Notícias do Mercado

-

23:22

Currencies. Daily history for Oct 15'2014:

(pare/closed(GMT +2)/change, %)

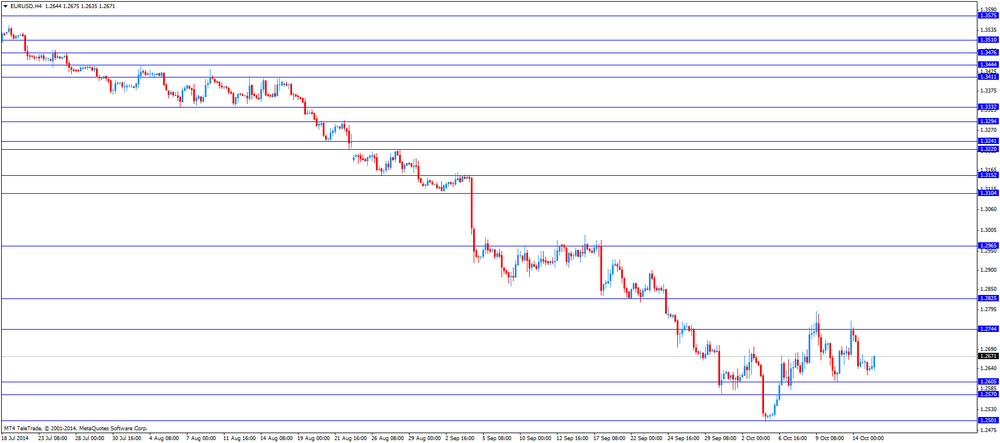

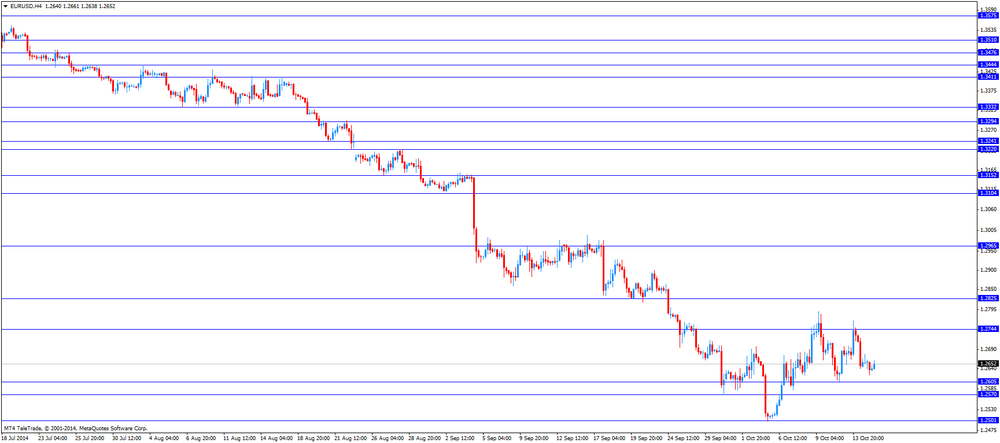

EUR/USD $1,2815 +1,23%

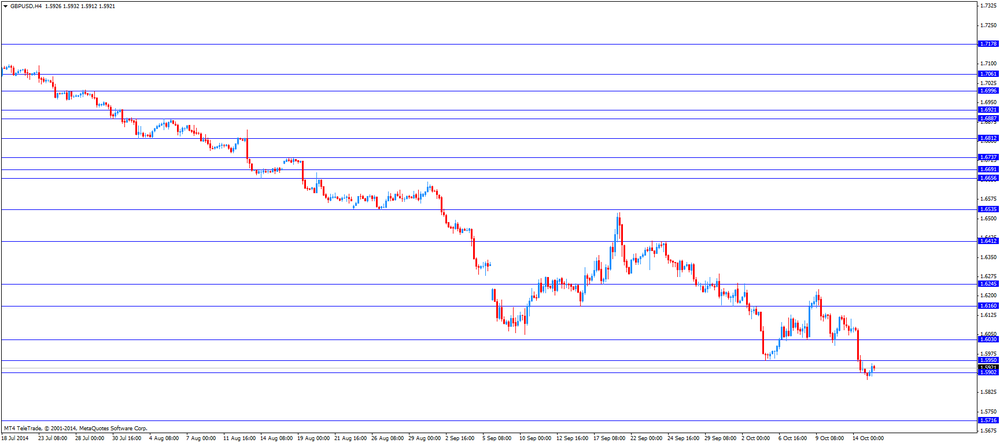

GBP/USD $1,6000 +0,60%

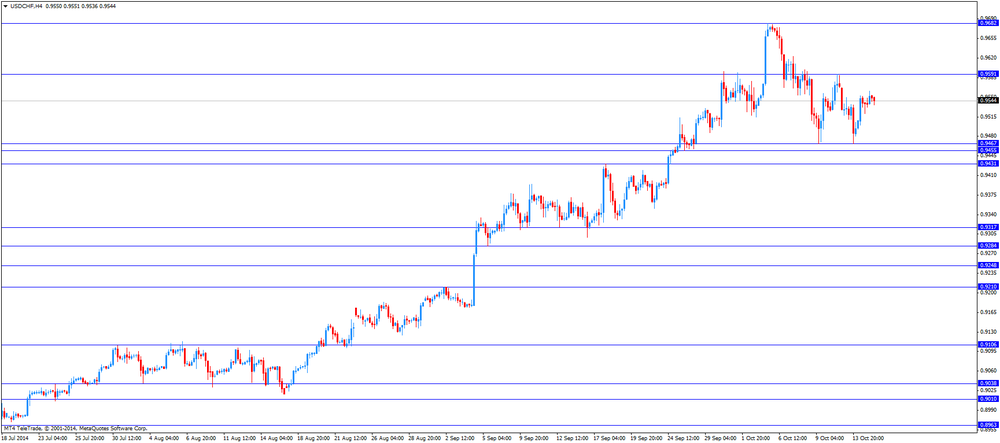

USD/CHF Chf0,9418 -1,26%

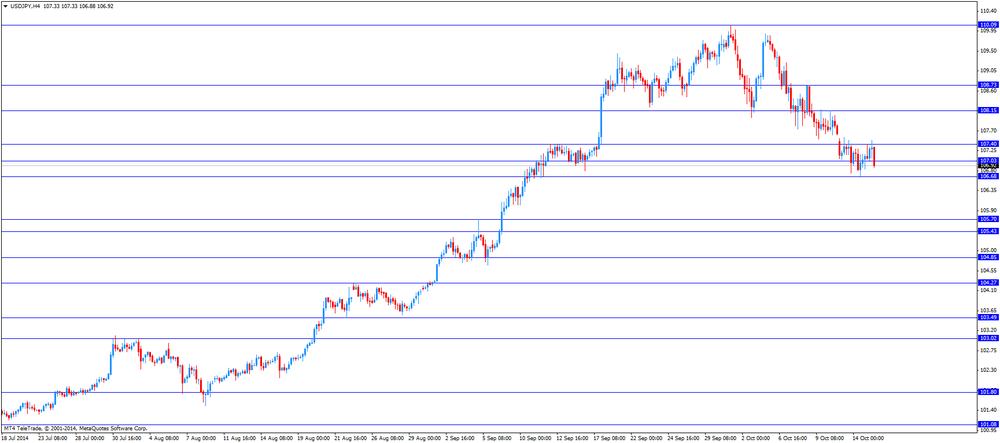

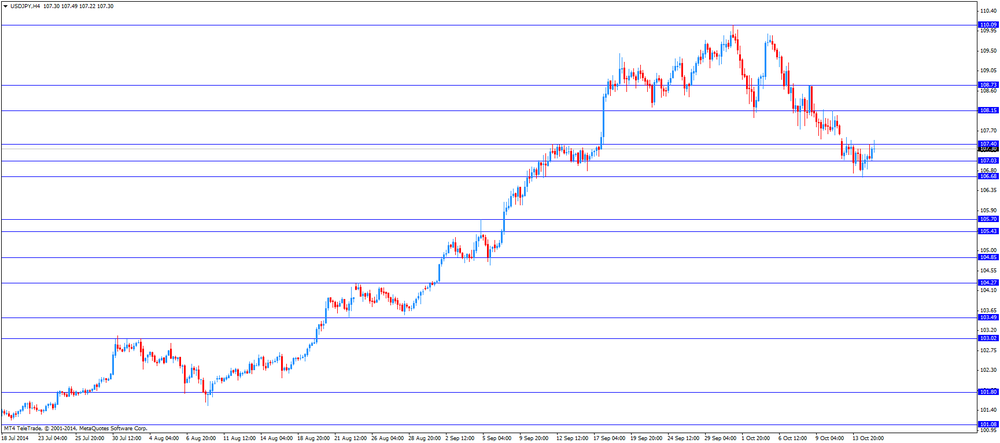

USD/JPY Y106,05 -1,02%

EUR/JPY Y135,90 +0,22%

GBP/JPY Y169,76 -0,36%

AUD/USD $0,8808 +1,02%

NZD/USD $0,7973 +1,71%

USD/CAD C$1,1264 -0,26%

-

23:00

Schedule for today,Thursday, Oct 16’2014:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation September +3.5%

02:00 Australia RBA Assist Gov Debelle Speaks

05:45 Switzerland SECO Economic Forecasts Quarter IV

09:00 Eurozone Harmonized CPI September +0.1% +0.4%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) September +0.3% +0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y September +0.7% +0.7%

09:00 Eurozone Trade Balance s.a. August 12.2 13.5

10:00 Eurozone ECB's Jens Weidmann Speaks

12:00 U.S. FOMC Member Charles Plosser Speaks

12:30 Canada Manufacturing Shipments (MoM) August +2.5% -1.6%

12:30 Canada Foreign Securities Purchases July 5.30 4.31

12:30 U.S. Initial Jobless Claims October 287 286

13:15 U.S. Industrial Production (MoM) September -0.1% +0.4%

13:15 U.S. Capacity Utilization September 78.8% 79.0%

14:00 U.S. Philadelphia Fed Manufacturing Survey October 22.5 19.9

14:00 U.S. FOMC Member Narayana Kocherlakota

14:00 U.S. NAHB Housing Market Index October 59 59

15:00 U.S. Crude Oil Inventories October +5.0

20:00 U.S. Net Long-term TIC Flows August -18.6 23.3

20:00 U.S. Total Net TIC Flows August 57.7

-

22:30

New Zealand: Business NZ PMI, September 58.1

-

16:39

Foreign exchange market. American session: the U.S. dollar traded dropped against the most major currencies after the weaker-than-expected U.S. economic data

The U.S. dollar traded dropped against the most major currencies after the weaker-than-expected U.S. retail sales, the U.S. producer price index (PPI) and the NY Fed Empire State manufacturing index.

The U.S. retail sales declined 0.3% in September, missing expectations for a 0.1% drop, after a 0.6% gain in August.

Retail sales excluding automobiles fell 0.2% in September, missing expectations for a 0.2% increase, after a 0.3% rise in August.

The U.S. PPI fell 0.1% in September, missing expectations for a 0.1% gain, after a flat reading in August.

The decline was driven by the fall in gasoline prices and food prices. Gasoline prices declined 2.6%, while food prices decreased 0.7%.

The U.S. PPI excluding food and energy was flat in September, missing expectations for a 0.1% rise, after a 0.1% gain in August.

The NY Fed Empire State manufacturing index decreased to 6.2 in September from 27.5 in August. Analysts had expected the index to decline to 20.3.

The U.S. business inventories rose by 0.2 percent in August, after a 0.4% in July. That was the smallest increase since June 2013.

The euro jumped against the U.S. dollar. Germany cut its growth forecasts for 2014 and 2015. The growth for this year was lowered to 1.2%, down from 1.8%, while the growth for 2015 was cut to 1.2%, down from 2%.

German consumer price inflation was flat in September, in line with expectations.

The British pound traded higher against the U.S. dollar. The U.K. unemployment rate dropped to 6.0% in the June to August quarter from 6.4% in the three months to July, exceeding expectations for a decline of 6.1%. That was the lowest level since late 2008.

The claimant count decreased by 18,600 people in September, missing expectations for a drop of 34,200 people, after a decrease of 33,200 people in August. August's figure was revised from a decline of 37,200.

Average weekly earnings, excluding bonuses, climbed by 0.9% in the June to August period.

Average weekly earnings, including bonuses, rose by 0.7% in the June to August period, but remained below the current inflation of 1.2%.

The Swiss franc traded higher against the U.S. dollar despite the weaker-than-expected survey by the ZEW Institute and Credit Suisse Group. A survey by the ZEW Institute and Credit Suisse Group showed today that Switzerland's economic sentiment index dropped to -30.7 points in October from -7.7 points in September, missing expectations for a decline to -12.0 points.

The decline was driven by the growth slowdown in the Eurozone could spill over into Switzerland.

The New Zealand dollar rose against the U.S. dollar in the absence of any major market reports from New Zealand.

Chinese economic data was weaker than expected. China's consumer price index declined to 1.6% in September from 2.0% in August, missing expectations for a decline to 1.7%.

China's producer price index dropped to 1.8% in September from a decline of 1.2% in August, missing expectations for a decrease to 1.4%.

The Australian dollar increased against the U.S. dollar. The Westpac consumer confidence in Australia increased 0.9% in October, after a 4.6% fall in September.

New motor vehicle sales in Australia rose 2.9% in September, after a 1.6% decline in August. August's figure was revised up from a 1.8% decrease.

The Japanese yen climbed against the U.S. dollar. Japan's industrial production declined 1.9% in August, after a 1.5% drop in July. Analysts had expected a 1.5% decrease.

Japanese Economics Minister Akira Amari said in parliament that the government does not want to intentionally weaken the yen, and any negative impact from rising import prices should be closely monitored.

-

15:42

US business inventories increased less than expected in August

The US Commerce Department released the business inventories data on Wednesday. The U.S. business inventories rose by 0.2 percent in August, after a 0.4% in July. That was the smallest increase since June 2013.

Analysts had expected a 0.4% increase.

Business sales dropped by 0.4% in August.

Sales by manufacturers decreased by 1.0%, while sales by wholesalers fell by 0.7%.

The business inventories/sales ratio remained unchanged at 1.29 months in August. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

15:00

U.S.: Business inventories , August +0.2% (forecast +0.4%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2605(E1.0bn), $1.2610(E353mn), $1.2700(E1.03bn), $1.2715(E750mn, $1.2735-40(E550mn)

USD/JPY: Y106.55($230mn), Y106.80($186mn), Y107.00($850mn), Y107.20($956mn), Y108.10-15($550mn)

EUR/GBP: stg0.7960(E720mn)

AUD/USD: $0.8800(A$329mn)

USD/CAD: C$1.1150($130mn)

-

14:33

US retail sales dropped 0.3% in September

The Commerce Department released the US retail sales data on Wednesday. The U.S. retail sales declined 0.3% in September, missing expectations for a 0.1% drop, after a 0.6% gain in August.

Retail sales excluding automobiles fell 0.2% in September, missing expectations for a 0.2% increase, after a 0.3% rise in August.

Sales at clothing retailers fell 1.2%, while sales at electronics and appliance stores rose 3.4% in September. Sales at auto dealers declined 0.8%.

-

13:31

U.S.: PPI excluding food and energy, m/m, September 0.0% (forecast +0.1%)

-

13:31

U.S.: PPI, y/y, September +1.6% (forecast +1.7%)

-

13:31

U.S.: PPI excluding food and energy, Y/Y, September +1.6% (forecast +1.7%)

-

13:30

U.S.: NY Fed Empire State manufacturing index , September 6.2 (forecast 20.3)

-

13:30

U.S.: Retail sales, September -0.3% (forecast -0.1%)

-

13:30

U.S.: PPI, m/m, September -0.1% (forecast +0.1%)

-

13:30

U.S.: Retail sales excluding auto, September -0.2% (forecast +0.2%)

-

13:07

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the better-than-expected labour market data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia New Motor Vehicle Sales (MoM) September -1.6% +2.9%

00:30 Australia New Motor Vehicle Sales (YoY) September -3.5% +0.8%

01:30 China PPI y/y September -1.2% -1.4% -1.8%

01:30 China CPI y/y September +2.0% +1.7% +1.6%

04:30 Japan Industrial Production (YoY) (Finally) August -0.7% -0.7% -3.3%

04:30 Japan Industrial Production (MoM) (Finally) August -1.5% -1.5% -1.9%

06:00 Germany CPI, y/y (Finally) September +0.8% +0.8% +0.8%

06:00 Germany CPI, m/m (Finally) September 0.0% 0.0% 0.0%

07:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Average earnings ex bonuses, 3 m/y August +0.8% Revised From +0.7% +0.8% +0.9%

08:30 United Kingdom Average Earnings, 3m/y August +0.6% +0.7% +0.7%

08:30 United Kingdom ILO Unemployment Rate August 6.2% 6.1% 6.0%

08:30 United Kingdom Claimant count September -33.2 Revised From -37.2 -34.2 -18.6

08:30 United Kingdom Claimant Count Rate September 2.9% 2.8%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) October -7.7 -12.0 -30.7

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. retail sales, the U.S. producer price index (PPI) and the NY Fed Empire State manufacturing index.

The U.S. retail sales are expected to decline 0.1% in September, after a 0.6% in August.

The U.S. PPI is expected to rise 1.7% in September, after a 1.8% gain in August.

The NY Fed Empire State manufacturing index is expected to decrease to 20.3 in September from 27.5 in August.

The euro traded higher against the U.S. dollar. Worries about the outlook for the economy in the Eurozone still weighed on the euro. Germany cut its growth forecasts for 2014 and 2015. The growth for this year was lowered to 1.2%, down from 1.8%, while the growth for 2015 was cut to 1.2%, down from 2%.

German consumer price inflation was flat in September, in line with expectations.

The British pound traded higher against the U.S. dollar after the better-than-expected labour market data from the U.K. The U.K. unemployment rate dropped to 6.0% in the June to August quarter from 6.4% in the three months to July, exceeding expectations for a decline of 6.1%. That was the lowest level since late 2008.

The claimant count decreased by 18,600 people in September, missing expectations for a drop of 34,200 people, after a decrease of 33,200 people in August. August's figure was revised from a decline of 37,200.

Average weekly earnings, excluding bonuses, climbed by 0.9% in the June to August period.

Average weekly earnings, including bonuses, rose by 0.7% in the June to August period, but remained below the current inflation of 1.2%.

The Swiss franc traded higher against the U.S. dollar despite the weaker-than-expected survey by the ZEW Institute and Credit Suisse Group. A survey by the ZEW Institute and Credit Suisse Group showed today that Switzerland's economic sentiment index dropped to -30.7 points in October from -7.7 points in September, missing expectations for a decline to -12.0 points.

The decline was driven by the growth slowdown in the Eurozone could spill over into Switzerland.

EUR/USD: the currency pair rose to 1.2675

GBP/USD: the currency pair increased to $1.5939

USD/JPY: the currency pair declined to Y106.88

The most important news that are expected (GMT0):

12:30 U.S. PPI, m/m September 0.0% +0.1%

12:30 U.S. Retail sales September +0.6% -0.1%

12:30 U.S. Retail sales excluding auto September +0.3% +0.2%

12:30 U.S. PPI, y/y September +1.8% +1.7%

12:30 U.S. PPI excluding food and energy, m/m September +0.1% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y September +1.8% +1.7%

12:30 U.S. NY Fed Empire State manufacturing index September 27.5 20.3

14:00 U.S. Business inventories August +0.4% +0.4%

18:00 Eurozone ECB President Mario Draghi Speaks

18:00 U.S. Fed's Beige Book

21:30 New Zealand Business NZ PMI September 56.5

-

13:00

Orders

EUR/USD

Offers $1.2900, $1.2865, $1.2800/10, $1.2765, $1.2680

Bids $1.2600, $1.2585/80, $1.2500

GBP/USD

Offers $1.6415, $1.6300, $1.6225, $1.6205/00

Bids $1.5875, $1.5850, $1.5800

AUD/USD

Offers $0.8895, $0.8845/50, $0.8820, $0.8810

Bids $0.8700, $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.00, Y137.85/90, Y137.50, Y136.55

Bids Y135.00, Y134.00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.15

Bids Y106.60, Y106.00

EUR/GBP

Offers stg0.7900, stg0.7980, stg0.7960

Bids stg0.7890, stg0.7840/30, stg0.7820, stg0.7800

-

11:30

UK unemployment rate dropped to 6.0% in the June to August quarter

The Office for National Statistics released the labour market data today. The U.K. unemployment rate dropped to 6.0% in the June to August quarter from 6.4% in the three months to July, exceeding expectations for a decline of 6.1%. That was the lowest level since late 2008.

The claimant count decreased by 18,600 people in September, missing expectations for a drop of 34,200 people, after a decrease of 33,200 people in August. August's figure was revised from a decline of 37,200.

The employment rate is now 73%.

Average weekly earnings, excluding bonuses, climbed by 0.9% in the June to August period.

Average weekly earnings, including bonuses, rose by 0.7% in the June to August period, but remained below the current inflation of 1.2%.

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD: $1.2605(E1.0bn), $1.2610(E353mn), $1.2700(E1.03bn), $1.2715(E750mn, $1.2735-40(E550mn)

USD/JPY: Y106.55($230mn), Y106.80($186mn), Y107.00($850mn), Y107.20($956mn), Y108.10-15($550mn)

EUR/GBP: stg0.7960(E720mn)

AUD/USD: $0.8800(A$329mn)

USD/CAD: C$1.1150($130mn)

-

10:10

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar after the solid economic data from Australia and despite the weaker-than-expected economic data from China

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia New Motor Vehicle Sales (MoM) September -1.6% +2.9%

00:30 Australia New Motor Vehicle Sales (YoY) September -3.5% +0.8%

01:30 China PPI y/y September -1.2% -1.4% -1.8%

01:30 China CPI y/y September +2.0% +1.7% +1.6%

04:30 Japan Industrial Production (YoY) (Finally) August -0.7% -0.7% -3.3%

04:30 Japan Industrial Production (MoM) (Finally) August -1.5% -1.5% -1.9%

06:00 Germany CPI, y/y (Finally) September +0.8% +0.8% +0.8%

06:00 Germany CPI, m/m (Finally) September 0.0% 0.0% 0.0%

07:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Average earnings ex bonuses, 3 m/y August +0.8% Revised From +0.7% +0.8% +0.9%

08:30 United Kingdom Average Earnings, 3m/y August +0.6% +0.7% +0.7%

08:30 United Kingdom ILO Unemployment Rate August 6.2% 6.1% 6.0%

08:30 United Kingdom Claimant count September -33.2 Revised From -37.2 -34.2 -18.6

08:30 United Kingdom Claimant Count Rate September 2.9% 2.8%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) October -7.7 -12.0 -30.7

The U.S. dollar traded mixed against the most major currencies on comments. No major economic reports were released in the U.S. yesterday. The demand for the greenback was supported by the weak economic data from the U.K. and the Eurozone.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major market reports from New Zealand.

Chinese economic data was weaker than expected. China's consumer price index declined to 1.6% in September from 2.0% in August, missing expectations for a decline to 1.7%.

China's producer price index dropped to 1.8% in September from a decline of 1.2% in August, missing expectations for a decrease to 1.4%.

The Australian dollar traded higher against the U.S. dollar after the solid economic data from Australia and despite the weaker-than-expected economic data from China. The Westpac consumer confidence in Australia increased 0.9% in October, after a 4.6% fall in September.

New motor vehicle sales in Australia rose 2.9% in September, after a 1.6% decline in August. August's figure was revised up from a 1.8% decrease.

The Japanese yen traded mixed against the U.S. dollar. Japan's industrial production declined 1.9% in August, after a 1.5% drop in July. Analysts had expected a 1.5% decrease.

Japanese Economics Minister Akira Amari said in parliament that the government does not want to intentionally weaken the yen, and any negative impact from rising import prices should be closely monitored.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. PPI, m/m September 0.0% +0.1%

12:30 U.S. Retail sales September +0.6% -0.1%

12:30 U.S. Retail sales excluding auto September +0.3% +0.2%

12:30 U.S. PPI, y/y September +1.8% +1.7%

12:30 U.S. PPI excluding food and energy, m/m September +0.1% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y September +1.8% +1.7%

12:30 U.S. NY Fed Empire State manufacturing index September 27.5 20.3

14:00 U.S. Business inventories August +0.4% +0.4%

18:00 Eurozone ECB President Mario Draghi Speaks

18:00 U.S. Fed's Beige Book

21:30 New Zealand Business NZ PMI September 56.5

-

10:03

Switzerland: Credit Suisse ZEW Survey (Expectations), October -30.7 (forecast -12.0)

-

09:31

United Kingdom: Claimant Count Rate, September 2.8%

-

09:31

United Kingdom: Average Earnings, 3m/y , August +0.7% (forecast +0.7%)

-

09:30

United Kingdom: ILO Unemployment Rate, August 6.0% (forecast 6.1%)

-

09:30

United Kingdom: Average earnings ex bonuses, 3 m/y, August +0.9% (forecast +0.8%)

-

09:30

United Kingdom: Claimant count , September -18.6 (forecast -34.2)

-

08:15

-

07:00

Germany: CPI, m/m, September 0.0% (forecast 0.0%)

-

07:00

Germany: CPI, y/y , September +0.8% (forecast +0.8%)

-

06:23

Options levels on wednesday, October 15, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2804 (2745)

$1.2748 (1729)

$1.2709 (1661)

Price at time of writing this review: $ 1.2643

Support levels (open interest**, contracts):

$1.2600 (1766)

$1.2556 (2625)

$1.2495 (3572)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 52866 contracts, with the maximum number of contracts with strike price $1,2900 (6614);

- Overall open interest on the PUT options with the expiration date November, 7 is 52370 contracts, with the maximum number of contracts with strike price $1,2400 (5404);

- The ratio of PUT/CALL was 0.99 versus 0.99 from the previous trading day according to data from October, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.6202 (1976)

$1.6104 (1072)

$1.6007 (423)

Price at time of writing this review: $1.5908

Support levels (open interest**, contracts):

$1.5888 (965)

$1.5792 (1585)

$1.5695 (1185)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 24975 contracts, with the maximum number of contracts with strike price $1,6200 (1976);

- Overall open interest on the PUT options with the expiration date November, 7 is 31158 contracts, with the maximum number of contracts with strike price $1,5400 (2397);

- The ratio of PUT/CALL was 1.25 versus 1.24 from the previous trading day according to data from October, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:32

Japan: Industrial Production (YoY), August -3.3% (forecast -0.7%)

-

05:31

Japan: Industrial Production (MoM) , August -1.9% (forecast -1.5%)

-

02:30

China: CPI y/y, September +1.6% (forecast +1.7%)

-

02:30

China: PPI y/y, September -1.8% (forecast -1.4%)

-

01:31

Australia: New Motor Vehicle Sales (MoM) , September +2.9%

-

01:31

Australia: New Motor Vehicle Sales (YoY) , September +0.8%

-

00:30

Australia: Westpac Consumer Confidence, October +0.9%

-