Notícias do Mercado

-

23:32

Commodities. Daily history for Jan 8’2015:

(raw materials / closing price /% change)

Light Crude 48.93 +0.29%

Gold 1,207.70 -0.07%

-

23:31

Stocks. Daily history for Jan 8’2015:

(index / closing price / change items /% change)

Nikkei 225 17,167.1 +281.77 +1.67%

Hang Seng 23,835.53 +154.27 +0.65%

Shanghai Composite 3,293.46 -80.50 -2.39%

FTSE 100 6,569.96 +150.13 +2.34%

CAC 40 4,260.19 +147.46 +3.59%

Xetra DAX 9,837.61 +319.43 +3.36%

S&P 500 2,062.14 +36.24 +1.79%

NASDAQ Composite 4,736.19 +85.72 +1.84%

Dow Jones Industrial Average 17,907.87 +323.35 +1.84%

-

23:30

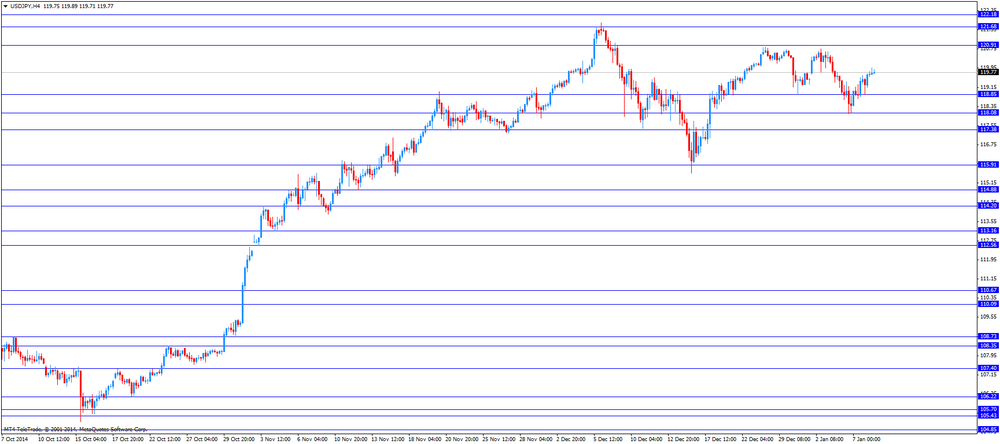

Currencies. Daily history for Jan 8’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1791 -0,41%

GBP/USD $1,5088 -0,14%

USD/CHF Chf1,0182 +0,39%

USD/JPY Y119,65 +0,33%

EUR/JPY Y141,09 -0,06%

GBP/JPY Y180,52 +0,20%

AUD/USD $0,8122 +0,55%

NZD/USD $0,7822 +0,52%

USD/CAD C$1,1829 +0,13%

-

23:00

Schedule for today, Friday, Jan 9’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Retail sales (MoM) November +0.4% +0.3%

00:30 Australia Retail Sales Y/Y November +5.7%

01:30 China PPI y/y December -2.7% -3.1%

01:30 China CPI y/y December +1.4% +1.5%

05:00 Japan Leading Economic Index November 104.5 Revised From 104.0 104.9

05:00 Japan Coincident Index November 109.9

06:45 Switzerland Unemployment Rate December 3.1% 3.1%

07:00 Germany Current Account November 23.1

07:00 Germany Industrial Production s.a. (MoM) November +0.2% +0.4%

07:00 Germany Industrial Production (YoY) November +0.8%

07:00 Germany Trade Balance November 20.6 19.6

07:45 France Industrial Production, m/m November -0.8% +0.4%

07:45 France Industrial Production, y/y November -1.0%

07:45 France Trade Balance, bln November -4.6 -4.5

08:15 Switzerland Consumer Price Index (MoM) December 0.0% -0.3%

08:15 Switzerland Consumer Price Index (YoY) December -0.1% -0.1%

09:30 United Kingdom Industrial Production (MoM) November -0.1% +0.2%

09:30 United Kingdom Industrial Production (YoY) November +1.1% +1.6%

09:30 United Kingdom Manufacturing Production (MoM) November -0.7% +0.3%

09:30 United Kingdom Manufacturing Production (YoY) November +1.7% +2.3%

09:30 United Kingdom Trade in goods November -9.6 -9.5

13:15 Canada Housing Starts December 195 191

13:30 Canada Building Permits (MoM) November +0.7% +0.8%

13:30 Canada Employment December -10.7 +10.3

13:30 Canada Unemployment rate December 6.6% 6.6%

13:30 U.S. Average hourly earnings December +0.4% +0.2%

13:30 U.S. Nonfarm Payrolls December 321 241

13:30 U.S. Unemployment Rate December 5.8% 5.7

15:00 United Kingdom NIESR GDP Estimate December +0.7%

15:00 U.S. Wholesale Inventories November +0.4% +0.4%

-

20:01

Dow 17,905.04 +320.52 +1.82%, Nasdaq 4,738.56 +88.09 +1.89%, S&P 500 2,062.66 +36.76 +1.81%

-

20:00

U.S.: Consumer Credit , November 14.1 (forecast 15.1)

-

17:00

European stocks closed: FTSE 100 6,576.51 +156.68 +2.44%, CAC 40 4,265.18 +152.45 +3.71%, DAX 9,848.28 +330.10 +3.47%

-

17:00

European stocks close: stocks closed higher on comments by the European Central Bank President Mario Draghi

Stock indices closed higher on comments by the European Central Bank President Mario Draghi. Draghi said in a letter to a European Parliament member, Luke Ming Flanagan, on Thursday that the central bank is ready to take unconventional measures if needed, including purchase of government bonds.

German seasonal adjusted factory orders dropped 2.4% in November, missing expectations for a 0.6% decline, after a 2.9% increase in October. October's figure was revised up from a 2.5% gain.

That was the first decline in three months.

Domestic orders plunged 4.7% in November, while foreign orders fell 0.7%.

Retail sales in the Eurozone rose 0.6% in November, exceeding expectations for a 0.3% increase, after a 0.6% gain in October. October's figure was revised up from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone surged 1.5% in November, beating expectations for a 1.1% gain, after a 1.6% increase in October. October's figure was revised up from a 1.4% gain.

Eurozone's producer price index fell 0.3% in November, missing expectations for a 0.2% decrease, after a 0.3% drop in October. October's figure was revised up from a 0.4% decline.

The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise interest rate later this year. But the central bank might delay its interest rate hike because of low inflation and a slowdown of the economic growth in the Eurozone. The wage growth in the U.K. remained under pressure despite the growth in the three months to October.

The recent released UK's manufacturing, services and construction sectors' economic reports showed a slowdown in these sectors.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,569.96 +150.13 +2.34%

DAX 9,837.61 +319.43 +3.36%

CAC 40 4,260.19 +147.46 +3.59%

-

16:38

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected number of initial jobless claims from the U.S.

The U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected number of initial jobless claims from the U.S. The number of initial jobless claims in the week ending January 03 in the U.S. fell by 4,000 to 294,000 from 298,000 in the previous week. Analysts had expected the number of initial jobless claims to decrease to 291,000.

These figures are adding to signs a strengthening labour market.

The number of initial jobless claims has remained below 300,000 for 17 straight weeks.

The greenback remained supported by yesterday's ADP labour market data. Private sector in the U.S. added 241,000 jobs in December, according the ADP report on Wednesday.

The Fed released minutes of its December 16-17 meeting on Wednesday. Minutes showed that the Fed is unlikely to hike its interest rate before April.

The euro rose against the U.S. dollar. The European Central Bank President Mario Draghi said in a letter to a European Parliament member, Luke Ming Flanagan, on Thursday that the central bank is ready to take unconventional measures if needed, including purchase of government bonds.

German seasonal adjusted factory orders dropped 2.4% in November, missing expectations for a 0.6% decline, after a 2.9% increase in October. October's figure was revised up from a 2.5% gain.

That was the first decline in three months.

Domestic orders plunged 4.7% in November, while foreign orders fell 0.7%.

Retail sales in the Eurozone rose 0.6% in November, exceeding expectations for a 0.3% increase, after a 0.6% gain in October. October's figure was revised up from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone surged 1.5% in November, beating expectations for a 1.1% gain, after a 1.6% increase in October. October's figure was revised up from a 1.4% gain.

Eurozone's producer price index fell 0.3% in November, missing expectations for a 0.2% decrease, after a 0.3% drop in October. October's figure was revised up from a 0.4% decline.

Political uncertainty in Greece still weighed on the euro.

The British pound traded higher against the U.S. dollar. The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise interest rate later this year. But the central bank might delay its interest rate hike because of low inflation and a slowdown of the economic growth in the Eurozone. The wage growth in the U.K. remained under pressure despite the growth in the three months to October.

The recent released UK's manufacturing, services and construction sectors' economic reports showed a slowdown in these sectors.

The Halifax house price index for the U.K. rose 0.9% in December, beating forecasts for a 0.3% gain, after a 0.5% increase in November. November's figure was revised up from a 0.4% rise.

On a yearly basis, the Halifax house price index for the U.K. climbed 7.8% in December, after a 8.1% rise in November. November's figure was revised down from a 8.2% gain.

The Canadian dollar traded mixed against the U.S. dollar after the weaker-than-expected Canadian new housing price index. Canada's new housing price index rose 0.1% in November, missing expectations for a 0.2% gain, after a 0.1% increase in October.

The New Zealand dollar increased against the U.S. dollar in the absence of any major market reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie rose against the greenback after the better-than-expected building permits data from Australia. Building approvals in Australia climbed 7.5% in November, beating expectations for a 2.7% decline, after a11.5% increase in October. October's figure was revised up from a 11.4% gain.

The Japanese yen traded higher against the U.S. dollar in the absence of any major market reports from Japan.

-

16:05

European Central Bank President Mario Draghi: the ECB could start to purchase a variety of assets if needed, including purchase of government bonds

The European Central Bank President Mario Draghi said in a letter to a European Parliament member, Luke Ming Flanagan, on Thursday that the central bank is ready to take unconventional measures if needed, including purchase of government bonds.

Draghi pointed out that the ECB would monitor "the risks to the outlook for price developments over the medium term".

"It will be particularly vigilant as regards the broader impact of recent oil price developments on medium-term inflation trends in the euro area," he noted.

-

15:58

The Wall Street Journal reported on Thursday Coca-Cola will cut 1,600 to 1,800 jobs around the world as part of a $3 billion cost-cutting program to trim costs

-

15:28

FOMC’s December minutes: the Fed is unlikely to hike its interest rate before April

The Fed released minutes of its December 16-17 meeting on Wednesday. Investors had expected to get insight into when the Fed will start to hike its interest rate. Minutes showed that the Fed is unlikely to hike its interest rate before April.

Analysts expect the first interest rate hike by the Fed in the mid-2015.

The Fed policymakers said that the Fed could start to hike its interest rate before inflation will pick up. But they added that "they would want to be reasonably confident that inflation will move" back toward the Fed's 2% inflation target.

The Fed's preferred gauge, the personal consumption expenditures price index (PCE), increased at annual rate of 1.2% in November. The PCE price index excluding food and energy costs rose 1.4%.

Many Fed officials think a global economic slowdown is "an important source of downside risks to domestic real activity and employment".

The net effect of falling oil prices was "anticipated to be positive", the officials said. They believe that falling oil prices won't impact their decision on interest rate hike.

Most Fed officials agreed that "it will be appropriate to raise the target federal funds rate fairly gradually".

-

14:58

U.S. number of initial jobless claims fall by 4,000 to 294,000

The U.S. Labor Department released the number of initial jobless claims on Thursday. The number of initial jobless claims in the week ending January 03 in the U.S. fell by 4,000 to 294,000 from 298,000 in the previous week. Analysts had expected the number of initial jobless claims to decrease to 291,000.

These figures are adding to signs a strengthening labour market.

The number of initial jobless claims has remained below 300,000 for 17 straight weeks.

The ADP report was released yesterday. It also showed an improvement of labour market. Private sector in the U.S. added 241,000 jobs in December, according the ADP report.

Official labour market data will be released tomorrow. Analysts expect that U.S. unemployment rate is expected to decline to 5.7% in December from 5.8% in November. The U.S. economy is expected to add 241,000 jobs in December.

The improving U.S. labour market could mean that the Fed will start to hike its interest rate sooner than expected.

-

14:35

U.S. Stocks open: Dow 17,605.72 +21.20 +0.12%, Nasdaq 4,689.42 +38.95 +0.84%, S&P 2,042.08 +16.18 +0.80%

-

14:25

Before the bell: S&P futures +0.80%, Nasdaq futures +0.84%

U.S. stock futures advanced on speculation central banks will support growth even as the American economy shows signs of strength.

Global markets:

Nikkei 17,167.1 +281.77 +1.67%

Hang Seng 23,835.53 +154.27 +0.65%

Shanghai Composite 3,294.35 -79.60 -2.36%

FTSE 6,526.35 +106.52 +1.66%

CAC 4,204.88 +92.15 +2.24%

DAX 9,677.11 +158.93 +1.67%

Crude oil $48.88 (+0.45%)

Gold $1210.00 (+0.04%)

-

14:17

Canada’s new housing price index increased 0.1% in November

Statistics Canada released its new housing price index on Thursday. New housing price index rose 0.1% in November, missing expectations for a 0.2% gain, after a 0.1% increase in October.

On a yearly basis, the index climbed to 1.7% in November from 1.6% in October.

-

14:05

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Wells Fargo & Company (WFC) initiated with an Outperform at Credit Suisse

JPMorgan Chase & Co. (JPM) initiated with an Outperform at Credit Suisse

Bank of America Corporation (BAC) initiated with an Outperform at Credit Suisse

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1750(E459mn), $1.1800(E1.23bn), $1.1830(E328mn), $1.1900(E529mn), $1.2000(E1.2bn)

USD/JPY: Y118.50($660mn), Y118.95($220mn), Y119.00($467mn), Y119.15-20($718mn), Y119.50($573mn), Y119.75($200mn), Y119.90($454mn), Y120.00($1.32bn)

EUR/CHF: Chf1.2100(E400mn)

AUD/USD: $0.8000(A$326mn), $0.8200(A$707mn)

EUR/AUD: A$1.4565(E206mn)

USD/CAD: C$1.1700($340mn), C$1.1800($240mn)

-

13:30

U.S.: Initial Jobless Claims, December 294 (forecast 291)

-

13:30

Canada: New Housing Price Index , November +0.1% (forecast +0.2%)

-

13:27

Eurozone’s retail sales rose 0.6% in November

Eurostat released retail sales figures for the Eurozone on Thursday. Retail sales in the Eurozone rose 0.6% in November, exceeding expectations for a 0.3% increase, after a 0.6% gain in October. October's figure was revised up from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone surged 1.5% in November, beating expectations for a 1.1% gain, after a 1.6% increase in October. October's figure was revised up from a 1.4% gain.

November's retail sales figures usually boosted by Christmas shopping.

The outlook in the Eurozone is still little optimistic. The inflation declined to an annual rate of -0.2% in December from 0.3% in November. That was the lowest level since October 2009. The decline was driven by falling oil prices.

The inflation excluding food and energy costs increased to an annual rate of 0.8% in December from 0.7% in November.

Producer price inflation in the Eurozone also declined. Eurozone's producer price index fell 0.3% in November, missing expectations for a 0.2% decrease, after a 0.3% drop in October. October's figure was revised up from a 0.4% decline.

-

13:05

Foreign exchange market. European session: the euro fell against the U.S. dollar after the mostly weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Building Permits, m/m November +11.5% Revised From +11.4% -2.7% +7.5%

00:30 Australia Building Permits, y/y November +2.5% +10.1%

07:00 Germany Factory Orders s.a. (MoM) November +2.9% Revised From +2.5% -0.6% -2.4%

07:00 Germany Factory Orders n.s.a. (YoY) November +2.6% Revised From +2.4% -0.4%

08:00 United Kingdom Halifax house price index December +0.5% +0.3% +0.9%

08:00 United Kingdom Halifax house price index 3m Y/Y December +8.1% +7.8%

10:00 Eurozone Producer Price Index, MoM November -0.3% Revised From -0.4% -0.2% -0.3%

10:00 Eurozone Producer Price Index (YoY) November -1.3% -1.6%

10:00 Eurozone Business climate indicator December 0.18 0.18

10:00 Eurozone Industrial confidence December -4.3 Revised From -5.1 -5.2

10:00 Eurozone Economic sentiment index December 100.7 100.7

10:00 Eurozone Retail Sales (MoM) November +0.6% Revised From +0.4% +0.3% +0.6%

10:00 Eurozone Retail Sales (YoY) November +1.6% Revised From +1.4% +1.1% +1.5%

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom MPC Rate Statement

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims from the U.S. The number of initial jobless claims in the U.S. is expected to decline by 7,000 to 291,000.

The greenback remained supported by yesterday's ADP labour market data. Private sector in the U.S. added 241,000 jobs in December, according the ADP report on Wednesday.

The Fed released minutes of its December 16-17 meeting on Wednesday. Minutes showed that the Fed is unlikely to hike its interest rate before April.

The euro fell against the U.S. dollar after the mostly weak economic data from the Eurozone. German seasonal adjusted factory orders dropped 2.4% in November, missing expectations for a 0.6% decline, after a 2.9% increase in October. October's figure was revised up from a 2.5% gain.

That was the first decline in three months.

Domestic orders plunged 4.7% in November, while foreign orders fell 0.7%.

Retail sales in the Eurozone rose 0.6% in November, exceeding expectations for a 0.3% increase, after a 0.6% gain in October. October's figure was revised up from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone surged 1.5% in November, beating expectations for a 1.1% gain, after a 1.6% increase in October. October's figure was revised up from a 1.4% gain.

Eurozone's producer price index fell 0.3% in November, missing expectations for a 0.2% decrease, after a 0.3% drop in October. October's figure was revised up from a 0.4% decline.

Political uncertainty in Greece still weighed on the euro.

The British pound traded mixed against the U.S. dollar after the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise interest rate later this year. But the central bank might delay its interest rate hike because of low inflation and a slowdown of the economic growth in the Eurozone. The wage growth in the U.K. remained under pressure despite the growth in the three months to October.

The recent released UK's manufacturing, services and construction sectors' economic reports showed a slowdown in these sectors.

The Halifax house price index for the U.K. rose 0.9% in December, beating forecasts for a 0.3% gain, after a 0.5% increase in November. November's figure was revised up from a 0.4% rise.

On a yearly basis, the Halifax house price index for the U.K. climbed 7.8% in December, after a 8.1% rise in November. November's figure was revised down from a 8.2% gain.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian new housing price index. Canada's new housing price index is expected to rise 0.2% in November, after a 0.1% gain in October.

EUR/USD: the currency pair declined to $1.1753

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index November +0.1% +0.2%

13:30 U.S. Initial Jobless Claims December 298 291

21:45 New Zealand Building Permits, m/m November +8.8%

-

13:00

Orders

EUR/USD

Offers $1.2200, $1.2150, $1.2125/20, $1.2100, $1.2000, $1.1895/00

Bids $1.1700, $1.1620, $1.1600

GBP/USD

Offers $1.5485, $1.5430, $1.5400, $1.5320/00, $1.5200

Bids $1.5000, $1.4980, $1.4910, $1.4800/10

AUD/USD

Offers $0.8250, $0.8200, $0.8165/60

Bids $0.8035, $0.8000, $0.7950

EUR/JPY

Offers Y146.00/05, Y145.50, Y145.30, Y144.15, Y143.00

Bids Y140.40/50, Y140.00

USD/JPY

Offers Y121.85, Y121.50, Y121.20, Y120.90/00

Bids Y118.70, Y118.05, Y118.00, Y117.00, Y116.80

EUR/GBP

Offers stg0.7900, stg0.7880/85, stg0.7875

Bids stg0.7800, stg0.7755/50, stg0.7745, stg0.7720, stg0.7700, stg0.7680

-

12:35

Bank of England keeps its interest rate on hold at 0.5% in January

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise interest rate later this year. But the central bank might delay its interest rate hike because of low inflation and a slowdown of the economic growth in the Eurozone. The wage growth in the U.K. remained under pressure despite the growth in the three months to October.

The recent released UK's manufacturing, services and construction sectors' economic reports showed a slowdown in these sectors.

Investors are awaiting the minutes of the monetary policy committee (MPC). The minutes of the meeting will be released on January 21.

The BoE policymakers remain divided on whether or not to raise interest rates in the U.K. Two MPC members voted in December for the fifth consecutive month to raise interest rates to 0.75% from 0.5%.

-

12:19

German factory orders dropped 2.4% in November

Germany's Economy Ministry released factory orders data on Thursday. German seasonal adjusted factory orders dropped 2.4% in November, missing expectations for a 0.6% decline, after a 2.9% increase in October. October's figure was revised up from a 2.5% gain.

That was the first decline in three months.

Domestic orders plunged 4.7% in November, while foreign orders fell 0.7%.

These figures show the slow recovery of confidence largest euro area economy.

Germany's Economy Ministry said that prospects for an increase in new orders in the fourth quarter are "overall good".

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1750(E459mn), $1.1800(E1.23bn), $1.1830(E328mn), $1.1900(E529mn), $1.2000(E1.2bn)

USD/JPY: Y118.50($660mn), Y118.95($220mn), Y119.00($467mn), Y119.15-20($718mn), Y119.50($573mn), Y119.75($200mn), Y119.90($454mn), Y120.00($1.32bn)

EUR/CHF: Chf1.2100(E400mn)

AUD/USD: $0.8000(A$326mn), $0.8200(A$707mn)

EUR/AUD: A$1.4565(E206mn)

USD/CAD: C$1.1700($340mn), C$1.1800($240mn)

-

10:02

Eurozone: Industrial confidence, December -5.2

-

10:01

Eurozone: Economic sentiment index , December 100.7

-

10:01

Eurozone: Business climate indicator , December 0.18

-

10:00

Eurozone: Producer Price Index, MoM , November -0.3% (forecast -0.2%)

-

10:00

Eurozone: Producer Price Index (YoY), November -1.6%

-

08:01

United Kingdom: Halifax house price index 3m Y/Y, December +7.8%

-

07:00

Germany: Factory Orders s.a. (MoM), November -2.4% (forecast -0.6%)

-

06:33

Options levels on thursday, January 8, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2053 (1983)

$1.1964 (1798)

$1.1900 (831)

Price at time of writing this review: $ 1.1820

Support levels (open interest**, contracts):

$1.1777 (2713)

$1.1739 (2150)

$1.1696 (1698)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 71966 contracts, with the maximum number of contracts with strike price $1,2500 (6643);

- Overall open interest on the PUT options with the expiration date January, 9 is 61624 contracts, with the maximum number of contracts with strike price $1,1900 (6274);

- The ratio of PUT/CALL was 0.86 versus 0.90 from the previous trading day according to data from January, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.5400 (842)

$1.5301 (1614)

$1.5202 (583)

Price at time of writing this review: $1.5083

Support levels (open interest**, contracts):

$1.4998 (1114)

$1.4899 (467)

$1.4800 (265)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 31937 contracts, with the maximum number of contracts with strike price $1,5850 (4020);

- Overall open interest on the PUT options with the expiration date January, 9 is 23927 contracts, with the maximum number of contracts with strike price $1,5500 (2592);

- The ratio of PUT/CALL was 0.75 versus 0.77 from the previous trading day according to data from January, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:03

Nikkei 225 17,151.35 +266.02 +1.58%, Hang Seng 23,881.04 +199.78 +0.84% Shanghai Composite 3,375.29 +1.34 +0.04%

-

00:31

Australia: Building Permits, m/m, November +7.5% (forecast -2.7%)

-

00:31

Australia: Building Permits, y/y, November +10.1%

-