Notícias do Mercado

-

23:52

Japan JP Foreign Reserves fell from previous $1238.1B to $1194.6B in October

-

23:51

Silver Price Analysis: Monday’s “hanging man” teases XAGUSD sellers below $21.00

- Silver price remains pressured after reversing from one-month high.

- Bearish candlestick formation, RSI’s nearness to overbought conditions favor short-term downside.

- Convergence of 200-DMA, three-month-old ascending trend line appears a tough nut to crack for bulls.

Silver price (XAGUSD) keeps the week-start losses around $20.75 during Tuesday’s Asian session. In doing so, the bright metal justifies the previous day’s bearish candlestick formation, namely the “hanging man”, at the one-month high.

Also supporting the short-term bearish bias is the RSI (14) which is near the overbought conditions.

It should be noted that the previous weekly top near $20.10 and the $20.00 could test the XAGUSD bears before directing them to the $19.45 support confluence including the 100-DMA and an upward-sloping trend line from October 14.

In a case where silver price remains bearish past $19.45, a gradual downturn towards the previous monthly low near $18.10 can’t be ruled out. During the fall, the $19.00 threshold may act as an intermediate halt.

On the flip side, a daily closing beyond October’s peak of $21.24 defies the bearish “hanging man,” candlestick.

Even so, a convergence of the 200-DMA and an ascending trend line from August, close to $21.50, will be a strong resistance for the XAGUSD bulls to cross.

Should the metal buyers manage to conquer the $21.50 hurdle, the odds of witnessing a run-up toward the mid-2022 peak surrounding $22.50 can’t be ruled out.

Silver price: Daily chart

Trend: Further weakness expected

-

23:39

EURJPY Price Analysis: Golden Cross strengthens euro bulls, 147.70 a critical resistance

- The cross is struggling to cross the 147.00 hurdle in the Asian session.

- An oscillation in the bullish range by the RSI (14) indicates that upside momentum is active.

- A golden cross, represented by the 50-and 200-EMAs at 145.90 indicates a bullish trend reversal.

The EURJPY pair is struggling to overstep the round-level resistance of 147.00 in the early Tokyo session. The asset has been advancing continuously for the past three trading sessions after sensing buying interest around 144.23.

Overall optimism in the risk sentiment is keeping the Shared Currency bulls in power. Apart from that, the sneaking intervention approach by the Bank of Japan (BOJ) in the currency market is failing to prevent the Japanese yen from further depreciation.

On an hourly scale, the cross has extended its recovery after overstepping the crucial resistance of 146.00. Going forward, a horizontal resistance placed from October 25 high at 147.73 will remain a key hurdle.

A golden cross, represented by the 50-and 200-period Exponential Moving Averages (EMAs) at 145.90, has underpinned the Eur bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which indicates the continuation of upside momentum.

Should the asset break above October 25 high at 147.73, the shared currency bulls will send the asset toward October 21 high at 148.40, followed by the psychological resistance at 150.00.

On the flip side, the cross will be dragged to near October 13 and October 10 lows at 141.76 and 140.90 respectively if it drops below Thursday’s low at 144.00.

EURJPY hourly chart

-638034611211000373.png)

-

23:36

Fed's Barkin: We will persist until inflation comes down

Richmond Federal Reserve President Thomas Barkin has crossed the wires.

Key comments

- We will persist until inflation comes down.

- We are seeing promising signs of inflation.

- It would have made sense for the Fed to start tightening earlier

On Friday he said he is ready to act more "deliberatively" on consideration of the pace of Fed rate hikes going forward but said rates could continue rising for longer and to a higher end point than previously expected.

Speaking in a CNBC interview, Barkin said:

"When you get your foot on the brake, you think about steering in a very different way. You pump the brakes, and sometimes you act a little bit more deliberatively, and I'm ready to do that. And I think the implication of that is probably a slower rate of pace of rate increases, a longer pace of rate increases and potentially a higher endpoint."

Meanwhile, a bearish US Dollar sentiment emerged from last Friday's activity in the US session. There are signs of some easing of market conditions following last week's mixed Nonfarm Payrolls report that shows that the Unemployment Rate rose to 3.7%. Investors are hopeful that the much sought-after Federal Reserve pivot could be on the horizon that would give relief to global stock markets. Consequently, US yields and the greenback are stalling.

-

23:32

AUDUSD retreats towards 0.6450 as market’s optimism stalls, Aussie data softens

- AUDUSD bulls take a breather at one-week high, pauses two-day uptrend.

- Australia’s Westpac Consumer Confidence eased in November, inflation expectations rally.

- Markets turn dicey in search of fresh clues as previous risk-on mood fades.

- Aussie NAB data, headlines from China, US can entertain traders ahead of Thursday’s US CPI.

AUDUSD prints mild losses around 0.6470 as bulls take a breather around the weekly top following a two-day uptrend. In doing so, the Aussie pair takes clues from the downbeat data from home, as well as from the market’s cautious mood.

That said, Australia’s Westpac Consumer Confidence slumped to -6.9% in November versus -0.9% prior.

Earlier in the day, the weekly print of ANZ-Roy Morgan Consumer Confidence dropped to the lowest levels since April 2020, to 78.7 at the latest. The details of the report also mentioned that the inflation expectations were the highest since the data was first released in April 2010.

Elsewhere, optimism surrounding the US Federal Reserve’s (Fed) rate hikes faded after the policymakers suggest nearness to the pivot rate. Also weighing on the US dollar could be the recently mixed US jobs report and a Reuters report suggesting that four policymakers were favoring smaller rate hikes.

Against this backdrop, Wall Street closed with gains and the US Treasury yields were firmer too. However, the US Dollar Index (DXY) remained pressured. That said, S&P 500 Futures remain directionless at the latest.

Moving on, AUDUSD pair traders may await the National Australia Bank’s (NAB) Business Conditions and Business Confidence indices for October for immediate directions. However, major attention will be given to Thursday’s key US Consumer Price Index (CPI) for October.

To sum up, AUDUSD buyers need fresh catalysts to extend the latest run-up, in absence of which the bears are ready to retake control, at least ahead of Thursday’s US CPI.

Technical analysis

AUDUSD bears can remain hopeful unless the quote offers a daily closing beyond the 0.6410-15 resistance confluence including the 50-DMA and a one-month-old descending trend line.

-

23:32

Poll: US President Joe Biden's public approval rating slips to 39%

Reuters reports on an Ipsos poll that has the US President Joe Biden's public approval rating slipping to 39%. This comes ahead of this week's midterm elections, where control of both chambers of Congress and dozens of governorships are on the line.

The polls suggest a Republican majority in the House and Senate, which is in line with historical relationships as well as the low approval ratings of President Biden due to the economy, inflation, and crime.

-

23:31

Japan Labor Cash Earnings (YoY) came in at 2.1%, above forecasts (2%) in September

-

23:31

Australia Westpac Consumer Confidence down to -6.9% in November from previous -0.9%

-

23:30

Japan Overall Household Spending (YoY) registered at 2.3%, below expectations (2.7%) in September

-

23:19

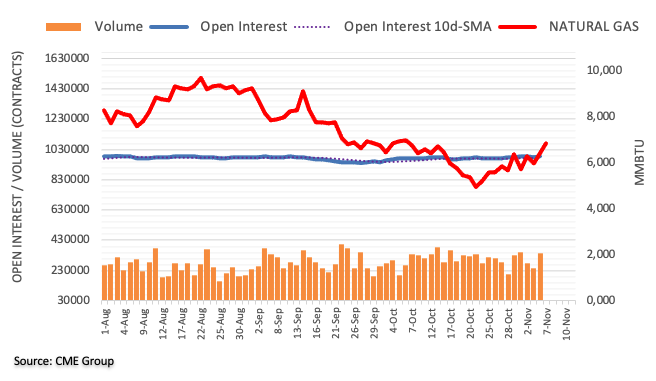

WTI falls into the hands of the bears as China stays committed to zero covid policy

- WTI stalls on the bid and slumps into the close of the day.

- Bears take note of China's commitment to zero-Covid policy.

West Texas Intermediate, WTI, was lower at the start of the week with Officials at China’s National Health Commission saying the country will “unswervingly” adhere to current virus controls. At the time of writing, black gold is trading at $91.87 and down 0.67% falling from $93.73 to $90.45bbls. China said it remains committed to its zero-Covid policy that has lowered economic growth and oil demand.

In future, as a consequence, WTI crude for December delivery closed down US$0.82 to US$91.79 per barrel. The officials on the weekend said the country will continue with the mass quarantines of major centres and regions when outbreaks of Covid-19 occur, Reuters reported. The statements ended hopes the country would move away from the policy and focus on growth. This followed rumours that a committee had been set up to consider how to ease restrictions.

''Nevertheless, the near-term fundamentals remain bullish. Futures opened sharply lower on Monday but slowly gained over the course of the day as the focus returned to supply side issues,'' analysts at ANZ Bank said.

''OPEC has begun reducing output in line with the agreement to reduce quotas by 2mb/d at its last meeting. The market is also facing the deadline for European imports of Russian oil before sanctions kick in on 5 December. This has left fuel inventories tight, with Brent crude oil futures flirting with USD100/bbl during the session.''

-

23:18

United States Consumer Credit Change came in at $24.98B below forecasts ($30B) in September

-

23:18

Australia AiG Performance of Services Index: 47.7 (October) vs previous 48

-

23:08

USDCAD remains sideways below 1.3500 as investors await US midterm elections

- USDCAD is juggling below 1.3500 as investors have shifted their focus toward US mid-term elections.

- The risk profile is extremely solid and is keeping the DXY on the back foot.

- The speech from BOC Macklem will dictate the likely monetary policy action ahead.

The USDCAD pair is displaying back-and-forth moves in a narrow range below the psychological resistance of 1.3500 in the early Asian session. The asset has turned sideways as investors are awaiting the US mid-term elections, which will set the ground ahead of the US Consumer Price Index (CPI) data.

The risk profile is certainly solid as S&P500 displayed handsome returns on Monday while the US dollar index (DXY) was being punished as odds for the continuation of 75 basis points (bps) rate hike pace won’t sustain for longer. The DXY has dropped to near 110.00 and a majority win of the Democratic will strengthen the positive risk profile further.

Meanwhile, the returns on US government bonds have not faced any pressure and are continuing their gradual upside. The 10-year US Treasury yields have been recorded at 4.225, at the press time.

The contest among 435 seats of the House of Representatives and 34 seats of the Senate will determine the extent of the power of the Democratic party. A loss in mid-term elections for the Democratic party would cripple the power of US President Joe Biden as the passing of bills will also demand approval from Republicans. This could also bring a sense of political instability.

A note from ANZ Bank states that “We regard a Republican-controlled Congress as the most likely scenario (55%). Not far behind, at 41%, is a split Congress, with a Republican-led House and a Democrat Senate.”

On the Loonie front, investors are awaiting the speech from Bank of Canada (BOC) Governor Tiff Macklem, which will provide cues about the likely monetary policy action ahead. Meanwhile, the oil prices have corrected to near $91.00 after a smart recovery as a commitment to the no-tolerance Covid-19 approach by the Chinese authorities has raised concerns over oil demand ahead.

-

23:04

Goldman Sachs downgrades three-month EURUSD forecast to 0.9400 from 0.9700

Research Analysts at Goldman Sachs (GS) cut down their EURUSD forecasts in the latest report, published late Monday. That said, the investment bank now expected the major currency pair to reach 0.9400 in the three months versus 0.9700 previous expectations.

While citing the reasons, GS said that for FX markets, the main takeaway from the FOMC meeting last week should be that the Fed acknowledged that "restrictive" is a moving target, and the balance of recent data suggests that the target is moving higher still.

“This matters because policymakers in other jurisdictions have not come close to matching that tone. In recent weeks, we have argued that there is a building case for policy divergence in the Dollar's favor ahead,” adds Goldman.

Additionally, the US bank also mentions, “Following some pivotal policy decisions in recent weeks, we now think this has moved from a risk scenario to the most likely path, which is one reason why we downgraded the near-term outlook for EURUSD.”

Also read: EURUSD struggles to defend 1.0000 level ahead of Eurozone Retail Sales, US inflation

-

23:00

South Korea Current Account Balance up to 1.61B in September from previous -3.05B

-

22:51

USDCHF Price Analysis: Bears poke 50-day EMA, five-week-old support line below 0.9900

- USDCHF bears struggle to extend two-day downtrend near a one-week low.

- MACD signals further downside but RSI, key supports challenge bears.

- Buyers need validation from 21-DMA to retake control.

USDCHF bears take a breather around a one-week low as the quote seesaws near 0.9885 during Tuesday’s Asian session. In doing so, the Swiss Franc (CHF) pair struggles with the 50-day EMA and an upward-sloping support line from September 30.

It’s worth noting that the MACD signals are in favor of the bears targeting a clear downside break of the 0.9880-70 immediate support zone. However, the steady RSI (14) suggests further grinding of the USDCHF prices.

As a result, another support line from August 11, close to 0.9830 at the latest, gains major attention.

Should the quote drops below 0.9830, the odds of witnessing a slump toward the late September swing low near 0.9740 can’t be ruled out. That said, the 0.9800 threshold could act as a buffer during the fall.

Alternatively, recovery moves need to cross the 21-day EMA level surrounding 0.9950 to convince the USDCHF pair buyers.

Even so, the 1.0000 parity level could challenge the upside momentum.

Following that, multiple hurdles near 1.0070 might act as the last defense of the USDCHF bears, a break of which will highlight the yearly peak of 1.0147 for the bulls.

USDCHF: Daily chart

Trend: Recovery expected

-

22:47

AUDJPY Price Analysis: Breaks above the 50/100-DMA eyeing 96.00 on risk-on mood

- AUDJPY remains trapped in a 250 pip range amid the lack of conviction of AUD and JPY traders.

- From a daily chart perspective, the AUDJPY is range-bound.

- Short term, the AUDJPY might pull back before challenging the top of the range at 95.60.

The AUDJPY advances for two consecutive days as Wall Street finishes the Monday session with solid gains, reflecting an improvement in market sentiment, as US midterm elections loom as traders brace for US inflation figures late in the week. In the FX space, risk-perceived currencies like the Aussie Dollar got bolstered, while safe-havens are trading with losses. Therefore, the AUDJPY is trading at 94.95, up by 0.03% as the Asian session begins.

AUDJPY Price Analysis: Technical outlook

From a daily chart perspective, the AUDJPY is neutral biased, as shown by the 50 and 100-day Exponential Moving Averages (EMAs) trendless, trapped within the 94.22/57 range. Additionally, the AUDJPY is range-bound within 94.20-95.60. At the same time, the Relative Strength Index (RSI) at 54.91, in bullish territory, suggests the cross could be headed upwards. Still, RSI needs to clear the 60 figure, which would indicate to AUDJPY traders that buyers are gathering momentum.

The AUDJPY one-hour timeframe depicts price action cleared the 100 and 200-hour EMAs, which would open the door for further gains if their slopes were not flat. Unless the AUDJPY clears last Friday's daily high at 95.97, a pullback towards the 200-hour EMA as its first target, followed by additional downside, is on the cards.

Hence, the AUDJPY first support would be the 200-hour EMa at 94.50, followed by the confluence of the S1 daily pivot and the 50-hour EMA at 94.39, followed by the 100-hour EMA at 94.20, ahead of the S2 daily pivot at 93.90.

On the other hand, a resumption to the upside needs to clear 95.60. Once done, the next supply zone would be the November 1 swing high at 95.55, followed by the 96.00 figure.

AUDJPY Key Technical Levels

-

22:38

GBPUSD retreats to 1.1500 despite UK’s political optimism, US inflation, British GDP eyed

- GBPUSD seesaws near a one-week high while struggling to defend the previous two-day uptrend.

- UK PM Sunak to strike LNG deal with the US, Chancellor Hunt could announce tax raid on inheritance.

- Hopes of Fed’s pivot weighed on the US dollar ahead of the key inflation data.

- UK’s Q3 GDP, fiscal policy announcements will also be important for near-term directions.

GBPUSD struggles to extend the two-day uptrend during Tuesday’s Asian session, easing back to 1.1505, as bulls take a breather amid a light calendar. In doing so, the Cable pair fails to cheer the upbeat news from the UK while waiting for the week’s key events.

Rishi Sunak is poised to announce a major gas deal with America after the Cop27 climate change summit, The Telegraph can disclose. “Talks about the “energy security partnership” are in their final stages, with the US planning to sell billions of cubic meters of Liquefied Natural Gas (LNG) to Britain over the coming year,” the news adds.

The reason for the GBPUSD buyer’s retreat could be linked to another news suggesting that the UK Chancellor Jeremy Hunt is set to announce a new tax raid on inheritance, per the UK Telegraph. The news also mentioned that Chancellor Hunt and Prime Minister (PM) Rishi Sunak are understood to have agreed to freeze the threshold above which people must pay tax for another two years.

Elsewhere, recently mixed comments from the US Federal Reserve (Fed) policymakers, suggesting a halt in the strong rate hike trajectory, especially after Friday’s mixed US jobs report, appeared to have drowned the US dollar in the last two days. On the same line could be the expectations from the US Midterm Elections suggesting more support for easy policies as the latest polls hint at the Republican’s victory in at least one house.

Against this backdrop, Wall Street closed with gains and the US Treasury yields were firmer too. However, the US Dollar Index (DXY) remained pressured.

Looking forward, there are no major data from the UK and the US to be released before Thursday’s key US Consumer Price Index (CPI) for October and the British Gross Domestic Product (GDP) for the third quarter (Q3), up for publishing on Friday. While fears of the UK’s economic pain could keep the bears hopeful, downbeat US inflation numbers may help the DXY bears to extend their latest ruling, which in turn could favor the GBPUSD bulls. Additionally, the UK’s fiscal policy announcements, up for November 17, appear the key for the pair buyers to watch amid high hopes from the new government.

Technical analysis

GBPUSD bulls will have a tough time ahead as the three-month-old resistance line and the 100-DMA, respectively near 1.1555 and 1.1680, stand tall to challenge the Cable pair’s further upside.

-

22:28

NZDUSD Price Analysis: Sees an upside on a break above the 0.5950 resistance area

- Kiwi bulls are eyeing a break above the immediate hurdle of 0.5950 for upside momentum.

- Sustainability above the 38.2% Fibo retracement has underpinned the Kiwi dollar against the Greenback.

- A golden cross, represented by the 50-and 200-EMAs adds to the upside filters.

The NZDUSD pair is struggling to cross the critical hurdle of 0.5940 in the Tokyo session. Odds are favoring an upside as the risk impulse is extremely positive. The S&P500 index continued its bullish performance on Monday after a positive Friday.

Meanwhile, the US dollar index (DXY) has witnessed a steep fall after failing to sustain above the crucial resistance of 111.00. Rising expectations of a slowdown in the pace of rate hikes by the Federal Reserve (Fed) have significantly trimmed the DXY’s appeal. Now, the focus has shifted to US mid-term elections, which will provide a decision price action ahead.

On a four-hour scale, the asset is hovering around the immediate hurdle of 0.5950. The sustainability of the asset above the 38.2% Fibonacci (Fibo) retracement (placed from August 12 high at 0.6470 to October 13 low of 0.5512) at 0.5880 has strengthened the antipodean against the Greenback.

A golden cross, represented by the 50-and 200-period Exponential Moving Averages (EMAs) at 0.5784, has underpinned the Kiwi dollar.

Meanwhile, the Relative Strength Index (RSI) (14) is focusing on keeping itself above 60.00 for bullish momentum.

Going forward, a break above the immediate hurdle of 0.5950 will send the asset toward the psychological resistance of 0.6000, followed by 61.8% Fibo at 0.6108.

Alternatively, a downside break below 23.6 Fibo at 0.5742 will drag the asset toward the round-level support at 0.5600. A slippage below the latter will drag the asset toward October 13 low of 0.5512.

NZDUSD four-hour chart

-638034568340038375.png)

-

22:14

EURUSD struggles to defend 1.0000 level ahead of Eurozone Retail Sales, US inflation

- EURUSD keeps two-day uptrend near a weekly high, sidelined of late.

- Risk-on mood, hawkish ECBspeak and firmer EU data underpin bullish bias amid a light calendar.

- Chatters surrounding US Mid-Term elections, nearness to Fed’s pivot also favored buyers.

- Eurozone Retail Sales for September will be important for the day, US inflation is the key.

EURUSD retreats to 1.0015 during Tuesday’s Asian session as bulls take a breather following a sharp run-up in the last two days. Even so, the bulls keep the reins ahead of Eurozone Retail Sales, as well as the US Consumer Price Index (CPI) for October.

Firmer sentiment joined upbeat EU data and hawkish comments from the European Central Bank (ECB) officials to favor the EURUSD buyers. On the same line were talks surrounding the Federal Reserve’s (Fed) pivot point and the Republicans’ victory in the US Midterm Elections.

Germany’s Industrial Production offered a positive surprise of 0.6% MoM during September versus -0.8% expected and downwardly revised prior of -1.2%. Further, the Eurozone Sentix Investor Confidence index improved to -30.9 in November from -38.3 in October versus -35.0 expected. The index rebounded from its lowest level since March 2020.

Elsewhere, “As long as underlying inflation has not peaked, we shouldn’t stop rate hikes,” the European Central Bank (ECB) Governing Council member and French central bank governor Francois Villeroy de Galhau said in an interview with the Irish Times on Monday. It should be noted that European Union (EU) economic commissioner Paolo Gentiloni mentioned that the bloc’s economy will shrink in the coming months due to the energy crisis and high inflation. Additionally, the EU Commission Executive and Vice President Valdis Dombrovskis signaled the updated economic forecasts for the EU would show a further weakening of the economy and high levels of inflation.

On the other hand, Friday’s mixed US employment data and recently downbeat comments from the Fed policymakers suggested that the US central bank is near the pivot and may ease on the rate hike trajectory.

Talking about the US Midterm Elections, the Australia and New Zealand Banking Group (ANZ) said, “Recent polling indicates that the Republicans will take control of the House of Representatives, with control of the Senate going down to the wire. Markets are expected to react positively to Republican control because even controlling one house would limit fiscal spending. Additional fiscal spending has the potential to undermine tighter monetary policy and therefore is considered a market risk.”

Amid these plays, Wall Street closed with gains and the US Treasury yields were firmer too. However, the US Dollar Index (DXY) remained pressured.

Moving on, the aforementioned risk catalysts could entertain the EURUSD traders and the covid fears, from China, might allow the bulls to take a breather. However, major attention will be given to the Eurozone Retail Sales, expected -1.3% YoY versus -2.0% prior. Should the scheduled data improve, the major currency pair can extend the latest rebound to cross the key 100-DMA hurdle. Following that, the US inflation data will be the key amid the downbeat Fedspeak.

Technical analysis

Unless providing a daily closing below the 50-DMA support near 0.9880, EURUSD bulls are all set to cross the 100-DMA hurdle surrounding 1.0045.

-

21:56

Gold Price Forecast: XAUUSD shifts into a rangebound structure below $1,680 ahead of US Inflation data

- Gold price is oscillating in a $1,673.96-1,681.95 range ahead of US mid-term elections.

- Overall positive sentiment is continuously providing support to the gold bulls.

- The returns on US government bonds are still solid despite rising odds of a slowdown in Fed’s rate hike pace.

Gold price (XAUUSD) is declining gradually after multiple attempts of breaking above the critical hurdle of $1,680.00. Overall positive sentiment is providing support to the gold prices while anxiety ahead of the US Consumer Price Index (CPI) data has capped the upside.

The precious metal has remained in a narrow range of $1,673.96-1,681.95 on Monday despite back-to-back bearish trading sessions in the US dollar index (DXY)’s counter. The DXY dropped to near the psychological support of 110.00 as the market participants believe that a slowdown in the pace of rate hikes by the Federal Reserve (Fed) is certain.

S&P500 advanced by more than 1% as a gradual incline in critical rates won’t impact corporate earnings to a greater extent. While, the 10-year US Treasury yields have not been impacted and are scaling higher, recorded at 4.22% at the time of writing.

On Tuesday, the major trigger for the assets will be developments on US mid-term elections with voting for all 435 seats in Congress and 35 of the 100 seats in the Senate. As strategists at ANZ Bank note, the US Dollar and equity markets tend to finish the month higher after midterms.

Gold technical analysis

On an hourly scale, the gold prices are forming a Bullish Flag chart pattern that signals a continuation of the upside move after the breakout of the consolidation. The 20-period Exponential Moving Average (EMA) at $1,674.87 has acted as major support for the counter.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped into the 40.00-60.00 range but that doesn’t warrant a reversal in the trend.

Gold hourly chart

-

20:54

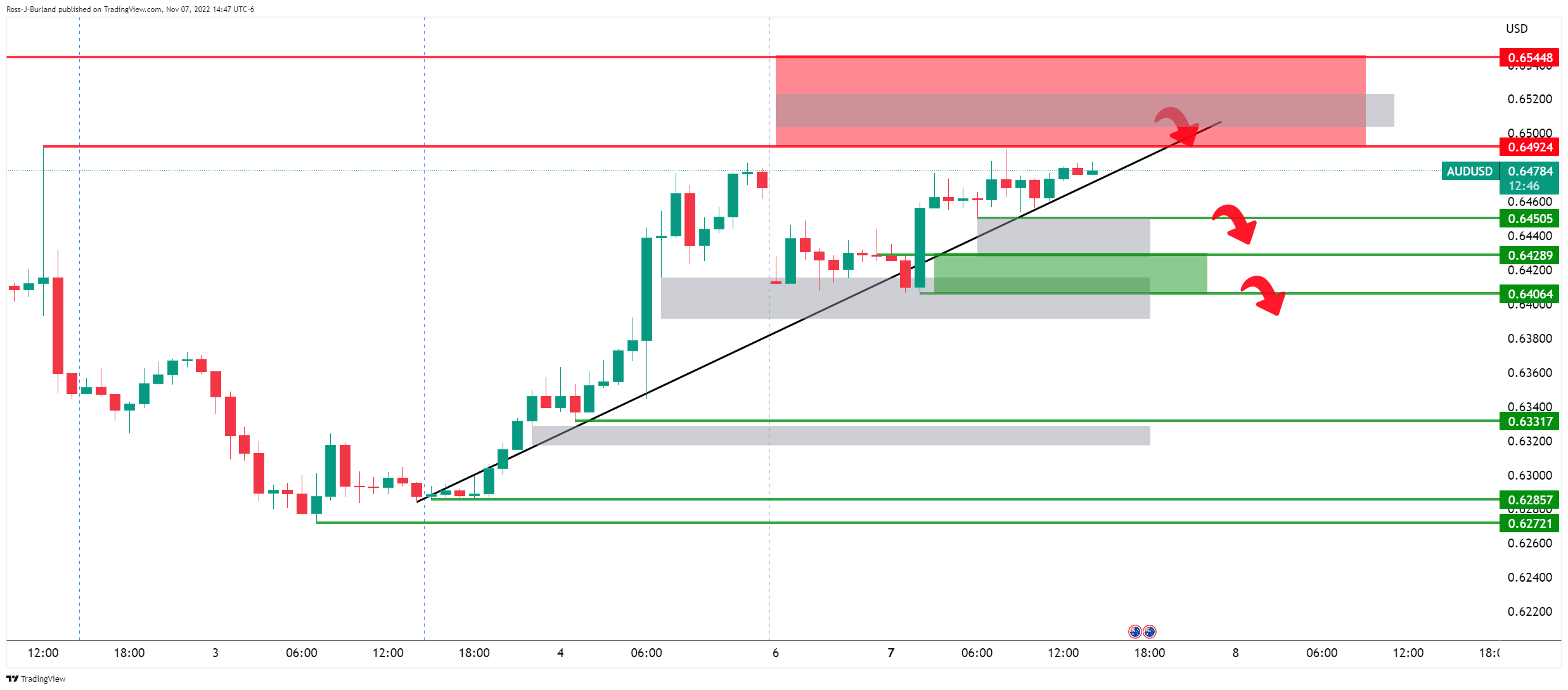

AUDUSD Price Analysis: Bears lurking around last week's highs

- AUDUSD bulls move in on last week's highs in a risk-on setting.

- A break of the highs will open risk to last month's highs, although trendline support could come undone.

AUDUSD has climbed at the start of the week, fididing demand due to a risk-on sentiment that emerged from last Friday's activity in the US session. There are signs of some easing of market conditions following last week's mixed Nonfarm Payrolls report that shows that the Unemployment Rate rose to 3.7%. Investors are hopeful that the much sought-after Federal Reserve pivot could be on the horizon that would give relief to global stock markets. Consequently, Us yields are stalling as the following technical analysis will show and AUDUSD is gathering pace on the bid into last week's highs:

AUDUSD H1 charts

The price is riding trendline support into last week's highs with the prior month's highs thereafter as targets for this week. However, there are a number of price imbalances that have been left behind for the start of the week's business ad the length of Friday's trade could be a target for the bears. If the bears commit at this juncture, then a break of 0.6450 could be significant and fuel interest from sellers. A move below the trendline support will be the first scenario to look out for in that regard.

-

20:09

GBPUSD Price Analysis: Bulls rally into resistance, but eye last week's highs

- GBPUSD bulls move in on Monday to cash in on weakness in the US dollar and yields.

- Cable has reached close to last week's high but may be facing headwinds at resistance.

Cable (GBPUSD) rose on Monday, supported by a risk-on sentiment across markets. there are signs of some easing of market conditions following last week's mixed Nonfarm Payrolls report that shows that the Unemployment Rate rose to 3.7%. This has fuelled hopes that the much sought-after Federal Reserve pivot could be on the horizon. Consequently, Us yields are stalling as the following technical analysis will show and GBPUSD is gathering pace on the bid.

GBPUSD H1 chart

The hourly charts show the price firmly bid with eyes towards last week's highs and then last month's highs in the 1.1616 area and 1.1645s.

GBPUSD M15 chart

Cable is stretched at this juncture into a resistance area on the 15-min charts. A move below the current micro trendline will set the stage for a move back onto to test structure at 1.1450.

US 2-year yields

The daily chart shows that there could be some stalling to come from the 2-year yields given the recent wicks and lower highs. A break of the current support near 4.644% opens risk of a significant move lower to test the trendline supports. In turn, such a switch in yields would likely dent the greenback and support Cable higher.

-

20:07

EURJPY continues appreciating and returns to the 147.00 area

- The euro extends recovery from lows near 144.00 to the 147.00 area.

- The Japanese yen loses ground amid a positive market mood.

- Investors are pricing in easier COVID restrictions in China.

The euro extended gains on Monday, following a sharp recovery from the 144.00 area on Friday, with the pair approaching 147.00 on Monday’s US afternoon trading session.

The yen dives in a risk-on session

In the absence of relevant macroeconomic releases, the positive market sentiment is driving currencies on Monday. Safe-haven assets like the US dollar or the Japanese are suffering, with investors' demand shifting towards riskier assets like the euro or the British pound.

Rumors that China is considering a certain relaxation in the Zero-COVID policy is feeding optimism on Monday. Equity markets have extended their rally, overlooking the denial from the Chinese authorities, that have warned about the possibility of severe restrictions ahead, as the winter flu season approaches.

In the European calendar, the Eurozone Sentix Survey has shown the first improvement in investor sentiment over the last three months. The warmer temperatures in Europe are easing previous fears about gas rationings and allowing moderate declines in energy prices.

Beyond that, the positive Non-Farm Payrolls data seen on Friday continues acting as a tailwind for risk appetite. The tight US labor market conditions add reasons to the Federal Reserve to maintain an aggressive tightening path and a positive policy differential with the Bank of Japan that has pulled the yen nearly 30% lower against the USD, and about 15% down against the euro so far this year.

Technical levels to watch

-

20:01

GBPJPY Price Analysis: Rallies more than 200-pips as risk-aversion fades

- GBPJPY registers gains of more than 1.30%, as buyers eye 170.00.

- The divergence between the GBPJPY price action and the RSI could exacerbate a correction before resuming the uptrend.

- Near term, if the GBPJPY fails to achieve a daily close above 168.90, it could open the door for further downside.

The GBPJPY stages a recovery trimming some of the last week’s losses as market sentiment improves during Monday’s Wall Street session. Factors like US midterm elections and also a mixed US jobs report opened the door for gradual tightening by the Federal Reserve, after hiking four times, 75 bps, for a total of 300 bps in the last meetings, in a period of stubbornly high inflation. At the time of writing, the GBPJPY is trading at 169.06.

GBPJPY Price Analysis: Technical outlook

The GBPJPY depicts the pair as upward biased, eyeing a test of the 170.00 figure, which could exacerbate a rally towards the YTD high reached on October 31 at 172.13. Nevertheless, GBP buyers should be aware that the Relative Strength Index (RSI) at 55.88, albeit in bullish territory, failed to clear the previous peaks as GBPJPY price action did. So a negative divergence could form if the GBPJPY breaks toward new YTD highs, suggesting a pullback is on the cards.

Short term, the GBPJPY hourly chart depicts the pair trades above the 200-hour EMA at 168.90, suggesting that buyers are gathering momentum. Still, unless they achieve a daily close above it, the cross-currency would be vulnerable to selling pressure. Of note, the Relative Strength Index (RSI) at 81.70 portrays the pair as overbought, which could exacerbate a correction lower.

Hence, the GBPJPY first support would be the R2 daily pivot at 168,15, followed by the confluence of the R1 daily pivot and the 100-hour EMA at 167.44 and 167.56, respectively, followed by the 167.00 figure.

GBPJPY Key Technical Levels

-

19:55

ECB's Lagarde: Inflation is ''much too high'', rates will rise further

European Central Bank President Christine Lagarde has repeated that the cycle of interest-rate increases must ensure that inflation returns to the 2% target over the medium term.

''Must bring inflation back to 2%,'' she said in recent trade, adding again that inflation is ‘much too high’'. She said rates will rise more.

Meanwhile, EURUSD is on the up and traders have been of the mind that the US economy is slowing enough to allow the Federal Reserve to ease its rate-hiking pace.

This is weighing on the greenback and the ongoing speculation that China may ease COVID restrictions is also playing a role in the downside at the start of the week.

EURUSD has been approaching last month's highs as the following hourly chart illustrates:

-

19:51

Forex Today: Dollar buyers struggle for a reason

What you need to take care of on Tuesday, November 5:

The week started with the greenback trying to recover the ground lost on Friday, but the American currency ended up losing further ground against its major rivals. The dollar accelerated its decline late in the US session as Wall Street picked up momentum ahead of the close.

Different factors underpinned the market sentiment, one of which is renewed speculation the US Federal Reserve is near a pivot on monetary policy. The central bank is expected to ease the pace of quantitative tightening regardless of Chair Jerome Powell´s hawkish comments. Another factor is China. Despite the number of new coronavirus cases on the rise, investors are once again pricing in easing restrictive measures. Finally, there is some growing speculation Russia and Ukraine may de-escalate the ongoing conflict.

US Treasury yields, however, were also on the rise. The yield on the 10-year note settled at 4.20%, while the 2-year note yield hovers around 4.72%.

The week will be lighter in terms of first-tier events, with the focus on the US Consumer Price Index, foreseen at 8% YoY in October, slightly better than the previous 8.2%.

The EURUSD pair trades in the 1.0030 price zone, its highest in over two weeks. Better than anticipated German data helped the shared currency, with Industrial Production improving by more than anticipated in September.

The GBPUSD pair trades above the 1.1500 level, benefiting from the broad dollar’s weakness. Market participants anticipate UK Chancellor Jeremy Hunt will outline £60 billion in tax increases and spending cuts.

USD/CAD trades right below the 1.3500 threshold, while AUD/USD hovers around 0.6470. Safe-haven currencies appreciated vs their US rival, with USD/CHF currently trading around 0.9880 and USD/JPY at 146.50.

Gold holds on to the previous weekly gains and stands at $1,676 a troy ounce, while crude oil prices ticked higher. WTI currently trades at $92.00 per barrel.

Polkadot price eyes bullish breakout to $10 as $355 million in trading volume comes in}

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:07

USDCAD bears move in again, capping upside breakout attempts

- USDCAD bulls were knocked back as the US Dollar slumps again.

- All eyes are on US CPI and Fed speakers this week.

USDCAD is trading flat on the day following an initial surge in the early part of the New York session into shorts established at the start of the day in Asia and London. At the time of writing, the pair is trading at 1.3490 and has ranged between a high of 1.3553 and a low of 1.3465. The price is consolidating on coiled market conditions in the forex space as investors weigh the risks of this week's Consumer Price Index, (CPI), and midterm elections from the US vs. prospects of heightened risk appetite.

The focus will also be on US inflation data, CPI, for October, due to be released on Thursday, for clues on whether the US Federal Reserve's rapid interest rate hikes are helping cool down the economy. Traders are now betting on 61% odds of a 50-basis point rate hike at the US central bank's meeting in December.

Risk-on, risk-off

Meanwhile, investor sentiment recovered in Asia and London following an initial opening gap in the forex space. The Hang Seng China Enterprise index in Hong Kong rose 2.8%, taking its 5-day gain to 12.6% even as Reuters reported that new Covid cases in China rose to a six-month high of 5,496 on Monday as the nation continues to grapple with new outbreaks.

Nevertheless, Kinger Lau, chief China equity strategist at Goldman Sachs, wrote in a note that China may start to reopen in the second quarter of next year and that a full reopening may drive a 20% upside for the nation’s stocks. Such sentiment has been a weight on the US dollar and positive for high-beta currencies such as the Canadian dollar. Such speculation that China, the world's largest commodity consumer, might open its economy lifted copper by 7% on Friday in its biggest one-day rally since 2009, while oil rose by more than 4% from which the Canadian Dollar benefits.

Additionally, four Federal Reserve policymakers on Friday indicated they would consider a smaller interest rate hike at their next policy meeting, sounding less hawkish than Chair Jerome Powell. There are several Fed officials that are scheduled to speak this week as well. Markets are now narrowly leaning toward a half-point rate hike next month to 4.25-4.5% which can support CAD vs. the US Dollar. Two-year Treasury yields, which are most sensitive to inflation and interest rate expectations are below the highs of the day but remain 1% higher at 4.711%, although now well below 4.88% and Friday's peak.

-

19:04

Silver Price Forecast: XAGUSD subdued around $20.85s amidst an upbeat sentiment

- The Silver price registers a minuscule loss of 0.02% late in the New York session.

- Last week’s US employment data was a headwind for the American Dollar, which tumbled the most since March 2020.

- Silver Price Analysis: Neutral-upwards, and if it pierces $21.00, a test of the YTD high is on the cards.

The Silver price fluctuates in the North American session due to risk appetite improvement after last Friday’s US employment data showed that the economy continues to add jobs, though the Unemployment Rate jumped, signs that the Federal Reserve’s policy is beginning to impact the “tight” labor market. That, alongside uncertainty on US midterm elections and inflation data to be released, keeps the American Dollar on the defensive. At the time of writing, the XAGUSD is trading at $20.82, below its opening price by 0.11%.

An improvement in risk appetite, a headwind for Silver

Wall Street continues to trade in the green, while the US Dollar drops to fresh two-week lows, as shown by the US Dollar Index (DXY). Last week US employment report showed that the economy added more jobs than estimated, meaning that the Fed would need to do more; however, the unemployment rate edged up and is closing to 4% as the labor market flashed signs of easing, meaning that the Fed, could keep tightening, but at a slower rhythm.

Meanwhile, Fed officials began to cross wires. Boston Fed President Susan Collins said it makes sense to slowly hike rates to balance growth and inflation risks as the US central bank tries to achieve a “soft landing.” Nonetheless, it reiterated that rates might be higher than September’s projections. Later, Richmond’s Fed President Thomas Barkin said that the Federal funds rate (FFR) would likely end above 5%, while he foresaw a “potential” higher peak.

That said, XAGUSD rallied since last Friday as speculation that the Fed would lift rates gradually surfaced. Nevertheless, US Treasury bond yields recovered some ground, with the 10-year hup four bps at 4.197%, a headwind for the precious metals. In the meantime, as of Friday, the 10-year US Treasury Real yields stay at 1.72%, providing support for the greenback.

What to watch

Late in the day, further Fed speakers will cross newswires, led by Cleveland’s Fed President Loretta Mester, alongside Boston’s Fed President Susan Collins.

Silver Price Analysis (XAGUSD): Technical outlook

The XAGUSD is neutral-biased, though it should be noted that price action is getting closer to the 200-day Exponential Moving Average (EMA) at $21.49, which could shift the white metal bias to neutral-upwards. If XAGUSD reclaims the latter and clears the June 6 swing high at $22.51, that would turn Silver bullish and pave the way towards the YTD high at $26.94.

Otherwise, the XAGUSD first support would be the $20.00 figure, which, once cleared, could open the door towards the 100-day EMA at $19.46.

-

19:02

EURGBP retreats to 0.8700 area after rejection at 0.8785

- The euro fails to break resistance at 0.8785 and retreats to 0.8700.

- The pound remains bid with the US dollar losing ground.

- EURGBP is expected to depreciate in the longer-term – Danske Bank.

The euro is pulling back on Monday, giving away gains after a three-day rally last week. The pair was rejected at the 0.8785 resistance area during the early European session before pulling back to the 0.8700 area, against a stronger British pound.

The GBP appreciates amid broad-based USD dollar

The favorable market mood witnessed on Monday, which is weighing further on the safe-haven US dollar, has increased support for the GBP, with investors focusing on the British Government’s plans to tackle UK’s debt crisis.

Finance minister Jeremy Hunt is working on a plan to fill a 50 billion pound deficit in the country’s finances, which contemplates spending cuts between 30 and 35 billion and tax increases of between 20 and 25 billion, according to market sources.

The project will be presented on November 17 with the intention to restore investors’ confidence after the market turmoil triggered by Liz Truss’ tax-cutting program presented in late September.

EURGBP: Expected to move lower in the long term – Danske Bank

Currency analysts at Danske Bank expect the pair to appreciate in the short term and lose ground in the longer term: “We see a case for EURGBP to remain elevated in the near-term, but in the longer-term expect the cross to move lower as a global growth slowdown and the relative appeal of UK assets to investors are positive for GBP relative to EUR.”

Technical levels to watch

-

18:39

ECB's Kazaks: There is no pivot

The European Central Bank's Martins Kazaks said ''there is no pivot, we still say that inflation is a problem, and we will keep raising rates.''

He was also recently quoted saying that the European Central Bank must raise interest rates much further, but that it is impossible to say how far because economic uncertainty is too high.

“Nobody at the moment can know with any precision where exactly the terminal rate will be,” Kazaks said in an interview in Riga. Borrowing costs “are still way below where they should be” and must move to levels that equate to monetary tightening, not just a withdrawal of stimulus, he said.

Meanwhile, the euro is advancing on Monday. Investors have been of the mind that the US economy is slowing enough to allow the Federal Reserve to ease its rate-hiking pace and the ongoing speculation that China may ease COVID restrictions. The euro is approaching last month's highs as the following hourly chart illustrates:

-

18:09

EURUSD Price Analysis: Bears getting set for a fade above last week's highs

- EURUSD will depend on the US yields following this week's CPI.

- For now, the Euro is breaking last week's structure with eyes on last month's highs.

EURUSD has moved up in the New York session as the greenback sinks some more for the month to a fresh low at 110.14. This has sent the euro through last week's highs with last month's high, 1.0093, now on the radar as the following analysis will illustrate.

EURUSD H1 chart

However, given the steep rise in the euro and the number of imbalances of price left behind, there are prospects of a move to the backside of the trendline for the immediate future. A break below 0.9975 could set off a cascade of stops into 0.9925. This would be the last defence for a move all the way back towards 0.9800.

Meanwhile, all will come down to this week's inflation data from the US. Currently, the markets are of the mind that the US economy is slowing enough to allow the Federal Reserve to ease its rate-hiking pace and the ongoing speculation that China may ease COVID restrictions.

In this regard, the US 10-year yields will be an important feature in markets for the week ahead:

A break back into the trendline would be expected to see the US dollar rise and weigh on the euro.

-

18:06

NZDUSD remains bid on Monday, pushing against 0.5940 resistance area

- New Zealand's dollar returns to the 0.5940 resistance area.

- Rumors of easier COVID-19 restrictions in China have boosted risk appetite.

- Investors' optimism is weighing on the safe-haven US dollar.

The New Zealand dollar has opened the week on the same positive tone that closed the last one. The pair bounced up at 0.5870 on Monday's early trade, to return towards the seven-week high at the 0.5940 area, which, so far, is holding upside attempts

Rumors of easier COVID-19 restrictions in China

With a considerably thinner economic calendar ahead this week, market rumors suggesting that Chinese authorities would be easing coronavirus restrictions have boosted optimism on Monday, supporting riskier assets to the detriment of the safe-haven USD.

European stock markets have witnessed a strong opening, although the enthusiasm has eased somewhat after the Chinese National Health Commission denied the rumors and warned about severe restrictions ahead as the winter flu season approaches. US stocks are moderately positive, with the Dow Jones Index advancing 0.84%, the S&P ticking up 0,35%, and the Nasdaq Index 0.70% above opening levels at the time of writing

Market sentiment, however, remains moderately positive, with the investors still assessing Friday’s strong US NoN-Farm Payrolls report. Private sector payrolls increased by 264,000 in October, beating expectations of a 200,000 increment, while September’s reading was revised up to 315,000 from the previous estimate of 264,000.

The market is at a crossroads amid the contradictory news from China, with major currency crosses at key levels. In this context, some hesitation should be contemplated, as the investors may seek further data before placing significant bets in either direction.

In that case, US Consumer Inflation figures could offer further insight into the US Federal Reserve’s next monetary policy decision and thus increase USD volatility.

Technical levels to watch

-

17:21

USDJPY Price Analysis: Tumbles from 147.00 after testing a two-week-old resistance

- The USDJPY is testing the drops for the second straight day and tests last Friday’s low.

- Elevated US Treasury yields, alongside a two-month-old upslope trendline, capped the USDJPY from falling below 145.00.

- USDJPY Price Analysis: A daily close below 146.50 exacerbates a fall to the 100-day EMA; otherwise, the pair could test 148.00.

The USDJPY consolidates above a two-month-old upslope trendline drawn from September 16 lows around 140.27, previously tested twice. Still, Japanese Yen buyers could not crack it following the two “known” Bank of Japan (BoJ) interventions, opening the door for further American Dollar upside. Also, the US Treasury yields rise, putting a lid on the USDJPY fall, and with further Federal Reserve’s tightening looming, the USDJPY might re-test the YTD highs. At the time of typing, the USDJPY is trading at 146.59, below its opening price.

USDJPY Price Analysis: Technical outlook

Given the previously mentioned scenario of the USDJPY consolidating, as shown by the daily chart, the upside scenario might be capped by a downslope trendline drawn after the USDJPY hits its 151.94 YTD high, keeping the USDJPY from testing the 150.00 figure. The Relative Strength Index (RSI), at 49.44, is in bearish territory and opens the door for a test of the 50-day Exponential Moving Average (EMA) at 145.10 before the September 16 swing low at 140.27.

The USDJPY one-hour chart shows the pair dived to its daily low at 146.08, shy of the S1 daily pivot, and is testing last Friday’s low at 146.55. So if the USDJPY achieves a daily close below the latter, that could lay the ground for further downside pressure. If that scenario plays out, the USDJPY’s first support would be the S1 daily pivot of 146.00. Once cleared, the pair might test key support levels, like the November 2 daily low at 145.66, followed by the S2 daily pivot at 145.35 and the 145.00 figure.

On the flip side, if the USDJPY surpasses 147.00, it could exacerbate a rally toward 148.00. Hence, the USDJPY first resistance would be the daily pivot level at 147.20, followed by the confluence of the 50, 100, and 200-hour EMAs around 147.38/50, followed by the R1 daily pivot and the 148.00 figure.

USDJPY Key Technical Levels

-

17:18

Gold Price Forecast: XAU/USD remains capped below the $1,680 resistance area

- Gold picks up again, but it remains unable to breach $1,680.

- The positive market mood is weighing on the safe-haven dollar.

- Rumors that Chima would be about to relax its Zero-COVID policy have boosted optimism.

Gold futures have bounced up from $1,665 on Monday’s early European session appreciating on the back of US dollar weakness in a risk-on session, although it seems unable to find acceptance above $1,680 so far.

Precious metals appreciate as market sentiment improves

Precious metals have opened the week on a moderately bid tone, favored by a positive mood. Market rumors pointing out to a review of COVID-19 restrictions in China have improved investors’ sentiment on Monday, curbing demand for the safe-haven USD.

The comments by the Chinese National Health Commission, which has reiterated the Government’s commitment to the Zero-COVID policy and warned about the possibility of severe restrictions ahead, as the winter flu season approaches have tempered appetite for risk but have not altered the market mood, which remains moderately positive, with the greenback losing ground against a basket of the most traded currencies.

In absence of first-tier macroeconomic releases, the positive Friday’s Non-Farm Payrolls report is still driving market sentiment on Monday. Furthermore, the Eurozone Sentix survey has recorded an improvement in investors’ sentiment in November and has contributed to underpin appetite for risk.

Technical levels to watch

-

16:41

GBPUSD reclaims 1.1400 on weaker US Dollar

- The GBPUSD is trading solidly in the green, gaining 0.81% at the beginning of the week.

- Mixed US employment report and speculations for a softer Federal Reserve keep risk-perceived currencies underpinned.

- Last week’s BoE’s dovish 75 bps weighed on the GBP, but US midterm elections are a tailwind for the GBPUSD.

The British Pound extended its gains during the North American session due to upbeat market sentiment spurred by a seasonal US mid-term elections rally. At the same time, investors brace for there results of the latter, and the October US Consumer Price Index (CPI), which depending on its outcome, will add/ease pressure on the Federal Reserve. Even though the Bank of England (BoE), said that they would hike rates, but not at the level money market futures priced in, the GBPUSD is trading above its opening price by 0.73%.

The Pound Sterling climbs on a soft US Dollar

In the last week, the US Department of Labor reported October’s data that the labor market remains tight, adding 261K jobs to the economy, usually perceived as hawkish for the Federal Reserve. Still, the Average Hourly Earnings eased from 5% in September to 4.7%, aligned with estimations, while, the Unemployment Rate edged up from 3.5% to 3.7%, suggesting the effects of monetary policy began to affect the labor market.

Aside from this, some Fed officials during the last week, led by Susan Collins of the Boston Fed, said that rates need to go higher than expected in September, though she said that it makes sense to move slowly to balance inflation/growth risks. In the meantime, Richmond Fed President Thomas Barkin said it is “conceivable” that the Federal funds rate (FFR) will end above 5%, and he foresees a potentially higher peak.

Elsewhere, the US midterm elections are weighing on risk-off assets like the US Dollar.

On the UK side, last Thursday, the Bank of England lifted rates by 75 bps, its highest increase in 33 years, though in words from Governor Andrew Bailey clarified that the peak in rates will be “lower than priced into financial markets.” Once the headline crossed newswires, the GBPUSD tumbled from 1.1420s to 1.1150s.

Nevertheless, uncertainty in the US political scenario and the US Consumer Price Index (CPI) report looming, refrained investors from opening fresh bets in the USD, even though it is sought as a safe haven.

That said, the US Dollar Index, which tracks the greenback’s value against six currencies, falls by 0.37%., at 110.382, bolstering the GBP. It should be noted most G8 currencies are boosted by negative sentiment surrounding the American Dolla, even though fundamentals have not changed.

GBPUSD Price Analysis: Technical outlook

The GBPUSD daily chart suggests the pair remains neutral-to-downward biased, even though it cleared the 50-day Exponential Moving Average (EMA). Although the recovery is remarkable, it would need to clear the confluence of the 100-day EMA and the September 13 swing high at around 1.1683/1.1738, so the bias could shift to neutral, as that could open the door for a test of the 1.2000 figure. The Relative Strength Index (RSI), at bullish territory, suggests that buyers are gathering momentum, so a correction to the 100-day EMA is on the cards.

-

16:37

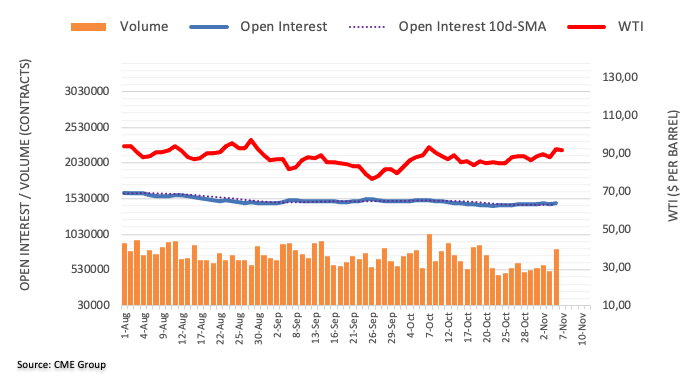

WTI rallies beyond $93.00 as the USD dives on risk appetite

- Oil prices rally beyond $93 with the US dollar losing ground.

- Rumors of easier COVID restrictions in China have boosted market mood.

WTI prices have resumed the upward trend witnessed on Friday as the US oil benchmark bounced up from levels right above $90 on the early trade, to reach levels past $93 for the first time in the last four weeks.

Oil prices rally with the US dollar losing ground

Appetite for risk is prevailing on Monday as investors start pricing in a certain relaxation in the COVID-19 restrictions in China, which is easing fears about a new set of restrictions that would curb crude oil demand.

The denial of such rumors by the Chinese authorities has failed to kill market optimism which has weighed the safe-haven US dollar, providing additional support to crude prices.

In a rather thin macroeconomic docket, the Eurozone Sentix survey has shown that investors’ confidence improved in November for the first time in the last three months. This, and the positive Non-Farm employment levels seen on Friday have contributed to feeding investors’ optimism on Monday.

The US Dollar Index, which measures the value of the US dollar against a basket of the most traded currencies, drops 0.3% on the day, to reach session lows right above 110.00, after having peaked at 113.15 on Thursday.

Technical levels to watch

-

16:32

USDMXN Price Analysis: More downside while under 19.50

- USDMXN with bearish momentum while below 19.50.

- Recovery above 19.50 to alleviate bearish pressure.

- Dollar to strengthen with a break above 19.80.

The USDMXN is trading at 19.45, at the lowest intraday level since May 30 and is about to post the lowest daily close since March 2020. The Mexican Peso benefited from risk appetite and Banxico’s interest rate. On Thursday, the central bank of Mexico is expected to raise rates again by 75 bps to 10%.

Last week, USDMXN broke the 19.80 barrier and on Monday below 19.50, improving the outlook for the Mexican Peso. The technical bias favors more losses for the pair as long as it remains under the long-term area of 19.50. The next target is seen at 19.25.

The RSI is at oversold levels, normally after eight days of declines, still moving south. Despite the extreme readings, no signs of a correction are seen at the moment. A recovery above 19.50 would alleviate the bearish pressure, pointing to some consolidation, probably between 19.50 and 19.70. A recovery above 19.80 would favor the greenback, suggesting a return to the 19.80-20.00 range.

Price action over the last sessions ended with many days of limited moves. Now volatility appears to be on course to remain elevated, supported also by general market conditions and ahead of US elections and key inflation data from the US and Mexican.

-638034355098808343.png)

-

16:07

USDCHF falls to weekly lows under 0.9900

- US dollar remains weak after NFP, ahead of CPI.

- USDCHF extends its slide after finding resistance again at 1.0150.

- Next critical support is seen around 0.9850.

The USDCHF is falling on Monday for the second day in a row and it dropped to 0.9874, reaching the lowest level since October 27. It is hovering slightly below 0.9900, as the Swiss Franc holds to gains.

The key driver in the USDCHF slide continues to be a weaker US Dollar across the board. The greenback started to decline on Friday, after the US official employment report and amid risk appetite. Now, attention is set on the next inflation numbers due on Thursday with the Consumer Price Index for October that is expected to show a monthly increase of 0.7%.

But on Tuesday, the US holds its midterm elections. Analysts point out that the Republicans have the chance to regain control of Congress. “If Republicans retake one or both chambers of Congress, sweeping fiscal policy changes seem unlikely over the next two years, absent a crisis like the one that occurred in 2020. Under this election outcome scenario, we doubt we would make any major changes to our forecasts for GDP growth, inflation or the federal funds rate as a result of the election. Instead, status quo and political gridlock strike us as the most likely outcomes, with the possibility for some government shutdown/debt ceiling theatrics over the next two years”, said analysts at Wells Fargo.

Critical levels

The short-term bias points to the downside in USDCHF but it needs to break 0.9850 to signal further weakness ahead, targeting 0.9775. On the upside, above 1.0060 the greenback should recover momentum and could test again 1.0150. As long as it remains under 1.0150 gains seem limited.

-

16:00

US stocks tend to do well if the Republicans win control of both the Senate and the House – SocGen

This week's focus will be on the US mid-term elections on Tuesday. Economists at Société Générale expect equities to go up if the Republicans win control of both the Senate and the House.

Victory for the GOP could have negative ramifications for the Euro

“The US midterms could have an important say on equities and by extension high beta currencies. If history is a guide, US stocks tend to do well if the Republicans win control of both the Senate and the House.”

“Victory for the GOP could have negative ramifications however for the Euro if Washington decides to whittle back financial/ military support for Ukraine.”

“If stocks can hold their ground/stretch gains on a Republican victory in Congress tomorrow with control of Senate and the House, then the Dollar may well have reached a turning point, with carry staging a tentative return.”

-

15:56

AUDUSD keeps pushing against 0.6480 resistance in a risk-on market

- The aussie appreciates to 0.6480 amid a positive risk sentiment.

- Rumors of more relaxed COVID-19 restrictions in China have boosted optimism

AUD/USD facing an important resistance hurdle at 0.6480.

The Australian dollar has opened on the same positive tone that it closed the previous one, with the pair bouncing up from 0.6400 to launch another attack to the 0.6400 resistance area, which, so far, remains intact.

The dollar loses ground on a positive market mood

Investors' sentiment remains positive on Monday, fuelled by market speculation suggesting that Chinese authorities could be contemplating a certain relaxation of the COVID-19 restrictions.

The Chinese National Health Commission, however, has denied those rumors, confirming their commitment to the Zero-COVID policy and warned about the possibility of a severe situation ahead, as the country is entering the winter flu season.

Furthermore, the impact of the positive US Non-Farm Payrolls report on Friday and the mild temperatures in Europe, which have eased fears about a gas rationing this winter have triggered risk appetite. In this context, the safe-haven US dollar has been losing ground in favor of riskier assets like the Australian dollar.

AUDUSD: facing a significant resistance hurdle at 0.6480

A look at the four-hour chart shows that Friday’s sharp rally has pushed the pair to an important resistance area between 0.6470 and 0.6520.

The bullish cross seen between the 50 and the 200-period SMA anticipates the possibility of further appreciation, although, the pair is close to overbought levels in hourly charts, which anticipates the possibility of some hesitation before further appreciation occurs.

AUDUSD 4-hour chart

Technical levels to watch

-

15:54

EURSEK to see choppy activity around the 10.90 level – Rabobank

Since late October, the Swedish Krona has been recovering some ground versus the Euro. However, economists at Rabobank expect the EURSEK to remain choppy around the 10.90 mark.

Limited scope for a strong uptrend in the value of SEK vs. the EUR

“While a 75 bps rate hike from the Riksbank could bring some additional near-term support, the possibility that the market will be unwinding some of its rate hike expectations for 2023 suggests limited scope for a strong uptrend in the value of SEK vs. the EUR.”

“We expect to see some choppy activity around the 10.90 level on a one to three-month view.”

-

15:46

S&P 500 Index: Recent strength seen as a bear market rally – Credit Suisse

S&P 500 may see some near-term consolidation. Nonetheless, analysts at Credit Suisse remain of the view recent strength has been a bear market rally and look for a retest of key support from the 200-week average at 3620/19.

Scope for a near-term bounce

“S&P 500 managed a small rebound on Friday but with the market having been capped at and having rejected our recovery target of the late September high, falling 63-day average and 50% retracement of the fall from September at 3902/07 our bias is to view this as a temporary bounce only.”

“Resistance at 3796/3804 capping can keep the immediate risk lower for a fall back to 3698, then support next at the 3652/47 late October low ahead of a retest of the key 200-week average at 3620/19.”

“Above 3804 can see a deeper rebound to 3824 initially, then 3864, but with the 3890/3912 zone clearly expected to remain a major barrier.”

-

15:25

USDCAD stumbles towards 1.3500 amid a risk-on impulse, Canadian jobs data

- USDCAD dropped after hitting the 1.3800 weekly high last week, falling almost 2.50%.

- The Canadian employment data crushed estimates while adding to inflationary pressures due to wages reaching the 5.55% threshold.

- The US jobs data was mixed, though a higher unemployment rate could deter the Federal Reserve from hiking aggressively.

The USDCAD extends its losses to two-consecutive days, testing the 50-day Exponential Moving Average (EMA) amidst an upbeat market sentiment, as the United States mid-term elections and the US Consumer Price Index (CPI) grab the spotlight. Hence the American Dollar is falling, and the Loonie is capitalizing on it. At the time of writing, the USDCAD is trading at 1.3510, down by 0.22%.

US and Canadian job reports undermined the USD, boosted the CAD

The October US employment report was mixed, with investors focusing not on the headline figure, which showed that 261K new jobs were added to the economy, but on the Unemployment Rate, which edged higher, towards 3.7%, above the 3.6% estimates and also September’s 3.5%. Also, Average Hourly Earnings compared to the last month’s eased from 5% to 4.7% YoY, so the last couple of figures augmented investors’ speculation that the Federal Reserve would slow down its’s pace of tightening, as they expressed on its last monetary policy meeting, while also commenting that the peak of rates would be higher than September’s projections.

On the Canadian side, October’s data crushed expectations for a 10K print, with the economy adding a staggering 108K jobs. Meanwhile, the six-month trend for job creation sits at +9K, which according to TD Securities Analysts, “Is consistent with GDP growth in the mi-1s.” Regarding wages, the Average Hourly Wagest jumped by 5.5%, YoY, above 5.2% of the previous month, as it would add further pressure on the Bank of Canada (BoC) to keep tightening.

Elsewhere, the US Dollar Index, which tracks the buck’s value against six currencies, drops 0.34%., at 110.404, a headwind for the USDCAD. It should be noted that the Loonie is taking advantage of a weaker US Dollar, as oil prices are sliding as China’s backpedaled against easing Covid-19 restrictions, which would delay economic recovery and might affect the black gold prices.

What to watch

Later in the day, Fed speakers, with the Cleveland Fed President Loretta Mester and Boston’s Fed President Susan Collins, would cross newswires.

USDCAD Key Technical Levels

-

15:23

USD is prone to a sizeable correction in the long run – Scotiabank

The USD is trading generally lower as the Q4 consolidation in the 2022 rally extends. Economists at Scotiabank believe that the greenback is set to suffer a sizeable corerction.

USD is poised to remain relatively firm in the short run

“Broadly, we think the USD is poised to remain relatively firm in the short run but we do think the long run USD rally is looking over-extended and prone to a sizeable correction.”

“Seasonal pressures (USD-negative) are working as expected and should exert a little more negative influence on the broader trend in the next few weeks, assuming year-end liquidity pressures remain contained.”

“A sharper fall in the USD may have to wait until investors are more convinced the Fed tightening cycle is complete.”

-

14:56

USDCAD: Break below 1.3455 to confirm fresh weakness and signal a move to 1.3351/3289 – Credit Suisse

USDCAD looks as though it has confirmed a top. A break below 55-Day Moving Average (DMA) at 1.3455 would act as a leading signal for a broader turn, analysts at Credit Suisse report.

Bearish “head and shoulders” top

“USDCAD looks to have formed a bearish ‘head and shoulders’ top and with weekly MACD now also rolling over, a further decline looks to be an increasingly likely scenario. However, we keep our core bullish view intact for now and see the 55DMA at 1.3455 as the last line of defence to avoid a stronger shift lower.”

“Back above 1.3625 and next above 1.3657/74 is needed to relieve some downside pressure and put the market back towards the middle of the recent range.”

“A close below 1.3455 would confirm the turn lower and suggest further decline towards the 50% retracement of the rise form August and trendline support at 1.3351/3289 initially.”

-

14:37

Turkey Treasury Cash Balance: -72.18B (October) vs -79.26B

-

14:36

EURUSD remains firm in multi-day highs around parity

- EURUSD extends the move higher just above parity.

- The dollar remains on the defensive amidst mixed US yields.

- EMU’s Sentix index improved to -30.9 in November.

The buying interest around the European currency remains well and sound and motivates EURUSD to revisit the parity zone at the beginning of the week.

EURUSD stronger on USD-selling

EURUSD advances for the second session in a row and gains more than two cents since last week’s lows around 0.9730, always against the backdrop of the persistent sell-off in the greenback.

Indeed, the dollar remains offered as market participants continue to gauge the mixed results from Friday’s US Payrolls as well as recent Fedspeak leaning towards an impasse in the Fed’s normalization process.

The continuation of the move higher in the pair so far comes in line with the mixed performance in US yields and some loss of momentum in the German 10-year bund yields after two daily advances in a row.

Earlier in the session, Germany’s Construction PMI rose to 43.8 in October and the Investor Confidence in the euro area improved to -30.9 for the current month according to the Sentix Index.

What to look for around EUR

EURUSD extends Friday’s recovery and confronts the initial target at the parity region so far on Monday.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The recent decision by the Fed to hike rates and the likelihood of a tighter-for-longer stance now emerges as the main headwind for a sustainable recovery in the pair (if it was any at all).

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Eurogroup Meeting, Germany Construction PMI (Monday) – EMU Retail Sales (Tuesday) – Italy Industrial Production (Thursday) – Germany Final Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EURUSD levels to watch

So far, the pair is gaining 0.41% at 0.9998 and faces the next resistance at 1.0045 (100-day SMA) seconded by 1.0093 (monthly high October 27) and finally 1.0197 (monthly high September 12). On the other hand, a breach of 0.9730 (monthly low November 3) would target 0.9704 (weekly low October 21) en route to 0.9631 (monthly low October 13).

-

14:33

If US yields are close to their highs, then USDJPY probably is too – SocGen

How much further will US 10-year yields rise? If a peak is close, the USDJPY pair is set to reverve back lower, in the view of Kit Juckes, Chief Global FX Strategist at Société Générale.

Short GBPJPY is an appealing trade

“In the US, tomorrow’s mid-term elections could gridlock the US Government, and Thursday’s CPI data should be well-behaved at the core level, which probably peaked in September. Maybe there’s enough there to limit how much further US yields rise, even against a backdrop of continued solid employment data. If US yields are close to their highs, then USDJPY probably is too.”

“The BOJ has intervened aggressively (and expensively) on the MOF’s behalf, and it’s easy enough to imagine that if USDJPY shows clear signs of having peaked, the Yen has plenty of room to rally before shorts are all squeezed out or before it could reasonable be called an ‘expensive’ currency.”

“Shorting the Dollar against the Yen looks like a better trade than going long EURUSD. But maybe short GBPJPY is an even more appealing trade.”

-

14:20

EURUSD eyes further consolidation and potentially still, a deeper recovery – Credit Suisse

EURUSD staged a strong recovery at the end of last week. The pair is expected to see further consolidation and potentially still, a deeper recovery with weekly MACD momentum having turned higher, analysts at Credit Suisse report.

Support is seen at 0.9886/83 initially with resistance seen at 0.9999

“With weekly MACD momentum having already crossed higher, this raises the prospect of further consolidation and indeed potentially a deeper recovery. Above 0.9999 would be seen to add weight to this view for strength back to the 1.0095 recent high.”

“Beyond 1.0095 can see resistance next at the September high and 23.6% retracement of the 2021/2022 downtrend at 1.0198/1.0201, which we would look to cap at first.”

“Support is seen at 0.9898 initially, then the 13 and 55-day averages at 0.9886/83, which we look to try and hold. Below can see a fall back to 0.9840, then 0.9796.”

-

14:03

USD still has some upside into year-end, but the path remains data-dependent – HSBC

The USD extended its gains on a hawkish Fed but risk aversion has also supported the upward momentum. Economists at HSBC see a stronger USD, albeit on a data-dependent path.

USD to likely strengthen into year-end

“The Fed has lifted rates by 375 bps since March 2022 and signalled more rate hikes. We now expect two more 50 bps rate hikes, taking the federal funds target range up to 4.75-5.00%. We also acknowledge an upside risk to the policy rate amid the likely elevated US core inflation into next year, while the Fed is unlikely to deliver any rate cuts in 2023 or 2024.”

“We continue to believe the USD still has some upside into year-end, based on the three drivers of progressively hawkish Fed policy, slowing global growth, and risk aversion. Nonetheless, this path remains data-dependent and so this USD bounce will likely need inflation readings sufficient to warrant additional Fed hikes, while data that sustain concerns about recession risks may trigger risk aversion, benefitting the ‘safe haven’ USD.”

-

13:57

USDJPY Price Analysis: Bulls trying to defend over a one-week-old ascending trend-line

- USDJPY turns lower for the second straight day amid sustained USD selling bias.

- Bears await a break below ascending trend-line support before placing fresh bets.

- Attempted recovery might continue to confront stiff resistance near the 147.55 area.

The USDJPY pair struggles to capitalize on its modest intraday gains to the 147.55 area and turns lower for the second successive day on Monday. The downward trajectory drags spot prices back below pivotal support near the 200-period SMA on the 4-hour chart, with bears now awaiting a break below the 146.00 mark before placing fresh bets.

The US Dollar adds to the post-NFP heavy losses and drops to over a one-week low amid speculations that the Federal Reserve will slow the pace of its rate-hiking cycle. Apart from this, expectations that Japanese authorities might intervene again to soften any steep fall in the domestic currency exert some downward pressure on the USDJPY pair.

That said, the risk-on impulse might keep a lid on any meaningful gains for the safe-haven JPY and help limit deeper losses. This, along with a big divergence in the monetary policy stance adopted by the Fed and the Bank of Japan, supports prospects for the emergence of some dip-buying around the USDJPY pair, warranting caution for bearish traders.

From a technical perspective, the 146.00 round figure coincides with a one-and-half-week-old ascending trend-line support. Some follow-through fall might prompt aggressive technical selling and make the USDJPY pair vulnerable. The subsequent fall has the potential to drag spot prices towards the late October low, around the 145.00 psychological mark.

On the flip side, the 146.80 region now seems to act as an immediate hurdle ahead of the 147.00 level. Any further move up might continue to confront stiff resistance near the daily top, around the 147.55 region. A sustained strength beyond the latter could allow the USDJPY pair to reclaim the 148.00 mark and test the 148.35-148.45 supply zone.

USDJPY 4-hour chart

-638034261623345158.png)

Key levels to watch

-

13:17

NZDUSD flits with multi-week high, just below mid-0.5900s amid notable USD supply

- NZDUSD fills the weekly bearish gap opening amid the prevalent USD selling bias.