Notícias do Mercado

-

16:39

European Central Bank Vice President Vitor Constancio: that falling inflation expectations would be "extremely harmful"

The European Central Bank (ECB) Vice President Vitor Constancio warned that falling inflation expectations would be "extremely harmful".

Constancio expects a modest economic recovery in 2015, but added that there are downside risks.

The ECB vice president pointed out that the ECB's accommodative monetary policy "ensures a safer return to price stability over the medium term".

-

16:31

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the better-than-expected Reuters/Michigan consumer sentiment index

The U.S. dollar traded higher against the most major currencies after the better-than-expected Reuters/Michigan consumer sentiment index. The index rose to 86.4 in October from 84.6 in September, beating forecasts of a decline to 84.3.

Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations. August's figure was revised up from 956,000 units.

Building permits in the U.S. increased 1.5% to 1.018 million annualized rate in September from a 1.00 pace in August, missing expectations for a rise to 1.04 million units.

The Federal Reserve Chair Janet Yellen didn't address the economic outlook or monetary policy in speech at the Conference on Economic Opportunity today and Inequality in Boston.

The euro traded lower against the U.S. dollar. Eurostat revised the economic growth figures. Eurozone's gross domestic product (GDP) grew 1.5% in the second quarter, exceeding expectations for a flat reading of 0.0%. The previous reading was 0.0%.

On a yearly basis, Eurozone's gross domestic product (GDP) fell 0.3% in the second quarter, missing expectations for a 0.7% rise. The previous reading was a 0.7% gain.

The British pound traded slightly lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the Canadian consumer inflation data. Canadian consumer price inflation increased 0.1% in September, exceeding expectations for a flat reading, after a flat reading in August.

On a yearly basis, the consumer price index fell to 2.0% September from 2.1% in August.

Canadian core consumer price index, which excludes some volatile goods, climbed 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.5% increase in August.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.1% in September.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

In the overnight trading session, the kiwi briefly dropped against the greenback, but quickly recovered its losses as the Reserve Bank of New Zealand (RBNZ) released a wrong statement. The RBNZ released a repeat of an earlier statement on the exchange rate of New Zealand's currency.

Later, the RBNZ released a correct statement. The central bank will increase its currency basket to 17 from 5. The currency basket is used by the RBNZ to calculate the value of the kiwi.

The Australian dollar fell against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded declined against the U.S. dollar in the absence of any major economic reports from Japan. The yen remained supported by the demand for safe-haven assets. Worries about the global economy still weighed on markets.

-

16:05

Federal Reserve Chair Janet Yellen concerned about the growing wealth and income inequality gap in the U.S.

The Federal Reserve Chair Janet Yellen said at the Conference on Economic Opportunity today and Inequality in Boston that she was concerned about the growing wealth and income inequality gap in the U.S. She asked if "this trend is compatible with values rooted in our nation's history, among them the high value Americans have traditionally placed on equality of opportunity".

The Fed Chair pointed out that the intergenerational mobility "is lower in the United States than in most other advanced countries."

Yellen didn't address the economic outlook or monetary policy in her remarks.

-

15:42

US housing market data was mixed in September

The U.S. Commerce Department released the housing market data today. Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations. August's figure was revised up from 956,000 units.

Building permits in the U.S. increased 1.5% to 1.018 million annualized rate in September from a 1.00 pace in August, missing expectations for a rise to 1.04 million units.

The construction of single-family homes rose only 1.1% in September. Building permits for single-family homes fell 0.5% in September.

Construction of multifamily buildings jumped 16.7% in September.

-

15:04

Canadian consumer price inflation fell to 2.0% in September

Statistics Canada released consumer price inflation data today. Canadian consumer price inflation increased 0.1% in September, exceeding expectations for a flat reading, after a flat reading in August.

On a yearly basis, the consumer price index fell to 2.0% September from 2.1% in August.

The consumer price index was driven by higher prices for shelter and food. Shelter costs rose 2.7% in September, while food prices climbed 2.7%.

Canadian core consumer price index, which excludes some volatile goods, climbed 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.5% increase in August.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.1% in September.

The Bank of Canada's inflation target is 2.0%.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, October 86.4 (forecast 84.3)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E607mn), $1.2630(E316mn), $1.2650(E464mn), $1.2740(E301mn), $1.2750(E200mn) $1.2800(E652mn), $1.2850(E423mn), $1.2900-05(E621mn)

USD/JPY: Y105.50($1.15bn), Y106.25($300mn), Y106.70-75($703mn), Y107.00($455mn)

GBP/USD: $1.6000(stg438mn)

USD/CHF: Chf0.9480(E540mn)

AUD/USD: $0.8600(A$511mn), $0.8800(A$522mn)

NZD/USD: $0.7865(NZ$212mn), $0.7940(NZ$652mn), $0.8000(NZ$633mn)

AUD/NZD: NZ$1.1100(A$440mn)

USD/CAD: C$1.1150($300mn), C$1.1200($626mn), C$1.1250($1.77bn), C$1.1300($1.19bn), C$1.1365($370mn)

-

13:31

U.S.: Building Permits, mln, September 1.02 (forecast 1.04)

-

13:31

U.S.: Housing Starts, mln, September 1.02 (forecast 1.02)

-

13:31

Canada: Consumer price index, y/y, September +2.0%

-

13:31

Canada: Bank of Canada Consumer Price Index Core, y/y, September +2.1%

-

13:30

Canada: Bank of Canada Consumer Price Index Core, m/m, September +0.2% (forecast +0.1%)

-

13:30

Canada: Consumer Price Index m / m, September +0.1% (forecast 0.0%)

-

13:10

Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies ahead of the U.S. economic data and a speech by Fed Chair Janet Yellen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:45 Eurozone ECB's Vitor Constancio Speaks

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.0% 0.0% 1.5%

09:00 Eurozone GDP (YoY) (Finally) Quarter II +0.7% +0.7% -0.3%

The U.S. dollar traded lower against the most major currencies ahead of the U.S. economic data and a speech by Fed Chair Janet Yellen. The number of initial jobless claims in the U.S. is expected to decline by 1,000 to 286,000.

Housing starts in the U.S. are expected to rise to 1.020 million units in September from 1.00 million units in August.

The number of building permits is expected to increase to 1.040 million units in September from 0.96 million in August.

The Reuters/Michigan consumer sentiment index is expected to fall to 84.3 in October from 84.6 in September.

The euro traded higher against the U.S. dollar. Eurostat revised the economic growth figures. Eurozone's gross domestic product (GDP) grew 1.5% in the second quarter, exceeding expectations for a flat reading of 0.0%. The previous reading was 0.0%.

On a yearly basis, Eurozone's gross domestic product (GDP) fell 0.3% in the second quarter, missing expectations for a 0.7% rise. The previous reading was a 0.7% gain.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead the Canadian consumer inflation data. The consumer price index in Canada is expected to remain flat in September.

The core consumer price index in Canada is expected to rise 0.1% in September, after a 0.5% gain in August.

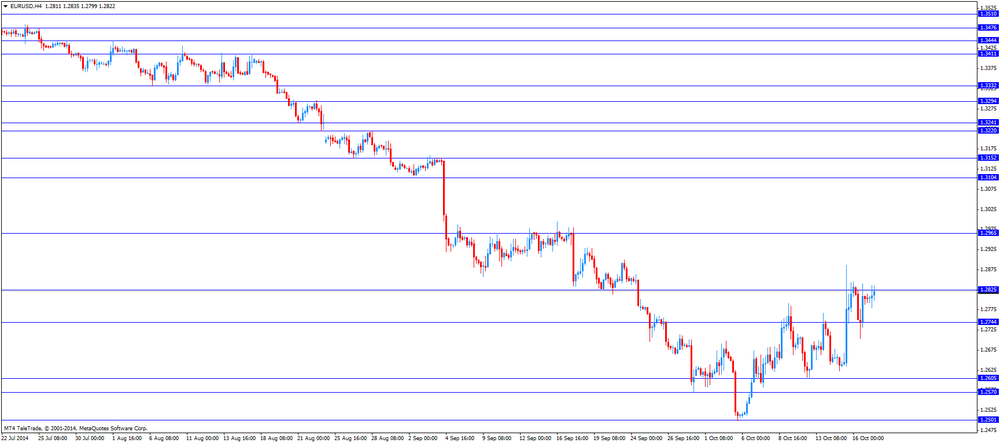

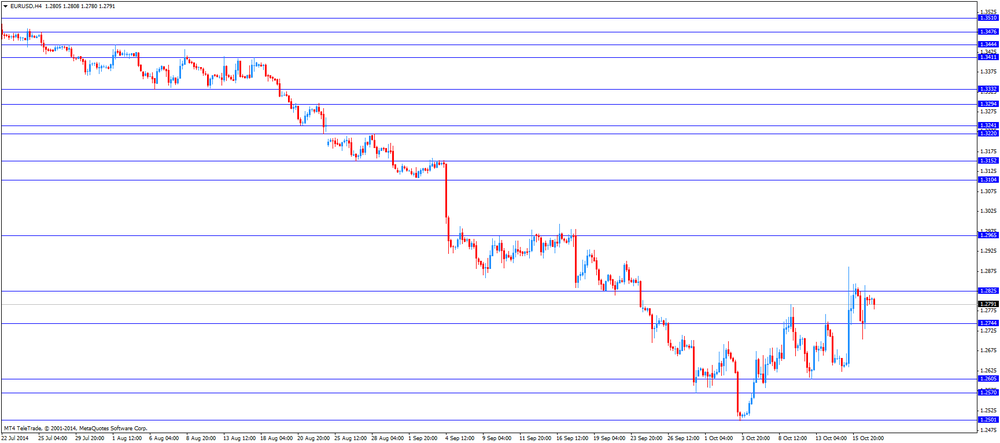

EUR/USD: the currency pair rose to 1.2836

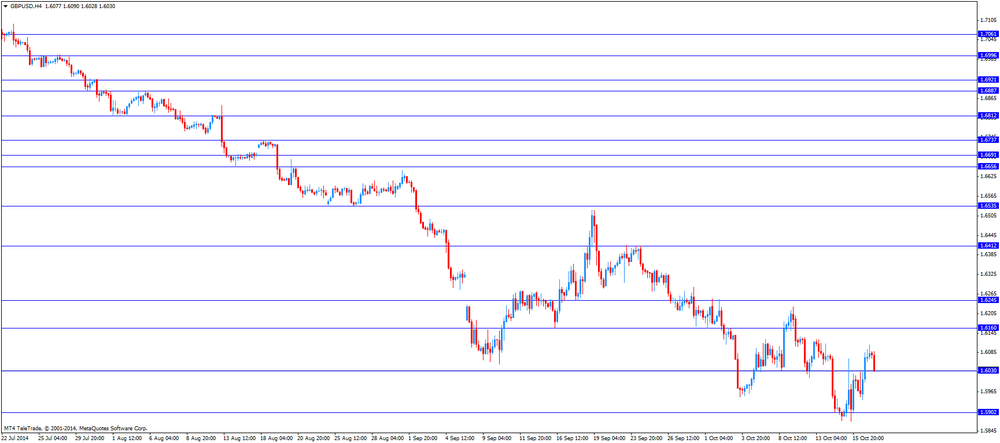

GBP/USD: the currency pair increased to $1.6124

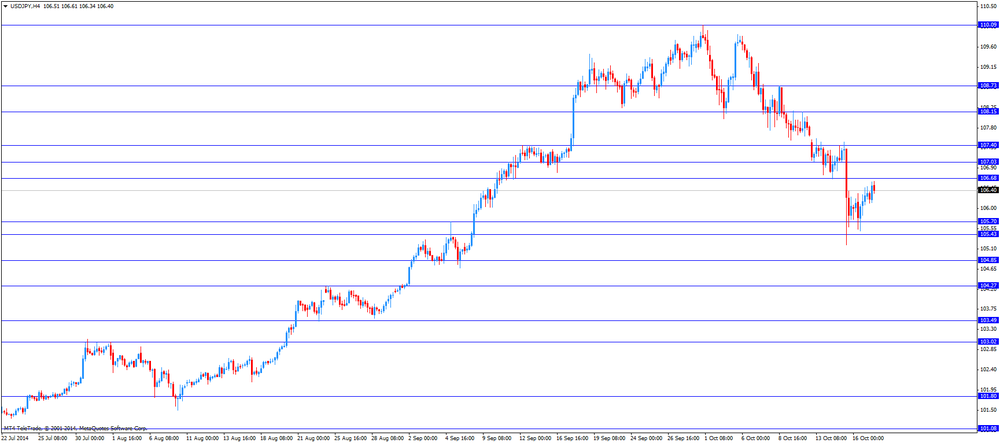

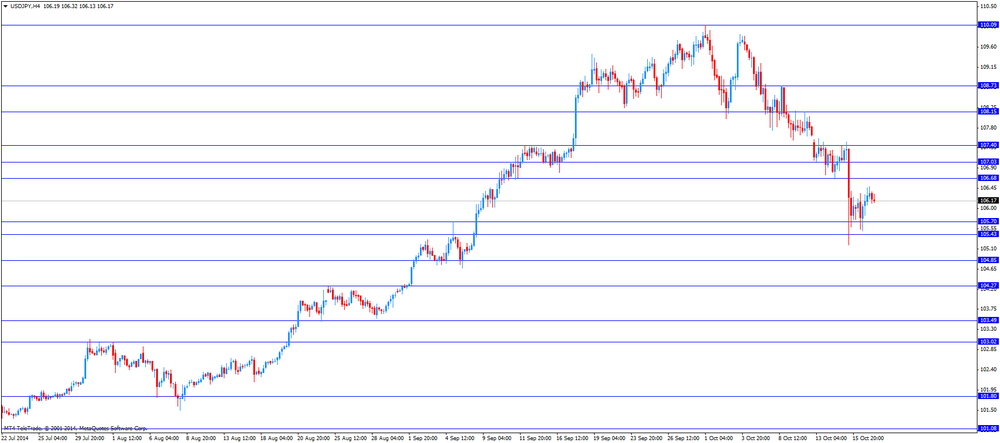

USD/JPY: the currency pair climbed to Y106.61

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m September 0.0% 0.0%

12:30 Canada Consumer price index, y/y September +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m September +0.5% +0.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September +2.1%

12:30 U.S. Building Permits, mln September 1.00 1.04

12:30 U.S. Housing Starts, mln September 0.96 1.02

12:30 U.S. Fed Chairman Janet Yellen Speaks

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 84.6 84.3

-

13:00

Orders

EUR/USD

Offers $1.3000/95, $1.2930, $1.2900, $1.2885, $1.2845

Bids $1.2700, $1.2675, $1.2620

GBP/USD

Offers $1.6300, $1.6225, $1.6135/30

Bids $1.6000, $1.5940, $1.5875, $1.5850, $1.5800

AUD/USD

Offers $0.8895, $0.8860/50, $0.8800

Bids $0.8700, $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.00, Y137.85/90, Y137.50, Y136.55

Bids Y135.00, Y134.10/00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.15, Y107.50

Bids Y105.20, Y105.00

EUR/GBP

Offers stg0.8100, stg0.8045, stg0.8000

Bids stg0.7935, stg0.7900, stg0.7850

-

12:37

European Central Bank (ECB) executive board member Benoît Coeuré: the central bank will start buying private-sector debt instruments in coming days

The European Central Bank (ECB) executive board member Benoît Coeuré said the central bank will start buying private-sector debt instruments in coming days. He also said that it is too early to say Germany could fall into recession.

Coeuré pointed out that the ECB monitors its asset purchases, and there is "no target" for the exchange rate of the euro.

The ECB board member noted that "the recovery in the Eurozone is weak and uneven", and "there is no room for complacency either for us as monetary policy makers or for governments".

Coeuré also said that ""the Eurozone is still in a recovery path".

-

10:18

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E607mn), $1.2630(E316mn), $1.2650(E464mn), $1.2740(E301mn), $1.2750(E200mn) $1.2800(E652mn), $1.2850(E423mn), $1.2900-05(E621mn)

USD/JPY: Y105.50($1.15bn), Y106.25($300mn), Y106.70-75($703mn), Y107.00($455mn)

GBP/USD: $1.6000(stg438mn)

USD/CHF: Chf0.9480(E540mn)

AUD/USD: $0.8600(A$511mn), $0.8800(A$522mn)

NZD/USD: $0.7865(NZ$212mn), $0.7940(NZ$652mn), $0.8000(NZ$633mn)

AUD/NZD: NZ$1.1100(A$440mn)

USD/CAD: C$1.1150($300mn), C$1.1200($626mn), C$1.1250($1.77bn), C$1.1300($1.19bn), C$1.1365($370mn)

-

10:01

Eurozone: Construction Output, m/m, August 1.5% (forecast 0.0%)

-

10:01

Eurozone: Construction Output, y/y, August -0.3%

-

09:57

Foreign exchange market. Asian session: the Japanese yen traded slightly higher against the U.S. dollar, supported by the demand for safe-haven assets

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:45 Eurozone ECB's Vitor Constancio Speaks

The U.S. dollar traded mixed against the most major currencies on comments. The greenback was supported by yesterday's strong U.S. economic data. The number of initial jobless claims in the week ending October 11 in the U.S. dropped by 23,000 to 264,000. Analysts had expected the number of initial jobless claims to decline by 1,000 to 286,000.

The U.S. industrial production rose 1.0% in September, exceeding expectations for a 0.4% gain, after a 0.2% decline in August.

The Philadelphia Fed manufacturing index decreased to 20.7 in October from 22.5 in September, beating forecasts of a decline to 19.9.

The New Zealand dollar traded slightly against the U.S. dollar in the absence of any major economic reports from New Zealand.

The kiwi briefly dropped against the greenback, but quickly recovered its losses as the Reserve Bank of New Zealand (RBNZ) released a wrong statement. The RBNZ released a repeat of an earlier statement on the exchange rate of New Zealand's currency.

Later, the RBNZ released a correct statement. The central bank will increase its currency basket to 17 from 5. The currency basket is used by the RBNZ to calculate the value of the kiwi.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded slightly higher against the U.S. dollar in the absence of any major economic reports from Japan. The yen was supported by the demand for safe-haven assets. Worries about the global economy still weighed on markets.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y106.12

The most important news that are expected (GMT0):

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.0% 0.0%

09:00 Eurozone GDP (YoY) (Finally) Quarter II +0.7% +0.7%

12:30 Canada Consumer Price Index m / m September 0.0% 0.0%

12:30 Canada Consumer price index, y/y September +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m September +0.5% +0.1%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September +2.1%

12:30 U.S. Building Permits, mln September 1.00 1.04

12:30 U.S. Housing Starts, mln September 0.96 1.02

12:30 U.S. Fed Chairman Janet Yellen Speaks

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 84.6 84.3

-

06:29

Options levels on friday, October 17, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2939 (2343)

$1.2890 (3154)

$1.2857 (1680)

Price at time of writing this review: $ 1.2800

Support levels (open interest**, contracts):

$1.2764 (1924)

$1.2735 (3206)

$1.2692 (3117)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 54235 contracts, with the maximum number of contracts with strike pric $1,2900 (6570);

- Overall open interest on the PUT options with the expiration date November, 7 is 56435 contracts, with the maximum number of contracts with strike price $1,2600 (5528);

- The ratio of PUT/CALL was 1.04 versus 1.00 from the previous trading day according to data from October, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.6303 (1551)

$1.6206 (1933)

$1.6110 (1263)

Price at time of writing this review: $1.6076

Support levels (open interest**, contracts):

$1.5990 (2180)

$1.5894 (1294)

$1.5796 (1517)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 25893 contracts, with the maximum number of contracts with strike price $1,6200 (1933);

- Overall open interest on the PUT options with the expiration date November, 7 is 31574 contracts, with the maximum number of contracts with strike price $1,5400 (2457);

- The ratio of PUT/CALL was 1.22 versus 1.23 from the previous trading day according to data from October, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-