Notícias do Mercado

-

23:58

GBP/USD regains 1.1500 after Fed’s Powell, UK PM Truss inspired volatility

- GBP/USD picks up bids to pare the previous day’s mild losses after a volatile day.

- Fed’s Powell advocated for stronger fight with inflation, below trend growth.

- UK PM Truss announced details of her energy plan, British Queen Elizabeth II died.

- Risk catalysts will be crucial amid a light calendar, inflation eyed.

GBP/USD consolidates the recent losses around 1.1515, after an active day, as traders reassess latest catalysts during Friday’s sluggish Asian session. In doing so, the Cable pair also cheers the energy plan of UK PM Liz Truss while showing less reaction on the death of the British Monarch Elizabeth II.

British Prime Minister (PM) Truss announced on Thursday the government will introduce a two-year "energy price guarantee" and explained that a typical household will pay no more than £2,500 a year on energy bills. “Treasury announcing a joint scheme working with BOE to address extraordinary liquidity requirements faced by energy firms, worth £40 billion,” added UK PM Truss.

On a Brexit page, UK PM truss also mentioned, per the UK Express, that she wants a “negotiated solution” to the row warning it must “deliver all the things” the UK has demanded before.

Elsewhere, Fed Chairman Jerome Powell said on Thursday that they need to act forthrightly and strongly on inflation, as reported by Reuters. "We think by our policy moves we will be able to put growth below trend and get labor market back into better balance," added Fed’s Powell.

It should be noted that the a sustained decline in the US Weekly Initial Jobless Claims to the lowest levels since May, with the latest figures beyond 222K, joins recent headlines concerning the US-China trade ties, to favor the market sentiment and underpin the GBP/USD rebound.

Against this backdrop, Wall Street closed with mild gains while the US 10-year Treasury yields rose to 3.32%.

Looking forward, a light calendar may restrict moves while China’s Consumer Price Index (CPI) and Producer Price Index (PPI) may offer intermediate moves ahead of next week’s US CPI. Even so, risk catalysts around the UK politics and Brexit may keep the GBP/USD traders busy.

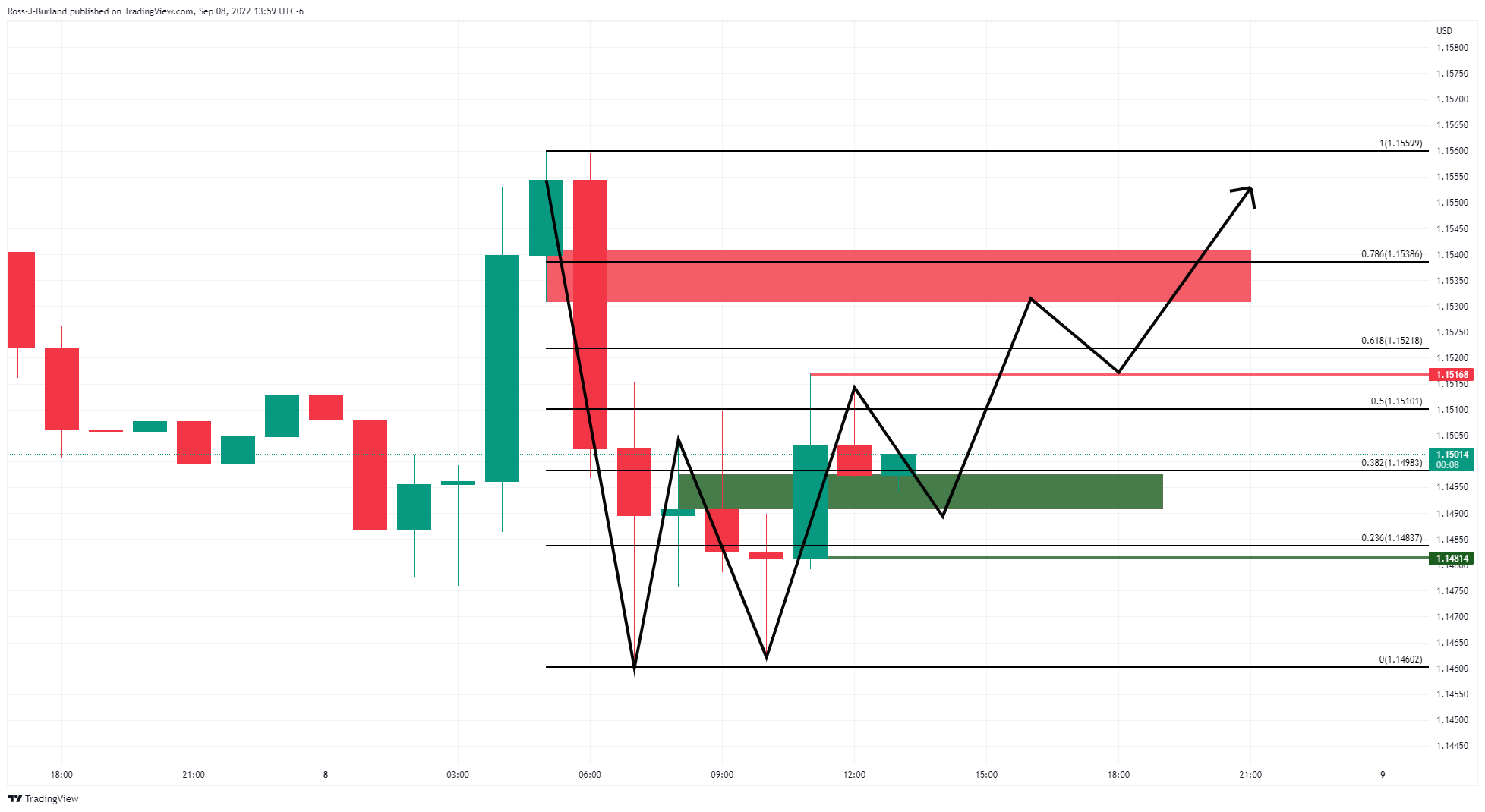

Technical analysis

Bullish RSI divergence keeps GBP/USD buyers hopeful inside a monthly falling channel between 1.1520 and 1.1300. Also acting as an upside filter is the 50-SMA near 1.1560.

-

23:45

New Zealand Electronic Card Retail Sales (YoY) increased to 26.9% in August from previous -0.5%

-

23:45

New Zealand Electronic Card Retail Sales (MoM) rose from previous -0.2% to 0.9% in August

-

23:32

White House weighs order to screen US investment in tech in China, other countries – WSJ

“The Biden administration is weighing an executive order to screen and possibly restrict U.S. overseas investment in cutting-edge technology development in China and other potentially hostile countries,” reported Wall Street Journal (WSJ) late Thursday.

Key quotes

The White House is aiming to issue such an order within the next couple of months to monitor and potentially block outbound investment by American companies and investors, according to people familiar with the matter.

The Chinese embassy in Washington said Beijing opposes the order, adding the measure would limit normal investment in China, disrupt international trade and distort global semiconductor supply chains.

Administration officials continue to discuss which agency would lead the new effort, as well as how far its authority might extend.

As with the earlier legislation, the order is likely to try to close what supporters of investment screening see as a gap in current government oversight.

Of particular concern are joint ventures where US companies transfer knowledge or technology to Chinese partners and Silicon Valley venture-capital firms that invest in China through their U.S. funds or China affiliates.

FX implications

The news appears a positive one for the market sentiment and hence may help extend the US dollar’s pullback. However, the previous news quoting US Treasury Secretary Janet Yellen challenged the optimism. Even so, a lack of major data/events joins an initial hour of the trading day to restrict the market’s reaction to the news.

Also read: US Treasury Secretary Yellen expects downward pressure on US inflation

-

23:31

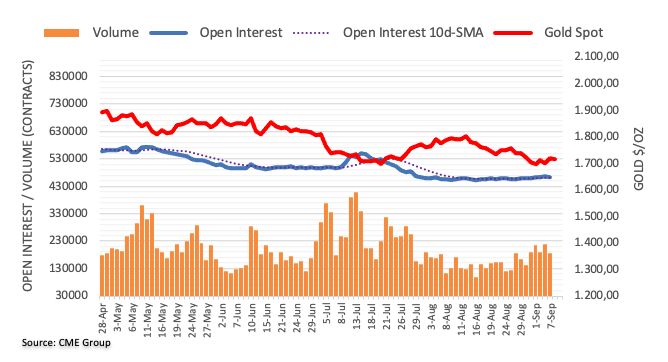

Gold Price Forecast: XAU/USD sees a downside to near $1,700, US Inflation hogs limelight

- Gold price is declining towards $1,700.00 as hawkish Fed Powell weakened gold bulls.

- The Fed is prepared to make growth sacrifices for bringing price stability.

- Falling gasoline prices may weigh pressure on headline US inflation data.

Gold price (XAU/USD) has displayed a less-confident pullback after a sheer downside move in the late New York session. The precious metal is expected to extend its weakness after dropping below the immediate support of $1,704.00. A downside break will drag the asset towards the psychological support of $1,700.00.

The gold prices witnessed a vertical drop after a hawkish speech from Federal Reserve (Fed) chair Jerome Powell. Fed Powell is ‘strongly committed to bringing price stability with odds of lower sacrifice in overall demand against prior instances of fighting inflation. Esteemed jobs demand sacrifices from growth prospects and the Fed is set to go all in to fix the inflation chaos.

Meanwhile, the US dollar index (DXY) has turned sideways as investors are shifting their focus toward the US Consumer Price Index (CPI) data, which will release on Tuesday. Well, the comments from US Treasury Secretary Janet Yellen on the inflation rate, citing that weaker gasoline prices may put further downward pressure on headline consumer price inflation for August, reported by Reuters, will trim the estimates for the headline inflation data.

Gold technical analysis

Gold prices are gyrating in 50% and 61.8% Fibonacci retracement placed at $1,709.87 and $1,705.53 respectively on the hourly scale. The touch points of the above-mentioned Fibo retracement are marked from Wednesday’s low at $1,691.47 to Thursday’s high at $1,728.27.

The 20-and 50-period Exponential Moving Averages (EMAs) are on the verge of displaying a bearish crossover at around $1,711.24.

Also, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range and will trigger a downside momentum on sliding into the bearish range of 20.00-40.00.

Gold hourly chart

-

23:30

USD/CAD Price Analysis: Double-top emerges, targeting 1.2930

- USD/CAD prepares to finish the week with decent losses of 0.27%.

- Failure at around 1.3200 spurred a double-top formation in the USD/CAD daily chart, which targets 1.2930.

- The USD/CAD in the near term is also downward biased.

The USD/CAD slides for the second consecutive day, tumbling to fresh weekly lows at around 1.3077, after failing to break the YTD high at 1.3227 twice in September. At the time of writing, the USD/CAD is trading at 1.3089, above its opening price, as the Asian Pacific session begins.

USD/CAD Price Analysis: Technical outlook

The USD/CAD daily chart indicates the pair is neutral-upwards biased. Nevertheless, price action during the last seven days witnessed a double-top formation, meaning that downside risks remain. Therefore, the USD/CAD first support would be the neckline at around 1.3074. A break below will expose an upslope trendline that passes around 1.3060, followed by the 20-day EMA at 1.3029. Once cleared, the next demand zone would be the 50-day EMA at 1.2952, followed by the double-top target at 1.2930.

Short term, the USD/CAD 4-hour chart depicts a trendline break, which also confluences with Friday’s daily pivot point at around 1.3110. However, a break below 1.3077 would exacerbate a move towards the confluence of the S1 daily pivot and the 100-EMA around 1.3048-60, which, once cleared, would pave the way towards the S2 pivot point at 1.3037, followed by the S3 daily pivot at 1.2975.

USD/CAD Key Technical Levels

-

23:21

EUR/USD flirts with parity even as ECB, Fed’s Powell rocked the boat, US inflation eyed

- EUR/USD traders take a breather after a volatile day.

- ECB hiked interest rates by 75 bps, President Lagarde signalled more rate lifts.

- Fed’s Powell highlighted the determination to tame inflation, put growth below trend and balance labor market.

- Absence of major data from EU/US could restrict moves, next week’s US CPI in focus.

EUR/USD remains sidelined near the 1.0000 level, picking up bids of late, as traders catch some rest after an eventful day. That said, the European Central Bank’s (ECB) monetary policy announcements and Fed Chair Jerome Powell’s speech offered a volatile day while a lack of major data seems to restrict the major currency pair’s moves during Friday’s Asian session.

On Thursday, the European Central Bank (ECB) matched the market’s expectations by announcing a 75 basis points (bps) increase to the key rates. As a result, the interest rate on the main refinancing operations, the marginal lending facility and the deposit facility will be increased to 1.25%, 1.5% and 0.75% in that order.

Following the announcements, ECB President Christine Lagarde said, "It will take more than 2 meetings but less than 5 to get to the end of hikes." The policymaker also resisted confirming the next rate hike as 75 bps while highlighting the data dependency. It should be noted that ECB’s Lagarde mentioned that the downside scenario for growth includes negative growth in 2023.

Additionally, ECB’s economic forecasts unveiled a significant upward revision to the inflation projections to an average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024. The bloc’s central bank also cut growth forecasts while expecting the economy to grow by 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024. The ECB’s economic update also stated, “After a rebound in the first half of 2022, recent data point to a substantial slowdown in euro area economic growth, with the economy expected to stagnate later in the year and in first quarter of 2023.”

On the other hand, Fed Chairman Jerome Powell said on Thursday that they need to act forthrightly and strongly on inflation, as reported by Reuters. "We think by our policy moves we will be able to put growth below trend and get labor market back into better balance," added Fed’s Powell.

Elsewhere, a sustained decline in the US Weekly Initial Jobless Claims to the lowest levels since May, with the latest figures beyond 222K, joins recent headlines suggesting improvement in the US-China trade ties, favoring the market sentiment.

Amid these plays, Wall Street closed with mild gains while the US 10-year Treasury yields rose to 3.32%.

Moving on, a light calendar may restrict EUR/USD moves while China’s Consumer Price Index (CPI) and Producer Price Index (PPI) may offer intermediate moves ahead of next week’s US CPI.

Technical analysis

Despite crossing a three-week-old resistance line, now immediate support around 0.9990, EUR/USD buyers need to print a successful run-up beyond the 21-DMA hurdle of 1.0025 to retake control.

-

22:54

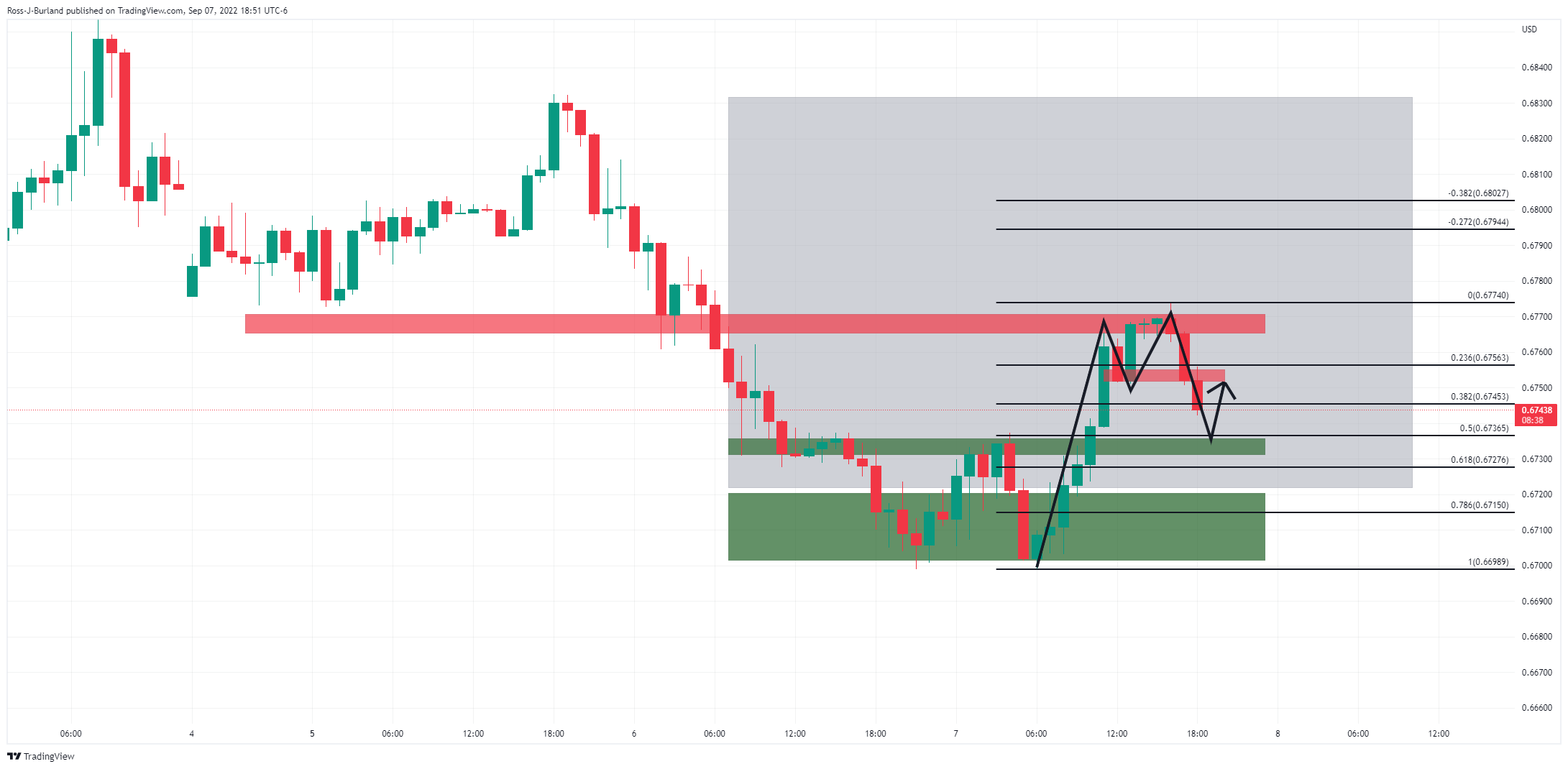

AUD/USD turns sideways around 0.6750 as focus shifts to China's Inflation data

- AUD/USD is juggling around 0.6750 as investors await China’s CPI data.

- A higher-than-expected China’s inflation will weaken the aussie bulls.

- The DXY failed to sustain above 110.00 despite the hawkish speech from Fed Powell.

The AUD/USD pair is oscillating around 0.6750 as investors are awaiting the release of China’s inflation data. The pair is displaying a volatility contraction phase after continuous efforts of overstepping the immediate hurdle of 0.6760. On Thursday, the asset spent the trading session in a 0.6713-0.6770 range despite the release of various catalysts.

The speech from Reserve Bank of Australia (RBA) Governor Philip Lowe has provided a further roadmap for the aussie bulls. RBA Lowe advocated scaling down the pace of hiking interest rates to support the retail demand. As the RBA has set the peak for the Official Cash Rate (OCR), which is 3.85%, the deviation of 150 basis points (bps) from the current OCR will be covered easily. Also, the central bank is expected that the inflation rate will top around 7%.

Apart from that, weaker trade data also kept the antipodean in a tight range. The commodity-linked currency has reported a decline in monthly export data by 9.9% against an expansion of 5.1%. Also, imports have accelerated by 5.2% vs. 0.7% in the prior release. The Trade Balance has trimmed dramatically to 8,733M against the expectation of 14,500M.

In today’s session, investors will focus on the release of China’s Consumer Price Index (CPI) data, which is seen higher at 2.8% vs. 2.7% recorded earlier. An increment in China’s CPI may hurt the aussie bulls as a higher price rise index will force the People’s Bank of China (PBOC) to sound less dovish than expected. It is worth noting that Australia is a leading trading partner of China and higher inflation in China could scale down Australian exports.

Meanwhile, the US dollar index (DXY) failed to sustain above the psychological resistance of 110.00 despite the hawkish speech from Federal Reserve (Fed) chair Jerome Powell. The Fed will continue its path of hiking interest rates as bringing price stability is its foremost priority. Going forward, the focus will shift to the US CPI, which will release on Tuesday.

-

22:48

AUD/NZD Price Analysis: Bears could be about to make a significant move

- AUD/NZD bulls could be seen moving in for the day ahead.

- A 61.8% ratio retracement could be on the cards as the last defence for a downside continuation.

AUD/NZD has been sliding from the higher quarter of the 1.11 area on Thursday. This leaves the focus on the downside for the day ahead while the following analysis illustrates on the hourly chart:

AUD/NZD H1 chart

The price is testing a key support level that if this were to hold, then the focus will be on a restest of the resistance and a 61.8% ratio retracement for the day ahead. If this were to see the bears committing, then a downside continuation to test the sideways range towards 1.1120 will be on the cards for the last sessions of the week.

AUD/NZD daily chart

The daily chart has seen a move into the 50% mean reverison area which leaves the prospects of a move lower for the week ahead.

-

22:18

US Treasury Secretary Yellen expects downward pressure on US inflation

Reuters reported that US Treasury Secretary Janet Yellen explained that falling gasoline prices may put further downward pressure on headline consumer price inflation for August. He also said that there is a lot of uncertainty over the inflation outlook due to Russia's war in Ukraine and energy supplies.

Speaking to reporters in Detroit, Yellen said she also was concerned about the global outlook due to an acute energy crisis in Europe.

Meanwhile, the US dollar index, which measures the greenback vs. a basket of currencies has travelled between a low of 109.334 and a high of 110.243 so far while the 10-year Treasury yield has recovered to a 3.304% high on the day from a low of 3.201%. The two-year yield reached a high of 3.506% from a low of 3.404% and is currently up 1.45% on the day. The US dollar and shorter-dated US Treasury yields climbed on Thursday on the back of Federal Reserve Chair Jerome Powell's comments who said that the Fed was "strongly committed" to controlling inflation.

-

22:17

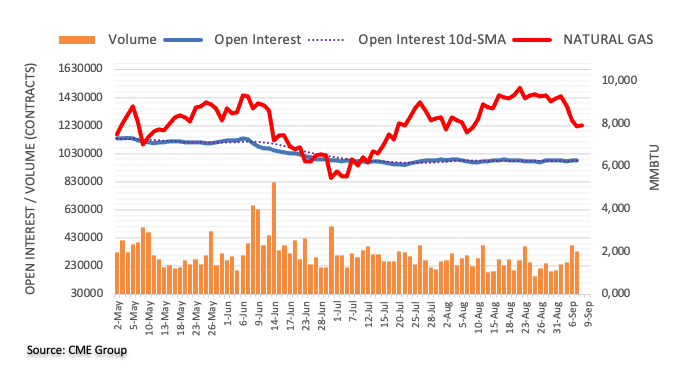

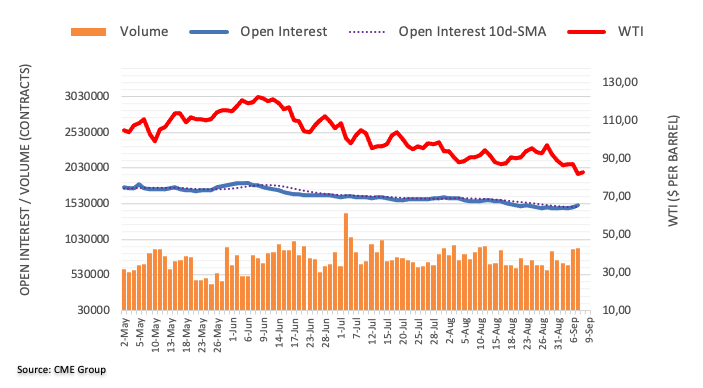

WTI recovers from five-month-lows climbs above $82.50

- On Thursday, WTI is advancing 1%, snapping two straight days of losses.

- China’s Covid-19 lockdowns, US oil inventories growing, and Russia’s halting oil and natural-gas flows could bolster WTI prices.

- WTI Price Analysis: Risks are skewed to the downside, but buyers reclaiming $86.00, could pave the way for higher prices.

US crude oil, also known as WTI, advances 1% during Thursday’s trading session after diving to a seven-month-old low at around $81.27 per barrel due to Russia’s halting oil and natural gas exports to some “unfriendly” buyers, while European’s energy crises worsen. At the time of writing, WTI is trading at $82.76, above its opening price.

Factors like China’s Covid-19 concerns, while US stockpiles surprisingly building more than estimates, were only two factors driving the price of the black gold down. Additionally, the US Biden administration is weighing another release of the US Strategic Petroleum Reserve (SPR).

On Wednesday, WTI plunged more than 5%, with Western Texas Intermediate (WTI) testing February’s 2022 lows. Nevertheless, even though initially the price dropped further on Thursday, it bounced off towards the daily highs at $84.24 PB before retracing to current levels.

Sources cited by Reuters attributed the jump in prices to an “oversold technical condition,” which allowed oil to shrug off news of the US stockpiles building, which accounted for nearly 9 million in the last week.

In the meantime, tensions between Europe and Russia keep energy investors uneasy. As the European Union proposed to put a lid on Russia’s oil, Russian President Vladimir Putin threatened to cut off all energy supplies if they advanced toward that path.

WTI Price Analysis: Technical outlook

Oil’s daily chart depicts the black gold as downward biased, despite bouncing from five-month lows. Unless buyers lift prices above the August 16 low-turned-resistance at $85.74 PB, risks are skewed to the downside. If WTI reclaims the latter, a test of the 20-day EMA at $89.58 is on the cards.

On the flip side, WTI’s first support would be the YTD low at $81.27. The break below will expose the $80.00 figure, followed by the January 2 daily low at $74.30.

-

22:08

NZD/USD bulls are moving in for the last day of the week from key support

- NZD suffers at the hand of rising US yields and the greenback.

- However, NZD/USD bulls step in at key H4 support.

NZD/USD was ending the North American session on the back foot. The price made a low of 0.6301 and had fallen from a high of 0.6078. The US dollar and shorter-dated US Treasury yields climbed on Thursday on the back of Federal Reserve Chair Jerome Powell's comments who said that the Fed was "strongly committed" to controlling inflation.

The DXY index, which measures the greenback vs. a basket of currencies has travelled between a low of 109.334 and a high of 110.243 so far while the 10-year Treasury yield has recovered to a 3.304% high on the day from a low of 3.201%. The two-year yield reached a high of 3.506% from a low of 3.404% and is currently up 1.45% on the day.

The move in the kiwi largely reflects short-term stability seen in the USD itself (at elevated levels) against a backdrop of a small bounce in equities and softer oil prices, analysts at ANZ Bank said. ''Technically, the fact that 0.60 has held, is, as we noted yesterday, a positive. But of course it wouldn’t take much to break it, and in that regard, next week’s duo of US CPI data on Tuesday night (NZT) and NZ Gross Domestic Product on Thursday are key risk events.''

Investors digested hawkish remarks by Powell and other policymakers that are underpinning the sentiment for a large interest rate hike later this month. In more recent trade, Chicago Fed President Charles Evans joined his fellow policymakers in saying that reining in inflation is "job one," although he said that he would prefer to raise rates and hold for some time, rather than raise too far and then have to cut. ''I'm open-minded on 50 bps or 75 bps rate hike for Sept.'' Money market traders see nearly 90% odds that the Fed will hikes rates by 75 basis points at this month's meeting.

NZD/USD technical analysis

The bulls are holding at the W-formation's neckline support which could give rise to an impulse higher for the day ahead.

-

21:11

GBP/USD Price Analysis: Pound rests in middle of the week's range, bulls in play

- GBP/USD has stalled above the recently made bear cycle lows.

- GBP/USD is approaching a price imbalance on the hourly chart, bulls eye break of 1.1516.

GBP/USD has been pressured to the lowest level since 1985 this week. However, it is trading in the middle of the week's range and as the following analyses illustrate, there are prospects of a bullish correction for the days and weeks ahead.

GBP/USD weekly charts

The weekly chart shows that the price is stalling at old support and a correction could be underway:

The bulls will be aiming for a break of the trendline resistance and the M-formation could be the catalyst for such a scenario. This is a reversion pattern that would typically see the price retrace to restest the neckline as old support turned resistance. If the bulls commit at this juncture, then a move above the formation will crystalise the bullish outlook for the weeks ahead.

GBP/USD daily chart

The daily chart, however, shows that 1.1600 could be a tough nut to crack as it has already resisted on the first attempt and now aligns with a 38.2% Fibonacci retracement level.

GBP/USD H1 chart

For the immediate future, the focus is on the upside for a retest of the highs. The price has left a W-formation on the chart and a break of 1.1516, the prior candle high, could seal the deal for a grind higher towards 1.1550 and beyond the recent highs.

-

20:30

Forex Today: Speculative interest more concerned than policymakers

What you need to take care of on Friday, September 9:

The greenback finished the day mixed across the FX board after a volatile day. The EUR/USD pair is little changed, just below parity after the European Central Bank hiked rates by 75 bps as expected.

The ECB upwardly revised the inflation projections to an average of 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024. Policymakers also expect the economy to keep growing regardless of signs of recession, with the annual GDP seen up by 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024.

The speech from President Christine Lagarde shed some light on future actions. She said it would take more than two meetings but less than five to get to the end of rate hikes, which is taking them to neutral levels. At the same time, she cooled down expectations of another 75 bps hike by saying it is not a norm but added that they could go for higher increases if needed.

US Federal Reserve Chief Jerome Powell delivered remarks on local inflation and monetary policy. Among other things, Powell said that the pandemic is the main reason behind the current situation, and repeated policymakers are strongly committed to bringing inflation down, as the longer it remains above target, the greater would be the risk.

As several other worldwide central bank leaders, Powell and Lagarde put taming inflation before stimulating growth. Lagarde diminished risks of recession but market players are well aware the energy crisis is yet to take its toll on the Union.

In the UK, the new Prime Minister Liz Truss announced a cap on household energy bills starting October 1. The government also announced it will put in place an equivalent cap for businesses' energy costs. The GBP/USD pair eased with the news, ending the day at around 1.1500.

The Canadian dollar surged against the greenback, with the pair trading at around 1.3090 as BOC officials reiterated more rate hikes are in the docket as inflation remains stubbornly high. AUD/USD trades little changed at around 0.6750.

The USD/CHF pair plunged, now trading at around 0.9700, while USD/JPY steadies at around 144.00.

Gold ended the day with losses at around $1,708 a troy ounce, while crude oil prices posted modest gains, with WTI ending the day at $83.25 a barrel.

US Treasury yields finished the day with modest gains. The 10-year note currently yields 3.29% not enough to trigger demand for the greenback but getting close to it.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Shakeouts, Fakeouts, Hopes & Dreams pt.3

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:01

United States Consumer Credit Change below expectations ($33B) in July: Actual ($23.81B)

-

20:00

Gold Price Forecast: XAU/USD bulls pressured, but eye a retest and breakout above $1,730

- Gold has underperformed on the day as the US dollar and yields rise.

- Gold bulls, however, are not going down without a fight and are eyeing a third attempt of a breakout.

The gold price is down on the day after falling heavily from a high of $1,728.23 to a low of $1,704.00. The yellow metal is trading around $1,709.33 at the time of writing and lowing some 0.5%. The US dollar index and shorter-dated US Treasury yields rose on Thursday following Federal Reserve Chair Jerome Powell's comments that the central bank was "strongly committed" to controlling inflation.

The DXY index, which measures the greenback vs. a basket of currencies has travelled between a low of 109.334 and a high of 110.243 so far while the 10-year Treasury yield has recovered to a 3.304% high on the day from a low of 3.201%. The two-year yield reached a high of 3.506% from a low of 3.404% and is currently up 1.45% on the day.

Meanwhile, US stocks have struggled for direction as investors digested hawkish remarks by Powell and other policymakers that are underpinning the sentiment for a large interest rate hike later this month. In more recent trade, Chicago Fed President Charles Evans joined his fellow policymakers in saying that reining in inflation is "job one," although he said that he would prefer to raise rates and hold for some time, rather than raise too far and then have to cut. ''I'm open-minded on 50 bps or 75 bps rate hike for Sept.'' Money market traders see nearly 90% odds that the Fed will hikes rates by 75 basis points at this month's meeting.

''Over the last multiple decades, gold prices have tended to outperform in the earlier stages of a hiking cycle, but have displayed a systematic underperformance when markets expect the real level of the Fed funds rate to rise above the neutral rate,'' analysts at TD Securities explained. ''In turn,'' they added, ''while gold prices may now have accurately captured the expected level of interest rates, they are not reflecting the implications of a sustained period of restrictive policy.''

This leaves the focus on the downside for gold, as the analysts have been arguing and suggesting to ''fade the technical rebound in gold prices.''

''While gold prices are flirting with a break of a multi-decade uptrend near $1675/oz, the stars are aligning for additional downside in precious metals to ensue. Rates markets appear to be nearing a fair pricing for Fed funds, but gold's price action is still not consistent with its historical performance when hiking cycles enter into a restrictive rates regime.''

''At the same time, the margin of safety against a short squeeze continues to grow, increasing odds that we can break through this critical support.''

Meanwhile, adding insult to injury, US data showed the number of Americans filing new claims for unemployment benefits fell last week to a three-month low. This proves a robust labout market even in the face of higher levels of interest rates. In this regard, investors will be waiting for a critical last-minute US August inflation report next week ahead of the Fed meeting that will offer some final key information that could give fresh clues on whether the Fed will need to raise by 75 or 50 basis points at the next policy meeting due Sept. 20-21.

Gold technical analysis

From a 4-hour chart perspective, the harmonic pattern is playing out with the price correcting higher from the C-D lows. However, as the chart below ill show, the bulls are making hard work of it:

The price has stalled ahead of a 38.2% Fibonacci retracement level on two levels of rise. The third attempt could be more successful and a break of 1,730 might be significant. The M-formation is a reversion pattern, so the next attempt could be imminent.

-

19:48

USD/JPY advances modestly bolstered by Fed officials as a Japanese intervention looms

- USD/JPY advances, preparing to finish the week with gains of almost 2.80%.

- Fed policymakers are laser-focused on taming inflation towards its 2% target.

- Japanese authorities remain nervous due to high volatility in the FX markets.

The USD/JPY climbs for the fourth consecutive day, thought retreats from around YTD highs reached on Wednesday at 144.99, clinging to the 144.00 figure, after Fed officials reiterated their commitment to bringing inflation down toward its 2% goal.

During the day, the USD/JPY began trading near the 144.00 figure, climbing late in the Asian session towards the daily high. Nevertheless, it tumbled towards the daily low at 143.32, but Fed’s Powell remarks before Wall Street opened bolstered the USD/JPY above the 144.00 figure. At the time of writing, the USD/JPY is trading at 144.00.

USD/JPY rises due to upbeat mood, reaching a 24-year high around 145.00

Risk appetite is positive through the Thursday session. Fed officials throughout the day remained vocal about tackling inflation, while Fed Chair Jerome Powell emphasized the Fed needs to act forthrightly, strongly as we have been doing.”

Data-wise, the US Bureau of Labor Statistics revealed that unemployment claims for the week ending on September 3 dropped to 222K from 235K estimated, flashing the labor market remains robust. The four-week moving average, which smooths out volatile week-to-week moves, decreased to 233K – the lowest since early July.

On the Japanese side, the Vice finance minister for international affairs, Masato Kanda, said that “volatility is recently heightening in the currency market. Especially in the past few days, we’ve seen one-sided, rapid yen declines driven by speculative moves. It’s clearly a move that can be described as excess volatility.”

"The yen's recent rapid moves cannot be justified by fundamentals," Kanda added after attending a meeting with officials of the Ministry of Finance, the Bank of Japan (BoJ), and the Financial Services Agency (FSA).

Meanwhile, the USD/JPY has retreated from around 145.00 due to the overextended move towards 24-year highs. Also, the Relative Strength Index (RSI) in overbought conditions is at 78.58, but its slope still points upward, meaning that buying pressure stills. However, Japanese authorities threatening to intervene in the Forex market might refrain USD/JPY traders from opening long bets on the major.

USD/JPY Key Technical Levels

-

19:04

Fed's Evans: Would prefer to raise rates and hold for some time rather than raise too far

Federal Reserve Bank of Chicago President Charles Evans said policymakers could deliver a third straight jumbo increase in interest rates when they gather on September 20-21, but he is opened minded between a 50 or 75 basis point hike.

Key notes

''I'm open-minded on 50 bps or 75 bps rate hike for Sept.''

''Will monitor breadth of inflation, and if anything surprises on wages may need to get to peak rate sooner.''

''Signs of inflation cooling won't change need to get to peak fed funds rate of 4%, but maybe not as soon.''

''Don't have 'heartburn' about getting to peak 3.75%-4% fed funds range by year-end or January.''

''Dollar strength shows the confidence we'll get inflation back down.''

''Hopeful that unemployment won't do all the work getting inflation down; will be special factors, supply chains.''

''Need to be confident inflation is heading back down to our 2% objective.''

'' Would prefer to raise rates and hold for some time, rather than raise too far and then have to cut.''Meanwhile, the US dollar index and shorter-dated US Treasury yields rose on Thursday following Federal Reserve Chair Jerome Powell's comments that the central bank was "strongly committed" to controlling inflation.

The DXY index, which measures the greenback vs. a basket of currencies has travelled between a low of 109.334 and a high of 110.243.

-

18:37

Silver Price Forecast: XAG/USD clings to gains above $18.50 despite higher US T-bond yields

- Silver prices advance despite higher US Treasury bond yields.

- Hawkish commentary by Jerome Powell fueled estimations that a 75 bps rate hike in September is a done deal.

- US 10-year Treasury Inflation-Protected Securities (TIPS), a proxy for real yields, approaches the 0.90% threshold, a headwind for precious metal prices.

Silver price holds to earlier gains after Federal Reserve Chair Jerome Powell emphasized that the Fed will continue to tighten monetary policy at the expense of slower economic growth. The XAG/USD is trading at $18.52, above the opening price, by 0.56%.

Sentiment has shifted mixed, with US equities fluctuating. Fed officials are crossing newswires as the Federal Reserve blackout period approaches, led by Fed Chair Jerome Powell. On Thursday, Powell commented that the Fed is “strongly committed” to bringing inflation to its 2% target and added that the Fed needs to act“forthrightly, strongly as we have been doing.”

Related to this, Barclays said now that it sees a 75 bps rate hike in September, but a 50 bps in November, via Reuters.

The US Department of Labor featured Initial Jobless Claims for the week ending on September 3, with figures falling to 222K, lower than estimates. In the meantime, the US Dollar Index, a gauge of the buck’s value measured vs. a basket of peers, gains 0.34% at 109.905.

Meanwhile, the US 10-year Treasury yield edges up two bps, sitting at 3.294%, putting a lid on the white metal gains. Also, the US 10-year TIPS, a proxy for real yields, climbed sharply, approaching the 0.90% mark, as recent Fed’s commentary fueled expectations of a 75 bps rate hike in September.

Late in the day, Chicago’s Fed Charles Evans said the labor market remains tight and added that the Fed is “increasing interest rate expeditiously.” Evans said that he expects GDP growth to remain at positive levels and commented that inflation would likely remain around 4 to 5% in core PCE and by 2023 at 3%, perhaps 2.5%.

Silver Price Forecast (XAG/USD): Technical outlook

Silver price remains neutral-to-downward biased. Even though silver buyers reclaimed the July 21 low at $18.24, downward risks remain. Additionally, solid resistance at around the 20-day EMA at $18.93, alongside the 50-day EMA at $19.24, would be challenging levels to overcome as the Relative Strength Index (RSI) turns horizontal. On the other hand, if XAG/USD registers a daily close below $18.24, it would open the door for a re-test of the YTD low at $17.56.

-

18:34

United States 4-Week Bill Auction increased to 2.5% from previous 2.47%

-

18:31

BoC’s Rogers: Front-loading best way to navigate to soft landing

Bank of Canada senior deputy governor Carolyn Rogers says bank has seen early signs monetary policy is working.

''We're not where we were in July, but we're a long way from where we need to be.''

''The bank still sees a path to a stop to a soft landing, that's still our objective's.''

''Neutral territory is a range, it's an estimate, there is no magic formula.''

Asked if outsize rate hikes can still be expected, we continue to say that we think front loading is the best way to deal with the underlying causes of inflation.

The speech by Senior Deputy Governor Carolyn Rogers comes one day after the BoC hiked its benchmark interest rate to a 14-year high of 3.25%.

The Canadian dollar was rising to 1.3080 to the greenback. On Wednesday, the currency touched its weakest intraday level in nearly eight weeks at 1.3208.

-

17:37

AUD/USD: Softness in the Australian dollar to remain through the end of 2022 – Wells Fargo

On Tuesday, the Reserve Bank of Australia (RBA) raised interest rates by 50 basis points to 2.35%. Analysts at Wells Fargo see the RBA making further rate hikes in the near term but at a slower pace, which should weigh on the Australian dollar. They point out that risks in the AUD/USD exchange rate are titled to the downside.

Key Quotes:

“Solid growth but uncertainty regarding consumer and household trends amid high inflation reinforces our view for continued rate hikes from the RBA, albeit at a slower pace than the recent 50 bps per meeting trend.”

“Our outlook for smaller magnitude rate hikes moving forward has implications for the Australian dollar's path as well. We expect the Australian dollar to soften through the end of 2022, before a rebound as 2023 progresses. With our expectation for the RBA to hike rates at a 25 bps pace beginning in October, and as the Federal Reserve maintains its hawkish approach, RBA rate hikes should lag the Fed's and also fall short of monetary tightening currently priced by financial markets. This should contribute to Australian dollar softness versus the greenback through the end of this year and perhaps into early 2023.”

“The risks could be tilted toward less weakness in the Australian dollar than currently anticipated, as inflation pressures could lead the RBA to deliver larger rate hikes despite uncertainty surrounding the consumer sector. We see prospects for Australian dollar strength to improve as 2023 progresses, given we expect the United States to fall into recession and the Fed to cut rates.”

-

17:36

Fed's Evans: Optimistic will be able to avoid a recession

"We'll muddle through this year with positive growth but the unemployment rate likely to go up," Chicago Fed President Charles Evans said on Thursday and added that he was optimistic they will be able to avoid a recession, as reported by Reuters.

Additional takeaways

"The labor market is going to slow down."

"We are increasing interest rate expeditiously."

"Job one is to get inflation back to 2%."

"Worried about global economic slowdown, and Europe taking the brunt."

"Shouldn't be complacent about US prospects given global slowdown."

"I also worry about inflation expectations getting out of hand."

"I expect inflation will come down."

"Bringing job openings down usually means a recession, but it's different this time."

"Possible job openings can decline without a big rise in unemployment."

Market reaction

The dollar preserves its strength following these comments and the US Dollar Index was last seen rising 0.45% on the day at 110.10.

-

17:34

SNB's Jordan: Swiss franc rise tends to help rather than hurt

Swiss National Bank (SNB) Chairman Thomas Jordan said on Thursday that the appreciation of the Swiss franc tends to help the Swiss economy rather than hurt it, as reported by Reuters.

Additional takeaways

"We must ensure price stability over medium term."

"Exchange rates play a role in inflation, when big central banks act, this helps us."

"You should not be surprised that SNB acts independently."

"SNB decides monetary policy at regular meetings unless under severe time pressure."

"No decision yet on what to decide at September 22 policy meeting."

"Next step depends on analysis under way, need to gauge inflationary pressure, exchange rates."

"Uncertainty about inflation much higher than usual, can't say have reached peak."

"Severe gas shortages could fuel inflation."

"Price stability is our mandate, of course need to keep impact of policy on economy in mind as well."

"Experience shows it was costly to fight inflation, more costly not to fight inflation at the start."

"Real effective exchange rate of franc has been astoundingly stable."

Market reaction

USD/CHF edged lower after these comments and was last seen losing 0.5% on the day at 0.9715.

-

17:31

EUR/JPY corrects from critical resistance around 144.00 after ECB meeting

- Euro under pressure following the ECB meeting and Lagarde’s press conference.

- Japanese yen recovers some ground after days with significant losses.

- EUR/JPY again unable to hold above 144.00.

The rally of the EUR/JPY cross hit a strong resistance area around 144.25 and pulled back following the European Central Bank meeting. It recently hit a fresh daily low 143.15. The decline takes place after a 500-pip rally in three days.

Euro softens after ECB

On Thursday, the European Central Bank raised interest rates by 75 basis points as expected, to curb inflation and despite economic grow concerns in the Eurozone. The central bank said it will hike further rates. Lagarde said the next hike is not necessarily a 75 bps.

The euro weakened across the board following the press conference favoring the correction in EUR/JPY. The decline also took place amid a recovery of the yen. USD/JPY pulled back from multi-decades highs to 143.50. Higher US yield still keep the yen under pressure.

The 144.20/30 area again

Like what happened several times in June, the 144.20/30 capped the upside in EUR/JPY. The cross hit on Thursday at 144.32 the highest intraday level since January 2015 but it quickly pulled back.

The euro was unable to hold above 144.00 and lost momentum. The cross needs a consolidation above that area to open the doors to more gains over the medium term. On the flip side, below 143.00, the next support is seen at the 142.40 area (July highs).

Technical levels

-

17:17

AUD/USD accelerates its downfall towards 0.6720 after Fed’s hawkish rhetoric

- The AUD/USD to stay downward pressured post-Jerome Powell speech, reiterating the Fed’s commitment to control inflation.

- RBA’s Governor Philip Lowe opened the door for a slower pace of rate increases.

- US Initial Jobless Claims dropped, illustrating the US labor market remains tight.

The AUD/USD remains on the defensive spurred by hawkish commentary by the Federal Reserve Chair Powell on Thursday, while the European Central Bank (ECB) delivered a 75 bps rate hike.

Earlier, the AUD/USD began trading near the day high at around 0.6769 but tumbled towards its daily low at 0.6713, on remarks of the RBA’s Governor Philip Lowe. At the time of writing, the AUD/USD is trading at 0.6725, below its opening price.

AUD/USD drops on dovish RBA Lowe vs. Fed’s Powell hawkish speech

The Fed parade continued ahead of the blackout period. On Thursday, the US Federal Reserve Chair, Jerome Powell, reiterated the Fed is “strongly committed” to taming inflation and added that the Fed needs to act “forthrightly, strongly as we have been doing.”

Before Wall Street opened, the US Labor Department unveiled Initial Jobless Claims for the week ending on September 3. Data showed that unemployment claims fell to 222K, lower than forecasts of 240K. Sources cited by Bloomberg said that “these timely data are signaling that the labor market is still strong, with layoffs declining, even as the Fed is tightening aggressively to rebalance supply and demand.”

Elsewhere, the US Dollar Index, a gauge of the greenback’s value against its peers, climbs 0.40%, last seen at 109.970, approaching the 110.000 psychological barriers, a headwind for the AUD/USD major.

On the Australian dollar side, the Reserve Bank of Australia (RBA) Governor Philip Lowe said that even though further rate hikes are needed, he’s aware that rates had already risen sharply. Lowe said that the RBA “the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises.”

AUD/USD reacted to this, sending the major towards its daily low before recouping some of those losses to current exchange rates.

What to watch

Further Fed speaking, led by Chicago’s Fed President Charles Evans, will cross wires at 16:00 GMT.

AUD/USD Key Technical Levels

-

16:43

EUR/USD: Further declines likely in the near-term – Wells Fargo

The European Central Bank raised key interest rates by 75 basis points on Thursday, in line with market expectations. The statement and Lagarde’s comments suggested more rate hikes ahead. The euro lost ground across the board after the meeting while the dollar rose boosted by Fed’s Powell remarks. Analysts at Wells Fargo see more declines in the EUR/USD in the near term as the Fed tightens further and amid the economic outlook of the Eurozone.

Key Quotes:

“Following today's record rate increase, we now forecast the European Central Bank will raise its Deposit Rate another 50 basis points in late October and also 50 basis points in December, lifting the Deposit rate to 1.75% by the end of this year. We expect a final 25 basis point rate increase to 2.00% in early 2023.”

“From a currency perspective, we still expect some further declines in the euro in the near-term, given the Fed remains firmly in tightening mode for now and with the Eurozone economic outlook less than stellar. We do expect some rebound in the euro in 2023 as a steady ECB monetary policy outlook sees the euro outperform against the U.S. dollar, with the latter likely weighed down by the anticipation and eventual implementation of Federal Reserve monetary easing by late 2023.”

-

16:30

BoC's Rogers: Policy interest rate will need to rise further

Bank of Canada (BoC) Senior Deputy Governor Carolyn Rogers reiterated on Thursday that the BoC continues to judge that the policy rate will need to rise further, as reported by Reuters.

Additional takeaways

"Recent data show inflationary pressures in Canada are increasingly broad-based."

"Getting inflation all the way back down to 2% will take some time, there could be bumps along the way."

"Governing Council discussed the ongoing risk that inflation becomes entrenched."

"There is a risk consumer spending has more momentum than we expect, making inflation more persistent."

"Demand continues to outstrip supply in many parts of the Canadian economy and short-term inflation expectations remain high."

"We remain resolute in our goal to re-establish low, stable and predictable inflation."

"Because we are in a period of excess demand we need a period of lower growth to balance things out; the reduced spending that results will ultimately lead to lower inflation."

"Bank will be keeping a close eye on how global developments and commodity prices affect exports, business investment and pricing decisions."

"Bank will watch to see if supply disruptions are improving and labor shortages are subsiding."

"Bank's decisions now and the ones taken in recent months will take up to two years to have their full effect on inflation."

Market reaction

USD/CAD edged slightly lower after these comments and was last seen posting small daily losses at 1.3115.

-

16:20

USD/CAD seesaws around 1.3110s, post-Powell speech

- The Loonie weakened after Powell’s speech reiterated the Fed’s commitment to tackling inflation.

- Unemployment claims in the US decelerated, fueling estimations that the labor market remains tight.

- Even though the BoC and Fed are tightening at the same pace, the safe-haven status of the US dollar will keep the USD/CAD under buying pressure.

The USD/CAD trims some of its Wednesday losses, climbing towards the 1.3100 area amidst a risk-on impulse, with most European and US equities rallying, despite further central bank tightening monetary conditions, with the ECB hiking 75 bps.

During the overnight session, the USD/CAD began trading near the 1.3110s area and wobbled around the 1.3100-1,3140 range before reaching the day’s highs at 1.3159. Nevertheless, it erased those gains and is currently trading at 1.3118, above its opening price by 0.01%.

USD/CAD advances modestly after hawkish Powell speech

Sentiment-wise, the market is slightly tilted positive. The Federal Reserve Chair, Jerome Powell, reiterated the Fed is “strongly committed” to taming inflation. The market’s reacted, sending the greenback higher, while the US 2-year yield, the most sensitive to interest rate increases, climbed.

In the meantime, the US Department of Labor reported that Initial Jobless Claims for the week ending on September 3 decelerated to 222K, less than estimates of 240K by street analysts. Sources cited by Reuters commented that “Nothing in these data suggest the economy is softening further, still less that it is in recession.”

In the meantime, the US Dollar Index, a gauge of the buck’s value vs. a basket of currencies, gains 0.36%, up at 109.924, approaching the 110.000 psychological barriers, a tailwind for the USD/CAD. Meanwhile, US crude oil, also known as WTI, recovers some ground at $83.28 per barrel, up 1.08%, putting a lid on USD/CAD gains.

Additionally, market players digest the recent interest rate hike by the Bank of Canada (BoC) on Wednesday. Although the BoC sounded hawkish and prepared market players, the broad safe-haven status of the greenback, and further rate hikes by the Federal Reserve, could keep the USD/CAD under upside pressure.

USD/CAD Key Technical Levels

-

16:10

ECB will slow the pace of tightening from here – TDS

The European Central Bank raised interest rates by 75 basis points on Thursday as expected. According to analysts from TD Securities expect the ECB to hike 50bps in October, and 25bps at each of the three meetings from December to March, reaching a terminal of 2.00% at that meeting.

Key Quotes:

“Today's decision suggests that the ECB will slow the pace of tightening from here as it heads toward (and indeed possibly above) the neutral rate, which by most accounts lies somewhere in the 1-2% range. We expect the Governing Council to hike rates by 50bps in October, and 25bps at each of the December, February, and March meetings. This leaves the Depo Rate at 1.50% by year-end (in line with our prior forecast), and 2.00% by March 2023. From there, we expect the ECB to leave policy on hold until 2024, when it likely cuts rates back toward the mid-point of the neutral range.”

“Our forecast is for one more hike than President Lagarde suggested at the press conference, but given the meeting-by-meeting nature of the ECB's decision-making framework, and the ease with which they have eschewed guidance in the past, we'd put little weight on her specific timeline of hikes at this stage.”

-

16:03

EUR/CHF falls to multi-day lows after ECB

- ECB raises rates by 75 bps, will hike further.

- Euro tumbles after Lagarde’s press conference.

- EUR/CHF hits ten-day lows, finds support above 0.9660.

The EUR/CHF tumbled following the European Central Bank meeting and after Lagarde’s press conference. The cross bottomed at 0.9661, the lowest level since August 29.

The combination of a weaker euro and a stronger Swiss franc across the board sent the EUR/CHF sharply lower. The decline found support above 0.9660 and it is hovering slightly below 0.9700, back above the flat 20-day Simple Moving Average, currently at 0.9680.

As expected, the ECB raised interest rates by 75 basis points and said it expects more rate hikes at their next meetings. Lagarde noted that more than two but less than five meetings are ahead to get to the end of the cycle. “We expect another 75bp hike in October. The central bank remains relatively optimistic on the growth outlook. We see higher rates, a flatter curve and a weaker EUR ahead”, said analysts at Nordea.

The Swiss franc was among the top performer prior to the ECB decision and it remained strong afterwards. The USD/CHF is hovering around 0.9730, down for the second day in a row, at the lowest level since late August.

Technical levels

-

16:00

United States EIA Crude Oil Stocks Change above forecasts (-0.25M) in September 2: Actual (8.844M)

-

15:39

Canadian Jobs Preview: Forecasts from five major banks, gains again after two months of losses

Canada will release August employment figures on Friday, September 9 at 12:30 GMT and as we get closer to the release time, here are forecasts from economists and researchers at five major banks regarding the upcoming employment data.

15K new workers are expected in August after the losses recorded in June (-43K) and July (-31K). But the unemployment rate is set to increase to 5% from 4.9%.

RBC Economics

“We expect Canadian employment rose by 5K jobs in August. This would follow two consecutive monthly declines. These recent sluggish developments stem almost entirely from a lack of available workers, not weakening demand. At over 1 million in June, job vacancies were still well above pre-pandemic levels. We look for an increase in the unemployment rate to 5.0% (which is still very low).”

TDS

“We look for the Canadian labour market to add 15K jobs in August for a muted rebound from the consecutive declines across June and July, with gains spread across goods and services. Tight labour market conditions should help wages edge higher to 5.5%, and we expect the unemployment rate to hold at 4.9%.”

NBF

“Our call is for a 15K increase. Despite this gain, the unemployment rate could increase from 4.9% to 5.1%, assuming the participation rate rose two ticks to 64.9%.”

Citibank

“We expect a rebound in jobs of 30K in August. Wages in the monthly labor force survey have been volatile and suggest inflationary pressures caused by a tight labor market could be somewhat less embedded in Canada. As tighter monetary policy acts to cool demand, moderating wage growth will be a sign that inflationary pressures could ease somewhat faster in Canada.”

CIBC

“We’re anticipating only tepid net hiring in August (5K). Slower growth within the economy later this year and into 2023 could see the unemployment rate rise moderately to 5% from its current historic low levels.”

-

15:30

United States EIA Natural Gas Storage Change meets forecasts (54B) in September 2

-

15:28

ECB to interrupt the rate hike process at 1.75% by the beginning of next year – Commerzbank

The European Central Bank (ECB) Governing Council decided to raise its key interest rates by 75 basis points. How long will it stay on course? Further significant rate hikes in the pipeline but at some point the ECB will buckle because of the recession, economists at Commerzbank report.

This is not enough to bring inflation down to 2%

“The ECB sent a clear signal today by raising the key interest rate by 75 basis points. It held out the prospect of further interest rate hikes because of high inflation.”

“We continue to expect it to raise its deposit rate to 1.75% by the beginning of next year, but to pause the rate hike process after that because of the recession that will then be visible. However, to bring inflation back to 2%, we believe it would have to raise its deposit rate to around 4%.”

-

15:24

EUR/PLN to rise as further global economic slowdown weighs on the zloty – Danske Bank

The zloty has not strengthened much despite the Polish central bank (NBP) hiking policy rates to 6.5%. Economists at Danske Bank see further upside potential on the EUR/PLN pair.

Zloty facing global headwinds

“Polish monetary tightening has been too slow in coming and too modest to curb the huge inflationary pressures. Furthermore, the global economic slowdown, the Ukraine war and USD strengthening have also hurt the PLN. With these effects likely to remain in place, we expect the PLN to weaken.”

“Forecast: 4.72 (1M), 4.74 (3M), 4.76 (6M), 4.76 (12M), 4.78 (end-2023).”

-

14:48

GBP/USD refreshes daily low amid a pickup in USD demand, remains vulnerable

- GBP/USD retreats around 100 pips from the daily high amid resurgent USD demand.

- Fed Chair Jerome Powell reaffirms a 75 bps rate hike bets and boosts the greenback.

- The UK’s bleak economic outlook supports prospects for a further depreciating move.

The GBP/USD pair struggles to capitalize on its modest intraday uptick and attracts fresh selling near the 1.1560 area on Thursday. Spot prices refresh daily low, around the 1.1460 region during the early North American session and remain well within the striking distance of the lowest since 1985 touched the previous day.

Following a modest dip to a fresh weekly low, the US dollar regains positive traction and reverses a major part of the overnight retracement slide from a two-decade high. This turns out to be a key factor exerting downward pressure on the GBP/USD pair. Fed Chair Jerome Powell reiterated the central bank's strong commitment to bringing inflation down and reaffirmed expectations for a supersized rate hike at the September FOMC meeting.

In fact, the implied odds for a 75 bps now stands at 85%, which, in turn, pushes the US Treasury bond yields higher. Apart from this, a fresh leg down in the equity markets provides a goodish lift to the safe-haven greenback. Meanwhile, the optimism led by UK Prime Minister Liz Truss' announcement to cap energy bills for the next two years fades rather quickly amid the worsening UK economic outlook, which might continue to weigh on sterling.

The fundamental backdrop seems tilted firmly in favour of bearish traders and suggests that the path of least resistance for the GBP/USD pair is to the downside. That said, it will be prudent to wait for a sustained break below the 1.1400 round-figure mark before positioning for any extension of the recent downward trajectory witnessed over the past month or so.

Technical levels to watch

-

14:35

Lagarde speech: More than two but less than five meetings to get to end of hikes

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 75 basis points following the September policy meeting.

Key quotes

"Rate move increments may not decline as we get closer to the terminal rate."

"Terminal rate is not known."

"We are giving priority to the policy rate."

"It will take more than 2 meetings but less than 5 to get to the end of hikes."

Market reaction

EUR/USD is struggling to shake off the bearish pressure and was last seen losing 0.45% on a daily basis at 0.9957.

-

14:30

USD/CAD: Break below critical support at 1.3075 to open up downside potential – Scotiabank

USD/CAD is overbought but holds range. Economists at Scotiabank note that the pair could suffer significant losses on a break under key support at 1.3075.

Ongoing downside pressure towards 1.31

“The USD is holding its established, short-term range but by recent standards, it is looking overbought.”

“The charts suggest ongoing downside pressure towards 1.31 in the short run; key support is 1.3075, the early Sep low and 1.3210 double top trigger (downside potential to 1.2940 on a break under the neckline).”

-

14:27

EUR/SEK to enjoy further gains towards the 11 level – Danske Bank

Economists at Danske Bank see further upside on the EUR/SEK. They expect the pair to advance nicely towards the 11 level.

Gradual SEK weakening set to continue

“We have a negative view on the outlook for the SEK and would stress both short and long-term headwinds for the currency.”

“A short-term risk is that fixed income markets seem to be pricing too many rate hikes from the Riksbank. A repricing of the Riksbank, together with weaker global GDP growth and volatile asset prices, would pose significant headwinds to the cyclical SEK.”

“Forecast: 10.50 (1M), 10.60 (3M), 10.80 (6M), 11.00 (12M).”

-

14:21

Lagarde speech: We are still stimulating the economy

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 75 basis points following the September policy meeting.

Key quotes

"Downside scenario for growth includes negative growth in 2023."

"Downside scenario sees gas rationing."

"Downside scenario is really dark."

"Premature to look at other policy instruments (quantitative tightening)."

"We have started the process of normalization."

"Noted the depreciation of the euro."

"We will resolve matter of TLTRO, other remuneration."

"We are still stimulating the economy."

-

14:21

EUR/USD loses the grip and turns negative below parity on Lagarde

- EUR/USD abandons the area of recent peaks near 1.0030.

- The ECB’s projections are quite upbeat when it comes to growth.

- Future policy decisions by the ECB remain data dependent.

Sellers seem to be regaining control around the European currency and prompt EUR/USD to surrender initial gains and slip back below parity as Lagarde’s presser is under way.

EUR/USD looks offered, Lagarde fails to surprise markets

After climbing as high as the 1.0030 region, or multi-day highs, EUR/USD could not stick to those gains and sparked a corrective move back below the parity zone.

The move lower in spot followed Chairwoman C.Lagarde’s press conference after she reiterated that future policy decisions will remain data dependent and on a meeting-by-meeting basis. Lagarde acknowledged that the labour market remains strong and weaker global demand continued to weigh on growth.

She noted that the weaker euro also collaborates with the elevated inflation as well as supply bottlenecks. Still on inflation, Lagarde suggested that food and energy costs could remain higher than expected at the time when a pick-up in inflation expectations warrant monitoring.

Regarding Thursday’s rate hike, Lagarde declined to comment whether the next interest rate raise will also be of 75 bps, adding that this is not the norm. She also suggested that the neutral rate is higher.

In light of the recent depreciation of the euro, Lagarde reiterated the central bank does not target the exchange rate.

What to look for around EUR

EUR/USD now sinks well below the parity level after the C.Lagarde fails to meet bulls’ expectations at the ECB event on Thursday.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: ECB Interest Rate Decision, Lagarde press conference (Thursday) – Eurogroup Meeting, Emergency Energy Meeting (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is losing 0.65% at 0.9936 and a drop below 0.9863 (2022 low September 6) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2002 low). On the other hand, the next resistance aligns at 1.0090 (weekly high August 26) ahead of 1.0161 (55-day SMA) and then 1.0202 (August 17 high).

-

14:16

Powell speech: History cautions against prematurely loosening policy

FOMC Chairman Jerome Powell said on Thursday that they need to act forthrightly and strongly on inflation, as reported by Reuters.

Additional takeaways

"We need to keep going until we get the job done."

"My message is the Fed has and accepts responsibility for price stability."

"Longer inflation remains above target, greater the risk."

"History cautions against prematurely loosening policy."

"We are strongly committed to bringing inflation down."

"We will not be influenced by political considerations."

"We focus solely on our mandate."

"Public's expectations of inflation play an important role."

"Very important inflation expectations remain well anchored."

"Today they are pretty well anchored over longer term."

"At short end, the clock is ticking and more concerns public will incorporate higher inflation expectations."

"Wages are running at elevated levels."

"We hope to achieve a period of below-trend growth."

"We think by our policy moves we will be able to put growth below trend and get labor market back into better balance."

"In most recent labor market report, saw a welcome increase in labor force participation."

Market reaction

The dollar gathers strength against its rivals after these comments and the US Dollar Index was last seen rising 0.6% on the day at 110.20.

-

14:12

Gold Price Forecast: XAU/USD retreats from over a one-week high, back below $1,715 level

- Gold witnessed an intraday turnaround from over a one-week high touched earlier this Thursday.

- Aggressive rate hikes by major central banks continue to act as a headwind for the commodity.

- Retreating US bond yields keep the USD bulls on the defensive, though fail to lend any support.

Gold struggles to capitalize on its intraday positive move to a one-and-half-week high and meets with a fresh supply near the $1,728 region on Thursday. The pullback extends through the early North American session and drags spot prices to a fresh daily low, closer to the $1,710 level in the last hour.

More aggressive rate hikes by major central banks to tame inflation turn out to be a key factor that continues to act as a headwind for the non-yielding gold. It is worth recalling that the Reserve Bank of Australia raised its benchmark rates by 50 bps on Tuesday, while the Bank of Canada maintained a more hawkish bias and delivered a 75 bps hike on Wednesday.

This was followed by a supersized 75 bps rate increase on Thursday by the European Central Bank, which expects to raise interest rates further to dampen demand. Furthermore, the US central bank is also anticipated to continue to tighten its monetary policy at a faster pace. That said, a modest US dollar weakness limits the downside for the dollar-denominated gold.

The USD extends the overnight retracement slide from a two-decade high and remains on the defensive for the second successive day amid a further pullback in the US Treasury bond yields. Apart from this, the prevalent cautious mood - amid growing worries about a deeper global economic downturn - could further offer some support to the safe-haven precious metal.

The prospects for a further policy tightening by major central banks, economic headwinds stemming from fresh COVID-19 lockdowns in China and protracted war in Ukraine have been fueling recession fears. This continues to weigh on investors' sentiment, which is evident from a generally weaker tone around the equity markets and benefits traditional safe-haven assets.

The mixed fundamental backdrop warrants some caution before placing aggressive directional bets around gold. Even from a technical perspective, spot prices have been oscillating in a familiar range over the past week or so. Hence, a sustained move in either direction is needed to confirm the near-term trajectory for the commodity.

Technical levels to watch

-

14:07

Lagarde speech: Next rate hike not necessarily 75 bps

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 75 basis points following the September policy meeting.

Key quotes

"Policy decision was unanimous."

"We had different views around the table."

"Inflation is spreading across a whole range of products, including in services."

"Today wasn't an isolated decision."

"Next rate hike will not necessarily be 75 bps, that's not the norm."

"Given inflation, determined action had to be taken."

"Where we are is not the neutral rate, it will take further hikes to neutral."

-

14:02

Gold Price Forecast: Fade the technical rebound in XAU/USD – TDS

Gold registered strong daily gains on Wednesday. However, strategists at TD Securities expect the yellow metal to move back lower.

China's appetite for gold continues to ebb

“While gold prices are flirting with a break of a multi-decade uptrend near $1,675, the stars are aligning for additional downside in precious metals to ensue.”

“While gold prices may now have accurately captured the expected level of interest rates, they are not reflecting the implications of a sustained period of restrictive policy.”

“Gold markets still feature an extremely concentrated and bloated position held by a small number of family offices and proprietary trading shops, which are increasingly at risk as prices approach their pandemic-era entry levels.”

“Our tracking of Shanghai gold trader positioning suggests that China's appetite for gold continues to ebb, potentially adding into a liquidation vacuum.”

-

14:02

Lagarde speech: Future policy rate decisions are to be data-dependent

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 75 basis points following the September policy meeting.

Key quotes

"Risks to growth are to the downside in the near term."

"Energy supply disruptions are a major risk."

"Initial signs of inflation expectations above target warrant monitoring."

"Wage growth is still contained."

"Risks to inflation are tilted to the upside."

"Future policy rate decisions are to be data-dependent."

"Credit to firms have become more expensive."

-

14:00

Russia Central Bank Reserves $ down to $561.9B from previous $566.8B

-

13:57

Lagarde speech: Higher inflation pressures stem from a weaker euro

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 75 basis points following the September policy meeting.

Key quotes

"Gas disruptions reinforce slowdown."

"Weaker global demand also weigh on growth."

"Slowing economy to lead to some increase in the jobless rate."

"The labor market has remained robust."

"Oil prices expected to moderate, wholesale gas to stay high."

"Supply bottlenecks are putting upward pressure on inflation."

"Higher inflation pressures also stem from a weaker euro."

-

13:37

US: Weekly Initial Jobless Claims decline to 222K vs. 240K expected

- Initial Jobless Claims fell by 6,000 in the week ending September 3.

- US Dollar Index clings to small daily gains 109.50.

There were 222,000 initial jobless claims in the week ending September 3, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 228,000 (revised from 232,000) and came in better than the market expectation of 240,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 233,500, a decrease of 7,500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending August 27 was 1,473,000, an increase of 36,000 from the previous week's revised level," the DOL said.

Market reaction

The greenback stays resilient against its major rivals after this data with the US Dollar Index posting small daily gains at 109.60.

-

13:31

EUR/GBP holds steady above mid-0.8600s, moves little after ECB hikes rates by 75 bps

- EUR/GBP refreshes daily low after the ECB announced its policy decision, though lacks follow-through.

- The ECB hikes interest rates by 75 bps and expects to raise interest rates further to dampen demand.

- Investors now await ECB President Lagarde’s remarks at the post-meeting presser for a fresh impetus.

The EUR/GBP cross retreats further from its highest level since mid-June touched earlier this Thursday and refreshes its daily low after the European Central Bank announced its policy decision. The downtick, however, lacks follow-through and spot prices, for now, seem to have stabilized around the 0.8670 area.

As was widely expected, the ECB hiked its benchmark rates by 75 bps this Thursday and struck a more hawkish tone, expecting to raise interest rates further to dampen demand. Given that the move was fully priced in the markets, the announcement fails to impress traders or provide any impetus to the shared currency. That said, a modest uptick in the British pound seems to exert some downward pressure on the EUR/GBP cross.

The new British Prime Minister Liz Truss announces a cap on energy bills for the next two years, which is seen as a welcome development for households. This, in turn, offers some support to sterling, though the worsening outlook for the UK economy continues to act as a headwind. Furthermore, reluctance to place aggressive bets ahead of ECB President Christine Lagarde's post-meeting presser limits the downside for the EUR/GBP cross.

Investors will look for fresh clues about the ECB's near-term monetary policy outlook amid the risk of an extreme energy crisis in Europe and growing recession fears. This, in turn, will play a key role in influencing the sentiment surrounding the shared currency and determining the next leg of a directional move for the EUR/GBP cross.

Technical levels to watch

-

13:30

EUR/USD remains unfazed around parity post-ECB rate decision

- EUR/USD keeps the daily range around the parity zone.

- ECB raised its key rates by 75 bps, matching previous estimates.

- The ECB now sees the region’s economy expanding 3.1% in 2022.

The single currency now alternates gains with losses and motivates EUR/USD to keep hovering around the parity region after the ECB raised rates on Thursday.

EUR/USD now focuses on Lagarde

EUR/USD keeps the daily range after the ECB raised the interests rates by 75 bps, as widely expected. That said, the interest on the main refinancing operations, the interest rate on the marginal lending facility and the deposit facility are now at 1.25%, 1.50% and 0.75%, respectively.

In its statement, the ECB predicts that further interest rate hikes are on the table over the next several meetings aimed at undermining demand and tackle upside risks in inflation expectations.

The updated macroeconomic projections now forecast inflation to rise at an average 8.1% this year, 5.5% in 2023 and 2.3% in 2024. Back to the economic growth, the bank’s staff now sees the region expanding 3.1% in 2022, 0.9% in the next year and 1.9% in 2024.

Moving forward, market participants will now closely follow the usual press conference by Chairwoman Lagarde and the subsequent Q&A session, while the speech by Fed's Powell will also grab investors' attention.

What to look for around EUR

EUR/USD now clings to the parity region ahead of the always important press conference by Chair Lagarde after the ECB delivered a widely anticipated 75 bps rate hike.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence. The latter, in the meantime, keeps closely following the prevailing debate around the size of the next interest rate hikes by both the ECB and the Federal Reserve.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: ECB Interest Rate Decision, Lagarde press conference (Thursday) – Eurogroup Meeting, Emergency Energy Meeting (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.06% at 1.0005 and faces the next resistance at 1.0090 (weekly high August 26) ahead of 1.0161 (55-day SMA) and then 1.0202 (August 17 high). On the other hand, a drop below 0.9863 (2022 low September 6) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2002 low).

-

13:30

United States Initial Jobless Claims came in at 222K, below expectations (240K) in September 2

-

13:30

United States Continuing Jobless Claims registered at 1.473M above expectations (1.435M) in August 26

-

13:30

United States Initial Jobless Claims 4-week average down to 233K in September 2 from previous 241.5K

-

13:19

EUR/USD will likely hit new lows in 2023 – Danske Bank

Slower growth and Federal Reserve are set to boost the US dollar. Therefore, economists at Danske Bank expect the EUR/USD to move downward over the coming months.

Dollar set to strengthen in 2023

“Inflation prints will probably come down in 2023 but we see little room for strong global GDP growth as long as the global economy is running close to capacity. We expect Europe to take the brunt of the hit, given its exposure to cyclical industries and large commodity imports.”

“We expect monetary policies to remain tight and price levels to stay high for a number of years, and the European economies look particularly challenged in this environment.”

“Forecast: 0.99 (1M), 0.98 (3M), 0.96 (6M), 0.95 (12M), 0.93 (end-2023).”

-

13:15

European Monetary Union ECB rate on deposit facility in line with forecasts (0.75%)

-

13:15