Notícias do Mercado

-

23:54

GBP/JPY Price Analysis: Recovery remains elusive below 161.15

- GBP/JPY bounces off an eight-day low as it pares recent losses.

- Impending bear cross on MACD, sustained break of 200-DMA favor sellers.

- Five-month-old horizontal support lures bears, 61.8% Fibonacci retracement level adds to the upside filters.

GBP/JPY prints a corrective pullback as it regains the 160.00 threshold during a bounce off the weekly low.

Even so, the cross-currency pair remains bearish as it keeps the previous day’s downside break of the 200-DMA and the 61.8% Fibonacci retracement level, also known as the golden ratio, of the June-September downside.

Also adding strength to the bearish bias is the steady RSI (14) and the looming bear cross of the MACD line to the signal line.

That said, the quote’s current downside remains directed towards the 50% Fibonacci retracement level of 158.78 ahead of challenging the September 26 swing high near 157.20.

However, a horizontal area including level marked since May, around 155.60-40, appears a tough nut to crack for the bears.

Alternatively, recovery moves may aim for the 200-DMA and the so-called golden ratio, respectively around 160.70 and 161.15.

Following that, August month’s peak close to 164.00 and the current monthly top of 165.72 could gain the market’s attention.

GBP/JPY: Daily chart

Trend: Bearish

-

23:54

AUD/JPY Price Analysis: Retraces from around 92.30s on dampened mood

- AUD/JPY trimmed earlier gains on Tuesday, down by 0.34%, extending its weekly losses.

- Sentiment dampened on BoE’s Governor Bailey’s commentary about UK pension funds.

- The AUD/JPY bearish flag remains in play, targeting the 200-day EMA at 90.70.

The AUD/JPY retraced its earlier gains and tumbled on Tuesday, as the Bank of England’s (BoE) Governor Andrew Bailey spooked investors, which dumped every asset with the “risk” word attached to it, so in the FX space high beta currencies. Therefore, the AUD/JPY dived from daily highs above 92.00 to current exchange rates. As the Asian Pacific session begins, the AUD/JPY is trading at 91.54, slightly up 0.09%, at the time of writing.

AUD/JPY Price Forecast

The AUD/JPY daily chart portrays the cross-currency as neutral-to-downward biased. The bearish-flag pattern broke to the downside as expected but fell short of reaching the 200-day EMA target of 90.70. Notably, the AUD/JPY was headed upwards, reaching 92.32, Tuesday’s high, in an upbeat mood, but BoE’s Bailey words turned sentiment sour. AUD/JPY key support levels lie at 91.00, followed by the 200-day EMA at 90.70, which, once cleared, could open the door towards a test of the 90.00 figure.

On the other hand, if AUD/JPY buyers reclaim the 92.00 figure, the first resistance area would be October’s 10 high at 92.76, followed by the 93.00 figure, nearby the bearish-flag bottom trendline.

AUD/JPY Key Technical Levels

-

23:37

USD/CAD retreats from two-year top towards 1.3750 as oil bears, DXY portray cautious mood

- USD/CAD extends pullback from 29-month high, sidelined of late.

- Oil prices remain lackluster as economic fears join firmer yields, upbeat DXY.

- BOE’s Bailey, IMF’s growth forecast offer a major challenge to buyer’s return.

- Fed Minutes, risk catalysts are important for fresh impulse as bulls keep control.

USD/CAD snaps a two-day uptrend as it steps back from the two-year high while declining to 1.3790 during Wednesday’s Asian session. The Loonie pair’s latest weakness could be linked to the market’s consolidation ahead of this week’s key events, as well as a pause in the previously falling prices of Canada’s main export item WTI crude oil.

That said, the US Dollar Index (DXY) tracked the Treasury yields while renewing the weekly top earlier on Tuesday before ending the day with mild gains. The reason could be linked to the market’s consolidation ahead of today’s Federal Open Market Committee (FOMC) Meeting Minutes.

Even so, comments from Bank of England (BOE) Governor Andrew Bailey amplified the risk-off mood by citing the Financial Policy Committee’s (FPC) decision to intervene in the financial market after noting market volatility surpassed the bank stress test. It should be noted that the BOE expanded their gilt buying program to include inflation-linked gilts for the remainder of their intervention (due to finish on 14 October, UK time).

WTI crude oil might have sensed Saudi Arabia’s rejection of the US request of delaying the output cuts as a positive catalyst even if the International Monetary Fund (IMF) lowered the global economic growth forecast for 2023 to 2.7% from 2.9% estimated in July.

Against this backdrop, Wall Street benchmarks closed mixed after a volatile day while the US 10-year Treasury yields ended Tuesday with mild gains around the multi-month high marked the previous day.

It should be noted that the USD/CAD prices may witness lackluster moves ahead of today’s key Fed Minutes as the Fedspeak has recently been mixed but the market bets on November’s rate hike keep favoring the 75 bps move. Even so, the pair buyers are likely to keep the reins amid the market’s rush for risk safety and the hawkish Fed.

Technical analysis

The area comprising multiple tops surrounding 1.3835, followed by April 2020 low near 1.3850, appears challenging the USD/CAD bulls.

-

23:33

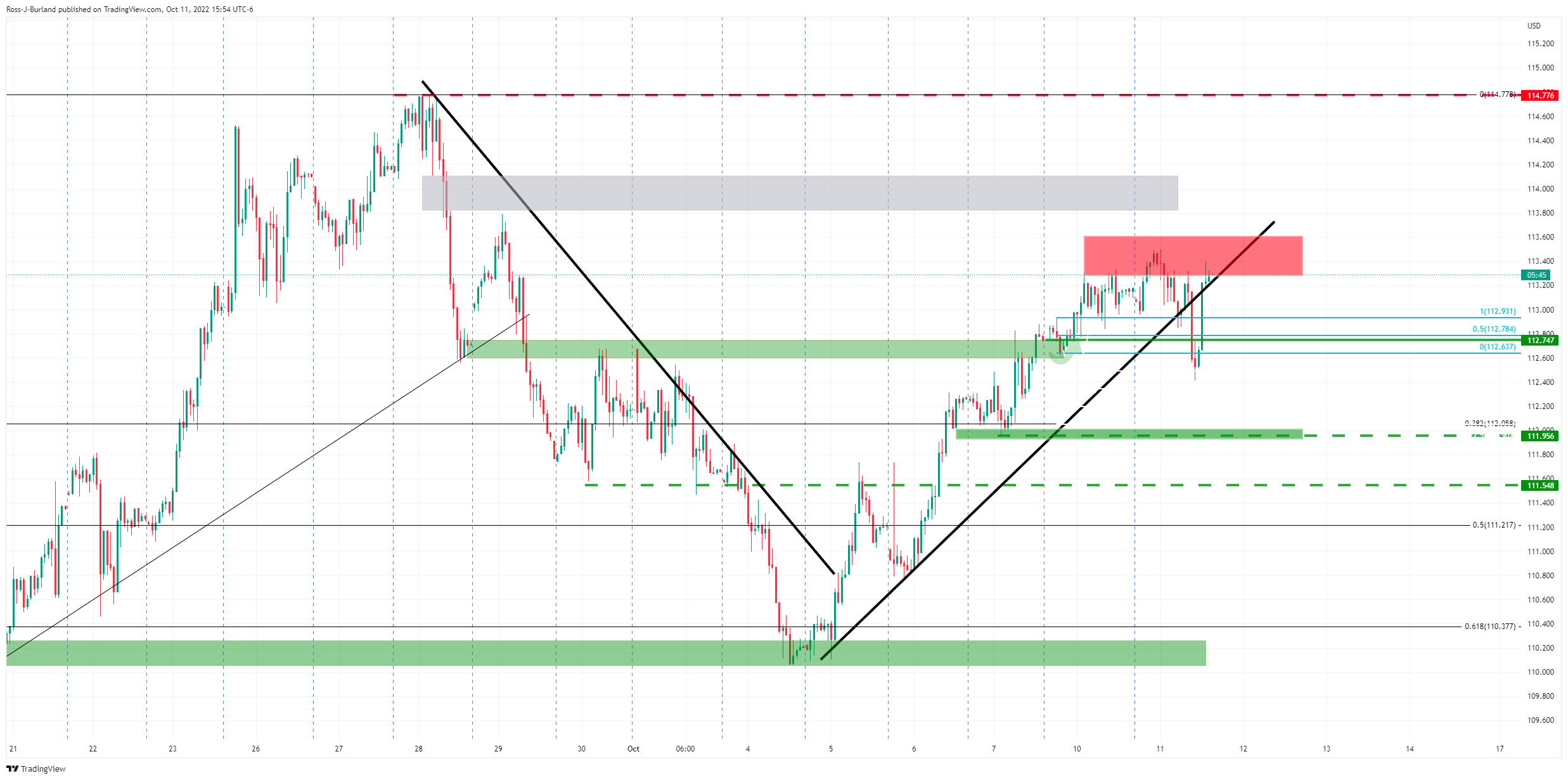

USD/JPY Price Analysis: Trapped around 145.30-90, as BoJ’s intervention looms

- USD/JPY marches steadily to re-test the 145.90 YTD high amidst Japanese authorities’ expressions about the FX markets.

- Short term, the USD/JPY is range-boun, though intervention fears keep long traders cautious.

- If the USD/JPY tumbles below 145.30, a fall toward 145.00 is on the cards.

The USD/JPY is trading at around the line on the sand imposed by the Bank of Japan (BoJ) intervention in the FX markets on September 22, when the central bank decided to propel the Japanese yen, putting a lid on the USD/JPY rise. At the time of writing, the USD/JPY is trading at 145.81, below its opening price by 0.04%.

USD/JPY Price Forecast

From a daily chart perspective, the USD/JPY advances steadily, without the strength that spurred the uptrend when the major dipped towards 130.00 before challenging the 145.00 mark. Due to last month’s FX central bank intervention, buyers remain cautious around the 145.00-146.00 area, refraining from opening fresh longs against the backdrop of the Boj’s stepping into the markets.

The USD/JPY, one-hour time frame, illustrates the pair is range-bound, within the 145.30-90 area, shy of the YTD high of 145.99, which, once touched, sparked the BoJ’s intervention. So a break above 146.00 could open the door for further gains. The first resistance would be the R2 and R3 daily pivot points, each at 146.20 and 146.50, respectively, ahead of the 147.00 mark.

Nevertheless, given the recent BoJ’s intervention around the 146.00 area, the path of least resistance is downwards. Hence, the USD/JPY first support would be the 20-EMA at 145.70, followed by the 50-EMA at 145.62, which, once cleared, could pave the way toward the weekly low of 145.23.

USD/JPY Key Technical Levels

-

23:30

AUD/USD aims to retest 0.6250 as risk-off profile rebounds ahead of Fed minutes

- AUD/USD is looking to test the 0.6250 cushion as the dismal market mood has rebounded.

- The DXY has recovered its losses after knee-jerk to near 112.50 ahead of Fed minutes.

- Fed policymaker's hawkish commentary has accelerated the odds of a 75 bps rate hike.

The AUD/USD pair has turned sideways in early Asia followed by a steep decline from around 0.6350 after a short-term risk-on mood faded. The asset is oscillating in a 0.6259-0.6280 range and is expected to retest the fresh two-year low at 0.6250 ahead. It indicates that the overall market mood is extremely negative and investors have capitalized on the pullback by adding shorts.

The late-night sell-off in the S&P500 after an intraday rebound has firmed up the negative market sentiment again. Apart from that, the US dollar index (DXY) has recovered to near 113.30 after a knee-jerk action. Meanwhile, the 10-year US Treasury yields are on the cusp of reclaiming the 4% hurdle.

Going forward, investors’ entire focus will be on the Federal Reserve (Fed) minutes, which are due on Wednesday. The minutes will provide detailed reasoning behind the announcement of the third consecutive 75 basis points (bps) rate hike by the Fed. Apart from that, projections over targeted terminal rate, inflation, and economic growth will be of utmost importance.

Meanwhile, hawkish commentary from Cleveland Fed President Loretta Mester that “we haven’t seen progress on inflation, we have seen some moderation- but to my mind, it means we still have to go a little bit further”, at Economic Club of New York, has accelerated odds of a fourth consecutive 75 bps rate hike in the first week of November. As per CME Fedwatch tool, chances for a 75 bps rate hike have improved to 77.7%.

On the Aussie front, Reserve Bank of Australia (RBA) Assistant Governor Luci Ellis has termed the neutral rate as a guide for policy, not a destination, which indicates that the targeted Official Cash Rate (OCR) at 3.85% by the central bank could be adjusted further. She further added that inflation expectations over one year will remain well anchored in a 2-3% range, at the Citi Australia and New Zealand Investment Conference.

-

23:19

GBP/USD steadies below 1.1000 after BOE’s Bailey favored bears, UK data, Fed Minutes eyed

- GBP/USD licks its wounds at fortnight low, pauses five-day downtrend.

- BOE Governor Andrew Bailey propelled risk aversion by discussing FPC’s market intervention.

- UK jobs report was mostly encouraging but failed to impress buyers as the “Old Lady” widened space for Gilt operations.

- Monthly data dump, FOMC Meeting Minutes to entertain traders but bears to keep the reins.

GBP/USD portrays a corrective bounce from a two-week low surrounding 1.0953 as it licks its wounds around 1.0980 during early Wednesday morning in Asia. In doing so, the Cable pair traces downbeat comments from Bank of England (BOE) Governor Andrew Bailey and the broad risk-aversion wave.

That said, global markets were pretty sluggish ahead, mildly positive, ahead of the speech from Andrew Bailey’s late Tuesday speech that amplified risk-off mood by citing the Financial Policy Committee’s (FPC) decision to intervene in the financial market after noting market volatility surpassed the bank stress test. It should be noted that the BOE expanded their gilt buying program to include inflation-linked gilts for the remainder of their intervention (due to finish on 14 October, UK time).

On a different page, UK’s headline Claimant Count Change rose by 25.5K during September versus expectations of -11.4K and 6.3K prior. Further, the ILO Unemployment Rate dropped below the 3.6% market forecasts and prior readings to 3.5% during the three months to August.

It should be noted that the mildly positive yields and the US dollar’s rebound appeared to have exerted additional downside pressure on the GBP/USD prices.

Further, the International Monetary Fund (IMF) lowered the global economic growth forecast for 2023 to 2.7% from 2.9% estimated in July. The IMF cited pressures from high energy and food cost, rate hikes as the key catalysts for the move. It’s worth noting that the Washington-based institute left the 2022 growth forecast unchanged at 3.2% versus 6.0% global growth in the 2021"

Amid these plays, Wall Street benchmarks closed mixed after a volatile day while the US 10-year Treasury yields ended Tuesday with mild gains around the multi-month high marked the previous day.

Moving on, GBP/USD is likely to remain bearish amid the downbeat headlines surrounding the “Old Lady”, as the BOE is mostly known. Also weighing on the quote are the geopolitical fears and recession woes discussed above. As a result, today’s UK data dump and Fed minutes will be analyzed to determine the strength of the latest rebound, as well as check the bearish bias amid more favor for the sellers.

Technical analysis

Not even short-term buyers can think of GBP/USD unless the quote rises past convergence of the 21-DMA and 10-DMA, around 1.1165-70.

-

23:19

New Zealand Visitor Arrivals (YoY) registered at 4748.8% above expectations (-40.9%) in August

-

23:02

RBA Ellis: Australia's neutral rate a guide for policy, not a destination

Reserve Bank of Australia (RBA) Assistant Governor Luci Ellis has emphasised that the neutral rate was a moving target and hard to determine at any stage in time, which limited its usefulness for monetary policy.

He explained that Australia's neutral interest rate is at least 2.5% but is not the sole determinant of policy which should be driven by changing circumstances in the economy.

Meanwhile, AUD/USD is holding in a positive territory around 0.6275 as it slides out of trendline resistance:

-

22:54

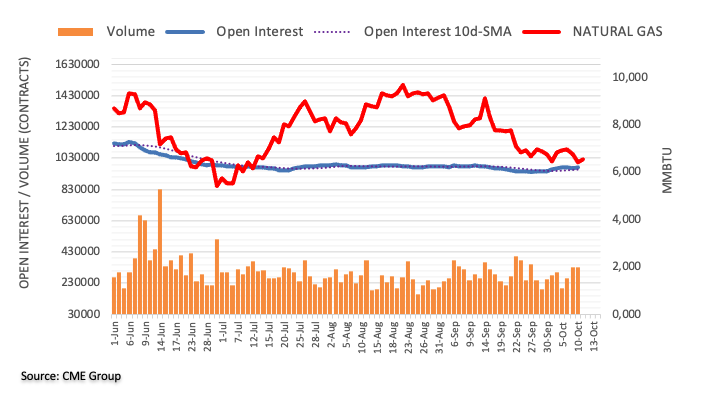

Gold Price Forecast: XAU/USD drops below $ 1,670 as DXY recovers, US CPI/Fed minutes hog limelight

- Gold prices have slipped below $1,670.00 as the risk-off profile has rebounded firmly.

- Fed minutes will provide a detailed explanation of announcing a third consecutive 75 bps rate hike.

- A divergence in headline and core CPI may create troubles for the Fed.

Gold price (XAU/USD) has witnessed a vertical fall after failing to sustain above the critical hurdle of $1,680.00 in the late New York session. Selling pressure built in the S&P500 in the last hours of trade on Tuesday after an extended weekend indicates that the risk-off impulse has rebounded firmly ahead of the release of the Federal Reserve (Fed) monetary policy minutes on Wednesday.

Meanwhile, the US dollar index (DXY) has recovered the majority of its losses and is trading at around 113.30, at the time of writing. The DXY picked bids after dropping to near 112.50. Also, the 10-year US Treasury yields have rebounded and are aiming to recapture the 4% hurdle.

On Wednesday, the release of the Fed minutes will provide an elaborative explanation behind announcing the third 75 basis points (bps) interest rate hike. The minutes will also provide viewpoints of all Fed policymakers toward interest rate targets to achieve price stability. Apart from that, the current situation of economic prospects will be of utmost importance.

Later this week, the US Consumer Price Index (CPI) data will be of utmost importance. The headline US inflation may trim to 8.1%, as per the expectations. While the core CPI that doesn’t consider oil and food prices may increase to 6.5%.

Gold technical analysis

On an hourly scale, the gold prices have slipped again below the 50% Fibonacci retracement placed at $1,672.61 after failing to sustain above the 50-period Exponential Moving Average (EMA) at $1,677.00. The 200-period EMA at $1,685.00 has tilted towards the south, which adds to the downside filters.

However, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bearish range of 20.00-40.00, which indicates a consolidation for a while.

Gold hourly chart

-

22:49

New Zealand Visitor Arrivals (YoY) came in at 0%, above forecasts (-40.9%) in August

-

22:48

New Zealand Visitor Arrivals (YoY) above forecasts (-40.9%) in August: Actual (47%)

-

22:31

ECB Villeroy: ECB should reach neutral rate close to 2% by end year

ECB member and Bank of France's head Francois Villeroy de Galhau said they should reach a neutral rate of close to 2% by the end year and said a discussion about 50 bps or 75 bps hike in October is premature amid volatile markets.

"It would not be consistent to keep a very large balance sheet for too long in order to compress the term premium, whilst at the same time contemplating tightening policy rates above neutral," the French central bank governor told an audience at Columbia University.

"The reimbursement of TLTROs comes first, and we should avoid any unintended incentives to delay repayments by banks," he said.

"Here we could start earlier than 2024, maintaining partial reinvestments but at a gradually reduced pace," he said.

He argued the ECB should start this unwind slowly and then accelerate, with a clearly communicated "end-point...in terms of both the terminal date and size".

Meanwhile, the safe-haven US dollar has gained in a second day while the International Monetary Fund says warns of global recession and has cut its 2023 global growth forecasts further:

The euro, as a consequence, is pressured below 0.9750:

-

22:05

EUR/USD holds to minimal gains above 0.9700, on risk aversion, after BoE's Bailey comments

- EUR/USD is barely up 0.08% on Tuesday, following BoE’s Baily remarks, which deteriorated traders’ mood.

- US Fed officials continued expressing that inflation is high and that further rate hikes are needed.

- The ECB Chief Economist Philip Lane commented that hiking rates’ impact is harder than unwinding the balance sheet.

The EUR/USD pares earlier gains, courtesy of a risk-off impulse spurred by the Bank of England’s Governor Andrew Bailey, which sent the GBP/USD tumbles below 1.1000, while the EUR/USD followed suit, approaching the 0.9700 figure.

At the time of writing, the EUR/USD is trading at 0.9704 after hitting a daily high nearby the 0.9770s mark, threatening to print a daily close below October’s 10 low of 0.9681.

Sentiment fluctuates, as US equities show, finishing Tuesday’s session mixed. BoE’s Governor Andrew Bailey spooked investors when he said that UK’s pension funds have just 3-days to rebalance, saying that the bond emergent program was part of the BoE’s financial stability operations, not a monetary policy tool. Earlier, the BoE stepped in, buying inflation-linked government bonds.

Therefore, the EUR/USD slid from around 0.9774 day’s high toward 0.9693 before reclaiming 0.9700.

Aside from this, in the last couple of days, Fed officials reiterated that they’re committed to bringing inflation down. Cleveland’s Fed Loretta Mester said on Tuesday that the Fed needs to continue to raise rates until they see compelling evidence that inflation is cooling, while Chicago’s Fed Evans commented that he sees the Federal Funds Rate (FFR) at 4.50% in early 2023.

Elsewhere, Fed’s Vice Chair, Lael Brainard, said, “monetary policy will be restrictive for some time to ensure that inflation moves back to target over time.” She confirmed that the pace and size of further moves would be data-dependent.

In the meantime, the US Dollar Index, a measure of the greenback’s value against its peers, is slight up at 113.273, bouncing off the day’s lows on the risk-off impulse sparked by Bailey’s comments.

During the European session, the ECB Chief Economist Philip Lane said that the ECB would impact the markets by hiking rates than selling its hefty pile of bonds on Tuesday. Given that the ECB raised rates from -0.50% to 0.75% in two months, expectations of another large size increase remained high.

What to watch

On Wednesday, the EU’s economic calendar will reveal the Industrial Production (IP) for August, with monthly and yearly figures estimated to persist in negative territory. On the US front, the calendar will feature the Producer Price Index (PPI) for September alongside Fed speaking.

EUR/USD Key Technical Levels

-

21:58

Fed's Mester: No progress on inflation, so interest rates need to move higher

Cleveland Fed President Loretta Mester said Tuesday that the Federal Reserve needs to continue raising interest rates.

“At some point, you know, as inflation comes down, them my risk calculation will shift as well and we will want to either slow the rate increases, hold for some time and assess the cumulative impact on what we’ve done,” Mester told reporters after a speech to the Economic Club of New York.

“But at this point, my concerns lie more on – we haven’t seen progress on inflation , we have seen some moderation- but to my mind it means we still have to go a little bit further,” Mester said.

“Given current economic conditions and the outlook, in my view, at the point the larger risks come from tightening too little and allowing very high inflation to persist and become embedded in the economy,” Mester said.

Meanwhile, the safe-haven US dollar has gained in a second day while the International Monetary Fund says warns of global recession and has cut its 2023 global growth forecasts further.

-

21:18

EUR/GBP surges past 0.8800 after BoE Bailey’s comments

- The euro breaks above 0.8800 to hit session highs at 0.8855.

- Bailey announces the end of the emergency support program and the pound plunges.

- BoE governor warns about unprecedented volatility in the long end of the gilt market.

The euro has broken higher against the British pound on Tuesday, breaching resistance at the 0.8800 area to hit two-week highs at 0.8855 so far. BoE Governor, Andrew Bailey’s comments regarding the latest monetary policy measures have crushed the pound

The BoE's emergency support program ends on Friday

Bailey has shown its concerns about the “unprecedented volatility in the long end of the gilt market” and urged pension fund managers to finish rebalancing their portfolios by Friday. The Bank of England will end its emergency support program for the country’s fragile bond market.

The Bank expanded the bond-buying scheme last Tuesday in order to include inflation-linked debt, two weeks after having launched it, aiming to confront the turmoil created by Prime Minister Liz Truss with her announcement of tax cuts as a part of a set of unfunded economic reforms.

EUR/GBP might gain bullish traction above 0.8800

From a technical perspective, if the euro confirms above 0.8800, bulls might gain confidence to attack the 0.9000 psychological level ahead of the September, 28 high at 0.9070.

On the downside, below 0.8800, the next support levels might be 0.8740 (October, 7 low) and then probably at 0.8690 (Sept. 22 low).

Technical levels to watch

-

21:03

Forex Today: Dollar resumes advance on risk-averse headlines

What you need to take care of on Wednesday, October 12:

The US Dollar is strong at the end of Tuesday and after an intraday knee-jerk that kept it in the red for most of the American session.

The Bank of England (BOE) introduced additional measures to improve financial market conditions. The central bank will temporarily pause corporate bond sale operations this week while it intends to purchase index-linked gilts up to GBP5 bln.

Also, the UK published its monthly employment report, which was generally encouraging. The ILO unemployment rate slid to 3.5% in the three months to August, beating the previous 3.6%. However, the number of those claiming jobless benefits unexpectedly surged by 25.5K in September, while growth in average total pay (including bonuses) was 6.0% and growth in regular pay (excluding bonuses) was 5.4% in the three months to August.

The International Monetary Fund (IMF) chief economist Pierre Olivier Gourinchas said the worst is yet to come and that 2023 could be a very bad year in terms of global growth.

Ahead of the US close, BOE Governor Andrew Bailey hit the wires and triggered another round of risk aversion. Among other things, he said that the Financial Policy Committee (FPC) took the decision to intervene in the financial market after noting market volatility surpassed bank stress test. Bailey also said that they are facing unprecedented volatility in the long end of the gilt market, but also marked the end of its emergency intervention by saying that they will be out of the market by the end of the week. The comments spurred risk aversion, sending Wall Street into the red and the US Dollar back up.

Across the pound, US Federal Reserve Cleveland President Loretta Mester reiterated on Tuesday the well-known hawkish message. Among other things, Mester said that the biggest risk is that the Fed does not hike rates enough, adding that she does not expect the central bank to lower rates in 2023. Finally, she added that fighting inflation is painful “but must happen.”

US government bonds fell sharply at the beginning of the day, pushing yields to fresh highs. The yield on the 10-year Treasury note peaked at 4.0%, while that on the 2-year note reached an intraday high of 4.35% ahead of the opening. Yields finished the day marginally higher and off their intraday lows.

Wall Street battled to recover ground but failed miserably. The Dow Jones Industrial Average started the day with a positive tone and, at some point, was roughly 300 points up. It trimmed all of its gains ahead of the close, while the S&P500 and the Nasdaq Composite spent the day in the red.

EUR/USD trades around 0.9710, while GBP/USD plunged towards 1.1000. Commodity-linked currencies also trimmed gains, with AUD/USD now trading in the 0.6270 region and USD/CAD at around 1.3800.

The American Dollar extended its advance against its safe-haven rivals, with USD/CHF now quoting at 0.9960 and USD/JPY at 145.80.

XAUUSD flirted with $1,684 a troy ounce but shed ground ahead of the close and settled at $1,666 a troy ounce. Crude oil prices extended their weekly decline after US officials asked Saudi Arabia to delay OPEC+ production for a month, a request that was dismissed by the Saudis. WTI now changes hands at $88.40 a barrel.

The US will publish the September Consumer Price Index is expected to have risen at an annualized pace of 8.1% in September, easing from 8.3% in the previous month. However, core inflation, excluding volatile food and energy prices, is foreseen increasing by 6.5%, higher than the previous 6.1%.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: The start of a larger decline

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:46

GBP/USD dives below 1.1000 as Bailey spooks investors

- The pound dives below 1.1000 on the back of BoE Bailey's comments.

- Unprecedented volatility in the long end of the gilt market.

- GBP/USD: Below 1.0905, the next target might be 1.0540 – BBH.

The British pound has extended its reversal from session highs near 1.1180 to hit lows at 1.0965 after BoE Governor Andrew Bailey spooked investors, revealing the latest monetary policy measures to stabilize the financial system.

Bailey has warned about unprecedented volatility in the long end of the gilt market and urged pension fund managers to finish rebalancing their portfolios by Friday when the bow is planning to end its emergency support program for the country’s bond market.

The Bank expanded the bond-buying program on Tuesday to include inflation-linked debt, two weeks after having launched it in an attempt to manage the turmoil in the bond markets triggered by Prime Minister Liz Truss's announcement of unfunded tax cuts.

The pound has dropped sharply on the back of Bailey's comments, with the pair turning negative on daily charts, on track to post a more than 4% reversal over the last five days, after peaking near 1.1500 last week.

GBP/USD: Below 1.0905, the pair might test 1.0540 – BBH

FX analysts at BBH, see the pair accelerating its downtrend below 1.0905: “A break below 1.0905 would set up a test of the September 28 low near 1.0540 (…) Only time will tell, but we note that whatever measures the BoE takes, it can only address the symptoms (disorderly markets) and not the underlying malady (irresponsible fiscal policy). Only the government can turn this thing around.”

Technical levels to watch

-

20:05

EUR/JPY appreciates to 142.00 as risk aversion eases

- The euro reaches levels past 142.00 after boucing up at 140.95.

- A brighter market mood is easing selling pressure on the euro.

- EUR/JPY expected to trend lower over the next months – ING.

The euro found support at 140.95 low earlier on Tuesday and is picking up during the North American session, to hit intra-day highs right above 142.00, favoured by a moderately brighter market mood moderately.

The euro pares losses after a four-day decline

The common currency has regained some ground on Tuesday, with the pair 0.5% up on the day, following a four-day losing streak. The brighter market sentiment, with US stock markets shifting into positive territory, has weighed on safe-haven assets as the yen, easing negative pressure on the euro.

In absence of first-tier macroeconomic figures, the Japanese yen remains is on the back foot amid the monetary policy differential between the US Federal Reserve and the Bank of Japan.

The US Central Bank has increased up borrowing cost from nearly 0% to a range of 3.00% - 3.25% and the market is pricing in another aggressive rate hike in November. The BoJ, meanwhile, is lagging behind the other major central banks, sticking to its ultra-expansive monetary policy, which is hurting the yen.

On the other hand, the euro remains unable to capitalize yen weakness. Market concerns about the impact of the escalation in the Ukrainian war and the high energy prices on eurozone’s economic prospects are adding negative pressure on the common currency.

EUR/JPY moving lower over the next months – ING

From a longer-term perspective, currency analysts at ING see the pair capped below 145.00: “Our bias would be that EUR/JPY struggles to sustain a break above the 145 level in an environment where central banks are actively looking to slow aggregate demand (…) Typically, the Japanese have been more interventionist than the eurozone and on that basis – and given the forthcoming eurozone recession – EUR/JPY risks look skewed lower the next six months.”

Technical levels to watch

-

19:56

BOE Governor Andrew Bailey revives risk aversion

Bank of England Governor Andrew Bailey spurred some risk aversion in the American afternoon, referring to the latest monetary policy measures to stabilize the financial system.

Bailey noted unprecedented volatility in the long end of the gilt market. Early on Tuesday, the Bank of England (BOE) introduced additional measures to improve financial market conditions. The central bank will temporarily pause corporate bond sale operations this week, while it intends to purchase index-linked gilts up to GBP5 bln.

Bailey added that they saw quite a serious crystallisation of risk, but also remarked that the will be out of the market by the end of the week.

GBP/USD plunged on the news, now trading at around 1.1045.

-

19:54

Silver Price Forecast: XAG/USD drops below the 50-DMA on risk-on impulse

- Silver stumbles on Tuesday, despite a broad US dollar weakness.

- Fed officials kept to the hawkish script, opening the door for further rate hikes.

- US T-bond yields remain heavy, even though market participants expect another 75 bps rate hike by the Fed.

Silver price extends its losses to five consecutive days after reaching a fresh three-month high at $21.23 a troy ounce. Since then has lost 8.50% due to overall US dollar strength, underpinned by elevated US T-bond yields.

At the time of writing, the XAG/USD is trading at $19.45, after hitting a daily high during the Asian session at around $19.71, before printing the day’s low of $19.19.

Investors sentiment improved as US equities bounced off the lows and trade positive. Earlier, the mood was sour, on fears spurred by expectations of worldwide economic slowdown and the Fed’s aggressive tightening, but stocks are getting a respite, despite that fundamentals have not changed.

During the last couple of days, Fed officials maintained their hawkish rhetoric, with Cleveland’s Fed President Mester saying that the Fed will need to keep raising rates until they see clear signs that inflation is indeed approaching the Fed’s goal. Meanwhile, Chicago’s Fed President Charles Evans said that he expects the Federal funds rate (FFR) to peak at around 4.50% in early 2023.

Elsewhere, Fed’s Vice Chair, Lael Brainard, said, “monetary policy will be restrictive for some time to ensure that inflation moves back to target over time.” She confirmed that the pace and size of further moves would be data-dependent.

In the meantime, the US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, edges down 0.39%, below 113.000 for the first time in the week. Additionally, US Treasury bond yields are easing from weekly highs, with the US 10-year bond yield at 3.890%, down seven bps. Even though, US bond yields and the greenback remain on the backfoot, the white metal has been unable to capitalize.

Early morning, the International Monetary Fund reported that the US economy would grow at 2.7% in 2023, below the 2.9% projected in July. According to the IMF chief Economist Pierre-Olivier Gourinchas, “The worst is yet to come, and for many people, 2023 will feel like a recession.”

What to watch

The US economic docket will feature Fed speaking alongside the Producer Price Index (PPI) for September on Wednesday,

Silver Key Technical Levels

-

19:11

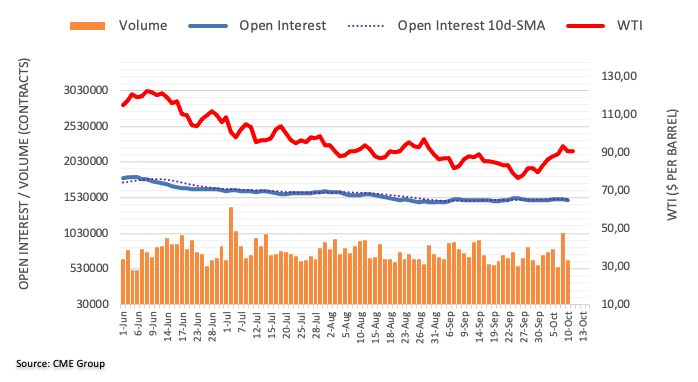

WTI limited below $90 amid global recession concerns

- WTI futures, capped below $90 after hitting lows at $88.40.

- Concerns of a globel recession offset the impact of output cuts.

- The increase of COVID-19 infections in China is adding negative pressure on oil.

WTI futures’ recovery attempt from intra-day lows at $88.40 has been unable to extend past $90 on concerns that a global economic recession might slash demand for oil.

Economic concerns offset the impact of output cuts

Crude prices are retreating for the second consecutive day on Tuesday. Investors are increasingly concerned about the potential impact of a global recession combined with the sharp monetary tightening cycle assumed by most of the major central banks.

Furthermore, news about a sharp increase of COVID-19 cases in China’s major cities, following the Golden Week Holiday, have increased fears about a decline on oil demand. Local authorities have reportedly,closed schools and tourist attractions, reviving lockdown memories.

The sourer investors’ mood has offset the bullish impact triggered by the production cuts announced by the OPEC+ last week. The club of the world’s largest oil suppliers agreed to reduce oil production by 2 million barrels per day, the largest cut since the outbreak of the COVID-19 pandemic, which sent crude prices skyrocketing.

WTI contained above support level at $88.40 area

From a technical perspective, WTI has broken the near-term bullish channel from September 22 low, to find support at $88.40, with next potential downside targets at $86.50 (mid-September highs) and $85.55 (October, 5 low).

On the upside, crude prices should regain the psychological level at $90.00 to build up bullish momentum and aim towards the 50-hour SMA at $91.50 ahead of $93.00 (intra-day high).

Technical levels to watch

-

18:40

EUR/GBP Price Analysis: Oscillates around 0.8750s on a strong pound

- EUR/GBP drops below the 20-day EMA, aiming to extend the downtrend towards 0.8700.

- If the EUR/GBP breaks below 0.8744, it will expose crucial supports at around 0.8736, 0.8700, and the S3 pivot at 0.8671.

The EUR/GBP is on the defensive, dropping for the first time in the last six days amid a risk-on impulse weighing on the shared currency. At the time of writing, the EUR/GBP is trading at 0.8756, below its opening price, after hitting a daily high of 0.8807.

EUR/GBP Price Forecast

The EUR/GBP daily chart shows the pair faced solid resistance at the 20-day EMA at 0.8783, which was briefly broken, though, the pair retreated, and it’s trading at around October 10 lows. Therefore, the EUR/GBP is range-bound, with price action contained between the high/low of yesterday, but as it printed a fresh 3-day low, the path of least resistance is downwards. A break below 0.8744 could tumble the pair towards 0.8725, ahead of the 0.8700 mark.

The one-hour time frame illustrates the EUR/GBP as range-bound, even though price action it’s below the 20, 50, 100, and 200-EMAs, with all trapped in the 0.8760-0.8777 range. Traders should be aware that even though the Relative Strength Index (RSI) is below the 50-midline unless the EUR/GBP decisively breaks below 0.8736, October 7 daily low, it would likely remain subdued.

If the above scenario plays out, the EUR/GBP next support would be 0.8700, followed by the S3 daily pivot at 0.8671.

EUR/GBP Key Technical Levels

-

18:16

USD/CAD dives below 1.3720 with the greenback losing steam

- The US dollar loses steam and retreats below 1.3720.

- A brighter market mood is weighing on the USD.

- USD/CAD expected to peak at 1.40 and dive to 1.32 in 2023 – CIBC.

The US dollar seems to have lost momentum on Tuesday’s North American session and is depreciating against its main rivals. The USD/CAD has dropped more than 100 pips from session highs highs to hit intra-day lows at 1.3717 so far.

A brighter market mood weighs on the USD

Investors’ sentiment seems to have improved after a negative opening in the US, which is pushing the US dollar lower across the board.

The main US stock indexes have jumped into the green, with the Dow Jones 1.22% higher while the S&P 500 and the Nasdaq advance 0.60% and 0.37% respectively. Furthermore US treasury bonds, which surged at market opening times, are retreating, with the 10-year yield retreating below 3.90% after having reached 4.00% earlier today.

On the macroeconomic front, in absence of key macroeconomic data, investors are focusing on the US inflation report, due on Thursday. These figures are expected to offer additional reasons for the Fed to keep rising borrowing costs at an aggressive pace which is likely to offer a fresh impulse to the greenback.

USD/CAD might reach 1.40 before diving to 1.32 next year – CIBC

On a wider perspective, The FX Analysis Team at CIBC sees the pair aiming to 1.40 before pulling back in 2023: “A run to 1.40 is quite possible, and a rebound at year end should still see CAD in 1.38 territory (…) In 2023, we see scope for a broad softening in the USD as the Fed pauses hiking below current market expectations, which will see CAD end the year stronger, with USD/CAD at 1.32.”

Technical levels to watch

-

18:03

United States 3-Year Note Auction up to 4.318% from previous 3.564%

-

18:01

GBP/USD climbs towards the 20-DMA, at around 1.1160s, as mood improved

- GBP/USD get a respite after diving 4% in the last four days due to the UK’s bond turmoil.

- Fed’s Mester commented that inflation is “unacceptably high” and estimates that rates will remain higher for longer.

- UK’s unemployment rate edged lower, despite increasing the number of people without a job or looking for one.

The GBP/USD is snapping four days of consecutive losses, though it remains below 1.1186, the 20-day EMA amidst a risk-off impulse in the markets, but not in the FX space, with the greenback remaining on the backfoot. Fears of lower worldwide economic growth, and further central bank tightening, keep traders on their toes.

At the time of writing, the GBP/USD Is trading at 1.1160, above its opening price by 0.98%, after hitting a daily low of 1.0997 early during the European session. So far, US equity markets have made a U-turn, trading in the green, reflecting the sentiment improvement.

The absence of US economic data keeps traders entertained with Fed speaking, led by Cleveland’s Fed President Loretta Mester. She said that even with a large number of rate increases in 2022, the central bank has not achieved its goal and would need to press forward with tightening monetary policy. Mester commented that inflation is “unacceptably high and persistent” while reiterating that she does not expect any rate cuts by 2023.

In the meantime, last Friday’s US Nonfarm Payrolls report showed that the labor market remains tight, albeit hiring was lower than August’s figures. Of note is that the Unemployment Rate decelerated from 3.7% to 3.5%, justifying the Fed’s need for more hikes.

On the UK side, employment data was worse than estimated, as reported by the ONS, that 252K of Britons are not looking working or looking for one, while the ILO Unemployment Rate edged lower from 3.6% to 3.5%. The number of people in employment fell by 109,000 in the June-August period.

That said, sources cited by Reuters estimate that the low unemployment rate and pay rises edging higher will keep the Bank of England on its tightening cycle, as the bank scrambles to tame inflation in two-digit levels.

What to watch

The UK calendar will feature GDP figures for 3-months, annual base reading, Industrial Production, and the Trade Balance. On the US front, the docket will feature Fed speaking and the Producer Price Index (PPI).

GBP/USD Key Technical Levels

-

17:43

USD/INR to continue moving higher – MUFG

The Indian rupee reach a record low of 81.950 against the USD in September on exceptional US dollar strength due to a hawkish Federal Reserve as well as a possibly smaller degree of intervention in the forex market by the Reserve Bank of India (RBI), explained analysts at MUFG Bank. They expect USD/INR to continue moving to the upside with a forecast of 84.00 by the end of the year.

Key Quotes:

“The 13.5%y/y jump in India’s real GDP growth in CYQ2 was the strongest growth rate in a year, driven mainly by substantial increases in private consumption and gross fixed capital formation.”

“The double-digit growth rate in CY Q2 was also the consequence of low base effects and far lower than what we have initially projected. We have since revised our real GDP growth forecast lower to 6.7% from 7.6% prior for FY22/23, and 5.8% for FY23/24 versus 6.6% prior.”

“The confluence of a stronger USD, deteriorating trade and current account balances for India, risks of a return in net portfolio outflows in Q4, and smaller scope for FX intervention point to further INR weakness ahead which would bring it to a new record low against the USD in the coming months after hitting a record low of 82.00 on 28 September.”

“Based on the latest available data, India’s foreign reserves have fallen by USD88.0 bn to USD545.7 bn. The magnitude of the decline in foreign reserves is close to the RBI’s USD100 bn threshold. This limits the scope for an aggressive pace of intervention in the coming months.”

“Our end-2022 USD/INR forecast is now at 84.00.”

-

17:33

NZD/USD regains upside traction to reach day highs at 0.5640

- The New Zealand dollar appreciates further nad reaches 0.5640.

- A somewhat softer USD is contributing to kiwi's recovery.

- NZD/USD likely to extend losses to 0.50 – ING.

The New Zealand dollar has picked up momentum on Tuesday’s US session after bouncing up from 0.5575, to hit day highs at 0.5640 so far. The pair appreciates beyond 1% on the daily chart to pare some of the previous three days’ losses.

The kiwi appreciates as the USD pulls back

The greenback seems to have lost steam on Tuesday after a four-day rally. The US Dollar Index is showing a moderate reversal, which is helping most of the major currencies to regain some of the recent losses.

Investors mood seewms to be improving, after a negative US market opening, and the main stock indexes showing gains at the time of writing, which is increasing demand for rislier assets in detriment of the safe-haven dollar.

On a wider perspective, however, the market is awaiting the release of a key US inflation report, due later this week. According to most accounts, price pressures are likely to have increased oin the US, which would offer additional reasons to the Federal Reserve to approve another aggressive rate hike in November, and offer a fresh boost to the USD.

NZD/USD might revisit 2009 lows at 0.50 – ING

The FX analysis team at ING maintain their bearish outlook intact and see the pair likely to reach 0.50: The Reserve Bank of New Zealand hiked by another 50 bps in October and signalled more tightening is on the way. Another 50 bps increase is largely expected at the November meeting. The role of monetary policy remains secondary compared to global risk dynamics (…) NZD/USD is looking at the 0.50 2009 lows as the next key support."

Technical levels to watch

-

17:31

USD/JPY: Forecast at 147.00 in a three-month perspective – Rabobank

The USD/JPY is falling on Tuesday, trading around 144.50, after approaching the multi-year high near 146.00. According to analysts from Rabobank, only a weaker US dollar could change the bullish dynamic for the USD/JPY. They have a 3-month forecast at 147.00.

Key Quotes:

“The late September FX intervention in support of the JPY vs. the USD had the effect of suggesting to the market that the USD/JPY 145.00 level was an unspoken line in the sand for the MoF. This was part of a game of chicken that Japanese officials and the market have become involved in. It is very clear to all participants that FX intervention cannot turn the direction of a currency pair unless the fundamentals are also pulling in the same direction. In the current instance, the hawkishness of the Fed coupled with the dovishness of the BoJ means that fundamentals are still tugging USD/JPY higher.”

“Another lurch higher in USD/JPY in the coming weeks may trigger some renewed verbal intervention from the MoF, but eventually that would have to be followed by more action – a decision which wouldn’t be taken lightly.”

“In view of the fact that Japan has suffered minimal wage inflation for decades, it may be optimistic to hope that Japan could be on the cusp of a structural move away from deflationary pressures. This, however, is the aim of policymakers. Signs that the spring wage talks bring higher wages could end policies such as yield curve control on the BoJ’s terms. Failing this only a weaker USD is likely to change the dynamic for USD/JPY. We expect USD strength to prevail for some time and at least into next spring. We maintain a 3 month forecast of USD/JPY 147.00.”

-

17:22

AUD/USD extends recovery from two-year lows, rises above 0.6320

- US dollar prints fresh lows across the board as US yields decline.

- Gold, silver and stocks in Wall Street extend recovery.

- AUD/USD to hold intraday bullish bias while above 0.6300.

The AUD/USD turned positive for the day and printed a fresh daily high at 0.6329. The pair is rebounding from the lowest level since April 2020 it reached earlier on Tuesday at 0.6246.

The move higher during the American session is driven by a broad-based US dollar slide across the board. The greenback lost momentum amid a recovery in Treasuries and also on the back of an improvement in risk sentiment.

The US 10-year yield is under 3.90% after exceeding 4.00% hours ago. The Dow Jones is gaining 0.64% and the Nasdaq is off lows, down by 0.39%. Metals recovered with XAU/USD testing $1680 and silver hovering around $19.50.

Market participants await key US economic data: on Wednesday the Producer Price Index and FOMC minutes, and on Thursday the Consumer Price Index. Inflation figures will be watched closely as they will influence Fed rate hike expectations.

Not out of the woods yet

The AUD/USD will face the 20-Simple Moving Average in 4-hour charts at 0.6350. Above, the next resistance stands at 0.6385 and then 0.6430. A recovery above the last one would alleviate the bearish pressure.

On the flip side, now 0.6300 is the immediate support followed by 0.6280. A decline below would expose the recent low at the 0.6245 area.

Technical levels

-

17:04

Fed's Mester: Biggest policy risk is that Fed doesn’t hike rates enough

Federal Reserve Bank of Cleveland President Loretta Mester reiterated on Tuesday that they are yet to make any progress on lowering inflation, as reported by Reuters.

Additional takeaways

"Monetary policy needs to be moved to restrictive levels."

"Not expecting the Fed to lower rates in 2023."

"Size of Fed rate rises will depend on economic conditions."

"High and persistent inflation remains the economy’s biggest challenge."

"Unemployment at 4.5% by end of 2023, move higher in 2024."

"Expecting inflation to fall to 3.5% next year, to 2% by 2025."

"Possible shock could tip the US economy into recession."

"Job market still remains very strong, outstripping supply."

"Fight to lower inflation is painful, but must happen."

"Fed is committed to using all tools to lower inflation."

"Expecting weak growth over next couple of years."

Market reaction

The US Dollar Index stays under bearish pressure despite these hawkish comments and was last seen losing 0.43% on the day at 112.70.

-

16:53

EUR/USD contained above 0.9680, remains moving sideways around 0.9700

- The euro fails to bounce up, althoiugh it remains steadu above 0.9680.

- A sour market mood underpins USD strength and weighs on the euro.

- EUR/USD to continue its downtrend towards 0.9650/00 – Scotiabank.

Euro’s reversal from intra-day high right below 0.9740 has been contained at 0.9690, and the pair remains moving without directions within a tight range around 0.9700.US dollar appreciates on a risk-off market

In absence of first-tier macroeconomic events, the sour market mood reflected on the negative stock indexes has been weighing on the pair’s bullish attempts, with the USD underpinned by its safe-haven status. The common currency is ticking up on the daily chart, in an attempt to put an end to a four-day decline.

Investors seem to be wary about the prospects of a global economic downturn, with the Ukrainian war escalating and energy prices at high levels an scenario that, combined with the effects of the monetary tightening cycle of most of the major central banks has boosted risk aversion among traders.

Furthermore, news about rising COVID-19 infections in some of China’s main cities, which have forced some local authorities to close schools and tourist attractions, have increased concerns about global economy.

EUR/USD, aiming to 0.9600/50 area – Scotiabank

Currency analysts at Scotiabank expect the pair to extend its downtrend to. The lower range of 0.9600: “Sequentially lower lows and lower highs keep the 2022 downtrend in the EUR very much intact on the daily chart – even with the selloff looking overextended (…) Intraday patterns look soft; the USD is pressuring EUR support in the low 0.97s, leaving the market on the cusp of a push back to the 0.9600/50 range.”

Technical levels to watch

-

16:35

USD/CHF retreats from three-month highs toward 0.9950 ahead of Jordan’s speech

- US dollar loses as US yields move off highs.

- USD/CHF bearish intraday bias, still above 0.9950

- SNB’s Jordan speaking in a few minutes.

The USD/CHF pulled back during the European session and bottomed at 0.9945 and then bounced back toward parity. Ahead of the speech SNB Chairman, it is hovering around 0.9965.

Earlier on Tuesday, USD/CHF peaked at 1.0020, the highest level since June 15. Afterwards, it retreated as the US Dollar lost momentum across the board. The combination of an improvement in risk sentiment and a decline in US yields.

The US 10-year yield hit levels above 4.00% earlier and currently, it is back under 3.90%. In Wall Street, the Dow Jones is up by 0.50% after a negative opening and the S&P drops by 0.25%.

In a few minutes, at 16:00 GMT, Swiss National Bank Chairman Thomas Jordan will deliver a lecture on ‘Ethics and Economics’ in Washington at the Peterson Institute. He might avoid speaking about monetary policy.

The intraday trend in USD/CHF remains bearish, although it has found support at 0.9950. A break lower is needed to trigger more losses. On the upside, above the parity area, the next critical resistance is the 1.0050 area.

Technical levels

-

16:26

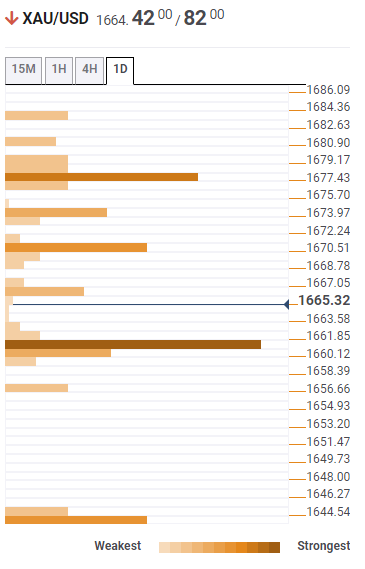

Gold Price Forecast: XAU/USD fluctuates around the 20-DMA at $1670

- Gold price trims earlier losses and reclaims $1670 on Tuesday.

- A strong US dollar underpinned by elevated US bond yields would likely keep precious metals on the defensive.

- According to the IMF, the United States will grow 1.6% in 2022.

- Gold Price Forecast: Range-bound between $1661-$1674.

Gold price is slightly up during the North American session, due to high US T-bond yields, alongside a strong US dollar, ahead of crucial US inflation figures to be released on Thursday, which could shed some light regarding the need for further Fed aggressive hikes. Hence, XAU/USD is trading at $1671, a troy ounce, registering minimal gains at the time of writing.

Sentiment remains deteriorated amidst fears that global central bank tightening would slash corporate earnings while dampening the economic outlook. The US 10-year Treasury bond yield is down by four bps but around YTD highs at 3.92%, while the greenback is pairing earlier losses.

The US Dollar Index, a gauge of the buck’s value vs. a basket of peers, losses 0.03%, at 113.147.

Last week’s US Nonfarm Payrolls report was better than estimated, confirming that the economy added more than 260K jobs. Even though the hiring pace slowed, the Unemployment rate decreased from 3.7% to 3.5%, which is not what the US Federal Reserve needs. Given that the labor market remains tight, further rate hikes by the Fed are expected.

The International Monetary Fund (IMF) adds to fears about global growth. On Tuesday, the IMF cut its forecast for the next year to 2.7% from 2.9% in July, almost 1% less than in January. According to the IMF chief Economist Pierre-Olivier Gourinchas, “The worst is yet to come, and for many people, 2023 will feel like a recession.”

The IMF said that the US would expand at 1% next year, unchanged from its previous forecast; nevertheless, for 2022, it cut its outlook from 2.3% in July to 1.6%.

The US economic docket is empty on Tuesday. On Wednesday, it will feature prices paid by producers. Alongside Mortgage Applications and Fed speakers.

Gold Price Forecast: XAU/USD Technical Outlook

From a daily chart perspective, XAU/USD remains neutral-to-downward biased, with all the DMAs, residing below the price. However, it should be noted that sellers’ failure to crack $1661 exposed essential resistance levels at around the 20-day EMA at $1673.97, followed by the $1700 figure. On the downside, the XAU/USD first support remains at a daily low of $1661. Once cleared, the September 28 cycle low at $1614.92 would be tested, followed by $1600.

-

16:11

BoE accepts 1.363 billion GBP of offers in daily long-dated gilt purchase

The Bank of England (BoE) accepted 1.363 billion sterling of offers in the daily purchase operation of conventional long-dated gilts, Reuters reported on Tuesday.

The BoE rejected 47.6 million GBP of offers in the same operation.

Market reaction

The 2-year UK gilt yield pushed lower with the initial reaction and was last seen losing nearly 2% on the day at 4.26%. Meanwhile, the British pound started to gather strength during the American trading hours. As of writing, the GBP/USD pair was trading near 1.1100, where it was up 0.4% on a daily basis.

-

16:05

NY Fed: 1-year consumer inflation expectations fall to 12-month low of 5.4%

The Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Tuesday that the US consumers' one-year inflation expectation declined to a new 12-month low of 5.4%, down from 5.7% in August's survey, as reported by Reuters.

The three-year-ahead inflation expectation edged higher to 2.9% from 2.8% and the five-year-ahead inflation expectation rose to 2.2% from 2%, the publication further revealed.

On a concerning note, households' year-ahead expected spending increase declined to 6% from 7.8% in August, marking the biggest drop in the series' history.

Market reaction

The US Dollar Index edged lower with the initial reaction to this report and was last seen losing 0.15% on the day at 113.00.

-

15:55

Gold Price Forecast: XAU/USD to regather bullish momentum on soft US core CPI data

Gold ended up closing the second straight week in positive territory. September inflation data from the US could trigger a significant market reaction and help the precious metal determine its next direction, FXStreet’s Eren Sengezer reports.

Focus shifts to CPI

“The Consumer Price Index (CPI) is forecast to rise to 8.5% on a yearly basis in September from 8.3% in August. Investors are likely to put more weight on the core figure and a print above 6.5% could fuel another leg higher in yields. On the other hand, an unexpected decline in core inflation should help XAU/USD gather bullish momentum. Nevertheless, the initial market reaction could fade unless it influences the market pricing of the next Feed action in a significant way.”

“The US Census Bureau will publish the Retail Sales data for September. Ahead of the weekend, the University of Michigan’s Consumer Sentiment Survey for October will be watched closely by market participants, especially the 5-year Consumer Inflation Expectation component, which declined to 2.7% in September from 2.9% in August. Another decline in this data could cause the USD to come under selling pressure and vice versa.”

See – US CPI Preview: Forecasts from 10 major banks, price pressure easing only very slowly

-

15:34

Silver Price Analysis: XAG/USD to suffer further losses on a dip below $18.90 – TDS

Silver continues losing ground for the third straight day. The white metal could extend its slide on a break under $18.90, strategists at TD Securities report.

Failed rally has raised the likelihood of a short acquisition program

“While trend follower shorts are not out of the woods just yet, the failed rally has raised the likelihood of a short acquisition program in silver markets.”

“Considering risk markets are vulnerable to our forecast for an upside surprise to this week's CPI data, we place our attention to the downside, estimating that a break below the $18.90 range in silver could spark additional selling flow from this cohort in the white metal.”

-

15:25

IMF: Financial stability risks have risen since April report

In its recently published Global Financial Stability Report, the International Monetary Fund warned that financial stability risks have risen since the April report and said that the balance of risks are "significantly skewed" to the downside, per Reuters.

Additional takeaways

"Financial conditions have worsened and there is a risk of disorderly tightening."

"Policymakers must balance resolute action to reduce inflation while avoiding disorderly market conditions."

"Seeing heightened risk of rapid, disorderly repricing in financial markets, amplified by existing vulnerabilities and poor liquidity."

"Global bank stress test shows up to 29% of emerging market banks would be undercapitalized in a severe economic downturn."

"Property downturn in China has deepened with a heightened risk of spillovers to banking, corporate and local government sectors."

Market reaction

Safe-haven flows continue to dominate the financial markets in the American session and the S&P 500 Index was last seen losing 1% on a daily basis.

-

15:15

United States IBD/TIPP Economic Optimism (MoM) declined to 41.6 in October from previous 44.7

-

15:12

BoE accepts 1.957 billion GBP of offers in first index-linked gilt purchase

The Bank of England (BoE) accepted 1.957 billion sterling of offers in the first purchase operation of index-linked gilts, Reuters reported on Tuesday.

The BoE rejected 466.9 million sterling of offers in the same operation.

Market reaction

Long-dated UK index-linked gilt yields mostly turned slightly positive on the day with the initial reaction to this development. The British pound, however, seems to be having a difficult time finding demand. As of writing, the GBP/USD pair was trading virtually unchanged on the day at 1.1055.

-

15:10

EUR/USD: On the cusp of a push back to the 0.9600/50 range – Scotiabank

EUR is little changed against firm US dollar. Nevertheless, the broader downtrend prevails, economists at Scotiabank report.

Major resistance seen at 1.0010

“Sequentially lower lows and lower highs keep the 2022 downtrend in the EUR very much intact on the daily chart – even with the selloff looking overextended.”

“Major trend resistance now stands at 1.0010.”

“Intraday patterns look soft; the USD is pressuring EUR support in the low 0.97s, leaving the market on the cusp of a push back to the 0.9600/50 range.”

-

15:08

US CPI Preview: Forecasts from 10 major banks, price pressure easing only very slowly

The US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data for August on Thursday, October 13 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming US inflation print.

On a monthly basis, the CPI is expected to rise by 0.2%. The Core CPI, which excludes volatile food and energy prices, is expected to have risen by 0.5% last month, which is below August's 0.6% read. Headline is expected at 8.1% year-on-year vs. 8.3% in August, while core is expected at 6.5% YoY vs. 6.3% in August.

ANZ

“We expect US core CPI to rise by 0.5% MoM in September, while lower energy prices should result in headline inflation increasing by 0.3%. Elevated rent and robust wage growth are expected to keep services inflation uncomfortably high. A confluence of factors should put downward pressure on goods inflation, namely moderating supply bottlenecks, softer commodity prices, lower shipping rates, and a stronger USD. The Fed remains singularly focused on inflation. It intends to leave policy restrictive for an extended time. This will result in a lengthy period of below-trend growth and higher unemployment.”

Commerzbank

“We expect the core CPI to rise by 0.5% on the previous month. This would bring the year-on-year rate to about 6.5%; however, the 3-month rate would ease. Over the medium-term, rental data from the real estate sector point to somewhat slower growth in rents, which could gradually reduce underlying inflationary pressures. The outlook for headline inflation is better. Here, the further fall in petrol prices is easing the situation. In addition, the rise in food prices should slowly lose momentum. We expect overall consumer prices to have risen by 0.3% compared to the previous month. The 12-month inflation rate would then fall again slightly to 8.1%.”

ING

“The headline rate will be depressed by the lagged effects of the fall in gasoline prices, which is also likely to translate into lower airline fares to some extent. However, the core (ex-food and energy) component is set to continue rising at a rapid pace. We look for a 0.4% MoM increase in prices, which would nudge the annual rate of core inflation up to 6.5% from 6.3%. This unfavourable shift is primarily due to housing costs and recreation prices and should cement expectations for a fourth consecutive 75 bps interest rate increase from the Federal Reserve on 2 November.”

TDS

“Core prices likely stayed strong in September, with the series registering another large 0.5% MoM gain. Shelter inflation likely remained strong, though we look for used vehicle prices to retreat sharply. Importantly, gas prices likely brought additional relief for the headline series again, declining by about 5% m/m. Our MoM forecasts imply 8.2%/6.6% YoY for total/core prices.”

Deutsche Bank

“We highlight that with gas prices down another near 7% from August to September, energy will again drag on the headline CPI print (+0.28% forecast vs. +0.12% previously). However, core CPI (+0.44% vs. +0.57%) will draw the most focus especially given last month’s upside surprise. Assuming our forecasts are correct, year-over-year headline CPI should continue to decline, falling two-tenths to 8.1%, while core should tick up two-tenth to peak at 6.5%. Whether one number should be the basis for huge swings in markets, it seems inevitable that a notable miss on core on either side could bring about big moves in trading over the coming weeks so stand by.”

SocGen

“We forecast a 0.2% headline CPI increase for September. Our core rate forecast is for 0.5%, but this figure is rounded-up, and our actual calculation is 0.45%. The emphasis on the unrounded number is to declare that we would not be at all surprised by a 0.4% MoM increase but would be surprised if the figure were 0.6% or higher.”

NBF

“Headline prices could have increased 0.2% MoM. If we are right, the YoY rate should come down to 8.1% from 8.3%. The core index, meanwhile, may have continued to be supported by rising rent prices and advanced 0.4% on a monthly basis. This would translate into a two-tick increase of the 12-month rate to 6.5%.”

CIBC

“The relief from higher prices at the pump extended into September, but continued pressure in food prices, where a labor shortage in the transportation industry and extreme weather conditions remain issues, could have resulted in a 0.2% monthly advance in total prices, leaving annual inflation at 8.1%. That would also include pressure in components outside of food and energy, which likely rose by 0.4% m/m, as the shelter component is still picking up the impact of leases resetting at higher rates, reflecting the housing market strength seen last year. Leaning against that could be some weakness in used car prices, in line with marginal improvement in supply chains. All told, core annual inflation is set to accelerate by two ticks, to 6.5%, magnified by base effects. We are in line with the consensus and market reaction should therefore be limited.”

Wells Fargo

“For September, we forecast headline CPI rose 0.2%, bringing the YoY rate down slightly to 8.1%. Energy prices were likely a considerable part of soothing the headline rate last month, as gasoline prices declined through most of the month. But scorching core inflation, up at a 3-month annualized rate of 6.5% in August, means that declines in commodity prices alone will not cut it when it comes to muting inflation for the long-haul. We expect core inflation rose 0.5% in September, which is above consensus but below August's 0.6% upward surprise. The more moderate core gain is likely to stem from goods inflation as consumer spending shifts back toward services and retail inventories are starting to pile up. Core services should again be a primary driver of inflation this month, as lags from rent and home price measures indicate another strong monthly gain. Wage gains are particularly important to the services sector, and by remaining elevated, continue to complicate the Fed's fight against inflation.”

Citibank

“US September CPI MoM – Citi: 0.2%, prior: 0.1%; CPI YoY – Citi: 8.1%, prior: 8.3%; CPI ex Food, Energy MoM – Citi: 0.5%, prior: 0.6%; CPI ex Food, Energy YoY – Citi: 6.6%, prior: 6.3%. We expect a continuation of the trend of still solid monthly increases. Risks are tilted slightly to the downside though due to a softening in goods prices generally over the coming months. Meanwhile, the trend of services prices, both for shelter and other services, continue to be the more important underlying drivers of inflation with we are again penciling in strong increases.”

-

14:55

Rise in US yields to lend further support to the dollar – BBH

The dollar continues to rise. Climbing US yields are set to continue boosting the greenback, economists at BBH report.

Dollar remains firm as US yields rise

“The US Dollar Index (DXY) is on track to test the September 28 high near 114.778.”

“The combination of ongoing risk off impulses and eventual repricing of Fed tightening risks is likely to see the dollar continue to recover after this recent correction.”

“We believe this generalized rise in US yields will continue and lend further support to the dollar.”

-

14:54

USD/CAD Price Analysis: Set-up favours bulls, move to 1.3900 remains on the cards

- USD/CAD retreats from its highest level since May 2020 amid a modest USD pullback.

- Sliding oil prices undermine the loonie and help limit the downside, for the time being.

- Bulls now await sustained strength beyond the 1.3830-40 area before placing fresh bets.

The USD/CAD pair attracts some dip-buying near the 1.3760 region and stalls its intraday pullback from the highest level since May 2020 touched earlier this Tuesday. Spot prices climb back to the 1.3800 mark during the early North American session and look to build on the recent rally witnessed over the past week or so.

Worries that a global economic downturn and rising COVID-19 cases in China will hurt global fuel demand drag crude oil prices lower for the second straight day. This, in turn, undermines the commodity-linked loonie and acts as a tailwind for the USD/CAD pair. That said, an intraday downtick in the US dollar could cap the upside.

From a technical perspective, the USD/CAD pair, so far, has been struggling to find acceptance or build on the momentum beyond the 1.3830-1.3840 supply zone. This makes it prudent to wait for strong follow-through buying beyond the daily swing high, around the 1.3855 region, before positioning for a further appreciating move.

The USD/CAD pair might then accelerate the momentum and aim to reclaim the 1.3900 round-figure mark. The next relevant hurdle is pegged near the 1.3925-1.3930 region, above which spot prices could climb further towards the 1.4000 psychological mark.

On the flip side, the 1.3760 area, or the daily low, now seems to act as immediate support. Any further downfall could be seen as a buying opportunity and remain limited near the 1.3700 mark. The latter should act as a pivotal point for short-term traders, which if broken decisively might prompt some technical selling.

The USD/CAD pair might then turn vulnerable to extend the corrective pullback towards the 1.3600 level before eventually sliding back to the monthly swing low, around the 1.3500 psychological mark.

USD/CAD 4-hour chart

Key levels to watch

-

14:46

GBP/USD to turn better bid above 1.11 – Scotiabank

GBP/USD steadies above 1.10. Economists at Scotiabank note that the pair would improve its prospects on a move above 1.11.

GBP still has a lot of work to do in order to stabilize

“The slowing in the pace of the sell-off from the early Oct high around 1.15 suggests that some bargain hunting is developing around 1.1000/50. Short-term resistance is firm in the 1.1085/95 zone, however, and the pound still has a lot of work to do in order to stabilize.”

“Look for cable to turn better bid above 1.11 but trade better offered again below 1.10 in the short-run.”

-

14:44

EUR/USD looks firm and advances to 0.9740

- EUR/USD keeps the optimism unchanged above 0.9700.

- German 10-year bund yields hover around 2.35% on Tuesday.

- Italian Industrial Production surprised to the upside in August.

Buyers appear so far in control of the sentiment around the European currency and help EUR/USD to keep the trade above the key 0.9700 hurdle on Tuesday.

EUR/USD appears bid on USD-selling

The corrective downside in the greenback allows EUR/USD to finally halt the recent sharp sell-off and rebound from earlier lows in the 0.9670/65 band to the 0.9740 zone, where some initial resistance has turned up.

Nothing new around the pair other than the recent pick-up in the risk aversion in response to renewed geopolitical concerns stemming from the war in Ukraine, which was eventually behind the persistent strength in the dollar in combination with expectations of a large rate hike by the Fed at the November gathering.

In addition, the uptick in spot comes in tandem with a marginal advance in the German 10-year bund yields vs. the corrective decline in US yields across the curve.

In the domestic calendar, Italian Industrial Production expanded 2.3% MoM in August and 2.9% from a year earlier. In the US data space, the NFIB Business Optimism Index rose to 92.1 in September and the IBD/TIPP Economic Optimism gauge is due later along with speeches from FOMC’s Harker and Mester.

What to look for around EUR

EUR/USD’s leg lower seems to have met some initial contention in the 0.9670/65 band so far this week.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Following latest results from key economic indicators, the latter is expected to extend further amidst the ongoing resilience of the US economy.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: EMU Industrial Production, ECB Lagarde (Wednesday) – Germany Final Inflation Rate (Thursday) – EMU Balance of Trade (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.12% at 0.9709 and the surpass of 0.9999 (weekly high October 4) would target 1.0050 (weekly high September 20) en route to 1.0197 (monthly high September 12). On the other hand, there is an immediate support at 0.9535 (2022 low September 28) ahead of 0.9411 (weekly low June 17 2002) and finally 0.9386 (weekly low June 10 2002).

-

14:31

SNB to guide EUR/CHF to 0.90 next year – ING

The Swiss National Bank (SNB) is set to drive the EUR/CHF lower. Therefore, economists at ING expect the pair to plunge towards 0.90 in 2023.

SNB looks set to guide EUR/CHF lower

“We still think the SNB is running a kind of monetary conditions framework, using both policy rates and the trade-weighted Swiss franc to tighten conditions.”

“With inflation among trading partners running 5-6% above Switzerland, the SNB will want a weaker EUR/CHF to keep the real franc stable. If we’re right, the SNB could be guiding EUR/CHF to 0.90 next year.”

-

14:30

IMF's Gourinchas: Dollar strength is putting a lot of strain on a number of countries

While presenting the World Economic Outlook on Tuesday, Pierre-Olivier Gourinchas, Economic Counsellor and Director of Research of the International Monetary Fund (IMF), noted that the dollar strength is putting a lot of string on a number of countries, per Reuters.

Additional takeaways

"There has seen some dysfunction in UK financial markets."

"We welcome the announcement of the UK medium-term budget at the end of October."

"Dollar strength is the result of fundamental economic forces, not market dysfunction."

"Appropriate response is not to try to stem the dollar's advance, but to let currencies adjust."

Market reaction

These comments don't seem to be impacting the dollar's valuation in a meaningful way. As of writing, the US Dollar Index was down 0.1% on the day at 113.06.

-

14:28

GBP/USD Price Analysis: Intraday bounce from 1.1000 stalls ahead of 100-period SMA on H4

- GBP/USD rebounds from over a one-week low touched on Tuesday amid a modest USD pullback.

- Aggressive Fed rate hike bets act as a tailwind for the buck and cap gains amid recession fears.

- The technical setup favours bearish traders and warrants caution before confirming a bottom.

The GBP/USD pair finds decent support near the 1.1000 psychological mark and stages a goodish intraday rebound from over a one-week low touched earlier this Tuesday. The positive move allows spot prices to snap a four-day losing streak, though bulls struggle to find acceptance above the 1.1100 round figure.

A modest pullback in the US Treasury bond yields, along with a slight recovery in the equity markets, prompts some profit-taking around the safe-haven US dollar and offers support to the GBP/USD pair. That said, concerns about the UK government's fiscal plans continue to act as a headwind for the British pound amid looming recession risks. This, in turn, keeps a lid on any meaningful upside for the major, at least for the time being.

From a technical perspective, the post-NFP downfall on Friday validated a bearish breakdown through the 1.1200 confluence. The said handle comprised the 23.6% Fibonacci retracement level of the corrective rally from an all-time low, the lower end of a nearly two-week-old ascending channel and the 100-period SMA on the 4-hour chart. The latter caps the intraday bounce for the GBP/USD pair and should act as a pivotal point for intraday traders.

A sustained strength beyond could trigger a short-covering rally and lift the GBP/USD pair towards the 1.1200 round figure (23.6% Fibo. level). Some follow-through buying will suggest that the recent pullback from the vicinity of the 1.1500 psychological mark has run its course and pave the way for additional gains. Spot prices might then accelerate the upward trajectory, allowing bulls to aim back to reclaim the 1.1300 round-figure mark.

On the flip side, the 38.2% Fibo. level, around the 1.1045 region, could act as immediate support ahead of the 1.1000 level. A convincing break below could drag the GBP/USD pair towards the 50% Fibo. level, around the 1.0920 area. This is followed by the 1.0900 mark, which if broken decisively will be seen as a fresh trigger for bearish traders.

GBP/USD 4-hour chart

-638010915051424033.png)

Key levels to watch

-

14:18

IMF's Gourinchas: Energy shock, especially in Europe, is not transitory