Notícias do Mercado

-

23:38

Currencies. Daily history for Feb 08’2018:

(raw materials / closing price /% change)

Oil 60.42 -2.22%

Gold 1,320.80 +0.47%

-

23:36

Currencies. Daily history for Feb 08’2018:

(index / closing price / change items /% change)

Nikkei +245.49 21890.86 +1.13%

TOPIX +15.78 1765.69 +0.90%

Hang Seng +128.07 30451.27 +0.42%

CSI 300 -38.45 4012.05 -0.95%

Euro Stoxx 50 -77.22 3377.30 -2.24%

FTSE 100 -108.73 7170.69 -1.49%

DAX -330.14 12260.29 -2.62%

CAC 40 -104.22 5151.68 -1.98%

DJIA -1032.89 23860.46 -4.15%

S&P 500 -100.66 2581.00 -3.75%

NASDAQ -274.82 6777.16 -3.90%

S&P/TSX -264.97 15065.61 -1.73%

-

23:34

Currencies. Daily history for Feb 08’2018:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2246 -0,15%

GBP/USD $1,3911 +0,22%

USD/CHF Chf0,93597 -0,76%

USD/JPY Y108,75 -0,53%

EUR/JPY Y133,18 -0,68%

GBP/JPY Y151,277 -0,32%

AUD/USD $0,7780 -0,51%

NZD/USD $0,7217 -0,23%

USD/CAD C$1,26012 +0,29%

-

23:15

Schedule for today, Friday, Feb 09’2018 (GMT0)

00:30 Australia Home Loans December 2.1% -1.1%

00:30 Australia RBA Monetary Policy Statement

01:30 China PPI y/y January 4.9% 4.4%

01:30 China CPI y/y January 1.8% 1.5%

04:30 Japan Tertiary Industry Index December 1.1% 0%

06:45 Switzerland Unemployment Rate (non s.a.) January 3.3% 3.4%

07:45 France Industrial Production, m/m December -0.5% 0.1%

09:30 United Kingdom Industrial Production (MoM) December 0.4% -0.9%

09:30 United Kingdom Industrial Production (YoY) December 2.5% 0.3%

09:30 United Kingdom Manufacturing Production (YoY) December 3.5% 1.2%

09:30 United Kingdom Manufacturing Production (MoM) December 0.4% 0.3%

09:30 United Kingdom Total Trade Balance December -2.804 -3.84

13:00 United Kingdom NIESR GDP Estimate January 0.6% 0.3%

13:30 Canada Unemployment rate January 5.7% 5.8%

13:30 Canada Employment January 78.6 10

15:00 U.S. Wholesale Inventories December 0.8% 0.2%

18:00 U.S. Baker Hughes Oil Rig Count February 765

-

21:27

The main US stock indexes finished trading in negative territory

Major US stock indices fell significantly on Thursday, which was due to correction, the need for which had long been brewing, and with the increase in yield of government bonds against the background of increased inflation expectations

The focus was also on US data and statements by Fed officials Kashkari, Harker, and Dudley. As it became known, the number of Americans applying for unemployment benefits unexpectedly fell last week, dropping to the lowest level in almost 45 years, as the labor market becomes even tougher, reinforcing the expectations of a faster growth of wages this year. Initial claims for unemployment benefits fell by 9,000 to 221,000, seasonally adjusted for the week ending February 3, the Ministry of Labor said. Primary treatment fell to 216,000 in mid-January, the lowest level since January 1973. Economists predicted that over the last week of circulation will grow to 232,000.

As for the speech of the representative of the Federal Reserve Bank of Kashkari, he said that I would not want to rush to conclusions about further increases in rates. Meanwhile, Fed representative Harker noted that the outlook for inflation is still surrounded by considerable uncertainty. In addition, Fed spokesman Dudley said that the rate increase rate depends on the indications of the economy.

All components of the DOW index finished trading in the red (30 of 30). Outsider were shares of American Express Company (AXP, -5.63%).

All sectors of the S & P index are in negative territory. The largest decrease was observed in the sector of industrial goods (-2.6%) and in the technological sector (-3.9%).

At closing:

Dow -4.15% 23,860.46 -1032.89

Nasdaq -3.90% 6,777.16 -274.82

S & P -3.75% 2.581.00 -100.66

-

20:00

DJIA -2.42% 24,289.92 -603.43 Nasdaq -2.27% 6,892.04 -159.94 S&P -2.06% 2,626.38 -55.28

-

17:00

European stocks closed: FTSE 100 -108.73 7170.69 -1.49% DAX -330.14 12260.29 -2.62% CAC 40 -104.22 5151.68 -1.98%

-

15:14

Fed's Harker says he's open to Fed raising interest rates at march policy meeting

-

15:14

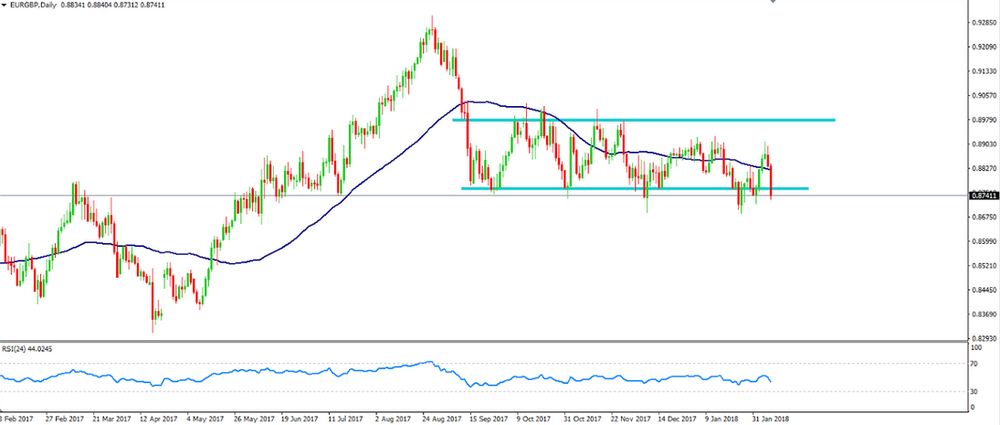

EUR/GBP Analysis

EUR/GBP is in a crucial zone which will help us understand whether the price could start a new bearish movement or a bullish movement.

On daily time frame chart, we can see that the price is stuck in the range between 0.897 - 0.877 which we can call consolidation zone.

Our suggestion is to wait for a clear price's reaction close to the bottom of the consolidation zone which is a support level as well in order to understand which trend it might start follow.

-

14:49

Fed's Harker says net impact of tax reform on U.S. economy is unclear

-

Small bump to U.S. GDP in 2018 from recent tax reform, adding about 0.2 pct point going forward

-

He's concerned about rising federal debt level from tax reform

-

-

14:34

U.S. Stocks open: Dow -0.26% Nasdaq +0.21%, S&P -0.04%

-

14:28

Before the bell: S&P futures +0.52%, NASDAQ futures +0.81%

U.S. stock-index futures were higher on Thursday, signaling the market set sights on rebound as volatility eased after hitting its highest level in more than two-and-a-half years earlier in the week.

Global Stocks:

Nikkei 21,890.86 +245.49 +1.13%

Hang Seng 30,451.27 +128.07 +0.42%

Shanghai 3,262.15 -47.11 -1.42%

S&P/ASX 5,890.70 +13.90 +0.24%

FTSE 7,228.98 -50.44 -0.69%

CAC 5,223.37 -32.53 -0.62%

DAX 12,488.10 -102.33 -0.81%

Crude $61.58 (-0.34%)

Gold $1,316.70 (+0.16%)

-

13:48

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

233.01

-0.18(-0.08%)

13065

ALCOA INC.

AA

47.98

0.28(0.59%)

810

Amazon.com Inc., NASDAQ

AMZN

1,431.00

14.22(1.00%)

55705

American Express Co

AXP

93.73

0.12(0.13%)

21565

Apple Inc.

AAPL

160.55

1.01(0.63%)

255442

AT&T Inc

T

37.09

0.16(0.43%)

9145

Barrick Gold Corporation, NYSE

ABX

13.44

0.05(0.37%)

9857

Boeing Co

BA

347.89

1.48(0.43%)

24919

Caterpillar Inc

CAT

154.55

0.21(0.14%)

5444

Chevron Corp

CVX

115.35

0.06(0.05%)

18649

Cisco Systems Inc

CSCO

40.45

0.11(0.27%)

22648

Citigroup Inc., NYSE

C

75.21

0.22(0.29%)

22367

Exxon Mobil Corp

XOM

77.45

0.51(0.66%)

52609

Facebook, Inc.

FB

180.9

0.72(0.40%)

309116

FedEx Corporation, NYSE

FDX

251.35

0.20(0.08%)

223815

Ford Motor Co.

F

10.85

0.09(0.84%)

31442

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

17.85

-0.01(-0.06%)

24018

General Motors Company, NYSE

GM

42.8

0.41(0.97%)

1488

Google Inc.

GOOG

1,050.01

1.43(0.14%)

6300

Home Depot Inc

HD

192.03

0.74(0.39%)

14107

Intel Corp

INTC

45.45

0.25(0.55%)

52314

International Business Machines Co...

IBM

152.65

0.30(0.20%)

8878

Johnson & Johnson

JNJ

132

0.58(0.44%)

19299

JPMorgan Chase and Co

JPM

113.09

0.22(0.19%)

8877

McDonald's Corp

MCD

165.93

0.22(0.13%)

17221

Merck & Co Inc

MRK

55.94

0.06(0.11%)

5014

Microsoft Corp

MSFT

90.32

0.71(0.79%)

98731

Nike

NKE

65.55

-0.08(-0.12%)

8794

Pfizer Inc

PFE

34.9

-0.08(-0.23%)

51340

Procter & Gamble Co

PG

81.9

0.06(0.07%)

28259

Starbucks Corporation, NASDAQ

SBUX

54.47

0.01(0.02%)

1156

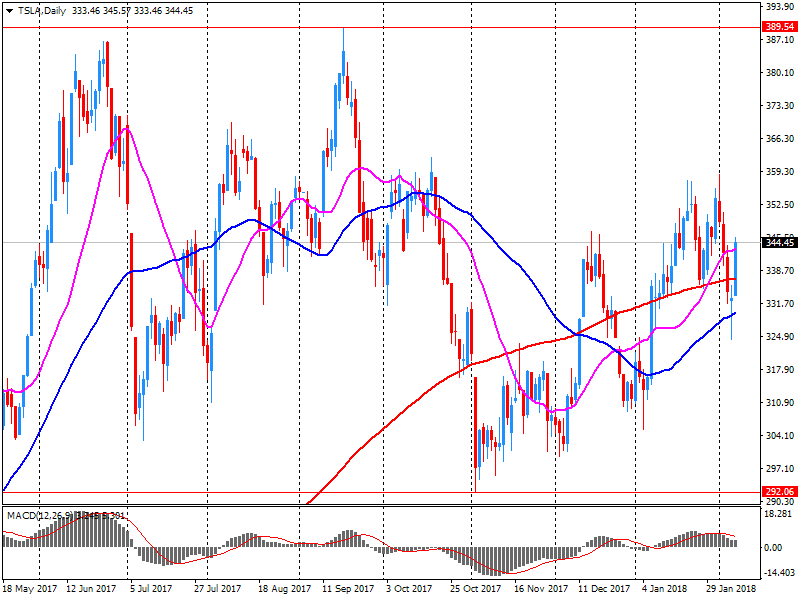

Tesla Motors, Inc., NASDAQ

TSLA

339.5

-5.50(-1.59%)

73996

Travelers Companies Inc

TRV

142.36

0.22(0.15%)

15512

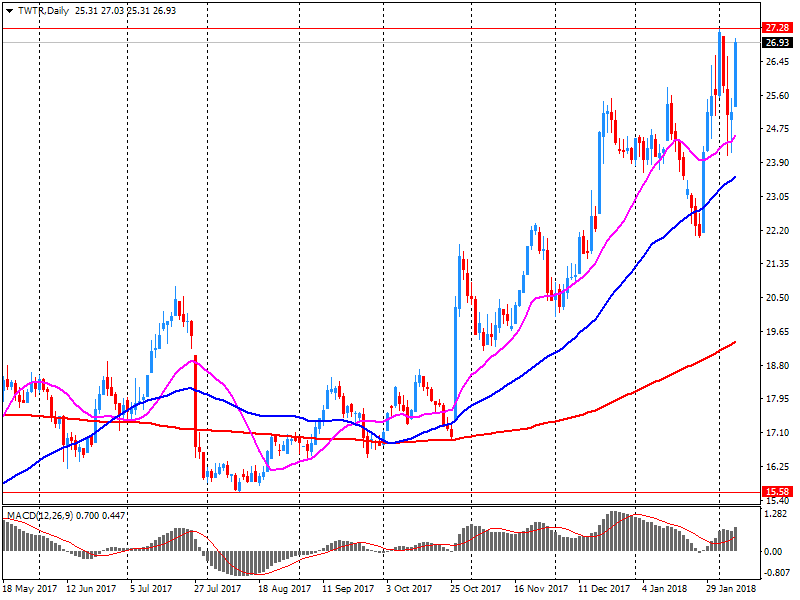

Twitter, Inc., NYSE

TWTR

33.91

7.00(26.01%)

11674127

United Technologies Corp

UTX

132.23

0.26(0.20%)

20619

UnitedHealth Group Inc

UNH

226.4

0.58(0.26%)

9511

Verizon Communications Inc

VZ

51.05

0.04(0.08%)

2771

Visa

V

120.12

0.47(0.39%)

3556

Wal-Mart Stores Inc

WMT

103.15

0.30(0.29%)

22323

Walt Disney Co

DIS

105

0.24(0.23%)

22099

Yandex N.V., NASDAQ

YNDX

37.54

0.56(1.51%)

1904

-

13:47

Analyst coverage resumption before the market open

Yandex N.V. (YNDX) resumed with a Overweight at JP Morgan; target $47

-

13:46

Target price changes before the market open

Tesla (TSLA) target raised to $400 from $340 at Dougherty & Company

Tesla (TSLA) target raised to $200 from $170 at Cowen; maintain Underperform

Walt Disney (DIS) target raised to $95 from $90 at BMO Capital Markets; Underperform

Boeing (BA) target raised to $289 from $240 at Buckingham Research; Neutral

-

13:44

Upgrades before the market open

DowDuPont (DWDP) added to Focus List at Citigroup

-

13:43

Canadian new house price index flat in December

In December, new house prices in Canada were unchanged for the first time since April 2015. Buyers in 15 of the 27 census metropolitan areas (CMAs) surveyed saw no price change. Increases in 8 surveyed CMAs across the country were offset by declines in the remaining 4.

In the Greater Golden Horseshoe, prices for new houses were unchanged in four of the six surveyed CMAs. Guelph posted the lone increase (+0.1%). Builders in Toronto, Canada's largest CMA, have not seen increases in prices in six of the previous seven months. In the neighbouring CMA of Hamilton prices fell 0.1% in December, following four months of no change.

-

13:41

U.S initial jobless claims lower than expected last week

In the week ending February 3, the advance figure for seasonally adjusted initial claims was 221,000, a decrease of 9,000 from the previous week's unrevised level of 230,000. The 4-week moving average was 224,500, a decrease of 10,000 from the previous week's unrevised average of 234,500. This is the lowest level for this average since March 10, 1973 when it was 222,000.

-

13:30

Canada: New Housing Price Index, YoY, December 3.3%

-

13:30

U.S.: Initial Jobless Claims, February 221 (forecast 232)

-

13:30

U.S.: Continuing Jobless Claims, January 1923 (forecast 1945)

-

13:30

Canada: New Housing Price Index, MoM, December 0% (forecast 0.1%)

-

13:16

Canada: Housing Starts, January 216.2 (forecast 210)

-

12:49

Company News: Twitter (TWTR) Q4 results beat analysts’ expectations

Twitter (TWTR) reported Q4 FY 2017 earnings of $0.19 per share (versus $0.16 in Q4 FY 2016), beating analysts' consensus estimate of $0.14.

The company's quarterly revenues amounted to $0.732 bln (+2.0% y/y), beating analysts' consensus estimate of $0.686 bln.

TWTR rose to $33.26 (+23.6%) in pre-market trading.

-

12:36

Company News: Tesla (TSLA) posts smaller-than-expected Q4 loss

Tesla (TSLA) reported Q4 FY 2017 loss of $3.04 per share (versus -$0.69 in Q4 FY 2016), beating analysts' consensus estimate of -$3.15.

The company's quarterly revenues amounted to $3.289 bln (+43.9% y/y), generally in-line with analysts' consensus estimate of $3.261 bln.

TSLA fell to $343.80 (-0.35%) in pre-market trading.

-

12:13

Bank of England - current market rate path implies further rise in bank rate to just under 1.2 pct after three years (nov forecast 1.0 pct)

-

Bank of England MPC says appropriate to set monetary policy so inflation returns to target "at a more conventional horizon"

-

Inflation in three years' time at 2.11 pct (nov forecast 2.15 pct), based on market interest rates

-

Inflation in two years' time at 2.16 pct (nov forecast 2.21 pct), based on market interest rates

-

Inflation report shows unemployment rate at 4.1 pct in two years' time (nov 4.2 pct), based on market rates

-

Brexit uncertainty weighing on uk business investment

-

Estimates overall slack within economy is "very small" at just under 0.25 pct of gdp

-

Policy statement makes no direct reference to appropriateness of current market expectations about interest rates

-

-

12:10

United Kingdom feb BoE bank rate stays flat at 0.5 % (fcast 0.5 %) vs prev 0.5 %

-

Policymakers vote 9-0 to maintain corporate bond purchase target at 10 bln stg (poll 10 bln stg)

-

Mpc says if economy grows as expected, policy will need to be tightened somewhat earlier and somewhat more than expected in november

-

Inflation in one year's time at 2.28 pct (nov forecast 2.37 pct), based on market interest rates

-

-

12:00

United Kingdom: Asset Purchase Facility, 435 (forecast 435)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

10:38

Fed's Kaplan: digital currencies are here to stay, will evolve

-

Some flattening of the yield curve doesn't worry me

-

Highly vigilant about market volatility

-

Market volatility will not in itself cause change in my views

-

-

09:20

ECB's Weidmann says euro appreciation unlikely to jeopardise expansion

-

09:19

ECB says wage growth may still be weighed down low inflation in the past, weak productivity growth labour market reforms: bulletin

-

08:28

Major stock exchanges in Europe started trading in the red zone: FTSE 7251.64 -27.78 -0.38%, DAX 12525.58 -64.85 -0.52%, CAC 5242.59 -13.31 -0.25%

-

07:55

Options levels on thursday, February 8, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2409 (2790)

$1.2370 (1452)

$1.2324 (3148)

Price at time of writing this review: $1.2280

Support levels (open interest**, contracts):

$1.2232 (4247)

$1.2191 (6878)

$1.2145 (3487)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 132852 contracts (according to data from February, 7) with the maximum number of contracts with strike price $1,2200 (6878);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4108 (1245)

$1.4023 (1977)

$1.3960 (2720)

Price at time of writing this review: $1.3893

Support levels (open interest**, contracts):

$1.3839 (1252)

$1.3774 (1003)

$1.3690 (1209)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 43942 contracts, with the maximum number of contracts with strike price $1,3600 (3442);

- Overall open interest on the PUT options with the expiration date February, 9 is 40006 contracts, with the maximum number of contracts with strike price $1,3400 (3038);

- The ratio of PUT/CALL was 0.91 versus 0.90 from the previous trading day according to data from February, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:40

BoJ board member Suzuki: recent market sell-off won't have much impact on BoJ's policy @livesquawk

-

07:35

Fed’s Williams says recent market turmoil has not fundamentally changed policy, economic outlook

-

07:34

Reserve Bank of New Zealand governor Grant Spencer says market volatility a "bit of a warning sign", shows nervousness towards interest rate normalisation

-

Says not actively monitoring crypocurrency markets, considers it a very small market

-

Next interest rate move could be up or it could be down

-

-

07:32

RBNZ holds interest rate, says monetary policy will remain accommodative for a considerable period

-

Sees annual CPI 1.7 pct by march 2019 (pvs 2.0 pct)

-

Domestic economic growth is projected to strengthen

-

NZD has firmed, assume it will ease in the period ahead

-

Future headline inflation expected to tend upwards towards the midpoint of the target band

-

Longer-term inflation expectations remain well anchored at around 2 percent

-

Numerous uncertainties remain and monetary policy may need to adjust accordingly

-

Labour market conditions continue to tighten

-

GDP growth in second half is expected to strenghthen

-

-

07:29

10-year U.S. treasury yield at 2.814 percent vs U.S. close of 2.832 percent on wednesday

-

07:28

Eurostoxx 50 futures down 0.8 pct, DAX futures down 0.5 pct, CAC 40 futures down 0.6 pct, FTSE futures down 0.8 pct, IBEX futures down 0.7 pct

-

07:25

German trade balance surplus higher than expected in December

Germany exported goods to the value of 1,279.4 billion euros and imported goods to the value of 1,034.6 billion euros in 2017. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 6.3% and imports by 8.3% in 2017 compared with 2016. In 2017, export and import levels were higher than the previous all-time highs recorded in 2016. At the time, goods to the value of 1,203.8 billion euros were exported and goods to the value of 954.9 billion euros were imported.

The foreign trade balance showed a surplus of 244.9 billion euros in 2017. In 2016, the surplus of the foreign trade balance reached an all-time high (248.9 billion euros).

-

07:16

Germany: Current Account , December 27.8

-

07:01

Germany: Trade Balance (non s.a.), bln, December 18.2

-

06:31

Global Stocks

European stocks finished with firm gains on Wednesday, breaking a seven-session losing run. The move tracked advances on Wall Street Tuesday and Wednesday, as U.S. equity markets managed to rally following the biggest global selloff in years. Bourses also got a lift from news that German Chancellor Angela Merkel's party and its former center-left partner agreed on a formal deal to set up a governing coalition for Europe's largest economy.

European stocks closed higher Wednesday, as markets worldwide attempted to shake off the major volatility seen in recent sessions. The pan-European Stoxx 600 closed at 2.06 percent, with all sectors and major bourses in positive territory.

Asian stocks vacillated Thursday as higher market volatility continued and investors struggled with what to make of the past week's global market selloff. Indexes in Hong Kong and China turned negative ahead of their midday break, with Shanghai's stock benchmark also turning negative for the year as large-cap stocks declined.

-

05:02

Japan: Eco Watchers Survey: Outlook, January 52.4 (forecast 53.5)

-

05:00

Japan: Eco Watchers Survey: Current , January 49.9 (forecast 55.2)

-

03:46

China: Trade Balance, bln, January 20.34 (forecast 54.1)

-