Notícias do Mercado

-

17:20

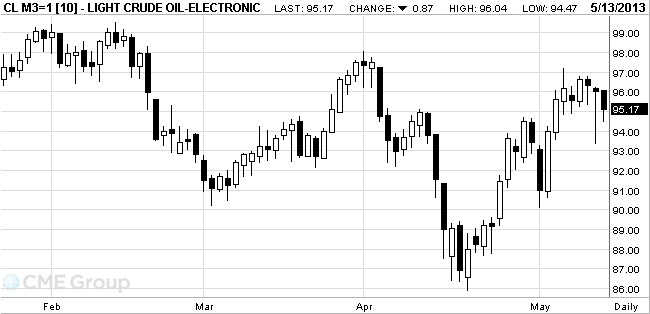

Оil fell for a third day

West Texas Intermediate oil fell for a third day as China's crude processing reached the lowest level in eight months in April and OPEC boosted output.

Prices dropped as much as 1.6 percent as refining in China decreased to 9.36 million barrels a day, according to data published today on the website of the Beijing-based National Bureau of Statistics. China's apparent oil demand, or domestic throughput plus net imports, was 9.66 million barrels a day last month, also the weakest since August, the statistics bureau data showed. China Petroleum & Chemical Corp., or Sinopec, the nation's biggest refiner, will cut processing by 1.5 million metric tons this quarter from an earlier plan because of higher fuel stockpiles, ICIS C1 Energy, a Shanghai-based commodity researcher, said last month.

Output in the Organization of Petroleum Exporting Countries rose last month to the highest level in five months.

OPEC produced 30.46 million barrels a day in April, up from 30.18 million in March, the group's secretariat said May 10. That's the most since November. Saudi Arabia pumped 9.27 million barrels a day in April, up from 9.13 million in March. That's the highest since November and compares with the country's own figure of 9.31 million barrels, based on its communication with the 12-member group.

WTI for June delivery fell to $94.47 a barrel on the New York Mercantile Exchange. Prices gained for a third week in the five days ended May 10.

Brent for June settlement lost $1.32, or 1.3 percent, to $102.59 on the ICE Futures Europe exchange in London. Volume was 6.4 percent below the 100-day average. Brent's premium to WTI narrowed to as little as $7.35, the lowest since January 2012.

-

16:45

Gold: an overview of the market situation

Gold traded lower on Friday within the range against the U.S. macroeconomic unconvincing.

According to published reports, the retail and food sales rose 0.1% to a seasonally adjusted 419.30 billion, the Commerce Department said on Monday. This is 3.7% higher than a year ago. These were higher than economists' expectations. Forecast assumes a 0.3% decline. Retail sales are a key component of consumer spending, which accounted for over two-thirds of demand in the U.S. economy. Spending at gasoline stations fell by 4.7% - this is the largest decline since December 2008, which reflected the decline in gasoline prices in April. Decline will continue during the summer holiday season.

Another Commerce Department report showed that up to March, the amount of inventories remained unchanged, indicating that the business remains tuned uncertainty regarding the strength of economic recovery.

According to the report, the seasonally adjusted volume of reserves remained unchanged at $ 1.270 trillion, unchanged compared with February. Note that according to the average forecasts of experts, the value of this index would grow by 0.3%. In addition, it was reported that total sales of U.S. companies fell during the month of March by 1.1%.

The cost of the June gold futures on COMEX today dropped to 1424.70 dollars an ounce.

-