Notícias do Mercado

-

23:43

Commodities. Daily history for Oct 13'2014:

(raw materials / closing price /% change)

Light Crude 85.07 -0.78%

Gold 1,236.20 +0.50%

-

23:32

Stocks. Daily history for Oct 13'2014:

(index / closing price / change items /% change)

Hang Seng 23,143.38 +54.84 +0.24%

S&P/ASX 200 5,155.5 -32.75 -0.63%

Shanghai Composite 2,366.01 -8.53 -0.36%

FTSE 100 6,366.24 +26.27 +0.41%

CAC 40 4,078.7 +4.99 +0.12%

Xetra DAX 8,812.43 +23.62 +0.27%

S&P 500 1,874.74 -31.39 -1.65%

NASDAQ Composite 4,213.66 -62.58 -1.46%

Dow Jones 16,321.07 -223.03 -1.35%

-

23:24

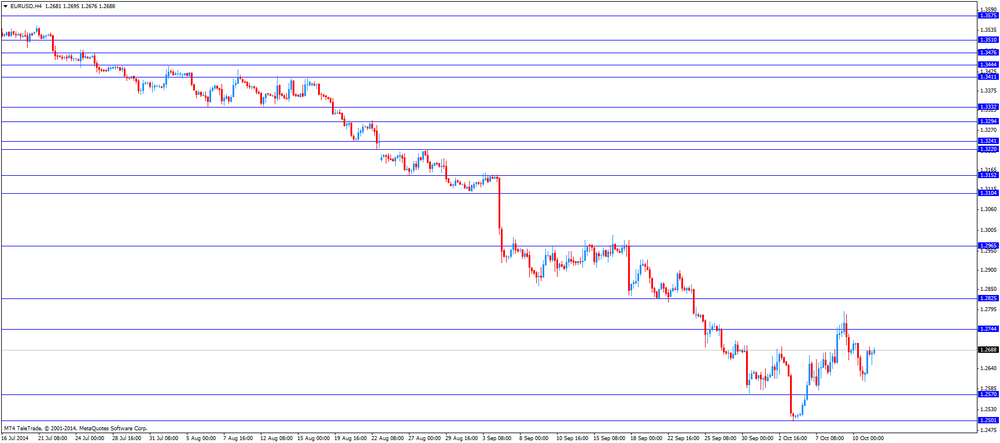

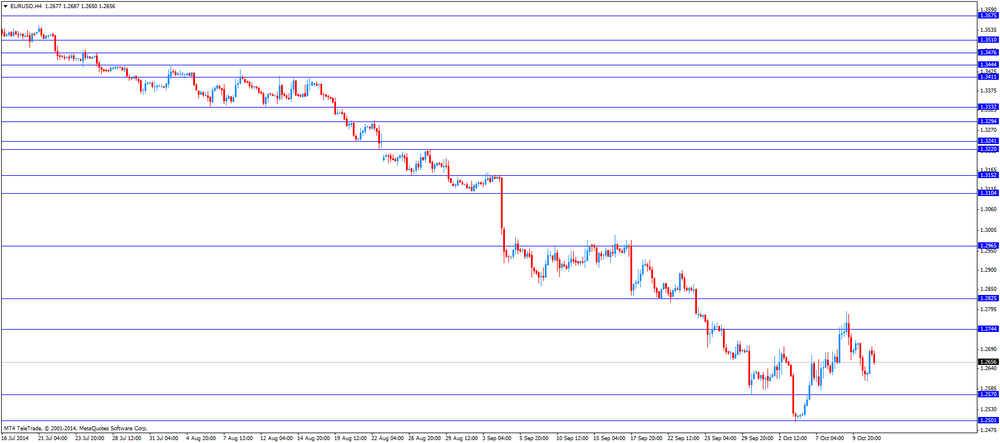

Currencies. Daily history for Oct 13'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2740 +0,88%

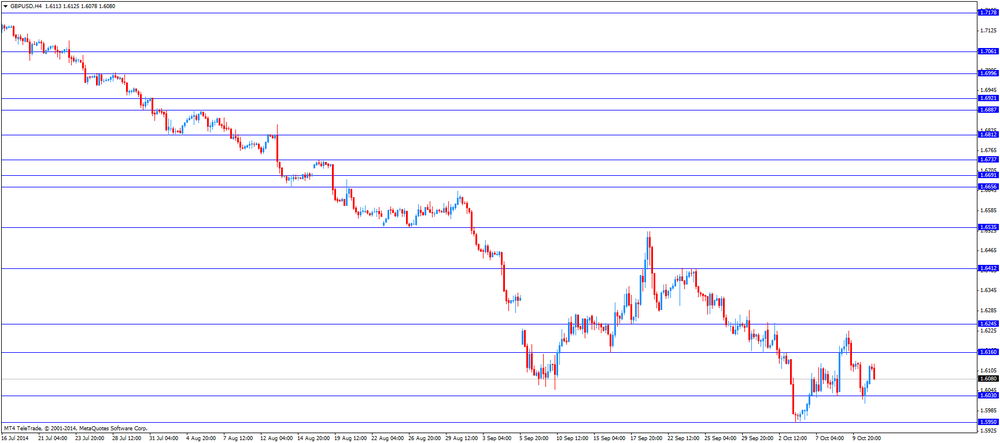

GBP/USD $1,6074 +0,01%

USD/CHF Chf0,9486 -0,87%

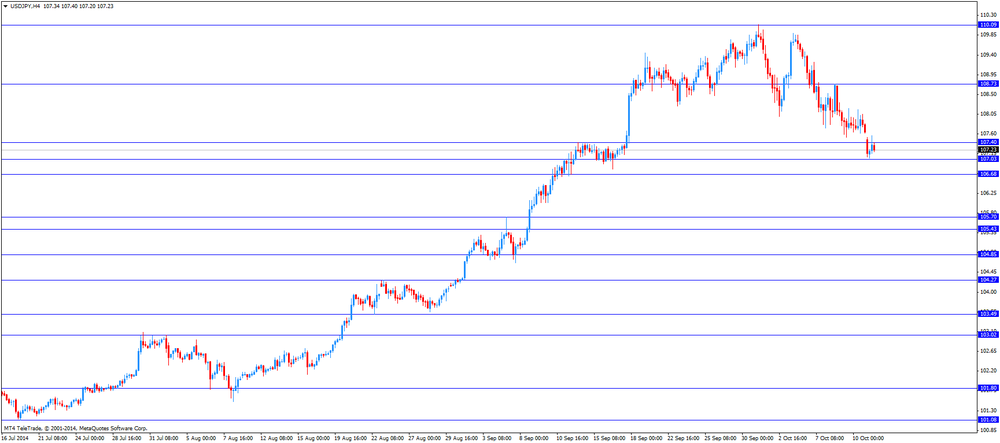

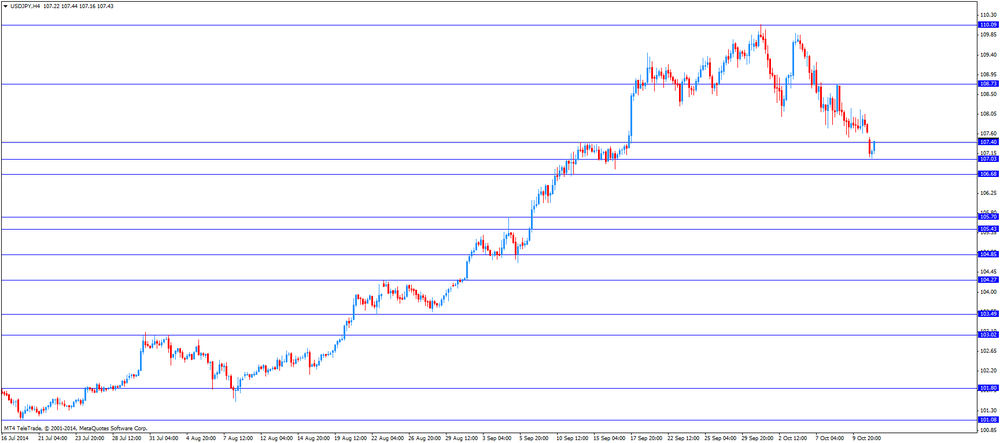

USD/JPY Y106,98 -0,62%

EUR/JPY Y136,30 +0,27%

GBP/JPY Y171,93 -0,63%

AUD/USD $0,8759 +0,86%

NZD/USD $0,7886 +0,93%

USD/CAD C$1,1190 -0,07%

-

23:01

Schedule for today, Tuesday, Oct 14’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia National Australia Bank's Business Confidence September 8

06:45 France CPI, m/m September +0.4% -0.3%

06:45 France CPI, y/y September +0.5% +0.4%

07:15 Switzerland Producer & Import Prices, m/m September -0.2% +0.3%

07:15 Switzerland Producer & Import Prices, y/y September -1.2% -1.4%

08:30 United Kingdom Retail Price Index, m/m September +0.4% +0.3%

08:30 United Kingdom Retail prices, Y/Y September +2.4% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) September -0.6% -0.4%

08:30 United Kingdom Producer Price Index - Input (YoY) September -7.2% -6.6%

08:30 United Kingdom RPI-X, Y/Y September +2.5%

08:30 United Kingdom Producer Price Index - Output (MoM) September -0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) September -0.3% -0.4%

08:30 United Kingdom HICP, m/m September +0.4% +0.3%

08:30 United Kingdom HICP, Y/Y September +1.5% +1.4%

08:30 United Kingdom HICP ex EFAT, Y/Y September +1.9% +1.8%

09:00 Eurozone ZEW Economic Sentiment October 14.2 7.1

09:00 Eurozone Industrial production, (MoM) August +1.0% -1.5%

09:00 Eurozone Industrial Production (YoY) August +2.2% -0.9%

09:00 Eurozone ECOFIN Meetings

09:00 Germany ZEW Survey - Economic Sentiment October 6.9 0.2

23:30 Australia Westpac Consumer Confidence October -4.6%

-

20:00

Dow 16,509.45 -34.65 -0.21%, Nasdaq 4,266.31 -9.93 -0.23%, S&P 500 1,898.81 -7.32 -0.38%

-

17:01

European stocks close: stocks closed slightly higher

Stock indices closed slightly higher. Global growth concerns still weighed on markets.

Several disappointing economic data was released in Germany last week. Market participants speculate Europe is headed for recession.

Investors also speculate the stimulus measures by the European Central Bank would not be enough to boost the economy in the Eurozone.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,366.24 +26.27 +0.41%

DAX 8,812.43 +23.62 +0.27%

CAC 40 4,078.7 +4.99 +0.12%

-

17:00

European stocks closed in plus: FTSE 100 6,366.24 +26.27 +0.41%, CAC 40 4,078.7 +4.99 +0.12%, DAX 8,812.43 +23.62 +0.27%

-

16:40

Oil fell

Brent crude headed for the lowest close in almost four years after Iraq followed Saudi Arabia and Iran in cutting prices. West Texas Intermediate dropped.

Iraq, OPEC's second-biggest producer, will sell its Basrah Light crude to Asia at the biggest discount since January 2009, the country's State Oil Marketing Co., known as SOMO, said yesterday. Iran last week said it will sell oil to Asia in November at the biggest discount in almost six years, matching cuts by Saudi Arabia.

"OPEC is not ready to act and that's making people continue to sell," said Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts. "Until we see some comments out of OPEC suggesting they are going to stabilize the price, I think the market will probably keep falling."

Brent for November settlement slid $1.83, or 2 percent, to $88.38 a barrel at 10:22 a.m. New York time on the London-based ICE Futures Europe exchange. A settlement at this level would be the lowest since November 2010. The volume of all futures was 39 percent above the 100-day average. Prices are down 23 percent from this year's highest close of $115.06 on June 19.

WTI for November delivery dropped $1.15, or 1.3 percent, to $84.67 a barrel on the New York Mercantile Exchange. Volume was 16 percent above the 100-day average. The U.S. benchmark crude was at a discount of $3.70 to Brent. It closed at $4.39 on Oct. 10.

-

16:35

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies in a quiet trade

The U.S. dollar traded higher against the most major currencies in a quiet trade. The U.S. bond market was closed for the Columbus Day holiday.

Comments by Federal Reserve Vice Chairman Stanley Fischer still weighed on the greenback. He warned at the weekend that the global recovery slowed down and the Fed could delay an interest rate hike.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone. Market participants speculate Europe is headed for recession.

Investors also speculate the stimulus measures by the European Central Bank would not be enough to boost the economy in the Eurozone.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar. Markets in Canada are closed for a public holiday.

The New Zealand dollar traded slightly lower against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the Chinese trade data. Chinese exports increased 15.3% in September, while imports climbed 7%. China's trade surplus decreased to $31 billion in September from $49.8 billion in August, missing expectations for a decline to a surplus of $41.2 billion.

New Zealand's food price index dropped 0.8% in September, after a 0.3% rise in August.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after the Chinese trade data. No major economic reports were released in Australia.

The Japanese yen traded slightly lower against the U.S. dollar. In the overnight trading session, the yen surged against the greenback due to increasing demand for safe-haven currency on concerns about the global economic growth. Markets in Japan were closed for a public holiday.

-

16:20

Gold rose to a four-week high

The price of gold reached a four-week high amid downturn in the equity markets and the dollar, as investors prefer low-risk assets, fearing for the stability of the global economic growth.

Asian stock markets during trading fell to seven-month low, while oil prices are close to a minimum of four years.

"With the decline of the dollar and the stock price, as well as comments from Fed officials over the weekend, which were perceived as favorable gold prices may continue to rise. We expect to increase to $ 1.240-1.250, but at this rate we will sell," - said a trader at precious metals in Hong Kong.

Fed officials expressed concern about the state of the world economy, forcing analysts to revise the forecast rise in interest rates. The delay in the rate increase is positive for the gold market, non-interest bearing.

"This week, gold will affect the stock markets and the dollar. We believe that these markets will continue to decline in the near future, giving support to the quotations of gold," - said analyst Edward Meir INTL FCStone.

The world's largest reserves of the gold-exchange-traded fund SPDR Gold Trust on Friday fell by 2.64 tonnes to 759.44 tonnes - the lowest level since December 2008.

Singapore on Monday began trading 25 killogramovymi contracts for gold to set the indicative price for the region. The most traded contract expiring on Tuesday, at the close of trading on the Singapore Exchange was worth $ 39,685 per gram, or $ 1.234,20 an ounce.

The cost of the December gold futures on the COMEX today rose to 1238.00 dollars per ounce.

-

14:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2650(E205mn), $1.2685(E811mn), $1.2700(E855mn), $1.2730(E252mn)

USD/JPY: Y105.00($1.32bn), Y108.75($295mn)

GBP/USD: $1.5900(stg830mn), $1.5905(stg201mn), $1.6220(stg252mn), $1.6230(stg598mn)

AUD/USD: $0.8665-75(A$340mn), $0.8700(A$756mn), $0.8720-25(A$502mn), $0.8750(A$433mn), $0.8800(A$486mn), $0.8850(A$1.1bn), $0.8900(1.15bn)

NZD/USD: $0.7870(NZ$301mn)

-

14:33

U.S. Stocks open: Dow 16,513.53 -30.57 -0.18%, Nasdaq 4,272.85 -3.39 -0.08%, S&P 1,902.95 -3.18 -0.17%

-

14:30

Before the bell: S&P futures +0.36%, Nasdaq futures +0.16%

U.S. stock-index futures climbed amid speculation slowing global growth may cause the Federal Reserve to delay raising interest rates.

Global markets:

Hang Seng 23,143.38 +54.84 +0.24%

Shanghai Composite 2,366.01 -8.53 -0.36%

FTSE 6,369.8 +29.83 +0.47%

CAC 4,088.44 +14.73 +0.36%

DAX 8,838.57 +49.76 +0.57%

Crude oil $84.63 (-1.35%)

Gold $1227.40 (+0.47%)

-

14:10

DOW components before the bell

(company / ticker / price / change, % / volume)

Walt Disney Co

DIS

86.30

+0.03%

0.6K

United Technologies Corp

UTX

100.00

+0.06%

0.1K

Pfizer Inc

PFE

29.15

+0.07%

11.3K

Chevron Corp

CVX

114.02

+0.11%

0.7K

Verizon Communications Inc

VZ

49.00

+0.12%

4.4K

American Express Co

AXP

85.15

+0.19%

0.3K

General Electric Co

GE

24.32

+0.21%

14.6K

JPMorgan Chase and Co

JPM

58.66

+0.24%

0.7K

AT&T Inc

T

34.34

+0.26%

6.6K

Goldman Sachs

GS

180.99

+0.34%

2.8K

Boeing Co

BA

122.06

+0.46%

4.0K

Exxon Mobil Corp

XOM

91.60

0.00%

4.4K

Procter & Gamble Co

PG

84.69

0.00%

1.3K

Johnson & Johnson

JNJ

101.20

-0.03%

0.8K

McDonald's Corp

MCD

92.24

-0.07%

0.3K

The Coca-Cola Co

KO

44.41

-0.13%

4.3K

Visa

V

204.60

-0.19%

0.2K

Cisco Systems Inc

CSCO

23.29

-0.21%

5.3K

Nike

NKE

87.00

-0.22%

1.5K

E. I. du Pont de Nemours and Co

DD

66.23

-0.47%

0.4K

Intel Corp

INTC

31.76

-0.47%

34.0K

Microsoft Corp

MSFT

43.76

-0.61%

28.8K

Merck & Co Inc

MRK

57.96

-1.19%

0.9K

-

13:00

Orders

EUR/USD

Offers $1.2800/10, $1.2715

Bids $1.2600, $1.2585/80, $1.2500

GBP/USD

Offers $1.6415, $1.6300, $1.6225

Bids $1.6010-00, $1.5980, $1.5950

AUD/USD

Offers $0.8845/50, $0.8820, $0.8800, $0.8785

Bids $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.20, Y138.00, Y137.85/90, Y137.50, Y137.20

Bids Y135.50, Y135.00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.20

Bids Y107.00, Y106.85/80

EUR/GBP

Offers stg0.7900, stg0.7980

Bids stg0.7840/30, stg0.7820, stg0.7800

-

13:00

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

02:00 China Trade Balance, bln September 49.8 41.2 31.0

09:00 Eurozone Eurogroup Meetings

12:00 Canada Bank holiday

The U.S. dollar traded mixed against the most major currencies. Comments by Federal Reserve Vice Chairman Stanley Fischer still weighed on the greenback. He warned at the weekend that the global recovery slowed down and the Fed could delay an interest rate hike.

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone. Market participants speculate Europe is headed for recession.

Investors also speculate the stimulus measures by the European Central Bank would not be enough to boost the economy in the Eurozone.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar. Markets in Canada are closed for a public holiday.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.6069

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

22:30 Australia RBA Assist Gov Debelle Speaks

-

12:00

European stock markets mid session: stocks traded slightly higher, global growth concerns still weighed on markets

Stock indices traded slightly higher. Global growth concerns still weighed on markets.

Several disappointing economic data was released in Germany last week. Market participants speculate Europe is headed for recession.

Investors also speculate the stimulus measures by the European Central Bank would not be enough to boost the economy in the Eurozone.

Current figures:

Name Price Change Change %

FTSE 6,356.09 +16.12 +0.25 %

DAX 8,841.56 +52.75 +0.60 %

CAC 40 4,091.8 +18.09 +0.44 %

-

10:50

Asian Stocks close: stocks closed mixed on global growth concerns

Asian stock indices closed mixed. Global growth concerns still weighed on markets.

Chinese exports increased 15.3% in September, while imports climbed 7%. China's trade surplus decreased to $31 billion in September from $49.8 billion in August, missing expectations for a decline to a surplus of $41.2 billion.

Markets in Japan were closed for a public holiday.

Indexes on the close:

Nikkei 225 closed

Hang Seng 23,143.38 +54.84 +0.24 %

Shanghai Composite 2,366.01 -8.53 -0.36 %

-

10:27

Option expiries for today's 1400GMT cut

EUR/USD: $1.2650(E205mn), $1.2685(E811mn), $1.2700(E855mn), $1.2730(E252mn)

USD/JPY: Y105.00($1.32bn), Y108.75($295mn)

GBP/USD: $1.5900(stg830mn), $1.5905(stg201mn), $1.6220(stg252mn), $1.6230(stg598mn)

AUD/USD: $0.8665-75(A$340mn), $0.8700(A$756mn), $0.8720-25(A$502mn), $0.8750(A$433mn), $0.8800(A$486mn), $0.8850(A$1.1bn), $0.8900(1.15bn)

NZD/USD: $0.7870(NZ$301mn)

-

10:11

Foreign exchange market. Asian session: the U.S. dollar traded lower against the most major currencies on comments by Federal Reserve Vice Chairman Stanley Fischer

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

02:00 China Trade Balance, bln September 49.8 41.2 31.0

09:00 Eurozone Eurogroup Meetings

The U.S. dollar traded lower against the most major currencies on comments by Federal Reserve Vice Chairman Stanley Fischer. He warned at the weekend that the global recovery slowed down and the Fed could delay an interest rate hike.

The New Zealand dollar rose against the U.S. dollar after the Chinese trade data. Chinese exports increased 15.3% in September, while imports climbed 7%. China's trade surplus decreased to $31 billion in September from $49.8 billion in August, missing expectations for a decline to a surplus of $41.2 billion.

New Zealand's food price index dropped 0.8% in September, after a 0.3% rise in August.

The Australian dollar increased against the U.S. dollar after the Chinese trade data. No major economic reports were released in Australia.

The Japanese yen jumped against the U.S. dollar due to increasing demand for safe-haven currency on concerns about the global economic growth. Markets in Japan were closed for a public holiday.

EUR/USD: the currency pair rose to $1.2697

GBP/USD: the currency pair increased to $1.6120

USD/JPY: the currency pair fell to Y107.05

The most important news that are expected (GMT0):

12:00 Canada Bank holiday

22:30 Australia RBA Assist Gov Debelle Speaks

-

06:23

Options levels on monday, October 13, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2837 (2212)

$1.2801 (2537)

$1.2741 (1715)

Price at time of writing this review: $ 1.2680

Support levels (open interest**, contracts):

$1.2582 (3213)

$1.2528 (2513)

$1.2502 (3703)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 50868 contracts, with the maximum number of contracts with strike price $1,2900 (6169);

- Overall open interest on the PUT options with the expiration date November, 7 is 50788 contracts, with the maximum number of contracts with strike price $1,2400 (5329);

- The ratio of PUT/CALL was 0.99 versus 0.98 from the previous trading day according to data from October, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.6402 (1476)

$1.6303 (1274)

$1.6206 (1920)

Price at time of writing this review: $1.6109

Support levels (open interest**, contracts):

$1.5990 (2088)

$1.5893 (910)

$1.5796 (1500)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 24726 contracts, with the maximum number of contracts with strike price $1,6200 (1920);

- Overall open interest on the PUT options with the expiration date November, 7 is 30587 contracts, with the maximum number of contracts with strike price $1,5400 (2504);

- The ratio of PUT/CALL was 1.24 versus 1.31 from the previous trading day according to data from October, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:20

Hang Seng 22,962.12 -126.42 -0.55%, S&P/ASX 200 5,158.5 -29.75 -0.57%, Shanghai Composite 2,360.25 -14.29 -0.60%

-

03:01

China: Trade Balance, bln, September 31.0 (forecast 41.2)

-