Notícias do Mercado

-

20:00

Dow 16,339.76 +222.52 +1.38%, Nasdaq 4,255.28 +37.89 +0.90%, S&P 500 1,883.49 +20.73 +1.11%

-

17:00

European stocks closed in plus: FTSE 100 6,310.29 +114.38 +1.85%, CAC 40 4,033.18 +114.56 +2.92%, DAX 8,850.27 +267.37 +3.12%

-

17:00

European stocks close: stocks closed higher on comments by the European Central Bank executive board member Benoît Coeuré

Stock indices closed higher on comments by the European Central Bank executive board member Benoît Coeuré. He said the central bank will start buying private-sector debt instruments in coming days. Coeuré also said that it is too early to say Germany could fall into recession.

Coeuré pointed out that the ECB monitors its asset purchases, and there is "no target" for the exchange rate of the euro.

The European Central Bank Vice President Vitor Constancio warned that falling inflation expectations would be "extremely harmful".

Eurostat revised the economic growth figures. Eurozone's gross domestic product (GDP) grew 1.5% in the second quarter, exceeding expectations for a flat reading of 0.0%. The previous reading was 0.0%.

On a yearly basis, Eurozone's gross domestic product (GDP) fell 0.3% in the second quarter, missing expectations for a 0.7% rise. The previous reading was a 0.7% gain.

Rolls-Royce Holdings Plc shares dropped 11% after profit warning. The impact of Russian sanctions weighed on the company.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,310.29 +114.38 +1.85%

DAX 8,850.27 +267.37 +3.12%

CAC 40 4,033.18 +114.56 +2.92%

-

16:39

European Central Bank Vice President Vitor Constancio: that falling inflation expectations would be "extremely harmful"

The European Central Bank (ECB) Vice President Vitor Constancio warned that falling inflation expectations would be "extremely harmful".

Constancio expects a modest economic recovery in 2015, but added that there are downside risks.

The ECB vice president pointed out that the ECB's accommodative monetary policy "ensures a safer return to price stability over the medium term".

-

16:31

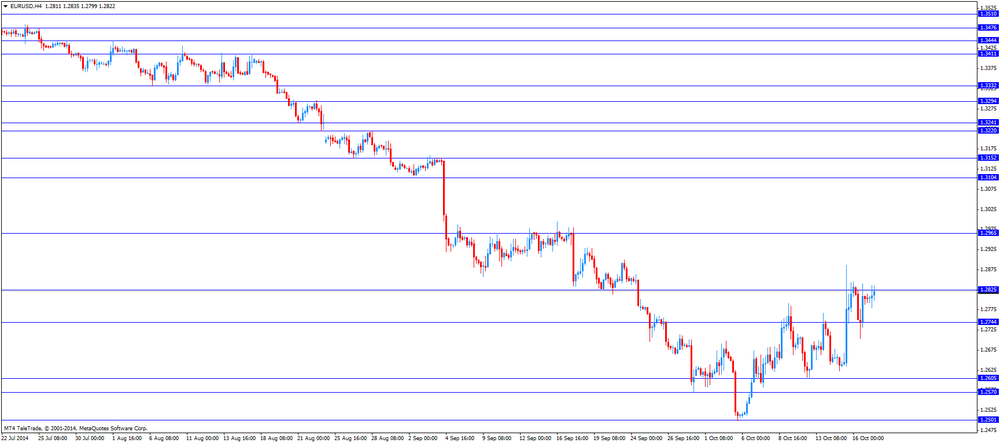

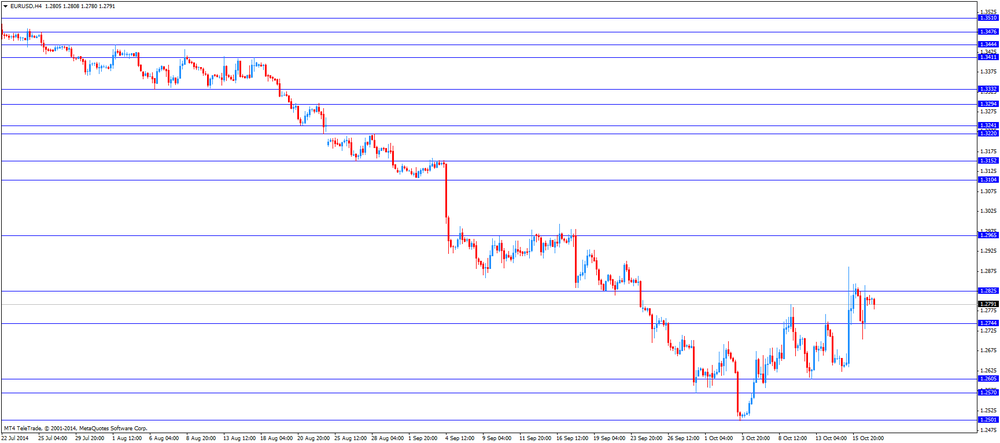

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the better-than-expected Reuters/Michigan consumer sentiment index

The U.S. dollar traded higher against the most major currencies after the better-than-expected Reuters/Michigan consumer sentiment index. The index rose to 86.4 in October from 84.6 in September, beating forecasts of a decline to 84.3.

Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations. August's figure was revised up from 956,000 units.

Building permits in the U.S. increased 1.5% to 1.018 million annualized rate in September from a 1.00 pace in August, missing expectations for a rise to 1.04 million units.

The Federal Reserve Chair Janet Yellen didn't address the economic outlook or monetary policy in speech at the Conference on Economic Opportunity today and Inequality in Boston.

The euro traded lower against the U.S. dollar. Eurostat revised the economic growth figures. Eurozone's gross domestic product (GDP) grew 1.5% in the second quarter, exceeding expectations for a flat reading of 0.0%. The previous reading was 0.0%.

On a yearly basis, Eurozone's gross domestic product (GDP) fell 0.3% in the second quarter, missing expectations for a 0.7% rise. The previous reading was a 0.7% gain.

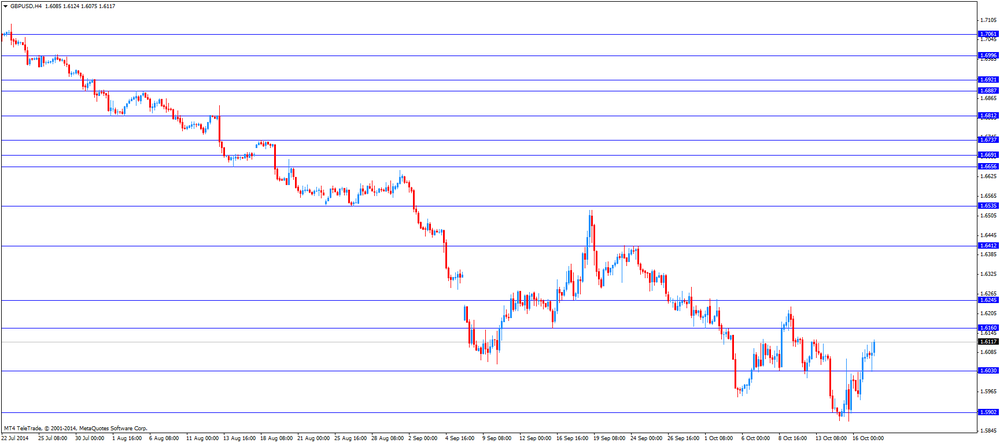

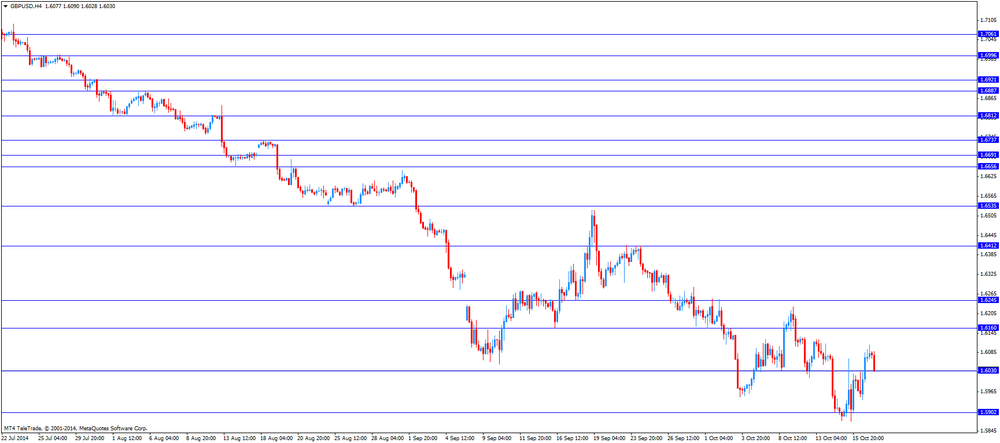

The British pound traded slightly lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the Canadian consumer inflation data. Canadian consumer price inflation increased 0.1% in September, exceeding expectations for a flat reading, after a flat reading in August.

On a yearly basis, the consumer price index fell to 2.0% September from 2.1% in August.

Canadian core consumer price index, which excludes some volatile goods, climbed 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.5% increase in August.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.1% in September.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

In the overnight trading session, the kiwi briefly dropped against the greenback, but quickly recovered its losses as the Reserve Bank of New Zealand (RBNZ) released a wrong statement. The RBNZ released a repeat of an earlier statement on the exchange rate of New Zealand's currency.

Later, the RBNZ released a correct statement. The central bank will increase its currency basket to 17 from 5. The currency basket is used by the RBNZ to calculate the value of the kiwi.

The Australian dollar fell against the U.S. dollar in the absence of any major economic reports from Australia.

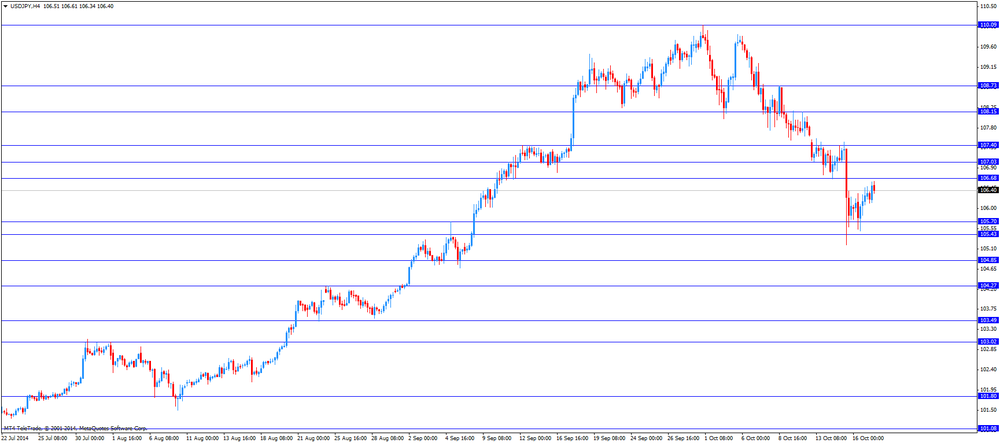

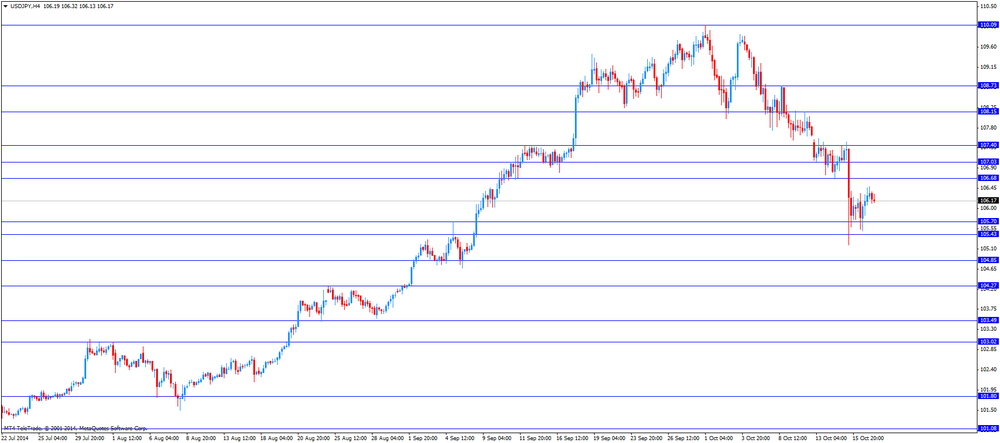

The Japanese yen traded declined against the U.S. dollar in the absence of any major economic reports from Japan. The yen remained supported by the demand for safe-haven assets. Worries about the global economy still weighed on markets.

-

16:20

Gold decline

Gold prices decline on Friday, but will increase the second consecutive week due to unceasing concern for the health of the global economy.

The growth of quotations of gold, as well as bonds and the Japanese yen, helping the increased demand for safe assets amid slowing global economic growth. Especially the market worried about the deterioration of economic indicators in Europe and China, while the United States is improving statistics.

Today, the price of gold showing a decrease, since the problems of the world economy fell slightly on Thursday after the release of positive American data, but concerns over the outlook for the eurozone is saved.

Demand for gold-seekers weakened after the United States Department of Labor reported that the number of initial claims for unemployment insurance for the week ending October 11 fell by 23,000 to a 14-year low of 264,000 from 287,000 the previous week. Analysts had expected jobless claims to fall to 286,000 by 1000.

A separate report showed that industrial production in the United States has increased in the last month by 1.0%, beating expectations of 0.4% growth.

Market sentiment also rose after the head of the Federal Reserve of St. Louis James Bullard said the central bank may need to store a program of bond purchases, given the reduction in inflation expectations.

Nevertheless, concerns about deflation in the euro zone persist after revised data showed on Thursday that consumer price inflation in the currency bloc rose in September by 0.3%, in line with expectations.

The inflation rate for 12 consecutive months are below 1%, while the inflation target marker for the European Central Bank is slightly less than 2%.

Today's report on the housing market has shown that the volume of new housing constructions grew moderately in September, confirming the predictions of experts. According to the data, at the end of last month, the volume of housing starts rose by 6.3% (seasonally adjusted), reaching an annual rate of 1.017 million. Units. The number of building permits increased by 1.5% - up to 1,018,000. Units. Economists forecast that the tab will rise to 1.02 million., And the number of permits would rise to 1.04 million. Units.

The world's largest reserves of the gold-exchange trading fund SPDR Gold Trust on Thursday rose by 0.24 percent to 760.94 tons. Physical demand in Asia has increased, as evidenced by the increase in margins in China's largest consumer of gold to $ 02.03 an ounce to the indicative spot price at $ 01.02 on Thursday. Demand for gold tends to rise in China and India in the fourth quarter due to holidays and weddings.

-

16:05

Federal Reserve Chair Janet Yellen concerned about the growing wealth and income inequality gap in the U.S.

The Federal Reserve Chair Janet Yellen said at the Conference on Economic Opportunity today and Inequality in Boston that she was concerned about the growing wealth and income inequality gap in the U.S. She asked if "this trend is compatible with values rooted in our nation's history, among them the high value Americans have traditionally placed on equality of opportunity".

The Fed Chair pointed out that the intergenerational mobility "is lower in the United States than in most other advanced countries."

Yellen didn't address the economic outlook or monetary policy in her remarks.

-

15:42

US housing market data was mixed in September

The U.S. Commerce Department released the housing market data today. Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations. August's figure was revised up from 956,000 units.

Building permits in the U.S. increased 1.5% to 1.018 million annualized rate in September from a 1.00 pace in August, missing expectations for a rise to 1.04 million units.

The construction of single-family homes rose only 1.1% in September. Building permits for single-family homes fell 0.5% in September.

Construction of multifamily buildings jumped 16.7% in September.

-

15:04

Canadian consumer price inflation fell to 2.0% in September

Statistics Canada released consumer price inflation data today. Canadian consumer price inflation increased 0.1% in September, exceeding expectations for a flat reading, after a flat reading in August.

On a yearly basis, the consumer price index fell to 2.0% September from 2.1% in August.

The consumer price index was driven by higher prices for shelter and food. Shelter costs rose 2.7% in September, while food prices climbed 2.7%.

Canadian core consumer price index, which excludes some volatile goods, climbed 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.5% increase in August.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.1% in September.

The Bank of Canada's inflation target is 2.0%.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, October 86.4 (forecast 84.3)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E607mn), $1.2630(E316mn), $1.2650(E464mn), $1.2740(E301mn), $1.2750(E200mn) $1.2800(E652mn), $1.2850(E423mn), $1.2900-05(E621mn)

USD/JPY: Y105.50($1.15bn), Y106.25($300mn), Y106.70-75($703mn), Y107.00($455mn)

GBP/USD: $1.6000(stg438mn)

USD/CHF: Chf0.9480(E540mn)

AUD/USD: $0.8600(A$511mn), $0.8800(A$522mn)

NZD/USD: $0.7865(NZ$212mn), $0.7940(NZ$652mn), $0.8000(NZ$633mn)

AUD/NZD: NZ$1.1100(A$440mn)

USD/CAD: C$1.1150($300mn), C$1.1200($626mn), C$1.1250($1.77bn), C$1.1300($1.19bn), C$1.1365($370mn)

-

14:34

U.S. Stocks open: Dow 16,253.00 +135.76 +0.84%, Nasdaq 4,279.12 +61.73 +1.46%, S&P 1,878.38 +15.62 +0.84%

-

14:29

Before the bell: S&P futures +1.32%, Nasdaq futures +1.48%

U.S. stock-index futures rallied on speculation central banks will support economic growth with more stimulus.

Global markets:

Nikkei 14,532.51 -205.87 -1.40%

Hang Seng 23,023.21 +122.27 +0.53%

Shanghai Composite 2,341.18 -15.32 -0.65%

FTSE 6,257.78 +61.87 +1.00%

CAC 4,001.25 +82.63 +2.11%

DAX 8,745.47 +162.57 +1.89%

Crude oil $83.72 (+1.16%)

Gold $1238.40 (-0.21%)

-

14:19

DOW components before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

90.27

+0.40%

8.2K

Procter & Gamble Co

PG

82.71

+0.57%

0.7K

Wal-Mart Stores Inc

WMT

74.27

+0.61%

0.5K

Verizon Communications Inc

VZ

47.97

+0.63%

23.8K

The Coca-Cola Co

KO

42.85

+0.68%

1.9K

E. I. du Pont de Nemours and Co

DD

66.69

+0.69%

11.2K

Travelers Companies Inc

TRV

92.44

+0.69%

6.7K

Johnson & Johnson

JNJ

97.50

+0.74%

17.4K

3M Co

MMM

136.06

+0.75%

4.8K

Home Depot Inc

HD

89.57

+0.78%

0.4K

Visa

V

204.70

+0.84%

0.5K

Merck & Co Inc

MRK

53.89

+0.86%

0.2K

International Business Machines Co...

IBM

181.40

+0.87%

12.8K

Boeing Co

BA

121.35

+0.88%

0.3K

Cisco Systems Inc

CSCO

23.02

+0.88%

22.6K

American Express Co

AXP

81.00

+0.95%

12.9K

Microsoft Corp

MSFT

43.15

+0.96%

7.6K

UnitedHealth Group Inc

UNH

86.25

+1.01%

9.1K

AT&T Inc

T

33.99

+1.04%

12.2K

Chevron Corp

CVX

112.25

+1.07%

0.4K

United Technologies Corp

UTX

100.30

+1.08%

1.6K

Nike

NKE

88.02

+1.13%

3.4K

Walt Disney Co

DIS

82.66

+1.13%

2.7K

Intel Corp

INTC

31.21

+1.17%

16.5K

Exxon Mobil Corp

XOM

91.71

+1.23%

10.4K

Pfizer Inc

PFE

28.05

+1.26%

5.2K

JPMorgan Chase and Co

JPM

55.81

+1.33%

623.3K

Goldman Sachs

GS

175.20

+1.52%

10.5K

Caterpillar Inc

CAT

95.28

+2.19%

3.0K

General Electric Co

GE

25.16

+3.75%

635.6K

-

14:03

Upgrades and downgrades before the market open

Upgrades:

UnitedHealth (UNH) upgraded from Mkt Perform to Outperform at Leerink Partners, target $100

Goldman Sachs (GS) upgraded from Mkt Perform to Outperform at Keefe Bruyette, target rised from $173 to $195

Downgrades:

Other:

-

13:31

U.S.: Building Permits, mln, September 1.02 (forecast 1.04)

-

13:31

U.S.: Housing Starts, mln, September 1.02 (forecast 1.02)

-

13:31

Canada: Consumer price index, y/y, September +2.0%

-

13:31

Canada: Bank of Canada Consumer Price Index Core, y/y, September +2.1%

-

13:30

Canada: Bank of Canada Consumer Price Index Core, m/m, September +0.2% (forecast +0.1%)

-

13:30

Canada: Consumer Price Index m / m, September +0.1% (forecast 0.0%)

-

13:10

Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies ahead of the U.S. economic data and a speech by Fed Chair Janet Yellen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:45 Eurozone ECB's Vitor Constancio Speaks

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.0% 0.0% 1.5%

09:00 Eurozone GDP (YoY) (Finally) Quarter II +0.7% +0.7% -0.3%

The U.S. dollar traded lower against the most major currencies ahead of the U.S. economic data and a speech by Fed Chair Janet Yellen. The number of initial jobless claims in the U.S. is expected to decline by 1,000 to 286,000.

Housing starts in the U.S. are expected to rise to 1.020 million units in September from 1.00 million units in August.

The number of building permits is expected to increase to 1.040 million units in September from 0.96 million in August.

The Reuters/Michigan consumer sentiment index is expected to fall to 84.3 in October from 84.6 in September.

The euro traded higher against the U.S. dollar. Eurostat revised the economic growth figures. Eurozone's gross domestic product (GDP) grew 1.5% in the second quarter, exceeding expectations for a flat reading of 0.0%. The previous reading was 0.0%.

On a yearly basis, Eurozone's gross domestic product (GDP) fell 0.3% in the second quarter, missing expectations for a 0.7% rise. The previous reading was a 0.7% gain.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead the Canadian consumer inflation data. The consumer price index in Canada is expected to remain flat in September.

The core consumer price index in Canada is expected to rise 0.1% in September, after a 0.5% gain in August.

EUR/USD: the currency pair rose to 1.2836

GBP/USD: the currency pair increased to $1.6124

USD/JPY: the currency pair climbed to Y106.61

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m September 0.0% 0.0%

12:30 Canada Consumer price index, y/y September +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m September +0.5% +0.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September +2.1%

12:30 U.S. Building Permits, mln September 1.00 1.04

12:30 U.S. Housing Starts, mln September 0.96 1.02

12:30 U.S. Fed Chairman Janet Yellen Speaks

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 84.6 84.3

-

13:00

Orders

EUR/USD

Offers $1.3000/95, $1.2930, $1.2900, $1.2885, $1.2845

Bids $1.2700, $1.2675, $1.2620

GBP/USD

Offers $1.6300, $1.6225, $1.6135/30

Bids $1.6000, $1.5940, $1.5875, $1.5850, $1.5800

AUD/USD

Offers $0.8895, $0.8860/50, $0.8800

Bids $0.8700, $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.00, Y137.85/90, Y137.50, Y136.55

Bids Y135.00, Y134.10/00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.15, Y107.50

Bids Y105.20, Y105.00

EUR/GBP

Offers stg0.8100, stg0.8045, stg0.8000

Bids stg0.7935, stg0.7900, stg0.7850

-

12:37

European Central Bank (ECB) executive board member Benoît Coeuré: the central bank will start buying private-sector debt instruments in coming days

The European Central Bank (ECB) executive board member Benoît Coeuré said the central bank will start buying private-sector debt instruments in coming days. He also said that it is too early to say Germany could fall into recession.

Coeuré pointed out that the ECB monitors its asset purchases, and there is "no target" for the exchange rate of the euro.

The ECB board member noted that "the recovery in the Eurozone is weak and uneven", and "there is no room for complacency either for us as monetary policy makers or for governments".

Coeuré also said that ""the Eurozone is still in a recovery path".

-

12:01

European stock markets mid session: stocks traded higher as the European Central Bank executive board member Benoît Coeuré said the central bank will start buying private-sector debt instruments in coming days

Stock indices traded higher as the European Central Bank (ECB) executive board member Benoît Coeuré said the central bank will start buying private-sector debt instruments in coming days. He also said that it is too early to say Germany could fall into recession.

Coeuré pointed out that the ECB monitors its asset purchases, and there is "no target" for the exchange rate of the euro.

The European Central Bank Vice President Vitor Constancio warned that falling inflation expectations would be "extremely harmful".

Eurostat revised the economic growth figures. Eurozone's gross domestic product (GDP) grew 1.5% in the second quarter, exceeding expectations for a flat reading of 0.0%. The previous reading was 0.0%.

On a yearly basis, Eurozone's gross domestic product (GDP) fell 0.3% in the second quarter, missing expectations for a 0.7% rise. The previous reading was a 0.7% gain.

Current figures:

Name Price Change Change %

FTSE 100 6,243.56 +47.65 +0.77%

DAX 8,702.34 +119.44 +1.39%

CAC 40 3,975 +56.38 +1.44%

-

10:44

Asian Stocks close: stocks closed mixed in the absence of any major economic reports

Asian stock indices closed mixed. Stocks were supported by yesterday's strong U.S. economic data. The number of initial jobless claims in the week ending October 11 in the U.S. dropped by 23,000 to 264,000. Analysts had expected the number of initial jobless claims to decline by 1,000 to 286,000.

The U.S. industrial production rose 1.0% in September, exceeding expectations for a 0.4% gain, after a 0.2% decline in August. August's figure was revised down from a 0.1% decrease.

The U.S. economic data eased investor concerns over the global growth.

Comments by Federal Reserve Bank of St. Louis President James Bullard calmed markets. Bullard said that the Fed should consider to delay the end of its bond-buying program.

Japanese stocks fell due to a stronger yen. The yen strengthened on worries about the global economy.

Chinese stocks declined on speculation a trading link between Hong Kong and Shanghai will be delayed.

Indexes on the close:

Nikkei 225 14,532.51 -205.87 -1.40%

Hang Seng 23,023.21 +122.27 +0.53%

Shanghai Composite 2,341.18 -15.32 -0.65%

-

10:18

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E607mn), $1.2630(E316mn), $1.2650(E464mn), $1.2740(E301mn), $1.2750(E200mn) $1.2800(E652mn), $1.2850(E423mn), $1.2900-05(E621mn)

USD/JPY: Y105.50($1.15bn), Y106.25($300mn), Y106.70-75($703mn), Y107.00($455mn)

GBP/USD: $1.6000(stg438mn)

USD/CHF: Chf0.9480(E540mn)

AUD/USD: $0.8600(A$511mn), $0.8800(A$522mn)

NZD/USD: $0.7865(NZ$212mn), $0.7940(NZ$652mn), $0.8000(NZ$633mn)

AUD/NZD: NZ$1.1100(A$440mn)

USD/CAD: C$1.1150($300mn), C$1.1200($626mn), C$1.1250($1.77bn), C$1.1300($1.19bn), C$1.1365($370mn)

-

10:01

Eurozone: Construction Output, m/m, August 1.5% (forecast 0.0%)

-

10:01

Eurozone: Construction Output, y/y, August -0.3%

-

09:57

Foreign exchange market. Asian session: the Japanese yen traded slightly higher against the U.S. dollar, supported by the demand for safe-haven assets

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:45 Eurozone ECB's Vitor Constancio Speaks

The U.S. dollar traded mixed against the most major currencies on comments. The greenback was supported by yesterday's strong U.S. economic data. The number of initial jobless claims in the week ending October 11 in the U.S. dropped by 23,000 to 264,000. Analysts had expected the number of initial jobless claims to decline by 1,000 to 286,000.

The U.S. industrial production rose 1.0% in September, exceeding expectations for a 0.4% gain, after a 0.2% decline in August.

The Philadelphia Fed manufacturing index decreased to 20.7 in October from 22.5 in September, beating forecasts of a decline to 19.9.

The New Zealand dollar traded slightly against the U.S. dollar in the absence of any major economic reports from New Zealand.

The kiwi briefly dropped against the greenback, but quickly recovered its losses as the Reserve Bank of New Zealand (RBNZ) released a wrong statement. The RBNZ released a repeat of an earlier statement on the exchange rate of New Zealand's currency.

Later, the RBNZ released a correct statement. The central bank will increase its currency basket to 17 from 5. The currency basket is used by the RBNZ to calculate the value of the kiwi.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded slightly higher against the U.S. dollar in the absence of any major economic reports from Japan. The yen was supported by the demand for safe-haven assets. Worries about the global economy still weighed on markets.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y106.12

The most important news that are expected (GMT0):

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.0% 0.0%

09:00 Eurozone GDP (YoY) (Finally) Quarter II +0.7% +0.7%

12:30 Canada Consumer Price Index m / m September 0.0% 0.0%

12:30 Canada Consumer price index, y/y September +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m September +0.5% +0.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September +2.1%

12:30 U.S. Building Permits, mln September 1.00 1.04

12:30 U.S. Housing Starts, mln September 0.96 1.02

12:30 U.S. Fed Chairman Janet Yellen Speaks

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 84.6 84.3

-

06:29

Options levels on friday, October 17, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2939 (2343)

$1.2890 (3154)

$1.2857 (1680)

Price at time of writing this review: $ 1.2800

Support levels (open interest**, contracts):

$1.2764 (1924)

$1.2735 (3206)

$1.2692 (3117)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 54235 contracts, with the maximum number of contracts with strike pric $1,2900 (6570);

- Overall open interest on the PUT options with the expiration date November, 7 is 56435 contracts, with the maximum number of contracts with strike price $1,2600 (5528);

- The ratio of PUT/CALL was 1.04 versus 1.00 from the previous trading day according to data from October, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.6303 (1551)

$1.6206 (1933)

$1.6110 (1263)

Price at time of writing this review: $1.6076

Support levels (open interest**, contracts):

$1.5990 (2180)

$1.5894 (1294)

$1.5796 (1517)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 25893 contracts, with the maximum number of contracts with strike price $1,6200 (1933);

- Overall open interest on the PUT options with the expiration date November, 7 is 31574 contracts, with the maximum number of contracts with strike price $1,5400 (2457);

- The ratio of PUT/CALL was 1.22 versus 1.23 from the previous trading day according to data from October, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:00

Nikkei 225 14,745.37 +6.99 +0.05%, Hang Seng 23,084.93 +183.99 +0.80%, S&P/ASX 200 5,288 +33.11 +0.63%, Shanghai Composite 2,354.03 -2.47 -0.10%

-