Notícias do Mercado

-

23:51

Japan JP Foreign Reserves: $1227.6B (December) vs $1226.3B

-

23:38

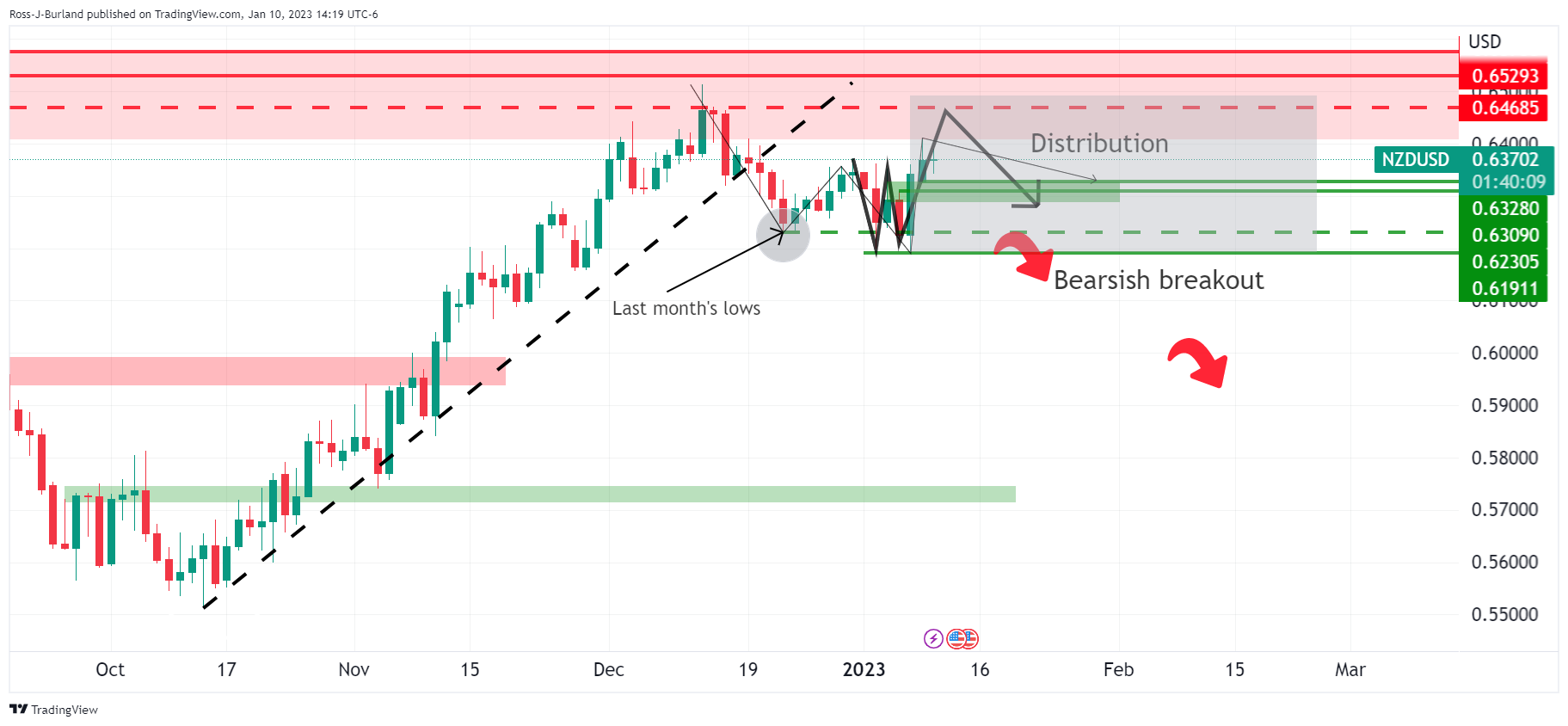

NZD/USD Price Analysis: Dribbles inside weekly triangle below 0.6400

- NZD/USD remains sidelined inside a short-term symmetrical triangle formation.

- Sustained trading beyond the key HMAs, steady RSI favor buyers.

- Sellers need to break 0.6190 to dominate further.

NZD/USD makes rounds to 0.6370-75 during early Wednesday, after snapping a two-day uptrend near a monthly top the previous day. In doing so, the Kiwi pair remains inside a symmetrical triangle formation connecting multiple levels marked since Monday.

Not only the immediate triangle but the steady RSI (14) also portrays the Kiwi pair’s latest inaction.

However, the quote’s successful trading above the 100 and 200 Hourly Moving Averages (HMAs) join the above 50 level of RSI to keep the NZD/USD buyers hopeful.

That said, a clear upside break of the stated triangle’s top line, close to 0.6385 by the press time, appears necessary for the bulls to take control.

Even so, the 0.6400 round figure and the recent high surrounding 0.6410 could act as additional upside filters to challenge the buyers before directing them to the previous monthly high near 0.6515. During the run-up, the 0.6500 threshold may act as a buffer.

On the flip side, a downside break of the triangle’s support line, around 0.6345 at the latest, won’t flash a strong bearish signal for the NZD/USD traders as a convergence of the 100 and 200 HMA could restrict the pair’s further downside near 0.6320-15.

Even if the pair drops below 0.6315, the monthly low near 0.6190 may act as the last defense of the NZD/USD buyers.

NZD/USD: Hourly chart

Trend: Further upside expected

-

23:38

EUR/JPY sees upside above 142.00 despite BOJ looks to exit loose policy ahead

- EUR/JPY is aiming to surpass 142.00 as Eurozone wage inflation may call for further policy tightening

- ECB Centeno expects the current process of interest rate increases is approaching its end.

- Japan may look for an exit from the ultra-loose monetary policy after the appointment of the new BOJ Governor.

The EUR/JPY pair is struggling to extend its upside journey above the immediate resistance of 142.00 in the early Asian session. The cross is demonstrating a sideways profile but is likely to remain in the bullish trajectory amid an upbeat market mood.

The Euro drove the cross to neat 142.00 firmly after European Economic Affairs Commissioner Paolo Gentiloni trimmed the contraction forecast for Eurozone Gross Domestic Product (GDP). In an interview with the Italian newspaper Il Sole 24 Ore, Gentiloni stated that he expects Eurozone GDP contraction around the start of this year may be less deep than was expected in November.

He further added that “The 0.3% forecast still seemed quite solid but various factors suggested the contraction expected in the fourth quarter of 2022 and the first quarter of this year would not be so sharp as had been expected,”

On the interest rate front, Reuters reported that the European Central Bank (ECB)'s governing council member Mario Centeno said on Tuesday the current process of interest rate increases is approaching its end. Centeno expects that the stubborn price index will face resistance in January and February but will start falling in March.

Contrary to the viewpoint of ECB Centeno, Economic Bulletin published by the ECB clears that wage growth is going to be extremely solid ahead led by robust labor markets that so far have not been substantially affected by an economic slowdown, increases in national minimum wages, and some catch-up between wages and high rates of inflation. Wage inflation is becoming a barrier for central banks in achieving price stability and it might force ECB President Christine Lagarde to continue to keep policy restrictive ahead.

On the Tokyo front, Japanese Prime Minister Fumio Kishida said that his government and the central bank must discuss their relationship in guiding economic policy after he names a new Bank of Japan (BOJ) governor in April. He further added that the administration is looking to revise its long-decade blueprint of beating deflation and may look for an exit from ultra-loose monetary policy.

-

23:21

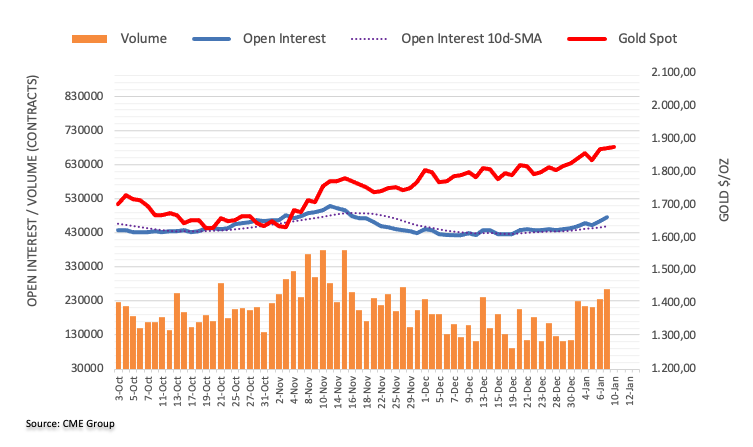

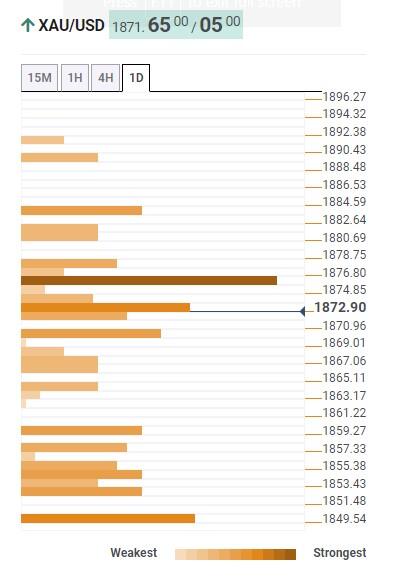

Gold Price Forecast: XAU/USD eyes further upside ahead of China, United States inflation

- Gold price remains inactive but defends the bull pennant chart formation.

- Federal Reserve Chairman Jerome Powell’s failure to provide monetary policy signals underpin XAU/USD upside.

- Bullish chart pattern, World Bank economic forecasts add strength to the Gold price even if US Dollar probes buyers.

- Strong inflation from China, United States could challenge XAU/USD buyers.

Gold price (XAU/USD) portrays the typical pre-data anxiety as it makes rounds to $1,875 during early Wednesday, probing a three-day uptrend around the highest levels since May 2022. In doing so, the yellow metal portrays the market’s confidence in the traditional safe-haven even if the US Dollar rebounds from a multi-day low. The reason could be linked to the uncertainty surrounding the next moves of the US Federal Reserve (Fed) and downbeat economic forecasts from the World Bank (WB), not to forget cautious optimism surrounding China.

Federal Reserve Chairman Jerome Powell favored Gold buyers

Federal Reserve (Fed) Chair Jerome Powell's comments at Riksbank's International Symposium on Central Bank Independence couldn’t offer further clarity on the US central bank’s monetary policy outlook and propelled the rush towards the Gold amid uncertainty. The policymaker highlighted the Fed’s autonomous nature and no obligation towards climate control while praising the US central bank’s latest moves in his latest public appearances. It’s worth noting that Federal Reserve Governor Michelle Bowman appeared hawkish while stating that more rate rises are needed to combat high inflation, which in turn should have probed the XAU/USD bulls afterward.

It’s worth mentioning that the recently easing hawkish bets on the Fed’s next moves, as well as softer US data, seem to keep the Gold buyers hopeful even if the Federal Reserve policymakers try to defend the restrictive monetary policy. On Tuesday, the US NFIB Business Optimism Index for December dropped to the lowest levels since 2013 if ignoring multiple jitters during the global Covid wave. Further, US Wholesale Inventories also remained unchanged with 1.0% growth for November.

Alternatively, a rebound in the US Dollar Index (DXY) from the seven-month low seems to challenge the Gold price, due to the inverse relationship between the XAU/USD and the greenback’s gauge versus the six major currencies. It should be noted that the DXY snapped a two-day downtrend on Tuesday while bouncing off the multiday low to close around 103.30. In doing so, the US Dollar Index traced the firmer US Treasury bond yields which rose 10 basis points (bps) to 3.61%.

World Bank economic forecasts propel rush towards XAU/USD

On Tuesday, the World Bank (WB) came out with its revised economic forecasts and propelled the rush towards the traditional safe haven Gold. The quest for the yellow metal became more intense amid uncertainty surrounding the next moves of the major central banks considering the recently easy data and looming inflation woes.

That said, the WB stated that it expects the global economy to grow by 1.7% in 2023, down sharply from 3% in June's forecast, as reported by Reuters. The Washington-based institute also raised fears of global recession by citing the scale of recent slowdowns.

Inflation is the key for Gold traders

To overcome the latest inaction, Gold traders should pay attention to the inflation data from China and the US. Although the US Consumer Price Index (CPI) becomes more important, Beijing’s status as one of the key Gold consumers, as well as the recent reopening of the dragon nation, highlights China's CPI as the key for the XAU/USD traders.

That said, firmer prints of these inflation numbers should challenge the Gold buyers while backing hopes of higher rates. However, the People’s Bank of China’s (PBOC) favor for easy money policies could let the XAU/USD remain firmer even if China's CPI rises a bit.

Gold price technical analysis

Gold price portrays a bull pennant price formation on the hourly chart, which in turn can suggest the metal’s further rise towards the theoretical target price of $1,930.

The above 50 level of the Relative Strength Index (RSI) line, placed at 14, as well as the looming bull cross on the Moving Average Convergence and Divergence (MACD) indicator, also tease XAU/USD buyers despite recent inaction.

It’s worth noting, however, that the upper line of a three-week-old ascending trend channel, close to $1,890 by the press time, will precede the $1,900 threshold to challenge the Gold buyers before directing them toward the $1,930 theoretical target.

Alternatively, the previous weekly top surrounding $1,865 appears to be the immediate support to watch during the XAU/USD declines.

However, the bearish bias remains off the table unless the Gold price stays inside the aforementioned channel, currently between $1,842 and $1,865. Also adding strength to the $1,842 support is the 200-Hour Moving Average (HMA).

Overall, Gold price appears lucrative for the buyers due to the bull pennant confirmation and upward-sloping trend channel pattern.

Gold price: Hourly chart

Trend: Further upside expected

-

23:15

AUD/JPY Price Analysis: Double bottom at risk as the spot tumbles to 91.10s

- AUD/JPY formed a doji in the daily chart, suggesting buyers lost momentum.

- The confluence of the 200-DMA and the 100-DMA, around 91.55/65, stalled the AUD/JPY uptrend.

- AUD/JPY double bottom is still in play, at risk of invalidation if the cross drops below 91.00.

After printing a doji on Tuesday, the AUD/JPY registers minuscule gains of 0.03% as Wednesday’s Asian session begins, though it remains around Tuesday’s close of 91.10. At the time of writing, the AUD/JPY is trading at 91.13.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY failed to crack the 200-day Exponential Moving Average (EMA) at 91.65 for two consecutive days and, after printing a weekly high of 91.82 on Monday, slid toward the 91.10s area. Tuesday’s price action formed a doji, usually a bearish signal, which could open the door for a test of the 20-day EMA in the near term.

AUD/JPY traders should know that the double bottom remains in play. However, a fall below the December 28 daily high of 91.05 could invalidate the chart pattern.

AUD/JPY support rests at 91.05. A break / close below the latter will expose the 20-day EMA at 90.54, followed by last Friday’s swing low of 90.01.

As an alternate scenario, the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest some buying pressure is building. Therefore, the AUD/JPY resistance levels lie at the 200-day EMA at 91.65, followed by the 92.00 figure and the December 13 daily high of 93.35.

AUD/JPY Key Technical Levels

-

23:05

USD/CHF juggles above 0.9200 as investors await US inflation for fresh impetus

- USD/CHF is hovering around 0.9220 as investors await US inflation for making informed decisions.

- Less-hawkish commentary from Fed Daly kept reins in the US equities.

- Only a stronger-than-expected US CPI would avoid a slide to fresh lows for the USD Index.

The USD/CHF pair is demonstrating a balanced profile around 0.9220 in the early Asian session. The Swiss franc asset has turned sideways as the market participants are awaiting the release of the United States inflation data for fresh cues.

Meanwhile, the risk profile is displaying mixed signals as S&P500 futures remained in the bullish trajectory on Tuesday but risk-perceived currencies showed a subdued performance. US equities picked strength after San Francisco Federal Reserve (Fed) President Mary Daly told the Wall Street Journal (WSJ) she would pay close attention to the Consumer Price Index (CPI) data and that both options of 25- and 50-basis point hikes are open for February monetary policy meeting.

The US Dollar Index (DXY) remained topsy-turvy below the immediate resistance of 103.00 ahead of the US Consumer Price Index (CPI) data. Meanwhile, the demand for US government bonds trimmed as the Fed is still subjected to combat inflation firmly despite a drop in wage growth. The 10-year US Treasury yields have escalated to 3.61%.

Meanwhile, the absence of economic events in the Swiss franc calendar is going to keep investors focused on events in the United States for further action in the Swiss Franc asset.

As per the consensus, the headline CPI will drop to 6.5% while the core inflation that doesn’t inculcate food and energy prices may scale lower to 5.7%. The US Dollar Index is oscillating around its seven-month lows and further downside seems favored. According to the economists at MUFG Bank, only a stronger-than-expected US Consumer Price Index (CPI) on Thursday would avoid a slide to fresh lows for the USD Index.

-

23:01

South Korea Unemployment Rate registered at 3.3% above expectations (2.8%) in December

-

22:50

Japan’s Saito: Interest rates remain low but current situation won't last indefinitely

Early Wednesday morning in Asia, Japan’s Ministry of Finance (MOF) Financial Bureau Chief Michio Saito crossed wires, via Reuters, as he teased higher rates.

More to come...

-

22:42

USD/CAD Price Analysis: 100-day EMA probes bounces off six-week low

- USD/CAD retreats from 100-day EMA after marking a corrective pullback from multi-day low.

- Clear downside break of a four-month-old ascending trend line, bearish MACD signals also favor sellers to aim for 1.3250.

- Buyers need validation from 1.3500 to retake control.

USD/CAD fades bounce off multi-day low, marked the previous day, as the 100-day Exponential Moving Average (EMA) challenges buyers during early Wednesday. That said, the quote currently retreats to 1.3420, after bouncing off the lowest levels since November 25 the previous day.

Not only the inability to cross the 100-day EMA but the Loonie pair’s sustained trading towards the south after breaking an ascending trend line from early September 2022, as well as the bearish MACD signals, also underpin the downside bias for the USD/CAD pair.

As a result, the USD/CAD is likely to decline towards the 1.3250 support confluence, including an upward-sloping support line from June and the 50% Fibonacci retracement level of the pair’s June-October 2022 upside.

Following that, July 2022 peak surrounding 1.3220 could act as the last defense of the pair buyers.

Alternatively, an upside clearance of the 100-day EMA, around 1.3430 by the press time, won’t offer a warm welcome to the USD/CAD buyers as the previous support line, close to 1.3470, acts as an extra filter towards the north.

Even if the quote rises past 1.3470, multiple lows marked since October 2022 around 1.3500 could offer additional challenges for the USD/CAD bulls.

USD/CAD: Daily chart

Trend: Further downside expected

-

22:38

GBP/USD oscillates around 1.2150 as focus shifts to US CPI

- GBP/USD is displaying a rangebound action around 1.2150 as investors await US inflation for fresh cues.

- The downward revision of CY2023 global growth projections by the World Bank failed to impact the S&P500 rally.

- The BOE blamed Prudential Regulation Authority for its faulty risk-management systems.

The GBP/USD pair is displaying back-and-forth moves around 1.2150 in the early Tokyo session. Trading activity in the FX domain has turned quiet as investors are looking to make informed decisions post the release of the United States inflation data. The Cable is likely to dance to the tunes of the US Dollar as anxiety among investors ahead of the US Consumer Price Index (CPI) is expected to soar.

Rally in S&P500 futures continued on Tuesday despite the World Bank slashing the CY2023 global growth forecast dramatically to 1.7% from 3% in June's forecast, as reported by Reuters. World Bank forecasts US 2023 Gross Domestic Product (GDP) growth at 0.5% vs. 2.2% in the June forecast, citing it as the weakest non-recession performance since 1970.

The US Dollar Index (DXY) continues its sideways auction below 103.00 as investors have adopted a ‘wait and watch’ approach ahead of the US price index data. Meanwhile, the 10-year US Treasury yields jumped above 3.6% supported by hawkish commentary from Federal Reserve (Fed) Governor Michelle Bowman.

Reuters reported that Bowman said she expects the rate-setting Federal Open Market Committee (FOMC) will continue raising interest rates to tighten monetary policy, as we stated after our December meeting while noting the pace of future actions will be driven by how the economy performs.

On the United Kingdom front, after a year of sheer volatility in the Pound Sterling region that exposed loopholes in lenders’ risk-management system, the Bank of England (BOE) has criticized UK banks’ defenses to dodge volatility.

In a series of letters from the BOE to the Prudential Regulation Authority, BOE stated that “During 2022, the market reaction to Russia’s invasion of Ukraine, and volatility in the nickel and long-dated gilt markets, reinforced the importance of a robust risk culture and sound risk management practices at firms,” However, events like the collapse of Archegos Capital demonstrated firms large and concentrated exposure to single counterparties.

-

22:23

EUR/USD: Bulls and bears jostle around mid-1.0700s with eyes on US Inflation

- EUR/USD lacks momentum after rising to eight-month high.

- US Dollar rebounds despite softer US data on Fed Chair Powell’s hesitance to provide monetary policy clues.

- ECB policymaker appears hawkish but World Bank’s signal for recession probes them.

- China inflation decorates calendar, highlighting risk catalysts as the key.

EUR/USD treads waters around 1.0740 during the early hours of Wednesday’s Asian trading, after portraying a sluggish performance on Tuesday, as traders await the key catalysts for clear directions. Among them, the US Consumer Price Index (CPI) for December gains major attention.

The quote’s latest inaction could be linked to the US Dollar’s ability to hold the ground despite softer prints of the second-tier data. That said, the US NFIB Business Optimism Index for December dropped to the lowest levels since 2013 if ignoring multiple jitters during the global Covid wave. Further, US Wholesale Inventories also remained unchanged with 1.0% growth for November.

The reason for the US Dollar's strength could also be linked to Federal Reserve Chair Jerome Powell's hesitance at Riksbank's International Symposium on Central Bank Independence in offering further clarity on the US central bank’s monetary policy outlook. However, Federal Reserve Governor Michelle Bowman appeared hawkish while stating that more rate rises are needed to combat high inflation.

On the other hand, European Central Bank's (ECB) governing council member Mario Centeno said on Tuesday the current process of interest rate increases is approaching its end. However, another ECB Governing Council member Isabel Schnabel highlighted the need for a restrictive monetary policy stance.

It’s worth noting that the World Bank’s grim economic forecasts and expectations of upcoming recession also seemed to have probed the EUR/USD traders. That said, the World Bank stated that it expects the global economy to grow by 1.7% in 2023, down sharply from 3% in June's forecast, as reported by Reuters.

Amid these plays, the US 10-year Treasury yields rose 10 basis points (bps) to 3.61% and put a floor under the US Dollar even if Wall Street managed to close on the positive side.

Moving on, EUR/USD traders will pay attention to the risk catalysts amid a dearth of major data/events on the calendar ahead of Thursday’s US Consumer Price Index (CPI) data. However, today’s China inflation numbers may entertain intraday traders.

Technical analysis

EUR/USD portrays a Doji candlestick at the multi-month high, which in turn joins nearly overbought RSI levels to tease sellers unless the quote stays below 1.0760.

-

22:08

GBP/JPY Price Analysis: Doji emerges, threatening to send prices tumbling below 161.00

- The GBP/JPY three-day rally stalled around the 20-DMA and the 161.00 mark.

- Oscillators suggest the GBP/JPY might continue its downtrend, but a decisive break above 161.00 could set the pair to challenge the 200-DMA.

On Tuesday, the GBP/JPY registered solid gains, but the rally stalled around the 20-day Exponential Moving Average (EMA) at 161.08, as sellers leaning into it stepped in, dragging the GBP/JPY lower. Nevertheless, as Wednesday’s Asian session begins, the GBP/JPY is almost unchanged at around 161.02.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY is neutral-to-downward biased. In the last two days, the GBP/JPY has been unable to crack the confluence of two technical indicators: the 20-day EMA and a five-month-old upslope support trendline, which turned resistance around the 161.00 mark. If the GBP/JPY pierces that latter, that would be the first step for higher prices, but its next hurdle would be the January 9 daily high of 161.24. A breach of the latter will clear the space towards the 200-day EMA at 162.50, followed by the 163.00 mark.

If that scenario is to play out, oscillators like the Relative Strength Index (RSI) would need to shift bullish, as it remains in bearish territory, while the Rate of Change (RoC) needs to show that selling pressure is waning. Otherwise, the GBP/JPY downtrend would resume.

Hence, the GBP/JPY first support would be the January 10 swing low of 160.04, followed by essential support levels like this week’s low of 159.30, ahead of 159.00.

GBP/JPY Key Technical Levels

-

22:06

AUD/USD needs to reclaim 0.6900 to avoid further downside ahead of US Inflation

- AUD/USD is looking to claim 0.6900 ahead of the Australian CPI and Retail Sales data.

- Market sentiment seems confusing as S&P500 remains solid while risk-perceived currencies witness correction.

- A decent increment in US Treasury yields has weighed down risk-sensitive currencies.

The AUD/USD pair is struggling to recapture the immediate resistance of 0.6900 in the early Asian session after a gradual decline from 0.6950. The Aussie asset is expected to hog the limelight on Wednesday as the Australian Bureau of Statistics will report the monthly Consumer Price Index (CPI) data and monthly Retail Sales.

S&P500 continued its upside momentum on Tuesday, portraying that the risk profile is highly positive. The US Dollar Index (DXY) has continued to hover below 103.00, which indicates that investors are awaiting the release of the United States inflation data for fresh impetus. It seems that risk-perceived currencies have been impacted by a sheer gain in return derived from US Treasury bonds. The 10-year US Treasury yields climbed to near 3.61%.

As per the consensus, the monthly Australian CPI (Nov) is seen higher at 7.3% vs. the former release of 6.9%. Also, Retail Sales are seen higher at 0.6% against a contraction of 0.2% released earlier. Both catalysts are expected to compel the Reserve Bank of Australia (RBA) to continue hiking interest rates further to tame soaring inflation.

On the United States front, Thursday’s inflation data will remain in the spotlight. The headline CPI (Dec) is expected to continue its declining spree and may drop to 6.5% from the former figure of 7.1%. While the core CPI that excludes oil and food prices might slip to 5.7% from 6.0% reported earlier. A similar kind of outcome is going to delight the Federal Reserve (Fed) ahead.

Meanwhile, hawkish commentary from Fed Governor Michelle Bowman failed to infuse strength into the US Dollar. Reuters reported that Bowman said she expects the rate-setting Federal Open Market Committee "will continue raising interest rates to tighten monetary policy, as we stated after our December meeting," while noting the pace of future actions will be driven by how the economy performs.

-

22:02

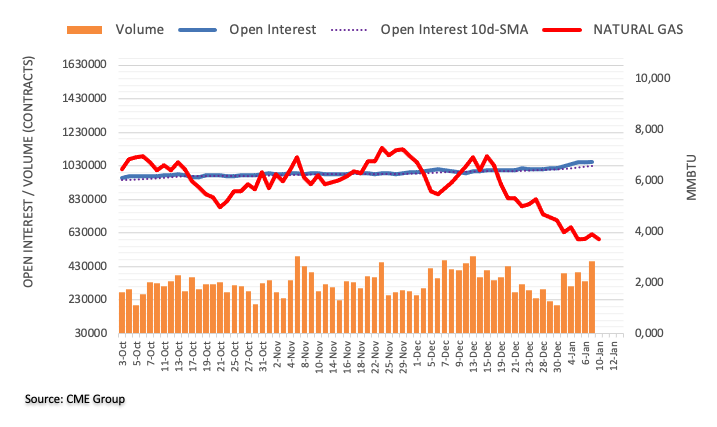

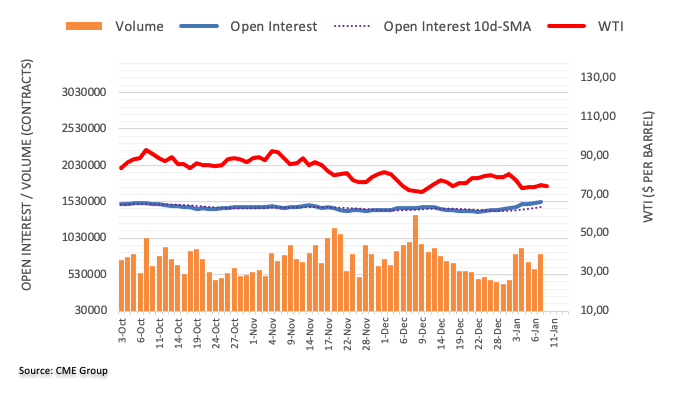

WTI Price Analysis: Bears eye a run towards $7bbls

- The 4-hour chart offers a head and shoulders scenario for WTI.

- We have already seen a break of structure, BoS, then this gives kudos to the downside bias with $70.00 eyed.

West Texas Intermediate, WTI, crude oil rose for a fourth-straight session Tuesday on optimism due to the reopening of China's borders. There is also speculation that the Federal Reserve is on the way to pivoting and this pouts this week's red calendar event, Consumer Price Index, in focus.

The US is expected to report inflation slowed again in December, easing pressure on the Federal Reserve to further slow the economy and therefore create a cheaper US Dollar environment for overseas investors of oil that could come in more demand.

Nevertheless, the technical outlook could be painting a conflicting scenario. Tuesday's price action could be deemed as a liquidity hunt before the next major move to the downside as the following will illustrate:

WTI weekly chart

There is a bearish bias while being on the front side of the weekly trend and the build-up of horizontal resistances.

WTI daily charts

The daily M-formation is compelling as the neckline is resisting bullish advances towards a 50% mean reversion.

Futures charts show the Ww-formation taking shape, so a pull on the price would be expected, at least while below the $76.70s.

WTI H4 chart

The 4-hour chart offers a head and shoulders scenario and given we have already seen a break of structure, BoS, then this gives kudos to the downside bias fore the foreseeable future with $70.00 eyed.

-

21:54

United States API Weekly Crude Oil Stock increased to 14.865M in January 6 from previous 3.298M

-

21:30

EUR/JPY Price Analysis: Creeps above the 20-DMA but stalls around 142.00

- EUR/JPY climbs but stalls around 142.00, the confluence of the figure and the 100-DMA

- The EUR/JPY would be bullish above 142.00; otherwise, it could plunge towards 141.00.

EUR/JPY extends its gains to three consecutive trading days, up by 0.38%, as Wall Street finished Tuesday’s session with solid gains. On its way toward two-week new highs, the EUR/JPY cleared the 20-day Exponential Moving Average (EMA) at 141.53 and is poised to test the 100-day EMA at 142.22. At press time, the EUR/JPY is trading at 141.97.

EUR/JPY Price Analysis: Technical outlook

The cross-currency pair daily chart suggests that buyers remain in charge after clearing the 200-day EMA on January 4, at around 140.16. To continue its uptrend, the EUR/JPY needs to reclaim the 142.00 figure, even though it would face solid resistance around the 100-day EMA. If the EUR/JPY breaks the latter, that will clear the way toward the 50-day EMA at 142.50, followed by the 143.00 mark.

However, if the EUR/JPY’s rally stalls at 142.00, tha can set the pair towards testing the 20-day EMA on the downside around 141.53. Once cleared, the EUR/JPY will slide towards 141.00, followed by a challenge of the 200-day EMA at 140.20.

EUR/JPY Key Technical Levels

-

20:26

NZD/USD bulls are tiring ahead of US CPI as the main event

- NZD/USD bulls eye a test of resistance before Thursday's CPI event that leaves the 0.6470s exposed.

- NZD/USD traders will be looking to the lower timeframes for signs of deceleration from the bulls that could lead to a break of 0.6200.

NZD/USD is heading into the end of the North American session flat on the day so far, giving kudos to the prior technical analysis, NZD/USD Price Analysis: Bears are lurking in critical resistance area.

In forex markets that are treading water in search of catalysts, at the time of writing, NZD/USD is trading at 0.6367, about where it opened on Tuesday but it ranged between a low of 0.6342 and 0.6389 on the day.

US CPI data in focus

In a note at the start of the Asian day on Wednesday, analysts at ANZ Bank said the fact that ''FX markets are treading water ahead of key US CPI data tomorrow night is no real surprise given the amount of emphasis bond markets is putting on that data (as the last major piece of the puzzle before the February Federal Reserve meeting).''

The analysts added that ''markets remain USD centric; and while US CPI has the scope to weaken the USD if the data is weak/softer, one of the Fed’s key messages remains that wherever its policy rate peaks, cuts will be a long way off. That may yet dampen USD headwinds.''

As for the expectations of the CPI data, analysts at TD Securities said that they are looking for core prices to have edged higher on a month-on-month basis (MoM) in December, closing out the year on a relatively stronger footing.

''Indeed, we forecast a firm 0.3% MoM increase, as services inflation likely gained momentum. In terms of the headline, we expect Consumer Price Index (CPI) inflation to register a slight decline on an unrounded basis in December but rounded up to flat MoM, as energy prices offered large relief again. Our m/m projections imply that headline and core CPI inflation likely lost speed on a year-over-year basis in December,'' the analysts added.

For the US Dollar, the analysts said ''unless the core measure significantly surprises to the upside, USD rallies should be sold into. We think the bar is high to compel a reversal of fortune despite the USD tactically stretched.''

NZD/USD technical analysis

Nevertheless, as per the prior technical analysis, NZD/USD is on the backside of the prior bullish trend and could be lining up for a bearish breakout:

That is not to say, however, that a test of resistance cannot happen before Thursday's CPI event. This leaves the 0.6470s exposed. In any case, traders will be looking to the lower timeframes for signs of deceleration from the bulls that could lead to a break of 0.6200 and the 0.6191 recent lows in time to come.

-

20:01

Forex Today: Wait-and-see continues ahead of US inflation figures

What you need to take care of on Wednesday, January 11:

The FX board saw little action on Tuesday amid a scarce macroeconomic calendar and as investors await some central banks’ clarity. US Federal Reserve Chief Jerome Powell and his counterparts from Canada and Japan were on the wires, although as part of a symposium on central bank independence, giving no fresh clues on monetary policies.

The US Dollar advanced throughout the first half of the day but ended it mixed as Wall Street managed to revert pre-opening losses and posted a modest advance. At the same time, US government bond yields advanced. Investors are unwilling to risk much ahead of the release of US inflation data next Thursday.

The EUR/USD pair hovers around 1.0740, while GBP/USD stands at 1.2160, down on the day. Commodity-linked currencies also eased against the greenback, with AUD/USD trading around 0.6890 and USD/CAD in the 1.3420 price zone. Finally, the USD/JPY pair trades marginally higher at around 132.20.

Gold consolidates at around $1,876 a troy ounce, while crude oil ticked higher in the American afternoon. WTI settled at $75.20 a barrel.

The upcoming Asian session will be interesting regarding macroeconomic data, as Australia will publish the November Monthly Consumer Price Index, which is foreseen at 7.3% YoY, up from the previous 6.9%. Also, Australia will unveil November Retail Sales, expected to have increased by 0.6% after falling 0.2% in the previous month. Finally, it is worth adding that China will publish the December Consumer Price Index (CPI) and the Producer Price Index (PPI) for the same month.

Solana price uptrend holding steady as bulls rally 60% on the month

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:54

Gold Price Forecast: XAU/USD bulls taking on critical equal highs ahead of US CPI

- Gold Price is moving up but bears are lurking with the United States Consumer Price Index eyed.

- The US Dollar is establishing after meeting seven-month lows and a rebound could be sparked on a higher Consumer Price Index.

- Gold Price test of equal highs and break thereto could be leading the bulls into a trap.

Gold price is trading higher by some 0.3% at the time of writing, after climbing from $1,867.92 to a high of $1,880.79 on the day so far. Gold price bulls have been in charge for several days as the US Dollar met a seven-month low of 102.9 in the prior sessions.

However, traders in Gold price will be mindful of red news on the calendar on Thursday in the United States Consumer Price Index (CPI) that marries up with a potentially technically bearish schematic on the charts as the following analysis, below illustrates. In essence. the bulls could be running into a trap. As analysts at Brown Brothers Harriman explained, who continue to believe markets are underestimating the Federal Reserve; ''it's hard to reconcile a risk rally with deep US yield curve inversion.''

China has been moving Gold price higher

Additionally, analysts at TD Securities argued that ''the strength in gold prices is inconsistent with the bearish macro backdrop, as highlighted by its diverging relationship with real rates.''

The analysts explained that ''under the hood, relentless buying from China has fueled a squeeze on CTA trend follower positioning over the past months, and has yet to show signs of abating.'' The analysts said ''mysterious large-scale Chinese purchases of gold have single-handedly catalyzed a $150/oz rally.''

''Our tracking of positioning for the top ten traders in China highlights a continued accumulation of gold, with this cohort adding another 2.4 tonnes of notional gold to their net length overnight,'' the analysts at TD Securities added.

''CTA trend followers could still exacerbate upside flows with a break north of the $1900/oz mark likely to spark a sizeable buying program equivalent to nearly +8% of algos' maximum historical position size,'' the analysts note explained further in conclusion.

US Dollar bulls emerge on hawkish Federal Reserve officials

Meanwhile, the US Dollar came under modest selling pressure following the Chair of the Federal Reserve (Fed), Jerome Powell, who made unrelated comments at the start of the US session: ''We are not and will not be a climate policymaker''.

However, the DXY index is trading back around 103.25 and is now flat on the day in the middle of the 103.03/49 range. The US Dollar has been recovering from a seven-month low of 102.9 in the prior session as hawkish remarks from Fed policymakers this week so far have sparked a fresh wave of demand for the US Dollar.

On Monday, San Francisco Fed president Mary Daly noted that she expects interest rates to rise beyond 5% in 2023. On the same day, Raphael Bostic argued policymakers should hike above 5% by early in the second quarter and hold rates there for a long time.

US Consumer Price Index could be a catalyst for Gold price

US Treasury bond yields rose ahead of US December inflation data coming Thursday. The report is expected to say inflation rose at an annualized rate of 6.5% last month, down from 7.1% in November. Analysts at TD Securities explained the following:

''We are looking for core prices to have edged higher on a month-on-month basis (MoM) in December, closing out the year on a relatively stronger footing. Indeed, we forecast a firm 0.3% MoM increase, as services inflation likely gained momentum. In terms of the headline, we expect Consumer Price Index (CPI) inflation to register a slight decline on an unrounded basis in December, but rounded up to flat m/m, as energy prices offered large relief again. Our m/m projections imply that headline and core CPI inflation likely lost speed on a year-over-year basis in December.''

For the US Dollar, the analysts said ''unless the core measure significantly surprises to the upside, USD rallies should be sold into. We think the bar is high to compel a reversal of fortune despite the USD tactically stretched.''

Gold price technical analysis

However, Gold price has been moving sideways over the course of several sessions within a three-day bullish impulse. With that being said, on the lower time frames the Gold price is coiled, leading to the assumption that a breakout is imminent, one way or the other and the CPI data could be the trigger to spark a wave of either demand or supply.

Nevertheless, the following technical analysis of the Gold price arrives at a bearish conclusion, at least for the near term.

Gold price weekly chart, above, shows Gold running towards $1,880. It is yet to be shown as to whether the market can end this week for a fourth consecutive bullish close. If we move down to the daily Gold price chart, we can see prior equal highs finally being tested and ''swept'' as follows:

This phenomenon occurs on a fractal basis whereby the equal levels are ''swept'' only to fuel a reversal in price. After all, most breakouts fail. So, the following will assume a near-term bearish scenario for the Gold price:

(Gold price daily chart zoomed in, above and below)

As it stands, the current Fibonacci scale drawn on the recent bullish Gold price rally puts the 38.2% ratio in line with prior resistance that would be assumed to act as support for a reversal in the Gold price.

Moving down to the Gold price 4-hour chart, the bears will need to break whatever bullish structure there are that ultimately guards the target area some $23/oz below towards $1,850.

-

18:55

USD/CHF Price Analysis: Rises back above 0.9200 as bullish harami emerges

- USD/CHF rebounds around 0.9170s as buyers stepped in, lifting the pair nearby 0.9200.

- For the USD/CHF to extend its losses, it needs a daily close below 0.9200.

- Otherwise, a bullish harami candlestick pattern could exacerbate a USD/CHF rally toward 0.9300.

USD/CHF is trimming Monday’s losses and bounces from daily lows, as sellers failed to gain traction beneath the 0.9200 figure, achieving a daily low of 0.9194 before giving way to buyers. Therefore, the USD/CHF is forming a bullish harami candlestick pattern, pending confirmation. Therefore, the USD/CHF is trading at 0.9234, gaining 0.25%.

USD/CHF Price Analysis: Technical outlook

After failing to extend its losses below 0.9167, the USD/CHF stages a comeback. Formation of a bullish harami could open the door for further upside, though it needs to be confirmed once the USD/CHF reclaims 0.9292. If that scenario is achieved, then the USD/CHF next resistance would be the 20-day Exponential Moving Average (EMA), which tracks bullish/bearishness price action in the pair, at 0.9299. followed by the last week’s high of 0.9409.

However, the Relative Strength Index (RSI) remains at bearish territory, though aiming up, keeping buyer hopeful of higher prices.

As an alternate scenario, the USD/CHF key support levels would be the 0.9200 figure, followed by the January 9 daily low of 0.9167, ahead of the 0.9100 mark.

USD/CHF Key Technical Levels

-

18:14

United States 3-Year Note Auction fell from previous 4.093% to 3.977%

-

18:08

ECB's Centeno tilts hat towards an end of the interest rate rise process

Reuters reported that the European Central Bank's governing council member Mario Centeno said on Tuesday the current process of interest rate increases is approaching its end.

''The central banker, who was answering Portuguese legislators during a committee hearing in Lisbon, added even though inflation may have some resistance in January and February it will resume falling in March.''

Key notes

We are approaching the end of the interest rate rise process.

Inflation may have some resistance in January and February but will fall again in March.EUR/USD update

EUR/USD Price Analysis: Bulls could be running into a trap

EUR/USD is extending the bullish rally on Tuesday and has been trying to print a fresh high for this week's initial balance, taking the US Dollar down to 1.0759 vs. the Single Currency on the bull's quest for a test towards 1.0800. However, as the analysis above hints, a bull trap could be in the making but Thursday's US Consumer Price Index data will be waited for as a potential catalyst as the following daily chart analysis illustrates:

-

17:59

EUR/USD Price Analysis: Bulls could be running into a trap

- EUR/USD bearish W-formation remains is in focus in the build-up to US CPI.

- Bulls could find themselves trapped in trying to break out through recent highs.

EUR/USD is extending the bullish rally on Tuesday and has printed a fresh high for this week's initial balance, taking the US Dollar down to 1.0759 vs. the Single Currency on the bull's quest for a test towards 1.0800. However, as illustrated at the start of the week's technical analysis, EUR/USD Price Analysis: Breakout traders triggered long, bears looking to pounce, we have red news on the calendar on Thursday that marries up with a technically bearish fo5rmation on the charts as the following will illustrate. Bull could be running into a trap and as analysts at Brown Brothers Harriman explained, who continue to believe markets are underestimating the Fed; ''it's hard to reconcile a risk rally with deep US yield curve inversion.''

EUR/USD technical analysis

In the prior analysis, it was explained that EUR/USD rallied towards a key resistance area but has started to slow in its ascent which leaves the focus on signs of distribution for the days ahead.

EUR/USD had reached up to test prior highs of 1.0736 and has moved into a critical resistance area as a potential last stop before the bears move back in. We have seen a bullish open for Tuesday but are yet to see a fresh high. Nevertheless, there is still time until Thursday's red news in the United States Consumer Price Index which leaves scope for a push towards 1.0800, although lacking a significant catalyst, this could be a tall order.

Zoomed in...

(Monday above, Tuesday, so far, below)

If the bears emerge below 1.0790, then the focus will be on signs of distribution again that will ultimately trap the breakout long positions.

The W-formation is supportive of such a thesis given that it is a reversion pattern. EUR/USD would be expected to revert towards the neckline and day's lows of near 1.0637. This could put the trendline support back under pressure and open the risk of a move below 1.0500 and on to test 1.0480, 0.0440 and then 1.0300 that guards 1.0290 and 1.0225 lower down.

In the meantime, bears will be on the lookout for the phenomenon of a sweep of the relatively equal highs towards, say, 1.0800, failures and a break of structure to the downside to change the character from bullish to bearish in the schematic. The lower time frames can be monitored for signs of buying exhaustion over the coming sessions. A long squeeze below 1.0750/36 could then be in order with US Consumer Price Index eyed as a potential catalyst on Thursday for this three-day set-up and bearish opportunity.

-

17:44

USD/CAD hovers around the 20-day EMA around 1.3420s

- USD/CAD struggles for direction as the US Dollar rises, while oil prices capped the upside.

- US Treasury bond yields spurred the uptick in the US Dollar, keeping the USD/CAD above its 20-DMA.

- Thursday’s US Consumer Price Index (CPI) and Jobless Claims would provide fresh impetus to USD/CAD traders.

The USD/CAD registers minuscule losses in the mid-North American session after hitting a daily low of 1.3357. Market sentiment remains fragile, fluctuating, while a late bid in the US Dollar (USD) spurred a jump in the USD/CAD pair. At the time of writing, the USD/CAD is trading at 1.3424, slightly down by 0.14%.

USD/CAD is directionless, influenced by a strong US Dollar, high oil prices

US equities are seesawing amidst a mixed mood. The greenback is pairing some of its losses, according to the US Dollar Index (DXY), which measures the buck’s performance against a basket of peers, up 0.11%, at 103.281, underpinned by high US bond yields. The US 10-year benchmark note rate is climbing nine bps, to 3.630%, after US Federal Reserve (Fed) Chief Jerome Powell’s speech did not acknowledge the monetary policy.

Of late, Federal Reserve Governor Michell Bowman said that continued rate hikes are needed to curb inflation. She added that she’s looking for “convincing evidence” that inflation has peaked and that incoming data will influence her view on the size of interest rate hikes.

On the Canadian side, a staggering labor market report last Friday increased the likelihood of a 25 bps rate hike, according to TD Securities analysts. “Today’s report leaves the Bank of Canada in an uncomfortable position.” They added that deceleration in wages would not satisfy Bank of Canada’s (BoC) policymakers and stated, “we now look for the Bank to hike another 25bps to 4.50% in January. We expect that 4.50% will be the BoC’s terminal rate for this cycle.”

In the meantime, a jump in crude oil prices is putting a lid on the USD/CAD recovery as WTI climbs 0.86%, exchanging hands around $75.44 per barrel.

Ahead of the week, the US economic docket will feature the release of the Consumer Price Index (CPI) for December, alongside unemployment claims, on Thursday. An absent Canadian economic calendar would leave USD/CAD traders adrift to US Dollar dynamics.

USD/CAD Key Technical Levels

-

17:35

Fed's Bowman's hawkish comments: More rate rises needed to combat high inflation

Federal Reserve Governor Michelle Bowman said on Tuesday the US central bank will have to raise interest rates further to combat high inflation. Her comments follow a slew of hawkish remarks from prior Fed speakers this week.

"Inflation is much too high," she said.

"We have a lot more work to do" she added in prepared remarks for a speech to a banking group in Florida.

Reuters reported that Bowman said she expects the rate-setting Federal Open Market Committee "will continue raising interest rates to tighten monetary policy, as we stated after our December meeting," while noting the pace of future actions will be driven by how the economy performs.

Key remarks

"Once we achieve a sufficiently restrictive federal funds rate, it will need to remain at that level for some time in order to restore price stability, which will in turn help to create conditions that support a sustainably strong labor market," Bowman said.

"I take this as a hopeful sign that we can succeed in lowering inflation without a significant economic downturn."

She added that "while the effects of monetary policy tightening on the job market have generally been limited so far, slowing the economy will likely mean that job creation also slows."

Bowman said that for her to know inflation has eased enough for the Fed to stop hiking rates, she will "be looking for compelling signs that inflation has peaked and for more consistent indications that inflation is on a downward path."

US Dollar update

The US Dollar came under modest selling pressure following the Chair of the Federal Reserve, Jerome Powell, who made unrelated comments at the start of the US session: ''We are not and will not be a climate policymaker''.

Meanwhile, the DXY index is trading around 103.25 and flat on the day in the middle of the 103.03/49 range. However, it has been recovering from a seven-month low of 102.9 in the prior session as hawkish remarks from Fed policymakers this week so far have sparked a fresh wave of demand for the US Dollar.

San Francisco Fed president Mary Daly noted yesterday that she expects interest rates to rise beyond 5% in 2023. On the same day, Raphael Bostic argued policymakers should hike above 5% by early in the second quarter and hold rates there for a long time.

-

16:12

USD/MXN Price Analysis: Mexican peso hits its highest level in a month, looking at 19.00

- US Dollar remains weak against Emerging Markets currencies.

- USD/MXN testing 2022 lows near 19.10, closer to 19.00.

- Bearish pressure to alleviate above 19.50

The USD/MXN is falling again on Tuesday as it continues to move with a bearish bias, approaching the 19.00 psychological area. Earlier today it bottomed at 19.08, the lowest level in a month and slightly above the 2022 low it hit in November.

The bias is bearish in USD/MXN but it is facing a strong resistance area between 19.10 and 19.00. Technical indicators are near oversold readings which could suggest some consolidation ahead before a break lower. A candidate for the range is the 19.00-19.30 band or a wider one between 19.00 and 19.50.

The strength of the Mexican Peso is likely to remain intact while USD/MXN trades under 19.50. The initial resistance level is seen at 19.30. Then comes the 20-day Simple Moving Average, currently at 19.47 and then the 19.50 area. A break above 19.60 would point to more gains for the US Dollar, targeting 19.80.

USD/MXN daily chart

-638089631429859377.png)

-

16:07

GBP/USD Price Analysis: Stalls around 1.2200, aims toward 1.2150s

- GBP/USD registers some decent losses after failing to climb above 1.2200.

- For the GBP/USD to extend its gains, it needs to reclaim 1.2200, to pose a challenge of 1.2300.

The Pound Sterling (GBP) trims some of its Monday gains vs. the US Dollar (USD), drops below 1.2200, and aims toward the 1.2150 area after hitting a daily high at around 1.2197. Hence, the GBP/USD falls 0.17% and is trading at 1.2161.

GBP/USD Price Analysis: Technical outlook

On Tuesday, the GBP/USD is edging toward the 200-day Exponential Moving Average (EMA) at 1.2107 after failing to decisively crack the 1.2200 figure. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that buying pressure is easing. So, chances of the GBP/USD’s testing the 200-day EMA, albeit slim, remain.

For that scenario to play out, the GBP/USD needs further to extend its losses and clear the 200-day EMA. Once done, the next hurdle would be 1.2100, followed by the 20-day EMA at 1.2074, and then the 1.2000 mark.

Otherwise, if the GBP/USD turns positive, the first resistance would be the 1.2200 mark. A breach of the latter will expose the December 19 daily high of 1.2242, followed by the 1.2300 mark.

GBP/USD Key Technical Levels

-

16:04

Gold Price Forecast: XAU/USD could skyrocket to $2,300 on a move beyond highs at $2,070/2,075 – Credit Suisse

Gold has started 2023 strongly. Strategists at Credit Suisse do not rule out a strong surge to the $2,300 mark.

Break below $1,729 to turn the risk back lower

“We look for further tactical gains to test the 61.8% retracement of the 2022 fall and June 2022 high at $1,876/96, which ideally caps for now. Should strength directly extend though we see resistance next at the 78.6% retracement and April 2022 high at $1,973/1,998.”

“Whilst on a big picture basis this strength is seen as a rally within a broader long-term sideways range, should the rally ever extend above the record highs from 2020 and 2022 at $2,070/2,075, this would be seen to mark a significant and long-term break higher, opening up we think $2,300 and likely beyond.”

“Support is seen initially at $1,824.50, then the 200DMA at $1,780. Below $1,729 though is needed to warn the broader risk may be turning lower again.”

-

15:49

EUR/GBP to inch higher towards 0.90 over coming months – Rabobank

EUR/GBP has paid little heed to the news related to Northern Ireland this week. Economists at Rabobank retain a six-nine month forecast of EUR/GBP 0.90.

UK backdrop remains sour

“Even though, this week’s news provides a glimmer of hope for the outlook regarding the Northern protocol and thus for an improvement in investor sentiment, as things stand that UK backdrop remains sour.”

“Insofar as UK fundamental remains characterised by recession, high inflation, low investment growth and weak productivity we continue to expect EUR/GBP to edge towards 0.90 on a six to nine-month view. That said, we will be continuing to watch developments surrounding the protocol closely.”

-

15:38

EUR/GBP rebounds from two-week lows toward 0.8850

- ECB officials continue to speak about higher interest rates.

- Euro is supported by higher EZ bond yields.

- EUR/GBP approaching again critical resistance area of 0.8850.

The EUR/GBP is rising for the second day in a row, after hitting on Monday the lowest level in two weeks. The cross climbed from 0.8769 and peaked on Tuesday at 0.8846, supported by a stronger Euro across the board.

Euro supported by yields

The Euro is up versus the Pound and the Swiss Franc on Tuesday. Higher Eurozone bond yields are helping the common currency. The German 10-year bond yield stands at 2.29% the highest in two days up 2.75% for the day.

European Central Bank officials continue to speak with a hawkish tone while in the UK, concerns about the health of the economy remain intact. UK fundamentals are on debate at the Bank of England’s Monetary Policy Committee.

“As UK fundamental remains characterised by recession, high inflation, low investment growth and weak productivity we continue to expect EUR/GBP to edge towards 0.90 on a 6 to 9 month view. That said, we will be continuing to watch developments surrounding the protocol closely”, explained analysts at Rabobank.

The chart show risks titled to the upside in EUR/GBP after the cross was able to hold above the 20-day Simple Moving Average (today at 0.8785). The upside remains limited by the critical resistance area of 0.8850. A daily close well above 0.8850 should open the doors to more gains in the short-term.

Technical levels

-

15:31

USD/BRL can hover around 5.30 despite insurrection in Brasilia – Wells Fargo

Over the weekend, supporters of former President Jair Bolsonaro stormed Brazil's capital. But insurrection in Brasilia does not change Wells Fargo’s outlook.

Riots unlikely to disrupt Brazil

“While political risk is typically elevated in Brazil and could weigh on local asset prices, we believe Brazil's ‘January 6 moment’ will not have a long-lasting impact on local financial markets nor the economy.”

“Despite more elevated political risk, we maintain our view that the USD/BRL exchange rate can hover around 5.30 by the end of Q1-2023 and that the Real can strengthen by the end of this year toward 5.00.”

“We also believe this past weekend's events will not alter the course of Brazilian Central Bank (BCB) monetary policy, and we continue to believe policymakers will begin an easing cycle in Q3 of this year. In addition, our base case scenario for a mild and modest economic recession by the middle of this year is still intact.”

-

15:17

USD/JPY fluctuates ahead of 132.00 on an upbeat mood, soft USD

- The USD/JPY seesaws nearby the 132.00 figure though it remains unable to reclaim it.

- Traders’ mood improved as US equities turned green, while the US Dollar continued to edge lower.

- USD/JPY Price Analysis: To remain sideways around 132.00 ahead of Thursday’s US CPI report.

The USD/JPY clings to gains following the release of the US Federal Reserve (Fed) Chair Jerome Powell’s Speech at Sweeden Riksbank, which did not acknowledge monetary policy, but rather focused on central bank independence. Therefore, risk appetite continues to improve as Wall Street futures shed some losses. At the time of writing, the USD/JPY is trading at 132.06, registering modest gains of 0.07%.

USD/JPY seesaws around 131.90s on mixed sentiment

Investors’ mood was negative ahead of the Fed’s Chair Powell speech. According to newswires, equities pullback was attributed to Fed’s Bostic and Daly comments on Monday, seen as hawkish. Nevertheless, the financial market did not respond to a “reprice” of a less hawkish Fed, meaning that US Treasury bond yields continued to fall, ignoring Fed officials’ comments.

Data-wise, an absent US economic docket keeps the USD/JPY trading unchanged. However, comments by Fed policymakers emphasizing the central bank’s resolution to curb inflation slightly weighed on investors’ mood. Fed’s Daly and Bostic added that rates would need to be above the 5% range and would need to be held higher for longer, at least until 2024.

As mentioned above, the odds for a 25 bps rate hike by the Federal Reserve remain at 77.2%, while for 50 bps stand at 22.8%.

Earlier in the Asian session, a hot Tokyo CPI print on an annual basis, around 4%, failed to underpin the Japanese Yen (JPY). So, in the short term, further USD/JPY upside could be expected.

The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, including the Japanese Yen (JPY), drops 0.06%, at 103.244. in the meantime, the US 10-year Treasury bond yield, which positively correlates with the USD/JPY, is gaining almost four bps, up at 3.573%, underpinning the USD/JPY.

USD/JPY Price Analysis: Technical outlook

Therefore, the USD/JPY bias remains neutral-to-downwards, though, in the near term, it could remain sideways ahead of Thursday’s US inflation report. For the USD/JPY to shift bullish, it would need a daily close above the 20-day Exponential Moving Average (EMA) above 133.38, which could underpin the major to test the 200-day EMA at 134.74. Otherwise, a fall beneath January’s 9 daily low of 131.30 could open the door for a test of the YTD low of 129.50.

-

15:09

USD/CAD: Break below 1.3380 to trigger more losses to the mid-1.33 zone – Scotiabank

The USD/CAD pair is trading unchanged in the session. Economists at Scotiabank believe that the cross could sustain losses on a dip under the 1.3380 mark.

Key support is located at 1.3220

“We spot intraday resistance at 1.3420 and support at 1.3380; weakness below 1.3380 should trigger more USD losses to the mid-1.33 zone.”

“Key support remains at 1.3220.”

“Resistance is located at 1.3510/15.”

See – USD/CAD: Support area at 1.3225/03 to serve as a firm floor to avoid further weakness – Credit Suisse

-

15:03

United States IBD/TIPP Economic Optimism (MoM) declined to 42.3 in January from previous 42.9

-

15:00

United States Wholesale Inventories unchanged at 1% in November

-

14:53

EUR/USD: Further upside appears limited around 1.0760

- EUR/USD navigates a narrow range amidst vacillating markets.

- The dollar also trades in an erratic fashion despite higher yields.

- Markets’ attention gyrates to Thursday’s US CPI release.

EUR/USD manages well to keep the trade in the area of multi-month peaks around 1.0740 so far on Tuesday.

EUR/USD remains supported above 1.0700

The generalized absence of volatility in the global markets motivates EUR/USD to alternate gains with losses above 1.0700 the figure, while bulls see their aspirations somewhat limited around 1.0760 for the time being.

The modest uptick in the pair comes in line with the equally humble advance in the German 10-year Bund yields, which add to Monday’s gains near 2.30%.

Earlier in the session, Industrial Production in France expanded 0.2% MoM in November, whereas the NFIB Business Optimism Index dropped to 89.8 in December.

Later in the US docket comes the IBD/TIPP Economic Optimism Index followed by Wholesale Inventories.

What to look for around EUR

EUR/USD has embarked on a strong recovery and has already retaken the key barrier at 1.0700 the figure and beyond.

In the meantime, the European currency is expected to closely follow dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: France Industrial Production (Tuesday) – France final Inflation Rate, Germany Full Year GDP Growth, MEU Balance of Trade/Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.05% at 1.0733 and faces the next resistance level at 1.0760 (monthly high January 9) followed by 1.0773 (monthly high June 27) and finally 1.0786 (monthly high May 30 2022). On the downside, the breach of 1.0496 (monthly low January 6) would target 1.0443 (weekly low December 7) en route to 1.0398 (55-day SMA).

-

14:49

World Bank lowers 2023 global growth forecast to 1.7% from 3% in June

The World Bank announced on Tuesday that it expects the global economy to grow by 1.7% in 2023, down sharply from 3% in June's forecast, as reported by Reuters.

Key takeaways

"World Bank forecasts US 2023 GDP growth at 0.5% vs 2.2% in June forecast; weakest non-recession performance since 1970."

"Growth outlook dimmed by effects of monetary tightening, slowdowns in US, Eurozone, China and Ukraine war spillovers."

"World Bank sees Eurozone GDP flat in 2023 vs 1.9% growth in June forecast due to soaring energy costs, rising borrowing costs."

"Investment in emerging market and developing economies projected to grow at 3.5% pace through 2024, half the pace of previous two decades."

"China's 2022 growth slowed to 2.7% due to COVID lockdowns but will recover to 4.3% for 2023."

Market reaction

This headline doesn't seem to be having a noticeable impact on risk sentiment. As of writing, the S&P 500 Index was virtually unchanged on the day at 3,890.

-

14:38

USD/MXN: Scope to extend the gradual decline to the 2017 low at 17.4395 – Credit Suisse

USD/MXN is seeing a gradual grind lower, which analysts at Credit Suisse think is likely to extend to 18.5155/17.4395.

Key resistance aligns at 19.9131/9482

“With the USD having peaked, we think the broader risk is likely to stay mildly lower during Q1 of 2023 and we thus see scope to extend the gradual decline to the 2020 low at 18.5155, where we think a potentially tougher support is likely to be found. Should this also break, next key support is identified at 17.4395 the 2017 low.”

“Initial key resistance is located at the recent high and 200DMA at 19.9131/9482, though only above the downtrend from late 2021 at 20.2145 would instead indicate that a more rangebound phase is emerging.”

-

14:27

USD Index treads water above 103.00 amidst a cautious tone

- The index lacks conviction to move on either direction on Tuesday.

- US yields regain some composure and bounce off recent lows.

- No comments on monetary policy from Powell in Sweden.

The greenback, in terms of the USD Index (DXY) keeps the inconclusive performance well in place following the opening bell in Wall St. on Tuesday.

USD Index remains prudent ahead of key releases

The index attempts to leave behind part of the recent steep pullback, although the absence of catalysts coupled with rising prudence in light of the release of US inflation figures later in the week keeps the price action subdued for the time being.

In the meantime, DXY navigates a tight range amidst a decent rebound in US yields across the curve, which manage to halt a multi-session negative streak at the same time.

In the calendar, the NFIB Business Optimism Index eased to 89.8 in December (from 91.9). Later in the NA session, Wholesale Inventories and the IBD/TIPP index area also due.

What to look for around USD

So far, the greenback remains under pressure in the low-103.00s against the backdrop of alternating risk appetite trend and pre-CPI cautiousness.

The mixed results from the US Nonfarm Payrolls for the month of December (Friday) seem to have reignited the idea of a probable pivot in the Fed’s policy in the next months, which comes in contrast to the message from the latest FOMC Minutes, where the Committee advocated the need to remain within a restrictive stance for longer, at the time when it ruled out any interest rate reduction for the current year.

Furthermore, the tight labour market, still elevated inflation and the resilient economy are also seen supportive of the firm message from the Federal Reserve and its hiking cycle.

Key events in the US this week: Wholesale Inventories, Fed’s Powell (Tuesday) – MBA Mortgage Applications (Wednesday) – Inflation Rate, Initial Jobless Claims, Monthly Budget Statement (Thursday) – Flash Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is losing 0.02% at 103.15 and the breach of 102.94 (monthly low January 9) would open the door to 101.29 (monthly low May 30) and finally 100.00 (psychological level). On the upside, the next hurdle comes at 105.63 (monthly high January 6) followed by 106.35 (200-day SMA) and then 107.19 (weekly high November 30).

-

14:26

EUR/USD to target 1.1000/50 on a consistent break above 1.0750 – Scotiabank

EUR/USD holds near mid-1.07s. A break above here would clear the way towards the 1.10 area, economists at Scotiabank report.

Intraday support aligns 1.0690/00

“The mild winter and China’s re-opening efforts are trimming economic pessimism and prompting an improvement in expectations for the economic outlook for the Eurozone this year which will encourage the hawks and provide some solid background support for the EUR.”

“Short-term trend oscillators are leaning bullish, suggesting ongoing upside pressure on spot.”

“A clear and consistent break above 1.0750 targets additional EUR gains to 1.1000/50.”

“Intraday support is 1.0690/00.”

-

14:18

Powell speech: We are not and will not be a climate policymaker

While speaking at Riksbank's International Symposium on Central Bank Independence, FOMC Chairman Jerome Powell said the Federal Reserve's independence from political influence is central to its ability to battle inflation, as reported by Reuters. Powell further noted that this independence requires the Fed to stay out of issues like climate change that are beyond its congressionally-established mandate.

"We are not, and will not be, a climate policymaker," Powell reiterated.

Additional takeaways

"Fed must resist the temptation to broaden its scope to address other important social issues."

"Taking on such goals would undermine our independence."

"Fed has narrow responsibilities regarding climate-related financial risks."

"Without congressional laws, inappropriate for us to use our monetary or supervisory tools to promote a greener economy."

"Also inappropriate for us to use our tools to achieve other climate-based goals."

Market reaction

The US Dollar came under modest selling pressure following these comments. As of writing, the US Dollar Index was virtually unchanged on the day at 103.15.

-

14:12

USD/CAD: Support area at 1.3225/03 to serve as a firm floor to avoid further weakness – Credit Suisse

USD/CAD looks weak in the near-term, but analysts at Credit Suisse look for a floor at 1.3225/03.

Rise above the 1.3661/3705 to put the pair back into more neutral territory

“Whilst we see scope for near-term losses towards the key support area at 1.3225/03, we look for this level to serve as a firm floor to avoid further weakness. Should this take place though, next key support would be located at the 200DMA at 1.3150 and further below at the uptrend from 2021 at 1.2762.”

“Resistance is seen at 1.3467/82 initially, though a rise above the 1.3661/3705 is needed to put the market back into more neutral territory.”

-

13:55

United States Redbook Index (YoY) down to 5.3% in January 6 from previous 10.2%

-

13:52

AUD/USD Price Analysis: Corrects from multi-month peak, bullish potential intact

- AUD/USD meets with a fresh supply and snaps a two-day winning streak to a multi-month top.

- A goodish USD recovery and a softer risk tone turn out to be key factors weighing on the Aussie.

- The technical setup favours bulls and supports prospects for the emergence of some dip-buying.

The AUD/USD pair comes under some selling pressure on Tuesday and moves further away from its highest level since late August, around the 0.6945 area touched the previous day. Spot prices drop to a fresh daily low, around the 0.6860 region during the early North American session and for now, seem to have snapped a two-day winning streak.

A combination of factors assists the US Dollar to stage a goodish rebound from a seven-month low set on Monday, which, in turn, is seen weighing on the AUD/USD pair. A goodish pickup in the US Treasury bond yields, amid some repositioning trade ahead of Fed Chair Jerome Powell's speech, acts as a tailwind for the buck. Apart from this, a generally weaker tone around the equity markets further benefits the greenback's relative safe-haven status and contributes to driving flows away from the risk-sensitive Aussie.

From a technical perspective, the overnight positive move validated the post-NFP breakout through the 0.6890-0.6900 supply zone and the very important 200-day SMA. Adding to this, positive oscillators on the daily chart support prospects for the emergence of some dip-buying around the AUD/USD pair. Hence, any subsequent pullback is more likely to find decent support near the 0.6840 region (200 DMA). That said, a convincing break below might prompt some technical selling and set the stage for deeper losses.

The AUD/USD pair could then accelerate the accelerate the fall towards the 0.6800 mark. The latter should act as a strong base for the major, which if broken decisively will negate the near-term positive outlook and shift the bias in favour of bearish traders. The subsequent fall has the potential to drag spot prices towards the next relevant support near the 0.6725-0.6720 area en route to the 0.6700 round figure.

On the flip side, the 0.6900-0.6910 area should now act as an immediate strong hurdle ahead of the overnight swing high, around the 0.6945 region. Some follow-through buying should allow the AUD/USD pair to aim back to reclaim the 0.7000 psychological mark. The positive momentum could get extended further towards an intermediate resistance near the 0.7045-0.7050 zone en route to the 0.7100 round-figure mark.

AUD/USD daily chart

Key levels to watch

-

13:26

EUR/USD Price Analysis: Further upside targets the 1.0773/86 band

- EUR/USD seems to have met some resistance near 1.0760.

- Further upside could see the June 2022 high retested.

EUR/USD falters just ahead of Monday’s monthly peaks around 1.0760 on Tuesday.

In case bulls remain in control, the pair should surpass the January high at 1.0760 (January 9) and then attempt a move to the June 2022 high at 1.0773 (June 27) followed by the May 2022 top at 1.0786 (May 30).

In the meantime, further gains remain in store for the pair while above the 200-day SMA at 1.0309.

EUR/USD daily chart

-

13:12

Gold Price Forecast: XAU/USD to extend its rally on slowing inflation – Commerzbank

Gold price climbed to $1,880 at the start of the week, thereby posting an eight-month high. The US inflation data for December will be released on Thursday and could lend further tailwind to the yellow metal, economists at Commerzbank report.

Inflation rate to have fallen from 7.1% to 6.5%

“US inflation data could lend further tailwind to the Gold price given that the slowing of inflation that has been observed since the summer is likely to have continued last month.”

“The market expects the inflation rate to have fallen from 7.1% to 6.5% – our economists even envisage a drop to 6.4%. The last time it was any lower was more than a year ago. That said, there is already a substantial discrepancy between the expectation of market participants regarding the Fed’s monetary policy this year and what the Fed is continuing to communicate.”

-

13:03

Silver Price Analysis: XAG/USD seems vulnerable to retest $23.10 support zone

- Silver remains under some selling pressure for the second successive day on Tuesday.

- The intraday technical setup supports prospects for a slide back to the $23.00 mark.

- A sustained strength beyond the $24.00 mark will set the stage for additional gains.

Silver extends the previous day's pullback from a three-day high and continues losing ground for the second successive day on Tuesday. The white metal remains depressed heading into the North American session and is currently placed just below the mid-$23.00s.

Looking at the technical picture, the recent bounce from the vicinity of the $23.00 mark falters near a two-month-old ascending trend line support breakpoint, now turned resistance. A subsequent slide back below the 100-period SMA on the 4-hour chart favours intraday bearish traders. Furthermore, oscillators on hourly charts have again started gaining negative traction and support prospects for further losses.

Hence, some follow-through weakness back towards testing last week's swing low, around the $23.10 area, looks like a distinct possibility. This is closely followed by the $23.00 round figure, below which the XAG/USD could slide towards the $22.60-$22.55 region. The next relevant support is pegged near the $22.10-$22.00 horizontal zone, which if broken decisively will be seen as a fresh trigger for bears.

On the flip side, the daily peak, around the $23.70 region, now seems to act as an immediate hurdle ahead of the $24.00-$24.10 ascending trend-line support-turned-resistance. A sustained strength beyond might shift the bias in favour of bullish traders. The XAG/USD might then surpass an intermediate hurdle near the $24.25 zone and test the multi-month high, around the $24.50-$24.55 region set last week.

Some follow-through buying should pave the wave for a further near-term appreciating move towards reclaiming the $25.00 psychological mark for the first time since April 2022.

Silver 4-hour chart

Key levels to watch

-

12:54

S&P 500 Index to remain in a bear trend whilst below 4101 – Credit Suisse

S&P 500 has failed to surpass the 4000 area. Economists at Credit Suissse expect the index to remain under bearish pressure.

Sustained move below 3698/3674 can reinvigorate the bear market

“S&P 500 has been capped as looked for at its 200DMA and downtrend from the beginning of 2022, currently seen at 3995 and 4075 respectively, with further key resistance seen at the 4101 December ‘reversal week’ high. Whilst we suspect we can see some further range-trading beneath here the overall trend will still stay seen bearish whilst below 4101.”

“A close above 4101 would be seen to turn the trend neutral and open the door to strength back to 4300/4325.”

“Key price and 200-week average support is seen at 3698/3674, a sustained move below which can reinvigorate the bear market to clear the way for a fall back to 3505/3492 and eventually we think 3234/3195 later in the year.”

-

12:41

German Government Adviser: Inflation in Germany has probably peaked

German government economic adviser Monika Schnitzer said on Tuesday that inflation in Germany has probably peaked amid falling global energy prices, as reported by Reuters.

Commenting on the European Central Bank's (ECB) policy outlook, "if nothing happens, there is no need for the ECB to raise the interest rate by more than 50 basis points in the next meeting," Schnitzer noted.

Market reaction

These comments don't seem to be having a noticeable impact on EUR/USD. As of writing, the pair was trading virtually unchanged on the day at 1.0728.

-

12:30

EUR/GBP to enjoy a deeper recovery in the long-term sideways range – Credit Suisse

EUR/GBP is expected to steadily strengthen within its long-term sideways range, in the view of economists at Credit Suisse.

Resistance is located at 0.8904/08

“The completion of a near-term base above 0.8823/29 is expected to provide the platform for a deeper recovery in the long-term sideways range.”

“Resistance is seen at 0.8904/08 initially, above which can see strength back to 0.9100/14 and potentially 0.9269/92.”

“Below 0.8690 is needed to see the base neutralized.”

-

12:26

USD Index Price Analysis: Extra decline could see the 101.30 zone retested

- Price action around the index looks unconvincing on Tuesday

- Persistent weakness should open the door to a drop to 101.30.

DXY trades in an inconclusive tone in the low-103.00s on Tuesday.

A drop below the so far January low at 102.94 (January 9) could prompt the May 2022 low around 101.30 (May 30) to re-emerge on the horizon ahead of the psychological 100.00 level.

In the meantime, while below the 200-day SMA at 106.35 the outlook for the index should remain tilted to the negative side.

DXY daily chart

-

12:21

US Dollar vulnerable to further weakness in the near-term – MUFG

The US Dollar Index hit an intra-day low yesterday of 102.94. In the view of economists at MUFG Bank, the greenback is prone to suffer further losses barring strong US inflation data.

Fed policy outlook in focus