Notícias do Mercado

-

23:34

Commodities. Daily history for Jule Aug 6'2014:

(raw materials / closing price /% change)

Light Crude 96.84 -0.08%

Gold 1,306.90 -0.10%

-

23:33

Stocks. Daily history for Jule Aug 6'2014:

(index / closing price / change items /% change)

Nikkei 225 15,159.79 -160.52 -1.0 %

Hang Seng 24,584.13 -64.13 -0.3 %

Shanghai Composite 2,217.46 -2.48 -0.1 %

FTSE 100 6,636.16 -46.32 -0.7 %

CAC 40 4,207.14 -25.74 -0.6 %

Xetra DAX 9,130.04 -59.70 -0.6 %

S&P 500 1,920.24 +0.03 0.0%

NASDAQ 4,355.05 +2.22 +0.1 %

Dow Jones 16,443.34 +13.87 +0.1 %

-

23:28

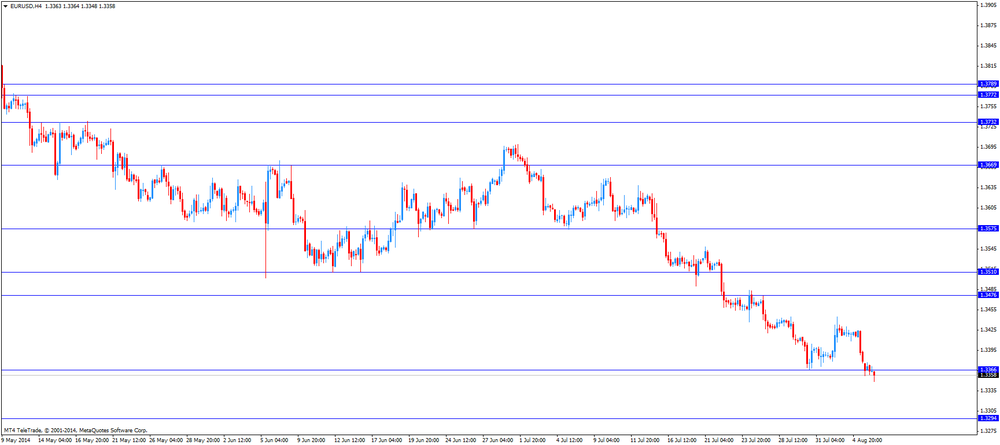

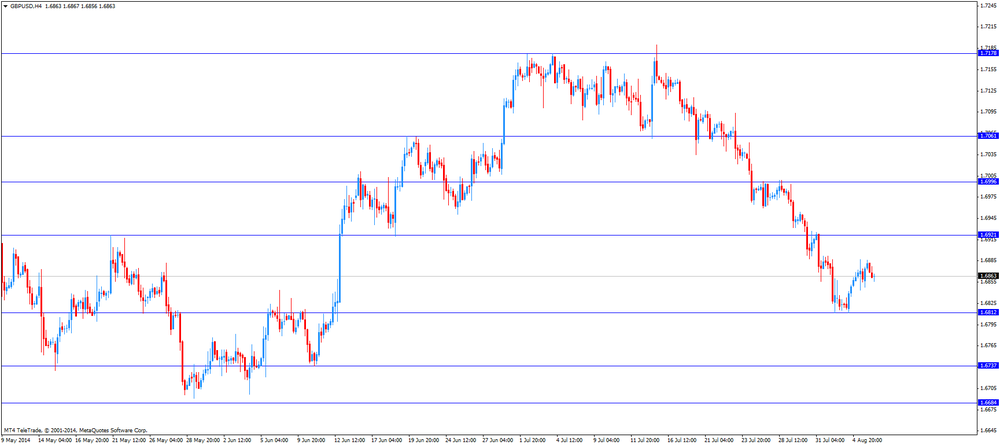

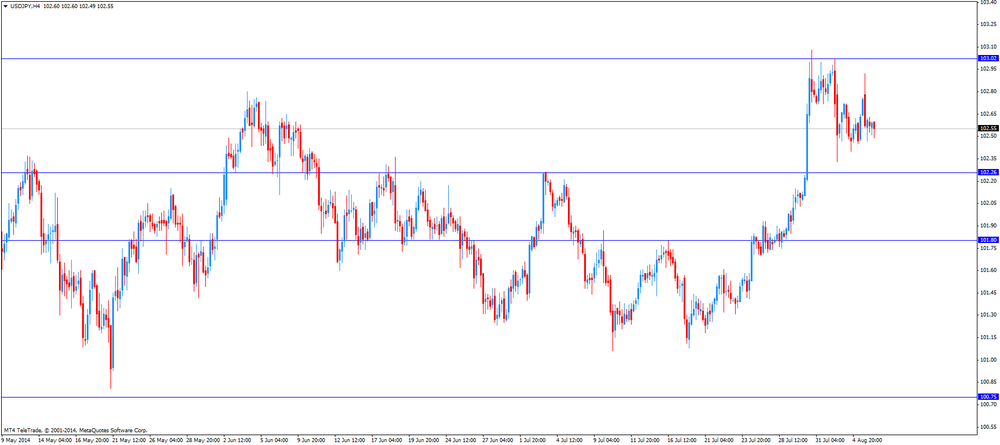

Currencies. Daily history for Aug 6'2014:

(pare/closed(GMT +2)/change, %)

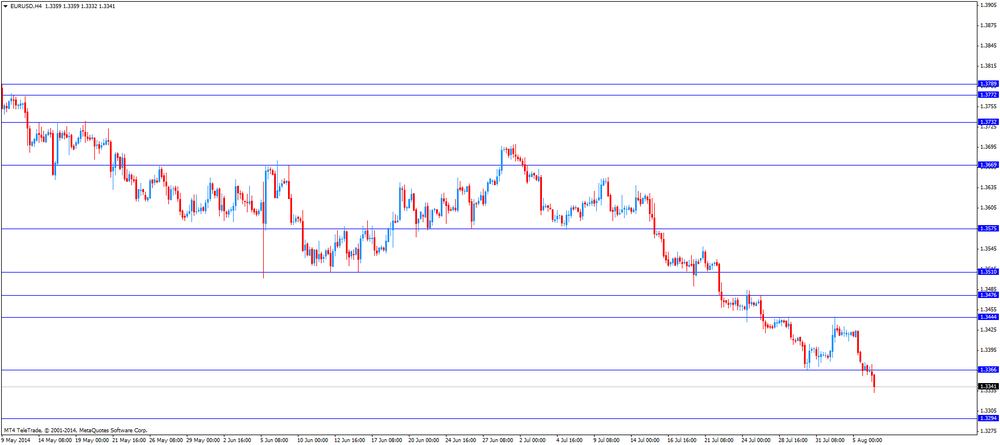

EUR/USD $1,3383 +0,08%

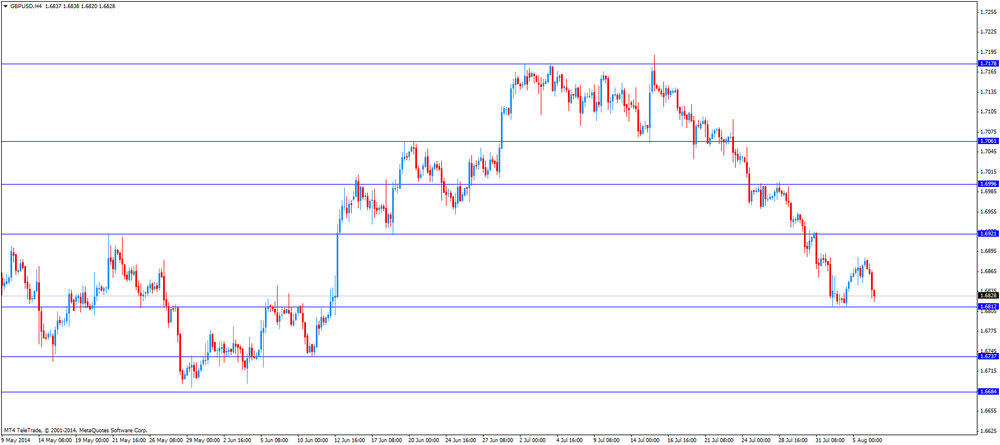

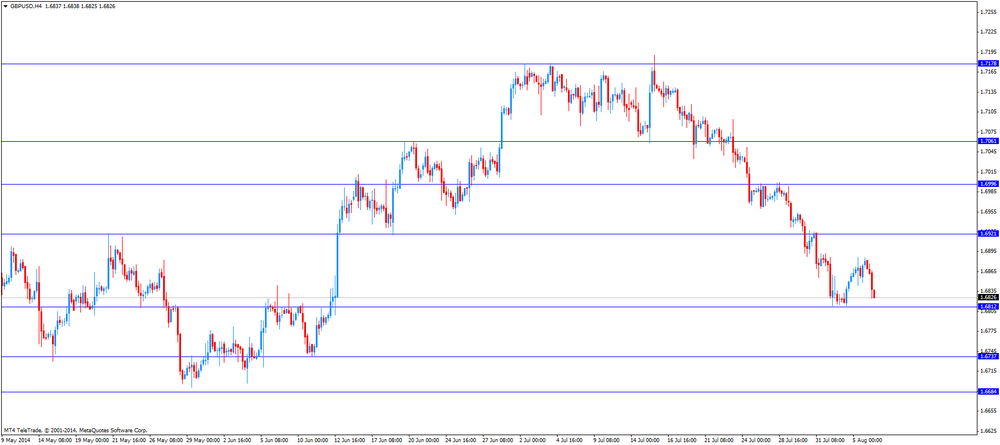

GBP/USD $1,6850 -0,19%

USD/CHF Chf0,9074 -0,20%

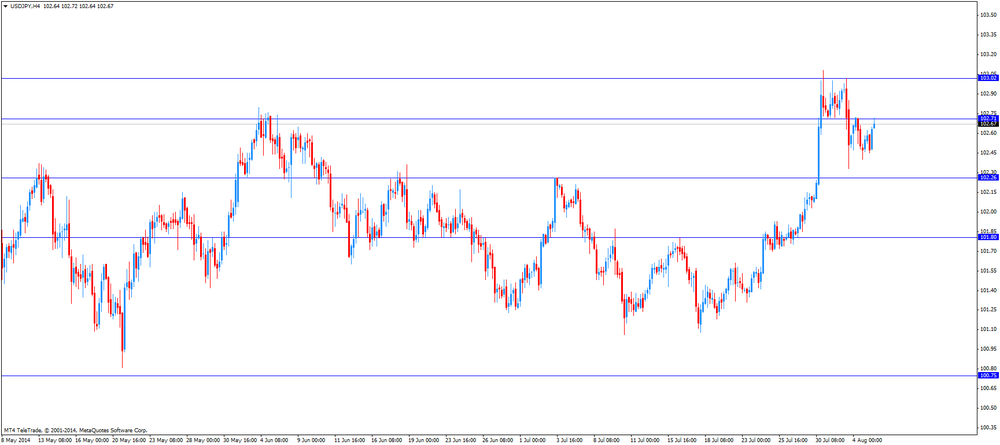

USD/JPY Y102,11 -0,49%

EUR/JPY Y136,66 -0,40%

GBP/JPY Y172,05 -0,68%

AUD/USD $0,9347 +0,47%

NZD/USD $0,8472 +0,13%

USD/CAD C$1,0915 -0,40%

-

23:00

Schedule for today, Thursday, Aug 7’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia Unemployment rate July 6.0% 6.0%

01:30 Australia Changing the number of employed July 15.9 13.5

05:45 Switzerland SECO Consumer Climate Quarter II 1 4

06:00 Germany Industrial Production s.a. (MoM) June -1.8% +1.4%

06:00 Germany Industrial Production (YoY) June +1.3%

06:45 France Trade Balance, bln June -4.9 -5.0

07:00 Switzerland Foreign Currency Reserves July 449.6

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:30 Eurozone ECB Press Conference

12:30 Canada Building Permits (MoM) June +13.8% -1.8%

12:30 U.S. Initial Jobless Claims July 302 305

14:00 Canada Ivey Purchasing Managers Index July 46.9 54.1

19:00 U.S. Consumer Credit June 19.6 18.3

23:50 Japan Current Account (adjusted), bln June 384.6 110.0

-

20:00

Dow 16,448.48 +19.01 +0.12%, Nasdaq 4,360.82 +7.98 +0.18%, S&P 500 1,921.16 +0.95 +0.05%

-

17:00

European stocks closed in minus: FTSE 100 6,636.16 -46.32 -0.69%, CAC 40 4,207.14 -25.74 -0.61%, DAX 9,130.04 -59.70 -0.65%

-

17:00

European stocks close: most stocks closed lower due to tensions over Ukraine and weak factory orders in Germany

Stock indices closed lower due to tensions over Ukraine and weak factory orders in Germany. Poland's foreign minister warned that Russia is about to increase its presence along its border with Ukraine. Investors preferred safe-haven assets.

Factory orders in Germany dropped 3.2% in June, missing forecasts of a 0.5% increase, after a 1.6% decline in May. That was the biggest drop since September 2011.

May's figure was revised up from a 1.7% fall.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,636.16 -46.32 -0.69%

DAX 9,130.04 -59.70 -0.65%

CAC 40 4,207.14 -25.74 -0.61%

-

16:40

Oil rose from a six-month low

West Texas Intermediate crude rose from a six-month low after an Energy Information Administration report showed declines in U.S. inventories of crude oil, gasoline and distillates.

The EIA said crude supplies decreased 1.76 million barrels in the week ended Aug. 1. Analysts surveyed by Bloomberg had expected a drop of 1.55 million. Gasoline inventories fell 4.39 million barrels to 213.8 million and distillates dropped 1.8 million to 124.9 million. Stockpiles at Cushing, Oklahoma, the delivery point for WTI futures, rose 83,000 barrels to 18 million.

"The market is trying to stabilize after reaching a multimonth low," said Gene McGillian, an analyst and broker at Tradition Energy in Stamford, Connecticut. "The selling pressure has run its course."

WTI for September delivery gained 68 cents, or 0.7 percent, to $98.06 a barrel at 10:35 a.m. on the New York Mercantile Exchange. The contract dropped to $97.38 yesterday, the lowest close since Feb. 5. The volume of all futures traded was about 32 percent below the 100-day average for the time of day.

Brent for September settlement rose 78 cents, or 0.7 percent, to $105.39 a barrel on the London-based ICE Futures Europe exchange. It closed at $104.61 a barrel yesterday, the lowest since Nov. 7. The European benchmark crude was at a premium of $7.33 to WTI on the ICE. It closed at $7.23 yesterday.

-

16:39

Foreign exchange market. American session: the Canadian dollar rose against the U.S. dollar due to the better-than-expected trade data from Canada

The U.S. dollar traded mixed against the most major currencies after the trade balance data in the U.S. The U.S. trade deficit declined to $41.5 billion in June from a deficit of $44.7 billion in May, beating expectations for a decrease to $44.2 billion. May's figure was revised down from a deficit of $44.4 billion.

Tensions over Ukraine weighed on markets. Poland's foreign minister warned that Russia is about to increase its presence along its border with Ukraine. Investors preferred safe-haven assets.

The euro traded lower against the U.S. dollar after the weak factory orders in Germany. Factory orders in Germany dropped 3.2% in June, missing forecasts of a 0.5% increase, after a 1.6% decline in May. That was the biggest drop since September 2011.

May's figure was revised up from a 1.7% fall.

The British pound traded lower against the U.S. dollar after the weaker-than-expected industrial production in the UK. Industrial production increased 0.3% in June, missing expectations for a 0.6% rise, after a 0.6% decline in May. May's figure was revised up from a 0.7% decrease.

On a yearly basis, industrial production rose 1.2% in June, missing expectations for an increase of 1.5%, after 2.3% gain in May.

Manufacturing production climbed 0.3% in June, missing forecasts of a 0.7% rise, after a 1.3% fall in May.

On a yearly basis, manufacturing production jumped 1.9% in June, after a 3.7% increase. Economists had expected a rise of 2.1%.

National Institute of Economic and Social Research (NIESR) estimated UK GDP grew by 0.6% in the three months to July, after a 0.9% growth in the previous three months.

The Canadian dollar rose against the U.S. dollar due to the better-than-expected trade data from Canada. Canada's trade surplus jumped to C$1.86 billion in June from C$0.58 billion in May, beating expectations for a deficit of C$0.10 billion. May's figure was revised up from a deficit of C$0.15 billion.

The Swiss franc traded lower against the U.S. dollar. Consumer price index in Switzerland declined 0.4% in July, beating forecasts of a 0.5% fall, after 0.1% decrease in June.

On a yearly basis, Switzerland's consumer price index remained flat in July, in line with expectations.

The New Zealand dollar declined to 2-month lows against the U.S dollar after the labour market data from New Zealand, but later recovered its losses. The number of employed people in New Zealand increased 0.4% in the second quarter, missing expectations for a 0.7% rise, after a 0.9% gain in the first quarter.

New Zealand's unemployment rate dropped to 5.6% in the second quarter from 6.0% in the first quarter, beating expectations for a decrease to 5.8%.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded higher against the U.S. dollar due to increasing demand for safe-haven currency. Japan's leading index climbed to 105.5 in June from 104.8 in May, in line with expectations. May's figure was revised down from 105.7.

The coincident index in June fell to 109.4 in June from 111.2 in May.

-

16:20

Gold rose sharply

Gold prices rose sharply to one-week high after reports that numerous Russian troops near the border focus Ukraine.

Gold's appeal as a safe-haven increased after NATO said on Wednesday that Russia has about 20,000 troops on the eastern border of Ukraine and can be used for the invasion as a pretext humanitarian mission or peacekeeping.

On Tuesday, Russian President Vladimir Putin ordered the government to prepare to retaliate against American and European sanctions imposed on Moscow last week for the support of the pro-Russian rebels in eastern Ukraine.

Gold is often seen as a safe haven for investment in times of geopolitical instability.

The growth of gold was caused by the weak data from several European countries, including Germany and the UK.

In Germany, the volume of orders, industrial enterprises fell in June by 3.2% compared with the previous month - the maximum decline since September 2011.

In the UK in June industrial output growth fell short of expectations: it reached 0.3% from the previous month and 1.2% on an annualized basis.

Italy's GDP, the third-largest eurozone economy, in April-June decreased by 0.2% compared with the previous quarter, which was a decline of 0.1%. In annual terms, the economy has lost 0.3% after contracting a revised 0.4% in January-March.

Trade deficit the United States in June 2014 decreased by 7% to its lowest since January, $ 41.5 billion. In May, according to revised data, the deficit was $ 44.7 billion instead of $ 44.4 billion, as previously reported.

The cost of the August gold futures on the COMEX today rose to $ 1309.00 per ounce.

-

15:30

U.S.: Crude Oil Inventories, July -1.8

-

15:00

United Kingdom: NIESR GDP Estimate, July +0.6%

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3380, $1.3400, $1.3465, $1.3500, $1.3600, $1.3680

USD/JPY Y102.00, Y102.30, Y102.80

GBP/USD $1.7000

AUD/USD $0.9300

USD CAD C$1.0800, C$1.0895, C$1.1000

-

14:34

U.S. Stocks open: Dow 16,417.33 -12.14 -0.07%, Nasdaq 4,326.96 -25.88 -0.59%, S&P 1,915.76 -4.45 -0.23%

-

14:29

Before the bell: S&P futures -0.39%, Nasdaq futures -0.58%

U.S. stock futures fell amid concern that the Ukraine crisis will escalate and as Sprint Corp. and Time Warner (TWX) Inc. tumbled on merger news.

Global markets:

Nikkei 15,159.79 -160.52 -1.05%

Hang Seng 24,584.13 -64.13 -0.26%

Shanghai Composite 2,217.46 -2.48 -0.11%

FTSE 6,601.43 -81.05 -1.21%

CAC 4,179.18 -53.70 -1.27%

DAX 9,071.81 -117.93 -1.28%

Crude oil $97.60 (+0.23%)

Gold $1303.20 (+1.38%)

-

14:11

DOW components before the bell

(company / ticker / price / change, % / volume)

JPMorgan Chase and Co

JPM

55.55

-0.91%

2.1K

Caterpillar Inc

CAT

100.72

-0.77%

0.3K

Microsoft Corp

MSFT

42.75

-0.77%

22.0K

Intel Corp

INTC

32.62

-0.61%

11.4K

Verizon Communications Inc

VZ

49.36

-0.60%

98.2K

Pfizer Inc

PFE

28.25

-0.56%

6.2K

Goldman Sachs

GS

168.50

-0.54%

1.7K

AT&T Inc

T

34.96

-0.43%

76.9K

Visa

V

209.75

-0.38%

0.6K

Home Depot Inc

HD

79.74

-0.36%

0.3K

3M Co

MMM

139.29

-0.35%

1.6K

Johnson & Johnson

JNJ

99.49

-0.33%

4.9K

Boeing Co

BA

120.16

-0.32%

2.3K

International Business Machines Co...

IBM

185.40

-0.32%

11.6K

McDonald's Corp

MCD

93.15

-0.30%

4.1K

Cisco Systems Inc

CSCO

24.90

-0.28%

7.7K

American Express Co

AXP

86.13

-0.27%

1.1K

Exxon Mobil Corp

XOM

97.95

-0.25%

3.6K

Merck & Co Inc

MRK

55.89

-0.25%

0.9K

The Coca-Cola Co

KO

39.11

-0.18%

2.7K

Procter & Gamble Co

PG

79.29

-0.15%

0.1K

Wal-Mart Stores Inc

WMT

72.82

-0.05%

0.6K

Walt Disney Co

DIS

86.73

-0.02%

6.8K

UnitedHealth Group Inc

UNH

80.99

0.00%

4.1K

General Electric Co

GE

25.14

+0.48%

87.3K

Chevron Corp

CVX

125.00

+0.03%

3.0K

-

14:06

Upgrades and downgrades before the market open

Upgrades:

General Electric (GE) upgraded from Mkt Perform to Outperform at Bernstein, target raised from $29 to $33

Downgrades:

Other:

Walt Disney (DIS) target raised from $89 to $92 at RBC Capital Mkts

American Intl (AIG) target raised from $64 to $65 at RBC Capital Mkts

-

13:30

U.S.: International Trade, bln, June -41.5 (forecast -44.2)

-

13:30

Canada: Trade balance, billions, June +1.9 (forecast -0.1)

-

13:07

Foreign exchange market. European session: the euro decreased against the U.S. dollar after the weak factory orders in Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index June 104.8 105.5 105.5

05:00 Japan Coincident Index June 111.3 109.4

06:00 Germany Factory Orders s.a. (MoM) June -1.6% Revised From -1.7% +0.5% -3.2%

06:00 Germany Factory Orders n.s.a. (YoY) June +5.5% -4.3%

07:00 United Kingdom Halifax house price index July -0.6% +1.4%

07:00 United Kingdom Halifax house price index 3m Y/Y July +8.8% +10.2%

07:15 Switzerland Consumer Price Index (MoM) July -0.1% -0.5% -0.4%

07:15 Switzerland Consumer Price Index (YoY) July 0.0% 0.0% 0.0%

08:30 United Kingdom Industrial Production (MoM) June -0.7% +0.6% +0.3%

08:30 United Kingdom Industrial Production (YoY) June +2.3% +1.5% +1.2%

08:30 United Kingdom Manufacturing Production (MoM) June -1.3% +0.7% +0.3%

08:30 United Kingdom Manufacturing Production (YoY) June +3.7% +2.1% +1.9%

The U.S. dollar traded higher against the most major currencies ahead of the trade balance data in the U.S. The U.S. trade deficit is expected to decline to $44.2 billion in June from a deficit of $44.4 billion in May.

The euro decreased against the U.S. dollar after the weak factory orders in Germany. Factory orders in Germany dropped 3.2% in June, missing forecasts of a 0.5% increase, after a 1.6% decline in May. That was the biggest drop since September 2011.

May's figure was revised up from a 1.7% fall.

The British pound declined against the U.S. dollar after the weaker-than-expected industrial production in the UK. Industrial production increased 0.3% in June, missing expectations for a 0.6% rise, after a 0.6% decline in May. May's figure was revised up from a 0.7% decrease.

On a yearly basis, industrial production rose 1.2% in June, missing expectations for an increase of 1.5%, after 2.3% gain in May.

Manufacturing production climbed 0.3% in June, missing forecasts of a 0.7% rise, after a 1.3% fall in May.

On a yearly basis, manufacturing production jumped 1.9% in June, after a 3.7% increase. Economists had expected a rise of 2.1%.

The Swiss franc dropped against the U.S. dollar. Consumer price index in Switzerland declined 0.4% in July, beating forecasts of a 0.5% fall, after 0.1% decrease in June.

On a yearly basis, Switzerland's consumer price index remained flat in July, in line with expectations.

EUR/USD: the currency pair declined to $1.3332

GBP/USD: the currency pair fell to $1.6820

USD/JPY: the currency pair was down to Y102.29

The most important news that are expected (GMT0):

12:30 Canada Trade balance, billions June -0.2 -0.1

12:30 U.S. International Trade, bln June -44.4 -44.2

14:00 United Kingdom NIESR GDP Estimate July +0.9%

14:30 U.S. Crude Oil Inventories July -3.7

23:30 Australia AiG Performance of Construction Index July 51.8

-

13:01

Orders

EUR/USD

Offers $1.3530, $1.3500-10, $1.3485, $1.3445-50, $1.3400

Bids $1.3320, $1.3300, $1.3295

GBP/USD

Offers $1.6700, $1.6926, $1.6900

Bids $1.6800, $1.6785/80, $1.6750, $1.6700-693

AUD/USD

Offers $0.9400, $0.9375/80, $0.9350

Bids $0.9275, $0.9250, $0.9200

EUR/JPY

Offers Y138.80, Y138.50, Y138.00, Y137.30

Bids Y136.75, Y136.60, Y136.35, Y136.00

USD/JPY

Offers Y104.00, Y103.50, Y103.15, Y102.90

Bids Y102.30, Y102.25/20, Y102.00, Y101.80

EUR/GBP

Offers stg0.8100, stg0.8000, stg0.7985, stg0.7960

Bids stg0.7900, stg0.7885, stg0.7870

-

12:00

European stock markets mid session: stocks traded lower due to tensions over Ukraine and weak factory orders in Germany

Stock indices traded lower due to tensions over Ukraine and weak factory orders in Germany. Poland's foreign minister warned that Russia is about to increase its presence along its border with Ukraine.

Factory orders in Germany dropped 3.2% in June, missing forecasts of a 0.5% increase, after a 1.6% decline in May. That was the biggest drop since September 2011.

May's figure was revised up from a 1.7% fall.

Current figures:

Name Price Change Change %

FTSE 100 6,600.01 -82.47 -1.23%

DAX 9,043.3 -146.44 -1.59%

CAC 40 4,173.76 -59.12 -1.40%

-

11:21

Currency pair GBP/USD declines due to the weaker-than-expected industrial production in the UK

The Office for National Statistics in the UK released industrial production data. Industrial production increased 0.3% in June, missing expectations for a 0.6% rise, after a 0.6% decline in May. May's figure was revised up from a 0.7% decrease.

On a yearly basis, industrial production rose 1.2% in June, missing expectations for an increase of 1.5%, after 2.3% gain in May.

Manufacturing production climbed 0.3% in June, missing forecasts of a 0.7% rise, after a 1.3% fall in May.

On a yearly basis, manufacturing production jumped 1.9% in June, after a 3.7% increase. Economists had expected a rise of 2.1%.

-

10:31

Asian Stocks close: stocks closed lower due to tensions over Ukraine

Asian stock indices closed lower due to tensions over Ukraine. Poland's foreign minister warned that Russia is about to increase its presence along its border with Ukraine. Market participants preferred safe-haven assets.

Japan's leading index climbed to 105.5 in June from 104.8 in May, in line with expectations. May's figure was revised down from 105.7.

The coincident index in June fell to 109.4 in June from 111.2 in May.

Indexes on the close:

Nikkei 225 15,159.79 -160.52 -1.05%

Hang Seng 24,584.13 -64.13 -0.26%

Shanghai Composite 2,217.46 -2.48 -0.11%

-

10:26

Option expiries for today's 1400GMT cut

EUR/USD $1.3380, $1.3400, $1.3465, $1.3500, $1.3600, $1.3680

USD/JPY Y102.00, Y102.30, Y102.80

GBP/USD $1.7000

AUD/USD $0.9300

USD CAD C$1.0800, C$1.0895, C$1.1000

-

09:55

Foreign exchange market. Asian session: the New Zealand dollar declined to 2-month lows against the U.S dollar after the labour market data from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index June 104.8 105.5 105.5

05:00 Japan Coincident Index June 111.3 109.4

06:00 Germany Factory Orders s.a. (MoM) June -1.6% Revised From -1.7% +0.5% -3.2%

06:00 Germany Factory Orders n.s.a. (YoY) June +5.5% -4.3%

07:00 United Kingdom Halifax house price index July -0.6% +1.4%

07:00 United Kingdom Halifax house price index 3m Y/Y July +8.8% +10.2%

07:15 Switzerland Consumer Price Index (MoM) July -0.1% -0.5% -0.4%

07:15 Switzerland Consumer Price Index (YoY) July 0.0% 0.0% 0.0%

08:30 United Kingdom Industrial Production (MoM) June -0.7% +0.6% +0.3%

08:30 United Kingdom Industrial Production (YoY) June +2.3% +1.5% +1.2%

08:30 United Kingdom Manufacturing Production (MoM) June -1.3% +0.7% +0.3%

08:30 United Kingdom Manufacturing Production (YoY) June +3.7% +2.1% +1.9%

The U.S. dollar traded higher against the most major currencies. The U.S. currency was supported by yesterday's better-than-expected ISM non-manufacturing PMI and factory orders in the U.S. The ISM non-manufacturing PMI increased to 58.7 in July, from 56.0 in June, exceeding expectations for a rise to 56.6. That was the highest level since January 2008.

Factory orders in the U.S. jumped 1.1% in June, beating expectations for a 0.6% rise, after a 0.6% fall in May.

The New Zealand dollar declined to 2-month lows against the U.S dollar after the labour market data from New Zealand. The number of employed people in New Zealand increased 0.4% in the second quarter, missing expectations for a 0.7% rise, after a 0.9% gain in the first quarter.

New Zealand's unemployment rate dropped to 5.6% in the second quarter from 6.0% in the first quarter, beating expectations for a decrease to 5.8%.

The Australian dollar rose against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded mixed against the U.S. dollar after the economic data from Japan. Japan's leading index climbed to 105.5 in June from 104.8 in May, in line with expectations. May's figure was revised down from 105.7.

The coincident index in June fell to 109.4 in June from 111.2 in May.

EUR/USD: the currency pair declined to $1.3360

GBP/USD: the currency pair decreased to $1.6870

USD/JPY: the currency pair traded mixed

NZD/USD: the currency pair was down to $0.8421

The most important news that are expected (GMT0):

12:30 Canada Trade balance, billions June -0.2 -0.1

12:30 U.S. International Trade, bln June -44.4 -44.2

14:00 United Kingdom NIESR GDP Estimate July +0.9%

14:30 U.S. Crude Oil Inventories July -3.7

23:30 Australia AiG Performance of Construction Index July 51.8

-

09:30

United Kingdom: Industrial Production (MoM), June +0.3% (forecast +0.6%)

-

09:30

United Kingdom: Industrial Production (YoY), June +1.2% (forecast +1.5%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , June +0.3% (forecast +0.7%)

-

09:30

United Kingdom: Manufacturing Production (YoY), June +1.9% (forecast +2.1%)

-

08:38

DAX 9,078.98 -110.76 -1.21%, CAC 40 4,201.53 -31.35 -0.74%, EUROFIRST 300 1,323.72 -10.87 -0.81%, FTSE 100 6,634.12 -48.36 -0.72%

-

08:15

Switzerland: Consumer Price Index (YoY), July 0.0% (forecast 0.0%)

-

08:15

Switzerland: Consumer Price Index (MoM) , July -0.4% (forecast -0.5%)

-

08:00

United Kingdom: Halifax house price index, July +1.4%

-

08:00

United Kingdom: Halifax house price index 3m Y/Y, July +10.2%

-

07:00

Germany: Factory Orders s.a. (MoM), June -3.2% (forecast +0.5%)

-

06:27

Options levels on wednesday, August 6, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3503 (2985)

$1.3457 (2914)

$1.3417 (1205)

Price at time of writing this review: $ 1.3365

Support levels (open interest**, contracts):

$1.3333 (3220)

$1.3294 (2935)

$1.3248 (1332)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 34510 contracts, with the maximum number of contracts with strike price $1,3600 (4223);

- Overall open interest on the PUT options with the expiration date August, 8 is 33929 contracts, with the maximum number of contracts with strike price $1,3500 (5867);

- The ratio of PUT/CALL was 0.98 versus 0.98 from the previous trading day according to data from August, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (2740)

$1.7000 (1146)

$1.6902 (926)

Price at time of writing this review: $1.6866

Support levels (open interest**, contracts):

$1.6799 (3815)

$1.6700 (1096)

$1.6600 (431)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 19683 contracts, with the maximum number of contracts with strike price $1,7100 (2740);

- Overall open interest on the PUT options with the expiration date August, 8 is 26370 contracts, with the maximum number of contracts with strike price $1,6800 (3815);

- The ratio of PUT/CALL was 1.34 versus 1.33 from the previous trading day according to data from August, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:04

Japan: Leading Economic Index , June 105.5 (forecast 105.5)

-

06:03

Japan: Coincident Index, June 109.4

-

03:00

Nikkei 225 15,199.55 -120.76 -0.79%, Hang Seng 24,513.7 -134.56 -0.55%, Shanghai Composite 2,212 -7.94 -0.36%

-