Notícias do Mercado

-

23:20

Currencies. Daily history for Oct 14'2014:

(pare/closed(GMT +2)/change, %)

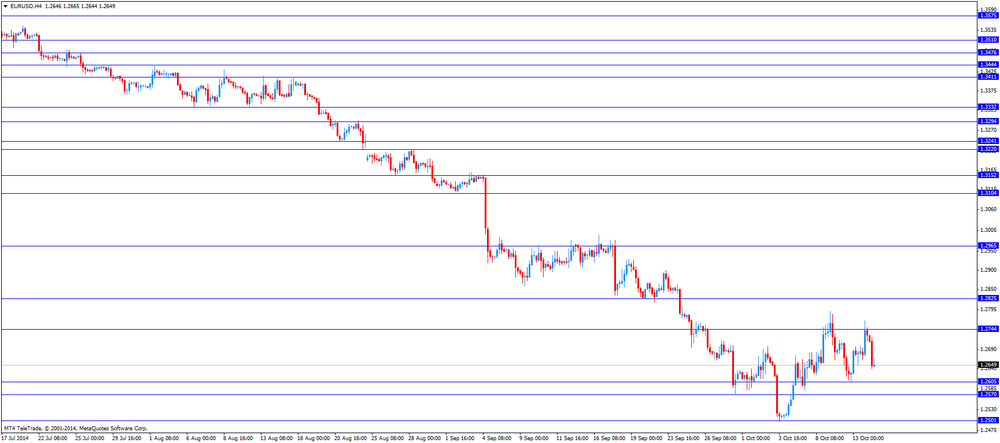

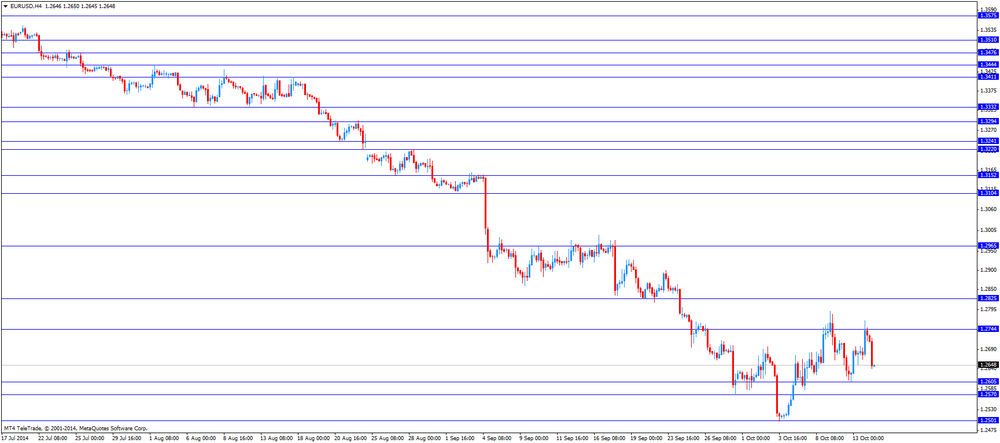

EUR/USD $1,2657 -0,66%

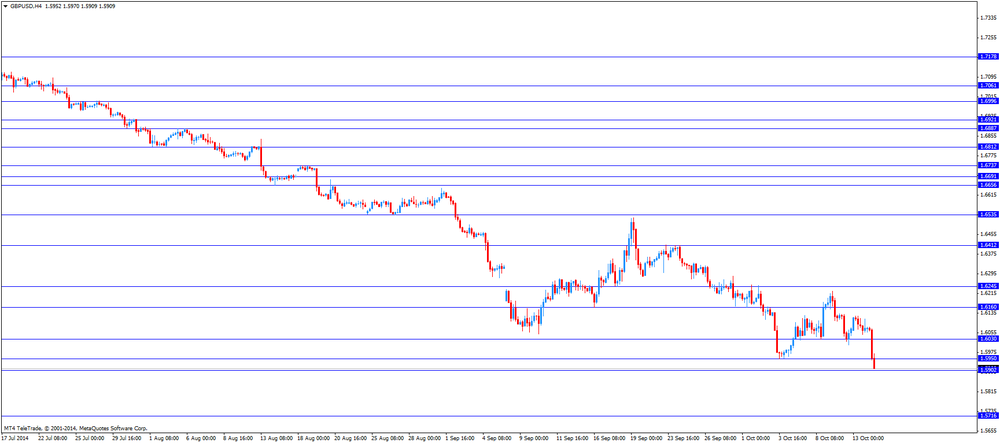

GBP/USD $1,5904 -1,07%

USD/CHF Chf0,9537 +0,53%

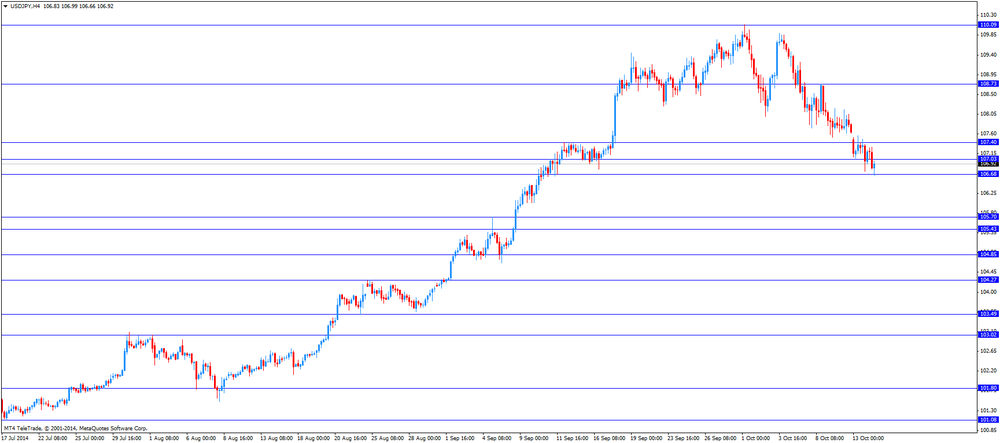

USD/JPY Y107,13 +0,14%

EUR/JPY Y135,60 -0,52%

GBP/JPY Y170,37 -0,92%

AUD/USD $0,8718 -0,47%

NZD/USD $0,7837 -0,63%

USD/CAD C$1,1293 +0,91%

-

23:01

Schedule for today, Wednesday, Oct 15’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia New Motor Vehicle Sales (MoM) September -1.8%

00:30 Australia New Motor Vehicle Sales (YoY) September -3.5%

01:30 China PPI y/y September -1.2% -1.4%

01:30 China CPI y/y September +2.0% +1.7%

04:30 Japan Industrial Production (YoY) (Finally) August -0.7% -0.7%

04:30 Japan Industrial Production (MoM) (Finally) August -1.5% -1.5%

06:00 Germany CPI, y/y (Finally) September +0.8% +0.8%

06:00 Germany CPI, m/m (Finally) September 0.0% 0.0%

07:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Average earnings ex bonuses, 3 m/y August +0.7% +0.8%

08:30 United Kingdom Average Earnings, 3m/y August +0.6% +0.7%

08:30 United Kingdom ILO Unemployment Rate August 6.2% 6.1%

08:30 United Kingdom Claimant count September -37.2 -34.2

08:30 United Kingdom Claimant Count Rate September 2.9%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) October -7.7 -12.0

12:30 U.S. PPI, m/m September 0.0% +0.1%

12:30 U.S. Retail sales September +0.6% -0.1%

12:30 U.S. Retail sales excluding auto September +0.3% +0.2%

12:30 U.S. PPI, y/y September +1.8% +1.7%

12:30 U.S. PPI excluding food and energy, m/m September +0.1% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y September +1.8% +1.7%

12:30 U.S. NY Fed Empire State manufacturing index September 27.5 20.3

14:00 U.S. Business inventories August +0.4% +0.4%

18:00 Eurozone ECB President Mario Draghi Speaks

18:00 U.S. Fed's Beige Book

20:30 U.S. API Crude Oil Inventories October +5.1

21:30 New Zealand Business NZ PMI September 56.5

-

16:33

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

The U.S. dollar traded mixed against the most major currencies. No major economic reports will be released in the U.S. today.

The euro traded higher against the U.S. dollar. Earlier, the euro dropped against the greenback due to the weaker-than-expected the weaker-than-expected ZEW economic sentiment data. The ZEW released its economic sentiment index for Germany and the Eurozone today. The economic sentiment index for Germany dropped to -3.6 in October from 6.9 in September, missing expectations for a decrease to 0.2.

The economic sentiment index for the Eurozone fell to 4.1 in October from 14.2 in September, missing expectations for a decline to 7.1.

The ZEW economic sentiment data fuelled concern the Eurozone falls into recession.

Eurozone's industrial production fell 1.8% in August, missing expectations for a 1.5% decline, after a 0.9% gain in July. July's figure was revised down from a 1.0% increase.

France's consumer price index declined to an annual rate of 0.4% in September from 0.5% in August, in line with expectations.

The British pound traded mixed against the U.S. dollar. In the morning trading session, the pound plunged against the greenback due to the weaker-than-expected consumer price inflation in the U.K. The U.K. consumer price index declined to 1.2% in September from 1.5% in August, missing forecasts of a fall to 1.4%. That was the lowest level since September 2009.

The drop was driven by lower energy and food prices. Fuel prices decreased 6% in September, while food prices fell 1.5%.

The consumer price inflation data could mean that the Bank of England will delay its interest rate hike.

The Swiss franc traded higher against the U.S. dollar. In the morning trading session, the Swiss franc declined against the greenback. Swiss producer and import prices declined 0.1% in September, missing expectations for a 0.3% gain, after a 0.2% drop in August.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi increased the greenback as the People's Bank of China lowered a 14-day repo rate. That could be signs that China's central bank is willing to boost the economy. Bloomberg reported that the People's Bank of China sold 20 billion yuan of 14-day repurchase agreements at 3.4% (a 14-day repo rate was 3.5% last week).

No major economic reports were released in New Zealand.

The Australian dollar traded mixed against the U.S. dollar. The National Australia Bank's business confidence index fell to 5 in September from 7 in August. August's figure was revised down from 8.

The RBA assistant governor Guy Debelle said at the Citi Annual Australian and New Zealand investment conference in Sydney that the Aussie was still too high despite the decline in September. He also said that the next sell-off in global fixed-income markets could be "relatively violent".

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports in Japan.

-

16:15

Switzerland’s producer and import prices fell 0.1% in September

Switzerland's Federal Statistical Office released the producer and import prices data today. Swiss producer and import prices declined 0.1% in September, missing expectations for a 0.3% gain, after a 0.2% drop in August.

On a yearly basis, producer and import prices fell 1.4% in September, in line with expectations, after a 1.2% decline in August. That was the 12th decline in 12 months.

-

15:57

Reserve Bank of Australia (RBA) assistant governor Guy Debelle: the Aussie was still too high despite the decline in September

The Reserve Bank of Australia (RBA) assistant governor Guy Debelle said at the Citi Annual Australian and New Zealand investment conference in Sydney:

- The Aussie was still too high despite the decline in September;

- "The exchange rate is thus offering less assistance than would normally be expected in achieving balanced growth in the Australian economy. A lower exchange rate would be helpful in achieving that objective";

- The next sell-off in global fixed-income markets could be "relatively violent";

- Monetary policies in "the U.S., China, Europe and Japan are moving in divergent directions";

- "It is challenging for foreign exchange markets and it creates a complicated environment for setting monetary policy in other parts of the world, including here in Australia";

- Volatility picked up in foreign exchange markets but "it has not yet returned to a 'normal' level of volatility".

- The Aussie was still too high despite the decline in September;

-

15:14

Drop of ZEW economic sentiment for Germany was driven by geopolitical tensions and the weak economic development

The ZEW released its economic sentiment index for Germany and the Eurozone today. The economic sentiment index for Germany dropped to -3.6 in October from 6.9 in September, missing expectations for a decrease to 0.2. That was the 10th straight decline in 10 months and the lowest level since November 2012.

The economic sentiment index for the Eurozone fell to 4.1 in October from 14.2 in September, missing expectations for a decline to 7.1.

The ZEW President Clemens Fuest said that the decline was driven by "geopolitical tensions and the weak economic development in some parts of the Eurozone". He added the disappointing economic data have contributed to the growing pessimism.

-

14:48

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E1.67bn), $1.2615(E610mn), $1.2625(E2.44bn), $1.2650(E2.36bn), $1.2700(E1.29bn), $1.2725(E313mn), $1.2740(E383mn), $1.2745(E348mn), $1.2750(E2.17bn), $1.2800(E218mn), $1.2825(E1.37bn)

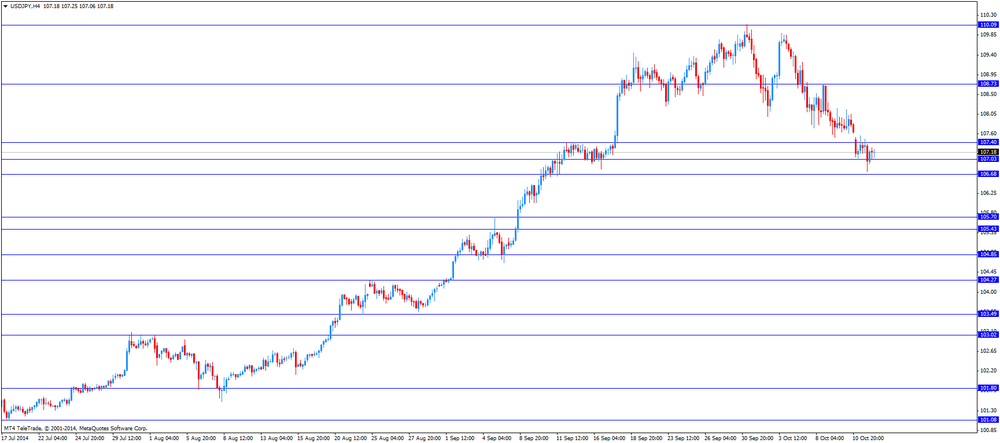

USD/JPY: Y106.85($410mn), Y107.00($917mn), Y107.50($701mn), Y107.75($600mn), Y108.00(1.1bn)

EUR/JPY: Y135.80(E200mn)

GBP/USD: $1.6100(stg210mn)

EUR/GBP: stg0.7900(E200mn), stg7960-65(E420mn)

AUD/USD: $0.8780(A$200mn), $0.8800(A$1.48bn), $0.8855(A$200mn)

NZD/USD: $0.7940(NZ$729mn)

AUD/NZD: NZ$1.1025(A$290mn), NZ$1.1135(A$360mn)

USD/CAD: C$1.1150($365mn), C$1.1260-65($470mn)

-

13:05

Foreign exchange market. European session: the British pound plunged against the U.S. dollar due to the weaker-than-expected consumer price inflation in the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia National Australia Bank's Business Confidence September 7 Revised From 8 5

06:45 France CPI, m/m September +0.4% -0.3% -0.4%

06:45 France CPI, y/y September +0.5% +0.4% +0.4%

07:15 Switzerland Producer & Import Prices, m/m September -0.2% +0.3% -0.1%

07:15 Switzerland Producer & Import Prices, y/y September -1.2% -1.4% -1.4%

08:30 United Kingdom Retail Price Index, m/m September +0.4% +0.3% +0.2%

08:30 United Kingdom Retail prices, Y/Y September +2.4% +2.3% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) September -0.6% -0.4% -0.6%

08:30 United Kingdom Producer Price Index - Input (YoY) September -7.2% -6.6% -7.4%

08:30 United Kingdom RPI-X, Y/Y September +2.5% +2.3%

08:30 United Kingdom Producer Price Index - Output (MoM) September -0.1% -0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) September -0.3% -0.4% -0.4%

08:30 United Kingdom HICP, m/m September +0.4% +0.3% +0.0%

08:30 United Kingdom HICP, Y/Y September +1.5% +1.4% +1.2%

08:30 United Kingdom HICP ex EFAT, Y/Y September +1.9% +1.8% +1.5%

09:00 Eurozone ZEW Economic Sentiment October 14.2 7.1 4.1

09:00 Eurozone Industrial production, (MoM) August +1.0% -1.5% -1.8%

09:00 Eurozone Industrial Production (YoY) August +2.2% -0.9% -1.9%

09:00 Eurozone ECOFIN Meetings

09:00 Germany ZEW Survey - Economic Sentiment October 6.9 0.2 -3.6

The U.S. dollar traded higher against the most major currencies. No major economic reports will be released in the U.S. today.

The euro dropped against the U.S. dollar due to the weaker-than-expected the weaker-than-expected ZEW economic sentiment data. The ZEW released its economic sentiment index for Germany and the Eurozone today. The economic sentiment index for Germany dropped to -3.6 in October from 6.9 in September, missing expectations for a decrease to 0.2.

The economic sentiment index for the Eurozone fell to 4.1 in October from 14.2 in September, missing expectations for a decline to 7.1.

The ZEW economic sentiment data fuelled concern the Eurozone falls into recession.

Eurozone's industrial production fell 1.8% in August, missing expectations for a 1.5% decline, after a 0.9% gain in July. July's figure was revised down from a 1.0% increase.

France's consumer price index declined to an annual rate of 0.4% in September from 0.5% in August, in line with expectations.

The British pound plunged against the U.S. dollar due to the weaker-than-expected consumer price inflation in the U.K. The U.K. consumer price index declined to 1.2% in September from 1.5% in August, missing forecasts of a fall to 1.4%. That was the lowest level since September 2009.

The drop was driven by lower energy and food prices. Fuel prices decreased 6% in September, while food prices fell 1.5%.

The consumer price inflation data could mean that the Bank of England will delay its interest rate hike.

The Swiss franc fell against the U.S. dollar. Swiss producer and import prices declined 0.1% in September, missing expectations for a 0.3% gain, after a 0.2% drop in August.

EUR/USD: the currency pair fell to 1.2639

GBP/USD: the currency pair decreased to $1.5909

USD/JPY: the currency pair rose to Y106.66

The most important news that are expected (GMT0):

23:30 Australia Westpac Consumer Confidence October -4.6%

-

13:00

Orders

EUR/USD

Offers $1.2900, $1.2865, $1.2800/10

Bids $1.2600, $1.2585/80, $1.2500

GBP/USD

Offers $1.6415, $1.6300, $1.6225

Bids $1.5900, $1.5850

AUD/USD

Offers $0.8895, $0.8845/50, $0.8820, $0.8810

Bids $0.8700, $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.00, Y137.85/90, Y137.50, Y136.95, Y136.00

Bids Y135.00, Y134.00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.15, Y107.60

Bids Y106.60, Y106.00

EUR/GBP

Offers stg0.7900, stg0.7980, stg0.7955

Bids stg0.7890, stg0.7840/30, stg0.7820, stg0.7800

-

11:25

UK consumer price inflation fell to 1.2% in September

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. today. The U.K. consumer price index declined to 1.2% in September from 1.5% in August, missing forecasts of a fall to 1.4%. That was the lowest level since September 2009.

The drop was driven by lower energy and food prices. Fuel prices decreased 6% in September, while food prices fell 1.5%.

The Retail Prices Index declined to 2.3% in September from 2.4% in August.

The Bank of England's target is about 2%.

The consumer price inflation data could mean that the Bank of England will delay its interest rate hike.

-

11:02

EURUSD declines due to the weaker-than-expected ZEW Economic Sentiment

The ZEW released its economic sentiment index for Germany and the Eurozone today. The economic sentiment index for Germany dropped to -3.6 in October from 6.9 in September, missing expectations for a decrease to 0.2.

The economic sentiment index for the Eurozone fell to 4.1 in October from 14.2 in September, missing expectations for a decline to 7.1.

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E1.67bn), $1.2615(E610mn), $1.2625(E2.44bn), $1.2650(E2.36bn), $1.2700(E1.29bn), $1.2725(E313mn), $1.2740(E383mn), $1.2745(E348mn), $1.2750(E2.17bn), $1.2800(E218mn), $1.2825(E1.37bn)

USD/JPY: Y106.85($410mn), Y107.00($917mn), Y107.50($701mn), Y107.75($600mn), Y108.00(1.1bn)

EUR/JPY: Y135.80(E200mn)

GBP/USD: $1.6100(stg210mn)

EUR/GBP: stg0.7900(E200mn), stg7960-65(E420mn)

AUD/USD: $0.8780(A$200mn), $0.8800(A$1.48bn), $0.8855(A$200mn)

NZD/USD: $0.7940(NZ$729mn)

AUD/NZD: NZ$1.1025(A$290mn), NZ$1.1135(A$360mn)

USD/CAD: C$1.1150($365mn), C$1.1260-65($470mn)

-

10:04

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar despite the weak National Australia Bank's business confidence index and comment by the Reserve Bank of Australia assistant governor Guy Debelle

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia National Australia Bank's Business Confidence September 7 Revised From 8 5

06:45 France CPI, m/m September +0.4% -0.3% -0.4%

06:45 France CPI, y/y September +0.5% +0.4% +0.4%

07:15 Switzerland Producer & Import Prices, m/m September -0.2% +0.3% -0.1%

07:15 Switzerland Producer & Import Prices, y/y September -1.2% -1.4% -1.4%

08:30 United Kingdom Retail Price Index, m/m September +0.4% +0.3% +0.2%

08:30 United Kingdom Retail prices, Y/Y September +2.4% +2.3% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) September -0.6% -0.4% -0.6%

08:30 United Kingdom Producer Price Index - Input (YoY) September -7.2% -6.6% -7.4%

08:30 United Kingdom RPI-X, Y/Y September +2.5% +2.3%

08:30 United Kingdom Producer Price Index - Output (MoM) September -0.1% -0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) September -0.3% -0.4% -0.4%

08:30 United Kingdom HICP, m/m September +0.4% +0.3% +0.0%

08:30 United Kingdom HICP, Y/Y September +1.5% +1.4% +1.2%

08:30 United Kingdom HICP ex EFAT, Y/Y September +1.9% +1.8% +1.5%

09:00 Eurozone ZEW Economic Sentiment October 14.2 7.1 4.1

09:00 Eurozone Industrial production, (MoM) August +1.0% -1.5% -1.8%

09:00 Eurozone Industrial Production (YoY) August +2.2% -0.9% -1.9%

09:00 Eurozone ECOFIN Meetings

09:00 Germany ZEW Survey - Economic Sentiment October 6.9 0.2 -3.6

The U.S. dollar traded mixed against the most major currencies on comments. No major economic reports were released in the U.S. yesterday. The U.S. bond market was closed for the Columbus Day holiday.

The New Zealand dollar traded higher against the U.S. dollar as the People's Bank of China lowered a 14-day repo rate. That could be signs that China's central bank is willing to boost the economy. Bloomberg reported that the People's Bank of China sold 20 billion yuan of 14-day repurchase agreements at 3.4% (a 14-day repo rate was 3.5% last week).

No major economic reports were released in New Zealand.

The Australian dollar traded higher against the U.S. dollar despite the weak National Australia Bank's business confidence index and comment by the Reserve Bank of Australia (RBA) assistant governor Guy Debelle.

The National Australia Bank's business confidence index fell to 5 in September from 7 in August. August's figure was revised down from 8.

The RBA assistant governor Guy Debelle said at the Citi Annual Australian and New Zealand investment conference in Sydney that the Aussie was still too high despite the decline in September. He also said that the next sell-off in global fixed-income markets could be "relatively violent".

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair rose to $1.2697

GBP/USD: the currency pair increased to $1.6120

USD/JPY: the currency pair fell to Y107.05

The most important news that are expected (GMT0):

23:30 Australia Westpac Consumer Confidence October -4.6%

-

10:01

Eurozone: ZEW Economic Sentiment, October 4.1 (forecast 7.1)

-

10:00

Eurozone: Industrial production, (MoM), August -1.8% (forecast -1.5%)

-

10:00

Eurozone: Industrial Production (YoY), August -1.9% (forecast -0.9%)

-

10:00

Germany: ZEW Survey - Economic Sentiment, October -3.6 (forecast 0.2)

-

09:32

United Kingdom: Producer Price Index - Output (YoY) , September -0.4% (forecast -0.4%)

-

09:32

United Kingdom: Retail Price Index, m/m, September +0.2% (forecast +0.3%)

-

09:32

United Kingdom: Retail prices, Y/Y, September +2.3% (forecast +2.3%)

-

09:32

United Kingdom: HICP ex EFAT, Y/Y, September +1.5% (forecast +1.8%)

-

09:31

United Kingdom: Producer Price Index - Input (YoY) , September -7.4% (forecast -6.6%)

-

09:31

United Kingdom: Producer Price Index - Input (MoM), September -0.6% (forecast -0.4%)

-

09:31

United Kingdom: Producer Price Index - Output (MoM), September -0.1% (forecast -0.1%)

-

09:30

United Kingdom: HICP, Y/Y, September +1.2% (forecast +1.4%)

-

09:30

United Kingdom: HICP, m/m, September +0.0% (forecast +0.3%)

-

08:16

Switzerland: Producer & Import Prices, y/y, September -1.4% (forecast -1.4%)

-

08:15

Switzerland: Producer & Import Prices, m/m, September -0.1% (forecast +0.3%)

-

07:45

France: CPI, m/m, September -0.4% (forecast -0.3%)

-

07:45

France: CPI, y/y, September +0.4% (forecast +0.4%)

-

06:30

Options levels on tuesday, October 14, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2881 (1982)

$1.2844 (2564)

$1.2782 (4254)

Price at time of writing this review: $ 1.2724

Support levels (open interest**, contracts):

$1.2661 (1654)

$1.2627 (3234)

$1.2589 (1789)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 52468 contracts, with the maximum number of contracts with strike price $1,2900 (6362);

- Overall open interest on the PUT options with the expiration date November, 7 is 52137 contracts, with the maximum number of contracts with strike price $1,2400 (5343);

- The ratio of PUT/CALL was 0.99 versus 0.99 from the previous trading day according to data from October, 13

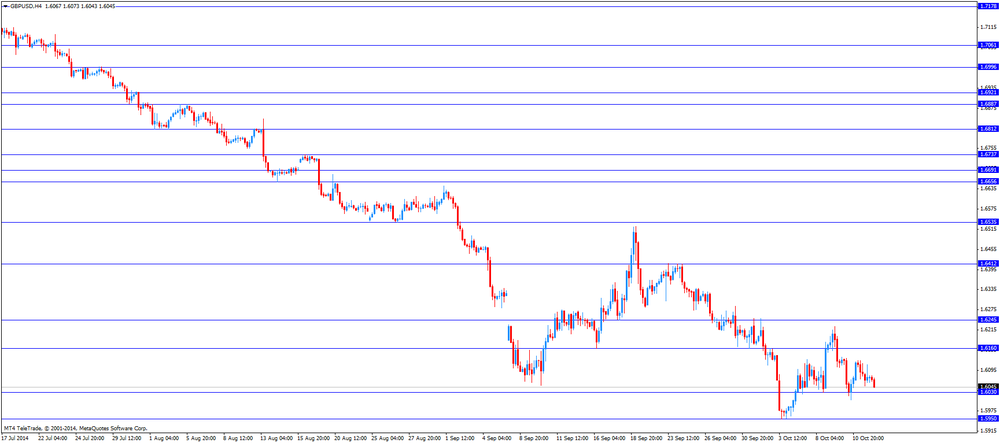

GBP/USD

Resistance levels (open interest**, contracts)

$1.6303 (1358)

$1.6205 (2004)

$1.6109 (1017)

Price at time of writing this review: $1.6078

Support levels (open interest**, contracts):

$1.5991 (2267)

$1.5894 (940)

$1.5796 (1485)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 25236 contracts, with the maximum number of contracts with strike price $1,6200 (2004);

- Overall open interest on the PUT options with the expiration date November, 7 is 31236 contracts, with the maximum number of contracts with strike price $1,5400 (2504);

- The ratio of PUT/CALL was 1.24 versus 1.24 from the previous trading day according to data from October, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:30

Australia: National Australia Bank's Business Confidence, September 5

-

00:01

United Kingdom: BRC Retail Sales Monitor y/y, September -2.1%

-