Notícias do Mercado

-

23:57

Japan Trade Balance - BOP Basis came in at ¥-1759.7B, below expectations (¥-1405.1B) in September

-

23:50

Japan Bank Lending (YoY) came in at 2.7%, above expectations (2.5%) in October

-

23:50

Japan Current Account n.s.a. came in at ¥909.3B, above forecasts (¥234.5B) in September

-

23:43

USDCHF sees a downside below 0.9830 amid weaker DXY, US Inflation hogs limelight

- USDCHF is expected to witness more downside below 0.9830 as the risk profile soars.

- Less room for bigger rate hikes by the Fed is weighing on US Treasury yields.

- The SNB is not bound to keep the inflation rate in a 0-2% range but will keep focusing on bringing price stability.

The USDCHF pair has sensed selling pressure after failing to overstep the critical hurdle of 0.9875 in the early Asian session. The asset is hovering around its fresh two-week low at 1.3869 and is expected to surrender the same amid a risk-on market mood.

A meaningful recovery in S&P500 in the late New York session cleared that the risk-perceived currencies are on the buying list of the market participants. Meanwhile, the US dollar index (DXY) printed a fresh seven-week low at 109.36 amid a decline in safe-haven's appeal.

The alpha generated by the US government bonds has slipped sharply as investors see no continuation of the bigger rate hike announcement by the Federal Reserve (Fed). The 10-year US Treasury yields have dropped to 2.13% as the room for bigger rate hikes is extremely low now.

The deviation between current interest rates and the proposed terminal rate is mere 80 basis points (bps) now. Therefore, Fed chair Jerome Powell is expected to adopt a gradual approach to hiking policy rates. In case of the absence of exhaustion in October’s inflation report, Fed policymakers could come forward with higher targets for interest rates and the central bank would continue hiking rates further.

As per the preliminary estimates, the headline inflation is seen lower at 8.0% vs. the prior release of 8.2%. While the core Consumer Price Index (CPI) is expected to drop marginally to 6.5% against the prior print of 6.5%.

On the Swiss franc front, Swiss National Bank (SNB) Chairman Thomas J. Jordan has clarified that the monetary policy decisions are not purely based on the inflation rate at High-Level Conference on Global Risk, Uncertainty, and Volatility, in Zurich.

The central bank is not committed to fine-tuning the inflation range at 0-2% but will take necessary action when will face the risk of soaring inflation. He further added that “We are also experimenting with machine-learning models that are trained using a large set of economic and alternative indicators.”

-

23:34

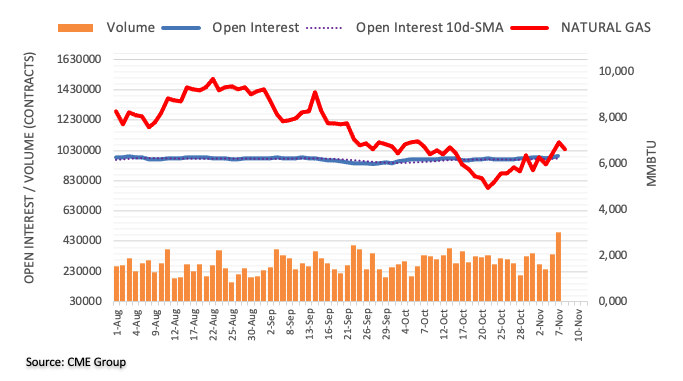

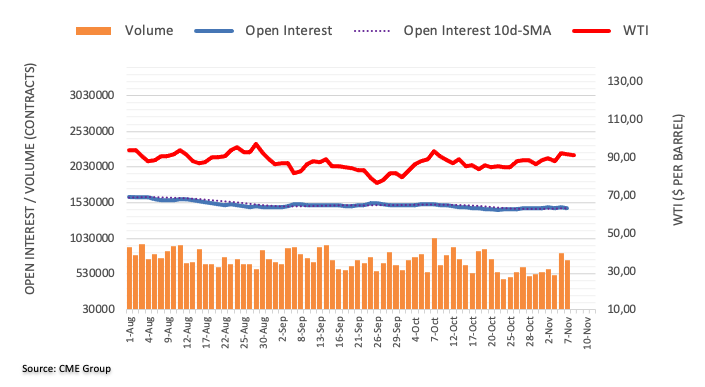

WTI bears attack $88.00 as concerns over China’s demand, US mid-term elections join API inventory build

- WTI reverses Friday’s jump during a three-day downtrend, remains pressured of late.

- China reported the biggest daily jump in covid cases in six months, teased more lockdown.

- Fears of challenges to US spending in case of Republican victory, surprise build in API inventories also favor the Oil bears.

- China inflation, EIA stockpiles will be important for intraday directions.

WTI bears keep the reins for the third consecutive day, despite recent inaction around $88.00, amid fears of less demand and higher inventories. However, the cautious mood ahead of the key China inflation data and weekly official inventory data from the US Energy Information Administration (EIA) test the commodity traders.

A six-month high of the fresh covid numbers from China bolstered the market’s fears of multiple lockdowns and a reduction in the energy demand from the world’s biggest industrial player on Tuesday. On the other hand, the latest polls suggesting hardships for the Democrats to keep control in both Houses also seem to challenge the oil bulls amid fears of less spending and demand for the black gold.

Recently exerting downside pressure on the energy benchmark is the weekly prints of the American Petroleum Institute’s (API) Crude Oil Stock data. That said, the weekly inventories for the period ended on November 04 rose to 5.618M versus -6.53M prior.

Elsewhere, comments from Oman's Energy Minister Salim al-Aufi also weighed on the WTI as he said, per Reuters, on Tuesday he saw oil prices coming down from the range of $90 a barrel after the winter season.

It should be noted that the black gold failed to cheer the broad US dollar weakness, as well as an upbeat performance of equities and bonds while portraying the bearish move of late.

Moving on, China’s Consumer Price Index (CPI) and the Producer Price Index (PPI) for October will act as the immediate catalyst for the WTI traders ahead of the weekly prints of EIA inventories, expected 1.1M versus -3.115M prior. Given the market’s recent shift in sentiment and likely hardships for the commodity traders, the Oil bears are expected to keep the reins.

Technical analysis

A clear pullback from the 100-DMA hurdle, around $90.70 at the latest, directs WTI bears towards a six-week-old support line, close to $86.40 by the press time.

-

23:31

NZDUSD Price Analysis: Bulls holding above key 0.5950 as bears try to take back control

- Bears eye a move into the key Fibonacci near 0.5850 in a 50% mean reversion.

- Bulls remain on the front side of a key underlying trendline support.

NZDUSD spiked as the US Dollar sold off on Tuesday, extending the losses that started to take shape on Friday. Tuesday was the third day of longs in the market since last week and bears could be lurking on a mid-week opportunity to counter the trend into in-the-money-longs as the following will illustrate.

NZDUSD H1 charts

The bears broke the micro trendline and met key support, as anticipated in the prior analysis: NZD/USD Price Analysis: Bears move in from key highs for the week

(Prior analysis, 07/11/2022)

Meanwhile, the price is now topping out at a fresh high for this and last week:

The pair is testing the commitments of the bulls at the next micro trendline. 0.5950 is important in this regard.

NZDUSD daily chart

As for the daily chart, the price is bounded by resistance and the doji could turn out to be pivotal for the pair and week. If the bears commit, then there will be prospects of a test of the broader trendline and a move into the key Fibonacci near 0.5850 in a 50% mean reversion.

-

23:08

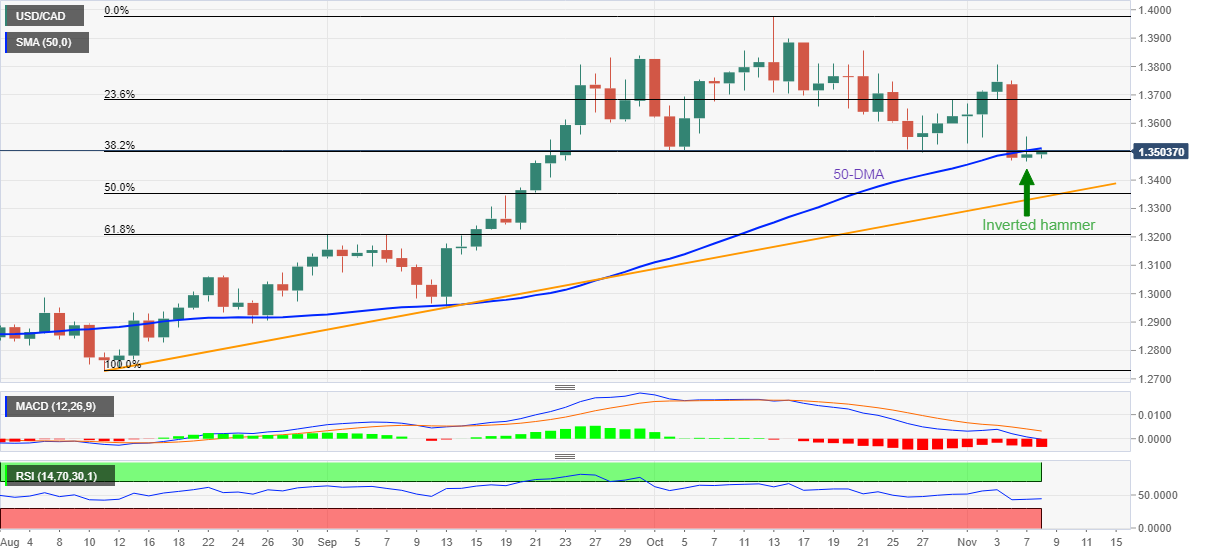

USDCAD Price Analysis: Breakdown of H&S indicates more weakness ahead, 1.3200 eyed

- Loonie bulls have been strengthened amid a risk-on market mood.

- The breakdown of an H&S chart pattern has triggered a bearish reversal.

- Potential death cross formation will trigger more downside ahead.

The USDCAD pair dropped in early Asia after facing barricades around the critical hurdle of 1.3468. A sheer recovery in S&P500 clarified that the risk-on impulse is solid and every pullback in risk-perceived assets has been considered as a buying opportunity for the market participants.

Meanwhile, the US dollar index (DXY) has turned sideways after a mild recovery from a fresh seven-week low at around 109.35.

On a four-hour scale, the asset has delivered a downside break of the Head and Shoulder chart pattern that indicates a bearish reversal after a prolonged consolidation phase. The south-side break of the neckline placed from October 5 low at 1.3505 has accelerated odds of a vertical fall ahead.

The 50-and 200-period Exponential Moving Averages (EMAs) are on the verge of delivering a ‘death cross’ at around 1.3585, which will add to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates that the downside momentum has been triggered.

Going forward, a decisive move below Tuesday’s low at 1.3387 will drag the asset towards the round-levels support at 1.3300, followed by September 1 high around 1.3200.

Alternatively, the Loonie bulls could lose their grip if the asset manages to surpass the previous week’s high at 1.3809. This will drive the asset toward October 14 high around 1.3900 and October high of around 1.3978.

USDCAD four-hour chart

-638035456497799474.png)

-

23:07

EURUSD Price Analysis: Bulls take a breather on the way to 1.0150

- EURUSD treads water after rising to a two-month high.

- Clear break of 100-DMA, three-month-old descending trend line keeps buyers hopeful.

- Bullish MACD signals, firmer RSI favor buyers to aim for upper line of the short-term bullish channel.

EURUSD seesaws around 1.0075-80, after refreshing a two-month high, as bulls await fresh clues during Wednesday’s Asian session. Even so, the major currency pair remains well on the buyer’s radar inside a bullish chart formation as it crossed the key resistance confluence, now support, the previous day.

A daily closing beyond the convergence of the 100-DMA and a downward-sloping trend line from early August, around 1.0050-40, allowed EURUSD buyers to refresh the multi-day high on Tuesday. The upside moves also gained support from the bullish MACD signals and the RSI (14).

As a result, the quote is likely to remain firmer unless declining back below 1.0040. Even so, the 1.0000 parity level and a joint of the 50-DMA and 21-DMA, close to 0.9880, could challenge the EURUSD bears.

It’s worth noting that the pair’s downside past 0.9880 hinges on a clear rejection of the six-week-old bullish channel, having a support line near 0.9760.

Meanwhile, the aforementioned channel’s resistance line near 1.0150 is an immediate target for the EURUSD buyers ahead of challenging September’s top surrounding 1.0200.

If the major currency pair remains firmer past 1.0200, the odds of witnessing a rally towards the August month high near 1.0370 can’t be ruled out.

EURUSD: Daily chart

Trend: Further upside expected

-

23:00

South Korea Unemployment Rate registered at 2.8% above expectations (2.6%) in October

-

22:52

AUDNZD grinds higher past 1.0900 on softer NZ data ahead of China CPI

- AUDNZD picks up bids to extend the previous day’s recovery amid risk-on mood.

- New Zealand’s Electronic Card Retail Sales grew past forecasts in October but eased from priors.

- Strong equities, bonds allowed buyers to keep the reins despite mixed Aussie statistics.

- Bulls may have a tough task defending the gains should China’s monthly inflation data, covid news surprise.

AUDNZD holds onto the previous day’s upside momentum around 1.0925 during the initial Asian session on Wednesday. The risk-on mood and softer data from New Zealand (NZ) seemed to have favored the buyers previously. However, cautious sentiment ahead of the key China inflation numbers and covid fears challenge the pair’s upside of late.

That said, New Zealand’s Electronic Card Retail Sales eased to 1.0% MoM growth in October versus 1.3% prior and 0.2% expected. Further, the yearly figures suggest 16.6% increase in the data compared to 28.6% previous readings and 11.4% market forecasts.

On Tuesday, National Australia Bank’s (NAB) Business Conditions eased to 22 in October from 25 prior, versus 20 forecast. Further, the NAB Business Confidence slumped to 0 during the stated month compared to the market’s consensus of reprinting 5 figure. Additionally, the Westpac Consumer Confidence slumped to -6.9% in November versus -0.9% prior. Further, the weekly print of ANZ-Roy Morgan Consumer Confidence dropped to the lowest levels since April 2020, to 78.7 at the latest. The details of the report also mentioned that the inflation expectations were the highest since the data was first released in April 2010.

It should be noted that the hopes of easy spending, due to challenges for the US Democrats in the Mid-term Elections, seemed to have triggered the latest wave of optimism in the markets amid a lack of major data/events. In doing so, the traders also pay little attention to China’s covid woes as it registered the highest numbers in six months the previous day.

While portraying the mood, Wall Street printed a three-day uptrend whereas the US Treasury yields slumped, which in turn allowed the risk-barometer Australia Dollar (AUD) to rise.

Moving on, the key China Consumer Price Index (CPI) and the Producer Price Index (PPI) for October will challenge the pair buyers should the numbers suggest the need for the Reserve Bank of Australia (RBA) to remain cautious.

Technical analysis

AUDNZD bulls remain off the table unless witnessing a clear upside break of the 200-DMA and the six-week-old resistance line, respectively around 1.1010 and 1.1025.

-

22:33

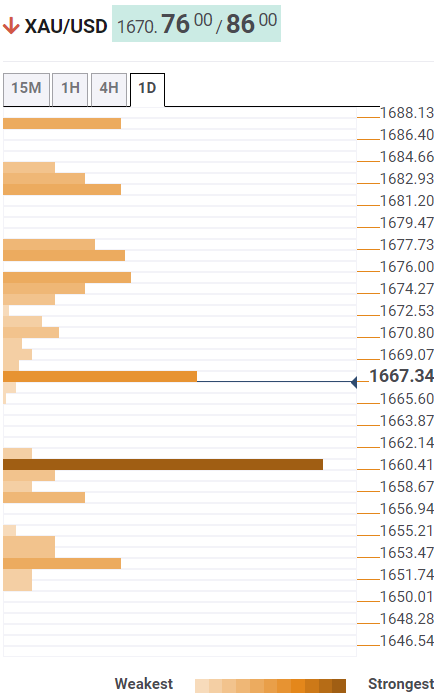

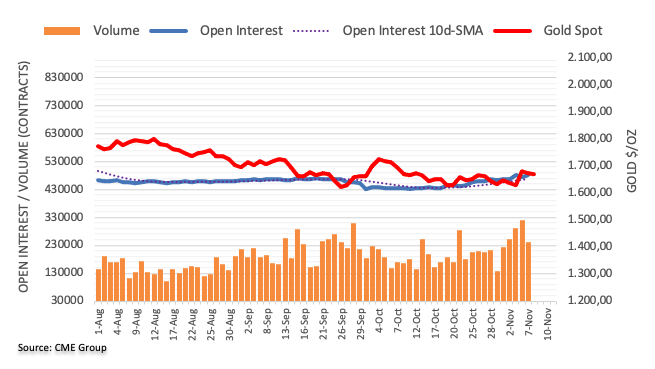

Gold Price Forecast: XAUUSD clings to monthly high above $1,700 amid softer DXY, China, US inflation eyed

- Gold price remains sidelined around 100-DMA after crossing short-term key resistance line.

- Risk-on mood joined downbeat yields to weigh on the US dollar.

- Optimism surrounding US Mid-Term Elections propelled equities, bonds amid light calendar.

- Inflation data from US/China could offer immediate directions, softer CPI can weaken XAUUSD amid talks of Fed’s easy rate hikes.

Gold price (XAUUSD) treads water around $1,712-13, after rising to the one-month high the previous day. That said, the bullion’s inaction during early Wednesday could be linked to the cautious mood amid US Midterm Elections and waiting for China’s inflation data. However, the market’s optimism surrounding the US elections outcome and a lack of major directives led to the metal’s rally that crossed a short-term key hurdle on Tuesday.

The US Mid-term Elections are underway and the Democrats may lose control in one of the Houses considering a small gap to retake control for the Republicans. The election results, which would take a couple of days, also become important as ex-President Donald Trump teased a “very big” announcement coming on November 15. Should the Democrats lose power in any house, President Biden’s policies concerning higher spending will be challenged and so the inflation may also ease.

The hopes of a respite from inflation enabled equities to rally and drowned the US Treasury yields the previous day, which in turn exerted downside pressure on the US Dollar Index (DXY). On the same line could be a reduction in the US NFIB Small Business Optimism Index for October, 91.3 versus 92.1 prior.

Given the light calendar and a lack of major macros, the XAUUSD bulls could cheer the technical break even if the latest cautious mood ahead of the key China Consumer Price Index (CPI) and the Producer Price Index (PPI) for October challenge the commodity buyers of late.

Although forecasts suggest easy inflation numbers from China, any surprise uptick might not go well with the gold buyers as they seem running out of steam of late.

Technical analysis

A daily closing beyond the three-week-old resistance line, now support around $1,677, allows gold buyers to keep the reins even as the 100-DMA challenges the immediate upside around $1,717.

It’s worth noting, however, the RSI (14) is approaching the overbought territory and is also forming a bearish divergence with the prices.

Hence, further upside hinges on a clear break of $1,717, which in turn could propel prices toward the tops marked in October and September, respectively near $1,730 and $1,735.

Meanwhile, XAUUSD declines remain elusive until the quote stays beyond the resistance-turned-support surrounding $1,677. That said, the $1,700 threshold late September swing high around $1,688 may act as an intermediate halt during the fall.

Overall, gold buyers are running out of steam but the bears need validation from $1,677 to retake control.

Gold price: Daily chart

Trend: Limited downside expected

-

22:25

AUDUSD eyes an establishment above 0.6500 as risk profile soars, US/China CPI in focus

- AUDUSD is aiming to shift business above 0.6500 amid a cheerful market mood.

- US core CPI data will remain in the spotlight for further guidance on US monetary policy.

- A decline in China’s CPI will accelerate the odds of a dovish policy from the PBOC.

The AUDUSD pair has turned sideways above the psychological resistance of 0.6500 in the early Asian session. In late New York, the asset rebounded after sensing a buying interest of around 0.6480. A sheer recovery in the S&P500 futures indicated that the risk profile is still solid and the decline has been bought by the market participants.

Meanwhile, the US dollar index (DXY) has rebounded marginally after registering a fresh seven-week low at 109.36. The 10-year US Treasury yields have dropped to 4.13% amid chatters over a less-hawkish monetary policy by the Federal Reserve (Fed) in December.

But before that, investors are laser-focused on the release of the US Consumer Price Index (CPI) data, which will release on Thursday. As per the estimates, the headline inflation is seen lower at 8.0% vs. the prior release of 8.2%. Weaker gasoline prices are continuously weighing on the headline inflation rate as oil is a key component.

While the core CPI that excludes oil and food prices is seen marginally lower at 6.5% against the former release of 6.6%. The absence of promising exhaustion signs in the core CPI has remained a major factor, which drove Fed’s interest rates at sheer speed.

On the Aussie front, investors are awaiting the release of China’s CPI data. The annual inflation rate is seen lower at 2.4% vs. 2.8% reported earlier. A decline in the inflationary pressures will trigger the expectations of more stimulus packages and dovish commentaries from the People’s Bank of China (PBOC). It is worth noting that Australia is a leading trading partner of China and PBOC’s policies have a significant impact on the antipodean.

-

21:54

AUDJPY Price Analysis: Subdued nearby the 50/100-DMAs at around 94.70

- AUDJPY is subdued slightly above the 50/100-day Exponential Moving Averages (EMAs), which are almost flat.

- If The AUDJPY cracks 95.74, it could climb toward 96.00.

- AUDJPY Price Analysis: Once it clears the 50/100-day EMAs, a fall toward 93.50 is on the cards.

The AUDUSD sits above the 50-day EMA following a subdued trading session in the financial markets that witnessed US equities fluctuating, though, in the end, Wall Street finished with decent gains. Therefore, risk-perceived currencies trimmed some of their earlier losses. The AUDUJPY is trading at 94.72, down by 0.21%, beneath its opening price.

AUDJPY Price Analysis: Technical outlook

Consolidation is the name of the game for the AUDJPY. With the 50 and 100-day EMAs lying within a narrow 33-pip range (94.57-94.22), price action meandered above the former, registering a weekly high of 95.19, while the Relative Strength Index (RSI) edged towards the 50-midline, still in bullish territory, though with a bearish slope, suggesting buying pressure is fading.

However, if Australian Dollar buyers reclaim the October 21 pivot high at 95.74, a test of the 96.00 psychological level is on the cards. Otherwise, market sentiment shifting sour or another round of intervention by the Bank of Japan (BoJ) would expose the Aussie Dollar to further selling pressure.

Therefore, the AUDJPY's first support would be the confluence of the 50/100-day EMAs at around 94.57-94.22. A breach of the latter will expose an almost one-month-old upslope support trendline at around 93.50 before tumbling toward the psychological 93.00 figure on its way to the 200-day EMA at 91.85.

AUDJPY Key Technical Levels

-

21:53

GBPUSD aims to recapture 1.1600 amid risk-on mood, US CPI remains key ahead

- GBPUSD is looking to reclaim the 1.1600 hurdle amid an upbeat market mood.

- US stocks will perform strongly if Fed confirms a slowdown in the rate hike pace.

- The BOE will do whatever is needed to drag the inflation rate to 2%.

The GBPUSD pair has witnessed the entry of smart money after a corrective move from 1.1600 in the early Tokyo session. The Cable is expected to recapture a weekly high around 1.1600 amid an improvement in investors’ risk appetite. Positive market sentiment is continuously punishing the mighty US dollar index (DXY).

The DXY slipped to near 109.35 and registered a fresh seven-week low and three-consecutive bearish trading sessions for the first time in the past two months. S&P500 is having a ball and has been on a winning spree. It seems that expectations for a slowdown in the pace of the rate hike chosen by the Federal Reserve (Fed) are fetching optimism.

The 10-year US Treasury yields have dropped dramatically to 4.13% as guidance from Fed is getting less hawkish. Also, anxiety ahead of October’s Consumer Price Index (CPI) report is keeping US government bonds’ returns at the edge.

Economists at Charles Schwab are of the view that “Central banks seem to be stepping down from aggressive rate hikes, which may lead to a year-end "Santa Pause" rally for stocks”. They further added that “There can be no guarantee that central banks will continue to step down the pace of their hikes or pause them, but if they do it is possible a ‘Santa Pause’ rally could be in store for markets as the year draws to a close.”

On the UK front, Bank of England (BoE) Chief Economist Huw Pill at the UBS European Conference cited that the central bank will be blamed for the UK recession but it is driven by other factors. The BOE will do whatever is needed to drag the inflation rate to 2%. Going forward, UK’s Gross Domestic Product (GDP) data will remain in focus. The GDP data on an annual basis is seen lower at 2.1% vs. the prior release of 4.4%. And, the quarterly regime is expected to display negative growth by 0.5% against an expansion of 0.2%.

-

21:45

New Zealand Electronic Card Retail Sales (YoY) registered at 16.6% above expectations (11.4%) in October

-

21:45

New Zealand Electronic Card Retail Sales (MoM) above forecasts (0.2%) in October: Actual (1%)

-

21:43

United States API Weekly Crude Oil Stock up to 5.618M in November 4 from previous -6.53M

-

20:50

EURUSD moves back into longs following sharp breakout

- EURUSD bulls are throwing in the towel into he close on Wall Street.

- The US Dollar is trying to battle back into bullish territory ahead of US CPI.

EURUSD rallied in a broad risk-on setting, taking out the Monday highs for a fresh high for the week, eating into shorts from the prior. At the time of writing, the pair is ducking below 1.0096 highs into 1.0078 but remains a good 100 pips above the lows of the day.

Investors cheered the prospects of gridlock in US politics as the US midterm election voting got underway with results expected later tonight in the US hours. Investors are hoping for a political gridlock that could prevent radical policy changes and for a slowdown in the pace of rate hikes from the Federal Reserve. The UK's Telegraph explained that ''the first wave of vote tallies are expected on the East Coast between 7 pm and 8 pm EST (12 am and 1 am GMT). An early indication of Republican success could come if the races expected to be close - like Virginia's 7th congressional district or a US Senate seat in North Carolina - turn out to be Democratic. By around 10 pm or 11 pm EST, when polls in the Midwest will be closed for an hour or more, it is possible Republicans will have enough momentum for experts at US media organisations to project control of the House.''

Eyes turn to US CPI

As for the Fed, there were no officials slated during the midterm elections although there will be plenty to go on between speakers and data before the December 13-14 meeting. However, for this week, the US Consumer Price Index will be critical. It will be scrutinized and analysts at TD Securities suggested that Core prices likely slowed modestly in October but to a still strong 0.4% MoM pace.'' All told, our MoM forecasts imply 7.9%/6.5% YoY for total/core prices.

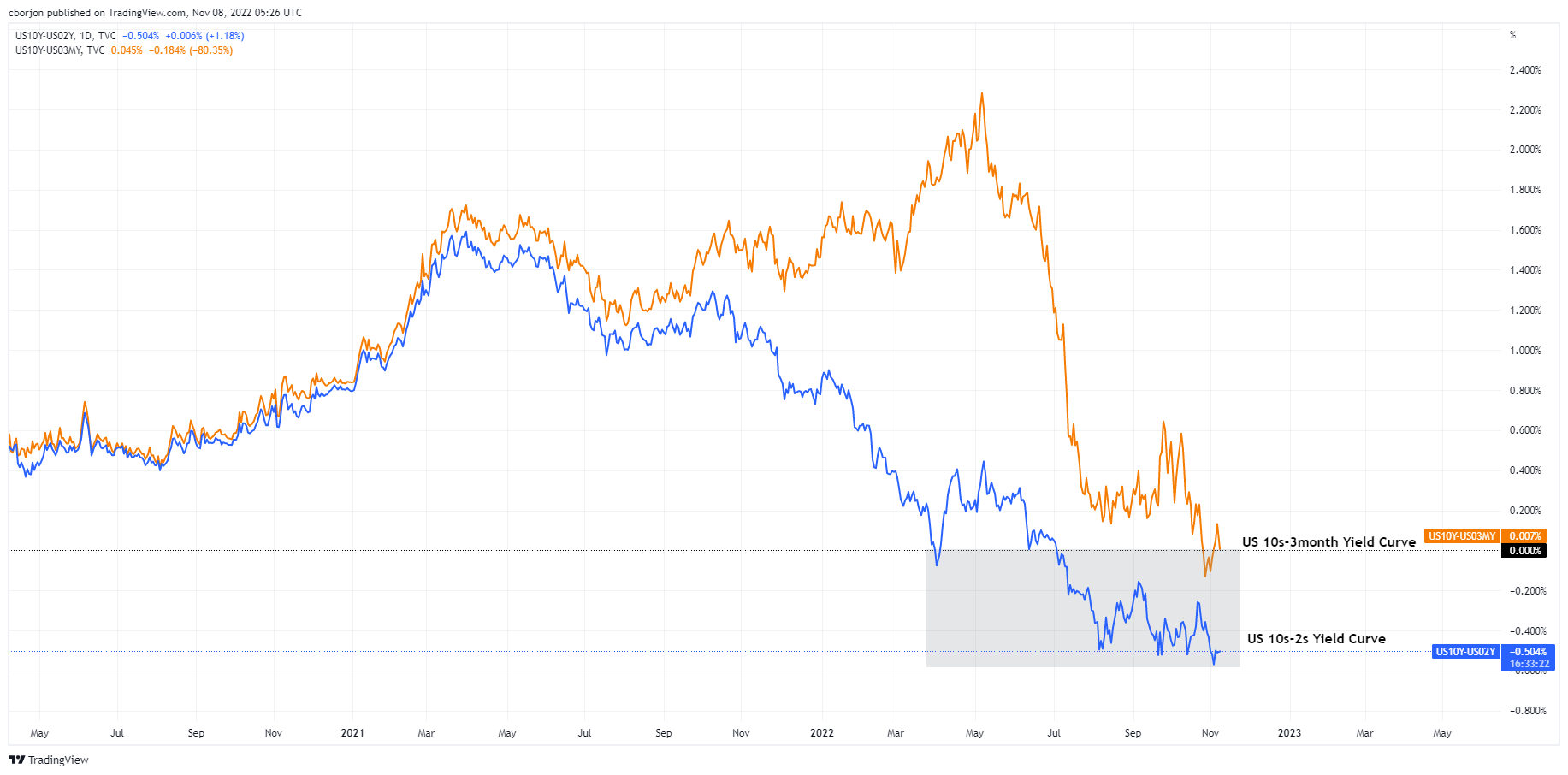

'A below consensus print is likely to help push the pricing for the terminal funds rate modestly lower, likely bull steepening the curve in the process,'' analysts at TD Securities argued. ''The risk of a lower reading is why we took profit on our 2s10s curve steepener last week and went long 10y Treasuries, which we viewed as attractive,'' they said.

EURUSD a fade on rallies

Analysts at Rabobank would argue that the Euro is lofty and rallies would be a fade considering the various macro implications for the eurozone economy and the length that is being built up in speculative positioning. ''The latest CFTC speculators’ positioning data have showed a sharp ramping up in the levels of net EUR longs over the past two weeks, to the highest levels since June last year. ''

''The positive sentiment surrounding the EUR in late October and into the first day of November reflects the impact of both the 75 bps rate hike from the ECB last month and the relief that came from the falling back of European gas prices in October. Helped also by a broadly softer greenback in recent days, EUR/USD is currently testing parity and pushing up against its 100 day sma. A break above could encourage more buyers in the near term.'

''However, in our view, fundamentals are still bias towards further downside pressure for the currency pair in the coming months, meaning we would view rallies as an opportunity to sell. In particular we don’t see the EUR as being priced for the impact of winter 2023 and what a prolonged period of expensive energy may mean for the German business model, Europe’s trade and current account balances and the value of the EUR. We have revised lower our forecast for EUR/USD on a 12 mth view to 0.95 from 1.05. We expect EUR/USD to trade choppily around this level in the months ahead.''

-

20:19

Silver Price Analysis: XAG/USD eases from four-month highs $21.65

- Silver prices resume their bullish trend to hit four-month highs at $21.65.

- US dollar weakness boosts precious metals.

- The pair needs to consolidate above $21.30/50 resistance area.

Silver prices resumed their rally on Tuesday, following a moderate pullback on Monday, with the white metal stretching above the $21.30 resistance area to reach fresh four-month highs at $ 21.65

Precious metals appreciate as the US dollar dives

In the absence of relevant macroeconomic data and with the US elections in the spotlight, precious metals have rallied during the North American session. US Treasury bonds have reacted with declines to the first polls pointing out to a Republican victory, dragging down the US dollar with them.

The US Dollar Index has turned lower after having appreciated moderately during the Asian and European trading sessions, extending its reversal from last week's highs at 113.15 to six-week lows at 109.30 area.

A republican takeover is highly likely to lead to a Congress gridlock and block the stimulus measures projected for 2023. This would ease the Federal Reserve’s pressure to keep hiking rates at the current pace, which has brought the idea of the dovish pivot, back to the table.

XAGUSD is struggling at the $21.30 resistance area

Silver prices are now attempting to consolidate above the $21.30/50 resistance area where the October 4 high and the 38,2% Fibonacci retracement level of the March-August decline meet the 200-day SMA>

Above here, the next potential targets would be mid-June highs at $21.90 ahead of the 50% Fibonacci level, at $22.45.

The pair, however, has reached overbought levels in hourly and daily charts, which anticipates the possibility of a moderate pullback before further rally should be contemplated.

Immediate support lies at the intra-day level of $20.60, ahead of the $20.00 round level and the 50 and 100-day SMAs at $19.30/50.

XAGUSD daily chart

Technical levels to watch

-

20:01

GBPJPY Price Analysis: Tumbles from the 50% Fibonacci retracement, eyeing 166.00

- The GBPJPY snaps two days of gains, diving almost 90 pips amidst a risk-off impulse.

- GBPJPY Price Analysis: Neutral-to-upward biased, but failure to crack 169.00, exposed the pair to selling pressure.

The GBPJPY drops from weekly highs at around 169.08 as sentiment shifts, with most US equities trading in the red, except for the Dow Jones Industrial, clinging to gains. In the FX, safe-haven currencies begin to pare their earlier losses, so the Japanese Yen is staging a comeback against the Pound Sterling. At the time of writing, the GBPJPY is trading at 167.92, down by 0.47%.

GBPJPY Price Analysis: Technical outlook

After snapping four days of consecutive losses, the GBPJPY recovered some ground and registered this week’s previous high at around 169.09. However, as market sentiment shifted negatively, the cross-currency pair tumbled but failed to push below 167.60, which could open the door for a re-test of weekly lows at 165.92. Hence, the GBPJPY’s first support would be the 167.00 figure. The break below will expose the 166.00 psychological level, followed by the weekly low.

Otherwise, if the GBPJPY stays above 167.60, the pair could resume its uptrend but face solid resistance levels on the upside. The first supply zone would be the psychological 168.00 figure, followed by the weekly high of 169.09 and then the 170.00 mark.

GBPJPY Key Technical Levels

-

19:18

Gold Price Analysis: XAUUSD bulls break a critical trendline as US Dollar bears move in

- Gold is on the move and on the backside of a key trendline.

- The US Dollar is under pressure to test a key daily trendline.

The Gold price is running higher on the day as the US dollar falls away while XAUUSD head close to the $1,720s scoring a high of $1,716.97 so far. DXY, an index that measures the greenback vs. a basket of currencies has come under scrutiny as it drops below the 110 mark, a level not seen in almost two weeks. This is also taking on a critical daily trendline, as illustrated below, a break which could be significant for the price of the yellow metal in the days to come. DXY was trading at a low of 109.39 so far from 110.61 as the high.

Risk appetite returned to the markets with attention turning to the midterm elections, with results that are due out later in the day. Investors are hoping for a political gridlock that could prevent radical policy changes and for a slowdown in the pace of rate hikes from the Fed. This in turn is weighing on the greenback, US yields and is thus beneficial for the price of gold.

Control of just one chamber of Congress by Republicans would put a block on President Joe Biden's legislative push for more business regulations. ''Congressional Republicans have threatened a debt ceiling showdown next year in an effort to cut entitlements and Medicare if they win a majority in the House. In recent weeks, polls have been tilting in favour of the Republicans in both the House and the Senate,'' analysts at Brown Brothers Harriman explained.

When can we expect US midterm election results?

The UK's Telegraph explained that ''the first wave of vote tallies are expected on the East Coast between 7 pm and 8 pm EST (12 am and 1 am GMT). An early indication of Republican success could come if the races expected to be close - like Virginia's 7th congressional district or a US Senate seat in North Carolina - turn out to be Democratic.

By around 10 pm or 11 pm EST, when polls in the Midwest will be closed for an hour or more, it is possible Republicans will have enough momentum for experts at US media organisations to project control of the House.''

US CPI and outlook for the Fed

Investors also await key US inflation data later this week that could influence the size of the Federal Reserve's rate hike in December. Markets are pricing in a scenario that the Fed will hike rates by 50 basis points in December after delivering four successive 75 basis point rate increases and despite the Chair Jerome Powell's pushback against a pivot following last week's Fed decision.

In his presser, Jerome Powell argued that we could see a higher terminal rate vs the prior market expectations. However, in the recent Nonfarm Payrolls report, the Unemployment Rate was a disappointment. This, combined with recent dovish rhetoric from some Fed speakers following prior disappointments on other important data, such as Manufacturing and Services, investors have begun to flip the switch on their outlook for the Fed and expect a slower pace of tightening is on the cards.

Looking ahead in this regard, we will get one more jobs report and two sets of inflation and Retail Sales data before the December 13-14 meeting. However, for this week, the US Consumer Price Index will be critical. It will be scrutinized and analysts at TD Securities suggested that Core prices likely slowed modestly in October but to a still strong 0.4% MoM pace.'' All told, our MoM forecasts imply 7.9%/6.5% YoY for total/core prices.

'A below consensus print is likely to help push the pricing for the terminal funds rate modestly lower, likely bull steepening the curve in the process,'' analysts at TD Securities argued. ''The risk of a lower reading is why we took profit on our 2s10s curve steepener last week and went long 10y Treasuries, which we viewed as attractive,'' they said. Ultimately, this would be encouraging for gold as a softer core print will exacerbate positioning which has moved to swiftly reduce USD longs recently. Conversely, chatter that the Fed may tilt somewhat less hawkish has convinced Gold specs to build more modest long positions that could continue in such an outcome for this week's CPI.

Gold technical analysis

As per the pre-open weekly analysis on Gold, Gold, Chart of the Week: XAUUSD bulls pushing up against key resistances ahead of US CPI, it was stated that '' the charts see the price pressured in a firm downtrend and there are prospects of a bull correction to fully test the bear's commitments ahead of the US Consumer Price Index data for the forthcoming week''

That W-formation looks menacing for the week ahead with prospects of a push into the trendline and when coupled with the following Crab harmonic pattern on the daily chart:

Gold update

With a high of $1,716, there is still some way to go until the $1,730 rounded number and October highs. Indeed, there are still a number of sessions to go until the US CPI event as well and a day is also a long time in US politics.

If the US Dollar breaks clean below the trendline, then the gold has the potential to move higher:

-

19:13

EURGBP Price Analysis: Consolidation above 0.8700 with upside attempts capped below 0.8745

- The euro is trading in a range between 0.8700 and 0.8740.

- The pair has eased bearish pressure after breaking downtrend resistance from late-September highs.

The euro has found support at 0.8700 after Monday’s rejection at 0.8790 and the pair has remained consolidating for most of the day, with upside attempts limited below 0.8745.

From a wider perspective, the daily chart (in the image) shows the pair hesitating above the bearish trendline resistance from late-September lows, now around 0.8540, with the 20-day SMA, at 0.8690 acting as support.

On the upside, the pair should breach the intra-day level at 0.8740 to resume the upside trend from late-December lows at 0.8575, and aim for the October 12 high at 0.8865 on its way to the 0.9000 psychological level.

So far, the mentioned 20-day SMA at 0.8690 is holding bears, with the next potential targets on the downside at the 0.8645 trendline and then probably the 100-day SMA, at 0.8600.

EURGBP daily chart

Technical levels to watch

-

19:09

Forex Today: Dollar bears broke the Matrix

What you need to take care of on Wednesday, November 9:

Financial markets started the day in cautious mode amid the lack of relevant news and ahead of the release of US inflation figures. The American Dollar posted a modest intraday comeback but finished the day plummeting to fresh monthly lows against most of its major rivals.

There was no clear catalyst for the US Dollar’s collapse, although the positive tone of US equities and easing government bond yields put pressure on the greenback after Wall Street’s opening. The yield on the 2-year Treasury note touched an intraday low of 4.65% after peaking at a multi-year high of 4.80% on Friday. It later recovered to settle just below the 4.70% level.

The DJIA rallied for a third consecutive day, but the S&P500 and the Nasdaq Composite posted modest gains.

The results of the US mid-term elections would take a couple of days. They could have long-lasting effects on the American dollar, mainly if Democrats are not able to retain control of both houses. Republicans do not need much to seize control of Congress. If that’s the case, they may oppose President Joe Biden’s massive expenses, which would exacerbate the risk of an economic downturn. Equities will likely collapse, and it does not seem the dollar could benefit much from it.

The EURUSD pair neared 1.0100 and holds on to gains ahead of the US close, despite some discouraging news. A new chapter of the European energy crisis was written after the European Commission said there is no way to create a gas price cap as requested by EU leaders at the end of October.

GBPUSD benefited from the broad dollar weakness also from Bank of England Chief Economist Huw Pill, who said the central bank has “more to do” on tightening the monetary policy. The pair trades around 1.1550.

The USDJPY pair edged sharply lower, now trading around 145.50. The Japanese cabinet approved a second supplementary budget spending worth 29.1 trillion yen for this fiscal year to fund an economic stimulus package. Meanwhile, AUDUSD hovers around 0.6510 while USDCAD trades in the 1.3420 price zone.

Gold soared and reached levels last seen in September. The bright metal trades around $1,714 a troy ounce. Crude oil prices, on the other hand, were sharply down, with WTI now trading at around $89.40 a barrel.

Loads of noise in the crypto market amid the collapse of FTX and Binance’s decision to save the crypto exchange. Bitcoin plummeted to $18,355, a fresh 2022 low.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:00

Argentina Industrial Output n.s.a (YoY) dipped from previous 7.6% to 4.2% in September

-

18:34

WTI dips to $90 area concerns about China and US elections

- Oil price dips on renewed fears about Chinese demand.

- The US dollar's reversal has failed to support crude prices.

- WTI falls beyond 2% on the day to hit session lows near $90.00.

WTI prices have extended losses for the second consecutive day on Tuesday, as hopes about a relaxation of the COVID-19 restrictions in China faded, and the investors brace for the outcome of the US mid-term elections.

China confirms its Zero-COVID policy

Hopes that China was contemplating a relaxation on the coronavirus restrictions waned on Tuesday. The Chinese authorities confirmed their commitment to strict COVID-19 controls, which has reactivated fears of negative consequences in oil demand, as the infections increase as the winter flu season approaches.

Furthermore, the uncertainty about the outcome of the US mid-term elections has increased negative pressure on oil prices. Investors have adopted a wait-and-see stance, while the first polls point out to a Republican victory.

The dollar reversal witnessed during the North American trading session has failed to offer any relevant aid to oil futures. Crude prices have dropped more than 2% on the day, extending their reversal from Monday’s highs at 93.65 to session lows right above $90.00.

Technical levels to watch

-

18:32

USDCHF Price Analysis: Drops below parity, extending its losses towards the 50-DMA

- USDCHF tumbles after hitting a daily high of 0.9926 amidst US Dollar weakness.

- USDCHF Price Analysis: A daily close below the 50-DMA might exacerbate a fall toward 0.9700.

The USDCHF tumbles for the second straight day and falls beneath the 50-day Exponential Moving Average (EMA) as the American Dollar gets battered across the board amidst a risk-on impulse underpinning risk-perceived assets. Furthermore, US Treasury yields sank, undermining the greenback. At the time of writing, the USDCHF is trading at 0.9860, below its opening price by 0.15%.

USDCHF Price Analysis: Technical outlook

The USDCHF remains neutral-to-downward biased, even though the major dived since last Friday, when the USDCHF fell short of testing the YTD high at 1.0147, plunging almost 190 pips, after the release of US employment figures. However, the data was mixed, bolstered speculations that the US Federal Reserve will slow the pace of rate hikes.

Since then, the USDCHF extended its losses by more than 1.20%, and the 50-day EMA at 0.9852 is acting as support at the time of typing. So if USDCHF sellers achieve a daily close below the latter, that would expose the 100-day EMA at 0.9734, and the USDCHF will need to hurdle some key support levels.

Therefore, the USDCHF's first support would be the 50-day EMA, followed by the psychological 0.9800 figure. Once cleared, the next support would be the October 6 daily low at 0.9708, followed by the 100-day EMA.

On the upside, the USDCHF first resistance would be 0.9900. Break above will expose the parity, followed by the 1.0100 figure.

USDCHF Key Technical Levels

-

18:04

United States 3-Year Note Auction increased to 4.605% from previous 4.318%

-

17:58

NZDUSD tests 1, ½-month highs at 0.6000 as the US dollar dips

- The kiwi appreciates to 0.6000 amid broad-based dollar weakness.

- USD dives on speculation of a Republican victory in the mid-term elections.

- NZDUSD might appreciate to 0.6500 in 2023 – ANZ.

New Zealand's dollar bounced off the 0,5925 area earlier during Tuesday’s US session, to breach the top of the previous days' trading range, around 0.5950, and reach levels near 0.6000 for the first time since mid-September.

The US dollar dives as the Americans vote

Market speculation about a Republican victory in the mid-term elections has been welcomed by investors. US stock markets have extended gains after a lukewarm opening, with the US dollar and US Treasury bonds losing ground.

The first polls are anticipating a Republican win that may bring Congress to a gridlock. This scenario is expected to complicate the approval of the stimulus measures projected for next year, which would ease pressure on the Federal Reserve to keep ramping up interest rates.

The US dollar Index has dropped nearly 0.9% during the US session to hit six-week lows at 109.40, with the 10-year US Treasury yields retreating from 4.22% to 4.13%.

US stocks, on the other hand, are going through a solid advance, following a mixed opening. The Dow Jones Index trades 1.5% higher, while the S&P Index advances 1.2% and the Nasdaq Technological Index moves 1.5% above the opening levels.

NZD/USD expected to reach 0.65 in 2023 – ANZ

In the long run, FX Analysts at ANZ observe a bullish potential on the pair and point out to a 0.65 target: “With the RBNZ expected to hike by 75 bps at the next two meetings, and the Fed expected to slow the pace of hikes, the NZD has scope to regain some lost ground (…) “One other string in the NZD’s bow is the gap between its current level and fair value, which we see at around 0.65. Our forecasts have this gap slowly closing over coming quarters, taking the NZD to fair value by the end of 2024.”

Technical levels to watch

-

17:56

Wall Street rallies on US midterm election implications and Fed outlook

- US stocks rally in the hope of political gridlock and a Fed pivot.

- US CPI this week will be key as will the results of the midterm elections.

Following a bullish session in Asia, with the Japanese index Nikkei 225 (JP225) reaching its highest level since the 15th of September at around 27,861 points, US stock indexes rose for the third straight session as voting began in the crucial midterm election. The widespread belief is that a Republican win will make it really hard, if not impossible, for Democratic President Joe Biden to carry out proposed tax rises. At the time of writing, the Dow is up 1.43%, the S&P 500 is up 1.15% and the Nasdaq is higher by 1.63%.

When combining the bullish prospects of the elections with a recent turn in sentiment surrounding the Federal Reserve, risk-on is the name of the game this week. Investors are hoping for a political gridlock that could prevent radical policy changes and for a slowdown in the pace of rate hikes from the Fed. Control of just one chamber of Congress by Republicans would put a block on President Joe Biden's legislative push for more business regulations. ''Congressional Republicans have threatened a debt ceiling showdown next year in an effort to cut entitlements and Medicare if they win a majority in the House. In recent weeks, polls have been tilting in favour of the Republicans in both the House and the Senate,'' analysts at Brown Brothers Harriman explained.

When can we expect results?

The Telegraph explains that ''the first wave of vote tallies are expected on the East Coast between 7 pm and 8 pm EST (12 am and 1 am GMT). An early indication of Republican success could come if the races expected to be close - like Virginia's 7th congressional district or a US Senate seat in North Carolina - turn out to be Democratic.

By around 10 pm or 11 pm EST, when polls in the Midwest will be closed for an hour or more, it is possible Republicans will have enough momentum for experts at US media organisations to project control of the House.''

US CPI and Fed outlook

Sentiment slipped on the back of last week's nonfarm Payrolls data and a pivot is eyed by markets sooner than later, despite the Chair Jerome Powell's pushback following last week's Fed decision. In his presser, he advocated a higher terminal rate vs market expectations. However, the Unemployment Rate was a disappointment on Friday and investors are of the mind that a slower pace of tightening is on the cards. We will get one more jobs report and two sets of inflation and Retail Sales data before the December 13-14 meeting. Meanwhile, WIRP suggests a 50 bp hike then is fully priced in, with 30% odds of a larger 75 bp move. The swaps market continues to price at a terminal rate near 5.25%. This brings us to this week's key event in the US Consumer Price Index.

''A below consensus print is likely to help push the pricing for the terminal funds rate modestly lower, likely bull steepening the curve in the process,'' analysts at TD Securities argued. ''The risk of a lower reading is why we took profit on our 2s10s curve steepener last week and went long 10y Treasuries, which we viewed as attractive.'' Ultimately, this would be encouraging for stocks as a softer core print will exacerbate positioning which has moved to swiftly reduce USD longs recently and support risk appetite.

-

17:34

Silver Price Forecast: XAGUSD hits 5-month high and trades above the 200-DMA as buyers' eye $22.00

- Silver price soars more than 3%, back above $21.40s, eyeing a break of the 200-DMA.

- Falling US Treasury yields undermine the greenback, which is also down by more than 0.60%.

- Silver Price Analysis: A daily close above the 200-DMA will exacerbate a rally toward $23.00.

Silver price rallies sharply and is testing the 200-day Exponential Moving Average (EMA) as US Treasury bond yields drop, undermining the American Dollar, on Tuesday amidst a light economic calendar, as US midterm elections get the center spotlight. At the time of typing, the XAGUSD is trading at $21.47 after hitting a fresh 5-month high at $21.62.

Silver price skyrockets as US Treasury yields dip

Wall Street trades in the green, registering gains between 1.16% and 1.48%. The midterm elections in the United States are the main driver of the session, underpinning risk-perceived assets linked to equities rallying after the polls. However, the lack of US economic data until Thursday’s Consumer Price Index (CPI) for October is expected to ease, with headline estimated at 8% and core CPI at 6.5% on annual base readings.

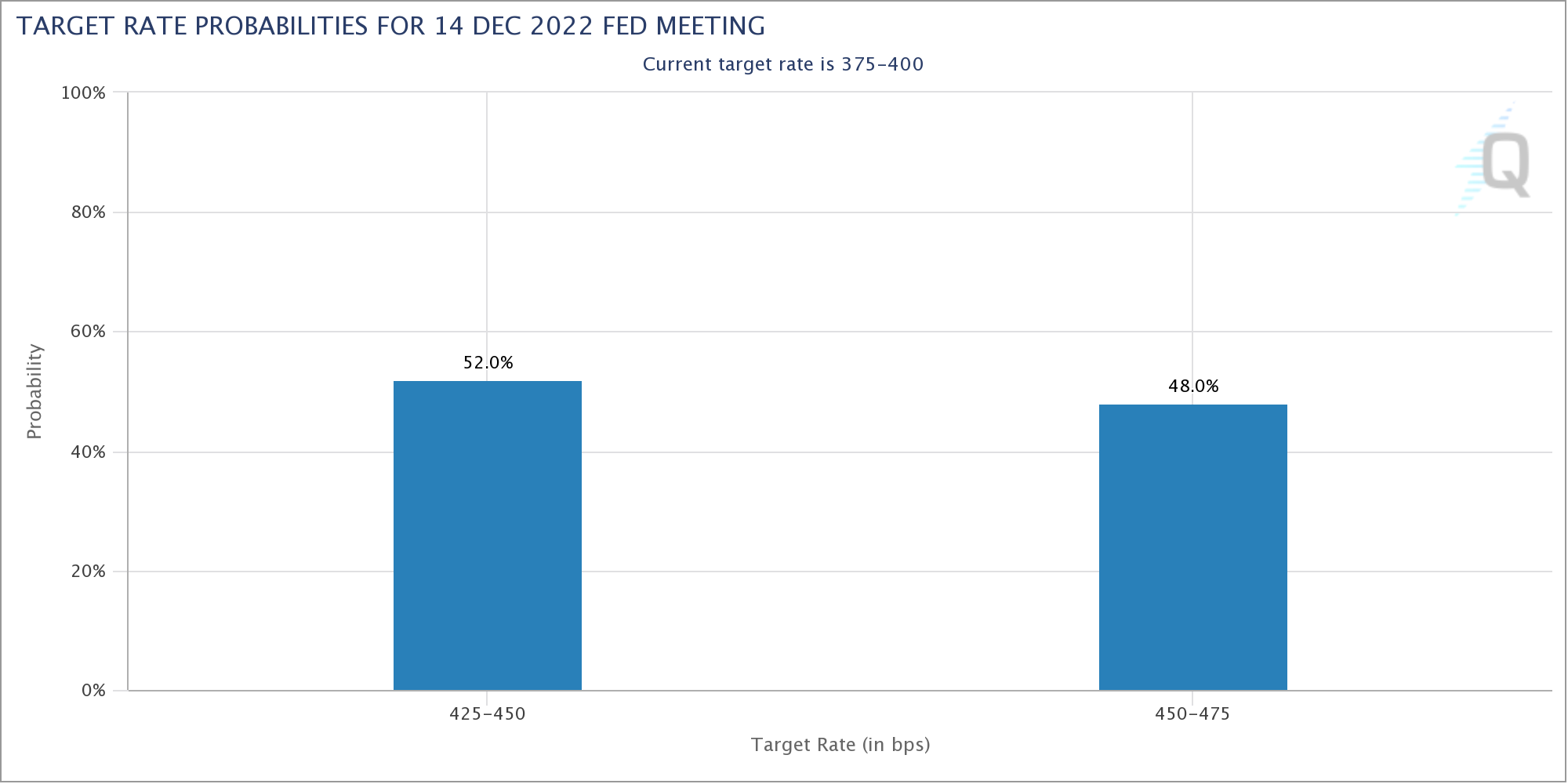

Meanwhile, US Treasury yields, particularly the 10-year benchmark note rate, have decreased from weekly highs of 4.24% to 4.141%. Expectations for the Federal Reserve’s December meeting remain tilted towards hiking 50 bps, as shown by the CME FedWatch Tool at 56.8%. The odds for a 75 bps increase are 43.2%, unchanged from a day ago.

The US Dollar Index, which tracks the buck’s value against a basket of peers, plunges 0.66% and exchanges hands at 109.503, though it should be noted that it has fallen from daily highs at around 110.610.

A light US economic docket revealed the US Redbook Index, which came at 7.6% below its previous reading, while the US IBD/IPP Economic Optimism for November dived from 41.6 to 40.4.

Silver (XAGUSD) Price Analysis: Technical outlook

Silver price is advancing sharply and pierced the 200-day EMA toward hitting the 5-month high at $21.62. Nevertheless, it trimmed some gains, hoovering around the 200-day EMA at $21.48. if XAGUSD buyers achieve a daily close above the latter, the white metal bias will shift upwards, opening the door for further gains. Hence, the XAGUSD’s first resistance would be $22.00, followed b the June 6 swing high at $22.51, followed by the psychological $23.00.

-

17:19

GBPUSD rallies to levels near 1.1600 as the US dollar dives

- The pound shrugs off previous weakness and jumps to session highs near 1.1600.

- US dollar dives, stock markets advance as the Americans go to the polls.

- Investors welcome the first surveys hinting at a Republican victory.

The pound rushed higher during Tuesday’s US session, bouncing off the 1.1470 area to erase daily losses and session highs right below 1.1600 as the Americans head to the polls.

US stocks advance and the dollar dives with all eyes on the elections

The greenback has dropped across the board in the US trading session, with US Treasury bond yields losing ground and Wall Street posting gains, with all eyes on the outcome of the US mid-term elections.

A hitherto rangebound market has led to a significative US dollar pullback as the first surveys started hinting at a Republican victory. This scenario might create a gridlock in the US Congress that would be welcomed by the market as it will hinder the approval of new regulations.

US stock indexes have extended gains after a mixed market opening. The Dow Jones advances 1.6%, while the S&P500 and the Nasdaq Indexes are 1.5% and 1.2% up respectively at the time of writing.

The US Dollar Index, which measures the value of the USD against a basket of the most traded currencies has turned negative on the daily chart, dropping from the 110.30/40 area to six-week lows at the lower range of the 109s.

Technical levels to watch

-

16:51

USDCAD dives below 1.3400 as the US Dollar tanks

- USDCAD plunges close to 0.80% on Tuesday amid broad US Dollar weakness.

- Midterm elections in the United States and Thursday’s US Consumer Price Index (CPI) keeps investors leaning on market sentiment moves.

- USDCAD Price Analysis: A head-and-shoulders chart pattern to send the pair towards 1.3030, shy of the 200-day EMA.

The USDCAD tumbled below the 50-day Exponential Moving Average (EMA) as the US Dollar suddenly weakened across the board as US midterm elections got underway, which has usually been positive for US stocks,risk-perceived assets, to the detriment of the safe-haven status of the greenback. Therefore, the USDCAD is trading at 1.3390, below its opening price by 0.72% after hitting a daily high of 1.3526

The US Dollar sells off, while risk assets extend their gains

Wall Street is extending its gains after opening mixed. The American Dollar is getting battered, as shown by the US Dollar Index, down 0.55%, at 109.60, about to hit a fresh 8-week low. US Treasury yields are also heading south, as the US 10-year extends its losses by almost seven bps, at 4.149%. The United States midterm election grabbed all the headlines, while traders brace for October’s Consumer Price Index (CPI) in search of cues of what the Federal Reserve might do at the next meeting.

In the last week, US employment figures exceeded estimates, but the report was mixed. Even though more jobs were added to the economy, the unemployment rate edged higher, from September’s 3.5% to 3.7%, while wages slid. That said, investors perceived the report as the first sign that the labor market is finally easing.

Concerning the Canadian economy, the latest jobs report smashed the 10K expectations rose by 108K, while Average Hourly Wages increased by 5.5% YoY, above 5.2% of the previous month, adding upward pressures on inflation, which would open the door for further Bank of Canada tightening.

What to watch

On Wednesday, the Canadian economic calendar is empty. On the US front, Fed speakers led by John Williams and Thomas Barking would cross newswires. Data-wise, Wholesale inventories and MBA mortgage applications would be released.

USDCAD Price Analysis: Technical outlook

The USDCAD is neutral biased, though a head-and-shoulders formation in the daily chart surfaced, opening the door for further losses. Also, traders need to be aware that the USDCAD slid below the head-and-shoulders neckline, validating the chart pattern, which, as measured by the distance between the YTD high and the neckline, would fall towards 1.3033. Therefore, the USDCAD first support would be the 1.3300 figure, followed by the 100-day Exponential Moving Average (EMA) at 1.3212, followed by the psychological 1.3100.

-

16:36

AUDUSD breaks through 0.6480 to hit one-month highs at 0.6530 area

- The aussie breaks higher to reach one-month highs above 0.6300.

- The US dollar dives with all eyes on the mid-term elections.

- AUDUSD: A breach of 0.6550 might puss the pair to 0.6680/6750 – SocGen.

The Australian dollar broke higher with the US dollar dropping across the board on Tuesday’s US session. The pair has broken past 0.6480 resistance area to reach levels past 0.6500 for the first time since early October.

The dollar dives with the market's focus on the US elections

A hitherto steady US dollar has lost momentum on the US morning trade, heading lower across the board with the market focusing on the US mid-term elections. Although the final results may still take days, the first polls are anticipating a Republican victory, that might bring the US congress to a gridlock.

That scenario would complicate Biden’s plan to pass the fiscal stimulus measures projected for the next year, which would provide further reasons for the Fed to ease its sharp monetary tightening cycle.

In a rather thin macroeconomic docket, Australian Business conditions deteriorated less than expected in October, although business confidence stalled, reaching its lowest level since January, according to data from the National Australian Bank.

In the US, the NFIB Business Optimism index retreated to 91.3 in October from 92.1 in the previous months. The highlights of the week in the US =calendar, however, will be October’s CPI data, which might offer further insight into December’s monetary policy decision.

AUDUSD: Above 0.6550, the pair might reach 0.6680/6750 – SocGen

From a technical perspective, FX analysts at Société Générale see the pair appreciating further if the 0.6550 resistance is broken: “The pair is evolving within an Inverted Head and Shoulders denoting potential rebound (…)Neckline at 0.6550 is the first layer of resistance. If this is overcome, a short-term up move could materialize towards the July low of 0.6680/0.6750.”

Technical levels to watch

-

16:02

USDMXN Price Analysis: Mexican Peso firm below 19.50

- USDMXN is bearish despite extreme oversold readings.

- The next target is seen at the 19.20/25 support area.

- Recovery above 19.50 to alleviate bearish pressure.

The USDMXN is trading at 19.46, after matching the lowest intraday level since March 2020. Earlier on Tuesday, it rose to 19.50 but then turned to the downside amid a sharp decline of the US Dollar across the board, on US Election Day and ahead of US and Mexico inflation data. On Thursday, Banxico will decide on monetary policy.

The USDMXN is looking comfortable below 19.50, holding a solid negative bias and with the doors open to more losses even as technical indicators in the daily chart show oversold conditions. Below 19.42, the next barrier is seen around 19.20/25 which if reached could trigger a rebound.

The greenback needs to recover firm above 19.50 to alleviate the bearish pressure and point to some consolidation ahead, most likely between 19.50 and 19.70. If the move extends to levels above 19.80, it would suggest a return to the 19.80-20.00 range.

USDMXN daily chart

-638035197698031137.png)

-

16:00

EURUSD, jumps to session highs at 1.0050 as the US dollar dips

- The euro bounces up and hits session highs at 1.0050.

- The US dollar pulls back with all eyes on the US elections.

- EURUSD is aiming for 1.0100 – SocGen.

The euro has squeezed higher on Tuesday’s US trading to hit session highs at 1.0550 with the US dollar dropping suddenly across the board. From a wider perspective, however, the pair has been moving without a clear direction, both sides of the parity level, with the investors adopting a more cautious stance.

The dollar dives with all eyes on the US mid-term elections

Appetite for risk waned on Tuesday as the markets await the outcome of the US mid-term elections. The definitive results of the elections are likely to draw out for some days but initial polls are suggesting a Republican victory that would trigger a Congress gridlock.

The foreseen Republican victory is likely to complicate the approval of the fiscal stimulus measures expected to be launched next year, which would ease pressure on the Fed to ramp up interest rate hikes.

The US dollar has rallied across the board this year, appreciating beyond 10% against the euro, fuelled by the Federal Reserve’s aggressive monetary tightening cycle. With market developments feeding speculation about the end of that cycle, the US dollar might start to give away gains.

EURUSD: aiming to 1.0100 – SocGen

Currency analysts at Société Générale see the pair aiming for October’s peak, at 1.0100: “Daily MACD has been posting positive divergence since July and has now entered positive territory denoting downward momentum is gradually receding. However, the pair has to establish itself beyond 1.0100 to affirm an extended bounce towards 1.0190 and graphical levels of 1.0290/1.0360.”

Technical levels to watch

-

15:57

EURUSD to trade choppily around 0.95 in the months ahead – Rabobank

This year’s move by EURUSD to, and then below, parity marked the first time in about 20 years that the currency pair has traded at these levels. Economists at Rabobank expect EURUSD to move around 0.95 in the coming months.

Fundamentals still biased toward further downside pressure for the Euro

“Fundamentals are still biased towards further downside pressure for the currency pair in the coming months, meaning we would view rallies as an opportunity to sell.”

“In particular we don’t see the EUR as being priced for the impact of winter 2023 and what a prolonged period of expensive energy may mean for the German business model, Europe’s trade and current account balances and the value of the EUR.”

“We have revised lower our forecast for EURUSD on a 12-month view to 0.95 from 1.05. We expect EURUSD to trade choppily around this level in the months ahead.”

-

15:49

EURNOK to see a deeper downtrend on a break below 10.05 – SocGen

A volatile week ended with EURNOK closing below 10.20. Economists at Société Générale expect the pair to sustain further losses on a dip under the 200-Day Moving Average (DMA) at 10.05.

Short-term resistance seen at 10.54/10.56

“A short-term pullback is taking shape; a revisit of the 200-DMA near 10.05 is not ruled out. In case the pair fails to defend this MA, a deeper downtrend is likely towards 9.91 and the lower band of the channel at 9.72/9.70.”

“Short-term resistance is at 10.54/10.56, the 76.4% retracement of recent pullback.”

-

15:45

USDJPY tumbles to weekly lows under 145.50 as USD sinks

- Greenback turns sharply on a surprise moved, US yields also sink.

- US votes a new Congress and governorships.

- USDJPY could post lowest daily close in a month.

The USDJPY accelerated the decline on Tuesday amid a broad-based USD decline and also amid a rally in Treasuries. The pair bottomed at 145.47, hitting the lowest intraday level since October 27. It is hovering near the lows, under pressure, and starting to look at the 145.00 critical support.

And suddenly… a free fall

It was a quiet session, with markets looking how US votes, when the greenback turned sharply lower with no particular trigger. The DXY turned negative and broke under 110.00. It is down for the third consecutive day, now looking at October lows. The US 10-year fell from above 4.20% to 4.15% while the US 2-year dropped from 4.71% top 4.67%, the lowest level since Friday.

US mid-term elections are taking place with Republicans poised for a victory according to the latest polls that could give them full control of Congress. People are voting to elect one third of the Senate, all seats of the House of Representatives, and more than 30 governors. Biden’s administration agenda is at risk.

Regarding US economic data released on Tuesday, the NFIB Business Optimism Index declined in October to 91.3 from 92.1. On Asian hours, Chinese inflation numbers are due and on Thursday US CPI, a report that will weight on expectations about Federal Reserve’s monetary policy.

Looking at 145.00

The slide in USDJPY has taken the 145.00 area back into the radar. A firm break below could trigger more losses, with no much support until 143.80. The mentioned area could also prompt a rebound of the USD. It is a critical level. On the upside, the bearish pressure will fade if the pair rises above 147.00.

-

15:37

US Dollar: Negative pressure is building – Scotiabank

USD holds range ahead of mid-term elections but charts suggest bearish pressures, economists at Scotiabank report.

Washington gridlock to be supportive for stocks

“While the results – especially those from the more contentious races or where the tallying of votes may take some time – risk being disruptive, markets appear to be betting on Washington gridlock (assuming the Republicans do take control of Congress) being supportive for stocks.”

“We note that seasonal trends typically run USD-negative through Q4. Some year-end USD offshore funding pressures are evident (via cross-currency basis) but tensions have eased somewhat over the past couple of weeks, suggesting that USD liquidity, while a little tighter amid rising US interest rates, is not especially problematic at this point. If risk appetite does pick up further momentum into year-end, the USD is liable to ease.”

“Technically, we note incremental pressure on broader measure of the USD’s performance (DXY, Bloomberg Dollar Index) which supports the nearer-term outlook for more consolidation or outright softness.”

-

15:28

GBPUSD to hold back a bullish readjustment in the short-term – SocGen

A muddled message by the Bank of England did not do Sterling any favours last week. Economists at Société Générale expect the GBP to remain under pressure for the time being.

UK Q3 GDP forecast to contract 0.5%

“The explicit lowering of market rate expectations by BoE Governor Bailey is at odds with the US where Fed Chair Powell talked up expectations for the terminal rate. This divergence and growth differentials should hold back a bullish readjustment of the GBPUSD in the short-term.”

“Unless US CPI surprises to the downside this week, investors may decide against cutting Sterling shorts with UK Q3 GDP forecast to contract 0.5%. This will signal the start of the two-year recession.”

-

15:17

Gold Price Forecast: XAUUSD jumps to fresh 5-week high, approaches $1700 amid a soft US dollar

- Gold price creeps higher amidst the lack of US economic data as investors brace for US elections and October’s CPI.

- US Treasury bond yields are lower on the day, while expectations for a 50 bps rate hike by the Fed stood above 50%.

- Gold Price Analysis: Neutral-to-upward biased and might test $1700 in the short term.

Gold price is subdued as the North American session begins, extending its gains due to a bid US Dollar as midterm elections in the United States increased risk appetite while rising US Treasury yields are a headwind for the precious metals segment. Hence, the XAUUSD is trading at $1694.60, slightly above the 50-day Exponential Moving Average (EMA), down by 0.04%.

Gold price recovers its bright, though fluctuating, as traders brace for US midterm elections

Sentiment is mixed, as US equities fluctuate at the New York open. The lack of meaningful economic data, aside from the US midterm elections, with the US House and the Senate at stake, is grabbing the headlines. Also, October inflation figures of the United States, to be released on Thursday, would be the barometer for investors of what the Federal Reserve would decide in the December meeting.

Aside from this, US Treasury yields, mainly the 10-year T-bond yield is, retreating from weekly highs of 4.24% down to 4.161%. Meanwhile, expectations for the Federal Reserve’s December meeting remain tilted towards hiking 50 bps, as shown by the CME FedWatch Tool at 52%. The odds for a 75 bps increase are 48%, unchanged from a day ago.

The US Dollar Index, which tracks the buck’s value against G8 currencies, dives 0.44%, at 109.74, though it should be noted that it has fallen from daily highs at around 110.610.

A light US economic docket revealed the US Redbook Index, which came at 7.6% below its previous reading, while the US IBD/IPP Economic Optimism for November dived from 41.6 to 40.4.

Gold (XAUUSD) Price Analysis: Technical outlook

XAUUASD suddenly jumped unexpectedly in the last 5 minutes, recording a daily high of $1698, shy of breaking the $1700 figure, which could open the door to pose a challenge to the 100-day Exponential Moving Average (EMA) at $1716.96. If the XAUUSD clears the latter, that will open the door toward the 200-day EMA at $1805.

On the other hand, key support levels lie at the 50-day EMA at $1672, ahead of the November 8 daily low at $1664.80 and the $1650 figure.

-

15:05

Stepping down from aggressive rate hikes could help boost stock markets – Charles Schwab

Central banks seem to be stepping down from aggressive rate hikes, which may lead to a year-end "Santa Pause" rally for stocks, economists at Charles Schwab report.

"Santa Pause" rally could be in store for markets as the year draws to a close

“Markets seem to have been taking their direction from central banks for most of 2022. While a pivot to rate cuts does not seem likely in the near term, if central banks signal a step down in the size of the rate hikes or a pause, stocks may breathe a sigh of relief.”

“Stepping down from aggressive rate hikes could help boost stock markets. Since signs of stepping down began to emerge at the start of October, the MSCI EAFE Index of international stocks climbed nearly 10%. Stock markets outside the US that are outperforming the S&P 500 Index this year include many countries where the central banks are stepping down.”

“There can be no guarantee that central banks will continue to step down the pace of their hikes or pause them, but if they do it is possible a ‘Santa Pause’ rally could be in store for markets as the year draws to a close.”

-

15:03

United States IBD/TIPP Economic Optimism (MoM) dipped from previous 41.6 to 40.4 in November

-

14:53

USD Index: Bullish move runs out of steam near 110.60

- The daily rebound in the dollar falters around 110.60.

- NIFB Business Optimism Index eases to 91.3 in October.

- Investors’ attention remains on the midterm elections on Tuesday.

The dollar’s recovery appears to be losing some momentum after reaching daily highs around 110.60 when tracked by the USD Index (DXY) on turnaround Tuesday.

USD Index looks at midterm elections

The index clings to its daily gains north of the 110.00 region on Tuesday, looking to finally set aside two consecutive daily retracements and embark on a more serious rebound.

The dollar trims part of its advance along with a tepid retracement in US yields across the curve, while market participants remain cautious as the US midterm elections are under way.

In the US data space, the NIFB Business Optimism Index receded a tad to 91.3 in October (from 92.1), while the IBD/TIPP Economic Optimism index is due later ahead of the weekly report by the API on US crude oil inventories in the week to November 4.

What to look for around USD

The index manages to stage a mild recovery after hitting 2-week lows in the proximity of the 110.00 region on Tuesday.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the buck.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Consumer Credit Change (Monday) – Midterm Elections (Tuesday) – MBA Mortgage Applications, Wholesale Inventories (Wednesday) – Inflation Rate, Initial Jobless Claims, Monthly Budget Statement (Thursday) – Preliminary Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: US midterm elections. Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.07% at 110.29 and faces the initial resistance at 113.14 (monthly high November 3) followed by 113.88 (monthly high October 13) and then 114.76 (2022 high September 28). On the downside, the breakdown of 109.53 (monthly low October 27) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13).

-

14:46

GBPUSD rebounds back above 1.1450 on a quiet session

- GBPUSD with a bearish intraday bias, Pound to strengthen above 1.1550.

- DXY up for the first time after two negative days on US Election Day.

- Americans vote for a new Congress and governorships.

The GBPUSD hit a fresh daily low at 1.4128 on Tuesday and then rose back above 1.1450. It remains in negative territory for the day, pulling back after being unable to hold above 1.1500.

The key driver in cable's retreat is a stronger US dollar, even as US yields decline. US mid-term elections are taking place. Republicans are poised for a victory according to the latest polls. Americans are voting to elect one-third of the Senate, all seats of the House of Representatives, and more than 30 governors. The election results will likely have significant implications for Biden's administration agenda.

With a cautious tone amid US elections, price action across financial markets remains limited. US yields are modestly lower while the DXY gains 0.12%, rising after two days of sharp declines.

Regarding US economic data released Tuesday, the NFIB Business Optimism Index declined to 91.3 in October from 92.1. This week's key number will be the Consumer Price Index on Thursday, which could critically impact markets and expectations about Federal Reserve's monetary policy.

Earlier today, Bank of England Chief Economist Huw Pill said the central bank needs to raise rates further to tighten monetary policy. "At some point, we need to think about broader economic outlook".

Bearish intraday, above 1.1400

The GBPUSD is moving with a bearish intraday bias, but so far it has remained above an important support area between 1.1400 and 1.1420. A break lower could trigger more losses, toward the 20-Simple Moving Average in 4-hour charts at 1.1350.

On the upside, a firm break above 1.1550 would strengthen the outlook for the Pound, targeting 1.1600 and probably a test of the monthly high at the 1.1650 zone.

Technical levels

-

14:38

GBPUSD: Major resistance at 1.1550/60 to contain gains in the short-run – Scotiabank

GBPUSD consolidates below major resistance in the mid-1.15s. Economists at Scotiabank expect Sterling to struggle to see further gains.

Short-term support looks firm at 1.1425/35

“Higher rates plus some – likely significant –fiscal retrenchment to be unveiled by the Chancellor next week suggest even stiffer growth headwinds (beyond the cost-of-living crisis) for the UK economy in the months ahead.”

“Sterling may struggle to extend gains against a soft USD and seems liable to remain weak on the crosses at least until the extent of Chancellor Hunt’s plans is revealed.”

“Short-term support looks firm at 1.1425/35 intraday.”

“Major resistance lies above the market at 1.1550/60 – recent peaks and major trend resistance off the early 2022 high. This may contain GBP gains in the short-run – unless the USD weakens more significantly.”

-

14:23

AUDUSD to see a short-term bounce on a break past 0.6550 – SocGen

The AUDUSD pair turned south after having failed to clear the 0.6500 hurdle. The Aussie needs to surpass the 0.6550 mark to see a bounce towards 0.6680/0.6750, analysts at Société Générale report.

A short-term bounce is not ruled out

“The pair is evolving within an Inverted Head and Shoulders denoting potential rebound.”

“Neckline at 0.6550 is the first layer of resistance. If this is overcome, a short-term up move could materialize towards the July low of 0.6680/0.6750.”

“Right shoulder level at 0.6270 is important support.”

-

14:18

EURUSD Price Analysis: Immediately to the upside comes the 100-day SMA

- EURUSD sees its recent strong upside temporarily trimmed on Tuesday.

- Gains could accelerate beyond the 100-day SMA at 1.0040.

EURUSD meets robust resistance in the 1.0030/40 band for the time being, an area coincident with the 100-day SMA.

If the pair manages to surpass that region in a sustainable note, it could then challenge the October high at 1.0093 (October 27) prior to the September top at 1.0197 (September 12).

While above the 9-month resistance line, today near 0.9850, extra gains look likely.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0455.

EURUSD daily chart

-

13:55

United States Redbook Index (YoY) declined to 7.6% in November 4 from previous 9.7%

-

13:22

Gold Price Forecast: XAUUSD’s latest upswing lacks one important fundament support – Commerzbank

Gold price climbed to $1,680 following the publication of US labour market data on Friday. As strategists at Commerzbank note, a weaker US Dollar pushes up the yellow metal but ETF outflows continue to weigh on price.

Latest surge likely attributable to covering of speculative short positions

“Gold was up by 2.2% at the end of the week’s trading. The upswing was boosted by the depreciation of the USD. This is remarkable given the renewed sharp rise in US employment in October, plus a marked upward revision of the previous month’s figure. It seems that market participants were focusing more on the steeper-than-expected rise in the US unemployment rate.”

“The latest surge in the Gold is likely to have been attributable to covering of speculative short positions. They amounted to a good 40,000 contracts just a few days earlier, according to the CFTC, putting them only marginally below their late-September high. By contrast, gold ETFs registered sizeable outflows at the end of last week, which picked up pace in the wake of the Fed meeting. The upswing in the gold price is thus lacking one important fundament support.”

-

13:16

EURUSD: Modest to resume above 1.0005/10 towards 1.0050 – Scotiabank

EURUSD trades narrowly around parity. Economists at Scotiabank expect the pair to see modest gains toward 1.0050 on a move past 1.0005/10.

ECB policymakers stress inflation control

“Comments from top ECB policymakers (Villeroy, Lagarde, Nagel) in the past day or so have stressed the importance of bringing inflation back under control as soon as possible – suggesting a broad consensus among hawks and the more centrist policy makers at least on the need for additional tightening being implemented quickly. This should help keep the EUR underpinned.”

“Modest EUR gains at least are likely to resume above 1.0005/10 towards 1.0050.”

“Key short-term resistance is 1.0090 (late Oct high) and 1.0195 (early Sep high). Support is 0.9955/60.”

-

12:49

US Midterm Elections: Three things to know – Morgan Stanley

Americans head to the polls on Tuesday, November 8 but it could be days before we know the midterm election results. Investors should be prepared, as unexpected outcomes can create market volatility, economists at Morgan Stanley report.

A surprise showing for Democrats may mean volatility