Notícias do Mercado

-

23:43

USD/CAD Price Analysis: Signals pullback towards 1.3735

- USD/CAD keeps pullback from three-day-old resistance line, pokes immediate support.

- RSI conditions favor sellers aiming for the 200-SMA.

- Bulls need validation from yearly peak for a further upside move.

USD/CAD teases sellers around an immediate support line near 1.3775 during Tuesday’s Asian session. In doing so, the Loonie pair justifies the previous day’s failure to cross a three-day-old resistance line, as well as the bearish divergence on the RSI (14).

That said, the quote is likely to break the nearby support of 1.3775, which in turn could quickly drag prices toward the 200-HMA support level near 1.3735. However, Monday’s bottom surrounding the 1.3700 theshold could challenge the pair bears afterward.

Also acting as a downside filter is a horizontal area surrounding 1.3675 that comprises the levels marked since the last Thursday.

In a case where the USD/CAD prices decline below 1.3675, the odds of witnessing a slump toward the monthly low near 1.3500 can’t be ruled out.

Meanwhile, an upside break of the ascending resistance line from Thursday, near 1.3785 by the press time, could recall the buyers trying to renew the yearly top marked the last month, currently around 1.3840.

In that case, April 2020 bottom surrounding 1.3960 will gain the market’s attention as the strong hurdle.

Overall, USD/CAD is likely to witness a pullback but a reversal of the present bullish trend is out of the question at the moment.

USD/CAD: Hourly chart

Trend: Pullback expected

-

23:34

Gold Price Forecast: XAU/USD sees a downside below $1,660 amid firmer DXY, US Inflation eyed

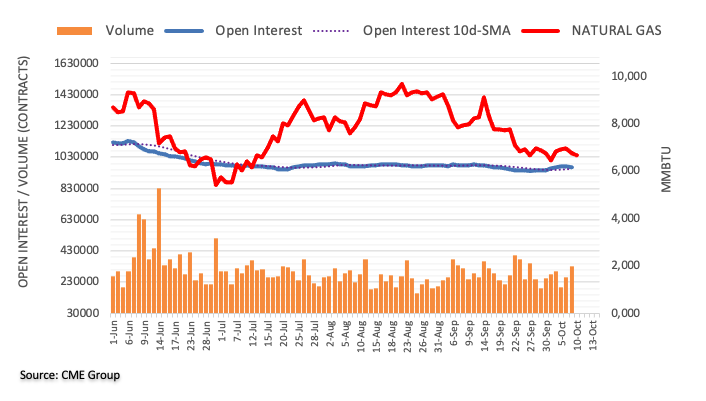

- Gold price has turned sideways after a sheer downside below $1,670.00 amid a risk-off market mood.

- Intensified missile attacks by Russia on Kyiv have trimmed the risk appetite of investors.

- This week, the US inflation data will be of utmost importance.

Gold price (XAU/USD) is displaying topsy-turvy moves below $1,670.00 in early Asia. The precious metal is expected to display sheer volatility if it ditches the cushion of $1,660.00 as the risk-off profile is intensifying amid aggressive attacks on Ukraine by Russia. After damaging the Crimean bridge in Russia that is acting as a supply line for Russian troops in southern Ukraine, Russia has intensified missile attacks in Kyiv.

Meanwhile, the US dollar index (DXY) has been strengthened on the dismal market mood and has established comfortably above the round-level hurdle of 113.00. US markets were closed on Monday but S&P500 futures have remained majorly rough amid negative market sentiment.

This week, the mega event of the US inflation data will provide lucid guidance for further direction. A decline in gasoline prices has resulted in a trimmed consensus for the headline US inflation data. The economic data is seen lower at 8.1%. While the core inflation that excludes oil and food prices is seen higher at 6.5%.

As per CME Fedwatch tool, more than 78% odds are favoring that the Federal Reserve (Fed) will announce a fourth consecutive 75 basis points (bps) rate hike.

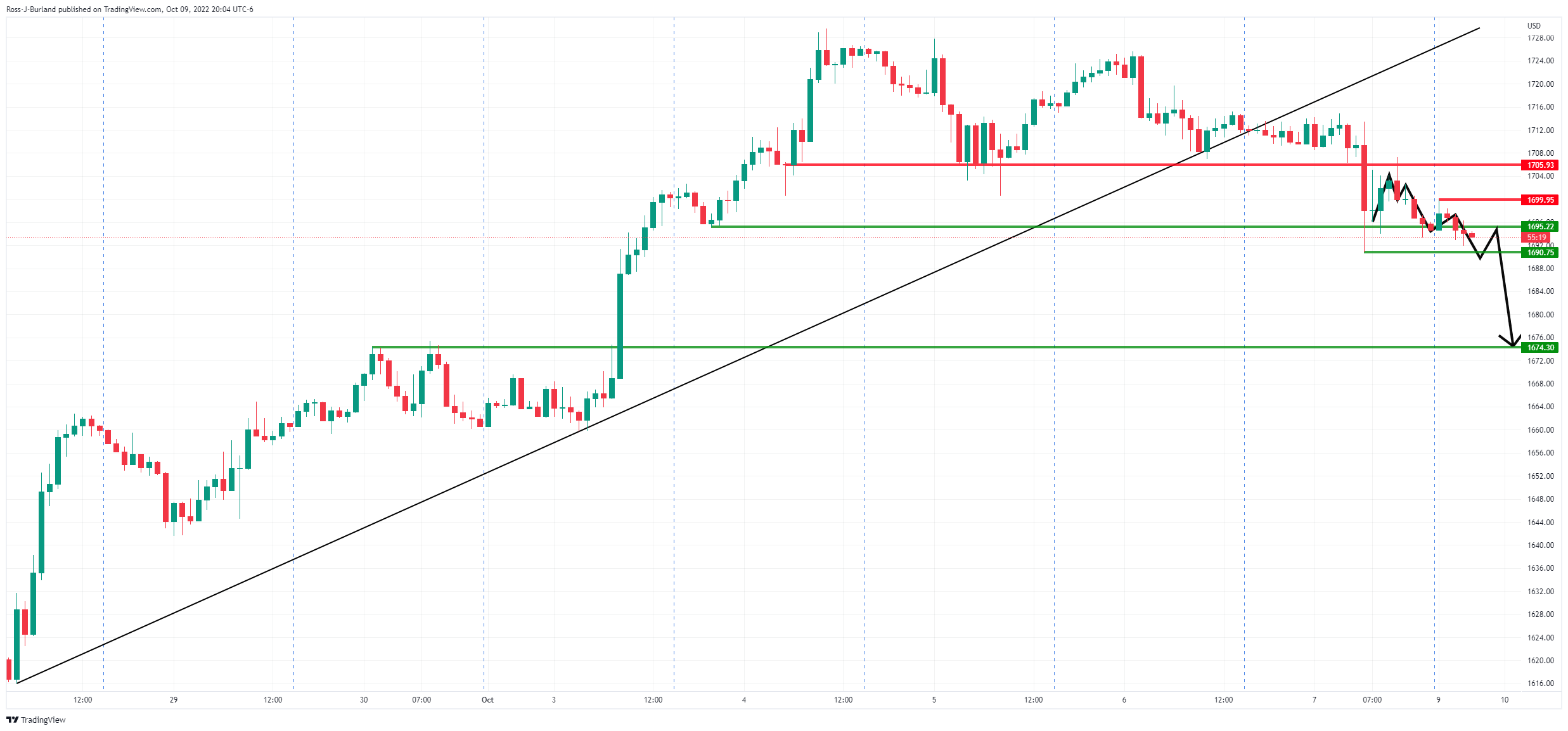

Gold technical analysis

On an hourly scale, the gold prices have established below the 50% Fibonacci retracement placed at $1,672.61 and are declining towards the 61.8% Fibo retracement at $1,658.90. The 50-and 200-period Exponential Moving Averages (EMAs) have delivered a death cross at around $1,690.00, which adds to the downside filters.

Adding to that, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold hourly chart

-

23:27

GBP/JPY Price Analysis: Fluctuates between the 20/200-DMA on a risk-off mood

- GBP/JPY is slightly up, but the Japanese intervention looming might likely stall the rally.

- The GBP/JPY trapped between the 20/200-DMA at around 161.26-160.65.

- Short term, the GBP/JPY is neutral-to-downward biased, and once it clears 161.00, a fall toward 160.00 is on the cards.

The GBP/JPY slightly advances as the Asian Pacific session begins, up by a minimal 0.03%, after finishing Monday’s trading day almost flat, seesawing between the 20 and 200-day EMAs. At the time of writing, the GBP/JPY is trading at 161.11.

GBP/JPY Price Forecast

From a daily chart perspective, the GBP/JPY is neutral-biased. However, it is worth noting that the cross-currency is approaching the 200-day EMA at 160.65, which, if broken, would exacerbate a fall toward the 50% Fibonacci retracement at 158.29. On the flip side, If the GBP/JPY clears the 20-day EMA at 161.26, it might open the door for a re-test of the 50-day EMA at 162.14.

In the one-hour timeframe, the GBP/JPY is neutral-to-downward biased. During the last two trading days, the pair has bottomed around the 160.50-161.50 area, fluctuating above/below the 20-EMA. At the time of typing, the GBP/JPY sits above the 20-EMA, which usually it’s a bullish signal. However, the presence of the 50, 100, and 200-EMAs, above the exchange rate would cap any rallies towards a re-test of October’s 7 high at 162.60.

Therefore, the GBP/JPY first support would be the daily pivot at 161.04. Once cleared, the next support would be the confluence of October 10 and the S1 daily pivot at around 160.46/49, followed by the S2 daily pivot at 159.94. A breach of the latter will expose the confluence of the September 30 low at 159,43 and the S3 pivot point at 159.35-43 area.

GBP/JPY Additional Technical Levels

-

23:20

EUR/USD steadies near 0.9700 even as risk-off mood favors DXY strength

- EUR/USD rests on 12-day-old horizontal support after four-day downtrend.

- Uncertainty over Germany’s support joint EU debt to battle energy crisis favored sellers at the latest.

- Fears of recession intensify amid escalating Russian shelling in Ukraine, hawkish Fedspeak and downbeat EU data.

- Return of full markets and comments from Fed/ECB policymakers will be crucial to determine the downside move.

EUR/USD bears take a breather around 0.9700 as a short-term horizontal support tests further downside after a four-day south-run to early Tuesday in Asia. Even so, the risk-aversion wave and fears that the recession is imminent for the old continent, not to forget the hawkish Fedspeak, keep the major currency pair sellers hopeful.

Recently, Germany’s rejection of the previous market chatters that Berlin backs the European Union (EU) joint debt issuance to battle the energy crisis, favored by Bloomberg, seemed to have flared the risk-off mood and weighed on the EUR/USD prices. However, the absence of major data/events and mixed comments from the Fed policymakers appeared testing the bears of late.

That said, “US can lower inflation relatively quickly without recession or large increase in unemployment,” said Chicago Fed President Charles Evans on Monday. The policymaker also added that the Fed needs to "carefully and judiciously" navigate to a "reasonably restrictive" policy rate. It should be noted that Federal Reserve Vice Chair Lael Brainard made the case for cautious rate hikes for the future, per the Wall Street Journal (WSJ).

On the contrary, “The European Central Bank (ECB) will have to take significant interest step again in October,” policymaker Klaas Knot said on Monday, adding that it's “too early to say how big step needs to be.” Further, European Central Bank (ECB) Governing Council member Mario Centeno said, “Normalization of monetary policy is absolutely necessary and desired”.

Elsewhere, the Eurozone Sentix Investor Confidence index deteriorated to -38.3 in October from -31.8 in September vs. -34.7 expected. The index fell to its lowest level since March 2020 while signaling a deep recession.

Other than the uncertainty over the debt issuance and central bankers’ comments, not to forget the downbeat data, hawkish Fed bets and Friday’s strong US jobs report also drowned the EUR/USD prices of late. On the same line could be the recently escalating Russian shelling on Kyiv. However, holidays in the US, Japan and Canada might have challenged the sellers.

That said, the US Dollar Index (DXY) rose to the one-week high during the four-day uptrend amid the risk-aversion wave.

Moving on, a slew of ECB and the Fed policymakers are up for speaking and hence may entertain the EUR/USD pair traders during the full markets. Even so, the odds favoring the bearish moves are high.

Technical analysis

With the oversold RSI challenging the EUR/USD bears, the quote struggles between a two-week-old horizontal support area and a weekly resistance line, respectively near 0.9680-70 and 0.9750 in that order.

-

22:52

AUD/USD turns sideways around 0.6300 as focus shifts to US Inflation

- AUD/USD juggles around 0.6300 ahead of the US inflation figures.

- A decline in core US CPI data is necessary for a less hawkish tone by the Fed.

- Market sentiment is extremely negative amid renewed Russia-Ukraine tensions.

The AUD/USD pair is oscillating around the immediate hurdle of 0.6300 in the Toyo session after a rebound move from a fresh two-year low at 0.6274. A rebound in the asset seems a dead cat bounce as the risk sentiment is extremely negative amid a weaker S&P500. The asset has displayed a five-day losing spell and is expected to remain on the tenterhooks ahead of the US Consumer Price Index (CPI) data.

Meanwhile, the US dollar index (DXY) has established firmly above 113.00 as investors are hiding behind the safe haven amid a risk-off market mood. The recent escalation in Russia-Ukraine tensions after Moscow claimed that Ukrainian military attacks have demolished a bridge linking the occupied Crimean Peninsula to Russia. The Crimean Bridge serves as a major supply line for Russian military forces available in southern Ukraine.

The event has escalated the fears of nuclear operations by Russia, which could damage the harmony in Europe to a broader extent.

Going forward, the extent of the deviation in the US CPI data will display the true picture of the rate hike announcement by the Federal Reserve (Fed) in November. As per the consensus, the headline US inflation will land at 8.1%, lower than the prior release of 8.3%.

Thanks to the falling gasoline prices in the US, which might keep the plain-vanilla inflation in check. While the release of the core CPI catalysts is gathering more importance. The event has not displayed signs of exhaustion yet. Also, it is expected to improve to 6.5% from the prior release of 6.3%.

On the Aussie front,

-

22:45

New Zealand Electronic Card Retail Sales (YoY) increased to 28.6% in September from previous 26.9%

-

22:45

New Zealand Electronic Card Retail Sales (MoM) climbed from previous 0.9% to 1.4% in September

-

22:18

Silver Price Forecast: XAG/USD slumps below $20.00 on risk aversion

- Silver price extends its losses below the 100-day EMA on risk-aversion.

- Fed’s aggressive tightening cycle and increasing geopolitical tensions bolstered the US dollar.

- US central bankers expressed that the Fed needs to be restrictive, with rates around 4.50% in early 2023.

- Silver Price Forecast: If it surpasses the 20-day EMA, it could pave the way to $19.00.

Silver price tumbles below the 100-day EMA, down for four consecutive days courtesy of a risk-off impulse sparked by the US central bank expectations for further tightening, tensions arising between the US-China chip embargo, and the escalation of the Russia-Ukraine war. Therefore, traders seeking safety kept the greenback in the driver’s seat. At the time of writing, the XAG/USD is trading at $19.59 a troy ounce, down by 2.50%.

US equities closed in the red, extending their losses for the fourth consecutive day. The lack of US economic data released on Monday keeps market players leaning on Federal Reserve speeches led by Vice-Chair Lael Brainard and Chicago’s Fed President Charles Evans.

Brainard said that even though the US economy decelerated “more than anticipated,” she added that some sectors remain lagging behind the effects of monetary policy. She commented that monetary policy needs to be restrictive for some time to reassure that inflation would get back under the Fed’s objective.

Earlier, Charles Evans said that the US central bank might be able to slow down inflation “while also avoiding a recession.” He estimates that the Federal funds rate (FFR) will peak at around 4.5% early in 2023 and remain higher for longer.

In the meantime, the greenback appreciated during the day on the escalation of the Russia/Ukraine conflict, as shown by the US Dollar Index, up 0.35%, at 113.145. Also, US semiconductors embargo on China is expected to spur some retaliation from one of the largest economies in Asia.

It is worth noting that the US bond market is closed, though it was not an excuse for the precious metals to begin the week on the wrong foot. However, the US 10-year bond yield is at 3.961%, while US 10-year Treasury Inflation-Protected Securities (TIPS) would open on Tuesday, yielding 1.62%.

All that said, most traders are expecting US inflation data to be released on Thursday. Expectations on the monthly reading are at 0.2%, above the previous reading, while on an annual based, they are at 8.1%, on the back of falling energy prices. Concerning core inflation, which strips food and energy, the MoM is expected to slow by 0.4%, less than August’s, while the year-over-year is estimated to jump by 6.5%, higher than the 6.3% in the previous month.

Silver Price Forecast

The XAG/USD dropped below the 100-day EMA at $19.95, extending its losses, nearby the 20-day EMA at $19.53. It should be noted that the Relative Strength Index (RSI) is getting towards the 50-midline, which, once broken downwards, would signal that sellers are gathering momentum. Then, the XAG/USD first support would be the 20-day EMA previously mentioned, followed by the 50-day EMA at $19.40, which, once cleared, could open the door for a re-test of the September 28 daily low at $17.97.

-

21:52

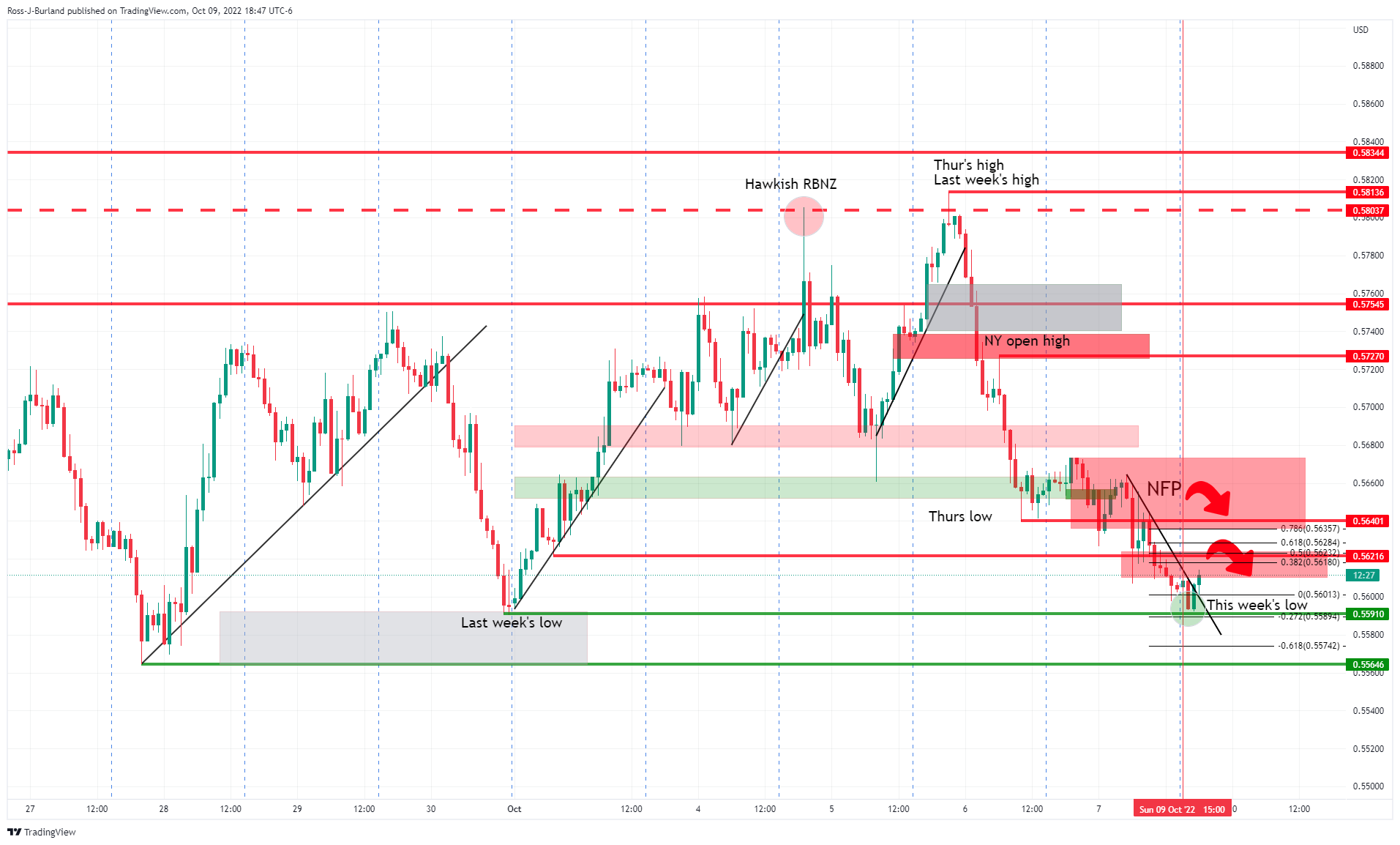

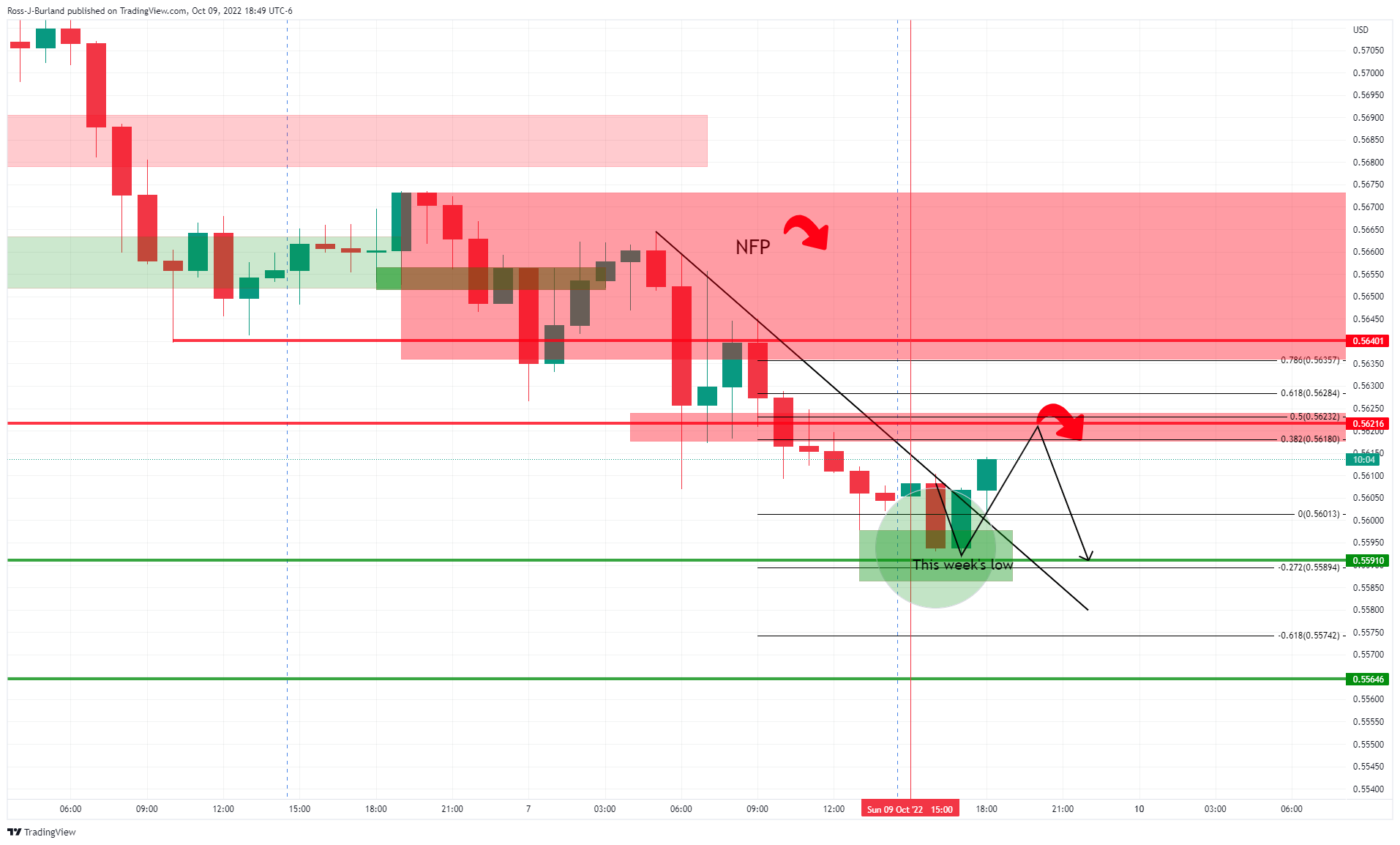

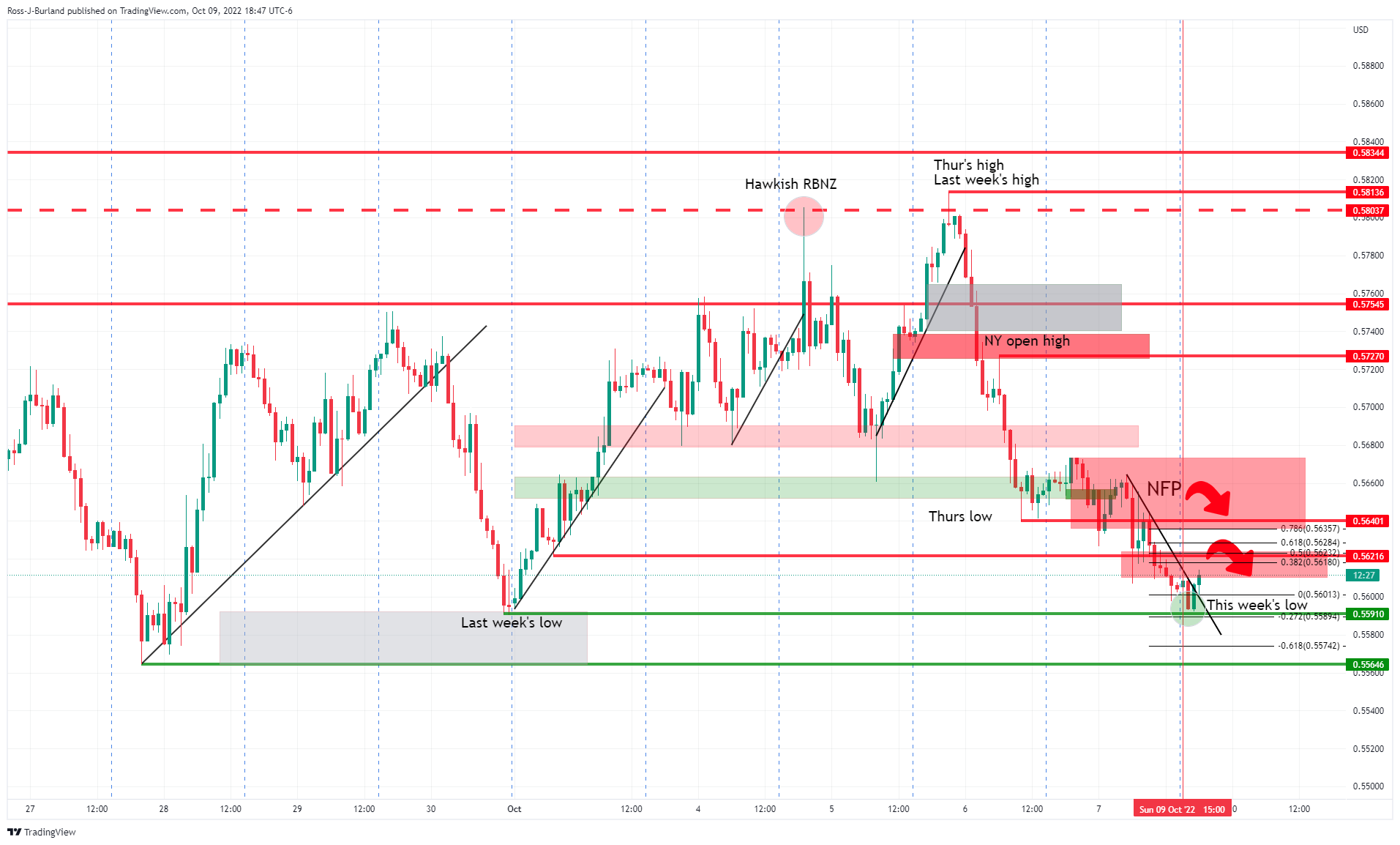

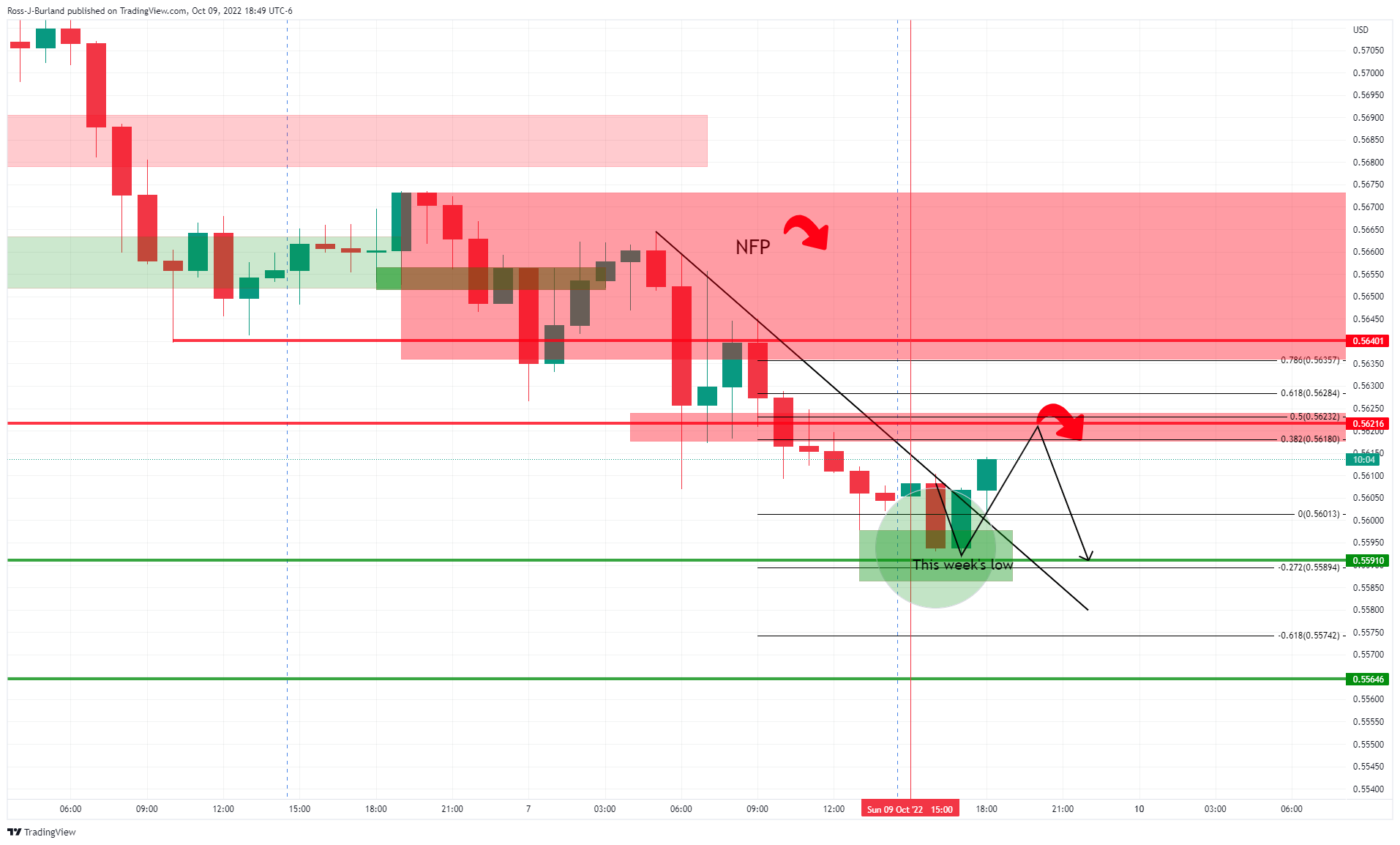

NZD/USD Price Analysis: Bulls eye 0.5580s

- NZD/USD bulls could be back in play for the day ahead.

- The bulls eye a return to the middle of the sell-off.

As per the prior day's analysis, the price has moved lower and we start the middle of the week on the back foot. The Kiwi is at a new cycle low ahead of key US Consumer Price Index data on Thursday night.

The driving force is US rates but the inflation risks in New Zealand could be contained by a hawkish central bank, offering support tot he bird. this gives rise to prospects of a correction for the day ahead in NZD/USD as the following analysis leans towards.

Prior analysis, NZD/USD

The price was attempting to slide out of the resistance of the dynamic bearish trendline that was formed on the back of the NFP data on Friday and that the bulls needed to clear 0.5625 to put a firm grip on the baton:

NZD/USD update, M15 chart

However, as the analysis illustrated if the bulls were unable to get above there, then the downside would be in play and that is what we got. The price sank, as expected, and the question now is whether this is going to be the high or low for the week. Given the number of catalysts on the calendar, perhaps not. However, in the meanwhile, the double bottom could be significant, at least for the Asian day ahead on Wednesday.

A break of the dynamics trendline resistance could be an opportunity for traders to look for a discount and target a significant correction towards the midpoint of the day's range near 0.5585 on a break of 0.5575. Bearish below 0.5550.

-

21:25

Forex Today: Dollar keeps rallying on fear

What you need to take care of on Tuesday, October 11:

The American dollar extended last week’s momentum and rose on Monday against most of its major rivals as risk aversion dominated financial boards.

On the one hand, the dismal mood was backed by Russia as the country resumed its aggressive attacks on Ukraine, firing multiple missiles that targeted communication and energy systems. The attack reached Kyiv and triggered a massive power outage in several Ukrainian cities.

Conversely, the Bank of England announced additional monetary measures to support the financial system. The central bank doubled its temporary QE bond purchases to £10 billion per day for the upcoming days, although buying should end on Friday.

Global stock markets closed in the red, reflecting market concerns. The EUR/USD pair settled at around 0.9700, while GBP/USD finished the day in the 1.1050 price zone. AUD/USD fell to 0.6274 a fresh 2-year low. USD/CAD trades around 1.3760 as crude oil prices give up on the dismal market’s mood.

The dollar appreciated against safe-haven rivals, with USD/CHF now trading at around parity and USD/JPY reaching 145.70, approaching the highs that triggered BOJ’s intervention.

Gold currently changes hand at $1,667 a troy ounce while WTI fell to $90.60 a barrel.

The focus this week will be on the US Consumer Price Index, to be out on Thursday.

Ethereum Classic price is down twice as much as Bitcoin and hints at a countertrend bounce

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:07

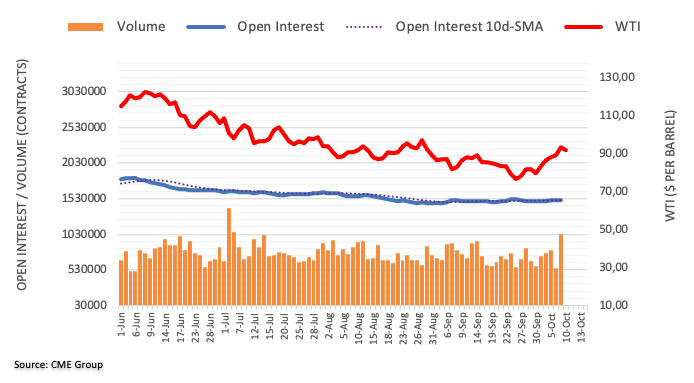

WTI retreats to $90.50 low after a five-day rally

- WTI Oil peaks at $93.60 and retreats to $90.50 area.

- Oil prices decline on profit-taking, economic concerns.

- The near-term positive trend remains intact while above $90.50 .

Front-month WTI prices have retraced half of the last Friday’s jump on Monday, returning to levels below $91.00. The US oil benchmark has broken a 5-day rally, deprecianting from 5-week highs at $93.60 to the mid range of $90.00.

Economic concerns and profit-taking weigh on oil prices

Crude prices have retreated beyond 2% on the day after the September Chinese Caixin Services PMI, released last week, showed a decline to 49,3, from 55 in August, casting shadows about the prospects of global demand for crude.

Furthermore, the sharp oil rally seen last week, which pushed prices 17% higher ,could have triggered some profit-taking movements that would have added negative pressure on prices.

Monday’s reversal has offset last week’s bullish momentum triggered by the production cuts announced by the OPEC+. The club of the world’s largest oil suppliers decided to slash oil production by 2 million barrels per day, the largest production cut since the outbreak of the COVID-19 pandemic, which sent crude prices skyrocketing.

WTI crude, testing support level at $90.50 area

From a technical perspective, WTI process might find suppot at the 50-hour SMA, now at $90.50, which has contained previous reversals over the last week, and would keep the near-8.2% term bullish trend intact.

Below $90.50, next potential targets would be $90.00 psychological level and mid-September highs around 86.50.

On the upside, above $93.00 (intra-day high) WTI prices might be aiming for $94.45 (38.2% retracement of the June – October decline) and then $97.25 (August 29 high).

Technical levels to watch

-

20:42

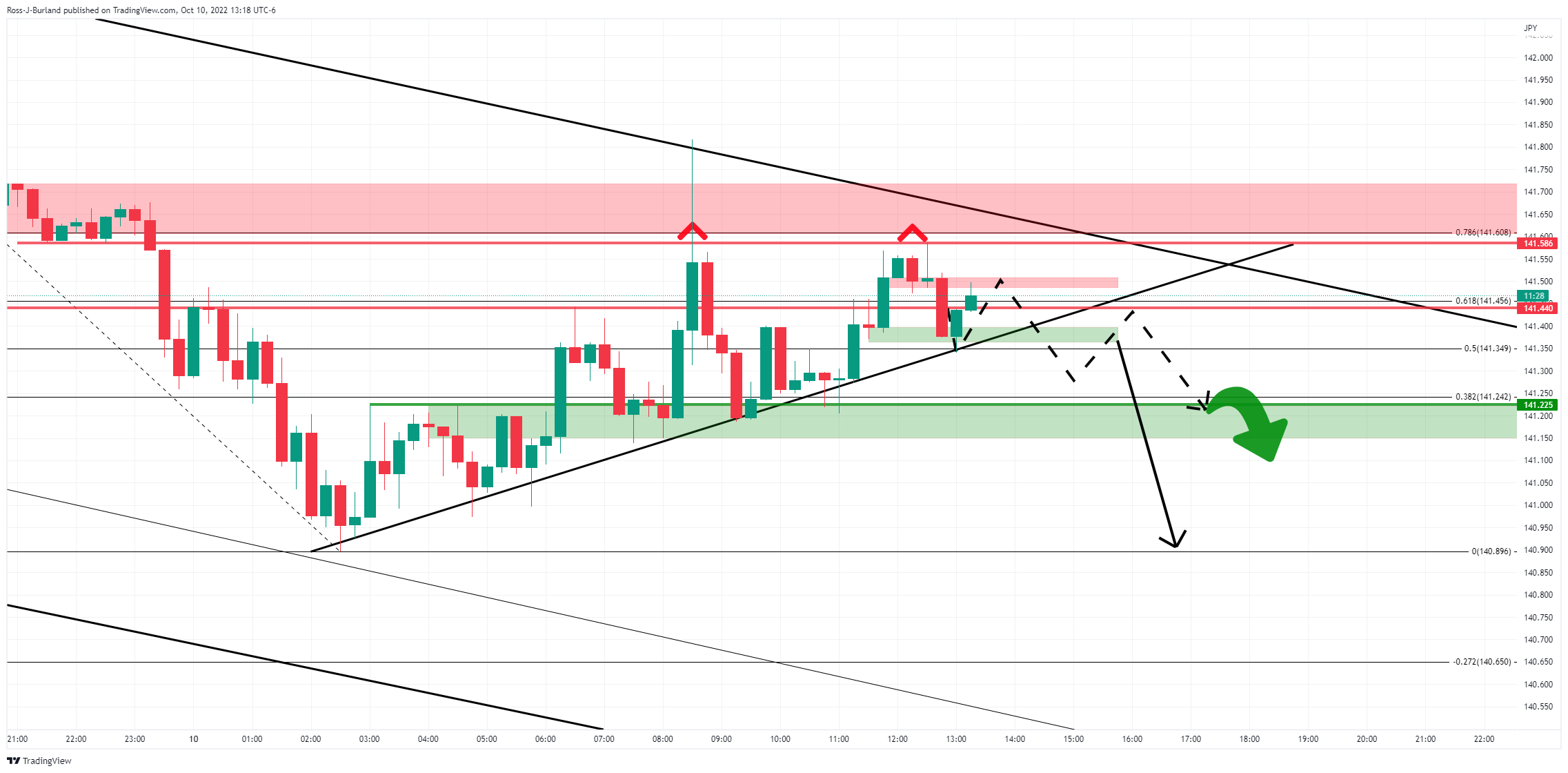

EUR/JPY Price Analysis: Bears about to bounce should USD/JPY sink

- EUR/JPY bulls could be nearing capitulation within the recent soft correction.

- Bears are targeting a blow-off to test below 141.00.

EUR/JPY, as the following analysis will illustrate, could be on the verge of a significant move to the downside. The price has been in a broad bearish trend since the start of the month and there could be more to come from the bears should the correction decelerate as follows:

EUR/JPY H1 chart

EUR/JPY M15 chart

While there this is by no means a cert', the price is forming a series of topping formations as per the arrows on top of the peaks. This signifies that the correction is decelerating and that a downside continuation is likely to be imminent. Given the grinding correction, there is the prospect of a sharp sell-off below 141.20 for a test below 141 for the days ahead.

However, the price could just as well creep below the trendline support and meet demand around 141.25 before gathering there ahead of the sell-off. In either scenario, USD/JPY bulls will need to capitulate which is a possible scenario considering the fears of intervention from the Bank of Japan:

''We are wary that a move above 145 in USDJPY will compel FX intervention, which could be more likely given the upcoming Consumer Price Index (especially if stronger). That could introduce temporary USD drag. Nonetheless, the USD remains best in class, and we look to accumulate on dips,'' analysts at TD Securities explained.

-

20:08

USD/CAD is pushing against the near-term top at 1.3750 area

- The US dollar hits one-week high at 1.3780.

- Lower oil prices an hawkish Fed hopes are undermining the CAD.

- USD/CAD seen rallying to 1.40 before dropping to 1.32 – CIBC.

The US dollar’s recovery from session lows near 1.3700 has managed to reach one-week highs at 1.3780 during Monday’s US session. The pair, however, has failed to consolidate above the top of last week’s horizontal range, at 1.3750/60.

Lower oil prices and hopes of a hawkish Fed hit the CAD

Crude prices have posted a significant retreat on Monday, which has been weighing on the oil-sensitive loonie. The US benchmark WTI has dropped to prices near $90.50 after having traded above $93, with Brent oil depreciating nearly 3% on the day to levels below $96.

On the other end, the US dollar remains bid across the board, with the market pricing in another aggressive rate hike by the Federal Reserve following this week’s monetary policy meeting.

Last Friday’s upbeat US employment report has boosted confidence on the strength of US economy, in the face of a global economic downtrend, which has paved the way for the Central Bank to maintain its hawkish stance.

USD/CAD might reach 1.40 before diving to 1.32 next year – CIBC

The FX Analysis Team at CIBC sees the pair aiming to 1.40 before pulling back in 2023: “The Fed’s hawkish announcement in late September and general risk aversion has sent the USD on a broadly stronger trajectory, and the loonie has depreciated as a result. There's likely more of the same to come, given a gap opening up in where policy rates will peak, and soft global growth favouring the USD and capping any upside for commodities (…) A run to 1.40 is quite possible, and a rebound at year end should still see CAD in 1.38 territory (…) In 2023, we see scope for a broad softening in the USD as the Fed pauses hiking below current market expectations, which will see CAD end the year stronger, with USD/CAD at 1.32.”

Technical levels to watch

-

19:51

NZD/USD tumbles to fresh two and half-year lows, as the king dollar flourishes

- NZD/USD fell to two and half-year lows at 0.5544 as the greenback strengthened.

- Fed’s policymakers emphasized rates need to be restrictive for some time, above the 4% threshold.

- Last week’s US NFP opened the door for further Fed hikes.

- NZD/USD Price Forecast: To re-test the 2020 YTD low at 0.5469 if it breaks below 0.5500.

The NZD/USD fell to a fresh two and half-year low at 0.5544, due to a dampened market mood, with investors seeking safety bolstered the greenback on several factors. At the time of writing, the NZD/USD is trading at 0.5567, after hitting a daily high at 0.5629, below its opening price by 0.67%.

Given the backdrop of the Federal Reserve’s aggressive tightening, which could take a toll on US Q3 company earnings, geopolitical risks and US-China arising tensions, are the main drivers of market mood.

Of late, comments of Fed officials led by Vice-Chair Lael Brainard commented that the US economy has decelerated by “more than anticipated”, but added that some sectors are not feeling the effects of rate hikes. She said that monetary policy needs to be restrictive for some time to ensure that inflation returns to the Fed’s 2% target. Earlier, Chicago’s Fed Evans expressed that the US central bank could be able to slow down inflation “while also avoiding a recession,” and still sees the Federal funds rate (FFR) above the 4.5% early in 2023 “and then remaining at this level for some time.”

Last week’s US economic data, mainly the Nonfarm Payrolls, justifies the Fed’s need for additional rate increases. With the US economy adding more than 263K jobs to the economy and the unemployment rate easing, the odds of the Fed hiking rates by 75 bps lie at 80% for November’s meeting

The US Dollar Index, a gauge of the greenback’s value, climbs 0.21%, at 112.980, gaining against most G8 currencies.

Albeit the NZD/USD dropped to fresh YTD lows, prices might be capped by the Reserve Bank of New Zealand’s (RBNZ) hawkish rhetoric and 50 bps rate hike during the last week’s meeting.

According to ANZ analysts: “In our view, the RBNZ said “all the right things” last week, and are clearly determined to get on top of rampant inflation, but markets continue to fret about recession risks, and at the same time, US interest rates continue to rise, undermining higher Kiwi rates. It’s all a bit messy, and market participants pushing back against the trend softening in risk appetite continue to get hit hard.”

NZD/USD Price Forecast

The NZD/USD weekly chart suggests the major could be testing the 2020 yearly low of 0.5469, 100 pips lower than the exchange rate at the time of typing. Nevertheless, RSI’s standing in oversold conditions, alongside price exhaustion, it opens the door for a consolidation. However, traders need to be aware that the release of US inflation figures on Thursday could open the door for further losses beyond 0.5469.

-

19:32

German govt source rejects report saying berlin backs joint EU debt for loans to ease energy crisis?

In a follow-up to prior news from the European session, Germany backs joint EU debt to tackle energy crisis – Bloomberg, whereby it was stated that Germany has reportedly agreed to back joint EU debt to tackle the energy crisis, in more recent trade, Reuters reporter that Germany has no plans to back a joint European Union debt issuance.

This came from a government source who told Reuters on Monday, denying a media report saying Chancellor Olaf Scholz supported joint debt issuances to tackle the energy crisis.

Market impact

During the general volatility of the Europena session, the original news may have been impactful, but in a quieter afternoon New York session, there has been no impact in this headline. However, investors are keeping a close watch on the deepening crisis in the European Union. Soaring gas and electricity prices threaten to shatter any semblance of policy cohesion in the 27-member bloc. Borrowing costs between member countries are beginning to diverge which is a negative for the euro as investors flood into the US dollar for a safe haven.

Tensions have flared after the German government last month unveiled a €200 billion ($306 billion) support package aimed at helping German households and the nation's businesses to cope with runaway inflationary energy bills. The Germans received a chorus of protest and a furious backlash from other EU countries, who accused Berlin of using its fiscal muscle to provide massive subsidies to benefit German producers.

Meanwhile, EUR/USD is down on the day by 0.24%, but up from its lows of 0.9681 that were made as the US dollar creeps back towards its 20-year highs.

-

19:28

EUR/USD contained above 0.9680, appreciates past 0.9700 again

- The euro bounces up above 2-week lows at 0.9680 to return past 0.9700.

- The pair attempts to set a bottom after a 5-day reversal.

- EUR/USD could reach 0.90 by year-end – MUFG.

Euro’s reversal from 0.9750 area earlier on Monday’s US trading session found support tight above the two-week low at 0.9680 and the pair is now trading above 0.9700 again.

Consolidating losses at 0.9700 after a five-day reversal

The euro seems to have found support at 0.9680, to gather strength following a fie-day downtrend that has pushed the common currency about 3% lower from last week’s peak at 1.0000.

A German Government source has recently denied an earlier report by Bloomberg pointing out to German support to a joint EU debt plan to tackle the energy crisis. These rumours offered a fresh impulse to the euro to climb towards 0.9750.

On a bigger picture, investors’ concerns about the escalating war in Ukraine, after Russia launched the biggest attack since the start of the war, coupled with the impact of higher oil prices are undermining confidence in the Eurozone economic prospects and weighing on the euro.

Furthermore, the US dollar remains bid across the board ahead of the Federal Reserve’s monetary policy meeting, due next Wednesday. The buoyant US employment report released last Friday showed that US economy remains solid despite the increasing global uncertainty. In this backdrop, the market is pricing in another aggressive Fed rate hike, which is underpinning demand for the USD.

EUR/USD could reach 0.90 by year-end – MUFG

Currency analysts at MUFG maintain their bearish perspectiveds for the pair on months ahead: “The key for any broad turn in US dollar strength must be a pause in the tightening cycle. We suspect the Fed will pause after hiking in December which should allow some EUR/USD correction from levels closer to 0.9000.”

Technical levels to watch

-

19:13

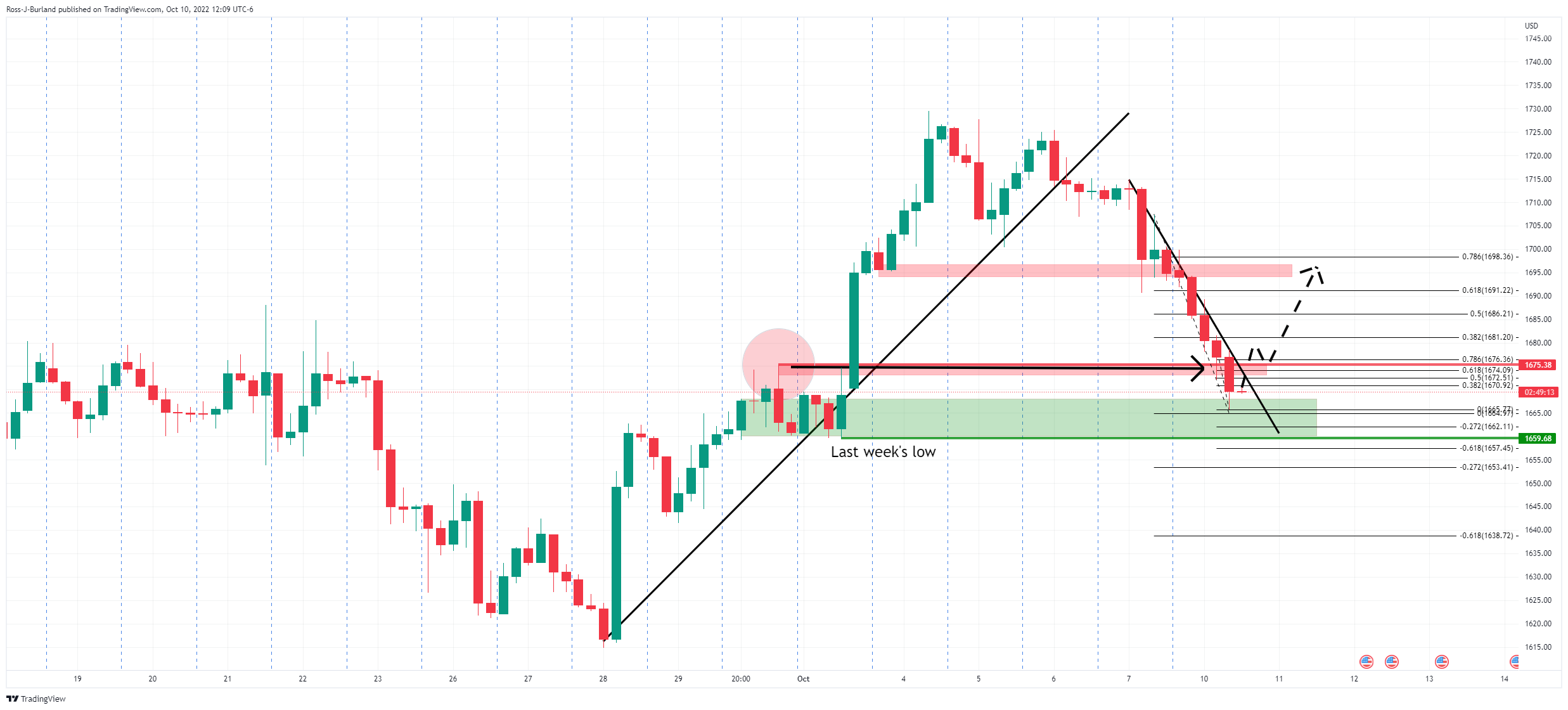

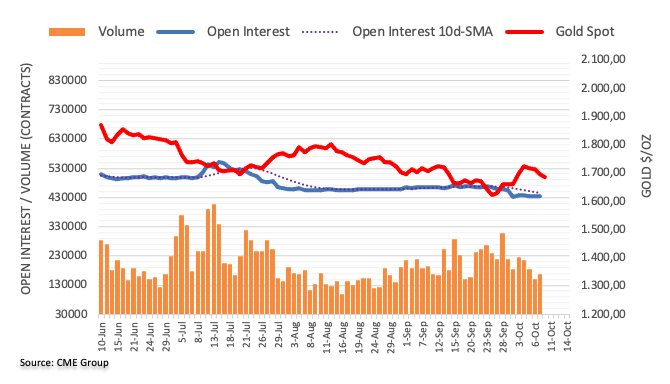

Gold Price Forecast: XAU/USD bears pounce and take a massive bite out of the market

- Gold bears move in on a critical area of support following a massive decline at the start of the week.

- The US dollar and yields have been relentless due to market sentiment surrounding the Fed narrative.

The gold price, as per the start of the week's pre-open analysis, Gold, the Chart of the Week: XAU/USD bears eye a run to key support near $1,675, US CPI eyed, has dropped significantly lower on Monday. Not only did the price take out $1,675, but it has also made a low of $1,665.77, taking on a key support area as the markets stay on the theme of a hawkish Federal Reserve.

The gold price dropped from a high of $1699.91 from the get-go this week, sliding in Asia and not looking back, pausing for only a brief hourly candle in European markets and at the open of New York forex trade at around $1,677. However, with an elevated US dollar and US yields reaching for blue skies, gold bulls had no choice but to capitulate, making way for a strong second wind from the bears during Wall Streets' first few hours of trade.

The yield on the 10-year US Treasury bond has made a high of 3.992%, surging in the last hour in what might be the last-ditch effort to breach the psychological 4.00% level having already cleared the prior week's highs. The next target beyond there is last month's high of 4.019%. In turn, the US dollar has reached a high of 113.333 after climbing from a low of 112.621 as per the DXY index which is now holding above both Friday's and last week's highs. It is worth noting that, speculators’ net long USD index positions recovered ground for the second consecutive week following a string of hawkish Fed speak. That said, net longs remained below recent averages which leaves room for further upside in the greenback.

The Fed is driving gold

As for the driver, the Fed sentiment, analysts at TD Securities, who have been advocating an imminent drop in the gold price for many weeks explain again that ''inflation's rising persistence suggests the Fed is unlikely to stop hiking preemptively.''

''A prolonged period of restrictive rates suggests traders should ignore gold's siren calls, as a sustained downtrend will likely prevail, while quantitative tightening continues to drive real rates higher. Indeed, a constant flow of hawkish Fedspeak has seen the upside momentum in gold ease in recent days.'' The analysts also cite important inflation data this week and remind their readers that ''there are plenty of catalysts which could see the focus shift back toward hawkish interest rate policy.''

In terms of Fed speakers, we have heard from both Chicago Fed President Charles Evans and, in more recent trade, Federal Reserve Vice Chair Lael Brainard. Evans said that the Fed needs to "carefully and judiciously" navigate to a "reasonably restrictive" policy rate, as reported by Reuters, while Brainard argued that US monetary policy has begun to be felt in an economy that may be slowing faster than expected. Both officals however, explained that "monetary policy will be restrictive for some time to ensure that inflation moves back to target over time," Brainard said. "Target rate needs to rise a bit above 4.5% by early next year and remain there as Fed takes stock," Evans argued.

Fed fund futures are now pricing in a 92% chance of a 75-basis-point hike at the next Fed meeting. Higher interest rates increase the opportunity cost of holding zero-yield bullion.

As for the rest of the week, we have the Fed minutes, US Consumer Price Index and Retail Sales. With regards to the two key events, firstly, the minutes, the analysts at TD Securities explained that '' the September dot plot revealed a higher-than-expected Fed Funds terminal rate of 4.625%, with a fairly even dot distribution around this level. The question is how much of this was reflected in the deliberations at the Sep meeting. The tone of these deliberations likely was more hawkish given core CPI inflation trends, upsetting the current dovish pivot markets narrative.''

Secondly, for CPI, the analysts said, ''core prices likely stayed strong in September, with the series registering another large 0.5% MoM gain. Shelter inflation likely remained strong, though we look for used vehicle prices to retreat sharply. Importantly, gas prices likely brought additional relief for the headline series again, declining by about 5% MoM. Our m/m forecasts imply 8.2%/6.6% YoY for total/core prices.''

Gold technical analysis

As per the pre-open analysis, the price dropped significantly at the start of the week:

Gold H1 chart

The price has reached the start of the prior rally as follows:

As illustrated, the price has made its way into the forecasted support area but still has some way to go until reaching last week's low. A correction into the key Fibonaccis that has a confluence with the prior structure could result in an onward move in the yellow metal to test the weekly lows:

A move beyond that resistance structure, however, could have implications for a move deeper correction, as per the following 4-hour analysis:

-

18:40

Fed's Lael Brainard: Policy taking hold on economy, with full impact still months ahead

Reuters reported that the Federal Reserve Vice Chair Lael Brainard said in a speech on Monday that tighter US monetary policy has begun to be felt in an economy that may be slowing faster than expected. She said, however, that the full brunt of Federal Reserve interest rate increases still won't be apparent for months

"Output has decelerated so far this year by more than anticipated, suggesting that policy tightening is having some effect" in sectors like housing that are directly influenced by borrowing costs for home mortgages, Brainard said in comments prepared for delivery to a National Association for Business Economics conference.

"In other sectors, lags in transmission mean that policy actions to date will have their full effect on activity in coming quarters, and the effect on price setting may take longer."

With foreign central banks all pulling in the same direction towards higher rates to fight inflation, she said, "the moderation in demand should be reinforced" even further."I now expect that the second-half rebound will be limited, and that real (gross domestic product) growth will be essentially flat this year," Brainard said.

"Uncertainty remains high, and I am paying close attention to the evolution of the outlook as well as global risks," that could stress financial markets Brainard said.

"In this environment, a sharp decrease in risk sentiment or other risk event that may be difficult to anticipate could be amplified, especially given fragile liquidity in core financial markets."

Still "monetary policy will be restrictive for some time to ensure that inflation moves back to target over time," Brainard said.

"In light of elevated global economic and financial uncertainty, moving forward deliberately and in a data-dependent manner will enable us to learn how economic activity, employment, and inflation are adjusting."

US dollar and bond yields update

The yield on the 10-year US Treasury bond has made a high of 3.992%, surging in the last hour of trade in what might be the last-ditch effort to breach the psychological 4.00% level having already cleared the prior week's highs. The next target beyond there is last month's high of 4.019%. In turn, the US dollar has reached a high of 113.333 after climbing from a low of 112.621 as per the DXY index which is now holding above both Friday's and last week's highs.

-

18:39

EUR/GBP fails to confirm above 0.8800 and eases to 0.8785 area

- The euro, unable to breach 0.8800, consolidates gains at 0.8785.

- BoE's pledge to support UK economy does not aid the pound

- The pair fails to capitalize on the brad-based GBP weakness.

The euro has failed to break resistance area at 0.8800/20 on its third attempt over the last days. The pair, however, maintains a mildly positive tone and remains steady at the upper range of 0.8700.

BoE pledge to support economy fails to aid the pound

The Bank of England’s new set of measures to support economy announced earlier on Monday have not helped to shore the pound sterling. The cable remains offered across the board, and has reached fresh two-week lows against the USD.

The sterling has remained on the back foot for the past recent weeks after UK Prime Minister, Liz Truss disrupted markets with a plan to cut taxes and increase government spending, which sent the currency into a tailspin.

On the other end, the euro, with challenges of its own ,has been unable to capitalize on GBP weakness. The common currency is going through a steady downtrend against the US dollar, crushed by investors’ concerns about the economic consequences of the escalating war in Ukraine and the high energy prices.

EUR/GBP capped below 0.8810/20 resistance area

From a technical perspective, the euro is going through a near-term positive trend, which should breach above 0.8820 (October 6,7 highs) in order to build momentum and attack 0.8850 (Sept. 30 high, Sept 26 and 28 lows), which would open the path towards 0.9000 area.

On the downside, immediate support lies at 0.8740 (October, 7 low) and then probably at 0.8690 (Sept. 22 low). Below here there is an important level at 0.8625 (September 15 low), which could trigger a Head and Shoulders figure, potentially pushing the pair towards the 0.8400 area.

Technical levels to watch

-

18:33

GBP/USD trips down below 1.1100 on sour sentiment, strong US dollar

- GBP/USD dropped to the 1.1000 area on broad US dollar strength.

- Investors’ mood deteriorated on expectations of weaker US Q3 earnings, on fears of the Fed’s triggering a recession.

- Fed officials expect rates to be above 4% in 2023, disregarding rate cuts throughout the year.

- UK’s Finance Minister, Kwasi Kwarteng, moved forward the presentation of his fiscal plan, to October 31, before BoE’s November meeting.

The GBP/USD extended its losses to four straight days after reaching an October high of 1.1495 after UK’s Prime Minister Liz Truss made a U-turn in the 45% tax cut budget. However, the damage was done, as the Bank of England (BoE) had to step in to calm the turmoil in the bond market. Nevertheless, recent US dollar strength, alongside weak fundamentals in the UK, is a headwind for the GBP/USD.

At the time of writing, the GBP/USD is trading at 1.1025 after hitting a daily high of 1.1110, though it is below its opening price by 0.58%.

Sentiment remains sour, as reflected by US equity markets. Fears that US companies will miss Q3 earnings expectations keep investors on their toes. That, alongside worries that the US Federal Reserve would continue to tighten monetary policy but would not be able to achieve a “soft landing,” added a pinch of salt to the already deteriorated mood.

Last Friday’s US Nonfarm Payrolls report was better than expected, which opened the door for further Fed tightening. Also, the Unemployment Rate ticked lower, from 3.7% estimated to 3.5%, revealing that the Fed needs to do more.

Fed officials during the last week expressed that they’re resilient to tackle inflation, despite acknowledging that the economy is slowing down and that it could trigger a recession. However, Fed policymakers said that rates must be higher in restrictive mode, above the 4% threshold.

During the day, the Chicago Fed President Charles Evans said that the US central bank could be able to slow down inflation “while also avoiding a recession.” Evans added that he stills sees the Federal funds rate (FFR) above the 4.5% early in 2023 “and then remaining at this level for some time.”

The US Dollar Index, a gauge of the greenback’s value, is advancing 0.45%, at 113.245, bolstered by investors seeking safety.

On the UK’s side, the Bank of England intervened in the UK’s bond market on Monday. Even though the BoE was expected to buy double September’s 28 GBP 5 billion, they only bought GBP 853 million. Of note is that the Chancellor of the Exchequer, Kwasi Kwarteng, said he would bring forwards his medium-term fiscal plan, including how the tax cuts will be paid for, on October 31, according to Reuters.

The change in the date, from November 23 to October 31, would give some time to the BoE to assess the government’s budget before it announces its monetary policy on November 3.

All that said, the GBP/USD reacted downwards, despite increasing bets that the Bank of England would hike rates aggressively. Nevertheless, UK’s gloomy economic outlook, and Brexit jitters, would likely keep the British pound pressured, opening the door for a re-test of the GBP/USD YTD lows around 1.0350s.

GBP/USD Key Technical Levels

-

17:42

USD/CHF is testing levels about parity after four months

- US dollar's rally reaches prices above 1.0000 for the first time since June.

- The greenback surges on hawkish Fed hopes and geopolitical concerns.

- USD/CHF seen at 0.9600 by year-end – UBS.

The US dollar is extending its four-day rally on Monday, and has launched a first attempt to break above 1.0000 on Monday’s US session. The paor remains 0.7% higher on the daily chart, to maintain a sharp four-day rally against the swissie.

A hawkish Fed and geopolitical fears are boosting USD demand

Last Friday’s buoyant US Nonfarm payrolls report has reaffirmed investor’s bets for another aggressive rate hike at the Federal Reserve meeting due later this week US bond’s yields rose sharply after the release of the US employment report, giving a fresh boost to the US dollar.

US Non-Farm Payrolls increased by 263,000 in September, beating expectations of a 250,000 increment, while the unemployment level declined to a 50-year low 3,5% from 3,7% in the previous month.

Furthermore, the escalation on the Ukrainian war, with Russia launching on Monday the biggest air strike since the war stared, has increased risk aversion at the start of the week, ultimately favouring the safe-haven USD.

USD/CHF to decline towards 0.96 by year-end – UBS

Currency analysts at UBS, however, observe the current US dollar rally as a good selling opportunity: “While Swiss inflation moderated both on a YoY and MoM basis in September, we believe the SNB remains on a tightening path and wants a stronger CHF to continue to fight inflation (…) Any rally toward USD/CHF 0.99 or higher is a good opportunity to sell the greenback in favor of the franc, in our view, forecasting the pair to hit 0.96 by year-end and 0.92 by June next year.”

Technical levels to watch

-

17:15

USD/JPY hovers around 145.70, shy of YTD highs as another BoJ intervention looms

- USD/JPY marches firmly at around the 145.70s area as threats of Japanese intervention loom.

- Last week’s US employment report justifies the Fed’s case to go 75 bps in the November meeting.

- Fed’s Evans is optimistic that the Fed might slow down inflation without “causing” a recession.

The USD/JPY is advancing steadily towards the YTD high at around 145.90, increasing the odds of another FX intervention by Japanese authorities to bolster the JPY, which has remained weakening against most G8 currencies, particularly the greenback. At the time of writing, the USD/JPY is trading at around 145.77, up 0.28%, shy of printing a new 24-year high, above 145.90.

Risk aversion keeps the greenback appreciating against most currencies. The US bond market is closed in observation of the Columbus holiday, with USD/JPY traders leaning on US dollar dynamics and market sentiment.

Last week’s US economic data, led by the US Nonfarm Payrolls, beat estimates, opening the door for further Fed rate hikes. In the past week, Fed officials emphasized the need to raise rates higher to tame inflation down, pushing back against cutting rates in 2023.

Earlier, Chicago’s Fed President Charles Evans said that the US central bank could be able to slow down inflation “while also avoiding a recession.” Evans added that he stills sees the Federal funds rate (FFR) above the 4.5% early in 2023 “and then remaining at this level for some time.”

Elsewhere, the US Dollar Index, a gauge of the greenback’s value against a basket of rivals, edges up by 0.35% at 113.147, a tailwind for the USD/JPY. Therefore, USD/JPY traders should expect further upside, though fears of another Bank of Japan’s (BoJ) intervention in the FX markets looming might stall the rally at around the 146.00 mark.

What to watch

The US economic docket will feature Fed speaking, led by Vice-Chair Lael Brainard and Loretta Mester. Data-wise, the September US Producer Price Index (PPI) will be unveiled on Wednesday, followed by inflationary figures on the consumer side by Thursday.

USD/JPY Key Technical Levels

-

17:03

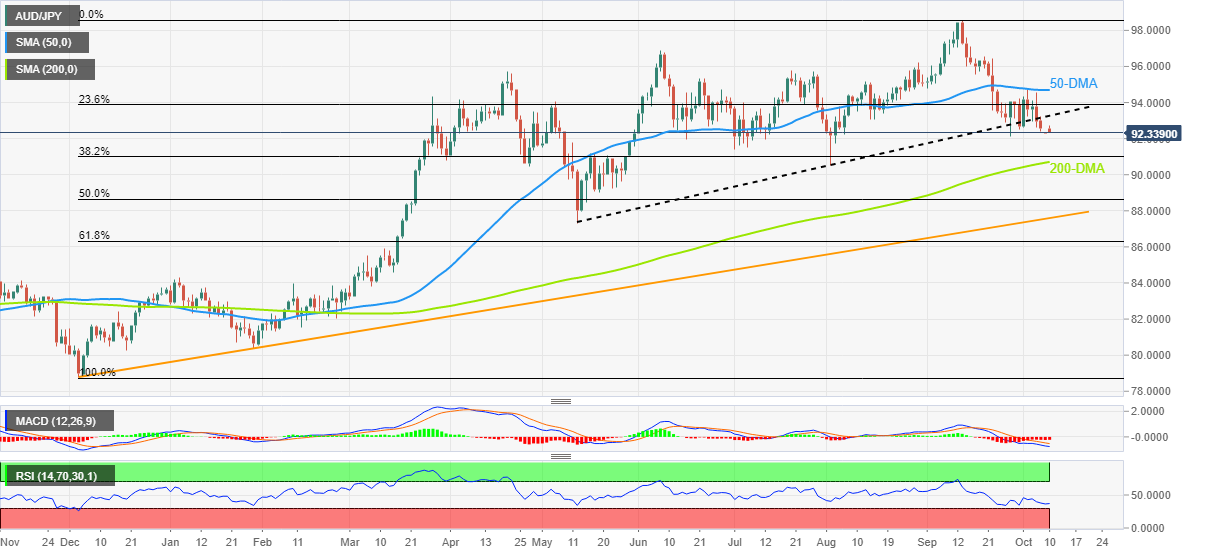

AUD/USD dives further and hits a fresh multi-year low at 0.6275

- The Australian dollar breaks below 0.6280 to fresh 2, 1/2-year lows.

- Ukrainian war, and hopes of a big Fed rate hike are crushing the Aussie.

- AUD/USD might extend decline to 0.6041 – Credit Suisse.

The Australian dollar has resumed its ecline on Monday’s US trading session. The pair has reversed the tame recovery attempt seen earlier in the day, to break below 0.6285 reaching 0.6275 area for the first time in more than two years

The aussie suffers against a strong US dollar

A risk-sensitive AUD is going through a strong bearish trend on the back of the downbeat sentiment and a strong US dollar, with the market betting on another aggressive rate hike in the US after the Federal Reserve’s meeting due later this week.

Investors’ concerns about the escalation in the Ukrainian war, after Russia launched the biggest air attack since the invasion started in February, are dampening demand for the aussie, which favours safe-havens like the USD.

Beyond that, the Reserve Bank of Australia disappointed the markets last week with a 25 basis points’ rate hike, instead of the 50 BP expected, which has increased negative pressure on the pair.

AUD/USD could extend its decline to 0.6040 – Credit Suisse

According to currency analysts at Credit Suisse, the pair might still see some more downtrend before posting any relevant recovery: “With the broader risk-off environment looking set to remain in place for the upcoming months, our view is to look for a further setback towards the next key support zone at 0.6041 – the 78.6% retracement and the low from April 2020.”

Technical levels to watch

-

16:25

Gold Price Forecast: XAU/USD drops below $1670 on a buoyant US dollar, risk-off impulse

- Gold price stumbles below $1700, extending its losses underneath the 20-day EMA.

- Broad US dollar strength keeps the yellow metal on the defensive.

- Fed’s Evans: Expect the Federal funds rate (FFR) to peak at around 4.50% in 2023; has high hopes to achieve a “soft landing.”

- Gold Price Forecast: To extend its losses towards $1650 after failing to hold $1700.

Gold price slides below the 20-day EMA, courtesy of a risk-off impulse, as portrayed by US equities trading in the red, as the greenback advances sharply amid the Columbus day holiday, which keeps the US bond market close. At the time of writing, the XAU/USD is trading at $1668.60, below its opening price by more than 1.50%.

A risk-off impulse keeps the greenback in the driver’s seat, as shown by the US Dollar Index (DXY), up by 0.35%, at 113.142. Since October 5, when the DXY hit 110.05, the buck has recovered 2.75%, though it keeps trailing the YTD high at around 114.778. Most of the commodity prices, US dollar-denominated, are under pressure, with oil down by 0.28% and the precious metals remaining heavy.

In the past week, Fed officials reiterated their commitment to bringing inflation to the Fed’s 2% target. On Monday, the Chicago Fed President Charles Evans said that he expects the Federal funds rate (FFR) to end at around 4.5% early in 2023 and then to remain around that level for “some time.” He sounded optimistic that the Fed could achieve a soft landing due to Fed projections of the unemployment rate hitting 4.4% by the end of next year, while the Fed’s inflation measure to fall to 2.8% from August’s 6.2%.

Also, the last week’s US Nonfarm Payrolls report, exceeding estimates, further justifies Evan’s case for the Fed to continue tightening at a large size. Fed’s odds of a 75 bps rate hike are at an 80% chance, according to the CME FedWatch Tool, for the November meeting.

Elsewhere, the US economic calendar will feature further Fed speaking, led by Vice-Chair Lael Brainard. Data-wise, the docket will reveal Wednesday’s Producer Price Index (PPI) for September and FOMC minutes. The next day, traders’ focus will shift to US inflation figures, namely the CPI and unemployment claims. To close the week, US Retail Sales, alongside the University of Michigan Consumer Sentiment, are widely expected.

Gold Price Forecast

Gold is sliding below the 20-day EMA after failing to crack the 50-day EMA on October 4 and 5. Since then, the yellow metal price has tumbled, accelerating its free-fall, to re-test the $1650 figure. Once cleared, it could pave the way towards the YTD low at $1614.92, followed by $1600. Worth noting that the RSI is in bearish territory, with enough room to spare, before reaching oversold conditions.

-

16:24

EUR/USD treads water at 0.9750 before pulling back to 0.9700 area

- The euro, capped at 0.9750, remains close to two-week lows at 0.9680.

- Rumours of a EU debt joint agreement might have favoured the pair.

- Hopes of another big Fed rate hike are underpinning the US dollar.

The common currency has launched an attempt to take off from two-week lows at 0.9680, before hitting resistance right below 0.9750 during Monday’s US trading session.

Euro picks up on news about a joint debt agreement

A Bloomberg news report pointing out to the possibility that Germany might have agreed to back joint debt for loans to tackle the energy crisis might explain the EUR/USD's squeeze. The pair jumped about 45 pips in the matter of minutes to pull back to previous levels, around 0.9700, shortly afterwards.

From a wider perspective, the euro remains heading south, trading 0.25% down on the day and on track to a four-day negative streak against an stronger US dollar.

The greenback remains bid across the board with the investors bracing for another aggressive rate hike by the Federal Reserve later this week, following the buoyant US employment report seen on Friday.

US Non-Farm Payrolls increased by 263,000 in September, beating expectations of a 250,000 increment, while the unemployment level declined to 3,5% from 3,7% in the previous month. These figures have boosted confidence that the Fed will maintain its hawkish stance, which is underpinning demand for the USD.

Technical levels to watch

-

15:59

AUD/USD ends the recent pause, further weakness to follow – Credit Suisse

AUD/USD has ended its recent pause after breaking below 0.6361. Analysts at Credit Suisse look for continued downside to 0.6041 and likely beyond.

Resistance moves to 0.6361/80

“We see the core bearish trend as resumed and with risk sentiment likely to remain weak, we look for further deterioration to follow.”

“Support shifts to 0.6281/74 and then a more meaningful support is seen at the late April 2020 low at 0.6250. Whilst we stay wary of signs of a brief pause here as well, our bias would be to see a direct move below here to eventually reach the 78.6% retracement of the 2020/21 uptrend and April 2020 low 0.6041/5978 and likely a move lower towards the 2020 low at .5506 thereafter.”

“Resistance moves to 0.6361/80 and then to 0.6411, though above here we look for the 13-day average at 0.6478 to continue to cap to maintain the downside.”

-

15:47

Germany backs joint EU debt to tackle energy crisis – Bloomberg

Germany has reportedly agreed to back joint EU debt to tackle the energy crisis, Bloomberg reported on Monday.

Last Tuesday, European Economic Commissioner Paolo Gentiloni and Internal Market Commissioner Thierry Breton called for joint borrowing to finance the response to the energy crisis in the euro area. German Finance Minister Christian Lindner, however, argued that a joint debt would not be the answer to the current crisis, which was very different from the one caused by the coronavirus pandemic.

Market reaction

With the initial reaction, EUR/USD pair jumped above 0.9740 before quickly retreating to the 0.9700 area.

-

15:40

S&P 500 Index: Corrective rebound may already be over, bearish outlook reinforced – Credit Suisse

S&P 500 has gapped sharply lower on increased volume. Economists at Credit Suisse look for a retest and break of 3594/84 for an eventual fall to their 3235/3195 core objective.

Price gap from Friday at 3707/3745 to cap

“An extremely poor end to last week has seen the S&P 500 gap sharply lower on increased volume post the payrolls report and this has seen an ‘island top’ reversal left behind to suggest the corrective rebound may already be over.”

“We look for a retest of pivotal flagged support from the rising long-term 200-week average and current cycle low at 3594/84. Whilst this should again be respected, we continue to look for a sustained break in due course. Our core objective though remains at the 3235/3195 support cluster, which includes the 38.2% retracement of the entire uptrend from the 2009 GFC low.”

“Resistance is seen at 3682 initially, with the price gap from Friday at 3707/3745 now ideally capping.”

-

15:21

USD/JPY to climb towards the 149 level by Q1 2023 – Wells Fargo

In the view of economists at Wells Fargo, the Japanese yen still has potential to weaken against the US dollar in the medium-term. The USD/JPY pair is forecast at 149 by the first quarter of 2023.

Yen to strengthen heading into late 2023

“The increasing divergence in monetary policy between a hawkish Federal Reserve and dovish Bank of Japan means we believe the yen still has room to weaken against the US dollar in the medium term, even if the Ministry of Finance intervenes in FX markets again to support the currency.”

“We believe that as yields continue to diverge, the yen can weaken toward a USD/JPY exchange rate of 149.00 by Q1-2023, before recovering somewhat as next year progresses.”

-

15:00

EUR/USD set to retest the 0.9537 low – Credit Suisse

EUR/USD remains under pressure following the rejection of key resistance at 1.0000/1.0051. Analysts at Credit Suisse look for a fall back to the 0.9537 low.

Initial resistance seen at 0.9818

“Support is seen initially at 0.9683, below which should cleat the way for a move back to the 0.9537 low. We look for a move below here to test the lower end of the downtrend channel from February, today seen at 0.9446, but would look for a fresh rebound from here. Our next core objective remains at 0.9338/30.”

“Resistance is seen initially at the 13-day exponential average and price resistance at 0.9818 which we look to try and cap on a closing basis. Above can see strength back to 0.9927, potentially a retest of 0.9991/1.0005.”

-

14:55

USD/CAD struggles for a firm intraday direction, stuck in a range above 1.3700 mark

- USD/CAD oscillates in a narrow band amid holiday-thinned liquidity conditions on Monday.

- A combination of factors, however, continues to act as a tailwind and limits the downside.

- Retreating oil prices undermines the loonie and lends support amid sustained USD buying.

The USD/CAD pair struggles to gain any traction on Monday and seesaws between tepid gains/minor losses through the early North American session. The pair, however, manages to hold above the 1.3700 mark and is supported by a combination of factors.

Crude oil prices edge lower and snap a five-day winning streak to the highest level since late August amid worries that a deeper global economic downturn will hurt fuel demand. This, in turn, undermines the commodity-linked loonie and acts as a tailwind for the USD/CAD pair amid the underlying bullish sentiment surrounding the US dollar.

In fact, the USD Index, which measures the greenback's performance against a basket of currencies - stands tall near a one-and-half-week high amid hawkish Fed expectations. Market players seem convinced that the US central bank will continue to tighten its monetary policy at a faster pace and have been pricing in another 75 bps rate hike in November.

The bets were further lifted by the robust US monthly employment details released on Friday, which pointed to the resilient economy. Apart from this, concerns about a deeper global economic downturn, a further escalation in the Russia-Ukraine conflict and fresh US-China trade jitters continue to benefit the safe-haven greenback.

That said, thin liquidity conditions in the wake of holidays in the US and Canada hold back bulls from placing aggressive bullish bets around the USD/CAD pair. Investors also prefer to wait for a fresh catalyst from this week's releases of the FOMC meeting minutes on Wednesday, which will be followed by the latest US consumer inflation figures on Thursday.

Technical levels to watch

-

14:19

GBP/USD set to fall back back to the 1.0347 low – Credit Suisse

GBP/USD maintains a small bearish “reversal day” to suggest the recovery is over. Analysts at Credit Suisse look for an eventual retest of the 1.0347 low.

Support seen at 1.0933/16, then 1.0786

“Support is seen at 1.1057/55 initially, then price support from the top of the late September base at 1.0933/16. Below here is seen needed to add further momentum to the decline with support seen next at 1.0786 ahead of 1.0539 and eventually back to the 1.0347 low.”

“Big picture, we look for an eventual test of the key psychological parity level.”

“Resistance is seen at 1.1186 initially, with a move back above 1.1227 needed to raise the prospect of further high-level ranging and a fresh test of resistance at 1.1490/1.1500, but with sellers expected to again show here.”

-

14:15

GBP/USD Price Analysis: Consolidates around 38.2% Fibo. level, not out of the woods yet

- GBP/USD edges lower for the third straight day and drops to over a one-week low on Monday.

- A combination of factors continues to underpin the USD and exerts some downward pressure.

- The technical setup also favours bears and supports prospects for additional near-term losses.

The GBP/USD pair recovers a few pips from over a one-week low and trades in neutral territory, around the 1.1075 region during the early North American session.

An intraday recovery in the global risk sentiment - as depicted by a positive turnaround in the equity markets - caps gains for the safe-haven US dollar and acts as a tailwind for the GBP/USD pair. The British pound further draws support from the Bank of England's move to launch the Temporary Expanded Collateral Repo Facility (TECRF) to support market functioning.

That said, worries about a deeper global economic downturn, a further escalation in the Russia-Ukraine conflict and fresh US-China trade jitters should keep a lid on any optimistic move. This should lend support to the buck amid hawkish Fed expectations. This, along with concerns about the UK government's fiscal policy, might cap the upside for the GBP/USD pair.

From a technical perspective, spot prices, so far, have shown some resilience below the 38.2% Fibonacci retracement level of the recent recovery from an all-time low. That said, the post-NFP breakdown below the 1.1180 confluence - comprising of 100-period SMA on the 4-hour chart and the lower end of a two-week-old ascending trend channel - favours bearish traders.

This, in turn, suggests that the path of least resistance for the GBP/USD pair is to the downside and any attempted recovery might still be seen as a selling opportunity. Hence, a subsequent fall below the 1.1025 area (the daily swing low), towards the 1.1000 psychological mark, remains a distinct possibility ahead of the monthly UK employment details on Tuesday.

On the flip side, the 1.1100 mark now seems to act as an immediate barrier ahead of the 100-period SMA on the 4-hour chart, currently around the 1.1165 region. This is followed by the 1.1200 round figure, which if cleared decisively could trigger a short-covering rally. The GBP/USD pair could then accelerate the recovery move and aim back to reclaim the 1.1300 round-figure mark.

GBP/USD 4-hour chart

-638010044332009034.png)

Key levels to watch

-

14:07

Fed's Evans: Need to carefully navigate to reasonably restrictive policy

Chicago Fed President Charles Evans said on Monday that the Fed needs to "carefully and judiciously" navigate to a "reasonably restrictive" policy rate, as reported by Reuters.

Additional takeaways

"US can lower inflation relatively quickly without recession or large increase in unemployment."

"Target rate needs to rise a bit above 4.5% by early next year and remain there as Fed takes stock."

"Without a period of restrictive policy to restrain demand, inflation would not fall to anything near 2% target."

"Many risks could derail Fed hopes for soft landing including Ukraine war, slow supply improvement, covid and monetary policy either not fixing inflation or weighing more than expected on jobs."

"Maybe labor shortages are having an unusually large influence on inflation, which could allow fast improvement on inflation as the economy cools."

"Inflation is currently the Fed's primary concern."

"Good news is that longer-horizon inflation expectations have generally remained within a range consistent with 2% target."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen posting small daily gains at around 113.00.

-

14:04

USD/TRY: No changes to the side-lined trading near 18.6000

- USD/TRY keeps the erratic performance just below 18.60.

- Unemployment Rate in Türkiye eased to 9.6% in August.

- President Erdogan advocated for further rate cuts over the weekend.

The Turkish lira starts the week on the defensive and lifts USD/TRY back to the 18.5800 region on Monday.

USD/TRY focuses on geopolitics, USD

USD/TRY quickly leaves behind Friday’s retracement on the back of the continuation of the bid bias in the dollar, while renewed Russian shelling on several highly populated Ukrainian cities have been also sustaining extra inflows into the safe haven universe.

In the meantime, the selling pressure in the Turkish lira is not expected to abandon the currency for the foreseeable future, not after President Erdogan comments over the weekend reiterating that the One-Week Repo Rate will be in single digits by year-end.

The Turkish central bank (CBRT) meets again on October 20 and is therefore expected to keep lowering the interest rate (currently at 12.00%).

In the domestic calendar, the Unemployment Rate in Türkiye receded to 9.6% in August (from 10.0%).

What to look for around TRY

USD/TRY keeps navigating the area of all-time tops near 18.60 amidst the combination of omnipresent lira weakness and the renewed bid bias in the dollar.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in the last three months), real interest rates remain entrenched well in negative territory and the omnipresent political pressure to keep the CBRT biased towards a low-interest-rates policy.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth (via higher exports and tourism revenue) and the improvement in the current account.

Key events in Türkiye this week: Unemployment Rate (Monday) – Current Account (Tuesday) – Industrial Production, Retail Sales (Wednesday) – End Year CPI Forecast (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.21% at 18.5778 and faces the next hurdle at 18.5908 (all-time high October 4) followed by 19.00 (round level). On the downside, a break below 18.1591 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

-

13:55

IMF's Georgieva: We cannot afford inflation to be a 'runaway train'

In a joint press conference with World Bank Group President David Malpass, International Monetary Fund (IMF) Managing Director Kristalina Georgieva said that they cannot afford inflation to become a 'runaway train,' as reported by Reuters.

Gerogieve further noted that they were seeing a significant problem in China due to the housing market dragging down growth.

Meanwhile, Malpass noted that there was a risk and a real danger of a global recession next year. "Development efforts are facing a crisis amid a vast array of problems," he added.

Market reaction

THese comments don't seem to be having a significant impact on risk mood. As of writing, the S&P Futures were virtually unchanged on the day.

-

13:31

NZD/USD remains depressed below 0.5600 mark, seems vulnerable near YTD low

- NZD/USD drifts lower for the third straight day and moves back closer to the YTD low.

- The USD remains well supported by a combination of factors and exerts some pressure.

- Recession fears, geopolitical risks, US-China trade jitters weigh on the risk-sensitive kiwi.

The NZD/USD pair attracts fresh selling following an early uptick to the 0.5630 region and turns lower for the third successive day on Monday. The pair remains depressed below the 0.5600 mark heading into the North American session and moves well within the striking distance of the YTD low set in September.

A combination of factors assists the US dollar to scale higher for the fourth straight day, which, in turn, is seen exerting downward pressure on the NZD/USD pair. The prospects for a more aggressive policy tightening by the Federal Reserve, a further escalation in the Russia-Ukraine conflict and fresh US-China trade jitters act as a tailwind for the safe-haven buck.

The robust US monthly jobs report released on Friday pointed to the resilient economy and gives the US central bank enough space to keep hiking rates at a faster pace to combat stubbornly high inflation. In fact, the markets are currently pricing in a greater chance of the fourth consecutive supersized 75 bps rate increase at the next FOMC policy meeting in November.

On the geopolitical front, Russia launched a barrage of missile attacks in Ukrainian cities, including the capital Kyiv, in response to the attack on the Kerch Strait bridge over the weekend. Furthermore, the White House announced export controls to cut China off from certain semiconductor chips, raising concerns about the worsening trade ties between the world's two largest economies.

The latest developments further fuel worries about a deeper economic downturn and continue to weigh on investors' sentiment. This is evident from a generally weaker tone around the equity markets, which tends to drive haven flows towards the greenback and further undermines the risk-sensitive kiwi. This, in turn, supports prospects for a further depreciating move for the NZD/USD pair.

That said, RSI (14) on the daily chart remains on the verge of breaking into oversold territory and warrants some caution for aggressive bearish traders amid relatively thin trading volumes. Investors might also prefer to move to the sidelines ahead of this week's release of the FOMC minutes on Wednesday and the latest US consumer inflation figures on Thursday.

Technical levels to watch

-

13:10

EUR/USD could tumble close to the 0.90 level before year-end – MUFG

EUR/USD has dipped under 0.97. Economists at MUFG Bank expect the pair to inch closer to the 0.90 level before the Federal Reserve pauses its hike cycle.

The risks are firmly to the downside

“Over the near-term, the risks are firmly to the downside and we expect a period of further US dollar strength as financial market conditions worsen as asset prices correct further to the downside. This will help push inflation expectations further lower.”

“The key for any broad turn in US dollar strength must be a pause in the tightening cycle. We suspect the Fed will pause after hiking in December which should allow some EUR/USD correction from levels closer to 0.9000.”

-

12:23

AUD/USD to fall towards 0.60 after RBA’s dovish decision – MUFG

The Reserve Bank of Australia’s (RBA) surprise decision to slow the pace of tightening by delivering a smaller 25 bps hike weighed on the aussie. Economists at MUFG Bank expect the AUD/USD pair to challenge the 0.6000 level.

RBA policy update reinforces downside risks

“We continue to believe that risks remain tilted to the downside for commodity currencies in the near-term.”

“The RBA’s policy shift has increased the likelihood that AUD/USD will fall towards the 0.6000 level.”

See: AUD/USD could witness further losses toward 0.6100 – SocGen

-

12:18

EUR/USD Price Analysis: Still room for a drop to the 2022 low

- EUR/USD gathers extra downside traction and breaches 0.9700.

- A deeper retracement could expose a move to the YTD low.

EUR/USD drops for the fourth consecutive session and revisits the sub-0.9700 region at the beginning of the week.

Further losses appear well on the cards for the time being. Against that, the pair should not meet any contention of note until the 2022 low at 0.9535 (September 28) prior to the round level at 0.9500.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0608.

EUR/USD daily chart

-

11:52

USD Index Price Analysis: Next stop at the 2022 high?

- DXY extends the upside move beyond the 113.00 yardstick.

- The continuation of the rebound could see the YTD peak revisited.

DXY’s bounce picks up extra pace and leaves behind the key barrier at 113.00 the figure at the beginning of the week.

If bulls push harder and the index surpasses 114.00, then the next target of note should emerge at the 2002 peak near 114.80 recorded on September 28 ahead of the round level at 115.00.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line near 107.60.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.93.

DXY daily chart

-

11:51

USD/JPY sticks to modest intraday gains around mid-145.00s amid sustained USD buying

- USD/JPY gains some positive traction on Monday and climbs to over a two-week high.

- Aggressive Fed rate hike bets continue to boost the USD and lend support to the pair.

- The Fed-BoJ policy divergence favours bulls and supports prospects for further gains.

The USD/JPY pair edges higher on the first day of a new week and climbs to over a two-week high, though lacks follow-through buying. Spot prices, however, stick to modest intraday gains near mid-145.00s and remain well within the striking distance of a 24-year high touched in September.

The US dollar buying remains unabated on the first day of a new week, which, in turn, is seen as a key factor offering support to the USD/JPY pair. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, climbs to a one-and-half-week high amid expectations for a more aggressive policy tightening by the Fed.

The markets are currently pricing in a greater chance of the fourth consecutive supersized 75 bps rate increase at the next FOMC meeting in November. The bets were reaffirmed by Friday's robust US monthly jobs report (NFP), which pointed to the resilient economy. This remains supportive of elevated US Treasury bond yields and underpins the USD.

The Bank of Japan, on the other hand, has been lagging behind other major central banks in the process of policy normalisation and remains committed to continuing with its monetary easing. The resultant Fed-BoJ policy divergence favours bullish traders and supports prospects for a further near-term appreciating move for the USD/JPY pair.

That said, intervention fears hold back traders from placing fresh bulls bets and capping gains for the major, at least for the time being. It is worth recalling that Japan's finance minister Shunichi Suzuki said last week that the government stands ready to intervene in FX markets to prevent deeper losses in JPY.

Market participants also seem reluctant to place aggressive bets and might prefer to move to the sidelines ahead of this week's key event/data risks. The minutes of the last FOMC meeting held on September 20-21 will be released on Wednesday, which will be followed by the latest US consumer inflation figures on Thursday.

Investors will look for clues about the Fed's future rate hike path, which, in turn, will influence the near-term USD price dynamics and provide a fresh directional impetus to the USD/JPY pair. In the meantime, spot prices seem more likely to prolong the range-bound price action amid thin liquidity on the back of a bank holiday in the US.

Technical levels to watch

-

11:48

US Dollar Index could break the 110-115 range to the upside – SocGen

After closing the previous week on a firm footing on the upbeat US September jobs report, the US Dollar Index (DXY) extends its gains. Kit Juckes, Chief Global FX Strategist at Société Générale, believes that the index could break above the 115 level.

No new news, but no reason to sell the dollar either

“In the aftermath of the US labour market report, and ahead of US CPI data on Thursday, we are left largely just reacting to known news. The US jobs data are strong enough to make a 75 bps Nov 2 hike pretty much a done deal; The Chinese economy is weak; the war in Ukraine goes on. The result: The dollar remains bid, though not wildly so.”

“Positioning isn’t stretched according to the CFTC data, but the message from custodian banks suggests this may understate how many long dollar positions there are at any one point in time. Certainly, there is nothing that argues for building dollar shorts.”

“I wouldn’t be surprised if DXY spent the rest of the year trading 110-115, but if it breaks one way or the other, the upside is the more vulnerable.”

-

11:41

EUR/JPY Price Analysis: Immediately to the downside comes 139.80/50

- EUR/JPY extends the bearish move to the sub-141.00 region.

- Further downside could revisit the 139.80/50 band in the near term.

EUR/JPY accelerates its losses and breaks below the 141.00 region to print new 2-week lows on Monday.

The continuation of the decline would likely leave the recent peaks in the 144.00 neighbourhood as short-term tops. In case the downside accelerates, there is an interim support at the 139.80/50 band, where the 100- and 55-day SMAs converge.

In the meantime, while above the key 200-day SMA at 136.20, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

-

11:14

Gold Price Forecast: XAU/USD drops to one-week low amid stronger USD, Fed rate hike jitters

- Gold remains under heavy selling pressure for the fourth successive day on Monday.

- Aggressive Fed rate hike bets continue to boost the USD and weigh on the XAU/USD.

- The risk-off mood could lend some support ahead of this week’s key event/data risks.

Gold extends last week's retracement slide from the $1,730 region and continues losing ground for the fourth successive day on Monday. The downward trajectory remains uninterrupted through the first half of the European session and drags spot prices to a one-week low, around the $1,678 region in the last hour.