Notícias do Mercado

-

20:00

DJIA 15,430.40 -30.48 -0.20%, S&P 500 1,673.90 -1.12 -0.07%, NASDAQ 3,588.04 9.74 0.27%

-

19:20

American focus: the euro fell after a downgrade of France

Euro fell after rising during the U.S. session against the U.S. dollar on news that Fitch Ratings agency downgraded the outlook on France, with the level of AAA to AA +, while maintaining a stable outlook in terms of the country's debt. As one of the main reasons behind this decision the agency has named a high level of insolvency of the French government. An estimated Fitch, in 2014, the level of public debt in the country will reach 96% of GDP, and will continue to decline slowly, falling in 2017 to a value of only 92%.

The dollar fell after the preliminary results of the research showed that were presented Thomson-Reuters and the Michigan Institute in July, American consumers feel less optimistic about the economy than had been recorded in the last month. According to the data, in July consumer sentiment index fell to 83.9, compared with a final reading for June at 84.1. It is worth noting that according to the average estimates of experts, the index should have grown to the level of 85.3.

At the same time, at the end of last month the U.S. producer prices rose significantly, thus showing the largest increase in the past nine months, which was caused by a jump in energy prices. Experts point out that the current situation calls for a slight acceleration of inflation, despite the subdued level of expenditure on a number of other products. According to a report in the June producer price index rose a seasonally adjusted 0.8%, which was followed after increasing by 0.5% a month earlier. The increase was due to the 2.9% growth in the index of energy prices, reflecting higher prices for gasoline.

Earlier, the EUR / USD dropped sharply, falling below the minimum values of yesterday. On the dynamics of trade have influenced the data for the euro area: the end of May the euro zone industrial output fell markedly, thereby exceeded the forecasts of experts, which may indicate a continuation of the recession in the currency zone in the second quarter. The report showed that in May, industrial output fell by 0.3% in April and 1.3% from May 2012. It is worth noting that according to the average forecasts of experts, industrial output had fallen by 0.2% for the month and 1.4% over the year. The data also showed that the decline in industrial production in May was due to weak domestic demand and exports, as well as a sharp decline in production of durable consumer goods and capital goods. The decrease in production was recorded in most of the currency area, and even in Germany and France, as well as in Spain and Greece. However, was recorded a very sharp rise in Portugal, and more modest growth in Italy. In general, the EU production fell by 0.6% from April, and decreased by 1.6% from May 2012.

The pound also fell against the dollar, despite the positive manufacturing data in the construction industry. As it became known, the amount of production in this sector jumped in April, suggesting that the sector will contribute to economic growth in the 2nd quarter. According to the data, production in the construction industry adjusted for seasonal variations in April increased by 4.6% compared with the previous month, and in May remained unchanged. Strong growth in April was provided by companies to carry out orders that have accumulated since March, when the weather was bad. The relatively strong performance sector in April, followed adverse 1st quarter, when a decline in production in the construction sector has undermined economic growth. In the 1st quarter of production in the construction sector fell by 1.8%, limiting the growth of GDP of 0.3%, despite the acceleration of growth in the largest sector of the economy - the service sector. Also, the data showed that, compared with the same period of the previous year, production in the construction sector in April fell by 2.2% in May - 4.8%. Such a sharp annual decline in production in May was mainly due to the fact that banks in May this year was one extra working day more than in May 2012.

The yen fell against the U.S. dollar. As it became known, the Bank of Japan expects a moderate increase in exports and industrial production as the economy recovers, according to the central bank's monthly report, published on Friday. Meanwhile, data released today, which have been revised, showed that industrial production in Japan rose by 1.9% in May compared with the previous month, reflecting a steady increase in industrial activity due to the forces of domestic demand. Figure compared with an initial value increased by 2.0% after a 0.9% increase in April. In addition, it was reported that the index of capacity utilization increased by 2.3% in May compared with the previous month - to 98.1.

On Thursday, the bank raised its assessment of the economy, saying, "The Japanese economy is beginning to recover at a moderate pace." The Bank used the word "recovery" for the first time since January 2011, two months before the deadly earthquake and tsunami in the island nation.

-

18:20

European stocks close

European stocks were little changed from a five-week high, as investors awaited U.S. earnings next week, while merger and acquisition activity offset a selloff in Spanish utility companies.

Citigroup Inc. and Goldman Sachs Group Inc. are among companies to report earnings in the U.S. next week. Profit at companies listed on the Standard & Poor’s 500 Index probably rose 1.8 percent last quarter, according to Bloomberg data. That compares with a projection of 8.7 percent six months ago.

National benchmark indexes climbed in eight of the 18 western-European markets today. The U.K.’s FTSE 100 rose less than 0.1 percent while Germany’s DAX climbed 0.7 percent. France’s CAC 40 dropped 0.4 percent.

Invensys jumped 15 percent to 508 pence after Schneider Electric, the world’s largest maker of low- and medium-voltage equipment, offered to pay 505 pence a share for the British company. The bid comprises 319 pence in cash and 186 pence in new Schneider shares. Invensys said it indicated to the French company that it will probably recommend the offer. Schneider fell 4.1 percent to 55.70 euros in Paris.

Phoenix jumped 10 percent to 719 pence after the U.K.’s biggest manager of closed life-insurance funds said it’s in preliminary talks to combine with Swiss Re’s Admin Re unit.

Swedish Match AB gained 2.6 percent to 248.60 kronor in Stockholm after the Daily Mail reported speculation that Imperial Tobacco Group Plc may make a bid of 350 kronor ($52.51) a share for the maker of smokeless-tobacco products. The newspaper did not cite anyone.

In Spain, the government announced plans to cut profit for renewable energy companies and the electric grid operator as part of Prime Minister Mariano Rajoy’s effort to eliminate a 4.5 billion euro deficit forecast this year for the industry.

Iberdrola SA, Spain’s biggest power company, fell 3.4 percent to 3.87 euros. Endesa SA slumped 4.6 percent to 16 euros, while Acciona SA, which owns more than 4 gigawatts of wind farms in the country, tumbled 8.5 percent to 37.95 euros. Red Electrica Corp. slid 7.5 percent to 38.34 euros.

-

17:00

European stocks closed in different ways: FTSE 100 6,544.94 +1.53 +0.02%, CAC 40 3,855.09 -13.89 -0.36%, DAX 8,212.77 +53.97 +0.66%

-

16:39

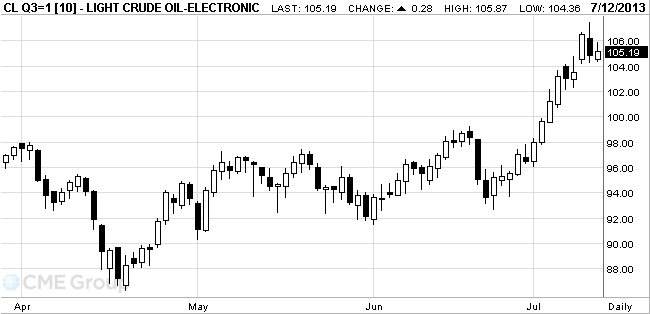

WTI crude heads for third weekly gain

West Texas Intermediate crude was little changed, heading for a third weekly increase, as U.S. corporate earnings topped analysts’ estimates and as U.S. inventories tumbled. Prices erased an early advance as the euro weakened against the dollar.

The U.S. dollar has returned to growth after the recession of the previous day, as investors were cautious before the publication of China's GDP.

The dollar exchange rate fluctuations repeats U.S. yields since Federal Reserve Chairman Ben Bernanke said in June that the U.S. economy is strong enough to reduce the amount of central bank could buy up bonds from the current $ 85 billion a month. On Monday, bond yields reached a 23-month high, but fell sharply after Bernanke said Wednesday that the need for super soft policy of the central bank to continue in the near future.

The market is also waiting for the report on China's GDP in the second quarter, which will be published on Monday. The median forecast of analysts, GDP growth slowed slightly to 7.5 percent.

Oil prices on Wednesday rose by 2.9%, after official data showed a sharp decline in U.S. oil inventories and rising Refinery utilization. On Thursday, many market participants took profits after the rise in oil prices by 10.3% this month.

According to data released on Wednesday, the U.S. Department of Energy, the oil reserves in the U.S. for the past two weeks decreased by 20.2 million barrels as refinery capacity utilization rate increased to above 16 million barrels a day, which is an 8-year high in the last two week. Oil reserves are now well below the levels recorded in the previous year, the first time since March 2012.

According to data published by the weekly Department of Energy, oil WTI at Cushing terminal fell by 5.4% in the week June 29 - July 5.

WTI crude for August delivery slipped 3 cents to $104.88 a barrel at 10:50 a.m. on the New York Mercantile Exchange. The volume of all futures traded was 15 percent above the 100-day average for the time of day. The August contract was 42 cents more than the September one.

Brent oil for August settlement gained 40 cents, or 0.4 percent, to $108.13 a barrel on the London-based ICE Futures Europe exchange. The volume of all futures traded was 12 percent below the 100-day average.

The European benchmark grade traded at a $3.25 premium to WTI contract. The spread dropped to $1.99 on July 10, the narrowest differential based on closing prices since November 2010.

-

16:20

Gold is down, but will show the maximum weekly gain in 2 years

Gold prices decline on profit taking after four days of growth, but this week is likely to show the highest growth in almost two years.

Since the beginning of the week the spot price rose 5 percent from a record weekly rise of 6.2 percent in October 2011.

From the beginning, gold fell by nearly 25 percent because of fears that the Fed will soon begin to reduce the amount of buying bonds from the current $ 85 billion a month. But Fed Chairman Ben Bernanke said on Wednesday that the central bank will keep a policy change in the near future. Minutes of the June meeting of the Federal Reserve showed that although many officials of the central bank does not want to reduce the amount of incentives is not yet convinced of the sustainable growth of employment, they generally agree that it is time to reduce the amount of buying up bonds.

According to analysts, gold will face resistance when trying to cross a boundary $ 1,300 per ounce. Many analysts are predicting that gold will fall in price this year due to an increase in demand for stocks, reduction of investments in gold-backed exchange-traded funds and weak physical demand.

The cost of the August gold futures on COMEX today dropped to $ 1266.40 per ounce.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, July 83.9 (forecast 85.3)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.2900, $1.2940, $1.2980, $1.3000, $1.3050, $1.3065, $1.3100

USD/JPY Y98.00, Y98.20, Y98.80, Y99.00, Y99.50, Y99.75, Y100.00, Y100.50, Y101.00

GBP/USD $1.4800, $1.4900, $1.4925, $1.5000, $1.5100

AUD/USD $0.9060, $0.9100, $0.9200

NZD/USD $0.8000

USD/CAD C$1.0500

-

14:33

U.S. Stocks open: Dow 15,464.89 +3.97 +0.03%, Nasdaq 3,580.37 +2.07 +0.06%, S&P 1,675.11 +0.09 +0.01%

-

14:29

Before the bell: S&P futures -0.03%, Nasdaq futures +0.07%

U.S. stock-index futures were little changed as investors weighed bank earnings and awaited a report on consumer confidence.

Global Stocks:

Nikkei 14,506.25 +33.67 +0.23%

Hang Seng 21,277.28 -160.21 -0.75%

Shanghai Composite 2,039.49 -33.50 -1.62%

FTSE 6,564.39 +20.98 +0.32%

CAC 3,872.53 +3.55 +0.09%

DAX 8,223.85 +65.05 +0.80%

Crude oil $105.49 -0.55%

Gold $1273.60 -0.49%

-

14:06

Upgrades and downgrades before the market open:

Upgrades:

Downgrades:

Pfizer (PFE) downgraded to Hold from Buy at Jefferies

Other:

-

13:31

U.S.: PPI excluding food and energy, m/m, June +0.2% (forecast +0.2%)

-

13:31

U.S.: PPI excluding food and energy, Y/Y, June +1.7% (forecast +1.6%)

-

13:31

U.S.: PPI, y/y, June +2.5% (forecast +2.1%)

-

13:30

U.S.: PPI, m/m, June +0.8% (forecast +0.5%)

-

13:16

European session: the U.S. currency strengthened

Data

01:30 Australia Home Loans May +0.8% +2.3% +1.8%

04:30 Japan Industrial Production (MoM) (Finally) May +2.0% +2.0% +1.9%

04:30 Japan Industrial Production (YoY) (Finally) May -1.0% -1.1%

05:00 Japan BoJ monthly economic report July

09:00 Eurozone Industrial production, (MoM) May +0.4% -0.2% -0.3%

09:00 Eurozone Industrial Production (YoY) May -0.6% -1.4% -1.3%

The EUR / USD fell sharply, approaching today to the lowest level yesterday. Note that the dynamics of trade have influenced the data for the euro area, as well as expectations of inflation data published in the United States. According to the median forecast of economists base value of the producer price index is likely to grow in June by 1.6%. It should be noted that the value is retained below the 2% target level of inflation the Fed.

Note that today's data from the Statistical Office of the European Union have shown that up to May, the euro zone industrial output fell markedly, thereby exceeded the forecasts of experts, which may indicate a continuation of the recession in the currency zone in the second quarter.

The report showed that in May, industrial output fell by 0.3% in April and 1.3% from May 2012. It is worth noting that according to the average forecasts of experts, industrial output had fallen by 0.2% for the month and 1.4% over the year.

The data also showed that the decline in industrial production in May was due to weak domestic demand and exports, as well as a sharp decline in production of durable consumer goods and capital goods. The decrease in production was recorded in most of the currency area, and even in Germany and France, as well as in Spain and Greece. However, was recorded a very sharp rise in Portugal, and more modest growth in Italy.

In general, the EU production fell by 0.6% from April, and decreased by 1.6% from May 2012.

The pound also fell sharply against the dollar, despite the positive manufacturing data in the construction industry. As it became known, the amount of production in this sector jumped in April, suggesting that the sector will contribute to economic growth in the 2nd quarter.

According to the data, production in the construction industry adjusted for seasonal variations in April increased by 4.6% compared with the previous month, and in May remained unchanged. Strong growth in April was provided by companies to carry out orders that have accumulated since March, when the weather was bad.

The relatively strong performance sector in April, followed adverse 1st quarter, when a decline in production in the construction sector has undermined economic growth. In the 1st quarter of production in the construction sector fell by 1.8%, limiting the growth of GDP of 0.3%, despite the acceleration of growth in the largest sector of the economy - the service sector.

Also, the data showed that, compared with the same period of the previous year, production in the construction sector in April fell by 2.2% in May - 4.8%. Such a sharp annual decline in production in May was mainly due to the fact that banks in May this year was one extra working day more than in May 2012.

The yen fell against the U.S. dollar. As it became known, the Bank of Japan expects a moderate increase in exports and industrial production as the economy recovers, according to the central bank's monthly report, published on Friday.

Meanwhile, data released today, which have been revised, showed that industrial production in Japan rose by 1.9% in May compared with the previous month, reflecting a steady increase in industrial activity due to the forces of domestic demand. Figure compared with an initial value increased by 2.0% after a 0.9% increase in April.

In addition, it was reported that the index of capacity utilization increased by 2.3% in May compared with the previous month - to 98.1.

On Thursday, the bank raised its assessment of the economy, saying, "The Japanese economy is beginning to recover at a moderate pace." The Bank used the word "recovery" for the first time since January 2011, two months before the deadly earthquake and tsunami in the island nation.

EUR / USD: during the European session, the pair fell to $ 1.3020

GBP / USD: during the European session, the pair fell to $ 1.5081

USD / JPY: during the European session, the pair rose to Y99.70

At 12:30 GMT the U.S. producer price index will be released in June. At 13:55 GMT the United States will present the consumer sentiment index from the University of Michigan in July. At 23:00 GMT New Zealand is to publish an index of housing prices from REINZ for June, as well as announce the change in the volume of home sales for June from REINZ.

-

13:00

Orders

EUR/USD

Offers $1.32085, $1.3130-50, $1.3123, $1.3100

Bids $1.3035/30, $1.3010/00, $1.2985/80, $1.2950, $1.2930/20

GBP/USD

Offers stg0.8700/05, stg0.8690/95, stg0.8660/65, stg0.8640

Bids stg0.8600, stg0.8575/65, stg0.8515/10, stg0.8500

AUD/USD

Offers $0.9280/85, $0.9250, $0.9220, $0.9200, $0.9170

Bids $0.9120, $0.9100, $0.9085/80, $0.9070, $0.9045/40

EUR/GBP

Offers stg0.8700/05, stg0.8690/95, stg0.8660/65, stg0.8640

Bids stg0.8613, stg0.8600, stg0.8575/65, stg0.8515/10, stg0.8500

EUR/JPY

Offers Y131.00, Y130.75/80, Y130.45/50, Y130.20, Y129.95/00

Bids Y129.00, Y128.50, Y128.39, Y128.25/20

USD/JPY

Offers Y100.50, Y100.20, Y100.00, Y99.80, Y99.40/50

Bids Y98.55/50, Y98.25/20, Y98.00, Y97.85/80

-

11:30

European stock indices rose

European stocks increased for a fifth day, their longest stretch of gains in 11 weeks, bolstered by merger and acquisition activity. U.S. stock index futures and Asian shares were little changed.

The benchmark Stoxx 600 rose 0.3 percent to 297.48 at 10:42 a.m. in London, extending its gain this week to 3.2 percent, as Alcoa Inc. started the U.S. earnings season with better-than-estimated results and Federal Reserve Chairman Ben S. Bernanke said the economy still needs stimulus.

European Central Bank executive board member Vitor Constancio said that the euro area’s slow economic recovery “implies that monetary policy has to stay accommodative for a longer period of time.” The U.S. Federal Reserve and the Bank of Japan indicated this week they will continue monetary stimulus.

In China, Finance Minister Lou Jiwei signaled the world’s second-biggest economy may expand less than the government’s target this year and that growth as low as 6.5 percent may be tolerable in the future.

While the government in March set a 2013 growth goal of 7.5 percent, Lou said he’s confident of achieving a 7 percent rate this year. He spoke yesterday at the U.S.-China Strategic and Economic Invensys jumped 15 percent to 504.5 pence after Schneider Electric, the world’s largest maker of low- and medium-voltage equipment, offered to pay 505 pence a share for the British company. The bid comprises 319 pence in cash and 186 pence in new Schneider shares. Invensys said it indicated to the French company that it will probably recommend the offer. Schneider fell 3.7 percent to 55.94 euros in Paris.

RWE increased 0.8 percent to 22.71 euros. The Wall Street Journal reported the German utility is in talks with the Qatar Investment Authority about selling its Dea oil-and-gas business, which has been valued at 4 billion ($5.2 billion) to 7 billion euros. The newspaper cited two people familiar with the matter.

Swedish Match AB gained 2.7 percent to 249 kronor in Stockholm. The Daily Mail reported speculation that Imperial Tobacco Group Plc may make a bid of 350 kronor ($52.51) a share for the maker of smokeless-tobacco products. The newspaper did not cite anyone.

Phoenix Group Holdings, the U.K.’s biggest manager of closed life-insurance funds, jumped 7.1 percent to 699.5 pence after saying it is in preliminary talks to combine with Swiss Re Ltd.’s Admin Re unit.

FTSE 100 6,577.48 +34.07 +0.52%

CAC 40 3,882.44 +13.46 +0.35%

DAX 8,235.67 +76.87 +0.94%

-

10:27

Option expiries for today's 1400GMT cut

EUR/USD $1.2900, $1.2940, $1.2980, $1.3000, $1.3050, $1.3065, $1.3100

USD/JPY Y98.00, Y98.20, Y98.80, Y99.00, Y99.50, Y99.75, Y100.00, Y100.50, Y101.00

GBP/USD $1.4800, $1.4900, $1.4925, $1.5000, $1.5100

AUD/USD $0.9060, $0.9100, $0.9200

NZD/USD $0.8000

USD/CAD C$1.0500

-

10:00

Eurozone: Industrial production, (MoM), May -0.3% (forecast -0.2%)

-

10:00

Eurozone: Industrial Production (YoY), May -1.3% (forecast -1.4%)

-

09:44

Asia Pacific stocks close

Asian stocks rose, with the regional benchmark index headed for its biggest weekly advance since April, amid optimism central bank stimulus and improving economic growth in the U.S. will buoy equities.

Nikkei 225 14,506.25 +33.67 +0.23%

Hang Seng 21,298.3 -139.19 -0.65%

S&P/ASX 200 4,973.89 +8.19 +0.16%

Shanghai Composite 2,039.49 -33.50 -1.62%

Miner BHP Billiton Ltd. gained 1.4 percent, tracking a surge overnight in metals prices.

Fast Retailing Co. sank 5.8 percent in Tokyo after Asia’s biggest clothing retailer reported earnings declined.

Newcrest Mining Ltd., Australia’s No. 1 gold miner, jumped 8.9 percent as the price of the precious metal headed for its steepest weekly surge in 21 months.

-

09:04

FTSE 100 6,558.26 +14.85 +0.23%, CAC 40 3,878.62 +9.64 +0.25%, Xetra DAX 8,186.79 +27.99 +0.34%

-

07:20

European bourses are initially seen trading higher Friday: the FTSE up 11, the DAX up 26 and the CAC up 7.

-

07:04

Asian session: Demand for the euro was limited

01:30 Australia Home Loans May +0.8% +2.3% +1.8%

04:30 Japan Industrial Production (MoM) (Finally) May +2.0% +2.0% +1.9%

04:30 Japan Industrial Production (YoY) (Finally) May -1.0% -1.1%

05:00 Japan BoJ monthly economic report July

Demand for the euro was limited before a government report which may show industrial production in the region declined. Euro-area output probably fell 0.3 percent in May from the previous month when it increased 0.4 percent, a separate Bloomberg poll showed. The European Union’s statistics office in Luxembourg is due to release data today.

The greenback was set for its first weekly slide in four against the yen before data next week forecast to show consumer price gains remained below the Fed’s 2 percent target. U.S. consumer prices probably grew 1.6 percent in the 12 months to June after a 1.4 percent year-over-year gain in May, according to the median estimate of economists surveyed by Bloomberg News before the Labor Department releases data on July 16. Labor Department data yesterday showed that initial claims for jobless benefits in the U.S. unexpectedly rose last week to a two-month high.

Fed Bank of St. Louis President James Bullard, who has advocated an increase in asset purchases if inflation slows, is due to speak today. Bullard, a voting member of the Federal Open Market Committee this year, speaks in Jackson Hole, Wyoming today. Minutes of the Fed’s June 18-19 meeting released July 10 showed that he said the central bank should “signal more strongly its willingness to defend its goal of 2 percent inflation” in light of low readings on consumer-price increases.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3075/00

GBP / USD: during the Asian session the pair traded in the range of $ 1.5165/85

USD / JPY: during the Asian session the pair traded in the range of Y98.70-Y99.30

There is a full data calendar on both sides of the Atlantic Friday, but perhaps the main feature will likely to be the late comments from Fed officials in the US. The European calendar gets underway at 0630GMT, with the release of the French June Bank of France retail survey. That is followed by the release of the French June HICP data at 0645GMT. Spanish inflation data is expected at 0700GMT, followed by the release of the Italian HICP data at 0800GMT. At 0830GMT, the UK May construction output data will be published, with analysts looking for a fall of 2.8% on year. At 0900GMT, the EMU May industrial output data will cross the wires, with expectations for a fall of 0.3% on month and a fall of 1.3% on year. At 1315GMT, German Chancellor Angela Merkel and Slovenian PM Alenka Bratusek will give a joint press conference after meeting in Berlin. At 1330GMT, ECB Executive Board member Vitor Constancio gives a keynote speech at a seminar on Asia's role in the economy, in Singapore.

-

06:23

Commodities. Daily history for Jul 11’2013:

Change % Change Last

GOLD 1,284.70 37.30 2.99%

OIL (WTI) 104.71 -1.81 -1.70%

-

06:22

Stocks. Daily history for Jul 11’2013:

Nikkei 225 14,472.58 +55.98 +0.39%

Hang Seng 21,423.5 +518.94 +2.48%

S&P/ASX 200 4,965.7 +64.34 +1.31%

Shanghai Composite 2,072.99 +64.86 +3.23%

FTSE 100 6,543.41 +38.45 +0.59%

CAC 40 3,868.98 +28.45 +0.74%

DAX 8,158.8 +92.32 +1.14%

DJIA 15,461.80 170.10 1.11%

S&P 500 1,676.13 23.51 1.42%

NASDAQ 3,578.30 57.55 1.63%

-

06:22

Currencies. Daily history for Jul 11'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3022 +1,81%

GBP/USD $1,5061 +1,29%

USD/CHF Chf0,9534 -2,03%

USD/JPY Y99,53 -1,56%

EUR/JPY Y129,60 +0,29%

GBP/JPY Y149,89 -0,22%

AUD/USD $0,9221 +0,53%

NZD/USD $0,7901 +0,68%

USD/CAD C$1,0428 -0,96%

-

06:00

Schedule for today, Friday July 12’2013:

01:30 Australia Home Loans May +0.8% +2.3%

04:30 Japan Industrial Production (MoM) May +2.0% +2.0%

04:30 Japan Industrial Production (YoY) May -1.0%

05:00 Japan BoJ monthly economic report July

09:00 Eurozone Industrial production, (MoM) May +0.4% -0.2%

09:00 Eurozone Industrial Production (YoY) May -0.6% -1.4%

12:30 U.S. PPI, m/m June +0.5% +0.5%

12:30 U.S. PPI, y/y June +1.7% +2.1%

12:30 U.S. PPI excluding food and energy, m/m June +0.1% +0.2%

12:30 U.S. PPI excluding food and energy, Y/Y June +1.7% +1.6%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index 84.1 85.3

17:00 U.S. FOMC Member James Bullard Speaks

-

05:31

Japan: Industrial Production (MoM) , May +1.9% (forecast +2.0%)

-