Notícias do Mercado

-

20:00

-

19:00

-

18:24

European stocks close

European stocks declined as wrangling between Greek politicians following the shutdown of the state broadcaster overnight renewed concerns about the stability of the country's government.

Greece's benchmark ASE Index dropped 3.2 percent, extending its slide so far this week to 12 percent, as Prime Minister Antonis Samaras shut the nation's public broadcaster overnight. The Pasok and Democratic Left parties today submitted a draft law to overturn the ruling.

Greece became the first developed country to be cut to emerging-market status by MSCI Inc. after the local equity gauge plunged 83 percent since 2007. The Mediterranean nation failed to meet criteria regarding securities borrowing and lending facilities, short selling and transferability, according to a statement yesterday from MSCI, whose equity indexes are tracked by investors with about $7 trillion in assets.

National benchmark indexes fell in 13 of the 18 western European markets today. France's CAC 40 retreated 0.4 percent, the U.K.'s FTSE 100 slid 0.6 percent, while Germany's DAX lost 1 percent.

Societe Generale SA slid 2.5 percent to 28.46 euros, Barclays lost 2.9 percent to 295.8 pence and Deutsche Bank declined 3.2 percent to 34.40 euros.

Severn Trent tumbled 8.9 percent to 1,765 pence after Borealis Infrastructure Management Inc. and its Kuwaiti-British partners late yesterday abandoned their 5.3 billion-pound ($8.3 billion) bid for the U.K. water utility as the offer deadline expired.

Kabel Deutschland jumped 8.2 percent to 80.84 euros, for the biggest advance on the Stoxx 600, after Vodafone, the world's second-largest wireless carrier, confirmed it discussed acquiring the German cable operator to expand in the broadband and TV market.

British Sky Broadcasting Group Plc rose 1.4 percent to 788.5 pence after Banco Espirito Santo SA wrote in a report that News Corp. may make a new bid for the U.K.'s largest pay-TV broadcaster after its shareholders approve a plan to split off publishing operations. Espirito said it sees a possible takeover valuation for BSkyB of 990 pence a share.

Inditex SA added 3.5 percent to 101.30 euros after reporting a 5.2 percent increase in first-quarter sales to 3.59 billion euros. The world's biggest clothing retailer also forecast stable profitability even after first-quarter profit advanced at the slowest pace in four years.

-

17:20

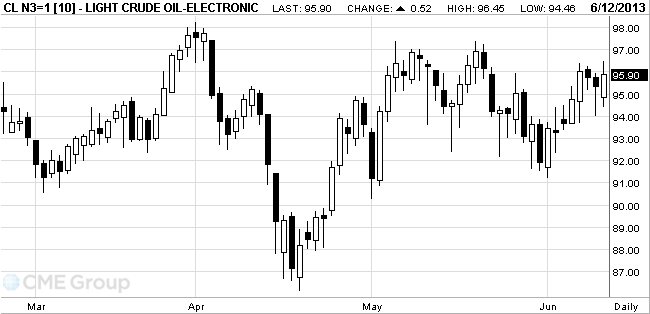

Oil climbed to the highest level in three weeks

West Texas Intermediate crude climbed to the highest level in three weeks.

Growth in oil futures did not prevent the data on the increase in stocks of crude oil from the U.S. Department of Energy. Crude oil inventories rose 2.52 million barrels compared to the expected decline of 0.5 million increase in gasoline stocks totaled 2.75 million barrels, is expected 0.5 million

Today, the International Energy Agency (IEA) reported that the consumption of oil in China this year is likely to be slightly less than previously estimated, with demand for oil in the country this year, seems to grow by 3, 8%.

Changing the outlook for demand in China is important for world oil markets, as the country is the second largest consumer of oil and is highly dependent on its imports. In January, the PRC government has reported that about 56% of its oil comes into the country as a result of imports.

In 2013, China's oil consumption will increase by 365,000 barrels per day, which is 3.8% more than last year. At the same time, this forecast by 15,000 barrels a day lower than forecast a month ago, according to a recent report by the IEA.

On Tuesday, the U.S. Department of Energy lowered its forecast for growth in oil demand in China in 2013 to 420,000 barrels per day. Now the Office predict growth in China is 4.1%, whereas in the past month, was expected to grow by 4.4%.

WTI for July delivery rose 89 cents, or 0.9 percent, to $95.38 a barrel at 11:26 a.m. on the New York Mercantile Exchange. Earlier, it touched $96.45, the most since May 21 on an intraday basis. The volume of all futures traded was 4.2 percent below the 100-day average for the time of day.

Brent for July settlement rose 94 cents, or 0.9 percent, to $103.90 a barrel on the London-based ICE Futures Europe exchange. Volume was 4.8 percent above the 100-day average for the time of day. Brent's premium to WTI widened by 5 cents to $7.63 a barrel.

-

17:00

-

16:20

Gold rises in price after the euro

Having played the gold incurred during the two previous sessions losses after better-than-expected data on industrial production in the euro area.

Industrial production in the euro zone rose in April for the third month in a row, suggesting a possible end of the recession in the region, which became the longest in the postwar period.

However, the increase in production was concentrated in the largest economies of the eurozone - Germany and France, while industrial production declined in the euro-zone countries whose economies most affected by the financial and banking crises, including in Italy, Spain, Greece and Portugal.

Bureau of Statistics of the European Union said on Wednesday that industrial production in the 17 countries of the euro zone by 0.4% compared with March, at the same time, production decreased by 0.6% compared with April 2012. Published data surpassed economists' expectations.

The cost of the August gold futures on COMEX today rose to 1394.0 dollars per ounce.

-

15:30

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3040, $1.3150, $1.3190, $1.3200, $1.3250

USD/JPY Y97.00, Y97.50, Y98.00, Y98.95, Y99.00, Y100.00

GBP/USD $1.5500

USD/CHF Chf0.9410

EUR/CHF Chf1.2300

AUD/USD $0.9450, $0.9500

-

14:33

-

14:28

Before the bell: S&P futures +0.54%, Nasdaq futures +0.39%

U.S. stock-index futures gained as investors weighed the effect of rising bond yields on equities.

Global Stocks:

Nikkei 13,289.32 -28.30 -0.21%

Hang Seng 21,354.66 -260.43 -1.20%

FTSE 6,344.84 +4.76 +0.08%

CAC 3,830.15 +19.59 +0.51%

DAX 8,210.89 -11.57 -0.14%

Crude oil $95.30 -0.08%

Gold $1375.80 -0.09%

-

14:02

Upgrades and downgrades before the market open:

Upgrades:

Downgrades:

Other:

Google (GOOG) reiterated at Buy at Needham, target raised from $900 to $1000

-

13:15

European session: the U.S. currency strengthened slightly

Data

00:00 China Bank holiday

00:30 Australia Westpac Consumer Confidence June -7.0% +4.7%

05:00 Japan BoJ monthly economic report June

05:30 France Non-Farm Payrolls (Finally) Quarter I -0.1% -0.1% -0.1%

06:00 Germany CPI, m/m (Finally) May +0.4% +0.4% +0.4%

06:00 Germany CPI, y/y (Finally) May +1.5% +1.5% +1.5%

06:45 France CPI, m/m May -0.1% +0.3% +0.1%

06:45 France CPI, y/y May +0.7% +0.9% +0.9%

08:00 Germany Constitutional Court Ruling

08:30 United Kingdom ILO Unemployment Rate April 7.8% 7.8% 7.8%

08:30 United Kingdom Average Earnings, 3m/y April +0.4% +0.3% +1.3%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April +0.8% +0.8% +0.9%

08:30 United Kingdom Claimant count May -7.3 -6.8 -8.6

08:30 United Kingdom Claimant Count Rate May 4.5% 4.5% 4.5%

09:00 Eurozone Industrial production, (MoM) April +1.0% -0.2% +0.4%

09:00 Eurozone Industrial Production (YoY) April -1.7% -1.1% -0.6%

09:00 United Kingdom MPC Member Fisher Speaks

The dollar rose against the euro, as to the interest to sell the pair increases. It should be noted that market participants following the news of the German Constitutional Court, where the second day of hearings on the legality of the program OMT, used by the European Central Bank. Yesterday, the European euro topped $ 1.33 level, but soon lost his position. An important goal for many graphs runs around $ 1.3340. A break of yesterday's low of $ 1.3230 would question the recent uptrend of the single currency.

It is worth noting that part of the dynamics of the affected data for Germany, which showed that by the end of last month inflation rate in Germany increased, which was associated with an increase in food prices, but remained below the target level of the European Central Bank.

According to the report, in May, the annual inflation rate rose to 1.5%, compared with 1.2% in April, confirming a preliminary assessment, and being in line with expectations of experts. The data also showed that on a monthly basis the consumer price index rose by 0.4%, which followed a 0.5% decline in the previous month. It should be noted that this value is consistent with the preliminary estimates and forecasts of analysts.

The Federal Bureau of Statistics also reported that the acceleration of the pace of the harmonized inflation in the country in May. However, the inflation rate was lower than the preliminary values. Harmonized index of consumer prices has risen from 1.1% in April to 1.6% in May from 1.7% previously calculated. Inflation has remained below the strategically important level of 2%. This level is important to determine the course of monetary policy. On a monthly basis, the harmonized index of consumer prices rose by 0.3% in May, as suggested earlier, after slowing to 0.5% a month earlier.

The pound traded restraint against the U.S. dollar is now at the level of the opening day. Increase the exchange rate did not help even data from the Office for National Statistics, which showed that by the end of last month the number of applications for unemployment benefits decreased markedly ahead with the predictions of most experts.

According to the report, in May, the number of applications for unemployment benefits fell by 8,600 units, compared with a revised downwards index for April at 11,800. It should be noted that the estimated value of the indicator economists was reduced to 6800, compared to a fall of 7300, which was originally reported last month.

The data also showed that for the three months that ended in April, the employment rate fell to 71.5% from 71.4% in the previous three months. Recall that the last time such a measure has been recorded in the last quarter of 2012.

In addition, the Office for National Statistics also reported that the recent slowdown in revenue growth reversed in the three months to April. According to data for the three months that ended in April, the average weekly gross earnings increased by 1.3% compared with the same period a year earlier, followed a growth of 0.6% in the three months to March. Analysts expect further slowdown in the last three months. In addition, it was reported that average earnings, which excludes bonuses and overtime, increased for the three months (to March) of 0.9%, compared with an increase of 0.8% in March. Also, today's report showed that the unemployment rate is estimated ILO has remained unchanged for the three-month period (April) - at 7.8%, which was in line with the expectations of experts.

EUR / USD: during the European session, the pair fell to $ 1.3263

GBP / USD: during the European session, the pair rose to $ 1.5685, but then fell to the opening level

USD / JPY: during the European session, the pair fell to Y97.04 to Y96.28

At 17:00 GMT the United States places the 10-year bonds. At 18:00 GMT the United States will be released monthly performance report for May. At 21:00 GMT we will know the decision of the Reserve Bank of New Zealand's main interest rate, and will be a press conference by the Reserve Bank of New Zealand. Also this time, the accompanying statement will be presented to the Reserve Bank of New Zealand and the minutes of monetary policy of the Reserve Bank of New Zealand.

-

13:00

Orders

EUR/USD

Offers $1.3430/35, $1.3400, $1.3370/80, $1.3360, $1.3340/50

Bids $1.3270, $1.3255/50, $1.3220, $1.3200-185

GBP/USD

Offers $1.5750/60, $1.5730, $1.5700, $1.5684

Bids $1.5630/20, $1.5605/00, $1.5585/80, $1.5530/20

AUD/USD

Offers $0.9700, $0.9680, $0.9650, $0.9600

Bids $0.9450, $0.9410/00, $0.9380, $0.9355/50

EUR/GBP

Offers stg0.8595/600, stg0.8575/80, stg0.8560/65, stg0.8551, stg0.8512

Bids stg0.8464, stg0.8445/40, stg0.8420, stg0.8400

EUR/JPY

Offers Y129.90/00, Y129.50, Y129.15/20, Y129.00, Y128.60/65

Bids Y128.00, Y127.75/70, Y127.50, Y127.00, Y126.55/50

USD/JPY

Offers Y98.00, Y97.80, Y97.50, Y96.85/90

Bids Y96.30/20, Y96.00, Y95.75/70, Y95.50

-

11:30

European stock indices rising

European stocks advanced, snapping a two-day decline, as merger and acquisition activity outweighed concern that central banks will taper stimulus measures. U.S. futures climbed while Asian shares were little changed.

The benchmark Stoxx Europe 600 Index gained 0.3 percent to 292.69 at 10:08 a.m. in London. The gauge has lost 5.8 percent since May 22 amid speculation the Federal Reserve will taper its bond-buying program that helped drive the measure to its highest level since June 2008.

Germany's top court continues its two-day hearing to address the European Central Bank's Outright Monetary Transactions program and the European Stability Mechanism. The ECB's top two German officials yesterday gave opposing evidence at the Federal Constitutional Court in Karlsruhe as judges consider the legality of the OMT bond-buying program.

"There is the realization in the market that some of the stimulatory measure out there are going to be coming to an end," said Lilley. "Fears of a worst-case scenario have abated for now, but for the market to really move ahead we need profit growth."

Greece became the first developed country to be cut to emerging-market status by MSCI Inc. after the local equity gauge plunged 83 percent since 2007.

The Mediterranean nation failed to meet criteria regarding securities borrowing and lending facilities, short selling and transferability, according to a statement yesterday from MSCI, whose equity indexes are tracked by investors with about $7 trillion in assets.

Kabel Deutschland rallied 7.7 percent to 80.51 euros, for the biggest advance on the Stoxx 600, after Vodafone, the world's second-largest wireless carrier, confirmed it discussed acquiring the German cable operator to expand in the broadband and TV market.

Vodafone contacted Kabel Deutschland, which has a market value of about 7 billion euros ($9.3 billion), to discuss an offer within the past week, Bloomberg News reported yesterday, citing people with knowledge of the matter. Vodafone slipped 1.2 percent to 182.9 pence.

BSkyB rose 1.7 percent to 791 pence. Banco Espirito Santo SA wrote in a report that News Corp. may make a new bid for the U.K.'s largest pay-TV broadcaster after its shareholders approve a plan to split off publishing operations. Espirito said it sees a possible takeover valuation for BSkyB of 990 pence a share.

Severn Trent tumbled 7.8 percent to 1,786 pence after Borealis Infrastructure Management Inc. and its Kuwaiti-British partners late yesterday abandoned their 5.3 billion-pound ($8.3 billion) bid for the U.K. water utility as the offer deadline expired.

-

10:15

Option expiries for today's 1400GMT cut

EUR/USD $1.3100, $1.3200, $1.3210, $1.3285, $1.3300

USD/JPY Y95.80, Y97.00, Y97.25, Y97.50, Y98.00, Y98.40, Y98.50, Y99.00, Y99.05, Y99.50

EUR/JPY Y128.00, Y130.00

EUR/GBP stg0.8535

EUR/CHF Chf1.2375, Chf1.2400

AUD/USD $0.9350, $0.9400, $0.9450, $0.9550, $0.9580

-

10:02

-

10:01

-

09:40

Asia Pacific stocks close

Asian stocks fell, extending a rout that wiped out about $400 billion from the value of global equities yesterday, amid concern that central banks from Tokyo to Washington are increasingly reluctant to add stimulus.

Nikkei 225 13,289.32 -28.30 -0.21%

Hang Seng 21,354.66 -260.43 -1.20%

S&P/ASX 200 4,724.5 -32.56 -0.68%

Shanghai Composite 2,210.9 -31.21 -1.39%

Toyota Motor Corp., the world's largest carmaker, retreated 1.8 percent in Tokyo after the yen yesterday gained the most in three years.

Hyundai Merchant Marine Co. plunged 15 percent in Seoul after North Korea called off talks yesterday on a joint industrial zone.

Nomura Real Estate Master Fund Inc., Japan's largest initial public offering this year, fell 6.2 percent in its debut.

-

09:33

-

09:32

-

09:31

-

09:31

-

09:15

-

07:45

-

07:45

-

07:45

-

07:19

Asian session: The euro was less than 0.1 percent from its highest in 3 1/2 months

00:00 China Bank holiday

00:30 Australia Westpac Consumer Confidence June -7.0% +4.7%

05:00 Japan BoJ monthly economic report June

The euro was less than 0.1 percent from its highest in 3 1/2 months before European Central Bank executive board member Benoit Coeure speaks as expectations for lower benchmark interest rates in the region decline. The ECB's Coeure is due to speak in Berlin on the role of central banks in managing crisis and growth. In a speech on June 10, he said policy makers have the ability to provide additional stimulus to aid the currency bloc's economy. ECB President Mario Draghi said June 6 the euro-area economy will return to growth by the end of the year as policy makers held back further stimulus measures. The ECB's Governing Council left its main refinancing rate at 0.5 percent after reducing it by a quarter point last month.

The yen fell against all its major counterparts, trimming its biggest gain against the dollar since 2010.

The dollar gained versus the yen before tomorrow's retail sales report which economists forecast will show 0.4 percent growth in May, following a 0.1 percent gain in April, according to a Bloomberg News survey.

Australia's dollar rebounded from the lowest in almost three years as consumer confidence rose. "There's probably quite a few people who've got short the Australian dollar near the lows yesterday, and they're now suffering a painful squeeze," said Ray Attrill, the global co-head of foreign-exchange strategy in Sydney at National Australia Bank Ltd. "At the moment, there's the potential for a squeeze up to 95 or 96" U.S. cents, he said. A short position is a bet that an asset's price will fall.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3305/20

GBP / USD: during the Asian session the pair traded in the range of $ 1.5630/50

USD / JPY: during the Asian session the pair rose to Y96.65

There is a full calendar Wednesday, although data is largely skewed towards Europe. The calendar gets underway from 0530GMT, with the release of the French first quarter job creations data. At 0600GMT, Germany's May final HICP numbers are due for release. French data at 0645GMT sees the release of the May HICP numbers and the April current account data. At 0700GMT, in Brussels, EU Commission President Jose Manuel Barroso is slated to discuss economic policy and preparations for the EU leaders Summit. Also at 0700GMT, Spain's May final HICP is set for release. At 0800GMT, the IEA monthly oil market report numbers are set to cross the wires. Rate, Apr ILO Unemployment Rate and pay data. At 0900GMT, Italy's May final HICP and EMU Apr industrial output numbers will be released. Portugal President Anibal Cavaco Silva is to address the European Parliament, in Strasbourg, France, from 1000GMT.

-

07:01

-

07:01

-

06:31

-

06:18

Commodities. Daily history for Jun 11’2013:

Change % Change Last

GOLD 1,377.00 -9.20 -0.66%

OIL (WTI) 94.99 -0.78 -0.81%

-

06:17

Stocks. Daily history for Jun 11’2013:

Change % Change Last

Nikkei 225 13,317.62 -196,58 -1,45%

Hang Seng 21,345.18 -269,91 -1,25%

S & P / ASX 200 4,757.06 19,36 0,41%

Shanghai Composite -1,39 -31,21 2,210.9%

FTSE 100 6,340.08 -60.37 -0.94%

CAC 40 3,810.56 -53.80 -1.39%

DAX 8,222.46 -85.23 -1.03%

DJIA 15,122.00 -116.57 -0.76%

S&P 500 1,626.13 -16.68 -1.02%

NASDAQ 3,436.95 -36.82 -1.06%

-

06:17

Currencies. Daily history for Jun 11'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3312 +0,42%

GBP/USD $1,5643 +0,46%

USD/CHF Chf0,9245 -1,01%

USD/JPY Y96,03 -3,08%

EUR/JPY Y127,86 -2,62%

GBP/JPY Y150,24 -2,59%

AUD/USD $0,9437 -0,23%

NZD/USD $0,7876 -0,28%

USD/CAD C$1,0187 -0,06%

-

05:58

Schedule for today, Wednesday, June 12’2013:

00:00 China Bank holiday

00:30 Australia Westpac Consumer Confidence June -7.0%

05:00 Japan BoJ monthly economic report June

05:30 France Non-Farm Payrolls (Finally) Quarter I -0.1% -0.1%

06:00 Germany CPI, m/m (Finally) May +0.4% +0.4%

06:00 Germany CPI, y/y (Finally) May +1.5% +1.5%

06:45 France CPI, m/m May -0.1% +0.3%

06:45 France CPI, y/y May +0.7% +0.9%

08:00 Germany Constitutional Court Ruling

08:30 United Kingdom ILO Unemployment Rate April 7.8% 7.8%

08:30 United Kingdom Average Earnings, 3m/y April +0.4% +0.3%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April +0.8% +0.8%

08:30 United Kingdom Claimant count May -7.3 -6.8

08:30 United Kingdom Claimant Count Rate May 4.5% 4.5%

09:00 Eurozone Industrial production, (MoM) April +1.0% -0.2%

09:00 Eurozone Industrial Production (YoY) April -1.7% -1.1%

09:00 United Kingdom MPC Member Fisher Speaks

14:30 U.S. Crude Oil Inventories June -6.3

18:00 U.S. Federal budget May 112.9 -110.2

21:00 New Zealand RBNZ Interest Rate Decision 2.50% 2.50%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

-