Notícias do Mercado

-

22:11

USD/CHF Price Analysis: Finished the week positive, though fell beneath 0.9270s

- Albeit the USD/CHF fell 1% on Friday, the pair finished the week with gains of 0.45%.

- USD/CHF remains sideways, though slightly tilted downwards, and it could test the 0.9200 mark.

- If the USD/CHF reclaims 0.9300, that could pave the way to 0.9400.

The USD/CHF plunged after hitting fresh weekly highs around 0.9408, plummeting beneath the 0.9300 figure, on mixed US economic data that triggered a sell-off in the US Dollar (USD); therefore, the USD/CHF collapsed. At the time of writing, the USD/CHF is trading at 0.9281.

USD/CHF Price Analysis: Technical outlook

From a weekly chart perspective, after hitting a weekly high of around 0.9408, the USD/CHF finished the week with gains of 0.45%. It should be said that the week ending on January 6 printed a candlestick with a significant upper wick, meaning that sellers are gathering momentum. With the Relative Strength Index (RSI) extending its fall to bearish territory and the Rate of Change (RoC) aiming lower, the USD/CHF could test 0.9200 in the near term.

The USD/CHF daily chart portrays the pair as downward biased, though consolidating and unable to crack the 0,9200 mark. Following the upbreak of a falling wedge, the USD/CHF failed to gain traction and got trapped around the 0.9250-0.9400 mark.

Oscillators like the Relative Strength Index (RSI) shifted gears, turning bearish, while the Rate of Change (RoC) suggests that sellers outpaced buyers.

Therefore, the USD/CHF first support would be the falling wedge top-trendline which turned support at 0.9240, followed by the 0.9200 mark. Break below, and the USD/CHF might fall toward the 2022 low of 0.9091. On the flip side, the USD/CHF first resistance would be the 0.9300 mark. Once cleared, the next resistance would be January’s 6 high of 0.9408, followed by the 50-day Exponential Moving Average (EMA) at 0.9438.

USD/CHF Key Technical Levels

-

21:27

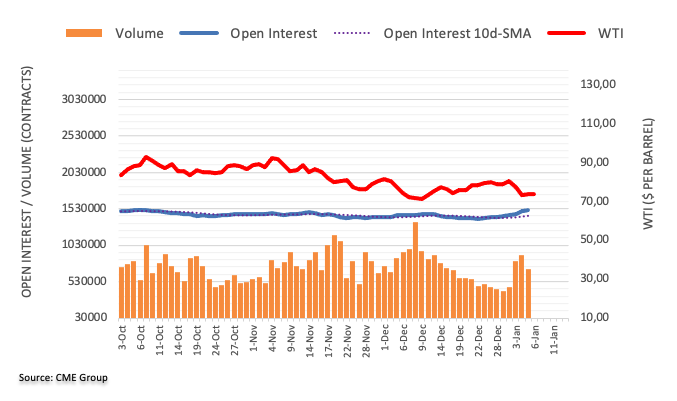

WTI hovers around $73.60 despite a soft US Dollar

- WTI is set to end the week with substantial losses of 8.40%

- The jobs report showed a slowdown in wages, while the labor market remains resilient.

- WTI failed to capitalize on US Dollar weakness after the US Services PMI shrinkage

Western Texas Intermediate (WTI), the US crude oil benchmark, hovers at around $73.70s, almost flat, albeit the US Dollar (USD) weakened sharply due to mixed US economic data, though global recession concerns weighed on oil prices. At the time of writing, WTI exchanges hand at $73.71.

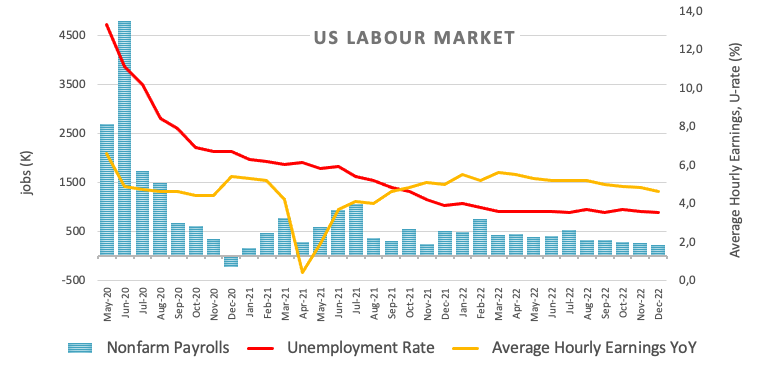

Wall Street is poised to end Friday’s session with hefty losses, boosted by disappointing PMIs. The ISM Services PMI plummeted to 49.6, below estimates of 55, on the lowest reading since May 2020. Meanwhile, the US economy added 223K people to its workforce, more than expected, the unemployment rate dropped, and wages aimed down, to 4.6% YoY, against estimates of 5%.

Consequently, the US Dollar turned south, plummeting below the 104.000 mark and down by 1.20%, though WTI failed to capitalize on that.

Back to oil-related news, Saudi Arabia lowered prices for Asia customers to their lowest since November 2021 as global pressures hit oil prices. Factors like China’s reopening and its Covid-19 outbreak keep investors uneasy as additional countries imposed restrictions on visitors from China.

WTI Key Technical Levels

-

20:53

United States Baker Hughes US Oil Rig Count dipped from previous 621 to 618

-

18:31

GBP/USD rallies sharply above 1.2070 on disappointing US Services PMI

- The GBP/USD soared close to 1.50% on disappointing US ISM Services data.

- Hawkish Fed speaking failed to weigh on the GBP/USD.

- Next week’s economic calendar would feature UK GDP, and US CPI reports.

The Pound Sterling (GBP) extended its gains against the US Dollar (USD), surging more than 160 pips on Friday, following a disappointing ISM Services report and an earlier jobs report. The GBP/USD Is trading at 1.2077.

US ISM Services Index plunges and weakened the USD

The GBP/USD printed another leg-up of more than 100 pips following the US Nonfarm Payrolls data release. Later, the Institute for Supply Management (ISM) revealed the Services PMI Index, which shrank to 49.6 against forecasts of 55 and trailed the November 56.5 jump. It should be said that it’s the lowest reading since May 2020, and traders should be wary that PMI readings below 50 indicate contraction.

Earlier, the US Department of Labor revealed that the US economy added more jobs than expected and that the Unemployment Rate edged lower. The report’s spotlight was Average Hourly Earning, which showed that wage inflation is easing, dropping to 4.6% YoY, below the 5.0% estimates.

Also read: GBP/USD pares Thursday losses, reclaims 1.1900 on soft USD after US NFP report

The GBP/USD extended its gains, above the 1.2050 mark, after the ISM Services PMI headline crossed newswires. The US Dollar Index, which tracks the American Dollar (USD) value against a basket of peers, plummets more than 1%, down at 104.000.

Meanwhile, further Fed speaking failed to underpin the US Dollar, as Federal Reserve Governor Lisa D. Cooks said that inflation is “far too high” and of “great concern” despite recent reports. In the meantime, Richmond’s Fed President Thomas Barkin said the Fed is still resolute on inflation and that it needs to stay on the case until inflation is “sustainably’ back to the 2% goal. He added that adopting a more gradual approach on interest rate paths should limit harm to the US economy.

UK’s next week’s calendar would feature Retail Sales, Gross Domestic Product, and the Trade Balance. On the US front, its calendar will feature the Consumer Price Index (CPI), unemployment claims, and the University of Michigan (UoM) Consumer Sentiment.

GBP/USD Key Technical Levels

-

16:54

EUR/USD uptrend in late 2022 to be replaced by pullbacks and choppy trading conditions – Rabobank

Although analysts at Rabobank are forecasting that the DXY index could end the year a little lower, they expect that 2023 will provide plenty of opportunities for USD bulls to become re-engaged. They retain a 1-month forecast of EUR/USD 1.05 and a 3-month forecast of EUR/USD 1.03.

Key quotes:

“The first trading week of the year has already seen investors question some of the strongest themes of last month. Weaker European headline inflation data have raised questions about whether it will be necessary for the ECB to maintain the degree of hawkishness it displayed last month. By contrast, signs of resilience in US labour data underpin the Fed’s protests that it may be too early to bet on a US rate cut prior to the end of this year.”

“The plunge in USD long positions and the increase in long EUR positions into the end of last year suggests that the uptrend in EUR/USD that developed in late 2022 could be replaced by pullbacks and choppy trading conditions. We maintain our 3 month EUR/USD forecast of 1.03.”

-

16:41

AUD/USD soars sharply above 0.6850 on weak ISM data and offered US Dollar

- AUD/USD surged on weak US ISM Services data, which contracted to its lowest since 2020.

- The US economy added more jobs than estimated while wage growth eases, helping the Federal Reserve’s job to tame inflation.

- Fed policymakers reiterated the need to curb inflation, emphasizing that they will stay the course.

The Australian Dollar (AUD) rallied against the US Dollar (USD) after the release of crucial economic data in the United States (US), although upbeat, failed to underpin the USD. Additionally, a services PMI survey dropped to contractionary territory, fueling speculations for a recession in the US. At the time of writing, the AUD/USD is trading at 0.6866, some 40 pips above the 200-day Exponential Moving Average (EMA).

Mixed US economic data underpinned the AUD/USD

December’s labor market data in the US painted a mixed report. Although 223K jobs were added to the economy exceeding estimates of 200K, fears that wage inflation would remain stickier waned. Average Hourly Earnings rose by 0.3% MoM, but on an annual basis, fell to 4.6% compared to 5.0% consensus. The slowdown would be welcomed by Fed policymakers, who see wage pressures as one of the factors keeping inflation above its 2% target.

The AUD/USD edged higher on the release and aimed toward the 0.6800 mark. However, weaker-than-expected ISM Services data and shrinkage of US Factory Orders added another leg up in the AUD/USD, extending its gains towards a two-day high of 0.6849.

The ISM Services PMI unexpectedly contracted to 49.6 vs. 55 estimates, and its lowest reading since May 2020, and trailed November’s 56.5 jumps, data released Friday showed. PMI readings below the 50-line signals contraction.

Aside from this, Fed speakers continued to cross newswires. Earlier, Atlanta’s Fed President Raphael Bostic said that December’s employment report does not change his outlook on the economy, emphasizing the need to “stay the course.” Later, Federal Reserve Governor Lisa D. Cooks said that inflation is “far too high” and of “great concern” despite recent reports.

Australia’s next week’s data would feature Building Permits, the release of the Monthly Consumer Price Index (CPI), Retail Sales and the Trade Balance. On the US front, its calendar will feature the Consumer Price Index (CPI), unemployment claims, and the University of Michigan (UoM) Consumer Sentiment.

AUD/USD Key Technical Levels

-

16:36

US: Recession is coming but the ISM does not mark the start of it – Wells Fargo

The ISM Service PMI for December released on Friday came in below expectations and triggered fears about a hard landing of the economy. Analysts at Wells Fargo forecast a recession is coming but they point out that this report does not market the start of it.

Key quotes:

“One unsettling takeaway from today's services ISM report is that the service economy is joining the manufacturing side of the economy in contraction. The headline services ISM came in at 49.6, down 6.9 points. Setting aside the pandemic-induced drop, that ties the biggest monthly decline since the financial crisis in November 2008.”

“The contractionary reading on the employment component seems at odds with the 223K workers that employers reported adding during December (see in this morning's nonfarm payroll release). But the sub-50 reading (49.8) here needn't imply layoffs so much as difficulty finding people.”

“This is a pretty down-beat report on services activity to end 2022. We try not to put too much weight on any one-month release, but the rapid deterioration in key components isn't good news. In some ways this is the economic direction the Fed is aiming for, to slow the economy without crushing the labor market.”

-

16:26

Fed's Bostic: US economy is definitely slowing

Atlanta Federal Reserve bank president Raphael Bostic said on Friday that how the economy evolves will shape what the Federal Reserve has to do, as reported by Reuters.

Key takeaways

"The US economy is definitely slowing."

"Housing and other interest rate sectors have seen significant slowing, business leaders see labor markets easing."

"It's still not easy to find workers but it is easier."

"Slowing so far is at a steady, gradual pace, so demand-supply imbalance is not changing rapidly, process will take some time."

"The US has a lot of momentum to absorb tje Fed policy and avoid a significant contraction."

Market reaction

The US Dollar continues to weaken against its rivals following these comments and the US Dollar Index was last seen losing 0.9% on a daily basis at 104.20.

-

16:14

EUR/USD breaks above 1.0600 on USD sell-off after weak ISM

- US Dollar under pressure across the board amid risk appetite and falling yields.

- US: A weak ISM Service sector report follows larger than expected increase in NFP.

- EUR/USD having best day in a month, still down for the week.

The EUR/USD jumped above 1.0600 amid a sharp reversal of the US Dollar that tumbled across the board following the ISM Service PMI report. The pair rose 1.25% from the daily low and is having the best day in a month.

NFP and ISM

The first leg lower of the US Dollar followed the release of the Nonfarm Payroll report. The economy added 223K in December which represents a slowdown from the prior month and shows the job market remains in good shape. The unemployment rate dropped to 3.5%.

More recently, ISM Service PMI index came in at 49.6 in December, well below the 55 of market consensus. The Price Paid Index fell unexpectedly from 70 to 67.6. The report triggered concerns about a potential “hard landing” for the US economy. At the same time, the jobs numbers keep the debate open about the next Federal Reserve rate hike by 25 or 50 basis points.

After the figures, the Greenback accelerated the decline across the board as US yields tumbled. The US 10-year yield fell from 3.75% to 3.61%, the lowest level since December 20. European yields are also sharply lower. The German 10-year bond yield fell to 2.19%, the lowest since December 19, while the Italian 1-year fell to 4.19%.

The EUR/USD peaked at 1.0613, more than a hundred pips above the one month low it hit earlier at 1.0483. Euro bulls are now looking at the 1.0635 area that is the next resistance. Ahead of the weekend the bias is bullish while above 1.0550.

Technical levels

-

15:30

NZD/USD jumps toward 0.6300 as US Dollar tumbles

- Greenback drops sharply after NFP and ISM service sector.

- US yield falls to multi-day lows, commodities rebound.

- NZD/USD reverses from monthly lows, and trims weekly losses.

The NZD/USD has risen a hundred pips from the daily low and it is trading at 0.6290, with a solid bullish tone supported by a broad-based USD decline.

The greenback turned to the downside after the release of the Nonfarm Payrolls report that came in above expectations. After a brief recovery, it resumed the downside following the ISM Service Sector report for December that showed a larger than expected slide.

Following the numbers, US yields tumbled with the 10-year falling from 3.75% to 3.61%, the lowest level since December 20. The DXY reversed sharply from one-month highs above 105.50 to under 104.50, turning negative for the day, but still positive for the week.

The NZD/USD is looking at the 0.6300 zone and toward the next resistance that stands at 0.6310 (Jan 5 high). Above attention would turn to 0.6355/60, a critical area that capped the upside several times. A consolidation above 0.6360 should open the doors to more gains. On the flip side, 0.6250 is the immediate support, followed by 0.6215.

Technical levels

-

15:27

USD/JPY tumbles below 133.00 on broad US Dollar weakness, post-NFP data

- December’s US Nonfarm Payrolls data weakened the US Dollar, even though the labor market remains tight.

- Average Hourly Earnings easing sparked speculations for a dovish move of the Federal Reserve in the February meeting.

- USD/JPY Price Analysis: Likely to remain downward biased below 133.00.

The USD/JPY struggles at the 200-day Exponential Moving Average (EMA) around 134.82, dropping beneath the 134.00 mark, after US economic data, although positive, weighed on the US Dollar, exacerbating a fall of 100 pips in the major. At the time of writing, the USD/JPY is trading at 132.81, below its opening price by 0.44%.

The US Department of Labor revealed that Nonfarm Payrolls in December increased by 223K, above estimates of 200K, data showed on Friday. The Unemployment Rate fell to 3.5% YoY, against estimates of 3.7%, while Average hourly earnings rose 4.6%, below the market consensus of 5.0%, welcomed news for Fed officials, who see wage pressures as a hurdle to tackle inflation.

The Wall Street Journal (WSJ) Fed Watcher Nick Timiraos Tweeted that “revisions to average hourly earnings data paint a marginally less worrisome picture for the Fed on wages than the Nov report.”

The US Dollar Index, which measures the buck’s value against a basket of rivals, tumbled below the 105.000 mark, spurred by that Timiraous Tweet, at 104.963. Nevertheless, it recovered some ground, above 105.000 before reversing its trend, and turned negative at around 104.682, down by 0.46%.

Meanwhile, US Treasury bond yields edged lower by nine bps, down at 3.625%, a headwind for the USD/JPY, which is diving from daily highs reached at 134.77.

Of late, Atlanta’s Fed President Raphael Bostic is crossing newswires. He said that December’s labor market data does not change his outlook on the economy, adding that the Fed needs to stay the course as inflation remains too high. Bostic's base case for the Federal Funds rate (FFR) is to hit the 5.00-5.25% range, and to stay at that level, well into 2024.

USD/JPY Price Analysis: Technical outlook

In the short term, the USD/JPY hourly chart flashes the US Dollar continues to weaken, extending its gains beneath the daily pivot point at 133.04. On its way down, the USD/JPY cleared the 20 and 50-EMAs, though a downslope trendline and the confluence of the 100 and 200-EMAs around 132.55/57 might stall the fall, shy of the S1 daily pivot at 132.03. On the flip side, if the USD/JPY reclaims 133.00, that could open the door for a resumption of the uptrend, exposing resistance levels like the 134.00 mark, followed by the R1 daily pivot point at 134.45.

-

15:09

US: ISM Services PMI slumped to 49.6 in December vs. 55 expected

- US ISM Services PMI dropped below 50 in December.

- US Dollar continues to weaken against its major rivals.

The economic activity in the US service sector contracted in December with the ISM Services PMI dropping to 49.6 from 56.5 in November. This reading came in much worse than the market expectation of 55.

Further detail of the publication decealerd that the Employment Index decline to 49.8 from 51.5 and the Prices Paid Index fell to 67.6 from 70, compared to the market expectation of 71.5.

Market reaction

The US Dollar came under renewed selling pressure after the disappointing PMI survey. As of writing, the US Dollar Index was down 0.32% on the day at 104.80.

-

15:01

United States ISM Services PMI came in at 49.6, below expectations (55) in December

-

15:01

Canada Ivey Purchasing Managers Index s.a down to 33.4 in December from previous 51.4

-

15:00

United States Factory Orders (MoM) registered at -1.8%, below expectations (-0.9%) in November

-

15:00

Canada Ivey Purchasing Managers Index declined to 40.6 in December from previous 51.5

-

15:00

United States ISM Services New Orders Index came in at 45.2 below forecasts (58.5) in December

-

15:00

United States ISM Services Employment Index registered at 49.8, below expectations (50.2) in December

-

15:00

United States ISM Services Prices Paid below expectations (71.5) in December: Actual (67.6)

-

14:23

Canada: Unemployment Rate declines to 5% in December vs. 5.2% expected

- Employment in Canada rose at a stronger pace than expected in December.

- USD/CAD erased its daily gains and declined below 1.3550 after the data.

The data published by Statistics Canada revealed on Friday that the Unemployment Rate declined to 5% in December from 5.1% in November . This reading came in better than the market expectation of 5.2%.

Further details of the publication showed that the Net Change in Employment was +104K, much higher than analysts' estimate of +8K.

"Year-over-year growth in the average hourly wages of employees remained above 5% for a seventh consecutive month in December, up 5.1% (+$1.57 to $32.06) compared with December 2021 (not seasonally adjusted)," Statistics Canada noted in its publication. "Total hours worked were little changed on a monthly basis in December, and up 1.4% compared with 12 months earlier."

Market reaction

USD/CAD declined sharply after the Canadian jobs report and was last seen losing 0.2% on the day 1.3540.

-

14:20

USD Index turns negative around 105.00 as investors digest US NFP

- The index fades the earlier advance past the 105.60 level.

- The US economy added more jobs than expected in December.

- The wage growth seems to have lost momentum in the last month.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main competitors, gives away initial gains and returns to the negative territory below the 105.00 mark on Friday.

USD Index looks offered post-Payrolls

The index quickly leaves behind the earlier uptick to 4-week highs in the 105.60/65 band and slips back to the sub-105.00 region as investors continue to digest the publication of the Nonfarm Payrolls.

On the latter, the US economy added 223K jobs in December and the jobless rate ticked lower to 3.5% (from 3.6%). The salient point of the labour market report, however, comes from the performance of the wage growth tracked by the Average Hourly Earnings, which came on the soft note after it expanded 0.3% MoM and 4.6% YoY.

The loss of momentum in the wage growth appears to lend some oxygen to the view that the Fed could pause its tightening plans in the near term, which eventually puts the dollar under some selling pressure along with declining US yields across the curve.

Other than Payrolls, the US calendar will show the ISM Non-Manufacturing, Factory Orders and speeches by Atlanta Fed R.Bostic (2024 voter, hawk), FOMC Governor L.Cook (permanent voter, centrist) and Richmond Fed T.Barkin (2024 voter, centrist).

What to look for around USD

The dollar falters in the area of multi-week peaks, as the latest NFP release seems to have torpedoed the Fed’s tighter-for-longer narrative.

However, the idea of a Fed’s pivot has been pushed further back following the publication of the FOMC Minutes on Wednesday, where the Committee advocated the need to remain within a restrictive stance for longer, at the time when it ruled out any interest rate reduction for the current year.

Furthermore, the tight labour market, still elevated inflation and the resilient economy are also seen supportive of the firm message from the Federal Reserve and its hiking cycle.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate, ISM Non-Manufacturing PMI, Factory Orders (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is losing 0.04% at 105.10 and the breakdown of 103.39 (monthly low December 30) would open the door to 101.29 (monthly low May 30) and finally 100.00 (psychological level). On the upside, the next hurdle turns up at 105.63 (monthly high January 6) seconded by 105.82 (weekly high December 7) and then 106.31 (200-day SMA).

-

14:16

GBP/USD pares Thursday losses, reclaims 1.1900 on soft USD after US NFP report

- US Nonfarm Payrolls rose by 223K, exceeding estimates, while the unemployment rate fell.

- Average Hourly Earnings were lower than the 5% foreseen, signaling that inflation on wages is easing.

- GBP/USD Price Analysis: The rally could cap around the 50-EMA and daily pivot confluence around 1.1950.

The GBP/USD is trimming some of its Thursday losses, as the US Department of Labor released upbeat economic data, which was positive, though the US Dollar (USD) is weakening across the board. Therefore, the GBP/USD is trading volatile at around 1.1900-1.1920 after hitting a daily low of 1.1841.

Investors’ mood remains upbeat following the release of December’s US Nonfarm Payrolls report by the US Bureau of Labor Statistics. Payrolls jumped by 223K exceeding estimates of 200K, flashing a solid labor market and justifying the need for further Federal Reserve’s (Fed) tightening. Data showed that the Unemployment Rate dropped to 3.5%, while Average Hourly Earnings dropped to 4.6% YoY, vs. estimates of 5%.

According to a tweet by Wall Street Journal (WSJ) Fed Watcher Nick Timiraos, “revisions to average hourly earnings data paint a marginally less worrisome picture for the Fed on wages than the Nov report.” That said, the US Dollar Index, which measures the buck’s value against a basket of rivals, tumbled below the 105.000 mark, spurred by that Tweet, down by 0.19%, at 104.963, a tailwind for the GBP/USD, which remains negative in the week by 1.38%, though in the day, registering minuscule gains of 0.13%.

Regarding US Treasury bond yields, the 10-year benchmark note rate edged lower by four bps, down at 3.675%, while the CME FedWatch Tool shows that odds for a 25 bps rate hike in the February meeting are approaching the 70% threshold.

GBP/USD Reaction

Per the GBP/USD 1-hour chart, the pair jumped from around 1.1850, rallying sharply towards the 1.1920 mark. On its way north, it cracked the 20-EMA at 1.1906, though it remained slightly shy of reaching the daily pivot point at around 1.1952. The Relative Strength Index (RSI) crossed above its 50 mid-line, while the Rate of Change (RoC) indicates buying pressure is building. Therefore, the GBP/USD key resistance levels would be 1.1952, followed by the 100-EMA at 1.1979 and the 200-EMA at 1.2016.

As an alternate scenario, GBP/USD first support level would be the 20-EMA at 1.1906, above the 1.1900 figure, followed by today’s daily low of 1.1841.

-

13:49

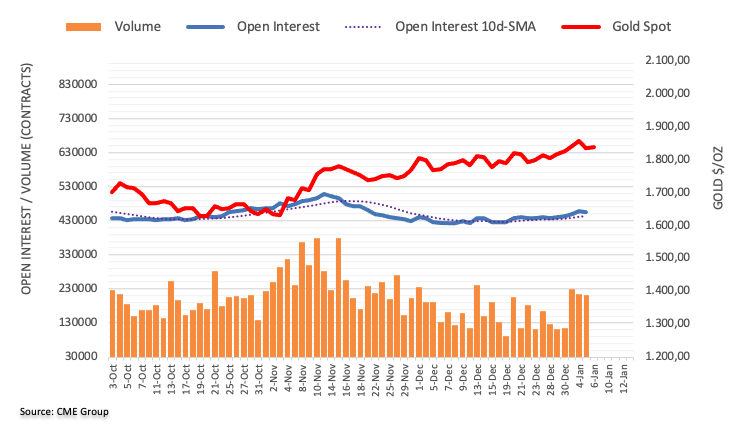

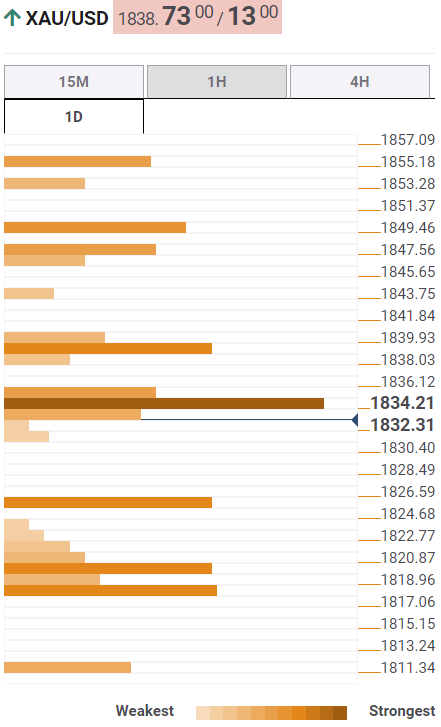

Gold Price Forecast: XAU/USD climbs steadily toward $1,850 after solid US NFP data

- US Nonfarm Payrolls exceeded estimates of 200K, while the unemployment rate edged lower.

- Average Hourly Earnings were lower than the 5% foreseen, signaling the absence of a wage spiral.

- Gold Price Forecast: To find solid resistance around $1,852-$1,860.

Gold price extends its gains after the US Nonfarm Payrolls showed the US economy added more jobs than estimates while the rate of unemployed Americans edged lower. At the time of writing, XAU/USD trades volatile around the $1,837-$1,844 range.

The US Bureau of Labor Statistics revealed that December’s Nonfarm Payrolls rose by 223K above the 200K estimates, signaling the robustness of the labor market and justifying the need for further Federal Reserve (Fed) action. In the meantime, the Unemployment Rate tumbled to 3.5%, while Average Hourly Earnings dropped to 4.6% YoY, vs. estimates of 5%.

Meanwhile, the US Dollar Index is almost flat around 105.223, while the US 10-year Treasury bond yield is unchanged at 3.72%, a reason for Gold to continue extending its gains.

XAU/USD’s reaction

XAU/USD 1-hour chart broke higher on the release, towards $1,843.75, and quickly stabilized just shy of the daily pivot point at around $1,838.85. On the upside, XAU/USD was capped by the 50-EMA around $1,840, though it remains trading volatile as investors assess the overall US jobs market.

On the upside, the next resistance would be the R1 daily pivot point at around $1,852.67, followed by the January 5 daily high of $1,859.03. As an alternate scenario, the XAU/USD first support would be the pivot point around $1,838.85, followed by the 200-ENA at $1,828.68, followed by January’s 5 daily low of $1,825.04 and the S1 pivot level at $1,818.68.

-

13:46

USD/CAD surrenders intraday gains, back below 1.3600 post-Canadian/US jobs data

- USD/CAD meets with some intraday selling in reaction to the stellar Canadian jobs report.

- The mixed US NFP data fails to impress the USD bulls or provide any meaningful impetus.

- The price-action warrants caution for bullish traders and positioning for additional gains.

The USD/CAD pair surrenders a major part of its intraday gains and retreats below the 1.2600 mark during the early North American session.

The Canadian Dollar gets a strong boost in reaction to the upbeat domestic employment details, which, in turn, prompts some selling around the USD/CAD pair. In fact, Statistics Canada reported that the

economy added 104K new jobs in December, beating estimates for a reading of 8K by a huge margin. Adding to this, the unemployment rate unexpectedly ticked down to 5.0% during the reported month from 5.1% recorded in November.That said, a softer tone around crude oil prices acts as a headwind for the commodity-linked Loonie. This, along with the intraday bullish sentiment surrounding the US Dollar, assists the USD/CAD pair to stick to its modest gains for the second successive day. The USD bulls, meanwhile, seem rather unimpressed by the upbeat US jobs data, which showed that the economy added 223K new jobs in December as compared to the 200K estimated.

Furthermore, the jobless rate edged down to 3.5%, beating estimates for a reading of 3.7%. That said, softer Average Hourly Earnings data overshadows the upbeat report, which, along with a sharp spike in the US equity futures, acts as as headwind for the safe-haven greenback. This, in turn, warrants some caution before placing aggressive bullish bets around the USD/CAD pair and positioning for an extension of the overnight bounce from the 100-day SMA.

Technical levels to watch

-

13:41

EUR/USD bounces past 1.0500 post-Payrolls

- EUR/USD keeps the trade around the 1.0500 level on Friday.

- US Non-farm Payrolls came in on the strong side in December.

- The jobless rate ticked lower to 3.5%, bettering consensus.

EUR/USD remains on the defensive near the 1.0500 neighbourhood in the wake of the release of US NFP on Friday.

EUR/USD trims losses post-NFP

EUR/USD saw its downside curtailed after the US economy created 223K jobs during December, leaving behind previous estimates for a gain of 200K jobs. Furthermore, the November reading was revised down to 202K (from 263K).

Additional results showed the Unemployment Rate deflating to 3.5% and the key Average Hourly Earnings – a proxy for inflation via wages – increasing at a monthly 0.3% and 4.6% over the last twelve months. Finally, the Participation Rate improved slightly to 62.3% (from 62.2).

Later in the NA session the focus of attention should gyrate to the release of Factory Orders and the ISM Non-Manufacturing seconded by speeches by FOMC’s Bostic, Cook and Barkin.

What to look for around EUR

EUR/USD faces some heightened downside near the 1.0500 mark or multi-week lows.

Looking at the broader scenario, the shared currency is expected to closely follow dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Germany Retail Sales, EMU Flash Inflation Rate, EMU Retail Sales.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.16% at 1.0504 and the breach of 1.0496 (monthly low January 6) would target 1.0443 (weekly low December 7) en route to 1.0311 (200-day SMA). On the other hand, the next up barrier emerges at 1.0713 (weekly high December 30) ahead of 1.0736 (monthly high December 15) and finally 1.0773 (monthly high June 27).

-

13:31

United States Nonfarm Payrolls registered at 223K above expectations (200K) in December

-

13:31

United States Labor Force Participation Rate came in at 62.3%, above expectations (62.1%) in December

-

13:31

United States Average Weekly Hours registered at 34.3, below expectations (34.4) in December

-

13:31

United States Average Hourly Earnings (MoM): 0.3% (December) vs previous 0.6%

-

13:31

Canada Net Change in Employment registered at 104K above expectations (8K) in December

-

13:31

United States Average Hourly Earnings (YoY) registered at 4.6%, below expectations (5%) in December

-

13:31

Canada Unemployment Rate below forecasts (5.2%) in December: Actual (5%)

-

13:30

Breaking: US Nonfarm Payrolls rise by 223,000 in December vs. 200,000 expected

Nonfarm Payrolls in the US rose by 223,000 in December, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading came in much higher than the market expectation of 200,000 and followed November's increase of 256,000 (revised from 263,000).

Follow our live coverage of market reaction to the US jobs report.

Further details of the publication revealed that the Unemployment Rate declined to 3.5% in December from 3.6% in November. The Labor Force Participation Rate improved modestly to 62.3% from 62.1% and the annual wage inflation, as measured by the Average Hourly Earnings, declined to 4.6% from 4.8%, compared to market expectation of 5%.

Market reaction

With the initial reaction, the US Dollar Index retreated from daily highs and was last seen rising 0.22% on the day at 105.37.

-

13:30

United States Unemployment Rate registered at 3.5%, below expectations (3.7%) in December

-

13:30

Canada Participation Rate above forecasts (64.8%) in December: Actual (65%)

-

13:30

United States U6 Underemployment Rate registered at 6.5%, below expectations (6.7%) in December

-

13:12

Singapore: High Street seems to be losing momentum – UOB

Alvin Liew, Economist at UOB Group, comments on the November’s contraction of Retail Sales.

Key Takeaways

“After two months of sequential increases, Singapore’s retail sales contracted by -3.7% m/m in Nov, from an unchanged +0.1% m/m in Oct. That still translated to a 6.2% y/y expansion in Nov (from a downwardly revised 10.3% in Oct), and was the first time the y/y growth fell to single-digit expansion after seven consecutive months of double-digit growth. Excluding motor vehicle sales, the m/m decrease was more pronounced at -4.3%, (from +0.7% in Oct), translating to an 8.7% y/y increase (from 14.2% y/y in Oct).”

“Delving into the details of the latest retail sales growth, eight of the 14 main segments recorded m/m decreases in Nov, up from five in Oct. The main segment that recorded the biggest m/m decrease was computer & telecommunication equipment followed by department stores, others, watches & jewellery and wearing apparel & footwear. We think the m/m declines in many of these (discretionary spending) segments may be due to the start of school holidays and in turn the start of year-end holiday travel for many Singaporean households which reduced their spending domestically in Nov.”

“Outlook – Year-to-date, retail sales grew by 10.8% y/y and we continue to project retail sales to expand by 10% in 2022 (unchanged from the previous report) which implies a more moderate forecast of around 3.1% retail sales growth in Dec 22. Going into 2023, key downside risks to retail sales are the still elevated inflation pressures that may increasingly curb discretionary spending of households, in addition to the 1ppt GST hike from 7% to 8% effective from 1 Jan 2023, while the favourable low base effect is also likely to fade going into the new year. That said, upside growth factors for retail sales could still come from the continued recovery in leisure and business air travel and inbound tourism, which will benefit many in-person services sectors, and the impact of China’s reopening from 8 Jan is likely to be positive for Singapore’s travel- and tourism-related sectors including retail, but the boost by China’s re-opening is highly uncertain as there are various factors that may limit the return of inbound Chinese tourists, especially in the near term. We have conservatively maintained a 2.3% retail sales growth for 2023, but the upside potential to our forecast is mainly China.”

-

13:09

AUD/USD drops to fresh daily low, holds above 0.6700 mark ahead of US NFP

- AUD/USD turns lower for the second straight day amid strong follow-through USD buying.

- Thursday’s upbeat US macro data fuels hawkish Fed expectations and underpins the buck.

- Looming recession risks further benefit the safe-haven USD ahead of the crucial US NFP.

The AUD/USD pair attracts fresh selling following an early uptick to the 0.6800 neighbourhood and turns lower for the second successive day on Friday. The steady intraday descent drags spot prices to a fresh daily low, around the 0.6725-0.6720 region heading into the North American session and is sponsored by a strong follow-through US Dollar buying.

In fact, the USD Index, which measures the greenback's performance against a basket of currencies, trades near a one-month high and continues to draw support from Thursday's upbeat US macro data. The US ADP report on private-sector employment and an unexpected fall in Weekly Initial Jobless Claims pointed to a strong labour market, which could allow the Fed to stick to its aggressive rate hike path.

Apart from this, the prevalent cautious market mood further seems to benefit the safe-haven greenback and contributes to driving flows away from the risk-sensitive Australian Dollar. Despite the latest optimism over the easing of strict COVID-19 restrictions in China, concerns about a deeper global economic downturn weigh on the sentiment and tempers investors' appetite for riskier assets.

It, however, remains to be seen if the USD bulls can maintain their dominant position as the focus shifts to the closely-watched US monthly jobs data. The popularly known NFP report could influence the Fed's near-term policy outlook and play a key role in driving the USD demand. This, in turn, should assist investors to determine the next leg of a directional move for the AUD/USD pair.

Hence, it will be prudent to wait for strong follow-through selling before confirming that spot prices have topped out in the near term and positioning for any further depreciating move. Nevertheless, the AUD/USD pair remains on track to register losses for the first time in the previous three weeks.

Technical levels to watch

-

13:08

EUR/USD Price Analysis: Further weakness could revisit 1.0440

- EUR/USD extends the bearish note sparked on Thursday.

- A deeper pullback could see the weekly low at 1.0443 revisited.

EUR/USD accelerates its losses and drops to multi-week lows south of the key 1.0500 barrier on Friday.

If sellers push harder, then the pair could extend the decline to, initially, the weekly low at 1.0443 (December 7) prior to the 55-day SMA at 1.0365.

In the meantime, further gains remain in store for the pair while above the 200-day SMA at 1.0311.

EUR/USD daily chart

-

13:01

South Korea: BoK could hike rates by 25 bps this month – UOB

Economist at UOB Group Ho Woei Chen suggests the BoK could raise the policy rate by 25 bps at its January event prior to pausing its hiking cycle.

Key Takeaways

“High cost of utilities, food and transport continued to drive the inflation in the country. The electricity prices are set for a 9.5% jump in 1Q23 which may lift the inflation this month.”

“The current elevated inflation environment would warrant another 25bps rate hike to bring the 7-day repo rate to 3.50% at the upcoming monetary policy meeting on 13 Jan. We see that as the ‘terminal rate’ as slowing economic growth will increasingly dominate the policy setting.”

“To engineer a soft-landing this year, the government has also announced measures to support the property market and boost the semiconductor industry and will be frontloading 65% of the budget allocated for the central government in 1H23.”

“We maintain our forecast for a moderation in GDP growth to 1.6% y/y in 4Q22 from 3.0% y/y in 1Q-3Q22 with the full-year growth at 2.7% in 2022. Our forecast for South Korea’s GDP growth remains at 1.7% for 2023. The advance 4Q22 GDP will be released on 26 Jan.”

-

12:57

USD Index Price Analysis: The hunt for the 200-day SMA

- The index extends the weekly optimism beyond 105.00.

- Immediately to the upside comes the 200-day SMA.

DXY adds to Thursday’s rebound and surpasses the key barrier at 105.00 the figure at the end of the week.

The dollar trades in multi-week highs north of the 105.00 barrier and the current upside momentum allows for the continuation of the upside bias for the time being. Against that, the next target of note comes at the key 200-day SMA, today at 106.32.

While below the latter, the outlook for the index should remain tilted to the negative side.

DXY daily chart

-

12:39

Philippines: Inflation figures surprised to the downside – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the latest release of inflation readings in the Philippines.

Key Takeaways

“Headline inflation picked up for a fourth consecutive month but at a slowerthan-expected pace of 8.1% y/y in Dec (UOB est: +8.4%, Bloomberg est: +8.2%, Nov: +8.0%). This brought the full-year inflation rate to an average of 5.8% in 2022 (2021: 3.9%), matching BSP’s forecast but coming in a tad lower than our projection of 5.9%. Costlier food, energy bills, recreational goods & cultural services, restaurants & accommodation related expenses, as well as personal care were key factors lifting the headline inflation further last month, which fully counteracted the effects of easing energy prices and a recovering Peso (PHP).”

“For 2023, inflation risks are still tilted to the upside due to both external and domestic forces. It is expected to revert to BSP’s medium-term inflation target range of 2.0%-4.0% only in late 3Q23, at the earliest, with year-ago high base effects, full impact of restrictive monetary policy on consumption, and moderating global growth lending a helping hand. This will result in a full-year inflation rate of 4.5% (BSP est: 4.5%).”

“We think that the slower-than-expected headline inflation outturn in Dec is less likely to throw BSP off its rate-hike path. But, the softer inflation reading coupled with gloomier global growth prospects will allow BSP to continuously embark on a slower rate hike path in the coming months. We stick to our BSP call for two more 25bps hikes in 1Q23 before taking a pause at 6.00% thereafter. The first Monetary Board Meeting of the year is slated for 13 Feb.”

-

12:35

When is the Canadian monthly jobs report and how could it affect USD/CAD?

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly employment report for December later this Friday at 13:30 GMT. The Canadian economy is anticipated to have added 8K jobs during the reported month, down from November's reading of 10.1K. Moreover, the unemployment rate is anticipated to edge higher from 5.1% to 5.2% in December.

How could the data affect USD/CAD?

The data is more likely to be overshadowed by the simultaneous release of the closely-watched US jobs report - popularly known as NFP. That said, a significant divergence from the expected readings might still influence the Canadian Dollar and provide some meaningful impetus to the USD/CAD pair.

Ahead of the key releases, a modest downtick in crude oil prices is seen undermining the commodity-linked Loonie. This, along with a strong follow-through buying around the US Dollar, assists the USD/CAD pair to capitalize on the overnight bounce from the vicinity of the 100-day SMA and gain traction for the second successive day.

Any disappointment from the Canadian employment details could further weigh on the domestic currency and provide an additional boost to the USD/CAD pair. Conversely, stronger data might do little to benefit the Canadian Dollar, suggesting that the path of least resistance for the major is to the upside.

Key Notes

• Can Canadian jobs numbers change the BOC's mind?

• USD/CAD Outlook: 100-day SMA holds the key for bulls, US/Canadian jobs data awaited

• USD/CAD climbs back closer to mid-1.3600s, focus remains on US NFP/Canadian jobs data

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

-

12:31

EUR/JPY Price Analysis: Extra gains target the 143.00 zone

- EUR/JPY extends the weekly recovery past the 141.00 barrier.

- The continuation of the rebound should target the 143.00 region.

EUR/JPY reverses Thursday’s pullback and regains the 141.00 mark and beyond at the end of the week.

In light of the ongoing price action, further upside could not be ruled out in the ear term. That said, the immediate target emerges at the weekly high at 142.93 (December 28), which appears underpinned by the vicinity of the 100-day SMA.

The outlook for EUR/JPY is expected to shift to constructive while above the 200-day SMA, today at 140.52.

EUR/JPY daily chart

-

12:23

FOMC Minutes: The battle against inflation remains the main target – UOB

Senior Economist at UOB Group Alvin Liew assesses the publication of the FOMC Minutes of the December meeting.

Key Takeaways

“The key takeaways from the US Federal Reserve’s (Fed) 13/14 Dec 2022 FOMC minutes released overnight (5 Jan, 3am SGT) were: 1) Fed officials were intent on keeping to hiking rates to lower inflation back toward their 2% target, warning against premature loosening and that no rate cuts were expected in 2023, and 2) policymakers highlighted the downshift to a 50bps hike was not a weakening of its resolve to bring inflation back to 2% target and signaled their concerns regarding market views about the future path of the policy Fed Funds Target rate (FFTR), warning that an ‘unwarranted easing in financial conditions’ would impede their efforts to achieve price stability.”

“The minutes also showed Fed policymakers see the continuing need to balance two risks related to the conduct of its monetary policy: the risk of an insufficiently restrictive monetary policy versus the risk of the lagged cumulative effect of policy tightening, even though participants generally still err to the side of caution, which affirmed more hikes in 2023. For the second consecutive meeting, Fed staff economists’ warned the ‘possibility of a [US] recession sometime over the next year as a plausible alternative to the baseline’, but FOMC policymakers again did not provide any expectation (or mention) of a US recession in 2023.”

“FOMC Outlook – The latest FOMC minutes suggest that the Fed’s hawkish leaning remains very much alive at this point, despite the improving CPI trajectory. As such, we keep our existing forecast for a 50bps hike in Jan/Feb FOMC followed by another 25bps hike in Mar FOMC to our projected terminal FFTR level of 5.25%. We expect this terminal rate of 5.25% to last through 2023. The cumulative rate increases in 2022 amounted to 425bps, with another 75bps increases on the cards in 1Q23.”

-

12:11

When is the US monthly jobs report (NFP) and how could it affect EUR/USD?

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data for December. The popularly known NFP report is scheduled for release at 13:30 GMT and is anticipated to show that the economy added 200K jobs during the reported month, down from the 263K in November. The upbeat ADP report on the US private-sector employment, however, might have lifted expectations from the official figures. The unemployment rate, meanwhile, is foreseen to hold steady at 3.7% in December. Apart from this, investors will take cues from Average Hourly Earnings for fresh insight into the possibility of any further rise in inflationary pressures.

How could the data affect EUR/USD?

Heading into the key data risk, some follow-through US Dollar buying drags the EUR/USD pair to a nearly one-month low, below the 1.0500 psychological mark. Surprisingly stronger US employment details should be enough to trigger a fresh leg up in the greenback.

Conversely, any disappointment is more likely to be overshadowed by looming recession risk, which might continue to underpin the safe-haven buck. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside.

Eren Sengezer, Editor at FXStreet, offers a brief technical overview and outlines important technical levels to trade the pair: “EUR/USD was last seen trading slightly above 1.0500, where the Fibonacci 50% retracement of the latest uptrend is located. In case the pair drops below that level and starts using it as resistance, it could extend its slide toward 1.0450 (Fibonacci 61.8% retracement) and 1.0400 (psychological level, static level).”

“On the upside, the 200-period SMA on the four-hour chart aligns as immediate resistance at around 1.0550. This level is also reinforced by the Fibonacci 38.2% retracement. With a four-hour close above that hurdle, EUR/USD could gather recovery momentum and target 1.0610/20 area (Fibonacci 23.6% retracement, 100-period SMA, 50-period SMA),” Eren adds further.

Key Notes

• Nonfarm Payrolls Preview: Layoffs spreading or another blockbuster month? Three scenarios for the US Dollar

• EUR/USD Forecast: Can 1.0500 support hold on another NFP beat?

• EUR/USD challenges the 1.0500 region ahead of key data

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous month's reviews and the unemployment rate are as relevant as the headline figure.

-

11:01

Ireland Retail Sales (YoY) declined to -4.2% in November from previous -2.6%

-

11:00

Ireland Retail Sales (MoM) fell from previous 0.7% to -1.4% in November

-

10:45

Silver Price Analysis: XAG/USD recovers from two-week low, not out of the woods yet

- Silver regains some positive traction and snaps a three-day losing streak to a two-week low.

- The technical setup favours support prospects for the emergence of selling at higher levels.

- Any subsequent move up might still be seen as a selling opportunity and fizzle out quickly.

Silver attracts some buying on Friday and reverses a part of the previous day's losses to the $23.00 neighbourhood, or a two-week low. The white metal sticks to intraday gains, just below mid-$23.00s through the first half of the European session and for now, seems to have stalled this week's pullback from over an eight-month high.

The technical setup, however, still seems tilted in favour of bearish traders, warranting some caution before positioning for any further intraday positive move. This week's break below a two-month-old ascending trend line and a subsequent slide below the 200-period SMA on the 4-hour chart validates the negative outlook. Furthermore, oscillators on the daily chart have been losing momentum and support prospects for the emergence of fresh selling at higher levels.

Hence, any subsequent move up is more likely to meet with a fresh supply near the $23.70 area, or the 200-period SMA on the 4-hour chart. This, in turn, should cap the XAG/USD near the aforementioned ascending trend-line support breakpoint, now turned resistance, around the $23.90-$24.00 zone. The latter coincides with the overnight swing high and should act as a pivotal point, which if cleared decisively might prompt some short-covering around the white metal.

The XAG/USD might then aim to surpass an intermediate resistance near the $24.25 area, which is followed by the multi-month high, around the $24.50-$24.55 region set on Tuesday. A sustained strength beyond the latter will negate any near-term negative outlook and allow bulls to reclaim the $25.00 psychological mark for the first time since April 2022.

On the flip side, the $23.20-$23.10 area now seems to have emerged as immediate support. Some follow-through selling below the $23.00 round figure could drag the XAG/USD towards the $22.60-$22.55 region en route to the next relevant support near the $22.10-$22.00 horizontal zone. Failure to defend the said support levels will be seen as a fresh trigger for bearish traders and set the stage for a further near-term depreciating move.

Silver 4-hour chart

Key levels to watch

-

10:42

USD/CNH: Firm support aligns around 6.8400 – UOB

Further losses in USD/CNH should not be ruled out for the time being, note Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “Yesterday, we indicated that USD ‘is likely to drift lower but is unlikely to challenge the support at 6.8700’. Our view turned out to be correct as USD dipped to a low of 6.8714 before rebounding. The underlying tone still appears to be soft, but while USD could dip below 6.8700 today, the next support at 6.8560 is unlikely to come into view. On the upside, a breach of 6.9000 (minor resistance is at 6.8900) would indicate that the current mild downward pressure has eased.”

Next 1-3 weeks: “There is not much to add to our update from yesterday (05 Jan, spot at 6.8910). As highlighted, while the decline in USD from last month has slowed, the risk is still on the downside. Only a break of 6.9250 (‘strong resistance’ level was at 6.9400 yesterday) would indicate that the downward pressure has eased. That said, any decline is expected to face solid support at 6.8400.”

-

10:35

European Monetary Union Business Climate remains unchanged at 0.54 in December

-

10:35

USD/CAD climbs back closer to mid-1.3600s, focus remains on US NFP/Canadian jobs data

- USD/CAD turns positive for the second straight day and is supported by a combination of factors.

- A downtick in oil prices undermines the Loonie and acts as a tailwind amid sustained USD buying.

- Investors now look to the monthly employment data from the US and Canada for a fresh impetus.

The USD/CAD pair attracts fresh buying near the 1.3540-1.3535 area on Friday and builds on the previous day's goodish rebound from the vicinity of the 100-day SMA support. The uptick, also marking the second successive day of a positive move, lifts spot prices to the 1.3625-1.3630 area during the first half of the European session and is sponsored by a combination of factors.

Crude oil prices struggle to capitalize on the overnight gains and edge lower on the last day of the week, which, in turn, undermines the commodity-linked Loonie. Despite the latest optimism led by the easing of strict COVID-19 curbs in China, which is expected to boost fuel demand, looming recession risks act as a headwind for the black liquid. This, along with a strong follow-through buying around the US Dollar, offers additional support to the USD/CAD pair and remains supportive of the momentum.

The USD continues to draw support from Thursday's upbeat US macro data, which pointed to a resilient US labour market and could allow the Federal Reserve to stick to its aggressive rate hike path. This, along with the prevalent cautious market mood, further seems to benefit the safe-haven greenback. It, however, remains to be seen if the USD bulls can retain control or opt to lighten their bets ahead of the closely-watched US monthly jobs data, due for release during the early North American session.

The popularly known US NFP report, due for release later during the early North American session, could influence the Fed's near-term policy outlook. This, in turn, will play a key role in driving the USD demand. Investors will further take cues from the release of the monthly employment details from Canada, which, along with oil price dynamics, should provide some meaningful impetus to the USD/CAD pair.

Technical levels to watch

-

10:32

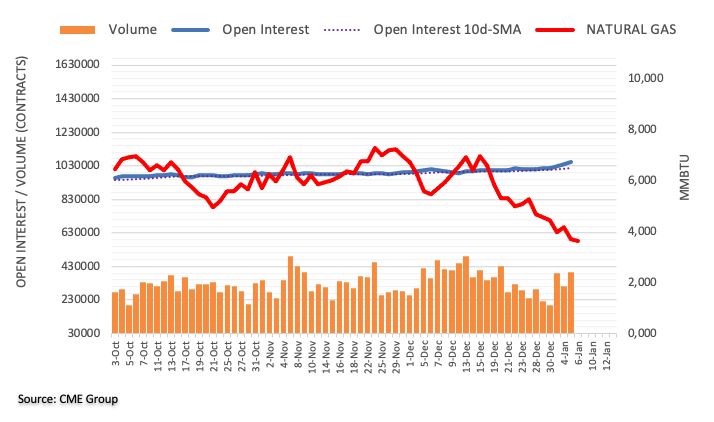

Natural Gas Futures: Further losses in the pipeline

Advanced prints from CME Group for natural gas futures markets noted open interest increased for the sixth session in a row on Thursday, this time by around 13.8K contracts. Volume followed suit and rose by around 84.7K contracts, extending at the same time the recent erratic performance.

Natural gas: On its way to $3.50?

Prices of the natural gas resumed the downtrend on Thursday and revisited multi-month lows amidst rising open interest and volume. Against that, the commodity risks a deeper pullback in the very near term with the immediate target at the $3.50 region per MMBtu (December 30 2021).

-

10:02

European Monetary Union Industrial Confidence came in at -1.5, below expectations (-1.2) in December

-

10:02

European Monetary Union Services Sentiment registered at 6.3 above expectations (3.5) in December

-

10:02

European Monetary Union Consumer Confidence meets expectations (-22.2) in December

-

10:02

European Monetary Union Economic Sentiment Indicator registered at 95.8 above expectations (94.7) in December

-

10:01

Breaking: Annual HICP in euro area drops to 9.2% in December vs. 9.7% expected

Inflation in the euro area, as measured by the Harmonised Index of Consumer Prices (HICP), declined to 9.2% on a yearly basis in December from 10.1% in November, Eurostat announced on Friday. This reading came in below the market expectation of 9.7%.

The annual Core HICP rose to 5.2% from 5%, surpassing analysts' estimate of 5%. On a monthly basis, the HICP declined by 0.3% but the core HICP was up 0.6%.

Market reaction

EUR/USD edged slightly higher with the initial reaction to inflation figures and was last seen trading at 1.0515, where it was down 0.05% on a daily basis.

-

10:01

European Monetary Union Harmonized Index of Consumer Prices (MoM) came in at -0.3%, below expectations (0.8%) in December

-

10:01

European Monetary Union Core Harmonized Index of Consumer Prices (MoM) came in at 0.6%, above forecasts (-0.1%) in December

-

10:01

European Monetary Union Core Harmonized Index of Consumer Prices (YoY) came in at 5.2%, above expectations (5%) in December

-

10:00

European Monetary Union Harmonized Index of Consumer Prices (YoY) below expectations (9.7%) in December: Actual (9.2%)

-

10:00

European Monetary Union Retail Sales (YoY) above expectations (-3.3%) in December: Actual (-2.8%)

-

10:00

European Monetary Union Retail Sales (MoM) registered at 0.8% above expectations (0.5%) in December

-

09:55

USD/JPY faces a probable rebound to 135.00 – UOB

Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group hint at the probability of a move to the 135.00 region in USD/JPY in the short term.

Key Quotes

24-hour view: “Our view for USD to trade sideways was incorrect as it surged to a high of 134.05 before easing off to close at 133.40 (+0.59%). Upward momentum has improved, albeit not much. USD could continue to rise today but it is unlikely to challenge the major resistance at 135.00 (there is another rather strong level at 134.50). The upside pressure is intact as long as USD does not move below 132.55 (minor support is at 133.00).”

Next 1-3 weeks: “We highlighted yesterday (05 Jan, spot at 132.00) that ‘downward pressure appears to have eased and USD has likely moved into a consolidation phase’ and we expected USD to ‘trade between 129.50 and 133.50 for a period of time’. We did not expect the sharp rise in USD to a high of 134.05. Upward momentum is building and the current price actions are likely the early stages of a corrective rebound that could extend to 135.00. In order to keep the momentum going, USD should not move below the ‘strong support’ level, currently at 131.50, within the next few days.”

-

09:30

United Kingdom S&P Global Construction PMI below expectations (49.6) in December: Actual (48.8)

-

09:26

EUR/USD challenges the 1.0500 region ahead of key data

- EUR/USD probes the vicinity of the 1.0500 zone, or new lows.

- The preliminary inflation figures in the euro area come next.

- Later in the day, the focus of attention will be on US Payrolls.

The single currency trades on the defensive vs. the dollar and motivates EUR/USD to trade in an offered fashion around 1.0500 on Friday.

EUR/USD focuses on EMU CPI, US NFP

EUR/USD tests the proximity of the 1.0500 neighbourhood following the sharp pullback seen in the previous session, all against the backdrop of the generalized consolidative pattern seen in the global markets ahead of key data releases on both sides of the Atlantic.

On the latter, advanced inflation figures in the broader Euroland for the month of December will take centre stage later in the European morning, while the US labour market report, Factory Orders and the ISM Non-Manufacturing will grab all the attention in the US data space.

Earlier in the old continent, Retail Sales in Germany contracted at an annualized 5.9% in November.

In the meantime, the German 10-year Bund yields post marginal gains and add to Thursday’s small uptick.

What to look for around EUR

EUR/USD seems to have met some decent contention near 1.0500 so far this week amidst the resumption of the bid bias around the greenback. The pair’s price action will most likely be put to the test in light of key data releases scheduled later in the session.

In the meantime, the European currency is expected to closely follow dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Germany Retail Sales, EMU Flash Inflation Rate, EMU Retail Sales.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.16% at 1.0504 and the breach of 1.0496 (monthly low January 6) would target 1.0443 (weekly low December 7) en route to 1.0311 (200-day SMA). On the other hand, the next up barrier emerges at 1.0713 (weekly high December 30) ahead of 1.0736 (monthly high December 15) and finally 1.0773 (monthly high June 27).

-

09:15

GBP/USD struggles near multi-week low, below 1.1900 mark ahead of US NFP

- GBP/USD remains on the defensive near a multi-week low amid sustained USD buying.

- Thursday’s upbeat US data reaffirms hawkish Fed expectations and underpins the USD.

- The focus remains glued to the release of the closely-watched US monthly jobs report.

The GBP/USD pair struggles to gain any meaningful traction on Friday and oscillated in a narrow trading band through the first half of the European session. The pair is currently placed just below the 1.1900 mark, or a fresh six-week low touched in the last hour.

Thursday's upbeat US macro data continues to boost the US Dollar for the second successive day, which, in turn, is seen as a key factor acting as a headwind for the GBP/USD pair. In fact, the better-than-expected ADP report on the US private-sector employment and Initial Jobless Claims pointed to a resilient US labour market.

This further suggested that the economy ended 2022 on solid footing and could allow the Federal Reserve to stick to its aggressive rate hike path. That said, subdued action around the US Treasury bond yields fails to impress the USD bulls and could lend some support to the GBP/USD pair ahead of the closely-watched US jobs data.

The popularly known US NFP report, due for release later during the early North American session, could influence the Fed's near-term policy outlook. This, in turn, will play a key role in driving the USD demand and provide a fresh directional impetus to the GBP/USD pair. The bleak outlook for the UK economy, meanwhile, still favours bearish traders.

Hence, any attempted recovery could now be seen as a selling opportunity and runs the risk of fizzling out. The GBP/USD pair seems vulnerable to extending its recent pullback from the vicinity of mid-1.2400s, or the highest level since June 2022. Nevertheless, spot prices remain on track to register heavy weekly losses, marking the third in the previous four.

Technical levels to watch

-

09:03

Germany: Industrial orders slumped in November – Commerzbank

A senior economist at Commerzbank offers a grim outlook on the German industrial sector after the country’s factory orders plunged in November.

Key quotes

“German industry received 5.3% fewer new orders in November than in October. This means that the downward trend in order intake has if anything worsened.”

“However, due to the large order backlogs built up over the past two years, this is hardly having an impact on production.”

“Real sales, which correlate strongly with production, actually rose by 2.1% in November.”

“In view of the weaker order intake and the burden of high energy prices, production may therefore fall in the coming months, but a slump is unlikely.”

-

08:49

China’s Commerce Ministry: Will actively study and implement measures to boost consumption

China’s Commerce Ministry spokesperson said on Friday, that they will actively study and implement measures to boost consumption.

“Domestic consumption demand will be gradually released, and consumption is expected to recover steadily,” the spokesperson said.

Market reaction

These above comments have little to no impact on the Chinese proxy, the Australian Dollar. The AUD/USD pair was last seen trading at 0.6752, +0.05% on the day.

-

08:23

USD/JPY climbs to over one-week high, closer to mid-134.00s ahead of US NFP report

- USD/JPY scales higher for the fourth straight day and climbs to over a one-week high on Friday.

- Thursday’s upbeat US data, hawkish Fed expectations underpin the USD and remain supportive.

- Investors now look forward to the release of the US NFP report before placing directional bets.

The USD/JPY pair builds on this week's recovery move from mid-129.00s, or its lowest level since June 2022 and gains traction for the fourth successive day on Friday. The momentum lifts spot prices to over a one-week high, around the 134.40 area during the early part of the European session and is sponsored by a strong follow-through US Dollar buying.

Thursday's better-than-expected US macro data pointed to a resilient US labour market and could allow the Federal Reserve to stick to its aggressive rate hike path. Furthermore, Fed officials reiterated that they were still focused on bringing down inflation to the 2% target, which continues to act as a tailwind for the US Treasury bond yields and the greenback.

Apart from this, a generally positive tone around the equity markets, bolstered by the optimism over the easing of strict COVID-19 curbs in China, undermines the safe-haven Japanese Yen. This is seen as another factor lending support to the USD/JPY pair. The upside, however, seems limited amid reports that the Bank of Japan (BoJ) plans to raise its inflation forecasts.

According to Reuters, the upgrade would underscore the BoJ's conviction that robust domestic demand will keep inflation around the 2% target in coming years. This, in turn, fueled speculations that the central bank will phase out its ultra-lose policy settings when Governor Haruhiko Kuroda's second five-year term ends in April, warranting caution for bulls.

Traders might also refrain from placing aggressive bets and prefer to wait for the release of the closely-watched US monthly jobs data. The popularly known NFP report, due later during the early North American session, could influence the Fed's near-term policy outlook and drive the USD demand. This, in turn, should provide a fresh directional impetus to the USD/JPY pair.

Technical levels to watch

-

08:07

AUD/USD faces further range bound trading – UOB

AUD/USD could now navigate within the 0.6660-0.6860 range in the next few weeks, comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “We highlighted yesterday that ‘the rapid rise appears to be overdone and AUD is unlikely to advance further’ and we expected AUD to ‘trade sideways between 0.6770 and 0.6870’. However, instead of trading sideways, AUD plummeted to a low of 0.6737 before closing on a weak note at 0.6752 (-1.26%). While AUD could continue to decline, oversold conditions suggest it is unlikely to challenge the support at 0.6700 (next support is at 0.6660). Resistance wise, a break of 0.6820 (minor resistance is at 0.6790) would indicate that the weakness in AUD has stabilized.”

Next 1-3 weeks: “Yesterday (05 Jan, spot at 0.6825), we highlighted that while upward momentum, AUD has to break clearly above 0.6900 before a sustained rise is likely. We added, ‘the likelihood of AUD breaking clearly above 0.6900 is not high for now but it would remain intact as long as AUD stays above 0.6735 within the next few days’. In NY trade, NY plummeted and came close to taking out 0.6735 with a low of 0.6737. While 0.6735 is not breached, upward momentum has faded. The current price actions are likely part of a broad consolidation range and AUD is likely to trade between 0.6660 and 0.6860 for now.”

-

08:04

Crude Oil Futures: Rebound could extend further

CME Group’s flash data for crude oil futures markets noted traders added around 3.8K contracts to their open interest positions on Thursday, extending the uptrend in place since December 23. Volume, instead, set aside three daily drops in a row and went up by around 192.5K contracts.

WTI: A visit to the $70.00 area is not ruled out

Thursday’s small bounce in prices of the WTI was on the back of rising open interest, which suggests the probability of another move higher in the very near term. The sharp decline in volume, however, leaves the door open to extra downside to, potentially, the 2022 low near the $70.00 mark per barrel.

-

07:49

GBP/USD: Further decline on the cards – UOB

In the opinion of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, GBP/USD could see its losses accelerate to the 1.1850 region in the short term.

Key Quotes

24-hour view: “The sharp drop in GBP came as a surprise (we were expecting GBP to range-trade). The sharp and swift drop appears to be overdone, there is room for the weakness in GBP to extend to 1.1850 before stabilization is likely. The next support at 1.1800 is unlikely to come into view. Resistance is at 1.1950, but only a break of 1.1980 would indicate that the weakness has stabilized.”

Next 1-3 weeks: “We highlighted yesterday (05 Jan, spot at 1.2050) that GBP is likely to consolidate between 1.1900 and 1.2150 for the time being. We did not expect the subsequent sharp drop to 1.1873. The rapid build-up in momentum is likely to lead to further GBP weakness. Support levels are at 1.1850 and 1.1800. The downside risk is intact as long as GBP stays below the ‘strong resistance’ level, currently at 1.2020.”

-

07:45

France Consumer Spending (MoM) registered at 0.5%, below expectations (1%) in November

-

07:40

Gold Price Forecast: XAU/USD edges higher to $1,840 area, upside seems capped ahead of US NFP

- Gold price regains positive traction on Friday and reverses a part of the overnight losses.

- Some follow-through buying around the USD should keep a lid on the non-yielding metal.

- Traders keenly await the release of the US monthly employment details, or the NFP report.

Gold price attracts some dip-buying on the last day of the week and stalls its retracement slide from the highest level since June 2022, around the $1,865 area touched on Wednesday. The XAU/USD maintains its bid tone through the early European session and is currently placed near the top end of the daily range, just below the $1,840 level.

The intraday uptick in Gold price could be attributed to some repositioning trade ahead of the release of the closely-watched US monthly jobs data. The popularly known NFP report will play a key role in influencing the Fed's rate hike path and help determine the next leg of a directional move for the non-yielding yellow metal. In the meantime, a strong follow-through buying around the US Dollar could keep a lid on any meaningful upside for the Dollar-denominated commodity.

The USD continues to draw support from Thursday's better-than-expected US macro data, which pointed to a resilient US labour market and could allow the Federal Reserve to stick to its aggressive rate hike path. In fact, Automatic Data Processing (ADP) reported that the US private sector employers added 235K jobs in December against consensus estimates for a reading of 150K. Furthermore, Initial Jobless Claims unexpectedly declined to 204K last week.

This comes on the back of a hawkish tone from the minutes of the Federal Open Market Committee (FOMC) December meeting, showing that policymakers were set to keep interest rates higher for longer. Moreover, Federal Reserve officials reiterated on Thursday that they were still focused on bringing inflation back to the 2% target. Heading into the key data risk, the Fed's hawkish outlook should contribute to capping Gold price and warrants caution for bullish traders.

Technical levels to watch

-

07:36

Gold Futures: Downside looks limited near term

According to preliminary readings from CME Group for gold futures markets, open interest dropped by nearly 3K contracts on Thursday after four consecutive daily builds. In the same line, volume shrank for the second session in a row, this time by around 4.6K contracts.

Gold could revisit recent peaks around $1865

Gold prices retreated sharply on Thursday on the back of shrinking open interest and volume, which is supportive that a deeper pullback appears out of favour in the very near term. The resumption of the upside momentum is expected to retarget recent highs at $1865 per ounce troy.

-

07:30

Switzerland Real Retail Sales (YoY) below forecasts (3%) in November: Actual (-1.3%)

-

07:13

EUR/USD risks a probable drop to 1.0450 – UOB

Further decline in EUR/USD looks likely and could retest the 1.0450 and 1.0410 levels in the next weeks, suggest Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “Our expectations for EUR to range-trade were incorrect as it dropped sharply and closed at a 1-month low of 1.0520 (-0.75%). The decline gained considerable momentum and EUR is likely to weaken further. That said, the major support at 1.0450 is likely out of reach today (minor support is at 1.0485). Resistance is at 1.0545, followed by 1.0580.”

Next 1-3 weeks: “We highlighted yesterday (05 Jan, spot at 1.0610) that downward momentum is beginning to build and we held the view that EUR is likely to trade with a downward bias but expect solid support at 1.0510. In NY trade, EUR dropped sharply and came close to 1.0510 (low of 1.0513). Downward momentum has improved further and a break of 1.0510 would not be surprising. In view of the improved momentum, EUR could weaken to the next support at 1.0450, possibly 1.0410. On the upside, a break of 1.0630 (‘strong resistance’ level was at 1.0675 yesterday) would indicate that downward pressure has eased.”

-

07:08

USD Index climbs to new highs past 105.00 ahead of Payrolls

- The index adds to Thursday’s advance and trespasses 105.00.

- Markets remain largely in a consolidative mood ahead of NFP.

- All the attention shifts to the US labour market, Fedspeak.

The greenback, in terms of the USD Index (DXY), keeps the optimism well and sound and reclaims the area above the 105.00 barrier at the end of the week.

USD Index looks at Payrolls, ISM, Fed speakers

The index adds to Thursday’s gains and manages to climb past 105.00 the figure on Friday, extending the bid bias in the second half of the week as investors continue to assess recent results in US fundamentals.

In the meantime, investors are expected to closely follow the release of the Nonfarm Payrolls for the month of December, where the economy is expected to have created 200K jobs and the jobless rate to remain unchanged at 3.7%.

The results from the US labour market – and particularly, its resilience - have been growing in importance as of late due to its implications for the Fed’s plans regarding its ongoing tightening process.