Notícias do Mercado

-

23:42

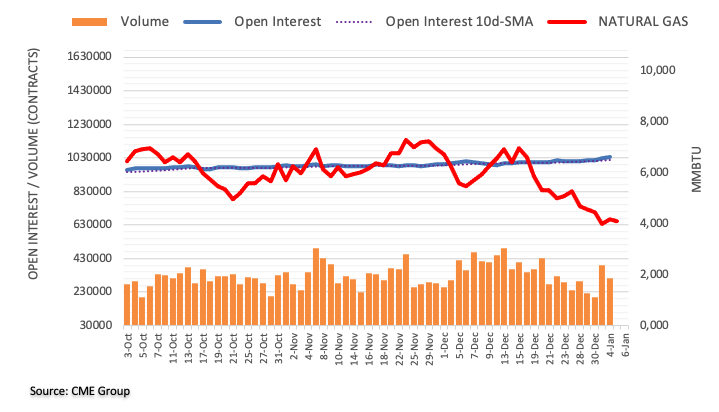

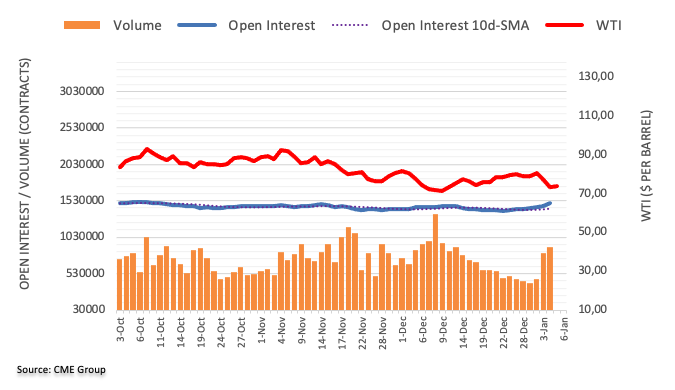

WTI continues rangebound action around $74.00 despite soaring recession fears

- Oil price is displaying a sideways auction after a perpendicular fall.

- Solid US payroll data is acting as a twin-edged sword for the oil price.

- Upside revision in China’s GDP projections could bring some optimism for the black gold.

West Texas Intermediate (WTI), futures on NYMEX, is displaying back-and-forth moves in a narrow range around $74.00 in the early Tokyo session. The oil price is struggling to get a direction after a perpendicular fall to near $73.00 from the critical resistance of $81.00.

The black gold remained inside the woods despite the release of solid United States Automatic Data Processing (ADP) Employment Change data. According to the agency, the United States economy has generated fresh 235K vs. the expectations of 150K and the former release of 127K.

Solid US payroll data is acting as a twin-edged sword for the oil price. No doubt, higher demand for labor force is generally required to cater to bumper demand from firms to address operations, which displays a stellar requirement of oil to execute operations. On the other side, a tight US labor market will be compromised with higher wage inflation, which would not provide any room for the Federal Reserve (Fed) to look for moderating the pace of policy tightening till the end of CY2023 and may also trigger recession fears.

Commenting on the minutes of the Federal Reserve's December policy meeting, TD Securities analysts noted that officials remained in broad agreement about the need to push the policy stance further into restrictive territory in the near term. Therefore it expects another 50 basis points (bps) rate increase in February, and expects 25 bps rate hikes in March and May. It projects that the Fed will therefore settle on a terminal Fed funds target rate range of 5.25%-5.50% by May."

Meanwhile, a significant pace adopted by the Chinese administration in reopening the economy for spurting the volume in economic activities has resulted in an upside revision of Gross Domestic Product (GDP) projections. The National Bureau of Statistics had revised China’s real GDP growth to 8.4% for 2021 (previous 8.1%), a higher base comparison for 2022.” This could result in a rebound in the oil prices ahead.

-

23:31

Japan Labor Cash Earnings (YoY) came in at 0.5% below forecasts (1.5%) in November

-

23:08

USD/JPY Price Analysis: Rallies and stalls around the 20-DMA, as buyers target 134.00

- A four-month-old downslope trendline break could shift the USD/JPY bias to upwards.

- USD/JPY Price Analysis: Neutral biased, but could turn bullish above the 200-DMA.

The USD/JPY advance towards the 20-day Exponential Moving Average (EMA) as Friday’s Asian Pacific session begins, though it remains shy of piercing the 133.82 area, following Thursday’s 0.60% gain. At the time of typing, the USD/JPY is trading at 133.42

USD/JPY Price Analysis: Technical outlook

From a technical perspective, the USD/JPY shifted its bias from downward to neutral biased. After the USD/JPY bottomed around 129.50, the major rallied 3% and reclaimed the 133.00 figure. Additionally, it’s testing a four-month-old downslope trendline drawn from 2022 highs above 150.00, which, once broken, could open the door for a test of the 200-day Exponential Moving Average (EMA) at 134.81.

However, the Relative Strength Index (RSI) remains in bearish territory, almost flat, while the Rate of Change (RoC) shows buyers are beginning to gather impulse. Unless the RSI slope aims upward, traders might refrain from opening fresh long positions in the USD/JPY.

The USD/JPY key resistance levels are the 20-day EMA at 133.82, short of the 134.00 figure. A breach of the latter will expose the 200-day EMA at 134.81, followed by the 50-day EMA at 136.82. As an alternate scenario, the USD/JPY support levels would be the four-month-old downslope trendline turned support around 133.00, followed by the January 5 low of 131.68. Once cleared, the next support would be the YTD low of 129.50.

USD/JPY Key Technical Levels

-

23:06

AUD/USD Price Analysis: More downside on cards amid a risk-off market mood

- AUD/USD is expected to kiss the upward-sloping trendline of the Ascending Triangle amid a risk-off impulse.

- The 200-EMA at 0.6725 is still providing support to the Australian Dollar.

- A 40.00-60.00 range oscillation by the RSI (14) indicates consolidation in the major.

The AUD/USD pair has displayed a less-confident rebound after dropping to near 0.6730. The Aussie asset is likely to conclude its recovery move sooner and may resume its downside journey as investors have underpinned the risk-aversion theme in the market.

The US Dollar Index (DXY) soared to near 105.00 after the Automatic Data Processing (ADP) agency in the United States announced bumper employment generation in December month. For further action, investors will focus on the release of the US Nonfarm Payrolls (NFP) data.

AUD/USD is declining towards the upward-sloping trendline of the Ascending Triangle chart pattern formed on a four-hour scale. The upward-sloping trendline of the chart pattern is plotted from December 20 low at 0.6629 while the horizontal resistance is placed from December 13 high at 0.6693.

The Aussie asset has dropped below the 50-period Exponential Moving Average (EMA) at 0.6780. While the 200-EMA at 0.6725 is still providing support to the Australian Dollar.

The Relative Strength Index (RSI) (14) is continuously oscillating in a 40.00-60.00 range, which indicates rangebound action till the release of a potential trigger ahead.

A downside move below December 29 low at 0.6710 will drag the major further toward December 22 low at 0.6650 followed by November 21 low at 0.6585.

On the contrary, a decisive break by the Aussie asset above December 13 high at 0.6893 will drive the major towards August 30 high at 0.6956 and the psychological resistance at 0.7000

AUD/USD four-hour chart

-

22:39

EUR/USD declines towards 1.0500 on tight US labor market, Eurozone Inflation eyed

- EUR/USD is expected to display more weakness to near 1.0500 amid upbeat US ADP Employment data.

- Bumper additions of fresh payrolls in the US will be offset by the promise of higher wages.

- The Eurozone inflation is seen lower amid falling energy prices.

The EUR/USD pair is hovering around the critical support of 1.0520 in the early Tokyo session. The major currency pair is likely to extend its downside journey to near the psychological support of 1.0500 as the tight labor market in the United States has triggered the risk of continuation of elevated interest rates by the Federal Reserve (Fed) beyond CY2023.

Risk-perceived assets like S&P500 witnessed extreme selling pressure from investors as the better-than-anticipated addition of fresh payrolls in the United States labor market for December month might spurt the wage inflation ahead. Investors underpinned the risk-aversion theme, which led to a rally in the US Dollar Index (DXY). The USD Index soared to near 105.00 amid an improvement in safe-haven appeal. A decline in investors’ risk appetite also trimmed the demand for US government bonds.

The Automatic Data Processing (ADP) agency of the United States reported a healthy improvement in the number of employment additions for December month to 235K vs. the expectations of 150K and the former release of 127K. It is highly transparent that higher requirements for talent will be offset by offering higher wages, which would spurt wage growth and therefore leave individuals with more funds for disposal. The expression could bring a recovery in the price index through bumper retail demand.

Going forward, the release of the United States Nonfarm Payrolls (NFP) data will provide more clarity on the employment status. The Unemployment Rate is seen unchanged at 3.7%. Apart from that, the release of the Average Hourly Earnings data will be of utmost importance.

On the Eurozone front, investors will keep the focus on the release of the Harmonized Index of Consumer Prices (HICP) data, which will release on Friday. Considering the drop in energy prices and German inflation, it is highly likely that inflationary pressures in the Eurozone economy will follow the same path.

Meanwhile, European Central Bank (ECB) policymaker Francois Villeroy de Galhau said in a New Year’s address that “It would be desirable to reach the right ‘terminal rate’ by next summer, but it is too early to say at what level” as reported by Reuters.

-

22:27

NZD/USD stumbles and prints a two-day low around 0.6210s on broad US Dollar strength

- NZD/USD dropped below the 200-day EMA, extending its losses courtesy of solid US data.

- Kansas City Fed President Esther George estimates rates to be around 5% in 2023 and 2024,

- Friday’s US Nonfarm Payrolls are estimated to fall to 200K.

The New Zealand Dollar (NZD) lost traction against the US Dollar (USD) courtesy of solid US data sparking further action by the Federal Reserve. Wall Street ended the session with losses, portraying a dampened market mood. At the time of writing, the NZD/USD is trading at 0.6223 after hitting a daily high of 0.6309.

The NZD/USD pair could not capitalize on early US Dollar weakness on Wednesday and was dragged lower after solid labor data was released. As reported by ADP, private hiring in December crushed estimates of 150K, jumping by 234K. Meanwhile, unemployment claims edged lower to 204K beneath 225K forecasts, reinforcing the workforce’s strength, suggesting further Fed tightening is needed.

Aside from this, Fed speakers like Esther George, Raphael Bostic, and James Bullard reiterated that inflation is too high and that rates must surpass the 5% threshold. Kansas City Fed President George said rates need to be around 5% until 2024. Bullard added the economy remains strong and acknowledged a resilient labor market that justifies Fed’s aggression.

Elsewhere, the US Dollar Index, which tracks the greenback’s performance against a basket of peers, printed a two-month high at 105.272, though at the time of typing, it clings to gains of 0.83% above the 105.000 figure. US Treasury bond yields bull flattened, with the 10-year benchmark note rate holding to 1% gains at 3.722%.

What’s next for the NZD/USD?

An absent New Zealand (NZ) economic docket would leave traders adrift to the dynamics of the United States (US) economy. On the US front, Nonfarm Payrolls for December are expected to edge low, estimated at 200K beneath the prior 263K, while the Unemployment Rate is foreseen at 3.7%, unchanged.

NZD/USD Key Technical Levels

-

22:05

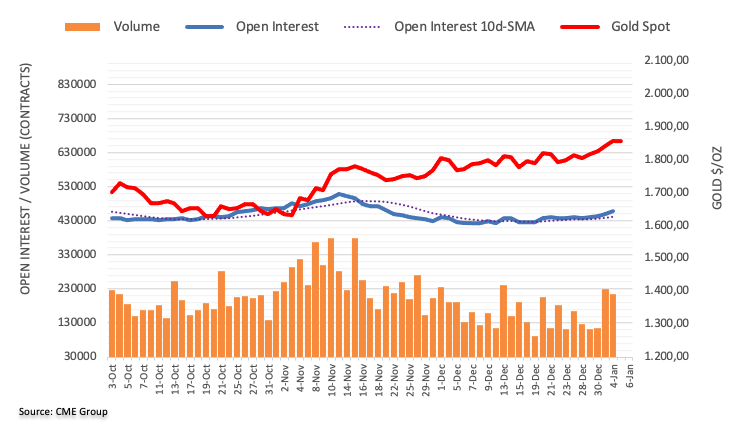

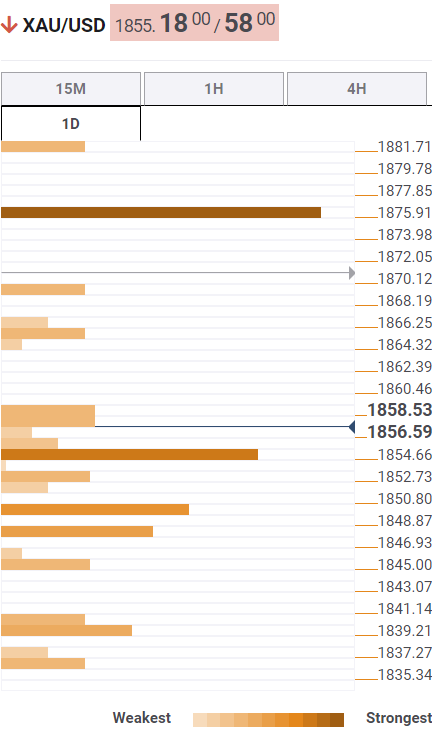

Gold Price Forecast: XAU/USD struggles to extend gains on upbeat US ADP Employment data

- Gold price is facing barricades in stretching its recovery move further ahead of US NFP data.

- The Fed might continue its interest rates on an elevated level for a longer period.

- An upbeat US ADP Employment Change data bolsters the expectations of solid US NFP data ahead.

Gold price (XAU/USD) has attempted a recovery move after dropping to near $1,825.00 in the late New York session. The precious metal is struggling to extend its rebound further as solid United States Automatic Data Processing (ADP) Employment Change data has triggered the risk of continuation of higher interest rate stability by the Federal Reserve (Fed) for a secular period.

S&P500 witnessed a massive sell-off from the market participants, portraying a risk-aversion theme, as higher additions of fresh payrolls in the United States labor market will compel the Fed to keep its hawkish stance on interest rates for a longer period. This has also triggered a risk of recession in the US economy. The Employment Change (Dec) soared to 235K vs. the expectations of 150K and the former release of 127K. Also, the weekly Initial Jobless Claims (IJC) has dropped to 204K vs. the consensus of 225K.

The US Dollar Index (DXY) recorded a juggernaut rally after sustaining above the critical resistance of 104.00 and climbed to near 105.00. Also, the 10-year US Treasury yields sensed demand and gained to near 3.72%.

On Friday, investors will keep an eye on US Nonfarm Payrolls (NFP) data. After observing upbeat cues from ADP Employment Change, it is highly likely that the US NFP will release better-than-projected data. The Unemployment Rate is seen stable at 3.7%.

Gold technical analysis

On a four-hour scale, the Gold price has dropped to near the 50-period Exponential Moving Average (EMA) at $1,827.60 after failing to extend rally. The upward-sloping trendline placed from November 23 low at $1,721.23 will act as major support for the precious metal ahead. Also, the 200-EMA at $1,790.23 has not been tested yet, which indicates that the long-term trend is still bullish.

The Relative Strength Index (RSI) (14) has dropped to near 40.00 which signals a consolidation ahead.

Gold four-hour chart

-

20:41

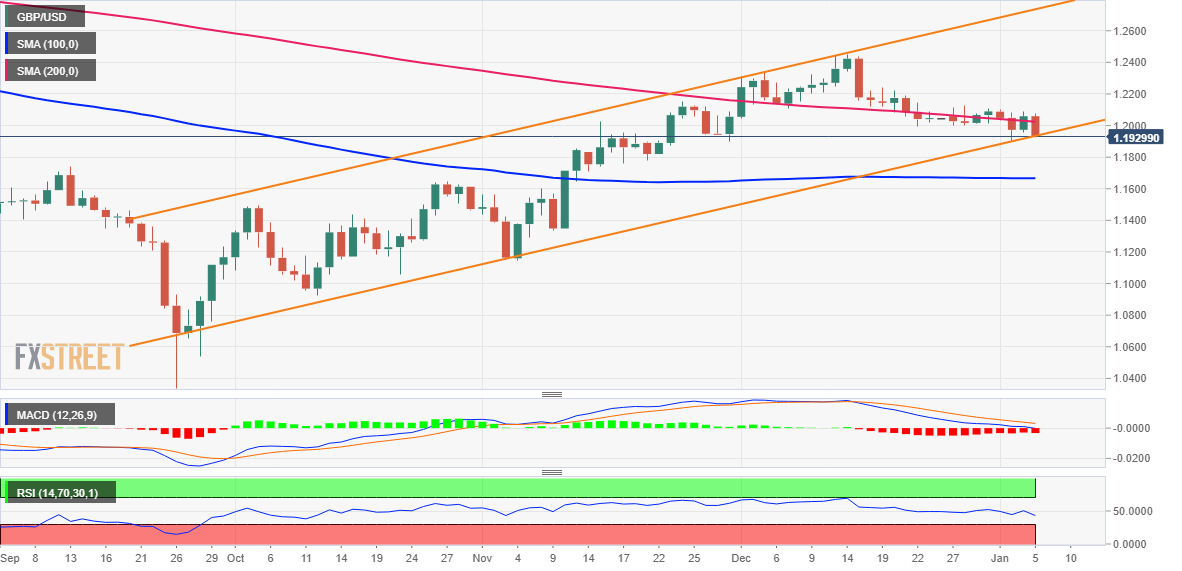

GBP/USD plunges toward 1.1900 on US data as traders eye US NFP

- Economic data in the United States strengthened the US Dollar vs. the Pound Sterling.

- Fed speakers remained worried about inflation, with some expecting rates at around 5% in 2024.

- GBP/USD traders are eyeing December’s US Nonfarm Payrolls data.

The GBP/USD plummets from 1.2078 daily highs toward the 1.1910s area on broad US Dollar (USD) strength triggered by solid labor market data. Wall Street is set to register losses, portraying investors’ dampened mood. At the time of writing, the GBP/USD is trading at 1.1912.

The Pound Sterling (GBP) continued to weaken as the New York session is about to end. ADP’s Employment Change report for December displayed that private hiring 234K more people than the 150K estimated, spurring speculations that Friday’s US Nonfarm Payrolls report could be the spark for a 50 bps rate hike by the Federal Reserve (Fed) on February 1.

Furthermore, the US labor department revealed that Initial Jobless Claims for the week ending December 31 dropped to 204K, lower than street analysts’ 225K mark estimates, while Continuing claims shrank to 1.694M less than the 1.708M expected.

Another reason that triggered a leg-down in the GBP/USD is Fed speaking. Kansas City Fed President Esther George said that inflation remains high and that rates need to be above 5% at least until 2024. Later, Atlanta’s Fed President Raphael Bostic stated that inflation is the biggest headwind for the US economy.

Of late, St. Louis Fed President said that it would be good for the Fed to get to a restrictive stance quickly. Bullard added that the job market remains strong and would justify Fed’s aggression. To finalize, he added that GDP is likely to moderate at a 2% pace in 2023 and that inflation would ease slower than the market’s estimates.

What to watch

Ahead into the week, with the GBP/USD pair trading at around the 1.1910s area, traders would be focused on the UK’s S&P Global/CIPS ConstructionPMI alongside the House Price Index. Regarding the United States (US) calendar, the docket will feature the US Nonfarm Payrolls report for December.

GBP/USD Key Technical Levels

-

19:40

Forex Today: EU inflation and US employment data could be decisive

What you need to take care of on Friday, January 6:

The American Dollar aimed higher early Thursday, backed by the echoes of a hawkish Fed. It gained additional momentum ahead of Wall Street’s opening following the release of upbeat US employment-related figures.

The United States Challenger Job Cuts report showed that layoffs were down to 43.651K in December from 76.835K in the previous month. Additionally, the ADP survey on Employment Changed showed that the private sector created 235,000 new positions in the same month, much better than anticipated. Finally, Initial Jobless Claims declined to 204,000 in the last week of December. The upbeat figures hint at an upcoming solid December Nonfarm Payrolls report to be out this Friday. Also, the Euro Zone will publish fresh inflation data. The December Harmonized Index of Consumer Prices (HICP) is expected to have increased at an annual pace of 9.7%

Kansas City Federal Reserve Bank President Esther George said that high inflation still needs Fed intervention, while she noted that the central bank would maintain ratest until 2024, aligned with FOMC’s hawkish stance. Also, St. Louis Fed President Jim Bullard said that inflation would likely ease more slowly than markets anticipate, reinforcing the idea of a continuously aggressive Federal Reserve’s monetary policy.

European Central Bank member French central bank chief Francois Villeroy noted that the ECB should aim to reach the terminal rate by Summer.

The EUR/USD pair fell to a fresh weekly low of 1.0514, recovering a few pips ahead of the close. GBP/USD finally gave up to US Dollar demand and fell towards 1.1900. The USD/JPY pair extended its advance and trades at around 133.30.

Commodity-linked currencies were among the most volatile, posting substantial losses against the Greenback. AUD/USD trades around 0.6760, while USD/CAD hovers around 1.3570.

Spot gold settled at $1,832 a troy ounce, with buyers still taking their chances on dips. Crude oil prices consolidate near weekly lows. WTI changes hands at $73.60 a barrel.

Binance US’s acquisition of bankrupt Voyager Digital faces opposition from regulators

Like this article? Help us with some feedback by answering this survey:

Rate this content -

18:34

USD/CHF Price Analysis: Steadily advances above 0.9350 after breaking a falling wedge

- USD/CHF climbs steadily, bolstered by US economic data and speculation for further Fed tightening.

- The USD/CHF pairs bounced at around a top-trendline of a falling wedge which turned support around 0.9250.

- A daily close above 0.9366 could send the USD/CHF rallying towards 0.9400 and beyond.

The USD/CHF erases Wednesday’s losses and rises more than 70 pips on Thursday, clearing on its way north solid resistance levels, like the 20-day Exponential Moving Average (EMA) at 0.9322. Factors like the release of robust labor market data in the United States (US) lifted the USD/CHF from around daily lows of 0.9260. At the time of writing, the USD/CHF is trading at 0.9360.

USD/CHF Price Analysis: Technical outlook

After finding support at around 0.9200, the USD/CHF resumed its uptrend, eyeing a break above Wednesday’s daily high of 0.9366. The USD/CHF dropped towards the top-trend line of a falling wedge, previously broken during the week, turned support. Hence, the major bounced at around 0.9250 and aimed toward a downslope resistance trendline that passed around 0.9370.

If the USD/CHF achieves a daily close above 0.9366, that could open the door for further upside, implying a test of the 0.9400 mark, which, once cleared, would send the USD/CHF aiming towards the 100-day EMA at 0.9445, followed by a test of 0.9500.

As an alternate scenario, the USD/CHF first support would be the 20-day EMA at 0.9322, followed by the 0.9300 figure and the top trendline of a falling wedge that resides around 0.9250.

USD/CHF Key Technical Levels

-

18:04

United States 4-Week Bill Auction up to 4.1% from previous 3.83%

-

17:28

WTI bounces off weekly lows and climbs to $73.50s following an inventory increase

- WTI trims some of its 9% losses attained during the week and reclaims the $73.00 mark.

- Recessionary fears sparked by weak PMI readings in China and the US dampened oil investors’ appetite.

- WTI Price Analysis: Downward biased as long as it stays beneath $82.00.

Western Texas Intermediate (WTI), the US crude oil benchmark, rebounds around month lows of $72.50 per barrel and climbs above the $74.00 mark courtesy of a sudden shut of a US fuel pipeline. Additionally, China’s reopening has been cheered by oil traders. At the time of writing, WTI exchanges hands at $73.65, up by 0.61%.

The oil market began 2023 with substantial losses of close to 9% on Tuesday and Wednesday, weighed by recessionary fears, following the release of US and China manufacturing activity reports, with both countries headed to a slowdown.

Sources quoted by Reuters said, “China’s pandemic and reopening challenges weigh on the market mood and put the bull thesis of a demand rebound under scrutiny.”

In the meantime, unscheduled maintenance to US pipeline operator Colonial Pipeline revealed that Line 3 had been shut for maintenance, resuming fuel flow on January 7. Therefore, WTI registered a slight jump n the day, reaching a daily high of $74.88.

According to market sources, the American Petroleum Institute inventories printed a rise in US crude and gasoline. Data revealed by the US Energy Information Administration (EIA) agency showed that Crude Production rose by 100K to 12.1M vs. 12.0M of previous data.

WTI Price Analysis: Technical outlook

Even though Thursday’s price action displayed a recovery on WTI prices, black gold continues to be pressured to the downside. WTI plummeted below the 50 and 20-day Exponential Moving Averages (EMAs) in the last couple of days and fell to fresh three-week lows at $72.50. Failure to extend beneath the latter opened the door to print a leg-up. But oscillators at bearish territories, like the Relative Strength Index (RSI) and the Rate of Change (RoC), portrayed further downside is expected.

WTI key support levels lie at $73.00, followed by $72.50, ahead of the 2022 yearly low of $70.10.

-

16:37

US: The case for additional labor market weakness is clear – Wells Fargo

On Friday, the US official employment report will be released. Market consensus is for an increase in payroll by 200K. Analysts at Wells Fargo point out the demand for workers has started to roll over. They argue job openings and hiring plans have declined since the start of 2022, and the trend in layoffs is no longer improving.

Some reports suggest labor market is cooling more than recent payroll numbers indicate

“The buoyancy of nonfarm payroll growth has seemed at odds with other signs that the jobs market is beginning to sour. We look for nonfarm payroll growth to downshift more noticeably in the months ahead, beginning with December's employment report showing hiring slowing to 205,000.”

“Other gauges of hiring, including the household survey, PMI employment indices and the latest Quarterly Census of Employment & Wages, suggest that the labor market is cooling more than the recent payroll numbers indicate.”

“As we look ahead, the case for additional labor market weakness is clear. If additional labor supply is not forthcoming, it will take softer labor demand to bring nominal wage growth back toward a pace that is consistent with the Fed's 2% inflation target. This is one reason the FOMC is still contemplating additional rate hikes even as other sources of inflationary pressure, such as spiking gasoline prices and hampered supply chains, have eased in recent months.”

“What remains to be seen is whether the Federal Reserve can engineer just the right amount of labor market cooling such that labor cost growth—and by extension inflation—sufficiently slows without causing a major increase in unemployment.”

-

16:34

Silver Price Forecast: XAG/USD tanks toward $23.20s ahead of US Nonfarm Payrolls

- Solid US employment data augmented speculations for further Fed tightening.

- The US Dollar remains bolstered by high US Treasury bond yields, which weigh on Silver prices.

- US Nonfarm Payrolls eyed, as Fed officials forecasted a jump in the Unemployment Rate to 4.6% in 2023.

Silver price extended its losses for the second consecutive day after hitting a nine-month high around $24.54 on Tuesday, plunging more than 2%. Robust labor market data in the United States (US) increased speculations for further tightening by the Federal Reserve (Fed), as shown by US Treasury yields rising. Therefore, the XAG/USD is trading at $23.20 after hitting a daily high of $23.91.

US employment data dampened traders’ mood. Private hiring increased in December, as the ADP Employment Change report showed the US economy added 2345K jobs crushing estimates. Some minutes following the release, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the last week fell to their lowest level since late September, at 204K vs. 225K estimated. The same report flashed Continuing Claims contracting to 1.694M less than the 1.708M expected.

At the same time, the US Department of Commerce (DoC) revealed that the US Trade Balance for December shrank its deficit, printing $-61.51B against the $-73.0B foreseen.

Moving aside from the releases of US data, the XAG/USD extended its losses after opening on the back foot since the Asian session. During the European session, Silver dropped to its daily low at 23.18 though it bounced back to the $23.60 area. Nevertheless, once American traders got to their desks, the US Dollar (USD) resumed its uptrend, to the detriment of dollar-denominated commodities.

The US Dollar Index (DXY), which tracks the value of the American Dollar against a basket of six currencies, is gaining 0.86%, back above the 105.000 mark, one factor that keeps the precious metals pressured. In the same tone, US Treasury bond yields are recovering some ground, with the US 10-year benchmark note rate up five bps at 3.739%, a headwind for the white metal.

Elsewhere, US Fed officials Esther George and Raphael Bostic had crossed the newswires. Kansas City Fed President Esther George said that high inflation requires Fed action, while his colleague, Atlanta’s Fed President Raphael Bostic, added that inflation is the biggest headwind for the US economy.

Ahead into the week, the US economy docket will feature the US Nonfarm Payrolls report, with most bank analysts estimating an increase of just 200K in December. Investors should be aware that the latest Fed Summary of Economic Projections (SEP) forecasts a growth in the Unemployment Rate to 4.6%, but December estimates surround the 3.7%. Misses to the downside should be viewed as positive for the USD, as it will suggest further rate hikes are needed.

Silver Key Technical Levels

-

16:24

Canada: Goods trade balance dipped a toe into deficit waters in November – CIBC

Data released on Thursday showed an unexpected goods trade balance deficit of 0.04bn in November after a surplus of 1.3K in the prior months. Analysts at CIBC point out that while the goods trade balance deteriorated slightly, the deficit in services narrowed to more than offset that move, with services exports rising during the month but imports declining. The overall trade deficit narrowed modestly to -$1.5bn in November, from -$1.9bn in the prior month, they reported.

Weakness in import and export could be a sign of weakening domestic and global demand

“Canada's goods trade balance dipped a toe into deficit waters in November, with the $0.04bn shortfall coming against consensus expectations for a modest surplus of $0.5bn. However, with exports and imports both declining by similar magnitudes over the month, the surprise deficit stemmed mainly from a downward revision to energy exports in the prior month which dramatically narrowed the surplus for October (now $0.13bn relative to $1.21bn first reported). The weakness in import and export volumes in November could be a signpost of weakening domestic and global demand, as well as the continuation of supply disruptions in some areas.”

“Weakness in exports and imports during November appear to largely reflect lower energy prices and monthly volatility within areas such as pharmaceutical products. However, there are some signposts of weakening global and domestic demand as well, particularly the decline in imports of toys and games suggesting that more discretionary goods spending is weakening in line with the rise in interest rates.”

-

16:06

USD/CAD hits fresh daily highs near 1.3600 as Dollar rallies

- US Dollar rises sharply after data, DXY hits highest in almost a month.

- USD/CAD rebounds from 1.3475 toward 1.3600.

- US and Canadian employment reports to be released on Friday.

The USD/CAD is up on Thursday by more than a hundred pips booted by a stronger US Dollar. The pair peaked during the American session at 1.3587. It remains near the high with a firm bullish tone.

Despite falling versus the Dollar, the Loonie is outperforming on Thursday. AUD/CAD is at two-day lows while NZD/CAD dropped to the lowest since late November weakened by a deterioration in market sentiment. The Dow Jones is falling by 1.20% and the Nasdaq tumbles by 1.28%. Crude oil prices are up but off highs.

The USD/CAD could face resistance around the 1.3610/15 area and then 1.3650. The key level n the upside is seen at 1.3700. A daily close above would point to further strength. On the downside, the pair has rebounded from the relevant support of 1.3470/80; a daily close below should clear the way toward 1.3400.

Dollar up on US data

Data released on Thursday showed an increase in private payrolls by 235K in December above the 150K of market consensus, according to ADP. The weekly jobless claims report showed a decline in initial claims to the 204K, the lowest since September. The December reading of the S&P Global Services PMI was revised to the upside from 44.4 to 44.7.

The US Dollar strengthened after the reports. The DXT surged to the highest level since December 8 above 105.00. US Treasury bond yields also climbed, reaching multi-day highs across the curve. The Nonfarm Payroll report is due on Friday. Market consensus is for an increase by 200K. The numbers could trigger more volatility.

In Canada employment report is also due on Friday. “We look for employment to rise by 8k in December as the Canadian labour market starts to cool. This should push the unemployment rate back to 5.2%, although we expect full-time employment to drive the headline print amid scarce labour supply. We also look for wages to push higher to 5.5% y/y with help from muted base effects, while hours worked should see a modest increase”, explained analysts at TD Securities.

Technical levels

-

16:00

United States EIA Crude Oil Stocks Change came in at 1.694M, above forecasts (1.154M) in December 30

-

15:30

United States EIA Natural Gas Storage Change above forecasts (-228B) in December 30: Actual (-221B)

-

14:57

Singapore: Manufacturing PMI resumed the downside in December – UOB

Senior Economist Alvin Liew at UOB Group assesses the latest PMI readings in Singapore.

Key Takeaways

“After the slight upside surprise in Nov, Singapore’s manufacturing Purchasing Managers’ Index (PMI) resumed its expected downward trajectory as it fell slightly by 0.1 point to 49.7 in Dec (from 49.8 in Nov), the 4th consecutive month of contraction in overall activity for the manufacturing sector after having expanded for 26 straight months between Jul 2020 and Aug 2022.”

“Unsurprisingly, the electronics sector PMI remained in contraction territory and declined in greater magnitude (compared to the headline PMI) as it slipped 0.3 point lower to 48.9 in Dec (from 49.2 in Nov). This was the 5th consecutive contraction since Aug 2022, after two years of continuous expansion.”

“Manufacturing PMI Outlook – We expect further downside to the PMIs in the first three months of 2023 and the weakness to extend at least another quarter (or even two). In our latest 4Q GDP report, we maintain our Singapore 2023 manufacturing forecast to contract by 5.4% due to the faltering outlook for electronics and weaker external demand. With the faltering 2023 manufacturing outlook and barring external events (such as escalating war in Europe and a deadlier variant of COVID-19), we keep our modest 2023 GDP growth forecast of 0.7% (closer to the lower end of the official forecast range of 0.5-2.5%). The manufacturing weakness may be cushioned by the upside growth factors attributed to the continued recovery in leisure and business air travel and inbound tourism. What this means is that the S&P Global Singapore PMI for the whole economy (which is currently higher at 56.2 in Nov) could stay supported by the services activity and remain in expansionary territory for most of 2023 even as the SIPMM PMIs slip further below 50.”

-

14:56

AUD/USD plunges beneath the 200-DMA and 0.6800 on solid US jobs data

- US ADP Employment Change crushed estimates, while unemployment claims missed estimates, foreseeing a solid US Nonfarm Payrolls report.

- The US Trade Balance deficit shrank, boosting the US Dollar.

- AUD/USD Price Analysis: Could extend its losses after dropping below the 200-day EMA.

The Australian Dollar (AUD) loses ground against the US Dollar (USD) after a tranche of economic data revealed in the United States (US) confirmed a robust labor market. Therefore, traders’ speculations augmented that the Federal Reserve (Fed) would continue tightening monetary conditions. At the time of writing, the AUD/USD is trading at 0.6767.

US labor market remains solid, weighed on AUD/USD

Before Wall Street opened, the ADP Employment Change report showed that private hiring increased by 235K for December, smashing the 153K estimated by analysts and almost doubled of November figures. The report showed that service providers added 213K while manufacturing a meager 22K. ADP’s chief economist, Nela Richardson, said, “The labor market is strong but fragmented, with hiring varying sharply by industry and establishment size.” She added that “business segments that hired aggressively in the first half of 2022 have slowed hiring and, in some cases, cut jobs in the last month of the year.”

Later the US Department of Labor revealed that Initial Jobless Claims for the last week rose less than estimates, by 204K vs. 225K expected, while continuing claims were lower than foreseen, at 1.694M vs. 1.708M estimated. At the same time, the Trade Balance deficit shrank compared with expectations, coming at $-61.51B vs. $-73.0B.

After the US economic data release, the AUD/USD dropped from around 0.6840 toward the daily low of 0.6766, failing to hold to its gains above the 200-day Exponential Moving Average (EMA), which sits a 0.6820.

Meanwhile, Australian data revealed in the Asian session witnessed further deterioration in the Services and Composite PMI on its final readings in December, each at 47.3 and 47.5, trailing November figures.

Ahead of the week, traders’ focus shifts toward Friday’s US Nonfarm Payrolls report. Following the release of the Federal Reserve’s (Fed) December minutes, officials stressed that the labor market remained strong, emphasizing the need for a higher unemployment rate. Therefore, solid US NFP data might increase the likelihood of a 50 bps rate hike by the US central bank.

AUD/USD Price Analysis: Technical outlook

After failing to break Thursday’s high of 0.6886 and dropping beneath the 200-day EMA, the AUD/USD might extend its losses during the day. Its first hurdle on its downtrend would be the 20-day EMA at 0.6747, followed by the 100-day EMA at 0.6706 and the 50-day EMA at 0.6696. Once all those levels are cleared, that could pave the way toward November’s 21 low at 0.6584.

-

14:54

EUR/USD Price Analysis: Immediate target comes around 1.0630

- EUR/USD’s upside momentum faltered once again around 1.0630.

- The breakout of that resistance could lead up to a test of 1.0713.

EUR/USD gives away initial gains and sinks in the red territory well south of the 1.0600 support on Thursday.

Subsequent bullish attempts need to clear the short-term top in the 1.0630/35 band (January 4,5) to allow for a potential visit to the weekly top at 1.0713 (December 30). Once cleared, the pair could then confront the December 2022 peak at 1.0736 (December 15).

The constructive outlook for EUR/USD should remain unchanged while above the key 200-day SMA, today at 1.0314.

EUR/USD daily chart

-

14:45

United States S&P Global Composite PMI registered at 45 above expectations (44.6) in December

-

14:45

United States S&P Global Services PMI above expectations (44.4) in December: Actual (44.7)

-

14:44

Fed's Bostic: Officials remain determined to beat inflation

Atlanta Federal Reserve bank president Raphael Bostic reiterated on Thursday that inflation is the biggest headwing to the US economy and that Federal Reserve's policymakers remain determined to beat it, as reported by Reuters.

"I appreciate recent reports that include signs of moderating price pressures, but there is still much work to do," Bostic added. "The most recent report showed the Fed's preferred measure of inflation running at a 5.5% annual rate."

Market reaction

The US Dollar Index extends its rally following these comments and was last seen rising 0.65% on the day at 104.95.

-

14:40

Gold Price Analysis: XAU/USD extends correction toward $1,830 after US data

- US Dollar strengthens across the board after US economic data.

- Gold accelerates bearish correction after a four-day positive streak.

- US yields break to the upside, Wall Street turns negative.

Gold Prices are falling by more than 1% on Thursday, retreating from the highest level since mid-June on the back of a stronger US Dollar and surging Treasury bond yields. XAU/USD printed a fresh two-day low at $1,831/oz.

Dollar wakes up after data, before NFP

Gold was already trading lower on Thursday when economic data from the US strengthened the US Dollar and triggered a sell-off in Treasury bonds. The ADP employment report showed an increase in private payrolls by 235K above the 150K of market consensus. Initial Jobless Claims dropped more than expected to 204K, the lowest since September.

Markets reacted to the economic figures, after holding quiet following the FOMC minutes on Wednesday. The DXY jumped to 104.96, the highest level in three weeks while US bonds tumbled. The US 10-year yield rose from 3.70% to 3.76% while the 2-year jumped from 4.39% to 4.48%, the highest level since late November.

The yellow metal broke decisively under $1,850 and tumbled to $1,831. It is hovering around $1,835 after Wall Street negative opening. The Dow Jones is falling by 0.75% and the Nasdaq drops by 0.79%.

XAU/USD looks vulnerable for the moment but losses seem limited while above the $1,830 area. The mentioned zone is a strong support that if broken should open the doors to another leg lower. On the upside, a recovery above $1,850 would change the intraday outlook to positive.

Technical levels

-

14:24

Singapore: 2023 GDP forecast remains at 0.7% - UOB

Senior Economist at UOB Group Alvin Liew comments on the recently published GDP figures in Singapore.

Key Takeaways

“The preliminary estimate of Singapore’s 4Q GDP was in line with market’s expectation at 0.2% q/q SA, 2.2% y/y expansion (versus Bloomberg est +0.2% q/q, 2.1% y/y, UOB est -0.2% q/q, 1.7% y/y), while 3Q’s GDP growth was slightly revised higher to 4.2% y/y (from 4.1% previously).”

“Even as manufacturing sector staged a surprise +1.8% q/q rebound in 4Q, it was still the main drag on the overall GDP as it contracted by 3.0% y/y (the first y/y fall since 2Q 2020) offsetting the y/y gains in services (-0.4% q/q, +4.1% y/y) and construction activity (+0.4% q/q, +10.4% y/y).”

“SG GDP Outlook: Our 2023 outlook is largely premised on broad moderation in external economies this year, and we project the US and European economies (which are key end markets for Singapore) to enter a recession this year amidst aggressive monetary policy tightening stance among these advanced economies. This will directly impact the manufacturing and external-oriented services sectors. We expect manufacturing sector to contract by 5.4% in 2023 (from +2.6% for 2022). Upside growth factors could be attributed to the continued recovery in leisure and business air travel and inbound tourism, which will benefit many in-person services sectors, and the impact of China’s reopening from 8 Jan is likely to be positive for these sectors although it is difficult to quantify at this juncture. With the faltering manufacturing outlook and barring external events (such as escalating war in Europe and a deadlier variant of COVID-19), we keep our modest 2023 GDP growth forecast of 0.7% (closer to the lower end of the official forecast range of 0.5-2.5%).

-

14:20

EUR/USD sinks to 1.0550 as dollar rebounds post-jobs data

- EUR/USD drops to daily lows near 1.0550 on Thursday.

- The dollar gathers further traction on upbeat jobs results.

- The US ADP report, weekly Claims surprised to the upside.

The selling pressure in the greenback now picks up further pace and drags EUR/USD back to the mid-1.0500s on Thursday, or daily lows.

EUR/USD: Further downside could retest 1.0520

EUR/USD quickly returned to the negative territory in response to the abrupt uptick in the greenback, which approaches the key 105.00 hurdle when measured by the USD Index (DXY).

Indeed, spot saw its losses accelerate after the US ADP report showed the US private sector added 235K jobs during December, surpassing initial estimates. In the same line, weekly Claims rose less than expected by 204K in the week to December 31, both prints highlighting the resilience and good health of the labour market.

The drop in the pair also falls in line with the uptick in US yields across the curve, while the German 10-year Bund yields also reverse part of the recent weakness.

Earlier in the euro docket, Germany’s trade surplus widened to €10.8B in November (from €6.9B) and the Construction PMI improved marginally to 41.7 in December. In the broader Euroland, Producer Prices contracted 0.9% MoM in November and rose 27.1% YoY. In Italy, flash inflation figures saw the CPI at 11.6% in the year to December.

What to look for around EUR

EUR/USD appears to lack conviction to surpass the recent resistance area near 1.0630 for the time being.

Moving forward, the European currency is expected to closely follow dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Germany Balance of Trade, Germany S&P Global Construction PMI, Italy Flash Inflation Rate (Thursday) – Germany Retail Sales, EMU Flash Inflation Rate, EMU Retail Sales.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.43% at 1.0557 and the breach of 1.0519 (weekly low January 3) would target 1.0443 (weekly low December 7) en route to 1.0314 (200-day SMA). On the other hand, there is an initial hurdle at 1.0713 (weekly high December 30) ahead of 1.0736 (monthly high December 15) and finally 1.0773 (monthly high June 27).

-

14:03

USD/JPY jumps to one-week high amid upbeat US data-inspired USD strength

- USD/JPY turns positive for the third straight day and climbs to a one-week high.

- The upbeat US macro data boost the USD and remains supportive of the move.

- A combination of factors could underpin the JPY and cap the upside for the pair.

The USD/JPY pair catches some bids during the early North American session and climbs to a one-week high in reaction to the upbeat US macro data. The pair is currently placed just above the mid-133.00s and looks to build on this week's recovery move from its lowest level since June 2022.

The US Dollar strengthens across the board following the release of the better-than-expected US ADP report, which, in turn, pushes the USD/JPY pair higher for the third successive day. In fact, the US private-sector employers added 235K jobs in December against consensus estimates for a reading of 150K. Adding to this, Initial Jobless Claims unexpectedly fell from 223K to 204K during the week ended December 30.

This comes on the back of a hawkish assessment of the FOMC meeting minutes released on Wednesday and triggers a sharp intraday spike in the US Treasury bond yields. This, in turn, provides a goodish lift to the Greenback and acts as a tailwind for the USD/JPY pair. Apart from this, technical buying above the 133.00 mark could also be attributed to the latest leg-up witnessed over the past hour or so.

That said, reports that the Bank of Japan (BoJ) plans to raise its inflation forecasts, could underpin the Japanese Yen and cap the upside. Apart from this, the risk-off impulse, which tends to benefit the JPY's relative safe-haven status, might further contribute to keeping a lid on the USD/JPY pair, at least for the time being. This, in turn, warrants some caution for aggressive bullish traders.

Technical levels to watch

-

14:00

USD Index Price Analysis: Initial up barrier emerges around 105.00

- The index keeps the erratic weekly performance unchanged.

- Extra gains are seen on a breakout of the 105.00 region.

DXY resumes the uptrend and appears en route to test the key resistance area around 105.00 on Thursday.

The index keeps the consolidative mood in place for the time being, although the surpass of the 105.00 neighbourhood could open the door to extra gains in the near term.

Immediately above comes the key 200-day SMA at 106.28. A move above this zone should shift the outlook to constructive and thus allow for further advances.

DXY daily chart

-

13:48

Fed's George: Fed will hold rates up into 2024

Kansas City Fed President Esther George told CNBC on Thursday that it will be key for the Fed to hold rates up once hikes end, as reported by Reuters.

Additional takeaways

"Hight inflation requires Fed action."

"Fed policy is having an impact on demand."

"Fed will hold rates up into 2024."

"Not forecasting a recession but there are risks."

"Risks to economy rise when Fed is hiking rates."

"Recent inflation data shows welcoming signs of pressure easing."

"Very important for Fed to continue to reduce balance sheet."

"Fed still has a lot to learn about how balance sheet policy works."

Market reaction

The US Dollar Index preserves its bullish momentum following these comments and was last seen gaining 0.5% on the day at 104.76.

-

13:42

GBP/USD Price Analysis: Bears challenge ascending channel support on upbeat US ADP report

- GBP/USD comes under heavy selling pressure on Thursday amid resurgent USD demand.

- The upbeat US ADP report provides an additional lift to the USD and contributes to the slide.

- The technical setup favours bearish traders and supports prospects for a further downfall.

The GBP/USD pair continues losing ground through the early North American session and weakens further below the 1.2000 psychological mark in reaction to the upbeat US ADP report.

According to the data published by Automatic Data Processing (ADP), the US private sector employers added 235K jobs in December against expectations for a reading of 150K. This comes on the back of a hawkish assessment of the FOMC meeting minutes and provides a strong boost to the US Dollar, which, in turn, exerts downward pressure on the GBP/USD pair.

From a technical perspective, the recent fall and acceptance below the 200-day SMA suggested that the strong recovery from an all-time low might have run out of steam already. This GBP/USD pair is seen flirting with support marked by the lower end of an ascending channel extending from late September, which if broken should pave the way for deeper losses.

Given that oscillators on the daily chart have just started gaining negative traction, the GBP/USD pair might then turn vulnerable to accelerate the slide towards the 1.1900 mark. The downward trajectory could get extended further towards the 1.1825-1.1820 intermediate support en route to the 1.1800 round figure and the 1.1750-1.1740 horizontal support zone.

On the flip side, attempted recovery might now confront immediate resistance near the 1.2000 mark ahead of the 1.2025 region (200 DMA). The next relevant hurdle is pegged near the 1.2075-1.2080 region ahead of the 1.2100 mark. A sustained strength beyond will negate any near-term negative outlook and allow the GBP/USD pair to aim back to reclaim the 1.2200 round figure.

GBP/USD daily chart

Key levels to watch

-

13:38

US: Weekly Initial Jobless Claims decline to 204K vs. 225K expected

- Initial Jobless Claims in the US decreased by 19,000 in the last week of 2022.

- US Dollar Index extends daily rally beyond 104.50 after the data.

There were 204,000 initial jobless claims in the week ending December 31, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 223,000 and came in better than the market expectation of 225,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 213,750, a decrease of 6,750 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending December 24 was 1,694,000, a decrease of 24,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar Index gathered bullish momentum after this data and was last seen rising 0.5% on the day at 104.76.

-

13:31

United States Initial Jobless Claims came in at 204K, below expectations (225K) in December 30

-

13:31

Canada Exports declined to $64.37B in November from previous $67.04B

-

13:31

United States Continuing Jobless Claims registered at 1.694M, below expectations (1.708M) in December 23

-

13:31

Canada International Merchandise Trade came in at $-0.04B below forecasts ($0.61B) in November

-

13:30

United States Goods and Services Trade Balance above forecasts ($-74B) in November: Actual ($-61.51B)

-

13:30

Canada Imports dipped from previous $65.82B to $64.41B in November

-

13:30

United States Initial Jobless Claims 4-week average dipped from previous 221K to 213.75K in December 30

-

13:30

United States Goods Trade Balance declined to $-84.1B in November from previous $-83.3B

-

13:16

Breaking: US private sector employment rises by 235K in December vs. 105K expected

The data published by Automatic Data Processing (ADP) showed on Thursday that private sector employment in the US rose by 235,000 in December. This reading came in much higher than the market expectation of 150,000.

Commenting on the data, "the labor market is strong but fragmented, with hiring varying sharply by industry and establishment size,” said Nela Richardson, chief economist, ADP. “Business segments that hired aggressively in the first half of 2022 have slowed hiring and in some cases cut jobs in the last month of the year."

Further detail of the publication revealed that annual pay was up 7.3% on a yearly basis in December.

Market reaction

US Dollar gathered strength against its rivals with the initial reaction. As of writing, the US Dollar Index was up 0.35% on the day at 104.62.

-

13:15

United States ADP Employment Change registered at 235K above expectations (150K) in December

-

13:04

FOMC minutes contained a strong message to the markets – BBH

Analysts at Brown Brothers Harriman & Co. (BBH) maintain a bullish outlook for the US Dollar in the wake of a generally hawkish tone from the FOMC meeting minutes released on Wednesday.

Key Quotes:

“We continue to believe that dollar weakness in late 2022 was overdone and we expect the greenback to claw back much of those losses in the coming weeks and months. Of note, ECB and BOE tightening expectations have fallen in recent days and we see room for Fed tightening expectations to move higher, especially after the strong message contained in the FOMC minutes.”

“There were quite a few passages referring to balancing two-way risks and keeping the policy outlook flexible. However, we believe the key takeaways come from the following: “A number of participants emphasized that it would be important to clearly communicate that a slowing in the pace of rate increases was not an indication of any weakening of the Committee’s resolve to achieve its price-stability goal or a judgment that inflation was already on a persistent downward path.” That is, the Fed was concerned that markets would misunderstand and take the decision to downshift to 50 bp as a pivot away from its inflation fight. Clearly, it wasn’t.”

“Furthermore: “Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the committee’s reaction function, would complicate the committee’s effort to restore price stability.” That is, the Fed does not want looser financial conditions due to any such misunderstanding. Since that December 13-14 meeting, financial conditions have tightened a bit. The 10-year yield has risen over 20 bp, high yields spreads have widened nearly 30 bp, and the S&P 500 has fallen around 5%. We believe that the Fed minutes serve notice that markets would do well not to underestimate the Fed’s resolve.”

-

12:55

Gold Price Forecast: XAU/USD remains depressed near $1,845 area, downside seems limited

- Gold price moves away from a seven-month high amid a modest US Dollar uptick.

- The prospects for smaller rate hikes by the Fed offer some support to the metal.

- A softer risk tone contributes to limiting the downside for the safe-haven XAU/USD.

Gold price comes under some selling pressure on Thursday and snaps a four-day winning streak to its highest level since June 2022, around the $1,865 area touched the previous day. The XAU/USD remains on the defensive heading into the North American session and is currently placed around the $1,846-$1,845 region, down nearly 0.50% for the day.

Modest US Dollar strength undermines Gold price

The US Dollar edges higher in the wake of a hawkish tone from the Federal Open Market Committee (FOMC) December meeting minutes released on Wednesday. This, in turn, is seen as a key factor undermining the US Dollar-denominated Gold price. In fact, the Federal Reserve policymakers were still focused on bringing down inflation and were set to keep interest rates in the US higher for longer.

Focus remains on US Nonfarm Payrolls (NFP)

Market participants also seem inclined to lighten their bearish bets around the US Dollar ahead of Friday's release of the closely-watched US monthly jobs data. The popularly known NFP report could influence the Federal Reserve's rate-hike path and drive the USD demand. This, in turn, will assist investors to determine the next leg of a directional move for the non-yielding yellow metal.

Bets for less aggressive Federal Reserve lends support to Gold price

In the meantime, the prospects for smaller rate hikes by the Federal Reserve keep the US Treasury bond yields depressed near a multi-week low and could lend some support to the non-yielding Gold price. It is worth recalling that Fed officials unanimously agreed that the central bank should slow the pace of aggressive interest rate increases. This, in turn, warrants some caution for bearish traders.

Softer risk tone contributes to limiting losses for Gold price

Apart from this, a generally weaker risk tone might further contribute to limiting the downside for the safe-haven Gold price. Despite the easing of strict COVID-19 restrictions in China, concerns about a deeper global economic downturn continue to weigh on investors' sentiment. This is evident from a fresh leg down in the US equity futures and could act as a tailwind for the safe-haven XAU/USD.

Fundamental backdrop favours bulls

The aforementioned fundamental backdrop suggests that the path of least resistance for the Gold price is to the upside and supports prospects for the emergence of some dip-buying at lower levels. Hence, it will be prudent to wait for strong follow-through selling before confirming that the XAU/USD has topped out in the near term and positioning for any meaningful corrective decline.

Thursday's US macro data could provide some impetus

Traders now look to the US economic docket, featuring the release of the ADP report on private-sector employment and the usual Weekly Initial Jobless Claims. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to Gold price. Apart from this, the broader risk sentiment might contribute to producing short-term trading opportunities.

Gold price technical outlook

From a technical perspective, any subsequent slide is likely to find support near the previous multi-month high, around the $1,833 area. This is followed by the $1,824-$1,822 horizontal resistance breakpoint, which should now act as a near-term base for Gold price. Failure to defend the said support levels could prompt some technical selling and drag the XAU/USD back towards the $1,800 mark.

On the flip side, the overnight swing high, near the $1,865 zone, could act as an immediate hurdle for Gold price ahead of the $1,870 region. Some follow-through buying will be seen as a fresh trigger for bullish traders and pave the way for a move towards reclaiming the $1,900 round figure for the first time since May 2022.

Key levels to watch

-

12:46

China: GDP outlook revised up for 2023 – UOB

UOB Group’s Economist Ho Woei Chen reviews the lates results from key Chinese fundamentals.

Key Takeaways

“The slump in China’s PMIs continued into Dec as its COVID-19 outbreak worsened following an abrupt pivot from its zero-COVID policy on 7 Dec.”

“Both the official manufacturing and non-manufacturing PMIs printed below expectation and fell past their lows during the Shanghai lockdown in Apr-May 2022, to their lowest since Feb 2020.”

“We are updating our GDP forecasts for 2022 and 2023 to account for the weaker-than-expected data in 4Q22 to-date as well as sooner-than-expected borders reopening in China which will likely contribute to a sharper economic rebound this year when herd immunity is achieved. China will reopen its borders to international travelers from this Sun (8 Jan). Furthermore, the National Bureau of Statistics had revised China’s real GDP growth to 8.4% for 2021 (previous 8.1%), a higher base comparison for 2022.”

“We expect 4Q22 GDP growth to slow to 2.2% y/y from 3.9% y/y in 3Q22 amid the COVID outbreak. Our updated forecasts for China’s 2022 and 2023 GDP growth are now at 2.8% (from 3.3%) and 5.2% (from 4.8%) respectively.”

-

12:41

EUR/JPY Price Analysis: Recovery now targets the 143.00 region

- EUR/JPY adds to the weekly rebound and surpasses 140.00.

- Next on the upside comes the weekly high near 143.00.

EUR/JPY adds to Wednesday’s gains and trespasses the key 140.00 barrier on Thursday.

The cross flirts with the critical 200-day SMA in the mid-140.00s. A sustainable move above the latter should shift the near-term outlook to positive and therefore open the door to extra gains.

Against that, the immediate barrier is then expected at the weekly peak at 142.93 (December 28). This resistance level is also underpinned by the proximity of the 100-day SMA (142.86).

EUR/JPY daily chart

-

12:30

United States Challenger Job Cuts down to 43.651K in December from previous 76.835K

-

12:01

Mexico Consumer Confidence above forecasts (41.5) in December: Actual (43.3)

-

12:01

Mexico Consumer Confidence s.a climbed from previous 41.8 to 42.5 in December

-

12:01

Mexico Consumer Confidence s.a rose from previous 41.8 to 43.3 in December

-

12:00

Mexico Consumer Confidence registered at 42.5 above expectations (41.5) in December

-

12:00

Brazil Industrial Output (YoY) came in at 0.9%, above expectations (0.8%) in November

-

12:00

Brazil Industrial Output (MoM) meets expectations (-0.1%) in November

-

11:59

FX option expiries for Jan 5 NY cut

FX option expiries for Jan 5 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0500 930m

- 1.0600 255m

- 1.0775 464m

- USD/JPY: USD amounts

- 134.00 475m

- EUR/JPY: EUR amounts

- 142.00 560m

- 144.00 694m

- GBP/USD: GBP amounts

- 1.2000 338m

- AUD/USD: AUD amounts

- 0.6800-05 610m

-

11:21

We look for another 50bp Fed rate increase in February – TD Securities

Commenting on the minutes of the Federal Reserve's December policy meeting, TD Securities analysts noted that officials remained in broad agreement about the need to push the policy stance further into restrictive territory in the near term.

Expecting 25bp rate hikes in March and May

"The focal points for the Fed's policy rate outlook in 2023 will be the pace of inflation based on core PCE services excl. housing and the tightness in the labor market. As both remain out of whack with an inflation trend in line with the Fed's target, the FOMC has raised its desired terminal Fed funds rate. In addition, once achieved, the Committee has no intention to move away from it soon, despite increasing downside risks to the growth outlook."

"We look for another 50bp rate increase in February, and expect 25bp rate hikes in March and May. We project the Fed will therefore settle on a terminal Fed funds target rate range of 5.25%-5.50% by May."

-

11:20

Indonesia: Inflation surprised to the upside in December – UOB

Economist at UOB Group Enrico Tanuwidjaja assesses the latest inflation figures in Indonesia.

Key Takeaways

“Indonesia’s headline inflation rate turned higher to 5.5% y/y in Dec from 5.4% in Nov, averaging 4.2% for 2022, which is almost triple the 2021’s average of 1.6%, and more than double the 2% average during the 2020 pandemic year.”

“The food, beverage, and tobacco price hikes alongside higher transportation prices led inflation to continue accelerating at 0.7% m/m. We expect overall inflation will stay elevated for months ahead as the second-round impact from the higher fuel prices has not been fully transmitted.”

“We keep our 2023 average inflation forecast to trend down slightly lower to 4%. We also keep our forecast for BI to continue hiking to reach its peak point of 6% in 1Q23, after raising a cumulative 200 bps during 2022 to 5.50%.”

-

11:14

Colombia Consumer Price Index (MoM) came in at 1.26%, above forecasts (0.87%) in December

-

11:14

Colombia Consumer Price Index (YoY) registered at 13.12% above expectations (12.64%) in December

-

10:58

USD/CNH: Further downside faces a tough support around 6.8400 – UOB

Extra losses in USD/CNH are seen meeting a solid support around the 6.8400 region in the near term, according to UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Key Quotes

24-hour view: “USD traded between 6.8819 and 6.9239 yesterday before settling at 6.9006 (-0.33%). The underlying tone has weakened somewhat and USD is likely to drift lower. However, any decline is unlikely to challenge the support at 6.8700. Resistance is at 6.9100, followed by 6.9240.”

Next 1-3 weeks: “While the decline in USD from last month has slowed, the risk is still on the downside. Only a break of 6.9400 (‘strong resistance’ level) would indicate that the downward pressure has eased. That said, any decline is expected to face solid support at 6.8400.”

-

10:33

NZD/USD keeps the red below 0.6300 mark amid softer risk tone, modest USD uptick

- NZD/USD comes under some fresh selling pressure, though lacks follow-through.

- Recession fears benefit the safe-haven USD and weigh on the risk-sensitive Kiwi.

- The Fed’s less hawkish outlook caps the buck and lends some support to the pair.

The NZD/USD pair meets with a fresh supply on Thursday and maintains its offered tone through the first half of the European session. The pair has now reversed a major part of the previous day's positive move and is currently placed near the lower end of its daily range, around the 0.6280-0.6275 region.

The intraday downtick for the NZD/USD pair could be attributed to a softer tone around the equity markets, which tends to benefit the safe-haven US Dollar and weigh on the risk-sensitive New Zealand Dollar. Despite the easing of strict COVID-19 restrictions in China, worries about a deeper global economic downturn continue to weigh on investors' sentiment.

That said, the prospect of smaller rate hikes by the Fed is holding back traders from placing fresh bullish bets around the USD and lending some support to the NZD/USD pair, at least for the time being. In fact, the minutes of the December FOMC policy meeting released on Wednesday showed that officials unanimously supported raising borrowing costs at a slower pace.

The Fed's less hawkish outlook keeps the US Treasury bond yields depressed near a multi-week low and acts as a headwind for the greenback. This makes it prudent to wait for some follow-through selling before positioning for an extension of the NZD/USD pair's pullback from levels beyond the 0.6500 psychological mark, or the highest since June 2022 touched last month.

Traders now look to the US economic docket, featuring the release of the ADP report on private-sector employment and the usual Weekly Initial Jobless Claims. This, along with the US bond yields and the broader risk sentiment, will drive the USD demand and provide some impetus to the NZD/USD pair. The focus, however, will remain glued to the US jobs report (NFP), due on Friday.

Technical levels to watch

-

10:21

Eurozone industrial producer prices decline by 0.9% in November

- Industrial producer prices in the euro area declined sharply in November.

- EUR/USD clings to modest daily gains slightly above 1.0600.

"In November 2022, industrial producer prices fell by 0.9% in both the euro area and the EU, compared with

October 2022," Eurostat reported on Thursday.With this monthly decline, the annual rate declined to 27.1 in the Eurozone from 30.8% in October, compared to the market expectation of 27.5%.

Market reaction

These figures don't seem to be having a noticeable impact on the Euro's performance against its major rivals. As of writing, EUR/USD was trading at 1.0620, rising 0.2% on a daily basis.

-

10:13

France 10-y Bond Auction rose from previous 2.19% to 2.77%

-

10:01

Italy Consumer Price Index (EU Norm) (YoY) meets expectations (12.3%) in December

-

10:00

Italy Consumer Price Index (EU Norm) (MoM) in line with expectations (0.2%) in December

-

10:00

Italy Consumer Price Index (YoY) in line with forecasts (11.6%) in December

-

10:00

Italy Consumer Price Index (MoM): 0.3% (December) vs previous 0.5%

-

10:00

European Monetary Union Producer Price Index (YoY) came in at 27.1%, below expectations (27.5%) in November

-

10:00

European Monetary Union Producer Price Index (MoM) meets expectations (-0.9%) in November

-

09:50

EUR/GBP clings to intraday gains below mid-0.8800s, upside potential seems limited

- EUR/GBP catches aggressive bids on Thursday and snaps a three-day losing streak.

- The UK’s bleak outlook undermines the Sterling and acts as a tailwind for the cross.

- Diminishing odds for a more aggressive ECB tightening could cap any further gains.

The EUR/GBP cross regains strong positive traction on Thursday and stalls its recent pullback from its highest level since late September. The cross maintains its bid tone through the first half of the European session and is currently placed near the top end of its daily range, just below mid-0.8800s.

The British Pound's relative underperformance comes amid a bleak outlook for the UK economy, which, in turn, is seen lending some support to the EUR/GBP cross. In fact, the UK Manufacturing PMI was finalized at 45.3 in December - marking the lowest level in 31 months. Adding to this, the gauge for the UK services sector remained in contraction territory for the third successive month in December.

The shared currency, on the other hand, draws some support from subdued US Dollar demand, weighed down by the prospects for smaller rate hikes by the Fed. That said, softer German consumer inflation figures released earlier this week pushed back expectations for a more aggressive policy tightening by the European Central Bank. This, in turn, could keep a lid on the Euro and cap the EUR/GBP cross.

Apart from this, worries about economic headwinds stemming from the protracted Russia-Ukraine war warrant some caution for bullish traders. Hence, it will be prudent to wait for strong follow-through buying before positioning for the resumption of the recent move-up witnessed over the past four weeks or so. Nevertheless, the EUR/GBP cross, for now, seems to have snapped a three-day losing streak to a nearly two-week low.

Technical levels to watch

-

09:30

United Kingdom S&P Global/CIPS Services PMI registered at 49.9, below expectations (50) in December

-

09:30

United Kingdom S&P Global/CIPS Composite PMI in line with forecasts (49) in December

-

09:00

USD/JPY holds steady near multi-day high, remains below 133.00 ahead of US data

- USD/JPY touches a four-day high on Thursday, though lacks any follow-through.

- The emergence of some buying around the USD acts as a tailwind for the major.

- Reports that BoJ will raise inflation forecasts benefit the JPY and caps the upside.

The USD/JPY pair reverses an intraday dip to the 131.70-131.65 area and touches a four-day peak during the first half of the European session on Thursday. Spot prices, however, struggle to capitalize on the move and remain below the 133.00 mark, warranting caution before positioning for an extension of this week's recovery from the lowest level since June 2022.

The emergence of some US Dollar buying turns out to be a key factor lending some support to the USD/JPY pair. That said, the prospects for smaller rate hikes by the Federal Reserve keep the US Treasury bond yields depressed near a three-week low and holds back traders from placing aggressive bullish bets around the USD. In fact, the minutes of the December FOMC policy meeting released on Wednesday showed that officials unanimously supported raising borrowing costs at a slower pace.

This, along with reports that the Bank of Japan (BpJ) plans to raise its inflation forecasts, underpins the Japanese Yen and contributes to capping the USD/JPY pair. According to Reuters, the upgrade would underscore the central bank's conviction that robust domestic demand will keep inflation sustainably around its 2% target in coming years. This, in turn, fuels speculations that the BoJ will phase out its ultra-lose policy when Governor Haruhiko Kuroda's second five-year term ends in April.

The aforementioned fundamental factors suggest that the path of least resistance for the USD/JPY pair is to the downside and any meaningful upside is likely to get sold into. That said, traders might prefer to move to the sidelines ahead of the closely-watched US monthly jobs report (NFP), due on Friday. In the meantime, Thursday's US macro data - the ADP report on private-sector employment and Weekly Initial Jobless Claims - might produce short-term trading opportunities.

Technical levels to watch

-

08:53

USD/JPY is now seen within 129.50-133.50 – UOB

In the opinion of UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang, further consolidation could motivate USD/JPY to trade between 129.50 and 133.50 in the next few weeks.

Key Quotes

24-hour view: “USD soared as it surged to a high of 132.71 before easing off to close higher by 1.24% (132.62). The pullback from the high amid overbought conditions suggests USD is unlikely to advance much further. Today, USD is likely to trade sideways between 131.30 and 132.80.”

Next 1-3 weeks: “On Tuesday (Jan 3) the USD dropped to 129.50 before rapidly recovering. Downward pressure appears to have eased and USD has likely moved into a consolidation phase. From here, USD is likely to trade between 129.50 and 133.50 for a period of time.”

-

08:47

EUR/USD appears bid and looks to consolidate the breakout of 1.0600

- EUR/USD adds to Wednesday’s recovery above the 1.0600 level.

- The dollar looks indecisive as traders assess the FOMC Minutes.

- Investors will closely follow the ADP report and weekly Claims.

The single currency extends the recovery and lifts EUR/USD further north of the 1.0600 barrier on Thursday.

EUR/USD remains supported near 1.0520

EUR/USD advances for the second day in a row on Thursday and once again extend the march north past the 1.0600 barrier amidst the inconclusive session around the dollar.

In fact, the greenback treads water around Wednesday’s closing levels while market participants continue to gauge the somewhat hawkish message from the FOMC Minutes released late on Wednesday, where the Committee appeared leaning towards a more restrictive stance when it comes to monetary policy,

The daily uptick in the pair comes in line with a so far small bounce in the German 10-year Bund yields after three consecutive daily retracements.

In the euro docket, Germany’s trade surplus widened to €10.8B in November (from €6.9B) and the Construction PMI improved marginally to 41.7 in December. Later in the session, Producer Prices in the broader Euroland are due along with flash inflation figures in Italy.

Across the pond, usual Initial Jobless Claims are due along with the ADP Employment Change, Balance of Trade, final Services PMI and speeches by FOMC’s Bostic and Bullard.

What to look for around EUR

EUR/USD seems to have met some decent contention around 1.0520 so far this week and manages to reclaim the area beyond 1.0600 the figure.

In the meantime, the European currency is expected to closely follow dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Germany Balance of Trade, Germany S&P Global Construction PMI, Italy Flash Inflation Rate (Thursday) – Germany Retail Sales, EMU Flash Inflation Rate, EMU Retail Sales.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.14% at 1.0616 and is expected to meet the next up barrier at 1.0713 (weekly high December 30) ahead of 1.0736 (monthly high December 15) and finally 1.0773 (monthly high June 27). On the other hand, the breach of 1.0519 (weekly low January 3) would target 1.0443 (weekly low December 7) en route to 1.0314 (200-day SMA).

-

08:16

GBP/USD struggles near daily low, around 1.2000 mark amid modest USD strength

- GBP/USD comes under renewed selling pressure on Thursday amid a pickup in the USD demand.

- Recession fears weigh on investors’ sentiment and drive some haven flows towards the greenback.

- The Fed’s less hawkish outlook might keep a lid on the USD and limit deeper losses for the major.

The GBP/USD pair struggles to capitalize on the previous day's positive move and attracts fresh sellers near the 1.2075-1.2080 region on Thursday. The steady intraday descent drags spot prices to the 1.2000 psychological mark during the early part of the European session and is sponsored by the emergence of some buying around the US Dollar.

Despite the easing of strict COVID-19 restrictions in China, concerns about a deeper global economic downturn continue to weigh on investors' sentiment. This is evident from a fresh leg down in the US equity futures, which, in turn, is seen driving some haven flows towards the greenback and exerting downward pressure on the GBP/USD pair. That said, the prospects for smaller rate hikes by the Fed might hold back the USD bulls from placing aggressive bets and help limit losses for the major.

In fact, the minutes of the December FOMC policy meeting released on Wednesday showed that officials unanimously supported raising borrowing costs at a slower pace. The less hawkish outlook keeps the US Treasury bond yields depressed near a multi-week low, which could act as a headwind for the buck and lend some support to the GBP/USD pair. Traders might also prefer to move to the sidelines ahead of Friday's release of the closely-watched US monthly jobs report - popularly known as NFP.

In the meantime, Thursday's US economic docket, featuring the ADP report on private-sector employment, might provide some impetus to the GBP/USD pair later during the early North American session. This, along with the US bond yields and the broader risk sentiment, should influence the USD price dynamics and contribute to producing short-term opportunities heading into the key data risk.

Technical levels to watch

-

08:12

NZD/USD faces a mixed outlook – UOB