Notícias do Mercado

-

23:57

EURUSD Price Analysis: Bulls and bears about to go head to head

- EURUSD bears eye a deeper correction, but US CPI looms.

- EURUSD bulls look to guards 0.9950/75 that could hold as support.

The euro was hit hard on Wednesday and is trying to correct on Thursday, although is facing a robust US Dollar as traders braced for any upside surprise in the upcoming US Consumer Price Index report. US yields and the greenback rallied on a soft US Treasury auction which has left a bearish outlook on the charts for the rest of the week as the following illustrates from a bearish perspective.

EURUSD H1 chart

The bearish trend is dominant and the bears eye a break of the 0.9990s for a run to test below 0.9950 and the last quarter of the area. In doing so, this will be running into length built up over the course of the week, piggybacking on Friday's risk-on rally. On the other hand, a miss in the inflation data would likely play havoc on the greenback and see the Euro as a major beneficiary:

EURUSD daily chart

The price moved out of the trendline resistance and is therefore could be teeing up for a move higher. 0.9950/75 could hold as support.

-

23:50

Japan Foreign Investment in Japan Stocks increased to ¥340B in November 4 from previous ¥337B

-

23:50

Japan Foreign Bond Investment increased to ¥-581.8B in November 4 from previous ¥-1172.5B

-

23:49

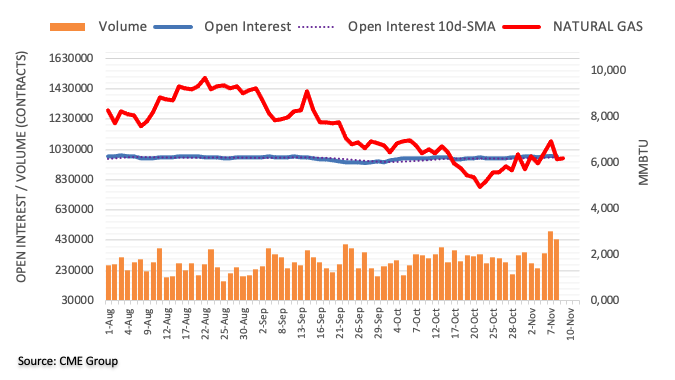

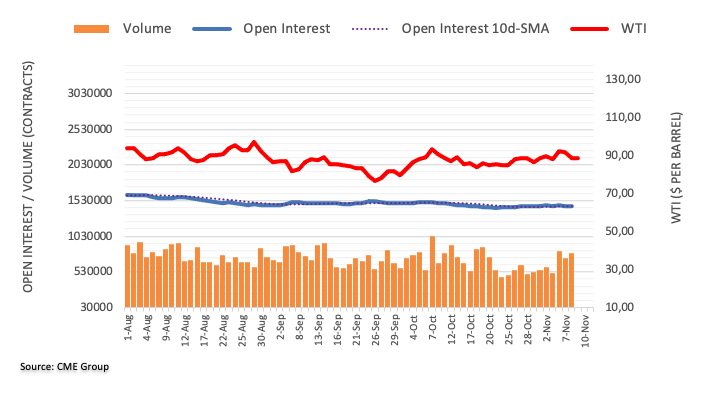

WTI declines near a two-week low below $85.00 as US CPI hogs limelight

- Oil prices have dropped to near a two-week low at $84.75 amid multiple headwinds.

- Build-up of oil inventories, recovery in the DXY, and inflation risks to the US economy add volatility to oil prices.

- IEA head slammed OPEC+ for oil supply cuts as it may worsen the developing nations’ situation.

West Texas Intermediate (WTI), futures on NYMEX, have plunged more than 3% to near two-week low at around $84.75 amid a build-up of oil inventories last week, and rising odds for the higher peak of Federal Reserve (Fed)’s terminal rate. The oil prices nosedived after surrendering the psychological support of $90.00 as oil demand is facing multiple headwinds.

On Wednesday, US Energy Information Administration (EIA) reported a build-up of oil inventories by 3.925 million barrels for the week ending November 4. The addition of oil stockpiles weighed significant pressure on oil prices.

Apart from that, raising fears of an economic downturn in the US economy is also dampening the market mood. Richmond Federal Reserve (Fed) President Thomas Barkin on Wednesday cited that Fed’s fight against inflation may lead to a downturn in the US economy but that is a risk that the Fed will have to take, reported Reuters.

A sheer recovery in the US dollar index (DXY) also impacted the oil prices. The DXY recovered sharply as odds for higher Fed’s peak rate accelerated. Economists at ABN AMRO predicted that the Fed will shift its peak higher than the projected terminal rate to 5% (with a 25 bps rate hike in the first two monetary policies in CY2023 after a 50 bps rate hike in December). Going forward, a higher release of US inflation will strengthen the DXY and may escalate selling pressure for oil.

For OPEC+’s production cut decision, head of the International Energy Agency (IEA) Fatih Birol slammed the oil cartel’s decision to cut oil production as it might worsen the outlook for developing countries that are sliding towards recession, reported Bloomberg. He further added that the move is fueling inflation, especially in developing countries, and may require a “rethink,”

In China, a postponement in the reopening of the economy is also adding to the sell-side filters for the oil prices. Expectations of weak oil demand in the coming months due to a continuation of the no-tolerance Covid-19 approach are supporting oil bears.

-

23:40

Bond strategists: Fed terminal rate to reach just under 5% – Reuters poll

Sovereign bond yields are likely to remain elevated in the near term and be at higher levels in a year than predicted last month,” per the latest Reuters survey of fixed income strategists. “The bond strategists expected a terminal Federal Funds Rate just under 5%,” the poll adds.

Key findings

The median forecast from over 30 bond strategists who answered an additional question in the Nov. 4-9 poll put the terminal fed funds rate at 4.75%-5.00%, with one forecast as high as 5.50%-5.75%.

That median view was one quarter percentage point higher than what economists expected in a separate Reuters poll, but slightly lower than what interest rate futures were pricing in.

A strong 74% majority, 23 of 31, expected the terminal rate to be reached by end-Q1 2023. While six said Q2, two chose Q4 of next year. The bulk of responses were taken before any results from the US midterm elections were available.

Also read: Forex Today: Looking for safety ahead of US CPI

-

23:32

Silver Price Analysis: Rising wedge confirmation favors XAGUSD bears near $21.00

- Silver price holds lower ground after confirming a bearish chart pattern.

- MACD conditions, clear break below November’s top add strength to the bearish bias for XAGUSD.

- 200-SMA appears strong support to watch during further downside, bulls need validation from $21.30 to return.

Silver price (XAGUSD) justifies the rising wedge confirmation as sellers attack $21.00 during Thursday’s Asian session. In doing so, the bright metal defends the previous day’s bearish move, the biggest daily fall in a week.

Not only the rising wedge confirmation but bearish MACD signals and the metal’s sustained break of the previous monthly peak also keeps the sellers hopeful.

That said, the $21.00 and the $20.00 round figures gain the short-term seller’s attention before a horizontal area comprising multiple levels marked since late September, around $19.90, challenges the XAGUSD bears.

Also acting as the key support is the 200-SMA level surrounding $19.50, a break of which won’t hesitate to print the theoretical target near $18.00.

Meanwhile, XAGUSD buyers may have a tough time in returning to the table as the support line of the stated wedge joins October’s peak to highlight $21.30 as the crucial upside barrier.

Following that, a one-week-old ascending resistance line near $21.90 and the $22.00 threshold could lure the silver buyers before June’s peak near $22.50.

Silver price: Four-hour chart

Trend: Further downside expected

-

23:12

GBPUSD holds lower ground below 1.1400 amid market’s anxiety ahead of US inflation, UK GDP

- GBPUSD stays defensive around 50-DMA support, inactive after falling the most in a week.

- Sour sentiment underpins firmer US dollar, light calendar in the UK keeps bears hopeful.

- US CPI for October precedes UK Q3 GDP to direct short-term market moves.

GBPUSD remains mildly bid around 1.1350, following a 1.6% daily fall, as traders seek clear directions during early Thursday.

The Cable pair portrayed broad US dollar strength amid a risk-off mood to recall the bears. However, the cautious sentiment ahead of today’s US Consumer Price Index (CPI) data for October and the British Gross Domestic Product (GDP) for the third quarter (Q3), up for publishing on Friday, restrict the Cable pair’s immediate moves.

Hopes of more positive measures from the UK, in its upcoming fiscal plan, join the hopes of political optimism to challenge the GBPUSD bears of late.

As per Bloomberg News, the UK is to cut surcharge on bank profits to 3% to keep industry Competitive. Also positive for the Cable pair are the latest diplomatic moves by UK Prime Minister (PM) Rishi Sunak. “Rishi Sunak will become the first British prime minister in 15 years to attend the British-Irish Council summit on Thursday and meet with the leaders of the Scottish and Welsh devolved governments as he bids to rebuild relations,” said Reuters.

Fears emanating from China’s coronavirus conditions joined the hopes of the US government gridlock, due to the midterm elections, to weigh on the market sentiment the previous day. While portraying the mood, equities returned to the red after a three-day absence while the US Treasury yields also remained depressed. Even so, the US Dollar Index (DXY) bounced off a six-week low to print the first daily gain in three.

Alternatively, downbeat comments from the US Federal Reserve (Fed) policymakers and the mixed headlines from Russia tried to restrict the GBPUSD pair’s downside.

Moving on, the US CPI for October, expected 8.0% versus 8.2% prior, to direct immediate GBPUSD moves ahead of the first readings of the UK Q3 GDP. While a likely easing in the US CPI could weigh on the quote amid the latest downbeat Fedspeak, anticipated weakness in the British GDP data could keep the pair sellers on the table.

Technical analysis

Although the 50-DMA challenges GBPUSD bears around 1.1320, the pair’s retreat from the two-week-old resistance line, close to 1.1585 by the press time, keeps the bears hopeful of meeting the monthly support line near 1.1200.

-

23:07

NZDUSD Price Analysis: Bears in control with eyes on daily trendline

- NZDUSD bulls are out of luck at this juncture.

- Bears look for a downside extension to the daily trendline.

The Antepodians have stalled into Thursday, reversing track as the US Dollar hardens while traders braced for any upside surprise in the upcoming US inflation report while US yields rallied on a soft US Treasury auction. As per the prior analysis, NZDUSD Price Analysis: Bulls holding above key 0.5950 as bears try to take back control, where it was explained that the pair was testing the commitments of the bulls at the next micro trendline, 0.5950 is important in this regard, the following played out:

NZDUSD prior analysis

Update:

As for the daily chart, the price was bounded by resistance and it was stated that the doji could turn out to be pivotal for the pair and week:

If the bears commit, then there will be prospects of a test of the broader trendline and a move into the key Fibonacci near 0.5850 in a 50% mean reversion:

Update...

We are still some ways to go yet and the engulfment of the doji could be significant, propelling the pair lower depending on the outcome of the US inflation data perhaps.

For the hourly template, this could mean a continuation is in order for the hours ahead:

-

23:05

GBPJPY attempts a rebound from 166.00 ahead of UK GDP data

- GBPJPY has witnessed a loss in the downside momentum of around 166.00 as the focus has shifted to UK GDP.

- The UK GDP data is seen lower at 2.1% vs. the prior release of 4.4% amid accelerating BOE rates.

- There is no third budget plan on the table for now by the Japanese administration.

The GBPJPY pair has sensed buying interest after a sheer decline to near 166.00 in the late New York session. The asset has displayed signs of exhaustion in the downside momentum, however, it would be early to call it a reversal amid the unavailability of any reversal trigger.

Meanwhile, the risk tone is extremely negative as S&P500 nosedived on Wednesday led by multiple headwinds. Lay-off by Meta to trim discretionary spending, anxiety ahead of the US Consumer Price Index (CPI) numbers, and firmer chances of Republicans’ win in US mid-term elections weighed significant pressure on the US equities.

For further guidance, investors are focusing on the UK Gross Domestic Product (GDP) data, which will release on Friday. The GDP data on an annual basis is seen lower at 2.1% vs. the prior release of 4.4%. And, the quarterly regime is expected to display negative growth by 0.5% against an expansion of 0.2%.

Accelerating interest rates by the Bank of England (BOE) to curtail the double-digit inflationary pressures have resulted in the postponement of the expansion plans by various firms to avoid hefty interest obligations. Therefore, the extent of the economic activities has declined sharply. The scale of economic activities may decline further as UK novel leadership is preparing a budget on spending cuts and tax hikes to contain the debt crisis.

On the Tokyo front, Japanese Economy Minister Shigeyuki Goto said on Wednesday, it is “desirable for FX to move stably reflecting fundamentals.” The Japanese official also clarified that there is no plan on the table for the third budget. This week the administration confirmed a second budget worth 29.1 trillion Japanese Yen after a budget of $198 Billion to spurt the aggregate demand.

-

22:55

AUDJPY Price Analysis: An evening star formation in the daily chart exacerbates a fall towards 93.00

- The AUDJPY extended its losses to two-straight days courtesy of risk aversion.

- AUDJPY Price Analysis: Break below 94.00 could tumble the pair towards November’s low at 92.96.

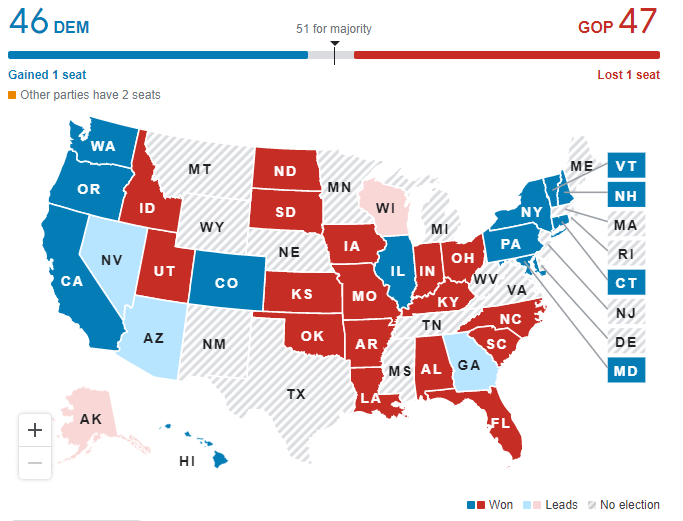

The AUDJPY dropped below the 50 and the 100-day Exponential Moving Averages (EMAs) on Wednesday, amidst a risk-off impulse courtesy of the US Republican Party failing to sweep the midterm elections, as speculations mounted that a Republican majority would suggest few major policy changes in the next two years. At the time of writing, the AUDJPY is trading at 94.14, registering minuscule gains as the Asian session begins.

AUDJPY Price Analysis: Technical outlook

The AUDJPY is range-bound, trapped within the 94.00-95.60 range for the last four trading days, unable to break above/below the range, even though market sentiment fluctuates, and kept global equities volatile. Of note, the Relative Strength Index (RSI) at 49 turned bearish, suggesting that sellers are gathering momentum. However, unless Japanese Yen buyers break beneath the AUDJPY 94.00, that would open the door for further losses. Otherwise, the cross-currency pair will remain subdued within the previously mentioned area.

During the last couple of days, the AUDJPY shifted neutral-to-downward biased in the near term. The AUDJPY Wednesday’s price action depicts the pair dived below the 50, 100, and 200-EMAs, laying the ground for further downside. So the AUDJPU path of least resistance is downwards. Further cementing the bearish bias case is the RSI at bearish territory and not even close to the 50-midline.

Hence, the AUDJPY’s first support would be the 94.00 psychological level. Break below will expose the S1 daily pivot at 93.84, followed by the S2 daily pivot level at 93.58.

AUDJPY Key Technical Levels

-

22:48

USDCHF Price Analysis: Retreats towards 0.9800 amid failure to cross 50-DMA

- USDCHF remains on the bear’s radar despite bouncing off a five-week low.

- Corrective bounce failed to cross the 50-DMA hurdle, suggesting further downside room.

- Bearish MACD signals, sustained trading below the previous key support also favor sellers.

- Ascending support lines from early August lure bears, 0.9900 adds to the upside filters.

USDCHF fades the previous day’s bounce off a monthly low as it drops back to 0.9845 during the early hours of Thursday. In doing so, the Swiss currency pair remains below the 50-DMA hurdle despite the latest corrective bounce.

Also keeping the pair sellers hopeful are the bearish MACD signals and the quote’ sustained trading below the five-week-old ascending support line, near 0.9900 by the press time.

Even if the USDCHF pair manage to cross the 50-DMA hurdle of 0.9860, as well as the aforementioned support-turned-resistance line, around 0.9900, the sellers aren’t off the table as multiple resistances near 0.9920 and 1.0060 could challenge the pair’s upside moves.

Alternatively, a three-month-old ascending trend line, around 0.9790 by the press time, restricts immediate losses of the AUDUSD pair.

Following that, another support line from early August, near 0.9680, could entertain the bears.

It’s worth noting, however, that the AUDUSD pair’s sustained downside past 0.9680 won’t hesitate to challenge September’s low near 0.9480.

USDCHF: Daily chart

Trend: Further downside expected

-

22:47

USDCAD Price Analysis: Bulls eye 1.3650 as next key upside target

- USDCAD could be in for a correction with the 61.8% Fibonacci eyed.

- Support is eyed around 1.3480/00 while1.3650 comes as the next key upside target.

The Canadian dollar weakened against its US counterpart on Wednesday following some strong two-way price action in the New York session that eventuated in a bid in the US dollar as US yields surged on the back of a weak Treasury auction. The moves have seen USDCAD rally onto shorts and there could be more to come. Investors are now shifting focus to US inflation data on Thursday for clues on the path of future interest rate hikes by the Federal Reserve which could seal the fate for the bears on a better-than-expected outcome. Meanwhile, the following illustrates the potential trajectory from a bullish perspective:

USDCAD H1 chart

The price is up to the prior highs of the sideways channel formed on Monday and Tuesday. A correction could be in order at this point and a reversion to the 61.8% Fibonacci meets structure around 1.3480/00.1.3650 comes as the next key upside target.

-

22:33

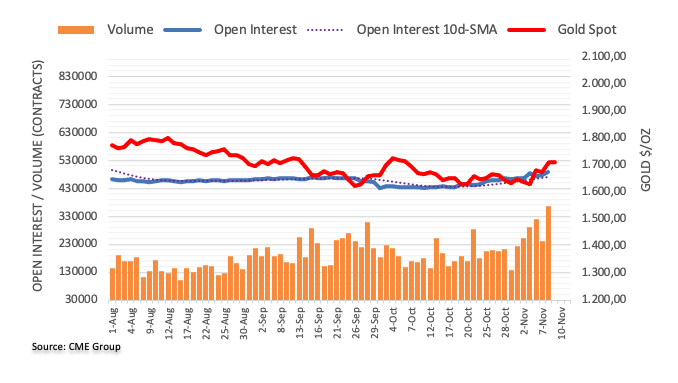

Gold Price Forecast: XAUUSD holds $1,700 support despite risk-off mood, US inflation eyed

- Gold price has sensed support around a $1,702.00 cushion despite negative market sentiment.

- The DXY recovered significantly to near 110.40 ahead of October’s inflation report.

- Core CPI figure will be of utmost importance as it has not displayed signs of exhaustion yet.

Gold price (XAUUSD) is continuously picking bids around the immediate hurdle of $1,702.00 from Wednesday. The precious metal surrendered its entire Wednesday’s gains after the risk profile turned soar as investors underpinned the US dollar index (DXY) ahead of the US inflation event.

The S&P500 index was the biggest victim as investors turned anxious ahead of the outcome of the mid-term elections in addition to October’s inflation report. A majority win of Republicans will trigger political instability as approval of bills and laws will have to take a tangled route. Meanwhile, the DXY recovered sharply after registering a fresh seven-week low at 109.35.

On Thursday, the US inflation figures will remain in the spotlight. As per the preliminary estimates, the headline US CPI will decline to 8.0% vs. the prior release of 8.2%. Thanks to the falling gasoline prices that are continuously weighing pressure on plain-vanilla Consumer Price Index (CPI) figures. Also, the core CPI is seen marginally lower at 6.5%. Investors will mainly focus on core CPI figures as the catalyst has not displayed signs of meaningful exhaustion yet.

Gold technical analysis

On an hourly scale, the gold price is oscillating in a range of $1,702.10-1,722.40 after a sheer upside move. The precious metal is still holding the 50-period Exponential Moving Average (EMA) at $1,698.40, which signals that the upside is intact.

The Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 after remaining in the bullish range, which indicates that the upside momentum has exhausted but that doesn’t warrant a bearish reversal.

Gold hourly chart

-

22:22

AUDUSD struggles to defend 0.6400, Australia Consumer Inflation Expectations, US CPI eyed

- AUDUSD holds lower ground after the biggest daily loss in a month.

- China’s covid woes, softer inflation data joined pre-US inflation anxiety to weigh on prices.

- Dovish comments from RBA’s Bullock strengthened bearish bias.

- Aussie Consumer Inflation Expectations can offer immediate directions but US CPI is the key.

AUDUSD bears pressure the quote to revisit 0.6400, despite the latest inaction around 0.6420, amid lackluster markets. In doing so, the Aussie pair extends the previous day’s losses, the biggest in one month, during the early hours of the key Thursday.

The China-linked risk aversion could be considered the key catalyst for the AUDUSD pair’s downside move the previous day. Fears from the dragon nation escalated after six-month high daily covid numbers and a fresh lockdown in one more district. Furthermore, downbeat China inflation data also weighed on the pair. That said, the headline Consumer Price Index (CPI) dropped to 2.1% versus 2.4% market forecasts and 2.8% prior. However, the Producer Price Index (PPI) improved to -1.3% compared to -1.5% expected and 0.9% previous readings.

Elsewhere, dovish comments from the Reserve Bank of Australia’s (RBA) Deputy Governor Michele Bullock also contributed to the AUDUSD pair’s weakness. There are “good reasons to think we are approaching the peak of inflation this cycle,” said RBA’s Bullock on Wednesday. The policymaker added, “We have already raised rates aggressively.”

It should be noted that the fears of a government gridlock in the US, due to the midterm elections, also exerted downside pressure on the risk-barometer pair.

On the other hand, New York Federal Reserve (Fed) President John Williams made some comments on inflation expectations in the text of a speech to be delivered to an audience in Zurich. “Relatively stable long-term inflation expectations are good news,” stated the policymaker.

Additionally, mixed headlines surrounding Russia also tried to tame the risk-off mood but failed to gain major attention. Russia appears to retreat from the only Ukrainian regional capital captured, namely Kherson, whereas President Vladimir Putin is less likely to attend the upcoming G-20 summit in Bali, starting from November 15.

Amid these plays, equities returned to the red after a three-day absence while the US Treasury yields also remained depressed. Even so, the US Dollar Index (DXY) bounced off a six-week low to print the first daily gain in three.

Moving on, Australia’s Consumer Inflation Expectations for November, expected 5.7% versus 5.4% prior, will precede the US Consumer Price Index (CPI) for October, expected 8.0% versus 8.2% prior, to direct immediate AUDUSD moves.

Given the recently dovish RBA comments and the risk-off mood, the AUDUSD is likely to stay on the bear’s radar unless the US inflation numbers disappoint the traders by a larger miss.

Technical analysis

A clear pullback from the 50-DMA, around 0.6500 by the press time, directs AUDUSD towards the 21-DMA nearby support, close to 0.6370 at the latest.

-

21:55

EURUSD rebound from parity, risk-off impulse still solid ahead of US CPI

- EURUSD has found an immediate cushion around 1.0000 ahead of the US CPI.

- US equities witnessed a massive sell-off amid anxiety ahead of US mid-term elections.

- Eurozone CPI is still seen at 3% in three years and 5.1% in the next 12 months.

The EURUSD pair has picked parity as immediate support in the early Tokyo session after a corrective move from around 1.0100. The asset sensed selling pressure as the market turned cautious ahead of the US Consumer Price Index (CPI) release.

S&P500 sensed an intense sell-off amid headwinds of the US mid-term elections outcome and upside risks from the inflationary pressures as they can move north despite projections for a decline. Meanwhile, the US dollar index (DXY) rebounded firmly to 110.50 amid an improvement in safe-haven’s appeal.

The 10-year US Treasury yields witnessed a steel fall below 4.10% as odds are favoring a rate hike of 50 basis points (bps) by the Federal Reserve (Fed) in its December monetary policy meeting, according to the CME FedWatch tool.

Economists at ABN AMRO are predicting that the Fed will shift its peak higher than the projected terminal rate to 5% (with a 25 bps rate hike in the first two monetary policies in CY2023 after a 50 bps rate hike in December). However, the Fed will also look for cuts from September and those cuts will be steeper once macro conditions in the US allow for this.

Going forward, the headline US CPI is seen lower at 8%, and the core inflation that excludes oil and food price growth would drop marginally to 6.5%.

On the Eurozone front, the inflation rate is in the double-digit figure and is hurting the households’ sentiment. A survey conducted by the European Central Bank (ECB) of consumer expectations for inflation dictates that consumers still see inflation at 3% in three years and 5.1% over the next 12 months.

-

21:55

NZDUSD struggles at the 200-DMA and tumbles below 0.5900 on risk aversion amid US elections

- The NZD weakened against the American Dollar on risk aversion.

- The USD got bolstered by the United States midterm elections split between the Republicans and the Democrats.

- NZDUSD was unable to crack the 200-day EMA and tumbled below 0.5900, ahead of the October US inflation report.

The New Zealand Dollar retraces after the NZDUSD hit on Tuesday its weekly high at 0.5999 amid a session of broad American Dollar weakness, as speculators were assessing a possible sweep of the Republican Party in the United States midterm elections, but a close race and a possible split in the US Congress fretted investors. On Wednesday, the story is different, as risk aversion took over, and the safe-haven status of the US Dollar weighs against most G8 currencies, including the NZD. At the time of writing, the NZDUSD is trading at 0.5880, down by more than 1%.

The United States midterm elections results suggest a split US Congress

US equities finished in the red as most Wall Street analysts were speculating that Republicans would sweep both the US House and the Senate, which was perceived as risk appetite positive. However, data confirms that Congress would be split. Regarding the US House, reports said that the Republicans gained 206 seats vs. 177 of the Democrats, while the US Senate is at 48 for each party. Nevada, Arizona, and Georgia are pending to finish the vote count. Still, at the time of typing, two out of those three states are leaning toward the Democrats, suggesting they would have the majority in the Senate.

All that said, the New Zealand Dollar, which is perceived as a high-beta currency, weakened against the greenback as the market mood shifted sour, bolstering flows toward safe-haven assets ahead of the US inflation report. Therefore, the USD benefitted, as shown by the US Dollar Index, which tracks a measure of the American Dollar value against a basket of six currencies, which rose by 0.73% at 110.426.

Traders’ focus shifts to US Consumer Price Index (CPI) for October

Aside from this, the Bureau of Labor Statistics (BLS) will reveal the October Consumer Price Index (CPI), with expectations for headline CPI at 8% YoY, while core CPI, which excludes volatile items like food and energy, is estimated to jump by 6.5% YoY, below the previous month’s reading. If the CPI cools down, it should be expected that the NZD could resume its recovery and reclaim the 0.5900 figure. Otherwise, the NZDUSD would be downward pressured and could extend its losses beneath the 0.5800 mark.

Fed’s Barkin compromised to tame inflation, even though it could slow down the US economy

Aside from this, a light US economic docket left NZDUSD traders adrift to Fed speaking, led by the Richmond Fed President Thomas Barkin. He said that the Federal Reserve’s willingness to fight inflation would lead to an economic downturn, though he added that the United States is not currently in a recession. He added that the country is at the back end of inflation and that it will begin to decline.

NZDUSD Price Analysis: Technical outlook

From a daily chart perspective, the NZDUSD remains in a downtrend. Since the beginning of April 2022, price action has been trading within a descending channel, unable to crack the top of it. On Tuesday, the NZDUSD edged toward the 100-day Exponential Moving Average (EMA) at 0.6029 but was short, reaching a fresh two-month high at 0.5999, exposing the NZD to further selling pressure. That said, the NZDUSD tumbled below the 0.5900 figure, and the path of least resistance is to continue to trend lower.

That said, the NZDUSD key support levels lie at the 50-day EMA at 0.5817, ahead of the 0.5800 figure. Once cleared, the next support would be the mid-line of the eight-month-old descending channel at 0.5770.

-

20:48

GBPUSD Price Analysis: Bulls are lurking at key support, eyes on a correction

- GBPUSD bulls could be about to move in to pick low-hanging fruit.

- The sell-off has been sharp but the M-formation is a reversion pattern.

GBPUSD was offered as the US dollar and yields rallied due to the US treasury notes selling today at 4.140% compared to 4.106% in the moments before the auction in the WI market. Since the sale, gains have been wiped clean and Cable remains under pressure. The results so far for the US midterm elections showed little evidence of a "red wave", leaving investors to focus on upcoming inflation data. Technically, there could be a reversion in order, however, as the market calm ahead of the event as the following will illustrate:

GBPUSD H1 chart

The bears have moved in and eye a break of the 1.1290 support line, Monday's lows. A correction in the meanwhile, however, could be in order.

GBPUSD H4 chart

The M-formation is a reversion pattern and the price would be expected to retrace at least to the 38.2% Fibonacci of the bearish impulse.

-

20:06

AUDUSD dives further and approaches 0.6400 in a cautious market mood

- The Aussie extends its reversal from 0.6550 to 06420 so far.

- A more cautious market mood has favored the safe-haven USD.

- AUDUSD: Support at 0.6210 is key to defend the recent up move – SocGen.

The Aussie has gone through a significant pullback on Wednesday, with the pair extending its reversal from 0.6550 high on Tuesday to 0.6420 so far as investors’ appetite for risk waned.

Cautious markets awaiting the results of the US elections

The market mood soured on Wednesday, with the world stock indexes trading lower while the US Dollar and Treasury bonds picked up as the market awaits the results of the US mid-term elections. In this context, the risk-sensitive Australian Dollar has lost about 1.4% on the day after having rallied beyond 3% over the previous three days.

In the US, with votes still being counted, the Democrats have achieved better-than-expected results, although the race to control the Congress is tight, which leaves President Biden’s economic agenda in the air.

In the macroeconomic front, with a thin calendar today, the focus is on the release of US CPI figures due on Thursday. With the market hyper-sensitive to Fed monetary policy expectations, any surprise in the US inflation figures might trigger a significant increase in Dollar volatility.

Earlier today Richmond Fed President Barkin affirmed that the inflation fight ‘may lead to a downturn” as, he says, rate increases are challenged by artificial elements such as “high consumer savings, lack of labor supply." These comments have eased bullish pressure on the USD.

AUDUSD: Defense of 0.6210 support is crucial – SocGen

From a technical perspective, FX analysts at Société Générale point out to the 0.6210 level to maintain the recent up move: “A bounce is not ruled out; the upper band of the channel near 0.6680/0.6720 and 0.6900 could be near-term resistances (…) In case the pair fails to hold recent higher trough at 0.6270, one more leg of downtrend could materialize towards 0.6100 and projections of 0.5980.”

Technical levels to watch

-

19:40

Gold Price Forecast: XAUUSD plummets on soft US Treasury auction

- Gold is now back in the hands of the bears as traders get set of US CPI.

- US yields and the Dollar rising may have set the high of the week in Gold.

Gold is under pressure following, dropping at the turn of the past hour after a spike to the day's highs, trapping breakout traders long when the US treasury notes sold today at 4.140% compared to 4.106% in the moments before the auction in the WI market. Since the sale, Us yields have surged, supporting the US dollar and weighing heavily on gold.

Gold is currently trading at $1,702.46, down some 0.46% after falling from a high on the day of $1,722.34 and is taking on the London of $1,703.16. Meanwhile, the Gold price has given something to both the bulls and the bears on the day as the following analysis will illustrate.

Looking ahead, all eyes will be on the US inflation data in Thursday's US Consumer Price Index. Investors will be looking for clues in the data to see if it can spur the Federal Reserve to continue to increase interest rates well into next year. The data could be a good litmus test to gauge whether investors are about to turn their backs on the greenback once and for all despite the Fed's Chair, Jerome Powell, recent pushback against the pivot sentiment.

Gold technical analysis

The price of gold remains on the front side of the bullish trendline. However, a low was put in by London and then in the opening of the New York session. The price subsequently rallied on the back of the double-bottom low and has potentially just locked in the high for the rest of the week which the following will show from a bearish perspective ahead of US CPI.

As we can see below, there is now an M-formation left on the chart which is a topping pattern. While the price could be expected to come in to retest the neckline, the bias is for a move to the bullish trendline for the sessions ahead:

Gold M1 chart

For some background on the price action that got is to hear and in order to help us arrive at the bearish scenario, the above chart illustrates the price flow since the London lows on the 1-minute chart. A fresh high was set at the start if New york day and a subsequent low was the bull's grounds for a buy into what could be the highs of the week. The strength of US yields and the US dollar have seen to that.

Gold bearish scenario

Zoomed in...

As illustrated, we could now have the high of the week locked in. There are traders trapped in long positions above and stops below. This is the ideal scenario for sellers. A move below the triple bottom lows of $1,703/04 opens the risk of a significant flush out of stale stop losses that have been trailing higher for the whole week and since last Friday's rally.

-

19:12

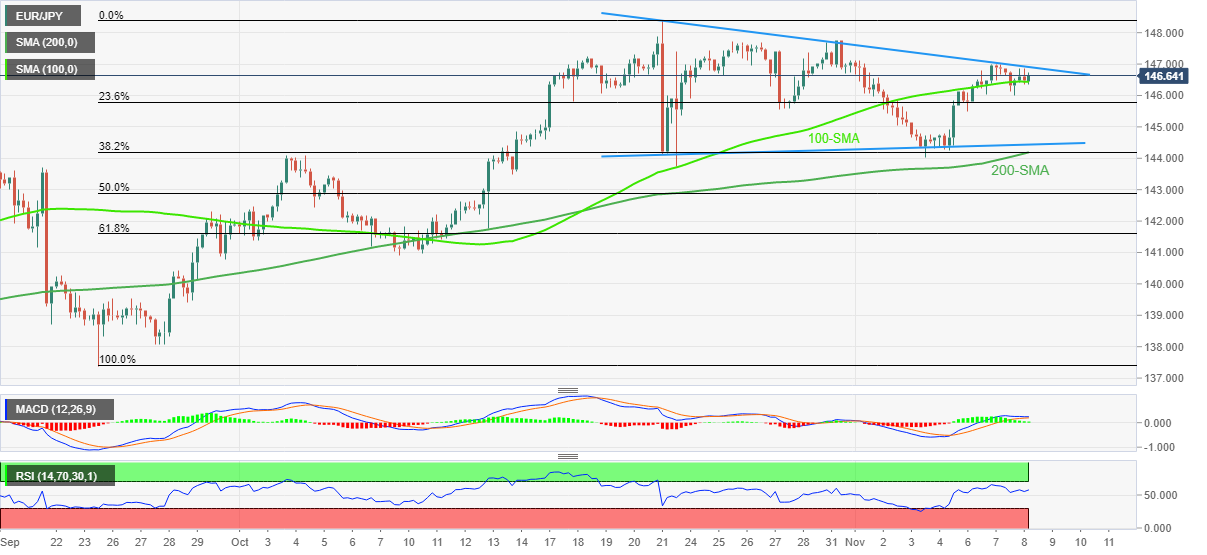

EURJPY Price analysis: Trapped within a tight range below 147.00

- The EURJPY is moving without a clear direction below 147.00.

- Markets remain calm awaiting the outcome of the US midterm elections.

The Euro is trading practically flat against the Japanese Yen for the second consecutive day. Upside attempts remain capped below 147.00, while support at the 146.30 area is keeping bears at a bay.

The pair wavers with the market on a wait-and-see stance

The Euro has lost the bullish momentum observed at the end of last week and the beginning of this one. The pair’s recovery from the 144.00 area traded water at 147.00 as the investors turned more cautious on the back of the uncertainty about the US midterm elections and ahead of the US CPI figures.

Euro bulls should extend past the 147.00/10 level to regain positive traction and extend gains towards 147.75 (October 26 and 31 highs) ahead of the long-term high at 148.40.

On the downside, a successful breach of the 100-period SMA might increase negative pressure to target the 146.00 area where the 50-period SMA meets November 8 lows. Below here, the next target would be November 6 low at 145.50.

EURJPY 4-hour chart

Technical levels to watch

-

18:41

Silver Price Analysis: XAGUSD struggles around the 200-DMA and tumbles toward the $21.10s area

- Silver struggles to break the 200-day EMA at $21.48 after hitting a daily high of $21.61.

- Silver Price Analysis: A doji in the daily chart suggests Silver is consolidating.

Silver price remains unable to clear the 200-day Exponential Moving Average (EMA) at $21.48 decisively, retreats after hitting a daily high of $21.61, trading below its opening price by 0.15%. At the time of writing, the XAGUSD is trading at $21.19 a troy ounce.

Silver (XAGUSD) Price Analysis: Technical outlook

The Silver rally stalled at around the 200-day EMA at $21.48, in the last couple of days, with Wednesday’s price action set to form a doji, meaning that buyers could be refraining from testing higher prices, with the US Consumer Price Index (CPI) report for October, right around the corner. It should be noted that if XAGUSD tumbles below $21.00, a fall toward this week’s low at $20.38 is on the cards,

Short term, the XAGUSD appears to be forming a top at around $21.40-60. The Relative Strength Index (RSI), at bearish territory with a downslope, suggests some selling pressure piling, but a break below the confluence of Wednesday’s low and the daily pivot point at $21.16 would exacerbate a test of the psychological $21.00.

XAGUSD key resistance levels lie at $21.60, followed by the R1 daily pivot at $21.82 and the $22.00 mark.

Silver (XAGUSD) Key Technical Levels

-

18:30

USDJPY’s recovery finds resistance at 146.55; eases to 146.00

- The Dollar's rebound from 145.15 remains limited below 146.00.

- The market has turned cautious ahead of the results of US elections and CPI data.

- USDJPY is risking further decline to 142.00 – SocGen.

The US Dollar’s recovery from two-week lows at the 145.15 area lost momentum at 146.55 earlier on Wednesday, before pulling back to levels right above 146.00. The pair remains moderately bid on daily charts, trimming losses after a 1.85% decline over the previous three days.

Cautious markets on the back of US elections’ uncertainty

Investors have turned cautious on Wednesday, which has favored the safe-haven US Dollar amid the uncertainty about the results of the US mid-term elections. The Republican “red wave” has not been seen, and both parties are in a tight race to decide the control of Congress and the fate of Joe Biden’s agenda for 2023.

In the absence of key macroeconomic events, the highlights of the week will be the release of US consumer inflation data. These figures might offer some insight into the Federal Reserve’s next monetary policy decision which could generate significant Dollar volatility.

Earlier today, Richmond Fed President, Richard Barkin, warned that the inflation fight “might lead to a downturn” as the central bank’s rate hikes are challenged by artificial elements such as “high consumer savings and lack of labor supply”. These comments might have put a lid on USD bulls.

USD/JPY: Risk of a pullback to 142 – SocGen

FX analysts at Société Générale warn about the risk of a pullback to 142 or lower: “Projections near 142 and the lower band of the daily channel at 140.30/139.40 are important support levels near term. Defending this channel could highlight continuation in uptrend (...) Once the pair reclaims the peak of 152, one more leg of up move is not ruled out. In this scenario, 153.50 and 1990 levels near 160 could be the next potential resistances.”

Technical levels to watch

-

18:07

EUR/USD is back testing the lows of the day towards parity, US CPI will be crucial

- EURUSD bears step on the gas into strength and eye parity.

- Traders getting set for a very crucial US CPI report.

EURUSD has dropped on the day by over 0.4% in a volatile session in New York that has seen good two-way business in the forex market. The US dollar advanced on Wednesday, as results so far for the midterm elections showed little evidence of a "red wave" resounding Republican victory. However, it was a wild ride between NY session lows and highs of 109.727 and 110.373 which pushed and pulled the Euro.

In US politics, a stronger showing by Republicans was expected to have fanned the flames of speculation around prospects of less fiscal support and potentially a lower peak in the Fed's terminal rate. This initially drove an offer into the greenback and subsequently supported the Euro on Friday and at the start of the week within its trading range of 0.97-1.01 for the month so far. However, the prospect of a divided US Congress and the expected Republican Red sweep seems not to have materialized. Consequently, Wall Street opened offered and remains in the red in the latter part of the session, bearish for the Euro.

Analysts at Rabobank argued that there is more downside to come for the single currency. ''In our view, fundamentals are still biased towards further downside pressure for the currency pair in the coming months, meaning we would view rallies as an opportunity to sell,'' they said.

''In particular, we don’t see the EUR as being priced for the impact of winter 2023 and what a prolonged period of expensive energy may mean for the German business model, Europe’s trade and current account balances and the value of the EUR. We have revised lower our forecast for EUR/USD on a 12 mth view to 0.95 from 1.05. We expect EUR/USD to trade choppily around this level in the months ahead.''

As for positioning, the latest CFTC speculators’ positioning data have shown a sharp ramping up in the levels of net EUR longs over the past two weeks, to the highest levels since June last year. This leaves room for a correction should the US Dollar manage to catch a bid again that has retreated from multi-decade highs in recent weeks as investors take profits following a months-long rally.

US CPI will be key for USD

There has been growing speculation grows that the Fed may be inching closer to pulling the curtain on its dollar-supporting interest rate hikes and such a pivot would be highly supportive of equities and all things high beta, such as the Euro and the commodity complex. In this regard, investors are waiting to see whether Thursday's US Consumer Price Index data will spur the Federal Reserve to continue to increase interest rates well into next year. After all, the Fed Chair, Jerome Powell, pushed back against the recent pivot sentiment and market rally at the last presser when he said the terminal rate could be higher. In any case, Thursday's inflation report could be a good litmus test to gauge whether investors are about to turn their backs on the greenback once and for all.

EURUSD eyed at 0.9500 end of year

In their outlook for the Euro, analysts at Noredea said, ''EURUSD will likely continue to have a bumpy ride but we still hold our view for a lower EURUSD towards the end of this year (around 0.95).''

''What we are seeing now is that investors are becoming more divided when interpreting economic data and implications for monetary policy. Confirmation bias surrounding the incoming data makes some certain of a Fed pivot even if the data shows otherwise.''

''Several central banks slowing the pace of hikes has led to a belief that rate cuts are not far away either. Some are emphasizing the risks of overtightening, however, the Fed sees a risk of not tightening enough or pausing too early to bring inflation under control.''

-

18:03

United States 10-Year Note Auction increased to 4.14% from previous 3.93%

-

17:43

NZDUSD is limited below 0.5900 in a risk-off trading session

- The New Zealand Dollar remains capped below 0.5900.

- Investors are cautious ahead of the results of the US elections.

- NZDUSD's broader negative outlook remains intact – Credit Suisse.

The New Zealand Dollar remains unable to return above 0.5900 during Wednesday’s US trading session, after having depreciated more than 1% on the day as market sentiment tanked.

Investors, cautious awaiting the outcome of the US elections

In the absence of relevant macroeconomic data, the focus is on the outcome of the US elections, with the investors reluctant to place any significant bet. The latest news has shown better-than-expected results for the democrats, although both parties are still in a tight race to control Congress.

Beyond that, the release of October’s US CPI data, due on Thursday is expected to provide further insight into the Federal Reserve’s next monetary policy decisions, and therefore, it might trigger significant US Dollar volatility.

NZD/USD: Broader negative outlook remains intact – Credit Suisse

In the long run, analysts at Credit Suisse maintain their bearish view on the pair, and point out to 0.5600 and below: “The recent recovery in our eyes still looks, for now at least, like a corrective countermove within the broader downtrend. Hence, our broader negative outlook stays intact, though with a move back below 0.5854 and then below 0.5600/5597 needed to turn the market on the path towards the YTD low 0.5510 and then the 2020 low at 0.5468.”

Technical levels to watch

-

17:24

USDCAD climbs towards the head-and-shoulders neckline, though hovers around 1.3470

- USDCAD rose by 0.35% as buyers are eyeing to reclaim the 50-day EMA at 1.3515.

- Risk aversion kept CAD buyers from extending the USDCAD losses towards the head-and-shoulders chart pattern 1.3030 targets.

- Canadian and US jobs data suggests that the BoC and the Fed need some work to do.

The American Dollar is recovering some ground against the Loonie in the North American session after a head-and-shoulders chart pattern emerged in the daily chart, which targets a fall of USDCAD towards 1.3030. Factors like the US midterm elections showing that the Republicans and Democrats would split congress caused a risk-off impulse. US Treasury yields rose, and the greenback remains bid across the board. At the time of writing, the USDCAD is trading at 1.3470 after hitting a daily low of 1.3410.

USDCAD trims some of its three-day free fall from around 1.3700

Sentiment remains negative, as shown by US equities trading with losses. Data-wise, the US economic docket reported that wholesale stockpiles increased less than estimated in September. The US Commerce Department revealed that Wholesale Inventories rose by 0.6% MoM, below estimates and September’s reading of 0.8%. Additionally, uncertainty around the US midterm elections refrained traders from opening fresh bets on risk-perceived assets as flows toward safe-haven assets increased.

In the meantime, Fed officials crossed news wires led by the Richmond Fed President Thomas Barkin. Barkin said that the Fed’s willingness to fight inflation would lead to an economic downturn, though he added that the United States is not currently in a recession. He added that the country is at the back end of inflation and that it will begin to decline.

The lack of Canadian economic data leaves USDCAD traders leaning on the last week’s employment figures. Canada’s October Employment Change report smashed expectations of just 10K new jobs, adding more than 100K, suggesting that the Bank of Canada (BoC) still has work to do. On the US front, Nonfarm Payrolls exceeded estimates of 200K, printing 261K, but what caught investors’ eye was that the Unemployment Rate jumped from 3.5% in September to 3.7% in October. That said, speculations that the Fed could decelerate its pace of rate hikes.

Ahead in the week, the US docket will feature the Consumer Price Index (CPI) for October alongside Fed speakers. On the Canadian front, the Bank of Canada (BoC) Governor Tiff Macklem will cross newswires.

USDCAD Price Analysis: Technical outlook

The USDCAD daily chart suggests the head-and-shoulders chart pattern remains intact, even though the major hit a aily high of 1.3494 at the neckline. However, CAD buyers stepped in and dragged the USDCAD toward current exchange rates. For USD buyers to invalidate the pattern, they need to reclaim 1.3500 and clear the “right shoulder” at around 1.3808; otherwise, the resumption of the downtrend would likely send the USDCAD towards the head-and-shoulders target at 1.3030.

-

16:53

GBPUSD moves above 1.1400 with the US dollar losing ground

- The pound trims losses and returns above 1.1400.

- Investors, on a wait-and-see stance, awaiting for US elections and CPI results.

- Fed's Barkin warns that inflation fight may lead to a downturn.

The pound has bounced up from session lows at the mid-range of the 113.00s on Wednesday’s US trading session, returning above 114.00 amid a broad-based US dollar pullback. The pair, however, is still 1% lower on the daily chart, after having peaked right above 1.1600 on Tuesday.

The dollar picks up in a cautious market session

The greenback is picking up on Wednesday, with investors reluctant to place significant bets, awaiting the outcome of the US mid-term elections and the release of US consumer inflation figures on Thursday.

The latest news has shown better-than-expected results for the Democrats as the “red wave” announced by the media has not crystallized. The final results, however, might still take some time, and key issues like the control of Congress and Biden’s next year agenda are still uncertain.

Beyond that US CPI data, due on Thursday, might provide further insight into the size of the Federal Reserve’s next interest rate hike. Any surprise in these readings might boost dollar volatility.

In a thin macroeconomic calendar on Wednesday, US oil stockpiles have shown a larger-than-expected increment in the week of November 4. The US Energy Information Administration has reported a 3.92 billion barrel increase, well above the consensus of 1.36 million barrels.

Furthermore, Richmond Fed President, Richard Barkin has warned that the inflation fight “might lead to a downturn” as the central bank’s rate hikes are challenged by artificial elements such as “high consumer savings and lack of labor supply”.

Technical levels to watch

-

16:32

Fed likely to go higher, meaning steeper rate cuts later in 2023 – ABN AMRO

On Thursday, October US CPI data will be released and should have an impact on the market and also on expectations about the Federal Reserve’s monetary policy. Bill Diviney, Sr. Economist at ABN AMRO, points out they now expect the FOMC to aim for a higher peak in interest rates, but this is likely to mean even steeper rate cuts later in 2023, once conditions allow.

Key Quotes:

“Following the 50bp hike we already expected in December, we now expect two further 25bp hikes at the February and March meetings. This will take the upper bound of the fed funds rate to 5%. However, we still expect significant rate cuts in H2 23, and if anything, the higher peak in rates implies a steeper drop-off, once macro conditions in the US allow for this.”

“We expect cuts to start somewhat later, in September rather than our prior expectation of July, but we also expect 125bp total rate cuts, up from 100bp previously. This will take the form of one 25bp cut in September, followed by two 50bp cuts in November and December. Thereafter, we expect the Fed to downshift to 25bp cuts until rates fall back to the Fed’s neutral estimate of 2.5% by mid-2024. From there we expect the Fed to pause.”

“With the Fed now more likely to overshoot in its rate hikes, we think that falling inflation next year combined with a deteriorating labour market will convince the Committee that rates are too restrictive, and that it will want to recalibrate policy before high rates do more damage to the economy than is necessary to bring inflation back to target.”

-

16:18

Fed's Barkin: Inflation fight may lead to downturn

The Federal Reserve's (Fed) fight against inflation may lead to a downturn in the United States (US) economy but that is a risk that the Fed will have to take, Richmond Fed President Thomas Barkin said on Wednesday, as reported by Reuters.

Key takeaways

"Fed rate hikes challenged by artificial elements in the current economy including high consumer savings, lack of labor supply."

"Not waiting for those issues to settle on their own, doing what it takes to return inflation to 2% target."

"Given the experience of the 1970s, Fed can't let inflation fester and expectations rise."

"The US could continue to face labor constraints going forward."

"Supply chains improving but slowly and inconsistently."

Market reaction

The US Dollar showed no immediate reaction to these comments and the US Dollar Index was last seen rising 0.35% on the day at 110.00.

-

16:14

EURGBP: Still keeping the three-month forecast at 0.89 – Rabobank

According to analysts from Rabobank, Pound’s traders should be focused on the impact of the Autumn Statement and on UK PM Rishi Sunak's political abilities, over the coming days. They still see EURGBP moving toward 0.89.

Key Quotes:

“Some commentators have attributed yesterday afternoon’s modest rally in GBP vs. the EUR to reports that the EU was optimistic that a compromise could be struck on the protocol. However, during the Brexit process GBP tended not to react hugely to day-to-day N. Ireland related news. This may be a function of the complexity of the situation. Over the coming weeks we would expect GBP investors to be focused on the impact of the November 17 Autumn Statement, the ability of PM Sunak to hold the Tory party together, the outlook for UK growth/recession and BoE interest rates.”

“We would expect issues surrounding the protocol only to have a clear impact on GBP as any related deadlines approach. We are yet to be persuaded to alter our bearish view on the pound and maintain a 3-month forecast of EUR/GBP 0.89.”

-

16:13

USDCHF’s recovery from 0.9800 remains capped below 0.9870

- The dollar attempts to bounce up from 0.9800 have found resistance at 0.9780.

- The market has turned cautious awaiting the results of the US elections.

- USDCHF is under mounting downside pressure – Credit Suisse.

The US dollar is attempting to set a bottom at 0.9800, following a 2.7% sell-off on the previous three days, although the pair has been unable to extend past 0.9870 previous resistance area. On the daily chart, the USDCHF remains practically flat, trading at 0.9850 at the time of writing.

Investors are awaiting US CPI and mid-term elections

Market sentiment has turned cautious on Wednesday, as investors await the outcome of the US mid-term elections. Recent news has shown better than expected results for the Democrats, yet with the control of the US Congress and the Government’s agenda still in the air.

On the macroeconomic front, in the absence of key releases, the focus is on Thursday’s US Consumer Prices Index figures. The increasing speculation about a potential dovish pivot by the Federal Reserve has boosted the interest in these figures, and therefore, an unexpected reading might pose a significant increase in dollar volatility.

USD/CHF is under mounting downside pressure – Credit Suisse

From a wider perspective, FX analysts at Credit Suisse see the pair under increasing negative pressure: “We think that the downside pressure is mounting. Key support is seen at the 55-day average and the recent price low at 0.9840/38, a close below which would then be seen to trigger a bearish ‘double top’ and likely clear way to 0.9737 next and potentially towards the 200-day average at 0.9616.”

Technical levels to watch

-

16:11

USDJPY Price Analysis: Bounces at the 50-day EMA, reclaims 146.00

- USDJPY snaps three days of losses tests the bottom of one-month-old upslope trendline.

- Sentiment remains downbeat as uncertainty around US midterm elections persists.

- USDJPY Price Analysis: Buyers reclaiming 146.70 will keep the upward bias intact; otherwise, a fall to the 100-day EMA is on the cards.

The USDJPY trims some of its Tuesday losses and bounces off the 50-day Exponential Moving Average (EMA) as buyers are trying to reclaim the 146.00 figure following three days of consecutive losses. Factors like the US midterm elections are likely to end with split control between Republicans and the Democrats in the US Congress, keeping risk appetite dented. At the time of writing, the USDJPY is trading at 146.10, above its opening price by 0.25%.

USDJPY Price Analysis: Technical outlook

After diving below a one-month-old upslope support trendline, the USDJPY is nearby to getting back above it, suggesting that buyers are gathering momentum. Of note, the Relative Strength Index (RSI) is in bearish territory but with an upslope, implying that the USDJPY would continue upwards once cleared.

In the near term, the USDJPY hourly chart appears to form a base around the 145.00 figure, and on its way towards reclaiming 146.00, buyers cleared the daily pivot point at 145.97 and tested the 146.63 R1 daily pivots. Nevertheless, USD buyers lacked the strength to clear the latter, and USDJPY prices retreated towards 146.20s.

The USDJPY key resistance levels lie at the R1 daily pivot at 146.63, which, once cleared would open the door for a test 100-hour EMA at 146.78, ahead of the psychological 147.00 mark. On the flip side, the USDJPY first support would be 146.00. A breach of the latter will expose the daily pivot point at 145.97, followed by the daily low at 145.17.

USDJPY Key Technical Levels

-

16:02

AUDUSD extends slide below 0.6450 as Wall Street turns negative

- Aussie under pressure amid risk aversion.

- US Dollar rises after a three-day negative streak, ahead of US CPI.

- AUDUSD drops more than a hundred pips from Tuesday’s high.

The AUDUSD pair printed a fresh two-day low during the American session as the US Dollar extended gains supported by risk aversion. It bottomed at 0.6431. The bearish pressure still persists.

Awaiting CPI numbers

The day before the release of the October US Consumer Price Index, the Greenback is gaining support and is rising after three days of consecutive losses. So far, the midterm elections showed no major surprises having a limited market impact. The focus is on the CPI due tomorrow which is expected to show inflation at 8%.

Earlier on Thursday, the Melbourne Institute will release the Survey of Consumer Inflationary and Wage Expectations. Inflation expectation were expected to rise from 5.4% in October to 5.7% in November.

Short-term outlook

The AUDUSD weakened as Wall Street and metals turned negative for the day. US yields are now lower, on a session without a clear direction. It the negative tone prevails in markets, more losses in the pair seem likely.

On Tuesday AUDUSD reached its highest level in seven weeks at 0.6550. The Aussie failed to consolidate above 0.6500 and is back under 0.6450 and also under the 20-Simple Moving Average in the 4-hour charts. The next support might be located at 0.6405/10.

A recovery above 0.6500 would remove the bearish pressure, exposing the recent high at 0.6550, with interim resistance at 0.6520.

Technical levels

-

16:00

Russia Consumer Price Index (MoM) climbed from previous 0.1% to 0.18% in October

-

15:54

Gold Price Forecast: Weekly close above $1,680 to ease pressure on XAUUSD – Credit Suisse

Gold has rebounded. Nonetheless, with a large “double top” in place, Credit Suisse’s core outlook stays bearish.

Gold to come under renewed pressure again

“Gold has rebounded over the past week but with a large ‘double top’ in place below $1,691/76 this is seen as a temporary rebound and we expect Gold to come under renewed pressure again in due course.”

“Support is seen at the $1,614 recent low, below which should reassert bearish pressure again with support then seen next at $1,560 and eventually our core objective at $1,451/40.”

“Only a convincing weekly close above the 55-day average at $1,680 would ease the pressure on the precious metal, with next resistance then seen at the even more important 200-day average, currently at $1,805, which we would expect to cap at the very latest.”

-

15:43

EURGBP breaks above 0.8800, hits four-week highs

- Pound under pressure, cable falls under 1.1400.

- EURGBP heads for highest daily close since October 11.

The EURGBP rose further during the American session and strengthened the rally after breaking above 0.8800. The cross peaked at 0.8820, reaching the highest level since October 11.

The pound is among the worst performers in the G10 space on Wednesday. The currency remains vulnerable after two months of political and economic tensions in the United Kingdom. The caution tone across financial markets is not helping the pound. The Dow Jones is falling by 0.87% and the Nasdaq drops by 1.25%.

The slide of GBPUSD below 1.1400 added to the broad-based slide of the pound. As of writing, Cable is trading at 1.1370, the lowest in two days, down more than 150 pips.

“Over the coming weeks, we would expect GBP investors to be focused on the impact of the November 17 Autumn Statement, the ability of PM Sunak to hold the Tory party together, the outlook for UK growth/recession and BoE interest rates. We would expect issues surrounding the (Northern Ireland) protocol only to have a clear impact on GBP as any related deadlines approach. We are yet to be persuaded to alter our bearish view on the pound and maintain a 3-month forecast of EUR/GBP 0.89”, said analysts at Rabobank.

Technical levels

-

15:38

WTI extends losses and nears $87 on concerns about Chinese demand

- Oil prices decline for the third consecutive day, to reach levels near $87.

- Fears about a decline on demand from China are weighing on prices.

- US crude stockpiles increased above expectations last week.

Front-month WTI crude futures are depreciating for the third consecutive day on Wednesday. Concerns about a potential decline in demand from China, as COVID-19 infections increase, are hurting oil prices.

The US benchmark WTI dives about 1.3% on the day, reaching levels at $87.20 at the moment of writing, a nearly 7% sell-off from Monday's peak, at $93.70.

US crude oil stockpiles increase beyond expectations

A Reuters report citing the American Petroleum Institute affirmed that US oil stocks increased by 5.6 million barrels in the week of November 4, well above the 1.4 million barrel rise expected by the market, which has added negative pressure on crude oil.

Investors remain wary about the possibility of new lockdowns in China after the country’s authorities reiterated their commitment to the Zero-COVID policy over the weekend. With coronavirus infections increasing with the winter flu season around the corner, a new set of restrictions is expected to curb global demand for oil over the coming months.

Beyond that, the US dollar steadied on Wednesday, after having depreciated sharply over the last three days, which has contributed further to the WTI decline. The Dollar Index, which measures the value of the dollar against a basket of the most traded currencies, has ticked up to the vicinity of 110.00 after bouncing off 109.30, its lowest level since mid-September.

Technical levels to watch

-

15:30

United States EIA Crude Oil Stocks Change above expectations (1.36M) in November 4: Actual (3.925M)

-

15:29

Brent Crude Oil to extend the rebound on a move above August peak at $104/105 – SocGen

Brent has staged a steady rebound after approaching downside projections and the multiyear descending trend line at $83.70/83.00. An extended bounce is expected on a break past $104/105, strategists at Société Générale report.

Monthly RSI has developed a positive reversal

“Daily MACD is above its trigger and has recently entered positive territory highlighting regain of upward momentum. August high of $104/105 is expected to be an important hurdle.”

“It is worth noting that monthly RSI has developed a positive reversal – a phenomenon where RSI records a lower trough, but price forms a higher low. This denotes upside potential.”

“If Brent overcomes the hurdle at $104/105, we can expect an extended rebound towards $113 and graphical levels of $123/125. Target for positive reversal is located at $139; this development gets negated in case Brent breaks below $87 (monthly close).”

-

15:01

Gold Price Forecast: XAUUSD probes the 100-day EMA as buyers' eye $1735

- Gold fluctuates in the New York session amid the uncertainty of midterm elections in the United States.

- US Treasury yields are rising, underpinning the US Dollar, which is up more than 0.50% against most G8 peers.

- Gold Price Analysis: Testing the 100-day EMA, which, once broken, would shift the bias to neutral-upwards as buyers are in control.

Gold price is trading in the red, unable to crack the key resistance level at around $1716, while US Treasury yields edge higher, underpinning the American Dollar, which per the US Dollar Index, tumbled below 110.000 on Tuesday. Factors like the United States midterm elections grabbed the spotlight, with a tighter-than-expected race weighing on the market mood. At the time of typing, the XAUUSD is trading at $1711.50, fluctuating.

Gold remains trendless around $1710 awaiting US midterm elections results and CPI

US equities are set to open lower, as shown by the futures market. A close race between the Republicans and Democrats turned sentiment sour, as polls suggest that the former might regain control of the US House while the Democrats would keep control of the US Senate. That said, the US Treasury yields rallied, led by the 10-year rising two basis points, at 4.155%, a tailwind for the precious metals space.

Additionally, the US 10-year real yield, which is the yield of the 10-year bond minus inflation expectations for the same time horizon, sits at 1.70%, capping the Gold rally on Tuesday. Meanwhile, the US Dollar Index, a gauge of the bucks’ value vs. a basket of peers, is snapping three days of consecutive losses, up by 0.54% at 110.220.

In the last week, the World Gould Council reported that central banks bought 400 tonnes of Gold in the third quarter, which according to last year’s data, was an increase of 300%, and it was the largest quantity of Gold bought since 2000.

That said, expectations for Gold resuming the uptrend lie in the hands of the Federal Reserve. Ahead of the week, the United States inflation report for October would keep investors on their toes as they assess the Fed-s next move. A US inflation jump wouldn’t deter Fed policymakers from tightening aggressively.

So if inflation moderates, that could be a tailwind for XAUUSD, which could benefit from “parked” US Treasury yields.

Gold Price Analysis: Technical outlook

Following Tuesday’s rally, which broke an eight-month-old downslope resistance trendline, the XAUUSD faces solid resistance at the 100-day Exponential Moving Average (EMA) at $1715.91. It should be said that Gold made a base at around the year-to-date lows of around $1614-$1617, and that zone was tested three times, with USD buyers unable to crack the $1600 figure. Therefore, a test of the August 25 daily high at $1765.48 is likely to happen, but XAU buyers need to clear the 100-day EMA.

Once done, the XAUUSD next resistance would be the August 22 daily low-turned-resistance at $1727.90, followed by the psychological $1750.

-

15:01

EURUSD to have a bumpy ride, but year-end forecast stands at 0.95 – Nordea

In the last month, EURUSD has trended higher trading in the range of 0.97-1.01. Markets are interpreting any “softer” data in favor of a Fed pivot, sending EURUSD up. However, a high US Consumer Price Index (CPI) print tomorrow may send the pair down, economists at Nordea report.

Dollar volatility to continue

“Admittedly, the latest upward swing EURUSD is in contrast to our view for a stronger USD ahead, but we think recent price action is a reflection of tactical positioning rather than a change of fundamentals.”

“The Fed has said clearly that a pause of its rate hikes is off the table so long as inflation is high. The fight against inflation means higher rates and more pain for risk assets and the real economy. It seems that stock markets investors refuse to get the memo and are interpreting any ‘softer’ data in favor of a Fed pivot, leading to risk-on and a weaker USD. Eventually, the tide should turn and investors will again feel the pain and remember the old adage: ‘don’t fight the Fed’.”

“Tomorrow’s CPI inflation report is the next key figure in the short-term. Higher-than-expected inflation figures have been a trigger for a stronger USD (6 out of the last 10 CPI releases this year) and that could easily be the case this week as well, especially when the data shows that financial actors are net short USD.”

“Looking ahead, EURUSD will likely continue to have a bumpy ride but we still hold our view for a lower EURUSD towards the end of this year (around 0.95).”

-

15:00

United States Wholesale Inventories below expectations (0.8%) in September: Actual (0.6%)

-

14:32

AUDUSD: Defense of 0.6270 is crucial for sustained bounce – SocGen

AUDUSD has pared gains after hitting a one-month high. The Aussie needs to stay above 0.6270 to sustain its recent up move, economists at Société Générale report.

One more leg of downtrend could materialize on failure to hold 0.6270

“AUDUSD has achieved the lower limit of a descending channel since April at 0.6170. Formation of a Doji candlestick (similar open and close prices) in October and a higher trough as compared to this low so far denote the pair is evolving within a small base.”

“A bounce is not ruled out; upper band of the channel near 0.6680/0.6720 and 0.6900 could be near-term resistances.”

“In case the pair fails to hold recent higher trough at 0.6270, one more leg of downtrend could materialize towards 0.6100 and projections of 0.5980.”

-

14:31

EURUSD: Bears remain in control below 1.0100

- EURUSD keeps the bearish tone unchanged in the sub-1.0100 area.

- The dollar’s recovery comes amidst higher US yields.

- US inflation, midterm elections results stay in centre stage.

The selling bias continues to hurt the European currency and keeps EURUSD well under pressure below the 1.0100 zone on Wednesday.

EURUSD offered on USD-buying

EURUSD falters once again just ahead of the key 1.0100 region – where the October and November peaks coincide so far – and triggers a corrective decline amidst some profit taking mood following three sessions in a row with strong gains.

In addition, fresh buying around the greenback appears underpinned by uncertainty around the results from the US midterm elections and increasing cautiousness in light of the release of US inflation figures on Thursday.

The downtick in the pair comes in line with another negative session in the German 10-year bund yields, which recede to 3-day lows near 2.20%. Earlier in the session, a 10-year bund auction came at 2.25%.

In the US docket, MBA Mortgage Applications contracted 0.1% in the week to November 4 and Wholesale Inventories figures are due later.

What to look for around EUR

EURUSD faces some selling pressure near the 1.0100 region amidst another bullish attempt in the greenback.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The recent decision by the Fed to hike rates and the likelihood of a tighter-for-longer stance now emerges as the main headwind for a sustainable recovery in the pair.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Italy Industrial Production (Thursday) – Germany Final Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EURUSD levels to watch

So far, the pair is retreating 0.48% at 1.0022 and a breach of 0.9888 (55-day SMA) would target 0.9730 (monthly low November 3) en route to 0.9704 (weekly low October 21). On the other hand, initial resistance comes at 1.0096 (monthly high November 8) seconded by 1.0197 (monthly high September 12) and finally 1.0368 (monthly high August 12).

-

14:11

USDCAD could decline to 1.30 in the next few weeks – Scotiabank

USDCAD consolidates after key technical break through 1.3495. Economists at Scotiabank believe that the pair could slump to the 1.30 mark in the new few weeks.

Resistance aligns at 1.3490/00

“Price signals suggest the USD is consolidating recent losses rather than reversing them.”

“Narrow gains leave USDCAD building a potential bear flag pattern (losses resume below 1.3420 intraday). Resistance is 1.3490/00.”

“Broader price signals remain USD-bearish, with the noted Head and Shoulders reversal on the daily chart targeting a measured move decline to 1.30 in the next few weeks.”

-

14:02

GBPUSD Price Analysis: Bears look to seize back control, break below 1.1400 awaited

- GBPUSD erodes a major part of its weekly gains amid resurgent USD demand.

- A sustained break below the 1.1400 mark will pave the way for further losses.

- Attempted recovery could be seen as a selling opportunity and remain capped.

The GBPUSD pair comes under heavy selling pressure on Wednesday and stalls a three-day-old bullish trend to over a one-week high touched the previous day. The intraday downfall picks up pace during the early North American session and drags spot prices to a fresh daily low, with bearish now awaiting a sustained weakness below the 1.1400 mark.

A fresh leg up in the US Treasury bond yields, along with a generally weaker tone around the equity markets, assists the US Dollar to stage a goodish recovery from a multi-week low. The British pound, on the other hand, is weighed down by the Bank of England's gloomy outlook for the UK economy. The combination of the aforementioned factors attracts fresh sellers around the GBPUSD pair and supports prospects for additional losses.

The overnight failure near the 1.1600 round-figure mark adds credence to the negative outlook. That said, technical indicators on the daily chart are yet to confirm a bearish bias and warrant some caution. This makes it prudent to wait for some follow-through selling before confirming that the post-NFP recovery move from levels just below mid-1.1100s has run out of steam and positioning for a further depreciating move for the GBPUSD pair.

Spot prices might then accelerate the fall to the 1.1355-1.1350 intermediate support before eventually dropping to the 1.1300 round figure. The downward trajectory could further get extended and expose the 1.1200 mark, below which the GBPUSD pair could aim to retest last week's swing low, around mid-1.1100s.

On the flip side, the 1.1445-1.1450 region now seems to act as an immediate strong resistance ahead of the 1.1500 psychological mark. Any further recovery might continue to attract fresh supply near the 1.1575-1.1580 region and remain capped. That said, some follow-through buying beyond the 1.1600 mark will negate the negative bias and lift the GBPUSD pair towards the October monthly swing high, around the 1.1645 region.

GBPUSD 4-hour chart

Key levels to watch

-

13:29

USDJPY rallies back closer to to mid-146.00s amid a strong pickup in USD demand

- USDJPY rebounds from a nearly two-week low touched earlier this Wednesday.

- Elevated US bond yields help revive the USD demand and remain supportive.

- The Fed-BoJ divergence also acts as a tailwind ahead of the US CPI on Thursday.

The USDJPY pair attracts some buying near the 145.15 region and stages a goodish recovery from a nearly two-week low touched earlier this Wednesday. The intraday uptick picks up pace during the early North American session and lifts spot prices to a fresh daily high, closer to mid-146.00s amid resurgent US Dollar demand.

Despite diminishing odds for a more aggressive policy tightening by the Federal Reserve, the markets are still betting on at least a 50 bps rate hike in December. This remains supportive of elevated US Treasury bond yields and assists the USD Index, which measures the greenback's performance against a basket of currencies, away from a multi-week low set on Tuesday.

The Japanese yen, on the other hand, continues to be weighed down by that the fact that the Bank of Japan, so far, has shown no intentions to raise interest rates. Moreover, the BoJ remains committed to guiding the 10-year bond yield at 0%, widening the US-Japan rate differential. This, in turn, supports prospects for a further appreciating move for the USDJPY pair.

That said, speculations that Japanese authorities might intervene again to soften any steep fall in the domestic currency might keep a lid on any meaningful upside for spot prices. Apart from this, a softer risk tone could offer additional support to the safe-haven JPY and contribute to capping gains for the USDJPY pair, at least for the time being.

Traders also seem reluctant and might prefer to wait for a fresh catalyst from the latest US consumer inflation figures, due for release on Thursday. The crucial US CPI report will play a key role in determining the Fed's rate-hiking cycles, which, in turn, should determine the near-term trajectory for the greenback and the USDJPY pair.

In the meantime, traders on Wednesday will take cues from speeches by influential FOMC members amid the absent relevant market-moving economic releases. Apart from this, the US bond yields and the broader market risk sentiment should allow traders to grab short-term opportunities around the USDJPY pair.

Technical levels to watch

-

13:11

USD Index: Defense of key 109/108.70 support can trigger rebound – SocGen

The US Dollar Index recently faced stiff resistance at 114.80. This test has stalled the uptrend resulting in a sideways consolidation. DXY could test 113.90 if manages to hold the 109/108.70 support, economists at Société Générale report.

Risk of short-term downtrend on a break under 109/108.70