Notícias do Mercado

-

20:00

Dow 17,758.58 -149.29 -0.83%, Nasdaq 4,715.45 -20.74 -0.44%, S&P 500 2,048.12 -14.02 -0.68%

-

17:00

European stocks closed: FTSE 100 6,501.14 -68.82 -1.05%, CAC 40 4,179.07 -81.12 -1.90%, DAX 9,648.5 -189.11 -1.92%

-

17:00

European stocks close: stocks closed lower as bank shares declined

Stock indices closed lower as bank shares declined.

Mostly weak economic data from the Eurozone also weighed on markets. German industrial production declined 0.1% in November, missing forecasts of a 0.4% rise, after a 0.6% gain in October. October's figure was revised up from a 0.2% increase.

Germany's trade surplus decreased to €17.7 billion in November from €20.8 billion in October, missing expectations for a decline to €19.6 billion. October's figure was revised up from a surplus of €20.6 billion.

France's trade deficit narrowed to €3.2 billion in November from €4.6 billion in October, beating expectations for a decline to a deficit of €4.5 billion.

Industrial production in France declined 0.3% in November, missing expectations for a 0.4% gain, after a 0.7% drop in October. October's figure was revised up from a 0.8% decline.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,501.14 -68.82 -1.05%

DAX 9,648.5 -189.11 -1.92%

CAC 40 4,179.07 -81.12 -1.90%

-

16:42

Oil headed for a seventh weekly decline

Oil headed for a seventh weekly decline in New York and London amid speculation that OPEC won't pare output to reduce a global surplus.

West Texas Intermediate slipped as much as 2.8 percent today while Brent fell 3.4 percent. The United Arab Emirates has no plans to reduce output no matter how low prices drop, according to Yousef Al Otaiba, the nation's ambassador to the U.S. Representatives from Saudi Arabia, Kuwait and the U.A.E. stressed a dozen times in the past six weeks that OPEC won't curb output to halt the rout. WTI's discount to Brent shrank to its narrowest since October.

"The price war continues and there's a great deal of excess supply," Phil Flynn, senior market analyst at the Price Futures Group in Chicago, said by phone. "The statements from the U.A.E. ambassador show that they're doubling down and taking no prisoners. This will be a long fought war and they have the Saudis behind them."

Oil is trading near the lowest levels since April 2009 amid concern that a global supply surplus estimated by Qatar at 2 million barrels a day will persist this year. The Organization of Petroleum Exporting Countries is battling a U.S. shale boom by resisting production cuts, signaling it's prepared to let futures fall to a level that slows the American output.

West Texas Intermediate for February delivery slipped $1.22, or 2.5 percent, to $47.57 a barrel at 11:06 a.m. on the New York Mercantile Exchange. The volume of all futures traded was 17 percent above the 100-day average for the time of day. The contract touched $46.83 on Jan. 7, the lowest intraday price since April 21, 2009. Futures are down 9.8 percent this week.

Brent for February settlement decreased $1.45, or 2.9 percent, to $49.51 a barrel on the London-based ICE Futures Europe exchange. Volume for all futures traded was 56 percent above the 100-day average. The North Sea oil is down 12 percent this week. The European benchmark crude traded at a $1.92 premium to WTI.

-

16:41

Building permits in Canada dropped 13.8% in November

Statistics Canada released housing market on Monday. Building permits in Canada plunged 13.8% in November, missing expectations for a 0.8% gain, after a 2.1% rise in October. October's figure was revised up from a 0.7% increase.

Building permits for non-residential construction climbed 15.8% in October, while permits in the residential sector decreased 19.9%.

-

16:29

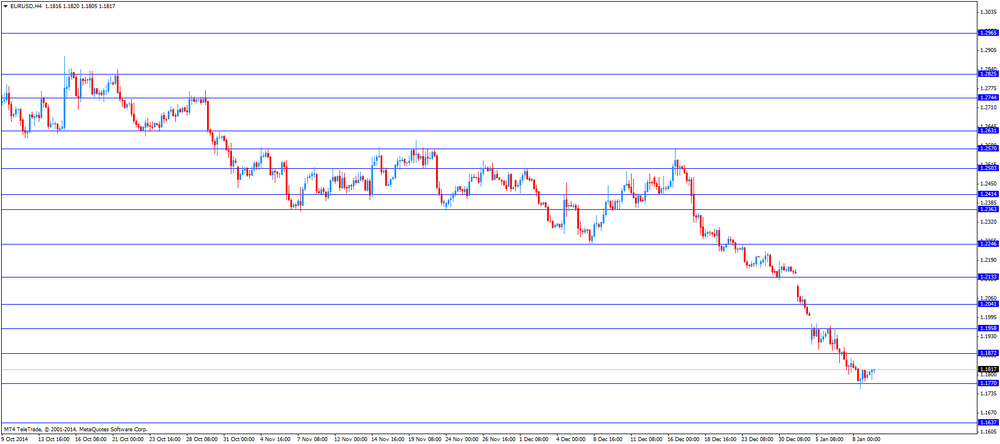

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies despite the better-than-expected U.S. labour market data

The U.S. dollar traded lower against the most major currencies despite the better-than-expected U.S. labour market data. The U.S. economy added 252,000 jobs in December, exceeding expectations for a rise of 241,000 jobs, after a gain of 353,000 jobs in November. November's figure was revised up from a rise of 321,000 jobs.

The jobless rate declined to the lowest level since June 2008.

The U.S. unemployment rate fell to 5.6% in December from 5.8% in November, exceeding expectations for a decline to 5.7%.

Average hourly earnings decreased 0.2% in December, missing forecasts of a 0.2% gain, after a 0.2% increase in November. November's figure revised down from a 0.4% rise.

Wholesale inventories in the U.S. rose 0.8% in November, exceeding expectations for a 0.4% increase, after a 0.6% gain in October. October's figure was revised up from a 0.4% rise.

That was the biggest increase since April 2014.

The euro traded slightly higher against the U.S. dollar despite the mostly weak economic data from the Eurozone. German industrial production declined 0.1% in November, missing forecasts of a 0.4% rise, after a 0.6% gain in October. October's figure was revised up from a 0.2% increase.

Germany's trade surplus decreased to €17.7 billion in November from €20.8 billion in October, missing expectations for a decline to €19.6 billion. October's figure was revised up from a surplus of €20.6 billion.

France's trade deficit narrowed to €3.2 billion in November from €4.6 billion in October, beating expectations for a decline to a deficit of €4.5 billion.

Industrial production in France declined 0.3% in November, missing expectations for a 0.4% gain, after a 0.7% drop in October. October's figure was revised up from a 0.8% decline.

Political uncertainty in Greece still weighed on the euro.

The British pound traded higher against the U.S. dollar. The National Institute of Economic and Social Research's (NIESR) estimate of gross domestic product estimate declined to 0.6% for the fourth quarter from 0.7% in the third quarter.

Manufacturing production in the U.K. rose 0.7% in November, exceeding expectations for a 0.3% rise, after a 0.7% drop in October.

On a yearly basis, manufacturing production in the U.K. increased 2.7% in November, beating expectations for a 2.3% gain, after a 1.7% rise in October.

Industrial production in the U.K. decreased 0.1% in November, missing forecasts of a 0.2% rise, after a 0.3% decline in October. October's figure was revised down from a 0.1% decrease.

The decline was driven by falling oil and gas prices and maintenance shutdowns at two large fields in the North Sea.

On a yearly basis, industrial production in the U.K. rose 1.1% in November, missing expectations for a 1.6% rise, after a 1.0% gain in October. October's figure was revised down from a 1.1% gain.

The U.K. trade deficit fell to £8.8 billion in November from £9.8 billion in October, beating expectations for a deficit of £9.5 billion. October's figure was revised down from a deficit of £9.6 billion.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian economic data. Canada's unemployment rate remained unchanged at 6.6% in December, in line with expectations.

The number of employed people decreased by 4,300 in December, missing expectations for a gain of 10,300, after a 10,700 decline in November.

Building permits in Canada plunged 13.8% in November, missing expectations for a 0.8% gain, after a 2.1% rise in October. October's figure was revised up from a 0.7% increase.

Housing starts in Canada increased to a seasonally adjusted annualized rate of 180,600 units in December from a revised reading of 193,200 units in November. November's figure revised down from 195,600 units. Analysts had expected an increase to 191,000 units.

The Swiss franc traded higher against the U.S. dollar. Switzerland's unemployment rate remained unchanged at 3.2% in December. November's figure was revised down from 3.1%. Analysts had expected the unemployment rate to fall to 3.1%.

Switzerland's consumer price index dropped 0.5% in December, missing expectations for a 0.3% fall, after a flat reading in November.

On a yearly basis, Switzerland's consumer price index declined 0.3% in December, missing expectations for a 0.1% drop, after a 0.1% decrease in November.

The New Zealand dollar increased against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback after the solid building permits data from New Zealand. Building permits in New Zealand rose 10.0% in November, after 9.8% in October. October's figure was revised up from a 8.8% gain.

The Australian dollar increased against the U.S. dollar. In the overnight trading session, the Aussie traded slightly higher against the greenback despite the weaker-than-expected retail sales data from Australia. Retail sales in Australia rose 0.1% in November, missing expectations for a 0.3% increase, after a 0.4% gain in October.

The Aussie was supported by Chinese consumer inflation data. Chinese consumer price index 1.5% in December, in line with expectations, after a 1.4% in November.

The Japanese yen traded higher against the U.S. dollar. . In the overnight trading session, the yen traded higher against the greenback. Japan's leading economic index decreased to 103.8 in November from 104.5 in October, missing expectations for a rise to 104.9. That was the lowest score since January 2013. October's figure was revised up from 104.0.

Japan's coincident index declined to 108.9 in November from 109.9 in October.

-

16:24

Gold rose

Gold prices rose after a report on the US labor market. The number of people employed in non-agricultural sector grew steadily at the end of last month, topping with the experts' forecasts, which indicates the continuing improvement in the US labor market. This was reported in the Ministry of Labour.

According to the data, the seasonally adjusted number of people employed in the non-agricultural sector increased in December by 252 thousand. Man. The main increase was recorded in professional and business services, construction, food service networks, health care and industrial sectors. We also add that the figures for October and November were revised upward - just 50 thousand. Jobs (growth in November to 353 thousand. 321 thousand., And in October - up to 261 thousand. 243 thousand.)

The unemployment rate was 5.6 percent in December, down two-tenths of a percentage point compared with the previous month. The last value is the lowest since June 2008. However, this change was associated with a decrease in the proportion of the labor force.

Economists had expected the number of people employed increased by 241,000 in December, and the unemployment rate drops to 5.7 percent.

Gold prices were supported by expectations of growing over whether the European Central Bank can start an active incentive program after meeting on 22 January, analysts said. This decision may have inflationary effects that enhance the attractiveness of safe-haven, such as gold.

The attractiveness of gold as a safe-haven weakened in recent months, as the US economic recovery is gaining momentum, and the rise in interest rates is more likely. However, gold futures rose this year amid concerns over a slowdown in global economic growth and revive concerns about financial stability in Greece.

The cost of the February gold futures on the COMEX today rose to 1221.0 dollars per ounce.

-

16:04

Housing starts in Canada increased to a seasonally adjusted annualized rate of 180,600 units in December

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Friday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 180,600 units in December from a revised reading of 193,200 units in November. November's figure revised down from 195,600 units.

Analysts had expected an increase to 191,000 units.

The CMHC's Chief Economist Bob Dugan that the decline was driven by "lower levels of both multiple and single-detached starts lower levels of both multiple and single-detached starts".

-

15:51

NIESR’s gross domestic product declined to 0.6% for the fourth quarter

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Friday. The GDP estimate declined to 0.6% for the fourth quarter from 0.7% in the third quarter.

According to NIESR, the economy grew at 2.6% in 2014, up from 1.7% in 2013. That was the best reading since the financial crisis.

-

15:27

Wholesale inventories in the U.S. surged 0.8% in November

The U.S. Commerce Department released wholesale inventories on Friday. Wholesale inventories in the U.S. rose 0.8% in November, exceeding expectations for a 0.4% increase, after a 0.6% gain in October. October's figure was revised up from a 0.4% rise.

That was the biggest increase since April 2014.

Inventories of durable goods increased 0.8% in November, while inventories of non-durable goods climbed by 0.7%.

-

15:00

U.S.: Wholesale Inventories, November +0.8% (forecast +0.4%)

-

15:00

United Kingdom: NIESR GDP Estimate, December +0.6%

-

14:57

Canada’s number of employed people dropped by 4,300 in December

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 6.6% in December, in line with expectations.

The number of employed people decreased by 4,300 in December, missing expectations for a gain of 10,300, after a 10,700 decline in November.

Full-time employment in December increased by 53,500 jobs, while part-time work decreased by 57,700.

The labour participation rate fell to 65.9% in December, the lowest since October 2001.

Canada's economy increased 5,100 private-sector jobs in December and added 5,500 positions in the public sector. The number of self-employed workers decreased by 14,900 jobs.

-

14:34

U.S. Stocks open: Dow 17,888.76 -19.11 -0.11%, Nasdaq 4,741.22 +5.03 +0.11%, S&P 2,063.08 +0.94 +0.05%

-

14:30

Before the bell: S&P futures +0.10%, Nasdaq futures +0.30%

U.S. stock-index futures rose as employment gained more than forecast in December and the jobless rate declined.

Global markets:

Nikkei 17,197.73 +30.63 +0.18%

Hang Seng 23,919.95 +84.42 +0.35%

Shanghai Composite 3,287.43 -6.03 -0.18%

FTSE 6,544.91 -25.05 -0.38%

CAC 4,244.83 -15.36 -0.36%

DAX 9,818.71 -18.90 -0.19%

Crude oil $48.63 (-0.27%)

Gold $1213.80 (+0.45%)

-

14:18

U.S. unemployment rate dropped to 5.6% in December

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 252,000 jobs in December, exceeding expectations for a rise of 241,000 jobs, after a gain of 353,000 jobs in November. November's figure was revised up from a rise of 321,000 jobs.

The jobless rate declined to the lowest level since June 2008.

The U.S. economy has added at least 200,000 jobs for 11 months in a row. This is the longest growth period since 1994.

The U.S. unemployment rate fell to 5.6% in December from 5.8% in November, exceeding expectations for a decline to 5.7%.

Average hourly earnings decreased 0.2% in December, missing forecasts of a 0.2% gain, after a 0.2% increase in November. November's figure revised down from a 0.4% rise.

The labour-force participation rate fell to 62.7% in December, the 37-year low.

These figures are signs that the labour market in the U.S. is strengthening. But the Fed might delay to hike its interest rate due to the weak wage growth figures.

-

13:52

U.K. trade deficit fell to £8.8 billion in November

The U.K. Office for National Statistics (ONS) released trade data on Friday. The U.K. trade deficit fell to £8.8 billion in November from £9.8 billion in October, beating expectations for a deficit of £9.5 billion. October's figure was revised down from a deficit of £9.6 billion.

The decline was driven by lower imports. Imports dropped 3.2% in November as oil imports fell 18.7%.

Exports of goods decreased 0.4% in November. Exports to the European Union (EU) fell 0.3%, while exports to countries outside the EU increased 6.0%.

The trade deficit with Germany reached a record level.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1750(E531mn), $1.1900(E1.5bn), $1.1980(E1.5bn), $1.2000(E4.0bn)

USD/JPY: Y118.00($7.0bn), Y119.50($2.1bn), Y120.00($1.5bn), Y121.00($2.1bn)

EUR/CHF: Chf1.2010(E200mn)

AUD/USD: $0.8075(A$257mn), $0.8100(A$300mn), $0.8105(A$315mn)

NZD/USD: $0.7780(NZ$250mn)

USD/CAD: C$1.1700($681mn)

-

13:32

Canada: Unemployment rate, December 6.6% (forecast 6.6%)

-

13:32

Canada: Employment , December -4.3 (forecast +10.3)

-

13:32

U.S.: Average hourly earnings , December -0.2% (forecast +0.2%)

-

13:32

Canada: Building Permits (MoM) , November -13.8% (forecast +0.8%)

-

13:31

U.S.: Nonfarm Payrolls, December 252 (forecast 241)

-

13:31

U.S.: Unemployment Rate, December 5.6 (forecast 5.7)

-

13:15

Canada: Housing Starts, December 181 (forecast 191)

-

13:04

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the better-than expected manufacturing output data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail sales (MoM) November +0.4% +0.3% +0.1%

00:30 Australia Retail Sales Y/Y November +5.7% +4.5%

01:30 China PPI y/y December -2.7% -3.1% -3.3%

01:30 China CPI y/y December +1.4% +1.5% +1.5%

05:00 Japan Leading Economic Index November 104.5 Revised From 104.0 104.9 103.8

05:00 Japan Coincident Index November 109.9 108.9

06:45 Switzerland Unemployment Rate December 3.2% Revised From 3.1% 3.1% 3.2%

07:00 Germany Current Account November 22.5 Revised From 23.1 18.6

07:00 Germany Industrial Production s.a. (MoM) November +0.6% +0.4% -0.1%

07:00 Germany Industrial Production (YoY) November +1.2% Revised From +0.8% -0.5%

07:00 Germany Trade Balance November 20.8 Revised From 20.6 19.6 17.7

07:45 France Industrial Production, m/m November -0.7% Revised From -0.8% +0.4% -0.3%

07:45 France Industrial Production, y/y November -1.0% -2.6%

07:45 France Trade Balance, bln November -4.6 -4.5 -3.2

08:15 Switzerland Consumer Price Index (MoM) December 0.0% -0.3% -0.5%

08:15 Switzerland Consumer Price Index (YoY) December -0.1% -0.1% -0.3%

09:30 United Kingdom Industrial Production (MoM) November -0.3% Revised From -0.1% +0.2% -0.1%

09:30 United Kingdom Industrial Production (YoY) November +1.0% +1.6% +1.1%

09:30 United Kingdom Manufacturing Production (MoM) November -0.7% +0.3% +0.7%

09:30 United Kingdom Manufacturing Production (YoY) November +1.7% +2.3% +2.7%

09:30 United Kingdom Trade in goods November -9.8 Revised From -9.6 -9.5 -8.8

The U.S. dollar traded lower against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to fall to 5.7% in December. The U.S. economy is expected to add 241,000 jobs in December.

The euro traded slightly higher against the U.S. dollar despite the mostly weak economic data from the Eurozone. German industrial production declined 0.1% in November, missing forecasts of a 0.4% rise, after a 0.6% gain in October. October's figure was revised up from a 0.2% increase.

Germany's trade surplus decreased to €17.7 billion in November from €20.8 billion in October, missing expectations for a decline to €19.6 billion. October's figure was revised up from a surplus of €20.6 billion.

France's trade deficit narrowed to €3.2 billion in November from €4.6 billion in October, beating expectations for a decline to a deficit of €4.5 billion.

Industrial production in France declined 0.3% in November, missing expectations for a 0.4% gain, after a 0.7% drop in October. October's figure was revised up from a 0.8% decline.

Political uncertainty in Greece still weighed on the euro.

The British pound traded higher against the U.S. dollar after the better-than expected manufacturing output data from the U.K. Manufacturing production in the U.K. rose 0.7% in November, exceeding expectations for a 0.3% rise, after a 0.7% drop in October.

On a yearly basis, manufacturing production in the U.K. increased 2.7% in November, beating expectations for a 2.3% gain, after a 1.7% rise in October.

Industrial production in the U.K. decreased 0.1% in November, missing forecasts of a 0.2% rise, after a 0.3% decline in October. October's figure was revised down from a 0.1% decrease.

The decline was driven by falling oil and gas prices and maintenance shutdowns at two large fields in the North Sea.

On a yearly basis, industrial production in the U.K. rose 1.1% in November, missing expectations for a 1.6% rise, after a 1.0% gain in October. October's figure was revised down from a 1.1% gain.

The U.K. trade deficit fell to £8.8 billion in November from £9.8 billion in October, beating expectations for a deficit of £9.5 billion. October's figure was revised down from a deficit of £9.6 billion.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 6.6% in December.

Canada's economy is expected to add 10,300 jobs in December.

The Swiss franc traded higher against the U.S. dollar. Switzerland's unemployment rate remained unchanged at 3.2% in December. November's figure was revised down from 3.1%. Analysts had expected the unemployment rate to fall to 3.1%.

Switzerland's consumer price index dropped 0.5% in December, missing expectations for a 0.3% fall, after a flat reading in November.

On a yearly basis, Switzerland's consumer price index declined 0.3% in December, missing expectations for a 0.1% drop, after a 0.1% decrease in November.

EUR/USD: the currency pair rose to $1.1820

GBP/USD: the currency pair increased to $1.5160

USD/JPY: the currency pair fell to Y119.16

The most important news that are expected (GMT0):

13:30 Canada Building Permits (MoM) November +0.7% +0.8%

13:30 Canada Employment December -10.7 +10.3

13:30 Canada Unemployment rate December 6.6% 6.6%

13:30 U.S. Average hourly earnings December +0.4% +0.2%

13:30 U.S. Nonfarm Payrolls December 321 241

13:30 U.S. Unemployment Rate December 5.8% 5.7

15:00 United Kingdom NIESR GDP Estimate December +0.7%

-

13:01

Orders

EUR/USD

Offers $1.2200, $1.2150, $1.2125/20, $1.2100, $1.2000, $1.1895/00

Bids $1.1750, $1.1700, $1.1620, $1.1600

GBP/USD

Offers $1.5485, $1.5430, $1.5400, $1.5320/00, $1.5200

Bids $1.5030, $1.5000, $1.4980, $1.4910, $1.4800/10

AUD/USD

Offers $0.8250, $0.8200, $0.8165/60

Bids $0.8100, $0.8035, $0.8000, $0.7950

EUR/JPY

Offers Y146.00/05, Y145.50, Y145.30, Y144.15, Y143.00, Y141.70//75

Bids Y140.40/50, Y140.00

USD/JPY

Offers Y121.85, Y121.50, Y121.20, Y120.90/00, Y119.95/00

Bids Y118.70, Y118.05, Y118.00, Y117.00, Y116.80

EUR/GBP

Offers stg0.7900, stg0.7880/85, stg0.7875, stg0.7855

Bids stg0.7755/50, stg0.7745, stg0.7720, stg0.7700, stg0.7680

-

12:25

Manufacturing production in the U.K. rose 0.7% in November

The U.K. Office for National Statistics released manufacturing and industrial production figures on Friday. Manufacturing production in the U.K. rose 0.7% in November, exceeding expectations for a 0.3% rise, after a 0.7% drop in October.

On a yearly basis, manufacturing production in the U.K. increased 2.7% in November, beating expectations for a 2.3% gain, after a 1.7% rise in October.

Industrial production in the U.K. decreased 0.1% in November, missing forecasts of a 0.2% rise, after a 0.3% decline in October. October's figure was revised down from a 0.1% decrease.

The decline was driven by falling oil and gas prices and maintenance shutdowns at two large fields in the North Sea.

On a yearly basis, industrial production in the U.K. rose 1.1% in November, missing expectations for a 1.6% rise, after a 1.0% gain in October. October's figure was revised down from a 1.1% gain.

-

10:17

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1750(E531mn), $1.1900(E1.5bn), $1.1980(E1.5bn), $1.2000(E4.0bn)

USD/JPY: Y118.00($7.0bn), Y119.50($2.1bn), Y120.00($1.5bn), Y121.00($2.1bn)

EUR/CHF: Chf1.2010(E200mn)

AUD/USD: $0.8075(A$257mn), $0.8100(A$300mn), $0.8105(A$315mn)

NZD/USD: $0.7780(NZ$250mn)

USD/CAD: C$1.1700($681mn)

-

09:31

United Kingdom: Manufacturing Production (YoY), November +2.7% (forecast +2.3%)

-

09:31

United Kingdom: Trade in goods , November -8.8 (forecast -9.5)

-

09:30

United Kingdom: Industrial Production (MoM), November -0.1% (forecast +0.2%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , November +0.7% (forecast +0.3%)

-

09:30

United Kingdom: Industrial Production (YoY), November +1.1% (forecast +1.6%)

-

08:15

Switzerland: Consumer Price Index (MoM) , December -0.5% (forecast -0.3%)

-

08:15

Switzerland: Consumer Price Index (YoY), December -0.3% (forecast -0.1%)

-

07:46

France: Trade Balance, bln, November -3.2 (forecast -4.5)

-

07:45

France: Industrial Production, m/m, November -0.3% (forecast +0.4%)

-

07:00

Germany: Trade Balance, November 17.7 (forecast 19.6)

-

07:00

Germany: Industrial Production s.a. (MoM), November -0.1% (forecast +0.4%)

-

07:00

Germany: Current Account , November 18.6

-

06:45

Switzerland: Unemployment Rate, December 3.2% (forecast 3.1%)

-

06:33

Options levels on friday, January 9, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2015 (3178)

$1.1953 (1997)

$1.1867 (1358)

Price at time of writing this review: $ 1.1807

Support levels (open interest**, contracts):

$1.1756 (2206)

$1.1692 (1944)

$1.1647 (868)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 74286 contracts, with the maximum number of contracts with strike price $1,2500 (6643);

- Overall open interest on the PUT options with the expiration date January, 9 is 59374 contracts, with the maximum number of contracts with strike price $1,1900 (5347);

- The ratio of PUT/CALL was 0.80 versus 0.86 from the previous trading day according to data from January, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.5400 (1115)

$1.5300 (1722)

$1.5201 (585)

Price at time of writing this review: $1.5092

Support levels (open interest**, contracts):

$1.4998 (1193)

$1.4900 (502)

$1.4800 (381)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 33029 contracts, with the maximum number of contracts with strike price $1,5850 (4020);

- Overall open interest on the PUT options with the expiration date January, 9 is 25396 contracts, with the maximum number of contracts with strike price $1,5500 (2592);

- The ratio of PUT/CALL was 0.77 versus 0.75 from the previous trading day according to data from January, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:01

Japan: Leading Economic Index , November 145.8 (forecast 104.9)

-

05:01

Japan: Coincident Index, November 108.9

-

02:01

Nikkei 225 17,247.5 +80.40 +0.47%, Hang Seng 23,967.7 +132.17 +0.55%, Shanghai Composite 3,274.58 -18.87 -0.57%

-

01:31

China: PPI y/y, December -3.3% (forecast -3.1%)

-

01:31

China: CPI y/y, December +1.5% (forecast +1.5%)

-

00:47

Australia: Retail Sales Y/Y, November +4.5%

-

00:30

Australia: Retail sales (MoM), November +0.1% (forecast +0.3%)

-