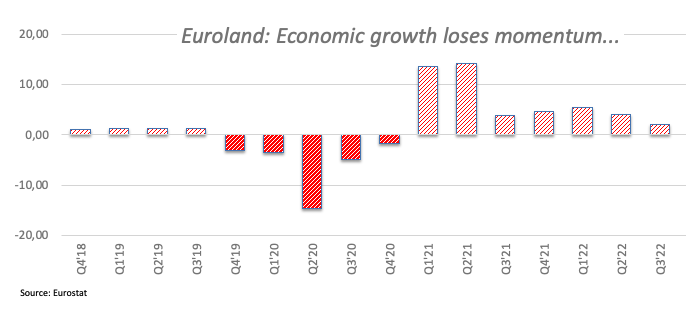

On Monday, the preliminary readings of the Eurozone’s third quarter (Q3) Gross Domestic Product (GDP) matched 0.2% QoQ forecasts versus 0.8% prior. Further, the bloc’s first readings of inflation data for October, per the HICP measure, jumped to 1.5% MoM versus 0.6% expected and 1.2% previous readings. On a yearly basis, the Eurozone HICP rallied to 10.7% compared to 9.8% prior and 10.2% market consensus.

Elsewhere, the US Chicago Purchasing Managers’ Index and Dallas Fed Manufacturing Business Index for October came in at 45.2 and -19.4 versus 47.0 and -15.0 expected respectively.

It should be noted that Russia’s retreat from the grain deal with the United Nations, Turkey and Ukraine joined the fresh wave of covid lockdowns in China to weigh on the market’s sentiment. Also, fears of higher rates and strong inflation were persistent and helped the US dollar to remain firmer.

With this, the US equities began the week on the negative side while yields recovered, which in turn underpinned the US Dollar Index (DXY) to print a three-day uptrend.

That said, traders await the US activity data for October before Wednesday’s all-important Federal Open Market Committee (FOMC) meeting. Among them, the US ISM Manufacturing PMI, expected to ease to 50.0 versus 50.9 prior, will be more important to watch. Additionally, The US S&P Global Manufacturing PMI for the stated month, expected to confirm the initial forecast of 49.9 figure, will join the JOLTS Jobs Openings for September, forecast 10M versus 10.053M prior, to also entertain the pair traders.

Given the hawkish hopes from the Fed, as well as the economic and geopolitical fears surrounding Eurozone, the EUR/USD pair is likely to remain weak.

Technical analysis

EUR/USD seesaws around the previous resistance line from March 31 and the 50-DMA while taking rounds to 0.9880-90. Given the downbeat RSI and the pair’s pullback from the 100-DMA hurdle, around 1.0075 at the latest, the quote is likely to remain weak, which in turn highlights the 0.9830 support confluence, including the 21-DMA and monthly ascending trend line to watch as the next rest-point.

-

22:07

Australia S&P Global Manufacturing PMI below expectations (52.8) in October: Actual (52.7)

-

22:01

Gold Price Forecast: XAU/USD aims to test a two-week low below $1,620 amid anxiety ahead of Fed policy

- Gold price is declining towards a two-week low at $1,617.28 amid rising hawkish Fed bets.

- The DXY continued its upside journey as the risk profile sours amid Fed’s pre-anxiety.

- The Fed will hike interest rates by 75 bps in November and by 50bps in December.

Gold price (XAU/USD) has witnessed a pullback move after dropping to near $1,632 in the early Tokyo session. The confidence seems to be lacking in the pullback move as the overall structure has become weak after the gold price surrendered the critical support of $1,638.00. The precious metal is declining toward a two-week low at $1,617.28 as the Federal Reserve (Fed) is set to tighten its policy further to combat rigid inflation.

Meanwhile, the US dollar index (DXY) extended its two-day winning streak on Monday after overstepping the critical hurdle of 111.00. Investors shifted to the risk aversion theme amid uncertainty ahead of the interest rate decision by the Fed. This also resulted in a sell-off in S&P500 and 10-year US Treasury yields flew higher to 4.05%.

As per the CME FedWatch tool, the chances of fourth consecutive 75 basis points (bps) rate hike stand at 86.5%. Analysts at Rabobank point out that with a Fed that is clearly prioritizing price stability over full employment, rates will go higher than currently anticipated. They expect a 75 bps rate hike in November and a 50 bps rate hike in December. And, the terminal rate would top around 5%.

Gold technical analysis

On an hourly scale, gold price has shifted into the bearish trajectory after surrendering the critical support of $1,638.00. The precious metal will test a two-week high at $1,617.28, recorded on October 21.

The 20-period Exponential Moving Average (EMA) at $1,638.00 is acting as major resistance for the counter. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold hourly chart

.

. -

21:45

New Zealand Building Permits s.a. (MoM) registered at 3.8% above expectations (-1.2%) in September

-

21:12

GBP/USD Price Analysis: Bulls hold the fort at key support, but bears are lurking

- GBP/USD bears are in town but the bulls have not thrown in the towel.

- The key support structure remains intact so far.

GBP/USD is threatening a move to the downside and into longs that were built up over the past week. The pair has been pressured over the course of the start of the week and made a low of 1.1459. The following charts show the bias on the hourly time frame while respecting the key structures:

GBP/USD H1 charts

the price is supported in a demand area and there are prospects of a move-in to test the resistance. However, failures there could result in a downside continuation for the days ahead. If the price breaks the 1.1430 mark, this would be a significant development:

In doing so, 1.1270 will be vulnerable which guards the start of the move from the October 21 lows near 1.1100/1.1050.

-

20:22

EUR/JPY turns lower and returns below 147.00

- The euro fails at 147.80 and retreats below 147.00.

- A sourer market mood underpins a mild JPY recovery.

- EUR/JPY is trapped on a bullish triangle pattern.

The euro was capped at 147.80 and pulled down against the Japanese yen on Monday, retracing Friday’s gains to hit session lows at 146.70. The sourer market mood at the start of the week has underpinned the safe-haven Japanese yen, weighing on the common currency.

The yen appreciates on risk aversion

Earlier on the day, the downbeat Chinese manufacturing and services activity figures reactivated investors’ concerns that the impact of the country’s strict COVID-19 restrictions, over the world's second-largest economy might dampen global growth, which has hammered risk appetite.

Beyond that, the market remains cautious ahead of the US Federal Reserve’s monetary policy meeting, due on Wednesday, which has weighed the euro against a stronger US dollar.

On the macroeconomic front, preliminary data showed that the eurozone inflation accelerated beyond expectations in October, showing a 10.7% annual rise against the 1.2% market consensus and following a 9.9% increase in the previous month.

These figures combined with the deceleration of the Gross Domestic Product; 0.2% in the Q3 against 0.8% in the previous quarter are posing a problem to the ECB and have increased bearish pressure on the euro.

EUR/JPY trapped within a bullish triangle pattern

From a technical perspective, the 4-hour chart shows the pair pulling back from the upper limit of a bullish triangle pattern (in the image below).

The pair’s reversal from the mentioned 147.80 area seems to have found buyers at the 50-period SMA, now around 146.80, which closes the path toward the lower limit of the triangle, at 146.20

On the upside, a successful move above 147.80 would increase bullish traction, which could push the pair towards the October 17 high at 148.40 ahead of the 150.00 psychological level.EUR/JPY 4-hour chart

Technical levels to watch

-

20:18

Silver Price Analysis: XAG/USD falls but is subdued around $19.10, ahead of FOMC’s decision

- Silver price tumbles ahead of the Fed November meeting on a buoyant US Dollar.

- From a daily chart perspective, XAG/USD remains neutral-to-downward biased.

- Short term, the XAG/USD is subdued around $19.10s.

XAG/USD slides from around the daily high at $19.25 towards the 50-day Exponential Moving Average (EMA) at $19.09 amidst broad US Dollar strength, exacerbated by US Treasury yields rising on an almost certain 75 bps Federal Reserve hike at November’s meeting. At the time of writing, XAG/USD is trading at $19.13, below its opening price by 0.40%.

XAG/USD Price Forecast: Technical outlook

From a daily chart perspective, XAG/USD remains neutral-to-downward biased, though it was neutral when the white metal reached a monthly high at $21.23. However, erased its gains, and at the time of typing, it meanders around $19.10s. Worth noting that on its way south, the white metal tumbled below the 100 and the 20-day EMAs, so as mentioned above, the bias remains unchanged.

The Relative Strength Index (RSI) crossed below the 50-midline, meaning sellers are gathering momentum. Nevertheless, XAG/USD needs to achieve a daily close below $19.00, to open the door for further losses.

Short term, the XAG/USD is range-bound. However, traders should be aware that the Exponential Moving Averages (EMAs) remain below the spot price except for the 50 and 100-EMA, hovering around the daily pivot point at $19.25 and $19.37, respectively. Also, the Relative Strength Index (RSI) below the 50-midline is trendless, meaning that silver is consolidated.

Key resistance levels lie at the 50-EMA at $19.25, followed by the daily pivot level at $19.28, ahead of the 100-EMA at $19.37. On the flip side, the XAG/USD first support would be the confluence of the 20 and 200-EMA at $19.12, followed by the S1 daily pivot at $18.93, followed by the S2 pivot level at $18.65.

Key Technical Levels

-

20:04

UK PM Sunak signs off on tax rises, GBP remains under pressure

The new Prime Minister for the UK, Rishi Sunak, is reported to be set to sign off on raising taxes across the board as the new British prime minister looks to plug a £50bn hole in public finances.

The Financial Times wrote in an article on Monday that Treasury insiders said that Sunak and chancellor Jeremy Hunt had agreed on Monday that while “those with the broadest shoulders should be asked to bear the greatest burden”, everybody’s taxes would go up.

the article reports that a Treasury official said after the bilateral meeting: “It is going to be rough. The truth is that everybody will need to contribute more in tax if we are to maintain public services.

“After borrowing hundreds of billions of pounds through Covid-19 and implementing massive energy bills support, we won’t be able to fill the fiscal black hole through spending cuts alone.”

The article states that the Treasury officials said there was an “eye-watering fiscal black hole”, as they attempted to prepare the public for tough economic news when Hunt delivers the Autumn Statement on November 17.

The UK political scene has been a major driver in financial markets of late. However, a new UK administration has brought more stability to the local bond and currency market.

With that being said, the economic slowdown and rising inflation pose ongoing risks to the pound which is down to the greenback by some 1.25% on the day so far. GBP/USD fell from a high of 1.1613 to a low of 1.1459.

-

19:46

USD/CAD Price Analysis: Bears losing their grip as price attempts to break channel resistance

- USD/CAD bulls seek a break of the hourly resistance structure.,

- Bears will remain favoured so long as the channel is respected.

USD/CAD has seen two-way price action in a mixed start to the week so far. The following illustrates the bullish and bearish scenarios on the hourly chart, leaning on a daily bearish bias. With the price on the backside of the prior bullish trend, USD/CAD remains in a bearish trend despite the recent correction. The bears could look to commit at this juncture and see the price revert to the downside within the descending channel. However, the 1.3502 level remains key at this point:

USD/CAD daily chart

USD/CAD H1 chart

The price on the hourly chart is sliding its way out of the channel resistance again and should the bears commit, they will need to get below 1.3600 where a void of liquidity could see the CAD rally to the daily support target in quick concession. On the other hand, should the bulls find the staying power, 1.3680 and then 1.3700 could come under pressure and give way to a breakout to the upside:

-

19:37

Forex Today: Dollar strengthens ahead of RBA, Fed and more

What you need to take care of on Monday, November 1:

The American dollar surged on Monday, posting uneven gains against most major rivals. Tepid Chinese data released at the beginning of the day, alongside continued signs that global inflation is out of control, fuel risk-averse trading.

At the beginning of the day, Australia reported that TD Securities Inflation was up by more than anticipated in October, now at 5.2% YoY from 5% in the previous month. Later in the day, the Eurozone published the preliminary estimate of the October Consumer Price Index, up at an annualized pace of 10.7%, a new record.

Central banks have adopted aggressive quantitative tightening to bring inflation down, but so far, there are no signs that price pressures have begun receding. The Bank of Canada and the Reserve Bank of Australia have already started easing the pace of tightening.

The Reserve Bank of Australia will open the central banks’ calendar on Tuesday and is expected to announce a modest 25 bps rate hike despite inflation jumping to a two-decade high in the third quarter of the year. The US Federal Reserve will announce its decision on Wednesday, and market players anticipate a 75 bps hike and hint it will start slowing the pace of rate hikes in December. Finally, the Bank of England will have a Super Thursday, with the latest political turmoil in the United Kingdom generating uncertainty on what Governor Andrew Bailey and co can do this time. Finally on Friday, the US will publish the October Nonfarm Payrolls report.

In the UK, Prime Minister Rishi Sunak and Chancellor Jeremy Hunt were on the wires, anticipating that it is unavoidable that all Britons would pay more taxes.

The EUR/USD pair lost the 0.9900 threshold and trades near a daily low of 0.9872, while GBP/USD trades around 1.1470. Commodity-linked currencies recovered some ground ahead of the close as Wall Street trimmed most of its early losses. AUD/USD trades just below 0.6400, while USD/CAD is down to 1.3620.

The USD/JPY pair advanced and is now trading around 148.60, while USD/CHF hovers around parity.

Gold trades at its lowest in a week, now hovering around $1,635, while crude oil prices edged lower and WTI changes hands at $86.40 a barrel.

Binance Coin price pumps on improving fundamentals – forecasting a bullish move to $380

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:30

GBP/JPY retreats from the 172.00 area to session lows sub-170.50

- The pound fails at 172.00 and drops below 170.50.

- Fed hike hopes and risk aversion weigh on the pound.

- The yen picks up as market sentiment deteriorates.

The pound is pulling back from long-term highs above 172.00, weighed by a broad-based USD strength and a sourer market sentiment. The pair has retreated about 0.5% on the day, to reach session lows at 170.35 so far.

The pound loses momentum with the US Fed on focus

Last week’s moderately positive market sentiment seems to have waned on Monday, with the investors in a more cautious mood ahead of the US Fed’s monetary policy decision. The bank is widely expected to hike rates by 75 basis points for the fourth consecutive time on Wednesday, which has provided a fresh boost to the USD.

Furthermore, the market seems to have digested Rishi Sunak’s appointment as British prime minister, which propelled the pound more than 2% higher against the yen last week.

This week, the focus has turned to the Bank of England’s monetary policy decision, due on Thursday. The BoE is also expected to hike rates by 0.75%, although the new cabinet, which has calmed the markets, coupled with the weak UK economic perspectives are feeding expectations of a somewhat softer tightening cycle in 2023.

In the Asian session, the positive Japanese retail sales, which rose beyond expectations in September, and the downbeat Chinese manufacturing data, also JPY-supportive on the back of its safe haven status, have increased downside pressure on the GBP.

Technical levels to watch

-

19:13

WTI creeps lower toward $86.20s on weak China PMI, higher US production

- Oil production in the US increased by almost 1%, according to the US EIA.

- US President Joe Biden calls oil companies to raise production to lower gasoline prices.

- China’s weak factory activity, and Covid-19 restrictions, were headwinds for oil prices.

The US crude oil benchmark, also known as Western Texas Intermediate (WTI), slides from around $88.260s on broad US Dollar strength, alongside estimates that US production could rise amidst weaker than estimated China’s data, threatening to slow down the second-largest economy. At the time of writing, WTI is trading at $86.26 per barrel, below its opening price by 2.28%.

According to the US Energy Information and Administration (EIA), production in the United States increased by 0.9% in August to almost 12 million barrels per day, its highest since March 2020. Data showed that crude oil production in Texas and New Mexico grew by 1.6% and 0.6%, respectively, contrary to North Dakota, with production falling by 0.5%.

Aside from this, the White House reported that the President of the United States, Joe Biden, will acknowledge the record profits by oil companies while Americans struggle to pay high fuel prices at around 20:30 GMT. The White House said Biden would speak after major oil companies reported record profits, led by Exxon Mobil and Chevron, which benefitted from surging natural gas and fuel prices.

Biden asked US companies to raise production instead of using profits for share buybacks and dividends.

Elsewhere, China’s manufacturing data weakened, as an official survey showed on Monday, weighed by soft demand and the zero-tolerance Covid-19 restrictions.

Additional headwinds for global oil demand is the Eurozone entering a recession, as last week’s Global S&P PMIs reported by the block keep raising concerns about the ongoing slowdown.

Of late, the Organization of the Petroleum Exporting Countries (OPEC) raised its forecast for world oil demand in the medium-longer term in an annual outlook revised on Monday. The cartel said $12.1 trillion of investment is needed to meet demand despite the energy transition.

WTI Key Technical Levels

-

19:00

NZD/USD refuses to give up the ghost in Halloween trade

- NZD/USD remains firm despite strong US yields and USD.

- Fed is the highlight of the week, domestically, NZ jobs on the radar.

NZD/USD refused to give up the ghost for Halloween trading at the start of the week despite firm US yields, poor Chinese data and sinking stocks on Wall Street. The bird remains underpinned by a hawkish stance at the Reserve Bank of New Zealand.

It was a mixed start to the week on Wall Street, with the high betas, such as the kiwi, initially under pressure before stocks tried to correct, supporting the antipodeans. NZD/USD fell to a low of 0.5774 before recovering to a high of 0.5820 in New York, back into London shorts. This occurred at the same time the cash market S&P 500 closed the opening gap, despite further disappointing US data while investors assessed the possibility of the Federal Reserve signalling this week a slowdown in the pace of interest-rate hikes from December. US Chicago PMI for October arrived at 45.2 vs. the estimated 47.0 vs. the previous 45.7.

Meanwhile, the key events come in this week’s FOMC announcement, mid-term elections and October labour market report. However, markets may still be optimistic about a Fed ‘pivot’, so the communications from the Fed's chair, Jerome Powell, will remain the main focus for the week. ''We look for the FOMC to deliver a fourth consecutive 75bp rate hike next week,'' analysts at TD Securities explained. ''The decision will bring policy to a level at which we think the FOMC will be more comfortable in shifting to a steadier hiking pace. The exact timing of the downshift, however, will highly depend on the Consumer Price Index data before the Dec meeting. Powell might offer hints of this in the post-meeting presser.''

NZ jobs market in focus

For the domestic week ahead, third-quarter data should confirm that the labour market remained exceptionally tight in the September quarter, as analysts at ANZ Bank explained.

''Data volatility means it’s highly uncertain where unemployment will actually land (we’ve pencilled in a 0.2ppt drop to 3.1%), but the overall release is expected to confirm that the inflationary chasm between labour demand and supply in New Zealand continues.''

''Wage growth is likely to accelerate again, with private sector average hourly earnings picked to rise 2.3% q/q (8.2% YoY), comfortably exceeding annual inflation of 7.2%. Productivity-adjusted private sector labour costs, meanwhile, are forecast to have lifted 3.9% YoY. Both measures of annual wage growth are expected to see their strongest prints on record (albeit in data only going back to the 1990s).''

The ''data may not shift the dial for the November MPS (where a 75bp hike is widely expected after last week’s shock CPI print), especially given that the RBNZ in August was expecting an even faster rise in wages than we are now. But a stronger-than-expected set of data could firm up expectations for another 75bp hike in February (ie our forecast).''

-

18:51

AUD/USD is attempting to regain the 0.6400 level after bouncing up from 0.6365

- The aussie trims losses and returns to the 0.6400 area.

- Fed hike expectations are strengthening the USD.

- AUD/USD should breach 0.6430 to ease downside pressure.

The Australian dollar is trimming losses on Monday’s US trading session and has reached the 0.6400 level, after having found support at 0.6365 earlier today. On the daily chart, the pair remains slightly lower after having entered the week on the back foot.

Hopes of a hawkish Fed are hurting the aussie

With the focus on the several monetary policy decisions scheduled this week, and with special attention on the US Federal Reserve, investors have remained cautious today. The Fed is widely expected to hike rates by 75 basis points for the fourth consecutive time, which is underpinning demand for the USD.

Furthermore, the downbeat Chinese Manufacturing PMI figures released earlier today have revived fears of a global economic slowdown. These figures have hammered risk appetite during the Asian session, increasing negative pressure on the risk-sensitive AUD.

In Australia, the RBA will announce its monetary policy decision on Tuesday. The event, however, is failing to provide any relevant support to the Aussie. The bank placed itself on the dovish side of the spectrum with a dovish rate hike on early October and the market has priced in a slowdown in the bank's tightening path over the months ahead.

AUD/USD should breach 0.6430m to ease downward pressure – UOB

FX analysts at UOB see the pair gaining downward traction, and point out to 0.6430 as a key level on the upside: “AUD dipped to a low of 0.6389. Downward momentum has improved a tad and AUD is likely to edge lower today, but a clear break of 0.6370 is unlikely. Resistance is at 0.6430 but only a break of 0.6460 would indicate that the current mild downward pressure has subsided.”

Technical levels to watch

-

18:22

EUR/USD dives toward the 50-DMA, eyeing 0.9800, on a buoyant US Dollar

- The EUR/USD could not cling to gains above 0.9900 despite Euro area economic data, justifying additional rate hikes.

- The Federal Reserve monetary policy meeting put a lid on the Euro’s rise as the week begins.

- Inflation in the bloc jumped surprisingly above 10.5%, despite that the ECB hiked rates by 75 bps in two consecutive meetings

The Euro continues its free-fall against the US Dollar, testing the 50-day Exponential Moving Average (EMA) at around 0.9886, amidst a mixed sentiment of the November’s Fed meeting, where the US central bank is foreseen to hike rates by 75 bps. However, expectations for a Fed pivot as US recession fears escalated, keeping investors on their toes. At the time of writing, the EUR/USD is trading at 0.9890.

The Euro loses ground against the US Dollar, albeit inflation figures justifying additional ECB tightening

Equities in the US reflect a dampened market mood as traders brace for the Federal Reserve. The US economic data revealed the Chicago PMI and the Dallas Fed Manufacturing Index, both October readings, and disappointed investors. The Chicago PMI missed expectations at 45.2, less than the previous reading. Later, the Dallas Fed Manufacturing Index plunged to -19.2, lower than estimates, showing business conditions deteriorating for the sixth consecutive month.

In the meantime, the Eurozone reported inflation for Germany, which sharply surprised the upside in October by 11.6% YoY, above estimates of 10.9%, weighing on the bloc’s figures. Meanwhile, the Eurozone Harmonized Index of Consumer Prices (HICP) rose by 10.7% YoY, exceeding forecasts of 10.3%, but core figures kept unchanged. The core HICP increased by 5% YoY, as estimated.

Elsewhere, the US Dollar Index, a gauge of the buck’s value against a basket of six currencies, soars 0.77%, at 111.523, underpinned by higher US Treasury yields, as the Fed’s decision looms

The CME FedWatch Tool estimates an 86% chance for a Fed 75 bps rate hike, while for December, traders are split between 50 and 75 bps. Worth noting that the odds for another ¾ percent raise increased from 43.4% to 49.5%, with 50 bps sliding to 44% from 48%.

What to watch

The EU’s economic docket would be light, with Germany reporting Import Prices for September. Contrarily, the US calendar will reveal the ISM Manufacturing PMI and the JOLTs Job Opening report for October, with both figures estimated at 50 and 10 million, respectively.

EUR/USD Key Technical Levels

-

18:10

Gold Price Forecast: XAU/USD bears turn up the heat on committed longs

- Gold bears are out in force at the start of the week as the US dollar continues its reign.

- The anticipation of a hawkish Fed is building again following conflicting WSJ reports.

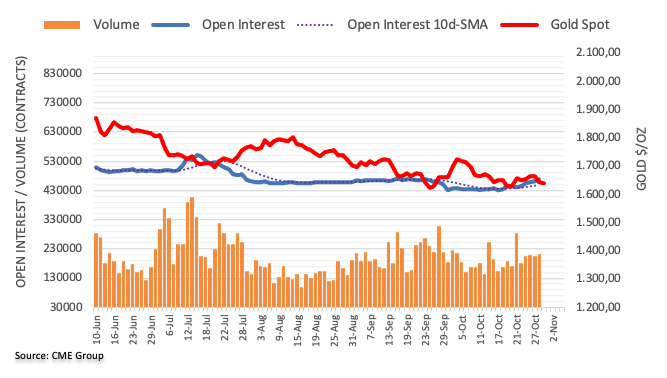

Gold has continued to slide, backing up from prospects of a bullish breakout as per the technical below. At the time of writing, XAU/USD is down 0.5% and has dropped from a high of $1645.74 to a low of $1,633.49 so far on the day. The yellow metal is heading for its longest streak of monthly losses on record with investors now in anticipation of continued rate hikes from central banks that will cause a strong US dollar and elevated US bond yields.

Looking to positioning data for the greenback, speculators’ net long USD index positions edged lower for a second week but remained essentially consolidative. The debate over whether the Fed is approaching a pivot point on policy has restarted in the market and that leaves scope for further length in the US dollar.

The sentiment has dented the non-yielding metal's appeal and nudged the bulls back a step further at the start of the week where the Federal Open Market Committee is expected to deliver a fourth consecutive 75bp rate hike this week. Hot US Consumer Price Index, strong growth numbers and conflicting ideas from the likes of WSJ have kept the US dollar underpinned.

As Reuters wrote in an opening note on Monday, ''the latest round of hopes for a shift in the Fed's tone seems to have stemmed from a Wall Street Journal article two weeks ago, flagging a possible discussion about slowing hikes. But a report from the same author over the weekend pointed to a lengthy period of high rates and traders have now tempered initial optimism, pricing in the funds rate to hit near 5% by May next year.''

This leaves the focus on the Fed chairman's presser. Jerome Powell will talk at a press conference where guidance for future increases could move the needle and after four jumbo-sized hikes. He may want to gauge economic responses before committing to anything besides hiking rates in the face of market speculating that the Fed would slow the pace of rate hikes amid concerns about overtightening.

Meanwhile, the greenback rose 0.8%, making gold more expensive for other currency holders. The benchmark 10-year Treasury yields also edged up at the start of this week. This is now using gold prices into a spiral of more than $400 since climbing above the key $2,000 per ounce level in March.

Gold technical analysis

On the downside, while below the weekly trendline, given that the price has already corrected to a 50% mean reversion of the prior bearish impulse, and considering it has failed to break key resistance so far, there is a strong argument for a downside extension:

The monthly chart could turn out a November candle such as the following:

-

17:51

GBP/USD extends losses below 1.1500 with the pound losing momentum

- The pound's reversal from 1.1645 extends below 1.1500.

- The sterling loses ground as the Sunak effect wanes.

- The US dollar appreciates ahead of the Fed's monetary policy meeting.

Sterling’s reversal from last week’s highs at 1.1645 accelerated on Monday, reaching levels below 1.1500. The cable is on the defensive at the start of the week against a stronger USD ahead of the Fed’s monetary policy meeting.

The sterling resumes its downtrend as the Sunak effect wanes

The positive impact triggered by the appointment of Rishi Sunak as British Prime Minister last week, which pushed the GBP to its highest levels in six weeks, seems to have waned. Bearing in mind the challenges ahead for the new cabinet, a sustained GBP rally was highly unlikely,

Beyond that, the focus this week has moved to the US Federal Reserve’s monetary policy meeting. The bank is widely expected to deliver the fourth consecutive 0.75% rate hike next Wednesday, which is stimulating demand for the US dollar.

The Bank of England is also expected to deliver another 0.75% hike on Thursday in an attempt to tame the soaring inflation pressures. The market, however, seems reluctant to place large GBP bets.

The new UK cabinet, and especially the confirmation of Jeremy Hunt as Chancellor of the Exchequer has calmed the market, which makes unnecessary an aggressive move to defend the pound. Furthermore, the prospects of an upcoming recession and the softer stance recently adopted by some of the world’s major central banks suggest that the BoE will soon follow suit and start slowing down its monetary normalization cycle.

Technical levels to watch

-

17:08

USD/CAD hits resistance at 1.3685 and retreats below 1.3650

- US dollar's recovery from 1.3495 finds resistance at 1.3685.

- The pair remains moderately bid with all eyes on the Fed.

- USD/CAD: needs to breach 1.3650 to confirm its upward trend – Scotiabank.

The US dollar is pulling lower on Monday’s US trading session, giving away previous gains after having peaked at 1.3685. On the daily chart, however, the pair remains moderately positive, on track to close a three-day rally from 1.3495 lows last week.

The US dollar appreciates ahead of Fed’s meeting

The Federal Reserve is attracting investors’ attention this week. The US central bank is widely expected to deliver the fourth consecutive jumbo hike next Wednesday, which is keeping the greenback moderately bid across the board at the start of the week.

US macroeconomic data, however, have not been dollar supportive on Monday. The Chicago Purchasing Managers’ Index deteriorated for the second consecutive month -to 45.2 in October from 45.7 in September- and the Dallas fed Manufacturing Index confirmed the lackluster perspectives of the sector, declining to a -19.4 reading in October from -17.2 in September.

On the other hand, the Canadian dollar has failed to capitalize on the recent USD weakness, weighed by lower oil prices. The US benchmark WTI is dropping nearly 2% on the day, amid concerns about the weak Chinese manufacturing data and its potential impact on demand.

USD/CAD: Confirmation above 1.3650 will increase upward momentum – Scotiabank

Currency analysts at Scotiabank point out at the 1.3650 level key to confirm the pairs’ neat-term trend: “USD/CAD pressured key support at 1.3505 on Thursday, but failing to achieve a sustained break under the figure leaves the market prone to a rebound (…) “Gains through 1.3650 are needed for the USD recovery to extend intraday. A high close today for the USD may add to short-term upward momentum.”

Technical levels to watch

-

16:43

NZD/USD marches steadily around 0.5800 despite a buoyant US Dollar

- NZD/USD seesaws around 0.5800 amidst overall US Dollar strength.

- A mixed sentiment keeps some high-beta currencies trending higher, though capped by a buoyant greenback.

- The US-3-month/10-year yield curve is inverted, meaning that the US could hit a recession within the next 12 months.

The NZD/USD slightly advanced during the mid-North American session, despite overall US Dollar strength, though the New Zealand dollar, after reaching a fresh three-day low, bounced off and reclaimed the 0.5800 figure. At the time of writing, the NZD/USD is trading at 0.5812, almost flat.

NZD/USD fluctuates as investors get ready for the Fed

US equities are trading within a mixed tone due to the deteriorated sentiment. Some US Federal Reserve regional banks unveiled PMI and Business Indices, namely the Chicago and Dallas Fed. The Chicago manufacturing PMI came at 45.2, lower than the 47.0 estimates, while the Dallas Fed Manufacturing Business Index dropped even further to -19.4 from -17.4 expected, exacerbating US recession fears around the financial markets.

Additionally, traders should be aware that the spread between the US 3-month/10-year turned negative, meaning that the yield curve inverted for the first time since March of 2020, signaling that a US recession is arriving, according to analysts at BBH.

In the meantime, geopolitical jitters like Russia’s blocking Ukraine from exporting grains, alongside a weaker-than-estimated China’s PMI figures, would likely keep the safe-haven US Dollar underpinned, even though the US economy is likely to head into a recession.

Also, the lack of tier 1 economic data keeps traders focused on the Federal Reserve’s decision. However, NZD/USD traders should be aware that November 1 ISM Manufacturing PMI for October could be the first domino of some usual “leading” indicators to flash signals of an impending slowdown in the US. Also, the JOLT’s report and the ADP Employment Change, ahead of the Fed’s policy meeting, would shed some light regarding the future outcome of the US Dollar.

NZD/USD Daily Chart

-

16:32

USD/CHF resurfaces above 1.0000 with all eyes on the Fed

- The dollar rallies for the third consecutive day, returning to levels beyond parity.

- Hopes of an aggressive Fed hike are buoying the USD.

- USD/CHF: Next upside targets are 1.0030 and 1.0145.

The US dollar is appreciating for the third consecutive day against the Swiss franc, extending its rebound from last week’s lows at 0.9840 to levels beyond parity, with the market focusing on the Fed’s monetary policy meeting, due later this week.

Hopes of an aggressive hike by the Fed are buoying the USD

Investors’ focus is on Wednesday's US Federal Reserve’s monetary policy decision, one of the highlights of the week. All signs point to another 0.75% rate hike, a favorable scenario for the US dollar, which is appreciating against its main rivals.

In the macroeconomic calendar, The US Chicago PMI has shown that business activity deteriorated beyond expectations in October and the same accounts for the Dallas Fed Manufacturing Index. These figures have increased fears about a slowdown in economic activity in the last quarter of the year, although the impact on the US dollar has been muted.

In Switzerland, retail sales increased at a 3.2% yearly pace in September, according to data from the Swiss Federal Statistics Office. This reading comes slightly below the 3.3% anticipated by the market, yet, well above the 2.1% seen in August.

USD/CHF: Increasing bullish momentum above 1.0000

From a technical perspective, the pair has confirmed its near-tern bullish bias breaching the 200-hour SMA at the 0.9980 area, which is now acting as support. On the upside, the pair is struggling against a resistance area at 1.0030 (October 24,25 highs) which would open the path toward a three-year high at 1.0145.

On the downside, the mentioned 200-hour SMA at the 0.9980 area is keeping bears at a bay. Below here, the next potential targets are October 30 low at 0.9945 and October 27 high at 0.9920/25.

Technical levels to watch

-

16:24

BoE: Looking at a dovish hike - Danske Bank

On Thursday, the Bank of England will announce its decision on monetary policy. Analysts from Danske Bank expect the central bank to hike the key rate by 75 basis points. They see later, fewer hikes than priced in markets as they emphasise the weak growth outlook.

Key Quotes:

“We expect the Bank of England (BoE) to hike the Bank Rate by 75bp on 3 November bringing it to 3.00%. Markets are currently pricing close to 75bp. Given the past months immense sell-off in gilt markets, we see the hawkish camp prevailing as an opportunity to restore market credibility as inflation remains significantly above target.”

“We expect the Bank to return to its more dovish stance as recession risks are becoming more pronounced and the growth outlook is increasingly becoming weaker. Likewise, the BoE tends to ear on the side of caution, why we expect a return to smaller increment hikes.”

“We keep the rest of our forecast unchanged, expecting a 50bp hikes in December followed by a final 25bp hike in February 2023, which is fewer hikes than priced in markets (currently 270bps until August 2023).”

“In our base case of a 75bp hike, we expect EUR/GBP to move slightly higher on announcement. As we expect the BoE to highlight the gloomy growth outlook for the UK economy amid rising recession risk, we expect EUR/GBP to continue its move higher during the press conference.”

-

16:20

Fed: We do not expect a pivot before 2024 – Rabobank

Analysts at Rabobank point out that with a Federal Reserve that is clearly prioritizing price stability over full employment, rates will go higher than currently anticipated. They expect the FOMC to raise the target range for the federal funds rate by 75 bps to 3.75- 4.00% on Wednesday. They do not expect the Fed to pivot before 2024.

Key Quotes:

“The next meeting of the FOMC takes place on November 1 and 2. Given the high inflation figures published in October, the FOMC is expected to take another giant step of 75 bps in November. Since that will take the top of the target range to 4.00%, and the FOMC had a terminal rate of 4.6% in mind in September, they are likely to slow down the hiking cycle at the next meeting in December.”

“We expect a 50 bps hike in December, followed by two hikes of 25 bps in February and March, which would take the top of the target range to 5.00%. We expect the Fed to remain on hold for the remainder of 2023.”

-

16:14

USD/JPY hits six-day highs near 149.00 ahead of critical days

- Japanese yen fall on Monday amid higher yields.

- Intervention: can it be sustained?

- USD/JPY with bullish bias in the very short term.

The USD/JPY is rising on Monday for the second day in a row and reached a six-day high at 148.83, before pulling back to the 148.50 area. The yen is among the worst performers even as equity markets in the US decline.

Higher US yields continue to be a key driver in USD/JPY. The US 10-year yield is holding firm above 4.00% while the 2-year approaches 4.50% again.

Intraday, the pair is moving with a bullish bias. The next resistance is seen around 149.10. On the flip side, support levels are 148.25 and 147.80.

Critical days ahead

Economic data released on Monday in the US showed an unexpected decline in the Chicago PMI and also in the Dallas Fed Manufacturing Business Index. Despite the numbers, the greenback remained in positive ground against most currencies. On Tuesday the ISM Manufacturing Index is due.

The FOMC will end its two-day meeting on Wednesday. The Fed is expected to raise the key interest rate by 75 basis points. On Friday, is the Non-farm payrolls report. Those events are likely to keep volatility elevated over the next sessions.

Data released in Japan gave light on the recent intervention from authorities to curb the yen’s weakness. After spending around 20 billion dollars in September, the total in October was above 40 billion. “In total, these interventions represent nearly 6% of its total foreign reserves and so it’s clear that this pace cannot be sustained on a regular basis. Rather, we think the BOJ will continue to intervene sporadically and quietly to try and keep the markets guessing. With the BOJ delivering another dovish hold last Friday, we think USD/JPY remains a buy at current levels”, said analysts at Brown Brother Harriman.

Technical levels

-

15:58

RBA Preview: Forecasts from 10 major banks, 50 bps rise is possible on upside surprises in inflation

The Reserve Bank of Australia (RBA) will announce its next monetary policy decision on Tuesday, November 1 at 03:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming central bank's decision.

The RBA will likely hike the cash rate by 25 basis points although a 50 bps move is still on the table, given the most recent inflation estimates.

ANZ

“The Q3 acceleration in CPI is expected to see the RBA lift its forecast for headline inflation for the full 2022 year to more than 8%. We think the equivalent forecast for trimmed mean inflation will lift to around 6.6% YoY. This shifts the narrative about Australia being on a different inflation pathway from other developed countries. The shift in this narrative has caused us to adjust our policy expectations for the RBA. We have pushed that up to another 125 bps, with the RBA no longer expected to pause in December. After consecutive 25 bps rate hikes this week and December, we see a further 75 bps of tightening over the first half of 2023 which will take the cash rate target to a revised peak of 3.85% in May(up from 3.6%). Absent a sharp negative external shock, we don’t think the RBA will be in a position to ease policy for some time. We have 50 bps of rate cuts penciled in for H22024.”

Westpac

“The RBA will lift the cash rate by 50 bps, to 3.10%. This is a non-consensus view – most commentators anticipate a move of 25 bps. It is significant that Q3 inflation data was much higher than anticipated. The 1.8%qtr, 6.1%yr increase in trimmed mean inflation was a shock result. It demands a more urgent response from the RBA. With inflation higher for longer the concern is that strong inflationary psychology may become entrenched.”

Standard Chartered

“We expect the RBA to hike the cash rate by 25 bps to 2.85% from 2.60% previously. Given the high frequency of RBA meetings, we think the RBA may keep to 25 bps hikes even though Q3 inflation surprised to the upside.”

UOB

“The latest Federal Budget, unveiled on 25 Oct, displayed strong fiscal discipline, which is crucial and consistent with RBA’s efforts to curb inflation. Notably, both headline and underlying inflation for 3Q22 came in higher than expectations. But we believe inflation will likely peak in 4Q22, in the absence of further significant global shocks. We are penciling in a 25 bps hike OCR to 2.85%.”

TDS

“The RBA made a judgment call in October and reduced the size of its rate hikes. However, the upside surprise in Q3 CPI cast doubt on the pivot though we think this adds upside risk to our terminal rate call rather than a return to 50 bps hike next month. The RBA will provide new forecasts and we expect downward revisions to growth and upgrades to its inflation forecasts.”

ING

“After the big upside miss to 3Q22 inflation, we think the RBA will have to return to 50 bps of tightening after it dropped to just 25 bps at the October meeting.”

SocGen

“We expect the RBA to increase the cash rate target from 2.60% to 3.10%, which means that it is likely to return to the 50 bps pace of tightening implemented from June to September after a one-off 25 bps hike in October. The upside surprises in the 3Q22 inflation data should be the main driver for the likely 50 bps hike, overwhelming other factors like the slowdown in employment and the stabilisation of global financial market conditions. The policy statement should continue to say that the RBA is resolute in its determination to return inflation to target while keeping the economy on an even keel. Meanwhile, we stick to our ‘terminal’ policy rate forecast of 3.60% at this juncture.”

NAB

“We expect the RBA to lift the cash rate by 0.25 bps to 2.85% but note that the AU Q3 Inflation data revealed high and broad-based inflation, setting up a tough choice for the RBA on Tuesday. Thus, a 50 bps will be considered and we see it as a material risk.”

Citibank

“We stick to our view of another 25 bps rate hike this week and further 25 bps hikes across December and February. The RBA will also provide updates to Australian GDP and CPI forecasts. We expect a downgrade to 2023 GDP while raising the unemployment rate forecast. However, we do not expect the RBA to materially change the headline inflation forecast despite last week’s solid Q3 CPI data.”

Wells Fargo

“While headline CPI inflation surprised to the upside and reached 7.3% year-over-year in Q3, we still expect this 25 bps rate hike pace to continue in November. However, we now believe the RBA will extend its rate hike cycle beyond this year into 2023, with 25 bps rate hikes in November, December, and February to a terminal rate of 3.35%.”

-

15:33

Gold Price Forecast: XAU/USD tumbles below the 20 DMA, targets the YTD low below $1,620, ahead of Fed meeting

- Gold tumbles and extends its yearly losses, eyeing the YTD low at around $1,615.

- Broad US dollar strength ahead of the Federal Reserve meeting keeps the precious metals segment under pressure.

- US ISM Manufacturing PMI and JOLTs Opening, eyed on Tuesday, before Fed’s decision.

Gold price slides for the second consecutive day as the US dollar advances, ahead of the Federal Reserve Open Market Committee (FOMC) meeting, which is widely expected to deliver the last jumbo-size rate hike of the US central bank, amidst growing speculation for a Fed pivot, while recession fears increased. At the time of writing, the XAU/USD is trading at $1,637 a troy ounce, down by 0.39%.

XAU/USD falls on a buoyant US Dollar, underpinned by elevated US T-bond yields.

Global equities remain under pressure. Inflation in the Eurozone reached a record high of 10.7% amidst an ongoing economic slowdown in the block, which weakened the EUR, and underpinned the USD. The greenback got bolstered by US Treasury yields rising, while the 3-month/10-year yield curve spread briefly inverted during the last week. According to BBH analysts, “the signal is impossible to ignore, and that is the US economy is moving closer to a recession within the next 12 months, give or take.”

Data-wise, the US economic docket featured the Chicago PMI, which decreased to 45.20, below estimates of 47, adding to the list of Federal Reserve regional indices, painting a recessionary scenario. Of late, the Dallas Fed Manufacturing Business Index dropped below 0 to -19.4, lower than estimates of -17.4.

Aside from this, the Institute for Supply Management (ISM) will be reported the Manufacturing PMI for October on November 1, with estimates at 50, below the previous month’s 50.9. Of note, particular attention would be to prices paid by companies and employees, which would signal if the US economy continues to expand or begins to feel the shock of higher interest rates. Last month’s readings were 68.7 and 53.0, respectively.

The US Dollar Index, a gauge of the buck’s value vs. a basket of peers, climbs 0.84% to 111.592, while the US 10-year benchmark note rate sits at 4.042%.

The US calendar will release the ISM Manufacturing PMI for October, JOLT’s opening, and the Federal Reserve’s monetary policy decision ahead of the week.

Gold Price Forecast (XAU/USD): Technical outlook

The yellow metal tumbled below last week’s low of $1638.40, exacerbating its fall to fresh two-week lows at around $1633.53. The Relative Strength Index (RSI) in the daily chart is headed downward, meaning that sellers remain in charge, though they will face solid support at around $1617, ahead of the YTD low at $1614.92. If buyers would like to shift gold bias to neutral, they need to reclaim the 50-day Exponential Moving Average (EMA) at $1682.69.

-

15:28

USD/MXN Price Analysis: Mexican peso continues to test the 19.80 barrier

- USD/MXN with bearish bias while below 19.95.

- Consolidation under 19.80 points to more weakness ahead.

- Immediate resistance at 19.95 followed by 20.00; upside limited under 20.15.

The USD/MXN is rising on Monday but it moved off highs and pulled back. The pair traded momentarily above 19.90 and then dropped below 19.85, and is it looking again at the key support around 19.80.

The critical support area around 19.80 has held fine so far and triggered a rebound, but it is still exposed and being challenged. A daily close below would reinforce the bearish bias, exposing the 19.50 key level (intermediate support at 19.70).

The 19.95 has become the immediate resistance, followed by 20.00, an area that also contains the 20 and 55-day Simple Moving Average. A break higher would expose the 20.15/20.20 key resistance. A break higher would suggest more gains ahead, targeting 20.45.

USD/MXN daily chart

-638028268926843569.png)

-

15:25

Colombia National Jobless Rate rose from previous 10.6% to 10.7% in September

-

15:19

USD to suffer a further leg lower if Fed commits to slowing down the pace – MUFG

After its late October swoon, the US Dollar Index is up for the third straight day as critical central bank week gets underway. Unless the Federal Reserve cements a pivot, the greenback is set to remain on a solid foot, economists at MUFG Bank report.

US rate market is expecting Fed to signal slower pace of hikes ahead

“If the Fed does slow the pace of hikes in December it does not necessarily mean as well that the total amount of tightening delivered in the current tightening cycle will be less although that will be the initial assumption. It could be that the Fed slows the pace of hikes but eventually keeps hiking for longer. The US rate market though is expecting that as the Fed slows the pace of hikes at the end of this year, it will then quickly bring an end to the hiking cycle in the 1H of next year leaving the terminal rate at around 4.75%.”

“After correcting lower over the past week/month, the Fed will have to send a clear signal that it plans to slow rate hikes and sound more cautious over the need for further tightening to trigger a further leg lower for the US dollar in the week ahead.”

-

14:38

US: Economy is seen expanding 1.6% in 2022 – UOB

Senior Economist at UOB Group Alvin Liew reviews the recent flash US GDP figures for the third quarter.

Key Takeaways

“The advance estimate of US 3Q GDP surprised on the upside with a 2.6% q/q SAAR expansion (versus Bloomberg est +2.4%) the first positive q/q print for this year, from an unchanged 0.6% decline in 2Q. The rebound in 3Q GDP was attributed to resilient private consumption expenditure, a continued gain in net exports, a rebound in non-residential fixed investment (business spending) as well as federal government, state and local government spending, offsetting the continued decrease in private inventories and a deeper plunge in residential fixed investment.”

“But with the 2.6% bounce in 3Q growth, even as we factor in a sizeable 3.6% contraction in 4Q, our full year GDP growth forecast will now be higher at 1.6% (from previous forecast of 1.0%). And for 2023, we continue to expect the US economy to fall into a shallow recession due to the combination of elevated inflation, global growth slowdown with a European recession and importantly, the impact from the aggressive Fed rate hikes. We keep our projection for US GDP to contract by 0.5% in 2023. That said, the risk of a deeper recession will rise in tandem with a more protracted and sharper Fed tightening cycle.”

“US GDP Outlook – The latest GDP report does not change our Nov FOMC outlook for a 75 bps rate hike. If anything, the resilient PCE component and rebound in business spending in 3Q vindicates the Fed to continue with “larger than usual” hikes in order to tame elevated inflation. The question is whether the more pessimistic outlook in 2023 will be enough to convince the Fed to slow its tightening pace after Nov.”

-

14:35

US: Dallas Fed Manufacturing Index drops to -19.4 in October vs. -15 expected

- Dallas Fed Manufacturing Index for October missed market expectations.

- US Dollar Index clings to strong daily gains near 111.50.

The headline General Business Activity Index of the Federal Reserve Bank of Dallas' Texas Manufacturing Survey declined to -19.4 in October from -17.2 in September. This reading came in weaker than the market expectation of -15.

Further details of the survey revealed that the Manufacturing Output Index fell to 6 from 9.3, the Employment Index improved to 17.1 from 15 and the Company Outlook Index edged higher to -9.1 from -10.7.

Market reaction

The greenback preserves its strength following this report and the US Dollar Index was last seen rising 0.75% on the day at 111.50.

-

14:35

EUR/USD: High inflation to dampen the risk of a sharper euro sell-off – MUFG

The euro has remained at weaker levels following last week’s European Central Bank (ECB) policy meeting. The release of stronger activity and inflation data from the eurozone are set to prevent a sharp euro sell-off as ECB tightening expectations have been challenged, economists at MUFG Bank report.

Economic data releases keep pressure on ECB to tighten policy

“The latest economic data from the eurozone did highlight that the ECB is still facing a difficult balance when setting policy with inflation continuing to surprise significantly to the upside. It will keep pressure on the ECB to keep delivering larger rate hikes as policy rates remain relatively low and well below inflation.”

“Activity in the eurozone economy appears to have held up better than expected in Q3. While a sharper slowdown is still likely over the winter period, the activity data for Q3 has provided some comfort.”

“The combination of stronger inflation and activity data should help to dampen speculation over an even bigger dovish pivot from the ECB anytime soon, and thereby dampen the risk of a sharper euro sell-off.”

-

14:34

EUR/USD: Bears don’t give up and push for more

- EUR/USD breaks below the 0.9900 mark to new lows.

- The dollar remains well bid ahead of the FOMC event on Wednesday.

- EMU Flash inflation rose more than expected in October.

The single currency remains mired in the negative territory and drags EUR/USD to fresh multi-session lows in the sub-0.9900 region at the beginning of the week.

EUR/USD weaker on USD-recovery

EUR/USD accelerates its losses on Monday and breaches the key support at 0.9900 the figure, that is more than 2 cents down from last week’s monthly highs just below the 1.0100 barrier (October 27).

Indeed, the continuation of the strong recovery in the greenback keeps undermining the sentiment around the euro and favours extra decline in the pair, as investors get ready for the FOMC gathering on Wednesday, which will be the salient event of the week.

The daily drop in the pair comes in tandem with the small rebound in the German 10-year bund yields, which add to Friday’s bounce beyond 2.10% at the same time.

In the euro docket, advanced inflation figures in the euro area now see the CPI rising more than expected 10.7% in the year to October, while the Core CPI is seen gaining 5.0% from a year earlier.

Still in the Euroland, the economy is predicted to expand 0.2% QoQ in Q3 and 2.1% on a yearly basis, according to preliminary results. In the first turn, German Retail Sales contracted 0.9% in September vs. the same month of 2021.

What to look for around EUR

EUR/USD extends a leg lower and breaks below the 0.9900 mark against the backdrop of persistent dollar strength on Monday.