Notícias do Mercado

-

21:14

United Kingdom CFTC GBP NC Net Positions down to £-50.4K from previous £-29.2K

-

21:13

United States CFTC S&P 500 NC Net Positions up to $-238.7K from previous $-239.6K

-

21:13

European Monetary Union CFTC EUR NC Net Positions up to €-36.3K from previous €-47.7K

-

21:13

Japan CFTC JPY NC Net Positions dipped from previous ¥-41.5K to ¥-58.2K

-

21:13

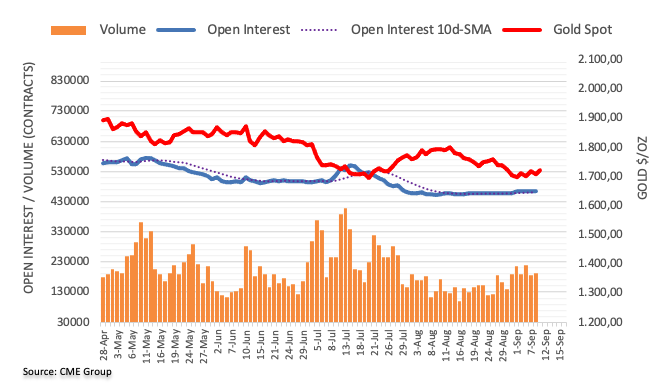

United States CFTC Gold NC Net Positions fell from previous $117.7K to $103.9K

-

21:13

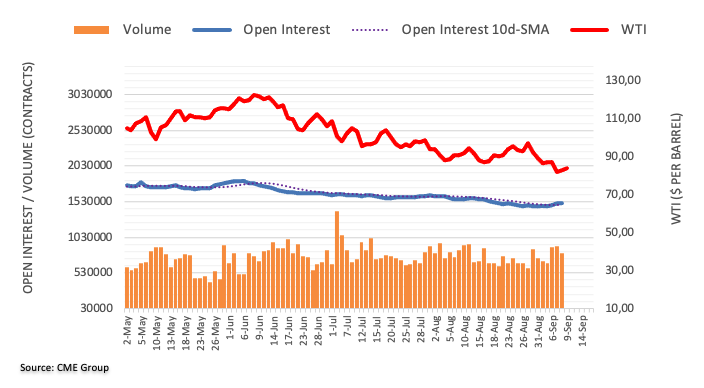

United States CFTC Oil NC Net Positions down to 214.5K from previous 229.2K

-

21:13

Australia CFTC AUD NC Net Positions climbed from previous $-57.4K to $-56.5K

-

18:14

United States Baker Hughes US Oil Rig Count declined to 591 from previous 596

-

17:10

Fed's Waller: I support another significant hike in two weeks

Federal Reserve Governor Christopher Waller said on Friday that it was too soon to say whether inflation was moving meaningfully and persistently downward, as reported by Reuters.

Key takeaways

"I support another significant hike in two weeks."

"The pace of tightening is uncertain; it will depend on the data."

"Fears of a recession have faded; robust US labor market is giving us the flexibility to be aggressive in our fight against inflation."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen losing 0.6% on a daily basis at 109.00.

-

17:03

Fed's George: Case for continuing to remove policy accommodation is clear cut

"A steady path of rate hikes, predictable adjustments based on data could improve market functioning, facilitate balance sheet runoff," Kansas City Fed President Esther George said on Friday, as reported by Reuters.

Additional takeaways

"For interest rate hikes, steadiness and purposefulness over speed."

"Case for continuing to remove policy accommodation is clear cut, but peak policy rate is likely just speculation at this point."

"Sustained policy response required to address inflation; only careful observation of the economy will show how much more tightening is required."

"Fed should clearly signal resolve to shrink the balance sheet."

"There may be benefits to announcing desired reserve levels as the balance sheet shrinks."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen losing 0.6% on the day at 109.00.

-

17:01

USD: There is a risk it could drop further in the near-term – MUFG

The recent pullback of the US dollar makes analysts at MUFG Bank more cautious over chasing the greenback further to the upside in the near term. They warn that next week’s US CPI report for August poses another downside risk for USD.

Key Quotes:

“It has been a volatile week in the foreign exchange market. In the first half of the week the dollar extended its recent advance hitting fresh year to date highs against other major currencies. EUR/USD hit a fresh year to date low of 0.9864 on Tuesday followed by cable hitting fresh year to date low at 1.1406, and USD/CNY and USD/JPY hitting fresh year to date highs at 6.9799 and 144.99 respectively on Wednesday. After putting in place fresh year to date highs the USD has since corrected sharply lower in recent days. It has been the largest sell-off for the dollar index since July.”

“The pullback for the USD has made us more cautious over chasing further USD upside in the near-term. We are not convinced that it is the start of a more sustained reversal lower for the USD, but there is a risk it could drop further in the near-term.”

“One potential downside risk in the week ahead for the USD is the release of the latest US CPI for August. The Fed has already downplayed the weaker US CPI report for July, but another weaker CPI report for August could challenge market expectations for a third consecutive 75bps hike later this month.”

-

17:00

Russia Consumer Price Index (MoM) above expectations (-4%) in August: Actual (-0.52%)

-

16:50

Canada: Despite weak labor numbers, another BoC rate hike is still likely – CIBC

The Canadian employment report released on Friday showed weaker-than-expected numbers, with an unexpected decline in net employment. Analysts at CIBC point out the weak headline figures may have the Bank of Canada questioning its apparent commitment to even higher interest rates but they noted numbers could rebound in the months ahead due to education employment.

Key Quotes:

“Summer lulling continued in the Canadian labour market, with a 40K drop in jobs marking the third consecutive monthly decline. However, unlike the prior two months, the latest drop can't be easily brushed aside as a consequence of reduced labour supply. Indeed, the participation rate actually edged up in August, meaning that the decline in employment took the jobless rate up to 5.4%, from 4.9% in the prior month. Yet with the decline in employment partly a result of a large drop in education, which often sees volatility in summer months, we doubt that today's weak headline numbers will change the Bank of Canada's commitment towards raising interest rates further.”

“The decline in jobs during August was focussed on full-time (-77k) and public sector (-28k) positions. By sector, a 28K drop in construction jobs (a sector previously booming) shows that interest rate hikes are having an impact on the labour market. However, the near 50K decline in education employment is more likely to represent difficulties in seasonal adjustments within this sector, and as a result we should see a rebound in the months ahead.”

“The weak headline figures may have the Bank of Canada questioning its apparent commitment to even higher interest rates. However, with the large drop in education employment potentially reversing ahead, and with one more labour force survey before the Bank's October meeting, it still seems likely that at least one more rate hike will be in store before a pause is seen.”

-

16:28

USD: Dollar to remain strong through the end of 2022 – Wells Fargo

Analysts at Wells Fargo continue to see further US dollar strength through the end of this year. They point out that despite a more aggressive pace of tightening from foreign central banks, they doubt international policymakers will be able to keep pace with the tightening cycle laid out by the Federal Reserve.

Key Quotes:

“Despite a more aggressive pace of tightening from select international central banks, the Federal Reserve is still likely to lead the charge toward tighter monetary policy. In that sense, we continue to forecast a stronger U.S. dollar through the end of this year. That dollar strength should materialize as the Fed raises interest rates an expected 75 bps in September and continues to shrink its balance sheet.”

“We believe the dollar will strengthen against both G10 and emerging market currencies, only peaking once Fed policymakers start to consider unwinding rate hikes as the U.S. economy enters recession.”

-

16:19

AUD/USD retreats from one-week highs, remains strong above 0.6820

- Aussie among top performers on Friday.

- AUD/USD retreat from near 0.6880 found support at 0.6820.

- AUD/NZD prints one-week highs around 1.1200.

The AUD/USD peaked during the European session at 0.6877, the highest level since August 31 and then pulled back amid a stabilization of the greenback. The retreat found support at 0.6820 and the pair is about to end the week on a positive note with gains.

A broad-based correction of the US dollar, higher commodity and equity prices are helping the aussie confirm weekly gains. The Australian dollar is among the top performers on Friday. Against the kiwi hit one-week highs, with AUD/NZD testing levels above 1.1200.

On a weekly basis, the AUD/USD managed to rebound from under 0.6700 and is it about to end the week with gains. Most important, it is avoiding a weekly close below 0.6770 that would have been the lowest since 2020, opening the doors to fresh lows.

Inflation and employment

Two critical reports are due next week for the AUD/USD pair. In the US, will be August inflation on Tuesday. The figures will have critical implications for market expectations regarding the next Federal Reserve meeting. Powell remained hawkish during the week, although a slowdown in the annual inflation rate could start to alleviate rate hike expectations, not necessarily for the September FOMC meeting.

On Thursday, Australian labor market data will be released. After a disappointment in July, the August report is expected to show an improvement. Market consensus is for a 35K increase in jobs. Another weak number could weigh on the aussie, as market participants would see more likely a 25 basis points rate hike from the Reserve Bank of Australia, rather than a larger increase.

AUD/USD weekly chart

Technical levels

-

15:19

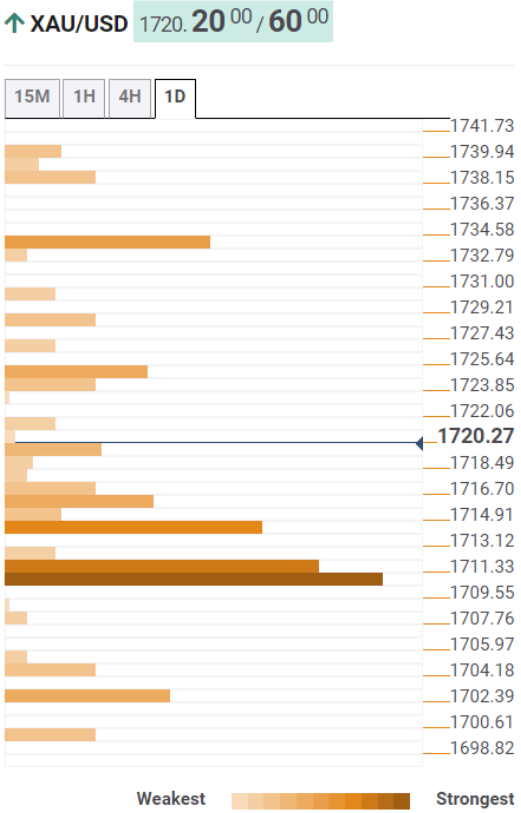

Gold Price Forecast: XAUUSD fails again near $1730, erases daily gains

- Sharp reversal in gold shows recovery is not an easy road.

- The dollar trims losses on Friday amid risk appetite and a rebound in US yields.

- The daily chart shows XAUUSD in a bearish channel, hovering around $1710.

Gold turned to the downside again after approaching the $1730 area and pulled back sharply toward $1710, erasing daily gains on Friday. Stabilization of the US Dollar and a rebound in yields weighed on the yellow metal.

XAUUSD failed to break the critical resistance around $1730 and weakened. A break above would strengthen the outlook for gold, targeting first $1745 and then exposing a downtrend line at $1760. On the flip side, a daily close below $1695 would expose the long term support area at $1675 (2021 and 2022 lows).

Dollar down, but off lows

The greenback moved off lows, with the DXY rising back toward 109.00 and the US 10-year yield recovering 3.30%. Those moves, made the barrier around $1730 in gold stronger.

Not even the better tone in Wall Street capped the retreat. XAUUSD found support at $1710$ and it is about to end the week hovering around $1715, below key resistance levels but also holding above $1700.

On Thursday, Fed Chair Powell continued with the hawkish tone. Next week, the key number will be August US CPI on Tuesday. If market participants see in the numbers that a peak has been reach, gold could benefit.

XAUUSD daily chart

-

15:00

United States Wholesale Inventories below expectations (0.8%) in July: Actual (0.6%)

-

14:45

EUR/USD Price Analysis: Downside pressure alleviated above 1.0200

- EUR/USD extends the recovery to 3-week highs past 1.0100.

- Further gains lie ahead once the 7-month resistance line is cleared.

EUR/USD regains upside traction and climbs to levels beyond 1.0100, or multi-week highs, on Friday.

Further upside should now meet the temporary hurdle at the 55-day SMA at 1.0152 ahead of the 7-month resistance line, today near 1.0200, an area also coincident with a minor up barrier at 1.0202 (August 17). The pair should see its downside pressure mitigated once this region is cleared.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0760.

EUR/USD daily chart

-

14:36

Gold Price Forecast: Stars are aligning for additional downside in XAU/USD to ensue – TDS

Gold has managed to attracts fresh buying on the last day of the week. However, strategists at TD Securities expect the yellow metal to remain under downside pressure.

Money managers continue to sell their length

“As gold prices flirt with a break of a multi-decade uptrend near $1,675, the stars are aligning for additional downside in precious metals to ensue.”

“Gold tends to outperform in the earlier stages of a hiking cycle, but have displayed a systematic underperformance when markets expect the real level of the Fed funds rate to rise above the neutral rate. In turn, while gold prices may now have accurately captured the expected level of interest rates, they are not reflecting the implications of a sustained period of restrictive policy.”

“Money managers continue to sell their length, while ETF holdings of gold remain in a sustained downtrend which will soon erode all safe-haven-led gains since the war in Ukraine.”.

-

14:30

ECB to start discussion on shrinking balance sheet in early October – FT

In a report published on Friday, the Financial Times said that the European Central Bank (ECB) policymakers have agreed to start discussions on shrinking its balance sheet in early October.

The ECB is likely to decide by the end of the year to reduce the amount of maturing bonds it replaces in a portfolio of mostly government securities.

Market reaction

The shared currency failed to benefit from this headline. As of writing, the EUR/USD pair was trading at 1.0055, where it was up 0.6% on a daily basis.

-

14:30

USD/CAD: Negative Canadian jobs unlikely to instigate loonie weakness as 1.30 is solid floor – TDS

The Canadian Labour Force Survey delivered more bad news in August. There is always a sense of caution in extrapolating implications from monthly jobs report to the CAD, but with USD/CAD finding its way back down to 1.30, that level may look attractive for many to fade, economists at TD Securities report.

Canadian employment down for third straight month

“Employment fell by another 39.7K in August, well below expectations for a 15K increase, to build on the loss of 74K jobs over the previous two months. We also saw a sharp rise in the unemployment rate to 5.4%, although stronger wage growth will cloud the broader implications for the Bank of Canada.”

“We doubt this number is the catalyst to instigate CAD weakness, but it may start to kick off the domino effect of bad news. That should keep the shelf life of CAD rallies short-lived.”

“USD/CAD near 1.30 should be solid support and a base to leg into longs.”

-

14:23

USD/CAD pares heavy intraday losses, back above 1.3000 post-dismal Canadian jobs data

- USD/CAD recovers around 50 pips from over a one-week low touched earlier this Friday.

- Aggressive Fed rate hike bets assist the USD to trim a part of its heavy intraday losses.

- Disappointing Canadian jobs data weighs on the domestic currency and offers support.

- Rallying crude oil prices continue to underpin the loonie and cap the attempted bounce.

The USD/CAD pair stages a goodish rebound from the 1.2980 region, or over a one-week low touched this Friday, though remains in the negative territory for the third successive day. The pair is seen trading near the 1.3025 region during the early North American session, still down nearly 0.50% for the day.

Expectations that the Federal Reserve will tighten its monetary policy at a faster pace assist the US dollar to trim a part of its heavy intraday losses to a fresh monthly low. The Canadian dollar, on the other hand, is undermined by disappointing domestic employment data. This, in turn, offers some support to the USD/CAD pair and contributes to the intraday recovery of over 50 pips.

Statistics Canada reported this Friday that the number of employed people declined by 39.7K in August against expectations for an addition of 15K. Further details of the publication revealed that full-time employment declined by 77.2K and the Unemployment Rate rose from 4.9% in July to 5.4% during the reported month. This, however, was offset by a strong rally in crude oil prices.

Against the backdrop of a symbolic output cut by OPEC+, Russia's threat to cut oil flows to any country that backs a price cap on its crude raises concerns about tight global supply. Rising oil prices offer support to the black liquid, which is underpinning the commodity-linked loonie amid a more hawkish Bank of Canada. This, in turn, keeps a lid on any further recovery for the USD/CAD pair.

Furthermore, the markets already seem to have fully priced in a supersized 75 bps rate hike at the next FOMC meeting on September 20-21. This, along with subdued action around the US bond yields, might hold back the USD bulls from placing aggressive bets. Hence, it will be prudent to wait for strong follow-through buying before positioning for any further appreciating move for the USD/CAD pair.

In the absence of any relevant economic releases from the US, scheduled speeches by Fed officials will play a key role in influencing the USD demand. Apart from this, oil price dynamics will be looked upon to grab short-term trading opportunities. Nevertheless, the USD/CAD pair remains on track to register heavy weekly losses and snap a four-week winning streak to the 1.3200-1.3210 strong barrier.

Technical levels to watch

-

13:55

US Dollar Index Price Analysis: Next on the downside comes 107.60

- DXY adds to the weekly decline and revisits the 108.40/35 band.

- A deeper drop to the 107.60 area should not be ruled out.

DXY intensifies the weekly retracement and breaks below the key 109.00 support with certain conviction on Friday.

Despite the corrective decline, the underlying bullish view in the dollar remains unchanged. That said, the index could allow a deeper drop to, initially, the weekly low at 107.58 (August 26). The proximity of the temporary 55-day SMA, today at 107.17, also reinforces this support zone.

In the meantime, the short-term constructive perspective remains bolstered by the 7-month support line just below 106.00.

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 101.33.

DXY daily chart

-

13:46

USD/JPY recovers few pips from multi-day low, still deep in the red below mid-142.00s

- USD/JPY stages an intraday bounce from a multi-day low touched earlier this Friday.

- The USD trims a part of heavy intraday losses and offers some support to the major.

- The risk-on impulse undermines the safe-haven JPY and contributes to the recovery.

The USD/JPY pair rebounds swiftly from a three-day low touched earlier this Friday, though struggles to capitalize on the attempted recovery move. The pair is currently trading around the 142.30-142.25 area, still down nearly 1.25% for the day.

The US dollar trims a part of its heavy intraday losses to a fresh monthly low and continues to draw support from rising bets for a more aggressive policy tightening by the Fed. Apart from this, the risk-on impulse - as depicted by a generally positive tone around the equity markets - undermines the safe-haven Japanese yen and assists the USD/JPY pair to attract some buying near the mid-141.00s.

The markets, however, already seem to have priced in a supersized 75 bps rate hike at the September FOMC meeting. Furthermore, speculations that authorities may soon step in to arrest the freefall in the JPY hold back traders from placing aggressive bets around the USD/JPY pair. This, in turn, might keep a lid on any meaningful upside for spot prices, at least for the time being.

That said, a big divergence in the monetary policy stance adopted by the Bank of Japan and the US central bank warrants some caution before confirming that the USD/JPY pair has topped out. Hence, Friday's sharp downfall might still be categorized as a corrective pullback amid extremely overbought conditions, especially after a strong rally of nearly 30% since the beginning of the year.

There isn't any major market-moving economic data due for release from the US on Friday. Hence, the focus will remain on scheduled speeches by Fed officials, which will play a key role in influencing the USD price dynamics. Apart from this, traders will take cues from the broader market risk sentiment to grab short-term opportunities around the USD/JPY pair.

Technical levels to watch

-

13:31

Canada: Unemployment Rate jumps to 5.4% in August vs. 5% expected

The Unemployment Rate in Canada rose to 5.4% in August from 4.9% in July, Statistics Canada reported on Friday. This reading came in worse than the market expectation of 5%.

Further details of the publication revealed that the Net Change in Employment was -39.7K, compared to the market expectation of +15K. Full-time employment declined by 77.2K and part-time employment increased by 37.5K in the same period.

The Participation Rate improved modestly to 64.8% from 64.7% in July.

Market reaction

With the initial reaction, USD/CAD gathered recovery momentum and erased a portion of its daily losses. As of writing, the pair was still down 0.5% on the day at 1.3028.

-

13:30

Canada Capacity Utilization came in at 83.8%, above expectations (82.5%) in 2Q

-

13:30

Canada Participation Rate in line with expectations (64.8%) in August

-

13:30

Canada Unemployment Rate registered at 5.4% above expectations (5%) in August

-

13:30

Canada Net Change in Employment came in at -39.7K, below expectations (15K) in August

-

13:27

EUR/USD to struggle to extend its advance much further above parity – MUFG

EUR/USD has surged above parity. However, the pair is unlikely to extend its race higher, in the opinion of economists at MUFG Bank.

Energy crisis will continue to cap the euro

“We still believe the energy crisis in Europe will continue to limit how far the euro can strengthen on the back of a hawkish ECB, and eventually limit how far the ECB will be to hike rates beyond this year.”

“We remain sceptical over EUR/USD’s ability to extend its advance much further above parity.”

-

13:24

USD/JPY: Upward trend could quickly resume without policy action from Japan – MUFG

The pullback for USD/JPY has gathered momentum. However, economists at MUFG Bank expect this move to run out of steam without action from the Bank of Japan (BoJ).

Japan is considering intervening to support the yen

“The heightened risk of intervention and/or a shift in BoJ policy has already helped the yen to rebound in recent days but the comments will need to be backed up by action for the pullback in USD/JPY to prove sustainable.”

“Without policy action from Japan, USD/JPY’s upward trend could quickly resume on the back of expectations for monetary policy divergence from the BoJ and Fed. There has been no indication that the Fed is considering scaling back their own plans for policy tightening in the near-term.”

-

13:14

King Charles III will be the first British monarch to pay more than a pound for a dollar – SocGen

In the view of Kit Juckes, Chief Global FX Strategist at Société Générale, GBP/USD may trade in a low range for now, but King Chares III is set to see the British pound value falling.

Next 10% move in USD/JPY more likely to be down than up

“The aggressive fiscal reactions to higher energy prices support a view that while we may not have seen the dollar’s peak, it isn’t very far away.”

“There’s a lot of bad news embedded in current FX levels and a period of EUR/USD and GBP/USD trading in low ranges is more likely than fresh 10% fall from here. It’s now much more likely the next 10% move in USD/JPY is down than up, too.”

“The long run sterling outlook is, however, a different story. There’s a strong chance that King Charles III will be the first British monarch to pay more than a pound for a dollar, or more than a pound for a euro or both. Neither is likely this year, but sterling’s post-GFC downtrend won’t end until there’s a seismic change in the direction of economic policy and the economy.”

-

13:00

Brazil IPCA Inflation came in at -0.36%, above forecasts (-0.39%) in August

-

12:44

EUR/JPY Price Analysis: Technical correction could retest 138.70

- EUR/JPY comes under pressure following earlier new cycle tops.

- The ongoing corrective decline could extend to the 138.70 region.

EUR/JPY advances to new tops near 144.70, an area last traded back in January 2015, before embarking on a corrective drop.

The cross comes down from the overbought territory and the ongoing technical move carries the potential to extend to the 138.70 region, an area coincident with the September low and the 55-day SMA.

In the meantime, while above the 200-day SMA at 134.84, the prospects for the pair should remain constructive.

EUR/JPY daily chart

-

12:30

India Bank Loan Growth registered at 15.5% above expectations (15%) in August 26

-

12:17

BoE postpones September rate decision to September 22

The Bank of England (BoE) announced on Friday that they postponed the interest rate announcement by a week to September 22 from September 15, as reported by Reuters.

No additional details had been shared yet on the matter.

Market reaction

With the initial market reaction, the British pound seems to have lost some interest. As of writing, the GBP/USD pair, which touched a daily high of 1.1650 earlier in the day, was trading at 1.1590, where it was still up 0.8% on a daily basis.

-

12:10

Malaysia: BNM hikes rates again – UOB

Senior Economist Julia Goh and Economist Loke Siew Ting at UOB Group review the latest interest rate decision by the BNM.

Key Takeaways

“As widely expected, Bank Negara Malaysia (BNM) raised the Overnight Policy Rate (OPR) today (8 Sep) by 25bps to 2.50%. This marks the third back-to-back rate hike since BNM started the hiking cycle in May this year as the economy recovered at a stronger pace. To date, BNM has hiked 75bps, which partly reversed the 125bps of rate cuts since the start of the pandemic in Jan 2020.”

“In the latest monetary policy statement (MPS), BNM continues to expect the domestic economy to expand, supported by private sector spending amid the transition to endemicity, positive labour market conditions, resumption of tourism activities and investments. However, BNM cautioned that external demand is expected to moderate amid softer global growth. BNM expects inflation to peak in 3Q22 before moderating thereafter amid abating base effects and easing global commodity prices.”

“BNM highlighted that there is no ‘pre-set course’ and the monetary policy committee (MPC) will continue to assess developments and their impact on domestic inflation and growth. BNM also reiterated that any adjustments will be done in a ‘measured and gradual’ manner. We think BNM may have signalled a temporary pause for rate hikes pending forward-looking growth and inflation dynamics. As such, we maintain our OPR target at 2.50% by year-end, and 3.00% by mid-2023. The next and final monetary policy meeting for the year is on 2-3 Nov.”

-

12:00

Mexico Industrial Output (YoY) below forecasts (3%) in July: Actual (2.6%)

-

12:00

Mexico Industrial Output (MoM) above expectations (0.1%) in July: Actual (0.4%)

-

11:59

When is the Canadian monthly jobs report and how could it affect USD/CAD?

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly employment details for August later this Friday at 12:30 GMT. The Canadian economy is anticipated to have added 15K jobs during the reported month, up sharply from the 30.6K fall reported in July. Meanwhile, the unemployment rate is expected to edge higher to 5.0% in August from the 4.9% previous.

Analysts at Citibank offer a brief preview of the report and seem more optimistic: “We expect a rebound in jobs of 30K in August. Wages in the monthly labor force survey have been volatile and suggest inflationary pressures caused by a tight labor market could be somewhat less embedded in Canada. As tighter monetary policy acts to cool demand, moderating wage growth will be a sign that inflationary pressures could ease somewhat faster in Canada.”

How could the data affect USD/CAD?

Ahead of the key release, the USD/CAD pair plunges below the 1.3000 psychological mark, hitting over a one-week low and is pressured by a combination of factors. A further recovery in crude oil prices from a multi-month low touched the previous day continues to underpin the commodity-linked loonie. Apart from this, the risk-on impulse drags the safe-haven US dollar further away from a two-decade high and further contributes to the heavily offered tone surrounding the major.

A stronger domestic data should provide an additional lift to the Canadian dollar and confirm a near-term bearish breakdown for the USD/CAD pair. Some follow-through selling below the 1.2970-1.2960 area, or the 50% Fibonacci retracement level of the August-September rally, will pave the way for additional losses. Spot prices might then accelerate the fall further towards testing the 1.2900 round figure.

Conversely, any disappointment from the Canadian jobs report is more likely to be overshadowed by the Bank of Canada's hawkish bias, indicating the need to raise interest rates further. This, in turn, suggests that the path of least resistance for the USD/CAD pair is to the downside. That said, worries about a deeper global economic downturn and hawkish Fed expectations should limit the downside for the buck, which, in turn, might lend support to the major.

Key Notes

• Canadian Jobs Preview: Forecasts from five major banks, gains again after two months of losses

• USD/CAD Analysis: Double-top, ascending channel breakdown in play ahead of Canadian jobs data

• USD/CAD: Prospects for a loonie rebound will improve in 2023 – Wells Fargo

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

-

11:30

Lagarde speech: ECB ready to provide liquidity to banks, not energy firms

European Central Bank (ECB) President Christine Lagarde is responding to the Q&A at a press conference at the Eurogroup Meetings, in Prague.

Key quotes

Fiscal authorities should provide support to energy firms.

Watering down prudential requirements for energy firms should be avoided.

ECB ready to provide liquidity to banks, not energy firms.

Related reads

- Lagarde speech: ECB will deliver on price stability, its top priority

- EU’s Gentiloni: Recession is not inevitable, but risk of one has increased

-

11:19

Lagarde speech: ECB will deliver on price stability, its top priority

European Central Bank (ECB) President Christine Lagarde is speaking at a press conference at the Eurogroup Meetings, in Prague.

Key quotes

ECB will deliver on price stability, its top priority.

ECB won't let price expectations get out of control.

Market reaction

EUR/USD remains unfazed by Lagarde’s comments, keeping its range below 1.0100. The pair is preserving a 1% gain on the day.

-

11:18

Gold Price Forecast: XAU/USD rises to more than one-week high amid heavy USD selling

- Gold gains strong positive traction on Friday amid aggressive USD long-unwinding trade.

- Aggressive Fed rate hike bets, elevated US bond yields should help limit the USD losses.

- The risk-on impulse could further contribute to capping the safe-haven precious metal.

Gold attracts fresh buying on the last day of the week and climbs to a nearly two-week high during the early part of the European session. The XAU/USD is currently placed just below the $1,730 level and is looking to build on its recent bounce from the lowest level since July 21 touched last week.

The US dollar comes under heavy selling pressure on Friday and retreats further from a two-decade high, which turns out to be a key factor boosting demand for the dollar-denominated commodity. The steep USD downfall to a fresh monthly low could be solely attributed to some long-unwinding and is more likely to remain limited amid hawkish Fed expectations.

In fact, the US central bank is anticipated to tighten its monetary policy at a faster pace to tame inflation and the bets were reaffirmed by Fed Chair Jerome Powell on Thursday. Speaking at a Cato Institute conference, Powell reiterated the central bank's strong commitment to bringing inflation down and added that the Fed needs to keep going until it gets the job done.

Powell's remarks reaffirmed market bets for a supersized 75 bps rate hike at the next FOMC meeting on September 20-21. This remains supportive of elevated US Treasury bond yields, which should help limit any meaningful USD corrective slide. Moreover, other major central banks, except the Bank of Japan, have also maintained a more hawkish bias.

Apart from this, the risk-on impulse - as depicted by a generally positive tone around the equity markets - might further contribute to capping the upside for the safe-haven metal. This, in turn, warrants some caution for aggressive bulls. Nevertheless, gold remains on track to register weekly gains and snap a three-week losing streak.

Technical levels to watch

-

11:13

EU’s Gentiloni: Recession is not inevitable, but risk of one has increased

European Union (EU) Economics Affairs commissioner Paolo Gentiloni is speaking at a press conference at the Eurogroup Meetings, in Prague.

Key quotes

Recession is not inevitable, but risk of one has increased.

The latest indicators point to slowing economic momentum.

The slowdown mostly due to the surge in energy prices.

Related reads

- ECB asks bank to analyze the gas-stop impact

- Eurogroup Head Donohoe: We are united in putting in place a level of response that will reduce inflation

-

11:08

Eurogroup Head Donohoe: We are united in putting in place a level of response that will reduce inflation

Eurogroup President Paschal Donohoe is speaking at a press conference at the Eurogroup Meetings, in Prague.

Key quotes

Eurozone finance ministers will intervene to support households and business against inflation shock.

We must reduce inflation.

We are united in putting in place a level of response that will reduce inflation.

Response will be coordinated with ECB and avoid adding to inflationary pressure.

Policy interventions should focus on income tranfers that are taregetted and exceptional.

Super levels of profitability should not be experienced by some, while others are suffering the consequences of war.

Market reaction

At the time of writing, EUR/USD is little changed around 1.0084, higher by 0.90% on the day.

-

11:02

Portugal Global Trade Balance up to €-6.965B in July from previous €-7.376B

-

10:54

Silver Price Analysis: XAG/USD steadily climbs to $19.00 neighbourhood, two-week high

- Silver scales higher for the third successive day and climbs to a two-week high on Friday.

- Mixed technical set-up warrants caution for bulls, before positioning for further move up.

- A convincing break below the $18.00 mark is needed to shift the bias in favour of bears.

Silver prolongs its recent recovery move from the lowest level since June 2020 and gains traction for the third successive day on Friday. This also marks the fifth day of a positive move in the previous six and lifts the white metal to a two-week high, closer to the $19.00 mark during the first half of the European session.

This week's breakout through the top end of a nearly one-month-old descending channel and a subsequent strength beyond the 100-period SMA on the 4-hour chart is seen as a key trigger for bullish traders. This might have set the stage for additional near-term gains, though mixed oscillators on hourly/daily charts warrant some caution.

Technical indicators on the daily chart - though have been recovering from the negative territory - as yet to confirm a bullish bias. Moreover, RSI (14) on the 4-hour chart is already flashing slightly overbought conditions. This makes it prudent to wait for some consolidation or a modest pullback before positioning for the next leg up.

From current levels, any meaningful slide is likely to find decent support near the $18.60-$18.50 region ahead of the descending trend-channel breakpoint, currently around the $18.20-$18.15 zone. Some follow-through selling below the $18.00 mark will negate the positive bias and suggest that the corrective bounce has run out of steam.

On the flip side, momentum beyond the $19.00 round figure is likely to confront stiff resistance near the 200-period SMA on the 4-hour chart. The said barrier, currently around the $19.35 region, should now act as a key pivotal point. Sustained strength beyond will reaffirm the constructive outlook and pave the way for further upside.

Silver 4-hour chart

-637983139200516157.png)

Key levels to watch

-

10:50

ECB asks bank to analyze the gas-stop impact

Reuters is reporting on Friday that the European Central Bank (ECB) has written to banks telling them to analyze the gas-stop impact.

Additional takeaways

“The ECB is to discuss readiness with executives by the end of September.”

“The ECB is concerned over potential wave of defaults via energy crisis.”

The European Union (EU) energy ministers are meeting this Friday to discuss ways to tame energy prices, which have surged as Russia has halted most gas flows to Europe in response to European sanctions.

Market reaction

EUR/USD is trading at 1.0084, retreating from daily highs of 1.0112 following the recent ECB commentary. The spot is still up 0.90% on the day.

-

10:15

USD/CAD plummets to sub-1.3000 levels, fresh monthly low ahead of Canadian jobs data

- USD/CAD remains under intense selling pressure for the third successive day on Friday.

- Recovering oil prices underpin the loonie and exert pressure amid a heavy USD sell-off.

- Investors now eye Canadian employment details for some meaningful trading impetus.

The USD/CAD pair prolongs this week's sharp pullback from levels just above the 1.3200 mark and remains under intense selling pressure for the third successive day on Friday. The steep intraday descent drags spot prices below the 1.3000 psychological mark during the first half of the European session and is sponsored by a combination of factors.

Crude oil prices build on the previous day's modest bounce from a multi-month low amid growing worries about tight global supply. Against the backdrop of a symbolic output cut by OPEC+, Russia's threat to cut oil flows to any country that backs a price cap on its crude adds to market concerns and acts as a tailwind for the black liquid. This, in turn, underpins the commodity-linked loonie, which along with aggressive US dollar selling, exerts heavy downward pressure on the USD/CAD pair.

The risk-on impulse - as depicted by a generally positive tone around the equity markets - turns out to be a key factor weighing on the safe-haven buck. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, retreats further from a two-decade high touched earlier this week and dives to a fresh monthly low. That said, expectations that the Fed will continue to tighten its monetary policy at a faster pace should help limit the USD downside.

In fact, the implied odds for a 75 bps Fed rate hike move in September now stands at 85%. The bets were reaffirmed by the overnight hawkish remarks by Fed Chair Jerome Powell, reiterating the central bank's strong commitment to bringing inflation down. This remains supportive of elevated US Treasury bond yields and should act as a tailwind for the USD. Furthermore, concerns that a deeper global economic downturn will hurt fuel demand should cap oil prices and lend some support to the USD/CAD pair.

Market participants now look forward to the release of the monthly Canadian employment figures, due later during the early North American session. This, along with oil price dynamics, will influence the Canadian dollar and provide a fresh impetus to the USD/CAD pair. Traders will further take cues from scheduled speeches by Fed officials. Apart from this, the US bond yields and the market risk sentiment will drive the USD demand, allowing traders to grab short-term opportunities around the pair.

Technical levels to watch

-

10:09

ECB’s Muller: Rapid inflation required a robust response

European Central Bank (ECB) Governing Council member Madis Muller said on Friday, “rapid inflation required a robust response.”

Muller appears to be justifying the 75 bps rate hike announced by the ECB on Thursday.

His colleagues have also tried to sound hawkish earlier this Friday but the ECB commentary has failed to extend the EUR/USD recovery.

The pair is trading at 1.0087, adding 0.98% on the day, at the time of writing.

-

10:00

Greece Consumer Price Index (YoY): 11.4% (August) vs previous 11.6%

-

10:00

Greece Industrial Production (YoY) down to 7% in July from previous 8.4%

-

10:00

Greece Consumer Price Index - Harmonized (YoY) dipped from previous 11.3% to 11.2% in August

-

10:00

FX option expiries for Sept 9 NY cut

FX option expiries for Sept 9 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 0.9925 429m

- 1.0000 760m

- 1.0015 379m

- 1.0050 398m

- 1.0065 303m

- 1.0100 558m

- 1.0200 387m

- GBP/USD: GBP amounts

- 1.1500 310m

- 1.1875 995m

- USD/JPY: USD amounts

- 141.50 310m

- 142.50 476m

- 143.00 650m

- USD/CHF: USD amounts

- 0.9600 400m

- AUD/USD: AUD amounts

- 0.6940 365m

-

09:49

ECB's Villeroy: Our hands completely free for next monetary policy move

"For our next policy move, we have our hands completely free," European Central Bank (ECB) policymaker Francois Villeroy de Galhau said on Friday, as reported by Reuters.

Additional takeaways

"We cannot exclude a limited recession."

"We decided to frontload on our monetary policy normalisation because inflation is too high, especially core inflation."

"Our will and our capacity to deliver on our mandate cannot be subject to any doubt whatsoever."

"Nobody should speculate about the magnitude of the next step – we did not create a new jumbo habit."

"The neutral rate can be estimated in the euro area at below or close to 2% according to me."

Market reaction

The EUR/USD pair preserves its bullish momentum following these comments and it was last seen rising 1.1% on the day at 1.0105.

-

09:48

EUR/USD could target 1.0160 next if it continues to hold above 1.0100

EUR/USD has gathered bullish momentum following Thursday's volatile session. The pair could extend its rebound if it manages to clear 1.0100, FXStreet’s Eren Sengezer reports.

Next recovery target aligns at 1.0160

“In case the pair starts using 1.0100, where the 200-period SMA is located, as support, it could target 1.0160 (Fibonacci 61.8% retracement of the latest downtrend) and 1.0200 (psychological level).”

“Buyers could stay on the sidelines if EUR/USD fails to hold above 1.0100. In that scenario, 1.0050 (Fibonacci 50% retracement) could be seen as interim support ahead of 1.0100 (psychological level, 100-period SMA).”

-

09:37

Malaysia: Foreign portfolio inflows picked up pace in August – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting assess the latest results from the foreign portfolio inflows.

Key Takeaways

“Foreign buying interest returned to Malaysian capital markets in Aug, with the highest non-resident portfolio inflows since Aug 2021 at MYR7.6bn (Jul: -MYR3.4bn). The resumption of foreign purchases was seen across Malaysian debt securities (Aug: +MYR5.6bn, Jul: -MYR3.5bn) and equities (Aug: +MYR2.0bn, Jul: +MYR0.1bn).”

“Bank Negara Malaysia (BNM)’s foreign reserves reversed course and declined by USD1.0bn m/m to USD108.2bn as at end-Aug (end-Jul: +USD0.2bn m/m to USD109.2bn). It marked the lowest level since Dec 2020. The latest reserves position is sufficient to finance 5.4 months of imports of goods & services and is 1.1 times total short-term external debt.”

“Apart from gloomier global growth prospects and tighter global financial conditions, greater exchange rate volatility will also spur volatility of foreign capital flows to emerging markets including Malaysia in the near term. With USD strength and CNY weakness expected to continue, we think that the MYR will still be on the defensive against the USD, hitting 4.58 by year-end and 4.60 by mid2023.”

-

09:33

EUR/USD climbs to 3-week highs past 1.0100

- EUR/USD quickly gathers traction and surpasses 1.0100.

- The greenback accelerates losses amidst prevailing risk-on mood.

- EU Energy Ministers will meet later in the session.

The single currency regains the smile and fresh buying interest and lifts EUR/USD to new 3-week highs past the 1.0100 level at the end of the week.

EUR/USD bolstered by risk appetite

EUR/USD seems to have broken above the recent consolidative phase and advances north of the 1.0100 hurdle on the back of the solid improvement in the risk-linked galaxy on Friday.

Extra upside in the pair also derives fresh oxygen from the intense selling pressure in the greenback, which currently forces the US Dollar Index (DXY) to confront multi-session lows in the 108.40 zone, all following new cycle highs near 110.80 recorded just a couple of sessions ago.

As market participants continue to digest Thursday’s unprecedented interest rate hike by the ECB, Friday’s focus of attention is expected to shift to the EU Energy Ministers emergency meeting amidst the ongoing energy cruch in the region.

Across the pond, the only release will be Wholesale Inventories for the month of July along with speeches by Fed’s Evans, George and Waller.

What to look for around EUR

EUR/USD fully reverses the recent weakness and advances on quite a convincing fashion well north of the parity level to print new multi-week tops following the renewed offered stance in the buck.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: Eurogroup Meeting, Emergency Energy Meeting (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is advancing 1.09% at 1.0103 and now faces the initial barrier at 1.0153 (55-day SMA) followed by 1.0202 (August 17 high) and then 1.0344 (100-day SMA). On the flip side, the breakdown of 0.9863 (2022 low September 6) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2002 low).

-

09:29

GBP/USD jumps to near two-week high, closer to mid-1.1600s amid notable USD selling

- GBP/USD catches aggressive bids on Friday amid broad-based USD weakness.

- The risk-on impulse prompts some long-unwinding around the safe-haven buck.

- Aggressive Fed rate hike bets, the UK’s bleak economic outlook might cap gains.

The GBP/USD pair gains strong positive traction on Friday and continues scaling higher through the early part of the European session. The momentum lifts spot prices to a one-and-half-week high, closer to mid-1.1600s, and is sponsored by the heavily offered tone surrounding the US dollar.

A goodish recovery in the risk sentiment - as depicted by a positive tone around the equity markets - drags the safe-haven buck further away from a two-decade high touched earlier this week. In fact, the key USD Index, which measures the greenback's performance against a basket of currencies, dives to a fresh monthly low and turns out to be a key factor behind the GBP/USD pair’s intraday momentum to the upside.

The British pound, on the other hand, draws support from the new UK Prime Minister Liz Truss's plans to cap energy bills for the next two years, which is seen as a welcome development for households. That said, the worsening outlook for the UK economy might continue to act as a headwind for sterling. Apart from this, hawkish Fed expectations should limit the USD corrective slide and cap the GBP/USD pair.

The markets seem convinced that the Fed will stick to its aggressive policy tightening path to tame inflation and have been pricing in a greater chance of a 75 bps rate hike at the September meeting. The bets were reaffirmed by Fed Chair Jerome Powell's hawkish remarks on Thursday, which remain supportive of elevated US Treasury bond yields and support prospects for the emergence of some USD dip-buying.

Hence, it will be prudent to wait for strong follow-through buying before confirming that the GBP/USD pair has formed a near-term bottom around the 1.1400 mark and positioning for any further gains. In the absence of any major market-moving economic releases, speeches by Fed officials might influence the USD later during the early North American session and provide some impetus to the GBP/USD pair.

Technical levels to watch

-

09:12

USD/CNH: All the attention remains on 7.0000 – UOB

The next key up barrier for USD/CNH remains at the 7.0000 level, comment FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang.

Key Quotes

24-hour view: “Yesterday, we held the view that USD ‘is likely to consolidate between 6.9450 and 6.9850’. Our view for consolidation was not wrong even though USD traded within a narrower range than expected (6.9510/6.9820) before closing largely unchanged at 6.9586 (+0.01%). Further consolidation appears likely, expected to be within a range of 6.9450/6.9750.”

Next 1-3 weeks: “Our view from two days ago (07 Sep, spot at 6.9770) still stands. As highlighted, after the recent strong surge in USD, all eyes are on 7.0000 now. That said, overbought shorter-term conditions could lead to a few days of consolidation first. As long as 6.9300 (no change in ‘strong support’ level from yesterday) is not breached, there is still chance for USD to break 7.0000. A break of this level would shift the focus to 7.0500.”

-

09:03

USD/TRY to see another leg of uptrend on a break above 18.36 – SocGen

USD/TRY is near the peak formed last year at 18.36. A break above here would see the pair staging another leg higher, economists at Société Générale report.

Support aligns at 17.80/60

“Once 18.36 is overcome, next leg of uptrend is expected to materialize towards projections of 19.30/19.70.”

“The 50-DMA at 17.80/17.60 is short-term support.”

-

09:00

USD/BRL to extend the bounce towards 5.51 and perhaps 5.66/5.72 on a brak past 5.32 – SocGen

USD/BRL recently took support at the previous bullish gap of 5.01 and has staged a steady bounce. First hurdle is located at last month's high of 5.32, a break above here would open up room for further gains, economists at Société Générale report.

Defending 5.01 crucial to avert a deeper pullback

“Daily MACD is attempting an entry within positive territory which would denote regain of upward momentum.”

“If USD/BRL reclaims 5.32, the bounce could extend towards 5.51 and perhaps even towards the multiyear descending trend line near 5.66/5.72.”

“Defending 5.01 would be crucial to avert a deeper pullback.”

-

08:56

EUR/SEK: Risks remains tilted to the upside for now, gradual return to 10.00 over 2023 – ING

The krona has been the worst performing G10 currency after the Japanese yen since the start of the year. Economists at ING expect the EUR/SEK pair to extend its grind higher as European growth worries mount.

The krona’s recovery is delayed again

“Given SEK’s high sensitivity to Europe’s growth outlook, we forecast EUR/SEK at 10.60 in 4Q22.”

“In the coming weeks, the balance of risks remains tilted to the upside, and a further deterioration in risk sentiment could prompt a re-test of July’s recent high (10.78) and potentially March’s highs (10.86).”

“In 2023, some improvement in the eurozone’s story and the end of global tightening cycles should help pro-cyclical currencies, including SEK, to re-appreciate. A calmer market environment may also revamp the search for carry and allow SEK to benefit from its relatively more attractive rate profile compared to EUR.”

“We expect a gradual return to 10.00 over the course of 2023, although geopolitical and energy-related developments do pose non-negligible risks to this profile.”

-

08:51

ECB's Knot: ECB has sent a forceful signal with rate rise

European Central Bank (ECB) policymaker Klaas Knot said on Friday that the ECB has sent a forceful signal with the 75 basis points rate hike, as reported by Reuters.

Knot further noted that the uncertainty surrounding the inflation outlook was too big and that it was making it difficult for them to give forward guidance. "Curbing the dynamic in inflation is the ECB's only concern," Knot added.

Market reaction

The shared currency continues to gather strength during the European trading hours on Friday. As of writing, the EUR/USD pair was trading at 1.0105, rising 1.1% on a daily basis.

-

08:45

AUD/USD surges to over one week high, beyond mid-0.6800s amid broad-based USD weakness

- AUD/USD witnessed an aggressive short-covering move on Friday and climbed to over a one-week high.

- The risk-on impulse drags the USD away from a two-decade high and benefits the risk-sensitive aussie.

- Aggressive Fed rate hike bets, recession fears could limit the USD losses and cap the upside for the pair.

The AUD/USD pair catches aggressive bids on the last day of the week and rallies to over a one-week high, beyond mid-0.6800s during the early European session.

Following the previous day's directionless price moves, the US dollar comes under renewed selling pressure and retreats further from a two-decade high touched on Wednesday. This turns out to be a key factor prompting some short-covering around the AUD/USD pair and behind the strong intraday positive move of over 100 pips.

A goodish recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - undermines the safe-haven buck. This largely offsets softer Chinese inflation figures and boosts demand for risk-sensitive aussie. The fundamental backdrop, however, warrants some caution for bullish traders.

Investors seem convinced that the Fed will continue to tighten its policy at a faster pace to tame inflation and have been pricing in a supersized 75 bps at the September FOMC meeting. The bets were reaffirmed by Fed Chair Jerome Powell on Thursday, reiterating the central bank's strong commitment to bringing inflation down.

The prospects for rapid interest rate hikes, along with economic headwinds stemming from COVID-19 curbs in China and the protracted war in Ukraine, have been fueling recession fears. This could keep a lid on any optimistic move in the markets and further contribute to capping the upside for the AUD/USD pair, at least for now.

Hence, the ongoing recovery move from sub-0.6700 levels, or the lowest level since July 14 touched earlier this week, runs the risk of fizzling out rather quickly. In the absence of any major market-moving macro data from the US, the AUD/USD pair remains at the mercy of the USD price dynamics and the broader market risk sentiment.

Technical levels to watch

-

08:28

ECB’s Kazimir: Decision to hike rates by unprecedented 75 bps was inevitable and right

European Central Bank (ECB) policymaker Peter Kazimir made some comments on Thursday’s 75 bps rate hike decision and inflation outlook on Friday.

Key quotes

Inflation in the eurozone has been unacceptably high.

Our fresh outlook sees inflation in eurozone above the 2% target in 2023, 2024.

In my view, risks for inflation are definitely in upward direction, while for economy in downward direction.

July and September rate hikes, and also those to follow in near future, are ECB's response.

Discussion on what level of rates the ECB aims to reach is premature.

Priority is to continue fiercely with the normalisation of monetary policy.

Being strict is necessary for price stability, for restoring equilibrium in economy, for return to prosperity.

-

08:08

USD/JPY moves away from 24-year peak set on Wednesday, drops to mid-142.00s

- A combination of factors prompts aggressive long-unwinding trade around USD/JPY on Friday.

- Japanese intervention speculations boost the JPY and exert pressure amid a further USD slide.

- The Fed-BoJ policy divergence should act as a tailwind for the major and limit deeper losses.

The USD/JPY pair comes under heavy selling on the last day of the week and retreats further from its highest level since August 1998, around the 145.00 mark touched on Wednesday. The pair maintains its offered tone through the early European session and is currently placed near mid-142.00s or a three-day low.

Speculations that authorities may soon step in to arrest the freefall in the Japanese yen turn out to be a key factor that prompts aggressive long-unwinding trade around the USD/JPY pair. This, along with the ongoing US dollar profit-taking slide from a two-decade high, further contributes to the sharp intraday decline. The USD downfall, however, seems cushioned amid firming expectations that the Fed will continue to tighten its policy at a faster pace to tame inflation.

In fact, the implied odds for a 75 bps Fed rate hike move in September now stands at 85%. The bets were reaffirmed by the overnight hawkish remarks by Fed Chair Jerome Powell, reiterating the central bank's strong commitment to bringing inflation down. This remains supportive of elevated US Treasury bond yields. The resultant widening of the US-Japan rate differential, along with a positive risk tone, could undermine the safe-haven JPY and lend support to the USD/JPY pair.

Furthermore, the Bank of Japan has been lagging behind other major central banks in the process of policy normalisation and remains committed to continuing with its monetary easing. This, in turn, suggests that the worst is still not over for the Japanese yen and the path of least resistance for the USD/JPY is to the upside. Hence, any subsequent corrective decline might still be seen as a buying opportunity and is more likely to remain limited, at least for the time being.

There isn't any major market-moving economic data due for release from the US, leaving the buck at the mercy of speeches by Fed officials. Apart from this, the US bond yields could influence the USD price dynamics and provide some impetus to the USD/JPY pair. Traders will further take cues from the broader risk sentiment to grab short-term opportunities around the major.

Technical levels to watch

-

08:05

US Dollar Index tumbles to multi-day lows below 109.00

- The index loses further momentum and breaches 109.00.

- The risk complex regains poise and leaves behind recent weakness.

- Fedspeak, Wholesale Inventories next on tap in the docket.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main competitors, sheds further ground and drops to multi-session lows in the sub-109.00 area on Friday.

US Dollar Index offered on upbeat risk appetite

The index quickly sets aside Thursday’s inconclusive price action and breaks below the 109.00 support with certain conviction amidst the noticeable improvement in the risk-associated universe.

That said, the dollar continues to correct lower after hitting fresh 20-year peaks near 110.80 earlier in the week (September 7), as investors seem to have already digested another hawkish message from Chief Powell, this time from his participation at a virtual event on Thursday.

In the US calendar, July’s Wholesale Inventories will be the sole event. In addition, and before the Fed’s blackout period, Chicago Fed C.Evans (2023 voter, centrist), Kansas City Fed E.George (voter, hawk) and FOMC’s Governor C.Waller (permanent voter, hawk) are all due to speak.

What to look for around USD

The index has embarked on a corrective path that has already broken below the key support at 109.00 at the end of the week.

Bolstering the dollar’s strength appears the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market. This view was reinforced by Chair Powell’s speech at the Jackson Hole Symposium.

Extra volatility in the dollar, however, should not be ruled out considering the ongoing debate around the size of the September’s interest rate hike by the Federal Reserve amidst the ongoing data-dependent stance in the Fed.

Looking at the more macro scenario, the greenback appears propped up by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Wholesale Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation over a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

US Dollar Index relevant levels

Now, the index is retreating 0.80% at 108.78 and faces the next support at 107.58 (weekly low August 26) seconded by 107.17 (55-day SMA) and then 104.63 (monthly low August 10). On the other hand, a break above 110.78 (2022 high September 7) would aim for 111.90 (weekly high September 6 2002) and then 113.35 (weekly high May 24 2002).

-

08:04

USD/CAD: Prospects for a loonie rebound will improve in 2023 – Wells Fargo

Economists at Wells Fargo expect the loonie to remain under pressure in the short-term. However, the Canadian dollar could enjoy a brighter outlook next year.

CAD unlikely to find support in the near-term

“Even with elevated Canadian interest rates, we do not expect much Canadian dollar support in the near-term while the Fed remains firmly in tightening mode.”

“We think the prospects for a Canadian dollar rebound will improve in 2023 as the US economy enters recession, and as the Fed begins easing monetary policy during the second half of next year.”

-

08:01

Slovakia Industrial Output (YoY): -6.4% (July) vs previous -5.7%

-

08:01

Austria Industrial Production (YoY) up to 5.1% in July from previous 4.6%

-

08:00

NZD/USD Price Analysis: Bulls need validation from 0.6140 to keep reins

- NZD/USD grinds higher around intraday top, eyes the first weekly gains in four.

- Sustained break of two-week-old resistance line, 50-SMA joins firmer oscillators to favor buyers.

- Convergence of 100-SMA, monthly high restricts immediate upside.

NZD/USD remains on the front foot around 0.6105 as bulls cheer upside break of the previous key hurdles during Friday’s initial European session. With this, the Kiwi pair also braces for the first weekly gain after printing the red in the last three consecutive weeks.

The quote’s latest upside could be linked to the successful break of a descending trend line from August 26 and the 50-SMA, currently around 0.6085. Also keeping buyers hopeful are the bullish MACD signals and the firmer RSI, not overbought.

It should, however, be noted that the upside momentum remains elusive unless crossing the 0.6140 resistance confluence, including the 100-SMA and the monthly high marked the last Friday.

Following that, the run-up towards 0.6200 and then to the late August swing high near 0.6255 can’t be ruled out.

On the contrary, pullback moves can be ignored until the quote stays beyond 0.6085 resistance-turned-support.

In a case where NZD/USD prices drop below 0.6085, the 0.6030 level may test the bears before directing them to the yearly low marked on Wednesday around the 0.6000 psychological magnet.

NZD/USD: Four-hour chart

Trend: Limited upside expected

-

08:00

Spain Industrial Output Cal Adjusted (YoY) below expectations (5.4%) in July: Actual (5.3%)

-

07:55

Forex Today: Dollar loses ground ahead of Fed's blackout

Here is what you need to know on Friday, September 9:

The dollar came under renewed selling pressure during the Asian trading hours on Friday and the US Dollar Index declined to its lowest level below 109.00. In the absence of high-tier macroeconomic data releases ahead of the weekend, comments from central bankers will be watched closely by market participants. European Central Bank (ECB) President Christine Lagarde will speak at 0930. Before the Fed goes into the blackout period, Chicago Fed President Charles Evans, Fed Governor Christopher Waller and Kansas City Fed President Esther George will be delivering speeches.

The risk-positive market environment seems to be weighing on the greenback on the last trading day of the week. The Shanghai Composite Index is up nearly 1% toward the end of the week and US stock index futures are rising between 0.3% and 0.5%. Meanwhile, the 10-year US Treasury bond yield stays relatively quiet at around 3.3%. Earlier in the day, the data from China showed that the Consumer Price Index (CPI) arrived at -0.1% in August.

On Thursday, FOMC Chairman Jerome Powell reiterated their commitment to do what's necessary to battle inflation. "History cautions against prematurely loosening the policy," Powell noted and the probability of a 75 basis points rate hike in September, as shown by the CME Group FedWatch Tool, climbed above 80%. On a more neutral note, Chicago Fed President Evans said that he was open-minded on a 50 or 75 bps hike at the next policy meeting.

Following the selloff witnessed during ECB President Lagarde's press conference, EUR/USD reversed its direction and climbed toward 1.0100. As expected, the ECB announced that it hiked its policy rate by 75 bps on Thursday. Commenting on the policy outlook, Lagarde said she didn't know what the terminal rate was and explained that they will take necessary tightening steps to get to the 2% medium-term inflation target. "We think that it will take several meetings to get there," Lagarde further elaborated. "Some people will ask how many is several? Well, it is probably more than two including this one but it is probably also going to be less than five."

GBP/USD ended Thursday's volatile session with small losses at 1.1500 before gathering bullish momentum early Friday. The pair was last seen rising more than 0.8% on the day at 1.1595. British Prime Minister Liz Truss announced on Thursday that the government will introduce a two-year "energy price guarantee" and explained that a typical household will pay no more than £2,500 a year on energy bills.

USD/CAD closed the second straight day in negative territory on Thursday and extended its slide toward 1.3000 early Friday. Statistics Canada will release the August jobs report later in the session. Investors expect the Unemployment Rate to edge higher to 5% from 4.9% and see the Net Change in Employment to arrive at +15,000.

After having registered impressive gains in the first half of the week, USD/JPY posted small losses on Thursday but turned south on Friday. Japanese Finance Minister Shunichi Suzuki repeated on Friday that they are closely watching the moves in foreign exchange markets and noted that they won't rule out any options. At the time of press, USD/JPY was down more than 100 pips on the day at 142.75.

Gold fluctuated wildly in both directions on Thursday but closed the day in the red. With US T-bond yields struggling to continue to stretch higher, XAU/USD gained traction and was last seen posting strong daily gains above $1,720.

Bitcoin reclaimed $20,000 during the Asian trading hours on Friday and extended its rally beyond $20,500 into the European session. Ethereum gathered bullish momentum early Friday and rose above $1,700 for the first time in two weeks.

-

07:54

EUR/USD: The upward movement could prove to be a brief interlude – Commerzbank

EUR/USD is surging higher and reached a daily high of 1.0080. However, economists at Commerzbank believe that the upward movement is set to be short-lived.

EUR should continue to struggle, particularly against USD

“EUR should continue to struggle, particularly against USD. Especially if the energy crisis in the eurozone continues to intensify and signs of a recession increase, and at the same time the market still does not trust the ECB to successfully fight high inflation, the EUR could come under depreciation pressure.”

“The upward movement in EUR/USD could prove to be a brief interlude.”

-

07:46

GBP/USD risks sinking back to the 1.1410 low – ING

GBP/USD has neared the 1.16 level. However, economists at ING believe that the pair is at risk of falling back to 1.1410.

Sterling remains fragile

“The UK Gilt market found little to sink its teeth into yesterday regarding the energy support package. Details were scarce in terms of the size of the package and how it is to be funded. At least some of that funding looks set to go through the Gilt market – meaning that the 10-year Gilt-Bund spread can widen out to the 200 bps area. That’s a sterling negative.”

“Cable risks sinking back to the 1.1410 low.”

“Given the challenges in continental Europe, EUR/GBP may trade close, but not break resistance at 0.8720.”

-

07:45

France Industrial Output (MoM) below expectations (-0.5%) in July: Actual (-1.6%)

-

07:43

EUR/PLN: Zloty set to weaken over the coming quarter – Commerzbank

The zloty exchange rate came under noticeable pressure after the National Bank (NBP) hiked rates by only a minimal 25 bps earlier this week. Economists at Commerzbank expect the PLN to remain under pressure.

NBP governor Adam Glapinski said little of support for the zloty

“The ECB’s own updated projections, which do not foresee inflation moderating to within 2% target even by 2024, now make it harder for an individual CEE central bank to take such an opposite view about inflation.”

“At Thursday’s press conference, NBP governor Adam Glapinski said little of support for the zloty. Overall, the rhetoric did not sound hawkish or convincing, but probably in line with what the FX market already knew about Glapinski.”

“We see the zloty weakening against the euro over the coming quarter.”

-

07:42

Gold Price Forecast: XAU/USD upside eyes $1,745 amid bullish RSI divergence, softer USD

- Gold price picks up bids to reverse the previous day’s pullback from weekly high.

- 100-SMA, 61.8% Fibonacci retracement and one-week-old resistance line stand tall to test XAU/USD buyers.

- US-China news, hopes from global central bankers trigger corrective moves and sluggish yields.

Gold price (XAU/USD) remains on the front foot around $1,720 amid early Friday morning in Europe. In doing so, the yellow metal cheers broad US dollar weakness amid cautious optimism in the market. Also favoring the bullion buyers are the technical signals.

US Dollar Index (DXY) pares the biggest daily loss in a month around 108.90, staying around the one-week bottom by the press time. In doing so, the greenback gauge fails to justify the hawkish comments from Fed Chair Jerome Powell, published the previous day, while highlighting the market’s firmer sentiment.

Market sentiment takes clues from firmer comments made late Thursday by US Treasury Secretary Janet Yellen, signaling a likely positive change in the US-China trade ties. Recently firmer US data and hopes that the global central bankers will be able to overcome inflation-led blow with a holistic approach and higher rates also seemed to have favored the market’s mood. It should be noted that talks over likely hardships for China's technology company and downbeat China inflation numbers seemed to have probed the XAU/USD bulls of late.

While portraying the mood, the US 10-year Treasury yields remain sidelined near 3.32%, after a positive day, whereas the S&P 500 Futures traces Wall Street’s gains around 4,020. It should be noted that the stocks in the Asia-Pacific region also remain firmer as cautious optimism spreads amid a sluggish session.

Given the risk-on mood and downbeat US dollar, the XAU/USD prices are likely to end the week on a positive note. However, the last round of Fedspeak ahead of the blackout period, starting from this weekend, should be given attention for fresh impulse. Also important will be chatters surrounding the US inflation ahead of the next week’s US Consumer Price Index (CPI) data.

Technical analysis

Gold price justifies the bullish RSI divergence as the bulls approach a convergence of the 100-SMA, 61.8% Fibonacci retracement level of July-August upside and a one-week-old rising trend line.

Given the bullish MACD signals, as well as the firmer RSI backing the higher low on prices, the XAU/USD is likely to overcome the $1,730 hurdle, which in turn could propel the commodity towards the August 25 swing high near $1,765.

However, the 50% Fibonacci retracement level near $1,745 may offer an intermediate halt during the run-up.

Alternatively, pullback moves may re-test the 78.6% Fibonacci retracement support, around $1,707, before directing gold bears towards the $1,700 threshold.

Even so, the sellers remain cautious as an upward sloping trend line from late July and the yearly low, respectively near $1,690 and $1,680, could test the metal’s further downside.

Gold: Four-hour chart

Trend: Further upside expected

-

07:40

USD/JPY: Upside could slow the pace near term – UOB

In the opinion of FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang, further upside in USD/JPY remains the most likely scenario for the time being, although a visit to 147.65 may have to wait for now.

Key Quotes

24-hour view: “Our expectations for USD to ‘breach 145.00’ yesterday did not materialize as it traded sideways between 143.30 and 144.55. The movement appears to be part of a consolidation and further sideway-trading would not be surprising. Expected range for today, 143.40/144.60.”

Next 1-3 weeks: “There is not much to add to our update from yesterday (08 Sep, spot at 144.10). As highlighted, USD could continue to rally but deeply overbought conditions suggest a slower pace of advance and at this stage, the chance for USD to rise to the 1998 high near 147.65 is not high. On the downside, a breach of 142.50 (‘strong support’ level was at 142.20 yesterday) would indicate that the rally in USD is ready to take a pause.”

-

07:37

EUR/USD: The meeting of EU energy ministers may prove bearish for the euro – ING

EUR/USD price action after a hawkish European Central Bank (ECB) session on Thursday proved very underwhelming. Economists at ING expect the EU energy ministers' meeting to add further downside pressure on the shared currency.

Hawkish ECB provides little support

“Short-dated yields moved in the euro’s favour, but to no avail for the currency. In addition, when asked about the weak euro, President Christine Lagarde had little to say beyond the ECB being attentive.”

“It seems growth differentials and the international investment environment are dominating the FX environment right now – neither of which are supporting the euro.”

“The meeting of EU energy ministers may prove bearish for the euro for a number of reasons. For example, reaching an agreement on gas price caps, gas sharing and electricity levies look to be difficult and may be delayed. Mandatory electricity reduction could spark what the Belgium PM calls de-industrialisation and social unrest. There is also the risk that if Russian oil and gas caps are approved, Russia could immediately suspend the remaining oil and gas shipments coming into the EU.”

“With the Fed remaining hawkish, expect EUR/USD to stay offered in a broad 0.9900-1.0100 range.”

-

07:36

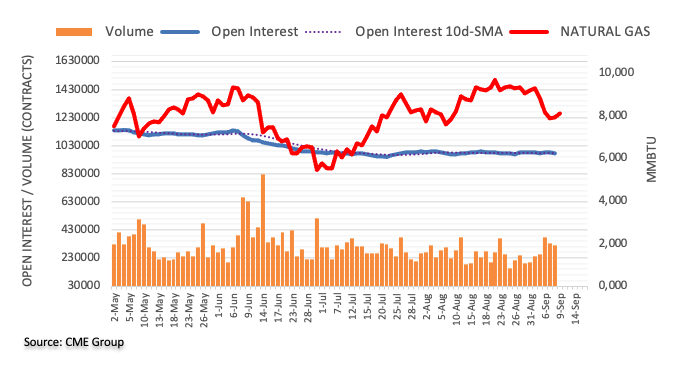

Natural Gas Futures: A deeper retracement is not ruled out

Open interest in natural gas futures markets shrank for the second session in a row on Thursday, this time by around 3.3K contracts according to preliminary results from CME Group. Volume, too, went down for the second straight day, now by around 16.5K contracts.

Natural Gas: Decent contention remains around $7.50

Prices of natural gas reversed part of the recent weakness on Thursday. The small advance, however, was accompanied by declining open interest and volume and is indicative that further gains look not favoured for the time being. On the downside, the commodity remains underpinned by the $7.50 mark per MMBtu.

-

07:30

EUR/HUF: Forint to weaken over the coming quarter – Commerzbank