Notícias do Mercado

-

23:24

Currencies. Daily history for Oct 13'2014:

(pare/closed(GMT +2)/change, %)

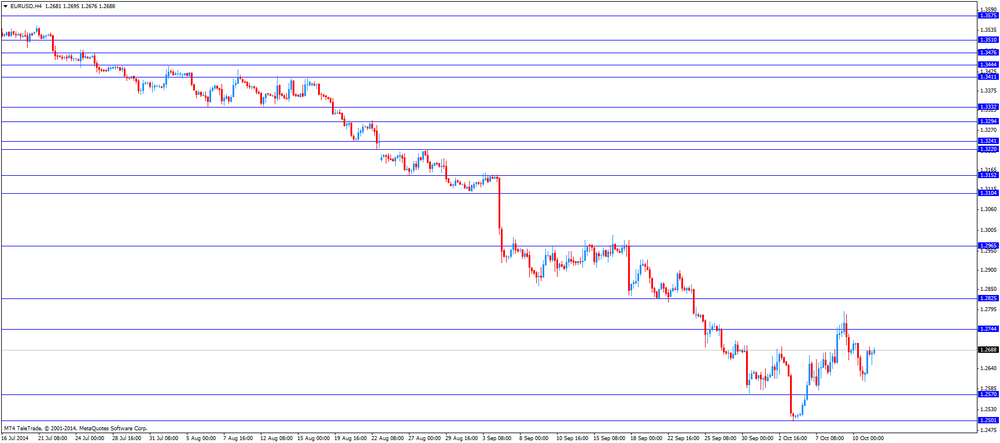

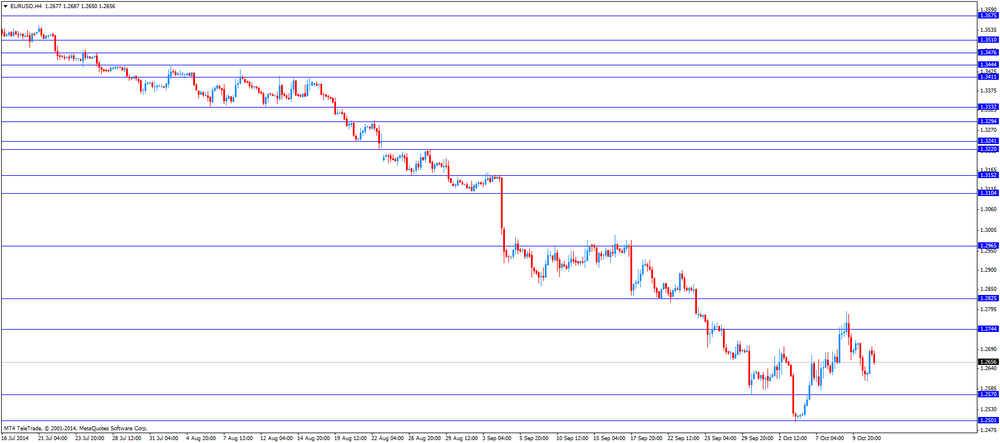

EUR/USD $1,2740 +0,88%

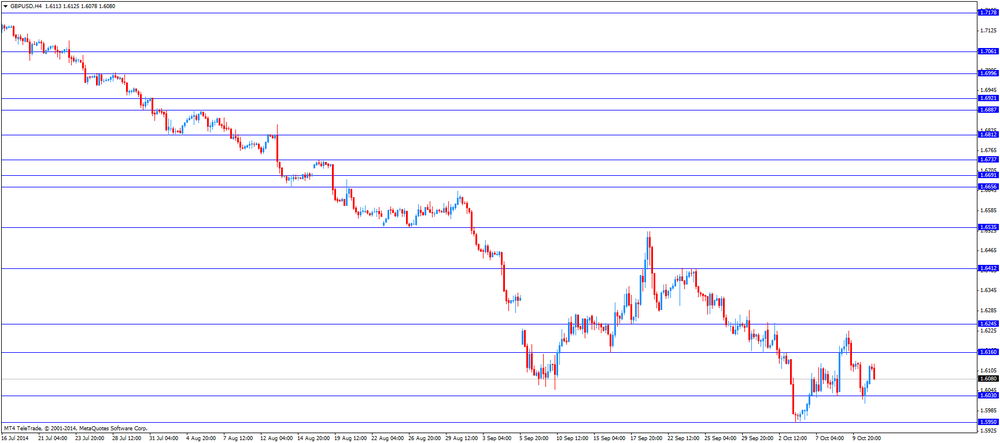

GBP/USD $1,6074 +0,01%

USD/CHF Chf0,9486 -0,87%

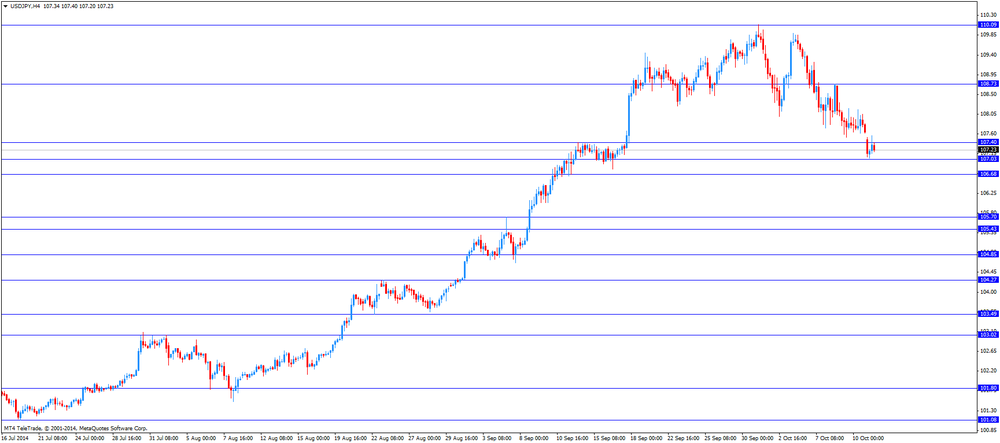

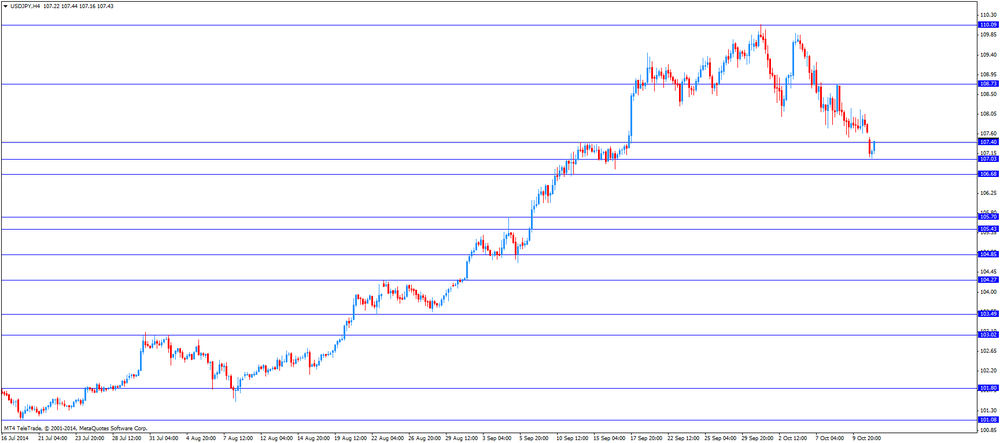

USD/JPY Y106,98 -0,62%

EUR/JPY Y136,30 +0,27%

GBP/JPY Y171,93 -0,63%

AUD/USD $0,8759 +0,86%

NZD/USD $0,7886 +0,93%

USD/CAD C$1,1190 -0,07%

-

23:01

Schedule for today, Tuesday, Oct 14’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia National Australia Bank's Business Confidence September 8

06:45 France CPI, m/m September +0.4% -0.3%

06:45 France CPI, y/y September +0.5% +0.4%

07:15 Switzerland Producer & Import Prices, m/m September -0.2% +0.3%

07:15 Switzerland Producer & Import Prices, y/y September -1.2% -1.4%

08:30 United Kingdom Retail Price Index, m/m September +0.4% +0.3%

08:30 United Kingdom Retail prices, Y/Y September +2.4% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) September -0.6% -0.4%

08:30 United Kingdom Producer Price Index - Input (YoY) September -7.2% -6.6%

08:30 United Kingdom RPI-X, Y/Y September +2.5%

08:30 United Kingdom Producer Price Index - Output (MoM) September -0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) September -0.3% -0.4%

08:30 United Kingdom HICP, m/m September +0.4% +0.3%

08:30 United Kingdom HICP, Y/Y September +1.5% +1.4%

08:30 United Kingdom HICP ex EFAT, Y/Y September +1.9% +1.8%

09:00 Eurozone ZEW Economic Sentiment October 14.2 7.1

09:00 Eurozone Industrial production, (MoM) August +1.0% -1.5%

09:00 Eurozone Industrial Production (YoY) August +2.2% -0.9%

09:00 Eurozone ECOFIN Meetings

09:00 Germany ZEW Survey - Economic Sentiment October 6.9 0.2

23:30 Australia Westpac Consumer Confidence October -4.6%

-

16:35

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies in a quiet trade

The U.S. dollar traded higher against the most major currencies in a quiet trade. The U.S. bond market was closed for the Columbus Day holiday.

Comments by Federal Reserve Vice Chairman Stanley Fischer still weighed on the greenback. He warned at the weekend that the global recovery slowed down and the Fed could delay an interest rate hike.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone. Market participants speculate Europe is headed for recession.

Investors also speculate the stimulus measures by the European Central Bank would not be enough to boost the economy in the Eurozone.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar. Markets in Canada are closed for a public holiday.

The New Zealand dollar traded slightly lower against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the Chinese trade data. Chinese exports increased 15.3% in September, while imports climbed 7%. China's trade surplus decreased to $31 billion in September from $49.8 billion in August, missing expectations for a decline to a surplus of $41.2 billion.

New Zealand's food price index dropped 0.8% in September, after a 0.3% rise in August.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after the Chinese trade data. No major economic reports were released in Australia.

The Japanese yen traded slightly lower against the U.S. dollar. In the overnight trading session, the yen surged against the greenback due to increasing demand for safe-haven currency on concerns about the global economic growth. Markets in Japan were closed for a public holiday.

-

14:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2650(E205mn), $1.2685(E811mn), $1.2700(E855mn), $1.2730(E252mn)

USD/JPY: Y105.00($1.32bn), Y108.75($295mn)

GBP/USD: $1.5900(stg830mn), $1.5905(stg201mn), $1.6220(stg252mn), $1.6230(stg598mn)

AUD/USD: $0.8665-75(A$340mn), $0.8700(A$756mn), $0.8720-25(A$502mn), $0.8750(A$433mn), $0.8800(A$486mn), $0.8850(A$1.1bn), $0.8900(1.15bn)

NZD/USD: $0.7870(NZ$301mn)

-

13:00

Orders

EUR/USD

Offers $1.2800/10, $1.2715

Bids $1.2600, $1.2585/80, $1.2500

GBP/USD

Offers $1.6415, $1.6300, $1.6225

Bids $1.6010-00, $1.5980, $1.5950

AUD/USD

Offers $0.8845/50, $0.8820, $0.8800, $0.8785

Bids $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.20, Y138.00, Y137.85/90, Y137.50, Y137.20

Bids Y135.50, Y135.00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.20

Bids Y107.00, Y106.85/80

EUR/GBP

Offers stg0.7900, stg0.7980

Bids stg0.7840/30, stg0.7820, stg0.7800

-

13:00

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

02:00 China Trade Balance, bln September 49.8 41.2 31.0

09:00 Eurozone Eurogroup Meetings

12:00 Canada Bank holiday

The U.S. dollar traded mixed against the most major currencies. Comments by Federal Reserve Vice Chairman Stanley Fischer still weighed on the greenback. He warned at the weekend that the global recovery slowed down and the Fed could delay an interest rate hike.

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone. Market participants speculate Europe is headed for recession.

Investors also speculate the stimulus measures by the European Central Bank would not be enough to boost the economy in the Eurozone.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar. Markets in Canada are closed for a public holiday.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.6069

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

22:30 Australia RBA Assist Gov Debelle Speaks

-

10:27

Option expiries for today's 1400GMT cut

EUR/USD: $1.2650(E205mn), $1.2685(E811mn), $1.2700(E855mn), $1.2730(E252mn)

USD/JPY: Y105.00($1.32bn), Y108.75($295mn)

GBP/USD: $1.5900(stg830mn), $1.5905(stg201mn), $1.6220(stg252mn), $1.6230(stg598mn)

AUD/USD: $0.8665-75(A$340mn), $0.8700(A$756mn), $0.8720-25(A$502mn), $0.8750(A$433mn), $0.8800(A$486mn), $0.8850(A$1.1bn), $0.8900(1.15bn)

NZD/USD: $0.7870(NZ$301mn)

-

10:11

Foreign exchange market. Asian session: the U.S. dollar traded lower against the most major currencies on comments by Federal Reserve Vice Chairman Stanley Fischer

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

02:00 China Trade Balance, bln September 49.8 41.2 31.0

09:00 Eurozone Eurogroup Meetings

The U.S. dollar traded lower against the most major currencies on comments by Federal Reserve Vice Chairman Stanley Fischer. He warned at the weekend that the global recovery slowed down and the Fed could delay an interest rate hike.

The New Zealand dollar rose against the U.S. dollar after the Chinese trade data. Chinese exports increased 15.3% in September, while imports climbed 7%. China's trade surplus decreased to $31 billion in September from $49.8 billion in August, missing expectations for a decline to a surplus of $41.2 billion.

New Zealand's food price index dropped 0.8% in September, after a 0.3% rise in August.

The Australian dollar increased against the U.S. dollar after the Chinese trade data. No major economic reports were released in Australia.

The Japanese yen jumped against the U.S. dollar due to increasing demand for safe-haven currency on concerns about the global economic growth. Markets in Japan were closed for a public holiday.

EUR/USD: the currency pair rose to $1.2697

GBP/USD: the currency pair increased to $1.6120

USD/JPY: the currency pair fell to Y107.05

The most important news that are expected (GMT0):

12:00 Canada Bank holiday

22:30 Australia RBA Assist Gov Debelle Speaks

-

06:23

Options levels on monday, October 13, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2837 (2212)

$1.2801 (2537)

$1.2741 (1715)

Price at time of writing this review: $ 1.2680

Support levels (open interest**, contracts):

$1.2582 (3213)

$1.2528 (2513)

$1.2502 (3703)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 50868 contracts, with the maximum number of contracts with strike price $1,2900 (6169);

- Overall open interest on the PUT options with the expiration date November, 7 is 50788 contracts, with the maximum number of contracts with strike price $1,2400 (5329);

- The ratio of PUT/CALL was 0.99 versus 0.98 from the previous trading day according to data from October, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.6402 (1476)

$1.6303 (1274)

$1.6206 (1920)

Price at time of writing this review: $1.6109

Support levels (open interest**, contracts):

$1.5990 (2088)

$1.5893 (910)

$1.5796 (1500)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 24726 contracts, with the maximum number of contracts with strike price $1,6200 (1920);

- Overall open interest on the PUT options with the expiration date November, 7 is 30587 contracts, with the maximum number of contracts with strike price $1,5400 (2504);

- The ratio of PUT/CALL was 1.24 versus 1.31 from the previous trading day according to data from October, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

China: Trade Balance, bln, September 31.0 (forecast 41.2)

-