Notícias do Mercado

-

20:02

-

19:11

American focus: the U.S. dollar increased

The dollar rose against most major currencies after the Commerce Department report showed that U.S. retail sales unexpectedly rose in April, reinforcing optimism about the world's largest economy. As it became known, retail sales in the U.S. rose in April by 0.1%, while the expected decline of 0.3%.

Euro falls a third day against the dollar in anticipation of data on euro area GDP, which economists forecast will show the reduction in the sixth quarter in a row. At the same time, the single currency rose against the yen.

The dollar rose to its highest level since 2008 against the yen, breaking the mark of 102 yen to the dollar, amid speculation that the incentive program the Federal Reserve will cut its monthly bond purchases to boost growth. Also, the yen weakened after Tokyo avoided direct criticism of its aggressive monetary program for the Group of Seven meeting over the weekend, putting the Japanese currency on the way to a further reduction in the short term. Analysts and traders said the dollar broke through the psychologically important level of 100 yen last week due to signs of improvement in the labor market in the United States, not by the actions of the Bank of Japan. The data show that Japanese investors are buying more foreign assets, which also precipitated the fall of the yen on Friday.

The Australian dollar weakened against the U.S. dollar on the background of the fact that a survey conducted by the National Bank of Australia, showed that business confidence fell in April, ahead of the release of the federal budget. Note that the index of the NAB business confidence fell to -2 in April from 2 in March, and the conditions index rose to -6 from -7 in March. Also today it was announced that in March month agreed amount of housing loans has increased significantly, thus showing the greatest growth over the past four years, as a series of interest rate cuts by the central bank since 2011 has increased the demand for mortgages. According to the report, on an annual basis, mortgage lending rose 5.2 percent in March after seasonal adjustment. It was the biggest gain since March 2009. In addition, it was reported that the number of loan approvals rose for a third consecutive month, after rising 2.1 percent in February and 0.7 percent in January.

-

18:20

European stocks close

European stocks declined from the highest level in almost five years as bank and airline shares retreated, overshadowing better-than-forecast retail sales data in the U.S.

National benchmark indexes fell in 11 of the 18 western European markets. France's CAC 40 retreated 0.2 percent, the U.K.'s FTSE 100 rose 0.1 percent while Germany's DAX was little changed. The volume of shares changing hands in Stoxx 600 companies was 16 percent lower than the 30-day average, according to data compiled by Bloomberg.

Commerzbank slid 4.7 percent to 9.94 euros, the biggest drop since March 14. Germany's second-largest bank will sell new shares a part of a 2.5 billion-euro ($3.3 billion) capital increase, Handelsblatt said, citing unidentified people in the finance industry.

Standard Chartered, the U.K. lender that earns most of its profit in Asia, slipped 1.9 percent to 1,552.5 pence as Block said he's betting against the lender's debt because of "deteriorating" loan quality.

Lonmin advanced 2.6 percent to 286 pence. The third-largest platinum producer returned to profit in its first half through March from a year earlier. The profit of 13.3 cents a share compared with a loss of 6.3 cents in the year-earlier period. The median estimate in a Bloomberg survey of five analysts was for a loss of 4 cents.

Vestas Wind Systems A/S surged 11 percent to 66.30 kroner, its highest price since February 2012. Credit Suisse Group AG raised the world's biggest wind-turbine maker to neutral from underperform, citing benefits from cost cuts.

-

17:20

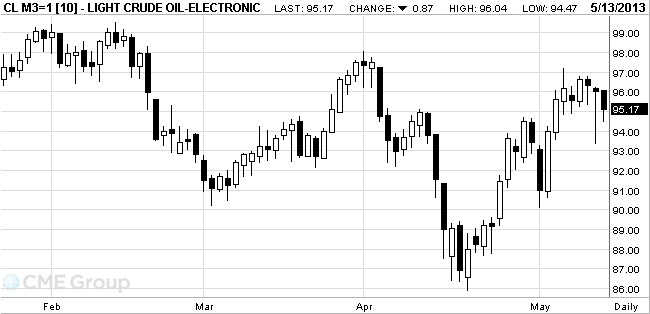

Оil fell for a third day

West Texas Intermediate oil fell for a third day as China's crude processing reached the lowest level in eight months in April and OPEC boosted output.

Prices dropped as much as 1.6 percent as refining in China decreased to 9.36 million barrels a day, according to data published today on the website of the Beijing-based National Bureau of Statistics. China's apparent oil demand, or domestic throughput plus net imports, was 9.66 million barrels a day last month, also the weakest since August, the statistics bureau data showed. China Petroleum & Chemical Corp., or Sinopec, the nation's biggest refiner, will cut processing by 1.5 million metric tons this quarter from an earlier plan because of higher fuel stockpiles, ICIS C1 Energy, a Shanghai-based commodity researcher, said last month.

Output in the Organization of Petroleum Exporting Countries rose last month to the highest level in five months.

OPEC produced 30.46 million barrels a day in April, up from 30.18 million in March, the group's secretariat said May 10. That's the most since November. Saudi Arabia pumped 9.27 million barrels a day in April, up from 9.13 million in March. That's the highest since November and compares with the country's own figure of 9.31 million barrels, based on its communication with the 12-member group.

WTI for June delivery fell to $94.47 a barrel on the New York Mercantile Exchange. Prices gained for a third week in the five days ended May 10.

Brent for June settlement lost $1.32, or 1.3 percent, to $102.59 on the ICE Futures Europe exchange in London. Volume was 6.4 percent below the 100-day average. Brent's premium to WTI narrowed to as little as $7.35, the lowest since January 2012.

-

16:59

-

16:45

Gold: an overview of the market situation

Gold traded lower on Friday within the range against the U.S. macroeconomic unconvincing.

According to published reports, the retail and food sales rose 0.1% to a seasonally adjusted 419.30 billion, the Commerce Department said on Monday. This is 3.7% higher than a year ago. These were higher than economists' expectations. Forecast assumes a 0.3% decline. Retail sales are a key component of consumer spending, which accounted for over two-thirds of demand in the U.S. economy. Spending at gasoline stations fell by 4.7% - this is the largest decline since December 2008, which reflected the decline in gasoline prices in April. Decline will continue during the summer holiday season.

Another Commerce Department report showed that up to March, the amount of inventories remained unchanged, indicating that the business remains tuned uncertainty regarding the strength of economic recovery.

According to the report, the seasonally adjusted volume of reserves remained unchanged at $ 1.270 trillion, unchanged compared with February. Note that according to the average forecasts of experts, the value of this index would grow by 0.3%. In addition, it was reported that total sales of U.S. companies fell during the month of March by 1.1%.

The cost of the June gold futures on COMEX today dropped to 1424.70 dollars an ounce.

-

15:00

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.2950, $1.3050, $1.3070, $1.3085, $1.3100

USD/JPY Y100.00, Y101.50, Y102.35, Y102.50

GBP/USD $1.5400, $1.5550

EUR/CHF Chf1.2365

AUD/USD $0.9900, $0.9970, $1.0000, $1.0065, $1.0145

USD/CAD C$1.0085 -

14:33

-

14:29

Before the bell: S&P futures -0.14%, Nasdaq futures -0.09%

The futures are under preasure after report in the Wall Street Journal that said Fed officials have mapped out a strategy for tapering the Fed's asset purchase program has been cited as a contributing factor for the early disposition.

The futures rightfully pared some of their losses after the Retail Sales report was released.

Global Stocks:

Nikkei 14,782.21 +174.67 +1.20%

Hang Seng 22,989.81 -331.41 -1.42%

Shanghai Composite 2,241.92 -4.91 -0.22%

FTSE 6,620.44 -4.54 -0.07%

CAC 3,946.37 -7.46 -0.19%

DAX 8,267.09 -11.50 -0.14%

Crude oil $95.47 -0.59%

Gold $1433.40 -0.22%

-

14:02

Upgrades and downgrades before the market open:

Upgrades:

Cisco Systems (CSCO) upgraded from Underperform to Mkt Perform at FBR Capital, target raised from $17 to $19

Downgrades:

Other: -

13:30

-

13:30

-

13:15

European session: the euro exchange rate fluctuates

Data

01:30 Australia Home Loans March +2.0% +3.8% +5.2%

01:30 Australia National Australia Bank's Business Confidence April 2 -2

05:30 China Retail Sales y/y April +12.6% +12.8% +12.8%

05:30 China Fixed Asset Investment April +20.9% +21.1% +20.6%

05:30 China Industrial Production y/y April +8.9% +9.4% +9.3%

07:15 Switzerland Retail Sales Y/Y March +2.4% +1.0% -0.9%

09:00 Eurozone Eurogroup Meetings May

The euro exchange rate was slightly higher against the dollar, helped by expectations of a report on retail sales in the United States. Recall that in March retail sales fell by 0.4%. The weakness was observed in many sectors, particularly in the consumer category, where during the month was recorded a decline in sales at sporting goods stores, book and music stores, as well as in the general stores. We add that the sale of vehicles and spare parts also saw a decline in March. Economists said the growth in employment and incomes continue to support consumer spending, however, the growth rate is unlikely to be able to maintain a tangible improvement in the retail sector. Note also that for the three-month average basis, retail sales growth has slowed, suggesting that consumers are still not sure about the adequacy of the economic recovery to pick up the costs on an ongoing basis. We expect that retail sales will continue to decline in April, but at a slower pace than in March.

The yen fell below 102 yen to the dollar after Tokyo avoided direct criticism of its aggressive monetary program for the Group of Seven meeting over the weekend, putting the Japanese currency on the way to a further decline in the short term.

Analysts and traders said the dollar broke through the psychologically important level of 100 yen last week due to signs of improvement in the labor market in the United States, not by the actions of the Bank of Japan. The data show that Japanese investors are buying more foreign assets, which also precipitated the fall of the yen on Friday.

The Australian dollar weakened against the U.S. dollar on the background of the fact that a survey conducted by the National Bank of Australia, showed that business confidence fell in April, ahead of the release of the federal budget. Note that the index of the NAB business confidence fell to -2 in April from 2 in March, and the conditions index rose to -6 from -7 in March.

Also today it was announced that in March month agreed amount of housing loans has increased significantly, thus showing the greatest growth over the past four years, as a series of interest rate cuts by the central bank since 2011 has increased the demand for mortgages. According to the report, on an annual basis, mortgage lending rose 5.2 percent in March after seasonal adjustment. It was the biggest gain since March 2009. In addition, it was reported that the number of loan approvals rose for a third consecutive month, after rising 2.1 percent in February and 0.7 percent in January.

EUR / USD: during the European session, the pair is trading in the range of $ 1.2951-$ 1.2992

GBP / USD: during the European session, the pair rose to $ 1.5380

USD / JPY: during the European session, the pair fell to Y101.49

At 12:30 GMT the United States will become aware of the change in retail sales in April, and 14:00 GMT - the change in our Business Inventories for March. Also at 14:00 GMT the United States will announce the percentage of late payments on the mortgage for the 1st quarter. At 22:45 GMT New Zealand will report on changes in the volume of retail trade and changes in retail sales excluding auto sales for the 1st quarter. At 23:01 GMT Britain will present a balance in housing prices from the RICS in April.

-

13:00

Orders

EUR/USD

Offers $1.3080/85, $1.3040/50, $1.3015/20, $1.3000

Bids $1.2935, $1.2915/00, $1.2880/75, $1.2860/50

GBP/USD

Offers $1.5520/25, $1.5480/85, $1.5450/55, $1.5400/20, $1.5380/90

Bids $1.5335/30, $1.5300/295, $1.5285/80, $1.5265/50

AUD/USD

Offers $1.0145/50, $1.0120, $1.0090/00, $1.0070/80, $1.0050, $1.0015/20

Bids $0.9925/20, $0.9900, $0.9850

EUR/GBP

Offers stg0.8545/50, stg0.8530/35, stg0.8500/10, stg0.8470/75, stg0.8453

Bids stg0.8430/25, stg0.8410/00

EUR/JPY

Offers Y133.50, Y133.00, Y132.50, Y132.15/20

Bids Y131.50, Y131.30, Y131.10/00, Y130.80

USD/JPY

Offers Y103.00, Y102.50, Y102.25, Y102.10/20, Y101.95/00

Bids Y101.50, Y101.20, Y101.00, Y100.80, Y100.60/50

-

11:15

European stock indices fell

European stocks declined from their highest level in almost five years before a report that may show U.S. retail sales fell in April for a second month. U.S. index futures declined, while Asian shares rose.

The Stoxx Europe 600 Index slid 0.3 percent to 304.18 at 9:13 a.m. in London, snapping four days of gains. The gauge advanced 1.3 percent last week as companies from BT Group Plc to Hochtief AG posted better-than-expected earnings and European Central Bank President Mario Draghi said policy makers are ready to cut interest rates if needed.

A report in the U.S. today may show retail sales fell in April for a second consecutive month. The 0.3 percent drop last month would follow a 0.4 percent decline in March, according to the median forecast of economists.

European finance ministers will meet in Brussels at 3 p.m. to review programs for Cyprus and Spain and may sign off on aid payments to Greece.

A report on May 15 may show that the euro region is suffering the longest recession since the single currency's creation. Gross domestic product in the 17-nation economy fell 0.1 percent in the first three months of 2013, a sixth straight quarterly decline, according to the median of economists' forecasts.

In China, industrial output in April rose 9.3 percent from a year earlier and retail sales gained 12.8 percent, the National Bureau of Statistics said today.

Commerzbank AG slid 4.5 percent to 9.97 euros. Germany's second-largest bank will sell new shares a part of a 2.5 billion-euro ($3.3 billion) capital increase, Handelsblatt said, citing unidentified people in the finance industry.

Standard Chartered, the U.K. lender that earns most of its profit in Asia, slipped 4.4 percent to 1,514 pence as Block said he's betting against the lender's debt because of "deteriorating" loan quality.

'Red Flags'

Lonmin jumped 5.6 percent to 294.4 pence. The third-largest platinum producer returned to profit in its first half through March from a year earlier. The profit of 13.3 cents a share compared with a loss of 6.3 cents in the year-earlier period. The median estimate in survey was for a loss of 4 cents.

Vestas Wind Systems A/S (VWS) advanced 5.7 percent to 63.24 kroner, its highest price since March 2012. Credit Suisse Group AG raised the world's biggest wind-turbine maker to neutral from underperform, citing benefits from cost cuts

At that moment:

FTSE 100 6,606.82 -18.16 -0.27%

CAC 40 3,936.16 -17.67 -0.45%

DAX 8,222.73 -55.86 -0.67%

-

10:23

Option expiries for today's 1400GMT cut

EUR/USD $1.2950, $1.3050, $1.3070, $1.3085, $1.3100

USD/JPY Y100.00, Y101.50, Y102.35, Y102.50

GBP/USD $1.5400, $1.5550

EUR/CHF Chf1.2365

AUD/USD $0.9900, $0.9970, $1.0000, $1.0065, $1.0145

USD/CAD C$1.0085

-

10:01

Monday: Asia Pacific stocks close

Asia's regional benchmark stock index headed for its first advance in three days, driven by a rally in Japanese exporters after the yen weakened past 102 versus the dollar. Stocks outside Japan declined.

Nikkei 225 14,782.21 +174.67 +1.20%

S&P/ASX 200 5,210.3 +4.21 +0.08%

Shanghai Composite 2,241.92 -4.91 -0.22%

Toyota Motor Corp., the world's biggest carmaker, climbed 3.8 percent in Tokyo.

Panasonic Corp. jumped 7.6 percent after Japan's second-largest television maker said it will return to profit this fiscal year.

Hyundai Merchant Marine Co., South Korea's No. 1 shipping line, dropped 5.7 percent after reporting a loss.

-

09:42

-

08:17

-

07:08

Asian session: The yen slid

01:30 Australia Home Loans March +2.0% +3.8% +5.2%

01:30 Australia National Australia Bank's Business Confidence April 2 -2

05:30 China Retail Sales y/y April +12.6% +12.8% +12.8%

05:30 China Fixed Asset Investment April +20.9% +21.1% +20.6%

05:30 China Industrial Production y/y April +8.9% +9.4% +9.3%

The yen slid for a fourth day to breach 102 per dollar for the first time in four years as Group of Seven finance chiefs indicated they'll tolerate a slide in the currency for now as they focus on Japan's recovery strategy.

The dollar's advance may be capped before Commerce Department figures today that may show U.S. retail sales fell in April for a second month, according to the median forecast of economists surveyed by Bloomberg News. Excluding automobiles and gasoline, sales probably climbed.

The greenback strengthened versus its 16 major peers after Treasury benchmark 10-year yields rose to the highest in seven weeks and before Federal Reserve Bank of Philadelphia President Charles Plosser speaks tomorrow. Plosser said May 9 that U.S. unemployment will probably fall to 7 percent at the end of 2013 and he would favor reducing the Fed's $85 billion monthly pace of bond-buying next month. His remarks highlight a debate within the Federal Open Market Committee on whether to expand or curb the pace of asset purchases that pumped up the central bank's balance sheet to $3.32 trillion.

The Australian dollar extended a slump from last week, the biggest five-day decline since November 2011, as Treasurer Wayne Swan is forecast to project a fifth and sixth year of budget deficits tomorrow.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.2955-80

GBP / USD: during the Asian session, the pair is trading around $ 1.5350

USD / JPY: during the Asian session, the pair rose to Y102.15

With G7 finance ministers and central bankers out of London, the calendar quietens somewhat Monday, with a lack of data in Europe. Central bankers fly from London to Switzerland for the latest meeting of the BIS. Eurozone finance ministers meet for the Eurogroup in Brussels on Monday night and will have a lot to discuss given the continuing growth slippage in the zone and the push from many states for more time to hit their budget deficit targets. A final decision on the Commission recommendation that these states get two more years to get their deficits down to 3% will not come until the Eurogroup meets in June or July, however. They are also set to approve the next tranches of aid payment for both Greece and Cyprus.The limited European data calendar gets underway at 0630GMT, with the release of the Bank of France business survey. At 1230GMT, German Chancellor Angela Merkel is set to give a speech at a conference on sustained development, in Berlin. Wage talks for Germany's metalworking and engineering sector continue in southwestern German city of Boeblingen, getting underway at 1300GMT. At 1315GMT, German Finance Minister Wolfgang Schaeuble will give a speech at a tax advisers conference, in Dresden. -

06:33

-

06:33

-

06:32

-

06:00

Schedule for today, Monday, May 13’2013:

01:30 Australia Home Loans March +2.0% +3.8%

01:30 Australia National Australia Bank's Business Confidence April 2

02:30 New Zealand REINZ Housing Price Index, m/m April +2.4%

05:30 China Retail Sales y/y April +12.6% +12.8%

05:30 China Fixed Asset Investment April +20.9% +21.1%

05:30 China Industrial Production y/y April +8.9% +9.4%

07:15 Switzerland Retail Sales Y/Y March +2.4% +1.0%

09:00 Eurozone Eurogroup Meetings May

12:30 U.S. Retail sales April -0.4% -0.3%

12:30 U.S. Retail sales excluding auto April -0.4% -0.1%

14:00 U.S. Business inventories March +0.1% +0.3%

22:45 New Zealand Retail Sales, q/q Quarter I +2.1% +0.9%

22:45 New Zealand Retail Sales ex Autos, q/q Quarter I +1.5% +0.7%

23:01 United Kingdom RICS House Price Balance April -1% -2%

-