Notícias do Mercado

-

23:54

GBP/USD fades recovery near 1.1100, US inflation, BOE’s bond-buying eyed

- GBP/USD pares the biggest daily gains in over a week.

- BOE-linked operations, sluggish US dollar allowed buyers to sneak-in despite downbeat UK data.

- US CPI, BOE’s bond-buying will be in focus as sellers brace for entry.

GBP/USD struggles to extend the previous day’s rebound from a two-week low, retreating to 1.1095 of late, as markets turn dicey ahead of Thursday’s US inflation data. Also weighing on the Cable pair could be recently hawkish comments from the Federal Reserve Governor Michelle Bowman, as well as fears surrounding the British economy and the Bank of England’s (BOE) bond-buying program.

Federal Reserve Governor Michelle Bowman said on Wednesday that if high inflation does not start to wane she will continue to support aggressive rate rises aimed at taming price pressures, reported Reuters.

On the other hand, Bank of England policymaker Catherine Mann stated that tackling inflation will hurt the UK more than others. On the same line could be the UK PM Liz Truss’ determination to keep the widely criticized mini budget despite knowing that it will post a £60 billion funding hole. "I am still inclined to believe that a significant monetary policy response will be required in November," Bank of England (BOE) Chief Economist Huw Pill said on Wednesday, as reported by Reuters.

On Wednesday, chatters that the Bank of England (BoE) will extend its gilt purchases triggered the GBP’s upside before the “Old Lady”, as the BOE is informally known, mentioned that gilt purchases are a temporary program and that they will be unwound in a smooth and orderly fashion. The news reversed Sterling’s initial gains and recollected downbeat UK statistics to challenge the GBP/USD bulls before the US dollar weakness favored the upside momentum.

That said, UK Gross Domestic Product (GDP) dropped to -0.3% MoM in August versus 0.0% expected and 0.2% prior whereas the Industrial Production (IP) and Manufacturing Production (MP) also slumped into the negative territory during the stated month.

Additionally, a survey conducted by YouGov and consultancy the Centre for Economics and Business Research stated that the UK Consumer Confidence gauge fell to 97.7 in September from 98.8. The detail also stated that British consumer confidence fell due to a steep deterioration in homeowners’ attitudes toward their house values.

It should be noted that the latest Federal Open Market Committee (FOMC) Meeting Minutes failed to impress the US dollar bulls despite showing the policymakers’ hawkish bias amid concerns over more persistently high inflation. The Fed Minutes also mentioned that the participants agreed the Committee needed to move to, and then maintain, a more restrictive policy stance in order to meet the Committee’s legislative mandate to promote maximum employment and price stability.

Amid these plays, yields remained weak for the second consecutive day and the equities ended the day with mild losses while the US dollar snapped a five-day uptrend.

Looking forward, GBP/USD pair can witness further consolidation of the latest gains but the decline is likely to be smoother ahead of the US inflation data wherein the headline CPI is expected to ease to 8.1% YoY versus 8.3% prior but the more important CPI ex Food & Energy is likely to increase to 6.5% YoY from 6.3% prior and can trigger more downside considering the recession woes.

Technical analysis

GBP/USD’s rebound failed to cross the 21-DMA immediate hurdle, around 1.1155 by the press time, which in turn directs the cable pair towards the 1.0930-15 horizontal support area established from September 26.

-

23:41

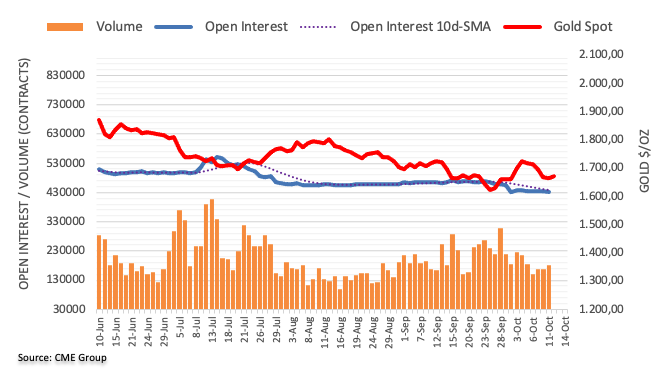

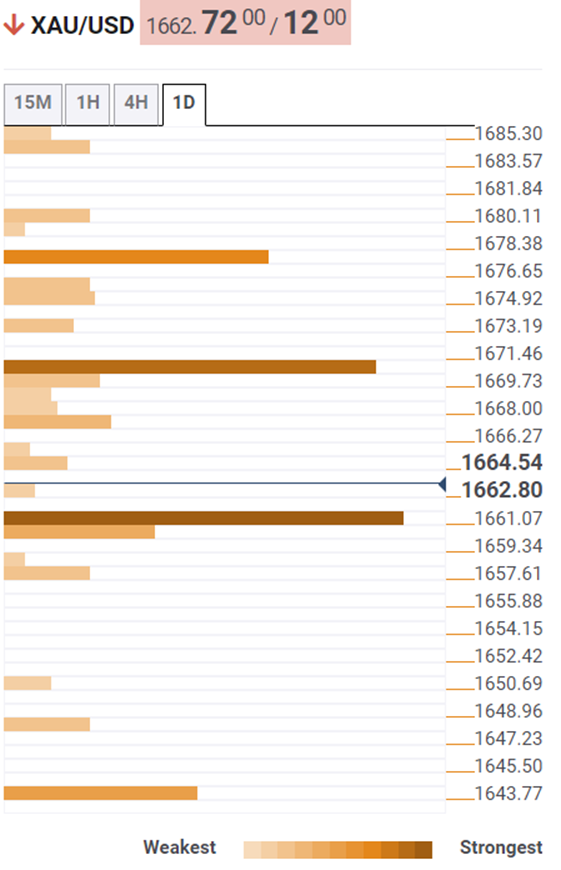

Gold Price Forecast: XAU/USD establishes above $1,670 despite mix risk profile, US Inflation eyed

- Gold price has established comfortably above the $1,670.00 hurdle despite mixed market mood.

- The odds of a fourth consecutive 75 bps rate hike by the Fed have soared vigorously.

- The mighty DXY has locked in a chartered territory ahead of the US inflation report.

Gold price (XAU/USD) has shifted its business above $1,670.00 despite the mixed responses from the risk profile. The majority of the assets are displaying a lackluster performance while the precious metal seems in a better position after a rebound from around $1,660.00.

The yellow metal has not been impacted by the accelerating chances for a fourth consecutive 75 basis points (bps) rate hike by the Federal Reserve (Fed) in the first week of November. As per CME FedWatch tool, 84.8% odds are favoring a fourth consecutive 75 bps rate hike by the Fed.

Meanwhile, the US dollar index (DXY) is balancing in a 113.06-113.60 range and is awaiting the release of the US Consumer Price Index (CPI) data for further guidance. The consensus on the inflation report indicates that the headline US CPI will land at 8.1%, lower than the prior release of 8.3% while the core CPI that excludes oil and food prices will accelerate to 6.5% vs. the former print of 6.3%. Thanks to the declining gasoline prices, which have trimmed projections for the headline inflation rate.

Gold technical analysis

Gold price is working hard to sustain itself above the 61.8% Fibonacci retracement (placed from September’s low at $1,618.68 to October 5 high at $1,726.53) at $1,658.60 on an hourly scale. The precious metal is oscillating in a $1,661.85-1,684.05 range. The 20-and 50-period Exponential Moving Averages (EMAs) are on the verge of a bullish crossover of around $1,674.00.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bearish range of 20.00-40.00 and is attempting to cross the 60.00 hurdle.

Gold hourly chart

-

23:34

Fed’s Bowman: More big rate hikes on table if inflation will not cool

Federal Reserve Governor Michelle Bowman said on Wednesday that if high inflation does not start to wane she will continue to support aggressive rate rises aimed at taming price pressures, reported Reuters.

Key quotes

Inflation is much too high, and I strongly believe that bringing inflation back to our target is a necessary condition for meeting the goals mandated by Congress of price stability and maximum employment on a sustainable basis.

Fed rate rises this year, which have been very large relative to the pace of past rate rise campaigns, had her full support.

If we do not see signs that inflation is moving down, my view continues to be that sizable increases in the target range for the federal funds rate should remain on the table.

I believe a slower pace of rate increases would be appropriate.

To bring inflation down in a consistent and lasting way, the federal funds rate will need to move up to a restrictive level and remain there for some time.

Not yet clear how far the Fed will need to increase the cost of short-term credit and how long it will need to maintain a restrictive policy stance.

Under current circumstances, however, the best we can do on the public communications front is, first, to continue to stress our unwavering resolve to do what is needed to restore price stability.

US Dollar licks its wounds

Following the news, the US dollar seems to be picking up the bids as prices of the most active pairs in the early Asian session, like AUD/USD, eased after the release. That said, the Aussie pair was last seen retreating from the intraday high to 0.6270.

Also read: AUD/USD braces for key inflation numbers below 0.6300 amid sluggish markets

-

23:31

GBP/JPY Price Analysis: Bounces off weekly lows, though stalls at 163.00

- GBP/JPY recovered Tuesday’s losses, gaining in the week, so far 1.05%.

- Short term, the GBP/JPY is upward biased, though facing solid resistance at the 100-day EMA around 163.00.

The GBP/JPY slightly advances as the Asian session begins, following a positive trading session for the British pound, which recovered Tuesday’s losses, courtesy of BoE’s Governor Andrew Bailey, who spooked investors when he said that the BoE due date for the emergency buying program, would be October 14. Traders reacted negatively, dumping risk-perceived assets. At the time of writing, the GBP/JPY is trading at 162.90.

On Wednesday, the GBP/JPY opened below the 160.00 mark, rallying sharply close to 300 pips. Why? All this happened as market sentiment improved earlier in the New York session and relieved that the UK’s Chancellor of the Exchequer, Kwarteng, authorized an additional 100 billion quid for the BoE, increasing its bond purchasing power to GBP 995 billion.

GBP/JPY Price Forecast

Given the backdrop, the GBP/JPY is still neutral-to-upward biased. Even though the GBP/JPY faces solid resistance around the 100-day EMA at 163.13, the GBP/JPY registered a fresh four-day high, meaning buyers are gathering momentum. Another factor that justifies the bias is the RSI on bullish territory, which could exacerbate a rally towards October 5 cycle high at 165.71.

The GBP/JPY four-hour scale illustrates six-consecutive bullish candles as the cross-currency pair edged toward 163.00. On its way upwards, the pair cleared the 20, 50, and 200-EMA, opening the door for further gains. Key resistance lies at the R1 daily pivot found at 164.30, which is also October’s 5 cycle high. Break above will expose the 165.00 figure, followed by the confluence of the October 4 daily high and the R2 pivot point at 165.71.

GBP/JPY Key Technical Levels

-

23:31

United States API Weekly Crude Oil Stock rose from previous -1.77M to 7.054M in October 7

-

23:24

AUD/USD braces for key inflation numbers below 0.6300 amid sluggish markets

- AUD/USD grinds near 31-month low amid cautious trading.

- FOMC Minutes unveiled policymakers’ concerns for doing too little, as expected.

- Fresh covid woes, firmer US data challenged risk profile despite a retreat in yields, sluggish equities.

- Aussie Consumer Inflation Expectations, US CPI could direct traders, mostly towards the south amid recession fears.

AUD/USD licks its wounds at the multi-month low, staying mostly unchanged around 0.6280 during Thursday’s Asian session. In doing so, the risk barometer pair portrays the inactive markets ahead of inflation data from Australia and the US.

AUD/USD dropped to a fresh low since March 2020 the previous day before bouncing off 0.6235 amid the US dollar’s pullback and improvement in the market sentiment. However, broad fears and a lack of major surprises, as well as anxiety ahead of today’s key data, kept the quote captive afterward.

The latest Federal Open Market Committee (FOMC) Meeting Minutes failed to impress the US dollar bulls despite showing the policymakers’ hawkish bias amid concerns over more persistently high inflation. The Fed Minutes also mentioned that the participants agreed the Committee needed to move to, and then maintain, a more restrictive policy stance in order to meet the Committee’s legislative mandate to promote maximum employment and price stability.

Elsewhere, US Producer Price Index (PPI) declined to 8.5% YoY in September versus 8.4% expected and 8.7% prior. Further, the Core PPI eased to 7.2% versus 7.3% previous readings and market forecasts.

It should be noted that Minneapolis Fed President Neel Kashkari said on Wednesday that they will have room to assess the economy by moving rates at an "aggressive but not overwhelming" pace, as reported by Reuters. "A judgment call on whether we move in 50 or 75 bps increments on rates," added Fed’s Kashkari.

At home, Reserve Bank of Australia (RBA) Assistant Governor Luci Ellis mentioned, that the central bank’s policy is no longer in an expansionary place. However, comments like, “The neutral rate was a moving target and hard to determine at any stage in time,” seemed to have weighed on the AUD/USD prices earlier on Wednesday.

That said, fresh coronavirus fears from China and Europe, as well as anxiety ahead of today’s US Consumer Price Index (CPI) for September, not to forget Australia’s Consumer Inflation Expectations for October, restricted the AUD/USD pair’s immediate moves.

Moving on, the quote may witness a lackluster session ahead of the Aussie data, expected 5.8% for October versus 5.4% prior, while an upbeat outcome may not impress buyers much due to the RBA’s recent dovish hike. Major attention, however, will be given to the US inflation data wherein the headlines CPI is expected to ease to 8.1% YoY versus 8.3% prior but the more important CPI ex Food & Energy is likely to increase to 6.5% YoY from 6.3% prior and can trigger more downside considering the recession woes.

Technical analysis

Despite the latest rebound from the 31-month low of 0.6235, the AUD/USD pair remains inside a five-week-old bearish channel, between 0.6160 and 0.6430 by the press time. That said, oversold RSI (14) signals limited downside room.

-

23:01

Chile BCCH Interest Rate meets expectations (11.25%) in September

-

22:58

EUR/USD displays a rangebound structure around 0.9700 ahead of US Inflation

- EUR/USD has turned sideways around 0.9700 as investors are laser-focused on US CPI data.

- Fed policymakers withstand restrictive policy measures despite slowing labor market.

- A hawkish commentary from ECB Lagarde failed to strengthen the shared currency bulls.

The EUR/USD is displaying a lackluster performance in the early Tokyo session as investors are laser-focused on the US Consumer Price Index (CPI) data. The asset is oscillating around 0.9700 after a rebound from 0.9670 amid a conflicting risk-profile structure. The pullback move in S&P500 in early trade was whitewashed near settlement amid concerns over the release of the US inflation report.

Also, the US dollar index (DXY) was auctioned in a balanced profile chartered in a range of 113.06-113.60. The mighty DXY displayed a sideways performance despite the rising odds of a 75 basis point (bps) rate hike by the Federal Reserve (Fed). As per CME FedWatch tool, 84.8% odds are favoring a fourth consecutive 75 bps rate hike by the Fed. Apart from that, the 10-year US Treasury yields are hovering around 3.9% after failing to cross the 4.0% hurdle.

The release of the Fed minutes on Wednesday has made it ‘loud and clear’ that bringing price stability is the foremost priority of the Fed. Despite the slowing labor market, officials are committed to standing with a ‘restrictive’ stance on interest rates. The majority of Fed policymakers believe that reaching the targeted terminal rate and sticking to it for an uncertain period of time is critical to contain the mounting price pressures.

Going forward, the US inflation data is the most important catalyst for a decisive move in the currency market. The headline US inflation may trim to 8.1%, as per the expectations. While the core CPI that doesn’t consider oil and food prices may increase to 6.5%.

On the Eurozone front, hawkish commentary from European Central Bank (ECB) President Christine Lagarde has failed to strengthen the shared currency bulls. ECB policymaker stated that the Governing Council is having discussions on Quantitative Tightening (QE) and interest rate is the most appropriate tool in current circumstances.

-

22:45

New Zealand Food Price Index (MoM) came in at 0.4%, above expectations (-0.1%) in September

-

22:35

ECB’s De Cos: Some shocks in ECB downside scenario have materialised

Some shock in the European Central Bank's downside has materialised according to the ECB policymaker Pablo Hernandez de Cos said who crossed the wires late in the North America session. He previously said earlier this week that risks to the inflation outlook in the eurozone remain on the upside and have intensified, particularly in the short term.

He also said today that the UK situation should not be contagious if properly managed. He says this as the UK 20- and 30-year yields hit 20-year high above 5%

following Andrew Bailey's comments, who is the governor of the Bank of England. The government borrowing costs surged again when Bailey told pension funds they had three days to fix liquidity problems before the bank ends emergency bond-buying that has provided support.Meanwhile, the euro is under pressure as the US dollar remains the favourite. Earlier today, Minneapolis Fed President Neel Kashkari reaffirmed policymakers' commitment to the current rate-hike path, saying the bar for a shift away from monetary policy tightening is "very high." These comments come ahead of Thursday's US Consumer Price Index reading which is expected to return to a four-decade high. Meanwhile, prices paid to US producers rose more than expected in September, supporting the greenback, according to data released on Wednesday.

Additionally, Reuters reports that the ECB's policymakers are close to deal to change the terms of targeted longer-term refinancing operations and that the decision could come Oct 27. The deal is governing trillions of euros worth of loans to banks in a move that will shave tens of billions of euros off in potential banking profits, sources close to the discussion said.

EUR/USD update

-

22:14

USD/CAD Price Analysis: Bulls eye a run to last week's highs, 1.,3855

- USD/CAD bears are taken on by the bulls and eyes are on last week's highs.

- A break of the consolidation phase could be on the cards for Asia.

As per the pre-FOMC Minutes analysis, USD/CAD Price Analysis: The pair is teed up ahead of the FOMC Minutes, whereby the break of trendline support was teeing up a move to the downside, the price made a move but has been picked up by the bulls at a discount and above anything particularly significant.

USD/CAD prior analysis

As illustrated, the pair was expected to move lower into the consolidation's key area of demand. However, the minutes had something for everyone and while there was a move towards the area, the bulls stepped in again despite a note within the minute that was regarded as leaning towards a dovish pivot: ''Several participants noted that... it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook."

USD/CAD update

Bears could be out of luck as the price forms a new structure around 1.3810 following a failed attempt to break out of the consolidation area to the downside. The focus is on last week's high near 1.3855.

-

22:07

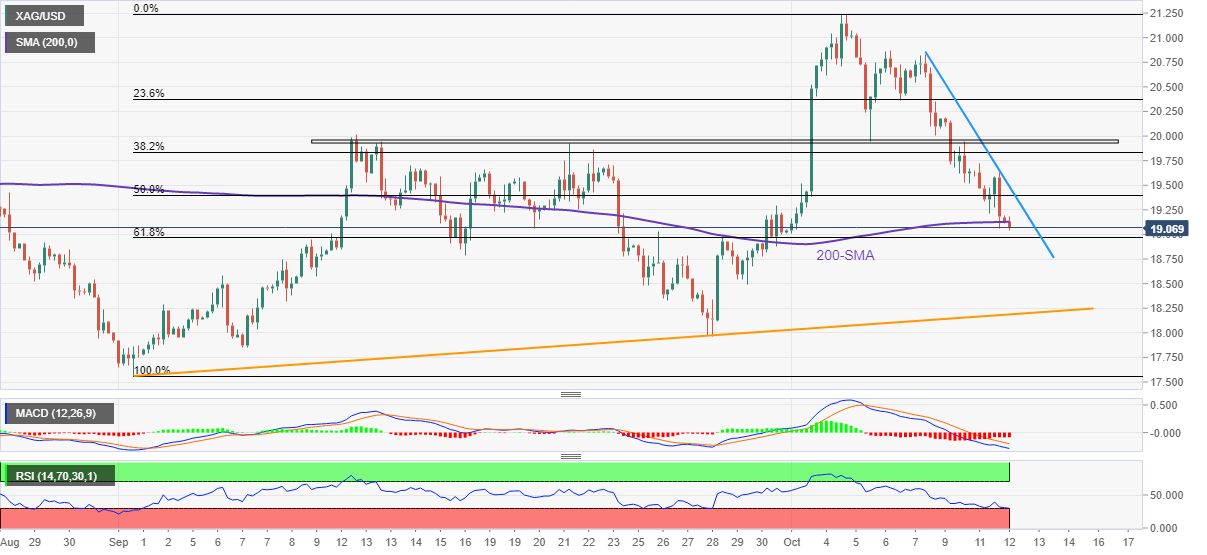

Silver Price Forecast: XAG/USD tumbles as the greenback pares its losses

- XAG/USD extended its weekly losses by almost 3%.

- FOMC’s minutes showed that officials prefer overdoing tame inflation over avoiding recession.

- Investors brace for September’s US Consumer Price Index (CPI), which could shed some light regarding Fed’s path on monetary policy.

Silver price extended its losses to four straight days, albeit US Treasury bond yields easing from weekly highs, courtesy of FOMC minutes showing Fed officials worried about declaring victory on inflation.

XAG/USD slides on overall market mood

The XAG/USD hit a daily high of $19.30 earlier in the European session, though as the session progressed, it slid to the day’s low at $18.84 before recovering some ground. At the time of writing, XAG/USD is trading at $19.05, 0.77% below its opening price.

US equities finished Wednesday’s session down with minimal losses. The mood shifted sour on the BoE’s emphasizing that the emergency bond-buying program would end by October 14, while September FOMC minutes weighed on risk-perceived assets.

FOMC’s minutes reflected that policymakers “emphasized the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action.” Officials added that it would be necessary to “calibrate the pace of further rate hikes” to reduce the impact on the US economy.

About a possible Fed pivot, several Fed members expressed the need to maintain a restrictive policy for as long as necessary,” reiterating the need to increase rates higher for longer.

Aside from this, traders are bracing for September’s US inflation report on Thursday. Wednesday’s data showed that the Producer Price Index (PPI) grew by 8.5% YoY, whiles excluding volatile items like food and energy, the so-called core PPI rose by 7.2%, less than the previous reading and forecasts.

Given the backdrop, the odds of a 75 bps rate hike lie at 82%, as shown by the CME FedWatch Tool. Therefore, the white metal would likely remain under pressure, which would refrain Silver buyers from opening fresh bets as US T-bond yields rise.

XAG/USD Key Technical Levels

-

21:26

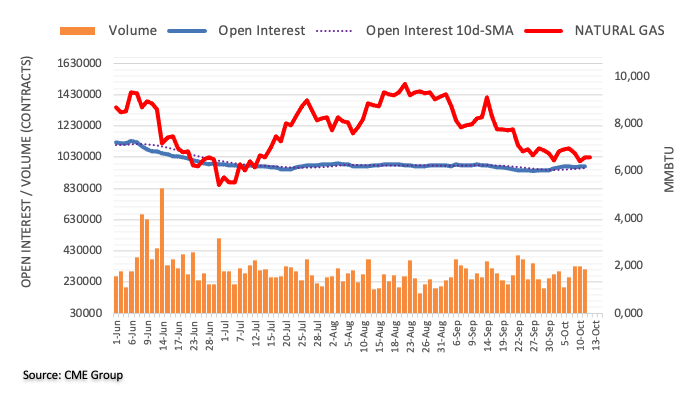

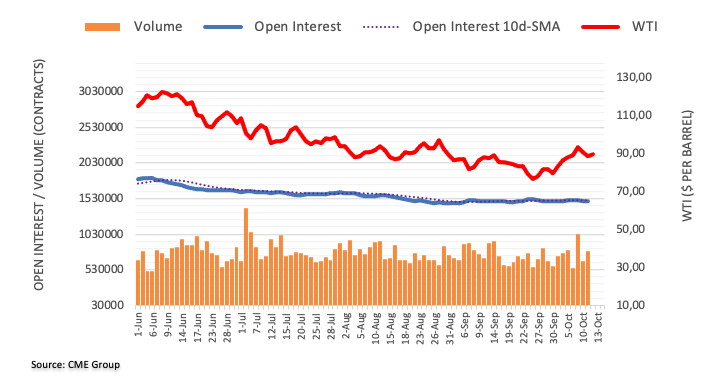

WTI supply risks in focus ahead of US CPI

- WTI is under pressure leading up to the key event of the week in US CPI.

- Energy supply risks are rising in OPEC's influential Monthly Oil Market Report.

West Texas Intermediate (WTI) has been on the back foot on Wednesday, losing over 1.8% on the day into the close on Wall Street. OPEC lowered its demand expectations for this year and next following the cut to production targets made last week by two-million barrels per day. At the time of writing, WTI is trading at 87.03 having travelled between a low of $86.30 and a high of $90.05.

Oil prices are a key theme this week with regard to Thursday's release of the US Consumer Price Index where core prices have likely stayed strong in September, with the series registering another large 0.5% MoM gain. ''Shelter inflation likely remained strong, though we look for used vehicle prices to retreat sharply. Importantly, gas prices likely brought additional relief for the headline series again, declining by about 5% MoM. Our MoM forecasts imply 8.2%/6.6% YoY for total/core prices,'' analysts at TD Securities explained. The data will likely be firming the Federal Reserve's determination to slow the economy through higher interest rates and heightening the recession fears that have been a bearish factor for oil.

Meanwhile, energy supply risks are rising at a fast clip and in its influential Monthly Oil Market Report, OPEC cut its 2022 demand forecast by 0.5-million barrels per day due to "the extension of China's zero-COVID-19 restrictions in some regions, economic challenges in OECD Europe. OPEC+'s cut to production targets last week comes despite opposition from the Biden Administration as the group looks to bolster high prices for oil

''The OPEC+ group's effective 1.1m bpd cut will tighten physical balances, providing a positive catalyst for both spot prices and timespreads and thereby incentivizing additional participation,'' analysts at TD Securities argued. ''This is creating a set-up for a substantial rise in prices as the US SPR releases grind to a halt, while Russian production starts to be eroded at a faster clip. While the resumption in flows from Kazakhstan provides a partial offset, oil industry strikes in Iran have reportedly spread to a major crude refinery in the southwest, further adding to supply risks. The right tail in oil prices is still fat.''

''Meanwhile, a pipeline leak is halting an estimated 200k bpd of flow from the Northern Druzhba pipeline, exacerbating the near-term tightening in balances. This leaves traders' attention placed on the demand side of the equation — a very-hard landing could still derail the recovery in energy prices, but the garden-variety recession that most economists expect is likely to see oil demand growth slow, but not decline. This could exacerbate the tightening in energy markets at a time when Chinese mobility continues to firm, as highlighted by our tracking of road traffic conditions for the top 15 cities by vehicle registrations.''

-

21:05

AUD/JPY Price Analysis: Hovering above a key support area

- AUD/JPY has reached a key support area at 90.20/40.

- The activation of potential H&S formation might send the pair to 84.00 or lower.

The Australian dollar has been going through a steady downward trend against the Japanese yen over the last weeks, weighed by the negative market sentiment.

The Aussie dollar has now reached an important support area at 91.29/40 area, which contained bears in late May and early June and also prompted the recovery from the August 2 low.

In this case, the mentioned area corresponds with the neckline of a potential Head & Shoulders figure (as shown in the following daily chart), which might send the pair down to the 84.00 area.

On the upside, a successful breach of the 94.60 resistance area (October 4,6 highs) would ease downside pressure and probably increase bullish momentum to aim for 96.45 (September 20, 22 highs) before retesting September’s peak at 98.60.

AUD/JPY Daily Chart

Technical levels to watch

-

20:34

Forex Today: Central banks are noisy ahead of US inflation data

What you need to take care of on Thursday, October 13:

The American Dollar finished Wednesday little changed, despite some noise coming from major central banks. Investors await US inflation data, which could provide fresh clues on where the US Federal Reserve is heading next

The Bank of England (BOE) Governor Andrew Bailey was once again on the wires this Wednesday amid the latest emergency program. Rumors that the central bank could extend its latest emergency founding program beyond this week triggered risk appetite early on Wednesday, although the BOE quickly denied such a possibility, sending investors back into the US Dollar. Bank of England Chief Economist Huw Pill later noted that he believes a “significant” monetary policy response would be required in November.

UK Prime Minister Liz Truss aims to move forward with the mini-budget, despite criticism about the £60 billion funding hole. Truss repeated that she would not cut public spending, despite tax cuts and skyrocketing inflation.

Mid-US afternoon, the US Federal Reserve released the Minutes of the latest meeting. Policymakers repeated they are determined to maintain the restrictive monetary policy to control elevated inflation. Additionally, officials said that once they reach what they consider a restrictive level, “it would be appropriate to keep it there for a period of time.”

Restricted volatility could be blamed on the upcoming US Consumer Price Index report. Inflation is expected to have risen by 8.1% YoY, decreasing slightly from the previous 8.3%. Core inflation, on the other hand, is expected to have ticked higher toward its recent multi-decade high of 6.5%. Also, Germany will publish the final estimate of its September CPI, foreseen steady at 10.9% in its EU harmonized version.

Despite being away from investors’ radar, coronavirus may soon become a theme across financial markets. China’s zero-covid policy is seeing fresh shutdowns in the country, with Shanghai closing schools, bars, gyms, and other venues. China is not alone, as Europe and the WHO warned about a new wave entering Europe, which could be complicated by a resurgence of flu.

The EUR/USD pair remains stable at around 0.9700, while GBP/USD has been a bit more volatile, ending the day at around 1.1100. The USD/CAD currently trades at 1.3810, while AUD/USD is up to 0.6280.

The Japanese yen plunged against the greenback, with USD/JPY reaching a fresh multi-decade high of 146.96, holding on to gain as the Bank of Japan refrained from intervening.

Gold ticked higher and trades around $1,675 a troy ounce, while crude oil prices extended their slide. WTI is now at $87.20 a barrel.

Bitcoin price: The slingshot is pulled back, BTC ready to test $16,900?

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:33

Gold Price Forecast: XAU/USD spikes up to $1,678 on the back of FOMC minutes

- Gold squeezes higher to reach $1,678 after Fed's minutes.

- The US dollar loses ground as the Fed hints to moderate the hiking pace.

Gold futures spiked up to session highs at $1,677, with the US dollar turning lower as the minutes of September’s Fed meeting have been considered as tilted to the dovish side.

The yellow metal, however, has given away gains shortly afterward, with the US dollar retracing lost ground. XAU/USD is practically back at pre-Minutes levels at the time of writing.

Investors see hints of moderation in the Fed’s minutes

The Federal Reserve has shown its surprise at the pace of inflation and has confirmed that the officials maintain their commitment to continue hiking interest rates until the problem shows signs of resolving.

The market, however, has analyzed one comment as a potential sign of moderation on the monetary tightening cycle: “Several participants noted that (…) it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook.”

These comments have been taken as a hint that the bank might be considering smaller rate hikes in the next months. This has had a negative impact on the USD, which sent gold futures higher.

Technical levels to watch

-

20:25

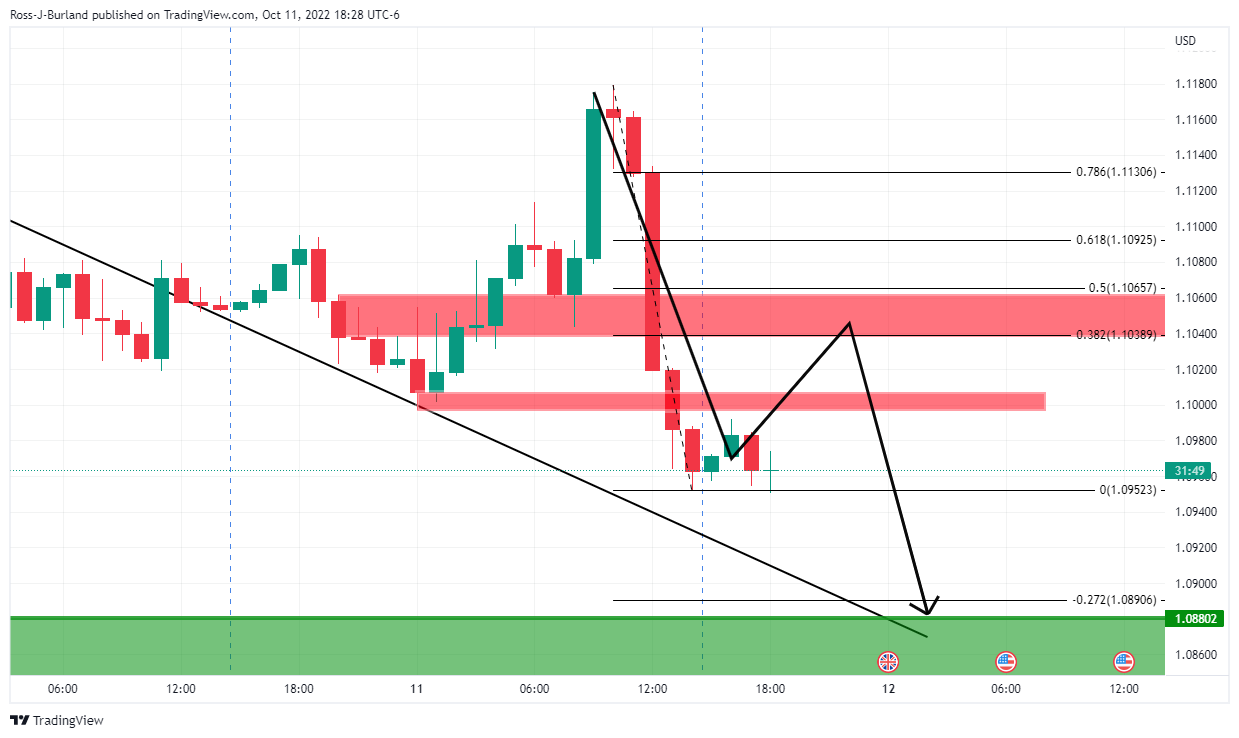

GBP/USD Price Analysis: Bulls and bears battle it out at key trendline support

- Cable bulls moved in on the back of the FOMC minutes.

- GBP/USD bears are attempting to break the trendline support.

GBP/USD is perking up following the Federal Open Market Committee minutes and has printed a fresh high for the day of 1.1133. It has since dipped back to 1.1090 to test the neckline of the 15-minute chart's W-formation and near the dynamic trendline support as the following chart shows:

GBP/USD M15 chart

The price is above last week's high, which is bullish for the day ahead whereby traders in Tokyo will note and acknowledge the prior day's highs also as a potential target area.

Failing that, however, on a break of the trendline support, a move back to the prior day's low could come about in an aggressive sell-off should the US dollar be a favourite among investors again ahead of Thursday's Consumer Price Index:

-

19:59

NZD/USD extends recovery past 0.5600 after FOMC minutes

- The Kiwi gains traction and reaches session highs past 0.5600.

- The US dollar loses ground after the release of the Fed's minutes.

- NZD/USD's downtrend could extend to 0.50 – ING

The New Zealand dollar is taking advantage of a moderate US dollar pullback. The pair has rushed past 0.5600 on Wednesday's US session, to hit session highs at 0.5630 so far.

The US dollar eases after Fed’s minutes

The greenback lost ground immediately after the release of September’s Federal Reserve meeting minutes. The US Dollar Index has dropped to session lows below 113.00, triggering moderate advances on its main rivals.

The Federal Reserve's minutes reflect the committee's surprise at the pace of inflation and reiterate the bank's commitment to keeping hiking rates until the problem shows signs of resolving.

Investors, however, have analyzed one comment as a potential sign of moderation in the monetary tightening pace, which might explain USD's reversal. According to the meeting minutes, “Several participants noted that, particularly in the current highly uncertain global economic and financial environment, it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook,”

NZD/USD might extend its downtrend towards 0.50 – ING

From a wider perspective, FX analysts at ING remain bearish in the long-term: The Reserve Bank of New Zealand hiked by another 50 bps in October and signalled more tightening is on the way. Another 50 bps increase is largely expected at the November meeting. The role of monetary policy remains secondary compared to global risk dynamics (…) NZD/USD is looking at the 0.50 2009 lows as the next key support"

Technical levels to watch

-

19:48

AUD/USD pops on hint of a pivot from FOMC officials

- AUD/USD bulls step in on a whisper of a dovish pivot at the Fed.

- The FOMC minutes have been digested, on the knee-jerk, as less hawkish.

AUD/USD has popped on the back of a hint of a dovish tilt at the Federal Reserve following the release o the minutes that signified that officials are concerned about the detrimental effects higher rates will have on the US economy. At the time of writing, AUD/USD is trading at 0.6285, a touch below the post-FOMC minute's highs of 0.6298. The pair have travelled between a low of 0.6235 and 0.6298 so far.

On the margin, these minutes could be taken as somewhat less hawkish than the rhetoric that we have heard from Fed speakers and lean towards a pivot: "Several participants noted that... it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook."

In additional notes, however, the minutes stated that Fed officials determined that they needed to adopt and maintain a more restrictive policy stance in order to achieve their goal of lowering elevated inflation.

- Many participants raised their assessment of the federal funding path required to meet committee objectives.

- Many participants indicated that once the policy had reached a sufficiently restrictive level, it would be appropriate to keep it there for a period of time.

- Several participants predicted that as policy became more restrictive, risks would become more two-sided.

- Several participants emphasized the importance of maintaining a restrictive stance for as long as necessary.

- Despite a slowing labour market, officials are committed to raising interest rates.

Meanwhile, and as for the Reserve Bank of Australia, the Assistant Governor (Economic) Luci Ellis's speech titled "The Neutral Rate: The Pole-star Casts Faint Light" didn't shed much light on the policy path ahead, as analysts at TD Securities noted.

''Instead'', they said, the speech was ''reiterating the Bank's view that neutral interest rate is probably "at least 2.5%". The RBA models estimate that the real neutral rate is roughly in the range from "-0.5% to 2%", and an average pins it just under 1%.''

The analysts explained that ''this is close to the RBA's previous update of the real neutral rate in 2017 where the RBA estimated the real neutral cash rate to be around 1%.''

''The Asst Governor further emphasised that the neutral rate is broadly an estimate and not to think of it "as a mechanistic approach of ‘we have to get back to neutral’, or above neutral".''

The analyst's main takeaway from the speech is that the RBA is trying to make clear to the market that the hiking cycle is likely not over despite the RBA returning to its "business as usual" approach of 25bps hikes. ''We view any expectation for the RBA to near a pause as misguided and see the Bank hiking the cash rate by 25bps consecutively to 3.60% by March 2023.''

AUD/USD technical analysis

as the above 15-minute chart illustrates, the pair have attempted to break out from the consolidation as it pushes back against the trendline support following the double-bottom pout in earlier in the day. Should the bulls commit, then there will be a case for a significant move towards the prior day;s and last week's highs.

-

19:38

USD/JPY Price Analysis: Hold to gains above 146.70, despite worries of a BoJ intervention

- USD/JPY climbs above 146.00, an area where the BoJ intervened in the market, though the major extended its gains.

- BoJ’s Governor Kuroda remained dovish as the BoJ is trying to get inflation to its 2% target.

- USD/JPY remains upward biased, and worries about BoJ’s intervention keep traders cautious.

The USD/JPY extends its rally above the 146.00 mark, courtesy of BoJ’s Governor Kuroda, giving the green light to continue weakening the Japanese yen. Hence, USD/JPY traders opened fresh longs, lifting the pair toward the 147.00 level. At the time of writing, the USD/JPY is trading at 146.72, up by 0.73%.

USD/JPY Price Forecast

On Wednesday, the USD/JPY cleared the top of the 145.30-90 range, extending its gains above the 146.00 figure. Even though fears of a possible BoJ intervention waned with Governor Kuroda’s earlier comments, it kept the USD/JPY upward pressured. Traders should be aware that a break above 147.00 will expose an essential resistance at 147.67 on its way toward 150.00.

The USD/JPY, one-hour time frame, suggests the pair is upward biased. Nevertheless, it peaked at around 146.96 due to recent US fundamental news, namely the FOMC’s last meeting minutes, spurring a reaction to the downside. Broad US dollar weakness weighed on the USD/JPY, sliding toward the 146.70 region. Once cleared, the next support area would be the confluence of the 20-EMA and the R3 daily pivot at around 149.45/46, from where the pair could resume its uptrend.

If that scenario plays out, the USD/JPY first resistance would be the October 12 high at 146.96. Break above will expose 147.00, followed by August’s 1998 high of 147.67.

USD/JPY Key Technical Levels

-

19:19

GBP/JPY rallies to 163.00 amid rumours of bond-buying extension

- The pound shrugs off the previous weakness to bounce up towards 163.00.

- Rumours about the extension of the BoE's bond-buying are buoying GBP.

- Downbeat GBP data confirm fears of a recession in the UK.

The British pound is showing a strong recovery after having lost more than 3% on its reversal from the 165.70 high last week. The pair has bounced right below 160.00 on Wednesday to approach the 163.00 area, buoyed by rumours that the BoE might extend its emergency program.

Mixed signals about BoE’s bond-buying program

A Financial Times news report suggesting that the Bank of England might have signaled privately to lenders that it is open to extending its bond-buying program has cheered investors, pushing the battered GBP higher against its main rivals.

The Bank of England spooked the market on Tuesday when BoE Governor Andrew Bailey urged pension fund managers to rebalance their portfolios before Friday, the deadline for the bank’s emergency program.

Beyond that, additional media reports point out that the British Government might be ready to scrap more elements of the mini-Budget that rattled financial markets.

The GBP/JPY lost about 1.5% on the back of Bailey’s words on Tuesday, to complete a 3.4% decline over the previous five days. The pair, however, is regaining lost ground on Wednesday showing a nearly 2% recovery despite the downbeat macroeconomic data.

UK economy contracts against expectations

British economy contracted at a 0.3% pace in August, against market expectations of a 0% reading and following a 0.1% expansion in the month before. These figures confirm predictions that the UK economy could be entering recession over the next months.

Manufacturing production has dropped at a 1.6% pace, which has been one of the main reasons for the economic contraction.

Technical levels to watch

-

19:04

Fed Minutes: Officials determined that they needed to adopt and maintain a more restrictive policy stance

The Federal Open Market Committee minutes of September's meeting have been released:

Fed officials determined that they needed to adopt and maintain a more restrictive policy stance in order to achieve their goal of lowering elevated inflation.

Many participants raised their assessment of the federal funding path required to meet committee objectives.

Many participants indicated that once the policy had reached a sufficiently restrictive level, it would be appropriate to keep it there for a period of time.

Several participants predicted that as policy became more restrictive, risks would become more two-sided.

Several participants emphasized the importance of maintaining a restrictive stance for as long as necessary.

Despite a slowing labour market, officials are committed to raising interest rates.On the margin, these minutes could be taken as somewhat less hawkish than the rhetoric that we have heard from Fed speakers and lean towards a pivot:

"Several participants noted that... it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook."

Market Update

US bond yields are softer with the 10-year in decline:

Meanwhile, the attention will now turn to the US inflation data on Thursday. On Wednesday morning, US producer prices increased more than expected in September, further boosting the dollar, especially against the yen where the market's attention is focused the most. The producer price index for final demand rebounded 0.4%, above the forecast for a 0.2% rise. In the 12 months through September, the PPI increased 8.5% after advancing 8.7% in August.

Following the US PPI data, the greenback rose as high as 146.88 yen. The DXy index has reached a peak of 113.59 ahead of the FOMC minutes. USD/JPY remains near its strongest level since August 1998. It was last up 0.7% at 146.84, marking a fifth straight session of gains to a high of 146.09 so far. However, there is a hint of downside pressure coming through now that the markets are digesting the minutes as follows:

About the FOMC Minutes

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

-

18:55

USD/CAD Price Anaalysis: The pair is teed up ahead of the FOMC Minutes

- USD/CAD setting up for a blow-off on FOMC minutes?

- The price is wedged into a consolidation ahead of the minuets and a breakout could be imminant.

As the following technical analysis of USD/CAD will show, the pair has been consolidating in a range at the top of the 'box' below weekly, monthly and yesterday's highs. This could serve as a key resistance and depending on how the minutes come out, there could be a significant reaction with the path of least resistance tiled to the downside:

USD/CAD M15 chart

As illustrated above, the price has carved out the 'cox' which is the range between the recent highs and lows. It has recently slid out behind the dynamic trendline support which could equate to a sell-off towards key supports around the FOMC event. If, however, the minutes turn out to be hawkish, on top of today's Producer Price Index that was better than expected, and in anticipation of much of the same from tomorrow's Consumer Price index, then the weekly, and monthly highs could come under pressure to the upside:

-

18:36

WTI tumbles toward $87.40 on a strong US dollar, despite OPEC’s cutting production

- WTI remains heavy, extending its losses to three consecutive days, down 1.40%.

- The OPEC and the US Department of Energy cut their oil production forecasts for 2023.

- Poland reported a leak in the Druzhba pipeline, which pumps oil to Europe, disregarding possible sabotage.

Western Texas Intermediate (WTI), the US crude oil benchmark, extends its losses after hitting a weekly high of $93.62 on reports that the OPEC would cut 2 million barrels per day, letting the black gold from below $80 levels. Nevertheless, oil is sliding due to a stronger US dollar and fears that a global economic slowdown would diminish demand. At the time of writing, WTI is trading at $87.36 PB.

US equities are trading in the green, reflecting an upbeat mood. The OPEC cut its demand by 2.64 million barrels per day or 2.7% in 2022, the Organization of the Petroleum Exporting Countries (OPEC) said in a monthly report.

The organization said that “the world economy entered a period of heightened uncertainty,” blaming several factors. Developed countries’ central bank’s tightening and high inflation levels might hurt demand for crude oil.

Echoing the cartel’s comments was the US Energy Department, which cut its production and demand estimates, seeing a 0.9% increase in consumption for 2023, down from a rise of 1.7%. Crude production is expected to grow 5.2%, less than 7.2%.

In the meantime, WTI’s fall was capped by news from Poland reporting a leak in the Druzhbka pipeline, which supplies Europe with Russian oil. Poland said that it was probably caused by accident rather than sabotage.

“Security of supply in Germany is currently guaranteed,” a spokesperson told Reuters. “The refineries in Schwedt and Leuna continue to receive crude oil via the Druzhba pipeline.”

Elsewhere, Fed officials led by Minnesota Fed President Neil Kashkari reiterated that the Fed would stick to its current monetary policy stance to bring inflation down. He added, “we have not yet seen much evidence that underlying inflation...is yet softening.”

Aside from this, US economic data revealed earlier by the Labor Department justified the Fed’s need for another 75 bps rate hike when prices paid by producers remained high, with headline inflation augmented by 8.5%, while core PPI decelerated to 7.2% YoY, from 7.3% estimated and previous month’s figure.

WTI Key Technical Levels

-

18:36

BoE's Mann says tackling inflation will hurt the UK more than others

Bank of England policymaker Catherine Mann has crossed the wires again this month and said the UK labour market inactivity is a drag on the economy yet tackling inflation will hurt the UK more than others.

Earlier in the month, she said her vote in September to raise Bank Rate by 0.75 percentage points reflected her concerns about a weak currency, rising inflation expectations and the boost to household incomes from an energy price cap.

GBP/USD update

Meanwhile, GBP/USD has been pressured on the back of the governors Andrew Bailey's remarks but managed to rebound despite an FT report that the BoE had suggested to private lenders that it was open to extending its bond purchases beyond Friday's deadline if market conditions demanded it, citing three sources briefed on the discussions.

However, the report was at odds with comments from BoE Governor Bailey who had initially told publicly told investors hit by the slump in bond prices that the Old Lady will end its emergency bond-buying programme as planned on Friday.

"My message to the funds involved and all the firms involved managing those funds: You've got three days left now. You've got to get this done," Bailey said at an event on Tuesday organised by the Institute of International Finance in Washington.

GBP/USD has moved between 1.0923 and 1.1099 so far on the day ahead of the Federal Open Market Committee minutes at the top of the hour.

GBP/USD M15 chart

-

18:29

EUR/USD capped below 0.9700, ticks down after ECB Lagarde’s speech

- The euro heads lower after failing to break past 0.9700.

- ECB Lagarde's mentions of rate hikes fail to support the euro.

- EUR/USD: Stagflation might pull the euro towards 0.93 – Danske Bank.

The common currency remains on the back foot on Wednesday and is on track to complete a six-day reversal against the US dollar. The pair has turned lower from the 0.9700 area despite ECB Lagarde’s comments.

ECB’s Lagarde fails to support the euro

The President of the European Central Bank, Cristine Lagarde, has reaffirmed the importance of interest rate hikes to fight inflation in the Eurozone and announced that the Governing Council has started discussions on quantitative tightening, according to a Reuters report.

The pair, however, seems to be losing momentum, as the US dollar picks up with the market awaiting the release of the minutes of the Federal Reserve’s September meeting.

These minutes will be carefully watched to assess the reasons for the central bank to raise interest rates by 75 basis points for the third consecutive time and, more importantly, to find signals to anticipate the size of November’s move.

On the macroeconomic front, US producer prices have shown a larger-than-expected increase in September, 0.4% against the 0.2% market consensus. These figures show that inflationary pressures remain high, which offers additional reasons for the Fed to maintain its aggressive monetary tightening path.

EUR/USD: Stagflation might take the pair to 0.93 – Danske Bank

Currency analysts at Danske Bank see the pair falling further as stagflation takes hold of the eurozone’s economy: “The large negative terms-of-trade shock to Europe vs the US, a further cyclical weakening among trading partners, the coordinated tightening of global financial conditions, broadening USD strength and downside risk to the euro area makes us keep our focus on EUR/USD moving still lower (targeting 0.93) – a view not shared by the consensus.”

Technical levels to watch

-

18:05

United States 10-Year Note Auction climbed from previous 3.33% to 3.93%

-

17:45

USD/CHF steady above 0.9970 after rejection at 1.0000

- The US dollar remains steady, right below the 1.0000 psychological level.

- The greenback ticks up with all eyes on the Fed's minutes.

- US producer prices confirm the persistent inflationary pressures.

The US dollar failed in its attempt to break above parity against the Swiss franc during Tuesday’s early US session. The pair, however, remains slightly positive on the daily chart, so far supported above 0.9970 so far.

The greenback edges up ahead of the Fed’s minutes

With investors' sentiment brightening up as US stock markets shift into positive territory after a moderately negative opening, the US dollar keeps moving within a tight range near the 1.0000 psychological level, with all eyes on the release of the Fed minutes.

Later today, the minutes of September’s monetary policy meeting will be explaining the reasons for the third consecutive 0.75% interest rate hike. Most importantly, they will be also carefully observed to assess any hint about the details of the next monetary policy decision.

Regarding macroeconomic events, the US Producer Prices Index accelerated by 0.4% in September, beating expectations of a 0.2% increment. These figures confirm that inflation pressures persist, despite the Fed’s monetary policy and increase the odds for another aggressive rate hike in November.

USD/CHF keeps pushing against 1.0000

From a technical perspective, immediate resistance remains at the 1.0000 psychological level, which is capping upside attempts. Above here, 1.0020 (October 11 high) and 1.0065 (May 12 high) are the next potential targets.

On the downside, immediate support lies at 0.9970 (50-hour SMA) and below here, probably the 100-hour SMA, at 0.9950 before October 11 low at 0.9915.

Technical levels to watch

-

17:16

NZD/USD climbs steadily towards 0.5600 ahead of US CPI figures

- NZD/USD bounced off the YTD lows and reclaimed 0.5600 in a volatile trading session.

- US Producer Price Index for September remained elevated as traders brace for tomorrow’s US CPI.

- NZD/USD Price Forecast: Subject to a mean reversion move, as prices overextended sharply, so a test of 0.5700 is on the cards.

The NZD/USD recovers some ground, extending its gains to two consecutive days, amidst a fragile sentiment, with US equities swinging between gains and losses. US economic data shows that inflation remains elevated, pressuring the Fed, while worldwide central banks’ expressions of further tightening weighed in riskier assets. At the time of writing, the NZD/USD is trading at 0.5601, above its opening price by 0.30%.

NZD/USD recovers some ground despite a mixed sentiment

On Wednesday, the US Department of Labor reported that prices paid by producers in September rose, beating estimates, therefore justifying the need for higher interest rates. The headline PPI figure delineated prices increasing at an 8.5% annual pace, while the core PPI, which strips volatile items, jumped 7.2% YoY but below forecasts and Agusts’s 7.3% figure.

US central bank policymakers reiterated that the Fed needs to keep hiking rates. Further reinforcing the case, Minnesota’s Fed President Neil Kashkari crossed wires on Wednesday. He said there’s “tremendous uncertainty about fundamentals of the US economy” while commenting that hiking rates aggressively would allow room to assess the economy. Kashkari added that the foresees rates to peak at around 4.50%.

On the New Zealand side, the Reserve Bank of New Zealand needs to keep the rhythm of its tightening cycle as inflationary pressures remain. Analysts at Westpac noted that they foresee the RBNZ would hike the Oficial Cash Rate (OCR) to 4.5%, with increments of 50 bps in the November and February meetings.

NZD/USD Price Forecast

From a daily chart perspective, the NZD/USD remains neutral-to-downward biased. However, the downtrend overextending for a long period and the Relative Strength Index (RSI) exiting from oversold conditions could pave the way for a mean reversion move. Therefore, a move toward the 20-day EMA at 0.5737 is on the cards. On the flip side, a fall below the YTD low at 0.5534 would open the door to 0.5500.

-

17:12

EUR/GBP: Liquidity concerns to weigh on GBP in the near-term – Danske Bank

Analysts at Danske Bank forecast the EUR/GBP cross at 0.86 in twelve months, but they expect fragile risk appetite including, specific concerns regarding the United Kingdom to weigh on GBP in the near term.

Key Quotes:

“Given the sizeable expected increase in the twin-deficit, we see a level shift having taken place in EUR/GBP, with the cross to trade in a higher range. In the near-term, we expect high volatility in the cross amid crucial BoE meetings and budget presentation.”

“We forecast EUR/GBP at 0.89 in 3M as we expect to see fragile risk appetite, where liquidity concerns weigh on GBP. Further out, we remain cautiously optimistic that the cross will head lower as a global growth slowdown and the relative appeal of UK assets to investors are a positive for GBP relative to EUR.”

“The key risk to see EUR/GBP moving above 0.90 is a sharp selloff in risk where capital inflows fade and liquidity becomes scarce. This risk has only increased with the outlook of further unfunded fiscal easing. Other risks are the outlook for the UK economy deteriorating sharply compared to the Euro Area and renewed escalations in EU-UK tensions.”

-

17:09

EUR/USD: Stagflation to take pair even lower – Danske Bank

Analysts at Danske Bank lowered their forecast profile for EUR/USD and they expect the pair at 0.93 in 12 months on the back of a substantial negative terms-of-trade shock to Europe compared to the US, tightening of global financial conditions, broadening USD strength and downside risk to Eurozone growth.

Key Quotes:

“The key risk to shift EUR/USD towards 1.15 is seeing global inflation pressures fade and industrial production increase. However, ‘transitory’ has substantially lost credibility and European industrial production continues to be weak. This will continue as manufacturing PMIs heads below 50. The upside risk also include a renewed focus on easing Chinese credit policy and a global capex uptick but neither appear to be materialising, at present.”

“The large negative terms-of-trade shock to Europe vs US, a further cyclical weakening among trading partners, the coordinated tightening of global financial conditions, broadening USD strength and downside risk to the euro area makes us keep our focus on EUR/USD moving still lower (targeting 0.93) – a view not shared by the consensus.”

-

16:57

USD/MXN Price Analysis: Around 20.00, without clear signs

- USD/MXN moves sideways around a flat 20-day SMA.

- Price offers no clear signs, likely to remain between major range of 19.80/20.20.

- Break above 20.25 to open the doors to more gains.

The USD/MXN is falling modestly on Wednesday and is approaching the 20.00 level. On Tuesday the pair peaked at 20.11 before pulling back toward 20.00. In the short term it is moving between 19.95 and 20.15.

Technical indicators offer no clear signs, affected by price action over the last two weeks. Momentum and RSI are flat around midlines. Also key Simple Moving Averages are flat.

An interim support emerges at 19.95. A break lower would target 19.90 and below the 19.80 critical support area. A break lower would point to an extension to the downside.

On the upside, at 20.17 a resistance level is seen but only a clear break of 20.20 should strengthen the outlook for the US dollar. A daily close above 20.30 would confirm the break, exposing the next resistance located at 20.45.

USD/MXN daily chart

-638011869428712063.png)

-

16:48

GBP/USD finds support at 1.1020 and approaches 1.1100 session high

- The pound resumes its recovery and approaches the 1.1100 area.

- Mixed signals about the end of BoE's bonds-purchasing program.

- GBP/USD will improve its prospects above 1.1100 – Scotiabank.

The pound is trying to resume the upside trend shown during Wednesday’s Asian and early European sessions. The pair has found buyers at the 1.1020 area on its reversal from 1.1100, to return towards 1.1080 so far.

Mixed signals about BoE’s bond purchases

A Financial Times report suggested earlier on Wednesday that the Bank of England would have signaled private lenders that it would be prepared to extend bond purchases. This has eased concerns triggered by Governor Bailey, who pointed out next Friday as the deadline for the emergency program and urged.

This news and additional rumors suggesting that the British Government could be contemplating a U-turn on the mini-Budget that rattled financial markets have eased negative pressure on the sterling. The GBP/USD has bounced about 1.3% higher on the day, to regain some of the ground lost on Tuesday.

In the macroeconomic domain, the UK economy shrunk by 0.3% in the three months prior to September, according to the NIESR GDP Estimate. This is a larger contraction than the 0.1% forecasted by the analysts and confirms the Bank of England’s recession forecasts.

GBP/USD should break above 1.11 to gain traction – Scotiabank

FX analysts at Scotiabank point out 1.11 as a key level to improve GBP’s prospects: “The slowing in the pace of the sell-off from the early Oct high around 1.15 suggests that some bargain hunting is developing around 1.1000/50. Short-term resistance is firm in the 1.1085/95 zone, however, and the pound still has a lot of work to do in order to stabilize (…) Look for cable to turn better bid above 1.11 but trade better offered again below 1.10 in the short-run.”

Technical levels to watch

-

16:29

US: September PPI offers the latest evidence that inflation pressures are subsiding – Wells Fargo

Data released on Wednesday showed a larger-than-expected monthly increase in the US Producer Price Index of 0.4% versus 0.2%; the annual rate slowed down from 8.7% to 8.5%. According to analysts at Wells Fargo, the reading offers the latest evidence that inflation pressures are subsiding but they warn there remains significant ground to cover in returning inflation to normal levels.

Key Quotes:

“The September Producer Price Index (PPI) offers the latest evidence that inflation pressures are subsiding, but that there remains significant ground to cover in returning inflation to a more palatable level, and that the path will bear some curves. The PPI for final demand rose 0.4% in September to break back-to-back declines in July and August. Our preferred measure of core PPI, which excludes food, energy and trade services, also rose 0.4%, which was the largest monthly gain since May.”

“September's unexpected strength can be traced to a 0.6% increase in core services. However, the prospect for disinflation in the goods sector remains intact. Transportation and warehousing costs fell for a third consecutive month, trade services margins were little changed and intermediate costs continue to trend lower.”

-

16:17

Gold Price Forecast: XAU/USD remains steady around $1,670 ahead of FOMC minutes

- Gold holds around 1670$ even after US PPI data.

- Yellow metal stays firm despite dollar’s strength and silver slide.

- Market participants turn attention to FOMC minutes ahead of Thursday US CPI numbers.

Gold continues to trade around $1,670 as it has been the case since the beginning of the European session. It is moving sideways after US PPI numbers and ahead of the FOMC minutes.

Earlier XAU/USD tested the critical support around $1,660. It held above and rose to $1,675 hitting a daily high before stabilizing around $1,670. It is modestly higher for the day, rising after a five-day losing streak.

Following the release of the US Producer Price Index gold approached daily lows but it quickly bounced back to the upside. The PPI rose 0.4% in September, above the 0.2% of market consensus. The annual rate fell from 8.7% to 8.5%. The greenback gained momentum across the board after the numbers, but just for a few minutes. It continues to move sideways, with mixed results.

Market participants await the FOMC minutes for new clues about the trajectory of US monetary policy. The document will be released at 18:00 GMT. It could trigger volatility if it contains surprises. A hawkish Fed continues to be a critical support for the dollar as it keeps boosting US yields. The next FOMC meeting is in November and another 75 basis points rate hike seems likely according to current market pricing.

Despite higher inflation numbers and the decline in silver and crude oil, gold is still up for the day. A break under $1,660 should open the doors to more losses. On the upside, a consolidation above $1,680 would be a positive technical development for bulls. Silver trades under $19.00, at the lowest levels since late September.

Technical levels

-

16:12

AUD/USD hovers around 0.6270s, almost flat, amid a mixed mood

- AUD/USD tumbled to fresh two and half-year lows at 0.6235 but is almost flat around current exchange rates.

- Fed’s Kashkari: “tremendous uncertainty about fundamentals of the US economy;” and expects rates to peak around 4.50%.

- AUD/USD Price Forecast: Once it clears 0.6300, it could aim towards 0.6350; otherwise, a re-test of the YTD is on the cards.

The AUD/USD slides for the seventh consecutive day, amid a slightly downbeat mood, with US equities fluctuating while European bourses tumble. US prices paid by producers rose, as shown by data from the US Labor Department, while traders brace for Thursday’s consumer inflation figures.

At the time of writing, the AUD/USD is trading at 0.6258, below the opening price, after hitting a daily high of 0.6288.

The US Producer Price Index revealed that prices rose in the last month, exceeding estimates. The headline number for September rose by 8.5% above estimates but lower than the August reading. At the same time, core PPI, which excludes volatile items, decelerated to 7.2%, below estimates and the previous report.

Fed officials have remained vocal during the week. At the time of typing, the Minnesota Fed’s President Neil Kashkari is crossing news wires, saying that Fed’s measures could cause a housing downturn but not a crash, as reported by Reuters. He added that there is “tremendous uncertainty about fundamentals of the US economy” while adding that hiking rates aggressively allow some room for assessment of the economy. Later added that he expects the Federal funds rate (FFR) to reach 4.50%, and then remain there for some time.

Earlier in the week, Fed officials remained vocal about high levels of inflation and emphasized the need to hold rates higher for longer into restrictive territory. Echoing their comments was the OECD, which expressed that the US faces “larger-than-usual” risks in the inflation battle.

Consequently, US bond yields remained higher, with the 10-year note rate yielding 3.94% underpinning the greenback, a headwind for the AUD/USD.

On the Aussie side, weak Chinese economic data weighed on the risk-perceived currency. Also, in a speech of the Reserve Bank of Australia (RBA), Assistant Governor Luci Ellis, commented that inflation expectations over a year stay anchored in the 2-3% range while adding, “the neutral rate is an important guide rail for thinking about the effect policy might be having.”

AUD/USD Price Forecast

The AUD/USD remains neutral to downward biased, though it fell to fresh two and half-year lows below 0.6300, though it’s bouncing off those lows, meandering around current exchange rates. In oversold conditions, oscillators, particularly the Relative Strength Index (RSI), suggest that the pair might be subject to a mean-reversion move. Therefore, the AUD/USD could re-test crucial resistance at 0.6300, followed by the October 11 daily high at 0.6346. On the downside, a break below 0.6235 would pave the way to 0.6200.

-

16:04

BoE accepts 2.3754 billion GBP of offers in daily long-dated gilt purchase

The Bank of England (BoE) accepted 2.3754 billion sterling of offers in the daily purchase operation of conventional long-dated gilts, Reuters reported on Wednesday.

The BoE rejected zero offers in the same operation, compared to 47.6 million GBP on Tuesday.

Market reaction

The 2-year UK gilt yield is down more than 2% on a daily basis. Meanwhile, the British pound preserves its strength against its rivals in the second half of the day. As of writing, GBP/USD was trading at 1.1075, where it was up 1% on a daily basis.

-

15:39

Fed's Kashkari: Judgment call on whether we move in 50 or 75 bps increments on rates

Minneapolis Fed President Neel Kashkari said on Wednesday that they will have room to assess the economy by moving rates at an "aggressive but not overwhelming" pace, as reported by Reuters.

Key takeaways

"There may be a housing downturn, but not necessarily a hard crash."

"Tremendous uncertainty about fundamentals of US economy."

"A judgment call on whether we move in 50 or 75 bps increments on rates."

"We have to deliver what we said we would do on rates."

"That's the only way to validate medium and longer-term inflation expectations."

Market reaction

These comments don't seem to be having a significant impact on the dollar's performance against its major rivals. As of writing, the US Dollar Index was up 0.1% on the day at 113.40.

-

15:13

ECB's Knot: Terminal rate lower in eurozone than in US

European Central Bank (ECB) policymaker Klaas Knot said on Wednesday that they need a few more significant rate hikes before reaching neutral territory and noted that the terminal rate in the eurozone is lower than in the US, per Reuters.

"I have no indication that with steps up to 75 basis points we will not be able to achieve our price stability mandates 2% inflation over the medium term," Knot added and reiterated that there were no convincing signs of a wage-price spiral.

Market reaction

EUR/USD continues to trade within its daily range after these comments and was last seen posting small losses at 0.9695.

-

15:09

BoE accepts 1.9798 billion GBP of offers in index-linked gilt purchase

The Bank of England (BoE) accepted 1.9798 billion sterling of offers in the second daily purchase operation of index-linked gilts, Reuters reported on Wednesday.

The BoE rejected 38.9 million sterling of offers in the same operation.

Market reaction

The 2-year UK gilt yield edged lower and was last seen losing 0.45% on the day slightly below 4.2%. The British pound, however, showed no immediate reaction to this result. As of writing, the GBP/USD pair was trading at 1.1055, where it was up 0.85% on a daily basis.

-

15:01

USD/TRY: Getting ready for an assault of 18.6000

- USD/TRY remains within a consolidative theme below 18.60.

- Industrial Production in Türkiye surprised to the downside in August.

- Türkiye’s Retail Sales expanded nearly 4% MoM in August.

USD/TRY keeps the consolidative mood well in place for yet another session on Wednesday, always in levels just shy of the 18.60 mark.

USD/TRY remains bid ahead of the CBRT event

USD/TRY still appears capped by the 18.60 region amidst the lack of direction in the greenback as well as alternating risk appetite trends on Wednesday.

The lira keeps the downtrend well in place nonetheless, from time to time limited by intervention and closely following the next steps by the Turkish central banks (CBRT) as well as the government plans to fight inflation (if any at all).

The CBRT meets next week and is expected to cut the One-Week Repo Rate once again, according to latest comments from President Erdogan.

In the domestic calendar, Industrial Production expanded at an annualized 1.0% in August, advancing for the 26th consecutive month, although at a slower pace. Additional data saw Retail Sales expand 3.7% MoM also in August and 9.0% from a year earlier.

What to look for around TRY

USD/TRY keeps navigating the area of all-time tops near 18.60 amidst the combination of omnipresent lira weakness and bouts of strength in the dollar.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in the last three months), real interest rates remain entrenched well in negative territory and the omnipresent political pressure to keep the CBRT biased towards a low-interest-rates policy.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth (via higher exports and tourism revenue) and the improvement in the current account.

Key events in Türkiye this week: Industrial Production, Retail Sales (Wednesday) – End Year CPI Forecast (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.12% at 18.5867 and faces the next hurdle at 18.5980 (all-time high October 11) followed by 19.00 (round level). On the downside, a break below 18.1852 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

-

14:58

ECB's Lagarde: Discussion on QT has started, will continue

European Central Bank President Christine Lagarde said on Wednesday that the Governing Council has started discussions on quantitative tightening (QT), as reported by Reuters.

Lagarde further noted that they will continue to discuss QT but said that the interest rate is the most appropriate tool in current circumstances.

"Monetary and fiscal policy must cooperate, with fiscal policy focusing on the most vulnerable," she added.

Market reaction

These comments don't seem to be helping the shared currency gather strength during the American trading hours on Wednesday. As of writing, EUR/USD was trading at 0.9695, where it was down 0.8% on a daily basis.

-

14:57

Early signs of easing wage inflation are not enough to spark a Fed ‘pivot’ – Danske Bank

According to analysts at Danske Bank, the Fed is still far away from reaching its inflation target and it will take time until the economy has reached a new equilibrium.

Key Quotes:

“The September Jobs Report illustrated how the US labour market still remains in a relatively strong shape despite the rising global recession fears. Aside from the Jobs Report, alternative labour market indicators have also remained at relatively strong levels in September. The Q3 rebound in real purchasing power appears to have sparked at least a temporary uptick in both consumers' and businesses' optimism.”

“That being said, some clear signs of cooling labour demand and wage inflation are starting to emerge. Most notably, the August JOLTs Job Openings saw a steepest decline since the initial Covid-shock, all the way to the lowest level since June 2021. Turnaround in job openings has historically also predicted easing in wage inflation.”

“While clear signs of a cooling labour market and easing wage growth are a key requirement for Fed to eventually wrap up the ongoing hiking cycle, they are not sufficient on their own as long as the underlying consumer price pressures remain high.”

-

14:34

USD/JPY hits fresh 24-year peak, eyes 147.00 mark ahead of FOMC minutes

- USD/JPY gains strong traction on Wednesday and rallies to its highest level since August 1998.

- The Fed-BoJ policy divergence weighs heavily on the JPY and remains supportive of the move.

- Overbought oscillators on the daily chart could cap gains ahead of the FOMC meeting minutes.

The USD/JPY pair scales higher through the early North American session on Wednesday and hits a new 24-year peak, around the 146.85 region in the last hour.

A combination of factors continues to weigh on the Japanese yen and act as a tailwind for spot prices amid the underlying bullish sentiment surrounding the US dollar. The Bank of Japan (BoJ), so far, has shown no inclination to hike interest rates, marking a big divergence in comparison to a more hawkish stance adopted by other major central banks. Apart from this, Wednesday's domestic data, showing that machinery orders fell more than expected in August, is seen undermining the JPY.

The US dollar, on the other hand, remains well supported by the prospects for a more aggressive policy tightening by the Fed and provides an additional lift to the USD/JPY pair. In fact, the markets have been pricing in another supersized 75 bps Fed rate hike move in November. The bets were reaffirmed by the release of the US Producer Price Index, which came in stronger-than-estimated and might have lifted expectations from the US consumer inflation figures, due on Thursday.

The latest leg up could further be attributed to some technical buying above the Asian session swing high, around the 146.35-146.40 region. That said, speculations for more currency market intervention by Japanese authorities might hold back bullish traders from placing fresh bets amid overbought oscillators on the daily chart. BoJ Governor Haruhiko Kuroda said that the government intervention last month to stop one-sided depreciating moves in JPY was quite appropriate.

Furthermore, investors might also prefer to move to the sidelines and wait for a fresh catalyst from the FOMC meeting minutes, due later during the US session. The focus will then shift to the latest US CPI report on Thursday, which is anticipated to remain stubbornly high and reinforce the Fed's hawkish rhetoric. This, in turn, suggests that the path of least resistance for the USD/JPY pair is to the upside and corrective pullbacks could still be seen as a buying opportunity.

Technical levels to watch

-

13:55

BoJ's Kuroda: Will continue our monetary easing to achieve 2% inflation target

"We will continue our monetary easing to achieve the 2% inflation target in a stable and sustainable manner," Bank of Japan Governor Haruhiko Kuroda said on Wednesday, as reported by Reuters.

Additional takeaways

"Once the impact of energy, and fuel price rises start waning, Japan's inflation rate will slow down to less than 2% in next fiscal year."

"Central banks in the US and Europe have completely shifted to fighting inflation, which is quite appropriate in view of the high level of inflation."

"Big difference between Japanese monetary policy and US, European policies. The difference reflects difference in economic and price situations."

"Wages are certainly rising now but insufficient to guarantee 2% inflation in a sustainable and stable manner, so we have to make the economy grow in coming months and years."

"Cannot simply jump to conclusion Japan will be able to achieve 2% inflation in two years, or one year's time, so that we can change monetary policy now."

"If currency movement is so fast and uni-direction, probably caused by speculation, that would be bad for the economy."

"Yen depreciation may have a good impact on macro-economy as a whole, but there are some sectors which are suffering from weak yen."

"We have to carefully watch, and analyse the impact of currency movements on the economy."

"Japan's government intervened in the currency market to shore up the yen or stop its one-sided moves, which was quite appropriate."

"At this week's IMF meetings, many emerging economies will probably complain about the almost universal rise in the dollar that made them raise rates more than appropriate from a domestic economy point of view."

"The third arrow of Abenomics, such as deregulation, had made some contribution but not so much with japan's potential growth still around 1%."

Market reaction

USD/JPY continues to rise following these comments and was last seen trading at fresh multi-decade highs near 146.80, gaining 0.6% on a daily basis.

-

13:49

EUR/USD Price Analysis: Some consolidation is not ruled out near term

- EUR/USD comes under some pressure around the 0.9700 mark.

- Extra range bound appears on the cards in the very near term.

EUR/USD exchanges gains with losses in the 0.9700 region amidst an equally vacillating trend in the risk complex.