Notícias do Mercado

-

23:39

Commodities. Daily history for Oct 16'2014:

(raw materials / closing price /% change)

Light Crude 82.95 +0.30%

Gold 1,238.40 -0.23%

-

23:37

Stocks. Daily history for Oct 16'2014:

(index / closing price / change items /% change)

S&P/ASX 200 5,254.9 +9.29 +0.18%

TOPIX 1,195.5 -28.17 -2.30%

SHANGHAI COMP 2,367.86 -5.81 -0.24%

FTSE 100 6,195.91 -15.73 -0.25%

CAC 40 3,918.62 -21.10 -0.54%

Xetra DAX 8,582.9 +10.95 +0.13%

S&P 500 1,862.76 +0.27 +0.01%

NASDAQ Composite 4,217.39 +2.07 +0.05%

Dow Jones 16,117.24 -24.50 -0.15%

-

23:32

Currencies. Daily history for Oct 16'2014:

(pare/closed(GMT +2)/change, %)

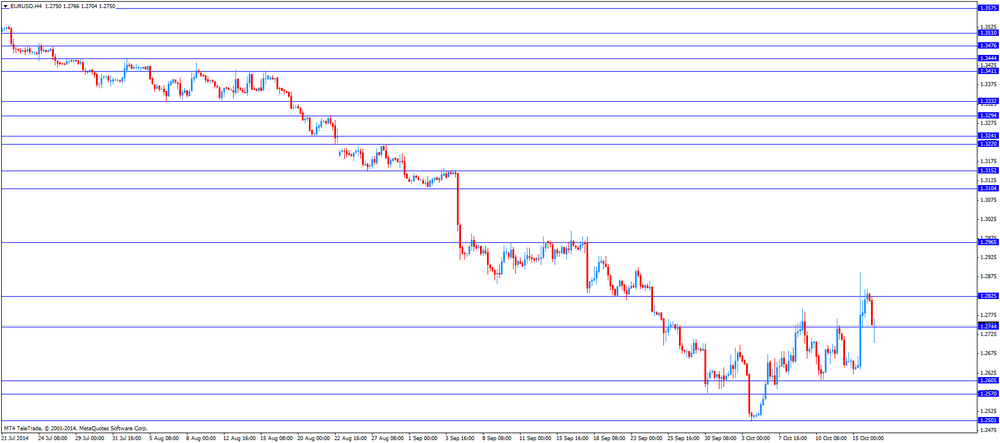

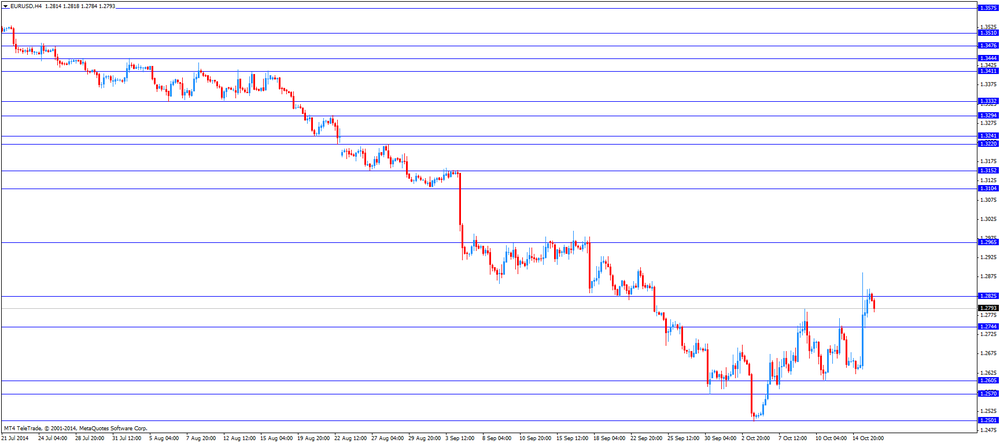

EUR/USD $1,2803 -0,09%

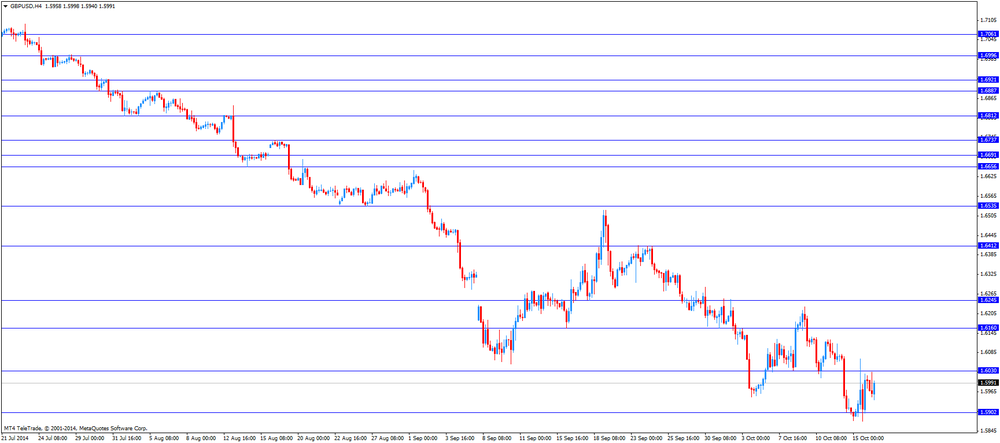

GBP/USD $1,6072 +0,45%

USD/CHF Chf0,9428 +0,11%

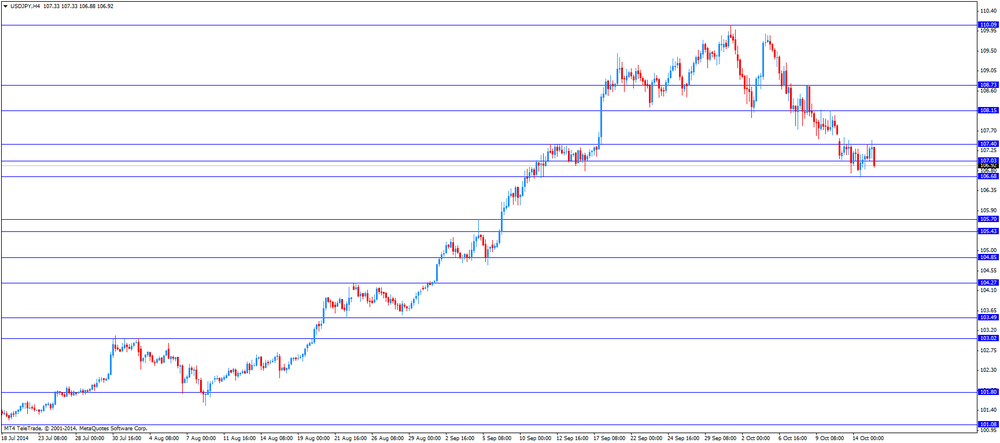

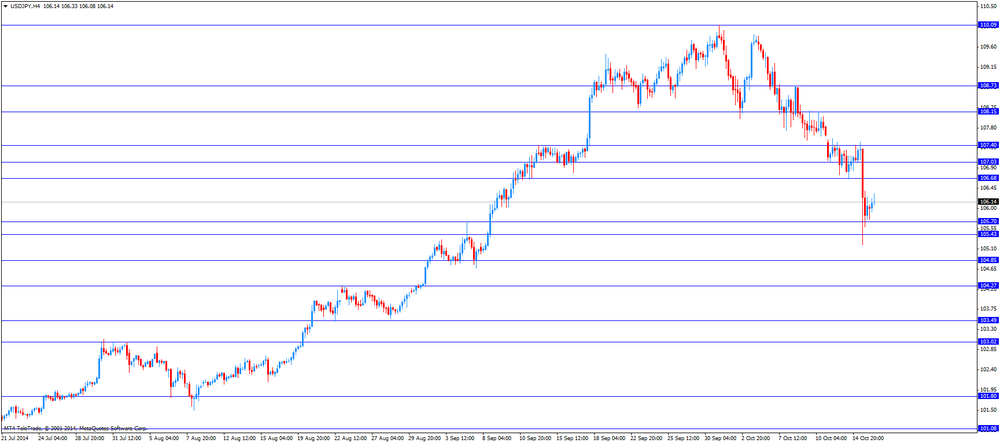

USD/JPY Y106,28 +0,22%

EUR/JPY Y136,07 +0,12%

GBP/JPY Y170,8 +0,61%

AUD/USD $0,8749 -0,67%

NZD/USD $0,7935 -0,48%

USD/CAD C$1,1263 -0,01%

-

23:00

Schedule for today, Friday, Oct 17’2014:

(time / country / index / period / previous value / forecast)

07:45 Eurozone ECB's Vitor Constancio Speaks

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.0% 0.0%

09:00 Eurozone GDP (YoY) (Finally) Quarter II +0.7% +0.7%

12:30 Canada Consumer Price Index m / m September 0.0% 0.0%

12:30 Canada Consumer price index, y/y September +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m September +0.5% +0.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September +2.1%

12:30 U.S. Building Permits, mln September 1.00 1.04

12:30 U.S. Housing Starts, mln September 0.96 1.02

12:30 U.S. Fed Chairman Janet Yellen Speaks

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 84.6 84.3

-

20:00

Dow 16,106.90 -34.84 -0.22%, Nasdaq 4,211.40 -3.92 -0.09%, S&P 500 1,860.60 -1.89 -0.10%

-

17:23

Minneapolis Federal Reserve Bank President Kocherlakota: interest rate hike in 2015 by the Fed would be “inappropriate”

The Minneapolis Federal Reserve Bank President Narayana Kocherlakota repeated on Thursday that interest rate hike in 2015 by the Fed would be "inappropriate".

Kocherlakota doesn't expect inflation (measured by the PCE price index) to reach 2% until 2018.

-

17:08

European stocks close: stocks closed mixed, stock erased almost all losses after comments by Federal Reserve Bank of St. Louis President James Bullard

Stock indices closed mixed. Stock erased almost all losses after comments by Federal Reserve Bank of St. Louis President James Bullard. Bullard said that the Fed should consider to delay the end of its bond-buying program.

Earlier, stocks dropped on worries the financial crisis is returning.

Spain's government failed to reach its maximum target in a bond sale. That also added to concerns over the Eurozone`s economy.

Eurostat confirmed on Thursday that the consumer price inflation in the Eurozone was at annual rate of 0.3% in September, in line with expectations, down from 0.4% in August. That was the lowest inflation since October 2009.

Eurozone's consumer price index excluding food and energy was at annual rate of 0.8% in September, up from the previous reading of 0.7%. Analysts had expected the consumer price index excluding food and energy to rise 0.7%.

Eurozone's trade surplus climbed to 15.8 billion euros in August from 12.7 billion euros in July. July's figure was revised up from 12.2 billion euros. Analysts had expected the trade surplus to increase to 13.5 billion euros.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,195.91 -15.73 -0.25%

DAX 8,582.9 +10.95 +0.13%

CAC 40 3,918.62 -21.10 -0.54%

-

17:00

European stocks closed in different ways: FTSE 100 6,200.9 -10.74 -0.17 %, CAC 40 3,918.62 -21.10 -0.54 %, DAX 8,586.94 +14.99 +0.17 %

-

16:42

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies despite the mainly better-than-expected U.S. economic data

The U.S. dollar traded lower against the most major currencies despite the mainly better-than-expected U.S. economic data. The number of initial jobless claims in the week ending October 11 in the U.S. dropped by 23,000 to 264,000. Analysts had expected the number of initial jobless claims to decline by 1,000 to 286,000.

The U.S. industrial production rose 1.0% in September, exceeding expectations for a 0.4% gain, after a 0.2% decline in August. August's figure was revised down from a 0.1% decrease.

The Philadelphia Fed manufacturing index decreased to 20.7 in October from 22.5 in September, beating forecasts of a decline to 19.9.

The NAHB housing market index fell to 54 in October from 59 in September. Analysts had expected the index to remain unchanged at 59.

The euro traded higher against the U.S. dollar. Earlier, the euro fell against the greenback after the release of Eurozone's inflation data. Eurostat confirmed on Thursday that the consumer price inflation in the Eurozone was at annual rate of 0.3% in September, in line with expectations, down from 0.4% in August. That was the lowest inflation since October 2009.

Eurozone's consumer price index excluding food and energy was at annual rate of 0.8% in September, up from the previous reading of 0.7%. Analysts had expected the consumer price index excluding food and energy to rise 0.7%.

Eurozone's trade surplus climbed to 15.8 billion euros in August from 12.7 billion euros in July. July's figure was revised up from 12.2 billion euros. Analysts had expected the trade surplus to increase to 13.5 billion euros.

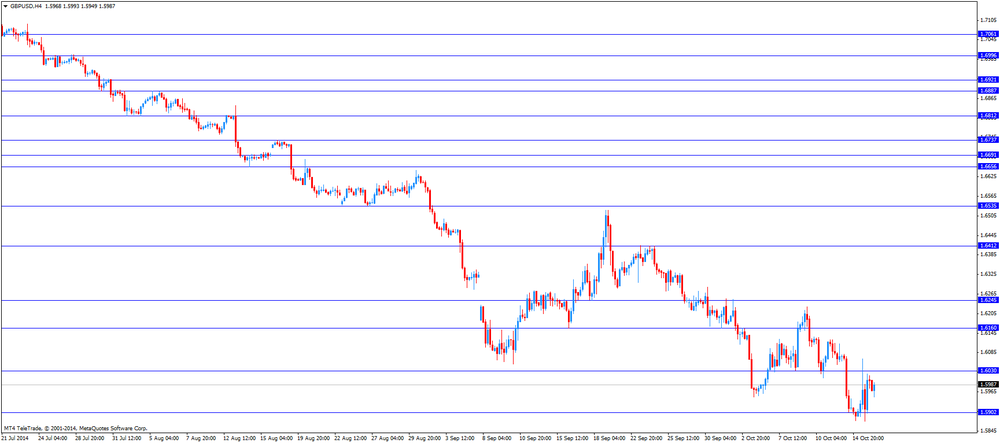

The British pound traded increased against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. The State Secretariat for Economics (SECO) lowered its growth forecasts for Switzerland to 1.8% from 2.0% for 2014 and to 2.4% from 2.6% for 2015. The cut was caused by the slowdown in Europe.

The Canadian dollar rose against the U.S. dollar after the mixed Canadian economic data. The Canadian manufacturing shipments declined 3.3% in August, missing expectations for a 1.6% decrease, after a 2.9% gain in July. July's figure was revised up from a 2.5% rise.

Foreign securities purchases in Canada jumped by C$10.28 billion in August, exceeding expectations for an increase by C$4.31 billion, after a C$5.20 billion rise in July. July's figure was revised down from a C$5.30 billion gain.

The New Zealand dollar traded higher against the U.S. dollar. The Business NZ performance of manufacturing index (PMI) rose to 58.1 in September from 57.0 in August. August's figure was revised up from 56.5.

The Australian dollar traded higher against the U.S. dollar. Australia's Consumer Inflation Expectation declined to 3.4% in September from 3.5% in August.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

-

16:40

Оil fell

West Texas Intermediate oil fell after a government report showed U.S. crude inventories expanded last week, exacerbating a global glut. Brent dropped to the lowest level in almost four years.

Futures slid as much as 2.4 percent in New York, declining for the seventh time in eight days. U.S. crude supplies rose 8.92 million barrels to 370.6 million last week, according to the Energy Information Administration. Stockpiles were projected to increase by 2.45 million barrels, according to the median estimate of 10 analysts surveyed by Bloomberg.

Prices have collapsed amid speculation that Saudi Arabia and other members of the Organization of Petroleum Exporting Countries will refrain from cuts needed to drain a surplus, according to Commerzbank AG.

WTI for November delivery fell $1.09, or 1.3 percent, to $80.69 a barrel at 11.03 a.m. on the New York Mercantile Exchange. It earlier touched $79.78, the least since June 29, 2012.

Brent for November settlement, which expires today, declined 33 cents, or 0.4 percent, to $83.45 a barrel on the London-based ICE Futures Europe exchange. Futures reached $82.60, the lowest since November 2010.

-

16:20

Gold moderately cheaper

Gold prices fall, but still remain in the area of the one-month peak, as American disappointing data released on Wednesday highlighted the concerns over the outlook of the world economy by supporting demand for refuge.

On Wednesday, the price of gold soared to a one-month high after a series of disappointing data weakened the American expectations of a quick increase of the rate of the Federal Reserve System.

The slowdown in interest rates can support gold, as it lowers the relative cost of the metal retention, which guarantees investors a profit.

At the same time, statistics published on Thursday the United States was better than expected, which supported the investors' confidence in the world's largest economy, and reduced demand for safe-haven assets.

Fed said: By the end of last month, the volume of industrial production increased significantly, registering with the highest growth in nearly two years, helped by the improvement in activity and an increase in the utilities sector. According to the data, the September industrial output increased by 1.0 percent after falling 0.2 percent in August (revised from -0.1 percent). Last increase was the highest since November 2012. Experts expect that figure to grow by 0.4 per cent.

Number of new applications for unemployment benefits fell substantially last week, reaching with fourteen low last week, suggesting continued improvement in the American labor market. The Labour Department said the seasonally adjusted number of initial claims for unemployment benefits fell for the week ending Oct. 11, 23 000 - 264 000 to the level of last reading was the lowest since April 10-15, 2000 (when the number of calls was 259 th.). Economists forecast that the number of appeals will be 286 thousand.

The world's largest reserves of the gold-exchange trading fund SPDR Gold Trust on Wednesday fell by 0.27 percent to 759.14 tons. Physical demand in Asia declined, as evidenced by the decline in margins in China's largest consumer of gold to $ 01.02 an ounce to the indicative spot price from $ 4 on Wednesday. Demand for gold tends to rise in China and India in the fourth quarter due to holidays and weddings.

The cost of the December gold futures on the COMEX today dropped to 1235.20 dollars per ounce.

-

16:04

State Secretariat for Economics (SECO) cut its growth forecasts for Switzerland

The State Secretariat for Economics (SECO) lowered its growth forecasts for Switzerland to 1.8% from 2.0% for 2014 and to 2.4% from 2.6% for 2015. The cut was caused by the slowdown in Europe.

Disappointing German economic data weighed on the forecasts cut by SECO. Germany is Switzerland's main trading partner.

SECO forecasted that consumer prices in Switzerland would increase by 0.1% in 2014. The Swiss inflation is expected to be 0.4% next year. Both figures remained unchanged from its June forecasts.

-

16:00

U.S.: Crude Oil Inventories, October +8.9

-

15:33

Federal Reserve Bank of Philadelphia President Charles Plosse called on the Fed to raise its interest rate “sooner rather than later”

The Federal Reserve Bank of Philadelphia President Charles Plosser said on Thursday called on the Fed to raise its interest rate "sooner rather than later". He added that interest rate should not "necessarily be increased now".

Plosser also said that interest rate could begin to rise "sooner than previously anticipated", and the Fed should "prepare the markets for the fact that interest rates may begin to increase sooner than previously anticipated". He pointed out that the Fed have to adjust its policy guidance due to "significant progress" in U.S. inflation and employment.

Plosser expects about 3% GDP growth for the rest of this year and next year.

-

15:00

U.S.: NAHB Housing Market Index, October 54 (forecast 59)

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, October 20.7 (forecast 19.9)

-

14:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E1.85bn), $1.2640(E1.3bn), $1.2800(E260mn), $1.2900(E502mn)

USD/JPY: Y105.75($1.6bn), Y106.50($1.6bn), Y107.00($1.6bn), Y107.55($400mn)

EUR/JPY: Y134.50(E468mn), Y136.50(E468mn)

EUR/GBP: stg0.7980(E180mn), stg0.8010(E129mn), stg0.8060(E208mn), stg0.8150(E797mn)

AUD/USD: $0.8710(A$370mn), $0.8750-65(A$500mn), $0.8800(A$360mn)

NZD/USD: $0.7750(NZ$553mn), $0.8135-45(NZ$530mn)

USD/CAD: C$1.1200($489mn)

-

14:37

U.S. Stocsk open: Dow 15,950.27 -191.47 -1.19%, Nasdaq 4,159.05 -56.27 -1.33%, S&P 1,840.13 -22.36 -1.20%

-

14:29

Before the bell: S&P futures -1.16%, Nasdaq futures -1.15%

U.S. stock-index futures fell as equities around the world continued a selloff amid deepening concern that global growth is slowing.

Global markets:

Nikkei 14,738.38 -335.14 -2.22%

Hang Seng 22,900.94 -239.11 -1.03%

Shanghai Composite 2,356.5 -17.17 -0.72%

FTSE 6,110.18 -101.46 -1.63%

CAC 3,857.39 -82.33 -2.09%

DAX 8,440.12 -131.83 -1.54%

Crude oil $80.26 (-1.74%)

Gold $1238.40 (-0.52%)

-

14:22

DOW components before the bell

(company / ticker / price / change, % / volume)

UnitedHealth Group Inc

UNH

83.95

+2.18%

1.9K

Verizon Communications Inc

VZ

47.39

-1.11%

26.4K

McDonald's Corp

MCD

89.39

-1.16%

2.6K

Johnson & Johnson

JNJ

97.00

-1.23%

7.1K

Microsoft Corp

MSFT

42.64

-1.34%

66.6K

AT&T Inc

T

33.41

-1.36%

15.4K

Pfizer Inc

PFE

27.80

-1.38%

8.5K

Chevron Corp

CVX

107.75

-1.39%

3.9K

Merck & Co Inc

MRK

53.97

-1.39%

1.1K

Travelers Companies Inc

TRV

90.69

-1.41%

1.0K

Procter & Gamble Co

PG

81.77

-1.42%

6.8K

American Express Co

AXP

79.75

-1.46%

1K

United Technologies Corp

UTX

97.70

-1.48%

0.2K

Nike

NKE

83.90

-1.50%

6.9K

The Coca-Cola Co

KO

42.58

-1.50%

16.5K

3M Co

MMM

132.19

-1.51%

7.0K

Intel Corp

INTC

30.80

-1.52%

63.3K

International Business Machines Co...

IBM

178.99

-1.52%

0.7K

E. I. du Pont de Nemours and Co

DD

65.34

-1.64%

0.6K

Cisco Systems Inc

CSCO

22.58

-1.66%

3.5K

Caterpillar Inc

CAT

90.35

-1.68%

1.7K

Home Depot Inc

HD

86.36

-1.70%

2.4K

Boeing Co

BA

118.08

-1.76%

0.7K

Exxon Mobil Corp

XOM

88.60

-1.80%

11.7K

Wal-Mart Stores Inc

WMT

73.83

-1.82%

9.8K

General Electric Co

GE

23.80

-1.98%

83.7K

JPMorgan Chase and Co

JPM

54.30

-2.22%

10.6K

Walt Disney Co

DIS

80.01

-2.52%

4.3K

Goldman Sachs

GS

171.24

-3.39%

76.3K

-

14:18

Upgrades and downgrades before the market open

Upgrades:

Citigroup (C) upgraded from Sell to Hold at Argus

American Express (AXP) upgraded from Underweight to Neutral at JP Morgan, target raised to $95 from $90

Downgrades:

Walt Disney (DIS) downgraded to Neutral from Buy at Guggenheim

Other:

-

14:15

U.S.: Industrial Production (MoM), September +1.0% (forecast +0.4%)

-

14:15

U.S.: Capacity Utilization, September 79.3% (forecast 79.0%)

-

13:30

U.S.: Initial Jobless Claims, October 264 (forecast 286)

-

13:30

Canada: Manufacturing Shipments (MoM), August -3.3% (forecast -1.6%)

-

13:30

Canada: Foreign Securities Purchases, August 10.28 (forecast 4.31)

-

13:15

Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of Eurozone’s inflation data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation September +3.5% 3.4%

02:00 Australia RBA Assist Gov Debelle Speaks

02:00 China New Loans September 703 750 857.2

05:45 Switzerland SECO Economic Forecasts Quarter IV

09:00 Eurozone Harmonized CPI September +0.1% +0.4% +0.4%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) September +0.3% +0.3% +0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y September +0.7% +0.7% +0.8%

09:00 Eurozone Trade Balance s.a. August 12.7 Revised From 12.2 13.5 15.8

10:00 Eurozone ECB's Jens Weidmann Speaks

12:00 U.S. FOMC Member Charles Plosser Speaks

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 1,000 to 286,000.

The U.S. industrial production is expected to rise 0.4% in September, after a 0.1% decline in August.

The Philadelphia Fed manufacturing index is expected to decrease to 19.9 in October from 22.5 in September.

The NAHB housing market index is expected to remain unchanged at 59 in October.

The euro fell against the U.S. dollar after the release of Eurozone's inflation data. Eurostat confirmed on Thursday that the consumer price inflation in the Eurozone was at annual rate of 0.3% in September, in line with expectations, down from 0.4% in August. That was the lowest inflation since October 2009.

Eurozone's consumer price index excluding food and energy was at annual rate of 0.8% in September, up from the previous reading of 0.7%. Analysts had expected the consumer price index excluding food and energy to rise 0.7%.

Eurozone's trade surplus climbed to 15.8 billion euros in August from 12.7 billion euros in July. July's figure was revised up from 12.2 billion euros. Analysts had expected the trade surplus to increase to 13.5 billion euros.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. The State Secretariat for Economics (SECO) lowered its growth forecasts for Switzerland to 1.8% from 2.0% for 2014 and to 2.4% from 2.6% for 2015. The cut was caused by the slowdown in Europe.

The Canadian dollar declined against the U.S. dollar ahead the Canadian economic data. The Canadian manufacturing shipments are expected to decline 1.6% in August, after a 2.5% gain in July.

Foreign securities purchases in Canada are expected to climb by C$4.31 billion in August, after a C$5.30 billion rise in July.

EUR/USD: the currency pair fell to 1.2704

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y105.50

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) August +2.5% -1.6%

12:30 Canada Foreign Securities Purchases July 5.30 4.31

12:30 U.S. Initial Jobless Claims October 287 286

13:15 U.S. Industrial Production (MoM) September -0.1% +0.4%

13:15 U.S. Capacity Utilization September 78.8% 79.0%

14:00 U.S. Philadelphia Fed Manufacturing Survey October 22.5 19.9

14:00 U.S. FOMC Member Narayana Kocherlakota

14:00 U.S. NAHB Housing Market Index October 59 59

20:00 U.S. Net Long-term TIC Flows August -18.6 23.3

20:00 U.S. Total Net TIC Flows August 57.7

-

13:00

Orders

EUR/USD

Offers $1.3000/95, $1.2930, $1.2900, $1.2885

Bids $1.2700, $1.2675, $1.2620

GBP/USD

Offers $1.6225, $1.6135/30, $1.6100, $1.6050

Bids $1.5875, $1.5850, $1.5800

AUD/USD

Offers $0.8895, $0.8860/50

Bids $0.8700, $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.00, Y137.85/90, Y137.50, Y136.55

Bids Y135.00, Y134.00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.15, Y107.50

Bids Y105.20, Y105.00

EUR/GBP

Offers stg0.8100, stg0.8045

Bids stg0.7935, stg0.7900, stg0.7850

-

12:47

Eurozone’s consumer price inflation fell to the lowest level since October 2009

Eurostat confirmed on Thursday that the consumer price inflation in the Eurozone was at annual rate of 0.3% in September, in line with expectations, down from 0.4% in August. That was the lowest inflation since October 2009.

Eurozone's consumer price index excluding food and energy was at annual rate of 0.8% in September, up from the previous reading of 0.7%. Analysts had expected the consumer price index excluding food and energy to rise 0.7%.

Greece, Spain, Italy, Slovenia and Slovakia showed a decrease in consumer prices over the 12 months.

-

12:17

European stock markets mid session: stocks traded lower on worries the financial crisis is returning

Stock indices traded lower on worries the financial crisis is returning.

Spain's government failed to reach its maximum target in a bond sale. That also added to concerns over the Eurozone`s economy.

Eurostat confirmed on Thursday that the consumer price inflation in the Eurozone was at annual rate of 0.3% in September, in line with expectations, down from 0.4% in August. That was the lowest inflation since October 2009.

Eurozone's consumer price index excluding food and energy was at annual rate of 0.8% in September, up from the previous reading of 0.7%. Analysts had expected the consumer price index excluding food and energy to rise 0.7%.

Eurozone's trade surplus climbed to 15.8 billion euros in August from 12.7 billion euros in July. July's figure was revised up from 12.2 billion euros. Analysts had expected the trade surplus to increase to 13.5 billion euros.

Current figures:

Name Price Change Change %

FTSE 100 6,097.97 -113.67 -1.83%

DAX 8,417.5 -154.45 -1.80%

CAC 40 3,852.77 -86.95 -2.21%

-

10:40

Asian Stocks close: stocks closed lower following a sell-off on Wall Street

Asian stock indices closed lower following a sell-off on Wall Street. Yesterday's sell-off on Wall Street was triggered by the disappointing U.S. economic data. The U.S. retail sales declined 0.3% in September, missing expectations for a 0.1% drop, after a 0.6% gain in August.

The U.S. PPI fell 0.1% in September, missing expectations for a 0.1% gain, after a flat reading in August.

The NY Fed Empire State manufacturing index decreased to 6.2 in September from 27.5 in August. Analysts had expected the index to decline to 20.3.

Investors speculate that the Fed could delay its interest rate hike.

New loans in China increased to 857.2 billion yuan in September from 702.5 billion yuan in August, exceeding expectations for a rise to 750 billion yuan.

Indexes on the close:

Nikkei 225 14,738.38 -335.14 -2.22%

Hang Seng 22,900.94 -239.11 -1.03%

Shanghai Composite 2,356.5 -17.17 -0.72%

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E1.85bn), $1.2640(E1.3bn), $1.2800(E260mn), $1.2900(E502mn)

USD/JPY: Y105.75($1.6bn), Y106.50($1.6bn), Y107.00($1.6bn), Y107.55($400mn)

EUR/JPY: Y134.50(E468mn), Y136.50(E468mn)

EUR/GBP: stg0.7980(E180mn), stg0.8010(E129mn), stg0.8060(E208mn), stg0.8150(E797mn)

AUD/USD: $0.8710(A$370mn), $0.8750-65(A$500mn), $0.8800(A$360mn)

NZD/USD: $0.7750(NZ$553mn), $0.8135-45(NZ$530mn)

USD/CAD: C$1.1200($489mn)

-

10:04

Eurozone: Harmonized CPI ex EFAT, Y/Y, September +0.8% (forecast +0.7%)

-

10:04

Eurozone: Trade Balance s.a., August 15.8 (forecast 13.5)

-

10:03

Eurozone: Harmonized CPI, September +0.4% (forecast +0.4%)

-

10:03

Eurozone: Harmonized CPI, Y/Y, September +0.3% (forecast +0.3%)

-

09:58

Foreign exchange market. Asian session: the Japanese yen traded slightly lower against the U.S. dollar in the absence of any major economic reports from Japan

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation September +3.5% 3.4%

02:00 Australia RBA Assist Gov Debelle Speaks

02:00 China New Loans September 703 750 857.2

05:45 Switzerland SECO Economic Forecasts Quarter IV

The U.S. dollar traded mixed against the most major currencies on comments. The greenback dropped yesterday due to disappointing U.S. economic data. The U.S. retail sales declined 0.3% in September, missing expectations for a 0.1% drop, after a 0.6% gain in August.

The U.S. PPI fell 0.1% in September, missing expectations for a 0.1% gain, after a flat reading in August.

The NY Fed Empire State manufacturing index decreased to 6.2 in September from 27.5 in August. Analysts had expected the index to decline to 20.3.

The New Zealand dollar traded mixed against the U.S. dollar. The Business NZ performance of manufacturing index (PMI) rose to 58.1 in September from 57.0 in August. August's figure was revised up from 56.5.

The Australian dollar traded lower against the U.S. dollar. Australia's Consumer Inflation Expectation declined to 3.4% in September from 3.5% in August.

The Japanese yen traded slightly lower against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.5949

USD/JPY: the currency pair rose to Y106.22

The most important news that are expected (GMT0):

09:00 Eurozone Harmonized CPI September +0.1% +0.4%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) September +0.3% +0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y September +0.7% +0.7%

09:00 Eurozone Trade Balance s.a. August 12.2 13.5

10:00 Eurozone ECB's Jens Weidmann Speaks

12:00 U.S. FOMC Member Charles Plosser Speaks

12:30 Canada Manufacturing Shipments (MoM) August +2.5% -1.6%

12:30 Canada Foreign Securities Purchases July 5.30 4.31

12:30 U.S. Initial Jobless Claims October 287 286

13:15 U.S. Industrial Production (MoM) September -0.1% +0.4%

13:15 U.S. Capacity Utilization September 78.8% 79.0%

14:00 U.S. Philadelphia Fed Manufacturing Survey October 22.5 19.9

14:00 U.S. FOMC Member Narayana Kocherlakota

14:00 U.S. NAHB Housing Market Index October 59 59

20:00 U.S. Net Long-term TIC Flows August -18.6 23.3

20:00 U.S. Total Net TIC Flows August 57.7

-

06:37

Options levels on thursday, October 16, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2927 (2273)

$1.2895 (2927)

$1.2853 (4263)

Price at time of writing this review: $ 1.2816

Support levels (open interest**, contracts):

$1.2763 (871)

$1.2737 (1196)

$1.2704 (1135)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 53701 contracts, with the maximum number of contracts with strike pric $1,2900 (6704);

- Overall open interest on the PUT options with the expiration date November, 7 is 53719 contracts, with the maximum number of contracts with strike price $1,2400 (5384);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from October, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.6203 (1961)

$1.6105 (1144)

$1.6008 (402)

Price at time of writing this review: $1.5973

Support levels (open interest**, contracts):

$1.5889 (970)

$1.5793 (1513)

$1.5695 (1193)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 25533 contracts, with the maximum number of contracts with strike price $1,6200 (1961);

- Overall open interest on the PUT options with the expiration date November, 7 is 31354 contracts, with the maximum number of contracts with strike price $1,5400 (2463);

- The ratio of PUT/CALL was 1.23 versus 1.25 from the previous trading day according to data from October, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:15

China: New Loans, September 857.2 (forecast 750)

-

03:03

Nikkei 225 14,751.77 -321.75 -2.13%, Hang Seng 22,899.68 -240.37 -1.04%, S&P/ASX 200 5,194.8 -50.81 -0.97%, Shanghai Composite 2,356.71 -16.96 -0.71%

-

01:01

Australia: Consumer Inflation Expectation, September 3.4%

-