Notícias do Mercado

-

23:56

BoK Governor Rhee: Not worried about specific USD/KRW rate

“I’m not worried about the dollar/won exchange rate rising or falling to any specific level,” said Bank of Korea (BoK) Governor Rhee Chang-yong to Bloomberg TV early on late Thursday.

The policymaker also added that the bank's board members wanted to give a warning against betting on an early policy change due to uncertain inflation prospects.

It’s worth noting that the BoK left monetary policy unchanged with the benchmark rate at 3.5% earlier in the week.

USD/KRW licks its wounds

USD/KRW seesaws around the lowest levels in a week, making rounds to 1,300 by the press time, after falling the most in one month the previous day.

Also read: South Korea: BoK paused its tightening cycle in April – UOB

-

23:50

GBP/USD Price Analysis: Gets set to refresh 10-month high around 1.2600

- GBP/USD has shifted into an inventory adjustment phase after printing a fresh 10-month high at 1.2537.

- UK’s monthly GDP remained stagnant while the street was anticipating an expansion of 0.1%.

- US labor market conditions have loosened further as jobless claims remained higher than anticipated.

The GBP/USD pair is demonstrating a lackluster performance after printing a fresh 10-month high at 1.2537 in the early Tokyo session. The upside move in the Cable remained mostly capped in comparison with other risk-perceived currencies. The reason could be the weak United Kingdom’s monthly Gross Domestic Product (GDP) (Feb) data released on Thursday.

UK’s monthly GDP remained stagnant while the street was anticipating an expansion of 0.1%. Annual Industrial Production contracted by 3.1% against the consensus of 3.7% contraction. The Manufacturing Production data was contracted by 2.4%. The scale of contraction in Manufacturing Production was lower than the estimate of 4.7%.

The US Dollar Index (DXY) is juggling above the immediate support of 101.00. The downside bias for the USD Index looks solid as the United States Producer Price Index (PPI) softened dramatically on Thursday. Also, labor market conditions have loosened further as jobless claims remained higher than anticipated.

GBP/USD is showing a sheer contraction in volatility after testing the horizontal resistance plotted from April 04 high at 1.2525 on an hourly scale. The Cable is displaying an inventory adjustment move between institutional investors and retail participants. The odds are in favor of an upside break of the inventory adjustment move as the overall trend has remained bullish.

The 20-period Exponential Moving Average (EMA) at 1.2513 is providing cushion to the Pound Sterling bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, indicating that the upside momentum is still active.

For further upside, the Cable needs to surpass April 13 high at 1.2537, which will drive the asset towards a fresh 10-month high at 1.2597, which is 08 June 2022 high. A breach of the latter will expose the asset to May 27 high at 1.2667.

On the flip side, a break below the round-level support of 1.2400 will expose the asset to April 10 low at 1.2344 and March 30 low at 1.2294.

GBP/USD hourly chart

-

23:45

Silver Price Analysis: Multiple hurdles to prod XAG/USD bulls at 2023 peak near $26.00

- Silver price remains sidelined after rising to the highest levels in one year.

- Overbought RSI, multiple immediate resistances challenge XAG/USD buyers.

- Silver sellers stay off the table beyond $24.50.

Silver price (XAG/USD) remains firmer at $25.80, despite recent inaction at the highest levels in one year during early Friday in Asia. In doing so, the bright metal justifies the overbought RSI conditions, as well as fears of bulls amid a bumpy road towards the north. However, multiple supports and bullish MACD signals keep the XAG/USD buyers hopeful.

That said, the XAG/USD pullback needs validation from a 10-month-old previous resistance line, around $25.50.

Even so, the convergence of the 61.8% Fibonacci retracement level of the metals moves between May 2021 to September 2022 and a 23-month-old downward-sloping trend line, near $24.50, appears a tough nut to crack for the Silver sellers.

In a case where the Silver price remains bearish past $24.50, the odds of witnessing a gradual decline toward the 50% Fibonacci retracement level surrounding $23.20 can’t be ruled out.

On the flip side, the $26.00 round figure prods the XAG/USD bulls ahead of the 78.6% Fibonacci retracement, around $26.35.

Following that, a broad area comprising tops marked since July 2021, around $26.95-75, quickly followed by the $27.00 round figure, will be in focus.

Overall, the Silver price is likely to remain firmer even if the short-term pullback appears imminent.

Silver price: Daily chart

Trend: Pullback expected

-

23:45

New Zealand Visitor Arrivals (YoY) came in at 4998%, above forecasts (2.1%) in February

-

23:30

New Zealand Business NZ PMI came in at 48.1 below forecasts (51) in March

-

23:24

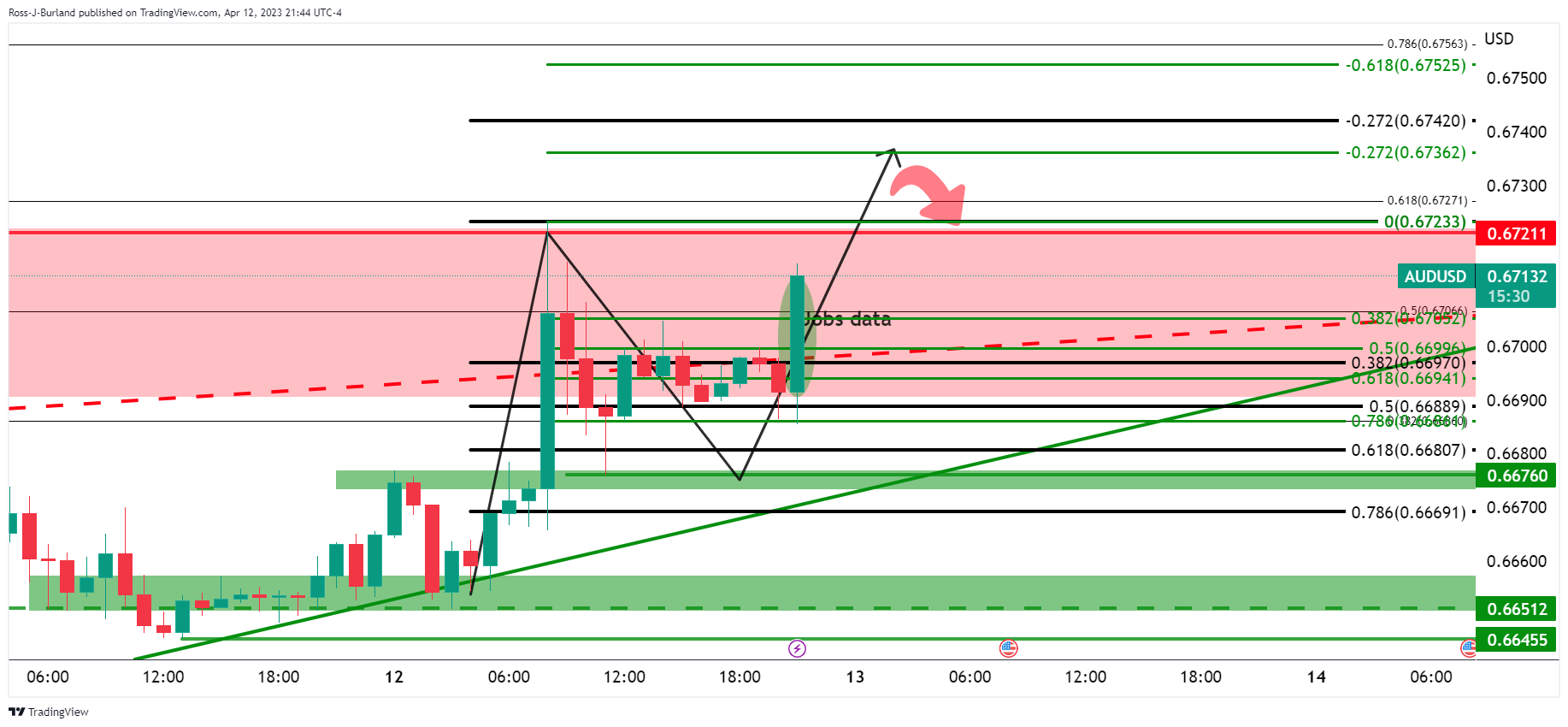

AUD/USD bulls attack 0.6800 as downbeat inflation, Fed concerns weigh on US Dollar

- AUD/USD bulls prod six-week-old resistance near 0.6800 after rising the most in two weeks the previous day.

- Strong Aussie employment figures contrast with downbeat US inflation signals to propel the pair.

- Dovish RBA concerns fail to weigh on Aussie pair, Fed policy pivot chatters gain less attention.

- Bulls are likely to keep the reins, more clues of US inflation eyed.

AUD/USD grinds higher around the seven-week top, making rounds to 0.6780 after poking the 0.6800 round figure early Friday in Asia. In doing so, the Aussie pair cheers upbeat Australian inflation data, as well as downbeat US inflation figures and Federal Reserve (Fed) concerns.

That said, Australia’s Employment Change jumps by 53K versus 20K expected and 64.6K prior while the Unemployment Rate remained unchanged versus the expectation of marking the 3.6% figure. Further, the Participation Rate also improved to 66.7% versus market forecasts of reprinting the 66.6% mark. Additionally, Australia’s Consumer Inflation Expectations for April eased to 4.6% YoY versus 5.3% expected and 5.0% prior.

It’s worth noting that mixed data from China failed to weigh on the AUD/USD price amid broad risk-on mood amid receding hopes of the Fed’s further rate hikes, except for May’s 0.25% rate lift. Talking about China data, the headline Trade Balance improved to $88.10B in March versus the $39.2B expected and $116.8B prior whereas Exports grew much faster than Imports during the stated month.

On the other hand, US Producer Price Index (PPI) for March dropped to a four-month low of -0.5% MoM versus 0.0% expected and prior whereas the PPI YoY also declined to 2.7% from 4.9% previous readouts, versus market forecasts of 3.0%. Further, US Initial Jobless Claims rose to 239K versus 232K expected and 228K prior.

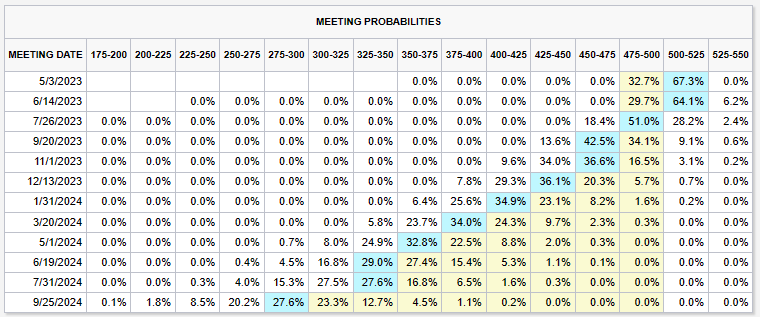

Against this backdrop, Wall Street remained firmer and the yields also improved but the US Dollar Index (DXY) dropped to the lowest levels since February. Additionally, the CME’s FedWatch Tool signals a 68% chance of a 0.25% rate hike in March versus 71% marked the previous day.

Given the light calendar ahead of the North American trading session, AUD/USD may remain lackluster at the multi-day high. However, the underlying bullish trend is likely to remain intact considering the market’s optimism and broad US Dollar weakness.

Moving on, US Retail Sales for March, expected to repeat -0.4% MoM figure, precedes the preliminary readings of the US Michigan Consumer Sentiment Index (CSI), likely staying unchanged at 62, to entertain AUD/USD traders. Also important to watch will be the University of Michigan’s (UoM) 5-year Consumer Inflation Expectations, prior 2.9%.

Technical analysis

A six-week-old ascending resistance line near 0.6800 precedes the 100-DMA hurdle of around 0.6805 to challenge the AUD/USD bulls. However, the bears are off the table unless the quote offers a daily closing below the 50-DMA support of around 0.6745.

-

23:09

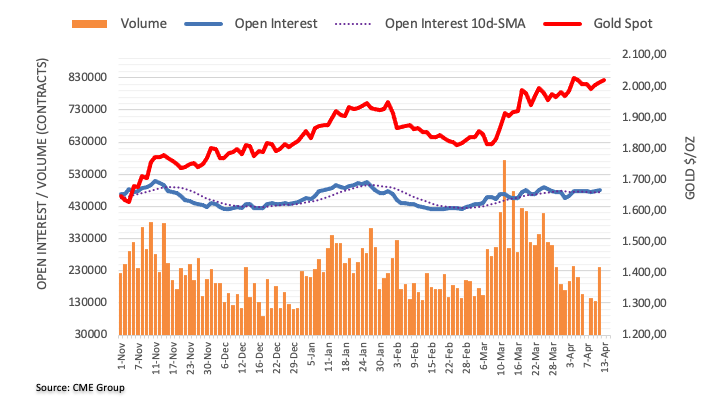

Gold Price Forecast: XAU/USD juggles above $2,040 ahead of US Retail Sales for further guidance

- Gold price is oscillating above $2,040.00 as investors await US Retail Sales.

- S&P500 settled Thursday’s session on a super-bullish note as fears of abrupt rate hikes cool down after softening of US PPI.

- The retail demand is likely to continue the pace of contraction as shown in February.

Gold price (XAU/USD) is consolidating in a narrow range above $2,040.00 in the early Asian session. The precious metal turned sideways in the New York session after printing a fresh annual high at $2,048.77 in hopes that the Federal Reserve (Fed) is required to take a pause call on the policy-tightening process as early as possible.

S&P500 settled Thursday’s session on a super-bullish note as fears of abrupt rate hikes cool down after softening of United States Producer Price Index (PPI) data, portraying a decent jump in the risk appetite of the market participants.

The US Dollar Index (DXY) refreshed its two-month low at 100.85 as the softened US Consumer Price Index (CPI) joined the heavily decelerated PPI and trimmed consumer inflation expectations dramatically. The USD Index has turned rangebound after a plunge ahead of US Retail Sales data. Contrary to that, demand for US government bonds remained weak despite easing inflation concerns. The yields offered on 10-year Treasury bonds jumped to near 3.45%.

The street is shifting its focus toward the monthly US Retail Sales (March) data. According to the consensus, the economic data will contract by 0.4%. The retail demand is likely to continue the pace of contraction as shown in February as US labor market conditions are cooling down. Also, the banking fiasco has impacted the confidence of households.

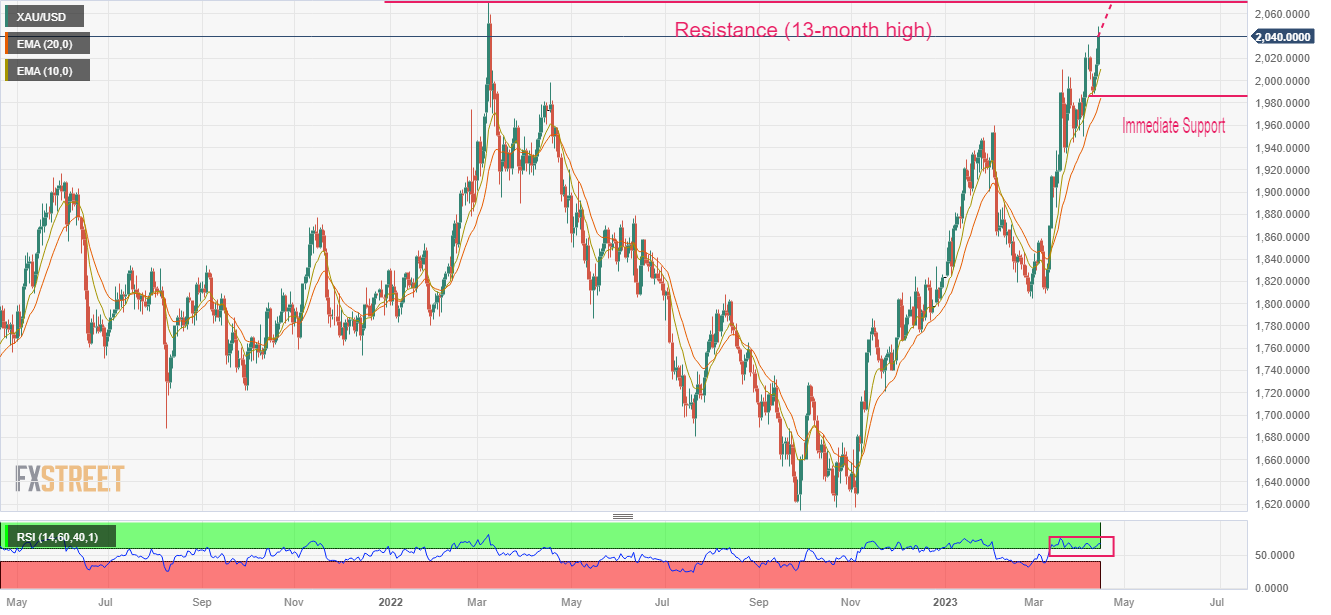

Gold technical analysis

Gold price is marching north to test a 13-month high at $2,070.54, which is 08 March 2022 high, plotted on the daily scale. Upward-sloping 10-and 20 period Exponential Moving Averages (EMAs) at $2,010.84 and $1,987.00 respectively, indicating a sheer strength in Gold bulls.

The Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, showing no signs of divergence and any sign of an oversold situation, cementing more upside ahead.

Gold daily chart

-

23:04

EUR/USD grinds near one-year high near 1.1050, US Retail Sales, Michigan CSI eyed

- EUR/USD bulls take a breather after rising to the highest levels in one year.

- Downbeat US PPI bolstered hopes of Fed’s policy pivot and drowned US Dollar.

- Upbeat Eurozone Industrial Production also helps the Euro pair.

- Bulls are likely to keep the reins even if US consumer-centric data offers positive surprise.

EUR/USD rose to the highest level since March 2022 during a three-day winning streak to 1.1067, before bulls caught a breather around 1.1050, making rounds to the same amid early Friday morning in Asia. The Euro pair rallied heavily as the downbeat US inflation clues joined a technical breakout of the February month high.

That said, US Producer Price Index (PPI) for March dropped to a four-month low of -0.5% MoM versus 0.0% expected and prior whereas the PPI YoY also declined to 2.7% from 4.9% previous readouts, versus market forecasts of 3.0%. Further, US Initial Jobless Claims rose to 239K versus 232K expected and 228K prior.

On the other hand, Reuters cited five sources with direct knowledge of the discussion on Thursday to say that the European Central Bank (ECB) policymakers are converging on a 25 basis points (bps) interest rate hike in May. “Though the debate is not over, with one small group still making case for a 50 bps hike in May; another small group advocating no change,” added the news and cited indecision among the policymakers.

While confirming the same, indirectly, ECB Council member Bostjan Vasle said that they are considering 25 and 50 basis points (bps) rate hike options for the May policy meeting, per Reuters.

On the other hand, the odds of the Federal Reserve’s (Fed) policy pivot gained momentum as a consecutive easing in the inflation clues and unimpressive Fed Minutes allowed the hawks to retreat. Even so, the CME’s FedWatch Tool signals a 68% chance of a 0.25% rate hike in March versus 71% marked the previous day.

Amid these plays, Wall Street remained firmer and the yields also improved but the US Dollar Index (DXY) dropped to the lowest levels since February.

Moving on, a light calendar ahead of the North American trading session may restrict the EUR/USD moves at the multi-day high. However, the underlying bullish trend is likely to remain intact considering the divergence between the ECB and the Fed, as well as softer US inflation data.

That said, US Retail Sales for March, expected to repeat -0.4% MoM figure, precedes the preliminary readings of the US Michigan Consumer Sentiment Index (CSI), likely staying unchanged at 62, to entertain EUR/USD traders. Also important to watch will be the University of Michigan’s (UoM) 5-year Consumer Inflation Expectations, prior 2.9%.

Technical analysis

A daily closing beyond the February 2023 high of around 1.1035 enables EUR/USD bulls to aim for March 2022 peak surrounding 1.1185.

-

23:02

EUR/GBP Price Analysis: Bulls seek a break of key daily trendline resistance

- EUR/GBP bulls lurking near a 61.8% ratio.

- Bulls eye a break of resistance with 0.8925 prior highs in focus.

EUR/GBP has been pressured on the backside of trendline resistance but supported by the next layer of trendline support and the horizontal support in the 0.8720s.

EUR/GBP daily charts

Nevertheless, as the following illustrates, we have a W-formation that would be expected to pull in the price to the neckline as follows:

However, so long as the bulls commit to trendline support, near a 61.8% ratio, then there will be prospects of a breakout of trendline resistance with eyes on 0.8925 prior highs.

-

23:01

USD/MXN shifts during the trading session, printing a new weekly low below 18.0000

- Initial Jobless Claims hit 239K, exceeding estimates of 234K.

- US inflation on the producer side edged lower, cementing the case for a Fed pivot.

- USD/MXN Price Analysis: To extend its losses past the 18.0000 support.

The Mexican Peso (MXN) extended its weekly gains below the 18.0000 barrier, as the USD/MXN hit a new weekly low at 17.9749. But a late bounce propelled the USD/MXN back above the 18.0000 mark, trimming some of its earlier losses. At the time of writing, the USD/MXN is trading at 18.0158, down by 0.30%.

Economic data from the United States weighed on the US Dollar, boosted the Mexican Peso

On Thursday, the sentiment remained positive after the release of softer-than-estimated US jobs data, followed by inflation at the factory gate. Initial Jobless Claims for the week ending on April 8 exceeded estimates of 234K and hit 239K while Continuing Claims dipped. The March Producer Price Index (PPI) edged lower on annual and monthly readings, while the core PPI was mixed. Core PPI was -0.1% MoM, below estimates of 0%, while annually based dropped to 3.4% from 4.8%.

Even though traders’ bets are pricing in a 25 bps rate hike by the US Federal Reserve at the upcoming meeting, a pivot is widely expected. In addition, investors are pricing three 25 bps rate cuts by the year’s end, which spurred the US Dollar (USD) weakness across the board.

Consequently, the US Dollar Index (DXY) tracks the buck’s value vs. a basket of six currencies, drops 0.51%, and exchanges hands at 101.012, weighed by falling US bond yields. The US 2-year bond yield finished Thursday’s session flat at 3.972%, though it began Friday’s Asian session down at 3.968%.

The latest meeting minutes from the Bank of Mexico (Banxico) were released. One official commented that policy must remain restrictive for at least a couple of years, while another member mentioned that core inflation had shown “greater persistence.” That member commented that the effects of the restrictive policy would be felt “clearly” in the second half of 2024.

Lastly, the minutes showed that the board would continue to consider the inflation outlook when deciding to continue its hiking campaign.

USD/MXN Technical Analysis

The USD/MXN is testing support at the 18.0000 figure, which, once cleared, it could pave the way for further downside. Therefore, the USD/MXN pair’s next support would be the weekly low of 17.9749, followed by the April 3 swing low at 17.9644. Break below, and the USD/MXN will test the YTD Low at 17.8968. On the flip side, the USD/MXN first resistance would be 18.1219, followed by the 20-day EMA at 18.2085, before reclaiming the April 5 high at 18.4010.

-

22:24

USD/ZAR forecast to move lower over the next months – CIBC

Analysts at CIBC, forecast the USD/ZAR pair at 17.85 by the end of the second quarter and at 17.45 by the end of the third quarter.

Key quotes:

“The recent episode of bank-related equity woes provided additional justification for investors to abandon high ZAR nominal yields in return for the safety and liquidity of the USD. Additional evidence of recent capital flight comes via the realization that speculative investors have extended ZAR shorts to alltime extremes in the wake of a record weekly ZAR position reduction in the middle of March.”

“The scale of the speculative investor capitulation allied to the substantive unwinding of bond holdings does suggest that should risk sentiment materially improve, we do not view recent financial sector effects as systemic this could suggest the near 7% year to date ZAR depreciation could materially snap back, prompting USD/ZAR to rebound back towards the 200Day MAV at 17.51.”

“The central bank (SARB) has lowered its 2023 growth assumption to 0.3%, due to substantive load shedding and or ongoing rail freight headwinds. Additionally, inflation remains a SARB concern. Inflation has remained outside of the 3-6% target range since May 2022. Policy tightening now

risks extending towards 8.00-8.25%, previously a terminal rate of 7.75% was assumed prior to the unexpected 50bps hike on 30 March.”

-

22:18

AUD/USD: Aussie to gain a tailwind ahead – CIBC

Analysts at CIBC point out the Australian Dollar should receive a lift from broad US Dollar weakness in 2023, and demand for exports supported by China's re-opening.

Key quotes:

“We are maintaining our view of a stronger AUD going forward. This is largely predicated on our forecast for a weaker US dollar, alongside the benefits from the ongoing reopening of China’s economy. Earlier this month, the RBA announced that they would hold the policy rate at 3.60%, while softening language around the need for more rate hikes. However, we expect one more 25bps hike for the RBA in early May, given our expectations of a firm upcoming CPI print, and still hawkish rhetoric from Governor Lowe.”

“Overall, a broadbased decline in the USD, alongside Chinese demand for Australian exports should continue to lift the AUD over the medium-term.”

-

21:58

Forex Today: Dollar consolidates after heavy losses, remains vulnerable

A quiet Asian session is ahead regarding economic data that could help the US Dollar stabilize after posting heavy losses on Thursday on the back of inflation and employment US data. On Friday, the key report will be the US March Retail Sales.

Here is what you need to know on Friday, April 14:

The US Dollar tumbled again, breaking technical and psychological support levels. At the same time, US stocks soared. The Dow Jones ended with a gain of 380 points or 1.15%, while the Nasdaq jumped by 1.99%. The VIX posted the lowest close since February. Big US banks will announce Q1 earnings on Friday.

On Wednesday, the US Consumer Price Index report showed that annual inflation eased to 5% in March, the lowest in two years, but the core rate remained elevated. On Thursday, data showed that wholesale inflation fell more than expected. The annualized Producer Price Index (PPI) inflation dropped from 4.9% to 2.7%, below the 3% expected, the smallest since January 2021. The latest round of data showed that inflation continues to slow down.

US Initial Jobless Claims rose to 239K, above the 232K expected, the highest level since January 2022. The report added signs of a softer labor market. More data is due on Friday with Retail Sales, Industrial Production and Consumer Confidence figures. Upbeat economic reports could help the US Dollar, but the trend is still down. Unless, good news triggers risk appetite and weighs further on the Greenback.

US Retail Sales Preview: Dollar set to jump above low barrier of expectations, three scenarios

EUR/USD posted the first daily close above 1.1000 in a year, helped by a firmer Euro and the sharp slide of the US Dollar. EUR/GBP gained for the third consecutive day, rising to the highest level in weeks above 0.8800.

USD/JPY fell for the second day in a row, although it trimmed losses during the American session, rebounding above 132.50. The improvement in market sentiment weighed on the Japanese yen.

GBP/USD rose for the third consecutive day and posted the highest daily close since June, above 1.2500. Data from the UK showed GDP was unchanged in February, against expectations of a 0.1% expansion. Bank of England’s (BoE) Silvana Tenreyro will participate in a panel on Friday at the International Monetary Fund Spring Meetings about how to fight inflation. At the last BoE meeting she voted to keep rates unchanged.

AUD/USD jumped toward 0.6800 and NZD/USD hit levels above 0.6300 amid a weaker US Dollar. The Kiwi outperformed. Early on Friday, the March Business NZ PMI is due. USD/CAD tumbled to 1.3340, a 2-month low.

USD/CHF confirmed the breakout of long-term support levels and extended the decline to 0.8854, the weakest level since January 2021. Switzerland will release wholesale inflation on Friday.

Gold continued its run toward record highs, rising above $2,040, while Silver approached $26.00. Bitcoin also benefited from the better mood across financial markets and retook $30,000.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:57

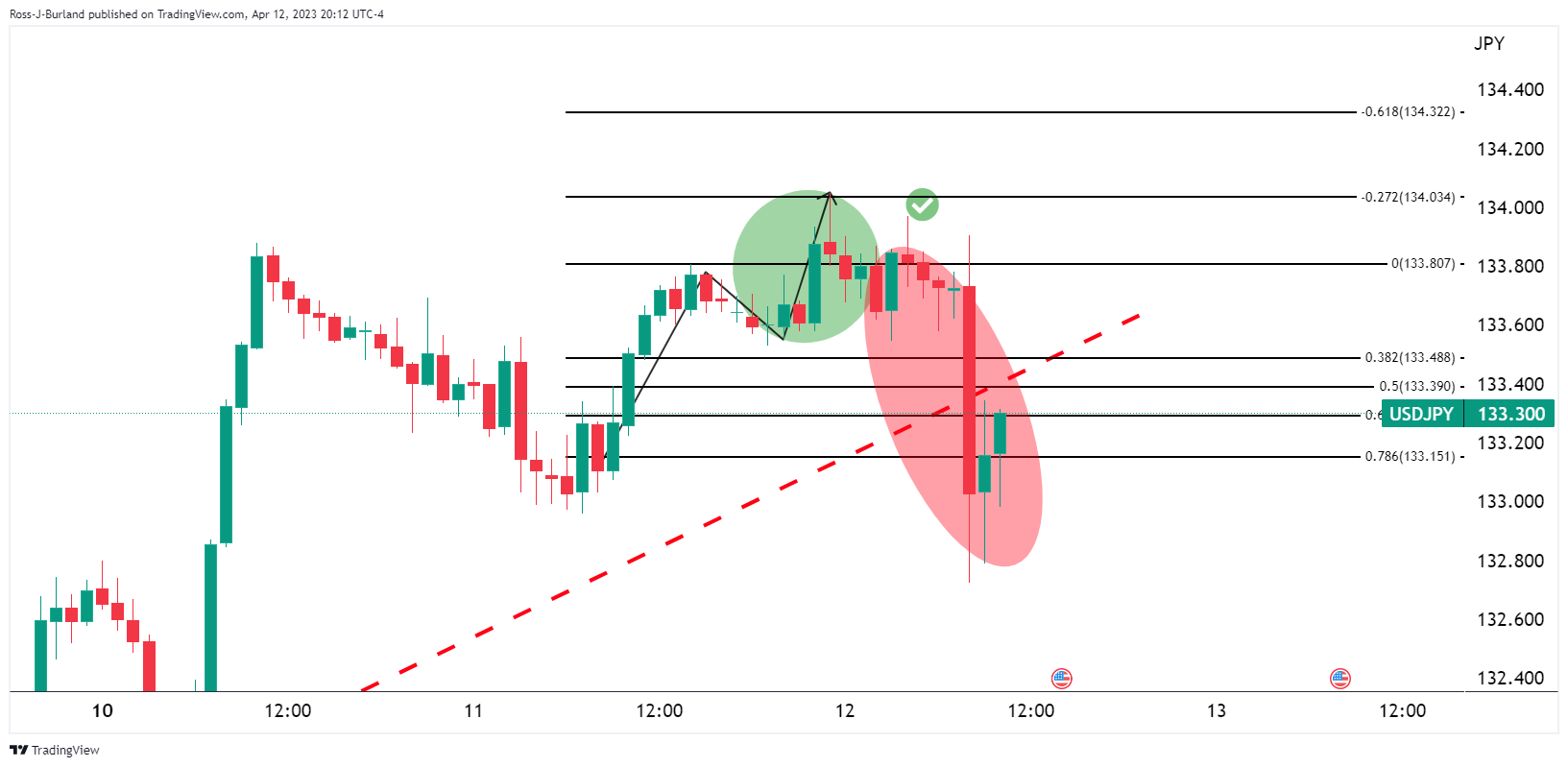

USD/JPY Price Analysis: Bulls depend on a lifeline at daily trendline support

- USD/JPY bulls are still in play with prospects of a daily close above 132.50.

- USD/JPYs trendline support is key at this juncture.

In the prior analysis, 132.50 was cited as a key level that needed to stay intact for the bullish thesis to remain in place. However, this was on a closing basis and we are yet to see a daily close below there, yet. Therefore, the money longs have been given a lifeline despite a heavy drop in the US Dollar this week.

USD/JPY prior analysis, daily chart

It was stated that ´´the bulls will need to commit, however, to the trendline support and preferably to above 132.50/70 for prospects of a breakout above 134.00.´´

USD/JPY updates

Meanwhile, we have since seen a move into test bullish commitments near 132.00 support, but the bulls are holding the fort where the trendline meets a 61.8% ratio of the daily bullish impulse. This leaves the bullish thesis intact but the bulls now need to get above the right shoulder of the head and shoulders on the 4-hour chart.

USD/JPY H4 head and shoulders

While a move to below support is troublesome for the bulls, so long as the 78.6% ratio holds, then it might not be game over for the bulls, but a break of the trendline will be problematic.

-

20:57

EUR/USD is perched at fresh 2023 highs

- EUR/USD bulls take out 2023 highs as US Dollar falls to fresh lows.

- Markets are suring up their bets of a peak Fed rate this summer.

EUR/USD has breached the early February highs and has gone on to hit its highest level since April 2022, as investors dumped the US Dollar on yet further data pointing to a pivot from the Federal Reserve later this year. At the time of writing, EUR/USD is trading at 1.1048 and has traveled between a low of 1.0976 and a high of 1.1067, currently up 0.52% on the day.

Data this week has led markets to believe that their thesis is correct, that the Federal Reserve will pause in its tightening policy campaign after one last rate hike in May. Firstly, the Consumer Price Index (CPI) inflation data on Wednesday came in at 5% year-on-year in March, down from 6% in February.

Then, on Thursday the easing inflationary pressures continues in data with the Producer Price Index (PPI) for final demand dropping 0.5% last month. In the 12 months through March, the PPI increased 2.7% which was the smallest year-on-year rise since January 2021 and followed a 4.9% advance in February. Additionally, the number of Americans filing new claims for unemployment benefits increased more than expected last week. Consequently, Fed funds futures traders are now pricing for the Fed's benchmark rate to peak at 5.002% in June, from 4.830% now, before falling back to 4.278% in December.

Meanwhile, over in Europe, central bankers have been a touch more hawkish than their US counterparts. For instance, European Central Bank's Robert Holzmann backed another 50 bps move. However, the general consensus is that the ECB is set to deliver a 25 bps rate increase on May 4 and another 25 bps hike by mid-year to combat inflation.

-

20:26

USD/CHF Price Analysis: Hits new YTD lows for the second consecutive day at around 0.8850s

- USD/CHF is poised for further decline on the daily chart.

- USD/CHF 4-Hour chart suggests consolidation, but a bearish continuation could happen below 0.8859.

- Bearish oscillators with oversold RSI may lead to an upward correction.

USD/CHF extended to new year-to-date (YTD) lows for the second straight day at 0.8859, though it rebounded slightly but remained below the psychological resistance at 0.8900. Fundamentals pointing the US economy toward a strong deceleration and a possible US Federal Reserve (Fed) pivot are the main reasons pressuring the American Dollar (USD). Therefore, the USD/CHF is trading at 0.8882 after hitting a high of 0.8974.

USD/CHF Price Action

From a daily chart perspective, the USD/CHF might continue to fall further, though buyers stepped in at around 0.8871, the February 16 cycle low. Although the USD/CHF fell beyond the latter, it bounced strongly, as USD/CHF bulls look forward to reclaiming the 0.8900 figure.

Short term, the USD/CHF 4-Hour chart suggests the pair is consolidating once it formed a doji, just below the S2 daily pivot point around 0.8888. For a bearish continuation, the USD/CHF needs to dive below 0.8859 to extend its losses toward the S3 pivot point at 0.8832, ahead of falling to 0.8800.

Although oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) maintain a bearish bias, the RSI is in oversold territory. Hence, an upward correction is likely, though buyers must reclaim the 0.8900 figure.

Once achieved, the USD/CHF next resistance would bet the S1 pivot point at 0.8925, followed by the confluence of the daily pivot point and the 20-day EMA at 0.8975/80 before testing 0.9000.

USD/CHF 4-Hour chart

USD/CHF Technical Levels

-

20:19

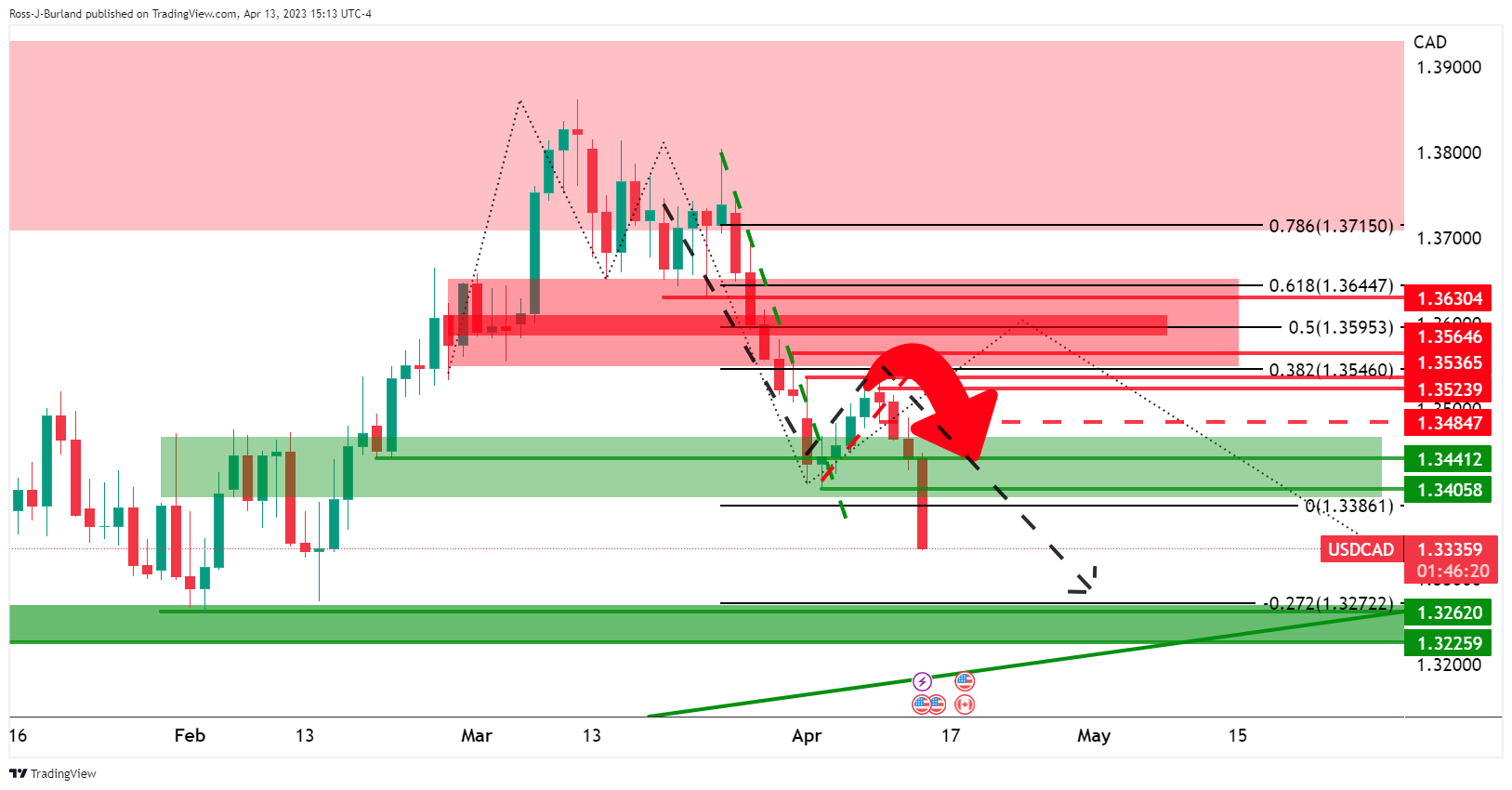

USD/CAD Price Analysis: Bears in control and eye lower to 1.3320

- US Dollar under pressure, commodities up.

- USD/CAD bears eye 1.3320 for the coming sessions and lower for the upcoming days.

In the prior analysis, USD/CAD Price Analysis: Bears are in the market and eye test of 1.3400, which arrived at a bearish bias, it stated that on the hourly chart, ´´we can see that the price is being rejected at old support again. A 38.2% Fibonacci retracement aligns with prior support that would be expected to act as resistance on a restest while the bears commit to the front side of the bearish trend. This in turn could lead to an additional push lower and into the target area of the 1.3400s.´´

USD/CAD prior analysis

USD/CAD H1 chart

USD/CAD, live updates

As illustrated, the price dropped into the target on the test of the 38.2% Fibonacci retracement in a textbook outcome.

Meanwhile, the US Dollar came under further pressure on Thursday and markets have jumped at the opportunity to long commodities as per the following CRB chart:

As such, the Canadian Dollar has found support, sending USD/CAD down like a stone and in line with the prior analysis:

Before:

After:

The forecast is into the 1.3270s for the coming days on a break of 1.3320:

-

18:59

GBP/USD bulls printing fresh bull cycle highs

- GBP/USD bulls taking the reigns as US Dollar swoops into key daily support territory.

- Markets anticipate the Federal Reserve is near the end of its rate hiking cycle.

GBP/USD is a touch higher on Thursday as the US Dollar slides deeper into what might be regarded as a meanwhile critical supporting area on the DXY´s daily chart. The price has traveled between a low of 1.2477 and a high of 1.2537 on the day so far and at the time of writing, the price is perched near the highs of the day at 1.2530, up 0.37%.

The British pound has been touching its strongest level since June 2022, as traders access the landscape across the pond with both US and UK data sending signals to markets as to how the two central banks are likely to respond.

For the US, there has been a series of data that is pointing to a pivot from the Federal Reserve and a mild recession later this year. There are signs of easing inflationary pressures and a slowdown in the country's labor market, both of which have started to reinforce the chances the Federal Reserve will be delivering a final rate hike in May before pausing its tightening cycle. This has seen the DXY index fall to as low as 100.84 and 200 points lower than the highs of the week.

The drop comes after the Consumer Price Index (CPI) inflation data on Wednesday came in at 5% year-on-year in March, down from 6% in February. The Greenback has been offered despite hotter Core inflation, which strips out volatile food and energy prices. The Core picked up to 5.6%, from 5.5% the previous month. Nevertheless, the data on Thursday confirmed the easing inflationary pressures with the Producer Price Index (PPI) for final demand dropping 0.5% last month. In the 12 months through March, the PPI increased 2.7% which was the smallest year-on-year rise since January 2021 and followed a 4.9% advance in February.

Furthermore, other data on Thursday showed that the number of Americans filing new claims for unemployment benefits increased more than expected last week, another sign that what has otherwise been considered a tight labor market is easing, up as higher borrowing costs, for which the Federal Reserve has triggered in its monetary policy path to date, has dampened demand in the economy.

As such, the data is boosting expectations that the Federal Reserve is near the end of its rate hiking cycle. Fed funds futures traders are now pricing for the Fed's benchmark rate to peak at 5.002% in June, from 4.830% now, before falling back to 4.278% in December.

BoE / Fed divergence coming in?

On the other side of the pound, a ONS report showed Britain's GDP stagnated in February due to strikes by public workers but January's growth was revised higher, suggesting the economy might avoid a recession in early 2023. On the policy front, the divergence between the Federal Reserve and the Bank of England that had been keeping a lid on GBP/USD is coming in. The BoE is expected to continue to raise interest rates further to combat inflation. For instance, Chief Economist Huw Pill said last week the central bank still could not be sure that it has raised interest rates enough to tame inflation.

-

18:49

Gold Price Forecast: XAU/USD reaches YTD high around $2,048 amidst US economic slowdown

- Factory gate inflation in the US continued its downtrend, except for core.

- Unemployment claims for the last week jumped for the second consecutive week.

- Gold Price Analysis: Set to test the ATH around $2,075; otherwise, it could drop below $2,000.

Gold price advances though it remains off the highs of the year, reached earlier at around $2,048.79 after US data continued to show the economy is decelerating. Therefore, the US Dollar (USD) weakened as US Treasury bond yields continued their downward trajectory, while Gold rallied on safe-haven flows. The XAU/USD is trading at $2039.10 after reaching a low of $2,013.90.

US prices paid by producers plunge as inflation cools

The US Bureau of Labor Statistics (BLS) revealed that the March Producer Price Index (PPI) plunged 0.5% MoM, below estimates of 0%. The so-called core PPI, which excludes volatile items, dropped 0.1% MoM, beneath the 0.3% foresaw by the consensus. When compared year-over-year, the PPI was 2.7%, lower than the 3% of the street’s projections, while the core PPI was unchanged at 3.4%. That weighed on the American Dollar (USD), which is seen losing 0.61%, per the US Dollar Index, at 101.913.

Initial Jobless Claims in the US climbed for the second straight week

At the same time, Initial Jobless Claims for the week ending on April 8, reported by the Bureau, exceeded expectations, at 239K, vs. 232K estimates. That, alongside inflation in the United States (US) decelerating steadily, weighed on the US Dollar and bolstered the safe-haven Gold price, which remains at around the $2,040 area.

Will the latest US data trigger a Fed pivot?

Given the above backdrop, the US Dollar remained offered across the FX board and against US Dollar denominated commodities. Expectations that the US Federal Reserve (Fed) is about to finish its tightening cycle inundated the financial markets, with the Federal Funds Rate (FFR) forecasted to peak at 5.00% - 5.25%. According to CME Fed WatchTool, chances for a 25 bps hike in May lie at 67.3%, but market participants have begun to price in rate cuts. Investors estimate the FFR would finish 2023 in the 4.25% - 4.50% range. That means 75 bps of rate cuts are expected following May’s hike.

Federal Reserve officials remained committed to taming inflation

Meanwhile, Federal Reserve policymakers led by San Francisco’s Fed Mary Daly said that “policy may have to tighten more to bring inflation down,” though acknowledged that there are good reasons that the economy “may continue to slow, even without additional policy adjustments.” Earlier, Richmond’s Fed President Thomas Barkin said that inflation has peaked but warned there are still ways to go.

XAU/USD Technical Analysis

After cracking the previous YTD high at $2,032.13, the XAU/USD dipped before posing another challenge to reach a new YTD high. That happened six days after, with the Gold price hitting a new YTD high, shy of the $2,050 psychological level. For a bullish resumption, the XAU/USD needs to crack $2,050, so it can challenge the all-time high (ATH) at $2,075.14 before aiming toward $2,100. On the other hand, if XAU/USD drops back toward $2,000, that would pave the way for a break below the latter. Once that happens, the XAU/USD next support would be the April 10 swing low at $1,981.78, followed by the 20-day EMA at $1,981.25.

-

18:03

United States 30-Year Bond Auction fell from previous 3.877% to 3.661%

-

17:36

Silver Price Analysis: XAG/USD rallies to new YTD highs, nearby $26.00

- Silver price is poised for upward momentum, above $26.00.

- The rate of Change (RoC) remains bullish, but the RSI portrays XAG as overbought.

Silver price advanced to a new YTD high at $25.96, though it fell short of cracking the $26.00 figure, which would have opened the door towards testing, last year's peak, nearly $27.00. At the time of typing, the XAG/USD is trading at $25.76 after hitting a low of $25.39.

XAG/USD Price Action

After registering a YTD high on Wednesday at around $25.66, the XAG/USD has extended its rally toward $25.96. Although it failed to break above the $26.00 figure, the XAG/USD remains controlled by buyers and might brace to April 16, 2022, swing high at $25.87 before re-challenging the $26.00 mark.

If XAG/USD breaks above $26.00, it will exacerbate a rally toward April 18, 2022, high at $26.21 before testing the 2022 yearly high at $26.94. Conversely, if the XAG/USD extends its losses past $25.50, the white metal might pull back toward the April 5 high at $25.13 before sliding toward $25.00.

Oscillators suggest that Silver is overbought, as shown by the Relative Strength Index (RSI). But due to the strength of the uptrend, a jump above 80 suggests the asset might consolidate as the RSI exits overbought conditions. The Rate of Change (RoC) is still bullish, although it flashed that buying pressure is fading.

XAG/USD Daily Chart

XAG/USD Technical Levels

-

16:50

AUD/USD extends gains to weekly highs, approaches 0.6800

- US Dollar Index tumbles after US economic data.

- US stocks rise on Thursday, the Nasdaq leads with a 1.40% gain.

- AUD/USD up by almost a hundred pips, approaches 0.6800.

The AUD/USD gained momentum after the release of US Data and continued to move higher during the American session amid risk appetite. The pair is hovering around 0.6778, at the highest level since April 4.

Earlier on Thursday, the Australia Employment report surprised with a 53K job gain in March above the 20K of market consensus. Analysts at ANZ, don’t think this will be enough for the Reserve Bank of Australia “to return to hiking the cash rate in May, given its reasoning for pausing in April: to assess the impacts of the cumulative 350bp of hikes delivered so far, given the long lags of monetary policy.”

The Aussie rose modestly after the jobs report, with AUD/USD climbing back above 0.6700. The rally took place after the release of US economic data, with wholesale inflation falling more than expected in March and Jobless Claims pointing to a softer labor market. Those number triggered a dollar sell-off and boosted risk appetite.

The context on Thursday favors commodity currencies. AUD/USD is up by almost a hundred pips and NZD/USD has broken above 0.6300.

Looking at 0.6800

The AUD/USD is trading at 0.6776, the highest level in a week and is testing the 55-day Simple Moving Average. A break above would turn the attention to the 0.6800 area.

The technical outlook looks constructive for the Aussie in the short-term. A slide under 0.6600 would strengthen the US Dollar.

Technical outlook

-

16:32

United States 4-Week Bill Auction fell from previous 4.44% to 4.03%

-

16:29

NZD/USD surges as US inflation and jobs data softens

- NZD/USD bulls hover at around 0.6290, eyeing a test of 0.6300 and beyond.

- US core PPI was unchanged at 3.4%, portraying stickier-than-expected inflation.

- The US labor market cools down on back-to-back weeks with unemployment claims rising above the consensus.

NZD/USD climbs to a new five-day high after forming a bullish engulfing candlestick pattern that exacerbated a jump of 80-plus pips on Thursday. The downtrend in inflation in the United States (US), alongside a cooling labor market, are the main reasons for today’s US Dollar (USD) weakness. The NZD/USD is trading at around 0.6290 after hitting a low of 0.6203.

NZD/USD underpinned by soft US economic data

US equities portray an upbeat sentiment. The case for a Fed pivot is gaining strength, as inflation on the producer side softened, and unemployment claims for the April 8 week exceeded estimates. The Producer Price Index (PPI) for March was -0.5% MoM, below forecasts of 0%, while the core PPI dropped 0.1% MoM, beneath estimates of a 0.3% expansion. Annually based, the PPI was 2.7%, below estimates, and the core PPI came at 3.4%, as foresaw by the consensus.

At the same time, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the last week edged higher, at 239K above forecasts of 232K. Continuing claims fell to 1.81 million in the prior’s week to April 8.

The NZD/USD jumped from around 0.6240 toward its daily high of 0.6299, shy of cracking 0.6300 on a soft US Dollar. The greenback tested YTD lows, as shown by the US Dollar Index, at around 100.846, before reclaiming the 101.022 mark, losing 0.50%.

US Treasury bond yields continued their downward trajectory, namely the 2-year, losses two basis points at 3.945%, as traders estimate one more rate hike of the US Federal Reserve (Fed) before pausing. The CME Fed WatchTool shows odds for a 25 bps hike by the Fed are at 66.5%, below April 12 70.4% chances.

NZD/USD Technical Analysis

After breaking above the 200-day Exponential Moving Average (EMA) at 0.6266, the NZD/USD is poised to crack 0.6300. Once cleared, the NZD/USD pair could rally towards April 6 high at 0.6324, followed by the prior’s day cycle high at 0.6379. A breach of the latter will expose 0.6400. Conversely, with a daily close below 0.6300, buyers would be at risk of losing support at the 200-day EMA. Break below 0.6266, and the pair might dip towards the confluence of the 100 and 50-day EMAs at around 0.6240-48.

-

15:53

IMF’s Georgieva: Inflation coming down but not fast enough

In an interview with CNBC on Thursday, International Monetary Fund’s (IMF) Managing Director Kristalina Georgieva said that she doesn't think there is a banking crisis in the US but acknowledged that there are vulnerabilities, per Reuters.

Gerogieva noted that the slowdown in the US economy will lead to Federal Reserve to recalibrate the policy. On inflation outlook, she said that inflation is coming down but added that the decline is not fast enough.

Market reaction

The US Dollar Index stays deep in negative territory after these comments and was last seen losing 0.5% at around 101.00.

-

15:30

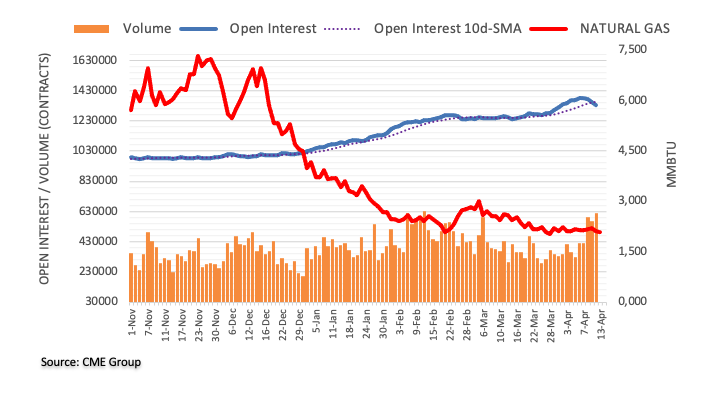

United States EIA Natural Gas Storage Change below expectations (28B) in April 7: Actual (25B)

-

14:50

USD/JPY drops to 132.00 neighbourhood, erases weekly gains amid broad-based USD weakness

- USD/JPY remains under heavy selling pressure for the second successive day on Thursday.

- The softer US PPI reaffirms bets for an imminent Fed rate hike pause and weighs on the USD.

- Looming recession risks benefit the safe-haven JPY and also contribute to the offered tone.

The USD/JPY pair comes under heavy selling pressure during the early North American session and drops to a three-day low, around the 132.00 round-figure mark in the last hour.

The US Dollar (USD) weakens across the board in reaction to the US Producer Price Index (PPI) and turns out to be a key factor dragging the USD/JPY pair lower for the second successive day. Against the backdrop of the softer US CPI report released on Wednesday, the US PPI print suggests that disinflation is progressing smoothly and may even accelerate. This, in turn, reaffirms expectations that the Federal Reserve (Fed) will be done with its monetary tightening after hiking one last time next month and weighs on the buck

Furthermore, the March FOMC meeting minutes showed that several policymakers considered pausing interest rate increases after the failure of two regional banks. Meanwhile, the prospects for an imminent pause in the Fed's rate-hiking cycle lead to a further decline in the US Treasury bond yields, resulting in the further narrowing of the US-Japan rate differential. This, along with looming recession risks, benefits the safe-haven Japanese Yen (JPY) and also contributes to the heavily offered tone surrounding the USD/JPY pair.

That said, the Bank of Japan's (BoJ) dovish near-term outlook might keep a lid on any meaningful gains for the JPY and hold back traders from placing aggressive bearish bets around the USD/JPY pair, at least for the time being. Nevertheless, spot prices now seem to have surrendered a major part of the weekly gains and remain at the mercy of the USD price dynamics. Apart from this, the US bond yields and the broader risk sentiment will be looked upon for short-term trading opportunities ahead of the US monthly Retail Sales data on Friday.

Technical levels to watch

-

14:38

ECB's Vasle: Considering 25 and 50 bps rate hike options for May

While speaking at the sidelines at the IMF event, European Central Bank (ECB) Governing Council member Bostjan Vasle said that they are considering 25 and 50 basis points (bps) rate hike options for the May policy meeting, per Reuters.

"Headline inflation is coming down but we are all focused on core inflation, which is still moving in the wrong direction," Vasle further noted. "This is, of course, not unexpected given the tightness of the labour market and still not fully materialised pass-through effects."

Market reaction

EUR/USD preserves its bullish momentum following these comments and was last seen trading at its highest level since March 2022 at 1.1060, gaining 0.65% on daily basis.

-

14:35

EUR/USD looks firmer and climbs to 12-month highs near 1.1060

- EUR/USD gathers extra pace and pokes with 1.1060.

- Industrial Production in the euro area surprised to the upside.

- US Producer Prices, weekly Claims came below consensus.

The upside momentum in the single currency and around the risk complex in general lifts EUR/USD to new highs near 1.1060 on Thursday.

EUR/USD: Next on the upside comes 1.1100

EUR/USD keeps the bid stance well and sound for the third session in a row on Thursday and trades in levels last seen around a year ago on the back of the unabated sell-off in the dollar.

Indeed, the greenback saw its decline gather extra impulse after US Producer Prices unexpectedly contracted 0.5% MoM in March, while weekly Initial Claims kept thew recent uptrend in place after rising more than estimated by 239K in the week to April 8.

Extra weakness in the dollar also comes in response to declining US yields in the short end and the belly of the curve, while expectations of a 25 bps rate hike by the Fed in May has been somewhat trimmed in the wake of US results.

Earlier in the domestic calendar, final inflation figures in Germany showed the CPI rose 7.4% in the year to March and 0.8% vs. the previous month, while Industrial Production in the broader Euroland expanded more than expected 2.0% YoY in February.

What to look for around EUR

EUR/USD advances well past the 1.1000 mark and records new YTD peaks on Thursday.

In the meantime, price action around the single currency should continue to closely follow dollar dynamics, as well as the incipient Fed-ECB divergence when it comes to the banks’ intentions regarding the potential next moves in interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany Final Inflation Rate, EMU Industrial Production (Thursday).

Eminent issues on the back boiler: Continuation, or not, of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.60% at 1.1057 and a break above 1.1100 (round level) would target 1.1184 (weekly high March 21 2022) en route to 1.1200. On the flip side, the next support comes at 1.0788 (monthly low April 3) followed by 1.0750 (55-day SMA) and finally 1.0712 (low March 24).

-

14:33

BoE's Pill: Precise path of inflation may be bumpier than we expect

Bank of England Chief Economist Huw Pill said on Thursday that they still expect Consumer Price Index (CPI) inflation to fall in the second quarter due to large rises in energy prices from last year dropping out of the annual comparison, per Reuters.

Key takeaways

"Bank staff continue to expect GDP to decline by 0.1% in 2023 Q1."

"Precise path of inflation may be bumpier than we expect."

"High frequency indicators of momentum in wage developments appear to be easing."

"Aggregate lending measures have slowed only slightly."

"Latest data is somewhat disappointing but much better than BoE forecasts from late last year."

"UK banking system remains very robust and resilient."

"Inflation persistence is the key focus for where monetary policy needs to go."

"Good news that latest job growth has come from falling inactivity rates."

"Open question whether unemployment will need to rise to dampen inflation pressures from higher wage growth."

Market reaction

GBP/USD showed no immediate reaction to these comments and was last seen rising 0.4% on a daily basis at 1.2530.

-

14:14

GBP/USD jumps to 1.2535 area, highest since June 2022 amid notable USD supply

- GBP/USD gains positive traction for the fourth successive day and touches a fresh YTD peak.

- Expectations for an imminent Fed rate-hike pause weigh on the USD and remain supportive.

- Acceptance above the 1.2500 mark favours bulls and supports prospects for additional gains.

The GBP/USD pair gains positive traction for the third successive day on Thursday and climbs to the 1.2530 area, or its highest level since June 2022, during the early North American session.

The US Dollar (USD) selling picks up pace following the release of the softer-than-expected US Producer Price Index (PPI) and turns out to be a key factor pushing the GBP/USD pair higher. In fact, the US Bureau of Labor Statistics reported that the US PPI fell to the 2.7% YoY rate in March from 4.9% previous (revised down from 4.6%). The annual Core PPI, meanwhile, declined to 3.4% during the reported month from 4.5% in February, matching analysts' estimate. On a monthly basis, the PPI and the Core PPI came in at -0.5% and -0.1%, respectively.

This comes on the back of the softer US CPI report on Wednesday and lifted hopes that disinflation is progressing smoothly, reaffirming expectations that the Federal Reserve (Fed) will soon pause its rate-hiking cycle. Moreover, the markets now expect the US central bank to start cutting rates during the second half of the year, which leads to a further decline in the US Treasury bond yields. Apart from this, a generally positive tone around the equity markets is seen denting demand for the safe-haven buck and lending support to the GBP/USD pair.

The aforementioned factors, to a larger extent, overshadow the mostly disappointing UK macro data released this Thursday. In fact, the UK Office for National Statistics reported that the economic growth remained flat in February as compared to the 0.1% rise estimated. Adding to this, the UK Manufacturing and Industrial Production figures missed expectations, overshadowing the better-than-expected Trade Balance data. That said, the recent mixed signals from the Bank of England (BoE) policymakers over future rate hikes might cap gains for the GBP/USD pair.

From a technical perspective, a move beyond the previous YTD peak and acceptance above the 1.2500 psychological mark could be seen as a fresh trigger for bullish traders. This, in turn, supports prospects for a further near-term appreciating move. Hence, some follow-through strength, towards reclaiming the 1.2600 round figure, looks like a distinct possibility.

Technical levels to watch

-

14:06

Germany Current Account n.s.a. up to €22.6B in February from previous €16.2B

-

14:00

Russia Central Bank Reserves $ rose from previous $593.9B to $600.8B

-

13:50

Breaking: Gold rises above $2,040 to highest since March 2022 after US data

Gold price rose more than $10 following the release of the March US Produce Price Index that came in below expectations and an increase in Initial Jobless Claims, triggering a dollar sell-off. XAU/USD jumped from below $2,030/oz to $2,040, the highest level since March 2022.

-

13:47

USD/CAD drops to nearly two-month low, bears flirt with 200-day SMA below 1.3400

- USD/CAD remains under some selling pressure for the fourth successive day on Thursday.

- Expectations for an imminent Fed rate-hike pause weigh on the USD and exert pressure.

- A modest pullback in Oil prices undermines the Loonie and helps limit any further losses.

The USD/CAD pair continues to drift lower for the fourth successive day on Thursday and drops to a nearly two-month low heading into the North American session. The pair is currently placed just below the 1.3400 mark, with bearish now awaiting a subsequent breakthrough the very important 200-day Simple Moving Average (SMA) before placing fresh bets.

The US Dollar (USD) selling remains unabated for the third straight day amid expectations that the Federal Reserve (Fed) is nearly done with its rate-hiking cycle and turns out to be a key factor exerting pressure on the USD/CAD pair. In fact, the markets now seem convinced that the US central bank will pause its monetary tightening after hiking one last time next month and the bets were reaffirmed by the softer-than-expected US Producer Price Index (PPI) figures released this Thursday.

According to the data published by the US Bureau of Labor Statistics, the US PPI declined to the 2.7% YoY rate in March from 4.9% previous (revised down from 4.6%). The annual Core PPI, meanwhile, fell to 3.4% during the reported period from 4.5%, matching analysts' estimate. On a monthly basis, the PPI and the Core PPI came in at -0.5% and -0.1%, respectively. This lifted hopes that disinflation is progressing smoothly and open the door for Fed to cut rates during the second half of the year.

Furthermore, the March FOMC minutes showed that several policymakers considered pausing interest rate increases after the failure of two regional banks. This, along with a generally positive tone around the equity markets, continues to weigh on the safe-haven Greenback and is seen dragging the USD/CAD pair lower. That said, retreating Crude Oil prices undermines the commodity-linked Loonie and assists spot prices to defend a technically significant 200-day SMA support, at least for now.

Technical levels to watch

-

13:46

EUR/USD Price Analysis: There is a minor hurdle at 1.1100

- EUR/USD advances further and records a new 2023 high.

- Extra upside could retest the round level at 1.1100 next.

EUR/USD keeps the bullish bias well in place and climbs to the 1.1040/50 on Thursday, or new YTD peaks.

The likelihood of extra advances appears favoured for the time being. Against that, the immediate target now appears at the round level at 1.1100 seconded by the weekly high at 1.1184 (March 21 2022).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0364.

EUR/USD daily chart

-

13:33

US: Annual PPI declines to 2.7% in March vs. 3% expected

- Annual producer inflation in the US declined sharply in March.

- US Dollar Index continues to push lower toward 101.00.

The Producer Price Index (PPI) for final demand in the US declined to 2.7% on a yearly basis in March from 4.9% in February (revised from 4.6%), the data published by the US Bureau of Labor Statistics revealed on Thursday. This reading came in lower than the market expectation of 3%.

The annual Core PPI dropped to 3.4% in the same period from 4.5%, matching analysts' estimate. On a monthly basis, the PPI and the Core PPI came in at -0.5% and -0.1%, respectively.

Market reaction

The US Dollar came under renewed selling pressure after this report and the US Dollar Index was last seen losing 0.35% on the day at 101.17.

-

13:33

US: Weekly Initial Jobless Claims rise to 239K vs. 232K expected

- Initial Jobless Claims in the US increased by 11,000 in the week ending April 8, to highest since January 2022.

- Continuing Jobless Claims decrease by 13,000 in the week ending April 1.

- US Dollar Index tumbled to the lowest since early February after US data.

There were 239,000 initial jobless claims in the week ending April 8, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's unrevised print of 228,000 and came in above the market expectation of 232,000. It is the highest level since January 15, 2022.

"The 4-week moving average was 240,000, an increase of 2,250 from the previous week's unrevised average of 237,750. This is the highest level for this average since November 20, 2021 when it was 249,250", the DOL said.

Continuing Claims decline by 13,000 in the week ended April 1 to 1.810 million, above the 1.814 million of market consensus.

"The 4-week moving average was 1,813,500, an increase of 9,500 from the previous week's unrevised average of 1,804,000. This is the highest level for this average since November 13, 2021 when it was 2,007,000," the DOL noted.

Market reaction

The US Dollar Index tumbled to fresh monthly lows, approaching 101.00, after claims and also alongside lower-than-expected inflation data.

-

13:31

United States Continuing Jobless Claims came in at 1.81M, below expectations (1.814M) in March 31

-

13:31

United States Producer Price Index (YoY) below expectations (3%) in March: Actual (2.7%)

-

13:31

United States Producer Price Index ex Food & Energy (MoM) came in at -0.1% below forecasts (0.2%) in March

-

13:30

United States Initial Jobless Claims registered at 239K above expectations (232K) in April 7

-

13:30

United States Producer Price Index (MoM) came in at -0.5%, below expectations (0%) in March

-

13:30

United States Producer Price Index ex Food & Energy (YoY) in line with expectations (3.4%) in March

-

13:30

United States Initial Jobless Claims 4-week average rose from previous 237.75K to 240K in April 7

-

12:45

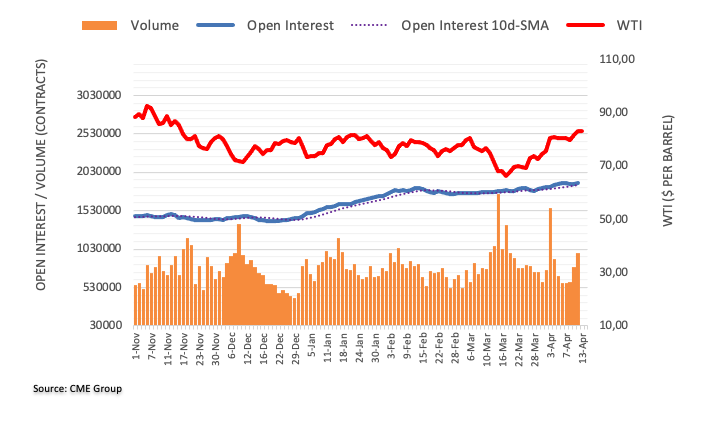

OPEC: World oil demand to rise by 2.32 million bpd in 2023

In its monthly report published on Thursday, the Organization of the Petroleum Exporting Countries (OPEC) said that it left the global oil demand growth forecast for 2023 unchanged at 2.32 million barrels per day, as reported by Reuters.

Additional takeaways

"China’s oil demand to rise by 760,000 bpd in 2023 (up from 710,000 bpd prev. forecast)."

"In summer oil market outlook, OECD inventories have been building in recent months, oil product balances are less tight than at the same time a year ago."

"Any economic weakness from rate hikes could weigh on US summer fuel demand, demand outlook for OECD europe forecast to remain challenged."

"Recent reopening of China has still not been sufficient to reverse declining trend in global refinery intakes."

"OPEC oil output fell by 86,000 bpd in March to 28.80 million bpd."

Market reaction

Crude oil prices showed no immediate reaction to this report and the barrel of West Texas Intermediate (WTI) was last seen posting small daily losses at around $83.

-

12:25

USD Index Price Analysis: Further losses exposes a drop to the 2023 low

- DXY gathers further downside traction and drops to 101.20.

- Extra decline now targets the 2023 low near 100.80.

DXY loses ground for the third session in a row and slips back to the area of 2-month lows around 101.20 on Thursday.

The loss of the 101.00 support could accelerate losses to the 2023 low at 100.81(February 2) in the relatively short-term horizon.

Looking at the broader picture, while below the 200-day SMA, today at 106.39, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:10

Indonesia: Consumer Confidence remains strong – UOB

Economist Enrico Tanuwidjaja and Junior Economist Agus Santoso at UOB Group comment on the recently published Consumer Confidence gauge in Indonesia.

Key Takeaways

“Consumer Confidence Index (CCI) rose to 123.3 in Mar from 122.4 in Feb and only 5.6 points from its highest level of 128.9 in May 2022.”

“The improvement of CCI was driven by an increase in consumer confidence in current economic conditions and expectations for the economic outlook.”

“Increase in purchases of durable goods, especially by people with expenditure levels of more than IDR5 mn/month had contributed to the improvement of the CCI. Improvement in business activity, people mobility, and the 7.5% increase in average minimum wage were the supporting factors of higher domestic consumption in 1Q23.”

-

12:03

United Kingdom NIESR GDP Estimate (3M) registered at 0.1% above expectations (-0.1%) in March

-

11:57

EUR/JPY Price Analysis: Bullish outlook remains unchanged

- EUR/JPY prints advances to new highs near the 147.00 hurdle.

- Further gains could now see the 2022 top revisited in the near term.

EUR/JPY maintains the needle-like recovery well in place and reaches fresh highs in the proximity of the 147.00 barrier on Thursday.

In light of the ongoing price action, further gains seem well on the cards for the time being. That said, the next target of note for the cross comes at the 2022 peak at 148.40 (October 21).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 141.98.

EUR/JPY daily chart

-

11:52

China: Inflation lost further traction in March – UOB

Ho Woei Chen, Economist at UOB Group, assesses the release of the latest inflation figures in China.

Key Takeaways

“Headline inflation slowed to 0.7% y/y in Mar, the lowest since Sep 2021 when it was at the same level. However, core inflation (excluding food & energy) edged marginally higher to 0.7% y/y from 0.6% y/y in Feb.”

“Overall, headline and core inflation averaged 1.3% y/y and 0.8% y/y respectively in 1Q23. Given the weak price pressure to-date, we will revise our full-year headline inflation forecast lower to 2.0% from 2.8%. This will be similar to the inflation rate in 2022.”

“China’s Producer Price Index (PPI) declined y/y for the sixth consecutive month due to the high base of comparison but was flat on a sequential basis for the second straight month which may suggest the stabilization of the domestic economy.”

“PPI decline averaged -1.6% y/y in 1Q23. We retain our forecast that PPI will remain in deflation through 1H23 and average -1.0% in 2023 after rising 4.1% in 2022 and 8.1% in 2021.”

“The inflation data continues to indicate weak demand pressure in China that is consistent with PBoC’s accommodative monetary policy stance and calls for continued fiscal support.”

-

11:20

Gold Price Forecast: XAU/USD clings to gains near YTD peak, just below $2,030 level

- Gold price scales higher for the third successive day and moves back closer to the YTD peak.

- Expectations for an imminent Fed rate hike pause weigh on the US Dollar and lend support.

- Looming recession risks provide an additional boost to the safe-haven metal and favour bulls.

Gold price gains positive traction for the third successive day on Thursday and extends its steady intraday ascent through the first half of the European session. The XAU/USD currently trades around the $2,030 region, just below the YTD peak touched last week and seems poised to build on its recent strong gains recorded over the past month or so.

Bets for rate-hike pause by Federal Reserve benefit Gold price

The latest consumer inflation figures from the United States (USD) released on Wednesday reaffirmed market expectations that the Federal Reserve (Fed) may soon be finished raising interest rates. Adding to this, the March Federal Open Market Committee (FOMC) showed that several policymakers considered pausing interest rate increases after the failure of two regional banks. This leads to a further decline in the US Treasury bond yields and is seen as a key factor benefitting the non-yielding Gold price.

Weaker US Dollar further underpins Gold price

Meanwhile, growing acceptance that the Fed will pause its monetary tightening after hiking one last time next month and possibly start cutting rates during the second half of the year continues to weigh on the US Dollar (USD). In fact, the USD Index, which tracks the Greenback against a basket of currencies, drops to its lowest level since early February. This, along with worries about a deeper global economic downturn, contributes to the bid tone surrounding the US Dollar-denominated Gold price.

Looming recession risk contributes to the positive move

It is worth recalling that the International Monetary Fund (IMF) trimmed its 2023 global growth outlook on Tuesday, citing the impact of higher interest rates. Furthermore, the mixed Chinese trade data released earlier this Thursday raises concerns that the post-COVID recovery in the world's second-largest economy is losing steam. This is seen as another factor driving flows towards the safe-haven Gold price and supports prospects for an extension of the recent well-established short-term bullish trajectory.

Traders now look to macroeconomic data from United States

The aforementioned fundamental backdrop suggests that the path of least resistance for the XAU/USD is to the upside and any meaningful dip could be seen as a buying opportunity. Market participants now look forward to the US economic docket, featuring the release of the Producer Price Index (PPI) and the usual Weekly Initial Jobless Claims. The data might influence the USD price dynamics and provide some impetus to Gold price later during the early North American session.

Gold price technical outlook

From a technical perspective, some follow-through buying beyond the $2,032 area, or the YTD peak, will be seen as a fresh trigger for bullish traders. The gold price might then accelerate the momentum towards the $2,048-$2,050 intermediate resistance en route to the all-time high, around the $2,070-$2,075 region.

On the flip side, the daily swing low, around the $2,014-$2,013 zone, could act as a support and protect the immediate downside. Any subsequent fall is likely to attract fresh buyers near the $2,000 psychological mark. This should help limit losses for Gold price near the $1,990-$1,980 horizontal support.

Key levels to watch

-

11:02

Ireland Consumer Price Index (MoM) dipped from previous 1.6% to 1.1% in March

-

11:01

Portugal Consumer Price Index (YoY) remains unchanged at 7.4% in March

-

11:01

Ireland HICP (YoY) declined to 7% in March from previous 8.1%

-

11:01

Ireland HICP (MoM) declined to 0.9% in March from previous 1.5%

-

11:01

Portugal Consumer Price Index (MoM) unchanged at 1.7% in March

-

11:01

US Dollar devaluation continues after US inflation data

- US Dollar has continued to weaken against its major rivals following Wednesday’s selloff.

- EUR/USD technical outlook shows that the pair has the potential to renew 2023 highs.

- US Dollar could have a hard time staging a steady rebound as markets eye a looser Fed policy.

The US Dollar (USD) has been struggling to shake off the selling pressure on Thursday after having registered heavy losses against its major rivals on Wednesday. March inflation data from the United States seems to be the primary driver behind the broad-based USD weakness with markets forecasting a strong probability of one or more Federal Reserve (Fed) rate cuts in the second half of the year.

The US Bureau of Labor Statistics (BLS) reported on Wednesday that Consumer Price Index (CPI) declined to 5% on a yearly basis in March from 6% in February. This reading came in below the market expectation of 5.2%. Furthermore, the Core CPI, which excludes volatile food and energy prices, rose by 0.4% on a monthly basis, down from a 0.5% increase recorded in February.

Daily digest market movers: US Dollar under pressure ahead of PPI data

- The CME Group FedWatch Tool's probability for one more 25 basis points Fed rate increase in May holds above 60%. However, markets see a bigger-than-90% chance that the Fed will lower its policy rate back to the range of 4.75%-5% by September even if it opts for a rate hike at the upcoming meeting.

- The US Dollar Index (DXY), which tracks the USD performance against a basket of six major currencies, touched its lowest level since early February below 101.50 after having lost 0.6% on Wednesday.

- Commenting on the inflation data, "the beginning of the end of rate hikes – or the beginning of the countdown toward slashing borrowing costs? That seems to be the message from markets, which are rushing forward to price the next moves of the Federal Reserve (Fed)," noted FXStreet analyst Yohay Elam. "The world's largest economy is experiencing a "process of disinflation" that is somewhat frustrating but is on the right track. Markets are buying it."

- San Francisco Federal Reserve Bank President Mary Daly said on Wednesday that the strength of the US economy and elevated inflation suggests that they have more work to do on rate hikes.

- The BLS will release the Producer Price Index (PPI) data later in the day, which is forecast to fall to 3% on a yearly basis in March from 4.6% in February.

- The US Department of Labor’s weekly Initial Jobless Claims will also be featured in the US economic docket.

- Earlier in the week, NY Fed’s latest consumer survey revealed that the one-year inflation expectation climbed to 4.7% in March from 4.2% in February.

- NY Fed President John Williams argued on Monday that the pace of Fed rate increases was not behind the issues surrounding the two collapsed banks back in March. On Tuesday, "we've gotten policy to a restrictive stance, now we need to watch the data on retail sales, CPI and others," Williams stated.

- The US Bureau of Labor Statistics reported on Friday, April 7, that Nonfarm Payrolls in the US rose by 236,000 in March, slightly below the market expectation of 240,000. February’s print of 311,000 got revised higher to 326,000 from 311,000.

- Wage inflation in the US, as measured by Average Hourly Earnings, declined to 4.2% on a yearly basis from 4.6% in February. The Unemployment Rate ticked down to 3.5% with the Labor Force Participation Rate improving to 62.6% from 62.5%.

Technical analysis: US Dollar eyes further losses vs Euro

EUR/USD registered strong gains on Wednesday and continued to push higher early Thursday, advancing to its highest level in over two months above 1.1000 in the process. The Relative Strength Index (RSI) indicator on the daily chart is yet to climb above 70, suggesting that the pair has more room on the upside before turning technically overbought.

1.1035 (2023 high) aligns as interim resistance before 1.1100 (psychological level, static level) and 1.1160 (static level from April 2022).

On the downside, a daily close below 1.1000 could discourage buyers and open the door for an extended downward correction toward 1.0900 (psychological level, static level), 1.0850 (20-day Simple Moving Average SMA)) and 1.0800 (psychological level, static level).

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.

-

11:01

Ireland Consumer Price Index (YoY) declined to 7.7% in March from previous 8.5%

-

10:26

USD/JPY struggles for a firm direction, stuck in a range around 133.00 mark

- USD/JPY oscillates in a narrow trading band and is influenced by a combination of diverging forces.

- Bets for an imminent pause in the Fed’s rate-hiking cycle weigh on the USD and act as a headwind.

- The BoJ’s more dovish outlook caps gains for the JPY and limits any meaningful slide for the major.

The USD/JPY pair struggles for a firm intraday direction on Thursday and seesaws between tepid gains/minor losses through the first half of the European session. The pair is currently placed just above the 133.00 round-figure mark, nearly unchanged for the day, and is influenced by a combination of factors.

Growing worries about a deeper global economic downturn drive some haven flows towards the Japanese Yen (JPY), which, along with the prevalent US Dollar (USD) selling bias, act as a headwind for the USD/JPY pair. It is worth recalling that the International Monetary Fund (IMF) trimmed its 2023 global growth outlook on Tuesday, citing the impact of higher interest rates. Furthermore, the mixed Chinese trade data released earlier today adds to worries that the post-COVID recovery in the world's second-largest economy is losing steam.

Furthermore, growing acceptance that the Federal Reserve (Fed) is nearly done with its rate-hiking cycle leads to a further decline in the US Treasury bond yields. The resultant narrowing of the US-Japan rate differential is seen as another factor that benefits the JPY. Investors now seem convinced that the Fed will pause its monetary tightening after hiking one last time next month and the bets were reaffirmed by the softer US CPI report on Wednesday. This, in turn, drags the USD to its lowest level since early February and contributes to capping the USD/JPY pair.

That said, the Bank of Japan's (BoJ) dovish near-term outlook keeps a lid on any meaningful gains for the JPY and acts as a tailwind for the USD/JPY pair. This, in turn, might hold back bearish traders from placing aggressive bets and warrants some caution before confirming that the one-week-old uptrend has run its course. Market participants now look forward to the US economic docket, featuring the release of the Producer Price Index (PPI) and the usual Initial Weekly Jobless Claims, for short-term trading opportunities later during the early North American session.

Technical levels to watch

-

10:15

United Kingdom 10-y Bond Auction climbed from previous 3.495% to 3.592%

-

10:01

Eurozone Industrial Production increases by 1.5% MoM in February vs. 1.0% expected

Eurozone Industrial Production extends its uptrend in February, the official data showed on Wednesday, suggesting that the manufacturing sector recovery is holding ground.

Eurozone’s Industrial Output rose by 1.5% MoM, the Eurostats said in its latest publication, vs. 1.0% expected and 0.7% previous print.

On an annualized basis, the old continent’s Industrial Production arrived at 2.0% in February versus a 0.9% figure registered in January and 1.5% estimates.

FX implications

The shared currency failed to find any inspiration from the upbeat German industrial figures. At the time of writing, EUR/USD is trading at around 1.1010, gaining 0.21% on the day.

-

10:00

European Monetary Union Industrial Production w.d.a. (YoY) above forecasts (1.5%) in February: Actual (2%)

-

10:00

European Monetary Union Industrial Production s.a. (MoM) came in at 1.5%, above expectations (1%) in February

-

09:30

AUD/USD climbs to over one-week high, eyes 50/200 DMA confluence hurdle

- AUD/USD scales higher for the third straight day and touches over a one-week high.

- The upbeat Australian jobs data, along with the weaker USD, lend support to the pair.

- Expectations for an imminent Fed rate hike pause drag the USD to a two-month low.

The AUD/USD pair builds on this week's recovery from the 0.6620 area, or the monthly low, and gains positive traction for the third successive day on Thursday. The momentum lifts spot prices to over a one-week high, around the 0.6735 region during the first half of the European session and is sponsored by a combination of factors.

The Australian Dollar is drawing support from the upbeat domestic jobs data, which showed that the jobless rate stayed near a 50-year low level of 3.5% and the number of employed people rose by 53K in March, more than the 20K expected. The markets started pricing in the possibility of a 25 bps rate hike at the next Reserve Bank of Australia (RBA) meeting in May, which, along with the underlying bearish sentiment surrounding the US Dollar, provides a modest boost to the AUD/USD pair.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, drops to its lowest level since early February amid growing acceptance that the Federal Reserve (Fed) is nearly done with its rate-hiking cycle. The bets were reaffirmed by the softer-than-expected US consumer inflation figures released on Wednesday, which lifted hopes disinflation is progressing smoothly and may even accelerate, potentially opening the door for the Fed to cut rates during the second half of the year.