Notícias do Mercado

-

22:00

New Zealand: RBNZ Interest Rate Decision, 3.25% (forecast 3.25%)

-

20:01

Dow 16,835.05 -110.87 -0.65%, Nasdaq 4,325.79 -12.21 -0.28%, S&P 500 1,942.76 -8.03 -0.41%

-

19:00

U.S.: Federal budget , May -130 (forecast -142.8)

-

17:04

European stocks close: stocks declined due to losses in the airline sector

Stock indices declined due to losses in the airline sector. Deutsche Lufthansa AG shares dropped at fastest pace since September 2001.

The World Bank’s cut of the global economic growth forecast also weighed on stock markets. The World Bank lowered its global growth forecast to 2.8% from an earlier estimate of 3.2% due to a weaker outlook for the U.S., Russia and China.

The Office for National Statistics released the U.K. labour market data. The U.K. unemployment rate fell to 6.6% in the three months to April from 6.8% in the previous three months. That was the lowest level since early 2009. Analysts had expected a decline to 6.7%.

Deutsche Lufthansa AG shares dropped 14% after the company lowered its earnings forecasts for this and next year.

Vallourec SA, a steel pipe producer, slid 11% after lowering its earnings forecast for 2014.

Airbus Group shares declined 3.1% after Emirates cancelled an order for 70 A350 jets.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,838.87 -34.68 -0.50%

DAX 9,949.81 -78.99 -0.79%

CAC 40 4,555.11 -39.89 -0.87%

-

16:40

Oil rose

Brent crude held its gain after OPEC kept its production target unchanged and West Texas Intermediate was little changed in New York amid speculation that U.S. inventories dropped last week.

Futures rose 0.3 percent in London as OPEC ministers in Vienna left the group’s output ceiling unchanged at 30 million barrels a day. Crude stockpiles probably dropped by 2 million barrels last week to 387.5 million, a Bloomberg News survey shows before Energy Information Administration data today. In Iraq, a breakaway al-Qaeda group took control of the city of Mosul and there were conflicting reports about the situation in Baiji, home to the nation’s biggest refinery.

“There were no surprises with OPEC but the deteriorating situation in Iraq could start to have an effect at the margins,” Michael Hewson, a London-based market analyst at CMC Markets, said by e-mail.

Brent for July settlement gained 37 cents to $109.89 a barrel on the London-based ICE Futures Europe exchange at 1:15 p.m. London time. Prices have decreased 0.8 percent this year.

WTI for July delivery was at $104.46 a barrel in electronic trading on the New York Mercantile Exchange, up 11 cents. The volume of all futures traded was about 19 percent below the 100-day average for the time of day. The European benchmark crude traded at a premium of $5.50 to WTI. The spread narrowed for a third day yesterday to close at $5.17.

-

16:29

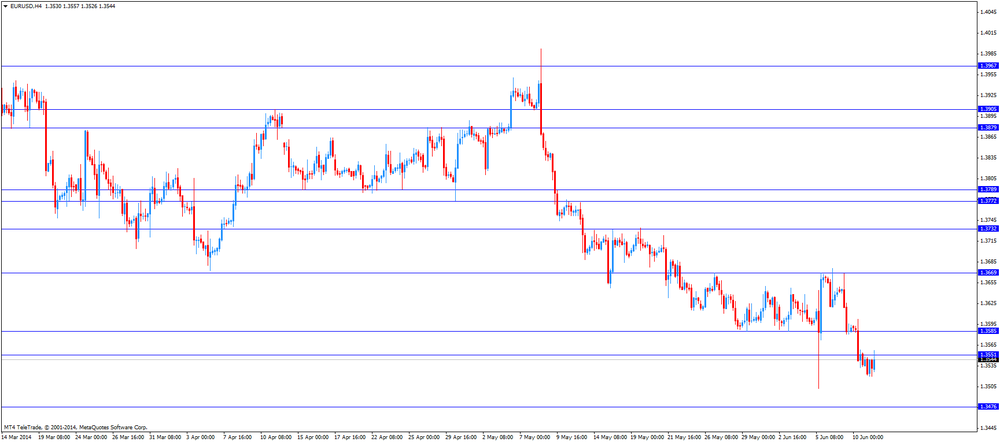

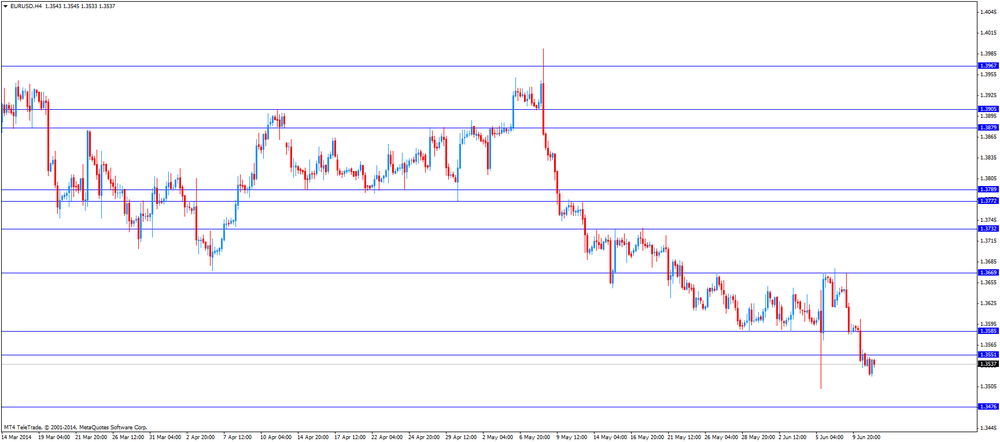

Foreign exchange market. American session: the euro traded mixed against the U.S. dollar

The U.S. dollar traded lower against the most major currencies, but the U.S. currency is still supported by higher U.S. Treasury yields. The yield on the U.S. 10-year Treasuries climbed to 2.64% on Tuesday. That was the highest yield since last month.

The euro traded mixed against the U.S. dollar. The euro suffers due to bond yield gap between some euro area government bonds and U.S. Treasuries. While the currency in the Eurozone is to remain permanently cheap, the first interest rate hike by the Fed in the United States and by the Bank of England in the U.K. is more likely.

The European Central Bank cut its interest rate last Thursday. The ECB reduced its deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s first major central bank to use a negative rate. The deposit rate of -0.10% means that commercial bank will be charged for holding their reserves. This measure should spur commercial banks to ramp up lending.

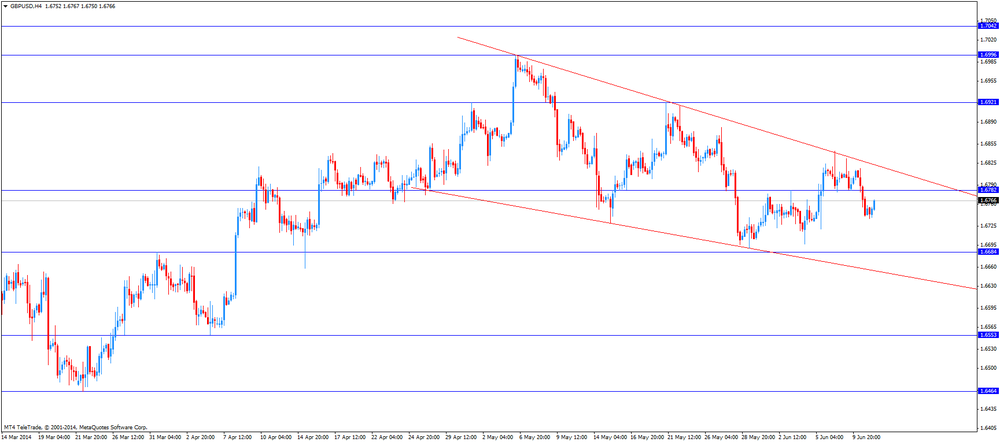

The British pound increased against the U.S. dollar due to the strong labour market data in the U.K. The U.K. unemployment rate fell to 6.6% in the three months to April from 6.8% in the previous three months. That was the lowest level since early 2009. Analysts had expected a decline to 6.7%.

Jobless claims (claimant count) declined by 27,400 in May, compared with a forecast for a decline of 25,000 people. April’s figure was revised to a decrease of 28,400 from 25,100.

Weekly earnings increased by 0.7% in the three months to April, missing expectations for a 1.2% gain, after a 1.7% rise in the previous three months. The growth of wages is slower than inflation in the U.K. The inflation rate in the UK was 1.8% in April.

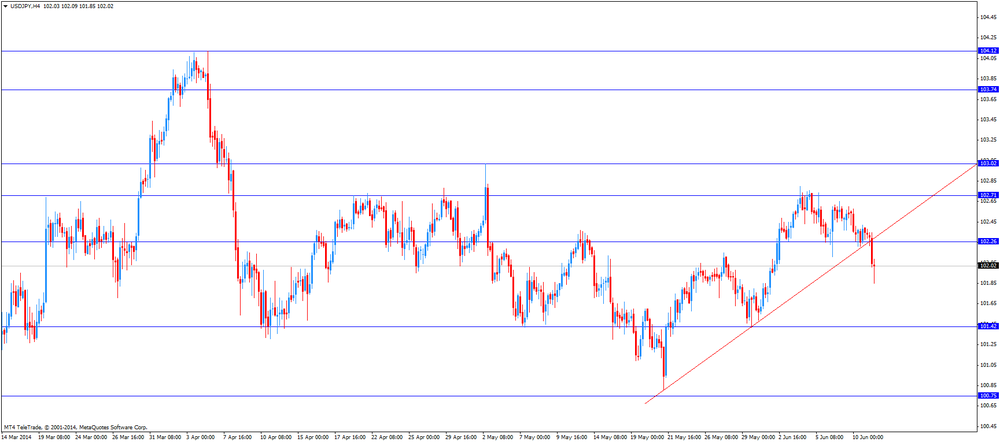

The Japanese yen rose against the U.S. dollar due to expectations that the Bank of Japan will not expand its stimulus measures at its meeting this week.

The Canadian dollar rose against the U.S. dollar in the absence of any economic data.

In the overnight trading session, the BSI manufacturing index was released in Japan. . Japan's BSI manufacturing index for the second quarter declined to 13.9 points from 12.7 in the first quarter, missing expectations for a rise to 14.1.

The New Zealand dollar rose against the U.S dollar in the absence of any major economic reports. The kiwi was supported by expectations the Reserve Bank of New Zealand (RBNZ) will raise interest rates again later in the day. Investors expect the RBNZ will hike its interest rate by 0.25% to 3.25%.

The Australian dollar climbed to 1-month highs against the U.S. dollar due to the better-than-expected consumer sentiment data from Australia. The Westpac consumer confidence in Australia increased 0.2% in June, after a 6.8% decline in May.

-

16:20

Gold is going up against lowering growth forecasts by the World Bank

Gold prices rose slightly after the World Bank cut growth forecast for the world economy, as investors increased demand for the precious metal as a safe-haven.

World Bank (WB) lowered its growth forecast of global gross domestic product (GDP) in 2014 from 3.2 to 2.8 percent. This is due to the conflict and the Ukrainian unusually harsh winter in the United States. So, if in January estimate of the growth of the world economy grew by 0.2 percent compared with a forecast in June 2013, it has now dropped to 0.4 percent.

In a new forecast based on the assumption that the conflict between Russia and Ukraine will continue, but it will not happen aggravation. According to Andrew Burns, the lead author of the WB study, the escalation of the conflict could undermine investor confidence. "Markets and investors do not like uncertainty," - he said.

The Bank has lowered its forecast for economic growth for developing countries from 5.3 to 4.8 percent. According to the head of Jim Yong Kim WB, GDP growth rates of countries "remain too moderate" and the third consecutive year will be below 5 percent.

For 2015 and 2016 the World Bank forecast remains unchanged, it indicates an increase in global economic growth by 3.4 or 3.5 percent. According to experts, in the current year expected economic boom due primarily to the fact that the economies of the rich countries continue to recover.

The cost of the August gold futures on the COMEX today rose to $ 1265.5 per ounce.

-

15:30

U.S.: Crude Oil Inventories, June -2.6

-

14:50

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3525, $1.3575, $1.3600, $1.3625

USD/JPY Y102.05, Y102.25, Y102.65, Y103.00

EUR/JPY Y139.00, Y140.00

EUR/GBP stg0.8050, stg0.8080, stg0.8115

EUR/CHF Chf1.2180-85, Chf1.2200

USD/CAD Cad1.0900

-

14:33

U.S. Stocks open: Dow 16,879.66 -66.26 -0.39%, Nasdaq 4,322.35 -15.65 -0.36%, S&P 1,943.51 -7.28 -0.37%

-

14:26

Before the bell: S&P futures -0.47%, Nasdaq futures -0.45%

U.S. stock-index futures fell as the World Bank cut its forecast for global growth.

Global markets:

Nikkei 15,069.48 +74.68 +0.50%

Hang Seng 23,257.29 -58.45 -0.25%

Shanghai Composite 2,054.95 +2.42 +0.12%

FTSE 6,832.3 -41.25 -0.60%

CAC 4,564.2 -30.80 -0.67%

DAX 9,939.29 -89.51 -0.89%

Crude oil $104.49 (+0.13%)

Gold $1263.60 (+0.28%)

-

14:06

DOW components before the bell

(company / ticker / price / change, % / volume)

American Express Co

AXP

95.20

-0.08%

0.5K

Walt Disney Co

DIS

84.66

-0.11%

4.0K

Visa

V

213.92

-0.15%

0.3K

Wal-Mart Stores Inc

WMT

76.50

-0.16%

0.2K

Procter & Gamble Co

PG

79.96

-0.24%

0.8K

AT&T Inc

T

34.85

-0.26%

7.9K

United Technologies Corp

UTX

118.75

-0.32%

0.7K

Merck & Co Inc

MRK

58.29

-0.34%

0.5K

Pfizer Inc

PFE

29.40

-0.34%

1.3K

3M Co

MMM

144.42

-0.38%

0.5K

Nike

NKE

76.00

-0.41%

5.6K

Intel Corp

INTC

28.12

-0.42%

5.1K

International Business Machines Co...

IBM

183.42

-0.47%

0.7K

Cisco Systems Inc

CSCO

24.87

-0.52%

13.2K

Verizon Communications Inc

VZ

49.25

-0.55%

41.4K

JPMorgan Chase and Co

JPM

57.57

-0.57%

1.8K

General Electric Co

GE

27.24

-0.62%

1.2K

Microsoft Corp

MSFT

40.84

-0.66%

7.7K

The Coca-Cola Co

KO

40.80

-0.66%

1.5K

Goldman Sachs

GS

164.97

-0.84%

1.6K

Boeing Co

BA

135.77

-1.08%

3.5K

-

14:02

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Boeing (BA) downgraded to Sector Perform from Outperform at RBC Capital Mkts, target $145

Other:

Apple (AAPL) target raised to $100 from $93 at Monness Crespi & Hardt

Amazon.com (AMZN) added to Conviction Buy list at Goldman

-

13:44

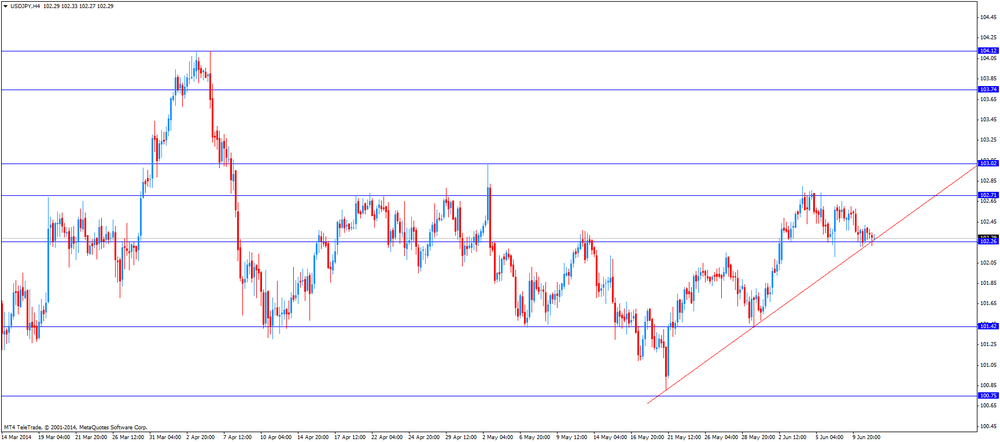

Foreign exchange market. European session: the yen rose against the U.S. dollar due to expectations that the Bank of Japan will not expand its stimulus measures

Economic calendar (GMT0):

00:30 Australia Westpac Consumer Confidence June -6.8% 0.2%

08:30 United Kingdom Average Earnings, 3m/y April +1.7% +1.2% +0.7%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April +1.3% +1.2% +0.9%

08:30 United Kingdom Claimant count May -25.1 -25.0 -27.4

08:30 United Kingdom Claimant Count Rate May 3.3% 3.2%

08:30 United Kingdom ILO Unemployment Rate April 6.8% 6.7% 6.6%

09:00 OPEC OPEC Meetings

The U.S. dollar traded lower against the most major currencies, but the U.S. currency is still supported by higher U.S. Treasury yields. The yield on the U.S. 10-year Treasuries climbed to 2.64% on Tuesday. That was the highest yield since last month.

The euro traded mixed against the U.S. dollar. The euro suffers due to bond yield gap between some euro area government bonds and U.S. Treasuries. While the currency in the Eurozone is to remain permanently cheap, the first interest rate hike by the Fed in the United States and by the Bank of England in the U.K. is more likely.

The European Central Bank cut its interest rate last Thursday. The ECB reduced its deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s first major central bank to use a negative rate. The deposit rate of -0.10% means that commercial bank will be charged for holding their reserves. This measure should spur commercial banks to ramp up lending.

The British pound increased against the U.S. dollar due to the strong labour market data in the U.K. The U.K. unemployment rate fell to 6.6% in the three months to April from 6.8% in the previous three months. That was the lowest level since early 2009. Analysts had expected a decline to 6.7%.

Jobless claims (claimant count) declined by 27,400 in May, compared with a forecast for a decline of 25,000 people. April’s figure was revised to a decrease of 28,400 from 25,100.

Weekly earnings increased by 0.7% in the three months to April, missing expectations for a 1.2% gain, after a 1.7% rise in the previous three months. The growth of wages is slower than inflation in the U.K. The inflation rate in the UK was 1.8% in April.

The Japanese yen rose against the U.S. dollar due to expectations that the Bank of Japan will not expand its stimulus measures at its meeting this week.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair climbed to $1.6796

USD/JPY: the currency pair declined to Y101.85

The most important news that are expected (GMT0):

14:30 U.S. Crude Oil Inventories June -3.4

18:00 U.S. Federal budget May 106.9 -142.8

21:00 New Zealand RBNZ Interest Rate Decision 3.00% 3.25%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:01 United Kingdom RICS House Price Balance May 54% 52%

23:50 Japan Core Machinery Orders April +19.1% -10.8%

23:50 Japan Core Machinery Orders, y/y April +16.1%

-

13:00

Orders

EUR/USD

Offers $1.3775, $1.3735, $1.3695/700, $1.3675, $1.3625, $1.3600/05

Bids $1.3520, $1.3500, $1.3480

GBP/USD

Offers $1.6900, $1.6880, $1.6845, $1.6815, $1.6790

Bids $1.6720, $1.6700, $1.6690

AUD/USD

Offers $0.9450, $0.9420, $0.9400

Bids $0.9335, $0.9300, $0.9255/50, $0.9235/30

EUR/JPY

Offers Y140.80, Y140.50, Y140.00, Y139.40, Y139.25, Y139.00

Bids Y138.25, Y138.00, Y137.00

USD/JPY

Offers Y103.50, Y103.00, Y102.75/80

Bids Y102.00, Y101.60, Y101.50

EUR/GBP

Offers stg0.8160/65, stg0.8150, stg0.8100

Bids stg0.8050, stg0.8035/30, stg0.8005/000

-

12:03

European stock markets mid session: stocks declined after the World Bank cuts economic global forecast

Stock indices declined after the World Bank cuts economic global. The World Bank lowered its global growth forecast to 2.8% from an earlier estimate of 3.2% due to a weaker outlook for the U.S., Russia and China.

The Office for National Statistics released the U.K. labour market data. The U.K. unemployment rate fell to 6.6% in the three months to April from 6.8% in the previous three months. That was the lowest level since early 2009. Analysts had expected a decline to 6.7%.

Deutsche Lufthansa AG shares dropped 13% after the company lowered its earnings forecasts for this and next year.

Vallourec SA, a steel pipe producer, slid 12% after lowering its earnings forecast for 2014.

Airbus Group shares declined 4% after Emirates cancelled an order for 70 A350 jets.

Current figures:

Name Price Change Change %

FTSE 100 6,838.03 -35.52 -0.52%

DAX 9,941.79 -87.01 -0.87%

CAC 40 4,561.40 -33.60 -0.73%

-

10:54

U.K. unemployment rate dropped to 6.6%

The Office for National Statistics released the U.K. labour market data. The U.K. unemployment rate fell to 6.6% in the three months to April from 6.8% in the previous three months. That was the lowest level since early 2009. Analysts had expected a decline to 6.7%.

Jobless claims (claimant count) declined by 27,400 in May, compared with a forecast for a decline of 25,000 people. April’s figure was revised to a decrease of 28,400 from 25,100.

Weekly earnings increased by 0.7% in the three months to April, missing expectations for a 1.2% gain, after a 1.7% rise in the previous three months. The growth of wages is slower than inflation in the U.K. The inflation rate in the UK was 1.8% in April.

-

10:37

Asian Stocks close: stocks were exhibiting a mixed trend after the World Bank cuts economic global forecast

Asian stock traded mixed trend after the World Bank cuts economic global forecast. The World Bank lowered its global growth forecast to 2.8% from an earlier estimate of 3.2% due to a weaker outlook for the U.S., Russia and China.

Japan's BSI manufacturing index for the second quarter declined to -13.9 points from 12.7 in the first quarter, missing expectations for a rise to 14.1.

Indexes on the close:

Nikkei 225 15,069.48 +74.68 +0.50%

Hang Seng 23,257.29 -58.45 -0.25%

Shanghai Composite 2,054.95 +2.42 +0.12%

-

10:22

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3525, $1.3575, $1.3600, $1.3625

USD/JPY Y102.05, Y102.25, Y102.65, Y103.00

EUR/JPY Y139.00, Y140.00

EUR/GBP stg0.8050, stg0.8080, stg0.8115

EUR/CHF Chf1.2180-85, Chf1.2200

USD/CAD Cad1.0900

-

09:55

Foreign exchange market. Asian session: the Australian dollar climbed to 1-month highs against the U.S. dollar due to the better-than-expected consumer sentiment data from Australia

Economic calendar (GMT0):

00:30 Australia Westpac Consumer Confidence June -6.8% 0.2%

08:30 United Kingdom Average Earnings, 3m/y April +1.7% +1.2% +0.7%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April +1.3% +1.2% +0.9%

08:30 United Kingdom Claimant count May -25.1 -25.0 -27.4

08:30 United Kingdom Claimant Count Rate May 3.3% 3.2%

08:30 United Kingdom ILO Unemployment Rate April 6.8% 6.7% 6.6%

The U.S. dollar traded mixed against the most major currencies. The U.S. dollar was supported by higher U.S. Treasury yields. The yield on the U.S. 10-year Treasuries climbed to 2.64% on Tuesday. That was the highest yield since last month.

The New Zealand dollar rose against the U.S dollar in the absence of any major economic reports. The kiwi was supported by expectations the Reserve Bank of New Zealand (RBNZ) will raise interest rates again later in the day. Investors expect the RBNZ will hike its interest rate by 0.25% to 3.25%.

The Australian dollar climbed to 1-month highs against the U.S. dollar due to the better-than-expected consumer sentiment data from Australia. The Westpac consumer confidence in Australia increased 0.2% in June, after a 6.8% decline in May.

The Japanese yen traded mixed against the U.S. dollar after the release of the economic data in Japan. Japan's BSI manufacturing index for the second quarter declined to 13.9 points from 12.7 in the first quarter, missing expectations for a rise to 14.1.

EUR/USD: the currency pair declined to $1.3520

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y102.25

The most important news that are expected (GMT0):

09:00 OPEC OPEC Meetings

14:30 U.S. Crude Oil Inventories June -3.4

18:00 U.S. Federal budget May 106.9 -142.8

21:00 New Zealand RBNZ Interest Rate Decision 3.00% 3.25%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:01 United Kingdom RICS House Price Balance May 54% 52%

23:50 Japan Core Machinery Orders April +19.1% -10.8%

23:50 Japan Core Machinery Orders, y/y April +16.1%

-

09:32

United Kingdom: Claimant Count Rate, May 3.2%

-

09:31

United Kingdom: ILO Unemployment Rate, April 6.6% (forecast 6.7%)

-

09:31

United Kingdom: Average Earnings, 3m/y , April +0.7% (forecast +1.2%)

-

09:31

United Kingdom: Average earnings ex bonuses, 3 m/y, April +0.9% (forecast +1.2%)

-

09:30

United Kingdom: Claimant count , May -27.4 (forecast -25.0)

-

08:39

FTSE 100 6,862.11 -11.44 -0.17%, CAC 40 4,577.74 -17.26 -0.38%, Xetra DAX 10,003.45 -25.35 -0.25%

-

06:40

Another flat to very modestly lower open for the main European bourses seen Weds: the FTSE, DAX and CAC all seen unchanged to 0.2% lower

-

06:30

Options levels on wednesday, June 11, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3624 (945)

$1.3603 (199)

$1.3573 (64)

Price at time of writing this review: $ 1.3539

Support levels (open interest**, contracts):

$1.3511 (1004)

$1.3494 (3806)

$1.3471 (4209)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 25329 contracts, with the maximum number of contracts with strike price $1,3700 (2550);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 40566 contracts, with the maximum number of contractswith strike price $1,3500 (5348);

- The ratio of PUT/CALL was 1.60 versus 1.60 from the previous trading day according to data from June, 10.

GBP/USD

Resistance levels (open interest**, contracts)

$1.7001 (993)

$1.6903 (1236)

$1.6805 (1180)

Price at time of writing this review: $1.6751

Support levels (open interest**, contracts):

$1.6694 (1036)

$1.6597 (1962)

$1.6499 (1811)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 13575 contracts, with the maximum number of contracts with strike price $1,7100 (1280);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 16200 contracts, with the maximum number of contracts with strike price $1,6600 (1962);

- The ratio of PUT/CALL was 1.19 versus 1.15 from the previous trading day according to data from June, 10.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:30

Australia: Westpac Consumer Confidence, June 0.2%

-

00:55

Japan: BSI Manufacturing Index, Quarter II -13.9 (forecast 14.1)

-

00:30

Commodities. Daily history for June 10’2014:

(raw materials / closing price /% change)Gold $1,259.80 +5.80 +0.46%

ICE Brent Crude Oil $109.64 -0.35 -0.32%

NYMEX Crude Oil $104.31 -0.36 -0.34%

-

00:25

Stocks. Daily history for June 10’2014:

(index / closing price / change items /% change)Nikkei 14,994.8 -129.20 -0.85%

Hang Seng 23,315.74 +198.27 +0.86%

Shanghai Composite 2,052.53 +22.03 +1.08%

S&P 1,950.79 -0.48 -0.02%

NASDAQ 4,338 +1.75 +0.04%

Dow 16,945.92 +2.82 +0.02%

FTSE 1,398.18 +4.47 +0.32%

CAC 4,595 +5.88 +0.13%

DAX 10,028.8 +20.17 +0.20%

-

00:20

Currencies. Daily history for June 10'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3544 -0,34%

GBP/USD $1,6753 -0,29%

USD/CHF Chf0,8991 +0,24%

USD/JPY Y102,35 -0,19%

EUR/JPY Y138,62 -0,55%

GBP/JPY Y171,45 -0,48%

AUD/USD $0,9369 +0,21%

NZD/USD $0,8524 +0,38%

USD/CAD C$1,0902 +0,01%

-

00:00

Schedule for today, Wednesday, June 11’2014:

(time / country / index / period / previous value / forecast)00:30 Australia Westpac Consumer Confidence June -6.8%

00:30 New Zealand REINZ Housing Price Index, m/m May +0.1%

08:30 United Kingdom Average Earnings, 3m/y April +1.7% +1.2%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April +1.3% +1.2%

08:30 United Kingdom Claimant count May -25.1 -25.0

08:30 United Kingdom Claimant Count Rate May 3.3%

08:30 United Kingdom ILO Unemployment Rate April 6.8% 6.7%

09:00 OPEC OPEC Meetings

14:30 U.S. Crude Oil Inventories June -3.4

18:00 U.S. Federal budget May 106.9 -142.8

21:00 New Zealand RBNZ Interest Rate Decision 3.00% 3.25%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:01 United Kingdom RICS House Price Balance May 54% 52%

23:50 Japan Core Machinery Orders April +19.1% -10.8%

23:50 Japan Core Machinery Orders, y/y April +16.1%

-