Notícias do Mercado

-

23:45

New Zealand: Food Prices Index, m/m, May +0.6%

-

23:30

New Zealand: Business NZ PMI, May 52.7

-

20:00

Dow 16,723.89 -119.99 -0.71%, Nasdaq 4,292.25 -39.68 -0.92%, S&P 500 1,929.21 -14.68 -0.76%

-

17:35

Bank of Canada Governor Stephen Poloz: housing market and high levels of household debt are the biggest risks to Canada’s economy and financial system

The Bank of Canada (BoC) Governor Stephen Poloz said today that high home prices and record levels of household debt remain the biggest risks to Canada’s economy and financial system.

But he added that the probability of a sharp correction in the housing market is low and the BoC still expects “a constructive evolution of household imbalances”.

The BoC Governor also said a potential financial disruption in China could affect the Canadian economy by reduced demand for Canadian exports and lower commodity prices.

-

17:04

European stocks close: stocks mostly lower after the weaker-than-expected U.S. retail sales and initial jobless claims

Stock indices traded mostly lower after the weaker-than-expected U.S. retail sales and initial jobless claims. The U.S. retail sales increased 0.3% in May, missing expectations for a 0.5% gain, after a 0.5% rise in April. April’s figure was revised up to a 0.5% gain from an increase of 0.1%.

The U.S. core retail sales excluding automobile sales were up 0.1% in May, missing expectations for a 0.4% increase, after a 0.4% rise in April. April’s figure was revised up to 0.4% from 0%.

The U.S. Labor Department released the number of initial jobless claims. The initial jobless claims in the week ending June 7 rose by 4,000 to 317,000. Analysts had forecasted the decline by 6,000 to 306,000.

Earlier in the trading session, the industrial production in the Eurozone was released. The industrial production in the Eurozone increased 0.8% in April, beating expectations for a 0.5% gain, after a 0.3% decline in March.

On a year-over-year basis, Eurozone’s industrial production rose 1.4% in April, exceeding expectations for a 0.9% increase, after a 0.1% fall in March.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,843.11 +4.29 +0.06%

DAX 9,938.70 -11.11 -0.11%

CAC 40 4,554.40 -0.71 -0.02%

-

17:00

European stocks closed in different ways: FTSE 100 6,843.11 +4.24 +0.06%, CAC 40 4,554.4 -0.71 -0.02%, DAX 9,938.7 -11.11 -0.11%

-

16:49

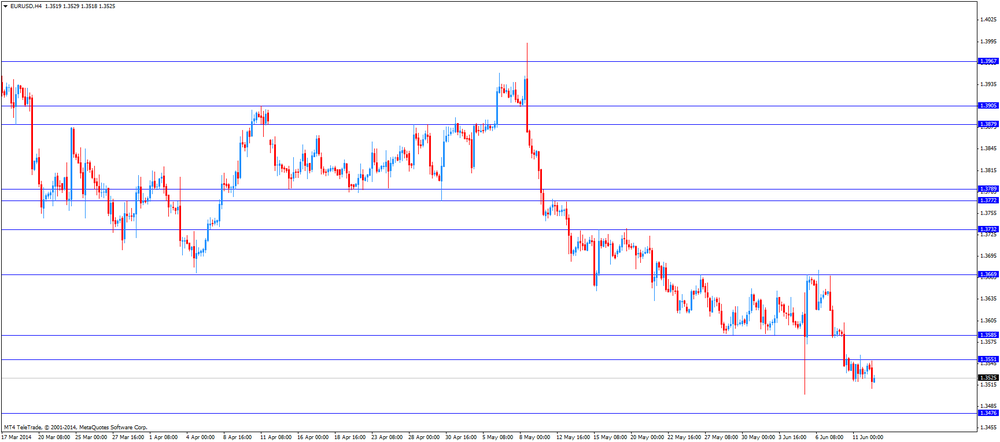

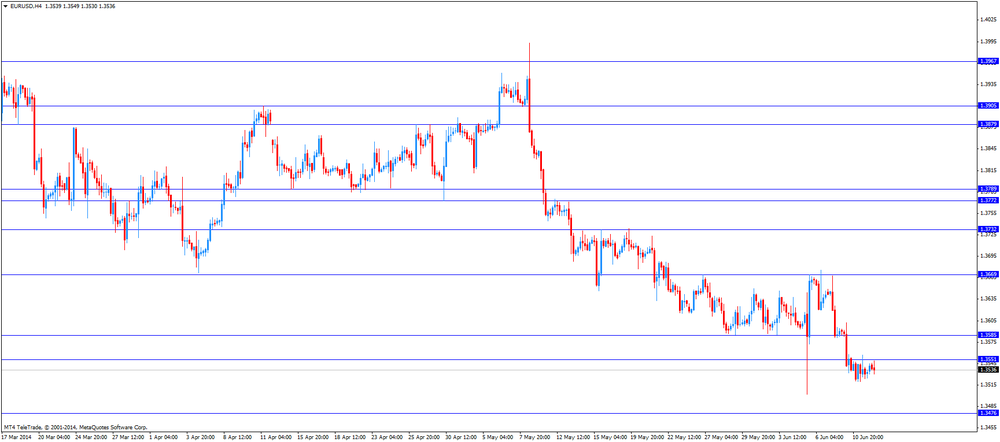

Foreign exchange market. American session: the U.S. dollar declined against the most major currencies after the weaker-than-expected U.S. economic data

The U.S. dollar declined against the most major currencies after the weaker-than-expected U.S. economic data. The U.S. retail sales increased 0.3% in May, missing expectations for a 0.5% gain, after a 0.5% rise in April. April’s figure was revised up to a 0.5% gain from an increase of 0.1%.

The U.S. core retail sales excluding automobile sales were up 0.1% in May, missing expectations for a 0.4% increase, after a 0.4% rise in April. April’s figure was revised up to 0.4% from 0%.

The U.S. Labor Department released the number of initial jobless claims. The initial jobless claims in the week ending June 7 rose by 4,000 to 317,000. Analysts had forecasted a decline by 6,000 to 306,000.

The U.S. import price index increased 0.2% in May, meeting expectations, after a 0.4 fall in April.

Business inventories in the U.S. rose 0.6% in April, exceeding expectations for a 0.4% gain, after a 0.4% increase in March.

The euro traded higher against the U.S. dollar due to the weaker-than-expected U.S. economic data. Market participants remained unimpressed by the better-than-expected industrial production in the Eurozone. The industrial production in the Eurozone increased 0.8% in April, beating expectations for a 0.5% gain, after a 0.3% decline in March.

On a year-over-year basis, Eurozone’s industrial production rose 1.4% in April, exceeding expectations for a 0.9% increase, after a 0.1% fall in March.

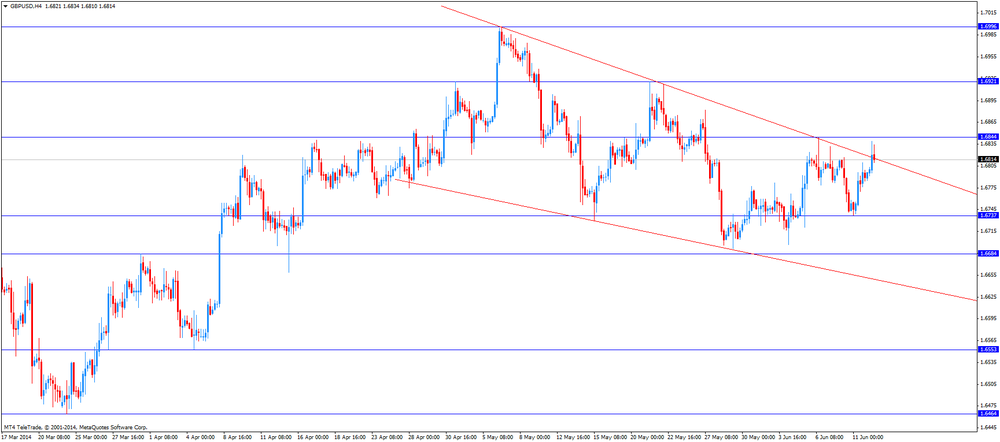

The British pound traded higher against the U.S. dollar. The British currency was still supported by the yesterday’s strong U.K. labour market data. The U.K. unemployment rate fell to 6.6% in the three months to April. Jobless claims (claimant count) declined by 27,400 in May. Investors speculate the Bank of England will raise interest rate sooner than expected.

The Canadian dollar increased against the U.S. dollar due to the weaker-than-expected U.S. economic data. The new housing price index in Canada rose 0.2% in April, missing expectations for a 0.3% increase, after a 0.2% gain in March.

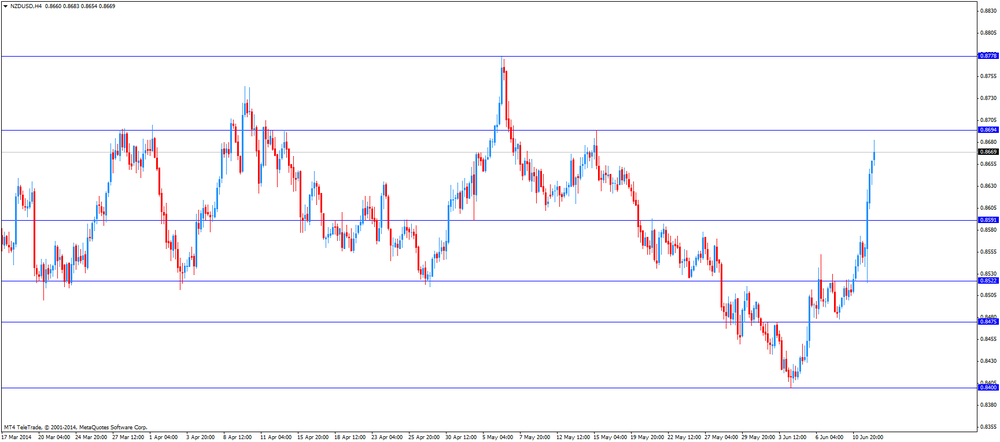

The New Zealand dollar climbed reached 1-month highs against the U.S dollar after the interest hike in New Zealand. The Reserve Bank of New Zealand (RBNZ) raised its interest rate to 3.25% from 3.00%. New Zealand’s central bank commented that borrowing costs could rise again this year.

The Australian dollar climbed against the U.S. dollar due to the weaker-than-expected U.S. In the overnight trading session, the labour market data was released in Australia. The number of employed people in Australia fell by 4,800 in May, missing expectations for a 10,300 rise, after 10,300 gain in April. April's figure was revised down to a 10,300 increase from a 14,200 increase.

Australia's unemployment rate remained unchanged at 5.8% in May. Analysts had expected an increase to 5.9%.

The Melbourne Institute released its inflation expectations for the next 12 months for Australia. The inflation expectations dropped to 4.0% in May from 4.4% in April.

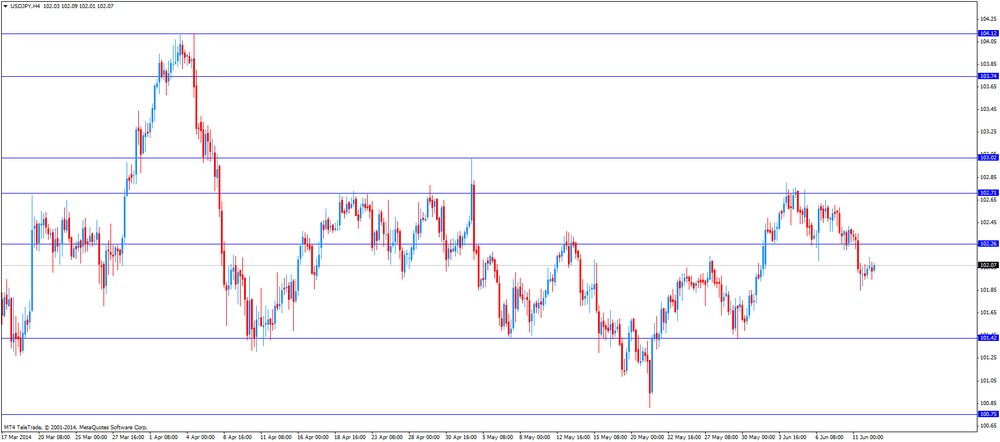

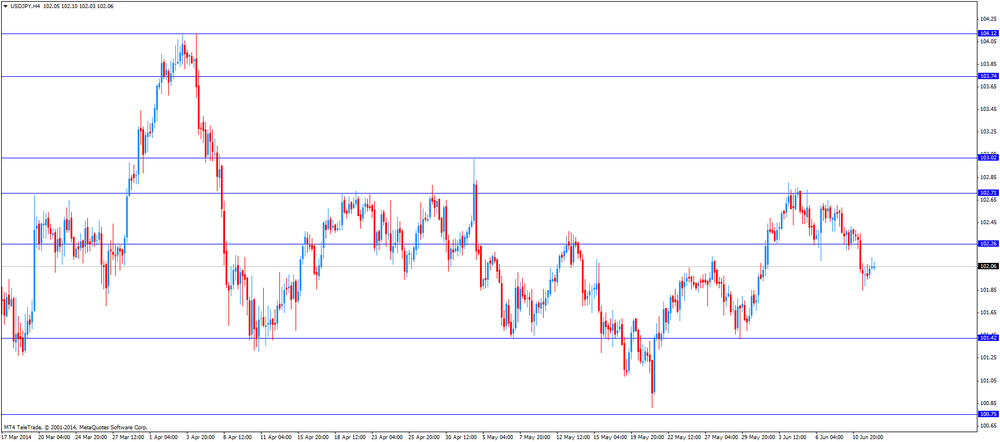

The Japanese yen traded higher against the U.S. dollar due to the weaker-than-expected U.S. economic data. Japan’s core machinery orders dropped 9.1% in April, after a 19.1% gain in March. Analysts had forecasted a 10.8% decline.

On a yearly basis, the core machinery orders in Japan climbed 17.6% in April, after a 16.1% rise in March.

-

16:40

Оil rose

Brent crude oil rose to the highest since the start of March and West Texas Intermediate to an eight-month high as violence escalated in Iraq, the second-largest producer in OPEC.

Brent rose as much as 2.2 percent to $112.34 a barrel. WTI, the U.S. benchmark, advanced 2 percent. Militants linked to al-Qaeda extended control over Iraq’s second-biggest city and battled for energy infrastructure, including the nation’s largest refinery. U.S. planes may bomb northern Iraq, Oil Minister Abdul Kareem al-Luaibi said today in Vienna.

“The Iraq development is the main driver for oil prices today and increases nervousness over the security of supply from the country,” Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt, said by phone today. The possibility of U.S. intervention in Iraq “is another sign of how desperate the situation is and how weak the government has become.”

Brent for July settlement rose by as much as $2.39 and was at $112.09 a barrel at 1:57 p.m. on the London-based ICE Futures Europe exchange. The contract expires tomorrow. The European benchmark crude traded at a premium of $5.79 to WTI. The spread widened yesterday for the first time in four days to close at $5.55.

WTI for July delivery climbed as much as $2.13 to $106.53 a barrel in electronic trading on the New York Mercantile Exchange. WTI traded as high as $108.99 on Sept. 19. The volume of all futures traded was about 206 percent above the 100-day average. Prices have increased 8 percent this year.

-

16:20

Gold continues to rise

The price of gold is rising in price on a weaker dollar after the U.S. unjustifiably forecasts data on retail sales and the labor market.

The data presented by the Ministry of Commerce, showed the results of last month expenditure grew moderately, but was lower than experts predicted, becoming a potentially troubling sign for an economy that is struggling to overcome the effects of the recession in the first quarter.

According to the report, the seasonally adjusted volume of retail sales increased in May by 0.3% - to $ 437.650 billion Excluding car purchases, sales grew by 0.1% compared with April. Excluding auto and gasoline sales were unchanged in May. Economists had expected a 0.5% overall growth in retail sales, and base - at around 0.4%.

Meanwhile, retail sales in April was higher than previously reported. Total sales rose 0.5% in March, compared with the initial estimate at 0.1%, while sales excluding autos rose 0.4% instead of 0.0%. But despite such notable revision, the April increase was much less than in March - at the level of 1.5%. Nevertheless, total retail sales increased in May by 4.3% compared to last year.

The number of Americans who first applied for unemployment benefits rose slightly last week, but remained near the level indicating a modest improvement in the labor market.

The Labor Department said: seasonally adjusted number of initial claims for unemployment insurance for the week ending June 7, increased by 4000 - to the level of 317,000. Economists had expected the value of this ratio will decrease to 306 thousand add the figure for the previous week was revised upward for 1000 - to the level of 313,000.

Furthermore, the data showed: an indicator assessing the average number of the last four weeks, up by 4750 - to reach 315 250. But despite the increase, the ratio has remained below the lowest level since the first half of 2007, before the recession began.

The cost of the August gold futures on the COMEX today rose to $ 1274.5 per ounce.

-

15:00

U.S.: Business inventories , April +0.6% (forecast +0.4%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3540, $1.3550, $1.3600

USD/JPY Y101.70-75, Y102.10-15, Y102.25, Y102.50, Y102.60

GBP/USD $1.6765

EUR/CHF Chf1.2200, Chf1.2225

AUD/USD $0.9300-20, $0.9335, $0.9350, $0.9400, $0.9425, $0.9450

AUD/NZD NZ$1.1000

NZD/USD $0.8395, $0.8530, $0.8550

USD/CAD C$1.0840, C$1.0975

-

14:35

U.S. Stocks open: Dow 16,834.44 -9.44 -0.06%, Nasdaq 4,322.97 -8.96 -0.21%, S&P 1,942.02 -1.87 -0.10%

-

14:29

U.S. retail sales miss expectations

The Commerce Department released the U.S. retail sales today. The U.S. retail sales increased 0.3% in May, missing expectations for a 0.5% gain, after a 0.5% rise in April. April’s figure was revised up to a 0.5% gain from an increase of 0.1%.

The U.S. core retail sales excluding automobile sales were up 0.1% in May, missing expectations for a 0.4% increase, after a 0.4% rise in April. April’s figure was revised up to 0.4% from 0%.

The strongest increase in May came from automobile and parts sales (+1.1%) and building supplies and gardening equipment (+1.4%). Sales of furniture and home sales climbed 0.5%.

-

14:28

Before the bell: S&P futures -0.06%, Nasdaq futures -0.05%

U.S. stock-index futures fell slightly after data showed a rise in jobless claims and a smaller-than-estimated gain in retail sales.

Global markets:

Nikkei 14,973.53 -95.95 -0.64%

Hang Seng 23,175.02 -82.27 -0.35%

Shanghai Composite 2,051.71 -3.24 -0.16%

FTSE 6,845 +6.13 +0.09%

CAC 4,557.8 +2.69 +0.06%

DAX 9,945.76 -4.05 -0.04%

Crude oil $106.33 (+1.85%)

Gold $1264.90 (+0.30%)

-

14:17

Reserve Bank of New Zealand raised its interest rate to 3.25%

The Reserve Bank of New Zealand (RBNZ) raised its interest rate to 3.25% from 3.00%. New Zealand’s central bank commented that the RBNZ could hike interest rate by 50 basis points this year.

The main comment of the Reserve Bank of New Zealand Governor Graeme Wheeler was after the interest hike that “it is important that inflation expectations remain contained and that interest rates return to a more neutral level”

The Reserve Bank of New Zealand Governor Graeme Wheeler said that inflationary pressures were expected to increase and next interest rise will depend on future economic and financial data and how these affect inflationary pressures. He added that future inflation should be kept near 2%.

The RBNZ said in the statement New Zealand's economic expansion had “considerable momentum”, with estimated GDP growth by around 4% in the year to June.

That was the third interest hike since March.

-

14:13

DOW components before the bell

(company / ticker / price / change, % / volume)

Boeing Co

BA

134.12

+0.01%

0.3K

Johnson & Johnson

JNJ

103.35

+0.03%

0.3K

General Electric Co

GE

27.16

+0.04%

0.2K

Caterpillar Inc

CAT

108.78

+0.08%

0.3K

Microsoft Corp

MSFT

40.90

+0.10%

0.4K

AT&T Inc

T

34.85

+0.11%

2.8K

International Business Machines Co...

IBM

182.50

+0.14%

4.7K

Nike

NKE

75.30

+0.21%

2.1K

Merck & Co Inc

MRK

58.50

+0.22%

0.1K

Chevron Corp

CVX

125.53

+0.28%

0.8K

United Technologies Corp

UTX

118.65

+0.30%

0.2K

Procter & Gamble Co

PG

80.31

+0.31%

0.2K

Home Depot Inc

HD

80.13

+0.40%

2.4K

Goldman Sachs

GS

166.30

+0.53%

9.2K

Exxon Mobil Corp

XOM

102.68

+0.72%

10.8K

McDonald's Corp

MCD

100.41

-0.01%

0.4K

The Coca-Cola Co

KO

40.55

-0.01%

11.2K

Verizon Communications Inc

VZ

49.36

-0.02%

4.7K

Visa

V

212.60

-0.04%

0.9K

JPMorgan Chase and Co

JPM

57.21

-0.10%

0.3K

Walt Disney Co

DIS

84.21

-0.12%

5.5K

Cisco Systems Inc

CSCO

25.00

-0.16%

4.3K

Intel Corp

INTC

27.82

-0.39%

8.4K

-

14:01

Upgrades and downgrades before the market open

Upgrades:

Hewlett-Packard (HPQ) upgraded to Neutral from Sell at Goldman

Downgrades:

Other:

Hewlett-Packard (HPQ) target raised to $35 from $30 at Mizuho

-

13:31

Canada: New Housing Price Index , April +0.2% (forecast +0.3%)

-

13:30

U.S.: Initial Jobless Claims, June 317 (forecast 306)

-

13:30

U.S.: Retail sales, May +0.3% (forecast +0.5%)

-

13:30

U.S.: Retail sales excluding auto, May +0.1% (forecast +0.4%)

-

13:30

U.S.: Import Price Index, May +0.2% (forecast +0.2%)

-

13:05

Foreign exchange market. European session: the euro traded lower against the U.S. dollar

Economic calendar (GMT0):

01:00 Australia Consumer Inflation Expectation June 4.4% 4.0%

01:30 Australia Changing the number of employed May 10.3 10.3 -4.8

01:30 Australia Unemployment rate May 5.8% 5.9% 5.8%

06:45 France CPI, m/m May 0.0% +0.1% 0.0%

06:45 France CPI, y/y May +0.7% +0.8%

08:00 Eurozone ECB Monthly Report June

09:00 Eurozone Industrial production, (MoM) April -0.3% +0.5% +0.8%

09:00 Eurozone Industrial Production (YoY) April -0.1% +0.9% +1.4%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. initial job claims and retail sales. The number of initial jobless claims should decline by 6,000 to 306,000.

Retail sales in the U.S. should climb 0.5% in May, after a 0.1% gain in April. Retail sales excluding autos should increase 0.4%.

The euro traded lower against the U.S. dollar. Market participants remained unimpressed by the better-than-expected industrial production in the Eurozone. The industrial production in the Eurozone increased 0.8% in April, beating expectations for a 0.5% gain, after a 0.3% decline in March.

On a year-over-year basis, Eurozone’s industrial production rose 1.4% in April, exceeding expectations for a 0.9% increase, after a 0.1% fall in March.

The British pound traded higher against the U.S. dollar. The British currency was still supported by the yesterday’s strong U.K. labour market data. The U.K. unemployment rate fell to 6.6% in the three months to April. Jobless claims (claimant count) declined by 27,400 in May.

The Canadian dollar traded mixed against the U.S. dollar ahead of the new housing price index in Canada and the speech of the Bank of Canada Governor Stephen Poloz. The new housing price index in Canada should rise 0.3% in April, after a 0.2% gain in March.

EUR/USD: the currency pair declined to $1.3510

GBP/USD: the currency pair climbed to $1.6839

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada New Housing Price Index April +0.2% +0.3%

12:30 U.S. Retail sales May +0.1% +0.5%

12:30 U.S. Retail sales excluding auto May 0.0% +0.4%

12:30 U.S. Initial Jobless Claims June 312 306

12:30 U.S. Import Price Index May -0.4% +0.2%

14:00 U.S. Business inventories April +0.4% +0.4%

15:15 Canada BOC Gov Stephen Poloz Speaks

22:30 New Zealand Business NZ PMI May 55.2

22:45 New Zealand Food Prices Index, m/m May +0.6%

22:45 New Zealand Food Prices Index, y/y May +1.5%

-

13:00

Orders

EUR/USD

Offers $1.3735, $1.3695/700, $1.3675, $1.3625, $1.3600/05

Bids $1.3500, $1.3475, $1.3400

GBP/USD

Offers $1.6900, $1.6880, $1.6845, $1.6815

Bids $1.6770, $1.6720, $1.6700, $1.6690

AUD/USD

Offers $0.9450, $0.9420, $0.9410

Bids $0.9335, $0.9300, $0.9255/50, $0.9235/30

EUR/JPY

Offers Y140.50, Y140.00, Y139.40, Y139.25, Y139.00

Bids Y137.85, Y137.00, Y136.20

USD/JPY

Offers Y103.50, Y103.00, Y102.75/80, Y102.35

Bids Y101.85, Y101.60, Y101.50/40, Y101.00

EUR/GBP

Offers stg0.8160/65, stg0.8150, stg0.8100, stg0.8085

Bids stg0.8045, stg0.8035/30, stg0.8005/000

-

12:00

European stock markets mid session: stocks traded slightly higher due to better-than-expected industrial production in the Eurozone

Stock indices traded slightly higher due to better-than-expected industrial production in the Eurozone. The industrial production in the Eurozone increased 0.8% in April, beating expectations for a 0.5% gain, after a 0.3% decline in March.

On a year-over-year basis, Eurozone’s industrial production rose 1.4% in April, exceeding expectations for a 0.9% increase, after a 0.1% fall in March.

Current figures:

Name Price Change Change %

FTSE 100 6,843.43 +4.56 +0.07%

DAX 9,952.44 +2.63 +0.03%

CAC 40 4,560.19 +5.08 +0.11%

-

10:35

Asian Stocks close: stocks declined due to a yesterday’s disappointing trading session on Wall Street

Asian stock declined due to a yesterday’s disappointing trading session on Wall Street. The World Bank’s cut of the economic global forecast weighed on U.S. markets. The World Bank lowered its global growth forecast to 2.8% from an earlier estimate of 3.2% due to a weaker outlook for the U.S., Russia and China.

Japan’s core machinery orders dropped 9.1% in April, after a 19.1% gain in March. Analysts had forecasted a 10.8% decline.

On a yearly basis, the core machinery orders in Japan climbed 17.6% in April, after a 16.1% rise in March.

Indexes on the close:

Nikkei 225 14,973.53 -95.95 -0.64%

Hang Seng 23,175.02 -82.27 -0.35%

Shanghai Composite 2,051.71 -3.24 -0.16%

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3540, $1.3550, $1.3600

USD/JPY Y101.70-75, Y102.10-15, Y102.25, Y102.50, Y102.60

GBP/USD $1.6765

EUR/CHF Chf1.2200, Chf1.2225

AUD/USD $0.9300-20, $0.9335, $0.9350, $0.9400, $0.9425, $0.9450

AUD/NZD NZ$1.1000

NZD/USD $0.8395, $0.8530, $0.8550

USD/CAD C$1.0840, C$1.0975

-

10:00

Eurozone: Industrial production, (MoM), April +0.8% (forecast +0.5%)

-

10:00

Eurozone: Industrial Production (YoY), April +1.4% (forecast +0.9%)

-

09:50

Foreign exchange market. Asian session: the New Zealand dollar climbed over 1% against the U.S dollar after the interest hike in New Zealand

Economic calendar (GMT0):

01:00 Australia Consumer Inflation Expectation June 4.4% 4.0%

01:30 Australia Changing the number of employed May 10.3 10.3 -4.8

01:30 Australia Unemployment rate May 5.8% 5.9% 5.8%

06:45 France CPI, m/m May 0.0% +0.1% 0.0%

06:45 France CPI, y/y May +0.7% +0.8%

08:00 Eurozone ECB Monthly Report June

The U.S. dollar traded mixed against the most major currencies. Market participants are awaiting the release of the U.S. initial jobless claims and retail sales later in the trading day.

The New Zealand dollar climbed toward 1-month highs against the U.S dollar after the interest hike in New Zealand. The Reserve Bank of New Zealand (RBNZ) raised its interest rate to 3.25% from 3.00%. New Zealand’s central bank commented that borrowing costs could rise again this year.

The Australian dollar traded mixed against the U.S. dollar after the mixed labour market data from Australia. The number of employed people in Australia fell by 4,800 in May, missing expectations for a 10,300 rise, after 10,300 gain in April. April's figure was revised down to a 10,300 increase from a 14,200 increase.

Australia's unemployment rate remained unchanged at 5.8% in May. Analysts had expected an increase to 5.9%.

The Melbourne Institute released its inflation expectations for the next 12 months for Australia. The inflation expectations dropped to 4.0% in May from 4.4% in April.

The Japanese yen traded slightly lower against the U.S. dollar after the release of the core machinery orders in Japan. Japan’s core machinery orders dropped 9.1% in April, after a 19.1% gain in March. Analysts had forecasted a 10.8% decline.

On a yearly basis, the core machinery orders in Japan climbed 17.6% in April, after a 16.1% rise in March.

EUR/USD: the currency pair climbed to $1.3545

GBP/USD: the currency pair increased to $1.6800

USD/JPY: the currency pair was up to Y102.15

NZD/USD: the currency pair increased to $0.8659

The most important news that are expected (GMT0):

09:00 Eurozone Industrial production, (MoM) April -0.3% +0.5%

09:00 Eurozone Industrial Production (YoY) April -0.1% +0.9%

12:30 Canada New Housing Price Index April +0.2% +0.3%

12:30 U.S. Retail sales May +0.1% +0.5%

12:30 U.S. Retail sales excluding auto May 0.0% +0.4%

12:30 U.S. Initial Jobless Claims June 312 306

12:30 U.S. Import Price Index May -0.4% +0.2%

14:00 U.S. Business inventories April +0.4% +0.4%

15:15 Canada BOC Gov Stephen Poloz Speaks

22:30 New Zealand Business NZ PMI May 55.2

22:45 New Zealand Food Prices Index, m/m May +0.6%

22:45 New Zealand Food Prices Index, y/y May +1.5%

-

08:40

DAX 9,955.28 +5.47 +0.05%, FTSE 100 6,840.65 +1.78 +0.03%, CAC 40 4,555.11 0.00 0.00%

-

07:45

France: CPI, m/m, May 0.0% (forecast +0.1%)

-

07:45

France: CPI, y/y, May +0.8%

-

06:40

European bourses are seen modestly higher at the open, bouncing back a little after the weakness seen Weds: the FTSE is seen up 0.2%, the DAX up 0.3% and the CAC up 0.2%.

-

06:17

Options levels on thursday, June 12, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3624 (945)

$1.3603 (199)

$1.3573 (64)

Price at time of writing this review: $ 1.3543

Support levels (open interest**, contracts):

$1.3511 (1004)

$1.3494 (3806)

$1.3471 (4209)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 25329 contracts, with the maximum number of contracts with strike price $1,3700 (2550);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 40566 contracts, with the maximum number of contractswith strike price $1,3500 (5348);

- The ratio of PUT/CALL was 1.60 versus 1.60 from the previous trading day according to data from June, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.7001 (993)

$1.6903 (1236)

$1.6805 (1180)

Price at time of writing this review: $1.6796

Support levels (open interest**, contracts):

$1.6694 (1036)

$1.6597 (1962)

$1.6499 (1811)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 13575 contracts, with the maximum number of contracts with strike price $1,7100 (1280);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 16200 contracts, with the maximum number of contracts with strike price $1,6600 (1962);

- The ratio of PUT/CALL was 1.19 versus 1.15 from the previous trading day according to data from June, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:32

Australia: Changing the number of employed, May 22.2 (forecast 10.3)

-

02:32

Australia: Unemployment rate, May 5.8% (forecast 5.9%)

-

02:00

Australia: Consumer Inflation Expectation, June 4.0%

-

00:50

Japan: Core Machinery Orders, April -9.1% (forecast -10.8%)

-

00:50

Japan: Core Machinery Orders, y/y, April +17.6%

-

00:30

Commodities. Daily history for June 11’2014:

(raw materials / closing price /% change)Gold $1,260.80 -1.10 -0.09%

ICE Brent Crude Oil $110.10 +0.58 +0.53%

NYMEX Crude Oil $104.49 +0.01 +0.010%

-

00:25

Stocks. Daily history for June 11’2014:

(index / closing price / change items /% change)Nikkei 15,069.48 +74.68 +0.50%

Hang Seng 23,257.29 -58.45 -0.25%

Shanghai Composite 2,054.95 +2.42 +0.12%

S&P 1,943.89 -6.90 -0.35%

NASDAQ 4,331.93 -6.07 -0.14%

Dow 16,843.88 -102.04 -0.60%

FTSE 1,391.59 -6.59 -0.47%

CAC 4,555.11 -39.89 -0.87%

DAX 9,949.81 -78.99 -0.79%

-

00:20

Currencies. Daily history for June 11'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3533 -0,08%

GBP/USD $1,6789 +0,21%

USD/CHF Chf0,8996 +0,06%

USD/JPY Y101,98 -0,36%

EUR/JPY Y138,02 -0,43%

GBP/JPY Y171,21 -0,14%

AUD/USD $0,9384 +0,16%

NZD/USD $0,8612 +1,02%

USD/CAD C$1,0865 -0,34%

-

00:01

United Kingdom: RICS House Price Balance, May 57% (forecast 52%)

-

00:00

Schedule for today, Thursday, June 12’2014:

(time / country / index / period / previous value / forecast)00:30 New Zealand REINZ Housing Price Index, m/m May +0.1%

01:00 Australia Consumer Inflation Expectation June 4.4%

01:30 Australia Changing the number of employed May 14.2 10.3

01:30 Australia Unemployment rate May 5.8% 5.9%

06:45 France CPI, m/m May 0.0% +0.1%

06:45 France CPI, y/y May +0.7%

08:00 Eurozone ECB Monthly Report June

09:00 Eurozone Industrial production, (MoM) April -0.3% +0.5%

09:00 Eurozone Industrial Production (YoY) April -0.1% +0.9%

12:30 Canada New Housing Price Index April +0.2% +0.3%

12:30 U.S. Retail sales May +0.1% +0.5%

12:30 U.S. Retail sales excluding auto May 0.0% +0.4%

12:30 U.S. Initial Jobless Claims June 312 306

12:30 U.S. Import Price Index May -0.4% +0.2%

14:00 U.S. Business inventories April +0.4% +0.4%

15:15 Canada BOC Gov Stephen Poloz Speaks

22:30 New Zealand Business NZ PMI May 55.2

22:45 New Zealand Food Prices Index, m/m May +0.6%

22:45 New Zealand Food Prices Index, y/y May +1.5%

-