Notícias do Mercado

-

23:32

Currencies. Daily history for Oct 16'2014:

(pare/closed(GMT +2)/change, %)

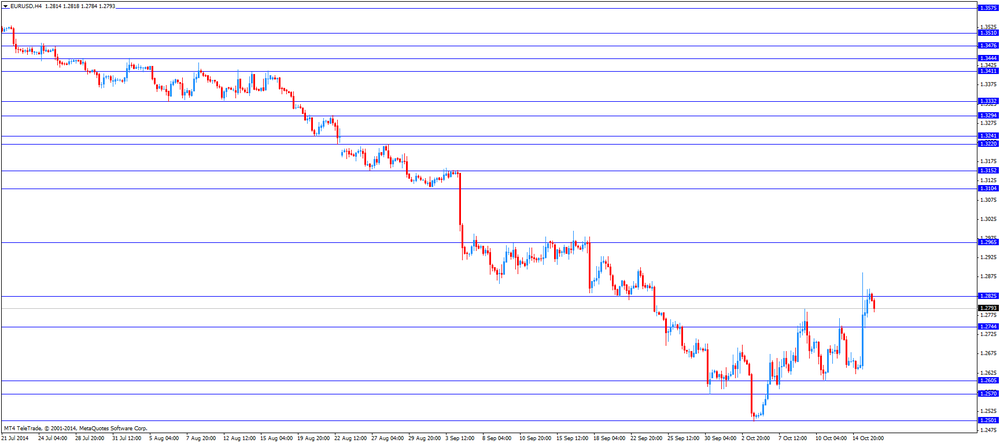

EUR/USD $1,2803 -0,09%

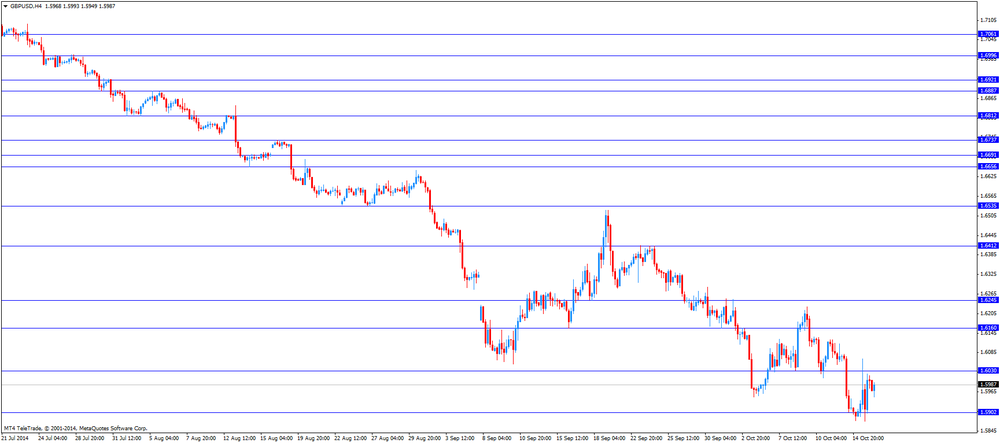

GBP/USD $1,6072 +0,45%

USD/CHF Chf0,9428 +0,11%

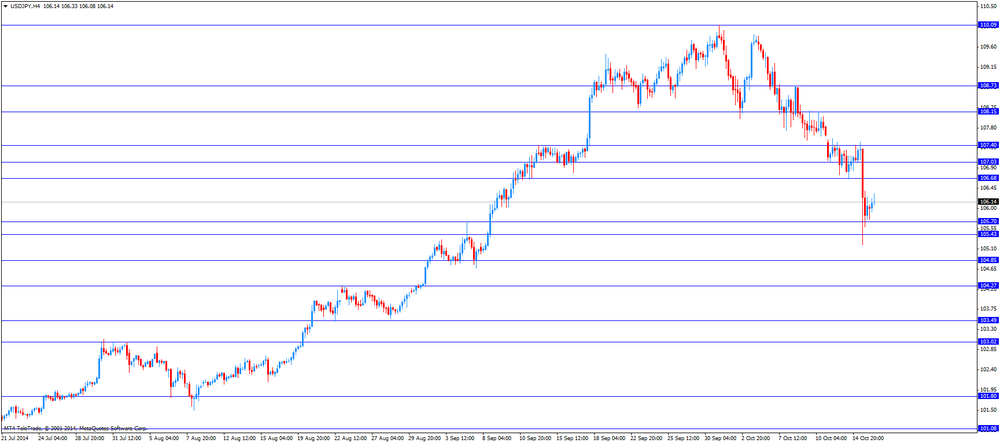

USD/JPY Y106,28 +0,22%

EUR/JPY Y136,07 +0,12%

GBP/JPY Y170,8 +0,61%

AUD/USD $0,8749 -0,67%

NZD/USD $0,7935 -0,48%

USD/CAD C$1,1263 -0,01%

-

23:00

Schedule for today, Friday, Oct 17’2014:

(time / country / index / period / previous value / forecast)

07:45 Eurozone ECB's Vitor Constancio Speaks

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.0% 0.0%

09:00 Eurozone GDP (YoY) (Finally) Quarter II +0.7% +0.7%

12:30 Canada Consumer Price Index m / m September 0.0% 0.0%

12:30 Canada Consumer price index, y/y September +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m September +0.5% +0.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September +2.1%

12:30 U.S. Building Permits, mln September 1.00 1.04

12:30 U.S. Housing Starts, mln September 0.96 1.02

12:30 U.S. Fed Chairman Janet Yellen Speaks

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 84.6 84.3

-

17:23

Minneapolis Federal Reserve Bank President Kocherlakota: interest rate hike in 2015 by the Fed would be “inappropriate”

The Minneapolis Federal Reserve Bank President Narayana Kocherlakota repeated on Thursday that interest rate hike in 2015 by the Fed would be "inappropriate".

Kocherlakota doesn't expect inflation (measured by the PCE price index) to reach 2% until 2018.

-

16:42

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies despite the mainly better-than-expected U.S. economic data

The U.S. dollar traded lower against the most major currencies despite the mainly better-than-expected U.S. economic data. The number of initial jobless claims in the week ending October 11 in the U.S. dropped by 23,000 to 264,000. Analysts had expected the number of initial jobless claims to decline by 1,000 to 286,000.

The U.S. industrial production rose 1.0% in September, exceeding expectations for a 0.4% gain, after a 0.2% decline in August. August's figure was revised down from a 0.1% decrease.

The Philadelphia Fed manufacturing index decreased to 20.7 in October from 22.5 in September, beating forecasts of a decline to 19.9.

The NAHB housing market index fell to 54 in October from 59 in September. Analysts had expected the index to remain unchanged at 59.

The euro traded higher against the U.S. dollar. Earlier, the euro fell against the greenback after the release of Eurozone's inflation data. Eurostat confirmed on Thursday that the consumer price inflation in the Eurozone was at annual rate of 0.3% in September, in line with expectations, down from 0.4% in August. That was the lowest inflation since October 2009.

Eurozone's consumer price index excluding food and energy was at annual rate of 0.8% in September, up from the previous reading of 0.7%. Analysts had expected the consumer price index excluding food and energy to rise 0.7%.

Eurozone's trade surplus climbed to 15.8 billion euros in August from 12.7 billion euros in July. July's figure was revised up from 12.2 billion euros. Analysts had expected the trade surplus to increase to 13.5 billion euros.

The British pound traded increased against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. The State Secretariat for Economics (SECO) lowered its growth forecasts for Switzerland to 1.8% from 2.0% for 2014 and to 2.4% from 2.6% for 2015. The cut was caused by the slowdown in Europe.

The Canadian dollar rose against the U.S. dollar after the mixed Canadian economic data. The Canadian manufacturing shipments declined 3.3% in August, missing expectations for a 1.6% decrease, after a 2.9% gain in July. July's figure was revised up from a 2.5% rise.

Foreign securities purchases in Canada jumped by C$10.28 billion in August, exceeding expectations for an increase by C$4.31 billion, after a C$5.20 billion rise in July. July's figure was revised down from a C$5.30 billion gain.

The New Zealand dollar traded higher against the U.S. dollar. The Business NZ performance of manufacturing index (PMI) rose to 58.1 in September from 57.0 in August. August's figure was revised up from 56.5.

The Australian dollar traded higher against the U.S. dollar. Australia's Consumer Inflation Expectation declined to 3.4% in September from 3.5% in August.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

-

16:04

State Secretariat for Economics (SECO) cut its growth forecasts for Switzerland

The State Secretariat for Economics (SECO) lowered its growth forecasts for Switzerland to 1.8% from 2.0% for 2014 and to 2.4% from 2.6% for 2015. The cut was caused by the slowdown in Europe.

Disappointing German economic data weighed on the forecasts cut by SECO. Germany is Switzerland's main trading partner.

SECO forecasted that consumer prices in Switzerland would increase by 0.1% in 2014. The Swiss inflation is expected to be 0.4% next year. Both figures remained unchanged from its June forecasts.

-

16:00

U.S.: Crude Oil Inventories, October +8.9

-

15:33

Federal Reserve Bank of Philadelphia President Charles Plosse called on the Fed to raise its interest rate “sooner rather than later”

The Federal Reserve Bank of Philadelphia President Charles Plosser said on Thursday called on the Fed to raise its interest rate "sooner rather than later". He added that interest rate should not "necessarily be increased now".

Plosser also said that interest rate could begin to rise "sooner than previously anticipated", and the Fed should "prepare the markets for the fact that interest rates may begin to increase sooner than previously anticipated". He pointed out that the Fed have to adjust its policy guidance due to "significant progress" in U.S. inflation and employment.

Plosser expects about 3% GDP growth for the rest of this year and next year.

-

15:00

U.S.: NAHB Housing Market Index, October 54 (forecast 59)

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, October 20.7 (forecast 19.9)

-

14:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E1.85bn), $1.2640(E1.3bn), $1.2800(E260mn), $1.2900(E502mn)

USD/JPY: Y105.75($1.6bn), Y106.50($1.6bn), Y107.00($1.6bn), Y107.55($400mn)

EUR/JPY: Y134.50(E468mn), Y136.50(E468mn)

EUR/GBP: stg0.7980(E180mn), stg0.8010(E129mn), stg0.8060(E208mn), stg0.8150(E797mn)

AUD/USD: $0.8710(A$370mn), $0.8750-65(A$500mn), $0.8800(A$360mn)

NZD/USD: $0.7750(NZ$553mn), $0.8135-45(NZ$530mn)

USD/CAD: C$1.1200($489mn)

-

14:15

U.S.: Industrial Production (MoM), September +1.0% (forecast +0.4%)

-

14:15

U.S.: Capacity Utilization, September 79.3% (forecast 79.0%)

-

13:30

U.S.: Initial Jobless Claims, October 264 (forecast 286)

-

13:30

Canada: Manufacturing Shipments (MoM), August -3.3% (forecast -1.6%)

-

13:30

Canada: Foreign Securities Purchases, August 10.28 (forecast 4.31)

-

13:15

Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of Eurozone’s inflation data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation September +3.5% 3.4%

02:00 Australia RBA Assist Gov Debelle Speaks

02:00 China New Loans September 703 750 857.2

05:45 Switzerland SECO Economic Forecasts Quarter IV

09:00 Eurozone Harmonized CPI September +0.1% +0.4% +0.4%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) September +0.3% +0.3% +0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y September +0.7% +0.7% +0.8%

09:00 Eurozone Trade Balance s.a. August 12.7 Revised From 12.2 13.5 15.8

10:00 Eurozone ECB's Jens Weidmann Speaks

12:00 U.S. FOMC Member Charles Plosser Speaks

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 1,000 to 286,000.

The U.S. industrial production is expected to rise 0.4% in September, after a 0.1% decline in August.

The Philadelphia Fed manufacturing index is expected to decrease to 19.9 in October from 22.5 in September.

The NAHB housing market index is expected to remain unchanged at 59 in October.

The euro fell against the U.S. dollar after the release of Eurozone's inflation data. Eurostat confirmed on Thursday that the consumer price inflation in the Eurozone was at annual rate of 0.3% in September, in line with expectations, down from 0.4% in August. That was the lowest inflation since October 2009.

Eurozone's consumer price index excluding food and energy was at annual rate of 0.8% in September, up from the previous reading of 0.7%. Analysts had expected the consumer price index excluding food and energy to rise 0.7%.

Eurozone's trade surplus climbed to 15.8 billion euros in August from 12.7 billion euros in July. July's figure was revised up from 12.2 billion euros. Analysts had expected the trade surplus to increase to 13.5 billion euros.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. The State Secretariat for Economics (SECO) lowered its growth forecasts for Switzerland to 1.8% from 2.0% for 2014 and to 2.4% from 2.6% for 2015. The cut was caused by the slowdown in Europe.

The Canadian dollar declined against the U.S. dollar ahead the Canadian economic data. The Canadian manufacturing shipments are expected to decline 1.6% in August, after a 2.5% gain in July.

Foreign securities purchases in Canada are expected to climb by C$4.31 billion in August, after a C$5.30 billion rise in July.

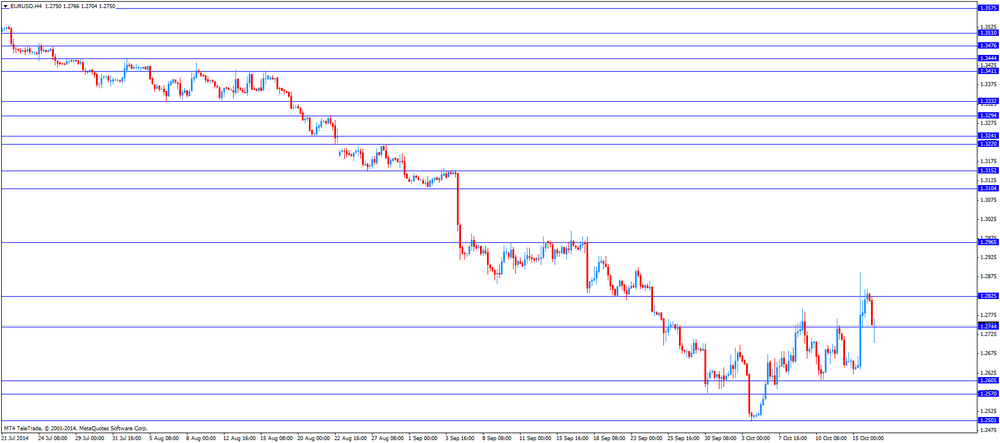

EUR/USD: the currency pair fell to 1.2704

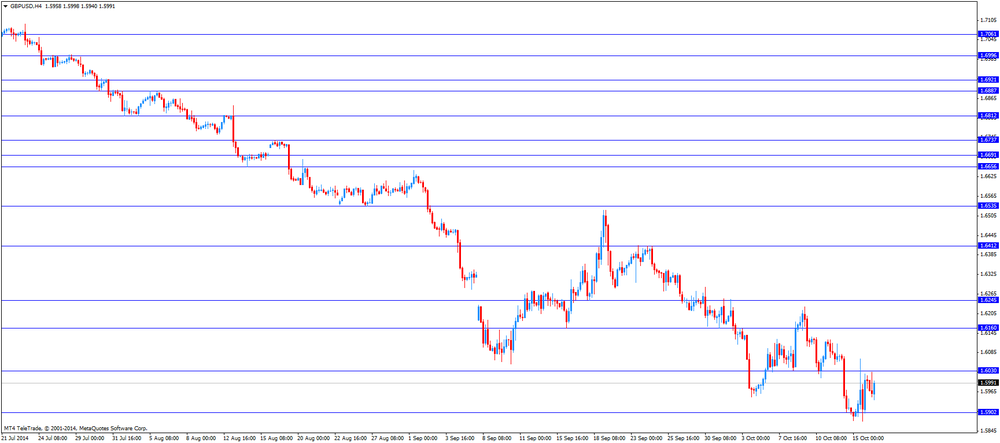

GBP/USD: the currency pair traded mixed

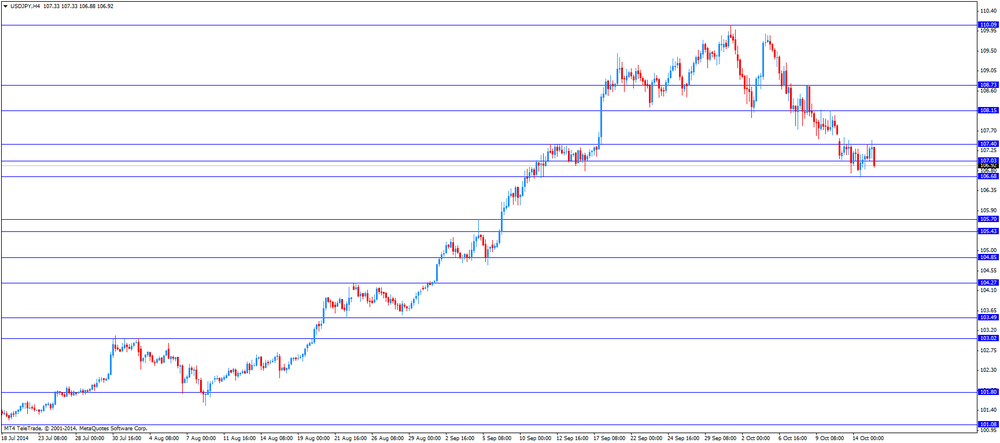

USD/JPY: the currency pair declined to Y105.50

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) August +2.5% -1.6%

12:30 Canada Foreign Securities Purchases July 5.30 4.31

12:30 U.S. Initial Jobless Claims October 287 286

13:15 U.S. Industrial Production (MoM) September -0.1% +0.4%

13:15 U.S. Capacity Utilization September 78.8% 79.0%

14:00 U.S. Philadelphia Fed Manufacturing Survey October 22.5 19.9

14:00 U.S. FOMC Member Narayana Kocherlakota

14:00 U.S. NAHB Housing Market Index October 59 59

20:00 U.S. Net Long-term TIC Flows August -18.6 23.3

20:00 U.S. Total Net TIC Flows August 57.7

-

13:00

Orders

EUR/USD

Offers $1.3000/95, $1.2930, $1.2900, $1.2885

Bids $1.2700, $1.2675, $1.2620

GBP/USD

Offers $1.6225, $1.6135/30, $1.6100, $1.6050

Bids $1.5875, $1.5850, $1.5800

AUD/USD

Offers $0.8895, $0.8860/50

Bids $0.8700, $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.00, Y137.85/90, Y137.50, Y136.55

Bids Y135.00, Y134.00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.15, Y107.50

Bids Y105.20, Y105.00

EUR/GBP

Offers stg0.8100, stg0.8045

Bids stg0.7935, stg0.7900, stg0.7850

-

12:47

Eurozone’s consumer price inflation fell to the lowest level since October 2009

Eurostat confirmed on Thursday that the consumer price inflation in the Eurozone was at annual rate of 0.3% in September, in line with expectations, down from 0.4% in August. That was the lowest inflation since October 2009.

Eurozone's consumer price index excluding food and energy was at annual rate of 0.8% in September, up from the previous reading of 0.7%. Analysts had expected the consumer price index excluding food and energy to rise 0.7%.

Greece, Spain, Italy, Slovenia and Slovakia showed a decrease in consumer prices over the 12 months.

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E1.85bn), $1.2640(E1.3bn), $1.2800(E260mn), $1.2900(E502mn)

USD/JPY: Y105.75($1.6bn), Y106.50($1.6bn), Y107.00($1.6bn), Y107.55($400mn)

EUR/JPY: Y134.50(E468mn), Y136.50(E468mn)

EUR/GBP: stg0.7980(E180mn), stg0.8010(E129mn), stg0.8060(E208mn), stg0.8150(E797mn)

AUD/USD: $0.8710(A$370mn), $0.8750-65(A$500mn), $0.8800(A$360mn)

NZD/USD: $0.7750(NZ$553mn), $0.8135-45(NZ$530mn)

USD/CAD: C$1.1200($489mn)

-

10:04

Eurozone: Harmonized CPI ex EFAT, Y/Y, September +0.8% (forecast +0.7%)

-

10:04

Eurozone: Trade Balance s.a., August 15.8 (forecast 13.5)

-

10:03

Eurozone: Harmonized CPI, September +0.4% (forecast +0.4%)

-

10:03

Eurozone: Harmonized CPI, Y/Y, September +0.3% (forecast +0.3%)

-

09:58

Foreign exchange market. Asian session: the Japanese yen traded slightly lower against the U.S. dollar in the absence of any major economic reports from Japan

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation September +3.5% 3.4%

02:00 Australia RBA Assist Gov Debelle Speaks

02:00 China New Loans September 703 750 857.2

05:45 Switzerland SECO Economic Forecasts Quarter IV

The U.S. dollar traded mixed against the most major currencies on comments. The greenback dropped yesterday due to disappointing U.S. economic data. The U.S. retail sales declined 0.3% in September, missing expectations for a 0.1% drop, after a 0.6% gain in August.

The U.S. PPI fell 0.1% in September, missing expectations for a 0.1% gain, after a flat reading in August.

The NY Fed Empire State manufacturing index decreased to 6.2 in September from 27.5 in August. Analysts had expected the index to decline to 20.3.

The New Zealand dollar traded mixed against the U.S. dollar. The Business NZ performance of manufacturing index (PMI) rose to 58.1 in September from 57.0 in August. August's figure was revised up from 56.5.

The Australian dollar traded lower against the U.S. dollar. Australia's Consumer Inflation Expectation declined to 3.4% in September from 3.5% in August.

The Japanese yen traded slightly lower against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.5949

USD/JPY: the currency pair rose to Y106.22

The most important news that are expected (GMT0):

09:00 Eurozone Harmonized CPI September +0.1% +0.4%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) September +0.3% +0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y September +0.7% +0.7%

09:00 Eurozone Trade Balance s.a. August 12.2 13.5

10:00 Eurozone ECB's Jens Weidmann Speaks

12:00 U.S. FOMC Member Charles Plosser Speaks

12:30 Canada Manufacturing Shipments (MoM) August +2.5% -1.6%

12:30 Canada Foreign Securities Purchases July 5.30 4.31

12:30 U.S. Initial Jobless Claims October 287 286

13:15 U.S. Industrial Production (MoM) September -0.1% +0.4%

13:15 U.S. Capacity Utilization September 78.8% 79.0%

14:00 U.S. Philadelphia Fed Manufacturing Survey October 22.5 19.9

14:00 U.S. FOMC Member Narayana Kocherlakota

14:00 U.S. NAHB Housing Market Index October 59 59

20:00 U.S. Net Long-term TIC Flows August -18.6 23.3

20:00 U.S. Total Net TIC Flows August 57.7

-

06:37

Options levels on thursday, October 16, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2927 (2273)

$1.2895 (2927)

$1.2853 (4263)

Price at time of writing this review: $ 1.2816

Support levels (open interest**, contracts):

$1.2763 (871)

$1.2737 (1196)

$1.2704 (1135)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 53701 contracts, with the maximum number of contracts with strike pric $1,2900 (6704);

- Overall open interest on the PUT options with the expiration date November, 7 is 53719 contracts, with the maximum number of contracts with strike price $1,2400 (5384);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from October, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.6203 (1961)

$1.6105 (1144)

$1.6008 (402)

Price at time of writing this review: $1.5973

Support levels (open interest**, contracts):

$1.5889 (970)

$1.5793 (1513)

$1.5695 (1193)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 25533 contracts, with the maximum number of contracts with strike price $1,6200 (1961);

- Overall open interest on the PUT options with the expiration date November, 7 is 31354 contracts, with the maximum number of contracts with strike price $1,5400 (2463);

- The ratio of PUT/CALL was 1.23 versus 1.25 from the previous trading day according to data from October, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:15

China: New Loans, September 857.2 (forecast 750)

-

01:01

Australia: Consumer Inflation Expectation, September 3.4%

-